BTCDEMANDWEAKENS

MARKETSIGNALS

BTCDemandWeakens

MACROUPDATE

SignalsofStrainEmergeastheU.S. EconomySlowsIntoYear-End

BTCDemandWeakens

SignalsofStrainEmergeastheU.S. EconomySlowsIntoYear-End

Bitcoinisenteringaphasewhereweakeningspotdemandandpersistentstructural softness are colliding, revealing a market that is stabilising but far from healthy Despite drifting higher from its recent lows, BTC remains trapped in a tight $84,000$91,000 range while the S&P 500 sits near record highs, underscoring deepeningrelativeweaknessandawideningdecouplingfromtraditionalriskassets. On-chain data shows more than seven million BTC sitting at an unrealised loss, mirroring conditions last seen during the choppy consolidation of early 2022 and emphasizingthemarketʼsstruggletoreclaimitsTrueMarketMean,thedividingline between mid-cycle fatigue and full bear-market deterioration. Yet capital inflows remainmodestlypositive,offeringatleastathinbufferagainstanyfurtherdownside.

At the same time, spot-side demand has meaningfully eroded: US Bitcoin ETFs haveloggedpersistentoutflows,takerbuyinghasdeterioratedsignificantly,and Cumulative Volume Delta across major exchanges has turned decisively negative,signallingtradersaresellingintostrengthratherthanaccumulating.

The latest economic data signals a US economy still advancing but much more slowly, with slowing consumer spending, persistent inflation, and signs of strain emerging. Real consumer spending was flat in September, with incomes barely keepingupwithprices,highlightingfinancialstrainforlower-andmiddle-income householdsandsignallingasofterfourthquarter. Inflation remainedstubbornat 2.8 percent year-over-year, complicating expectations for a widely anticipated December rate cut, especially as Fed officials remain divided over whether the economyhascooledenoughtojustifyeasing.

Meanwhile, labour and business indicators reveal a similarly uneven landscape. Private-sector hiring unexpectedly fell in November, led by small-business job losses,evenasjoblessclaimsdroppedtotheirlowestlevelsince2022,showing employersarehesitanttocutstaff.Theservicessectorcontinuedtoexpand,with stronger demand and rising backlogs, though hiring within the sector contracted and prices remained elevated. Together, the data suggest an economy that is cooling unevenly—supported by resilient services and stable employment—but increasingly vulnerable as persistent inflation erodes household strength and weighsongrowthheadingintotheFedʼsnextpolicydecision.

In the news, Vanguard, long known for rejecting cryptocurrencies as too speculative,hasreverseditsstancebyallowingclientstotradethird-partycrypto ETFsandmutualfunds,includingthosetiedtoBitcoinandEthereum.Whileitstill does not plan to offer its own crypto products, and says explicitly that it will not endorse any investment allocation to meme coins, the decision reflects growing confidenceinthematurityofcryptomarketsaswellasstronginvestordemand.

Governments too are updating their view of the crypto industry, with the UK passing the Property Digital Assets etc.) Act 2025, which recognises cryptocurrencies as a distinct form of personal property. This reform offers clearer rights in cases of theft, insolvency, and inheritance, and is viewed as a crucialsteptowardmakingtheUKamoreattractiveenvironmentfordigital-asset businesses. In the United States, regulators are also moving forward: the Commodity Futures Trading Commission has authorised the first-ever listing of spot cryptocurrency products on federally regulated exchanges, aiming to provide a safer, regulated alternative to offshore markets. Collectively, these developments reflect a global trend toward integrating digital assets into established financial and legal systems, expanding access, protection, and legitimacyforcryptomarkets.

1.MarketSignals

● BitcoinRangesButRelativeWeakness Continues

● SpotBidLowButDerivativesMetrics

SignalStructuralReset

● StagnantConsumerSpendingandFirm InflationPutsPressureonFed

● USEconomyShowsUnevenMomentumas PrivateHiringFalls,ServicesStrengthen

2.GeneralMacroUpdate 3.News

● VanguardʼsStrategicPivot:Embracing CryptoETFsonItsPlatform ● UKʼsLandmarkMove:CryptoDeclaredLegal PropertyUnderNewLaw

Regulators

It has now been 63 days since Bitcoin set its all-time high, a peak that also coincidedwithalocaltopintheS&P500.Butwhiletraditionalequitymarketshave recoveredandgoneontoprintfreshhighs,BTChasendureditslargestdrawdown ofthecycleat35.91percent.

Although Bitcoin is now drifting higher from its recent low of $80,822 on 21 November,thecurrentpriceactionremainscompressedwithinarelativelynarrow $84,000$92,000 range. In contrast, the S&P 500 now trades just 0.4 percent below its all-time high. The divergence between the two markets has therefore continuedtowiden,withrelativeweaknessandde-correlationincryptobecoming increasinglypronounced.

