SPECIAL TOPIC

SPECIAL TOPIC

EAGE

TECHNICAL

CHAIR EDITORIAL BOARD

Clément Kostov (cvkostov@icloud.com)

EDITOR

Damian Arnold (arnolddamian@googlemail.com)

MEMBERS, EDITORIAL BOARD

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no)

Philippe Caprioli, SLB (caprioli0@slb.com) Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

• Anthony Day, NORSAR (anthony.day@norsar.no)

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Kara English, University College Dublin (kara.english@ucd.ie)

• Stephen Hallinan, Viridien (Stephen.Hallinan@viridiengroup.com)

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca)

Fabio Marco Miotti, Baker Hughes (fabiomarco.miotti@bakerhughes.com)

Susanne Rentsch-Smith, Shearwater (srentsch@shearwatergeo.com)

• Martin Riviere, Retired Geophysicist (martinriviere@btinternet.com)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS Andrew McBarnet (andrew@andrewmcbarnet.com)

PUBLICATIONS MANAGER

Hang Pham (publications@eage.org)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org) Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48 3981 AJ Bunnik

The Netherlands

• +31 88 995 5055

• eage@eage.org

• www.eage.org

EAGE MIDDLE EAST OFFICE

EAGE Middle East FZ-LLC

Dubai Knowledge Village PO Box 501711

Dubai, United Arab Emirates

• +971 4 369 3897

• middle_east@eage.org www.eage.org

EAGE ASIA PACIFIC OFFICE

EAGE Asia Pacific Sdn. Bhd.

UOA Centre Office Suite 19-15-3A No. 19, Jalan Pinang

50450 Kuala Lumpur

Malaysia +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE LATIN AMERICA OFFICE

EAGE Americas SAS Av Cra 19 #114-65 - Office 205 Bogotá, Colombia

• +57 310 8610709

• americas@eage.org

• www.eage.org

EAGE MEMBERS’ CHANGE OF ADDRESS

Update via your MyEAGE account, or contact the EAGE Membership Dept at membership@eage.org

FIRST BREAK ON THE WEB www.firstbreak.org

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

29 Stochastic agent-based modelling of hydrocarbon migration in stratigraphically complex basins

Roderick Perez Altamar

35 Sensitivity for monitoring array of Distributed Acoustic Sensors (DAS) in a vertical borehole

Zuzana Jechumtálová, Denis Anikiev and Leo Eisner

39 Colorado School of Mines’ Reservoir Characterization project celebrates 40 years with important lessons to share on carbon capture

Tom Davis

43 Fast-tracking carbon storage insights utilising holistic screening criteria for saline aquifers

Ashley Uren, Joseph Jennings and Graeme Nicoll

51 Underground gas storage and passive seismic

Stephen A. Sonnenberg

57 Utility of the Geological Carbon Sequestration (GCS) business: Potential perils and scenarios till 2150 and beyond

Ruud Weijermars

66 Calendar

Andreas Aspmo Pfaffhuber Chair

Florina Tuluca Vice-Chair

Esther Bloem Immediate Past Chair

Micki Allen Contact Officer EEGS/North America

Hongzhu Cai Liaison China

Deyan Draganov Technical Programme Officer

Eduardo Rodrigues Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison CIS / North America

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Mark Vardy Editor-in-Chief Near Surface Geophysics

Yohaney Gomez Galarza Chair

Johannes Wendebourg Vice-Chair

Lucy Slater Immediate Past Chair

Wiebke Athmer Member

Alireza Malehmir Editor-in-Chief Geophysical Prospecting

Adeline Parent Member

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Xavier Troussaut EAGE Observer at SPE-OGRC

Robert Tugume Member

Timothy Tylor-Jones Committee Member

Anke Wendt Member

Martin Widmaier Technical Programme Officer

Carla Martín-Clavé Chair

Giovanni Sosio Vice-Chair

SUBSCRIPTIONS

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 85.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to First Break B.V., Journal Subscriptions, Kosterijland 48, 3981 AJ Bunnik, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by First Break B.V., The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2025 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

EAGE has been forming a number of strategic partnerships with leading industry organisations to help address the visibility needs of geoscience and engineering in the energy sector. The initiative aims to reinforce the Association’s commitment to supporting value-driven solutions, fostering innovation and collaboration, and driving progress across the sector.

bp

EAGE has entered into a four-year strategic partnership with bp to support the drive for energy transformation through cutting-edge technology and innovation. Leveraging its global network and expertise, EAGE enables industry collaboration and knowledge exchange to accelerate progress in this space.

As part of this partnership, bp will play an integral role in shaping discussions at three of EAGE’s flagship events – EAGE

Digital 2025 in Edinburgh, EAGE Annual 2026 in Aberdeen, and EAGE GET 2027 also in the UK – driving conversations that advance the energy transition and technological innovation.

EAGE is strengthening its collaboration with SpotLight, a French seismic monitoring company, to advance carbon capture and storage (CCS) geophysics. This partnership aligns with the Association’s broader efforts to enhance CCS technologies and industry cooperation in tackling global energy challenges.

Through this collaboration, SpotLight will participate in EAGE’s CCS-focused events, sharing expertise on seismic monitoring for CCS. By working with organisations at the forefront of CCS research and development, EAGE contin-

EAGE is committed to fostering industry visibility and meaningful collaborations. These partnerships highlight its role in bringing together key industry players to drive innovation and engagement. Organisations looking to strengthen their presence in a specific area are encouraged to connect with EAGE to explore ways to contribute to and shape industry discussions.

ues to facilitate knowledge exchange and support innovation in the transition to a more sustainable energy future.

In a move to strengthen geoscience in Africa’s energy sector, EAGE is partnering with AOW Energy, a leading platform for energy companies on the continent. AOW Energy, this year in Ghana, brings together a specialist community to discuss emerging exploration opportunities, address technical challenges, and exchange expertise in energy development and resource management across Africa. Through this partnership, EAGE and AOW Energy reinforce their joint mission to drive technical excellence and industry

collaboration across disciplines. By working together, the organisations seek to elevate Africa’s role in global energy advancements, providing new opportunities for professionals and businesses in the region.

A major milestone for EAGE is its leadership role in the inaugural World CCUS Conference, set to take place in Bergen, Norway in September 2025. EAGE has been entrusted by the conference Board to lead the organisation and promotion of this landmark event. With extensive experience in professional networking and event planning, EAGE is poised to deliver a world-class conference that will help to shape the future of CCUS

technology and its role in accelerating a low-carbon future.

As a knowledge partner for the EAGE Annual in Toulouse (2-5 June 2025), S&P Global Commodity Insights has published an executive brief and will release a full extended report in June, providing valuable insights and expertise on the future of geoscience, technology, and energy.

In collaboration with EAGE, S&P Global’s Executive Brief analyses key trends shaping the E&P industry, offering perspectives on innovation, workforce evolution, and sustainability. The Full Extended Report will be available in June for event attendees and accessible online through EAGE and S&P Global’s digital platforms.

According to the executive brief, energy and petroleum (E&P) industry is on the brink of a significant transformation, driven by technological advancements and evolving workforce demographics. As organisations prepare for the future, understanding these changes is crucial for maximising knowledge retention and ensuring sustainable practices.

Technological innovations are reshaping the E&P landscape, offering new tools that enhance data-driven decision-making and improve operational efficiency. The integration of artificial intelligence and automation is becoming increasingly vital, allowing companies to streamline processes and optimise resource allocation. Embracing these advancements fosters innovation and positions organisations to tackle the challenges of exploration and resource discovery.

Workforce demographics are also evolving, with a new generation of professionals entering the industry. This shift necessitates a focus on skills evolution and knowl edge transfer to ensure that critical expertise is retained within organ isations. Building larger, localised teams can facilitate education and meet local content requirements further enhancing the industry’s adaptability. Additionally, fostering an inclusive culture that attracts diverse talent will be essential for driving creativity and innovation.

Sustainability and decarbonisation strategies are becoming paramount as the global energy landscape shifts towards greener practices. Organisations must prioritise these initiatives to align with societal expectations and regulatory demands. By embedding sustainability into their core operations, companies can reduce their environmental impact and enhance their competitive advantage. The commitment to sustainable development will also resonate with consumers, who increasingly favour

be defined by its ability to adapt to technological advancements, embrace workforce changes, and prioritise sustainability. By focusing on these key areas, organisations can navigate the complexities of the evolving landscape and position themselves for long-term success. Join us at the EAGE Annual in Toulouse to explore these themes and engage in discussions on the future of geoscience, technology, and energy.

