GANDHIDHAM: The Deendayal Port Authority (DPA), is pleased to announce rebates and concessions on Vessel Related Charges (VRC) for vessels discharging or loading coastal or foreign consignments of coal or coke at the dry cargo jettiesinKandlaHarbour.

SignicantDiscountsOffered

The program offers tiered discounts depending on the cargosize:

• 20% discount on VRC for parcels between 40,000 MT and49,999MT.

• 30% discount on VRC for parcels between 50,000 MT and59,999MT.

• 35% discount on VRC for parcels of 60,000 MT and above. Cont’d. Pg. 19

MUNDRA: Adani Ports and Special Economic Zone Limited (APSEZ), India's leading commercial port operator, is proud to announce a series of remarkable achievements that underscore its commitment to excellenceandoperationalefficiency. Cont’d. Pg. 19

Head Office - Mumbai :

Unit 802, B Wing, 8th Floor, Godrej Two, Pirojsha Nagar, Eastern Express Highway, Vikhroli (E), Mumbai, 400079, India

Tel: +91 022 61247300, Fax: +91 022 26665780

Delhi Office : 238, 3rd Floor Okhla Industrial Estate, Phase-3 New Delhi-110020, India

Tel: +91 011 66266627 / 66266625, 66266609, 66266628, 66266608 , 66266618

Mundra Office :

Second Floor, Plot No. 86, Sector 1A, Near Hero Motorcycle Showroom, Gandhidham – 370 201

Mumbai Sales - Mr. Kaushik Valecha 9769963483 kaushik.valecha@coscon.com

Mumbai Customer Service - Ms. Minal Bharati 9869082992 minal.bharati@coscon.com

Mundra Sales - Mr. Vicky Bhatia 9879843963 vicky.bhatia@coscon.com Mundra Customer Service - Ms. Rupal Thacker 9429814071 rupal.thacker@coscon.com

New Delhi Sales - Mr. Rohit Dixit 9717295812

Cargo Steamer's Agent's ETD

Jetty Name Name

CJ-I SW South Wind Synergy Seaport 27/07

CJ-II Della Synergy Seaport 25/07

CJ-III Sweet Lady III BS Shpg. 26/07

CJ-IV Hai Phoung 87 Chowgule S. 24/07

CJ-V Athos Arnav Shpg. 25/07

CJ-VI Bellina Colossus Dariya Shpg. 28/07

CJ-VII Sand Topic Dariya Shpg. 24/07

CJ-VIII VACANT

CJ-IX Gramba Synergy Seaport 25/07

CJ-X AP Astarea Benline 24/07

CJ-XI Safeen Power Hapag Llyod 23/07

CJ-XII TCI Anand TCI Seaways 23/07

CJ-XIII Propel Grace Cross Trade 25/07

CJ-XIV Cariboo Synergy Seaport 26/07

CJ-XV Yuan Wang He Xie Mystic Shpg. 24/07

CJ-XVA African Wagtail Cross Trade 26/07

CJ-XVI Fortune ARK Trueblue 25/07

TUNA VESSEL'S NAME AGENT'S NAME ETD

Linda Hope Taurus 23/07

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I Symi

OJ-II Rabigh Sunshine

OJ-III SC Hongkong

OJ-IV Sea Elegant Samudra 23/07

OJ-V VACANT

OJ-VI Sanman Sitar Malara Shpg. 23/07

OJ-VII CL Huaiyang Interocean 23/07

African Bari Bird 18/07 USA

TCI Express 19/07 Manglore/Cochin/ Tuticorin

SCI Chennai 19/07 Jebel Ali

Doris 19/07 Tanzania

Haj Abdallah T 19/07 Yemen

Kwai Kwai 19/07 Castellon

Jaador 19/07

Patriot 19/07

Shamim 20/07 Bandar Abbas

SSF Dynamic 20/07 Port Khalifa

Aruna Eagle 20/07 USA

Hampton Ocean 21/07 Europe

CJ-XVA African Wagtail Cross Trade

Stream AL Mothanna Malara Shpg. Dji Bouti

Stream Asi M Chowgule S. China

Stream BBC Zarate Marcons

Stream Cetus Cachalot Chowgule S. Korea

Stream Common Venture BS Shpg. Cotonou

CJ-II Della Synergy Seaport Nacala

23/07

Ince Ilgaz Arnav Shpg. 18/07

CJ-IX Gramba Synergy Seaport New Zealand 43,055 CBM Pine Logs 2024061361

CJ-IV Hai Phoung 87 Chowgule S. Indonesia 5,051 T.

