For over 40 years, the largest mining companies in the world have put their confidence in Richwood’s innovative material handling solutions.

When it comes to solving problems with dust and material containment, Richwood achieves success with engineered passive dust containment systems. Application-specific solutions optimize efficiency through sealed and protected load zones without the need for vacuums, filters or other additional equipment. The reduced wear and tear on equipment and controlled dust and spillage create a safer and more productive work environment. Worry-free load zones are designed and built by Richwood every day.

What would it mean for your productivity if dust and spillage issues were eliminated? Contact Richwood today for a review of your application.

Rely on Richwood!

As we enter 2026, automation is on the rise in mining, thanks to advancements in AI, ML, sensor technologies, and robotics. Those interested the operational, economic and safety reasons for this transition, as well as the resulting productivity, savings and culture, will find several stories to their liking in this issue.

February’s cover story (page 6) embraces the shift towards automation, demonstrating the benefits of tailored, off-road autonomous haulage systems.

In this issue, we travel the globe, exploring automated lithium extraction efforts in Nevada (page 24), a multi-sensor approach in Namibia (42) and automated drilling in Zambia (26). Meanwhile, One overlooked topic addressed in this issue is the development of PPE for pregnant mining workers.

One South African company is providing specialised maternity clothing to combat the practice of putting women in male PPE.

We would be remiss not to address the ongoing geopolitical tensions dominating the headlines. The global competition for critical metals has intensified due to drivers such as national security, daily technologies and energy transition advancements.

If you are curious about China’s dominance in the mining industry or Greenland’s natural resources, pages 14 and 20 respectively explore these topics.

Lastly, as copper demand continues to surge due to the energy transition, we examine the financial implications of increased demand, as well as how we can work to meet it (page 34).

Saskia Henn Editor

6

COVER STORY

6

– FEBRUARY 2026 –

12

Autonomous haulage

An AI-based solution supports simplified off-road autonomous haulage systems

LOAD & HAUL

8

Better connected The advantages of underground 5G

10 Make it 3D

Epiroc’s Deep Automation navigates complex spaces to enhance fleet visualisation

Smart fleets

A look at Caterpillar’s first launches of the year, from excavators to site systems

OPERATIONS MANAGEMENT

14

18

China's rare earth grip

How Chinese critical mineral dominance came to be and what we can expect in 2026

Digital industrial motion control

German specialist ASC Sensors is harnessing advanced IMUs utilising superior Japanese navigation technology

20

What's the deal with Greenland?

Examining the potential of Greenland’s vast rare earths amid international disagreement

22 Simple by design

Rotating shaft sealing technology specialist

SealRyt explains why the best solution is often the least intricate option

SPECALIST EQUIPMENT

24 Looking for Lithium

An innovative automation overhaul prepares for greater lithium demand

26 Zambia’s quest for automation

Automated drilling across the country’s copper belt region could develop new mining frameworks

28 Is compliance enough?

A whitepaper suggests that fighting fire risks takes more than just a checklist

30 The perfect fit

A South African company has developed special PPE for its pregnant employees

PUBLISHER Jerry Ramsdale

EDITOR

Saskia Henn shenn@setform.com

STAFF WRITER

Lydia Arundel larundel@setform.com

DESIGN – Dan Bennett, Jill Harris

HEAD OF PRODUCTION

Luke Wikner production@setform.com

HEAD OF SALES & PARTNERSHIPS

David Pattison

ACCOUNT DIRECTORS

John Abey | Peter King

SENIOR ACCOUNT MANAGERS

John Davis | Darren Ringer | Roy Glasspool

ACCOUNT MANAGERS

Paul Maher | Iain Fletcher | Marina Grant e advertising@setform.com

32 A psychosocial perspective

How incorporating new mining technologies can impact key workers

MATERIALS HANDLING

34 Seeing red

A look at the deployment of new technologies at greenfield copper sites

36 Mass matters

Accounting for bulk density in conveyor efficiency

40 Digging deep

The environmental solution for elemental mercury

42 Sorting with sensors

A Namibian mine has doubled its gold grade using a multi-sensor approach

SHOW PREVIEW

44 Resilient energy

SME is kicking off the new year with Minexchange

45 An educational emphasis

The PDAC convention is entering its 94th year

Setform’s international magazine for mining engineers is published four times annually and distributed to senior engineers throughout the world. Other titles in the company portfolio focus on Process, Design, Transport, Oil & Gas, and Power.

The publishers do not sponsor or otherwise support any substance or service advertised or mentioned in this book; nor is the publisher responsible for the accuracy of any statement in this publication. ©2026. The entire content of this publication is protected by copyright, full details of which are available from the publishers. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner.

Setform Limited | 6 Brownlow Mews, London, WC1N 2LD, United Kingdom t +44 (0) 207 253 2545 e mail@setform.com

Protect your hydraulic cylinders from abrasive wear and premature failure with Seal Saver.

Seal Saver designs custom-fitted, lightweight flexible protective boots to keep your hydraulic equipment running efficiently in tough mining conditions. Each protective boot is resistant to debris, minerals, abrasions and installs in minutes.

Minimize Rod Scoring

Prevent Chemical Wash Pitting

Protect Cylinder Seals

Four Material Options Including Kevlar & Ballistic Nylon

10 Minute Install - No Disassembly Required

A Silicon Valley approach to automation technology could be key, reports

Saskia Henn

Autonomous haulage systems are rapidly becoming a useful tool for increasing productivity on a mine site. One company at the forefront of automation technology is Pronto AI.

Pronto AI was founded as an onroad autonomous vehicle technology developer in 2018 by Anthony Levandowski, the founder of Waymo. The company entered the mining and quarrying sectors six years ago as it became clear the demand was rising.

Headquartered in San Francisco, Pronto’s team of Silicon Valley veterans uses its advanced AI and software expertise to provide equipment from OEMs such as Caterpillar and Komatsu with specialised automation technology.

“We knew we had to bring more than just the technology – to be successful in this, you have to be experts in the industry,” says Pronto CFO Christian Kurasek. “You can’t just take an on-road technology and slap it on a haul truck.”

The company’s off-road AHS technology is designed in house to provide precise situational awareness through computer vision and GNSS. Advanced object detection is possible through ML capabilities to reduce false positives and avoid unnecessary downtime and shutdowns.

The technology can be tailored to a specific site through programmable software to add operational safeguards and rules of the road. All-stop buttons are provided in all manually operated equipment that interacts with the AHS. A retrofit drive-by-wire kit can be installed.

Pronto’s AHS software can learn a haul route from an operator, who manually drives once on the route. After this, operators can dispatch trucks to saved routes from their smartphones via Pronto’s mobile app.

Rovers can be mounted onto equipment to help autonomous vehicles identify and navigate around other non-autonomous vehicles. This can

help with planning, collecting data and familiarising trucks with the mine site.

“We put transponders on every piece of equipment,” says Kurasek.

“So the Pronto System – the mine’s server, which is kind of the brains coordinating everything the site –knows where everything is at any point in time.”

Traditionally, Pronto’s AHS technology only uses camera sensors with GPS to minimise potential points of failure and complex maintenance requirements. The camera and GPSbased hardware stack is lighter, faster and more affordable than radar and lidar-based systems. However, Pronto recently acquired autonomy company SafeAI, and with it, lidar and radar expertise, which can be incorporated into projects depending on customer needs, site size and safety requirements.

Pronto’s technology can adjust to different terrains. “We have guys on site every day on mines or quarry

A 2023 joint study released by Pronto AI and Whittle Consulting found that:

With AHS, the modelled mine operating with a fleet of 40t haul trucks would experience a 31% greater net present value than if the mine were operated with a fleet of 100t manually driven off-road haul trucks

Autonomy reduced truck downtime, standby and operating delays to 5% of availability (20% for manual vehicles)

The proposed theory that a greater number of smaller trucks would lead to congestion was incorrect

For more information, read the whitepaper: Autonomous swarm haulage: The economics of autonomous haulage with small trucks

sites. We do the deployments ourselves, so we’re deeply embedded in our customers’ operations,” says Kurasek.

Pronto’s ability to handle challenging conditions comes from rigorous, realworld testing. The technology has been tested in Nevada deserts, Alaskan ports, Brazil during monsoon season and most recently, Saudi Arabia.

One of Pronto’s most notable projects is with building materials specialist Heidelberg Materials. Pronto agreed in 2025 to deploy Pronto AHS to over 100 trucks operating at Heidelberg Materials sites worldwide over the next three years.

