CBRE’S QUARTERLY CAPITAL MARKETS MAGAZINE, PROVIDING INSIGHTS ACROSS ALL MAJOR SECTORS.

Adaptive Spaces

The Impact of Artificial Intelligence (AI) on the Australian Office

Resilience

CBRE’S QUARTERLY CAPITAL MARKETS MAGAZINE, PROVIDING INSIGHTS ACROSS ALL MAJOR SECTORS.

Adaptive Spaces

The Impact of Artificial Intelligence (AI) on the Australian Office

Resilience

As we power into quarter three with some improved momentum off the June transactional window, we have seen sales volumes increase year-on-year and some consistent pricing data points recorded. Whilst deal time frames remain painstakingly slow, first mover capital is starting to take advantage of significant pricing reversion.

In this issue, we delve into the key factors driving this recent activity. Our H1 2024 Australia Lender Sentiment Survey reveals strong lending appetite, with 58% of lenders keen to increase their commercial real estate exposures over the next three months. This is a promising sign for the market’s resilience amidst continued economic uncertainty.

In our Sector Spotlights we take a look at the maligned office sector where capital and occupiers are continuing to prioritise quality assets. Despite low investor appetite over the last two years, a surge in transactions on the East Coast recently has provided clear pricing evidence paving the way for valuation adjustments in June and further trading in the second half of 2024. Additionally, we delve into the transformative potential of Artificial Intelligence (AI) on the Australian office market, highlighting how technology is revolutionising the way we work.

We also examine the Metropolitan Investments landscape and jump across the ditch to the New Zealand Capital Markets scene where significant value has emerged alongside the recognised benefits of more efficient tax structures, refocusing capital back on the country.

CBRE’s Head of APAC research, Dr. Henry Chin recently visited and provided a positive outlook with Australia’s commercial real estate market generally showing a significant re-pricing and therefore good value compared to other markets in the region. Australia’s stability, strong rule of law, and transparent market are appealing to international investors, particularly from other parts of Asia. Looking ahead, Dr. Chin emphasises the importance of innovation and sustainability, urging developers and investors to adapt to changing tenant requirements, incorporate sustainability practices, and leverage technology.

We hope you find this issue of Capital Edge informative and insightful. As always, we remain committed to providing you with the latest market intelligence and expert advice to help you make informed investment decisions. Here’s to a prosperous quarter ahead.

Flint Davidson

Head of Capital Markets, Pacific +61 411 183 061

flint.davidson@cbre.com.au

In the H1 2024 Australia Lender Sentiment Survey, CBRE Research reported strong lending appetite amongst local and international banks as well as nonbanks. The survey, which garnered responses from 40 commercial real estate lenders, revealed that 58% of lenders are keen to increase their commercial real estate exposures over the next three months. Notably, no lenders surveyed expressed intentions to decrease their book.

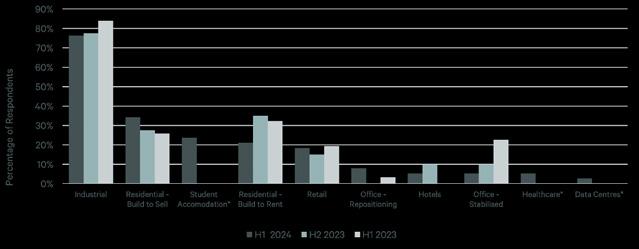

Lenders’ investment preference continues to be heavily concentrated in the Industrial & Logistics sector, with Residential coming in second. Interestingly, student accommodation has emerged as a top two preference for a quarter of the lenders surveyed. Despite this, lenders continue to demonstrate caution toward the Office sector.

In terms of new residential-to-sell construction lending, the majority of lenders require 80%-100% of debt funding to be covered by pre-sales. A moderate decrease in hedging requirements has also been observed, presumably as interest rate volatility has subsided from levels seen over 2023.

However, the total cost of debt remains high and there is no clear consensus yet amongst institutions and surveyed lenders as to whether rates have peaked or their expected trajectory over the next 12 months. Credit margin expectations have normalised following H2 2024’s survey, with over two-thirds of respondents in H1 2024 expecting flattish movement in credit spreads over the next two months.

In June 2024, the Reserve Bank of Australia (RBA) maintained the target cash rate at 4.35%. Inflation remains a key concern, specifically relating to uncertainty about the future path of interest rates. More than a third of surveyed lenders expect at least one rate hike to 4.60% or above by December 2024, while half expect the cash rate to reach 4.10% by June 2025.

The survey also revealed that 60% of lenders expect an increase in new loan appetite over the next three months. This consensus is particularly prevalent among domestic and non-bank respondents (63% and 85% respectively).

Shifting preferences in LVR requirements were observed, with majority of respondents indicating LVR requirements between 40-60%, consistent with prior surveys. Moreover, ICR requirements remained stable over the last six months with over half (53%) of lenders requiring a 1.5x ratio.

Overall, the survey results indicate a strong lending appetite among the majority of lenders, with a particular focus on the Industrial & Logistics and Residential sectors. As macroeconomic conditions become more certain, this trend is expected to support increased levels of loan appetite.