23/07 Imari DBC

Cargo Stream Ince Ilgaz Arnav Shpg.

CJ-XIII Propel Grace Cross Trade

CJ-VII Sand Topic Dariya Shpg.

T. Coal In Bulk

23/07

Stream Jal Kishan GAC Shpg.

23/07 Kruibeke Seaworld

Stream KS Angelina Samudra

Stream Penna J M Baxi

Stream Raon Teresa Samudra

In Port Kota Nilam (V-211W) PIL India Berbera In Port TS Hongkong (V-24002W) Unifeeder Agency Nhava Sheva 22/07 Xin Chang Shu (V-87E) Cosco Shipping Karachi

GFS Giselle 2408 4072606 Global Feeder Sima Marine Port Kelang, Busan, Gwangyang (CSC)

02/08 01/08-PM CCNI Angol 430E 4072683 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 03/08 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, Port Kelang (FEX1)

TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, (FEX) TO LOAD FOR INDIAN SUB CONTINENT

In Port —/— Kmarin Azur 427W 4062350 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA) 23/07 29/07 29/07-AM GFS Giselle 2408 4072606 Global Feeder Sima Marine Karachi (CSC) 30/07

TBA Asyad Line Seabridge Marine Karachi (REX)

Port Kmarin Azur (V-427W) 4062350 Maersk India Nhava Sheva

26/07 Maersk Cairo (V-430S) 4072454 Maersk India Port Qasim 27/07 SM Neyyar (V-429) - MBK Logistics Jebel Ali

Wan Hai 625 13E 2402639 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX) 29/07 23/07 23/07-PM Northern Practise 31E 2402384 FeedertechFeedertech Port Kelang, Singapore, Leam Chabang.(AGI) 24/07 23/07 22/07-AM Zhong Gu Ji Nan 24004E 2402636 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao. (AIS)

TS Lines Samsara Shpg 26/07 26/07-AM Wan Hai 309 023E 2402709 Wan Hai Line Wan Hai Lines Port Kelang, Jakarta, Surabaya. (SI8 / JAR)

KMTC / Interasia KMTC (I) / Interasia 29/07 29/07-PM Zoi 115E 2402545 Interasia/GSL Aissa M./Star Shpg Port Kelang, Singapore, Tanjung Pelepas, Xingang, Qingdao, 30/07 Evergreen/KMTCEvergreen/KMTC (FIVE) TBA One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) — KMTC /TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX) TO

FOR

In Port —/— TS Hongkong 24002W 2402530 Evergreen / ONEEvergreen / ONE Colombo (CISC)

In Port —/— MOL Presence 015E 24243 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 22/07 02/08 02/08-0500 Dimitris Y 0246E24251 ONE ONE (India) (TIP) 03/08 22/07 —/— One Theseus 088E 24241 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 23/07 29/07 29/07-1500 Conti Conquest 028E 24250 HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3) 30/07

24/07 24/07-0600 OOCL Hamburg 151E 24245 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 25/07 04/08 04/08-0600 OOCL Luxmbourg 111E 24252 Gold Star / RCL Star Shpg/RCL Ag. (CIXA) 05/08 24/07 24/07-2000 GSL Nicoletta 425E 24234 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 25/07 27/07 27/07-2000 CCNI Angol 430E 24241 X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 28/07

02/08 02/08-2000 X-Press Odyssey 24031E 24246 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan. 03/08 02/08 02/08-2000 Xin Beijing 146E 24249 COSCO COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 03/08 Nansha, Port Kelang (CI1)

26/07 25/07-1800 W Kithiria 429W 24240 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 27/07 30/07 30/07-0300 Seaspan Jakarta 430W 24247 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX)

02/08 02/08-0300 SM Neyyar 429W 24248

TO LOAD FOR INDIAN SUB

PORTS &

In Port —/— MOL Presence 015E 24243 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo.

