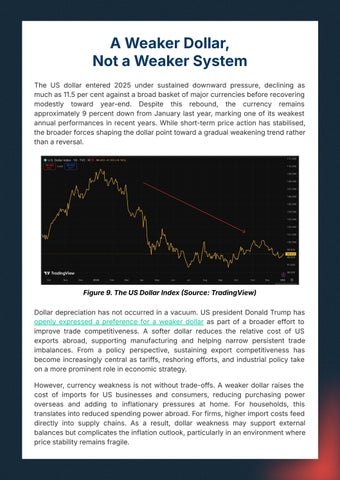

A Weaker Dollar, Not a Weaker System The US dollar entered 2025 under sustained downward pressure, declining as much as 11.5 per cent against a broad basket of major currencies before recovering modestly toward year-end. Despite this rebound, the currency remains approximately 9 percent down from January last year, marking one of its weakest annual performances in recent years. While short-term price action has stabilised, the broader forces shaping the dollar point toward a gradual weakening trend rather than a reversal.

Figure 9. The US Dollar Index Source: TradingView) Dollar depreciation has not occurred in a vacuum. US president Donald Trump has openly expressed a preference for a weaker dollar as part of a broader effort to improve trade competitiveness. A softer dollar reduces the relative cost of US exports abroad, supporting manufacturing and helping narrow persistent trade imbalances. From a policy perspective, sustaining export competitiveness has become increasingly central as tariffs, reshoring efforts, and industrial policy take on a more prominent role in economic strategy. However, currency weakness is not without trade-offs. A weaker dollar raises the cost of imports for US businesses and consumers, reducing purchasing power overseas and adding to inflationary pressures at home. For households, this translates into reduced spending power abroad. For firms, higher import costs feed directly into supply chains. As a result, dollar weakness may support external balances but complicates the inflation outlook, particularly in an environment where price stability remains fragile.