LENDER EXPECTATIONS FOR THE OFFICIAL RBA CASH RATE AS OF:

The Industrial sector has continued to attract the strongest proportion of lender interest driven by its continued record-low vacancy rates and strong rental growth across Australia.

Student accommodation reached the third highest percentage of respondents reaching 24% in H1 2024. The sector offers strong demand fundamentals amidst a relatively under-supplied market relative to our global peers 1.

Lender preference for residential assets continues to remain strong, with the percentage of build-to-sell respondents growing for the second consecutive period.

Lender preference for office assets continues to remain subdued. Despite this, a moderate uptick in ‘Office - repositioning’ responses was recorded in H1 2024. We attribute this to the attractive value proposition offered by the risk-return offerings of credit investment in office assets. Notably, this is most reflective of non-bank respondents, whose comfort in the asset class has increased since prior surveys.

• Appetite for new loans over the next three months has increased for majority of lenders, 58% want to grow commercial real estate exposures with and no surveyed lenders intending to decrease their book.

• Lender investment preference continues to be dominated by the Industrial & Logistics sector, followed by Residential. Nearly 1/4th of Lenders rank student accommodation as a top two preference. Lenders continue to display caution towards the Office sector.

• For new residential-to-sell construction lending, the largest cohort of lenders require 80%-100% of debt funding covered by pre-sales.

• The total cost of debt remains at elevated levels and there is no clear consensus view has yet to be formed amongst institutions and surveyed lenders as to whether rates have peaked, and their expected trajectory over the next 12 months.

• Credit margin expectations normalised following H2 2024’s survey, with over 2/3rds of respondents in H1 2024 expecting flattish movement in credit spreads over the next 3-months.

• A moderate decrease in hedging requirements, presumably as interest rate volatility has subsided from levels seen over 2023.

• Preferred LVR requirements have shifted moderately, however majority of respondents continue to have LVR requirements between 40-60%, consistent with prior surveys.

• ICR requirements remained stable over the last six months with more than half (53%) of lenders requiring a 1.5x ratio.

LENDER EXPECTATIONS FOR THE OFFICIAL RBA CASH RATE AS OF:

Sydney’s iconic Luna Park, one of Australia’s most recognisable amusement parks, has been listed for sale for the first time in two decades. The sale is tipped to generate significant domestic and international buyer interest in the unique site on the shores of Sydney Harbour.

CBRE’s Simon Rooney, James Douglas and Paul Ryan have been exclusively appointed to steer the campaign for the landmark amusement attraction on behalf of global investment firm Brookfield.

“The sale presents a unique opportunity to secure the Luna Park business in a globally recognised Sydney landmark underpinned by outstanding investment fundamentals and a strong brand. Trophy assets such as Luna Park are tightly held and rarely traded, with the campaign providing an opportunity to secure a world class entertainment, event and experience destination with further upside” notes Simon Rooney, Head of Retail Capital Markets.

John Hughes, CEO of Luna Park Sydney, said: “Since opening in 1935, Luna Park has played an important role in Sydney’s social and cultural fabric. The business has undergone a strategic transformation, with a A$40 million upgrade during the last four years adding new rides and immersive experiences, both of which are driving record visitation. Our outstanding management team is pursuing a strong pipeline of new opportunities that will further add value to the business.”

Luna Park Sydney now features 17 amusement rides, the heritage-listed Coney Island, 7,000 square metres of building floorspace including Sydney’s Immersive Big Top and the 1935-built Crystal Palace as well as a 389-space car park.

Simon adds “Luna Park is more than just an amusement park. It is the beating heart of Sydney with an impressive track-record of long-running events including Halloscream, New Year’s Eve and collaborations with key city-wide

festivals such as Sydney Festival, Vivid and Lunar New Year. The existing floorspace provides opportunities to further enhance the profile of the precinct and drive income growth through additional amusement and immersive experiences or F&B initiatives. This follows a recent major investment in redeveloping the park’s Big Top as a 3,000 square metres multi-purpose venue, catering to growing global demand for captivating and all-in experiences.”

Luna Park will continue to operate as normal during the sales process.

Expressions of Interest in the Luna Park leasehold close in late August.

Luna Park Sydney opened on 4 October 1935 to immediate success. The amusement park concept was based on the first Luna Park which opened on Coney Island, New York in 1903. American entrepreneur Herman Phillips and others brought the idea to Australia. Luna Park is run smoothly under the management of showman David Atkins until 1957 and engineer Ted Hopkins until 1969 with revolving activations. Following overseas excursions in the 1950s and 1960s, a series of new rides and attractions are purchased and installed, including a new Penny Arcade, the famous Rotor and the Wild Mouse rollercoaster.

To revitalise Luna Park in the 1970s, a group of artists are commissioned to redecorate. The group of artists, later forming as the Friends of Luna Park, understood and appreciated the work of their artistic predecessors. Following a fatal fire in the Ghost Train on 9 June 1979, Luna Park is closed.

The Friends of Luna Park, stage public rallies and meetings to save Luna Park. The Friends of Luna Park are commissioned by the Government to prepare a report on the significance of Luna Park, as a step to ensure its protection. A new leaseholder is appointed and Luna Park re-opens in May 1982 with a mix of new and reconditioned rides. A series of high-rise proposals are unsuccessful, resulting in the consideration of an Act of parliament to protect Luna Park.