Figure1. BTC/USD4HChart.Source:Bitfinex/S&P

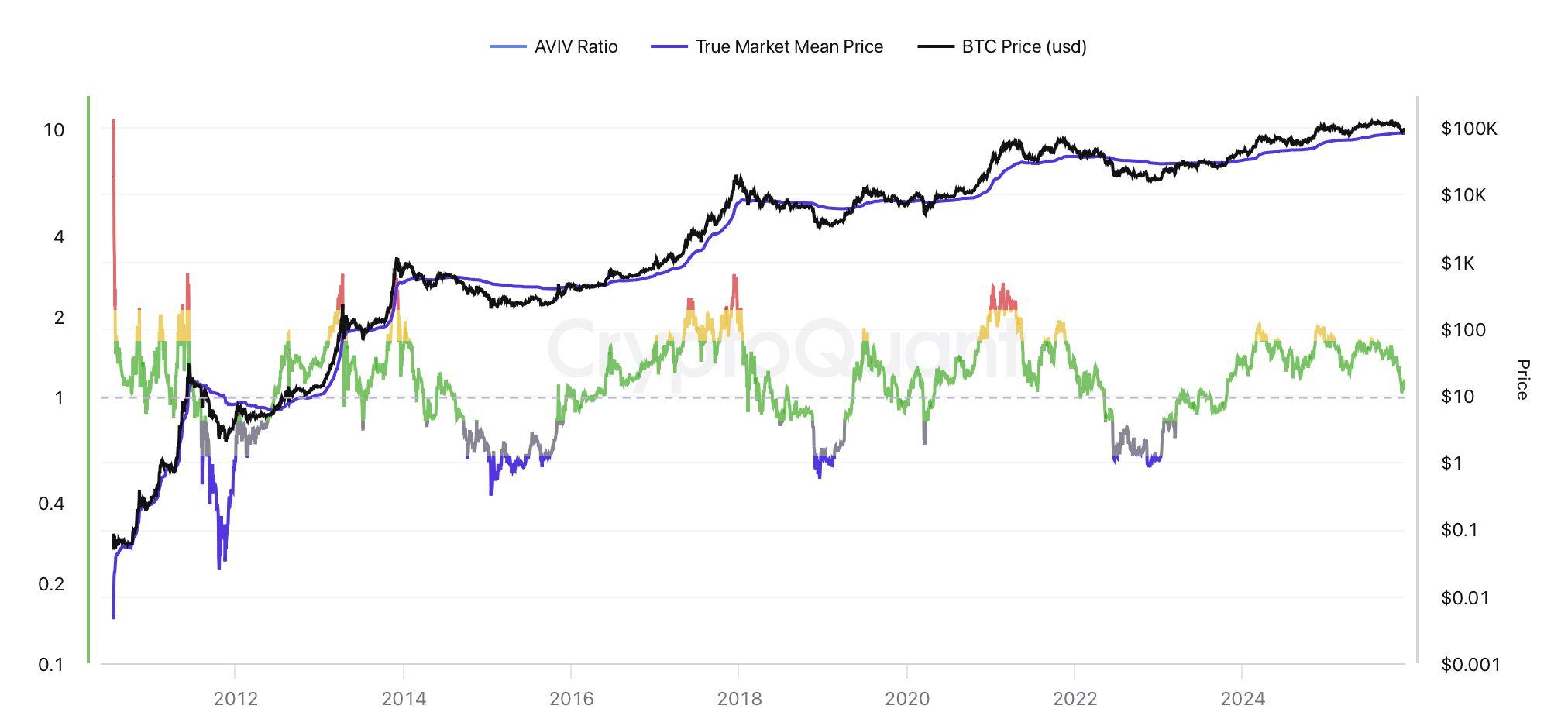

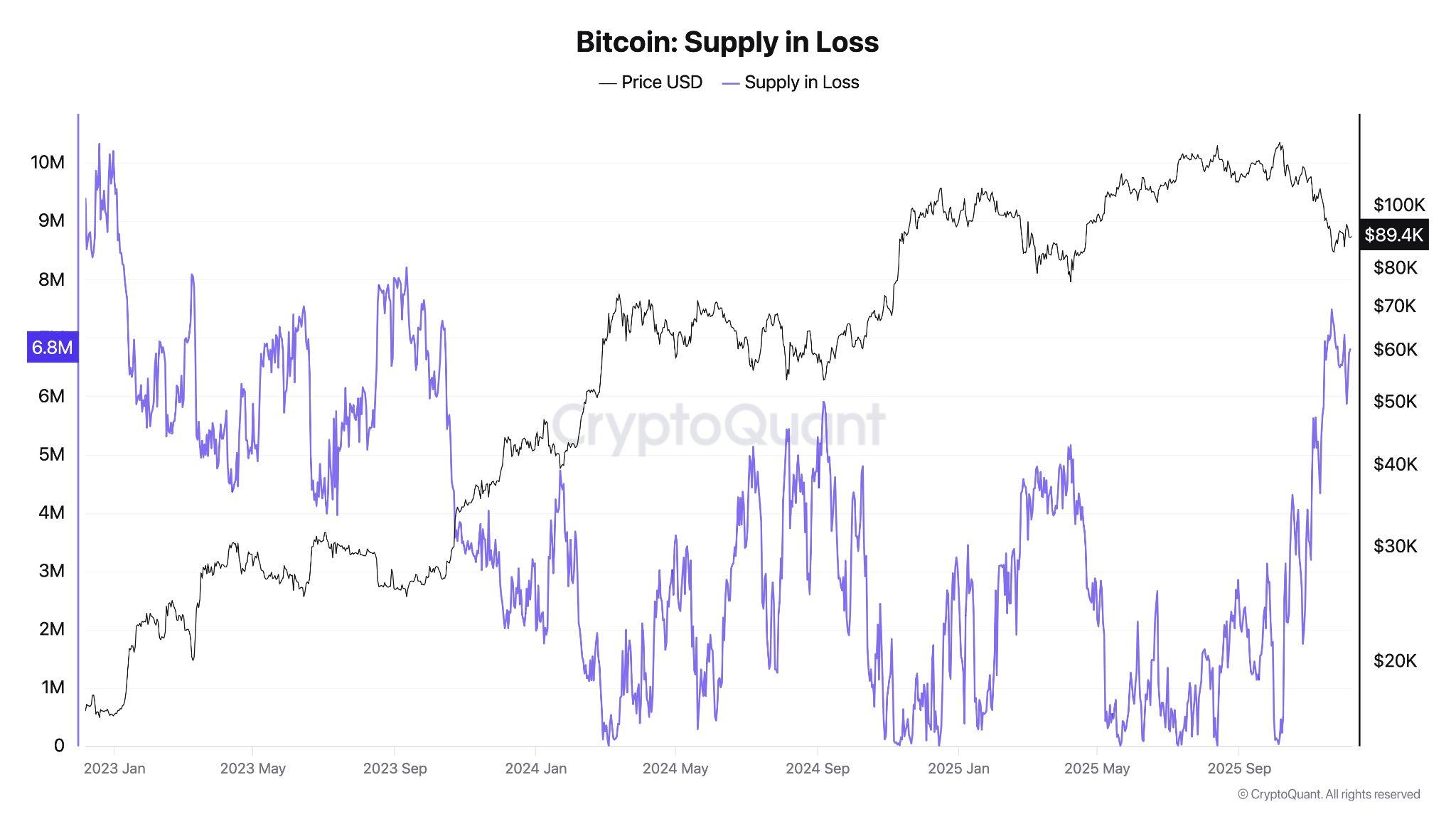

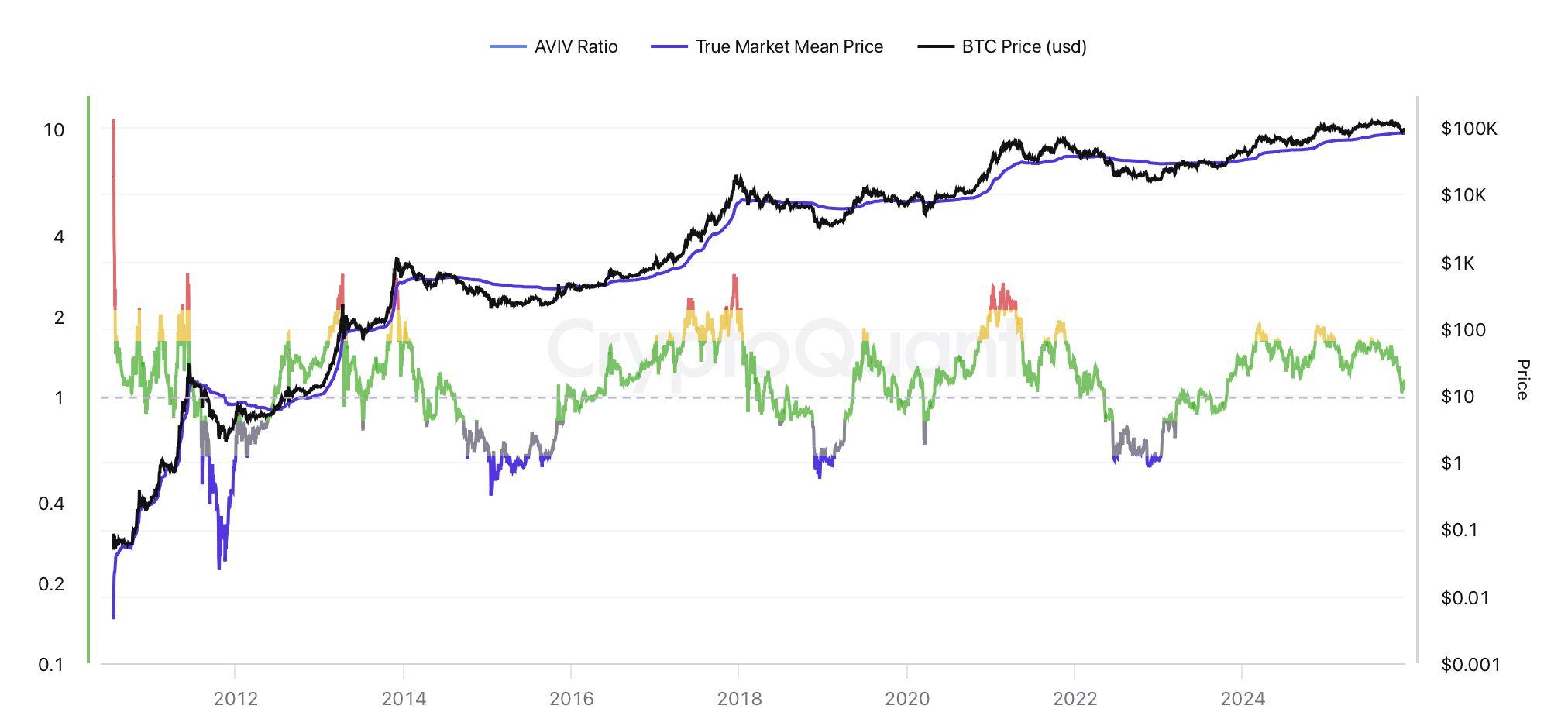

Building on this structural perspective, it is useful to examine the behaviour of buyersthroughthelensofTotalSupplyinLoss,ametricwhichgaugestheextentof unrealised pain across the market. The seven-day Simple Moving Average of this measure rose to 7.1 million BTC last week, the highest reading since September 2023,indicatingthattheaggregateprofitaccumulatedacrossmorethantwoyears ofbull-marketpriceappreciationhavebeencompletelyundonebywhathasbeena relativelyshallowpullbackincomparisontopastcycles.SeeFigure1below)

The current band of supply in loss, fluctuating between 57 million BTC, closely resemblesconditionsseenduringthesidewaysmarketofearly2022.Thisparallel reinforces the similarities we highlighted earlier, indicative of a market structure oscillatingaroundapivotalthreshold.

Together, these dynamics underscore the importance of what we refer to as the True Market Mean (the cost basis of all active coins within Bitcoinʼs circulating supply,excludingminers),whichisadividinglinebetweenacontained,mid-cycle bearishphaseandtheonsetofamoredefinitivebear-marketregime(seeFigure3 below).Sustainedrejectionbelowthisthresholdwouldheightentheriskofdeeper structuraldeterioration,whereasreclaimingitremainsessentialforresettingmarket momentum.ThecurrentTMMpriceisat$81,470.

Despite the ongoing relative weakness and the absence of a clear uptrend, capital momentum flowing into Bitcoin has remained marginally positive. This helps explain why price has found support near key supply quantile levels and hassincerecoveredabove$85,000.

