MARKETVIEW | JAPAN OFFICE | Q2 2025

Tokyo Grade A vacancy rate drops to 1.4%; Strong Grade A performance drives rent increases across all three major cities

Forecast* Q-o- Q, Annualized

GDP Growth Q2 15pp BOJ Tankan DI (All Enterprises) Q2

*JCER Forecast (ESP forecast) ±0pp Q-o-Q

Tokyo Grade A Rent Q2

Tokyo: Grade A vacancy rate drops to 1.4%, breaking 2% threshold for first time in four years

Tokyo Grade A Vacancy Rate Q2

‒ The All-Grade vacancy rate slid by 0.5 pp q-o-q to 2 5% in Q2 2025, while the Grade A vacancy rate recorded a sharper decline of 2.2 pp q-o-q to 1 4% Relocations to larger premises and in-house expansions were observed across a wide variety of sectors, as were new office openings Rents rose for all grades, with Grade A rents registering a significant spike of 2 7% from the previous quarter While an increasing number of landlords raised their asking rents, tenants also demonstrated an increased tolerance for such rent rises

Osaka: Grade A vacancy rate drops, rents continue to rise

‒ The All-Grade vacancy rate remained unchanged from the previous quarter at 2.6%, while the Grade A vacancy rate dropped by 0.4 pp q-o-q to 3.6%. Although there were vacancies remaining in the large property completed this quarter, existing vacancies were filled in several properties completed last year by companies opening new offices or relocating from company-owned premises. Rents increased across all grades for the fourth consecutive quarter, with Grade A rents continuing their strong surge seen in Q1 2025 driven by robust tenant demand

Nagoya: Grade A rents record largest single-quarter increase since Q1 2020

‒ The All-Grade vacancy rate slid by 0 4 pp q-o-q to 3.1% in Q2 2025. The Grade A vacancy rate dropped by 0.9 pp to 1.4%, falling below the 2% threshold for the first time since Q1 2021. During the quarter, relocations to larger premises, in-house expansions, and new office openings were observed across a wide variety of sectors such as IT. Rents also increased across all grades, with those in the Grade A segment recording a rise of 1 5% q-o-q Asking rents were raised by landlords of several buildings, particularly those attracting strong tenant interest

Regional cities: Rents rise in all 10 cities for first time since Q1 2020

‒ All-Grade vacancy fell q-o-q in five of the 10 cities surveyed, and increased in the remaining five. Tenant demand was robust nationwide, with vacancies absorbed by companies relocating to new premises in superior locations or higher-grade buildings, as well as by those seeking to expand their office space or establish new offices. Rents rose q-o-q in all 10 cities for the first time since Q1 2020. While the rates of increase in regional cities were generally below those in the three major metropolitan areas, rents are gradually rising

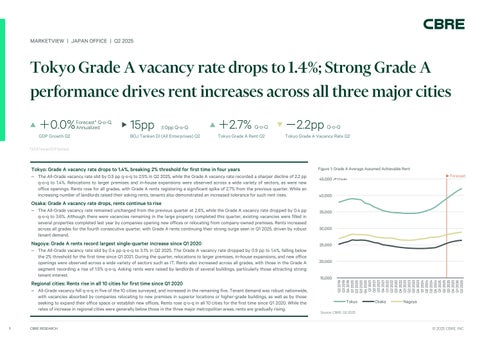

Figure 1: Grade A Average Assumed Achievable Rent

Forecast

Tokyo Osaka Nagoya

Source: CBRE, Q2 2025

Tokyo

Grade A vacancy rate drops to 1.4%, breaking 2% threshold for first time in four years

The All-Grade vacancy rate slid by 0.5 pp q-o-q to 2.5% in Q2 2025. While new supply consisted of 41,000 tsubo, roughly equivalent to the past quarterly average, net absorption was more than 2x this level, at 83 000 tsubo. In addition to relocations to larger premises, in-house expansions, and new office openings driven by business expansions and return-to-office, companies across a broad range of industries relocated to higher-grade buildings or moved office due to the reconstruction of their original premises.

Grade A led the way in terms of falls in vacancy, with a significant decline of 2 2 pp to 1 4%, falling below the 2% threshold for the first time since Q2 2021 In addition to the quarter’s one new building entering operation at almost full occupancy, significant vacancies were filled in several relatively new properties In the Grade B segment, the vacancy rate fell by 0 2 pp to 2 1%, as vacancies continued to be filled in centrally located buildings seen as offering superior value for money The Grade A- vacancy rate increased by 0 4 pp q- o-q to 3 4% The two new buildings completed during the quarter were in less-than-ideal locations and still had vacancies remaining upon completion At the same time, vacancies emerged in several existing properties due to tenants relocating to new Grade A buildings Vacancies of a reasonable size in high-quality properties in favorable locations are now rare and valuable, leading to fierce competition among potential tenants. Pre-leasing is proceeding well for Grade A buildings slated for completion in the coming quarters, making it extremely difficult for tenants to secure space of any significant size. Even developments not due for completion until 2028 or 2029 have already secured some tenants.