Heidelberg’s Lake Bridgeport Quarry in Texas experiencing success with its

mixed fleet of Pronto AHS-equipped Caterpillar and Komatsu haul trucks. “True scalability in the aggregates industry requires the ability to automate the iron you already own,” says Pronto CEO Anthony Levandowski. “By successfully running a mixed fleet of Caterpillar and Komatsu trucks on Pronto AHS, we have proven that autonomy is no longer a ‘one-brand’ luxury.”

The fleet includes Caterpillar 775G rigid frame trucks, Komatsu HD6058 and Komatsu HD605-10 trucks. Since the deployment of these trucks, Heidelberg has autonomously hauled over two million tonnes of limestone at Lake Bridgeport.

Pronto is never short of ideas. “We have big ambitions,” says Kurasek. “We like to say Pronto will eventually automate everything with wheels.”

For now, Pronto will continue focusing on haul trucks and begin automating other pieces of equipment in the mining industry. “Right now, our challenge is we can’t keep up with demand,” says Kurasek. “We can’t deploy trucks fast enough.” The company is currently growing its team, making hires in Europe and organising a 10-person team in Brazil. With demand for automation rising, Pronto AI will be busy for years to come.

For more information, visit: www.pronto.ai

The deployment of 5G networks in mines is surging, and for good reasons

5G can support devices even in remote or harsh conditions

In 2025, the deployment of 5G networks in mines increased, with efficiency, connectivity and safety at the forefront of the transition.

From vast pit spaces to underground areas, 5G can support devices in many remote or harsh conditions.

One example of a 5G equipped mine site is Boliden’s Kankberg in northern Sweden, which produces mostly gold and tellurium. Boliden worked

with telecommunication companies Telia and Ericsson to build a 5G underground network with new radio (NR) for the site.

“5G technology is, from the start, designed to handle mobility and roaming in a better way compared to Wi-Fi,” says Boliden director of group communications Klas Nilsson. 5G can work where Wi-Fi and 4G fail because it uses a wide range of frequencies to offer robust coverage and capacity, even underground.

Kankberg is located northwest of Skellefteå in Västerbotten county, northern Sweden

“Since we are testing vehicles that are moving from different parts of the mine, steered remotely and equipped with multiple high-definition video cameras requiring high uplink bandwidth, we need to ensure that the safety control loop in the network has priority and that the video streams have low latency,” says Nilsson.

“Roaming between cells must work seamlessly with high load. So our strategy was to design the network fulfilling these requirements. The requirement of high uplink capacity is in general the opposite way of designing public networks.”

Currently, the network is being used for testing and evaluation purposes rather than as the main production network.

Kankberg is not the only mine incorporating 5G networks into its operations. Just last year, American gold mining company Newmont deployed Ericsson 5G at Australia’s largest underground mine, Cadia goldcopper mine in NSW.

Roaming between cells must work seamlessly with high load. So our strategy was to design the network fulfilling these requirements

Similarly, Nokia and Boldyn networks also deployed a private 5G network at the copper site Callio FutureMINE in Pyhäjärvi, Finland. The idea was to provide full connectivity across tunnel networks and multiple underground levels as deep as 1.5km.

As mining companies continue to implement 5G across their sites, the value of such a deployment is becoming clearer. In addition to extended connectivity across operations, 5G sites are also experiencing more

precise operations that lead to a safer, more efficient process.

Even in Kankberg, where the 5G deployment is for testing only, the mine is seeing higher levels of interest about daily operations. “We have experienced more engagement from workers using the new technologies, such as the remote control,” says Nilsson.

So as new 5G technology finds its place in an industry with old bones, the benefits of 5G are emerging and becoming more convincing than ever.

As 5G is playing a transformative role in the mining industry, here are some of the ways that it is impacting mining operations:

Safety: 5G can extend to wearable devices and monitoring systems to provide a rapid response

Autonomy: A stable connection across deep and vast mine sites supports autonomous operations across fleets

Real-time data: Sensors provide instant data

A sustainable path forward: The more precise the data, the more that can be done with it

visualisation for underground haulage just got easier

Acommon concern when incorporating automation into haulage is the potential for operations to run more slowly as the trucks adjust to an unfamiliar site.

Mining operations feature complexities such as ramps and extreme depths that could make it more difficult to coordinate traffic or visualise safe routes. This is why having a robust digital foundation is vital to running a safe and productive mine site.

Epiroc has brought autonomous truck haulage into 3D, enabling advanced fleet control across multi-level ramps for underground operations. The technology, called Deep Automation, was developed and tested at Agnico Eagle’s Odyssey Mine, a gold mine in Quebec.

“Epiroc’s Deep Automation makes fast, intelligent decisions to boost safety, reduce downtime, and increase overall efficiency. Whether machines are sharing ramps or collaborating on joint assignments, Deep Automation ensures optimal task completion,” says Johannes Mutamba, global project manager of Deep Automation at Epiroc’s Underground division.

Following hands-on research at the Canadian mine, Deep Automation can eliminate deadlocks and delays with intelligent traffic management. Meetand-pass encounters at pre-defined locations help the trucks to proactively avoid encounters, even at narrow drifts where passing is impossible.

“The tests conducted at the Odyssey mine demonstrate tangible progress and confirm that the solution is moving in the right direction. This innovation paves the way for more efficient and safer operations, and it is encouraging to see the trials progressing successfully,” says Ghislain Couture, Agnico Eagle’s Odyssey Mine superintendent automation.

The desired automation can be simulated in 3D before a truck’s tires touch the dirt, to simulate different solutions. Operators then set up a safety system to ensure that safe

access control is guaranteed before recording, turning and teaching routes to the smart trucks.

Once the site is running and autonomous trucks have been trained, it is possible to take control of safety, production assignments and autonomous traffic in real time.

The 3D automation technology is compatible with a range of trucks, including various Epiroc Scooptrams and Minetrucks. This includes the Epiroc Minetruck MT54 S and MT65 S.

The MT54 S and MT65 S are high-capacity underground haulage trucks, now with smart features offering high ramp speeds. The MT54 S features an increased speed b up to 6.5% going up the ramp, lowering fuel consumption per hauled tonne.

This is possible due to the updated transmission and optimised gear selection that ensures gear shifting occurs at the right time and place.

The MT65 S has the highest payload in its segment, and its updated drivetrain helps the truck go faster up the ramp as well as downhill. Live data and the truck’s smart control system (Rig Control System) helps operators remain informed while increasing the number of cycles per shift.

With the use of Deep Automation, the MT65 S can continuously operate on autonomous hauling loops even during blasting and venting out blast fumes. Operators can control these from a safe distance.

For over 45 years, we’ve been at the forefront of innovation, providing advanced Sizer technology to industries around the globe. Whether it’s soft, sticky material or hard abrasive rock, our tailored Sizers and Sizer Stations, powered by cutting-edge technology, offer reliable and efficient solutions to simplify the complexities of modern mining operations.

As a turnkey provider, we bring both the expertise and the equipment to deliver end-to-end solutions—from initial concept and design, through to manufacturing, installation and ongoing aftersales support. We’re not just a supplier; we’re your partner on a sustainable journey, committed to helping you optimize performance, reduce costs and achieve long-term success.

Caterpillar has started the new year by introducing several new product lines aiming to support autonomous mining operations.

“By embedding autonomy into construction workflows, we’re reshaping the industry to achieve safer jobsites, better jobs and easy precision that redefines productivity for the modern jobsite,” said Caterpillar chief technology officer Jaime Mineart.

The intelligent machines are built with a mix of AI, machine learning, computer vision and edge computing. Integrated LiDAR, radar, GPS, and high-resolution cameras provide a 360-degree, constantly updated digital view of the jobsite, enabling precise and reliable autonomous operations — even in complex and chaotic environments.

Autonomous and smart mines are becoming increasingly prevalent. Last year, GlobaData’s Mining Intelligence Centre tracked 3,832 autonomous haul trucks operating on surface mines

around the world in a report titled “Development of Autonomous Trucks in the Global Mining Sector”.

The report found that China currently leads the way forward in the use of 2,090 autonomous haul trucks, even more than Australia, which previously held the top spot.

Chn Energy Investment Group (China Energy), a state-owned energy conglomerate, operates the largest truck fleet in the world, operating with 509 units. China Energy is the world’s largest company for thermal power, wind power, coal mining, electricity generation and chemicals.

However, Australia still has an established fleet with major operators such as Rio Tinto. Canada and Chile follow in the third and fourth spots.

