BTCBOTTOM SHOULDBENEAR

MARKETSIGNALS

BitcoinGetsRecoveryBounce

MACROUPDATE

RetailSoftens,CapexJumps: MixedSignalsEmergeastheFed FacesCriticalDataGaps

BitcoinGetsRecoveryBounce

MACROUPDATE

RetailSoftens,CapexJumps: MixedSignalsEmergeastheFed FacesCriticalDataGaps

Bitcoin staged a notable recovery last week, rising over 15 percent from its recent lows to $93,116 after enduring the sharpest correction of the cycle, a 35.9 percent drawdown from its all-time high. However, selling pressure remains as BTC moved 4.1percentlowerimmediatelyafterthecurrentweeklyopen.

This rebound aligns with our earlier view that the market is approaching a local bottom from a time perspective, even though it is yet to be seen whether we have seen a bottom in terms of price. However, with extreme deleveraging, capitulation among short-term holders, and emerging signs of seller exhaustion, we believe the groundworkisinplaceforastabilisationphasetocommence.

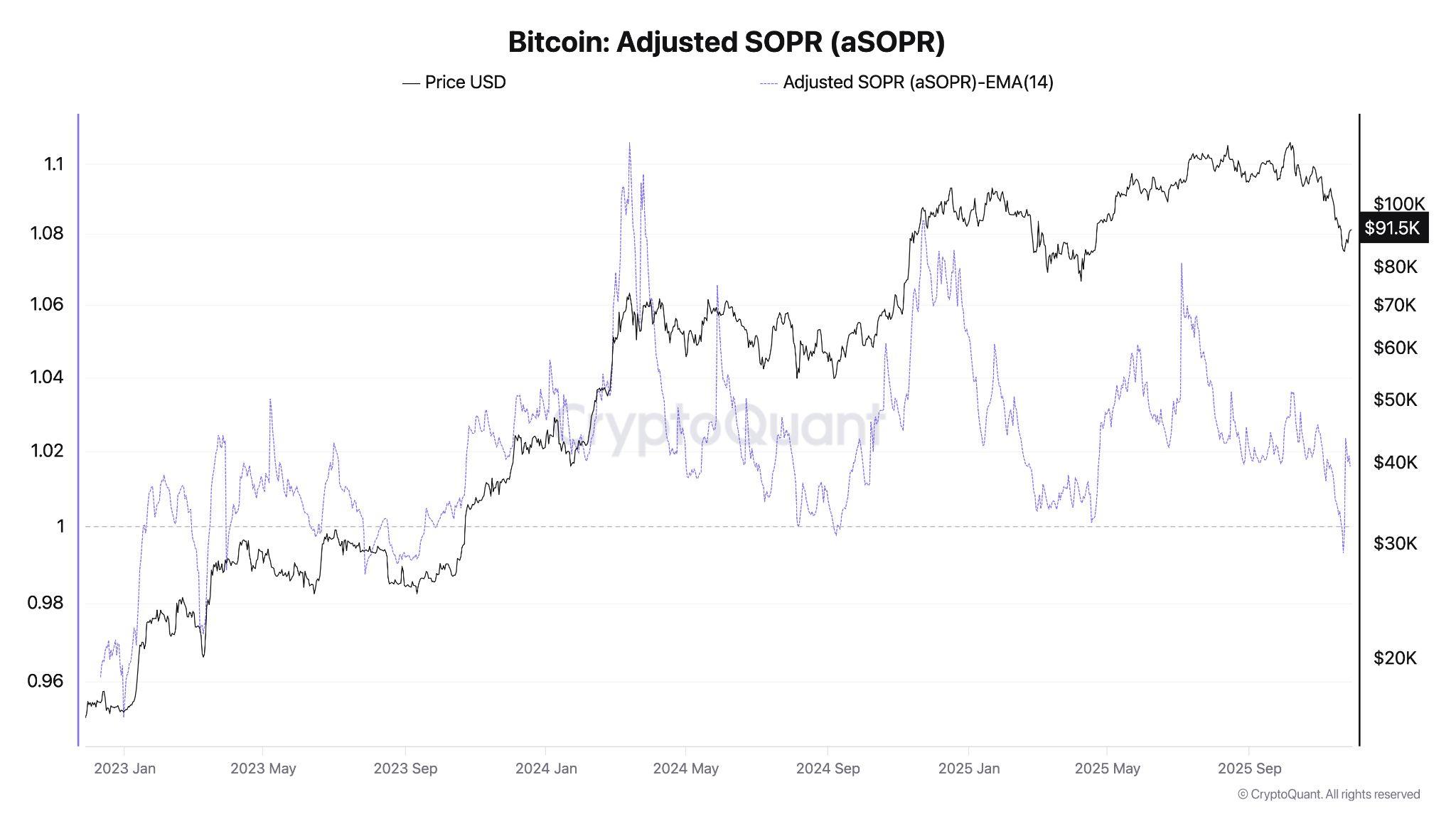

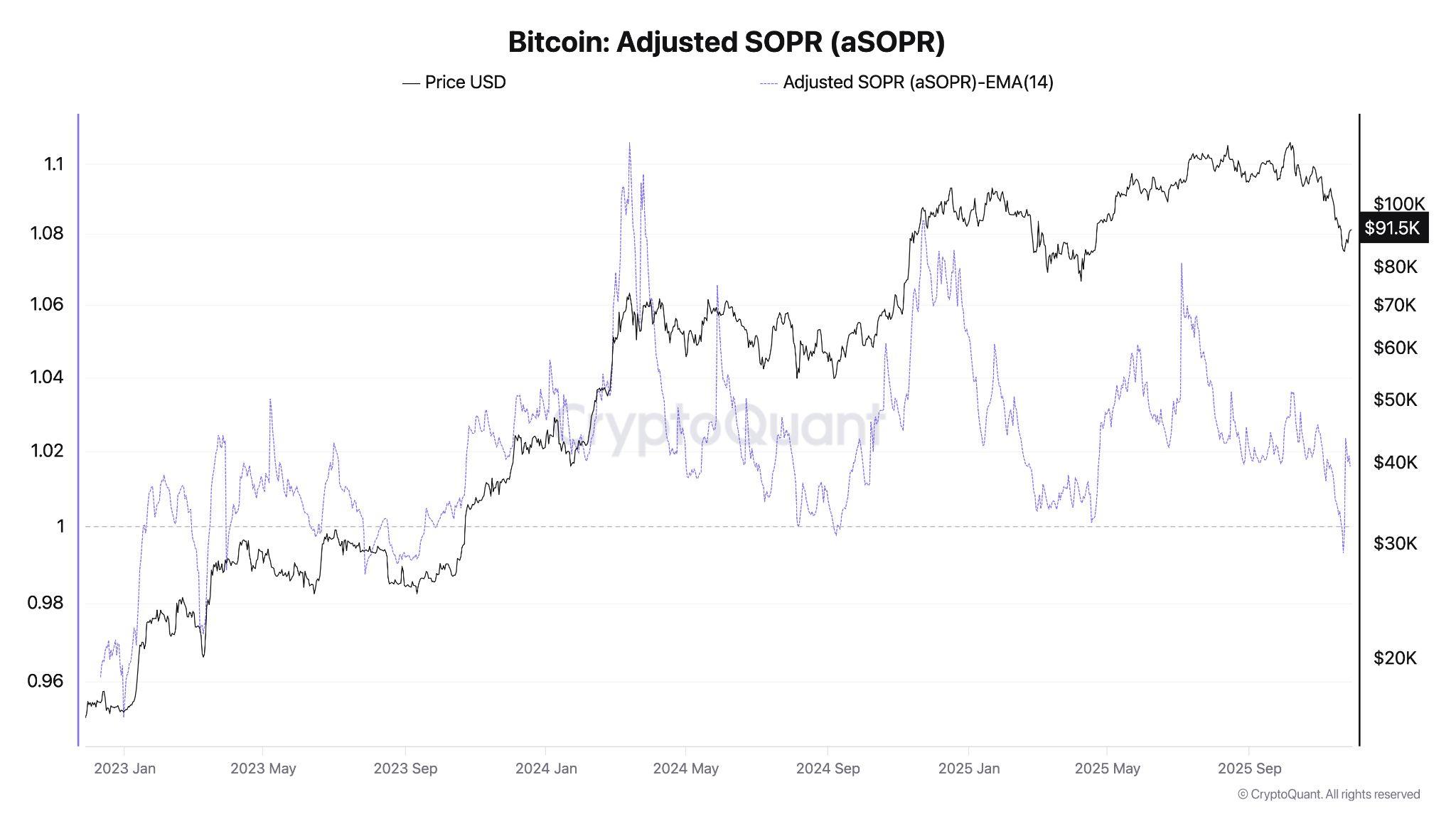

On-chainmetricsfurtherreinforcethisthesis:theAdjustedSpentOutputProfitRatio has fallen below 1 for only the third time since early 2024, matching the same loss-realisation dynamics observed at prior cyclical lows in August 2024 and April 2025.

The depth of current loss-taking is also evident in Entity-Adjusted Realised Losses, whichhavesurgedto$403.4millionperday,exceedingthelossesmeasuredbythis metricatpreviousmajorlows.