DUG Elastic MP-FWI Imaging solves for three-component reflectivity, Vp, Vs, P-impedance, S-impedance and density. It delivers not only another step change in imaging quality, but also elastic rock properties for quantitative interpretation and pre-stack amplitude analysis — directly from field-data input. It’s worth reading that last sentence again!

info@dug.com | dug.com/fwi

Dr Gang Wang, assistant professor at the Institute of GeoEnergy Engineering and underground hydrogen storage theme lead at iNetZ+, Heriot-Watt University, discusses his upcoming short course on Reservoir engineering for hydrogen storage in subsurface porous media at the EAGE Annual 2025 on Sunday 1 June.

What inspired you to develop this course?

The rapid scale-up of the hydrogen value chain is crucial for advancing the energy transition. This demands not only substantial investment but also specialised technical expertise. Reservoir engineering is, and will continue to be, a vital discipline for utilising geological resources, which

may hold the key to enabling the hydrogen economy at scale. That is why I developed this course, grounded in my research, to equip professionals with critical insights into subsurface hydrogen solutions and their essential role in driving the energy transition forward.

A major challenge in the hydrogen value chain is scalable storage. Due to its extremely low density, hydrogen requires significant storage capacity for large-scale deployment. Storing hydrogen in subsurface porous media offers a unique advantage, enabling cost-effective, long-duration energy storage at scale. This is crucial for integrating and maximising the potential of intermittent renewable energy sources, making hydrogen a more viable and flexible component of the future energy mix.

What would be an example of the complexity of hydrogen storage?

A key lesson from real-world case studies is the crucial role of cushion gas design in hydrogen storage. Cushion gas maintains reservoir pressure and prevents early water breakthrough, but its mixing with hydrogen can reduce purity and recovery.

One of my field examples highlights how local high-permeability zones in the middle

PROCESSING OF MULTIPLES: CONCEPTS, APPLICATIONS, TRENDS, BY CLÉMENT KOSTOV

6 JUN STATE OF THE ART IN FULL WAVEFORM INVERSION (FWI), BY IAN JONES

of the formation create preferential flow paths during hydrogen injection, leading to non-piston flow behaviour. During the shutin period, this non-uniformly distributed hydrogen migrates upward due to gravity, causing further mixing with cushion gas and reducing purity. An effective cushion gas design helps maintain hydrogen purity by confining flow and accumulating high-purity hydrogen near the wellbore, optimised through tailored injection strategies. More details will be covered in the course.

What professional skills are involved?

The fundamental principles underlying subsurface applications, such as hydrocarbon recovery, CCS, and now hydrogen storage, are largely transferable. A strong technical foundation in subsurface science and engineering is necessary. That said, it is crucial to recognise the unique challenges associated with hydrogen. Unlike CCS, hydrogen storage must ensure temporary, safe containment while allowing for its full or near-full withdrawal in a pure, uncontaminated state. This necessitates a good understanding of multiphase and multi-component flow behaviour, reservoir geology, geomechanics, and the biogeochemical interactions involved.

For the last few years we have been building the Strategic Programme at the Annual. In Toulouse this year we are having ten high-level sessions over the four days of the main event under the theme ‘Navigating change: Geosciences shaping a sustainable transition’.

The idea is to reflect on some of the wider issues such as oil and gas E&P in the energy transition era, the most promising transition solutions from renewables to CCS, the pace of change, the impact on the geoscience and engineering community and its workforce, and meeting public expectations for climate change mitigation. Global leaders such as TotalEnergies, bp, Chevron, Shell, Aramco, and Microsoft will be providing voices for this conversation, sharing their perspective on the status of the energy transition and where we go from here.

Here’s what awaits you:

Leadership Interview

A one-on-one conversation featuring TotalEnergies’ SVP of exploration, Kevin McLachlan, in discussion with Andrew McBarnet, EAGE emeritus editor.

Navigating change: Geosciences shaping a sustainable future

With the energy market shifting toward renewables, geoscientists remain vital in resource management and sustainable development. The session will explore how geoscience expertise will shape the future, addressing economics, technology, geopolitics, and societal attitudes over the next decade.

Role of technologies to accelerate project turn around

Despite declining investment in oil and gas technology, the demand for innovation is growing. AI and digital tools are driving efficiency, reducing costs, and accelerating exploration. The panel will highlight emerging technologies, R&D investment strategies, and breakthroughs needed to meet rising energy demand.

Responsible exploration — faster, cleaner, cheaper

The energy transition is reshaping exploration strategies. Companies are prioritising

cost-effective, low-emission field development to accelerate time-to-market. The session will discuss new approaches, seismic industry collaboration, and strategies for faster and more sustainable exploration.

Are geosciences equipped for the energy transition?

Geosciences are critical to decarbonisation efforts but risk falling behind as renewables scale up. This discussion will examine how geoscientists can remain relevant, attract new talent, and enhance their role in shaping future energy systems.

Reshaped service industry and impact on market (Senior Executive Managers’ Breakfast)

Industry consolidation and the energy transition are forcing service companies to diversify. Leaders will discuss how these changes impact the market and explore new business models, supply chain strategies, and innovations to ensure a resilient energy technology ecosystem.

technology investments

Balancing risk and reward in technology investments is increasingly challenging. The session will explore R&D funding strat egies, the role of emerging technologies, and how companies can justify high-value investments in a competitive market.

The future of energy — where are we heading?

Even if oil demand peaks by 2030, as predicted by some, hydrocarbons will remain part of the energy mix. The panel will discuss the speed of transition, challenges in developing economies, and how companies are adapting to balance energy security with low-carbon solutions.

Energy innovation through diverse perspectives

Diversity fosters innovation. By embracing different backgrounds, expertise, and perspectives, the energy industry can develop more adaptable and inclusive solutions. The discussion will explore how diversity enhances problem-solving, drives creativity, and strengthens business resilience.

Geoscience skills shortage — a threat to the energy transition?

Geoscience professionals are essential for subsurface exploration, yet workforce shortages threaten long-term energy transition goals. The session will examine how to attract young talent, invest in education, and reshape the industry’s image to ensure future expertise.

The impact of AI on future ways of working

AI is revolutionising decision-making, automation, and operational efficiency in the energy sector. Beyond technology, it is also transforming business models, leadership approaches, and workforce adaptability. This session will explore how companies can leverage AI to stay agile in a rapidly changing industry.

Stay updated with the latest speaker announcements and agenda details at www.eageannual.org. Take advantage of discounted registration fees available until 15 May 2025. We look forward to welcoming you this June.

Our Annual Conference serves many purposes, one of which is to provide a platform for students to connect, learn, and launch their careers.

Sebastian Lozada from Universidad Nacional, Bogotá attended EAGE Annual 2024 in Oslo. This is what he said: ‘These events are a great opportunity to expand your network and learn about industry developments. It’s also an incredible experience where you not only gain knowledge but also meet fascinating people and create unforgettable memories.’

Lozada’s team from the Universidad Nacional, Bogotá won a prize through the GeoQuiz that gave them entrance to the Annual in Oslo in 2024. ‘The organisers were always supportive, making the experience much easier and more enjoyable,’ he says. ‘The experience was amazing, and I enjoyed every part of the event. But if I had to choose my favourite part, it would

be the field trip. It was a unique opportunity to learn about the geology of the area and interact with students from different countries and academic levels, making the experience even more enriching and fun.’

At the 2025 Annual, the final of the GeoQuiz will again be a highlight of the Student Programme. It will also be the occasion to see the finalists of the Laurie Dake Challenge present their solutions on CO2 capture in basalts, with winners announced during the Opening Session. The student field trip will offer a geological walk through Toulouse, exploring the city’s geo-heritage and urban development. Students can also join the Exhibition Tour & Education Hunt, meet exhibiting companies, and learn about career opportunities.

Meeting people is at the heart of the event, with the Networking Café providing a space to connect with industry representatives and fellow students. Meanwhile the

Student Chapters meeting is an opportunity to exchange experiences and best practices with peers worldwide.

For those looking to jump-start their careers, the Career Advice Centre offers trial interviews with industry experts and professional portrait photography to enhance CVs.

So, if you are a student and you don’t want to miss out, we recommend you register now at www.eageannual.org.