The Luna Park Site Act was introduced in 1990 with the objective “to return the Luna Park site to the people of New South Wales and to ensure that Luna Park and the associated harbour foreshore remain available and accessible for the enjoyment of the people of New South Wales.”

A new leaseholder is announced in 1999 along with a commitment of $65m in investment. In the new millennium, Luna Park Sydney Pty Ltd was formed and assumed a 40-year lease and new construction and total refurbishment of buildings and rides begin, including new rides and a 2000-seat auditorium. Luna Park is listed on the NSW State Heritage Register.

Today, Sydney’s Luna Park continues to be a cherished destination.

Simon Rooney

+61 418 284 680 simon.rooney@cbre.com

Paul Ryan

+61 402 503 755 paul.ryan@cbre.com

James Douglas

+61 419 973 245 james.douglas@cbre.com

State Director, Office, Capital Markets, New South Wales

+61 408 553 000

james.parry@cbre.com

• Despite low investor appetite over last two years, there’s a clear shift towards quality assets

• Recent Sydney transactions providing better pricing guidance for investors

• After a record-low period, NSW saw increased sales volumes in the first half of 2024

Australia’s office markets are undergoing a changing dynamic, with flight to quality still very much on the agenda for occupiers and investors. Investor appetite has been low for over two years.

In Sydney, it’s clear that the lowest sales volumes are behind us, with a recent spate of transactions providing better guidance as to market pricing. Buyer activity is expected to increase as investors look to capitalise on price discounts that are in the range of 20-30% from the market peak in 2022.

With the cyclical shift, book values continue to be written down (circa 50 basis points in June 2024) and are expected to come closer to buyers expectations by the end of this year.

What distress! We have not seen any distressed sales in the commercial sector in New South Wales, and frankly if some do materialise, we anticipate they will be isolated.

After a two year period of record low sales volumes in New South Wales, activity has returned with $2.7 billion (AUD) of transactions in the first half of 2024, representing an increase of 149% year-on-year. We expect an equally active second half of the year that will continue into 2025.

In Sydney, Mirvac and Dexus comprise the bulk of the sell-side as they curate their portfolio’s by selling non-core assets. We are yet to see any significant selling from wholesale investors which we expect will selectively sell assets as buyer activity returns.

• Institutional: Activity has escalated with recently announced deals being 55 Pitt Street, Sydney (66% at a confidential price); 5 Martin Place, Sydney (50% at $302.5 million AUD); and 40 Miller Street, North Sydney ($141 million AUD).

• Non-institutional: Mid-sized sales are also gathering pace in New South Wales, albeit from a very low level. We expect $50 to $200 million AUD to be an active segment.

Buyer hesitation is slowly dissipating as buyers look to capitalise on Sydney’s revised pricing. With the emergence of new investors, we expect competitive tension will stabilise pricing.

• Institutional: The bulk of the buyers up until recently has been offshore investors, however this is starting to shift evidenced by Cbus’ recent acquisition of 5 Martin Place, Sydney. We expect domestic buyers to feature on bidding schedules.

• Non-institutional: Buyers both domestic and offshore are returning to the market as they look to take advantage of recent pricing. This is evidenced by a recent CBRE transaction (circa $50 million AUD) that received 10 bids.

A key driver of both pricing and buyer conviction has clearly been borrowing costs. Notwithstanding current forecasts, we expect buyer confidence is largely driven by the interest rate cycle, which if we’re not at the bottom, is extremely close to it, further boosting buyer conviction.

In the largest office transaction of 2024 so far, Japanese conglomerate Mitsui Fudosan has secured a 66% stake in the $2 billion (AUD) office development, 55 Pitt Street. The transaction, facilitated by CBRE and Knight Frank, marks a significant milestone in the office landscape.

Located in Circular Quay, a waterfront precinct in Sydney’s CBD, 55 Pitt Street will deliver approximately 63,000 square metres of premium commercial and activated retail space as part of a vibrant new destination that will contribute towards the revitalisation of the iconic Circular Quay precinct.

Mitsui Fudosan, renowned for its extensive real estate portfolio, has strategically positioned itself in the heart of Sydney’s business district. With this acquisition, the company solidifies its presence in the Australian market and gains a foothold in one of the most sought-after office spaces.

Australian property developer, Mirvac, the original stakeholder, will continue to play a pivotal role in 55 Pitt Street. They will co-own and actively participate in the development, ensuring continuity and excellence. Additionally, Mirvac’s property management expertise will contribute to the building’s seamless operation.

Flint Davidson

+61 411 183 061

flint.davidson@cbre.com.au

In conjunction with Knight Frank

Stuart McCann

+65 9824 5834

stuart.mccann@cbre.com

40 MILLER STREET, NORTH SYDNEY

In a landmark deal, Barings has secured the 100% freehold interest in 40 Miller Street, North Sydney, for a staggering $141.0 million. The property, sold by CBRE in June 2024, commands an impressive price of $11,178 per square meter.

Developed by Mirvac in 2000, the building offers commanding views of Sydney harbour from all floors, with outdoor balconies providing additional amenity for tenants. The A-grade office tower boasts 12,615 square meters of net lettable area and stands as a testament to North Sydney’s thriving commercial

James Parry

+61 408 553 000 james.parry@cbre.com

real estate market. With a remarkable 91% occupancy rate and a weighted average lease expiry of 4.1 years, the property promises stability and long-term value.