The report also determined that Caterpillar is one of four original equipment manufacturers (OEMs) that make up 88% of all autonomous truck brands tracked in the report. The other OEMs were Komatsu and Chinese OEMs Tonly and LGMG.

For more information, visit: www.caterpillar.com

The intelligent machines are built with a mix of AI, machine learning, computer vision and edge computing

• Excavators: Autonomous trenching, loading, grading and more

• Loaders: Material handling and truck loading, powered by autonomous navigation and real-time data processing

• Haul trucks: Off-road machines that carry and distribute massive amounts of materials like rock, soil and minerals

• Dozers: Precision grading and earthmoving for optimal efficiency

• Compactors: Automated surface preparation, ensuring consistent quality and safety for construction

• Site Optimisation: Cat VisionLink and Cat MineStar site systems connect fleets and enable coordinated, intelligent operations across the jobsite

How rare earths became strategic and why diversification won’t be easy, reports Lydia Arundel

China has been able to dominate the global rare earths supply chain, thanks to its willingness to bear the brunt of the consequences. Rare earths are essential to clean energy, advanced manufacturing, and defence, making it a strategic vulnerability for governments and industry to have the production and supply concentrated in one country.

HOW DID CHINA GAIN ITS DOMINANCE?

Since the 1980s, China has invested in rare earth mining, processing and refining, which happen to be the most complex, polluting, and costly stages of production. Rare earths are not

rare, but the ability to separate and purify them requires multiple energyintensive steps and generates toxic, sometimes radioactive, waste.

China was willing to bear the environmental and human costs to build this capacity. In regions such as Inner Mongolia, home to the world’s largest rare earth operations, mining and processing have created toxic tailings ponds, contaminated water supplies, and added to pollution.

For years, workers and nearby communities were exposed to heavy metals, radioactive materials and toxic dust, resulting in heightened rates of respiratory illness, bone disease, and other long-term health issues. Under China’s state-led

system, local opposition had little to no weight behind it, enabling production to continue regardless of its consequences.

This tolerance for consequences has allowed China to continue to scale production, lower global prices, and reshape supply chains. As rare earths became cheaper, Western processing facilities closed due to stricter environmental regulations and political costs. Despite the fact that mining continued outside of China, ores were increasingly shipped to the country for refining. This helped China gain control of around 70% of global rare earth mining and over 90% of processing by the early 2020s, leaving the rest of the world strategically dependent.

Being able to reduce dependence on China would take more than opening new mines. The choke point lies in processing and refining, as in democratic countries, strict environmental regulations, lengthy permitting processes, and local opposition make building facilities for these processes slow and politically controversial. The conditions that China tolerated to gain dominance make recreating its ecosystem a years-long project.

Advanced economies are starting to coordinate their response to China’s dominance. At a meeting in Washington, finance ministers from the G7 agreed to accelerate efforts to reduce overreliance on China for critical minerals, citing shared vulnerabilities across energy, manufacturing, and defence supply chains. Officials emphasised the need to ‘derisk’- diversifying supply while maintaining market stability, instead of pursuing full decoupling.

The G7 has launched a critical minerals cooperation plan, focusing on monitoring shortages, coordinating responses to market disruptions, and jointly diversifying mining, processing, manufacturing, and recycling.

The participating countries account for over 60% of global rare-earth demand and are exploring means such as minimum pricing and shared labour and human rights standards to counter what they see as structurally underpriced Chinese supply.

In the US, this shift is prevalent in the proposed Dominance Act, which hopes to align diplomacy, development finance, export credit, and workforce policy around critical minerals. Rather than relying entirely on domestic production, the strategy prioritised building supply chains with trusted allies, formalising leadership in the Minerals Security Partnership, and coordinating government agencies to support projects across the value chain.

Already this year, the US has also introduced bipartisan legislation, the Securing Essential and Critical US Resources and Elements (Secure)

Being able to reduce dependence on China would take more than opening new mines. The choke point lies in processing and refining

It is also important to rebuild human capital, as ageing mining workforces and specialised processing skills are in short supply

Minerals Act of 2026. This act aims to establish a Strategic Resilience Reserve (SRR) to encourage domestic production and processing of minerals needed for electrification, clean energy and national defense.

Success would unlikely see China left out of global critical mineral markets. Instead, success will involve reducing concentration risk until supply chains are resilient to political pressure, making it so that no single country can control the majority of processing capacity, no single export restriction could cause a market panic, and no defence or energy system would be dependent on a politically exposed supplier. This

would involve commercially viable processing hubs outside China, longterm offtake agreements among allied producers and manufacturers, pricing structures that reflect environmental, labour, and security costs instead of short-term cost minimisation. Japan’s experience of decreasing its dependence on Chinese rare earths from around 90% to 60% has provided a partial model: diversification without delusions about speed or cost.

It is also important to rebuild human capital, as ageing mining workforces and specialised processing skills are in short supply, and success is as dependent on training engineers, metallurgists, and project financiers as it is on new mines. Targeting younger populations for training could help

to plug the gap between the older, retiring workers and new generations of miners.

China’s dominance in the mining industry was forged over decades of investment, state direction and a tolerance for environmental and social costs.

Trying to reverse the concentration will require long-term coordination, patient capital, and an acceptance of higher costs in exchange for greater resilience. To be successful in this, China will not be excluded from global markets; instead, success would be achieved by ensuring that no single country can exert overwhelming control over the global supply chain again.

You’re looking at the first XNO® powered hybrid vehicle.

Unveiled by Switch Technologies, this pioneering development gives mining operations high performance electrification with a low total cost of ownership.

XNO®, Echion’s uniquely robust anode

INTRODUCING THE SLR® System

• Up to 5x More Crush Resistant

• Clog Resistant and Reusable

• Allows for Improved Flow and Pressure Equalization

Germany specialist ASC Sensors is harnessing advanced IMUs utilising superior Japanese navigation technology

From modern mining and construction machinery to e-trucks and automated vehicles, sophisticated motion control systems share one essential requirement: For demanding positioning, tracking and navigation, the exact output of acceleration and angular velocity isn’t enough. As these applications require integration of real-time data processing with additional algorithms to obtain attitude angles, heading or GPSsupported position information for moving objects or components.

To help with these challenging tasks, the German inertial sensor specialist ASC delivers highly advanced digital inertial measurement units (IMUs) utilising proprietary navigation technology from Japan Aviation

Electronics Industry, Ltd (JAE). These IMUs were developed originally for precision excavators in mining, as well as for the aerospace industry.

“Anyone in need of highperformance digital IMUs – whether for a specific task or advanced, comprehensive motion control solutions – can now combine world-leading technology with fast availability, at very competitive cost,” says ASC Sensors general manager Renate Bay. “To maximise the productivity of your mining, drilling or quarrying operation and to ensure long-term business success.”

The JIMS-80S is a cost-effective, compact, lightweight IMU based on

micro electro-mechanical system technology (MEMS). Its three gyroscopes and three accelerometers capture all six degrees of freedom (DOF). This IMU was first developed to assist a multinational producer of heavy mining equipment in securing position control of excavator components.

The measurement range of the JIMS80S’s inbuilt accelerometers is ±8g, while the gyroscopes feature ±300°/s. Supported via RS-232 standard or CAN digital interface, it provides precise real-time measurements of angular rate, acceleration and attitude angle. Beyond mining and construction, this reliable industry grade IMU is frequently leveraged in precision farming, industrial plants, commercial and utility vehicle orientation and navigation as well as robotics.

For nearly 70 years, JAE has developed inertial sensors and other components for Japan’s high-speed Shinkasen trains

Autonomous vehicles in mining are controlled by a combination of innovative technologies including inertial sensors, GPS, laser sensors, cameras and radar. These help operate heavy machinery such as trucks and excavators without human drivers. This improves safety by removing humans from hazardous environments. Vehicles stop automatically when an obstacle is detected and can be controlled remotely in case of emergency.

This approach further strengthens the efficiency and sustainability of mining operations: Autonomous systems perform work shifts without interruption, which increases productivity. They enable precise planning and reduce congestion and setup times through consistent speeds. Lastly, autonomous vehicles and machinery may reduce emissions, particularly through the use of electric drive concepts.

JAE’s advanced JCS-7603 is a tactical grade performance IMU utilising industry-leading MEMS gyroscopes and accelerometers. With six DOF, it supports the most demanding scenarios including the navigation, control and localisation of automated mining vehicles and equipment.

