BITCOINATHLEADSTO CONSOLIDATION

CryptoFailsToBreakout;ForNow MACROUPDATE

Tari s,Services,andSticky In ation:ADoubleSqueezeon HouseholdsandBusinesses

CryptoFailsToBreakout;ForNow MACROUPDATE

Tari s,Services,andSticky In ation:ADoubleSqueezeon HouseholdsandBusinesses

Bitcoin briefly pushed to a new all-time high of $123,640 last week before retreating 5.4 percent as hotter-than-expected US inflation data curbed risk appetite. The move highlights the marketʼs sensitivity to macro headwinds, with BTC now consolidating betweenitsATHandlocalrangelows.Untilstrongercatalystsemerge,suchasdovishFed signals or renewed ETF inflows, price action is likely to remain range-bound, reflecting digestionratherthanoutrightweakness.

Ethereumhasbeenthestandout,climbingfrom$1,386inAprilto$4,783lastweek,within reach of its 2021 peak of $4,864. Its strength is fuelling risk rotation into higher-beta assets,reflectedinBitcoindominanceslippingfrom65percentto59percentoverthepast twomonths.

While this shift underscores growing speculative appetite, it also increases fragility across altcoins, where rallies remain short-lived without structuralinflows.Themajors continue to anchor institutionalflows,leavingthe broader market at a critical inflectionpoint.

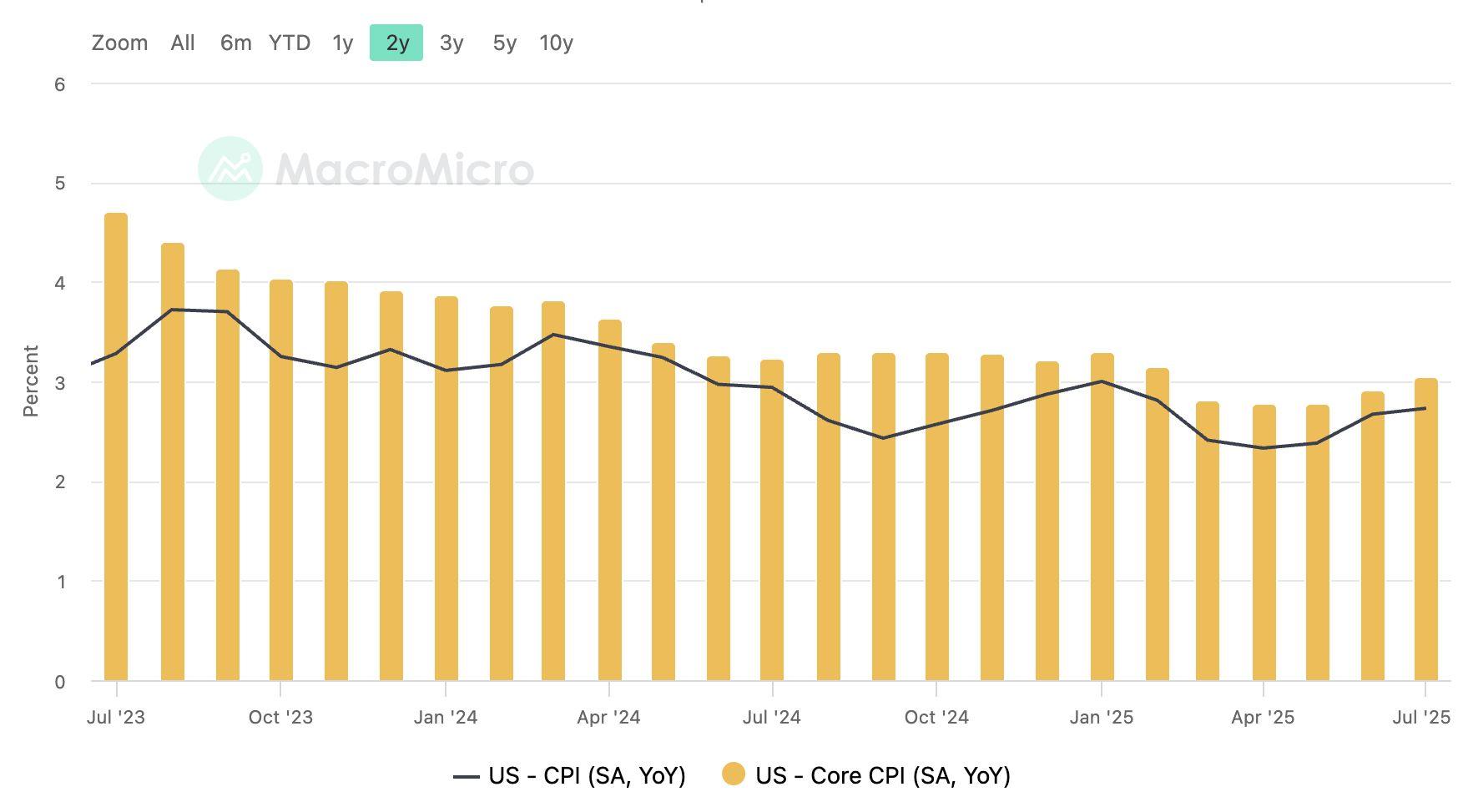

The latest US inflation reports underscored the persistence of price pressures, with both theConsumerPriceIndexCPIandProducerPriceIndexPPIhighlightinghowtariffsand service costs continue to strain households and businesses. Julyʼs CPI showed headline moderation, largely due to falling gasoline prices, but core inflation climbed at its fastest paceinsixmonths,drivenbyservice-sectorincreasesandtariff-linkedgoods.

