Refer Back Pg.

Tel : 2266 1756, 2266 1422, 2269 1407

JNPA handles 635,665 TEUs in January 2025, rising 23.21%

Also handles highest-ever rail traffic

Refer Back Pg.

Tel : 2266 1756, 2266 1422, 2269 1407

JNPA handles 635,665 TEUs in January 2025, rising 23.21%

Also handles highest-ever rail traffic

N A V I M U M B A I :

RIYADH: Bahri announced its financial results for the fourth quarter and full year 2024 showing an 18% and a 34% increase in net profit, compared to the same periods in 2023, respectively, driven by favorable freight rates overall, increased cargo volume supported by fleet expansion, improved operating cost efficiencies, and higher earnings from associated companies.

Shri Unmesh Wagh, IRS Cont’d. Pg. 6

J a w a h a r l a l N e h r u Po r t Authority (JNPA), India’s B e s t - P e r f o r m i n g P o r t , handled 635,665 TEUs of containers in January 2025, which is higher by 23.21% as compared to traffic in January 2024. JNPA handled 6,013,086 TEUs of container traffic from April 2024 to January 2025 which is higher by 14.08% as compared to the corresponding period in the previous financial year

Eng. Ahmed Ali Al Subaey, Chief Executive Ofcer of Bahri, commented: “2024 was more than just a recordbreaking year for Bahri – it was a pivotal year that laid the foundation for our future. We took strategic steps to reinforce Bahri’s position as a global leader in shipping and logistics by modernizing and expanding our fleet, with a net addition of five vessels. We also grew our customer base and secured new demand channels, supported by the trust and reputation for reliability we have built in the market, along with the strength of our partnerships and our employees’ unrelenting focus on consistently exceeding expectations. Cont’d. Pg. 6

Average customs duty cut to 10.65% : CBIC Chairman

Refer Pg. 27 Refer Pg. 17

Port of Call : Shanghai, Leam Chabang, Pensacola, Houston, Wilmington, Ennore, Baltimore, Genoa, Alexandria, Suez Canal, Jeddah, Abu Dhabi, Jebel Ali, Dammam

Mr. Kishore Iyer : +91 88797 30536 csv.agency@radiant-india.net

Mr. Muralikrishna : +91 89399 90227 sales1chn@radiant-india.net

Capt. Jyothish Nair : Mob.+91 89289 52582 E-mail : jyothish@radiant-india.net Capt. Amarendra Mishra : Mob. +91 7750077756 E-mail : c-amishra@bahriline.sa Flat No. 2, First Floor, Door 28/1 Rajarathinam Street, Kilpauk, Chennai - 600

Mr. Anish Gopi : +91 74001 35099 anish@radiant-india.net Mr. S. Naveen Rao : +91 89398 87681 naveenrao@radiant-india.net

SKCL Prime, Plot No.C46 A, CIPET Road, Guindy, Chennai-600032

Cont’d. from Pg. 3

Highlights of Jan-2025:

1. JNPA handled 635,665 T E U s o f c o n t a i n e r s & 7.92 Million Tonnes of total cargo in Jan-2025 which is higher by 23.21% & 17.77 % respectively as compared to traffic in Jan-2024.

2. During Jan-2025, JNPA handled 641 container rakes and 101,984 TEUs as compared to 542 rakes and 84,752 TEUs during the corresponding period in the previous financial year This is the highest-ever rail traffic handled in a month surpassing the previous highest of 100,166 TEUs in Mar-2010.

Highlights of FY 2024-2025:

1. JNPA handled 6,013,086 TEUs of containers &

76.29 Million Tonnes of total cargo from Apr-2024 to Jan-2025 which is higher by 14.08% & 7.99% respectively as compared to the corresponding period in the previous financial year

2.From April 2024 to January 2025, JNPA handled 5,630 container rakes and 891,988 TEUs as compared to 5,338 rakes and 851,153 TEUs during the corresponding period in the previous financial year

With consistent efforts to enhance operational efficiency and trade-centric ser vices, JNPA continues to drive India's maritime trade growth As the nation’s premier port, JNPA remains committed to delivering seamless, sustainable, and futureready port operations, setting new benchmarks for the sector

Cont’d. from Pg. 3

Throughout the year, we remained committed to operational excellence –building resilience, efficiency and discipline across our business, while maintaining agility to seize opportunities and mitigate risks presented by a volatile and evolving market.

Our journey remains firmly directed towards delivering sustained, value-accretive growth for our shareholders, championing the transformation of the Kingdom’s shipping and logistics sector in line with Vision 2030, and strengthening our role as a vital and responsible participant in the global supply chain.”

Fourth Quarter 2024

Bahri’s fourth quarter 2024 (Q4 2024) revenue grew 10% year-on-year (YoY) to SAR 2.22 billion, primarily supported by increased overall cargo volumes mainly driven by the expansion of Bahri’s operated fleet (owned and chartered vessels), as well as generally higher freight rates.

Q4 2024 EBITDA increased 13% YoY to SAR 1.12 billion, driven by EBITDA margin expansion to 50% from 49% in Q4 2023, reflecting improved cost efficiencies m a i n l y f r o m v o y a g e o p t i m i z a t i o n a n d f l e e t modernization Bahri’s EBITDA growth was mainly propelled by increased EBITDA by the Oil and Integrated Logistics business units (BUs), as well as increased income from associated companies.

Consequently, Bahri’s Q4 2024 net profit rose 18% YoY to SAR 474 million, with net profit margin improving to 21% from 20% in Q4 2023.

Full Year 2024

In 2024, Bahri achieved a record-breaking revenue of SAR 9.48 billion, up 8% compared to 2023, driven mainly by higher cargo volumes resulting from fleet expansion and generally higher freight rates.

