CONTACT

Summer 2023 www.dfwcai.org

A Resource For Homeowners Associations, Condominiums, Townhomes, and Cooperatives Community

Gregory

Our Leadership Kate

A Full-Service Community Association and Business Law Firm General Counsel | Aggressive Enforcement | Collections | Litigation/Insurance Defense | Alternative Dispute Resolution | Construction Defect 737.261.0600 | www.caglepugh.com

CagleAdam Pugh

Kilanowski

CONTACT | SUMMER 2023 • 3 Community Associations Institute is a national, non-profit, membership organization dedicated to the successful creation and operation of community associations. The Dallas/Fort Worth Chapter was established in 1980 to provide support for the North Texas area. Community Contact is published by the Dallas/Fort Worth Chapter of Community Associations Institute and is issued with the understanding that the publisher is not engaged in rendering financial, legal, accounting or other professional services, or be construed as a recommendation for any course of action regarding financial, legal, accounting or other professional services by Community Contact or its authors or advertisers. The services of a competent professional should be sought where professional services are required. The articles appearing in Community Contact do not necessarily reflect the opinion of CAI or the DFW Chapter, and acceptance of advertising does not constitute an endorsement of the products or services. All contents of Community Contact are protected by copyright. Reproduction in whole or in part without written permission is expressly prohibited. AAMC, AMS, and PCAM are registered trademarks of Community Associations Institute. CMCA is a registered trademark of the Community Association Managers International Certification Board. Many of the designations used by manufacturers and sellers to distinguish their products are claimed as trademarks. Use of a term in this publication should not be regarded as affecting the validity of any trademark or service mark. CONTACT Community Sponsors 6 2023 DFW CAI EXPO Recap 30 Chapter Party Recap 46 Membership Report 50 Summer2023 Overcoming Irrigation Damage 10 IN COMMERCIAL LANDSCAPING Crisis Management Tips 14 FOR CONDOMINIUM OWNERS 5 Common HOA Rules: 18 WHY THEY’RE SO PREVALENT AND HERE TO STAY How You Can Safeguard Your Community 22 Association’s Finances Against Fraud Compassion, empathy, and responsibility: 26 RESOLVING CONFLICT INVOLVING MENTAL ILLNESS Federal Advocacy – 28 FIRST QUARTER…BOOTS ON THE GROUND HOA Assessments: 34 WHAT THEY COVER, WHY YOU NEED TO PAY, AND WHAT HAPPENS WHEN YOU DON’T Save Lives 38 WITH THESE SUMMER SWIMMING SAFETY TIPS

2023 BOARD OF DIRECTORS

President

Joe Veach

Globus Construction Group jveach@globusmanage.com

President-Elect

Olivia Hurtado, CMCA First Citizens Bank olivia.hurtado@cit.com

Vice President

Wendy Hazelwood, CMCA Alliance Association Bank whazelwood@allianceassociationbank.com

Treasurer

Diana R. Larson, AMS, PCAM Assured Association Management, Inc. dlarson@assuredmanagement.com

Director

Leah K. Burton, Esq. Steptoe & Johnson, PLLC leah.burton@steptoe-johnson.com

Director

Madan Goyal West Park Homeowners Association goyaltexan@hotmail.com

Director

Mark Norton, AMS, PCAM Insight Association Management, Co. AAMC mnorton@insightam.com

Immediate Past President

Chris Broach, CMCA, AMS, PCAM Blue Hawk Management cbroach@bluehawkmgmt.net

MANAGEMENT

James Nicholson, Chapter Executive Director DFW Community Associations Institute 14070 Proton Road, Suite 100 Dallas, TX 75244-3601

(972) 246-3540

www.dfwcai.org office@dfwcai.org

4 • CONTACT | SUMMER 2023

Lone Star Fountains offers the largest selection of fountain and aeration products and services in the DFW area

Lone Star Fountains began in 1997 and quickly became the premier provider for fountain sales and service in North Texas. We sell and represent all major fountain manufacturers, including Aqua Control, Aqua Master, Airmax, Kasco Marine and Solar. We are the world’s largest Aqua Control distributor.

Our mission is to provide our clients with long lasting, quality products that are both functional and beautiful.

Our services focus on customer solutions that will give you the greatest return on your investment and time, and they include:

• Fountain and Aeration Installation

• Waterfall Pump Sales and Installation

• Solar and Wind Aeration Products

Lone Star Fountains

• Fountain and Water Aeration Preventive Maintenance Programs

• Troubleshooting and Repair Services for All Brands

• Maintains a facility solely dedicated to fountain and aeration services and repairs

• Is the only factory-certified service center for ALL major brands

• All fountain technicians are highly trained and factory certified by ALL major brands

• 3 service trucks fully stocked with parts to repair on site

• 1 full-time shop technician

• Fastest repair response time

• Carries Professional Liability and Worker’s Comp Insurance

CONTACT | SUMMER 2023 • 5 Lone Star Fountains • 217 N Coppell Rd • Coppell, TX 75019 972-471-3810 • www.lonestarfountains.com • stan@lonestarfountains.com Contact Lone Star Fountains for a free estimate today!

THANK YOU TO OUR 2023 SUPER SPONSORS

6 • CONTACT | SUMMER 2023

DIAMOND SPONSORS

Alliance Association Bank

CCMC

Clients First Landscape Solutions

RTI/Community Management Associates, Inc.

“CMA”, AAMC

First Citizens Bank

Insight Association Management, AAMC

Kerrane Storz, PC

McKenzie Mena, LLP

Neighborhood Management, Inc., AAMC

Roberts Markel Weinberg Butler Hailey, PC

RTC Restoration & Glass, Inc.

Staying-A-Float Lifeguarding (S.A.F. Guarding)

Shepperd Construction

Steptoe & Johnson, PLLC

Vensure Group

PLATINUM SPONSORS

Advanced Association Management

Association Insurance Partners

Brightview Landscape Services

Cardinal Strategies

Five Star Pools

Globus Construction Group

Kilowatt Partners

Robert’s Pool Service

Scarbrough, Medlin & Associates

Timothy, DeVolt & Company, P.C.

GOLD SPONSORS

Action Property Management

Henry Oddo Austin & Fletcher, P.C.

Horizon Emergency Services

Koper Outdoor

Pacific Western Bank

The Playwell Group

Popular Association Banking

SOLitude Lake Management

Symphony Risk Solutions, LLC

Truist Association Services

Yellowstone Landscape Services

Ambassadors of Fun

Joeline Simien

Community Affairs

Deena Still

Expo

Jenna Abernathy & Deena Still

Gala

Mark Norton, AMS, PCAM

Golf Tournament

David Garrett and Andy Babbitt, CMCA, AMS, PCAM

High Rise Managers Forum

Christopher Glennon and Jenifer Reider

SILVER SPONSORS

Association Reserves - Texas

Bob Owens Electric Co., Inc.

Castle Group

Classic Construction & Restoration

Landscape Professionals of Texas

Master Systems Courts

PMP Management - Texas

Riddle & Williams, PC

BRONZE SPONSORS

Allegra Marketing Print Mail

Charles Taylor Engineering Technical Services

Kraftsman Commercial Playgrounds and Waterparks

Next Door Painting

RealManage

Reconstruction Experts

Reserve Advisors, LLC

Texas Disaster Restoration

EDUCATION SPONSORS

ARSM (Advanced Roofing & Sheet Metal)

Cavalry Construction

CTB Multifamily Services

Randolph-Brooks Federal Credit Union

Winstead PC

who are a part of all four CAI Texas Chapters.