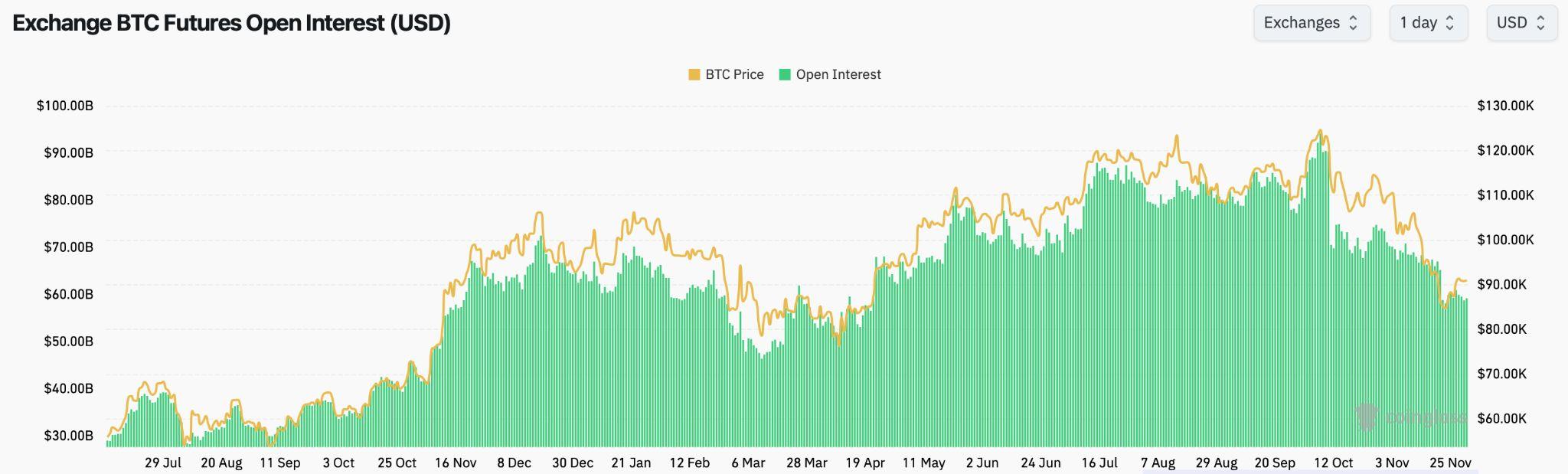

This level of realised losses typically signals that capitulation is nearing completion, rather than the start of a deeper decline. Meanwhile, derivatives data paint a similar picture of a controlled reset: total BTC futures open interest OI) has declined to $59.17 billion, well below its $94.12 billion peak, indicating that leverage has been flushedoutinanorderlyfashion.

ThecontinuedcontractioninOIalongsiderisingspotpricessuggestsshortcovering rather than renewed speculative risk-taking, reinforcing the view that the market is transitioning into a more stable consolidation regime, with reduced fragility and the potentialforasustainedrecoverybasetoestablishitselfin Q4.