Meanwhile, the July PPI revealed an even sharper squeeze on producers, with input costs rising more than expected and outpacing consumer price growth. This widening gapbetweenproducerandconsumerpricessignalledthatprofitmarginsaretightening, as businesses struggle to absorb tariff-related expenses while demand softens. Together, the reports depict a cycle of inflationary pressure building from both supply and demand sides, complicating the Federal Reserveʼs path ahead of its September policy meeting. While markets initially focused on the softer headline CPI, the deeper detailsofthereportsuggestinflationisfarfromsubdued,andexpectationsforswiftrate cuts may prove optimistic as tariff-driven costs and service-sector stickiness weigh on theoutlookforgrowthandcorporateearnings.

Meanwhile,lastweekunderscoredhowdigitalassetsarebecomingmoreentrenchedin global finance. In the US, Treasury Secretary Scott Bessent confirmed plans for a Strategic Bitcoin Reserve built on confiscated assets, halting government BTC sales whileexploring“budget-neutralˮwaystoexpandholdings—amovethatreducedsupply overhangbutspikedmarketvolatility.

Hong Kongʼs SFC, meanwhile, rolled out some of Asiaʼs toughest custody rules for licensed exchanges, mandating cold-wallet protections, whitelisted withdrawals, and real-time monitoring. The overhaul strengthens investor trust and aims to position Hong Kong as a leading regulated gatewayforinstitutionalcryptoadoption.

On the corporate front, Gemini, the centralised exchange, filed for a Nasdaq IPO despite steep losses, revealing a restructuring that shifts US users to Florida anda$75MstablecoincreditlinefromRipple. The listing would make it the third publicly traded US exchange, raising transparency and competitive benchmarks across the sector.

Finally,theFederalReserveendedits special oversight program for banks engaged in crypto and fintech, folding them back into regular supervision. Alongside similar moves by the FDIC, SEC, and OCC, this signals a shift toward mainstreaming digital-asset activity within the traditional banking framework, clearing the way for deeper institutionalintegration.

● CryptoFailsToBreakout;ForNow

● InflationPressuresMountasCPIand PPIHighlightTariffShock

● MixedUSDataCloudsFedOutlookas YieldsSteepen

● USTreasuryAdoptsCautiousStanceon BitcoinReserveExpansion

● HongKongʼsSFCImplements

ComprehensiveCustodyOverhaul

● GeminiFilesforNasdaqIPO ● FederalReserveEndsSpecialOversight ProgramforBanksInvolvedinCrypto andFintech

Bitcoin began trading last week, full of momentum, surging past resistance near $120,000 to set a new all-time high ATH) at $123,640.But the rally quickly fizzled out,giventhelackofmacroeconomiccatalystsneededtosustaintheprice,resulting inasharp5.44percentpeak-to-troughpullback,draggingBTCbacktowarditslocal range lows.Thanks to higher-than-expected consumer and producer price inflation prints in the US,risk appetite for BTC reduced,with caution being felt across asset classes.

Themarketisnowfirmlyinaconsolidationphase,adoptingawait-and-watchstance asinvestorsweighupcomingmacrocatalysts.WebelievehoweverthatbothBTCand Ethereumareexpectedtoresolvehigherintoyear-end,supportedbythelikelihoodof more favourable macro conditions, as we see potentially the beginning of a rate-cutting cycle from the Federal Reserve. For now, BTC is likely to continue oscillating within its established range, reflecting a period of digestion rather than weakness.

Altcoinsremainmorevulnerableinthisenvironment.AsliquidityconcentratesinBTC and ETH, capital is rotating down the risk curve, leaving altcoins exposed to more pronouncedretracements.Thisisafamiliarpatterninearlybull-marketstages,where capital first consolidates in majors before flowing into higher-beta assets. Once BTC andETHmakeadecisivebreakabovetheirrespectiveATHs,institutionalinflowsare expected to accelerate materially, creating conditions for broader market strength. Until then, traders should remain attentive to volatility and rotation dynamics, with range-bound price action likely to dominate across majors while altcoins underperforminrelativeterms.

Momentum across digital asset markets continues to build, with ETH leading the charge. The asset has advanced from a low of $1,386.8 in April to $4,783.90 on 14 August, its highestlevelsinceDecember2021andnowlessthantwopercentbelowitsall-timehigh of$4,864.90

Historically, Ethereum has acted as a bellwether for broader altcoin performance, and its recent resurgence is once again serving that role. Strength in ETH is fuelling renewed speculation in other altcoins, with capital rotation into higher-beta assets beginning to accelerate. This dynamic reinforces Ethereumʼs position as the key liquidity driver outside of BTC, setting the toneforthebroaderdigitalassetcomplexas thecycleprogresses