Legal Forum

Kate Kilanowski

Magazine

Tracy Wolin, CMCA, AMS, PCAM and Katy Hutchison

Membership

Cindy Martin, CMCA, AMS, PCAM

Programming

Deena Still and Jamie Patterson, CMCA, AMS

Sporting Clays

Scott Sieck

CONTACT | SUMMER 2023 • 7

This “Deep In The Heart of Texas” logo recognizes our Business Partners

2023 DFW CAI COMMITTEES

the SBB mission

ENDURING CLIENT

RELATIONSHIPS

UNPARALLELED STAFF

LONGEVITY

INDUSTRY LEADING TECHNOLOGY

CONTINUING EDUCATION

PROGRAMS

SENIOR DIRECT SUPPORT

PERSONNEL

ROBUST ACCOUNTING ANALYSIS

TOOLS

MOBILE MANAGEMENT PLATFORM

DIGITAL DOCUMENT MANAGEMENT

FAMILY CORPORATE CULTURE

8 • CONTACT | SUMMER 2023 SBB COMMUNITY MANAGEMENT IS DEDICATED TO PROVIDING PROFESSIONAL HOMEOWNERS ASSOCIATION MANAGEMENT AND CONSULTATION TO TEXAS COMMUNITIES 12801 N CENTRAL EXPRESSWAY SUITE 1401 DALLAS, TX 75243 PHONE: 972-960-2800 WWW.SBBMANAGEMENT.COM

"TO BE THE PREMIER COMMUNITY MANAGEMENT COMPANY BY PROVIDING EXPERIENCE, INNOVATION AND EXCEPTIONAL SERVICE IN

ALL WE DO”

CONTACT | SUMMER 2023 • 9

Overcoming Irrigation Damage in Commercial Landscaping

HOW AND WHEN TO BEST WATER YOUR LANDSCAPE TO AVOID DAMAGE

by Dustin Cotten Business Developer, Brightview

It’s warming up outside and soon the blistering summer months are going to be upon us. You know who else is starting to feel the heat? The lawns, plants and trees that make up your beautiful commercial landscaping.

When the temperature rises, we sweat, our dogs pant and our plants transpire to cool down. Landscape maintenance professionals may not typically describe plants as sweating but that’s essentially what is happening. Just like us, they draw in extra water so that the water vapors can escape through the plants’ pores, cooling it off. Just as it is essential for you and your pets to increase your water intake to stay healthy during increased temperatures, the same is true for your landscape— so buy your landscape a drink!

Avoid oversaturating your commercial property by keeping an eye out for pooling.

Can Irrigation Damage Landscaping?

Can you drink too much? Yes. And so can your landscape. If you feed your landscaping too much water too quickly, you will likely experience runoff. Irrigation runoff robs your lawn of adequate absorption and your wallet of unnecessary expenses.

Oversaturating your landscaping can drown it, depleting it of vital oxygen, causing it to die. So, keep an eye on the edge of lawns and planting beds to make sure you aren’t literally letting precious water run down the drain.

What is the Best Time for Commercial Landscape Maintenance?

Landscape irrigation systems should be set to water early in the morning, around sunrise. This allows the water time to soak down into the roots and the grass blades and plant leaves

a chance to dry off quickly, preventing disease. Watering in the early hours also decreases stress on the grass by keeping it cooler in the hottest part of the day and reduces the amount of water lost to evaporation reducing irrigation costs

What’s the Right Irrigation Formula for Your Landscaping?

Your region, rainfall and summer weather conditions all play a part in determining how often you will need to water. Your plantings will require the most water in conditions of heat, drought, low humidity, and high winds.

Your soil will also play a part. Clay soil holds water longer and can be watered less frequently than sandy soil, which drains very quickly and needs to be watered more often.

Regardless of the conditions, you will want to ensure your soil is wet 6 to 8 inches deep. For most lawns that’s 1.5 inches of water per week. And to avoid that runoff we spoke about above, it’s best to divide that watering over two to three days per week.

BrightView Commercial Landscaping Is Here to Help

BrightView commercial landscaping can become a valuable resource for establishing the right watering cycle for your investments. We will monitor the moisture levels and adjust the frequency and amounts accordingly.

10 • CONTACT | SUMMER 2023

CONTACT | SUMMER 2023 • 11 One Partner for All Your Landscape Needs Design Develop Maintain Enhance Contact Us Craig Zuczek 469 344 1267 craig.zuczek@brightview.com www.brightview.com A Resident Expert in your Landscape Creating a place that feels like home starts from the ground up. Enlist a skilled team with deep expertise in creating outdoor spaces that increase property value and ensure your community is a coveted place to live. With thoughtful planning and an unwavering attention to detail, we ensure your community’s goals are met and resident satisfaction is high.

12 • CONTACT | SUMMER 2023

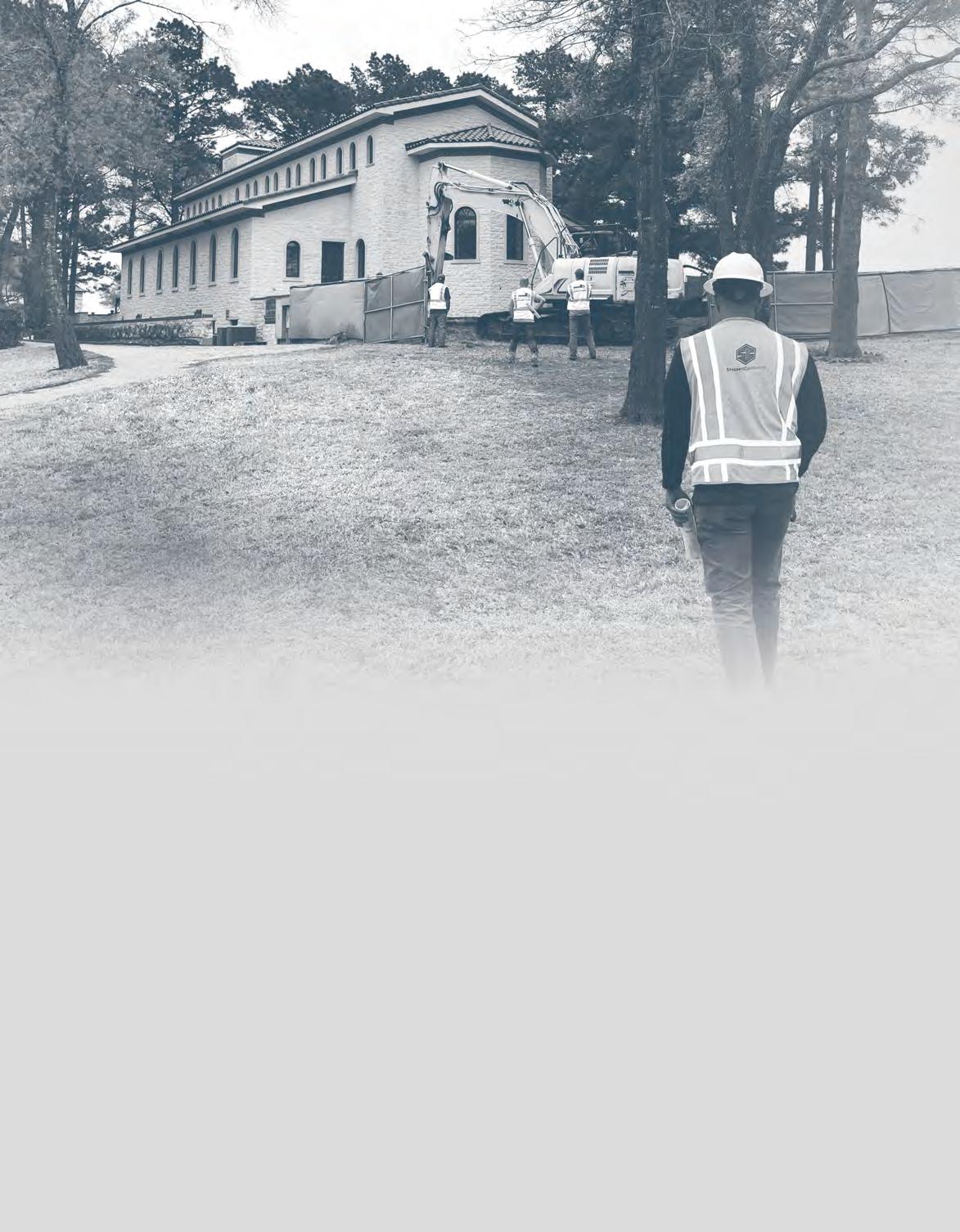

We Come Through When Others Won’t

That’s why we’re the Texas reconstruction company of choice for hundreds of Forensic Engineers, Defect Attorneys, Property Managers, Building Owners, Insurance Adjusters, HOA Board of Directors, and Construction Managers across Texas.

Building Excellence in Texas Since 2014

We’re a full-service reconstruction company dedicated to delivering top-shelf results on each construction or restoration project we undertake. We take pride in our customer-centric approach and thrive on building relationships and consistently surpassing expectations.

