AFTERTHECARNAGE, STILLSOMEHOPE

LargestLiquidationEventInCrypto

History

MACROUPDATE

UncertainPolicy,Resilient

Markets:TheFed’sDilemmaAmid

Washington’sGridlock

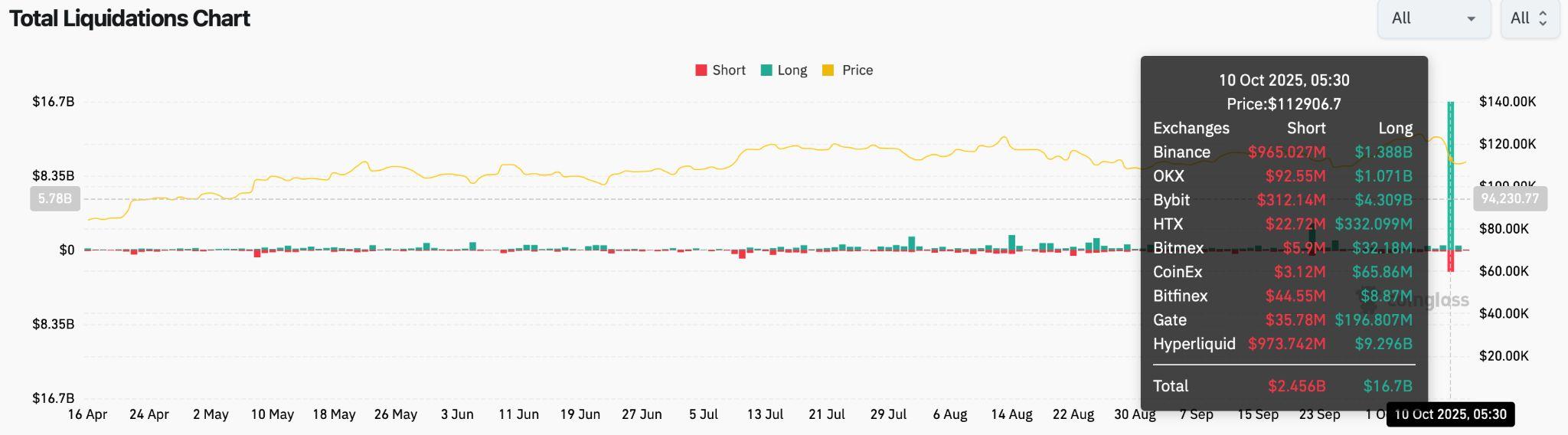

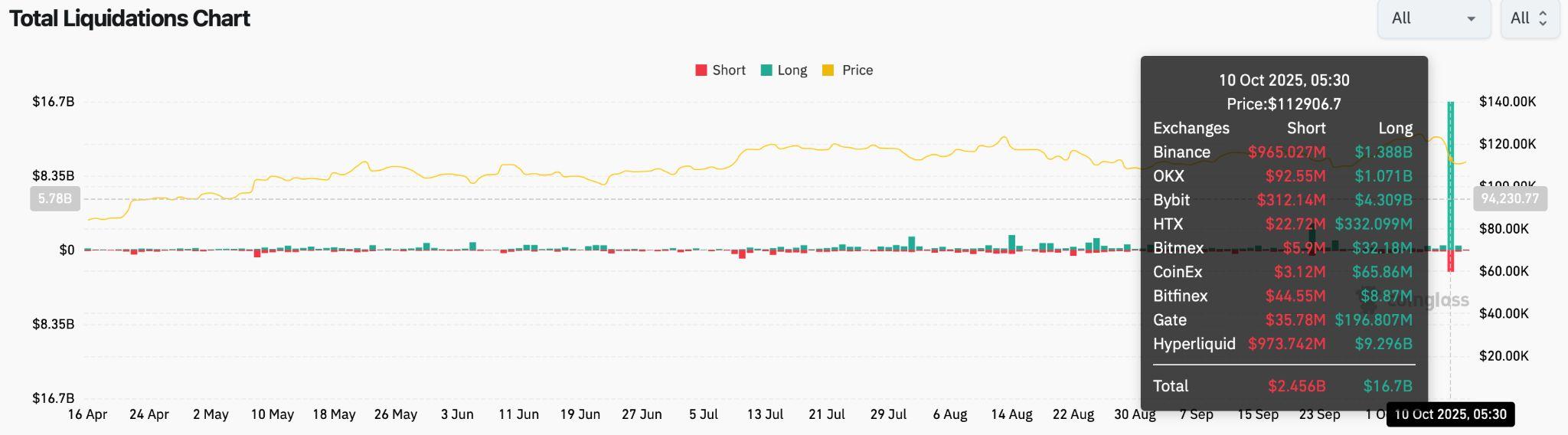

Bitcoinmovedfromabove$126,000lastweektobrieflybelow$103,310,markingan 18.1 percent drawdown and triggering the largest liquidation event in crypto history by notional value. Ether fell from $4,750 to $3,500, while several altcoins saw momentarydeclinesofover80percentamidvanishingliquidity.Roughly$1trillionin total market value was erased within three hours on Friday 10, October, as total crypto market capitalisation briefly plunged 22.6 percent from its October high of $4.26 trillion to $3.3 trillion. More than $19 billion in positions were liquidated in a singledaydwarfingpreviousrecordssetduringtheCOVIDcrashandFTXcollapse.

The sell-off was sparked by aggressive spot selling as USChina tariff tensions began escalating on 10 October, creating a 2.5x imbalance between sellers and buyers across major exchanges. Once the news broke of US tariffs on Chinese imports, futures markets compounded the decline, with Cumulative Volume Delta readings showing an overwhelming dominance of sell-side flow across both spot and perpetual markets. Historically, such liquidation-driven capitulations have been followed by mechanical rebounds as volatility compresses and excess leverage is flushed. For Bitcoin, reclaiming and holding above $110,000 would confirm a stabilisationphaseandopenrecoverytargetsnear$117,000$120,000,whilefailure todosorisksaretestofthe$100,000zone.

ThelatesteconomicbackdropintheUnitedStatesreflectsawideningdisconnect between policy intent and real-world impact. The Federal Reserveʼs September meeting minutes revealed deep divisions within the Federal Open Market Committee over the pace and scale of upcoming rate cuts. While most policymakers favour additional easing to counter slowing job growth, a minority remainconcernedthatprogressontacklinginflationhasstalled,andwarnagainst movingtooquickly.

