BTCSLIPS,ALTsSTAGNATE

MARKETSIGNALS

BitcoinSlidesBelow$110k; AltsFaceFurtherTurbulence

MACROUPDATE

StrongSpendingMeetsWeak BusinessActivity:FedFacesTough

SeptemberCall

BitcoinSlidesBelow$110k; AltsFaceFurtherTurbulence

StrongSpendingMeetsWeak BusinessActivity:FedFacesTough

SeptemberCall

Bitcoinhasslippedbelow$110,000,fallingbelowitsJanuary2025peakof$109,590and extendingitsdrawdowntoover13percentfromtheAll-TimeHighof$123,640.Whilethis breakdowncarriestechnicalweight,historicaldrawdownpatternsandseasonalitysuggest the market is actually in the later stages of its corrective phase, with $93$95,000 emerging as the most probable zone for a cyclical floor. On-chain data confirms this: the current Short-Term Holder Realised Price at $108,900 is now acting as a key pivot, with anysustainedtradingbelowthislevellikelytofuelfurtherdownside.Exchangeorderflow metricssuchasCumulativeVolumeDeltaalsohighlightaneutralisationofspotsentiment, reinforcingtheviewthatbuyersaresteppingbackuntilstrongercatalystsemerge.

.

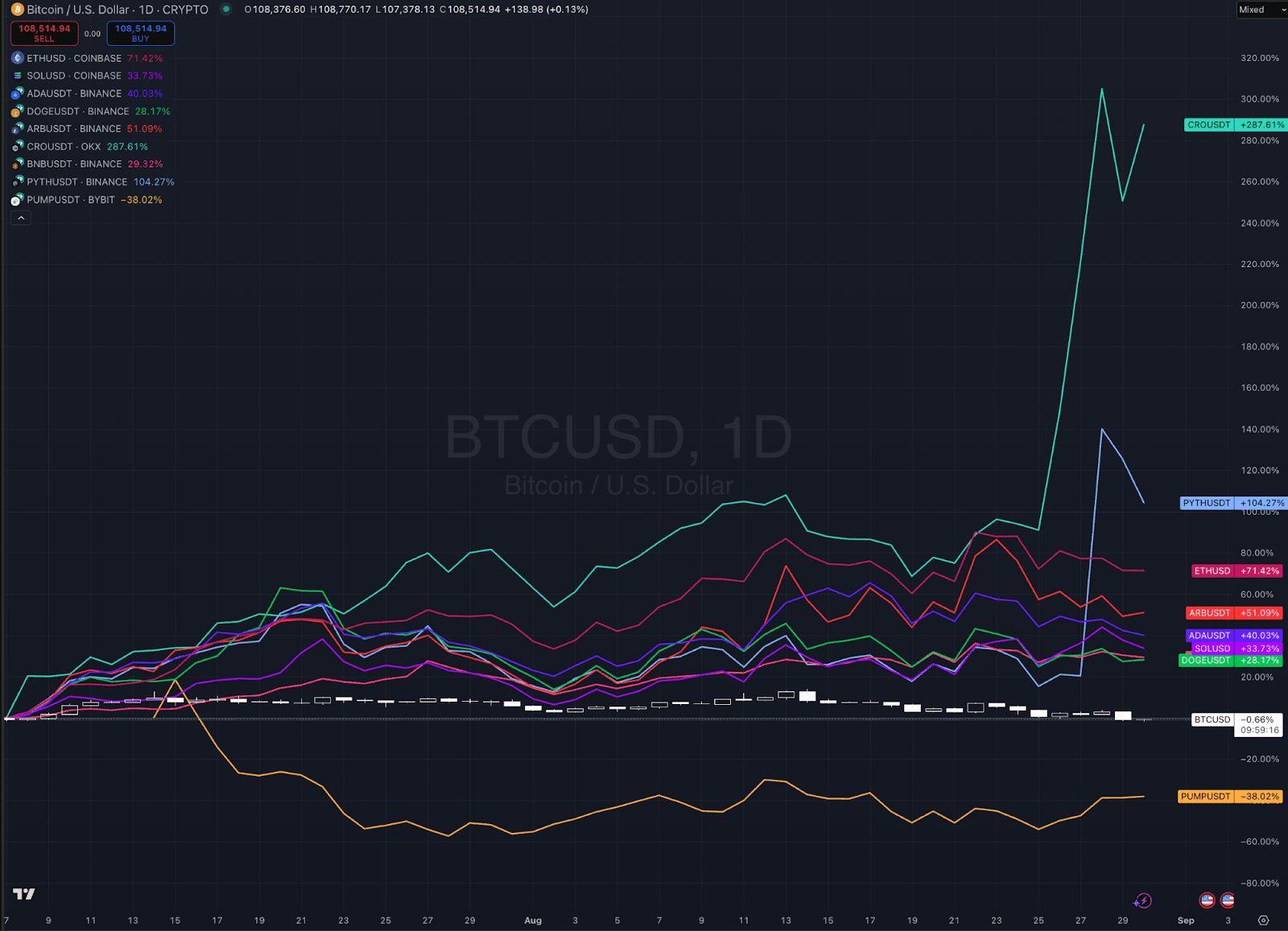

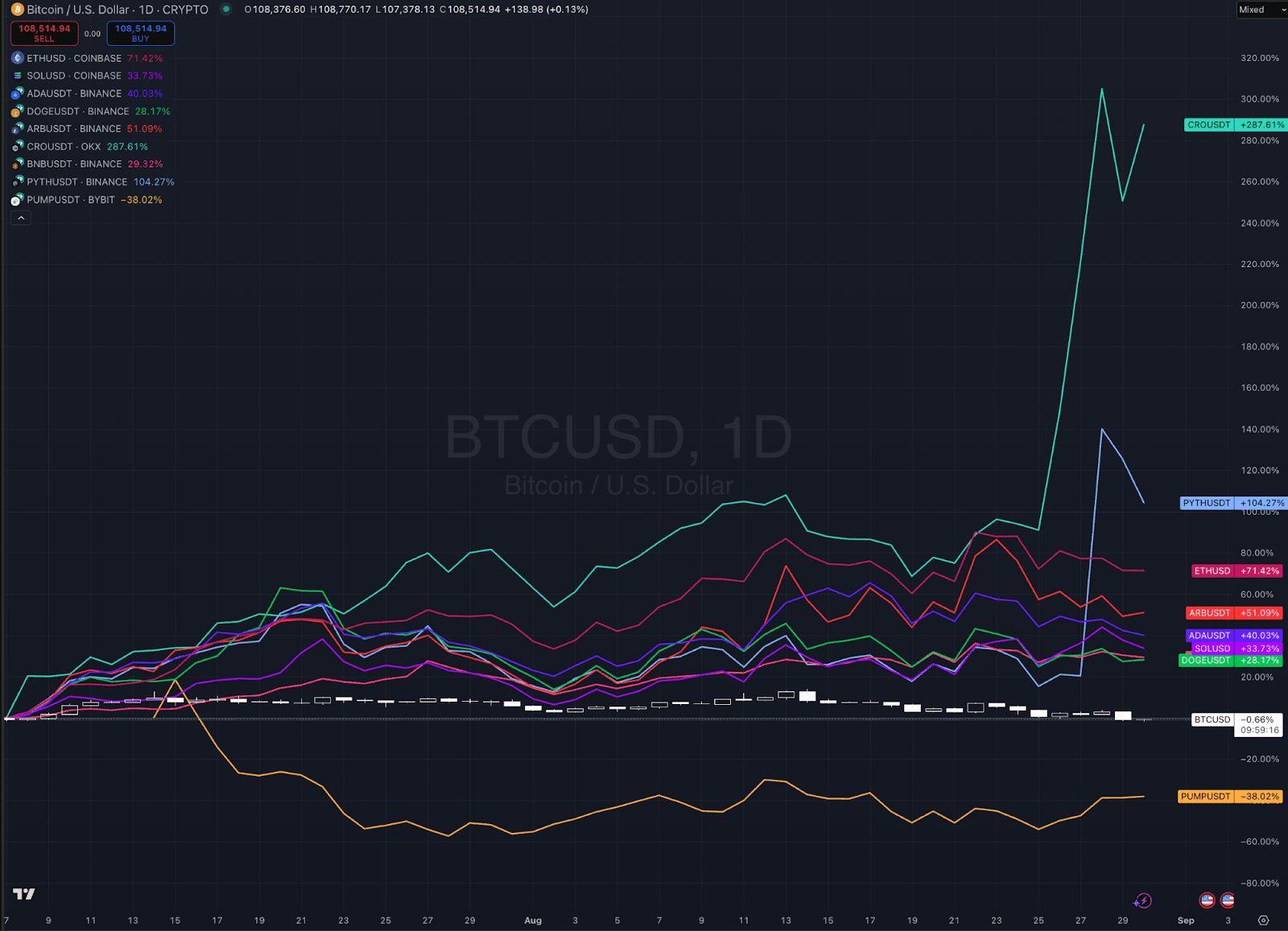

Altcoins have been faring worse, reflecting broad risk-off behaviour. ETH retreated 14 percent after briefly posting newATHs,whileXRP,ADA,and DOGE saw double-digit losses Yet institutional demand remains resilient beneath the surface, with ETH treasuries and corporate buyers continuingtoexpandholdings.