The JCS-7603 provides accurate angular rate up to ±400°/s,

acceleration up to ±10g, attitude (pitch, roll, yaw), heading, velocity and – combined with optional GPS information – position. Configuration and operation are supported via standard RS-232 or RS-422 digital interface. The IMU features a gyroscopic bias stability of <0.1°/h and an angular random walk of <0.02°/√h, while the integrated accelerometers achieve a bias stability of 15g. An optional embedded GPS receiver is available on request.

Both the JCS-7603 and JIMS-80S IMUs are mounted in a compact unit with optimised outputs, using specially developed algorithms. They feature standard digital interfaces and come in robust water – and dustproof IP67 housings to withstand tough conditions and climates. Designed for convenient integration in diverse measurement ecosystems, they enable a wide range of versatile uses.

For nearly 70 years, the international technology provider Japan Aviation Electronics Industry, Ltd (JAE) has been researching, developing, manufacturing and implementing diverse technology solutions for a range of industries. For example, the company’s inertial sensor technologies and other high-tech components help control, navigate and protect Japan’s efficient network of high-speed

Shinkansen bullet trains, as well as its metro transport systems carrying millions of commuters every day.

JAE’s advanced sensor systems are available to support demanding challenges in more than just East Asia. Through ASC Sensors, customers can access JAE’s advanced IMUs and other sensor technology innovations right at their doorstep in central Europe.

JAE’s inertial measurement units may be delivered to EU member states without a need for complex export licenses. In central Europe, they are available through ASC Sensors. This typically means fast availability, installation or resale and more flexibility to leverage these IMUs for international collaborations and customers.

Using ITAR-free components, JAE IMUs avoid the rigorous US and other comprehensive export licensing processes that often require time-consuming form and data submissions, extensive documentation, meticulous process adherence and, ultimately, high-level federal approvals. It is in these circumstances, after all, that the desired product might not arrive in time for a project start, or not at all.

Greenland could help diversify the rare earth supply chain – but it’s not as simple as it sounds, reports Lydia Arundel

The news has been saturated with US President Donald Trump attempting to stake his claim over Greenland, a region of Denmark, but why is the island gaining so much attention?

The answer lies with China, and how dominant the country has become over the rare earth supply chain. Rare earths are critical to electronics, renewable energy, EVs, and defence systems, meaning everyone wants them, but it seems only one country has them.

China currently has control over the majority of global rare earth refining and exports, with about 70% of mining and up to 90% of processing capacity. This has given China control over the supply chain and left the rest of the world vulnerable to any export restrictions the country wishes to impose, leaving them no choice but to seek other sources. This is where Greenland comes into play.

Greenland’s deposits of rare earth reserves and uranium make it an attractive alternative to China, with the Kvanefjeld deposit alone containing billions of tonnes of rare-earth oxides.

The island is thought to have close to 20% of the world’s rare earth reserves, making it a hot commodity in the eyes of Trump and forcing the prime minister of Greenland to state the island is not a “piece of property that can be bought”.

While the country is not for sale, Greenland is seeking to develop its mineral resources to diversify its economy away from fishing and Danish subsidies to create long-term, skilled jobs for its population. Local support, however, varies by project, with many concerned about the impact on nature, hunting, and fishing.

Despite what seems like the entire world, barring China and Greenland, wanting to mine the Arctic island, things are never simple. Up to 80% of Greenland is covered by an ice sheet, with the remaining 20% made up of mountainous terrain, steep cliffs, and deep fjords, not to mention the arctic to subarctic climate.

The environment is only one barrier making mining difficult. Most sites are only accessible by boat or helicopter due to a lack of roads. Any mining

company will have to build everything from scratch, including ports, power, housing, and processing plants.

Political and regulatory challenges also cause issues. Greenland has strict environmental laws, which can create public opposition against mining projects, particularly from local communities concerned about the environmental consequences.

For example, the 2021 uranium mining ban that blocked the Kvanefjeld project was put in place due to fears of toxic waste. This was a win for the local community but a significant loss for the Australian firm, formerly known as Greenland Minerals, which is now seeking around $11.3b in compensation from the Greenlandic government due to the ban halting the Kvanefjeld project. The firm spent 15 years and significant capital working toward approval.

Mining in Greenland would provide an alternate rare earths source, loosening China’s grip on the supply chain, but the island’s terrain, climate, and environmental regulations make it no easy feat to achieve.

Unexpected water ingress and poor ground conditions can cause significant delays and escalate costs. To counteract these risks, an economical approach is to pre-inject the ground ahead of the advancing face using microcements. MasterRoc ® MP microcements provide extremely effective penetration into fine cracks in rock and fine-grained soils to give efficient water tightness, stability and durability.

Foaming, water-sensitive polyurethanes combat water ingress quickly and effectively. Many of the products for preventing water ingress can be adjusted on site to suit local conditions.

The fast reacting and non-water-sensitive polyurethanes and polyurea silicate systems quickly stabilize poor ground and are suitable for strata consolidation and rock reinforcement. Specially developed foams are used for cavity filling and sealing bulk heads.

Mechanically stable sealing approaches are gaining traction

Mining operations demand reliability from pumping systems that operate in some of the harshest conditions. Abrasive slurries, corrosive media, high solids content, and continuous duty cycles create an environment where even wellengineered components struggle to survive. For decades, the industry default has been to apply increasingly complex mechanical seals in the hope that more precision would yield better results. In practice, the opposite has often been true.

Across mineral recovery circuits – from tailings handling and dredging to flotation and thickener underflow – the most common sealing problems are not seal-face failures. They are shaft movement, stuffing-box washout, and excessive flush water use. Abrasive slurries quickly erode sleeves and packing when the shaft is unstable, forcing operators to compensate with higher flush rates. The added water dilutes

Peter Chilton marketing manager at SealRyt

slurry, increases operating costs, and accelerates wear downstream. It also puts pressure on water availability –an issue that is becoming increasingly critical in many mining operations.

This is where simpler, mechanically stable sealing approaches are gaining traction. Instead of relying on delicate sealing faces and tight tolerances that assume ideal conditions, these systems focus on stabilising the shaft and controlling the sealing environment first. By restricting solids entrance and supporting the shaft with closeclearance bearings, packing-based systems can operate reliably without constant adjustment or excessive water. Unlike mechanical seals, these solutions rely on simple, tough components with no moving parts. Fewer failure modes mean greater tolerance for vibration, solids, and misalignment – conditions that are unavoidable in slurry service. Mining operations can’t afford extended downtime waiting on specialised replacement parts or overseas supply chains. Manufacturers

like SealRyt Corp. have responded by offering custom-engineered sealing systems with rapid turnaround – often designed and shipped in a matter of days, not months. That speed matters when uptime directly affects throughput and supply objectives.

The real-world results speak for themselves. At a mining site in the western United States, a dredge pump was being repacked twice per day, with shaft sleeves replaced every two weeks. The cost wasn’t just labour and parts – it was lost production time and excessive water consumption just to keep the pump running. After installing a PackRyt Bearing System with a properly matched packing configuration, the pump operated continuously for an entire six-month mining season. No sealing failures, no sleeve replacement and no constant adjustment.

By stabilising the shaft and eliminating the root cause of washout, the mine reduced water demand, maintenance labour, and unplanned downtime in one move. That kind of improvement doesn’t come from adding

complexity. It comes from removing it.

As mining operations look to improve reliability, conserve water, and maximise throughput, the industry is beginning to rethink what “advanced” really means. In many slurry applications, the most effective solution isn’t the most intricate – it’s the one designed to

survive the realities of mining. Simple, rugged sealing systems built around mechanical stability are proving that sometimes, less truly is more.

Drilling down several thousands of meters requires high-tech tools and equipment. Equally crucial is the appropriate sensor technology, to keep to the exact drilling path for precise results. So are shock and heat resistance to prevent strong vibrations and high temperatures from skewing measurement outcomes while drilling through the rock strata. For the geothermal energy industry, this is enabled by ASC inertial sensor technology. Our portfolio includes high-end JAE quartz-based JA-5 and JA-25 accelerometers particularly suitable for this purpose. In addition, MEMS-based ASC OS-series accelerometers conduct accurate, stable vibration analyses on machines like hydraulic deep drilling vibrators for soil inspection and preparation, to keep them running smoothly and prevent damage.

Lithium mines and their processing facilities are getting more complicated

Due to a surge in electric vehicles and battery storage needs, the demand for lithium is climbing. In 2024 alone, lithium use grew nearly 30%, and is expected to grow fivefold from today to 2040.