Class A NASCLA Licensed General Contractor

Our Services

Reconstruction

Invasive Testing

New Construction Services

Emergency Restoration

Insurance Restoration

ShepperdConstruction.com

CONTACT | SUMMER 2023 • 13

Crisis Management Tips for Condominium Managers

by Nathan Watson General Manager Bleu Ciel

As credentialed Association Managers, we all strive to be the very best. We plan, we train, and we execute our “game plans” on a daily basis. We often get into a groove and carve out certain portions of our day to walk our respective properties and inspect. We hope for the best each day, but hope is not an effective strategy. As Murphey’s law would suggest, “If it can happen, it will happen.” If you manage communities long enough, you will experience your share of crisis situations.

There are a few different types of crisis situations that rear their heads, which include Medical Emergencies, Fire Emergencies, Police Emergencies, Flooding and Mental Health crisis. All of these potential issues that you would have to manage can be stressful, but preparing for these situations will pay off when you find yourself in the middle of one. It is not a question of if it will happen, but most likely, when it will happen.

Medical emergencies can be filled with many different emotions. For managers of Condo communities, and especially managers in a high rise, managers come to know their residents very well, often establishing deeply rooted relationships with their community members. If you find yourself having to manage through a situation like this, it can be emotional and hard to focus on what needs to be done to help the person in need, or manage the situation. If you do not have an emergency plan, it is suggested that you find the time to create one.

Creating an emergency plan is the first step in preparing a Condo Association for any worst-case scenarios. Each type of emergency situation has different elements to be aware of and to be ready for. People often experience medical emergencies in their homes, and the communities we manage are no different. In single family homes, residents typically call 911 on their own, and do not involve anyone outside of their household in doing so. However, in Condominiums, staff members find themselves becoming the ones who interact with paramedics or fire rescue personnel. From receiving them in front of the building, providing access to elevators or escorting them to the unit, our sited staff in these cases are often the glue to help people through their worst times. If you or your team is not certified in CPR and the use of AED devices, it is highly recommended that at least select members of your team receive this training. Training in CPR and basic first aid can and will save lives.

Not every situation turns out well for the residents involved, and the death of a resident can be hard to deal with, professionally and personally. Deaths in communities happen, and even more often than one would think. Having a plan on how to deal with this situation and the appropriate measures to take are important. Family members that do not live in the community may only ever have this experience in the building, with the death of their loved one. Providing support to family members in this scenario can go a long way in the grieving process and help them not to have to worry about some of the details a situation like this brings.

Although fire emergencies may not have occurred in a Community you manage, measures should still be taken to limit any possible occurrences. Fires do happen, but ensuring systems are inspected regularly and all equipment works the way it is intended will save lives and limit how large a fire can become. Although individual homes that are owned by the Association’s members are out of the control of their respective HOA, fire inspections to homeowner units as well as any common areas will give you the confidence that the systems will provide the necessary function in the case of an actual fire.

A Fire Evacuation plan is often a requirement by the Fire Marshall during inspections. A Fire Evacuation plan will provide all of the emergency exits and the evacuation point where residents and any staff members would be accounted for. In high rises, it is recommended to have a printed list of homeowner and tenant contact information, and update it periodically to coincide with any new residents that may have moved out, or moved into their respective units. It is important to account for everyone in the building, as the building manager or manager on duty will have the duty of verifying this while the event unfolds.

14 • CONTACT | SUMMER 2023

It is important to maintain composure and stay relaxed, as your interaction is an important factor in helping people to stay calm and to help get them to safety. Having a written plan of action, and training on these steps periodically will allow some of these events to become more second nature, and helps to avoid becoming overwhelmed in the midst of a chaotic situation. Know the plan, teach the plan and execute the plan. Another emergency that Condo Associations deal a lot with are the instances of flooding. Flooding can occur in a number of ways, but a plan in place, and normal inspections of the building and its perimeters can help limit damage. In some areas, hurricanes and tornados pose a threat that are sometimes hard to avoid. If you are aware of a storm that will affect your community, taking proactive steps is important in limiting, or eliminating the potential for losses. In a situation where widespread flooding is possible, the safety and well-being of your community members becomes the priority.

Flooding is not just limited to natural weather events, but often manifests themselves inside of your building(s) common areas and inside individual homes. The most common occurrence of flooding in Condominiums is flooding from leaking pipes, bathtubs, showers, commodes, and appliances. Being aware of the water shut off valves to a unit is critical in limiting damage to a home. Identifying and training your staff to know what to look for and how to shut the water off to individual units could mean the loss of $10,000 vs $100,000 or more.

Flooding can also be caused by a combination of severe cold weather, and water pipes that freeze. The last several years, North Texas has experienced prolonged subfreezing temperatures, and the threat of flooding caused by these weather patters can have a devastating effect. Understanding your buildings systems and precautionary steps that can be taken prior to these weather events will likely save your community thousands of dollars.

One of the most common issues that building managers deal with are police emergencies. These issues have a wide range of cause and effect but include loitering, assaults, theft, burglary, social unrest, riots, and even the potential threat of active shooting situations. Local police agencies have been making it a point to ensure defenses for active shooter events are being discussed and that these situations are being trained on. Knowing where to go and what to do could be

the difference between life or death in a situation like this. Identifying characteristics or behaviors that could be early indicators is important and as is sharing that information with the authorities if warranted.

Mental heath related incidents typically coincide with police emergencies, but can involve medical and fire emergencies at the same time. Building managers should look into training that is offered by local police agencies that help to teach deescalation techniques and when it is appropriate to involve the police in assisting with an unruly homeowner or tenant. As community managers, we strive to represent our individual communities as the best they can be. From establishing relationships with homeowners, board members and their guests, we strive to provide a safe place to call home, but understand the risks that are out there and to possess the tools necessary to avoid some of the pitfalls that were discussed.

Crisis situations will eventually find themselves at the doorstep of any type of community, and in any part of our country. Creating an Emergency plan that accounts for all of the things that can go wrong and training the staff and residents on what to do and where to go, will help building staff stay focused and composed in the face of adversity such as the examples listed in this article.

Now, back to the simpler things, like making sure there are enough towels at the pool or whether the hallways are clean, or if the house car has gas for the dinner rush tonight. Good Luck Y’all!

CONTACT | SUMMER 2023 • 15

16 • CONTACT | SUMMER 2023

TRUE VISION SHARED TO OUR

Community associations and management professionals have something in common: they deserve a long-term relationship with a management company they can trust. Founded locally in 1983, CMA remains true to the vision that has set us apart for decades.

• We support the vibrancy and longevity of each neighborhood’s atmosphere and every staff member’s career by paying attention to what makes each one unique.

• We serve everyone ― customer and staff member alike ― with respect, integrity, and urgency, proving that a positive company culture exudes from the inside out.

• We work as a team. Our front-line managers are backed by corporate support staff (accounting, closing, customer care, and more) so they can focus on day-to-day community operations.

• We are problem-solvers and goal-setters. We’ve expanded entirely through referrals to become the largest privately owned association management company in DFW. Whether you want to contract with a new management team or ignite your career,we hope you’ll join us!

CONTACT | SUMMER 2021 • 17

www.cmamanagement.com 1800 Preston Park Blvd., Suite 200, Plano, TX 75093 972-943-2800

5 Common HOA Rules: Why They’re so Prevalent and Here to Stay

By Becky Hertzler, CMCA®, AMS®, PCAM® Associa Carolinas

Part of being a resident within a homeowners association (HOA) involves fulfilling responsibilities to the community—maintaining your property, paying assessments, and, maybe most importantly, following the rules. While every association is unique and has its own set of guidelines, there are some regulations that are necessary to maintain structure in all communities. Read on to learn five of the most common rules, what they cover, and why they have staying power.

Why Many HOAs Adopt These Five Rules

To some homeowners, community rules may seem prohibitive, but they’re there for a good reason. HOAs set the most essential guidelines based on a combination of their governing documents and applicable local, state, provincial, and federal laws. In addition to securing your financial home investment, these five HOA rules are designed to:

• Preserve the aesthetics of an area. Rules guarantee the look and feel of a community remain desirable.

• Protect and enhance home values. Maintenance standards ensure that a neighborhood is appealing to prospective buyers and homes stay structurally and visually sound for decades.