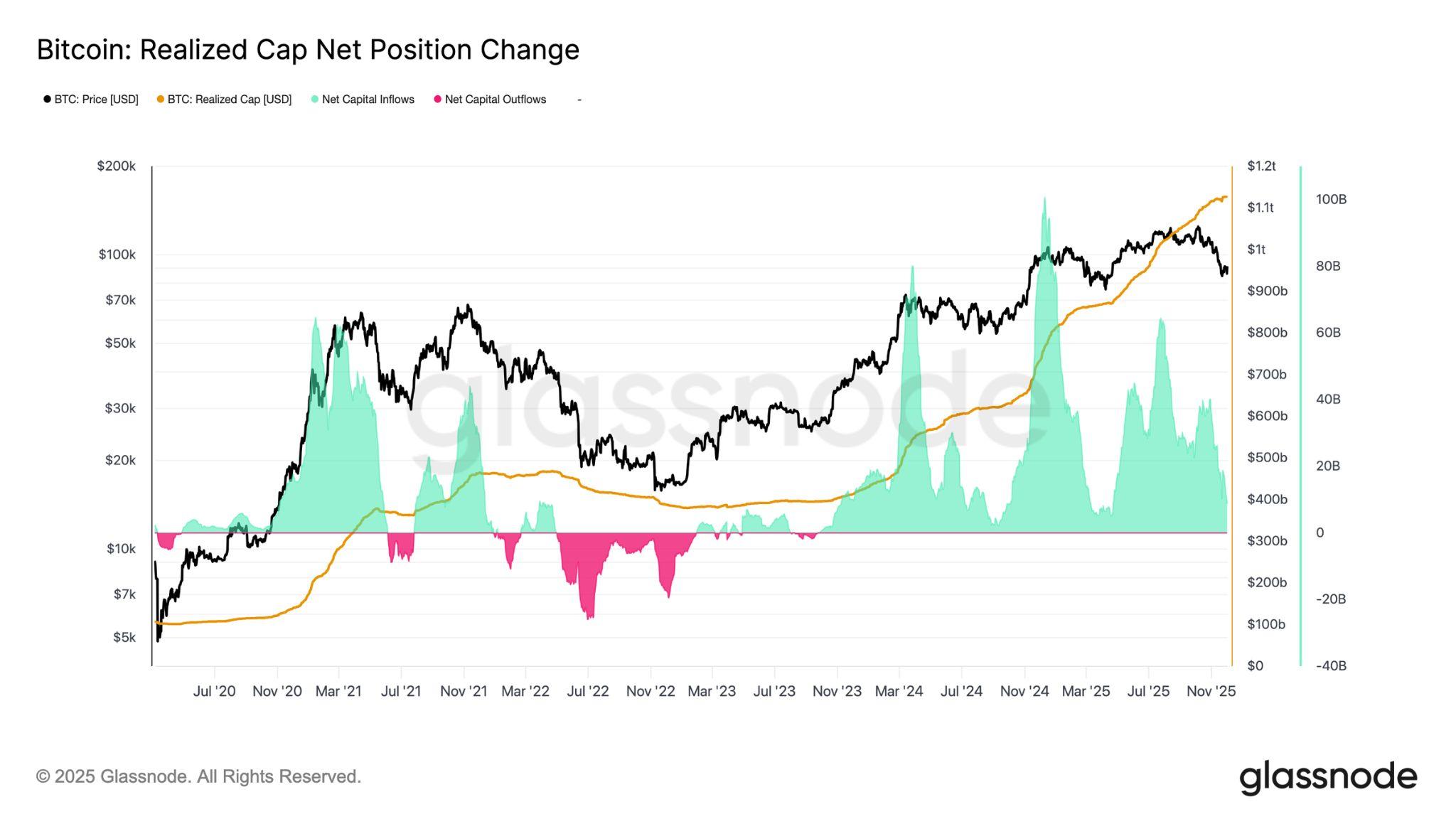

Figure4BitcoinRealisedCapitalisationNetPositionChange.Source:Glassnode)

OneeffectivewaytomeasurethisinflowstrengthisthroughtheNetChangein Realised Capitalisation (see Figure 4 above), which tracks whether aggregate capital entering the network exceeds capital leaving it. At present, this metric stands at $8.69 billion per month. While this is substantially lower than the cycle peak of $64.3 billion per month reached in July 2025, it remains meaningfully positive signalling that, even in a weakened environment, realised valuecontinuestoexpandratherthancontract.

Thiscontinued,butmoremoremoderate,capitalinflowprovidesapartialbuffer against deeper downside, supporting the marketʼs ability to stabilise despite fadingmomentum.