EBITDA increased by 23% YoY to SAR 4.71 billion, propelled by revenue growth and supported by effective cost management from voyage and scheduling optimization, as well as the cost savings resulting from the modernized fleet.

In addition, Bahri recorded a significant increase in income from associated companies compared to the prior year. This increase was primarily due to the twin effect of the increased equity stake of Bahri in Petredec Group from 30% to 40% back in October 2023, and Petredec’s higher net profit in 2024, compared to 2023.

Net profit reached an all-time high of SAR 2.17 billion in 2024, a 34% surge from the previous year, driven by

strong EBITDA performance. Bahri’s net profit margin markedly expanded to 23% in 2024 from 18% during the previous year

In 2024, Bahri generated SAR 3.47 billion in net operating cash flow, reflecting a 3% decline from 2023, primarily due to an unusually large release of cash from working capital changes in 2023.

Capital expenditures reached SAR 5.48 billion in 2024, up from SAR 1.65 billion a year ago, largely driven by a SAR 4.82 billion investment in fleet modernization and expansion. As a result, free cash flow for 2024 amounted to an outflow of SAR 2.01 billion, compared to an inflow of SAR 1.91 billion in 2023. SAR 524 million of cash proceeds from the sale of six older vessels during 2024 partially offset this outflow

Bahri funded its 2024 capital expenditures through a combination of cash generated from operations, vessel sale proceeds, new borrowings and its cash reserves. Net availment of loans and borrowings, after loan repayments and lease liability settlements, amounted to SAR 549 million, while the Company’s cash decreased by SAR 1.09 billion, leaving a year-end cash balance of SAR 1.82 billion.

A key financing milestone in 2024 was a USD 756 million (SAR 2.84 billion) 10-year Murabaha financing agreement secured in October to partially fund the approximately SAR 3.75 billion purchase of nine Very Large Crude Carriers (VLCCs) from Capital Maritime and Trading Corporation, with the vessels serving as collateral. By year-end 2024, USD 304 million (SAR 1.14 billion) of the facility had been utilized, reflecting full payment and delivery of four of the nine VLCCs ordered. Of these four VLCCs delivered, two vessels joined the operated fleet in Q4 2024.

As a result of increased borrowings and lower cash reserves, net debt rose to SAR 7.90 billion by end-2024, up from SAR 5.44 billion a year ago. Despite this increase, strong earnings during the year partially offset the impact, resulting to a net debt-to-EBITDA ratio of 1.68x compared to 1.42x at the end of 2023. The Company remains confident in maintaining a healthy balance sheet while continuing to invest in fleet modernization and expansion.

Following the close of 2024, Bahri secured a five-year Murabaha revolving credit facility of USD 800 million (SAR 3 00 billion) in January 2025 This facility will further strengthen the financial position of the Company, and support ongoing working capital and capital expenditure requirements, as needed.

Marathon Nextgen, Innova “A”-G01, Opp.Peninsula Corporate Park, Off.Ganpatrao Kadam Marg, Lower Parel(W), Mumbai-400013 Board Tel.:022-61657900, Fax: 022-61857299/98/97, E-Mail:info@evergreen-shipping.co.in, Website:http://www.shipmentlink.com/in

NHAVA SHEVA : Anchorage, Ship Agents Premises Co-op. Society Ltd., 3rd Floor, Unit Nos. 301, 302 & 303, Plot No. 2, Sector No.11, Dronagiri Node, Nhava Sheva, Navi Mumbai - 400707 Tel.: 022-27471601, Fax: 91-22-27246415, E-Mail: nxvlog@evergreen-shipping.co.in

NEW DELHI : 51, Okhla Industrial Estate, Phase - III, 1st Floor, New Delhi-110020 Tel.: 011-61657900 (Hunting), Fax: 011-66459698 / NDI Fax : 011-66459699, E-mail: ndibiz@evergreen-shipping.co.in

HoeghAutoliners MerchantShpg. Kingston,Veracruz,Freeport,Mobile,Jacksonville,Baltimore& South American & Caribbean Ports via Kingston 14/0318/03 CP Atlantic 44 Chipolbrok Samsara Houston. TO LOAD FOR FAR EAST / EAST, WEST & SOUTH AFRICA / AUSTRALIA & NEW ZEALAND

09/0210/02 Arc Commitment(USA) 003 1120102-22/01 EukorCarCarrier Parekh Marine Hongkong,Pyeongtaek. 15/0216/02 Hoegh Oslo 123 1121551-01/02 HoeghAutoliners MerchantShpg. Durban, Fremantle, Melbourne, Port Kembla, Auckland via Durban 14/0318/03 CP Atlantic 44 Chipolbrok Samsara Singapore, P Gudang, Shanghai, Dalian.

(As Agent of NYK Bulk & Project Carriers Ltd.)

(Formerly known as NYK Auto Logistics (India) Private Limited, in which NYK Line (India) Private Limited has been merged) CIN No.: U63000MH2004PTC143860 / PAN No. AAACH7663P

The captioned vessel is arriving at MUMBAI on 07/02/2025 with Import cargo.

Consignees expecting import cargoes on the captioned vessel are requested to present their ORIGINAL BILLS OF LADING duly discharged and obtain Delivery Orders. In the event of Mumbai Port Trust directing the shifting of the cargo from quay to a storage area within the docks, the same will be undertaken by the vessel agents at the consignee’s risks and costs.

“Stamp duty” is payable as per the directive of the Superintendent of stamps.

Consignees will please note that the Carriers and/or their agents are not bound to send the individual notifications regarding the arrival of the vessel or their cargo.

Consignees are requested to arrange for clearance of the cargo at the earliest on presentation of the packing list to our attending surveyors, as it is noticed that the cargo is arriving without proper Marks & Numbers and the same is also not indicated in the Bills of Lading for which the vessel/Owners/Agents will not be held responsible for the consequences arising thereof.