• Enforce the community’s Covenants, Conditions, and Restrictions (CC&Rs) and bylaws. CC&Rs are legally binding documents that outline the rights and responsibilities of the association, board members, and homeowners. Community guidelines often act as an extension of these regulations, emphasizing their most important aspects, while also establishing additional provisions.

• Maintain the property of the association. Certain guidelines help maintain community property, including the structures, landscape, and amenities so that all members can enjoy the place they call home.

18 • CONTACT | SUMMER 2023

The Five Most Common HOA Rules

A community’s specific set of rules is determined by a variety of factors. While size, location, and other attributes differentiate communities across North America, you’ll generally find these five standard guidelines everywhere:

1. Architectural controls. Rules may limit homeowners on the improvements or modifications they can make to their property. Examples include restricting exterior colors to certain shades, requiring specific roofing materials, or putting a cap on roof heights.

2. Holiday and lawn decoration restrictions. Communities may require residents to put up and take down holiday decorations within a window of time or restrict garden gnomes on front lawns.

3. Noise complaint policies. Policy limits may pertain to music at parties, construction, and even barking dogs.

4. Exterior home maintenance. Keeping lawns, gardens, and trees in tip-top shape benefits the overall community. Residents may be required to keep their grass under a particular height or limit the number of trees in the front of the house.

5. Home occupancy limits. This is often controlled for safety reasons. For example, in an active adult community, occupancy limits help to ensure that potential emergency evacuations from properties go smoothly for older residents.

Why These Rules Maintain Popularity Long-Term

When you purchase a home that’s part of a community association, you automatically become a member of the association. You sign forms, agree to abide by the governing documents, and pay assessments. You, as a homeowner, have certain duties to the community, and in return, expect the association to deliver on its promise to protect your home’s value and sustain a comfortable living environment.

One of the best ways for the community’s leadership to meet those expectations is by enacting and maintaining clearly defined rules. What gives these five common HOA rules staying power is that they’re transparent, easy to follow, and ultimately benefit everyone in the community.

Options for Changing Rules

Rules are designed to do good for the community and enhance the HOA lifestyle. However, it’s possible that some rules in your governing documents may seem ambiguous or vague. If that’s the case, call on your association’s board of directors to reexamine the rules and regulations. By speaking up and working with them, you’re demonstrating good stewardship and positioning the community for success.

To be most effective, know what rule you’d like to change and present your proposed amendment with informed confidence. Proposed rules should be reasonable, enforceable, and related to something that the association has authority overprotecting and enhancing property values. The goal is to get board members to share your vision and work strategically to enact positive change.

What Makes a Good HOA Rule?

HOAs promote the safety and well-being of the communities they serve and provide immense value for their residents. Even with all the value that HOAs provide, you may still find that your community’s rules are a struggle to understand and adhere to. These bad rules are entirely avoidable, and when you know the right questions to ask, you can prevent them from surfacing in your community.

Becky Hertzler is a General Manager with Associa® Carolinas, a leading provider of community management services. She can be reached via email at rebecca.hertzler@associacarolinas.com.

CONTACT | SUMMER 2023 • 19

Trust, Confidence, and Integrity.

• All general construction repairs performed.

• All types of roof repairs and replacements.

• Interior and exterior repairs performed.

• Professional roof and property inspection reports provided.

• All Insurance restoration repairs performed.

• Licensed and certified commercial and residential roofing contractor.

LET VENSURE GROUP ROOFING AND GENERAL CONSTRUCTION ASSIST WITH YOUR NEXT INSURANCE OR RENOVATION PROJECT!

20 • CONTACT | SUMMER 2023

VENSUREGROUP.COM SINCE 1982

CONTACT | SUMMER 2023 • 21

How You Can Safeguard Your Community Association’s Finances Against Fraud

by Wendy Hazelwood

Payment fraud is nothing new. Even in the Stone Age, someone likely tried to pass off a cheap stone ax for a nicer one. Fraudsters evolve as quickly as advances in payments methods and technologies — but new fraud-prevention tools can help protect your community association against deception and theft.

The dollar amounts of fraud are eye-watering. In 2022, internet fraud resulted in losses of $10.3 billion, according to the FBI’s Internet Cyber Crime Center. In Texas alone, losses of nearly $260 million were attributed to business email compromises (BEC).

As much as those statistics boggle the mind, the numbers become very real when considering your community association’s finances. A LexisNexis study found that fraud costs $4 for every $1 affected.

While some associations still choose to pay vendors by check, electronic payment methods are becoming the industry standard — and the share of ACH debits affected by fraudulent activity increased accordingly, from 33% in 2019 to 37% in 2021. Phishing scams and BEC can compromise the processes leading up to payment initiation. Thefts may involve anything from malware to elaborate fraudulent emails and websites.

On the other hand, check fraud typically involves counterfeiting, rerouting of checks or physical alteration, known as check washing. While check fraud had been on the decline — primarily due to people moving from using physical checks

to electronic payments — it increased by 84% in 2022, says the Financial Crimes Enforcement Network, a unit of the U.S. Treasury Department. According to the American Banking Association (ABA), this rise is partly due to social media channels, specifically Telegram, that allow users to hide their identities and encrypt messages. Telegram enables fraudsters to operate a robust network connecting check thieves with socalled “walkers,” who deposit altered checks into bank accounts in exchange for a fee.

Tackling these two key types of fraud requires a two-pronged approach encompassing electronic and physical security. To safeguard your payments processes, you may wish to consider implementing these best practices: Train management and employees about fraud methods, including BECs. Knowledge is power. It’s essential to scrutinize each payment, especially new vendor payment requests or any unusual request from a board member. Take care to access financial systems only from secured connections, avoiding home networks or unsecured networks at locations like hotels, airports or other public places. Also, confirm that

22 • CONTACT | SUMMER 2023

email addresses are correct — fraudsters sometimes change minor details, such as CEO@company_xyz.com vs. CEO@ company-xyz.com. You can strengthen your defenses by calling the vendor, board member or colleague to confirm the information before submitting a payment.

Modernize your business tools and practices. Many community management companies have been using the same tried-and-true tools for years. Indeed, that software and methodology may work just fine when it comes to accurate calculations. Often, though, it may not offer safeguards such as direct integration with your bank accounts to make fraud protection more accessible and more powerful.

Document appropriate processes and approval steps, and make sure your team uses them. You’ll want to make it a habit to remain vigilant and build policy into your company’s everyday operations. The faster you identify fraudulent activity, the greater the chances of minimizing losses. And, of course, encourage well-known practices like using strong passwords, never reusing passwords on different accounts and not sharing passwords, especially when asked over email or text. Developing a wire transfer policy that documents your established processes and corresponds with your bank’s products and services is also wise. Periodically review these procedures with all parties involved.

Consider cyber insurance. One customer recently experienced a system compromise in which scammers locked them out of their data and demanded a $1 million ransom. Fortunately, the large company had insurance coverage and significant profits. A smaller, less prepared company might have had to close its doors under the pressure. Cyber insurance for your company — and your client associations — can mitigate your risk.

Stay vigilant with record-keeping. Successful organizations immediately inspect financial statements against internal records to ensure payments are ones you’ve authorized, and review checks for duplicate check numbers. Autoreconciliation tools can simplify the process of validating entries — you may wish to ask your banking representative if they offer auto-reconciliation.

Adopt secured payment and deposit methods. For example, you can make it a policy to pay vendors with ACH credits rather than allowing ACH debits from your account. And using a single, dedicated computer for critical online banking functions can reduce the risk of corruption introduced through BEC or other non-secure sources. If a vender changes their mailing address or account-to-credit information, call and speak to someone who can confirm the changes are accurate. To guard against physical theft, it’s wise to deposit outgoing paper checks directly in a secure mailbox before the day’s mail pickup rather than leave them in an outgoing mail basket where they might be stolen.

Take advantage of your bank’s resources. Today, a wide variety of sophisticated digital treasury management solutions are available to optimize your company’s efficiency while helping to prevent fraud. These services are more accessible and affordable than ever for small and mid-size businesses. Key offerings include:

• A/P automation allows companies to pay vendors with easy digital payments, eliminating paper checks and associated check fraud.

• ACH Debit Block automatically returns ACH debit requests to the originating bank to ensure they do not post to your account.