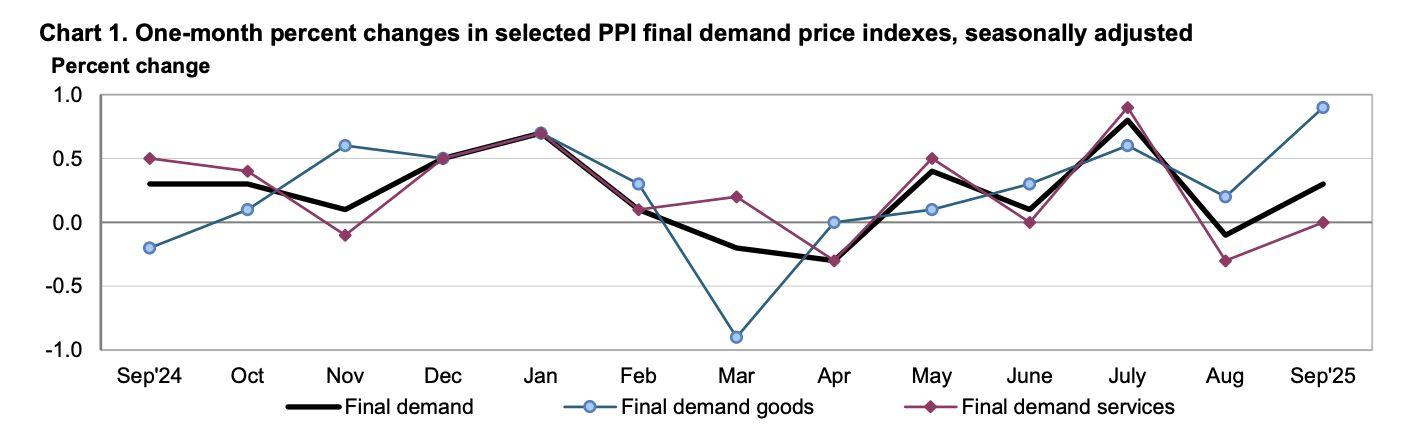

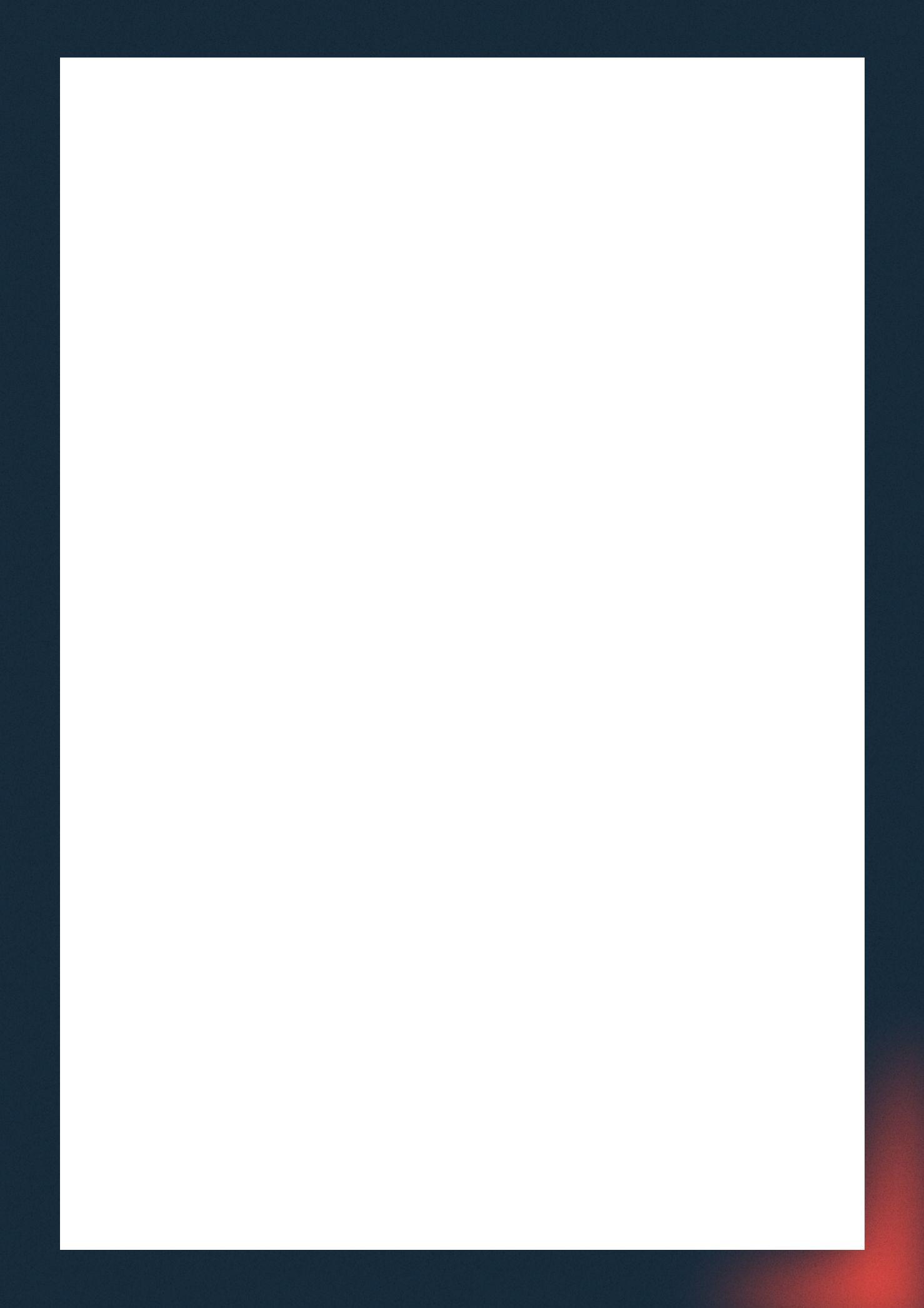

Recent US macroeconomic data revealed a growing divergence between softening consumer activity and strong business investment. Retail sales slowed sharply in September, rising only 0.2 percent, while the GDP-relevant control group slipped into negative territory. Elevated prices, many influenced by tariffs, and fading income growth weighed on households. At the same time, wholesale inflation firmed, with PPI up 0.3 percent on the month and energy costs surging 3.5 percent, indicating that upstream price pressures remain sticky. Consumer sentiment has meanwhile deteriorated, with the Conference Boardʼs Confidence Index droppingto88.7,ashouseholdsgrowmorecautiousaboutthejobmarket andpullbackfrombig-ticketpurchases.

Incontrast,USbusinessesareacceleratingspending.Corecapitalgoodsorders, an important gauge of business investment, rose 0.9 percent in September, matching Augustʼs momentum and far surpassing expectations. Companies are rampingupinvestmentsinAI,automation,andproductivity-enhancingequipment, evenastariffuncertaintyweighsonpartsofthemanufacturingsector.Thissurge in business investment has helped underpin a robust growth outlook, with the Atlanta Fedʼs GDPNow model estimating 3.9 percent annualised GDP growth for Q3. The contrast between cautious consumers and confident corporations highlights a widening divide in economic behaviour, leaving the Fed to navigate Decemberʼs policy meeting with limited visibility and increasingly uneven signals acrosstheeconomy.

The past week highlighted a clear shift toward deeper institutional integration of Bitcoin. BlackRockʼs latest SEC filing showed its Strategic Income Opportunities PortfolioincreaseditsIBITholdingsby14percent,bringingtotalexposureto2.39 million shares. The move underscores how even traditionally conservative bond fundsarenowusingBitcoinETFsasdiversificationtools,coincidingwithgrowing structuralsupportforIBIT,includingaproposedincreaseinoptionspositionlimits toaccommodatelargerinstitutionalstrategies.