02/08 02/08-0500 Dimitris Y 0246E24251

02/08-0400 SM Manali 044 24251 CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, 03/08 Krishnapatanam, Cochin, Mundra. (CCG)

(SMILE)

MUMBAI: Ratings agency ICRA has upgraded the rating of Adani Ports and Special Economic Zone (APSEZ) to AAA/Stable from AA+/Stable. The company’s long-term fund based/non-fund based facilities, nonconvertible debentures (NCDs) and commercial papers have been upgradedtoAAA/Stable.

APSEZ announced the development after market hours and the Adani Ports shares recently ended at Rs 1,491.95 on the NSE, downbyRs7.10or0.47%.

Theupgradecomesonthebackofa Bloombergnewsreport,whichsaidthe company planned to ramp up its investmenttoRs100billion($1.2billion) to boost its southern India transshipment container port. Citing people with knowledge of the matter, the report said the company is looking to luresomeoftheworld’slargestships.

The investment in the first-of-itskind Vizhinjam port in Kerala is part ofthesecondphaseoftheprojectthat is expected to finish by 2028, the report said, quoting people familiar with the Adani Group’s plans who did notwanttobeidentifiedasthedetails

arenotannounced.

Theport,whichislocatednearthe southernmosttipofIndia,closetothe international shipping routes and has deepest shipping channels, is set to receivethefirstcontainervesselfrom MaerskonJuly12aspartofatrialrun inthe800-metercontainerberth.

Adani Ports reported a 77% yearon-year(YoY)jumpinitsconsolidated net profit to Rs 2,014.77 crore. TheprofitstoodatRs1,139.07crorein the year-ago period. The revenue from operations for the said quarter grew 19% YoY to Rs 6,896.50 crore fromRs5,796.85crore.

NEW DELHI: India’s agriculture exports contracted 3 per cent to $5.88 billion during the first quarter of the financial year due to major ‘global headwinds and tight domestic supply conditions’.

Agricultural and Processed Food Products Export Development Authority (APEDA) chairman Abhishek Dev said the current challenges in the agriculture sector include the rise in shipping costs and air freight triggered by the Red Sea crisis, fall in global prices of maize,whichtookatollonexports.

Rice exports have also been constrained by export controls on certainvarietiesofthegrainincluding non-basmati rice imposed by India. During the quarter ended June this year, India exported rice – basmati and non-basmati – worth $2.8 billion, down0.46percent.

The Government, however, believes India will be able to catch up with last year’s rice exports in the next six months. “There have been a lot of issues in the logistics, particularly due to the Red Sea crisis,

which has been persisting and there has been an increase in cost of air freight. Due to issues between the US and China, there has been shortages in the containers also,” Dev told reporters. According to Dev, theproductionofmaizehasbeengood this year. However, it resulted in a declineinpricesglobally.

“Even though there is good production of maize in India also, our local prices are more than international prices. Due to that, exportsofmaizehavecomedownthis year,”hesaid.

According to Government data, exports of regulated agriculture items such as wheat, non-basmati rice, millet products, witnessed contraction during the first two months of the current financial year. On the other hand, exports of nonregulated agriculture including basmati rice, buffalo meat, fresh vegetables, fruits and juices, dairy products,saw3percentgrowth.

APEDA has also identified ‘25 focus products’ where exports can be further boosted. These items

include onion, basmati rice, groundnuts, cashew, banana, potato, ghee,pomegranate,andpineapple.

The Government is working towards launching an online platform to tackle non-trade barriers in the nexttwo-threemonths.

“All these issues take years to get resolved. But if we have an online mechanism to track and trace them, then an effective resolution is possible,” Rajesh Agrawal, Additional Secretary, Department ofCommerce,said.

The trade impact of non-tariff measures on the cost of exports is higher as compared to the impact of the imposition of tariff measures, accordingtomultiplestudies.

Agrawalsaidthatattimesthecost incurred to meet the non-tariff measures imposed by a partner country.“Therearestudiesthatgoon to say that non-tariff measures need greater compliance and they add to the cost, but at the same time such measures are also necessary from each country’s perspective to meet thequalityrequirements,”headded.