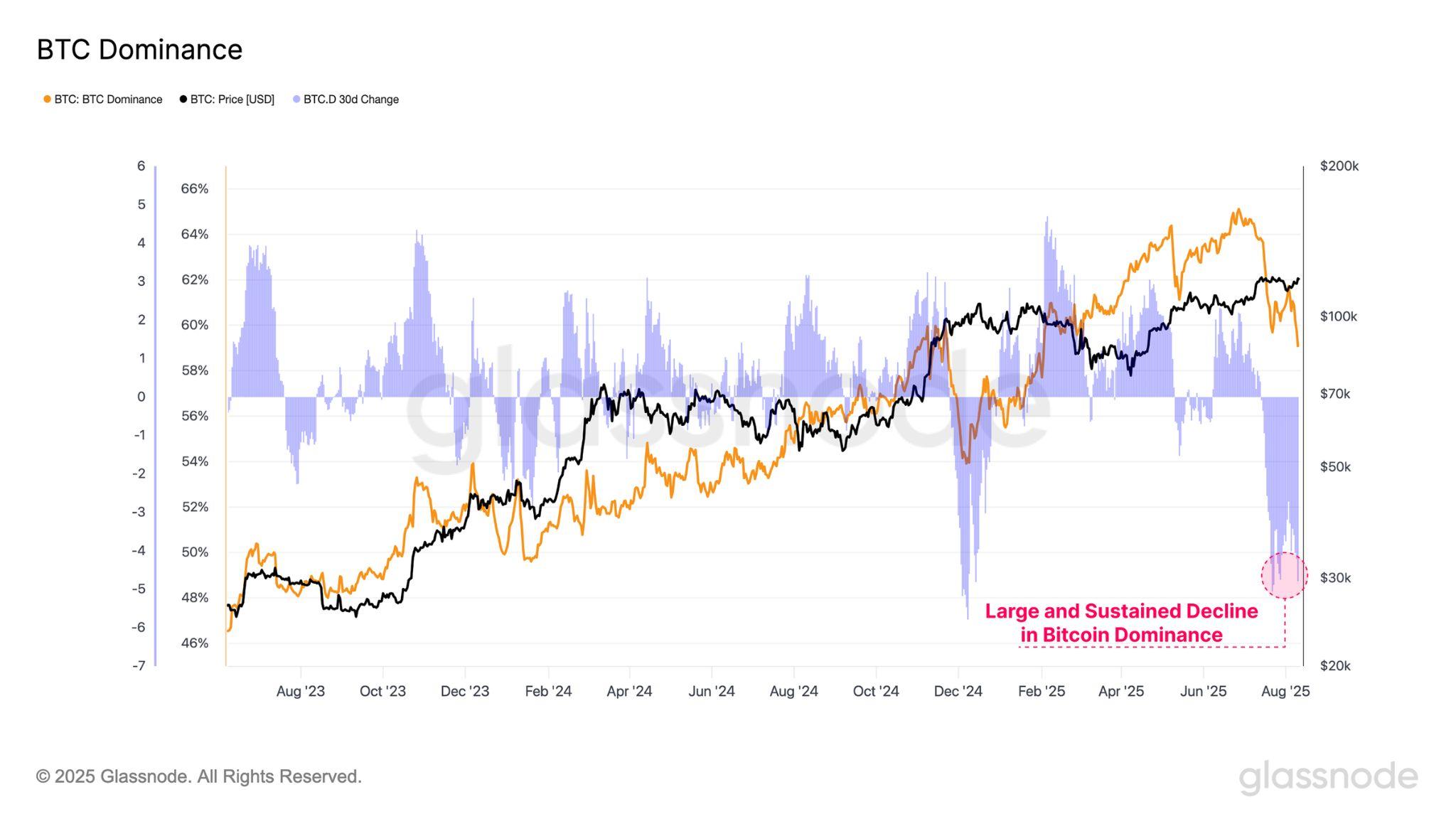

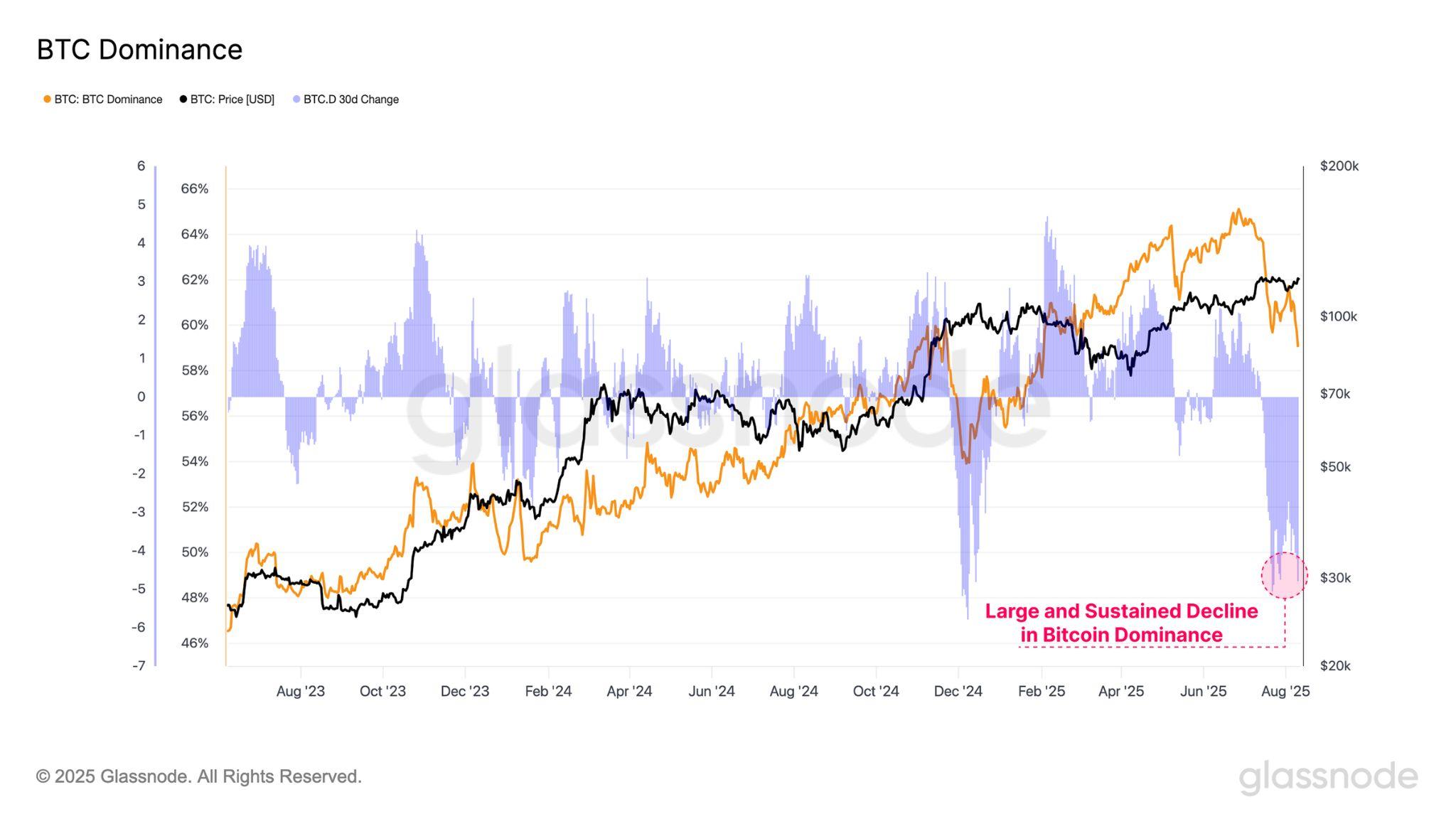

This capital rotation is clearly visible in the Bitcoin Dominance metric, which measures BTCʼs share of overall digital asset market capitalisation. Over the past two months, dominance has declined from 65 percent to 59 percent, signalling an active reallocation of capital toward alternative assets See chartbelow).

The move highlights the growing appetite for risk further along the curve, with investors positioning for higher returns in altcoins as majors consolidate. Such a decline in dominance has historically coincided with phases of accelerating speculation across the broader market, explaining why we are seeing this play out