Compounding the challenge is a surge in economic policy uncertainty, driven by theongoinggovernmentshutdown,shiftingtariffpolicies,andtighterimmigration rules. The shutdown has halted key data releases, forcing markets to rely on privateindicatorsshowinganeconomythatiscoolingbutnotcontracting.

Despite the fiscal gridlock, financial markets have remained resilient. Treasury yields declined as investors sought safety, and a strong response to recent bond auctions highlighted sustained demand for long-duration assets. Credit markets have also held firm: both investment-grade and high-yield spreads sit near two-year lows, signalling steady investor confidence and limited concern over defaults.

The past week underscored how crypto and traditional finance are rapidly converging.InJapan,mobilepaymentsgiantPayPayacquireda40percentstake in Binance Japan, paving the way for its 70 million users to trade and transfer cryptodirectlywithinthecountryʼsmostpopulardigitalwallet.Institutionalfinance isalsodeepeningitscryptoties.Digitalassetfinancinggroup,Antalphaleda$100 million investment to create Aurelion Treasury, soon to become the first Nasdaq-listedcorporatetreasurybackedentirelybyTetherGoldXAUt.

Meanwhile, GraniteShares filed to launch 3x leveraged crypto ETFs tracking Bitcoin, Ethereum, Solana, and XRP, expanding Wall Streetʼs roster of complex digital asset instruments. Grayscale debuts US Spot Crypto ETP with Native StakingFunctionality.

● FedMinutesHighlightDivisionas UncertaintyWeighsonGrowth

● MarketsStayResilientasWashington ShutsDown

● GrayscaleDebutsUSSpotCryptoETPs withNativeStakingFunctionality

● PayPayAcquires40PercentStakein BinanceJapan

● AntalphaLeads$100MInvestmentin AureliontoLaunchNasdaq-ListedTether

Bitcoindroppedfromahighlastweekof$126,110tobrieflybelow$103,310, erasing all gains accumulated since August. Ether too tumbled from above $4,750to$3,500beforepartiallyrecovering.Thissharpdecline-triggered by an escalation in USChina trade tensions on Friday 10, October - was exacerbatedbythebreachofthe$118,000level,whichwasidentifiedinthe previouseditionofBitfinexAlpha asakeydirectionallineinthesand,given thedensesupplyclusteratthatprice.Anymovebelowthislevelwasalways expectedtoresultinfurtherdownside.Thatsaid,thesubsequentsell-offwe saw exceeded expectations, culminating in the largest liquidation event in cryptohistoryinUSD-notionalterms.

Figure1. BTC/USD4HChart.Source:Bitfinex)

Thepeak-to-troughdeclineinBTClastweekamountedto18.08percent,butthis isstillnowhereclosetothelargestpullbackthiscycle,orsincetheETFswentlive (which has had the effect of reducing average volatility across major crypto assets). However, the speed of the decline, aided by the escalation in USChina tradetensionson10October,resultedinextrememovesacrossseveralaltcoins, someofwhichsawupto8090percentdrops,asorderbooksthinnedout.

Total cryptocurrency market capitalisation plunged over 13.2 percent within 24 hoursto$3.7trillion,withroughly$1trillioninvalueerasedinjustthreehours.

Thetotalcryptomarketcapmomentarilytouched$3.3trillion,ora22.58percent declinefromitsrecentATHnOctober6thof$4.26trillion.

On Friday, 10 October alone, more than $7 billion in positions were liquidated withinasinglehouroftrading.

Long positions bore the brunt of the damage, with losses amounting to $16.83 billion over the course of the day, compared with $2.49 billion in short liquidations.Over$19.3billionintotal.

BTCledtheliquidationcascadewith$5.38billionwipedout,followedbyEtherat $4.43billion,Solanaat$2.01billion,andXRPat$708million.

ThelargestsingleliquidationwasanETHUSDtpositionvaluedat$203.36million —thesecond-largestforcedclosureincryptohistory.

Thescaleofthiseventdwarfedallpreviousrecords,surpassingboththeMarch 2020 COVID crash, which saw $1.2 billion in liquidations, and the November 2022FTXcollapse,whichtriggered$1.6billion.Themagnitudeoftheliquidation underscores the sheer concentration of leverage across major assets and the vulnerabilityofhighlycorrelatedpositionswhenmarketstructurebreaksdown.

Alargeportionofthesharpdeclinecanbeattributedtoaggressivespotselling acrossmajorexchangesinthehourprecedingthetariff-relatednewsbrokebut after China announced that it would require approvals for any exports that contained Chinese rare earth minerals. During this period, exchange data showeda2.5ximbalancebetweenaggressivemarketsellersandbuyersonspot pairs, signalling a clear shift toward risk-off positioning even before headlines emerged.

Thiswaveofspotsellingwassoonfollowedbyasurgeinshortpositioningwithin perpetual futures, as traders moved to front-run the incoming volatility once the news of the tariff escalation broke. The dynamic was clearly observed through the aggregated Cumulative Volume Delta CVD) across all exchange pairs. At its core, CVD measures net order flow by calculating in real time, the difference between total market buy volume (orders executed at the ask) and total market sellvolume(ordersexecutedatthebid).

Sustained negative readings indicate dominant sell pressure, and in this instance, the sharp divergence confirmed an aggressive unwind across both spotandderivativesmarkets,amplifyingthescaleofthemovelower.Intandem withBTC,thedeclinewasevident acrossseveralaltcoinswherethenumberof leveraged long positions built up were arguably higher, and hence the subsequentlongliquidationcascadehadasignificantpriceimpact.

Followingtheliquidationshowever,Bitcoinandthebroadermarketexperienced amechanicalreboundcharacterisedbyreducedvolatilityandrange-boundprice action. This post-liquidation phase often allows markets to stabilise as excess leverageisclearedfromthesystem.

We believe that if historical Q4 seasonality - particularly in post Bitcoin-halving years — plays out, a relatively swift recovery still remains possible. This will especially be the case, once major assets consolidate and narrower price channelsaremaintainedonasustainedbasisoverseveralweeks.

For BTC, reclaiming and holding above $110,000 with sustained spot buying pressurewouldvalidaterecoveryscenariostargeting$117,000$120,000.Failure toregainthiskeylevel,however,wouldlikelyresultinaretestofthe10October lows. Broader market assets are expected to mirror BTCʼs trajectory but with heightenedvolatilityrelativetothebenchmark.

The mass liquidation has effectively purged leveraged positions, reducing immediatesellpressureandsettingthestageforpotentialbaseformation.