Consignees requiring steamer survey to be conducted for the goods discharge may contact the agents office for the same.

The company’s Surveyors are M/S. AINDLEY MARINE PVT. LTD.

9 Kamanwala Chambers, 1st Floor, Sir P. M. Road, Fort, MUMBAI- 400001

Tel: +91-22-66359901/2/3 E-mail : Email: ops@aindley.com and the usual survey conditions will apply

General Agent

Unit No 1205-1208, 12th Floor, Windfall Sahar Plaza Complex, Sir M. V. Road, J.B. Nagar, Andheri-Kurla Road, Andheri (East), Mumbai - 400 059. Contact details: Board : +91 22 - 4613 8181 Website : www.nyklineindia.com

Seaspan Oceania 0MXLPW1

COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras

07/02 1700 Aydogan 2503W Q2557 1118487-11/01 MBK Line MBK Logistics Jeddah, Beldeport 10/0211/02

TBATBA Athena 0057 Q2632 1119667-20/01 C Star Diamond Maritime (India Med Service) 11/0212/02

TBATBA Ghibli 25005W Q2766 1121428-30/01 Sealead Sealead Shpg Jeddah, Sokhna (RESIN Service) 17/0218/02

TBATBA CMA CGM Manaus 0QC31W1 Q2738 1121044-29/01 CMA CGM CMA CGM Ag. Djibouti. (BIGEX 2) 22/0222/02

TBATBA CMA CGM Vitoria 0QC2PW1

TO

05/0206/02 05/02 0700 Konard K0N0125W Q2729 1120975-28/01 Akkon Line Oasis Shpg. Aliaga Gemlik, Gebze (YIL Port), Ambarli, Felixstowe, Antwerp 06/0207/02 05/02 2359 X-Press Altair 25002W Q2672 1120093-22/01 X-Press Feeders Sea Consortium Jeddah, Al Sokhna 08/0209/02 TBATBA SSL Brahmaputra 923W Q2635 1119685-20/01 Wan Hai Wan Hai Lines (I) (RGI / IM1) 22/0223/02 TBATBA SSL Godavari 039W UnifeederUnifeeder

02/0303/03 TBATBA Wan Hai 501 254W Emirates Emirates Shpg. 07/0208/02 07/02 1200 X-Press Dhaulagiri 25002R Q2695 1120663-27/01 MSC MSC Agency King Abdullah, Jeddah. (Saudi Express) Hind Terminals 14/0215/02 TBA 0500 Dubai Tower 25003R Q2742 1121075-29/01 08/0209/02 TBATBA W. Kithira 505W Q2643 1119701-20/01 Maersk Line Maersk India Algeciras (MECL)

15/0216/02

TBATBA Maersk Detroit 506W Q2663 1119918-21/01 11/0211/02 11/02 1200 Wadi Duka 2506W Q2725 1120903-28/01 Folk Maritime Seastar Global Jeddah (IRSS) 21/0222/02 TBATBA Folk Jeddah 2507W Asyad Line Seabridge TO

05/0206/02 05/02 1000 MSC Regulus IS504A Q2630 1119666-20/01 MSC MSC Agency UK, North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 12/0213/02 11/02 1000 MSC Luciana IS505A Q2721 1120905-28/01 SCI CMT Barcelona, Felixstowe, Hamburg, Rotterdam, Gioia Tauro, 20/0221/02 19/02 1000 MSC Laurence IS506A UK, North Continent & Other Mediterranean Ports. HimalayaExpress NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. UK, North Cont., Scandinavian & Med. Ports. Dron.2&Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. UK, North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa. Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware 06/0207/02 05/02 1000 MSC Barcelona IU505A Q2711 1120721-27/01

Haifa. (INDUS) Hind Terminal

MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals 14/0215/02 14/02 0900 MSC Pamela IP507A Q2795 1121903-04/02 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D). 21/0222/02 21/02 0900 MSC Nairobi X IP508A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre

COSCO COSCO Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Seahorse Ship UK, North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. Globelink Globelink WW UK, North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. UK, North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global UK, North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal UK, North Continent & Scandinavian Ports. Dronagiri-3 Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines UK, North Continent, Red Sea & Med. Ports. Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

07/02 0900 MSC

TBATBA W. Kithira 505W Q2643 1119701-20/01 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 15/0216/02 TBATBA Maersk Detroit 506W Q2663 1119918-21/01 Safmarine Maersk

Q2755

17/0218/02 TBATBA Shimin 26E Q2501 1117818-07/01 (CISC Service)

05/0206/02 05/02 1000 MSC Regulus IS504A Q2630 1119666-20/01 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, HindTerminals 12/0213/02 11/02 1000 MSC Luciana IS505A Q2721 1120905-28/01 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 20/0221/02 19/02 1000 MSC Laurence IS506A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast.