NEW DELHI: An efficient logistics sector is pivotal for India to become a globally preferred business destination. It reduces manufacturing costs, makes businesses more competitive, and links them with global value chains, boosting the Make in India initiative. The sector is also one of India’s largest employers, employing over 22 millionpeople.

In 2023, India ranked 38 out of the 139 nations in the World Bank’s Logistics Performance Index (LPI), up six places from the previous rankingsin2018.Indiahasnowsetthe ambitious goal of ranking among the world’s top 25 nations by 2030, bringing logistics costs down to the equivalentoflessthan10%ofGDP.

Decisive actions have been taken todevelopalogisticsbackboneforthe country. The national highways have expanded at an unprecedented rate, connecting ports to hubs of economic activity.Therailwaystoohavetakena quantum leap by building electrified freight-only corridors that link manufacturingcentrestoportsonthe eastern and western coasts. Longdefunct inland waterways are being rejuvenated. Many routes — including National Waterway 1 — have been strengthened, and efforts are on to move cargo through new river-to-seaconnections.

The Pradhan Mantri Gati Shakti National Master Plan and the

National Logistics Policy are key initiatives. The PM Gati Shakti initiative is breaking down the siloed approach to the planning and execution of multimodal infrastructure projects by integrating data from 16 ministries and departments onto a single Geographic Information Systembasedplatform.

Port and Customs services have also seen significant improvements. Cargoisnowclearedmuchfasterand containerised cargo can be tracked digitally.Today,ittakesaboutadayfor a ship to turn around at the Nhava Sheva(JN)PortinNaviMumbai.This is almost at par with Singapore, a world leader in logistics, which takes just 0.75 days. Gujarat has been ranked the top performer among coastal states in India, and West Bengal is taking advantage of its strategic location by placing a new thrust on logistics infrastructure and services.

Evenso,newtechnologiessuchas big data and artificial intelligence can beputtogreaterusetofulfilthevision of a nationally integrated, costeffective, reliable, and digitally enabledlogisticsecosystem.

First, the PM Gati Shakti platform can be overlaid with information on trade flows across the country. This will enable planners to mine the plethora of data available from the Goods and Services Tax Network and

E-Way bills to see where infrastructureneedstobeimproved.

Second, the multimodal logistics parks planned with connectivity to railway corridors can serve as warehouses and data centres, attracting private sector service providers and investors, while giving manufacturerslast-mileconnectivity.

Third, the country’s youth will need to be equipped with the skills needed by this dynamic industry. Womentoocanbenefitfromnewjobs, especially in softer skills such as packaging, sorting, and warehouse management. The Logistics Sector Skill Council is training workers in newer technologies to help them become full-fledged logistics professionals.

The World Bank has been supporting India through a variety of rail, road, and inland waterway projects. It is also helping the country increase digitisation and improve trade services, among other measures, and supporting the development of skills for this rapidly evolvingindustry.

India’s push to improve its logistics performance will not only improve its trade competitiveness, but will also increase jobs, and enable the country to emerge as a logistics hubfortheregionandbeyond.

By-AugusteTanoKouaméisthe World Bank's Country Director for India.

NEW DELHI: The much-awaited Western dedicated freight corridor, which connects Maharashtra with northern India, will be completed by the end of 2025, marking the completion of the dedicated freight corridor project after over 10 years of beingconceptualised.

“Thecorridorhasbeen completed in all states except Maharashtra. The project section in the state has seen physicalprogressof50percentsofar, and is likely to be completed by December 2025,” Dedicated Freight CorridorCorporationofIndia(DFCC) ManagingDirectorRKJainsaid.

The Vaitarna-JNPT section of the western corridor is the last leg of the project, which had been stuck in the past due to shortcomings of the contractor, Tata Projects.

The company was served a termination notice by DFCC in 2023, whichwaslaterrevoked.

Currently, the ministry of railways SPV is running 325 trains per day (as of June 2024), which is 60 per cent more than last year. The Eastern DFC, between Punjab and Bihar, wascompletedlastyearandhasbeen extensively used this financial year to ensuretimelydeliveryofthermalcoal topowerhouses.

According to DFCC, more than 10 per cent of the national transporter’s freight volumes are beinghandledbyit.