Nonetheless, the unresolved tariff situation continues to cloud sentiment. US President Donald Trumpʼs expected tariff announcement on 1 November, in responsetoBeijingʼsrestrictionsonrareearthexports,introducesfurtherpolicy uncertainty. Trump later suggested that the tariffs could be reversed if China alters its stance before the deadline, a development that could spark a short-term relief rally. However, unlike spot drawdowns, liquidation-related losses are permanently locked in, meaning fresh capital inflows will be necessarytorestoretotalmarketcapitalisation.

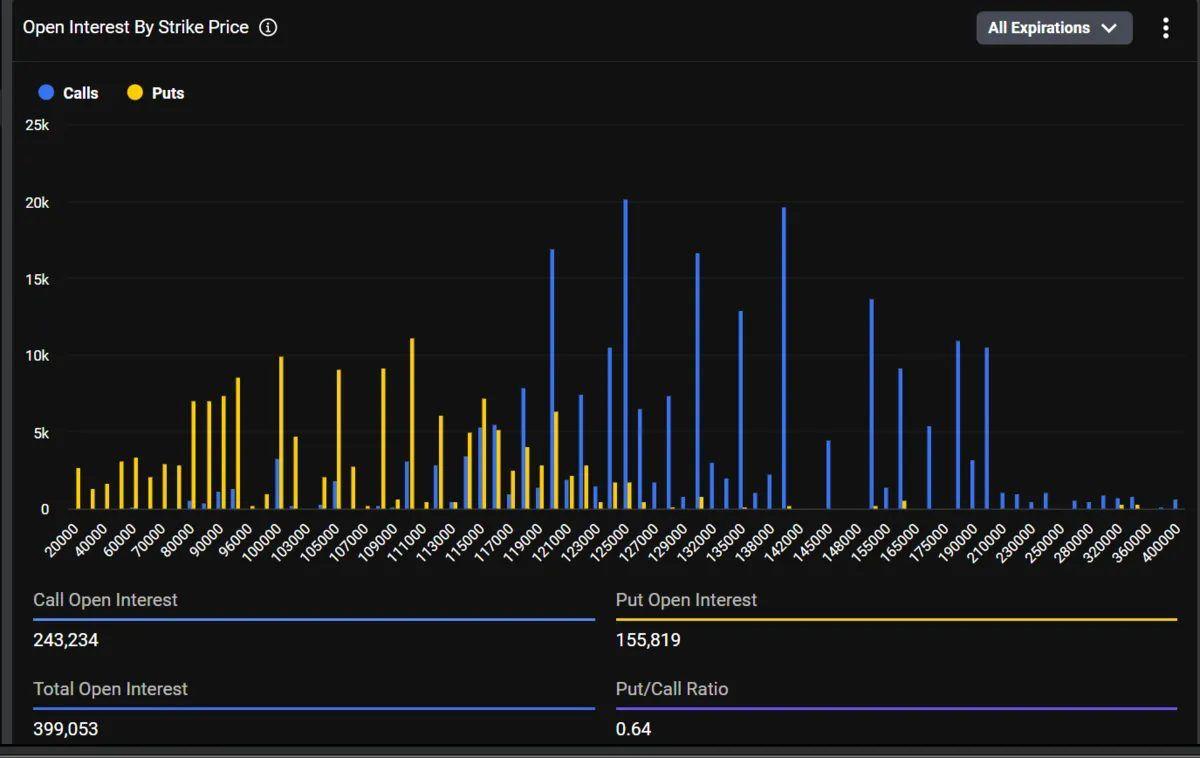

From a technical standpoint, the critical levels to monitor are $110,000 and $100,000.Optionsmarketdatasupportsthisview,withthehighestconcentration of put strikes positioned at $110,000 and the next major cluster at $100,000 underscoringthesethresholdsaskeyinflectionpointsfornear-termdirection.