06/0207/02 05/02 1000 MSC Barcelona IU505A Q2711 1120721-27/01 MSC

MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 13/0214/02 TBA 1000 Karlskrona IU506A Q2776 1121666-03/02 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 20/0221/02 TBA 1000 Conti Courage IU507A 07/0208/02 06/02 1500 MSC Joanna IP506A Q2740 1121072-29/01 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals 14/0215/02 14/02 0900 MSC Pamela IP507A Q2795 1121903-04/02 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira, Paita, 21/0222/02 21/02 0900 MSC Nairobi X IP508A Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK) Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports. AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America 08/0209/02 07/02 2100 CMA CGM Dolphin 0INJ1W1 Q2719 1120875-28/01 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah & Dron.-3 & Mul. 15/0216/02 TBATBA CMA CGM Pelleas 0INJ3W1 Q2760 1121314-30/01 OOCL OOCL(I) Other US East Coast Ports. Dronagiri-2

ONE Line ONE (India) India America Express (INDAMEX)

COSCO COSCO Shpg. Indial Indial Shpg. US East Coast & South America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. ConexTerminal Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

09/0210/02 09/02 0400 Nagoya Express 5106 Q2698 1120545-25/01 Hapag ISS Shpg. New York, Norfolk, Charleston, Savannah ULA CFS 16/0217/02

TBATBA Bremen Express 5107 Q2744 1121108-19/01 (TPI/INDAMEX)

GTI In Port 05/02 MOL Presence 0020E Q2576 1118908-15/01 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 08/0209/02 08/02 1200 Dimitris Y 0251E Q2689 1120562-25/01 & Caribbean Ports, Canada. 15/0217/02 TBATBA Cap Andreas 0018E Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 16/0217/02 TBATBA X-Press Anglesey 2001E West Indies Ports. (TIP Service) 09/0210/02 09/02 1000 One Reassurance 245E Q2699 1120546-25/01 ONE Line ONE (India) New York, Jacksonville, Savannah, Charleston, 24/0225/02 TBATBA One Readiness 005E HMM HMM

OOCL Hamburg 155E Q2653 1119867-21/01

OOCL OOCL (I) (Bangladesh India Gulf Express) 05/0206/02 Atlantic Ibis 2504W Q2705 1120674-27/01 Hapag ISS Shpg. Jebel Ali, Dammam, Shuaiba, UMM Qasr. (IG1) ULA CFS 11/0212/02 TBATBA Source Blessing 2505W Q2736 1121032-29/01 Alligator Shpg. Aiyer Shpg. Jebel Ali, Shuaiba, UMM Qasr. 08/0209/02 08/02 1200 Ren Jian 8 02SJZS1 Q2644 1119734-20/01 CMA CGM CMA CGM Ag. Khorfakkan, Jebel Ali (SWAX) Dron-3&Mul 17/0218/02

TBATBA CMA CGM Manaus 0QC31W1 Q2738 1121044-29/01 CMA CGM CMA CGM Ag. Jebel Ali. (BIGEX 2) TO LOAD FOR

In Port 05/02 Nadia 20 Q2674 1120106-22/01 Lubeck Giga Shipping Bandar Abbas In Port 06/02 Garsmere Maersk 506W Q2639 1119684-20/01 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile)

Maersk CFS 12/0213/02 TBATBA Maersk Boston 507W Q2660 1119916-21/01 06/0207/02 06/02 1000 Inter Sydney 0172 Q2649 1119926-21/01 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

06/0207/02 05/02 2359 X-Press Altair 25002W Q2672 1120093-22/01 X-Press Feeders Sea Consortium Jebel Ali 08/0209/02 TBATBA SSL Brahmaputra 923W Q2635 1119685-20/01 Wan Hai Wan Hai Lines (I) (RGI / IM1) 22/0223/02

02/0303/03

TBATBA SSL Godavari 039W UnifeederUnifeeder

TBATBA Wan Hai 501 254W Emirates Emirates Shpg. 08/0209/02

TBATBA W. Kithira 505W Q2643 1119701-20/01 Maersk Line Maersk India Salallah. (MECL) Maersk CFS

08/0209/02 08/02 2359 Shamim 1343W Q2706 1120674-27/01 HDASCO Armita India Bandar Abbas, Chabahar. (IIX)

09/0210/02

09/0210/02

09/0210/02

TBATBA Maersk Cape Town 507S Q2642 1119704-20/01 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS

TBATBA Terataki 2502W Q2673 1120114-22/01 Asyad Line Seabridge Jebel Ali. (FEX)

TBATBA Zhong Gu Chang Sha 02444S Q2594 1119075-16/01 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. 18/0219/02

TBATBA Zhong Gu Shen Yang 0PU45S1 Q2600 RCL/CUL Line RCL/Seahorse 20/0221/02

TBATBA Zhong Gu Fu Zhou 0PU49S1

21/0222/02

KMTC (India) (VGX West Bound)

TBATBA Zhong Gu Kun Ming 0PU4DS1 CMA CGM CMA CGM Ag.

SeaLead SeaLead Shpg Alligator Shpg. Aiyer Shpg. Jebel Ali, Dammam

TBATBA Celsius Edinburgh 005W ONE Line ONE (India) Jebel Ali. 23/0224/02 TBATBA Bright Fuji 005W UnifeederUnifeeder Jebel Ali. (MJI/ESX) Dronagiri OOCL OOCL (I) Jebel Ali.

0600 Celsius Nairobi 0925 Q2724 1120922-28/01 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 14/0215/02 TBATBA Zhong Gu Nan Ning 25002E UnifeederUnifeeder Basra. (ASX) QNL/Milaha Poseidon Shpg. Jebel Ali, Bandar Abbas. Speedy CFS Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DR

06/0207/02 06/02 1400 Advance 065W Q2646 1119773-20/01 COSCO COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain 12/0213/02 TBATBA Sprinter 066W Q2768 1121442-31/01 OOCL OOCL (I) (AGI-2)

07/0208/02 TBATBA Intersea Traveler 25002W Q2716 1120810-27/01 RCL/BTL RCL Ag./Bharat Feeder Umm Qasr, Dubai. (RWG / IMI) 07/0208/02 07/02 0900 HMM Promise 044W Q2666 1119928-21/01 HMM HMM Shpg Karachi (FIM West Bound) 08/0209/02 08/02 0800 Kota Naga 2250W Q2687 1120553-25/01 PIL PIL India Jebel Ali (RGS)