• ACH Positive Pay allows you to set up payment rules by account, defining them by vendor ID and amount. You can automate the process or review exceptions and approve or deny them.

• Check Positive Pay compares each check to your records and denies payments that do not match. By integrating reconciliation activities, you can stay on top of your activity daily.

• API integrations enable companies to connect their internal enterprise resource planning (ERP) platform to the bank through APIs to create even more seamless workflows.

If you’re interested in learning more about how a knowledgeable banker can help you safeguard your payment transactions, contact an Alliance Association Bank relationship officer today.

Wendy Hazelwood, CMCA, is the Vice President – North Texas, Oklahoma, Arkansas, Kansas, Missouri & Nebraska Regions for Alliance Association Bank. With her diverse background in banking, Wendy offers the insight and industry experience Alliance Association Bank customers rely on for their deposit and lending needs.

Alliance Association Bank, a division of Western Alliance Bank, Member FDIC, delivers a tailored suite of deposit, financing and technology solutions designed for community management companies and homeowner associations nationwide. The bank’s relationship officers provide a broad spectrum of innovative and customized solutions to help community associations succeed, all with a high level of expertise and responsiveness. Alliance Association Bank is part of Western Alliance Bancorporation, which has more than $65 billion in assets and ranked #1 among top-performing large banks in 2021 by both American Banker and Bank Director. With significant national capabilities, Alliance Association Bank delivers the reach, resources and deep industry knowledge that make a difference for customers. For more information, visit Alliance Association Bank.

CONTACT | SUMMER 2023 • 23

24 • CONTACT | SUMMER 2023 Talk to us about your community association’s financial needs. We can help. Popular Association Banking exclusively serves the community association industry. We offer:1 • Financing for building repairs and capital improvements. • Competitive fixed rates with terms up to 15 years. • Access to multi-million-dollar FDIC insurance coverage with ICS® and CDARS®.2 We are committed to delivering superior customer service for your association, offering financing, lockbox, cash management, and other depository services. Contact our Texas Relationship Manager: Larry Hooper, VP Cell: 949.842.6161 Toll free: 800.233.7164 LHooper@popular.com 1. Subject to credit approval. 2. Terms and conditions apply. CDARS and ICS are registered service marks of IntraFi Network LLC. © 2023 Popular Bank. Member FDIC. www.popularassociationbanking.com

WE WANT YOU ON OUR TEAM!

There is a new advocacy committee in town and WE WANT YOU ON OUR TEAM! The mission of the Texas Legislative Action Committee (TLAC) is simple – to advance, defend, protect, and strengthen public policy for the community association-housing model.

In order to be successful, we need to hear from Community Board Members, Community Managers, and those who are directly affected by HOA and condominium association policy reform. We want to know what issues matter to you, what are changes you would like to see during the next legislative session, and how can TLAC help your association operate more effectively.

TLAC is CAI’s brand new advocacy organization and is the only group in Texas supported and endorsed by both CAI National and all CAI Chapters in Texas.

TLAC is a separate organization from the Texas Community Association Advocates (TCAA).

TLAC represents over 20,000 community associations and 5.6 million homeowners in Texas.

TLAC is governed by a broad group of delegates from all over Texas with varying levels of experience and expertise.

TLAC is focused on making education, transparency, and information available to managers, management companies and homeowners PRIOR to and DURING the legislative session.

TLAC is requesting all community associations contribute $1 per door to help raise funds to support ongoing legislative efforts. Any contribution helps, but our success in Austin relies on everyone chipping in!

If you’re interested in getting involved, our industry needs your help! TLAC is recruiting volunteers to serve on its committees!

GET INVOLVED AND SUBMIT YOUR CONTRIBUTION! CONTACT YOUR LOCAL COMMUNITY ASSOCIATIONS INSTITUTE CHAPTER EXECUTIVE DIRECTOR:

CONTACT | SUMMER 2023 • 25 CAIONLINE.ORG/ADVOCACY/LAC/TX AUSTIN Robbie Williams robbie@caiaustin.org 512.763.2074 DALLAS/FT WORTH James Nicholson office@dfwcai.org 972.246.3540 HOUSTON & SAN ANTONIO Jesus Azanza jazanza@caihouston.org or ced@caisa.org 713.784.5462 / 210.389.6382

HOW CAN YOUHELP? Sign up for the TLAC email list Read and share TLAC information with other HOA associates Contribute $1 per door in your community to help raise funds for TLAC

26 • CONTACT | SUMMER 2023 lance williamschad

Proprietary collection technology available only to our clients Construction Defect Litigation Covenant Enforcement Litigation Defense of Directors/Associations Insurance Disputes Board/Member Meetings Drafting and updating restrictive covenants Complex Business Litigation 214.760.6766 | 3811 Turtle Creek Blvd., Suite 500, Dallas, Texas 75219 | www.riddleandwilliams.com PROTECTING COMMUNITY VALUES

robinson

A PARTNER WITH COMMUNITY ASSOCIATIONS FOR OVER 30 YEARS

Dean riddle

Compassion, empathy, and responsibility: Resolving conflict involving mental illness

Contributed by Leah K. Burton, Esq. and Noelle G. Hicks, Esq. | Apr 7, 2023

Contributed by Leah K. Burton, Esq. and Noelle G. Hicks, Esq. | Apr 7, 2023

At first blush, it may seem harmless—and not a community association’s responsibility— when a resident suffers from a mental illness, but there occasionally can be dangerous situations. Board members and community managers need to have a plan in place.

Community associations are designed to maintain common areas, preserve and protect property values, provide services for members, and develop a sense of community. Mental health issues could affect each of those responsibilities.

An association has an obligation to uniformly enforce its governing documents and to act in good faith and in what the board reasonably believes to be in the best interest of the community. Deed restriction enforcement, Fair Housing Act violations, and potential liability for negligence can be at play when dealing with a resident who has a mental illness. While it is not the community association’s duty or obligation (nor would it be appropriate) to try to determine if a resident has a mental disability, it is the association’s responsibility to preserve peace. Oftentimes, traditional deed restriction enforcement activities just aren’t effective at obtaining compliance from a mentally unstable resident.

Mental illnesses are some of the most common health conditions in the United States. One in five people live with a mental health condition of some kind. One in 25 people live with a serious mental illness such as schizophrenia, bipolar disorder, or major depression. Over 50% of us will be diagnosed with a mental illness or disorder at some point in our lives.

Community associations should lead with compassion and empathy while at the same time taking steps to comply with the association’s enforcement provisions.

It’s hard not to get emotionally involved in a troubled resident’s mental health struggles, but board members and managers must remember the purposes for which the community association model exists and the related obligations. They should educate themselves regarding the legal issues at play and understand best practices that can and should be utilized to address mental health issues in communities.

Board members and managers can confront mental health or illness in their communities by honoring the association’s obligations to the community and its membership while avoiding liability.

Leah K. Burton is an attorney with Steptoe & Johnson in Plano, Texas, and Noelle G. Hicks is an attorney with Roberts Markel Weinberg Butler Hailey in San Antonio. Hicks serves on the Community Association Managers International Certification Board of Commissioners and is a member of CAI’s 2023 Business Partners Council.

CONTACT | SUMMER 2023 • 27

Federal Advocacy –First Quarter…Boots on the Ground

by Dawn Bauman, CAE | Mar 30, 2023

by Dawn Bauman, CAE | Mar 30, 2023

The first quarter of 2023 brought a new Congress, a new Speaker of the House, Kevin McCarthy (R-Calif.), a Republican majority in the House, and a Democratic majority in the Senate. CAI’s advocacy team, including the incredible team from Cornerstone Government Affairs, Phoebe Neseth, Esq., and I were on Capitol Hill having one-onone meetings, attending fundraising events, receptions, and meet-and-greets. We’ve met with members of Congress and their staffs to discuss condominium safety; Fannie Mae and Freddie Mac condominium and housing cooperative lending requirements, FEMA disaster assistance, and amateur radio towers and antennas.

28 • CONTACT | SUMMER 2023

Condominium Safety Access to Government-Backed, Low-Interest Loan Products

Following the tragedy at Champlain Towers South in Surfside, Fla., building safety is a top CAI advocacy priority. Property insurance, mortgage underwriting rules, new ordinances and laws will result in more condominium building inspections that will spur needed maintenance and critical repairs of buildings. These repairs could be costly for homeowners, especially in buildings where maintenance has been deferred previously due to financial constraints.