At the same time, ARK Invest continued to lean into crypto despite sector-wide liquiditypressures.ARKexecutedmorethan$93millioninsingle-daypurchases, adding to positions in Coinbase, Circle, Block, and its own ARK 21Shares Bitcoin ETF. With Coinbase now over 5 percent of ARKK, the firmʼs aggressive accumulation reflects long-term confidence in digital assets even as crypto equitiesfacesharpmonthlydeclines.

Reinforcing this institutional momentum, Texas became the first US state to publiclyinvestinBitcoin,allocating$5milliontoIBITaspartofitsnewstate-level Bitcoin reserve program. While modest in size, the move is symbolically significant and marks the beginning of a transition toward direct BTC custody onceinfrastructureisready.

1.MarketSignals

● BitcoinGetsRecoveryBounce

2.GeneralMacroUpdate

● USRetailSalesLoseSteamasPrice PressuresPersist,DelayedInflationData ComplicatesFedOutlook

● USBusinessInvestmentRoarsBackin September,SettingtheStageforaStrong Third-QuarterGDPRebound

3.NewsFromTheCryptosphere

● BlackRockRaisesIBITHoldingsby14 Percent inLatestSECFiling

● ARKInnovationETFBoostsCryptoHoldings

● TexaslaunchesUSstate-levelBitcoin Reservewith

Overthepastweek,Bitcoinandthebroadermarketsawaperiodofrelief,with prices rebounding across multiple major assets. BTC climbed to $93,116, a recovery of more than 15 percent from the recent lows, and following the largest correction of the cycle,which saw a 35.91 percent decline from the all-timehigh.Thisreboundisconsistentwithourviewthatthemarketshould beclosetofindingitsfloorfromatimeperspective,evenifthefullextentof thepercentagedrawdownhadnotyetbeenrealised.Indeed,sellingpressure resumedatthestartofthisweekasBTCmoved4.1percentlowerimmediately afterthecurrentweeklyopen.

Figure1. BTC/USD4HChart.Source:Bitfinex)

Webelievehoweverthatthecombinationofextremedeleveraging,capitulation amongshort-termholders,andearlysignsofsellerexhaustionhascreatedthe conditions for a stabilisation phase and a relief bounce, even as the broader consolidationstructureremainsintact.

The Adjusted Spent Output Profit Ratio (aSOPR), which measures the profitabilityofcoinsbeingspent,butexcludescoinsthathavebeenheldforless than one hour (to filter out noisy short-term movements, such as arbitrage flows, or internal reshuffling), provides a clearer view of genuine investor behaviour.SeeFigure2below)

Figure2BitcoinAdjustedSpentOutputProfitRatio.Source:CryptoQuant)

With a reading below one indicating that a majority of spent outputs are being moved at a loss, historically such periods of elevated loss-realisation have tendedtooccurnearexhaustionpointsratherthaninthemiddleofdeepertrend continuations.

The current dip of aSOPR back below 1 therefore reinforces the view that the market may already have printed its local bottom, with the latest wave of loss-takingaligningcloselywithconditionsthatmarkedpreviouscyclicalturning points.

Extending this comparison further, another metric reflecting the scale of capitulation now underway is the sharp rise in Entity-Adjusted Realised Loss 30-daySimpleMovingAverage),whichhasclimbedto$403.4millionperday. SeeFigure3 below)

The Entity-Adjusted Realised Loss metric measures the total dollar value of coins that have been moved at a loss, when the price at the time of their most recenttransferwaslowerthanthepriceatwhichtheywerepreviouslymoved.

Crucially, this variant excludes volume transferred between addresses belonging to the same entity cluster. By filtering out internal or “in-houseˮ movements, the metric captures only genuine economic loss, providing a clearerandmoreaccurateviewofmarket-widecapitulationbehaviour.

Figure3BitcoinEntity-AdjustedRealisedLossesSmoothenedCurve. Source:Glassnode)

Thescaleofthelossessurpassestherealised-losswavesseenatthetwomajor lows earlier in the current cycle, notably during August 2024 and April 2025, signallingamorepronouncederosionofconfidence.Suchheavylossrealisation is characteristic of a market under stress, and one actively seeking liquidity as participants increasingly exit positions at a loss due to fading momentum and deterioratingsentiment.

Historically,thesespikesinrealisedlossestendtooccurnearthelaterstagesof correctivephases,aspricedropsflushoutweakerhandsbeforestabilitycanbe restored.

Turningtooff-chaindynamics,futuresandperpetualsBTCopeninterestOIhas also continued to decline in tandem with price, steadily unwinding the leverage accumulatedduringearlierphasesoftherally.Importantly,thisdeleveraginghas beenrelativelyorderly,withminimalevidenceofforcedliquidations,asignthat derivatives participants are managing risk proactively rather than capitulating underpressure.