08/0209/02 07/02 1700 KR Tasman 2506W Q2710 1120697-27/01 CU Lines Seahorse Shpg. Jebel Ali. (IMR1) 08/0209/02

TBATBA SSF Dream 079W Q2670 1120046-22/01 Safeen Fdrs. Sima Marine Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, 15/0216/02 TBATBA Al Rawdah 010W Q2714 1120726-27/01 Alligator Shpg. Aiyer Shpg. Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, 22/0223/02

TBATBA SSF Dynamic 083W Aqua Container Aqua Container Ajman, Umm Al Quwain, Ras Al Khaima. (UIG) 09/02 10/02

TBATBA Stephenie C 2502 Q2671 1120074-22/01 QNL/Milaha Poseidon Shpg. Sohar, Dammam, Hamad. Speedy CFS 11/02 12/02

TBATBA Chang Shun Qian Cheng 2501 Q2482 1117652-06/01 Asyad Line Seabridge Jebel Ali, Dammam, Hamad. (MGX-2/FEX) 09/0210/02 08/02 2100 Oshairij 2502 Q2726 1120930-28/01 QNL/Milaha Poseidon Shpg. Hamad. (NDX) Speedy CFS 15/0216/02

TBATBA Spirit of Kokata 2503 Q2775 1121665-03/02 Emirates Emirates Shpg. Hamad. Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr. Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports. LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Team Lines Team Global Log. Gulf Ports. Conex

ISS Shpg/Seahorse

(PS3 Service) HMM HMM Shpg.

OOCL Hamburg 155E Q2653 1119867-21/01 OOCL OOCL (I)

06/02 0900 Torrance 31E Q2619 1119629-20/01 Evergreen Evergreen Shpg. Colombo

Zoi 119E Q2690 1120560-25/01 KMTC/Gold Star KMTC(I)/Star Ship

14/0215/02 TBATBA KMTC Dubai 2501E Q2772 1121641-03/02 X-Press Feeders Sea Consortium (NIX Service) 21/0222/02 TBATBA Ever Elite 172E EmiratesEmirates Dronagiri-2 06/0207/02 06/02 0700 MSC Mundra VIII IW504A Q2678 1120200-23/01 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 06/0207/02 07/02 0900 Maersk Cardiff 506W Q2641 1119702-20/01 Maersk Line Maersk India Colombo (MW2)

CFS 08/0209/02 08/02 1400 X-Press Capella 25001E Q2566 1117846-13/01

11/0212/02 11/02 0400 One Reputiation 0006E Q2577 1118921-15/01 X-Press Feeders Sea Consortium (CWX/CIX5) 17/0218/02 TBATBA TS Keelung 25001E Q2762 1121360-31/01

10/0211/02 TBATBA Xin Beijing 150E Q2638 1119687-20/01

Balmer Law. CFS Dron. 17/0218/02

TBATBA Shimin 26E Q2501 1117818-07/01 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 24/0225/02

TBATBA Seattle Bridge 0095E

TBATBA Celsius Naples 908E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 17/0318/03

TBATBA ESL Da Chan Bay 25002E KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 24/0325/03

TBATBA Ever Eagle 187E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 (CISC Service)

HMM HMM Shpg. P.Kelang(S),Singapore, Xiangang, Qingdao,Kaohsiung. Seabird CFS

Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang Dronagiri

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. P Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 11/0212/02

TBATBA GFS Giselle 2502E Q2483 1117654-06/01 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo Dronagiri 15/0216/02

TBATBA Grace Bridge 2501E Q2764

Heung A Line Sinokor India (CSC/SIS2)

Sinokor Sinokor India Seabird CFS

TS Lines TS Lines (I)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR

TIME

No.No. No.&Dt.

In Port 05/02 MOL Presence 0020E Q2576 1118908-15/01 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 08/0209/02 08/02 1200 Dimitris Y 0251E Q2689 1120562-25/01 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 15/0217/02

TBATBA Cap Andreas 0018E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 16/0217/02

TBATBA X-Press Anglesey 2001E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service) HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS In Port 05/02 Wan Hai 507 E229 Q2682 1120312-24/01 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Dronagiri-1 16/0218/02

TBATBA Wan Hai 511 E097 Q2709 1120696-27/01 Evergreen Evergreen Shpg. Shekou. Balmer Law. CFS Dron. 23/0224/02

TBATBA Seaspan Brisbane 006E Q2770 1131524-01/02 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 25/0226/02

TBATBA Wan Hai 521 E021 TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 07/0208/02 06/02 2359 Aka Bhum E026 Q2647 1119844-21/01 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 14/0215/02

TBATBA Wan Hai 515 E097 Q2772 1120904-28/01 COSCO COSCO Shpg. Ningbo, Shekou. 21/0222/02

TBATBA Wan Hai 502 E131 Q2773 1121662-03/02 InterasiaInterasia (CI2) HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS 10/0211/02

TBATBA X-Press Odyssey 507E Q2727 1120931-28/01 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 18/0219/02

18/0220/02

TBATBA X-Press Carina 508E

X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3)

Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS

TBATBA Conti Crystal 139E Q2701 1120544-25/01 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 20/0222/02

TBATBA One Competence 093E

Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 27/0228/02

TBATBA YM Maturity 100E

HMM HMM Shpg. Seabird CFS (PS3 Service)

Samudera Samudera Shpg. Dronagiri

Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai OceanGate 21/0222/02

TBATBA OOCL Hamburg 155E Q2653 1119867-21/01

OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, GDL/Dron-1 28/0229/02

TBATBA OOCL Luxembourg 115E

CMA CGM Ag. Ningbo. (CIX-3) Dron.-3&Mul. 04/0305/03

TBATBA Startford 135E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 18/0319/03