The EAGE Local Chapter Czech Republic recently concluded its 12th competition for the best Master and Bachelor thesis in geophysics. 2024 was another competitive year for the seven Bachelors and three Masters competing for prizes in the name of Prof Vlastislav Červený, a revered seismologist who died in 2022.

Supported by INSET (as main sponsor), the Faculty of Mathematics and Physics of Charles University, G IMPULS Praha, Seismik and EAGE, the goal of the competition is to encourage young scientists from Central Europe to study and apply geophysics. Selection criteria include innovativeness, presentation of the results, and applicability to the industry.

In the Masters thesis category, MSc Franziska Heck (University of Hamburg) was chosen as the winner with the thesis ‘Using total electron content data for earthquake prediction’. The judging commission appreciated the detailed review of published methodologies, the exhaustive approach to their re-evaluation and critical thinking, combined with excellent quality of the thesis.

In the Bachelor thesis category, BSc Petr Fedorchuk (Charles University) won with the thesis ‘Seismic refraction tomography and surface waves dispersion analysis for near surface characterisation’. He was commended for the thorough theoretical analysis combined with practical data processing and critical interpretation of processed results in this well written thesis.

Additionally, the commission awarded an honorary mention to BSc Michelle Putri (Ludwig-Maximilians-Universität München) for her thesis ‘Palaeomagnetism of Cainozoic Volcanic Samples from Gorontalo (Sulawesi, Indonesia)’ citing her thorough fieldwork combined with the application of geophysics.

The winners received a cash prize and access to an EAGE online course of their choice to continue advancing their knowledge and skills. Details of the 2025 competition will be announced soon.

Every month we highlight some of the key upcoming conferences, workshops, etc. in the EAGE’s calendar of events. We cover separately our four flagship events – the EAGE Annual, Digitalization, Near Surface Geoscience (NSG), and Global Energy Transition (GET).

4th Carbon Capture & Storage Conference

Asia Pacific

30 June - 2 July 2025 – Kuala Lumpur, Malaysia

The three-day conference offers a crucial platform to explore the role of CCS technologies in mitigating climate change. Experience in-depth discussions on project implementation, technological advancements, policy frameworks, among many others. Connect with leading experts, industry pioneers, and policymakers from across the Asia Pacific region and beyond. Kuala Lumpur, a dynamic hub of energy innovation, provides the perfect backdrop for this essential event. Be part of the conversation driving the deployment of CCS.

Discounted registration fees available until 20 May 2025.

Sixth EAGE Borehole Geology Workshop

22-24 September 2025 – Montpellier, France

Under the theme Advancing borehole geology: Integrating multi-disciplinary approaches, we will once again bring together the geoscience community to exchange knowledge, share best practices, and explore the evolving frontiers of geoscience and technology in borehole geology. Building on the original scope of this workshop series, the focus will be on bridging the gap between 1D borehole data and 3D Earth digital models. This will include discussions on the latest technological advancements, innovative applications, and the expanding role of borehole geology across key industries such as energy, mining, and environmental sciences.

Abstract submission deadline: 7 April 2025.

7th EAGE International Conference on Fault and Top Seals 14-18 September 2025 – Bucharest, Romania

Prime topic will be faults and top seals and their roles in the energy transition, and how to foster collaboration essential for disseminating and advancing our knowledge and reducing uncertainties in future applications. Cross-industry collaboration is a game-changer, according to conference chair Sarah Weihmann (RWTH Aachen). Latest advances using diverse approaches, such as outcrop analogues, laboratory analysis, framework and reservoir modelling, and simulations will be presented. The conference also features a field trip in the Carpathians foothills, a classical study area for deciphering salt tectonics.

Abstract submission deadline: 30 April 2025.

First EAGE Workshop on Geophysical Techniques for Monitoring CO2 Storage

21-22 October 2025 – Toronto, Canada

The focus is on the application of geophysical methods in CO2 storage, including low-cost monitoring solutions, fibre optics, and debate between active versus passive monitoring. Topics include comparison of onshore and offshore storage sites, exploring different risk profiles, regulatory governance, and site-specific monitoring challenges as well as addressing how early stages of CO2 storage development influence monitoring strategies. By comparing large-scale projects to smaller BECCS (Bioenergy with Carbon Capture and Storage) initiatives, attendees will gain insights into the technical and regulatory considerations of various storage environments.

Abstract submission deadline: 15 June 2025.

As part of the EAGE Near Surface Geoscience Conference & Exhibition (NSG) annual event, this year in Naples on 7-11 September, we are introducing the 1st Conference on Geohazards Assessment and Risk Mitigation.

This new conference aims to serve as a critical platform for discussion of the increasing impact of geohazards, including earthquakes, volcanic eruptions, landslides, rock and debris falls, floods, coastal erosion, and others. These risks have become more frequent and severe due to climate change and rapid urbanisation. The choice of Italy, particularly the region around Naples, as the location for this inaugural event is highly appropriate. The region has a unique geological structure and a long history of vulnerability to natural hazard events, including eruptions from Mount Vesuvius and regional earthquakes.

The conference will cover a broad range of topics in geohazards assessment and risk mitigation including those faced in marine and offshore industries in the era of energy transition. Discussions will explore the application of AI and machine

learning in geohazards research and innovative methods for data acquisition and geohazards studies. Experts will examine integrated monitoring and characterisation of hazardous sites, the effects of climate and environmental changes on geohazards, and multi-disciplinary approaches for geohazard assessment and risk mitigation strategies including inland, coastal, and offshore sites. Forecasting and early warning systems will be a key area of focus as will integrated techniques for advancements in instrumentation and remote sensing for geohazards studies, and the broader impact of geohazards to ensure project feasibility and success, minimising risk on the environment and society.

Putting the spotlight on geohazards is urgent given that in recent decades, more than 4 billion people have been affected

by disasters caused by geohazards. The economic and human costs of these events are immense, making it clear that proactive preparation is far more effective and cost-efficient than reactive recovery. Most importantly, strategic planning and risk mitigation can save countless lives.

EAGE’s recently formed Technical Community on Geohazards will support the conference, offering expert insights and fostering collaborative discussions on mitigating these pressing risks. Joining this community is essential for professionals looking to stay at the forefront of geohazards research and risk mitigation strategies. More information on the Community can be found on the EAGE website.

For more details on the 1st Conference on Geohazards Assessment and Risk Mitigation in Naples, see www.eagensg.org.

Iain Stewart, professor of geoscience communication, University of Plymouth (UK), introduces a new EAGE initiative.

Two decades ago, a Caltech professor of geophysics, David Stevenson, presented what he called a ‘modest proposal’: a mission for a small communication probe to descend to the planet’s core. His provocation was partly tongue-in-cheek; he knew it was technically impossible. But it conveyed a more serious point. Above us, our space probes had ventured many billions of kilometres into a realm that was mostly empty, mostly unknown, and about 1057 times larger by volume than our planet. Below us, our Earth probes – drill holes – had penetrated only some 10 km into the planet’s skin, yet that realm was crammed with interesting stuff (and also still mostly unknown, despite its much

what is just beneath their feet. Modern geological science has built up a pretty detailed picture of what lies below, but the obscurity and complexity of that scientific endeavour ensures that most people remain completely oblivious to our modern understanding of the planet they live on. The language that we use to describe that geological underworld is codified and arcane, the ways that we represent it is generally abstract and opaque, and the relevance that it has for ordinary people’s lives is too often remote and peripheral.

Essentially, the public (mis)understanding of the geological subsurface is a communication problem. To most people, the geological subsurface is not only an

greater proximity to us).

The geological subsurface ought to be the new frontier for human exploration. In contrast to the vast barren emptiness of the heavens above, the geological subsurface holds the raw ingredients for much of the modern world: the metal and mineral resources to build our cities and their infrastructure, the energy sources to power that development, and the natural storage spaces to take our waste.

And yet, 20 years on, thanks to the enduring popular lure of the cosmos, both public and policy makers still seem to know more (and care more) about the far reaches of the universe than about

unfamiliar environment, it is an alien world – conditions beyond the comprehension of the everyday experience and consciousness. The so-called ‘land below ground’ lies out of public sight, and therefore, out of mind. Conveying that world – conceptually and visually – requires a substantial intellectual and practical effort. It involves re-setting the conventional narratives that we tell about the subsurface, re-storifying the scientific and technological challenges that geoscientists face, and re-imagining the societal impacts and benefits that our subterranean knowledge might offer. The science of the subsurface offers new human narratives – groundwater provision

in Africa or the sustainability of ‘the critical zone’ that underpins our food security and biodiversity. The long-term viability of our advanced way of living will not be possible without the wise exploitation and stewardship of that ‘hidden commons’ below.