Mid-capnameslikeCROandPUMPoutperformedvianarrative-drivenrallies,thoughthis rotationcameattheexpenseofweakernames,notnewinflows.

What is emerging is an Altcoin market cap that is stagnating, with any movement in alts signallingcapitalrotationratherthanexpansion.WithETFinflowsseasonallymutedand speculative excess flushed, September could mark the cyclical low point before structuraldriversreassertforaQ4recovery.

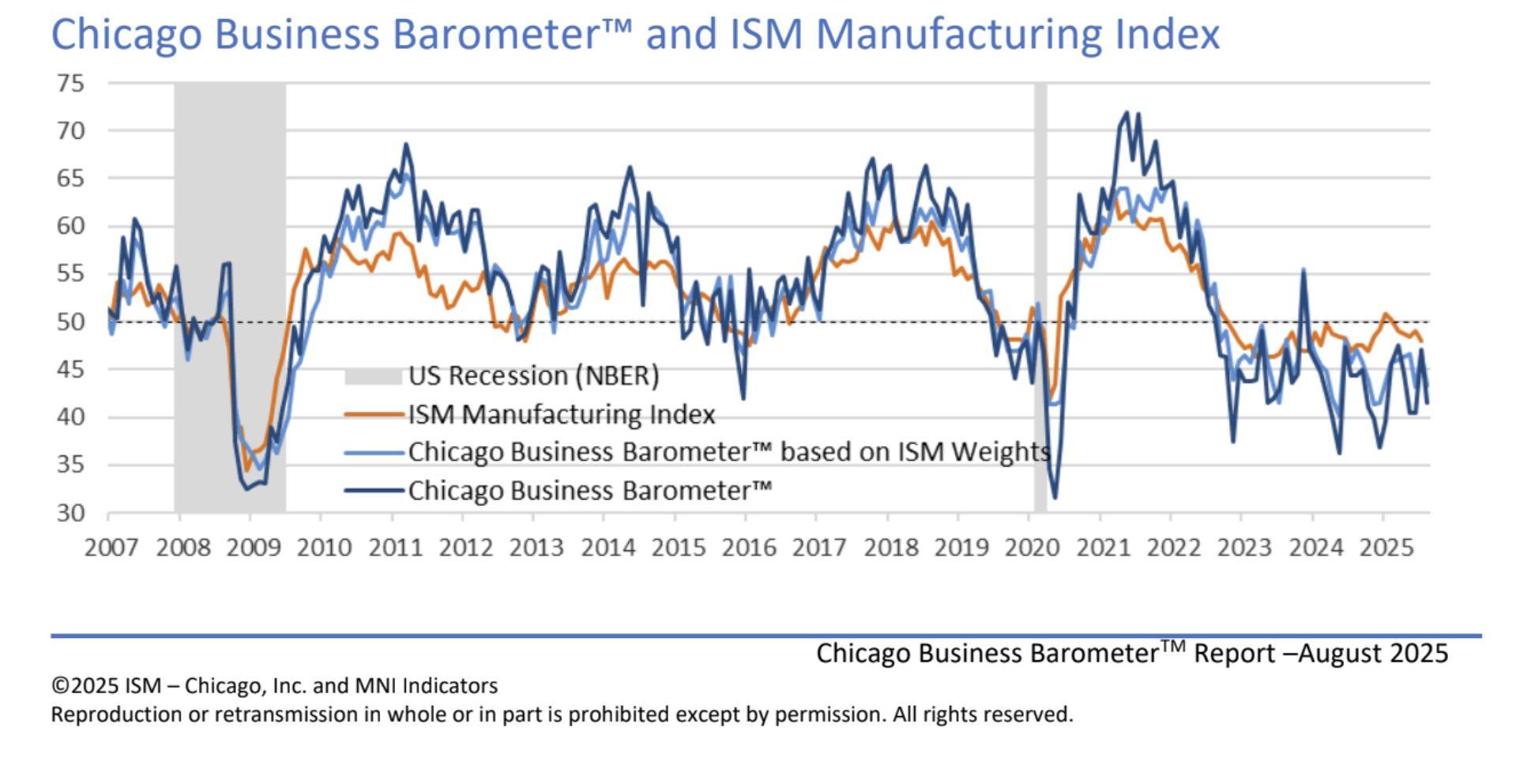

In the final week of August, US economic data presented a mixed picture for policymakersaheadoftheFederalReserveʼsSeptembermeeting.Consumerspendingin July rose 0.5 percent, the strongest in four months, but inflation pressures remained elevated, with core PCE advancing 2.9 percent year over year. At the same time, job creation slowed to an average of 35,000 per month, though updated benchmarks from the St. Louis Fed suggest fewer new jobs are now needed to sustain labour market stability. This recalibration lowers the threshold for policy easing, tilting expectations toward a September rate cut despite inflation staying above target. GDP data added to the complexity: second-quarter growth was revised higher to 3.3 percent, fuelled by strong intellectual property and equipment investment, yet regional surveys such as the Chicago Business Barometer signalled weakening business activity under the weight of tariffsandslowingconfidence.