TBATBA Yantian I 15E

Gold Star Star Ship Singapore, Hong Kong, Shanghai. 21/0322/03

25/0326/03

TBATBA Xin Da Yang Zhou 099E ANL CMA CGM Ag. Port Kelang, Singapore

TBATBA OOCL Taipei 083E TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

In Port 05/02 Interasia Elevate 048 Q2631 1119669-20/01 InterasiaInterasia Port Kelang, Ho Chi Min City, Laem Chabang (BTI) In Port 07/02 Interasia Accelerate E004 Q2652 1119866-21/01 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 13/0214/02 TBATBA Northern Guard E929 Heung A Line Sinokor India Hongkong 19/0220/02

TBATBA Wan Hai 516 E081 Wan Hai Wan Hai Lines

Dron-1 & Mul CFS 24/0225/02

TBATBA Wan Hai 627 021E

InterasiaInterasia (CI6) Feedertech Feedertech/TSA Dronagiri 05/0206/02 06/02 0900 Torrance 31E Q2619 1119629-20/01 Evergreen Evergreen Shpg. Port Kelang, BalmerLaw.CFSDron. 09/0210/02 TBATBA Zoi 119E Q2690 1120560-25/01 KMTC/Gold Star KMTC(I)/Star Ship Singapore, Dronagiri-3/— 14/0215/02

TBATBA KMTC Dubai 2501E Q2772 1121641-03/02 X-Press Feeders Sea Consortium Haipong, 21/0222/02 TBATBA Ever Elite 172E Emirates Emirates Shpg Qingdao, Dronagiri-2 28/0201/03

TBATBA Colorado 6E

Pendulum Exp. Aissa Maritime Shanghai, Ningbo, Da Chan Bay (NIX Service) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 05/0206/02 Kumasi 25001E Q2615 1119327-17/01 Sinolines Transorient Shanghai, Ningbo, Shekou & Other Far East Ports. 12/0213/02

TBATBA An Tong Fu Zhou 2501E SeaLead SeaLead Shpg. (CIW / FIX 2) 16/0217/02

TBATBA An Tong Dalian 2501E 06/0207/02 06/02 1000 Zhong Gu Ji Nan 24011E Q2668 1119949-21/01 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 12/0213/02

TBATBA Xin Pu Dong 279E Q2758 1121287-30/01 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 18/0218/02

TBATBA KMTC Nhava Sheva 2501E

COSCO COSCO Shpg. (AIS SERVICE) Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore Dronagiri-2 07/0208/02

TBATBA Sinar Sulawesi 016E Q2717 1120807-27/01 Samudera Samudera Shpg. Singapore (Adhoc) Dronagiri 08/0209/02

TBATBA Wan Hai 377 E004 Q2681 1120443-25/01 Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya

Dronagiri-1 13/0214/02

TBATBA KMTC Yokohama 2501E Q2761 1121359-31/01 KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Surabaya (AIS5/SI8 Service) Dronagiri-3/— 08/0209/02 08/02 1400 X-Press Capella 25001E Q2566 1117846-13/01 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 11/0212/02 11/02 0400 One Reputiation 0006E Q2577 1118921-15/01 X-Press Feeders Sea Consortium 17/0218/02

TBATBA TS Keelung 25001E Q2762 1121360-31/01 KMTC/TS Lines KMTC(I)/TS Lines(I)

Dron-3/Dron-2 18/0219/02

TBATBA Ever Lasting 081E Q2769 1121528-01/02 Gold Star Star Ship 22/0223/02

TBATBA KMTC Mundra 2501E RCL/PIL RCL Ag./PIL India (CWX/CIX5) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 08/0209/02

TBATBA Hyundai Courage 0117E Q2667 1119929-21/01 HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Seabird CFS 12/0213/02

09/02 10/02

TBATBA Hyundai Platinum 089E Sinokor Sinokor India Shanghai (FIM East Bound) Seabird CFS

TBATBA Stephenie C 2502 Q2671 1120074-22/01 Asyad Line Seabridge Shanghai, Ningbo, Shekou. (FEX) 09/0210/02

TBATBA Jira Bhum 0001E Q2684 1120289-23/01 RCL RCL Ag. Port Kelang, HaIphong, Nansha, Shekou. 19/0220/02

TBATBA Interasia Amplify E005 Q2778 PIL PIL India 22/0223/02

TBATBA Kota Cabar 0076E CU Lines Seahorse Ship 01/0303/03

08/0310/03

TBATBA Ever Smart 133W Evergreen Evergreen Shpg. (RWA/CIX 4) Balmer

TBATBA Hemma Bhum 005W InterasiaInterasia 15/0317/03

TBATBA Kota Lima 0022W Emirates Emirates Shpg. 10/0211/02

TBATBA Xin Beijing 150E Q2638 1119687-20/01 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 10/0211/02

11/0212/02

TBATBA Xin Dan Dong 543E Q2694 1120411-24/01 APL CMA CGM Ag. Nansha, Taichung, Kaohsiung.

TBATBA Xin Ya Zhou 167E Q2731 1120993-28/01 OOCL/RCL OOCL(I)/RCL Ag.