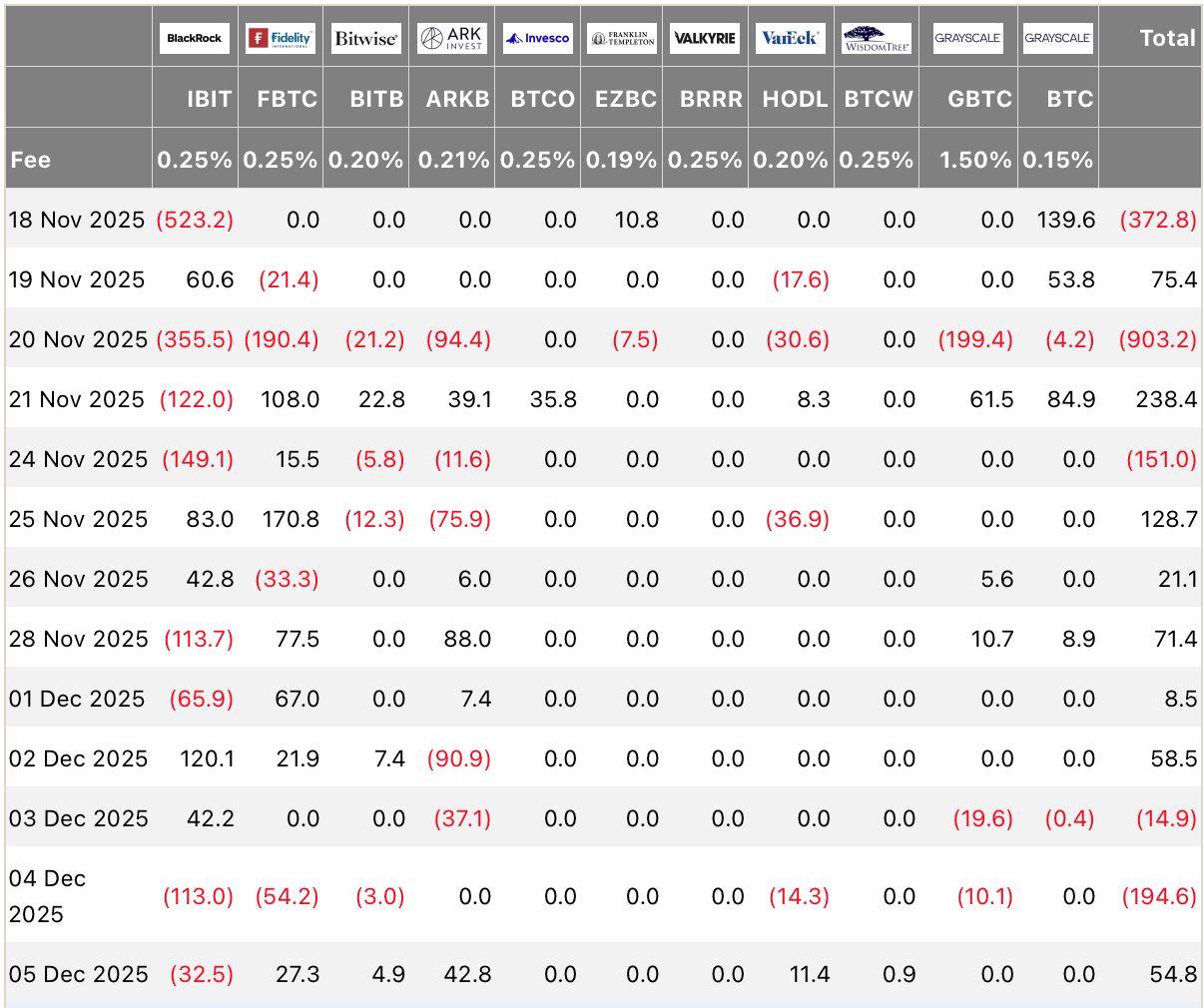

ETFflows,andtakerspotbuyinghaveremainedsubdued,evenasBitcoinhas recoveredmeaningfullyfromitsrecentlows.US-listedBitcoinETFshaveshown a clear deterioration in net flows, with the three-day average firmly negative throughout November. This represents a decisive shift from the persistent inflowregimethatsupportedpricesearlierintheyear,andpointstoabroader coolinginnewcapitalallocationtotheassetclass.

Notably, outflows have been spread across multiple issuers, signalling a market-wide reassessment rather than isolated rotation between products. Institutionalparticipantsappeartobetakingamoredefensivestanceasmacro conditionssoftenandliquidityexpectationsweaken.Overthepastweekalone, cumulative net flows across all US Bitcoin ETFs totalled $87.7 million, reinforcingthefadingdemandimpulse.

5.USBasedBitcoinETFsDailyNetFlowsAcrossAllProviders.Source: FarsideUK

With spot demand weakening, the market now faces a meaningfully lighter buy-side backdrop. This reduces immediate support for price and increases sensitivitytoexternalshocks,macro-drivenvolatility,andanyfurthertightening in financial conditions. In the absence of renewed ETF inflows, near-term price stability will depend more heavily on organic spot demand and a continued easingofsell-sidepressurefromexistingholders.

OntopofthedeteriorationinETFdemand,CumulativeVolumeDeltaCVD)has alsoturneddecisivelyloweracrossmajorexchanges.Theaggregatedexchange cohort now shows persistently negative CVD, indicating sustained taker-driven sellpressureastraderscrossthespreadtode-riskratherthanaccumulate.

US-based exchanges too, which often serve as a bellwether for US spot-side demand, have seen CVD flatten, signalling a broader retreat in high-conviction buying. This shift suggests that the bid from both retail and institutional spot participantshasweakenedmateriallyinrecentweeks.

Figure6.CumulativeVolumeDeltaBiasAcrossAllExchanges.Source: Glassnode)

WithETFflowssofteningandspotCVDfirmlybiasedtothedownside,themarket isnowoperatingonathinnerdemandbase.ThisleavesBTCmoresusceptibleto macrodevelopmentsandliquidityshocksinthebroaderriskenvironment.