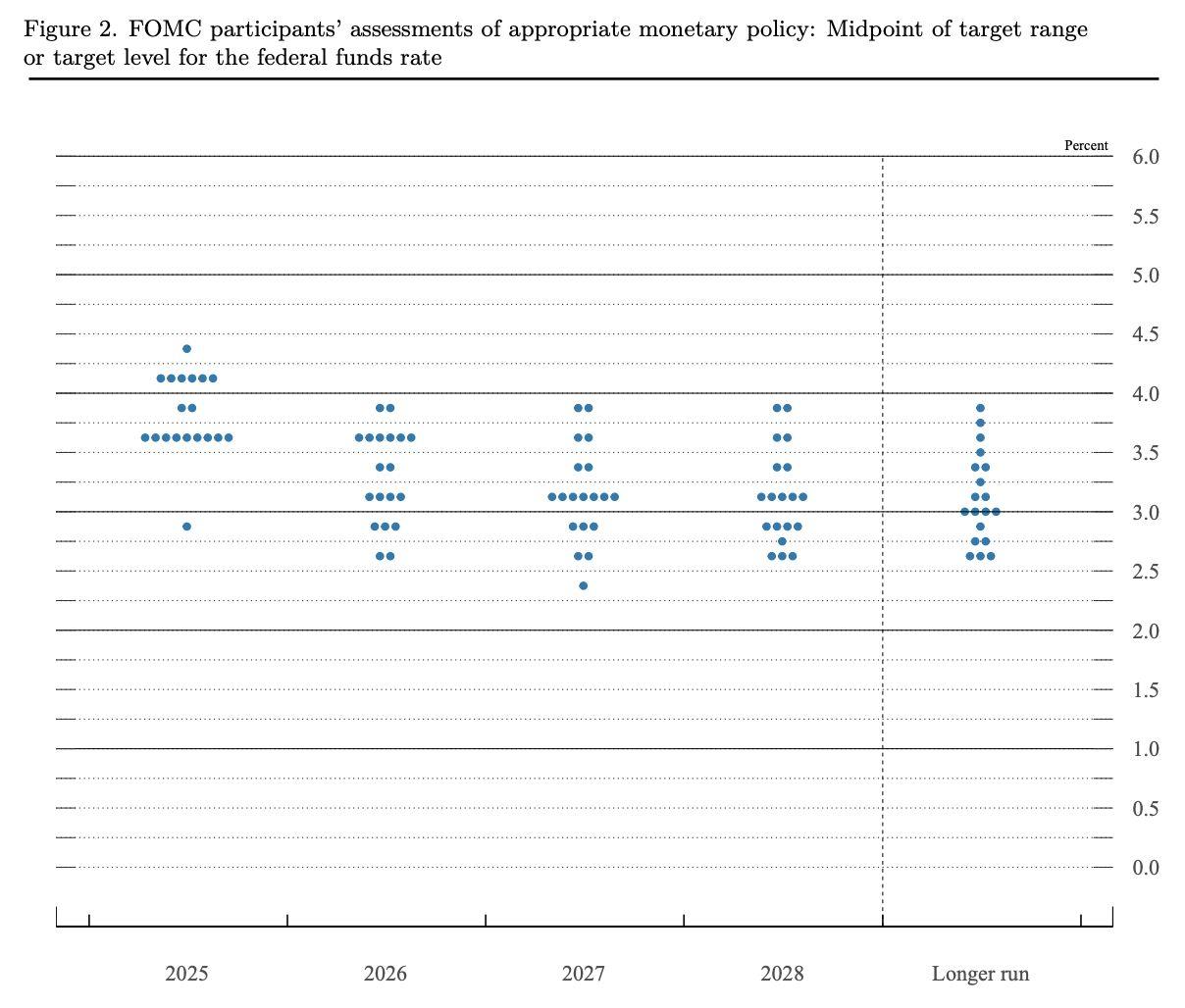

TheFederalReserveʼslatestminutesrevealacentralbankincreasinglydividedoverthe pace of rate cuts and the broader effectiveness of its policies, as political and fiscal uncertaintycloudtheoutlookfor2025.

DivisionInsidetheFed

Source:FederalReserveʼsSummaryofEconomicProjections)

The Federal Open Market Committee FOMC minutes from the September 16th–17th meeting, released last Wednesday, October 8th, showed that most officialsagreedthatfurtherratecutsthisyeararelikelyappropriatetosupporta softening labour market. Yet disagreement emerged over how aggressively to proceed.

A few policymakers argued that inflation progress had stalled and cautioned againstmovingtooquickly,warningthathighpricescouldbecomeentrenchedif inflation expectations drift upward. In contrast, one participant, widely seen as new Governor Stephen Miran, advocated for a deeper, half-point rate cut, suggesting the Fed was falling behind the curve in preventing further labour weakness.

While the committee justified its most recent 25-basis-point reduction by pointing to risks facing employment, many officials still viewed inflation as a persistent threat, with uncertainty lingering over tariffs and supply-side constraints. Some, however, acknowledged that inflation risks had eased comparedtoearlierintheyear.

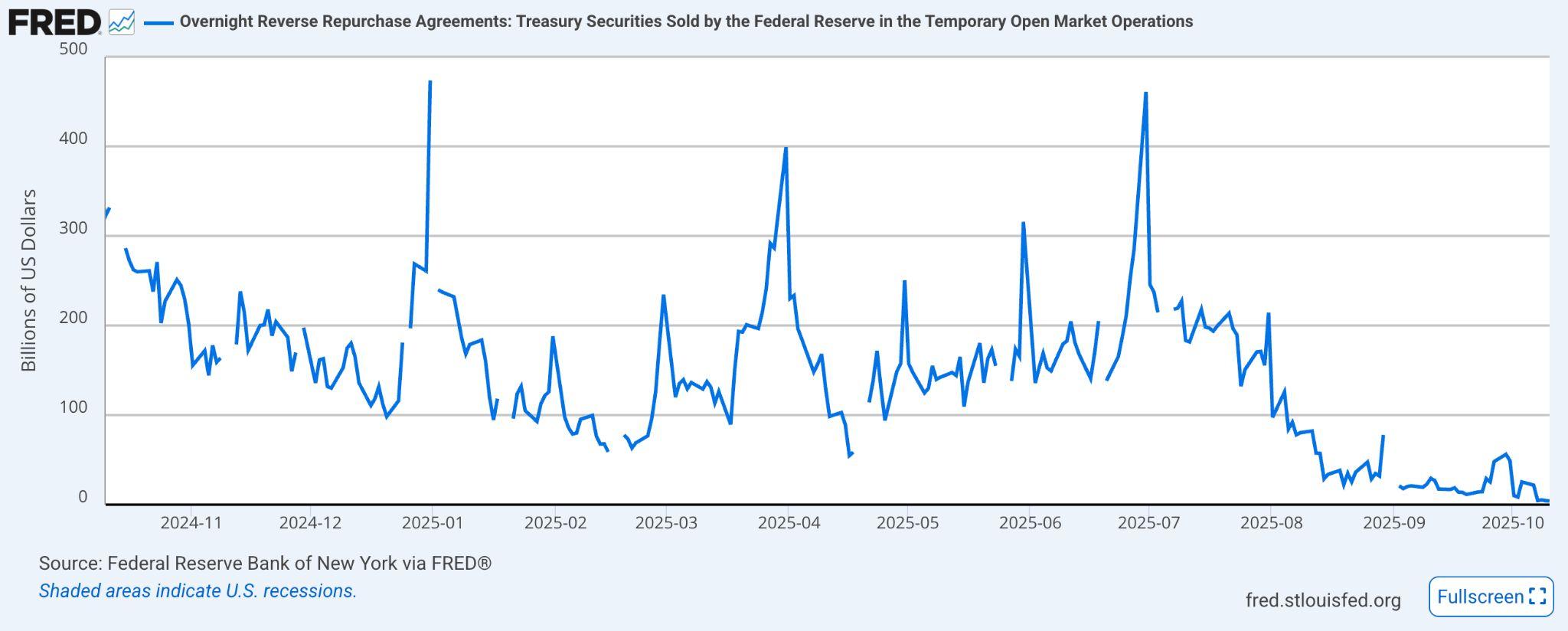

Theminutesalsonotedthatwhilejobcreationhadslowed,thedeclinereflected both weaker hiring demand and a shrinking labour supply, not a sharp deterioration in conditions. Policymakers also discussed the balance sheet runoff,notingtheneedtomonitorliquidityasbankreservesdecline,thoughFed Chairman Jerome Powell reaffirmed comfort with the current pace of bond roll-offs.

Compounding the Fedʼs challenge is a resurgence of economic policy uncertainty, with the Economic Policy Uncertainty Index spiking to 552 on October 5th, up from 363 the previous day, as the US government shutdown kicked into effect. This rise put the index back to levels last seen during the pandemicandthetariffturmoilofearly2020

This jump reflects a mix of political and fiscal disruptions, from shifting tariff policies to tighter immigration rules and the federal shutdown, all of which are clouding the outlook for businesses. Small and midsize firms are already reducingheadcounts,whilelargercompanieshaveslowedhiringtoacrawl.

