Managing Your Finances During the Pandemic Contributed by Dt. Tara Y. Davis Ahmed Court No. 134 Tallahassee, Fla. Most of the time, people do not know in advance they are going to lose their job. The news often comes as a complete and unwelcome surprise. As the COVID-19 Coronavirus continues to spread around the State of Florida and across the United States, staying healthy is a top priority. At the same time, having a monthly budget for the long term can help if you are experiencing tough financial times now and if you anticipate a loss of income soon. Reviewing your family budget should be a critical part of your COVID-19 response strategy. Revise Your Budget If you’re facing a job loss and don’t have a monthly budget for your household, make a household budget immediately. And if your current budget is based on your previous income, go through and analyze your expenses based on your new situation. Cutting costs can make getting through the current financial situation less stressful. Before you can do that, you first need to understand where and how you are spending money. Compare your expenses to your income. If your expenses are higher than your income, then look at adjusting your spending down to only the “essentials” – food, housing, utilities and transportation. If you are in disaster or emergency budgeting mode, prioritizing your expenses matters. Paying the rent or mortgage and keeping the utilities on should take precedence over buying clothes or dining out several times a week. Trim whatever you can from your spending. Some other ideas to save money on a tight budget include: • Cancel cable and watch TV online. • Cancel lawn services and trips to the dry cleaners. • Raise your car and home insurance deductibles to lower your monthly premiums. • Cancel subscriptions: magazines, gym memberships or subscription boxes. • Keep the air conditioning turned off or the heat turned down to save money on utilities. • Keep lights turned off as much as possible to save money on your electric bill. If you are worried you are going to be unable to pay for essential services such as electric, Internet, gas, or water during the current pandemic, call your provider and explain your situation. Many cities and private companies are halting service interruption due to nonpayment, waiving late fees, offering flexible payment plans, or even delaying payments altogether. Keep the lines of communication open and remember, you will get through it. Prioritizing Debt: Which Bills do I Pay First? Food and Medicine The most important thing is your health and well-being. Take care of yourself first, then move on to the other priorities. Food, medicine, soap, and paper products are up there with shelter, heat, and hot water on the list of essentials.

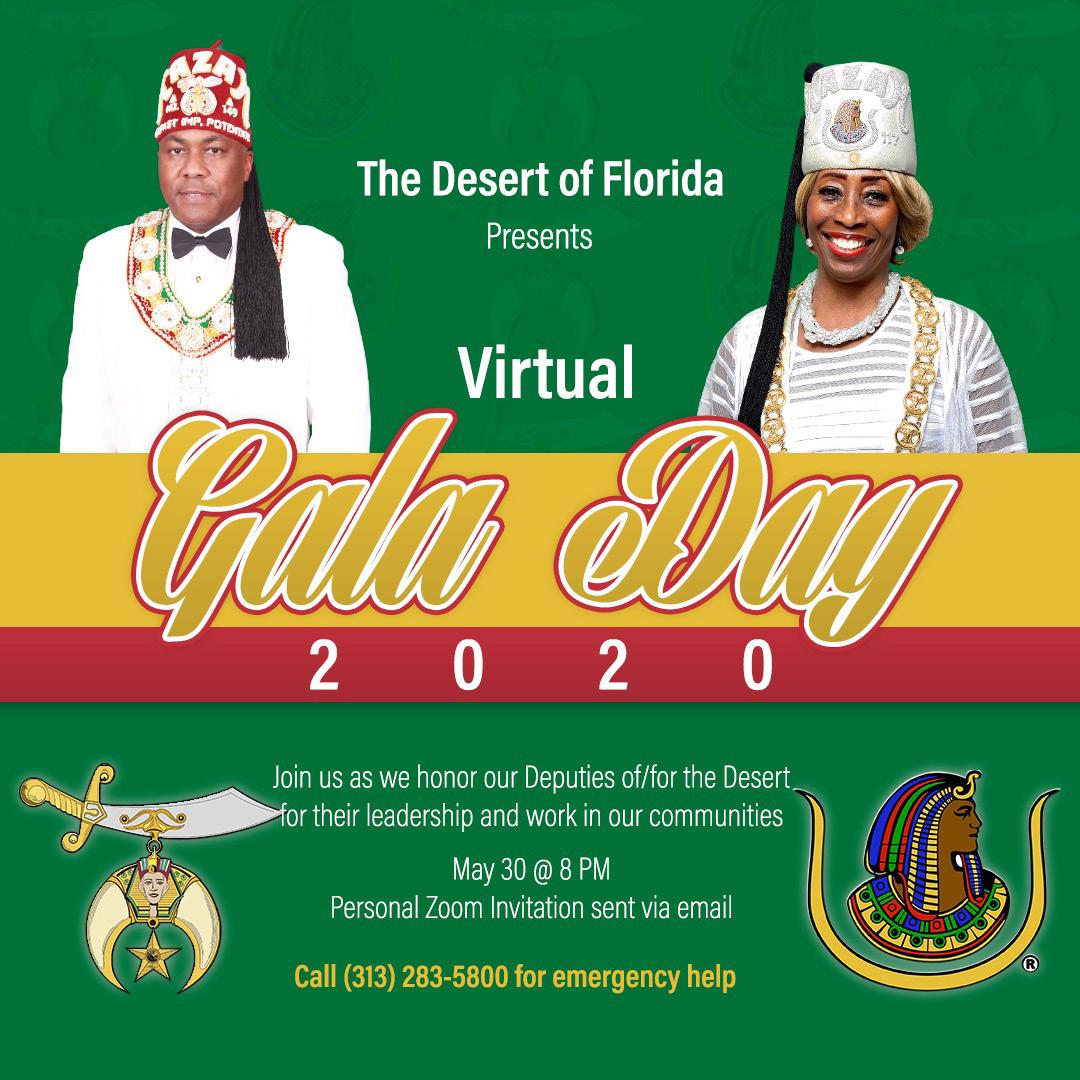

The Desert of Florida’s Oasis Magazine

9