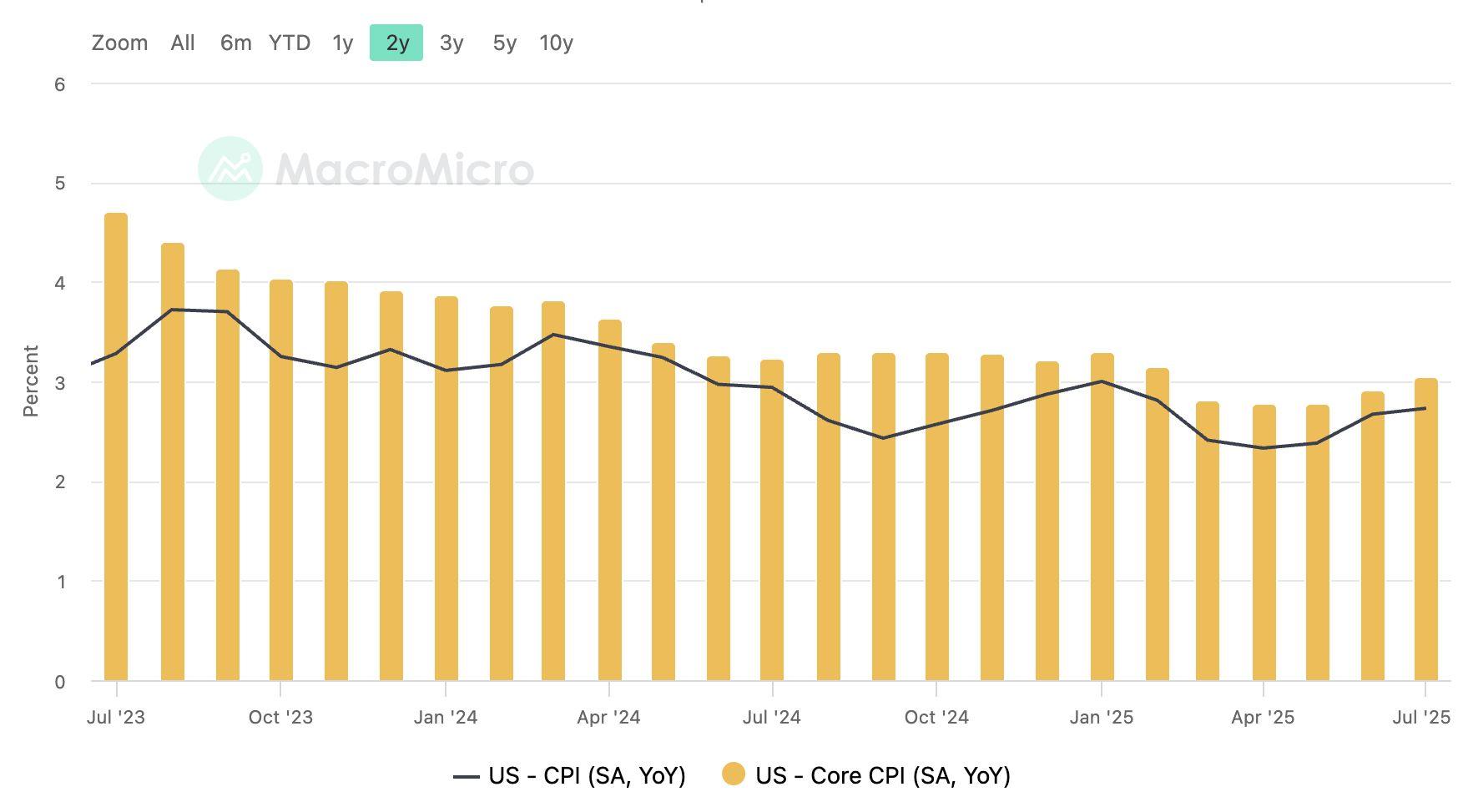

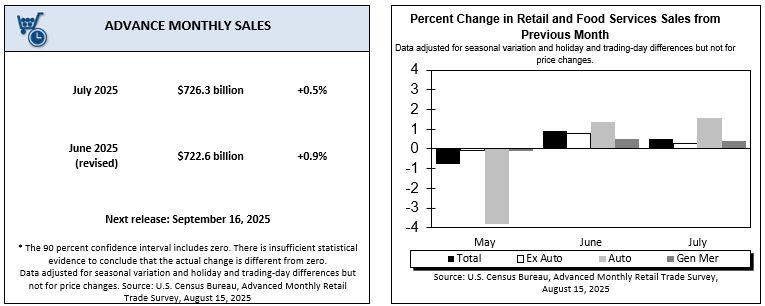

TheUSeconomywashitwithtwokeyinflationarysignalslastweekfollowingthe release of Consumer Price CPI and Producer Price PPI data for July. Both confirmed a picture of sticky inflation, with rising service costs and tariff-driven pricepressures,whichsuggestthatprofitmarginsmaynarrowandthatconsumer pricescouldremainelevatedinthemonthsahead.

The July CPI showed that consumer prices rose 0.2 percent from June and 2.7 percent from a year earlier. This relatively moderate number was due to a 2.2 percent monthly decline in gasoline prices, which helped offset increases elsewhere.However,thebiggerconcernwasthecoreCPI,whichstripsoutvolatile food and energy costs. That measure climbed 0.3 percent in July, its largest monthlygaininsixmonths,andwasup3.1percentfromlastyear.

Everyday purchases also squeezed consumers. Coffee prices surged 14.8 percent annually, beef and veal jumped 11.3 percent, and tomatoes rose 3.3 percent in July alone due to new trade taxes on Mexican imports. These increasesdirectlyaffectedhouseholdbudgetsandfueledconsumerunease.

IftheCPIshowedconsumerspayingmore,thePPIreportforJulyrevealedthat businessesareunderevengreaterstrain.Producerpricesrose0.9percentfrom June and 3.3 percent over the year, more than double the consensus forecast. ThismarkedasharpturnaroundfromJune,whenproducerpriceswereflat.

The PPI reflects the prices that producers receive for goods and services, and when those rise faster than consumer prices, it suggests that companies are struggling to pass on costs to buyers. This widens the gap between CPI and PPI—asignalthatprofitmarginsareshrinking.Businessesthatinitiallyabsorbed trade-related costs to protect market share are now being forced to consider price increases, reinforcing tariffs as a central inflationary driver. The strain is alreadyvisibleinweakeningindustrialproduction,wherehigherinputcostsmeet softerdemand—animbalancethatriskspressuringbothcorporateearningsand broadereconomicgrowth.

The Federal Reserve faces a growing dilemma ahead of its September 16th-17th policy meeting. On one hand, inflation pressures are intensifying, particularly in the core components that policymakers track most closely. On the other hand, thelabourmarkethasshownsignsofweakening,whilepoliticalpressuresremain elevatedastheWhiteHouseemphasisesthebroaderstrategicrationalefortariffs ratherthantheirinflationaryimpact.

WhilemarketsinitiallywelcomedthemodestheadlineCPIreading,theunderlying detailssuggestthatinflationisfarfromsubdued.Withtariffssettorisefurtherby early October, the risks lean toward continued price increases and squeezed margins. Equity markets, which have been supported by strong earnings, could feelpressureifcorporateprofitabilitydeteriorates.

ChartSource:Macromicro)

The July inflation data underscored that the US is not yet past its inflation challenges. The CPI report showed consumers facing higher costs for essential goodsandservices,whilethePPIreportrevealedmountingstrainonbusinesses from tariffs and supply-chain pass-throughs. Together, they highlight a cycle whereproducercostsarerisingfasterthanconsumerprices,settingthestagefor futureretailpricehikes.

For the Federal Reserve, this means that balancing its dual mandate of price stabilityandemploymentwillremaincomplex.Investorshopingforswiftratecuts in September may be disappointed, as the persistence of tariff-driven and service-sectorinflationleaveslittleroomforaggressivemonetaryeasing.