(CI 1) CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung. 14/0215/02

TBATBA Daphne 0872W Q2707 1120676-27/01 ONE Line ONE (India) Singapore 25/0226/02

TBATBA EF Olivia 0097W Samudera Samudera Shpg. (SIG) Dronagiri

16/0218/02

TBATBA Wan Hai 511 E097 Q2709 1120696-27/01

Tauranga, Madang, Port Lae, Rabaul, Port Moresby 23/0224/02 TBATBA Seaspan Brisbane 006E Q2770 1131524-01/02 TS Lines TS Lines (I) Australian Ports. Dronagiri-2 25/0226/02

TBATBA Wan Hai 521 E021 (CIX) 21/0222/02

TBATBA OOCL Hamburg 155E Q2653 1119867-21/01

28/0229/02 TBATBA OOCL Luxembourg 115E

TBATBA Startford 135E

(CIX-3) GDL 18/0319/03 TBATBA Yantian I 15E

TBATBA Xin Da Yang Zhou 099E Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 25/0326/03

TBATBA OOCL Taipei 083E

05/0206/02 Kumasi 25001E Q2615 1119327-17/01

(CIW)

(AIS

In Port 05/02 Zhong Gu Yin Chuan 25001W Q2466 1119066-16/01 SeaLead SeaLead Shpg. Mombasa,

12/0213/02 TBATBA Derby D 02SK1S1 Hapag

TBATBA AS Carlotta 001W Q2708 1120675-27/01

(India) Durban, Cape Town, Tema, Tincan, Apapa. 20/0221/02

Navios Dorado 2507W

Q2686 1120540-25/01 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3&Mul. 14/0215/02 TBATBA Fayston Farms 506S Q2662 1119919-21/01 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS 21/0221/02 TBATBA APL Cairo 0MTJLW1 DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira. (MIDAS-2) 09/0210/02 TBATBA Maersk Cape Town 507S Q2642 1119704-20/01 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 16/0217/02

TBATBA Maersk Cabo Verde 508S Q2665 1119921-25/01 (MWE SERVICE) 11/0212/02

TBATBA Maersk Cubango 506W Q2658 1119911-21/01 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 18/0219/02

TBATBA Maersk Colombo 507W Q2752 CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3&Mul. 21/0222/02 TBATBA Celsius Edinburgh 005W ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI)

05/0206/02 05/02 1000 MSC Regulus IS504A Q2630 1119666-20/01 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 12/0213/02 11/02 1000 MSC Luciana IS505A Q2721 1120905-28/01 Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware 06/0207/02 05/02 1000 MSC Barcelona IU505A Q2711 1120721-27/01 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Oran, Hind Terminals 13/0214/02 TBA 1000 Karlskrona IU506A Q2776 1121666-03/02 Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa (INDUS) 07/0208/02 06/02 1500 MSC Joanna IP506A Q2740 1121072-29/01 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 14/0215/02 14/02 0900 MSC Pamela IP507A Q2795 1121903-04/02 CMA CGM CMA CGM Ag. Dakar,Nouakchott,Banjul,Conakry, Freetown, Monrovia, Sao Tome,Bata, Dron.-3&Mul. 21/0222/02 21/02 0900 MSC Nairobi X IP508A Guinea Bissau,Nouadhibou, Dakar,Abidjan, Tema, Malabo & Saotome. (EPIC / IPAK) GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK) 09/0210/02

TBATBA MSC Mattina OM506A Q2715 1120777-27/01 MSC MSC Agency Dar Es Salamm, Mombasa. (EAST AFRICA EXPRESS) Hind Terminal

10/0211/02 TBATBA X-Press Odyssey 507E Q2727 1120931-28/01

Nacala, Tanga, Lilongwe & Harare. Dron.-3&Mul. 18/0219/02 TBATBA X-Press Carina 508E (NWX/FI-3)

• During Jan’25, APSEZ handled its highest ever monthly cargo volume at 39.9 MMT (+13 YoY), led by containers (+32% YoY) and liquids and gas (+18% YoY).

• YTD Jan’ 25, APSEZ handled 372.2 MMT of total cargo (+7% YoY), led by containers (+20% YoY) and liquids and gas (+9% YoY).

• Mundra Port created a new na�onal record in container handling by crossing the combined throughput of 7.72 lakh containers in a month.

• Container Terminal AICTPL achieved the highest handling of 3.05 lakh containers in a single month, which is the highest volume handled by any container terminal in India.

• Adani Marine team handled 884 vessel movements and 415 vessels.

AHMEDABAD/MUNDRA: Adani Ports and Special Economic Zone Limited (APSEZ), India’s largest integrated transport utility and part of the diversified Adani Group has handled its highest ever monthly cargo volume of 39.9 MMT (+13 YoY) during January ‘25, including containers (+32% YoY) and liquids and gas (+18% YoY) YTD January’25, APSEZ has crossed new milestones of handling 372.2 MMT (+20% YoY) of total cargo (+7% YoY) and liquids and gases (+9% YoY).

Along with this, Mundra Port has achieved a series of extraordinary milestones in cargo handling during January 2025, some of which have become national records. Record-breaking performance across various cargo segments underlines Adani Port as a leading global port and an engine of India’s economy

APSEZ Mundra has achieved a historic monthly cargo volume of 17.20 million metric tonnes, surpassing the previous record of 17.11 million metric tonnes, the highest ever by any Indian port in the history of maritime trade. This remarkable achievement demonstrates the port’s robust infrastructure, operational efficiency and ability to handle ever-increasing cargo volumes.

In container handling, Mundra created a new national record by crossing a combined throughput of 7.72 lakh TEUs in a month. This milestone demonstrates Mundra Port’s expertise in containerized cargo handling and Adani Port’s important role in the global supply chain.

Adani Mundra Marine Team handled 415 vessels with 884 movements, surpassing the previous record of 406 vessels and 876 movements. Mundra Railway Division achieved a record breaking monthly handling of 1.47 lakh TEUs, surpassing the previous record of 1.44 lakh TEUs handled. In addition, the Railway Team created two more records, handling the highest ever 682 trains, surpassing

the previous record of 662 trains, and the highest ever 447 double stack trains, surpassing the previous record of 429 double stack trains.

Container Terminal AICTPL achieved the highest handling of 3.05 lakh TEUs in a single month, surpassing the previous best record of 3.02 lakh TEUs, the highest volume handled by any single container terminal in India.