Alongside these macroeconomic shifts, regulatory and crypto market developments highlighted broader financial support for the asset class. The Commodity Futures Trading Commission reaffirmed the Foreign Board of Trade framework, clarifying that offshore exchangescanre-entertheUSmarketunder establishedrules—anadjustmentexpectedto improve liquidity and reduce market fragmentation. Corporate adoption of digital assets also accelerated, with BitMine Immersion Technologies reinforcing its position as the worldʼs largest Ethereum treasury company, holding $8.82 billion in cryptoandcashwhilepursuingitsambitionto acquire5percentofEthereumʼstotalsupply.

Meanwhile, El Salvador advanced its sovereign Bitcoin strategy by dispersing its $682 million reserve across multiple wallets to mitigate security risks, paired with a public dashboardaimedatreinforcingtransparencyandpositioningthecountryasabenchmark instate-levelcryptogovernance.

BitcoinSlidesBelow$110k;AltsFace FurtherTurbulence ● StrongSpendingandShiftingLabour BenchmarksComplicateFedDecision

● StrongerGDPMasksWeakBusiness ActivityasTariffsandInflationWeigh onUSOutlook ● CFTCReaffirmsFBOTFrameworkto ReopenUSCryptoMarketstoForeign Exchanges ● BitMineImmersionClaimstheThroneas theWorldʼsLargestEthereumTreasury Company

Bitcoin has broken below $110,000, notably undercutting even its January 2025highof$109,590.Thisisalevelthathasservedasresistanceformore thansixmonthsbeforeitwasfirstbreachedinJuly.Thispullbackisinlinewith ourthesisthatinthesummermonthsBTCislikelytobepronetoretracements and range trading.BTC is now down over 13 percent from its recent all-time highs,andwhiletradingbelowtheJanuarypeakisnotanencouragingsignal, webelievethemarketisnearingthebottomofthisdownturnaswemoveinto September.

1.BTC/USD4HChart.Source:Bitfinex)

Sincethebeginningof2023,whenarguablythecurrentbullruncommenced,we have seen pullbacks from cycle highs averaging around 17 percent peak-to-trough, before a new all-time high is eventually established. This suggests that while some downside may still be ahead, BTC is approaching the upper limit of its typical corrective drawdowns. Seasonality also favours this view:Septemberhasoftenmarkedcyclicallowsinpost-halvingyears,providing thefoundationforarenewedrallyintothefourthquarter.

Takentogether,thesefactorspointtowardsthemarketbeinginthelatestagesof its corrective phase, with conditions aligning for a potential Q4 recovery rally oncesellingpressureisabsorbed.

The market has just ended its third consecutive week of retracement from the $123,640 all-time high, prompting debate over whether this represents a temporarypauseortheonsetofadeepercontraction.

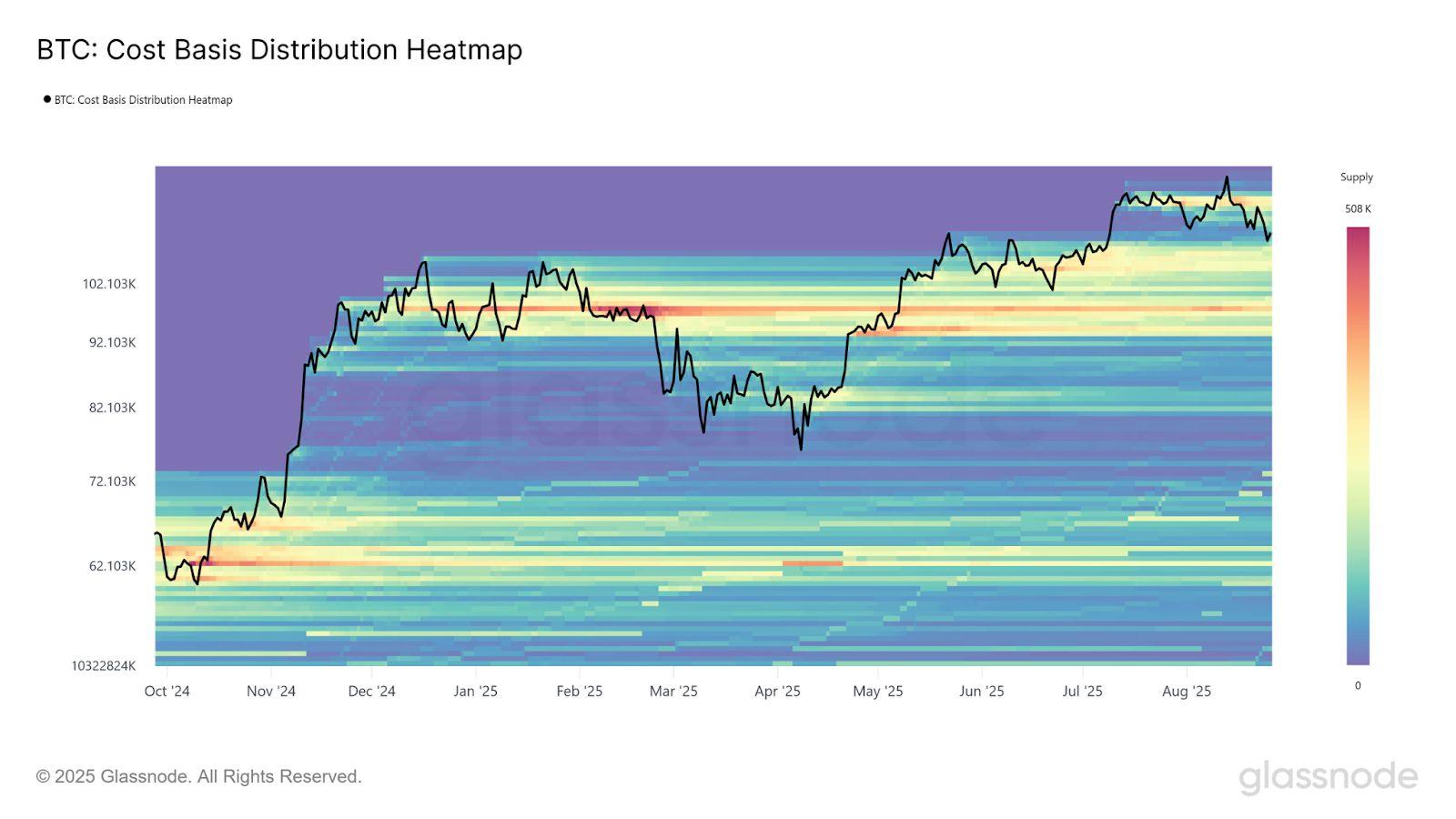

Tocontextualisesuchadiscussionwebelieve itisusefultoturntopricemodels, andparticularlytheCostBasisDistributionCBD)heatmap.

2. SpotBitcoinCostBasisDistributionHeatmap.Source:Glassnode)

This heatmap visualises where supply is concentrated across acquisition prices, highlighting the levels at which significant portions of coins last moved. These cost basis clusters often evolve into natural support and resistance zones. At present, BTC is trading at $109,000, sitting just below the lower boundary of an “airgapˮ,azonecreatedwhenthepriceralliessharplywithoutsignificantsupply changinghands.Historically,suchgapsarefrequentlyrevisitedandfilled,andthis isonereasonwehavebeenexpectingthecurrentretracementbelow$110,000.