Jain said that the completion of DFCs will be a vital landmark for India to reduce its logistics cost and for railways to gain a 45 per cent modalshareinnationallogistics.

The corporation was also entrusted with project planning for three future freight corridors –North-South (Itarsi-Vijaywada), east coast (Kharagpur-Vijaywada), andEast-West(Palghar-Dankuni).

Jain said that DFCC has submitted detailed project reports (DPRs) for these projects to the ministry of railways and is awaiting a decision on the same. According to the company, the transit time for coal from mines to thermal power plants (TPPs) has reduced from 35 hours in thepastto20hoursnow.

Jain,whoheadedtheorganisation from 2020, will serve until July 31. A new Managing Director has been appointed and will take over starting August to oversee the completion of theWesternDFC,officialssaid.

9 ports witness reduction in average release time with a significant 50 percent reduction in case of Integrated Check Posts (ICPs) and 6 percent reduction in case of Air Cargo Complex (ACCs) Y-o-Y

NEW DELHI: Shri Sanjay KumarAgarwal,Chairman,Central Board of Indirect Taxes and Customs (CBIC), along with other Members of the Board, released the NationalTimeReleaseStudy(NTRS) 2024report.

NTRS 2024 is 4th annual nationallevel study adopting a standardized methodology and covering the bills of entry (for imports) and shipping bills (for exports) submitted during the firstweekofJanuary2024whichwere trackedtillFebruary7,2024,forcargo clearance via 15 major customs formations (categorised into 4 categories- Seaports, Inland Container Depots (ICDs), Integrated Check Posts (ICPs) and AirCargoComplex(ACCs)).

For imports, the study has noted that,outofthe15portscoveredunder the purview of the study, 9 ports have witnessed a reduction in the average release timein2024 vis-a-visprevious year.Also,therehasbeenreductionin releasetimeincaseofICPsandACCs – a significant 50 percent reduction in case of ICPs and 6 percent reduction in case of ACCs in 2024 compared to thecorrespondingperiodin2023.

NTRS 2024 has also looked at the CBIC Pre-payment Customs Compliance Verification (PCCV) initiative, in which all the Customs formalities are completed and final clearance is pending only for want of payment of duties by the importer.

It was noticed that once the payment is made, the final Clearance is granted by the Customs through automatedMachineReleaseprocess, on an average, within 3 minutes from the duty payment. Further, the bills of entrythathaveallthethreefeaturesadvance bills of entry, facilitated bills of entry, and AEO (Trusted Clients programme) bills of entry — report a significantly lower average release timeof46%forseaports,36%forICDs and 45% for ACCs than the overall releasetimeforthatportcategory.

For exports, the study distinguishes between regulatory clearance (customs release), completed with the grant of Let Export Order (LEO), and the wider aspect of physical clearance, completed with the departure of the carrier with the goods. It was noticed thatthetimeofthearrivalofthecargo at the customs station/port to its regulatory clearance, marked by grant of Let Export order (LEO) has reducedforICDsandACCsin2024vis a vis 2023. In absolute terms, the average release time taken in export Customs clearance regulatory process, in 2024, stood at 22:49 hours for seaports, 30:20 hours for ICDs, 3:50 hours for ACCs and 5:28 hours forICPs.

The Time Release Study (TRS) serves as a performance measurementtoolaimedatproviding a quantitative measure of cargo

release time. This time is defined as the period from the arrival of cargo at the Customs station to its out-ofcharge for domestic clearance in the case of imports, and from the arrival of cargo at the Customs station to the eventual departure of the carrier in thecaseofexports.

The objective of NTRS 2024 is to present a comprehensive quantitative national-level assessment of the cargo clearance process for this year, compare it to performance during the correspondingperiodsoftheprevious years to measure success in terms of (a) the progress made towards the targets set under the National Trade Facilitation Action Plan (NTFAP) and (b) evaluate the impact of initiatives thatareputinplace.

NTRS 2024 has also attempted to expand the scope of time release study to cover the time taken in release of transit cargo from and to Nepal,cargoreleaseatICDGarhiand courier cargo handled by ACC Bengaluru. The quantification of time taken in the clearance of import and exportcargoatICDGarhiandcourier terminal, ACC Bengaluru has been included in NTRS 2024 with the intention to provide the benchmark dataforcomparisoninfuture.