The FOMCʼs latest minutes underscore a central theme: monetary policy is no longeractingwiththespeedorforceitoncedid.Withthegovernmentshutdown draggingonandinflationstillabovetarget,theFedisnavigatinganincreasingly complex landscape where its traditional levers yield diminishing returns. The coming months will test whether an easier policy can still support growth, or whetherfiscalgridlockanduncertaintywillagainovershadowmonetaryeasing.

TheUSeconomyenteredthesecondweekofOctoberundertheweightofa government shutdown that has frozen most official data releases, from employment and inflation, to retail sales. With agencies like the Bureau of Labor Statistics and the Bureau of Economic Analysis closed,investors and policymakers are navigating in partial darkness, relying on private-sector indicators,marketbehaviour,andconsumersentimenttogaugethehealthof theeconomy.

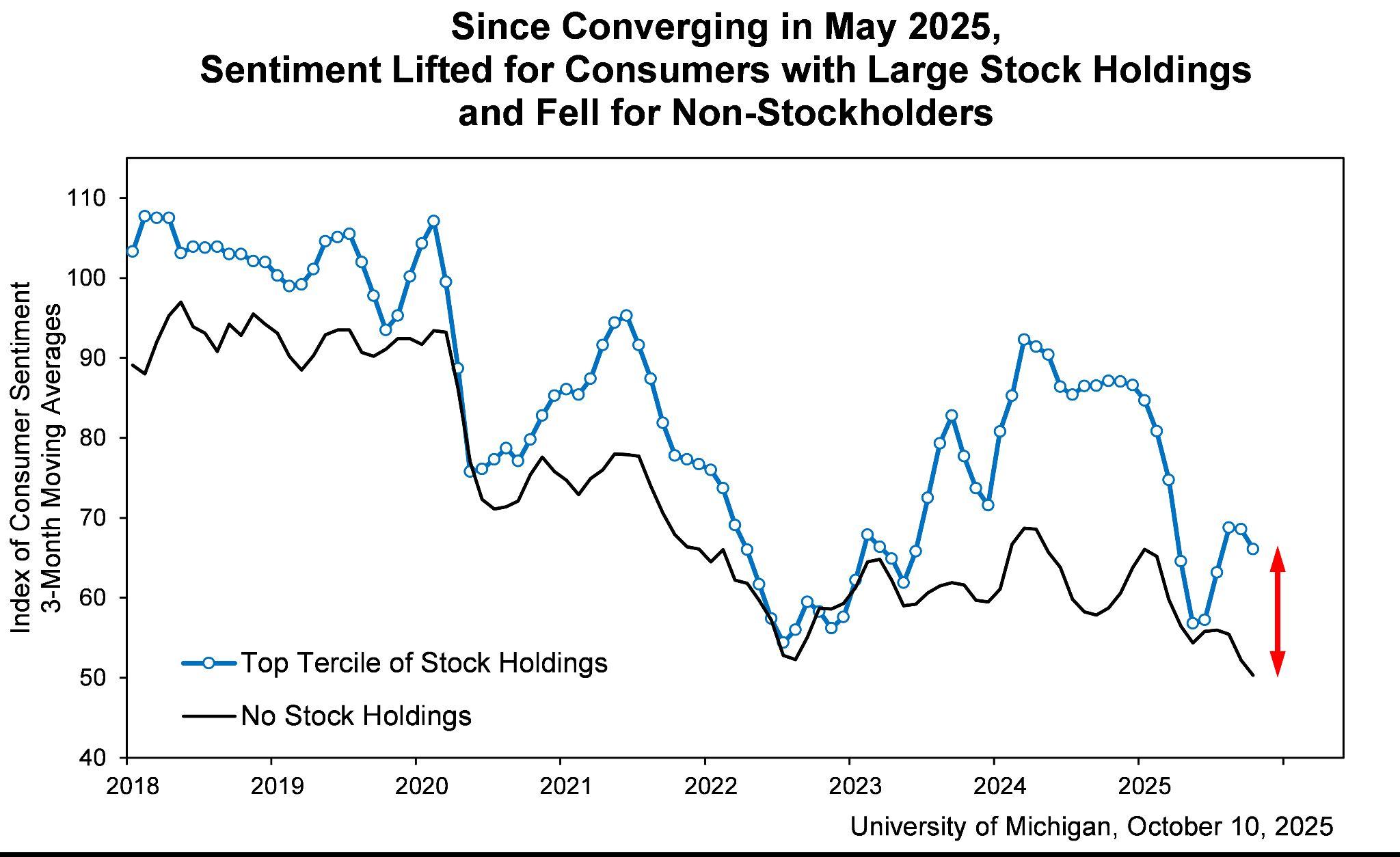

Alternative data show an economy that is cooling, but not collapsing. The Chicago Fedʼs real-time unemployment estimate hovered near 4.3 percent, while the University of Michiganʼs early October survey pegged consumer sentiment at 55.0, little changed from September. Households remain wary of inflationandjobprospects,thoughtheshutdownhasyettocauseameaningful deteriorationinoverallconfidence.

Figure9.Market-ImpliedInflationExpectationsRemainStableNear2.3 Percent,SignalingConfidencethatPricePressuresAreContained

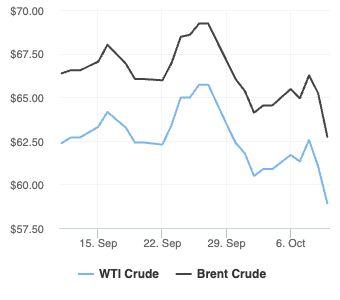

Market-basedinflationexpectationsremainstable,withthefive-yearbreakeven rate,whichreflectsthebondmarketʼsestimateofaverageinflationoverthenext five years, hovering near 2.35 percent. This suggests investors expect price pressures to stay close to the Federal Reserveʼs 2 percent target, despite data delaysandsupply-chainuncertainties.Commoditymarketsechothisview:Brent crude oil prices have fallen to a three-month low around $64.5 per barrel, weighed down by weaker global demand, rising inventories, and a stronger US dollar.

In the money markets, liquidity remainstightbutstable.Quarter-end funding pressures briefly lifted the Secured Overnight Financing Rate SOFR) to around 4.24 percent, a sign of tightening liquidity as the Fedʼs balance sheet continues to shrink. However, the quick normalisation of rates and steady reverse repo balances indicate that credit markets remain orderly, suggesting investors view the shutdownʼsdragastemporary.