However, the supply and processing of lithium is still concentrated, with 77% of raw lithium coming from just three countries: Australia (35.2%), Chile (19.3%) and China (22.3%). China is responsible for 70% of lithium refining.

As lithium supply becomes increasingly synonymous with energy security, 2025 research by extraction expert Lithium Harvest has indicated that “traditional supply is too centralised, too slow, and too inflexible to keep pace with global demand”.

To combat the sluggishness of the current lithium market, western countries are encouraging domestic lithium projects such as Lithium Americas’ (LAC) Thacker Pass

Lithium Project in Nevada. In fact, the home of the Thacker Pass site, McDermitt Caldera, is the world’s largest known lithium deposit, containing 20m-40m metric tonnes of lithium-rich clay.

Industrial equipment specialist Emerson is providing advanced automation to help develop the mine.

“Working with Emerson is expected to help us fulfil our purpose to safely and sustainably produce lithium from Thacker Pass,” says LAC president and CEO Jonathan Evans. “Their automation technologies will help us enable North America to reduce dependence on foreign critical minerals and drive value for our stakeholders.”

Construction has already begun to incorporate automation architecture, such as intelligent field measurement instrumentation, process control hardware and software, final control and isolation valves, and reliability technologies to optimise

production, enhance worker safety, reduce downtime and minimise environmental impact.

“Lithium mines and their processing facilities are getting more complicated, resulting in a greater need for automation, especially when you have mine sites and processing facilities in remote or inaccessible locations,” says Emerson’s director of strategic projects for North America Alan Harris.

Partnerships such as the one between Emerson and LAC can help to support remote, autonomous operations, which are becoming attractive to mining companies for the safety and quality of life for its workers. Sharing resources across geographic and technological understandings, as part of a collaboration, rather than following the traditional buyer/vendor route, could be key to efficient lithium recovery.

“We feel this is critically important,” says Harris. “For example, LAC could foresee issues with

getting valves and transmitters repaired due to their (Northern Nevada) location. They would need to send equipment over the Sierra Nevada mountains to California, which in winter is nearly impassable due to snow and road conditions.”

Caltrol, Emerson’s Impact Partner in the region, will support the project with a local valve and instrument repair and service centre to provide expert service and maintenance.

Emerson is providing its DeltaV Distributed Control System (DCS) and AMS 6500 Machinery Health Monitor, which will provide a single operations screen from which to control the bulk of the units at the site.

“We have utilised our DeltaV CTO DCS Smart Junction Box concept with DeltaV Electronic Marshalling to move the I/O cards closer to plant equipment, significantly reducing or eliminating CAPEX costs associated with home cables, cable tray, engineering, traditional junction boxes, and construction setup equipment,” says Harris.

Electronic marshalling enables tighter control of module yard or E-house schedules by allowing the smart junction boxes to be delivered early in module yard schedules. As a result, loop check can be completed at the module yard/E-house factory

rather than at the site.

Wi-Fi infrastructure is being implemented at the site, with DeltaV software on tablets supporting mobile operations within the plant. AMS 6500 provides real-time data on different pieces of rotating equipment throughout the facility to catch any potential failures early.

In addition to Wi-Fi infrastructure, Emerson will also provide final control technologies including Fisher control valves, isolation valves, pressurereducing and relief valves. Measurement instrumentation technologies such as Rosemount transmitters

As direct lithium extraction technologies develop, more advanced process control approaches could be required. “While DLE is new, we expect this to be the future of lithium extraction once the technology is proven in use,” says Harris. “Automation will be used in the water, wastewater, acid plants, heat recovery and power generation in acid recycling (if applicable to the plant), along with the traditional units, such as flotation, crushing and milling, for example.”

Thacker Pass Phase 1 is expected to produce up to 40,000t of batteryquality lithium carbonate per year – enough to support production of batteries for up to 800,000 electric vehicles annually.

Mechanical completion is targeted for late 2027.

Copper company First Quantum is introducing automated drilling technology at its Sentinel Mine in Zambia.

Sentinel is the country’s biggest infrastructure project since the construction of Kariba Dam 67 years ago, and already features advanced technology including the world’s largest steel-ball mills and semimobile rope shovels.

Three automated drill machines were tested at Sentinel in December 2025, operated by First Quantum’s subsidiary Trident Mining in partnership with the supplier, Flanders Inc. Following the test’s positive results, Flanders aims to open a Zambian office to support the rollout of automated drilling, as well as strengthen local capacity for the technology.

“This investment helps us improve productivity while keeping workers safe and protecting jobs,” says Zambia country director Anthony Mukutuma.

Training for higher-skilled roles will commence, as no jobs will be lost due to the emergence of automation at Sentinel. Training will include learning how to operate the technology from

a central control room and how to serve as roaming field operators who oversee the automated drilling.

So far, the new system has introduced improvements in drilling precision, due to advanced laser sensors and GPS technology. This has led to improvements in safety, as well as blasting quality and fragmentation. The number of holes drilled has also increased by over one-third.

This type of drilling technology

is already in use in mines in South Africa, Botswana, Australia, throughout South America and the United States. With the trials now complete, the company has received the necessary regulatory approval to roll out automated drilling in Zambia.

The drilling technology is expected to help Zambia toward its national goal of producing three million tonnes of copper per year without compromising safety or job security.

The move reflects the message shared by Ministry of Mines and Minerals Development Permanent Secretary Dr Kabeta Hapenga at the Zambia Chamber of Mines’ 9th Occupational Health, Safety, and Environment Conference in October. He reminded the sector that:

“Innovation and technology remain critical in our efforts to eliminate fatalities, injuries, and occupational diseases, ensuring that every miner returns home safely.”

He added: “Our focus on enhancing environmental safety and promoting local participation through job creation and wealth retention remains paramount. We are committed to building a safe, sustainable, and technology-driven mining and industrial sector.”

MOBISCREEN MSS 1102 PRO

Powerful, rugged, versatile: The MOBISCREEN MSS 1102 PRO stands out with its exceptionally robust design. It was developed mainly for use in natural stone and for high feed capacities of up to 750 t/h. The coarse screening plant excels with its easy operation – including SPECTIVE CONNECT. For greater sustainability, the MSS 1102 PRO can be operated 100% electrically thanks to its optional dual power drive. The MOBISCREEN MSS 1102 PRO – a genuine powerhouse.

www.wirtgen-group.com/mss-1102-pro-kleemann

There are many motivators that drive a mine site’s perception of risk

When

fire risk is changing rapidly, is compliance enough?

Fire protection systems are an integral part of mining operations, and companies around the globe implement specialised solutions to meet compliance. Clear escape routes, emergency exits, ventilation and regular fire drills are just some of the ways companies support their comprehensive safety plans.

A recent whitepaper was released called “Is compliance really enough? Managing your fire risks at mining and industrial facilities”. Written by Australian fire safety and engineering company Omnii, the whitepaper explores the evolution of fire safety blueprints, how they align with today’s mining reality and whether a mining company’s duty of care is met by following minimum fire safety compliance procedures.

Modern fire hazards are everywhere. From conveyor belts and pulleys to fuel storage and refilling points, each moving part of a mining operation comes with a certain amount of risk

Modern fire hazards are everywhere. From conveyor belts and pulleys to fuel storage and refilling points, each moving part of a mining operation comes with a certain amount of risk.

For example, in Australia, the world’s leading lithium producer, lithium-ion battery energy storage systems (BESS) are a relatively ‘new’ fire risk. BESS can cause explosive fires and toxic gas release, largely due to thermal runaway, a self-heating chain reaction resulting from damage.

Because today’s fire hazards have infiltrated most aspects of mining operations, complying to a fixed standard without examining the specifics of the site could be a fatal mistake.

“Holistic fire risk management shifts

Mobile plant (the most common fire occurrence at mine sites)

Conveyors (pulleys, idlers, belt, fines)

Fuel storage and refilling points

Lube oil systems and hydraulic power packs

Transformers and substations

Hot works and maintenance activities

Poor housekeeping

Complying to a fixed standard without examining site specifics could be a fatal mistake

the focus from ‘are we compliant?’ to ‘can we keep operating after a fire?’,” says Omnii national fire protection services lead Aaron Harris. “In many mining operations the governing risk is not health and safety but loss of production, asset damage and prolonged shutdowns - those risks are rarely addressed by compliance alone.”

Housekeeping habits, conveyor operations, equipment used, and fuel storage and lube oil systems are some of the variables that could guide personalised, more effective approach.