This latest pullback has facilitated the redistribution of supply at discounted prices,graduallyfillinginthegap.Importantly,adenseclusterofsupplybetween $93,000and$110,000hasbeenformingsinceDecember2024,nowmaturinginto what could serve as a durable floor. This process helps explain BTCʼs ongoing resilience, or rather, a slowing down of the downtrend once it moved under the $110,000level.Itsuggeststhatanydeepercorrectionwouldrequireeitherawave of acute short-term sell pressure or an extended demand pause, capable of frustratingtheseholdersintocapitulation.

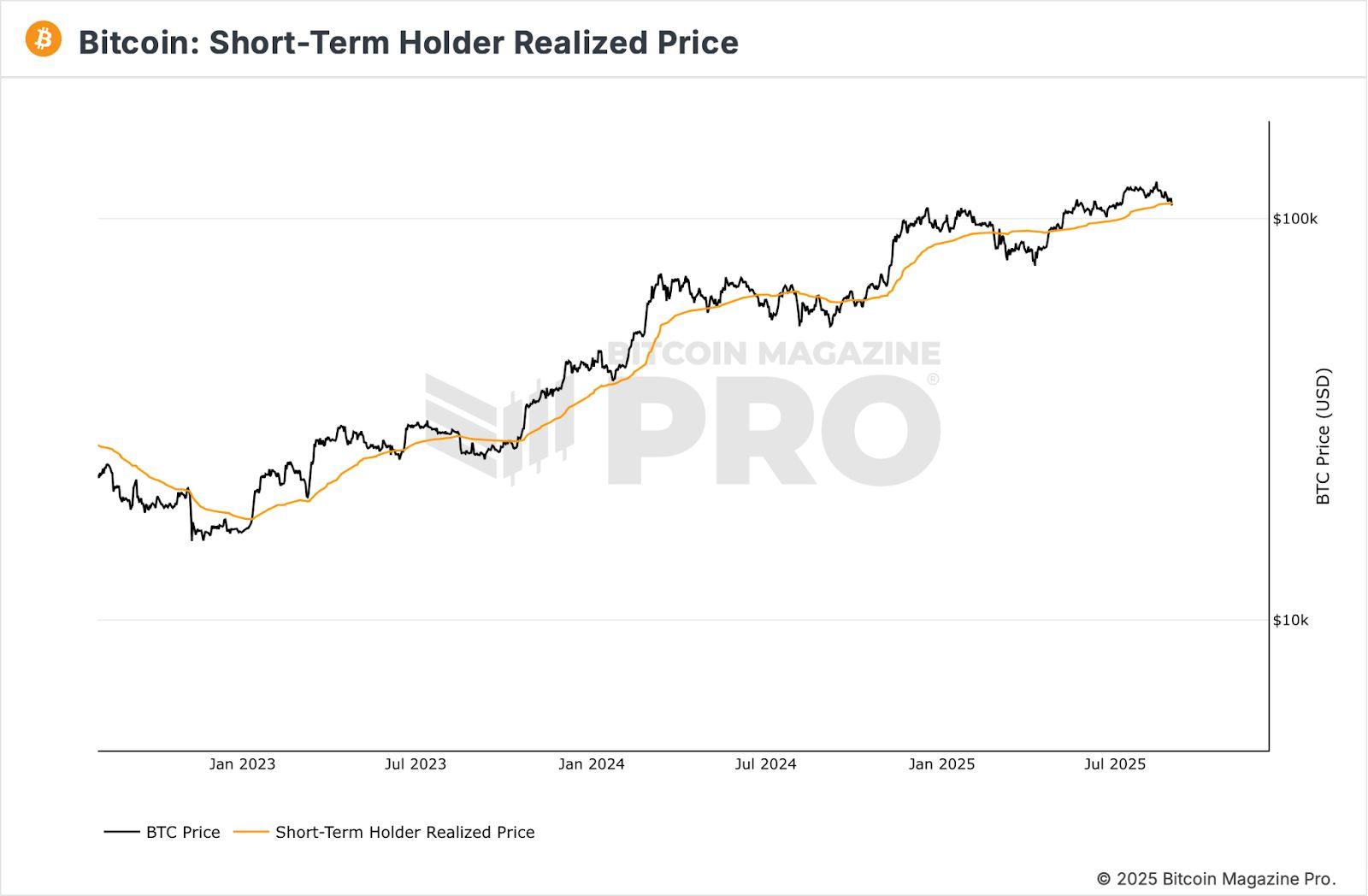

IfcurrentweaknesspersistsandBTCfallsbelowtheShort-TermholdersʼSTH RealisedPrice-currentlyatapproximately$108,900-thenmore cautionmight bewarranted.TheBTCSTHRealisedPricetrackstheaverageacquisitioncostof coins held for less than 155 days, offering a gauge of near-term sentiment and momentum.

In bull markets, the BTC price generally trades above the STH Realised Price, reflecting short-term holders sitting on profits. However, in bear markets, price trends below this level, leaves newer investors with unrealised losses. This distinction makes the STH Realised Price a useful indicator of where resistance orsellingpressuremayemerge.

Inpriorcycles,andespeciallyinthecurrentonewithnewbuyersintheformof BTC treasury companies and ETFs driving the spot market, sustained breaches of this threshold have frequently preceded multi-month bearish phases, as newerinvestorscapitulatedundertheweightofmountingunrealisedlosses.

Usingfour-yearstatisticalbands(standarddeviationsoftheSTHRPmetric)asa framework, previous drawdowns have typically found eventual lows around one standard deviation beneath the STH cost basis. Presently, this lower bound is estimated near $95,100 which should ideally cap all selling pressure unless the bullcycleisover.

Accordingly, if BTC fails to hold firm or deviates below the $106,000$108,900 range(accountingforminorfluctuations),themostprobablezoneforamid-term bottomformationliesbetween$93,000and$95,000.Thisalignscloselywiththe denseclusterofsupportidentifiedintheCBDheatmap,reinforcingthisarea asa potentialcyclicalfloor.