Figure10.WTIandBrentCrudePrices Source:Oilprice.com)

Figure11.ReverseRepoBalancesHaveDeclinedasInvestorsShiftToward Higher-YieldingTreasuryBills,TighteningShort-TermLiquidity

Figure12.SecuredOvernightFinancingRateSOFRSource:FederalReserve)

MarketRallyandCorporateCreditAppetite

Thebondmarkethasbeenasteadyanchoramidthepolicyfog.Treasuriesrallied this week, with the 10-year yield dipping to around 4.05 percent, as investors sought safety from fiscal and political uncertainty. A $22 billion auction of 30-year bonds on October 9th drew robust demand, underscoring strong appetiteforlong-durationassetsevenasofficialdataremainscarce.

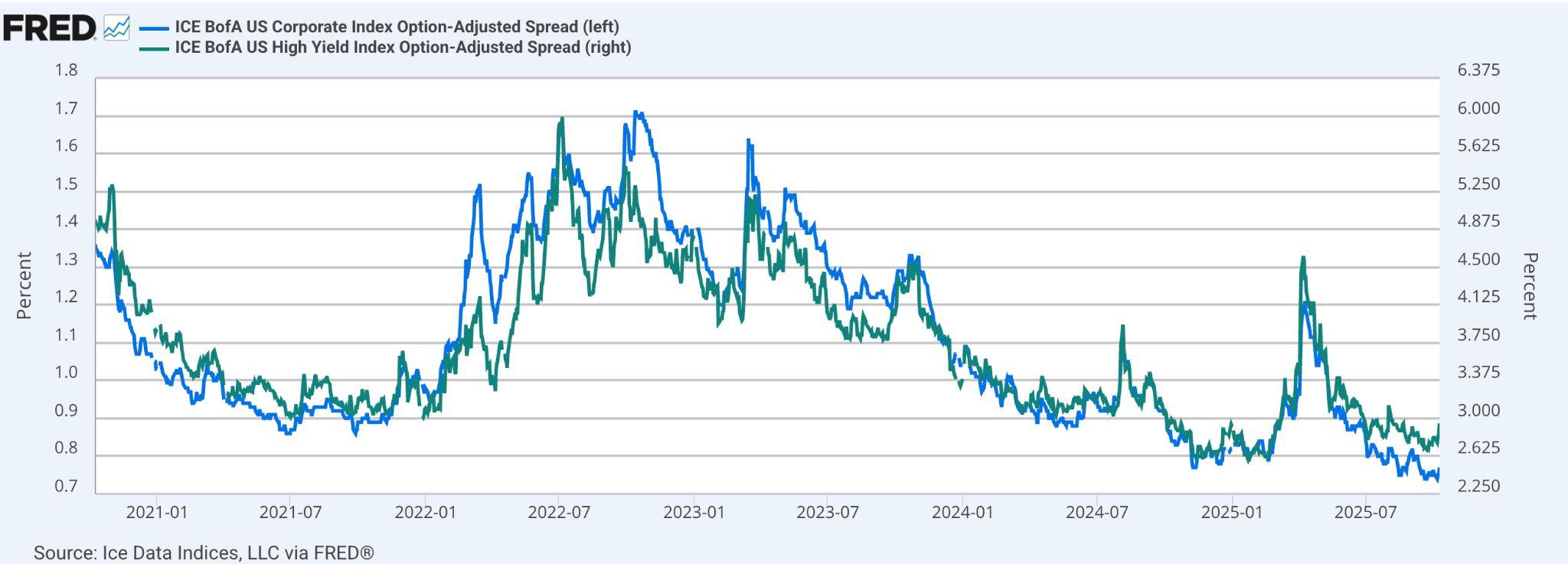

Corporate bond spreads have continued to compress across both investment-grade and high-yield markets, reflecting sustained investor confidence in credit. As shown in the chart below, investment-grade spreads have hovered just below 90 basis points, while high-yield spreads have narrowedtoaround270basispoints,theirlowestlevelsinnearlytwoyears.

This steady tightening suggests that investors are demanding only a modest premiumoverTreasuriesforholdingcorporatedebt,evenasmacrouncertainty persists. The high-yield segment, in particular, shows that risk appetite remains robust, with yields near 66.5 percent and volatility contained. Together, these trends underscore how credit markets have stabilised, positioning corporate bondsasacorepillarofglobalportfoliosamidexpectationsoffurthermonetary easing.

Private labour indicators point to a “low-hiring, low-firingˮ equilibrium. ADPʼs September report showed a modest 32,000-job decline, concentrated mainly among smaller firms, while job openings edged up slightly. This steady but subdued pace of hiring highlights how monetary easing is taking longer to filter through the economy, consistent with the Fedʼs recent 25-basis-point rate cut anditsrecognitionthatpolicyʼsmacroeconomiceffectstaketime.Aphenomenon wediscussfurtherbelow.