In addition to the hazards themselves, the whitepaper found other aspects of the mining industry that can impact decisions made about fire safety. It can be useful to

consider exactly who a fire safety event impacts. Many stakeholders also have reasons for wanting to know how fire risks are handled.

“Real fire risk management comes from proactively understanding the interaction between people, assets and operations, rather than reacting after a fire has already occurred and operations have been disrupted,” says Harris.

Aside from miners themselves, parties impacted by the consequences of a fire include other employees, visitors, customers, suppliers, contractors, asset owners and operators, insurers, shareholders, governmental bodies, media and the public. All of these parties have an interest in how fire risks are managed.

There are many motivators that drive a mine site’s perception

of risk in addition to health and safety.. ires cause loss of production, asset destruction, environmental consequences, reputational ruin and legal and regulatory difficulties.

As such, Omnii’s whitepaper concludes that compliance “should be seen as the minimum standard, rather than the end goal” as it “does not meet the duty of care owed to stakeholders”. Early intervention is stressed as critical to prevent the critical shutdowns that impact so many parties.

Taking a holistic approach to the mine site’s fire safety measures could help to capture a mine site’s ecosystem better than standard compliance.

For more information, visit: https://omnii.com.au

A South African mining company has developed special PPE for its pregnant employees

Women make up 8% to 17% of the global mining workforce

Although the mining industry only employs 1% of all workers, it is responsible for about 8% of fatal occupational accidents (approximately 15,000 per year), according to a 2003 report in the Journal of Safety Research. Many technological strides such as automation and remote monitoring are making mining safer, but these digital transitions are only part of the solution. Another aspect of safe mining is the availability of inclusive personal protective equipment (PPE).

Women are underrepresented in mining, making up 8%-17% of the global mining workforce. As a result, finding PPE that fits women appropriately is challenging, and in some cases, women are expected to don smaller menswear sizes. This leads to workers wearing ill-fitting PPE that compromises safety, reduces mobility and creates distractions.

Pregnant women, in particular, struggle to find PPE that fits appropriately. Anglo American’s South African mining company,

Kumba Iron Ore, has launched a maternity PPE initiative to develop specialised safety equipment designed for expecting mothers.

“This initiative shifts the needle in our industry by recognising that motherhood is a vital and supported part of our workforce’s journey,” said executive head of corporate affairs at Kuba Dr Pranill Ramchander. “We’re moving beyond basic legislative compliance to create an environment where women can bring their whole selves to work.”

Clothing gets caught, potentially on machinery

Goggles have gaps that expose the eyes and face

Trousers must be pulled up frequently

Gloves let air in or feel roomy

Layering clothes makes them fit more securely

Having to adjust your gait to accommodate large shoes

The programme is led by the Kumba Women in Mining (WiM) committee under Kumba’s transformation expert Kutlwano Takadi’s leadership. Under the programme, specialised maternity PPE is offered across all Kumba operations. The PPE comprises custom-designed, safety-compliant maternity two-tone Velcro shirts and maternity jeans.

In addition to tailored maternity PPE, the programme also offers maternity hampers and lactation facilities for new mothers. This approach is in line with 2025

research from the National Library of Medicine, which states that those who feel a sense of belonging tend to experience more motivation within organisations that value diversity and equity.

The maternity PPE initiative has created a structured and meaningful experience of inclusion that benefits organisational culture, according to Ramchander.

Kumba is now making plans to ensure the programme’s longevity for future employees.

As mining technology evolves, so does

Mining is a rough industry that can impact worker health in many ways.

Repetitive strain, dust, toxic gases and isolation are just some of the reasons miners can suffer physical, psychosocial and mental distress in a mining environment.

Such stress is well documented. In 2024, an epidemiological study in the National Library of Medicine journal was conducted with in-service workers. It found that workers’ immune function, renal function and anaemia risk were negatively impacted by working in a coal mining environment.

As mining technologies evolve to become more efficient, precise and eventually cost-effective, workers are constantly adapting to new workplace procedures and designs. According to 2026 research in Technological

The 2026 research also points to digital advancements introducing technological malfunctions, operational errors, cognitive overload, reduced job satisfaction and security risks

Forecasting and Social Change, this is leading to a muddled understanding of how automation, predictive maintenance, real-time data and simulations can impact miners. So, while the automation of dangerous tasks and the benefits of real-time information seem straightforward, the implementation of new technologies rarely comes without hiccups.

The 2026 research also points to digital advancements introducing technological malfunctions, operational errors, cognitive overload, reduced job satisfaction and security risks. While these phenomena can be considered anticipated challenges to be solved, the research suggests failing to address them early could “lead to increased stress, decreased engagement in safety or resistance to technological adoption, ultimately undermining the intended

benefits of automation”.

Given that the industry is entering a paradigm of technological advances and given that that human beings are some of the least predictable aspects of a mine site, it could be beneficial to invest in targeted stress management assistance.

An Australian case study from the National Library of Medicine found that stressed mining employees were associated with an average of 33.6% work impairment and $45,240.70 in productivity costs per employee. The study also found that stress management assistance is most effective when employees are convinced of its value, indicating that a steady embrace of safety culture could change people’s minds about wanting help.

Technological advances yield a variety of physical, psychological and social effects on workers, particularly for those working directly with machinery.

Although it is unclear what some of these effects may be, monitoring the impact of new technologies on employees’ physical, social and psychological wellbeing could pay off in the long run.

Demand for copper is increasing exponentially, which has led to the deployment of new technologies to greenfield sites. Nicola Brittain reports

Copper is one of the oldest metals known to man and remains one of the most in demand. The red element conducts heat and electricity and is non-corrosive, making it brilliantly suited for use in electronics. This combined with the surge in electrification and green energy in recent years (and the corresponding EVs, solar panels, wind turbines etc) has put a lot of pressure on mining companies to deliver the product, which in turn has increased demand for technology to enable this.

Perhaps an even bigger driver is that of electrification and AI data centres. Ian Harris, the CEO of tier 1 project Copper Giant, explained on a recent Commodity Culture podcast that this is the single biggest catalyst for demand. He said: “big technology companies simply can’t live without

copper because they are desperate not to lose the race on AI. They will pay anything to enable the build of their new data centres.”

The International Energy Agency expects demand to reach 41 million tonnes by 2050 from 2023’s 26 million tonnes. Supply constraints such as declining ore grades, accidents, limited water supply, and longer project lead times has led to companies collaborating to lower their costs.

S&P Global estimated that there were about 57 copper focused M&A deals between 2021 and 2024, significantly more than in the previous five years.

US trade uncertainty and tariffs creating market spikes and dips have also influenced the mining industry. There has been a rush to build

greenfield projects with one of the big stories of the last quarter being that global mining giant Rio Tinto has successfully produced copper from the Johnson Camp mine in Arizona - this is the first US mine to produce copper in a decade.

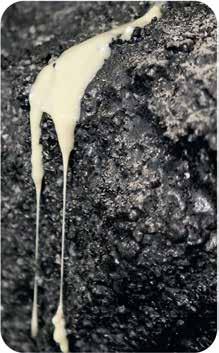

The company is using a technology called Nuton. Nuton is a proprietary bioleaching practice that relies on microorganisms that are grown on site and used to deliver a ‘heap leach pad’, targeting production of approximately 30,000 tonnes of refined copper over four years, according to the company. The aim is to support the domestic copper supply chain.

Rio Tinto copper chief executive Katie Jackson says: “This is a breakthrough achievement for our Nuton technology, which is proving that cleaner, faster, and more efficient copper production is possible at an industrial scale. In an industry where projects typically take about 18 years to move from concept to production,

MicroHammer reduces copper extraction energy consumption by over 20% while increasing production by almost a third

rock and make it possible to extract the copper without completely grinding the ore.

MicroHammer reduces copper extraction energy consumption by over 20% while increasing production by almost a third, according to Teledyne e2v. This could lead to big gains for an industry whose capital expenditure runs into billions of dollars.

Finnish company Metso is providing key process equipment for a copper smelter in Asia

Nuton has now proven its ability to do this in just 18 months.

“Nuton has designed a modular system deployed as a technology package integrating biology, chemistry, engineering, and digital tools, allowing it to be rapidly scaled and tailored to different ore bodies, unlocking resources that have historically been considered uneconomic or challenging.”

Nuton relies on naturally occurring microorganisms to extract copper from primary sulphide ores, which are traditionally difficult to process. These microbes, grown at large scale in Nuton’s proprietary bioreactors, accelerate the oxidation of minerals in the crushed ore heap, generating heat and enabling copper to dissolve into a leach solution, which is then processed into 99.99% pure copper cathode.