In short, modern geoscience needs better ‘Earth stories’ and geoscientists – the narrators of the planet’s ancient past – need to become better storytellers to translate dry, abstract technical information into compelling narratives that resonate with non-geoscience audiences and help them navigate future energy trajectories.

EAGE’s new community on Geoscience Communication and Public Engagement aims to bridge this gap. This initiative brings together geoscientists, educators, and communication experts to transform how we engage the world with the science beneath our feet. By fostering collaboration, sharing innovative storytelling techniques, and rethinking the way we present geoscience, we can make the geological subsurface as fascinating and relevant as the cosmos.

If you too are passionate about improving public understanding of Earth’s hidden depths, join us in shaping new, powerful visions that inform, inspire, and drive meaningful conversations about our planet’s future.

You can join the community by updating your EAGE affiliations and via LinkedIn by scanning the QR code.

For its first lecture of the year, Local Chapter London invited Dr Isobel Yeo and Dr Mike Clare, marine researchers at the National Oceanography Centre, UK, to present their study of the monstrous eruption of a mostly submerged Hunga volcano in the South Pacific Ocean offshore Tonga, an event which left its mark on our planet.

The extraordinarily powerful eruption triggered a tsunami that jumped across continents, a pressure wave that travelled several times around the world and created an eruption plume that shot through the atmosphere. The researchers showed how offshore surveys performed just months after the major eruption offered a full picture of the scale and profound impacts of the eruption on the seafloor.

As the eruption column collapsed, powerful flows of volcanic material plunged into the ocean, scouring deep gullies, and causing extensive damage to critical seafloor cables; cutting communication links to an entire country

at a critical time for disaster response. The timing and locations of cable breaks revealed that these unusually powerful flows travelled at high speeds (up to 122 km/hour) and over long distances (>100 km).

Hazards such as submarine landslides have continued to occur years after the initial event as a result of thick piles of sediment on the steep volcano flanks becoming destabilised by earthquakes.

Drs Yeo and Clare discussed how these findings can help understand hazards at other submerged volcanoes worldwide, how monitoring can help to address outstanding hazard blindspots, and how to enhance the resilience of critical seafloor infrastructure that keeps the internet and global communications running.

The recording of this lecture is available on the EAGE YouTube channel. To recognise the importance of research work and latest developments on future hazard mitigation strategies, a focus on geohazard assessment and risk mitigation has been added to the EAGE Near Surface Geoscience conference taking place in Naples this year where global experts including from the London community will converge. LC London renews the invitation to join the conversation in September by submitting an abstract by 1 May.

The mysterious, globally observed and unprecedented nine-day long seismic signal that captured scientists’ attention in September 2023 was the subject of the most recent talk at LCAberdeen. David Cornwell (Aberdeen University) described how it took the collaboration of over 70 scientists around the world combining a wealth of geophysi-

cal and geospatial data clues to find the reason for this event.

The explanation turned out to be the staggering 25 million m³ of rock and ice that collapsed into the remote Dickson Fjord in Greenland. This triggered a massive 200 m high mega-tsunami that continued sloshing back and forth in the narrow fjord for nine days,

a phenomenon known as a seiche. The findings revealed that the movement of such a vast mass of water generated vibrations powerful enough to travel through the Earth, sending seismic waves detectable across the globe. Never before have scientists recorded such an unusual mechanism causing a global seismic signal.

Dr Petr Tábořík, an internationally recognised expert in electrical resistivity tomography (ERT) in morphological studies, was this year’s first guest speaker for EAGE Local Chapter Czech Republic.

Currently a researcher at the Institute of Rock Structure and Mechanics of the Czech Academy of Sciences, Dr Tábořík discussed ‘Geophysical

investigation of active faults in the San Andreas Fault Zone (Southern California) and active landslides in the Cascadia Subduction Zone (Oregon)’. The presentation was based on research during a Fulbright scholarship in the USA in 2024 and provided valuable insights into his collaborative work with research groups in San Diego.

The core of Dr Tábořík’s talk focused on ERT measurements conducted at various sites within the San Andreas Fault Zone in Southern California, one of the most significant and closely monitored fault systems in the world, comparing his findings with data from other teams using seismic surveys and dilatometers. The strong potential

of ERT in identifying surface manifestations of deep tectonic structures, particularly seismic faults was highlighted.

Dr Tábořík then described geophysical studies of active landslides in the Cascadia Subduction Zone in Oregon. His research demonstrated the critical role of ERT in geological surveys of these landslides, some of which pose risks to existing road infrastructure. The resulting cross-sections revealed the complex structure of the landslides, underscoring the importance of ERT in analysing their dynamics and behaviour.

LC Czech Republic looks forward to an engaging series of discussions during the year and invite all interested members to join.

Shi Yuan Toh explains how being a committee member of the Young Professionals Special Interest Community can serve your career goals.

I first joined EAGE as an undergraduate, not realising how much it would shape my path forward. Looking back, those early days of membership gave me exactly what I needed as a budding geoscientist – a window into the real world of the profession and connections with people who shared my fascination with the field.

The real value came from the people I met at conferences and workshops. Seeing established professionals present their work and chat with students like me showed me what was possible in this field. It pushed me to think bigger about my own future. The organisation wasn’t just a line on my resumé; it became a bridge between classroom theories and real-world applications, helping me understand where my studies could actually take me.

Now, as a young professional on the EAGE committee, I’ve had the chance to give back. Last year’s EAGE GET event stands out in my mind. I volunteered alongside other young professionals, Carrie Holloway and Tie Xing, to help run the programme. There’s something energising about working with peers who are just as passionate about advancing geoscience education as you are. Whether we were handling logistics, chatting with

attendees, or moderating sessions, the whole experience reminded me why I love this field.

That volunteer experience taught me more than I expected. Beyond just improving my soft skills, it opened my eyes to how different people approach challenges in our industry. I got to learn from professionals at all career stages, each bringing their unique perspective to the table. It was fascinating to see how education and training methods evolve to keep pace with industry developments.

EAGE has been there through every stage of my journey so far, from confused undergraduate to budding researcher. The resources and community support have been invaluable in shaping both my professional goals and research direction. I’m excited to see where this community takes me next, and to keep contributing however I can along the way.

EAGE UNSA Student Chapter (Peru) recently conducted a structural geology workshop in the Puno region, famous for Lake Titicaca, said to be the highest navigable lake in the world. The workshop combining virtual theoretical sessions with field trips to three geologically significant locations: Azoguini Hill, the Pomperia Mine, and the geotouristic site of Aramu Muru. This five-day event aimed to strengthen participants’ technical skills in analysing geological structures, field mapping, and processing structural data using cutting-edge tools and methodologies.

At Azoguini Hill, a site known for its structural complexity and potential for studying faults and deformations, students were introduced to the Brunton compass, learning to measure parameters such as strike, dip, pitch/ rake, plunge, and trend. Such measurements are crucial for interpreting the orientation of rock layers and geological structures.

The second day focused on exploring the Pomperia Mine, a deposit known for its barite and hematite mineralisation. Here students were invited to identify the host and roof rocks and measured their inclination using the compass. Anaconda mapping techniques, commonly used in porphyry deposits, were applied, and evidence of low-sulfidation epithermal systems, such as banded jasper, chalcedony, and silica, was identified.

The final field day focused on fold analysis and a visit to the geotouristic site of Aramu Muru. In the rock for-

mations, hinges and inflection points in folded structures were identified using stereonets and maps to plot these features. The exercise helped participants understand the geometry and kinematics of folds, as well as their relationship to regional tectonic stresses.

At Aramu Muru, located in the Lower Puno Formation, a major fault caused a change in the orientation of the rock layers. Students were able to analyse the phenomenon in detail, and so understand how tectonic events can alter the original rock structure.

Through events like this, the EAGE UNSA Student Chapter reinforces its mission to support students in their professional development and its vision of being a benchmark for academic excellence in the geosciences field.

For more information about future events, you can contact the EAGE UNSA Student Chapter at eage.studentchapter.unsa@gmail.com.

The EAGE Student Fund supports student activities that help students bridge the gap between university and professional environments. This is only possible with the support from the EAGE community. If you want to support the next generation of geoscientists and engineers, go to donate.eagestudentfund.org or simply scan the QR code. Many thanks for your donation in advance!