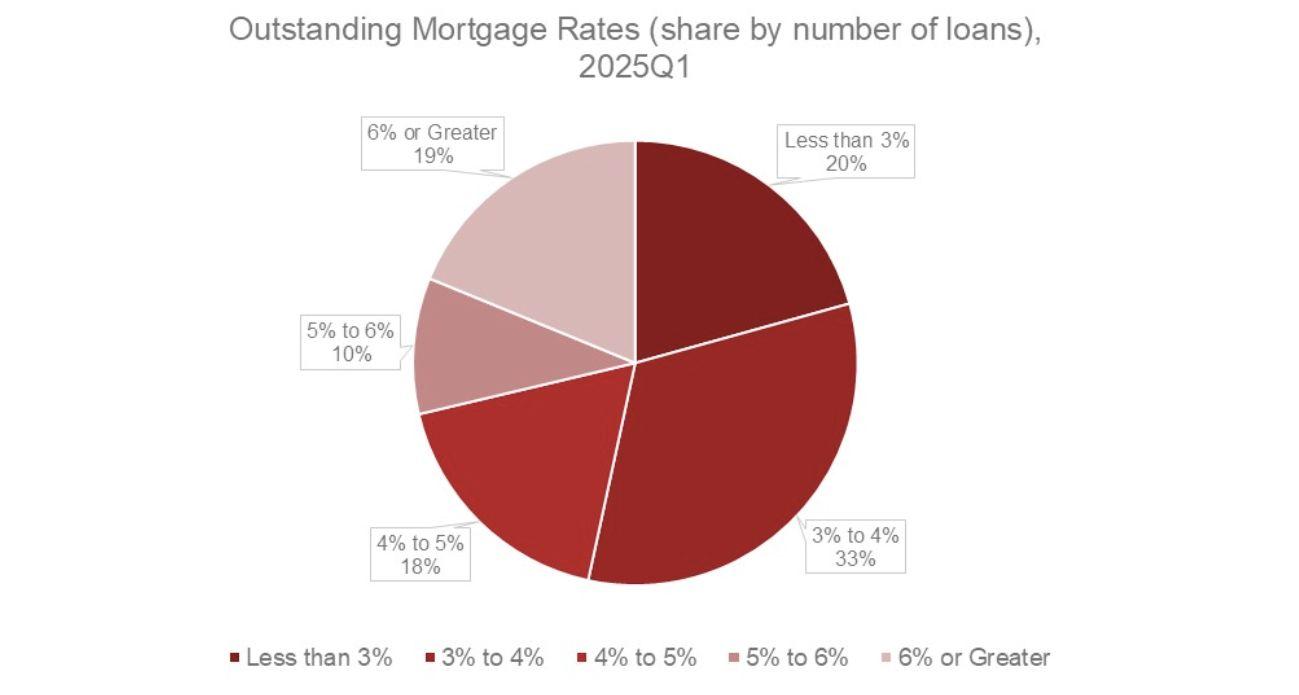

Figure16.OutstandingMortgageRates Source:Realtor.com,asofAugust2025

The usual stimulative effect on the economy, of lower rates is proving sluggish. Homeowners locked into sub-4 percent mortgages are not refinancing, limiting disposableincomegrowth.

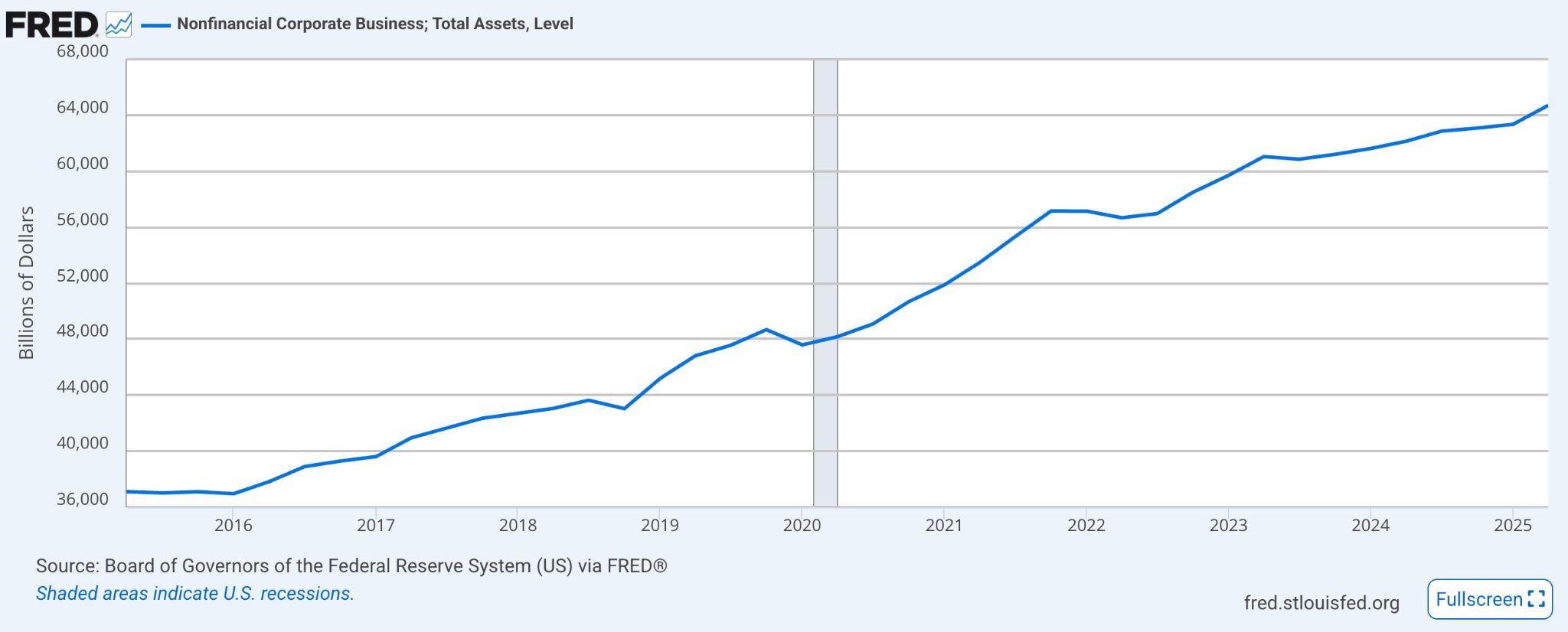

Corporate balance sheets, meanwhile, are healthier than theyʼve been in decades, meaning many firms are less sensitive to cheaper credit. As a result, rate cuts are taking longer to filter through the real economy, a dynamic the FediswatchingcloselyaheadofitsOctober2829meeting.

Figure17.NonFinancialCorporateBusinessTotalAssets:USCorporations HoldNear-RecordFinancialAssets,SignallingStrongLiquidityand ResilienceEvenAmidTighterCreditConditions.

Historically, shutdowns last an average of eight days and shave only a few hundredths of a percentage point off quarterly GDP. Equity markets have generally weathered these episodes well, and in past shutdowns the S&P 500 gainedabout4percentonaverageonceresolutionswerereached.

Historically, US government shutdowns have tended to be short, averaging around eight days. Equity markets have often held up: the S&P 500 gained an average1.5percentduringpastshutdowns.

The shutdown may have paralysed Washingtonʼs data machinery, but financial markets remain highly functional, and even surprisingly confident. Investor demandforbothTreasuriesandcorporatecreditsuggeststhatglobalcapitalstill viewstheUSasasafehaven,despitepoliticalgridlock.

At the same time, tighter money-market liquidity, policy lag effects, and high uncertainty around fiscal and trade direction have left investors dependent on sentiment and positioning rather than data. Equities remain resilient, and bonds haverallied.Fornow,theabsenceofdatamaybemaskingunderlyingfragility.If the shutdown persists, delayed reports on inflation and employment could amplify volatility once they are released. But the market message is clear: liquidity, credit confidence, and the expectation of further easing from the Fed arekeepingtheeconomyafloat, evenasthelightsinWashingtonremaindim.