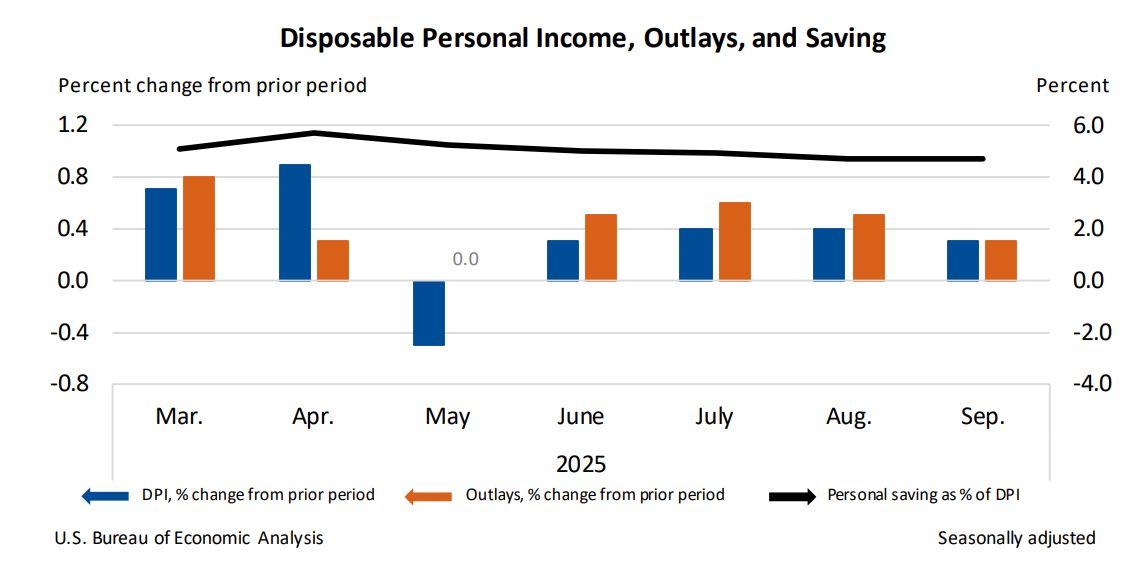

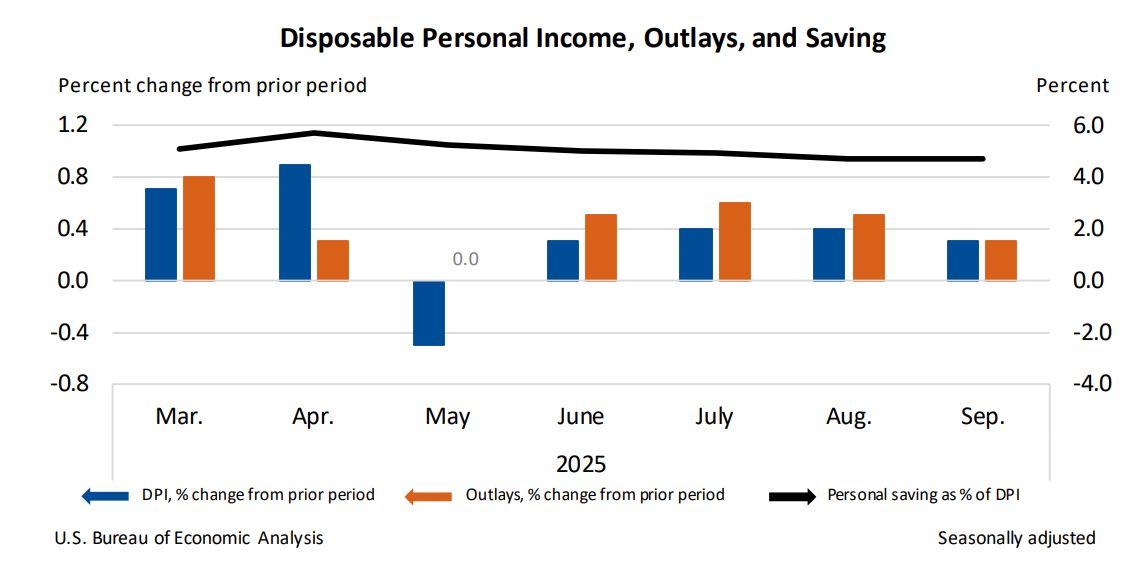

7.DisposablePersonalIncome,OutlaysandSavingsSource:USBureauof EconomicAnalysis)

US consumer spending came in quite lacklustre in September, reinforcing concerns that household purchasing power is being strained by persistent inflation and uneven income gains. According to the Commerce Departmentʼs Personal Income and Outlays Report, released last Friday, December 6, inflation-adjusted consumer spending was flat, mirroring the weak consumption patternsobservedduringtheThanksgivingweekend.Whilenominalincomegrew 0.4percent,realdisposableincomeincreasedonly0.1percent,underscoringthe pressure facing lower- and middle-income households. Unlike higher-earning Americans,whocontinuetodrivemuchoftheservicesdemand,manyfamiliesin thelowerendoftheincomedistributionseemtobetreadingwater.

ofEconomicAnalysis)

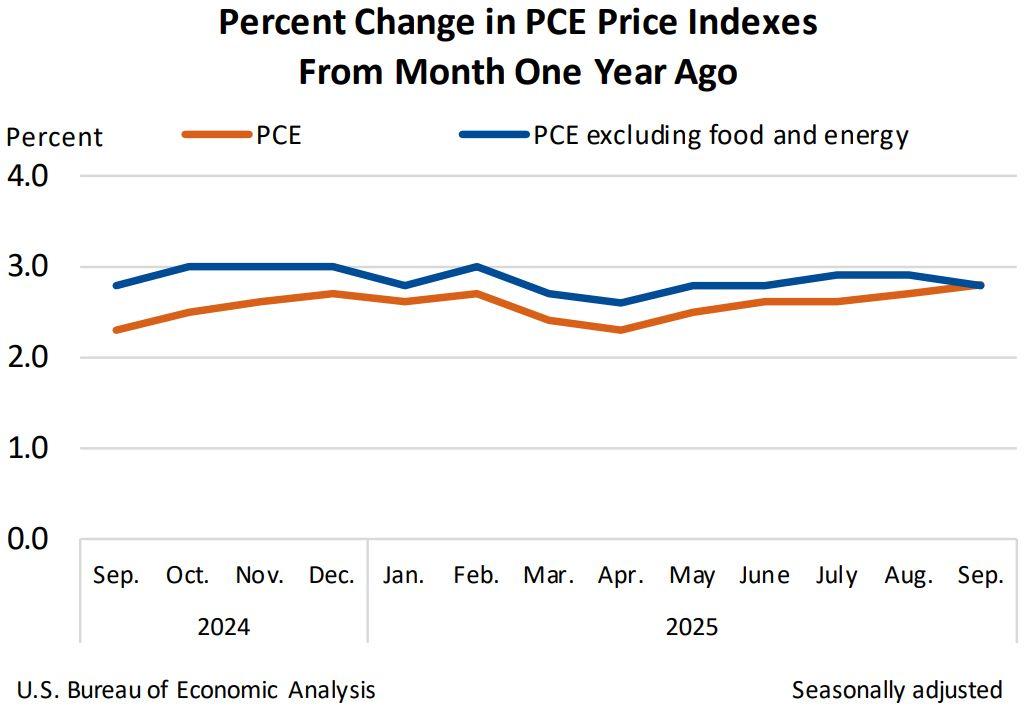

Theweaknessininflation-adjustedincomeandspendingisexpectedtoweighon fourth-quarter GDP, especially with the government shutdown contributing an estimated12percentdragongrowth.Atthesametime,inflationremainedsticky. The PersonalConsumptionExpendituresPCEPriceIndex,theFederalReserveʼs preferredinflationmeasure,rose0.3percentinSeptember.Bothheadlineandcore PCEincreased2.8percentfromayearearlier,withcoreinflationrising0.2percent onthemonth,matchingAugustandinlinewithforecasts.

The inflation backdrop is becoming more complex. Goods inflation, which had eased significantly since 2022, has reaccelerated since the spring. Prices for durablegoodsrose0.9percent,non-durablesincreased1.7percent,andservices inflation,stilldrivenheavilybyupper-incomespending,advanced3.4percentover the past year. Food prices climbed 2.4 percent and energy costs were up 2.7 percent.Thesedynamicsreinforcetheviewthatoverallinflationiscoolingbutnot quicklyenoughtobringtheFederalReserveclosertoitstwopercenttarget.