CAI advocates for legislation providing for a low-interest loan program authorizing FHA to insure condominium association building rehabilitation loans.

current law, community associations that own their own roads and/or facilities are NOT afforded the same FEMA recovery resources as other communities even though they pay the same federal taxes. CAI is advocating for legislation to be re-introduced this Congress that would give homeowners living in community associations access to FEMA resources.

Condominium

and Housing Cooperative Owners:

The bill creates access to FEMA funds for repair or replacement of essential major common area elements and facilities such as boiler rooms, elevators, and roofs.

Homeowners Associations

Fannie

Mae & Freddie Mac Condominium and Housing Cooperative Lending

After the Surfside, Fla., tragedy, Fannie Mae and Freddie Mac adopted emergency underwriting guidelines for condominium unit mortgages and housing cooperative share loans at the direction of Federal Housing Finance Agency (FHFA). The temporary condominium and housing cooperative guidelines became effective in 2022 and have caused significant problems including delays and outright lender denials for homeowners looking to purchase in a condominium building.

Under FHFA requirements, Fannie Mae and Freddie Mac are set to release final guidelines soon and industry stakeholders fear the final guidelines will create even greater problems for condominium ownership. With condominiums and housing cooperatives offering an affordable housing option to many first-time homebuyers, retirees, and low-income families, restricting access to credit will create inequity in homeownership.

CAI is advocating for Congress to urge FHFA to consider CAI and other industry stakeholders concerns and change the requirements to ensure access to mortgage lending in condominiums and housing cooperatives.

FEMA Disaster Assistance

The Disaster Assistance Equity ACT supports the 74 million Americans living in community associations impacted by a presidentially declared natural disaster—flood, hurricane, tornado, wildfire, blizzard, drought, or earthquake. Under

The bill creates access to FEMA resources (via the local municipality) for debris removal from privately owned roads within homeowners associations to ensure access in and out of the community for public safety. The bill would provide equal access to disaster recovery services for all homeowners paying local, state, and federal taxes.

Amateur (HAM) Radio Towers & Antennas

Amateur radio, sometimes known as HAM radio, is a hobby pursued by approximately 700,000 individuals nationwide. The HAM Radio lobby is working to have legislation introduced that will preempt community association covenants (private contracts) for the installation of HAM radio towers and/or antennas. CAI doesn’t support this legislation recognizing the community association is the best place for these covenants to be created and/or amended. The HAM radio lobby introduced legislation at the federal level on several occasions, and we expect they will try to introduce it again this year. CAI opposes preemption to community covenants.

HAM radio operators typically engage in radio broadcasts for recreational purposes, include working with communities as part of disaster preparedness, response, and recovery efforts. This cooperative effort works with the existing law and doesn’t need to change to support a community’s disaster response.

CAI wants Congress to know we oppose this legislation and encourage the House Energy and Commerce Committee and Senate Commerce Committee to stop this legislation. For more information visit https://advocacy.caionline.org/.

CONTACT | SUMMER 2023 • 29

2023 DFW CAI

CHAPTER PARTY

Attorneys and Counselors at Law

COMMUNITY ASSOCIATION LAW

Serving DFW Area Community Associations for over 40 Years.

THE RMWBH DIFFERENCE

POA Specific Services

RMWBH offers flexible and practical techniques for the collection of assessments, enforcement of restrictive covenants, and creation and modification of governing documents for all types of community associations, including:

Master Planned Associations

Community Associations

Townhome Associations

Mixed Use Associations

High-Rise Condominiums

Commercial Associations

POA Focused Attorneys Education

The legal needs of the POA industry in the DFW region are met by five RMWBH Shareholders, Sipra Boyd, Clint Brown, Noelle Hicks, Ashley Koirtyohann and Marc Markel, who have devoted their careers to the service of POAs

By using monthly webinars and community and managment specific training, new and experienced managers and board members benefit from RMWBH’s education programming that keep them up-to-date on the newest laws, current best practices, and provide the risk management tools that can be applied daily.

RMWBH Frisco

One Cowboys Way, Suite 585 Frisco, Texas 75034

214.365.9290

RMWBH.com

RMWBH

CONTACT | SUMMER 2023 • 33

by Joni Lucas | Apr 5, 2023

Much like local, state, and federal governments collect taxes to fund public services and programs, assessments are part of living in a community association. Homeowners have a responsibility to pay their assessments on time. Unfortunately, some owners refuse to pay or can’t pay assessments. What does that mean for the community? And how should board members respond?

Community association assessments help maintain roofs, sidewalks, streets, and landscaping. They also pay for popular amenities such as a community pool, playgrounds, fitness centers, and activities. Most associations collect assessments monthly, although some collect them quarterly and others in an annual lump sum.

Associations count on all owners to pay on time and, when necessary, rely on strict collection processes that comply with the requirements of governing documents, statutes, and the Fair Debt Collection Practices Act.

Owners who don’t pay on time are cheating their neighbors and the community they live in. The financial position of a community has a direct effect on every member, particularly if it forces amenities to be curtailed. Late payments can cause cash flow problems for communities with a tight budget

and, over time, can lead to diminished property values.

Community association boards need to have a collections policy that outlines what happens when an owner becomes delinquent. These policies should comply with applicable laws and governing documents and have reasonable timeframes with flexibility, says Richard A. Sussmann, CMCA, AMS, PCAM, community manager with Property Management People Inc., in Kearneysville, W.Va.

“Each case is unique, and boards of directors should be flexible when it comes to payment plans to encourage and work with delinquent owners whenever possible,” Sussmann says. A 100% collection rate is not a realistic expectation, he says, but it pays to do the best you can under the circumstances, and never assume anything.

34 • CONTACT | SUMMER 2023

HOA Assessments: What they cover, why you need to pay, and what happens when you don’t

“You never know what is going on in the lives of delinquent owners,” Sussmann says. “The most successful collection efforts involve creativity and patience.”

Owners become delinquent for many reasons. They might have fallen on hard times after losing their jobs, be facing significant medical bills, or have financial difficulties for other reasons. The unit may be a rental and the owner hasn’t provided an off-site mailing address, so they may not even be aware of the delinquency.

Some unwittingly become delinquent after a new management company takes over because they haven’t transferred their automatic payments to the new company.

“A lot of people don’t check their auto pay to make sure that it’s still coming out, so they think they’re good,” says Chantelle Neumann, lead attorney with Hirzel Law’s collections department in Farmington, Mich.

Delinquencies also can arise when an owner passes away or can’t pay the mortgage and abandons the property, sometimes without notice. And some repeat offenders simply aren’t diligent about paying bills.

“I’ve heard of people saying they don’t care about late charges; they’re only going to pay their assessments three months at a time and, instead of paying ahead, they pay behind,” says Neumann, who presented a CAI webinar in January on the topic.

Other offenders include angry owners who threaten to “defund the HOA,” balking at paying assessments because they disagree with bylaw violations.

Owners should always have the right to review the financial documents of the association and should ask the board where their money is going. Withholding a payment hurts the community and, ultimately, the owner withholding it.

Owners who have legitimate reasons for late assessment payments should contact the board or community manager to discuss financial obligations and alternative payment arrangements.

This is the first in a series of blogs on collecting assessments in community associations. Look for more on assessments in the weeks ahead.

CONTACT | SUMMER 2023 • 35

Your Full Service HOA Partner We specialize in construction, renovation,and property maintenance All major trades in-house, including: Roofing, Plumbing, Electrical, AC & Heating license # M40988 TECL175503 TACLB00048137E Located in the DFW area, Globus offers 24/7 support 972-494-1600 globusconstructiongroup.com License # M40988 TECL175503 TACLB00048137E

36 • CONTACT | SUMMER 2023

Save Lives with these Summer Swimming Safety Tips

by Tom Womack, Associa | Director of Public Relations

by Tom Womack, Associa | Director of Public Relations

CDC reports that drowning is leading cause of death for children ages 1-4; Drowning deaths for African Americans 1.5 times higher than Whites

DALLAS — June 19, 2023 — The summer swimming season is in full force and Associa, the community management industry’s largest company, urges homeowners, boards of directors, and community staff to do their part in helping reduce accidental drownings. The Centers for Disease Control and Prevention (CDC) estimates that 4,000 people die each year due to unintentional drowning. In addition, there are 8,000 non-fatal drownings in which the individual survives but often suffers permanent injury such as brain damage or long-term disability.