Significantly, processing copper ore with Nuton eliminates the need for concentration, smelting and refining, shortening supply chains and

delivering copper cathode at the mine gate. It achieves recovery rates of up to 85% from primary sulphides, the most abundant copper bearing ores in the world.

A related story involves Amazon Web services. As explained, AI supporting data centres are arguably the biggest current driver of copper; as such AWS recently signed a mega deal with the Arizona Rio Tinto mine, locking down the first domestic copper supply in more than a decade.

Other technology being deployed to extract copper to meet this surge in demand includes MicroHammer from Teledyne e2v. This technology utilises microwave technology to heat and expand the copper grains, causing them to split from the encasing rock. The microfractures weaken the host

Working with mining corporation Rio Tinto, a team from Nottingham university developed a demonstration system processing over 150 tonnes of rock per hour. Using numerical simulation and experimental validation, they showed that this could be expanded, developing the largest microwave processing system ever constructed, capable of processing up to 3,000 tonnes of rock per hour – the scale required for commercial use in a mining environment.

In other developments, the African division of KoBold is using AI technology to source copper from a region in Zambia – geologist had previously overlooked it. The company, founded in 2018 used AI to analyse vast geological datasets as well as drilling information from the region.

Other big copper stories over the last quarter include technology giant Metzo being awarded a contract with newly reopened copper mine in Kiruna, Sweden to supply two horizontal grinding mills worth EU16m. The delivery comprises Select SAG and ball mills engineered for rapid execution making them ideal for mine starts

For more information, visit: https://nuton.tech

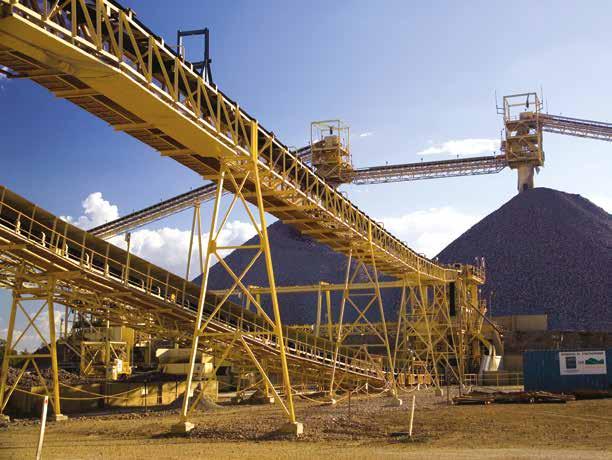

Accounting

Regardless of what is being handled, the belt’s vibration causes material to settle, with the heavier material on top and the lighter material on the bottom

The connection between bulk density and conveyor efficiency is often overlooked, but neglecting this link can cause equipment failures and downtime. During stoppages, operators may misidentify the issue, sometimes fabricating solutions or implementing costly equipment upgrades that address only symptoms rather than the underlying causes. This leads to additional problems later.

Each industry and operation establishes its own rules based on various factors: material type, environment, spatial or logistical constraints, regulatory compliance, and production demands. Today, many industry rules are not grounded in current engineering best practices, often defaulting to doing things the “same as before”.

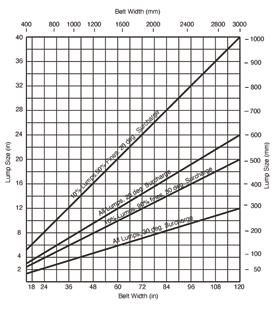

Most conveyor design principles were developed through early trial and error. Some early system design manuals are based on testing, but the original data has been lost, leaving engineers without a reason why the system is designed the way it is. Table 1 features common conveyor design guidelines that contradict each other.

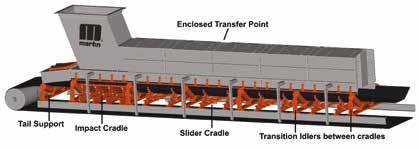

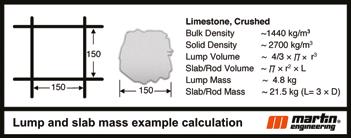

In Table 1, the references state that the lump size is to be considered two to three times the nominal or specified lump size. The lump size also influences idler selection due to impact forces [Fig. 1].

Selecting the maximum lump size also depends on if the material fractures into lumps or slabs. A flat slab, such as shale, could be much longer than two to three times the standard, while lumps tend to be roughly spherical.

For example, just because experience shows that limestone flows well on a 50-degree chute slope on one conveyor does not mean material from another pit or seam will flow down the same chute.

Bulk materials are hard enough to handle when they are consistent in size, share similar physical

properties, and shed roughly the same percentage of fines. In Figure 2, if the bulk density of 1440kg/m3 is used rather than the solid or specific density of 2700kg/m3, the mass used for idler and impact cradle selection would be nearly 50% underestimated, almost guaranteeing premature failures. For a slab or rod shape, the error could be significantly more than if using the nominal lump size.

Lump or slab mass is a direct variable inputted into the idler that impacts cradle selection methodologies. Correct maximum size and mass calculations are crucial for belt selection [Fig. 3]. As the percentage of fines increases, the maximum lump size that can be tolerated on narrower

Durable skirtboard liners are wear parts that can absorb the impact and shifting from loading

belts also increases. In this example, 150mm lumps with 10% fines, under a 30-degree surcharge, can be processed on a 900mm belt, whereas if the material consisted entirely of lumps, a 1600mm belt would be needed.

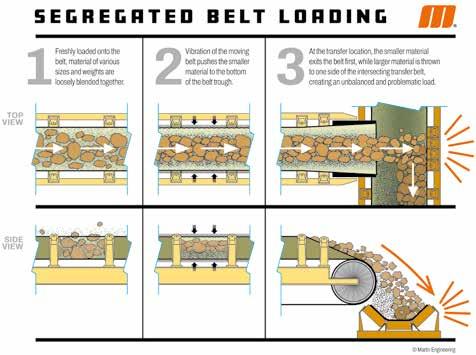

Regardless of what is being handled, the belt’s vibration causes material to settle, with the heavier material on top and the lighter material on

the bottom. When transferred to a perpendicular (90º) belt without using a chute or rockbox, larger material tends to discharge first and land on the far side of the belt. Fines have been found to accumulate at the near side of the belt. This is called “Segregated Belt Loading.” Since material will settle in the lowest point of the belt, it will begin to drift, with one side riding higher than the other [Fig.4].

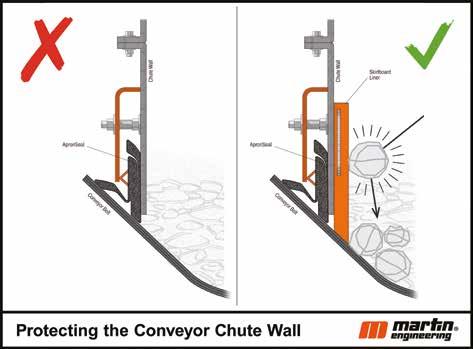

This highlights the importance of a well-designed chute wall, also

known as a “skirtboard”. The design should include skirtboard liners and skirting. Durable skirtboard liners are wear parts that can absorb the impact and shifting from loading. Skirtboard liners should feature external adjustability and removability to avoid confined-space entry [Fig.5]. Automatically adjusting skirting, or dual-seal skirting, reduces the need for maintenance and fine-tuning as it wears from friction.

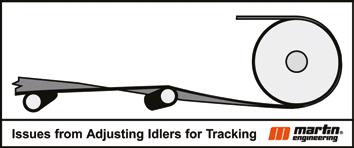

Tracking equipment location is critical to system performance. Recommended positions are before the belt enters the tail pulley, after the loading zone, before the belt discharges, and before the belt enters the takeup pulley. Most belt tracking problems are related to misalignment of the structure, pulleys, and idlers, not the absence of enough training idlers [Fig.6].

With the increased emphasis on efficiency and safety, using “same-asbefore” rules is unlikely to mitigate spillage, causing equipment fouling, belt mistracking, and unnecessary exposure to safety hazards. Aligning production expectations with the system’s specifications by installing modern accessories that improve the conveyor’s performance and safety compliance helps operators avoid unscheduled downtime, reduce the cost of operation, and shorten the return on their investment.