Raffaella Ocone began life in a small hilltop Italian town. She has been professor of chemical engineering at Heriot-Watt University since 1999, the first female professor of chemical engineering in Scotland and second in the UK. She serves as co-lead of the hydrogen theme within the iNetZ+ Global Research Institute (GRI). Recipient of numerous academic and achievement awards including in her native Italy, she becomes 84th president of the Institution of Chemical Engineers (IChemE) in June.

I grew up in a small rural town in southern Italy. From an early age, I loved school, with mathematics quickly becoming my favourite subject. My greatest aspiration was simply to read but I was practical enough to realise this alone would not pay the bills. I then thought to become a shepherd: my sheep could graze peacefully while I immersed myself in my books. Although my parents never attended university, they strongly believed in the value of education. I hope I inherited my mother’s curiosity and imagination, qualities essential for an academic career. My father had the engineer’s skills and attitude, always able to find a practical solution. I realise that he was my very first role model.

Why chemical engineering?

In high school, I discovered chemistry. It felt like an extension of maths, with chemical reactions governed by logical rules. Growing up in a small town, I was the first woman to study engineering. Despite consistently being at the top of my class, my decision was met with scepticism. But the more people doubted my ability to succeed, the more determined I became to prove them wrong.

Academia came by chance. When I enrolled in chemical engineering at the Università di Napoli there were only five of us women. This soon dissolved into three. I often felt insecure, especially com-

ing from a small town. A world-renowned professor in the department was to supervise my final thesis. His first words to me were: ‘Miss, are you sure you want to work with me? The project I can offer is very difficult, are you certain you can handle it?’ I was furious. But I refused to be intimidated, went back and told him I would accept the challenge. It was the best decision of my career, my undergraduate research was published, and thanks to his advice I ended up at Princeton.

Princeton was an immense challenge. I was the only Italian in the chemical engineering programme, my class was evenly split between American and Greek students. The experience taught me invaluable lessons: that perseverance could take me anywhere and that academia was where I truly belonged.

I guess my work in chemical reaction engineering of multi-component mixtures, research begun while working with my former undergraduate supervisor. We studied complex reaction systems, including thermal and catalytic cracking of oil cuts and hydrodesulfurisation processes. The work proved to be of crucial interest to the petrochemical industry and was later adopted by oil companies in the US, extending to refinery process management providing a more rigorous and systematic approach to handling complex reaction systems.

For a long time, I believed that discrimination against women in academia did not exist. In hindsight, I realise that I was in denial. We are still not where we should be, especially when it comes to promotions and leadership roles. However, I also firmly believe that focusing solely on gender is a mistake. Diversity takes many forms. In one way or another, we are all diverse, and without diversity, there can be no real progress.

Twenty years ago, I was invited to join a Royal Academy of Engineering committee focused on the teaching of ethics in engineering, a great opportunity to show to my philosopher brother that engineers can do ethics, whilst philosophers cannot do engineering! Anticipating the use and potential misuse of emerging technologies is not always straightforward, which is why ethics should be embedded in engineering education.

Reading is my preferred pastime (I do not own a television), with mystery and crime stories my favourites. Solving a mystery like maths, requires starting with data, following logical steps through deductive reasoning, and ultimately (hopefully) arriving at the correct solution. Beyond reading, I also love hiking and classical music (but limited success playing piano).

BY ANDREW M c BARNET

Samuel Goldwyn, a legendary Hollywood movie mogul, once quipped. ‘We want a story that starts out with an earthquake and works its way up to a climax’. Hopefully that’s not what we are witnessing with the current eruption of change in the energy landscape.

In the last few months government and industry leadership around the world have been noticeably adopting a more explicit pushback back on the net zero 2050 schedule and the means for getting there and a more vocal appreciation of the continuing need for oil and gas. It all adds up to a big shakedown of previous assumptions about where global energy supply and demand is heading, complicated by the disruptive influence of US energy strategy going forward.

Tempting as it is, not all the blame can be heaped on the newly elected US President Trump. In fact his early energy-related executive orders (EOs), disruptive as they may be, were telegraphed during his election campaign encompassed by ‘Drill, baby, drill’ the populist slogan first mouthed by the now forgotten failed vice-presidential candidate Sara Palin.

sentiment revoking all pre-existing mandates directing agencies to advance environmental justice (EJ) and require agencies to terminate all offices dedicated to EJ or ‘equity’.

Specifically with regard to US hydrocarbons production, the EOs are mostly shock and awe to please some sectors of the US electorate. In reality the impact may not be that significant, although encouraging to the oil business to know that the government is on its side. Despite the grumbling about over-regulation, the Biden Administration authorised a historic number of leases for oil drilling in the US in 2023. US oil and natural gas production also reached record highs in 2022 making it the world’s largest producer of crude oil with the highest level of refining capacity, producing a world record-breaking average 12.9 million barrels per day in 2023. It has also been the largest exporter of LNG, with an average export volume of 11.9 billion cubic feet per day in 2023.

‘Little to warrant emergency measures’

So it was expected that the US would immediately withdraw from the 2015 UN Paris climate accord (although even Darren Woods, CEO, ExxonMobil, protested this). To add salt to the wound, it has quit the Just Energy Transition Partnership (JETP) and cut its contribution to the $45 billion international initiative launched at the Glasgow COP26 climate summit to support several developing countries in their shift away from coal to clean energy.

Other headline EO directives included various deregulation measures to ‘unleash America’s affordable and reliable energy and natural resources’, lifting restrictions on LNG exports, promoting energy development in Alaska, pausing of offshore wind development and reversing the electric vehicle promotion mandate of the Biden administration (surprising given the president’s embrace of Elon Musk, CEO of Tesla, and his federal bureacracy chainsaw man). Two further EOs couldn’t resist some anti-woke

As analysts have pointed out, there seems little to warrant emergency measures. The US could in fact contribute to a potentially looming global oil glut exerting down pressure on the price of oil. That could bring relief at the gas pumps for US consumers in accordance with Trump’s wishes. However it reduces the incentive for any serious investment by oil companies in the near future, notwithstanding the newly created National Energy Dominance Council tasked with clearing the way for more US oil and gas production.

The US Energy Information Administration suggested in March that ‘oil inventories will build and place downward pressure on crude oil prices in late-2025 and through 2026 when we expect OPEC+ to unwind production cuts and non-OPEC oil production grows. It said: ‘As a result, we forecast the Brent crude oil price will fall to an average of $68/b in 2026’. No reference was made to the potential economic mayhem or otherwise likely from the Trump Administration’s tariff war antics against Canada, Mexico, China and the EU. For that you have to go to OPEC+.

OPEC+ confirmed in March its commitment to gradually unwinding its 2.2 million b/d voluntary cuts through to December

next year but emphasised the pre-cautionary nature of this strategy in line with maintaining a stable market. It is sticking to its demand growth projection of 1.4 million barrels per day for 2025 and 2026, and said it expects the global economy to grow by 3.1% this year and 3.2% next year with strong demand from the air travel and automotive industries. Uncertainty arising from the Trump administration’s tariff plans will ‘contribute to volatility’. OPEC+ said it expects the world economy to adjust. ‘It remains to be seen how and to what extent potential tariffs and other policy measures will play out. So far, they are not anticipated to materially impact current underlying growth assumptions, but the outcome of potentially further rising uncertainties and the scope and significance of potential tariffs and other policy measures will need close monitoring.’

Averaging the many forecasts available, the assessment seems to be that, without a major trade war, stockmarket crash, etc leading to recession, the oil price will hover precariously around the $70 a barrel mark for the next year or two with, if anything, a tendency to go lower, but no indication that the world is losing its appetite for oil.

This is not a good omen for rapid steps towards energy transition when taken in assocation with a generally cautious view of growth potential in the world economy following a limited rebound from the pandemic. For example, many OPEC+ members rely heavily on oil revenues to maintain their economies at a sustainable level, making substantial green investment a luxury they cannot afford. The situation is much worse for developing countries without an oil buffer. As Ruud Weijermars implies (Special Topic article in this issue), in the current economic climate with competing demands on their budgets, European countries may also baulk at the cost-effectiveness of a major decarbonisation investment such as carbon capture and storage and lack the political will required to achieve it.