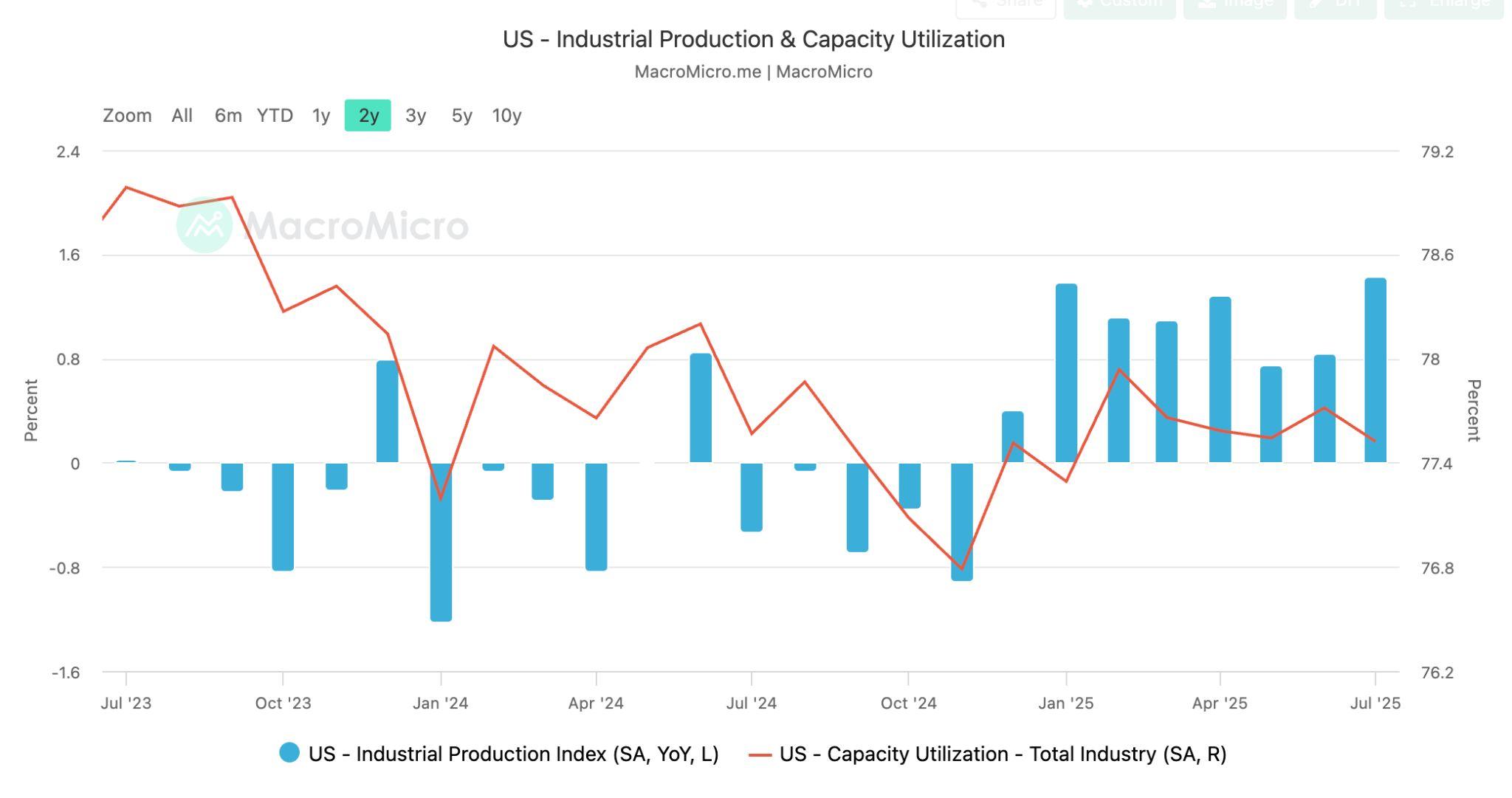

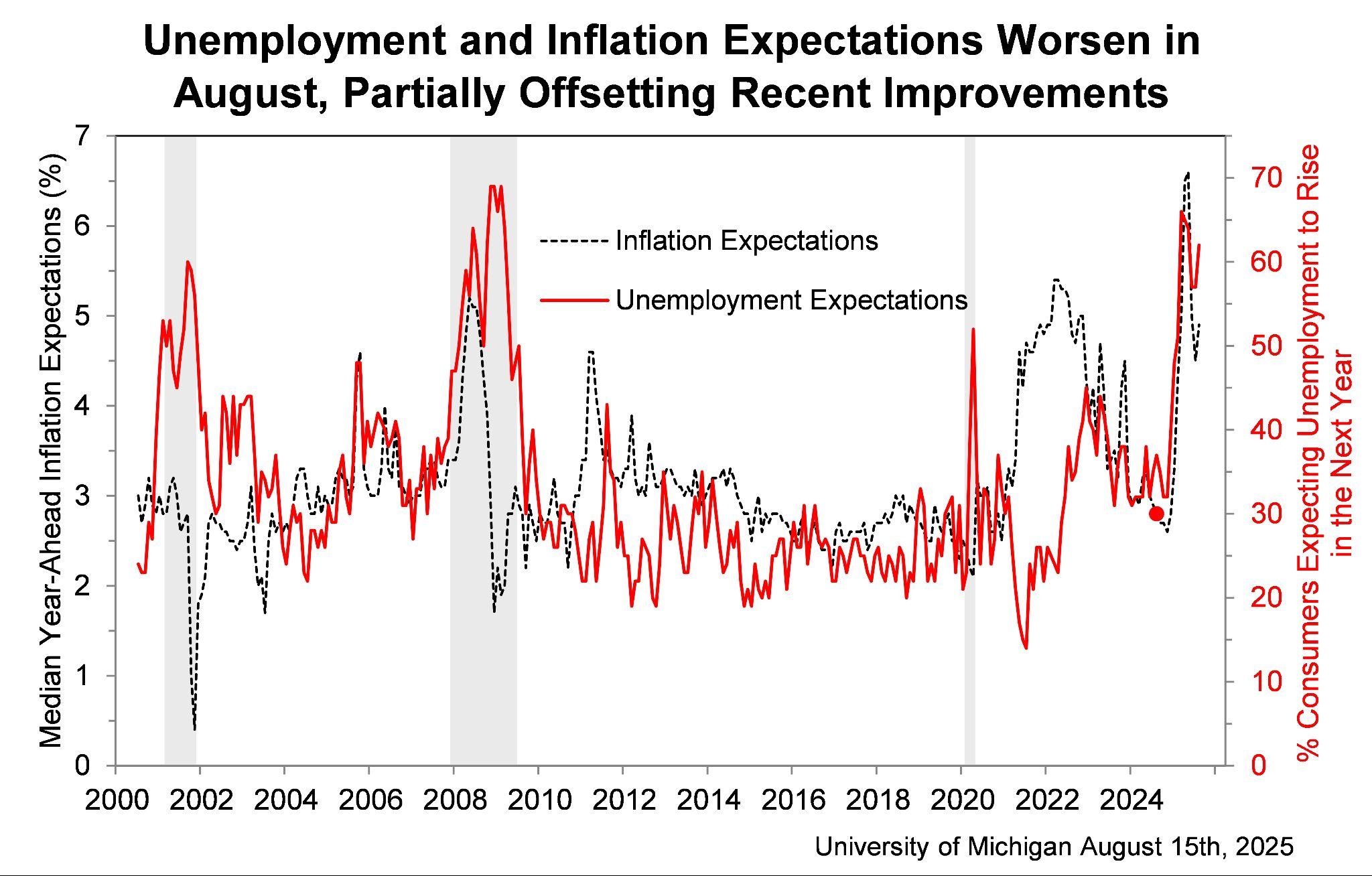

TheUSeconomysentamixedmessagelastweek,complicatingexpectationsforthe Federal Reserve's policy ahead of its September meeting. Data released Friday, August15th,includedRetailSalesandIndustrialProductionreportsfromtheFederal Reserve,aswellastheConsumerSentimentIndexfromtheUniversityofMichigan. Together, these pointed to an economy that is slowing but still grappling with inflationpressures—anuneasybalancethatisshapingbothmarketexpectationsand Treasuryyields.

RetailsalesinJulypostedasecondconsecutivemonthlyincrease.Onthesurface,this suggestedresilientconsumerdemand.Butmuchofthegainappearedtoreflecthigher prices and front-loaded spending as households adjusted purchases ahead of expectedcostincreases.

Furniture sales rose sharply, a sign that households may have accelerated purchases ahead of tariff deadlines. Seasonal events, such as Amazonʼs Prime Day and early back-to-school shopping, also boosted activity. While this behaviour highlights that Americanhouseholdsremainfinanciallycapableofadjustingspendingpatterns,italso suggestsfutureconsumptioncouldsoftenoncethepull-forwardeffectfades.Thisrisk is reinforced by consumer sentiment data, which shows households increasingly worriedaboutpersistentinflation—anindicationthatresilienceinspendingmaynotbe sustainable.

X.IndustrialProductionandCapacityUtilisationChartSource:Macromicro)

Incontrast,theFederalReserveʼsIndustrialProductionreport,releasedFriday,August 15th, showed that output slipped by 0.1 percent in July. Manufacturing activity has been weighed down by weaker demand and tariff-related cost pressures, adding to evidencethattheindustrialsideoftheeconomyisslowing.

This divergence—solid consumer spending but weaker production—highlights an economyrunningunevenly,withgoods-producingsectorsshowingmorevulnerability totradefrictions.

Figure8.InflationExpectationsandUnemploymentExpectationsSource:University ofMichigan)

Meanwhile, consumer attitudes have also weakened notably. The University of Michiganʼs Surveys of Consumers, released Friday, August 15th, reported that the ConsumerSentimentIndexdroppedto58.6inAugustfrom61.7inJuly.

The decline was driven largely by rising inflation expectations. One-year inflation expectationsroseto4.9percentfrom4.5percent,whilelong-runexpectationsclimbed to 3.9 percent from 3.4 percent. Buying conditions for durable goods, such as appliances and cars, fell to their lowest reading in a year as households braced for highercostslinkedtotariffs.