Despite that challenge, investors continue to expect a rate cut at the Fedʼs December 910 meeting, with the CME Fedwatch tool suggesting more than a 86 percent probability of a quarter-point reduction. Fed officials, on the other hand, seemmuchlesssure.Somepolicymakersarguethatprogressoninflationhasbeen too slow to justify easing, particularly after the central bankʼs inflation target has been missed for five straight years. Others point to signs of a gradually cooling labour market, such as slower hiring in private-sector payrolls, and warn that delayingsupportcouldincreasedownsideriskstoemployment.

The September spending and inflation data were delayed because the 43-day government shutdown prevented the Bureau of Economic Analysis from collecting information on schedule. As a result, the Fed will enter one of its most consequential meetings of the year without fresh CPI or employment data for October,complicatingitsabilitytoassesscurrenteconomicconditions.

TheinflationdynamicsarenotfriendlytoAmericanhouseholdsatthecurrenttime, and the combination of extended price pressures, stagnant real income, and delayed federal data is set to make the fourth quarter appear softer than earlier in the year. With household sentiment fragile and real spending barely growing, the Fed now faces a difficult choice: support an economy adjusting to prolonged inflation,orwaitforclearersignsofcoolingbeforecuttingrates.

10.USPrivateEmploymentSource:ADPResearch)

As consumer spending data pointed to early signs of fatigue, new labour and services-sector reports released last Wednesday added to the view of an economycoolingunevenly.

TheADPNationalEmploymentReport,aprivatesectorsurveypublished bythe private payroll processor ADP, showed that US businesses cut 32,000 jobs in November. This marked the first monthly decline since the pandemic era and a sharpreversalfromthe47,000jobsaddedinOctober.Smallbusinesseswerehit the hardest, shedding 61,000 positions, a sign that smaller firms, often most sensitivetointerestratesandslowerdemand,arefeelingthestrainof“cautious consumers and an uncertain macroeconomic environment,ˮ according to ADP ChiefEconomistNelaRichardson.

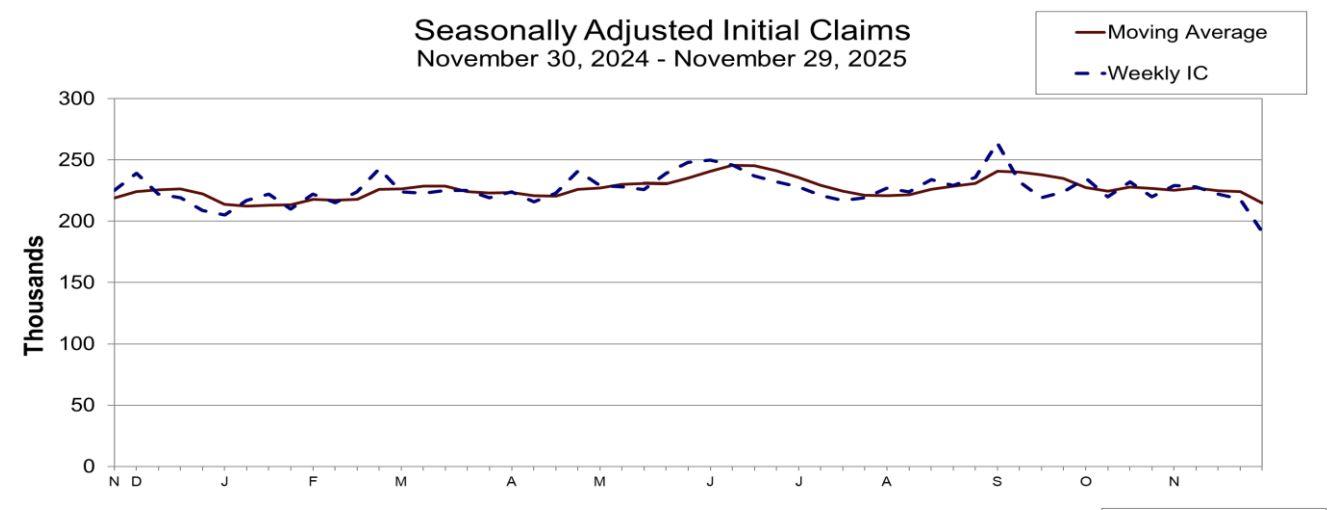

Figure11.InitialJoblessClaimsSource:USDepartmentofLabor)

Yet the next day, the US Department of Laborʼs Weekly Jobless Claims Report, released Thursday, painted a contrasting picture. Initial claims fell by 27,000, dropping to 191,000, the lowest level since September 2022. Jobless claims are a real-timeindicatoroflayoffs,andalowreadingsuggeststhat,despitesofterhiring, most employers are still reluctant to let workers go. This dynamic points to a coolinglabourmarket,notacollapsingone.

Thesecondkeydatapointcamefromthe ISMNon-ManufacturingPMI,amonthly survey released by the Institute for Supply Management. The index rose to 52.6 percent in November, its strongest reading since February, signalling continued expansion in the services sector, an important development given that services makeuproughly80percentofUSeconomicoutput.

New orders improved to 52.9 percent, and backlogs climbed to a ten-month high, suggestingdemandremainshealthy.However,theemploymentcomponentslipped to48.9percent,indicatingslightcontraction.Whiletheprices-paidindexeasedto 65.4 percent, its lowest reading in seven months, prices remain elevated by historical norms, consistent with broader inflation trends the Fed is monitoring closely.Surveyrespondentsnotedthatrecenttariffsandshutdown-relatedlogistics issuescreatedhurdles,butoverallsentimentleanedtowardcautiousoptimism,with severalpointingto“positivesignsofanemergingrecovery.ˮ

Figure12.One-monthand12-monthpercentchangesintheImportPriceIndex: September2024September2025

ThefinalreportcamefromtheUSBureauofLaborStatistics,whichshowed importpriceswereunchangedinSeptember,neitherrisingnorfallingonthe month.A1.5percentdeclineinfuelcostsoffsetmodest0.2percentincreasesin non-fuelgoods.Onayearlybasis,importpricesrose0.3percent,markingthe firstpositiveannualreadingsinceMarch.