31% that felt this way in 2024. Similarly, only 32% expect it by 2050. On average, oil and gas executives anticipate peak oil around 2038, a clear signal that sector leaders expect legacy assets to play a crucial role in meeting energy demand for the foreseeable future’.

Bain & Co says: ‘The era of enthusiasm for environmental, social, and corporate governance–driven investment is giving way to a harder-nosed focus on ROI. Tighter budgets, constrained balance sheets, and rapidly rising capital costs are forcing companies to make tough calls about where to place their bets.’

A similar story comes from a report from Fitch Group’s BMI unit (quoted by Rigzone). It cites some major companies which had set ambitious goals for renewable energy investment and achieving net zero goals, and are now revising their commitments. ‘Equinor halved its low carbon investment from $10 billion to $5 billion. bp has abandoned its 2030 oil output reduction target and is divesting its US onshore wind business. Shell has weakened its carbon reduction targets and is investing in Bonga North deep-water oil and gas project in Nigeria.’

‘Euro Majors’ cutbacks broadly mirror the global trend’

The Euro Majors’ cutbacks in low-carbon investment broadly mirror the global trend, according to a recent Wood Mackenzie commentary. After diverging for years, US and Euro Majors’ spend on low carbon is now converging at around 10-15% of total investment.

There are voices just as potent as President Trump’s that seek to normalise the oil industry’s outlook. At this months’s CERA Week international meeting in Houston, Saudi Aramco CEO Amin Nasser called for a ‘reset’ to acknowledge that demand for oil and gas is not going to be replaced soon. He called the ambitious timetables put out by consumer and environment groups a ‘fantasy’, and that there was more chance of Elvis (Presley) speaking after him at the meeting than current energy transition plans succeeding.

With pressure on margins, major oil companies have been reassessing their priorities, and particularly the value of investing in decarbonisation markets. They are clearly choosing to focus on their core business for two main reasons. Firstly, the pace of transition has been slower than anticipated, meaning the timing of the decline in demand for oil and gas is constantly being deferred. Secondly, green initiatives do not make sufficient return on investment to satisfy stakeholders. How much impact this will have on energy transition is unclear since the oil industry is not the only player in the game, but its investment dollars are obviously very significant.

Reports from two industry analysts seem to sum up the prevailing view. Bain & Company’s 2025 Energy & Natural Resources Executive Survey of 700 executives in oil and gas, utilities, chemical, mining and agribusiness found nearly half (44%) of energy and natural resources executives now expect the world to reach net-zero emissions by 2070 or later, a steep jump from the

The big picture, according to Wood Mackenzie is that investment in power and renewables, upstream oil and gas and critical metals for the transition are continuing to rise to a record $1.5 trillion, a 6% increase. Low carbon’s share of the total jumped from 32% in 2015 to 50% in 2021 but has stalled since and won’t increase on its forecasts until the end of the decade, thereby not anywhere meeting the Paris Agreement goals.

Thanks to the scale of the NOCs’ cash generation, overarching national targets to decarbonise and aspirations to diversify their economies away from oil and gas, Wood Mackenzie suggests NOCs will carry the low-carbon torch for the oil industry in the next stage of the energy transition. Between them Saudi Aramco, ADNOC, Petrobras, Petronas, PetroChina, CNOOC and ONGC are said to be planning to invest more than $20 billion a year through 2030 ‘albeit for many of these industry giants, it’s a much smaller proportion of free cash flow’.

In these times we must expect the unexpected.

Views expressed in Crosstalk are solely those of the author, who can be contacted at andrew@andrewmcbarnet.com.

Viridien has reported healthy fourth quarter results in a vindication of the asset light model that the company has put in place over the last few years.

As seismic companies with asset-heavy models continue to struggle because of the strict spending discipline imposed by the oil majors in 2024, Viridien reported a fourth quarter net profit of $29 million on revenues of $427 million compared to a net loss of $25 million on revenues of £265 million in Q4 2023. Operating profit was $49 million compared to an operating loss of $11 million in Q4 2023.

By contrast the asset-heavy Shearwater GeoServices has reported a net loss of $39 million on greatly reduced fourth quarter revenues of $104 million. TGS, meanwhile, which last year acquired PGS and its fleet of seismic vessels, has reported much improved fourth quarter net income of £38 million on revenues of $493 million. All companies reported a healthier pipeline of projects for 2025 in their results statements.

At Viridien, Digitial, Data and Energy Transition Q4 revenue was £238 million, up 10%. Orders are up for 89% year on year. ‘New Businesses in GEO confirm the positive market dynamics in carbon sequestration with several projects in Norway, US Gulf and in Asia Pacific, as well as in Minerals & Mining with the award of programs in Australia and Oman,’ said the company’s results statement.

Earth data revenue of $131 million was up 27% year on year. Prefunding grew by 6% to £205 million. After sales grew by 25% to $178 million. Capex was $252 million, including the large Laconia Ocean Bottom Nodes (OBN) project in the US Gulf, and the North Viking Graben streamer survey in Norway.

Sensing and Monitoring Revenue of $100 million was down by 16% year on year. New businesses in SMO experienced ‘strong momentum, with deliveries for the geothermal market and infrastructure monitoring.

Sophie Zurquiyah, chief executive officer of Viridien, said: ‘In 2024, we met our revenue and exceeded our profitability and cash generation targets driven by strong commercial success at Geoscience, a dynamic performance at Earth Data in both our key basins and prospective regions and the continued focus on operational efficiency at Sensing & Monitoring.

For the full year of 2024 Digital, Data & Environment revenue was $787 million (+17%). Revenue growth for Sensing & Monitoring was $330 million. Revenue growth for New Businesses was 33%, exceeding Viridien’s 30% target.

Net Cash flow was $56 million, including $(75) million contractual fees from vessel commitments. Viridien confirmed its 2025 target of $100 million of net cash generation, putting the company in a good position for balance sheet deleveraging this year, according to Zurquiyah.

Looking to 2025, Viridien said the E&P Capex environment is expected to be stable year on year. Offshore exploration is gaining momentum in key regions such as the US Gulf, Brazil, Norway as well as frontiers areas such as the Equatorial Margin and the East Mediterranean Sea. Middle East growth is expected with investments in advanced imaging and digital solutions. Demand is expected to be strong for high-end geophysical technologies, such as OBN and Full Waveform Inversion (FWI).

There is expected to be continued market growth in carbon sequestration and storage with new imaging contracts from oil and gas operators. There will be increased interest from the minerals and mining sector for subsurface characterisation. The infrastructure monitoring market will continue to increase by double digits.

‘Thanks to 2024 financial performance and the favourable debt market, our bond refinancing could be realised in 2025,’ said Viridien.

Shearwater Geoservices and TotalEnergies have signed a three-year agreement for worldwide marine seismic streamer acquisition services.

The capacity reservation agreement (CRA) guarantees a minimum of 18 vessel months of activity for Shearwater’s highend seismic fleet.

‘The CRA reflects the longstanding relationship between TotalEnergies and Shearwater straddling geophysical data collection and analysis, supporting exploration effort, production monitoring and carbon capture and storage activities,’ said Irene Waage Basili, CEO of Shearwater. ‘This capacity agreement is

the first of its kind with a major E&P company. This strategic CRA will in addition to providing valuable visibility for both parties and utilisation for Shearwater, also offering a great platform for potential further collaboration across other services in our portfolio. Our aligned interests and a focus on new frontier areas makes us a very complementary fit.’

Shearwater is already carrying out an ocean bottom node (OBN) survey for TotalEnergies over Block 32 in the Louro and Mostarda fields. It is also currently working on a contract for TotalEnergies offshore Angola.