A Texan waste compound is disposing of mercury, making gold mining more sustainable

Artisanal and small-scale gold mining (ASGM) is estimated to be responsible for 37% of the total 2200t of elemental mercury released by humans annually, according to the UNEP Global Mercury Assessment 2018. This makes mining the world’s largest source of anthropogenic mercury pollution.

Waste management specialist VLS Environmental Solutions has developed a patent-pending solution that removes mercury from the biosphere. In a webinar hosted by Global Mining Review’s editor Will Owen, VLS explained its mercury disposal method.

CSO of VLS Robert Wheatly presented with Jimmy Bracher, former president of waste disposal service Texas Molecular, as well as VLS sales VP. VLS acquired Texas Molecular in 2022. “Jimmy and his team - our chemists our scientists over there - they came up with the solution,” said Wheatly.

Mercury is transferred to a cumulation vessel and undergoes a chemical transformation process, which converts it into stable liquid. The solution is then injected into secure wells out of the biosphere.

The chemical transformation occurs in an enclosed building. Nitric acid acts as a reagent to dissolve the mercury, which is evacuated out of cannisters and into the reactor. Once the solution is fully solubilised in the acid, it goes through a series of scrubbers to the final formation. By the time the conversion occurs, a typical batch run takes up to four hours.

Since 2021, VLS/Texas Molecular has safely disposed of over 67m gallons of mercury-contaminated waste, all privately generated in multiple industry sectors.

“We’ve been handling mercury in diluted form for years. This is the

chance for us to bring in elemental mercury and convert it to materials we’ve already been processing, and which are very similar to that,” said Bracher.

VLS’ Deer Park facility in Texas is the largest waste disposable facility in the US. It contains Class I underground injection wells, with a no-migration petition. The specialised and regulated wells enable the deep disposal of hazardous industrial waste, including waste from gold mining. The wells penetrate Earth’s lower Frio layer (7,200ft deep), and are about 5,000ft below any drinking water tables in the US.

“There are only a few areas in the US that have the proper geology for these types of injection wells, and they are mostly along the Gulf Coast and up around the Great Lakes,” said Bracher. However, Bracher notes the

Texas location has pulled material out of about 30 different states.

Equipped with layers of conduit, surface and long string casings and epoxy resin cement, the wells remove mercury from the biosphere, ensuring it never re-enters the air, discharges into the water or sits in a landfill seeping into water tables.

While the permitting is challenging, the infrastructure and capacity for mercury disposal already exist at Deer Park and have demonstrated its success. Gold mining remains a significant source of mercury pollution, so the development of sustainable methods for its storage and disposal is critical.

A Namibian mine has doubled its gold grade using a multi-sensor approach

Navachab Gold Mine in Namibia has invested in Steinert KSS EVO 6.0 sorters to increase gold recovery, replacing its single sensor Steinert XSS T with newer dry sorting technology.

The open pit mine situated near Karibib is the oldest in Namibia, with the area’s first gold discoveries occurring in 1899. The Navachab gold deposit specifically was found in 1984 during geochemical sampling for carbonate-hosted gold deposits,

The 35m-thick ore body is estimated to contain 10.4m tonnes of ore with average grade of 2.3g of gold per tonne.

Since Navachab’s early days of discovery, the mine has made notable advances in its operations, which most recently includes the deployment of its modernised, multisensor sorting technologies.

Steinert’s EVO 6.0 multi-sensor generation uses a combination of colour detection, laser 3D detection and inductive sensors to detect different non-ferrous metals through its dense media separation (DMS) technology.

“I think the computer programs hold the key to sorting,” said Navachab project manager Hildebrand Wilhelm. “The more of a holistic view you have, the better you can decide what technologies can work, as long as you understand these technologies.”

DMS technology is a gravity separation method in which a suspension material such as magnetite or ferrosilicon is used to form a medium denser than water in separation. This method offers several advantages, including flexible particle size and less environmental impact due to the lack of water required for its operation.

The Steinert EVO 6.0 sorts 200t per hour to detect material falling below the CIP plant cut-off grade. Using the dry sorting plant, Navachab claims it has been able to double its gold grade. It also says that compared to previous processes using DMS, Steinert’s dry, sensor-based sorting runs at 1/4 of the overall operational costs.

“That is where the value is generated because then – with the

doubled grade – the material can be profitably treated by the downstream processes,” said Wilhelm.

The Steinert EVO 6.0 actively extracts all non-metals with a valve bar in the case of negative metal sorting. The valve bar can be lifted to prevent the valve bank from becoming clogged during maintenance work.

A permanently integrated railing with ladders provides easy access to sensors without requiring climbing gear. An integrated rolling platform permits quick and safe access to the nozzle bar and conveyor belt. Better access to the system components helps to accelerate maintenance tasks while keeping workers at a safe distance.

The low operating costs, lack of water required and ease of maintenance have all helped bolster Navachab’s production and encourage the precise sorting.

“We are now working to ensure that the mine has a very long life,” said Wilhelm.

“Navachab will carry on running as long as we are smart about things. After all, the gold is there.”

ulk material that is getting stopped due to obstruction at material transition points can cause some serious and costly problems: unscheduled downtime, potential injuries, lost production, and diminished profits.

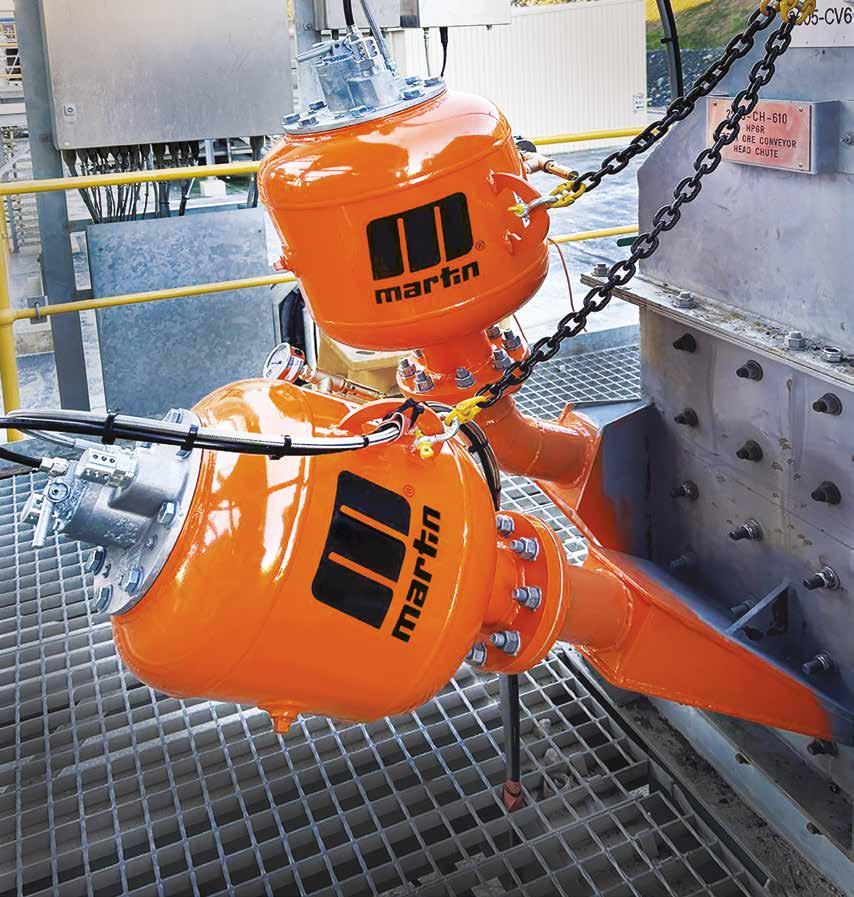

Martin®Air Cannons are the best way to clear accummulation, simplify maintenance and ensure continuous flow. Our cannons feature innovative valve designs that deliver more power with less air volume — highly effective with challenging wet and sticky materials.

Don’t get jammed. Martin delivers material flow solutions so you can maintain throughput, improve safety and reduce operating costs.

The Society for Mining, Metallurgy and Exploration (SME) is kicking off the new year with its annual conference, Minexchange 2026, in Salt Lake City, Utah. The conference and exposition attracts industry leaders from around the world, including many of SME’s 14,000 members. This year’s topic is Resilient Energy in Mining, casting a

spotlight on the latest innovations in mineral exploration, water management and permitting.

Over 800 booths across the expo’s show floor provide opportunities to network and find cutting-edge ideas relevant to your company. In addition to the conferences and expo opportunities for discussion, Minexchange 2026 offers short, indepth courses for those who register