Figure4. BitcoinTotalFuturesOpenInterestAcrossAllExchanges. Source:Coinglass)

The current total BTC OI stands at $59.17 billion, down from an ATH of $94.12 billion, a reading which coincided with the price ATH on 6 October 2025. See Figure4above)

As a result, the market is now operating on a leaner leverage base, which reducesthelikelihoodofsudden,liquidation-drivenvolatilityandreflectsamore cautious, defensive stance across futures markets. The recent bounce reinforces this view, with OI continuing to drift lower, despite the recovery in spotprices,indicatingthatlateshortpositionswerelikelysqueezed,particularly inBitcoin,whileleveragedlongexposureremainedlimited.

This configuration strengthens the case that the marketʼs remaining leverage is relatively well-contained, reducing systemic fragility and improving the prospectsforamorestableconsolidationphase.

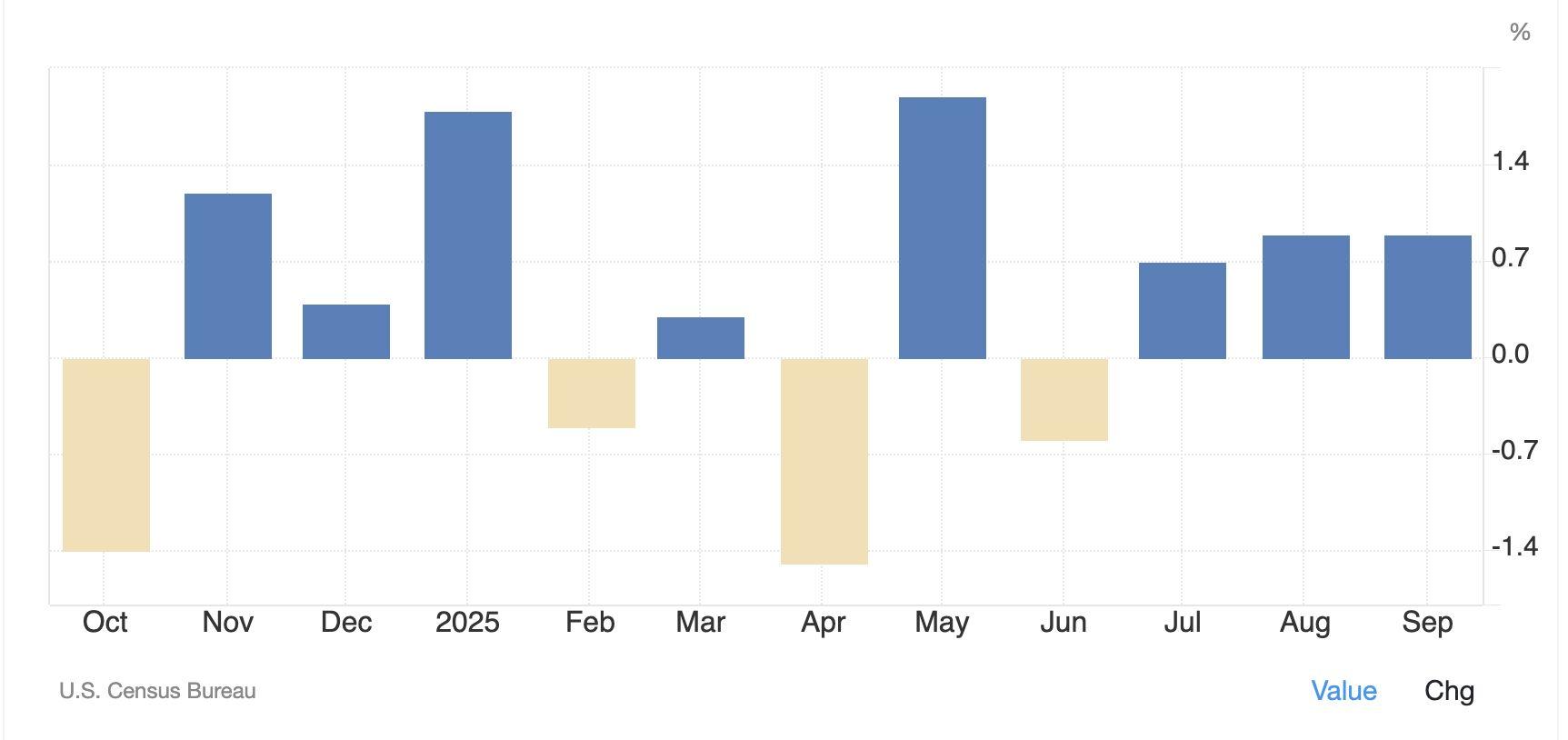

5.RetailSalesReport-SeptemberSource:USCensusBureau)

US retail spending cooled in September after months of steady gains, offering early signs that consumers may be becoming more selective in response to elevated prices and tighter household budgets. According to the US Commerce Departmentʼs Retail Sales Report, released last Tuesday, November 25, total retailsalesrosejust0.2percent,belowtheconsensusforecastandrepresenting anotableslowdownfromthe0.6percentgaininAugust.Retailsalesintheclosely watched “control group,ˮ which feeds directly into GDP calculations, slipped 0.1 percent, suggesting underlying consumption was softer than headline figures imply.