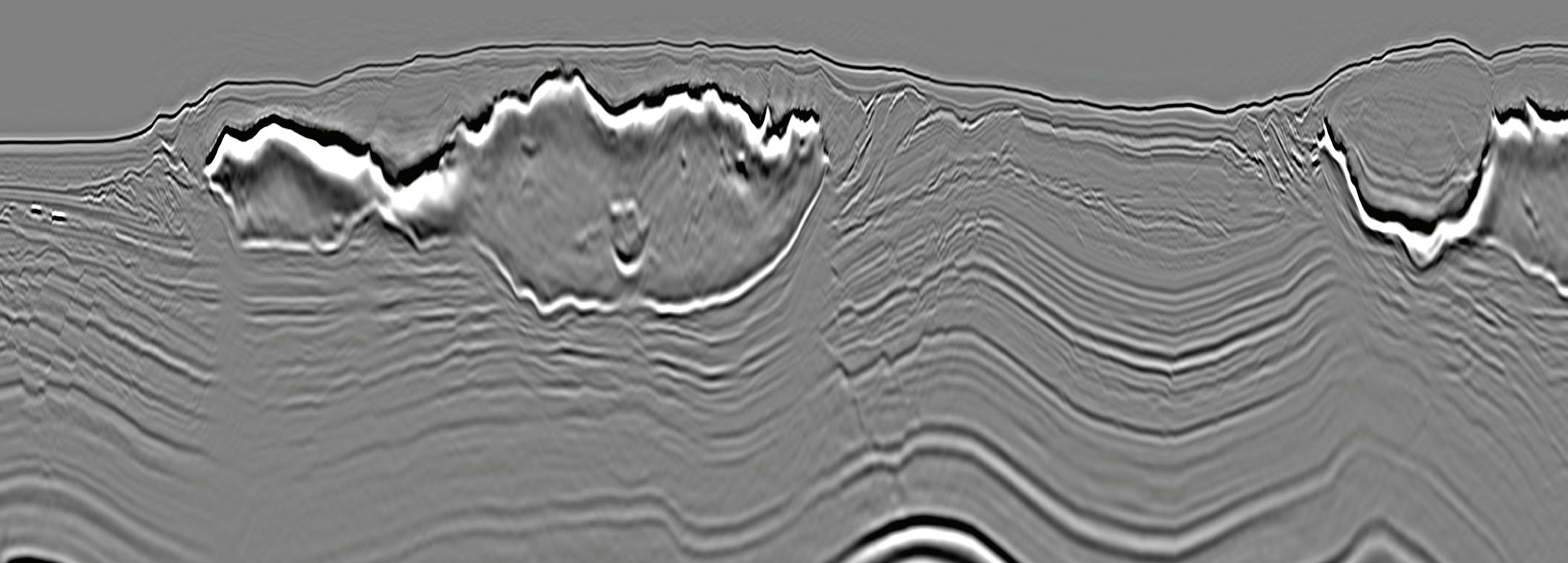

TGS has completed reprocessing of the Block 16 GeoStreamer MC3D seismic dataset in Angola’s Lower Congo Basin, in partnership with Agência Nacional de Petróleo, Gás en Biocombustiveis (ANPG).

‘Exploration in the deepwater Lower Congo Basin has experienced a resurgence in recent years, with numerous significant discoveries being made and rapidly brought on stream,’ said TGS. ‘This 3684 km2 rejuvenation project utilises modern depth processing workflows to deliver enhanced imaging beyond the original data, enabling detailed evaluation of deeper target plays in both post-salt and pre-salt sections.’

Angola’s Block 16 has remained largely underexplored since the early 2010s, with the most recent exploration well drilled in 2013, added TGS. ‘Until recently, publicly known oil and gas discoveries within Block 16, as imaged by this dataset, were limited to the Bengo (1994) and Longa (1995)

Upper Miocene finds in the northern section. However, a recent re-evaluation of wells in the Lower Congo Basin has identified oil recovery from Upper Miocene reservoirs in the southern part of the survey area.’

STRYDE has won a contract to supply 42,000 autonomous nodes to Smart Seismic Solutions (S3).

The nodes will be deployed on a 3D high-density seismic survey for the CarbonCuts carbon dioxide (CO2) storage project onshore in Denmark.

The CarbonCuts project is a high-profile initiative aimed at identifying optimal onshore subsurface storage solutions for CO2 sequestration, said STRYDE.

The seismic survey will be crucial in advancing Denmark’s ambitious goal of achieving net-zero emissions by 2045, utilising advanced seismic technology to map geological formations.

‘CO2 storage on land is significantly more affordable than offshore options and increasingly accessible for a wider range of emitters,’ said STRYDE. ’The survey will advance Denmark’s goal of achieving net-zero by 2045.’

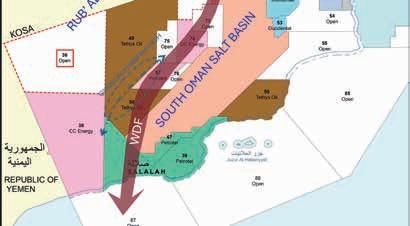

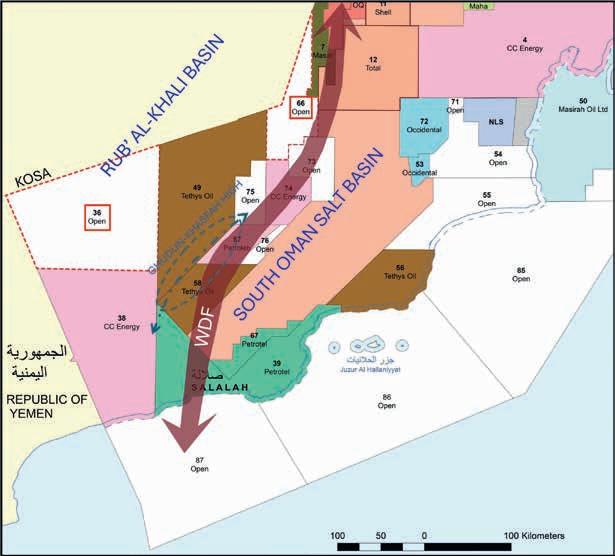

The Sultanate of Oman has launched a 2025 licensing round with three onshore blocks are on offer.

Blocks 36 and 66 border Saudi Arabia along a zone where the geology is transitioning between ‘typical’ South Oman Salt Basin (SOSB) and the Rub’ Al-Khali Basin This is in the vicinity of the compressional ‘Western Deformation Front’ (WDF), which was recently tested in Tethys Oil’s Kunooz-1 well.

‘Whilst we retain a deep interest into the Cambrian collisional tctonics within the WDF, these blocks will primarily focus on the younger Safiq Group Play (within the Haima Supergroup) and will revolve around the proven Silurian Sahmah Formation hot shale source rock (and seal)’, said Oman’s Ministry of Energy and Minerals.

‘The underlying Hasirah Fm sands represent a proven reservoir target, and younger sands within the Gharif and Al Khlata Formations also have potential, at least in Block 66. The primary challenges will lie in defining subtle trap configurations, especially for pinch-outs, together with the mapping of effective top seals. In addition, the top-seal capacity of the Sahmah shales will need to be circumvented if the Permian is to come into play, said the ministry. Both Circle Oil (Block 49) and Maersk (Block 48) have historically pursued these plays on the same trend. ‘Circle exited in 2015 after encountering drilling issues on its Shisr-1 well, so it is reasonable to assume that it didn’t disprove the play.

‘The deeper plays in the Huqf Supergroup (as targeted in Kunooz-1) are secondary and can be considered to have

a higher risk profile,’ said the ministry. ‘That said, work by Phillips Petroleum, when operating Blocks 36 and 38, cited gravity modelling to speculate the existence of a salt sequence to the west of the Ghudun-Khasfah High, which would be the time equivalent of the Ara Group in the SOSB. Although their published 2D seismic data were poor, this observation is consistent with our data-driven model for the evolution of the WDF, together with the more recent drilling results of PDO, PTTEP and Tethys Oil in the region.’

Searcher Seismic has launched GeoBot, an AI-powered assistant providing precise, on-demand answers to complex geological questions, enabling faster decisions.

Included with Searcher’s GeoClerk subscrip tion and built on advanced Retrieval-Augmented Generation (RAG) technology, GeoBot leverag es GeoClerk’s database and securely accesses an organisation’s private datasets to deliver tailored insights.

‘From exploration summaries and production data to deposit statistics, GeoBot transforms raw data into actionable insights in seconds, supporting everything from exploration strategy refinement to critical decision validation and serving as your knowledgeable, trusted assistant,’ said Searcher.

‘GeoBot’s LLM-agnostic architec ture ensures it can integrate with the best

AI models, giving organisations flexibility to evolve with cutting-edge technology. Importantly, GeoBot only works with AI providers that do not use or train on business data so your answers remain yours.’

Geobot ensures that every fact, insight, and answer provided is backed by verifiable sources, added Searcher. It retrieves relevant data from trusted geological reports, academic papers, and industry sources, embedding citations (and direct links to the original sources) directly within responses.

Tim Hall-Johnson, GeoClerk’s head of product and technology, said: ‘With its advanced AI capabilities, powered by one of the most extensive geoscience databases in the world, GeoBot enables geologists to obtain actionable insights faster than ever before.’