The complete findings of the NationalTimeReleaseStudy2024can be accessed on the CBIC website (https://www.cbic.gov.in/).

NEW DELHI: The popular interest equalisation scheme for exporters, that lapsed last month-end for all beneficiaries except for the MSME sector, may get extended for all. The Directorate General of Foreign Trade, under the Commerce Department, is moving a proposal to retaintheschemeinitsearlierformand will soon present it to the Expenditure Finance Committee (EFC) for its approval,officialsourceshavesaid.

“Once the EFC agrees to the proposal of retaining the interest equalisation scheme for all beneficiaries and decides on the time period for which the scheme should be extended, it will be sent to the Union Cabinetforclearance,”anofficialsaid.

The interest equalisation scheme, first implemented in April 2015 for five years, allows exporters of 410 identified products and all exporters from the MSME sector, access to bank credit at a subsidised interest rate determined by the government. The Government then reimburses the banks for their

lowerinterestearnings.

After the initial five years of the scheme, it was extended several times for smaller period of time. The last extension lapsed on June 30, 2024, following which it was extended for two moremonthsjustfortheMSMEsector.

“The two-month extension of the scheme for the MSME sector was to give breathing time to the Commerce & Industry Ministry to formulate a fresh proposal for its extension and get the relevant clearance. MSME exporters arethemostvulnerable,sotheyneeded protection. Hopefully, the EFC will agree to extend the scheme with retrospective effect for all exporters fromJuly1,2024,”theofficialsaid.

Boost competitiveness

The DGFT has proposed that the scheme should be extended as it was providing an interest equalisation benefit at the rate of 2 per cent on pre and post shipmentrupeeexportcredittomerchant and manufacturer exporters of the 410 identified tariff lines and 3 per cent toallMSMEmanufacturerexporters.

“Export bodies had made a case for higher subvention rates but the Commerce Department is proposing extensionoftheschemeattheratesthat wereinplacewhentheschemelapsedon June30,2024,”theofficialsaid.

The EFC is chaired by the Revenue Secretary so the scheme will get clearance if the Finance Ministry is on board. The Finance Ministry wants it to be firmly established that the scheme has been delivering results in terms of increasing exports, but a definite co-relationship is difficult to prove, theofficialsaid.

“The logic that the Commerce & Industry Ministry is pushing is that if peer countries, like East Asian countries and developed nations, have lower interest rate, then we are making ourexportersuncompetitivebecauseof ourownpolicies.Ourmonetarypolicyis affecting them. So, the idea is to bring interest rates at par or at least lower them a little so that the country’s exporters become more export competitive,”theofficialexplained.

NEW DELHI: India is aiming to boost annual Foreign Direct Investment by more than 50% to help lift economic growth, according to a top official at the Government’s investmentpromotionagency.

“Forthenextsevenyears,ourgoal is to draw $110 billion per year which amounts roughly $1 trillion plus over the next 10 years,” Nivruti Rai,

Managing Director of Invest India, said in an interview with BloombergTV’sPaulAllen recently. “We have to work hard toward growingataratehigherthan10%.”

India’s annual average FDI in the seven years through March 2023 amounted to $71 billion, according to figures from the investment agency, which is a joint venture between the

Ministry of Commerce and private businesschambers.

OfficialdatafromtheGovernment show a decline in FDI into India since 2022, even though the country is positioning itself as an alternative manufacturing hub to China, with companies like Apple Inc. setting up factories in the country in recent years.

NEW DELHI: The shipping industry is expecting that the upcoming Union Budget 2024 will greenlight the revised productionlinked incentive (PLI) scheme for manufacturing shipping-grade containers. Specific reforms expected include increased funding for port modernisation and incentives for green shipping practices.

Centre is expected to revive production-linked incentive (PLI) scheme for manufacture of shipping containers in budget. The Ministry of Ports, Shipping, and Waterways has proposed a revised PLI scheme to boost the manufacturing of shippinggrade containers, after a previous plan for the same was shelved post cabinet discussions, government officialstoldMoneycontrol.