Figure6.AverageHourlyEarnings,Year-over-yearChange

Source:USBureauofLabourStatistics)

A combination of higher prices, many driven by tariffs, and slowing income growthSeeFigure6above)weighedonspending,particularlyamongmiddleand lower-income households. While sales at restaurants and bars rose 0.7 percent,discretionarycategoriessuchasclothing,electronics,sportinggoods, and online retail all declined. Some of the earlier strength in spending are front-loaded, as consumers rushed to purchase electric vehicles ahead of expiringtaxcreditsandstockedupongoodsbeforetariffchangestookeffect.

Figure7.Month-over-monthchangeinProducerPriceIndex Source:BureauofLabourStatistics)

The retail data arrived alongside the Producer Price Index PPI, also released lastTuesdaybytheBureauofLabourStatistics.Thereportshowedwholesale inflationfirming.Producerpricesrose0.3percentinSeptember,drivenbya3.5 percent jump in energy costs and a 1.1 percent increase in food. On a year-over-year basis, PPI remained at 2.7 percent, indicating that upstream price pressures are not fading as quickly as hoped. Core producer prices, excludingfoodandenergy,roseamodest0.1percent,cominginslightlybelow theconsensusforecast.

Figure8.Year-over-Year

Source:BureauofLabourStatistics)

However,theFederalReserveʼsabilitytointerpretthesefiguresishinderedbya major data gap. Because of the 43 day government shutdown, the BLS was unabletocollectOctoberpricedata,forcingthecancellationoftheOctoberCPI release. This means the Fed will enter its policy meeting 910 December without fresh inflation or employment data, heightening uncertainty and contributingtowhatweexpecttobeanunusuallycontentiousdiscussionover whetheranotherratecutiswarranted.

Adding to the cloudy outlook, consumer confidence has also softened. The Conference Boardʼs Consumer Confidence Index, also released last Tuesday, fellto88.7,itslowestreadingsinceApril.Householdsacrossnearlyallincome levels grew more cautious about the labour market and more hesitant about big-ticketpurchasessuchashomes,vehicles,andappliances.

Consumers also reported a drop in vacation plans, a clear sign that tightening financial conditions are starting to influence spending decisions. The surveyʼs labour-market differential, a measure correlated with the unemployment rate, slipped to 9.7, reinforcing the view that the job market, while not deteriorating sharply,isgraduallycooling.

Economists caution that the disconnect between strong third-quarter GDP growth and weakening sentiment may reflect widening divides across income groups. Higher-earning households continue to spend, while middle- and lower-incomeconsumersappeartobereachingtheirlimits,creatingwhatsome describeasaK-shapedspendingpattern.

With retail momentum slowing, producer prices firming, and consumers increasingly cautious, the absence of October inflation data leaves the Federal Reserve navigating with less visibility at a critical time. With inflation no longer easing and new figures unavailable, the Fed is entering its Decembermeetingwithoutaclearconsensus.Whatisclear,however,isthat demandisbecomingmoreuneven,andthepathforwardwilldependonhow quickly both inflation and household confidence stabilise over the coming months.

US businesses ramped up spending in September, marking the third consecutive month of solid investment growth despite lingering policy uncertainty. The Monthly Advance Report on Durable Goods released by the Commerce Departmentʼs Census Bureau last Wednesday, 26 November showedthatnon-defencecapitalgoodsordersexcludingaircraft,akeygauge of business investment, rose 0.9 percent in September, matching Augustʼs upwardlyrevisedgain.

These“corecapitalgoodsˮareacloselywatchedproxyforbusinessequipment spendingandfeeddirectlyintoGDPcalculations.

The September results exceeded the consensus forecast of a 0.2 percent increase.ThegovernmentreleasehadbeendelayedduetotheUSgovernment shutdown, but despite that disruption, the latest figures suggest that business investmentcontinuedtostrengthenthroughoutthequarter.

The surge in capital spending can be attributed to a combination of factors. Companies appear to be accelerating investment in artificial intelligence, automation, and productivity-enhancing technologies, even as tariff-related uncertainty continues to weigh on manufacturing. Some firms may also be front-running future import duties by placing orders early. The result is a manufacturing sector experiencing uneven pressure, tariffs have dampened traditionaloutput,butAI-relatedequipmentdemandisrisingsharply.

Durablegoodsordersoverallincreased0.5percentinSeptember,followinga3 percentjumpinAugust.Whilenondefenseaircraftordersdropped6.1percent, Boeing reported 96 aircraft orders on the month, up significantly from 26 in August,suggestingfuturestrengthinthatcategory.

All signs point toward a strong GDP performance for the third quarter. The AtlantaFederalReserveʼsGDPNowmodelestimatestheeconomygrewata3.9 percent annualised rate between July and September, up from 3.8 percent in the prior quarter. The official third-quarter GDP report, delayed by the governmentshutdown,isscheduledforreleaseonDecember23rd.