Grayscale Investments launched a landmark offering last Monday, October 6th: spotcryptoexchange-tradedproductsETPsthatsupportstakingforinvestors. The newly enabled Grayscale Ethereum Trust ETF ETHE) and Grayscale EthereumMiniTrustETFETH)arenowthefirstUS-listedspotcryptoproducts toincorporatepassivestaking.Concurrently,GrayscaleSolanaTrustGSOL)has activated staking via its OTC-quoted structure and, subject to regulatory approval, may evolve into one of the first spot Solana ETPs with staking capabilities.

While ETHE and ETH are not registered under the Investment Company Act of 1940,meaningtheylacktheregulatoryprotectionsgrantedtotraditional40Act funds, these products provide investors with exposure to spot Ether, while simultaneously capturing yield via staking. GSOL, though not yet an ETP, will offeraparallelvehicleforaccessingspotSolanaexposureplusstakingrewards onceitgainsETPstatus.Inpractice,Grayscaleusesinstitutionalcustodiansand a diversified network of validator providers to stake the underlying assets, aimingtosupportnetworksecuritywhiledeliveringreturnstoinvestors.

Grayscale emphasises that these products bridge passive exposure and active protocol participation, enabling capital holders to benefit from both price appreciation and staking yields. The company also flagged plans to expand staking across its broader product suite, while maintaining a commitment to education, transparency, and rigorous reporting. As of September 30th, 2025, GrayscalemanagedaboutUS$35billionincustomerassets.

PayPay Corporation, Japanʼs dominant mobile payments platform backed by SoftBank Group and Yahoo Japan Z Holdings), has acquired a 40 percent ownership stake in Binance Japan, marking one of the most significant cross-sectordealsinthecountryʼsdigitalfinancelandscape.

The acquisition formalises a capital and business alliance aimed at integrating PayPayʼs extensive payments ecosystem with Binanceʼs advanced blockchain andcryptotradinginfrastructure.

Throughthispartnership,PayPayʼsmorethan70millionuserswillgainaccess to cryptocurrency trading and settlement capabilities directly within Japanʼs most widely used digital wallet. Users will be able to purchase crypto assets using PayPay Money and, crucially, transfer or withdraw crypto proceeds seamlessly between Binance Japan and their PayPay balance. This integration marks a significant operational milestone in Japanʼs Web3 expansion, effectivelyintegratingretailfintechandcryptointoasingle,consumer-friendly interface.

For Binance, the partnership secures a powerful local ally amid Japanʼs tight regulatory framework for digital assets. Following its 2023 re-entry into the market under new compliance conditions, Binance Japan has sought partnershipsthatalignwithJapanʼsFinancialServicesAgencyFSA)standards oncustody,transparency,anduserprotection.PayPayʼsinstitutionalcredibility and domestic market reach provide Binance with both legitimacy and scalability.

Strategically, the deal highlights the convergence of traditional financial and technologygiantsinJapantowardsblockchain-basedpaymentsystems.Italso reinforces Japanʼs growing global relevance as a crypto-friendly yet tightly regulated jurisdiction, attracting major players seeking regulatory clarity. By aligning payment rails with blockchain infrastructure, PayPay and Binance aim to set a precedent for Web2-to-Web3 integration, one that could serve as a modelformainstreamcryptoadoptioninAsiaʼsmaturefinancialmarkets.

Institutional digital asset firm Antalpha has taken a major step into real-world asset RWA) finance, leading a $100 million private placement and $50 million seniordebtfacilityforPrestigeWealth,whichwillsoonrebrandasAurelion.The fundingroundwillbeusedtoestablishAurelionTreasury,settobecomethefirst Nasdaq-listedcorporatetreasurycomposedentirelyofTetherGoldXAUt.

Tether Gold is a tokenised form of physical gold, with each XAUt representing onetroyounceofgoldstoredinSwitzerlandandredeemableforLondonBullion Market Association LBMAstandard bars. Since its 2020 debut, the asset has accumulated roughly seven tons of physical gold as backing, reflecting steady institutionalinterestindigitalgoldinstruments.

Following the transaction, Antalpha will hold a 32.4 percent equity stake and control 73.1 percent of voting rights, effectively becoming Aurelionʼs largest shareholder.OtherparticipantsintheroundincludeTGCommodities,theissuer behind Tether Gold, and Kiara Capital, which contributed $15 million and $6 million,respectively.

In a statement on Friday, Antalpha Chief Financial Officer Paul Liang described themoveasamilestoneinbridgingtraditionalanddigitalfinance:

“WeareexcitedtocollaboratewithTether,thelargeststablecoincompanyinthe world, to expand the trusted digital gold ecosystem. Digital assets will be more tangibletomanywhenonecanwalkintoajewelrystoreandredeemagoldbar with Tether Gold XAU₮. Through AntalphaRWAHub, we hope to deliver new capabilities and services like this that will increase the liquidity and product offeringsofTetherGoldXAU₮ˮ

The initiative marks one of the most prominent institutional efforts to integrate tokenisedcommoditiesintocorporatefinance.BypositioningAurelionTreasury as a publicly listed entity backed entirely by gold-linked digital assets, the partnership underscores the growing convergence of blockchain-based instrumentswithtraditionalfinancialmarkets.

GraniteShares submitted new regulatory filings last Tuesday, October 7th, for 3× leveraged exchange-traded funds ETFs that would track Bitcoin BTC, EthereumETH,SolanaSOL,andXRP.

This move marks yet another entry in the emerging trend of high-leverage crypto investment vehicles, positioning GraniteShares to offer amplified exposuretomajordigitalassets.

Under the proposed structure, each of these ETFs would aim to deliver three times the daily return, positive or negative, of their respective underlying assets. Such leverage magnifies both gains and losses, making the funds especially sensitive to volatility, path dependence, and compounding effects across trading days. Investors must thus closely monitor short-term movements,asthecumulativereturnsovermediumtolongperiodscandiverge significantlyfrom“3×timesˮtheassetʼsrawperformance.

The proposed filings deepen the competitive landscape of crypto ETFs, especiallyasissuersexperimentwithmoreexoticstructuresbeyondplainspot orunleveredproducts.GraniteSharesappearstobetargetingactivetradersand those seeking tactical plays on crypto momentum. However, leveraged crypto ETFs face regulatory scrutiny, market-maker risk, liquidity challenges, and heightenedoperationalcomplexity.