The revised PLI scheme recommended by the Ministry of Ports, Shipping and Waterways has a reducedbudgetofRs5,000croreanda

shorter tenure of three years.

The earlier proposal for Rs 11,000 crore of incentives over 9 years was shelved by the Cabinet Committee on EconomicAffairs(CCEA). WhatBudgetmaydeliver

Expectations are also that the government may launch a maritime development fund with a corpus of Rs 15,000 to 20,000 crore to support shipbuilding firms with low-interest loans, reported CNBC Awaaz. The fund will provide loans to shipbuilding firm at cheaper rates withsimpleconditions.

The Budget could also see the announcement of a green ship scheme under which the government plans to promote pollution-free hydrogen-based vessels on domestic waterways,accordingtothereport.

The Centre is reportedly planning to replace oil-guzzling ships plying on theIndianriverswithcleanvesselsby providing incentives under its green shipscheme.

The Ministry has proposed a joint venture between the Shipping Corporation of India (SCI) and Indian Oil Corporation (IOC) for the manufacturing of large oil tankers, aiming to reduce dependence on foreignfirms,theCNBCAwaazreport added.

The shipbuilding scheme, as part ofwhich,thecompaniesreceiveupto 20 percent financing may be extended beyond 2026 in Union Budget2024.

The Shipbuilding Financial Assistance Policy (SBFAP), launched to promote the “Make in India” initiativeandsupporttheshipbuilding industry, may be extended beyond 2026.

This policy, which offers financial aid to Indian shipyards for contracts signed between April 1, 2016, and March 31, 2026, could continue with financial assistance remaining at 20 percent, suggested a Zee Business report.

NEW DELHI: On-network logistics-as-a-service on the government-backed Open Network for Digital Commerce (ONDC), touched one million transactions in June,ONDCsaid,onFriday.

This is an initiative bridging the demand gap for third-party logistics and the delivery of products across thenetwork.

On-network logistics gives sellers real-time options to optimise costs and ensure timely deliveries. Currently, the on-network logisticsas-a-service is spread across all 28 states and seven union territories ofIndia.Thehighestordershavebeen delivered to Karnataka followed by DelhiandTelangana.

The network is delivering more than 93% compliance to promised delivery timelines to customers. Ola, pidge, and Loadshare Networks have a high turnaround time adherence, ONDC said. Delhivery, shadowfax, and Loadshare Networks

maintainedafillrateofmorethan98% across months, it said. Fill rate is defined as the percentage of orders thataredelivered,whichisameasure ofperformancebyalogisticssupplier.

But the logistics suppliers on the network are still in the early stages, the network said. More than 75% of magicpin’s retail orders are now being serviced by on-network logistics suppliers. “This growth has been enabled by the extensive outreach by the logistics supply applications offering both hyperlocal andintercitysupply,”ONDCsaid.

A significant proportion of the onnetwork logistics orders are also currently being fulfilled by Ola, said ONDC.

Players like Pidge, Loadshare, Shadowfax, Adloggs and Zypp have recorded more than 50 per cent month-on-month growth, it said. “While currently the playbook for hyperlocal logistics is being built upon, the network participants are

parallelly working on building capacity for intercity logistics also,” thenetworksaid.

ONDC has started getting active interest from various consumer packaged goods players, direct-tocustomer (D2C) brands and fashion domaintooptimisethecostofservice.

“The key value proposition of using on-network logistics is cost optimisation, supply unification of both intercity and hyperlocal across the country, instant scaling up of any business across India, single integration to access the whole supply, and enhanced supply chain resilience,”thenetworksaid.

Farmer Producer Organisations (FPOs) are finding value in D2C engagement on the network and on-network logistics suppliers are working on ramping up the supply to pick up the products from small sellers and FPOs that are located in remote geographies and delivering thesamepan-India,ONDCsaid.

Cont’d. from Pg. 3

These discounts apply to Pilotage, Port Dues, and Berth Hire Charges as specified in the DPA’sScaleofRates.

The rebates will be effective

from July 19, 2024, and remain in place for a period of six months. Following this period, the program will be reviewed for potential continuation. This initiative aims to incentivize the import and export of coal and coke through DPA, offering significant cost savings for port usersandtradeassociations.

• Become First Na�onal Port to handle 51.2MMT in single month.