Notably, this transaction marks a historic milestone—the first suburban asset to settle above the $100 million mark in 2024. Barings’ acquisition underscores the robust demand for premium office spaces in North Sydney and sets a new benchmark for the region.

Flint Davidson

+61 411 183 061 flint.davidson@cbre.com.au

Mitch Noonan

+61 423 931 119 mitch.noonan@cbre.com

Over the past few years, Australian superannuation funds have significantly adjusted their allocation to property investments. Currently, their allocation stands at 7.25%, which is the lowest it has been for a decade and a notable decline from the long-term average of 8.20%.

Part of the reason for this is that superannuation funds have experienced devaluation of their existing property portfolios. Also, the pricing of Real Estate Investment Trusts (REITs) has dropped, which has impacted on their listed property exposure. In addition, Super funds have strategically reweighted their portfolios toward equities, particularly in tech-heavy indices like the NASDAQ. The AI boom has driven strong returns in these equities.

Despite the overall decline, commercial property is starting to appear relatively

cheap, compared to other asset classes. If superannuation funds were to return to their historical average allocation of 8.2%, they would need to invest approximately $22 billion AUD into unlisted and listed property. Also, this figure ignores the circa $60 billion AUD of net inflows that superannuation funds need to invest each year. The reweighting back into property could trigger a solid improvement in transaction volumes in Australia over the coming years.

Tom Broderick

Head of Office and Capital Markets Research

+61 430 405 910 tom.broderick@cbre.com.au

In CBRE’s recent report titled “AI’s Impact on the Australian Office,” we delve into the transformative potential of Artificial Intelligence (AI) within workplace environments. From reshaping design to automating maintenance, AI promises to revolutionise how we work.

In recent years, AI has gained significant momentum, promising to reshape our world across various sectors. From finance to healthcare, AI tools are revolutionising roles by analysing data, predicting trends, and even assisting in customer service. However, what about the Australian office market? How will AI transform the way we work?

RESHAPING WORKPLACE DESIGN

AI is poised to revolutionise workplace design. Imagine offices that adapt to employee preferences in real time. Smart sensors adjust lighting, temperature, and seating arrangements based on individual needs. The result? A more productive and comfortable work environment.

AUTOMATING MAINTENANCE AND CLEANING

Manual maintenance and cleaning schedules are becoming obsolete. AI-powered robots efficiently handle routine tasks. From vacuuming floors to restocking supplies, these smart machines free up human resources for more strategic work.

ENABLING SMART BUILDINGS

AI-driven smart buildings are on the horizon. These structures optimise energy usage, monitor occupancy patterns, and enhance security. Imagine an office that adjusts lighting and heating based on employee presence, reducing costs and environmental impact.

INCREASED INVESTMENT IN TECHNOLOGY INFRASTRUCTURE

To fully harness AI’s potential, Australian offices must invest in robust technology infrastructure. High-speed internet, data storage solutions, and other tools enable AI-driven innovation.

While fears of massive job losses persist, experts believe that AI’s impact on white-collar employment will be more nuanced. Rather than eliminating jobs, AI will transform them. The Australian office market stands at the forefront of this transformation, poised to embrace the benefits of AI while adapting to new challenges.

Download the full report: AI’s Impact on Australian Office READ MORE

Managing Director, Metropolitan Investments, Pacific +61 431 121 914

mark.lafferty@cbre.com.au

“Investors and

• Despite market challenges, recent months have seen an uptick in activity

• More unit blocks are coming to market across the Eastern seaboard, driven by housing demand and diversified income streams

• The Pacific Metropolitan Investments team is also engaging with investors in Asia during their annual roadshow

CBRE’s Pacific Metropolitan Investments team specialise in investment and development properties in the sub-$35 million (AUD) bracket and look at varied asset types including retail, office, development sites, apartment blocks, petrol stations, and more.

The Metropolitan Investments sector like all sectors has not been immune to the challenges of the current market, but over the last few months we have seen an uptick in activity with purchasers focusing on assets that will achieve rental growth and the potential for long term appreciation. In line with this strategy, we have seen an increased number of unit blocks coming to market across the Eastern seaboard market, with investors taking advantage of the diversified income stream and rental growth driven by housing demand, which is only expected to continue given forecast increase in migration.

We have also seen a flight to quality in the development site space, with campaigns launching in Queensland and Victoria demonstrating the return of the market in the high-end development site space. 1 Connor Street on the Gold Coast launched this month, offering a site placed at the busiest intersection in the region for the first time in a quarter of a century. Located within walking distance to the beach, future light rails station and the famous Burleigh Pavilion, the site offers the purchaser the ultimate flexibility to take advantage of the beach-side location and the development upside offered by the four-storey height limit.

In Victoria, the team is bringing 79 Victoria Parade, Collingwood to market. This trophy corner landholding provides the opportunity to secure one of the largest developable footprints in Melbourne’s premier city fringe, underpinned by substantial existing improvements and holding income.