The European Carbon Capture and Storage Association (CCSA) has urged the UK’s government to move faster in delivering carbon capture projects.

The report outlines three further key recommendations. Learning from Track-1, the next phase of CCUS funding must improve the risk-sharing between parties and optimise the full value chain; from supply chain, CO2 capture project, transporting the CO2 to permanent CO2 storage, without any delay to the allocation process. The government must also commit to regular future allocation rounds, as it has in offshore wind, to signal the scale and timing of future opportunities to investors, industry and the supply chain, which will drive down costs.

To accelerate delivery of comprehensive carbon markets both in the UK and internationally, The UK must efficiently implement its planned expansion of the UK Emissions Trading Scheme (ETS), introduce a UK Carbon Border Adjustment Mechanism (CBAM), and develop cross-border CO2 transport and storage markets, said the report.

Public finance should be leveraged through GB Energy and National Wealth Fund: targeted public finance

mechanisms should be used to derisk first-of-a-kind projects, to attract further private investment in the mediumto-longer term.

If these recommendations are implemented, the CCUS industry is projected to create 50,000 skilled jobs, unlock £94 billion of cumulative GVA in the UK and CO2 storage exports could generate revenues of £30 billion per year by 2050.

Mark Sommerfeld, UK Director, said: ‘Getting spades in the ground for the first CCUS clusters will provide other projects with important lessons and work towards strengthening the value chain. This is critical as we work to achieve economies of scale that will foster innovation and promote collaboration in contracting and supply chains. In doing so, we will be able to realise efficiencies and strengthen investor confidence in the industry, ultimately lowering the cost of delivering and operating CCUS across the UK’s industrial heartlands.

Most importantly, the government must sustain momentum by providing long-term certainty and commit funding to the already-selected CCUS projects and the broader pipeline. Acting now will reduce costs in the future.’

TGS has won a 4D streamer contract acquisition project in the Barents Sea covering the Goliat 4D field operated by Vår Energi. The Goliat 4D project is scheduled to start in July with a total duration of approximately 20 days.

Meanwhile, TGS has a new multi-client 3D streamer acquisition and processing project, also in the Goliat area of the Norwegian Barents Sea. The GeoStreamer survey will span up to 1600 km 2 over recent discoveries such as Countach, Elgol and Lupa, and expanding on TGS’ data coverage in the Goliat area of the prolific Hammerfest Basin. The Hammerfest Basin 3D project is scheduled to start in early August.

Kristian Johansen, CEO of TGS, said: ‘The Goliat area is one of the hotspots in the Norwegian Barents Sea with significant drilling success and exciting new discoveries. We are very pleased to secure funding for more multi-client 3D acquisition in this part of the Norwegian Continental Shelf for the 2025 summer season.’

The Malaysia Bid Round 2024 (MBR 2024) has concluded with the signing of two Production Sharing Contracts located off the coast of Sabah. The PSCs were awarded to a consortium of Inpex, Petronas Carigali, and SMJ Energy.

This milestone brings the total to 14 new PSCs signed under MBR 2024,

involving 12 different operators. These contracts encompass 11 discovered resource opportunities and three exploration blocks.

Petronas has also signed technical evaluation agreements for the Langkasuka Basin in the Straits of Malacca and the Layang-Layang Basin off the coast

of Sabah. ‘The agreements, made with seven leading oil and gas companies – bp, Eni, Inpex, Petronas Carigali, Pertamina, PTTEP and TotalEnergies – underscore Petronas’ commitment to unlocking frontier basins and driving exploration at these promising regions,’ said Petronas.

MBR 2025 is offering five exploration blocks in the Malay and Penyu Basins offshore Peninsular Malaysia, and the Sandakan Basin, off the coast of Sabah, ‘each presenting diverse geological plays with significant resource potential’. Additionally, three discovered resource opportunities (DRO) clusters are available in shallow waters near existing infrastructure and potential gas markets, enabling rapid monetisation.

The MBR 2025 virtual data room is open. visit http://www.petronasmbr.com

Shearwater GeoServices has reported a net loss of $39 million on revenues of $104 million for the fourth quarter of 2024 compared to a net loss of $31 million on revenues of $179 million in Q4 2023.

The company reported an operating loss of $24 million compared to an operating loss of $18 million in Q4 2024.

Marine seismic acquisition decreased due to project delays earlier in the year. An uptick in the number of tenders and awards during the second half of the year did not impact actual acquisition activity,’ said the company. However, Shearwater was awarded three OBN and six streamer-contracts in Q4, the equivalent of approximately 26 vessel months. Year-end contract backlog was $337 million compared with $239 million at the end of the third quarter of 2024 and $585 million at the end of the third quarter of 2023.

Shearwater operated an average of 9.9 active vessels in the quarter, compared to 11.1 active vessels in the third quarter of 2024 and 9.2 in the fourth quarter of 2023. The decline from the previous quarter reflected the project delays and lower activity in key regions such as India and Brazil. Utilisation of the active fleet was 50% compared to 61% in the previous quarter and 68% in the fourth quarter of 2023.

The multi-client revenue of $14 million in the quarter relates to the first Pelotas season in Brazil and Namibia late sales. At year-end, Shearwater had more than $30 million of additional unrecognised multi-client revenue related to already acquired, but not yet delivered data. Total operating expenses were $127.4 million compared to $197.2 million in the same period of 2023.

Full-year operating revenue was $619.8 million, down from $922 million in 2023, due to lower activity with 63% utilisation of the active fleet compared to 78% a year earlier. Marine acquisition

represented 92% of revenue, Software, Processing and Imaging 4% and the multi-client segment 3%. Net loss for the year was $53.4 million compared to a net profit of $47.8 million in 2023. Net cash flow from operating activities for the full-year amounted to $92.5 million compared to $309.6 million in 2023.

The SW Tasman/Pearl node platform has mobilised to perform consecutive West Africa contracts. At completion of current contract pipeline, the SW Tasman/Pearl kit will have had about 18 months of consecutive operations since January 2024. Meanwhile, Shearwater is also ‘further strengthening our multi-client position’ by preparing for the second Pelotas Basin multi-client 3D acquisition season in Brazil.

Irene Basili, CEO of Shearwater, said: ‘Marine seismic acquisition activity was muted towards year-end extending the weaker-than-expected 2024 market. This was also reflected in the fourth quarter financial performance. Still, the pace of contract awards was encouraging.

Several contracts delayed in 2024 are moving ahead, adding to the underlying market demand. While these signs are positive, our outlook remains influenced by our client’s continued cautiousness and capital discipline. Therefore, we cannot assume that the yearover-year increase in activity at the start of 2025 will continue. That said, we are well positioned to benefit from a tighter market as an industry consolidator with available swing capacity and technology leadership.’

Shearwater expects to report an active fleet for the first quarter of 2025 in line with the fourth quarter of 2024, but with significantly improved utilisation with more vessels allocated towards contract work following recent awards.

bp has set out how it intends to increase oil and gas investment and reduce investment in renewables after disappointing fourth quarter 2024 results.

Upstream investment will increase to around $10 billion a year to grow production to 2.3-2.5mmboed by 2030 and generating an extra $2 billion in cash flow.

There will be more ‘selective investment’ in energy transition projects, such as biogas, biofuels and EV charging. ‘Capital-light partnerships’ will be set up in the hydrogen/CCS sectors. Overall, investment in transition businesses of $1.5–2bn p.a will be more than $5bn a year lower than previous guidance.

bp will target structural cost reductions of $4-5 billion by the end of 2027 to reduce annual capex to $13-15 billion. It will also make some $20 billion of divestments by 2027.

‘bp will grow its upstream oil and gas business, focus its downstream business, and invest with increasing discipline into the transition. It builds on bp’s distinct strengths and competitive advantages as an integrated energy company – with a world-class portfolio with top tier oil and gas businesses in attractive basins and leading integrated positions and brands across value chains, all underpinned by trading, technology, and partnerships.

Chief executive Murray Auchincloss said: ‘We are reducing and reallocating capital expenditure to our highest-returning businesses to drive growth, and relentlessly pursuing performance improvements and cost efficiency. We will grow upstream investment and production to allow us to produce high margin energy for years to come. We will focus our downstream business on markets where we have leading integrated positions. And we will be very selective in our investment in the transition, including through innovative capital-light platforms.’

In 2024, BP’s net income fell to $8.9bn, down from $13.8bn in 2023.