Export prices also held flat month-over-month but surged 3.8 percent year-over-year, the strongest gain since 2021. Much of the strength came from higherdemandforUSindustrialsuppliesandcapitalgoodsabroad,anencouraging signfortradedespiteongoingglobaluncertainty.

Viewed together, the three reports underscore an economy moving forward unevenly. The economy continues to grow, supported by a firm services sector, easing inflation pressures, and strong export trends. Jobless claims remain near multi-yearlows,showingemployersarecautiousaboutcuttingstaffevenashiring slows.ButtheunexpecteddropinADPemploymentsignalsthatcertainpocketsof the economy, particularly small businesses, are becoming more vulnerable, especially as they face higher costs and uneven consumer demand during the crucialholidayseason.

VanguardGroup,theworldʼssecond-largestassetmanager,hasannouncedthatitwill beginallowingitsbrokerageclientstotradeexchange-tradedfundsETFsandmutual fundsthatchieflyholdcryptocurrencies.

Previously, Vanguard had firmly rejected crypto-linked products on its platform, even blocking access to the first wave of spot-Bitcoin ETFs launched in 2024. This refusal alignedwiththefirmʼslong-standingconservativeapproach:viewingcryptocurrencies astoospeculativeandvolatiletobelonginportfoliosintendedforlong-terminvestors.

Thechange,whichtakeseffectimmediately,opensupcryptoaccessforover50million Vanguardclients,whotogethermanageroughlyUS$11trillioninassets.Underthenew policy, clients will be able to buy and sell third-party funds tied to major digital assets suchasBitcoin,Ethereum,Ripple,andSolana

However, Vanguardʼs embrace of crypto does not extend to all digital-asset products: the firm explicitly excludes funds tied to “meme-coinsˮ and indicates that it will not createitsownproprietarycryptoETFsormutualfunds.Instead,Vanguardtreatscrypto funds similarly to other “non-coreˮ asset classes, akin to how it handles gold or other nicheexposures.

According to Vanguard executives, the shift is justified by maturation in crypto fund infrastructure, improved operational readiness to service such funds, and evolving client demand. In particular, the firm argues that crypto ETFs have “performed as designedˮ through periods of volatility and maintained liquidity, a claim that contrasts sharplywiththeirpreviousscepticism.

Industry observers view this move as a milestone for mainstream adoption of cryptocurrencies. Since early 2024, when spot-crypto ETFs became available in the US, billions of dollars have flowed into these products, especially into offerings like iShares Bitcoin Trust. Vanguardʼs change of heart may signal to other traditional financial firms that crypto is no longer a fringe asset class, but a substantial segment deservinginclusioninmodernportfolios.

On December 2, 2025, after receiving Royal AssentI, the Property Digital Assets etc.) Act 2025 became law, marking a historic shift in how the UK treats digital assets. Under this Act, digital assets such as cryptocurrencies, stablecoins, and other token-based holdings are now formally recognised as a third category of propertyunderlaw,alongsidetraditionalphysicalproperty(“thingsinpossessionˮ) andcontractual/intangiblerights(“thingsinactionˮ).

For holders of crypto and other digital assets, the implications are significant. By codifying crypto as legal personal property, the Act gives owners clearer protectionsandrightsinscenariossuchastheft,fraud,insolvency,inheritance,and estateplanning.Intheabsenceofthelaw,courtshadsometimestreatedcryptoon acase-by-casebasis,butthisnewlegislationoffersconsistent,statutoryclarity.

The law was introduced in response to a 2023 recommendation from the Law Commission of England and Wales, which noted that cryptocurrencies did not neatly fall under the existing legal categories, thereby creating legal ambiguity about ownership and rights. The new classification addresses this ambiguity by explicitlyallowing“thingsthataredigitalorelectronicinnatureˮtobethesubjectof personalpropertyrights.

Industry groups, such as CryptoUK, have praised the development, calling it a “clearerlegalfootingˮfordigitalassetsandhighlightingitsimportanceforenabling proper legal recourse, for example, recovering stolen tokens, sorting out estate claims, or handling bankruptcy scenarios involving crypto. Some observers have described this as the biggest change to property law in England in centuries, underscoringitshistoricnature.

Beyondindividualprotection,thelegalrecognitionalsoimprovestheregulatoryand business environment, boosting confidence for crypto- and blockchain-related companies, and potentially making the UK a more attractive hub for fintech and digital-assetinvestment.

OnDecember4,2025,theCommodityFuturesTradingCommissionCFTCissued Release No. 914525, through which the agency formally authorised, for the first time ever, the trading of listed spot cryptocurrency products on US federally regulatedexchanges.

Under this new framework, spot-crypto instruments such as Bitcoin or other digital-assetcontractscannowbelistedonCFTC-registered“DesignatedContract Marketsˮ DCMs, bringing them under the same regulatory oversight, customer-protectionstandards,andmarket-integrityrulesthathavelonggoverned futuresandothercommoditymarkets.

Inannouncingthemove,actingCFTCChairCarolineD.Phamframeditaspartofa broader US effort to reclaim global leadership in digital-asset markets, offering Americans a safer, regulated alternative to offshore crypto exchanges that often lackconsumerprotections.

The regulatory shift follows earlier steps by the CFTC under its “Crypto Sprintˮ initiative and incorporates recommendations from the Presidentʼs Working Group on Digital Asset Markets. Among the envisioned future reforms are allowing tokenised collateral (including stablecoins) in derivatives trading and modernising settlement and reporting infrastructure to accommodate blockchain-native markets.

By enabling spot crypto trading on regulated US exchanges, the CFTCʼs decision could significantly reshape the digital-asset landscape, potentially drawing in more institutional capital, improving liquidity, reducing reliance on unregulated offshore platforms, and pushing the crypto sector toward mainstream legitimacy underestablishedcommodity-marketlaws.