Average rents increased across all grades, led by Grade A rents, which grew by 2.7% from the previous quarter. While an increasing number of landlords are raising their asking rents in response to declining vacancy, tenants are also demonstrating an increased tolerance for such rent rises. The lack of vacancies in the city suggests that rent levels are likely to continue to trend upward, with CBRE forecasting Grade A rents to increase by a further 9.4% over the next 12 months.

Osaka

Net absorption outstrips new supply to pull down Grade A vacancy; rents continue to rise

The All-Grade vacancy rate remained unchanged from the previous quarter at 2.6%, with robust tenant activity observed across various business sectors and categories of floor space. The Grade A vacancy rate slipped by 0.4 pp q-o-q to 3.6%. Despite the quarter’s one new building with around 10,000 tsubo of floor space coming on stream below full occupancy, significant vacancies were filled in several properties completed last year by tenants looking to open new offices or relocate from company-owned buildings

The Grade B vacancy rate rose by 0 1 pp to 2 1%, largely because the one new property commenced

operations with significant vacancies remaining. However, demand remains robust, with steady absorption of vacancies in excess of 100 tsubo in existing buildings by companies opening new offices, expanding inhouse, and relocating to larger premises This resulted in a negligible increase in the vacancy rate for the quarter With future supply limited, tenants are securing new premises more quickly than before

Average rents rose across all three grades for a fourth straight quarter, up by 2 2% q-o-q to JPY 25,150 for Grade A office buildings; by 1 3% q-o-q to JPY 15,050 for Grade B; and by 0 9% q-o-q to JPY 14,550 for AllGrade Driven by robust tenant demand for properties in and around the Umeda area, this quarter’s strong growth in Grade A rents represented another significant rise from the 1 9% q-o-q increase recorded in Q1 2025 With rents on the rise in both low-rent and high-rent areas, CBRE observed vey few cases in which asking rents were lowered. Limited future supply and robust demand should ensure that rents continue to trend upward, with CBRE forecasting Grade A rents to increase by a further 5.0% over the next 12 months.

Nagoya

Grade

A rents record largest single-quarter increase since Q1 2020

The All-Grade vacancy rate for the quarter slid by 0.4 pp q-o-q to 3 1%. Relocations to larger premises, inhouse expansions, and new openings of secondary offices were observed across a wide variety of sectors, led by companies in IT-related fields. The Grade A vacancy rate dropped by 0.9 pp to 1.4%, falling below the 2% threshold for the first time since Q1 2021. With almost no new vacancies, several of the few existing vacancies were filled during the quarter The Grade B vacancy rate also dropped by 0.2 pp to 3 4%. While new vacancies appeared in some buildings as the result of consolidations or downsizings, other vacancies were filled, particularly in properties seen as offering superior value for money.

New supply of approximately 30,000 tsubo of floor space, more than double the past annual average, is slated to come on stream in 2026, predominantly in the Grade A segment However, pre-leasing in several of these buildings has been brisk, suggesting that many of these properties will have high occupancy upon completion As most companies who have pre-leased space are relocating from self-owned premises or rebuilding their existing offices, secondary vacancies should be limited Available floor space has therefore become very limited, leading to more cases in which multiple tenants are competing over single units

Rents increased from the previous quarter across all grades. Grade A rents led the way with a rise of 1.5% q-o-q, the largest single-quarter increase for the grade since Q1 2020. Although asking rents were raised in several buildings, particularly those attracting significant tenant interest, many tenants have shown a willingness to pay these higher rates. However, recent rent hikes have meant that only a limited number of prospective tenants can afford the more expensive units, particularly in the Grade A segment. This could well lead to a slight slowdown in the pace of rent increases. CBRE forecasts Grade A rents to increase by 3.4% over the next 12 months.

3: Average Assumed Achievable

Regional cities

(Sapporo/Sendai/Saitama/Yokohama/Kanazawa/Kyoto/Kobe/Takamatsu/Hiroshima/Fukuoka)

Strong nationwide tenant demand spurs relocations to newer buildings

All-Grade vacancy rates fell q-o-q in five of the 10 cities surveyed in Q2 2025, rising in the other five. In two of the cities where the vacancy rate rose, new supply was the primary cause, while large vacancies emerged in the remaining three. However, no decline in demand was observed, with tenant interest holding firm throughout the country.

Yokohama recorded the steepest decline in vacancy rate, falling by 0 5 pp q-o-q to 5 3% Several major vacancies were taken up, and other buildings also saw space absorbed by new secondary office openings and in-house expansions Kobe followed with a drop of 0 4 pp q-o-q to 2 0% One new property came on stream at almost full capacity, attracting demand for relocations from suburban areas and the opening of new secondary offices Vacancies in existing buildings were also absorbed by new offices, in-house expansions, and forced relocations In Sapporo, the vacancy rate fell by 0 1 pp q-o-q to 3 1% While the quarter’s one new property entered operation at less than full capacity, many other vacancies in relatively new buildings were filled by companies opening new secondary offices or relocating to superior locations or larger premises

Among the five regional cities where vacancies rose, new supply was the primary cause in Sendai and Fukuoka In Fukuoka, the four newly completed properties were those subject to floor area ratio bonuses as part of the Tenjin Big Bang and Hakata Connected development projects. The new supply of 16,000 tsubo was equivalent to 4% of existing stock, but the vacancy rate only rose by 0.5 pp q-o-q to 4.6%. Some of the new buildings came on stream at high occupancy rates, having secured demand from companies looking to upgrade their premises, those seeking to expand, and those forced to leave their previous offices Major vacancies were also filled in other recently completed properties by companies opening new offices or moving to larger premises.