In partnership with REA Group (realcommercial. com.au), the Pacific Metropolitan Investments team is heading over to Asia for our annual ‘Asia Investment Roadshow’ this August. Following on from last year’s trip which included Singapore, Hong Kong and Taiwan, this year the team will be heading to Kuala Lumpur, Malaysia and Ho Chi Minh, Vietnam. Partnering with our local teams on the ground, we will be presenting our current appointments to the most active investors in the region, educating these groups on the Pacific investment market.

The evolving dynamics of the property market were portrayed in a recent transaction of an apartment block located at 66 Ernest Street. The property, sold by CBRE, comprised 15 one-bedroom apartments and was auctioned off for $8.85 million in May 2024.

The sale price per apartment stood at approximately $590,000, delivering a gross yield of 4.2%, and an annual gross income of around $375,600.

The sale process showcased the robust interest and demand in the real estate market. The property generated 270 enquiries, 38 due diligence requests, and 27 inspections. It was an active auction with seven registered bidders, resulting in a local buyer claiming the asset.

The transaction highlighted the continued appeal of such properties in the

residential market. Despite the changing economic landscape, the market for low-density residential properties proves to be resilient, demonstrating sustained interest from potential buyers.

Moreover, the sale of the 66 Ernest Street property supports the trend of local investment in the real estate market. The successful bidder’s origin not only underlines the local confidence in the residential property market but also the continued attractiveness of such investments for generating steady income.

Angus Beevers

+61 431 744 830

angus.beevers@cbre.com

Toby Silk

+61 422 143 813

toby.silk@cbre.com.au

In one of the most strategic transactions in Henderson’s maritime real estate landscape, Development WA has acquired one of the largest waterfront holdings for $51 million AUD. CBRE’s Derek Barlow and Jarrad Grierson brokered the sale on behalf of the property’s private owners.

Located at 49-53 Clarence Beach Road, Henderson, the property enjoys a strategic position in the shipbuilding precinct of the Australian Marine Complex. It boasts over 140 metres of water frontage, making it a prime asset in the maritime real estate sector. This significant property includes a lease to Echo Yachts, a renowned super yacht builder. Echo recently inked a globally significant contract for constructing ‘the world’s largest sailpowered catamaran,’ measuring an impressive 57 metres in length.

Derek Barlow, Capital Markets Director, revealed that the property attracted substantial interest from numerous buyers, including several international groups. However, the Vendors ultimately decided to transact with the state government due to the simplicity of the terms presented.

Jarrad Grierson, commented on the uniqueness of the property. He highlighted its significant scale and direct waterfront access, which makes it one of the few sites able to service the super yacht and ship manufacturing and service industry. Grierson also pointed out that strong fundamentals, particularly in defence and mining services, will continue to fuel growth and positively impact the Henderson industrial market.

The property encompasses a 4.63 hectares waterfront landholding over two free-hold titles. It comes with a sea-bed licence and an established slipway launch structure.

The sale of the Henderson Waterfront Maritime Complex is a testament to CBRE’s unrivalled market knowledge and professional expertise in managing high-profile transactions. It further underscores the company’s commitment to creating exceptional outcomes for its clients and the wider maritime industry.

Derek Barlow

+61 417 941 478 derek.barlow@cbre.com.au

Jarrad Grierson

+61 413 242 240 jarrad.grierson@cbre.com.au

D iscover diverse opportunities. Expand your portfolio in one day. Where?

Wednesday, 21st August 2024 from 10:30am How? In room, online and phone bidding available

Executive Chairman, Head of New Zealand Capital Markets +64 21 870 508 brent.mcgregor@cbre.co.nz

“The

• Generally, transactions are occurring 25% to 35% off peak book values, and at discount to replacement costs

• Recent transactional activity shows transactions cap rates a sitting at or around the debt rate

• Genuine opportunity to buy ahead of the curve

With interest rates at cyclical peaks, a clear runway to interest rate easing signaled and a re-rating of asset values beginning to come through, the current market represents the best buying opportunity of my career. Whilst transaction volumes throughout the New Zealand market largely remain subdued compared to the abundance of activity that occurred throughout 2020 to 2022, the lengthy period of market inertia and stagnation that has occurred over the past 18 to 24 months as a result of wide bid-ask spreads is showing strong signs of having subsided.

In 2023, $20 million NZD+ transaction volumes in New Zealand totaled $1.876 billion NZD, and felt like the trough of the cycle, with volumes near historic lows. This followed a global theme of reduced transaction activity, with New Zealand down 52% on the prior year, almost identical to the 50% fall in Australian transaction activity over the same period.

Having hiked New Zealand’s official cash rate higher and quicker than all developed nations, bank consensus forecasts suggest a consensus average 158 basis point lowering of New Zealand’s Official Cash Rate (OCR) over the next year and a half. As at 12 July, CPI sits only 0.3% outside of the RBNZ target range of 1% to 3%.

Together, with a general improvement in market confidence, we have seen several transactions occur in the first half of this year from investors looking to take advantage of the next cycle. These sales include:

• Office: $21.35 million NZD sale of 63 Albert Street, Auckland Central to a local private investor for an initial yield of circa 7.5% that reflects a fully leased initial yield of circa 9.0%.