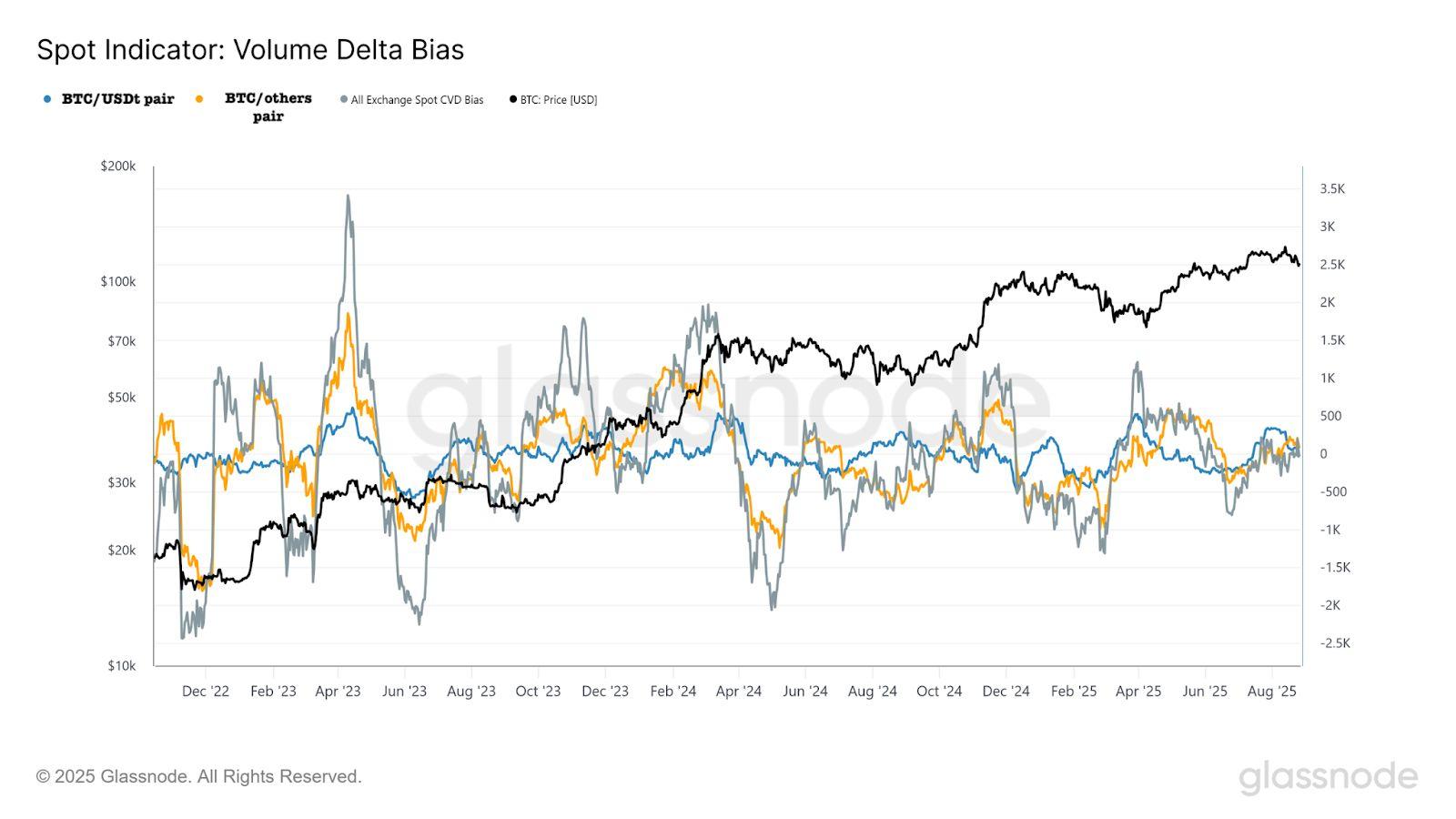

While both technical and on-chain metrics are providing evidence of a floor for BTC,itisgoodtoseethatoff-chainindicatorsalsosupportthisview.Cumulative Volume Delta CVD, which tracks the net difference between buyer- and seller-initiatedtrades,thenaggregatesthisimbalanceintoacumulativesignal,is ahelpfulindicatorinthisregard.

By comparing the 30-day moving average of CVD against its 180-day median, we can see the shifts in market behaviour. Across major centralised exchanges andontheUSD-denominatedandotherstablecoindenominatedpairs,aswellas inaggregatedexchangeflows,thisbiashasrecentlyconvergedtowardzero.This marks a significant departure from the strong buying pressure observed in April 2025,whichfuelledthereboundfrom$72,000.

Notwithstanding,thebriefpositivespikeinJuly,whichsetusonthepathofthe near-$124,000 ATH, the broader trend now shows a neutralisation of spot sentiment, signalling reduced conviction among buyers at current price levels. ThishasalsocoincidedwithslowingETFinflows,whichwehavelong-arguedis acriticalcomponenttoanynext-legupforBTC.

Major cryptocurrency assets endured a difficult week as macro jitters and the post-PPI sell-off weighed heavily on price action. BTC declined nearly 6.2 percent over the past seven days, holding just above $109,000, while Ether faredworse,down7.5percentafterfailingtosustainitsbreakoutaboveATHs. RippleʼsXRPextendeditsretracewithan8.1percentdrop,andSolanaeased1.6 percentasDeFisectorstrengthcouldnotoffsetbroaderselling.Amongtherest ofthetopten, ADAfell10.9percent, DOGEshed9.3percent,and TRXlost6.2 percent,leavingthemajorsboardfirmlyinthered.

ETH saw its latest All-Time High last Monday, before its sharp sell-off. Nevertheless,institutionalaccumulationofETHremainsrobust:Sharplinkadded $252 million in ETH, BitMineʼs holdings climbed to $7.9 billion, and only 18.3 millionETHnowsitonexchanges.

But some select mid-caps and sector plays outperformed, indicative of the concept of rotational capital flows in the Altcoin market. CRO led with a remarkable 100.8 percent surge following its Trump Media partnership, highlighting how narrative catalysts can drive outsized moves. PUMP gained 11.4 percent, sustaining momentum after surpassing $800 million in lifetime revenues.

6. ETH/USD4HChart.Source:Bitfinex)

Losses however, were widespread elsewhere and it is notable that the total Altcoin market cap remained unchanged, further reinforcing the thesis that capitalisrotatingacrossthesector,ratherthanthemarketseeingfreshinflows. ARB fell 15.6 percent as liquidity thinned, OKB retraced 14.4 percent after a multi-week rally, and XLM 14 percent), UNI 13.6 percent), and SUI 12.6 percent) all corrected sharply. Smaller high-beta names bore the brunt, including KTA 28.5 percent), BIO 28 percent), ZORA 26.8 percent), and MORPHO 25.7 percent). Even popular meme tokens were not spared, with PEPE down 12.4 percent and MOG dropping 21.8 percent, signalling that profit-takinghasspreadacrossnarratives.

In summary, the majors surrendered recent gains, while targeted rotations into mid-caps and sector plays created sharp divergences — producing both standout winners and heavy laggards. We expect the pullback to reach a conclusion relatively soon as we enter September. The Altcoin market seeing sharprotationsisoneofthesignshoweverthatmightresultinthemajorsseeing capital eventually flowing back in, particularly if the overall market declines furtherfromcurrentlevels.Themarketwouldlikelyviewsuchadevelopment,as a signal that a bottom is being reached, which would be in line with our end of summerthesis,whichiswhenETFflowsacrossmajorassetclassespickup.