• Creates Na�onal record by handling 45 vessel movements in 24 hours.

Cont’d. from Pg. 3

HistoricCargoHandlinginQ1FY25:

Mundra Port continues to set new benchmarks, handling an impressive 51.2 million metric tonnes (MMT)ofcargoinQ1FY25.Thisachievementpotentially marks the highest volume of cargo handled in a single quarter in India, highlighting Mundra Port's pivotal role inthenation'slogisticsandtradesectors.

Record-BreakingMarineOperations:

In Current month, Adani Ports' marine team achieved a significant milestone by managing 45 vessel movements within 24 hours, surpassing the previous record of 43 vessel moves set on December 17-18, 2023. This accomplishment, the highest number of vessels handled by Mundra Port in a 24-hour period, showcases the team's dedication and efficiency in safely coordinatingcomplexmarineoperations.

UnprecedentedContainerHandlingatMundraPort:

In June 2024, Adani Ports, Mundra, achieved an unprecedented feat by handling the highest number of 1,594 container rakes, equating to 1.68 lakh TEUs. This exceptional performance also included the handling of

thehighestnumberofoutward(import)TEUsinasingle day,with3,954TEUsmanagedbyatotalof33trains.

Senior Leadership of APSEZ, commented on these milestones, stating, "These achievements are a testamenttoourteam'srelentlessdedication,innovative approach, and commitment to setting new standards in port operations. We are proud to contribute significantly to India's logistics capabilities and remain focused on drivinggrowthandexcellenceinallourendeavors."

Adani Ports and Special Economic Zone Limited (APSEZ)continuestoleadtheindustrywithitsstrategic initiatives, advanced infrastructure, and a steadfast focusonoperationalexcellence.

OSLO: With the 2M Alliance between the two largest shipping lines, MSC and (1st) and Maersk (2nd), coming to an end in February 2025, and with Maersk then joining Hapag-Lloyd to form the Gemini Cooperation, MSC, it seems, is already shifting their focus onto their own-operated services. MSC have been growing capacity market share for their stand-alone services(servicesofferedoutsidethe2Malliance)onthe TranspacificandAsia-Europetrades.

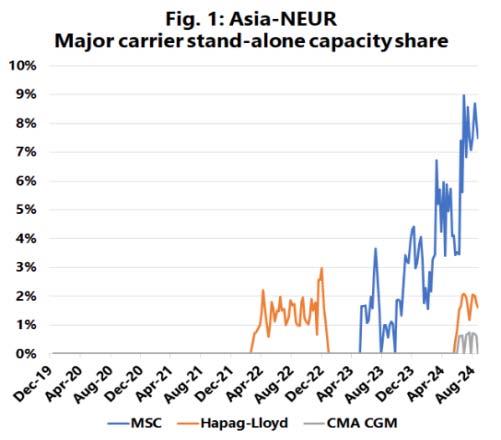

Figure 1 shows the share of Asia-North Europe capacity (3w avg.) offered by MSC on their stand-alone services, against those of Hapag-Lloyd and CMA CGM, whicharetheonlyothermajorcarriersonthetradelane withstand-aloneservices.

This increase for MSC should be seen not only in the context of the extreme pressure the markets are currently under, but of course also in the context of the terminationofthe2Malliance.Clearly,MSCisbeginning to carve out services on their own prior to the 2M termination date, whereas Maersk is not doing the same. It can also be seen that MSC began doing this before the Red Sea crisis – although an acceleration has clearly happened after the outbreak of the crisis. OnAsia-Mediterranean,themovefromMSCtoincrease stand-alone capacity share pre-dates the Red Sea crisis, with MSC stand-alone services accounting for approximately 9% of deployed capacity in the trade lane since2023-Q2.

A similar trend can also be seen on the two Transpacific trade lanes, especially on Asia to North America East Coast, where MSC have been increasing theirstand-alonecapacitymarketsharefrom3%to6%in 2023-Q3. On the Asia to North America West Coast trade lane, MSC stand-alone services were introduced when the pandemic market tightened in 2020-Q3, and have held a somewhat consistent capacity market share of around 6%, outside of a temporary increase to around 12%duringtheheightofthepandemicinlate2021.