• Retail: $37.1 million NZD sale of Woolworths’ Waiata Shores Neighbourhood Centre in Auckland to a local private investor for an initial

yield of 6.6% (brokered by CBRE).

• Industrial: $124 million NZD sale of Genuine Parts Company’s distribution centre to funds managed by BlackRock for an equivalent yield of 5.6% (brokered by CBRE).

Year-to-date, $20 million NZD+ transaction activity totals $596 million NZD with several considerable transactions including the sale of Auckland’s premium grade Vero Centre under contract subject to overseas investment office approval. Generally, transactions are occurring 25% to 35% off peak book values, and at a discount to replacement costs.

Recent activity shows that middle-market transactions for office and retail properties are occurring within proximity of the all-in-cost of debt, which now sits at around 7% to 8% and whilst valuers have not necessarily fully written down asset valuations, these recent transactions provide the pricing clarity the market needs to overcome its inertia.

On a global scale, the fundamentals of the New Zealand market offer significant strength and are attractive to global private and institutional capital. New Zealand is forecasting 9% population growth over the period to 2033, third only to Canada and Australia. Office vacancy, work-from-home, and shopping mall space per capita lie below all Australian cities; and the market operates on a lower tenant incentive basis, relative to Australia, translating to superior cash-oncash returns. Fundamentals are further enhanced by the favorable tax environment and settings that include no comprehensive capital gains tax, no stamp duty, transfer taxes or land taxes.

The current market presents a genuine opportunity to buy ahead of the curve with arguably greater value to be realised and in an environment with somewhat constrained market competition.

5.22% PERTH

New Zealand is a recognised gateway city, with a resilient office market that is outperforming comparable cities such as Sydney, Brisbane and Melbourne. On a relative basis, Auckland offers strong value, with an exceptional cash on cash returns profile.

4.89%

WOOLWORTHS WAIATA SHORES

In Auckland, Woolworths Waiata Shores Neighbourhood Centre is one of Auckland’s finest neighbourhood centres and New Zealand’s first 5-star Green Star rated supermarket.

Situated in a high-profile location, the neighbourhood offering is anchored by Woolworths and complemented by a fully integrated, purpose-built medical centre, that forms the heart of its local community.

The tenancy profile is heavily weighted toward a non-discretionary tenancy profile, providing resilient prospects complemented by the centres growth South Auckland catchment.

CBRE acted as exclusive agent on behalf of Woolworths Group, conducting an on-market campaign of the asset. The asset received a strong level of interest with seven offers received from local and offshore capital groups.

The relatively liquid investment quantum translated to a range of buyer groups bidding on the asset, including local and foreign high-net-worth individuals, institutional investors and a syndicator. A local private investor proved the sharpest capital in the market on this occasion, mirroring recent New Zealand trends of private investors recognising a window of opportunity to acquire high profile assets.

One of New Zealand’s highest quality industrial investment opportunities has been sold to funds managed by BlackRock, in a transaction facilitated by CBRE. This investment further strengthens BlackRock’s growing presence within the New Zealand industrial market.

Developed and occupied by GPC Asia Pacific, a leading distributor of automotive and industrial parts in Australasia, and part of a global group with an extensive network of over 10,000 locations across 17 countries –the asset was sold subject to a 15-year leaseback to GPC Asia Pacific.

The 33,468 square metre facility completed towards the end of 2022, represents one of the most significant premium-grade industrial investment opportunities to have been marketed for a number of years in New Zealand.

CBRE represented and advised GPC Asia Pacific on this divestment, and negotiated the transaction via an international on market process that culminated in over $750 million NZD of bid value being received at campaign close from domestic, American, European and Australasian capital.

Bruce Catley

+64 21 729 004 bruce.catley@cbre.com

John Holmes

+64 274 899 095 john.holmes@cbre.com

Chris O’Brien

+61 407 664 233 chris.o’brien@cbre.com.au

CBRE has appointed Caiti Morgan to the new position of Senior Director, Capital Markets - Retail, to lead and grow the company’s specialist retail sales capability in New Zealand as part of the market-leading CBRE Pacific Capital Markets Retail team.

Caiti is a highly experienced property professional with a background in valuation and consultancy. She is based in the company’s Christchurch office working closely alongside CBRE’s national capital markets sales team in Auckland, Wellington and Christchurch, as well as its specialist retail capital markets team in Sydney.

Tim Rookes, Managing Director of CBRE Christchurch, said Caiti’s experience in retail investment and advisory is of significant value to the company, at a time when retail property assets continue to gain investors’ attention in the high interest rate environment.

“Caiti brings a wealth of experience and specialist retail property knowledge, which is invaluable in assisting our clients who are evaluating retail investments in the context of ongoing global economic challenges. We are thrilled to have her on board at this pivotal time in the recovery of the retail investment market.”

Caiti has previously held senior valuation and advisory positions at CBRE and Cushman and Wakefield in Canada, leading assignments on some of the largest and most productive malls in North America. She has represented many of the top institutional and private retail property owners and managers globally over the past 18 years.

“CBRE’s domestic expertise and relationships coupled with its specialist international reach is what drew me to the role,” she said.

Retail property fundamentals in New Zealand are sound in comparison with many offshore markets, highlighting a positive outlook for investment here as the market recovers, said Morgan.