In the United States, drowning is a leading cause of death for children. Children ages 1–4 have the highest rates, with most drownings occurring in swimming pools. Many drownings occur when children are not expected to be near water, such as when they gain unsupervised access to pools. Fatal drowning is the second leading cause of unintentional injury death for children 5-14, behind motor vehicle crashes. Some factors that contribute to drowning deaths include an inability to swim, missing or ineffective fences around pool areas, and a lack of close supervision. Here are a few tips to reduce the risk of drowning in your community pool or spa and help ensure a safe, happy summer for everyone.

• Ensure that pool enclosures are complete and undamaged. Check that all gates are self-closing and self-latching and that they are in good condition.

• Remove all toys from the pool area that might attract children when it is not in use.

• Hold basic swimming and water safety lessons for residents.

• Offer CPR lessons to residents. What they learn could save someone’s life in the time it takes for paramedics to arrive.

38 • CONTACT | SUMMER 2023

• Stress to residents that children must be closely supervised at all times and never left unattended.

• Life jackets should be used by children and weaker swimmers of all ages. Do not rely solely on air-filled or foam toys, as these are not safety devices.

• Ensure that all pool and spa drain covers are in place, undamaged, and compliant with safety regulations.

“Summer is, and should be, a fun experience for the residents we manage,” said Andrew Fortin, Associa senior vice president of external affairs. “Our primary objective is to maximize comfort and create safety awareness within the communities we manage, so that homeowners and their families enjoy the highest possible quality of life. Providing these basic water safety tips is another opportunity for us to create an environment that helps them build a lifetime of memories.”

About Associa

With more than 225 branch offices across North America, Associa is building the future of community for nearly five million residents worldwide. Our 11,000+ team members lead the industry with unrivaled education, expertise, and trailblazing innovation. For more than 43 years, Associa has brought positive impact and meaningful value to communities. To learn more, visit www.associaonline.com.

Stay Connected

Like us on Facebook: https://www.facebook.com/associa

Subscribe to the Blog: https://hub.associaonline.com/

Follow us on Twitter: https://twitter.com/associa

Join us on LinkedIn: http://www.linkedin.com/company/ associa

Associa® -- Delivering unsurpassed management and lifestyle service to communities worldwide.

5401 N. Central Expressway, Ste. 280, Dallas, TX 75205

For every child under age 18 who dies from drowning, seven more receive emergency room care for nonfatal drowning.

40 • CONTACT | SUMMER 2023 COLORADO | KENTUCKY | OHIO | OKLAHOMA | PENNSYLVANIA | TEXAS | WEST VIRGINIA THIS IS AN ADVERTISEMENT 500 North Akard Street, Suite 3200, Dallas, TX 75201 steptoe-johnson.com Extraordinary Depth in HOA and Condominium Law Clients count on Steptoe & Johnson attorneys to provide advice on corporate governance, collections, and compliance issues with a focus on civility and communication within community associations. HOA and Condominium Law Team Leaders Leah Burton & Brady Ortego

CONTACT | SUMMER 2023 • 41

With a strong commitment to the community management industry, backed by sizable national resources, Alliance Association Bank provides an unmatched level of expertise and responsiveness. Our customer-focused approach means you get a dedicated, experienced relationship manager— a single point of contact—to help with your unique needs so you’re able to focus on what matters most: your business and your customers.

Why Choose Alliance Association Bank: Alliance Association Bank has over 50 years of combined experience meeting the unique and complex banking needs of community associations. This experience, combined with our financial strength and stability, make Alliance Association Bank a key financial institution to build an alliance with to grow your business. Alliance Association Bank is a division of Western Alliance Bank, Member FDIC. As one of the country’s top-performing banking companies, Western Alliance was #1 best-performing of the 50 largest public U.S. banks in the most recent S&P Global Market Intelligence listing and ranks high on the Forbes “Best Banks in America” list year after year.

42 • CONTACT | SUMMER 2023

so you can focus on growing yours. Online Homeowner Payment Portal Lending Solutions 3 Extensive Deposit Solutions 4 No-Fee Lockbox Services1 ConnectLive TM Software Integration Full Online Banking Services2 Specializing in:

Innovating community association banking solutions is our business, Meet Your Community Association Banking Experts: Wendy Hazelwood, CMCA Vice President (214) 837-7711 whazelwood@allianceassociationbank.com Joanne Haluska, CMCA, AMS Senior Managing Director, Central Region (216) 314-9100 jhaluska@allianceassociationbank.com | allianceassociationbank.com One of Forbes’ Best Banks in America Year After Year 1Funds deposited through the Lockbox will follow Western Alliance Bank’s funds availability policy as outlined in the Deposit Account Agreement Disclosure. 2Fees may be imposed for additional services related to online banking. Refer to Business Online Banking Setup and Authorization for more information. 3All offers of credit are subject to credit approval, satisfactory legal documentation and regulatory compliance. 4Refer to the disclosures provided at account opening and the Schedule of Fees and Charges for additional information. Alliance Association Bank, a division of Western Alliance Bank, Member FDIC. Western Alliance Bank ranks high on the Forbes “Best Banks in America” list year after year.

COMPLETE FERTILIZATION PROGRAMS

PRUNING & PLANTING CARE

CUSTOM HORTICULTURE PROGRAMS

SEASONAL COLOR PROGRAM

HERBICIDE & PESTICIDE PROGRAMS

IRRIGATION MANAGEMENT

SNOW & ICE REMOVAL

LANDSCAPE CONSTRUCTION

CONTACT | SUMMER 2023 • 43 KEEPING YOUR COMMUNITY FIRST 521 J PLACE, SUITE A • PLANO, TEXAS 75074 • SALES@CFLANDSCAPES.COM • (469) 531-9071

• MULCHING • WINTER RYE

MOWING

DESIGN • INSTALLATION • MAINTENANCE

44 • CONTACT | SUMMER 2023

Master Systems has 25 years of proven expertise in providing clients with innovative, customized, turnkey court solutions. DFW’s premier court construction and maintenance company, we are known for a tradition of integrity, craftsmanship and unparalleled service after the sale.

Master Systems specializes in building new post tension courts, resurfacing, repairing and cleaning existing courts.

CONTACT | SUMMER 2023 • 45 RESIDENTIAL & COMMERCIAL COURT SPECIALISTS CONSTRUCTION • RESURFACING • MAINTENANCE • EQUIPMENT

Consultation • Design • Construction • Resurfacing • Repair • Maintenance Cleaning • Fences and Gates • Windscreen and Netting • Shade Structures Lighting • Multipurpose Courts • Basketball • Volleyball • Pickle Ball • Bocce Ball • Batting Cages • Painted Games • Equipment and Accessories Quality work guaranteed. Fully licensed and

www.MasterSystemsCourts.com 4454 MYERWOOD LANE • DALLAS, TX 75244 Info@MasterSystemsCourts.com 972-620-9540 | 214-354-2738

OUR COURT SERVICES INCLUDE:

insured.

46 • CONTACT | SUMMER 2023

CONTACT | SUMMER 2023 • 47

LET REALMANAGE TAKE CARE OF

YOUR COMMUNITY

We’re not just a management company. We’re your partner in creating community.

Get Started Now!

RealManage.com | (866) 403-1588

48 • CONTACT | SUMMER 2023 Assessing community priorities is complicated NO NEED TO GO IT ALONE Our easy to understand reserve studies help your board make smarter, more confident decisions that support your community’s For your reserve study proposal, contact us at (800) 221-9882 or visit reserveadvisors.com. 844.815.5321 www.castlegroup.com/castle-texas Is your management company providing the layered support your community Castle Group’s Community Management team provides a complete array of services to operate the administrative, financial, physical, and people aspects of your Community. We have organized our company around supporting the operations of the on-site teams by employing specialists in variety of areas. Some of these areas include: large-scale community management, food & beverage, high-rise management, project management, and financial services. To learn more about how Castle Group can serve your community, please call 844.815.5321 | |

McKenzie Mena, LLP has represented thousands of homeowners and homeowners associations affected by defects in their townhomes, condominiums, lofts, high-rises, and single-family homes.