Thissuggestsconsumersareincreasinglyconcernedthatinflationarypressuresarenot fading,whichcouldweighonfuturespendingmomentum.

These mixed data points feed directly into bond markets, where investors are recalibratingexpectations.AccordingtoUSTreasurymarketdata,theyieldon2-year notes fell below 3.7 percent in early August, while 10-year yields eased to around 4.23percent.Thespreadbetweenthetwowidenedto54basispoints,upfromjust2 basispointslastNovember,markingasignificantsteepeningoftheyieldcurve.

A steeper curve often signals that investors expect rate cuts in the near term, while longer-term yields remain anchored by structural inflation risks and borrowing demand. For banks, this improves net interest margins, while for policymakers, it reflects scepticism about cutting too soon when trade-related inflation remains unresolved. For crypto investors, the steepening yield curve is especially relevant: it reflectsmarketbetsonfuturemonetaryeasing,whichcouldeventuallyimprovedollar liquidity conditions—a critical driver of flows into risk assets like Bitcoin and Ethereum,evenasnear-terminflationriskskeepvolatilityhigh.

The latest data leaves the Federal Reserve in a difficult position. Retail sales show consumers are still spending, but likely in anticipation of higher costs. Industrial production is weakening, and consumer sentiment is deteriorating under the weight of risinginflationexpectations.

Bond markets, meanwhile, are already leaning toward at least one rate cut before year-end, though the Fed is expected to hold steady in September to assess the full impact of tariffs. The interplay of consumer resilience, industrial softness, and inflationary pressures will be central to determining whether the Fed can cut rates in Decemberwithoutreignitingconcernsoverpricestability.

LastThursday,August14th,USTreasurySecretaryScottBessentoutlinedthe governmentʼs approach to its planned Strategic Bitcoin Reserve. The reserve will be built on confiscated and forfeited crypto assets, valued between $1520 billion, with Bessent stressing that no taxpayer funds will be used for purchases. He also confirmed that the Treasury will halt sales of existing Bitcoinholdings,effectivelytreatingthemasalong-termsovereignreserve.