“The majority of the retail sector in New Zealand weathered the pandemic well, and is still displaying resilience despite the downtown in consumer spending. Even with the current challenging economic conditions, many national and international retailers appear well capitalised and rent levels remain affordable compared with their trading revenue.”

CBRE’s 2024 New Zealand Market Outlook shows rents in Auckland regional shopping centres were more resilient than those in major Australian cities through Covid. Auckland regional shopping centre rents also experienced higher growth over the past decade than those in Australian cities, demonstrating the resilience of this market.

In addition, New Zealand’s tight zoning controls limit the supply of retail property, while continued population growth bolsters the demand side of the retail equation.

“Retail in New Zealand has a solid forward outlook as a result of these drivers, which is why we are seeing more investors looking at the sector,” said Morgan.

Logistics and transportation companies are increasingly prioritising sustainability and setting net-zero carbon targets, influencing the real estate decision-making process worldwide.

In the wake of increasing environmental consciousness among Fortune 500 transportation and logistics companies, CBRE Research has highlighted the growing trend and practicalities of ‘greening’ logistics real estate. According to June 2024’s Asia Pacific Leasing Sentiment Survey, over half the occupiers prefer facilities with green certification, with a quarter emphasising the need for electric vehicle charging infrastructure.

A key preference among Asia Pacific logistics occupiers is renewable energy supply, particularly in regions where coal-fired power plants are dominant. In response, many industrial asset owners are enhancing their portfolio’s access to renewable energy through on-site solar energy generation and connections to the renewable energy grid. In countries with open wholesale electricity markets like Australia, owners can switch to greener energy providers or enter into long-term Power Purchase Agreements (PPAs), enabling facilities to be fully powered by renewable energy.

The green transformation is not without its challenges, including long payback periods and varying energy generation capabilities. However, governments have a crucial role in accelerating renewable energy adoption through financial support and mandatory regulations. For instance, Singapore’s JTC Corporation has enforced mandatory solar deployment for all eligible new facilities and leases renewed from 2020.

Green building certification is another popular green feature. Despite its relatively early adoption stage in the industrial and logistics sector, several rating systems have expanded to cover warehouses, such as Australia’s NABERS. However, the energy performance between various types of industrial occupiers poses a challenge for landlords seeking green certification for their properties.

In addition to renewable energy and green certification, other green features include energy conservation, charging infrastructure for electric vehicles, and resilience to climate change. In Australia, Goodman has introduced a national green waste programme to repurpose gardening waste into mulch, soil or compost.

The electrification of road freight vehicles, contributing 29% of global transport carbon emissions, is also driving demand for on-site charging points in industrial and logistics buildings. Logistics operators in Australia, such as Australia Post, are part of this trend, aiming to drive the adoption of electric vehicles in their contractor supply chain by 2030.

Despite the growing demand for environmentally friendly logistics facilities, landlords and investors must prioritise green investment needs within their portfolios. CBRE recommends the use of green financing to meet the growing capital demand for asset retrofitting and upgrading, and the disposal of assets with limited prospects for green retrofitting.

Australia, along with Singapore, Hong Kong SAR and mainland China, is also seeing a rise in the implementation of green leases. Moreover, occupiers are seeking to improve their collaboration with landlords in the fields of environmental performance tracking and data sharing.

Amid the increasing demand for green logistics facilities, landlords and investors need to evaluate and prioritise green investment needs within their portfolios. With authorities in several markets, including Singapore, introducing financial support programmes to stimulate real estate decarbonisation, the future of logistics real estate seems to be paving the way towards a greener future.

Dr. Henry Chin, the leader of CBRE’s Asia Pacific research team who also guides investor thought leadership for CBRE globally, joined Kathryn House, CBRE’s Pacific Communication Director on his recent visit to Australia to discuss the resurgence of the Australian market with a focus on potential for growth, for CBRE’s Talking Property podcast.

“I have to say now the crown of La La Land has passed on. Australia is no longer a La La Land. The La La Land this year will be Hong Kong and Singapore, and that the price has shifted quite substantially over the past twelve months in Australia. I am very happy to say for the commercial real estate market, I think Australia is either closer to the bottom or in the bottom already, so therefore, I can see the sentiment has shifted. Twelve months ago, no one wants to look at Australia, but now people starting to get more and more interested to look at Australia’s commercial real estate markets.” Dr. Chin says, referencing his comments from his 2023 Australian visit.

The Australian commercial real estate has experienced a remarkable recovery over the past year. Despite the challenges posed by the COVID-19 pandemic, the market has shown resilience and is now back on the radar of local and international investors. According to Dr. Chin, “Australia has emerged as a highly attractive market for commercial real estate investors. The country’s management of the pandemic, steady economic recovery, and low interest rates have created a favourable environment for investment.”

There are some changing dynamics in the Australian office market. While remote work trends have impacted traditional office spaces, Dr. Chin believes that demand for well-located, high-quality office spaces will rebound as businesses prioritise collaboration and innovation. Dr. Chin asserts, “The office will remain a crucial part of the corporate ecosystem, providing a place for employees to connect, collaborate, and build relationships. We have already observed increased activity in sub-markets with high-quality office assets, indicating a strong resurgence of demand.”