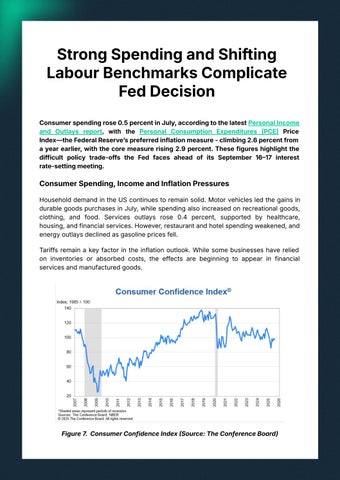

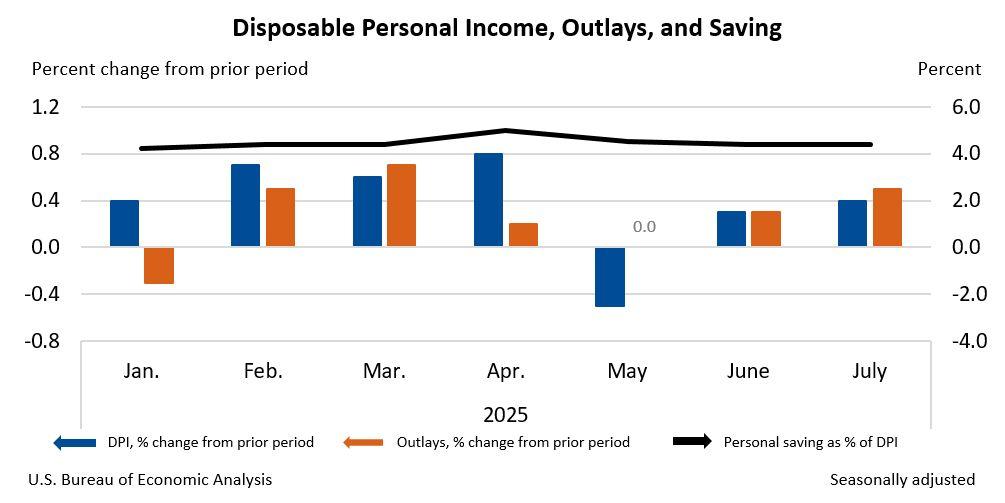

Consumerspendingrose0.5percentinJuly,accordingtothelatestPersonalIncome and Outlays report, with the Personal Consumption Expenditures PCE Price Index—theFederalReserveʼspreferredinflationmeasure-climbing2.6percentfrom ayearearlier,withthecoremeasurerising2.9percent.Thesefigureshighlightthe difficult policy trade-offs the Fed faces ahead of its September 1617 interest rate-settingmeeting.

HouseholddemandintheUScontinuestoremainsolid.Motorvehiclesledthegainsin durablegoodspurchasesinJuly,whilespendingalsoincreasedonrecreationalgoods, clothing, and food. Services outlays rose 0.4 percent, supported by healthcare, housing,andfinancialservices.However,restaurantandhotelspendingweakened,and energyoutlaysdeclinedasgasolinepricesfell.

Tariffs remain a key factor in the inflation outlook. While some businesses have relied on inventories or absorbed costs, the effects are beginning to appear in financial servicesandmanufacturedgoods.

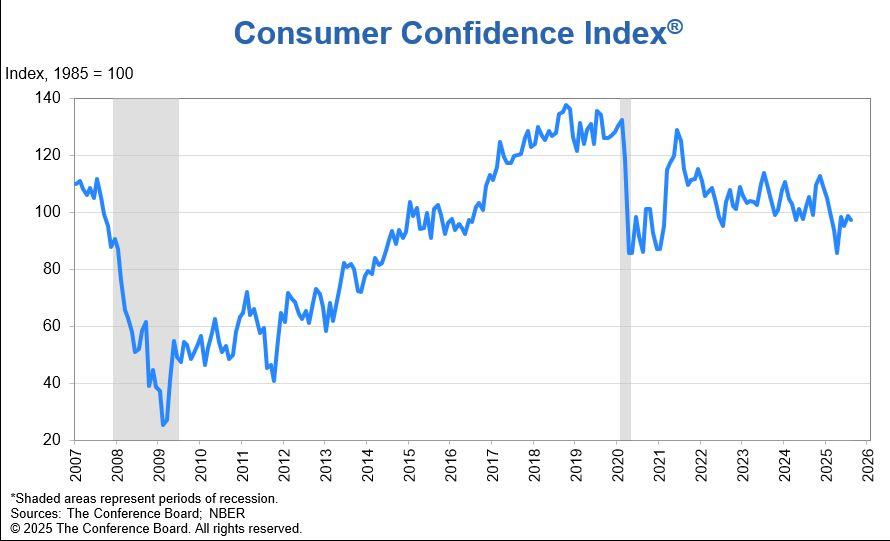

Figure7. ConsumerConfidenceIndexSource:TheConferenceBoard)

Compensation and wages increased 0.6 percent in July, with disposable income rising 0.5percent.However,jobcreationhasslowedsharply.Employmentgainsaveragedjust 35,000permonthoverthepastthreemonths,comparedwith123,000duringthesame periodlastyear.

Adding to these concerns, consumer sentiment weakened in August. The Conference BoardreportedlastTuesdaythatitsconsumerconfidenceindexslippedto97.4froma revised 98.7 in July, reflecting growing pessimism about job availability and future income. Notably, assessments of current job prospects declined for the eighth straight month, while optimism about earnings also faded. This divergence, strong spending in the present but weaker expectations for the future, underscores the uncertainty confrontinghouseholdsandpolicymakersalike.

The July PCE report confirmed that inflation continues to exceed the Fedʼs target. Headline inflation rose at a 2.9 percent pace over the past six months, while core inflation advanced at a 3.1 percent rate. Tariff-related pressures are expected to continuefeedingthroughtopriceslaterthisyear.

Traditionally, economists say that any job growth below 50,000 is a sign of economic weakness, while any growth above 100,000 is a sign of resilience. However, new estimates from the St. Louis Fed, published on Thursday, August 28th, suggests these benchmarksaretoohighgivenrecentdemographicshifts.

TheFederalReserveBankofSt.Louis'supdatedestimatesshowthat,withmuchlower immigrationexpectedin2025,thebreakevenemploymentgrowthratehaslikelyfallento between32,000and82,000jobspermonth.Thismeansthelabourmarketnowrequires farfewernewjobstokeeptheunemploymentratestable.

Recent data are consistent with this adjustment. Between May and July, job growth averagedjust35,000permonth,yettheunemploymentrateheldnear4.2percent.This outcomesupportstheviewthatevenmodestpayrollgainscanbesufficienttomaintain stability.

TheFederalReservehaskeptitsbenchmarkrateinthe4.25to4.5percentrangesince December.Model-basedestimates,usingstandardpolicyrulessuchasthosepublished by the Cleveland Fed, suggest the appropriate federal funds rate for mid-2025 lies between 4.1 and 4.7 percent. Given this range, holding the current rate in September appearsjustifiable.However,thelowerbreakevenjobgrowthfiguresalterthebalanceof risks.

With fewer jobs now needed to sustain labour market stability, an August payroll increase in the range of 70,00080,000 could be interpreted as adequate rather than disappointing.Thislowersthethresholdforeasingandincreasesthelikelihoodofa25 basis-pointcutattheSeptembermeeting,despiteinflationremainingabovetarget.

ThefinaldecisionwilldependheavilyontheAugustjobsreportdueonSeptember5th, alongsideupcomingconsumerandproducerpricedata.Astronger-than-expectedjobs figurecombinedwithstickyinflationmaykeeptheFedonhold.Butifpayrollgainsalign with the new breakeven range, policymakers may judge that modest hiring is sufficient—allowingthemtoprioritisesupportforthebroadereconomy.

The Fed faces a more nuanced policy challenge than in prior cycles. Strong spending and elevated inflation argue for caution, but new labour market benchmarks imply that smaller job gains are enough to preserve stability. This recalibration shifts the outlook: whatonceappearedacoinfliponratesisnowtiltingtowardaSeptemberratecut.