CONTACT | SUMMER 2023 • 49 MeMber of the CoMMunity AssoCiAtion institute

Mrs. Karley Cook (469)515-9950 kcook@harwoodlifestyle.com

Mr. Stewart James (214)542-7785 stewj34@gmail.com

Mrs. Corrie Lynn Kurz (214)218-2451 Cojo629@sbcglobal.net

Mr. John Mouser (940)368-9011 john@pmicrosstimbers.com

Craig Smith (469)667-6883 craig@pmicrosstimbers.com

Ms. Bridgette Bise CCMC - TX (972)370-0404 bbise@ccmcnet.com

Ms. Sheena Hickey CCMC - TX (469)602-5175 shickey@ccmcet.com

Mr. Michael Niederlander CCMC - TX (925)596-5347 mniederlander@ccmcnet.com

New Members

Mr. Buddy Finnie EverLine Coatings & Services (972)200-9317 buddy@everlinecoatings.com

Ms. Ava Mueller, CMCA FirstService Residential Dallas (505)459-5068 ava94nm@gmail.com

Ms. Brandi Head, CMCA, AMS, PCAM Gulf Professional Property Management (903)227-4696 brandih27@yahoo.com

Nebai Alvarez Junction Property Management (972)484-2060 nebai@junctionproperty.com

Ms. Cassindra Charity Nutter Lake Cliff Tower (214)948-9866 manager@lakeclifftower.com

Cameron Kirke Marsh McLennan Agency (303)704-8146 cameron.kirke@marshmma.com

Debbie L Harris Pecan Plantation Owners Association (817)680-0976 dharris275@yahoo.com

Ms. Gail Fishkin-Ogle, CMCA, AMS, PCAM PMI Green Country, Inc. (571)212-6360 Nolagail83@gmail.com

Anthony S. Harris Premier Oaks Lighting (817)984-4252

anthony@premieroakslighting.com

Ms. Antoinette Daly Prestonwood Country Club Condominium Association, Inc. (214)477-5883 office@pwccca.org

Mr. Tim Haynes RealManage (866)473-2573

Tim.haynes@realmanage.com

Ms. Veronica Trevino, CMCA, AMS RTI/Community Management Associates, Inc. (469)789-6684 vero3vino@gmail.com

Mr. Tim Gonzales Silverback Pressure Washing (469)294-2828

timothy@silverbackpressurewashing.com

Ms. Chantal Huffstetter Somerset Association Management (214)528-3911 chuffstetter@somersetassociations.com

Barbara Louisell Villas of Westridge (214)287-5009 Blouisell@aol.com

50 • CONTACT | SUMMER 2023

MEMBERSHIP

REPORT

Renewed Members Rejoined Members

Ms. Gloria C Black, CMCA, AMS

Mrs. Courtney Kay Compton

Ms. Kathleen E. Epperson, CMCA, AMS, PCAM

Ms. Beth Fairbrother

Ms. Suzanne Frish, CMCA, AMS

Mrs. Jennifer Harper, CMCA, AMS, PCAM

Mr. Chase Gschwend, CMCA, AMS

Mrs. Robyn A Gschwend, CMCA

Mr. James F. Hallas

Mrs. Nicole Zaitoon

Ms. Meg Rohrt, CMCA, PCAM

Ms. Adrienne Brewer, CMCA, AMS

Ms. Carolynn Garrison

Ms. Maria Alejandra Quiceno

Ms. Lisa Kay O’Neill, AMS, PCAM

Ms. Jennifer McLarry Bruington

Mr. Bob Owens

Mr. Scott A. Young

Mr. Richard Lack

Ms. Janet Stern

Ms. Kendall Abbott, CMCA, AMS

Ms. Leslie Gamel

Ms. Jennifer Anne Powers, CMCA

Ms. Reina Jeanne Zuckerman, CMCA, AMS

Ms. Danita Glenn, Esq.

Ms. Pam S Pinzone

Mr. David Beebe

Ms. Linda Brown

Ms. Pallavi Raj

Mr. Casey Meyers

Ms. Josephine Johnson, CMCA, AMS, PCAM

Mr. Jeremy Newman

Mr. Denton Novak

Mr. Bill White

Mrs. Tiffany Dessaints, CMCA, AMS, PCAM

Mrs. Lindsay Ann Dunn

Mr. Greg Farkas, CMCA, AMS

Ms. Sipra S Boyd, Esq.

Ms. Chelsea Chambo, CMCA, AMS

Ms. Jamie Lee Jakubowski, CMCA, AMS

Ms. Vanessa Burch, CMCA, AMS, PCAM

Ms. Vanessa Burch, CMCA, AMS, PCAM

Ms. Denise LeAnn Smith

Mrs. Marlo Ann Kelley, CMCA, AMS

Mr. Evan Wilson

Mrs. Jennifer L. Jennings, CMCA, AMS

Mr. Brock Troy

Ms. Myra L Baugh

Mr. Ron Cayon

Ms. Janell Ferguson

Mr. Roy Pochyla

Ms. Virginia Howard Townley, CMCA

Ms. Amelia Duckworth

Mr. Jared Baker

Mr. Fines Oliver Roberts, CMCA, AMS

Ms. Beatriz Mooney

Mr. Daryl Roberts

Mrs. Christina Marie Fountain

Mr. Louis Ellis, Jr., CMCA

Mrs. Nicole Rochelle Nelson-Hardeman, CMCA

Mr. Alex Valdes, Esq.

CONTACT | SUMMER 2023 • 51 MEMBERSHIP

REPORT

New Designations

Congratulations to our fellow CAI members who achieved new designations!

Ms. Dondi Cherie Morse, CMCA, AMS AMS 5/3/23

Ms. Veronica Trevino, CMCA, AMS AMS 5/9/23

Ms. Kristen Russell, CMCA, AMS AMS 5/12/23

Mr. Elimaris E Calo, CMCA, AMS AMS 5/25/23

***Certified Manager of Community Associations (CMCA®)

From CAMICB - “As a CMCA®, you have shown a commitment to your profession by staying informed about current community association issues and holding yourself to a high standard of professional conduct.”

***Association Management Specialist (AMS®)

The second level in the career development track for community association managers.

The AMS® designation demonstrates a higher level of commitment to your career and the community association industry. An AMS® designation is recommended for managers who want to enhance their career opportunities by increasing their knowledge and expertise.

***Professional Community Association Manager (PCAM®)

The pinnacle of community association management. The PCAM designation is the highest professional recognition available nationwide to managers who specialize in community association management. Earn your PCAM and join the elite—the select—the best.

Recommended for experienced managers who want to demonstrate advanced skills and knowledge and who wish to be recognized as one of the best and most experienced managers in the nation.

***Reserve Specialist (RS®)

Community associations rely on qualified reserve specialists to assist them in extensive reserve planning to keep their communities running smoothly. Gain the confidence of board members by obtaining the Reserve Specialist® (RS®) designation.

The RS designation is awarded to qualified reserve specialists who, through years of specialized experience, can help ensure that community associations prepare their reserve budget as accurately as possible.

52 • CONTACT | SUMMER 2023 MEMBERSHIP

REPORT

CONTACT | SUMMER 2023 • 53

With First Citizens Community Association Banking, formerly part of the bank’s CIT division, you can count on continued service from the experts you know. And as one of the nation’s top 20 banks, we offer market-leading products matched with innovation and award-winning technology to help you grow your business. Your community association management company deserves no less than a financial provider that can bring you the scale, service and capabilities you need to stay ahead. Contact me to learn more: Olivia Hurtado Vice President, Regional Account Executive – NTX, LA & MS olivia.hurtado@firstcitizens.com 214-717-2718 firstcitizens.com COMMUNITY ASSOCIATION BANKING Your experts in the HOA industry. © 2023 First-Citizens Bank & Trust Company. All rights reserved. MM#13170 14070 Proton Road, Suite 100 Dallas, TX 75244

by Dawn Bauman, CAE | Mar 30, 2023

by Dawn Bauman, CAE | Mar 30, 2023

by Tom Womack, Associa | Director of Public Relations

by Tom Womack, Associa | Director of Public Relations