Thefirmbusinessinvestmentcontrastssharplywiththesofterretailsalesdata seeninSeptember,highlightingadivergencebetweenconsumerandcorporate behaviour. With companies still willing to spend aggressively despite higher borrowing costs and slower job creation, business investment is providing a crucialcounterweighttomorecautioushouseholdspending.

BlackRockʼs Strategic Income Opportunities Portfolio, one of the asset managerʼs flagship flexible bond funds, has continued to increase its indirect Bitcoin exposure, accordingtoanewSECfilinglastWednesday,November26,2025.

Thefund boosteditsholdingsoftheiSharesBitcoinTrustIBIT)to2.39millionshares asofSeptember30,representingamarketvalueof$155.8million.Thattotalmarksa14 percent rise from the 2.09 million shares reported at the end of the second quarter, underscoring sustained institutional appetite for the asset despite broader market volatility.

The Strategic Income Opportunities Portfolio is built as an “unconstrainedˮ fixed-income strategy, meaning it can freely allocate across US Treasuries, corporate credit,securitisedproducts,emerging-marketdebt,andshort-durationinstruments.

Crucially,itsflexiblemandatealsopermitsallocationstonontraditionalvehiclessuchas ETFswhentheycomplementthefundʼsreturnobjectivesorstrengthendiversification. This is the mechanism that allows Bitcoin exposure, via IBIT, to sit alongside its bond holdings.

IBIT was also in the market spotlight after the Nasdaq ISE submitted a proposal to significantlyraisethepositionlimitforIBIToptionstoonemillioncontracts.Ifapproved, theadjustmentwouldexpandliquidityandenablelargerinstitutionalhedgingstrategies, adevelopmentthattypicallysignalsdeepeningmarketconfidence.

InstitutionalownershipofIBIThaspushedtofreshhighs.Totalaccumulatedsharesheld by institutions now exceed 400 million, rising steadily each month since the ETFʼs debut. This trajectory highlights the broadening adoption of Bitcoin exposure through regulatedmarketvehiclesratherthandirectholdings.

BlackRockʼscontinuedaccumulation,throughatraditionallyconservativefixed-income fund—reinforces a growing macro trend: Bitcoin is increasingly being treated as a legitimateportfoliocomponentwithinmainstreamassetallocationframeworks.

ARK Invest, the asset management firm that describes itself as an investor in disruptiveinnovation,increaseditsexposuretothedigitalassetswithaseries ofinvestmentsincryptocurrency-relatedequities,evenasthesharepricesof manyofthosecompaniesextendedtheirdecline.

LastTuesday,November25,ARKdisclosednewacquisitionstotalingover$93 million,markingoneofitslargestsingle-daybuyingeffortsofthemonth.The move comes as crypto equities struggle to rebound from the steep losses recordedinNovember,withliquidityacrossthesectortightening.

Thelatestbatchofpurchasesincludes:

● $7.6millioninCircleInternetGroup

● $13.5millioninBlock

● $3.86millioninCoinbase

● $1.52millioninBullish

● $878,794inRobinhood

● $2.8millionmoreoftheARK21SharesBitcoinETFARKB

Most of these acquisitions were made through ARKʼs flagship fund, the ARK Innovation ETF ARKK. Coinbase remains one of the ETFʼs largest positions, valuedat$391million,accountingfor5.22percentofthefund.

Thesestakesunderscorehowcentralcrypto-relatedcompanieshavebecome toARKʼshigh-convictionstrategy.

ARKʼs renewed accumulation comes at a time when companies tied to digital assets have experienced sharp month-over-month declines amid thinning liquidity and risk-off sentiment. Rather than retreating, the firm has continued to build positions, signaling long-term confidence in the sector despite near-termvolatility.

The state of Texas has taken concrete steps to turn its recently passed crypto-reserve law into action, by purchasing $5 million worth of shares in iSharesBitcoinTrustIBIT, aspotBitcoinexchange-tradedfundmanagedby BlackRock.

This move marks the first publicly disclosed deployment of funds under the stateʼs newly established reserve program, signed earlier into legislation via SB21.Thisallowsforatotalallocationof$10millionfromgeneralrevenuefor astrategicBitcoinreservemanagedbytheTexasTreasurySafekeepingTrust Company.

The$5millionIBITpurchasereportedlyoccurredonNovember20,according tocommentsfromTexasBlockchainAssociationleadership.Thisinitialstepis widelyseenasatemporarymeasure,whileTexasfinalisestheinfrastructure neededfordirectcryptocurrencycustody.Thestatehasindicateditsintentto eventuallyholdactualBitcoinitself(i.e.,self-custody),ratherthanrelyingon ETFs.

The IBIT ETF allocation will become the first crypto-asset exposure in the trustʼs portfolio, which previously consisted of traditional market assets like equitiesviafundssuchasSPYandaJanusHendersonfund.

While $5 million is relatively modest compared with typical state budgets or global institutional investments, this move carries symbolic and strategic importance: it makes Texas, as far as currently known, the first US state to publicly invest in Bitcoin via a state-sponsored reserve fund. Many analysts view it as a precedent that could inspire other states to consider similar reserve-ortreasury-levelcryptoallocations.