Rents rise in all 10 cities

All-Grade rents rose q-o-q in all 10 cities surveyed This was the first time that rents increased across all cities since Q1 2020 just after the onset of the COVID-19 pandemic. While the rates of rental increase in regional cities were generally lower than those in the three major metropolitan areas, rents are gradually increasing across all markets. In Sapporo, Saitama, and Hiroshima, rents set new record highs again this quarter. The most significant rent increases were seen in Kobe and Takamatsu, were they rose by 0 7% q-o-q In Kobe, landlords hiked rents not only for properties below-market rents, but also for some high-rent properties Average rents rose by 0 5% in Saitama, as landlords of large units in prime locations took advantage of their properties’ rarity to raise rents in what remains a tightly supplied market, with the vacancy rate at just 0 7% Almost no properties throughout the entire country saw rents lowered

Q1 2005-Q2 2025 Q2 2025

Tokyo All-Grade

B

Nagoya All-Grade Yokohama*

Q1 2005-Q2 2025 Q2 2025

* Effective Q2 2024 we have included “Kannai” area within the “Yokohama” submarket To reflect this change, we have also recalculated the historical data for “Yokohama”

Source: CBRE, Q2 2025

Nihonbashi

Akasaka

*1 Effective Q2 2024, we have included “Kannai” area within the “Yokohama” submarket. To reflect this change, we have also recalculated the historical data for “All” of “Yokohama”.

*2 The Vacancy Rate for “Sapporo” has been revised retroactively from Q2 2024 due to the addition of two buildings to the cohort

*3 Vacancy rates for the Tokyo submarkets of “Shinagawa/Tamachi” and “Osaki” have been revised retroactively from Q1 2025 due to certain adjustments to the cohorts.

Building Grade Definition

(except Grade A)

Age Generally less than 15 years Buildings satisfying the 1981 anti-seismic standards

Other Landmark status, specifications, etc.

Terms and Definitions

Space Measurement 1 tsubo=3.3058 square meters=35.58 square feet

*Central 5 Wards: Chiyoda Ward, Chuo Ward, Minato Ward, Shinjuku Ward, Shibuya Ward **350 tsubo for Osaka and Nagoya

Surveyed Buildings Office buildings for lease located in office markets in 13 major cities nationwide, with gross floor area of 1,000 tsubo or more and compliant with the new earthquake resistance standards.

Surveyed Period Quarterly vacancy rate: (1) End of March (2) End of June (3) End of September (4) End of December Quarterly assumed achievable rents: (1) End of March (2) End of June (3) End of September (4) End of December

Vacancy Rate Vacancies are those that are ready to receive tenants at time of survey

Assumed Achievable Rent Assumed achievable rent including common area maintenance fee Expressed as JPY per tsubo per month

New Supply Net leasable area of buildings completed during each period

Net Absorption Difference between occupied floor space (floor space used by tenants) in a given period and that of the previous period

Number of Grade A Buildings Tokyo: 107 Osaka: 33 Nagoya: 13 (as of Q2 2025)

Contacts

Yuji Iwama

Senior Director yuji.iwama@cbre.com

Yoshitaka Igarashi Director yoshitaka.igarashi@cbre.com

Kumiko Ninomiya Senior Analyst kumiko.ninomiya@cbre.com

Chinatsu Hani

Head of Research chinatsu.hani@cbre.com

Tokyo

Meiji Yasuda Seimei Building 2-1-1 Marunouchi, Chiyoda-ku

Tokyo

Osaka Grand Front Osaka 4-20, Ofuka-cho Kita-ku Osaka-shi, Osaka

Sapporo

Nihon Seimei Sapporo Building 4-1-1 Kitasanjonishi, Chuo-ku Sapporo-shi Hokkaido

Sendai

Sendai Mark One 1-2-3 Chuo, Aoba-ku Sendai-shi, Miyagi

Yokohama

Yokohama ST Building 1-11-15 Kitasaiwai, Nishi-ku Yokohama-shi, Kanagawa

Kanazawa

JR Kanazawa Station West 4th NK Building, 3-3-11 Hirooka, Kanazawa-shi Ishikawa

Nagoya

Chunichi Bldg. 21F, 4-1-1 Sakae, Naka-ku Nagoya-shi Aichi

Hiroshima Shishinyo Building 3-17 Fukuromachi Naka-ku Hiroshima-shi Hiroshima

Fukuoka Fukuoka Center Building 2-2-1 Hakata-Ekimae Hakata-ku, Fukuoka-shi, Fukuoka

To learn more about CBRE Research, or to access additional research reports, please visit the Insights & Research at Insights&Research