The podcast also highlights the emergence of alternative asset classes in Australia’s commercial real estate market. Industrial and logistics properties, data centres, and healthcare facilities have gained significant attention from investors seeking stable and resilient assets.

Dr. Henry Chin Global Head of Investor Thought Leadership & Head of Research, Asia Pacific henry.chin@cbre.com.hk

Dr. Chin explains, “Alternative asset classes have become increasingly popular due to their strong performance, long-term growth potential, and ability to withstand economic uncertainties. The e-commerce boom, increased focus on healthcare, and digitalisation of businesses have fueled demand for these asset types.”

Current investor sentiment and capital flows in Australia’s commercial real estate market. Dr. Chin emphasises that global investors are once again recognising Australia as an attractive investment destination, with significant capital inflows anticipated.

“Australia’s relative stability, strong rule of law, and transparent market make it an appealing choice for international investors,” says Dr. Chin. “We are witnessing a growing appetite for Australian assets from offshore investors, particularly from Asia and North America.”

Looking at the future of the market, Dr. Chin highlights the importance of adapting to changing tenant requirements, incorporating sustainability practices, and leveraging technology to enhance building performance. “Innovation and sustainability will be key drivers in the future of Australian commercial real estate,” states Dr. Chin. “Developers and investors need to remain agile, embracing technological advancements, and staying attuned to evolving tenant needs to maintain a competitive edge.”

Australia’s commercial real estate market is experiencing a strong resurgence, attracting both local and international investors. This episode provides valuable insights into the current trends and future prospects of the market. As Australia’s economy continues to recover and thrive, commercial real estate professionals must stay informed and adapt to capitalise on the opportunities that lie ahead.

Kathryn House Pacific Communications Director kathryn.house@cbre.com.au

OFFICE

Institutional and middle markets

CAPITAL ADVISORS

Equity and capital advisory services

DEBT & STRUCTURED FINANCE

Origination and loan services

LIVING

BTR, purpose built student accom, co-living and affordable housing

RETAIL

Institutional and middle markets

HOTELS

Accommodation, pubs and tourism

INDUSTRIAL & LOGISTICS

Institutional and Middle markets

Our trusted, tenured experts seamlessly collaborate to help clients connect to global capital and opportunities through a cohesive, cross-disciplinary service offering.

DEVELOPMENT

METROPOLITAN INVESTMENTS Commercial

DATA CENTRES

Data centres and digital infrastructure

INFRASTRUCTURE

Airports, roads and ports

ENERGY & RENEWABLES

Energy, oil, gas, mining and renewables

AGRIBUSINESS

Grazing, cropping, horticulture, viticulture, water licenses and carbon offsets

HEALTHCARE & SOCIAL

INFRASTRUCTURE

Childcare, medical, aged care, education, recreation and life sciences

Brent McGregor

Executive Chairman, Capital Markets, New Zealand brent.mcgregor@cbre.com

+64 21 870 508

Tim Rookes

Managing Director, Capital Markets, Christchurch tim.rookes@cbre.com

+64 27 562 3700

John Holmes

Senior Director, Capital Markets, Auckland

john.holmes@cbre.com

+64 27 489 9095

Warren Hutt

Senior Director, Capital Markets, Auckland warren.hutt@cbre.com

+64 27 562 2244

Natasha Sarkar

Director, Structured Transactions & Advisory Services natasha.sarkar@cbre.com

+64 21 940 940

Brad Ross

Senior Negotiator, Capital Markets, Auckland brad.ross@cbre.com

+64 20 453 2720

Alex Nikolaou

Director, Debt & Structured Finance, New Zealand alex.nikolaou@cbre.com

+64 21 374 741

Flint Davidson

Head of Capital Markets & Office, Pacific flint.davidson@cbre.com

Simon Rooney

Head of Retail Investments simon.rooney@cbre.com

Michael Simpson

Head of Hotels michaelj.simpson@cbre.com

Stuart McCann

Head of Capital Advisors, APAC stuart.mccann@cbre.com

Matthew St Amand

Managing Director, Capital Markets, Wellington matthew.stamand@cbre.com

+64 21 280 3467

Bruce Catley

Managing Director, Capital Markets – Industrial & Logistics bruce.catley@cbre.com

+64 21 729 004

John Bedford

Senior Director, Capital Markets – Industrial & Logistics

john.bedford@cbre.com

+64 21 772 121

Caiti Morgan

Director, Capital Markets – Retail caiti.morgan@cbre.com

+64 22 370 5144

Cameron Darby

Associate Director, Capital Markets, Christchurch cameron.darby@cbre.com

+64 27 450 7902

Richard Zhao

Director, Debt & Structured Finance, New Zealand richard.zhao@cbre.com

+64 21 230 5561

Chris O’Brien

Head of Industrial & Logistics chris.obrien@cbre.com

Mark Granter

Head of Alternatives mark.granter@cbre.com

Andrew Purdon

Head of Living Sectors andrew.purdon@cbre.com

Paul Ryan

Head of Capital Advisors, Pacific paul.ryan@cbre.com

cbre.co.nz/capitalmarkets

Transform our insights into your investment opportunity. Every dimension, one advisor – property sales, capital markets, metropolitan investments, debt & structured finances, structured transactions & advisory services.