TheUSeconomypresentsacomplicatedpictureasgovernmentdatapointstostronger growth,whileregionalbusinesssurveysrevealsignsofweakness.

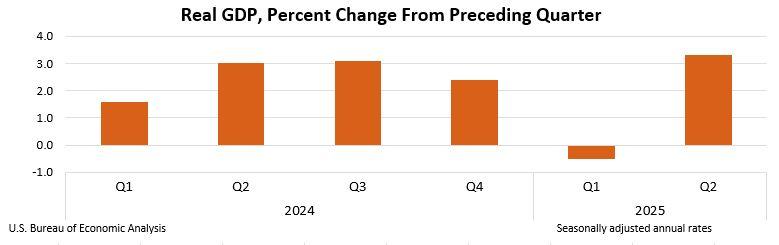

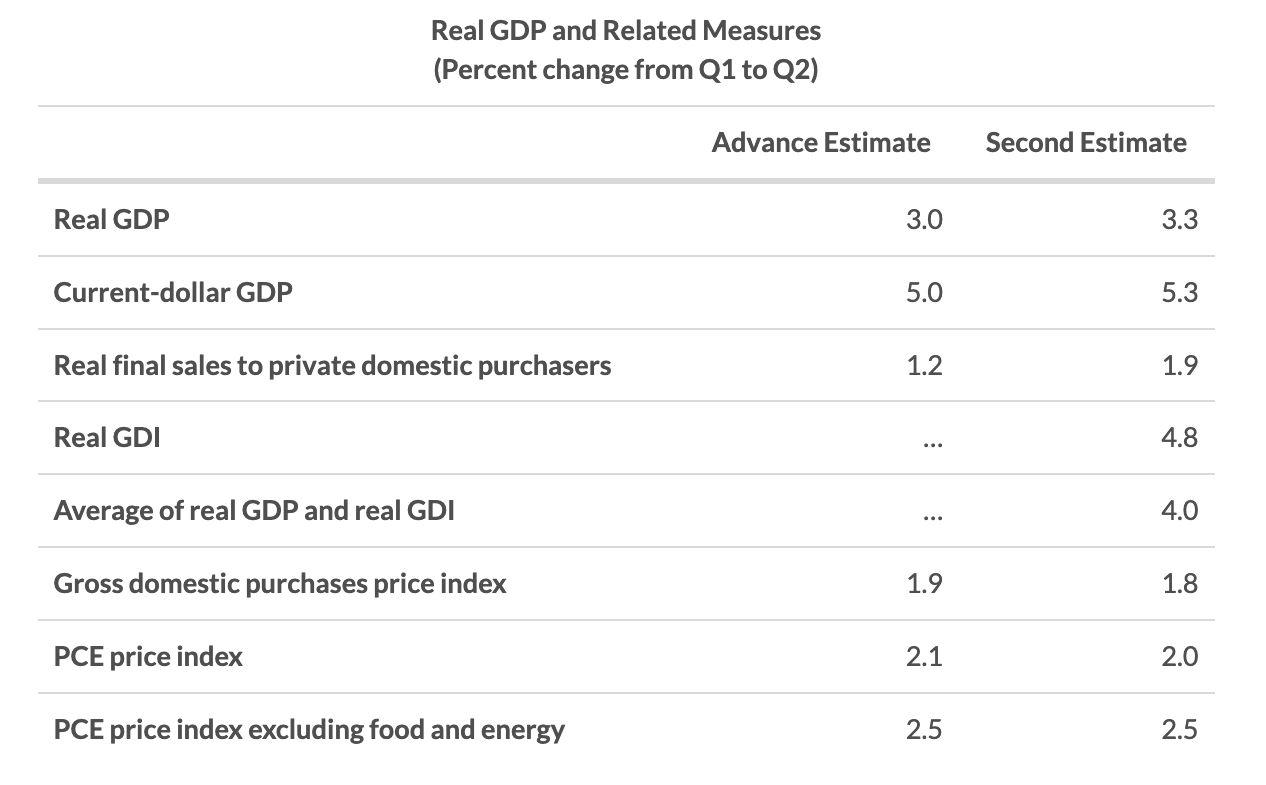

Figure8.RealGDP,PercentChangeFromPrecedingQuarter USBureauofEconomicAnalysis)

Last Thursday, Aug. 28th, the Commerce Departmentʼs Bureau of Economic Analysis released its second estimate of second-quarter Gross Domestic Product GDP. The economygrewata3.3percentannualisedpace,upfromtheinitial3percentreading.The revision reflected a rebound in profits, and robust business investment in intellectual property and equipment. Intellectual property investment, particularly in artificial intelligence, surged at a 12.8 percent rate—the fastest in four years—while equipment investmentwasrevisedhighertoa7.4percentpace.

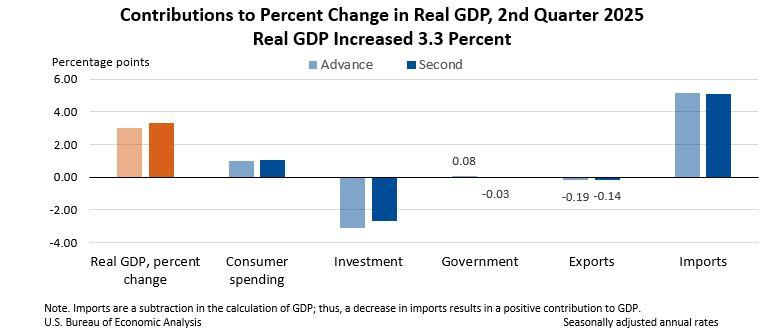

Figure9.ContributionstoPercentChangeinRealGDPforQ2,2025 Source:USBureauofEconomicAnalysis)

Quarterly consumer spending, the largest driver of growth, was also upgraded to 1.6 percent from the previously reported 1.4 percent. Profits from current production rebounded $65.5 billion last quarter, reversing a $90.6 billion decline in the first quarter,despitetariffsraisingcostsformanufacturersandretailers.

Source:USBureauofEconomicAnalysis)

Yetbeneaththestrongheadlinenumber,theeconomyʼsresiliencemaybeoverstated. Tariffs have distorted trade flows, with businesses front-loading imports earlier in the year, temporarily boosting growth. We anticipate these effects to fade in the second half,andmaydragdownfull-yeargrowth.

Evidenceofaslowdownisalreadyvisibleattheregionallevel.OnFriday,Aug.29th,the Chicago Business Barometer, compiled by MNI Indicators, fell to 41.5 in August from 47.1inJuly.Thereadingwaswellbelowthe50thresholdthatseparatesexpansionfrom contraction, signalling that business activity in the Chicago area is losing momentum. The consensus forecast was for a slight increase, underscoring the breadth of the slowdown.

Thecombinationofcoolingregionalactivity,elevatedtariffs,andsteadyinflationplaces the Federal Reserve in a difficult position ahead of its Sept. 1617 policy meeting. Fed ChairJeromePowellhas acknowledgedriskstothelabourmarket,whilealsowarning thatinflationpressuresremain.Withthecentralbankʼsbenchmarkinterestrateheldin the4.25to4.5percentrangesinceDecember,marketsarenowwatchingcloselyfora possibleratecutnextmonth.