Later that day, Bessent clarified that the Treasury is reviewing “budget-neutral pathwaysˮ for possible future acquisitions. While no details were given, the phrasing keeps the door open to additional reserve growth without raising federalspendingorwideningthedeficit.

The cautious rollout reflects a balancing act: fiscal discipline on one side, and strategicrecognitionofBitcoinʼsroleontheother.Marketreactionunderscored justhowsensitiveinvestorsaretoofficialUScryptopolicysignals,withvolatility risingimmediatelyafterBessentʼsremarks.

● Supply overhang reduced: Stopping government BTC sales removes a predictable seller.

● Policy floor established: Positioning BTC as a sovereign-held reserve strengthens its narrative as a long-term strategic asset.

● Upside optionality: “Budget-neutralˮ acquisitions leave open the possibility of futuregovernmentbuying—anincrementalbullishfactorformarketpsychology.

HongKongʼsSecuritiesandFuturesCommissionSFC overhaul of custody requirements for licensed virtual asset trading platforms, marking one of the most prescriptive digital asset safeguard regimes in Asia, according to a statement released last Friday, August 15th. The reforms place direct personal accountability on senior management for asset protection and aim to address gaps in custody, oversight, and operational controls identified duringarecentcybersecurityreview.

Exchangesmustnowmaintaincold-wallet systems backed by certified hardware security modules HSMs, stored in physically secured vaults and accessible only through strict multi-party authentication. Withdrawals are limited to pre-approved, whitelisted addresses, and any changes require auditable approvals. Platforms must also run 24/7 threat monitoring and immediately report potential breaches to the SFC. Importantly,therulesbantheuseofsmart contracts in cold storage, removing an entire class of vulnerabilities tied to on-chainexploits.

The measures respond to findings that some exchanges were over-reliant on third-party custody, lacked robust transaction verification, and gave staff excessive access rights—failures that have preceded major breaches elsewhere. By preempting such risks, the SFC aims to prevent confidence-shaking crises and align Hong Kong with institutional-grade custodybenchmarks.

● Institutionalentrypoint: Byembeddingthese standardsinitsASPIRe initiative,HongKong signalsitwantstobe thepreferredgateway forbanks,funds,and largeinvestorsseeking regulatedcrypto exposure.

Investortrust:Strongercustodyrulesreducecounterpartyandoperational

Crypto exchange Gemini filed its S1 registration statement with the SEC last Friday, August15th,formallyseekingtolistonNasdaqunderthetickerGEMI.TheIPOwillbe ledbyGoldmanSachs,Citigroup,MorganStanley,andCantorFitzgerald.

Thefilinghoweverrevealedasharpfinancialdeteriorationinthecompanyʼsfinancials: a $282.5 million net loss in the first half of 2025, compared with just $41.4 million in losses a year earlier. Adjusted EBITDA swung from a $32 million profit in 2024 to a $113.5millionlossthisyear.Forallof2024,Geminireported$158.5millioninnetlosses on$142.2millioninrevenue.

Aspartofitsrestructuring,GeminiwilltransitionmostUScustomerstoaFlorida-based entity Gemini Moonbase, LLC, while Gemini Trust continues operations in New York under the stateʼs strict BitLicense regime. The firm also disclosed a $75 million credit facility from Ripple, denominated in its RLUSD stablecoin and expandable to $150 million,thoughGeminihasnotyetdrawnfromit.

If successful, Gemini would become the third publicly traded US crypto exchange, joiningCoinbaseandBullish.

● Transparency & scrutiny: An IPO forces Gemini to disclose financials, giving investors new benchmarks against Coinbase and Bullish.

● Stablecoin credit backstop: The Ripple facility highlights how crypto-native credit lines are becoming strategic liquidity tools.

● Regulatory arbitrage: Shifting users to Florida underscores the ongoing impact of New Yorkʼs BitLicense regime—a signal to other firms navigating US state regulations.

The Federal Reserve has ended its Novel Activities Supervision Program moving banksʼ crypto and fintech oversight back into the regular supervisory framework.Theprogram,introducedinAugust2023,wasdesignedtogivethe Fed closer visibility into banks experimenting with crypto custody, stablecoin activity,andfintechpartnerships.Accordingtothecentralbank,ithasnowmet itsobjectiveofimprovingsupervisoryknowledge,makingadedicatedprogram unnecessary.

This step is part of a broader regulatory shift under the Trump administration. Earlierthisyear,theFDICwithdrewitsrequirementthatbanksnotifytheagency before engaging in crypto-related activities. At the same time, the Securities and Exchange Commission has launched “Project Cryptoˮ to modernise digital-asset rules, while the Office of the Comptroller of the Currency has clarified how existing banking regulations apply to stablecoin issuance and custody.

Takentogether,thesemovessignalacleartransition:ratherthantreatingcrypto as an isolated risk, US regulators are increasingly working to normalise digital-assetactivitywithintheperimeteroftraditionalfinancialsupervision.For banks,thisreducesregulatoryuncertaintyandoversightfriction.

Easierintegrationofcryptointothestandardbankingsystemcouldstrengthen fiat on- and off-ramps, improve liquidity for stablecoins, and accelerate the entry of traditional financial institutions into digital-asset services. For crypto markets, this means a clearer path for capital flows and institutional adoption, reducingoneofthestructuralbottlenecksofrecentyears.