The broader picture suggests an economy propped up by technology-driven investment but weighed down by tariffs and weakening confidence elsewhere, particularly among manufacturers and regional businesses. Without a broadening of business investment beyond select sectors, the outlook points toward slower growth ahead—evenasthedatacontinuestooffershort-termsignsofstrength.

● TheCFTCclarifiesthatforeignexchangescanserveUStradersunder thelongstandingFBOTregistrationsystem

● The move is expected to restore market access, boost liquidity, and reduce fragmentation in US crypto trading

TheUSCommoditiesFuturesTradingCommissionreaffirmedlastFriday,August 29, that the Foreign Board of Trade FBOT) registration framework, could be used by non-US exchanges to serve US traders. This framework applies to all types of markets—including commodities and digital assets such as cryptocurrencies—and restores a clear legal pathway for foreign exchanges to operatewithinUSjurisdiction.

Acting Chairman Caroline Pham emphasised that this revives a regulatory route that had become clouded by years of uncertainty and aggressive ‘regulation by enforcementʼofthelastUSadministration.ManyUScompaniesandexchanges had shifted operations offshore to avoid inconsistent regulatory interpretations. ByreassertingtheFBOTmechanism,inplacesincethe1990s,theCFTCaimsto bringbackmarketparticipantsunderastableandwell-establishedstructure.

The advisory issued last week, directly addresses industry confusion over whether foreign exchanges serving US customers should register as Designated Contract Markets DCMs or FBOTs. In recent years, shifting enforcement patterns had blurred the distinction, creating operational challenges for global platforms. The CFTCʼs latest statement clarifies that FBOT registration alone suffices, providing legal certainty and reducing complianceburdens.

ByreaffirmingtheFBOTpathway,theCFTCiseffectivelyre-openingthedoor for these platforms to re-engage with US traders. Analysts expect this will improve liquidity, expand trading options, and reduce fragmentation across cryptomarkets.

The decision also reflects the CFTCʼs broader modernisation efforts. The agency has recently deployed Nasdaqʼs Market Surveillance technology, enhancing its ability to detect fraud, monitor real-time market activity, and strengthen oversight across both traditional and digital asset markets. This dualfocusonregulatoryclarityandstrongersupervisionsignalsacommitment toreintegratingUStraderswhilemaintainingrobustmarketintegrity.

● BitMine Immersion now holds the largest Ethereum treasury globally, with$8.82billionincryptoandcash

● Backedbymajorinstitutions,thefirmaimstoaccumulate5percentof Ethereumʼstotalsupply

Last Sunday, August 24th, BitMine Immersion Technologies BMNR reported crypto and cash holdings totaling $8.82 billion, cementing its position as the worldʼs largest Ethereum-focused treasury company. Its reserves include 1,713,899 ETH—valued at approximately $4,808 per token—alongside 192 Bitcoinand$562millioninunencumberedcash.

BitMine now ranks as the number one corporate Ethereum treasury company globallyandthesecond-largestoverallcryptotreasurygroup,behindStrategy Inc.MSTR,whoseholdingsofover629,000Bitcoinarevaluedatroughly$71 billion. BitMineʼs rapid expansion underscores a growing corporate trend of concentratedcryptobalancesheetstrategies.

Within just one week, BitMine increased its total crypto and cash reserves by $2.2 billion, adding more than 190,500 ETH to its treasury. The pace of accumulationhasdrivenadramaticriseinthefirmʼsnetassetvalueNAV,with itscryptoandcashNAVpersharesurgingfrom$22.84onJuly27thto$39.84 by August 24th. This increase is based on a fully diluted share count of 221,515,180.

Thecompanyʼsaggressiveapproachissupportedbyheavyweightinstitutional investors including ARK Invest Cathie Wood), MOZAYYX, Founders Fund, Bill Miller III, Pantera Capital, Kraken, Digital Currency Group DCG, and Galaxy Digital. BitMine has publicly articulated its goal of accumulating 5 percent of Ethereumʼs total supply, a strategy referred to internally as the “alchemy of 5 percent.ˮ

BitMineʼs stock reflects this momentum, averaging $2.8 billion in daily trading volume, placing it among the 20 most liquid US equities. Chairman Thomas “Tomˮ Lee framed the companyʼs strategy within a broader macroeconomic andregulatoryshift,comparingthemomenttotheUSdeparturefromthegold standardin1971.WithlegislativeandregulatoryeffortssuchastheGENIUSAct andtheSECʼsProjectCryptounderway,BitMinepositionsEthereumnotmerely as an asset but as a foundational pillar for reshaping the global financial system.

● El Salvador will split its $682 million Bitcoin reserve across multiple wallets,eachcappedat500BTC

● Anewpublicdashboardwillprovidereal-timetransparencyonnational Bitcoinholdings

LastFriday,August29th,ElSalvadorʼsNationalBitcoinOfficeannouncedthatthe country will restructure the way it manages its sovereign Bitcoin holdings. The governmentconfirmeditwilltransferitsentireBitcoinreserve—currentlyvalued at around $682 million—from a single wallet into multiple addresses, with each capped at 500 BTC (about $54 million at current market rates). The move is designed to minimize security risks and strengthen government control over its digitalassets.

ATransparency-DrivenApproach

Alongsidetheredistribution,ElSalvadorwillrolloutapublicdashboardtoallow both citizens and international observers to monitor the countryʼs Bitcoin reserves in real time. The initiative underscores President Nayib Bukeleʼs push for transparency as a cornerstone of his administrationʼs cryptocurrency policy. ByofferingopenaccesstoitsnationalBitcoinbalance,ElSalvadorispositioning itselfasagloballeaderinstate-levelcryptogovernance.

El Salvador made history in 2021 by becoming the first nation to adopt Bitcoin as legal tender—adecisionthatattractedbothpraiseandskepticismworldwide.Overtheyears, the government accumulated more than 6,100 BTC, initially consolidated in a single address. In March 2025, the holdings were valued at about $550 million, climbing to over$682millionwithBitcoinʼspriceappreciation.

However, the countryʼs Bitcoin strategy has had to adapt to broader financial realities. Earlierthisyear,ElSalvadorsecureda$1.4billionloanfromtheInternationalMonetary FundIMF,whichrequiredadjustmentstothenationʼsBitcoinpolicies,includingscaling back certain mandates on usage and purchases. Despite these constraints, the governmenthascontinuedaccumulatingBitcoinunderarefinedframework.

ThedecisiontodisperseBitcoinreservesmarksafundamentalshiftfromcentralisation towardresilience.Cybersecurityexpertshavelongcautionedagainsttherisksofstoring large digital assets in a single wallet, and El Salvadorʼs new approach reflects both a securityupgradeandanevolutionininstitutionalmaturity.

By splitting funds into multiple wallets and pairing the move with a transparent public dashboard, the government not only reduces vulnerability to cyberattacks but also signalsacommitmenttoaccountability.TheshiftalignswithPresidentBukeleʼsbroader ambition of positioning El Salvador as a benchmark nation in sovereign Bitcoin management,settingstandardsthatotherstatesmayeventuallyfollow.