The APSEZ Mundra Liquid team achieved the highest monthly throughput of 0.841 million tonnes of cargo, surpassing the previous record of 0.832 million tonnes, while the APSEZ LPG team shipped a record 1.01 lakh metric tonnes of LPG in a single month.

These remarkable achievements further strengthen Mundra’s position as a leader in India’s port and shipping sector and a key port for India’s global trade. Adani Ports continues to invest in state-of-the-art infrastructure, advanced logistics solutions and sustainable development initiatives to enhance operational efficiency and meet the ever-evolving demands of global commerce.

NEW DELHI: The imposition of customs duties by the US on imports from China, Canada, and Mexico provides huge export opportunities for India to America, exporters say.

The tariffs would affect exports from China, Canada, and Mexico to the US as they would push prices of their goods in the American market, making them less competitive.

“The move can create opportunities for Indian exports due to the trade diversion effects as US buyers will seek alternative suppliers to avoid higher costs,” Federation of Indian Export Organisations (FIEO) Director General Ajay Sahai said.

He said the extent of benefits depends on India’s production capacity and competitiveness.

“The sectors which are likely to gain are electrical

machinery and components, auto components, mobile, pharma, chemicals, apparel, fabrics,” Sahai added.

US President Donald Trump on Saturday signed an order to impose stiff tariffs on imports from Mexico, Canada and China, fulfilling a campaign promise but raising the prospect of increased prices for American consumers.

Trump is declaring an economic emergency to put duties of 10 per cent on all imports from China and 25 per cent on imports from Mexico and Canada –America’s largest trading partners – except for a 10 per cent rate on Canadian oil.

During April-November 2024-25, the US was the second largest trading partner of India with USD 82.52 billion bilateral trade in goods (USD 52.89 billion worth of exports, USD 29.63 billion of imports and USD 23 26 billion trade surplus)

NEW DELHI : The Customs Duty reduction announced in the Budget on products such as motorcycles and synthetic flavouring essences would benefit American exports, economic think tank GTRI said recently

The Global Trade Research Initiative (GTRI) said that despite the repeated criticism of India as the biggest tariff abuser and tariff king by the Trump-administration, the country’s Budget has introduced significant tariff reductions on multiple products, many of which benefit the US exports.

“With key tariff cuts on technology, automobiles, industrial inputs, and waste imports, India appears to be taking steps toward facilitating trade even as the global trade environment remains tense Whether these reductions will alter Washington’s view of India’s trade practices or become a point of contention in the US election cycle remains to be seen,” it added.

Among the key tariff reductions, India lowered the duty on fish hydrolysate for the manufacturing of aquatic feed from 15 per cent to 5 per cent, a move that directly impacts US exports, which amounted

to $35 million in 2023-24.

Fo

motorcycles based on engine capacity For motorcycles with an engine capacity below 1,600cc, the tariff has been cut from 50 per cent to 40 per cent, while for motorcycles above 1,600cc, the tariff has been slashed from 50 per cent to 30 per cent

“The US motorcycle exports to India stood at $3 million in FY24, and this tariff cut could help expand m a r k e t a c c e s s

A m e r i c a n manufacturers,” the GTRI said.

Similarly, it said, tariff cut on ethernet switches (carrier-grade) under the others category from 20 per cent to 10 per cent would help American exporters.

The US exported $653 4 million worth of these products to India in the last fiscal, “making this a significant trade benefit”, GTRI Founder Ajay Srivastava said.

India has also lowered the duties on synthetic flavouring essences from 100 per cent to 20 per cent, a category in which Washington exports stood at $21 million in Fy24.

“In the space sector, tariffs on ground installation for satellites,

including spares and consumables, have been reduced to zero, benefiting American exporters who supplied $92 million worth of these products in Fy23,” Srivastava said.

However, in the last financial year, these imports dropped significantly to $0 07 million, suggesting a sharp decline in trade activity in this category

Additionally, the Budget has proposed elimination of tariffs on specific waste and scrap items, reducing duties from 5 per cent to zero.

America exported a total of $2.5 billion worth of waste and scrap of all types to India in 2023-24.

“While Trump has long criticised India’s tariff structure, these latest reductions indicate a shift in policy that could boost US exports across multiple sectors,” Srivastava said.

During April-November 2024-25, the US was the second largest trading partner of India with $82 52 billion bilateral trade in goods ($52.89 billion worth of exports, $29 63 billion of imports and $23.26 billion trade surplus) During 2021-24, America was the largest trading partner of India.

MUMBAI : During the quarter ended December 31, 2024, Snowman Logistics Ltd recorded revenue of INR 131 85 Crores as against INR 124.05 Crores for the same period in the previous year, registering a growth of 6.30%. EBITDA recorded at INR 21.83 Crores as against INR 27.50 Crores, in the corresponding quarter of the previous year.

Mr. Prem Kishan Dass Gupta, Chairman, Snowman Logistics

Limited said, “The industry is currently navigating headwinds due to a slowdown in consumption patterns during Q3, especially in the QSR business In addition, as A m a z o n n o l o n g e r r e q u i r e s dedicated fulfilment centres for their cold chain business, we have discontinued the warehouses leased for them. Regarding our ongoing projects, our Kolkata expansion has been delayed from Q3 to Q4, however

the project is nearing completion a n d e x p e c t e d t o c o m m e n c e operations during current quarter In addition, our Krishnapatnam expansion is well underway and expected to commence in Q1 of next year We remain positive about growth in broader demand and are actively evaluating multiple new locations to expand our capacity in the next financial year through both owned and asset-light models.”

M U M B A I : F o l l o w i n g a moderation in growth during December, India’s manufacturing activity showed signs of recovery entering the new year, at a six-month high with the Purchasing Managers’ Index (PMI) for the month of January at 57 7, data released by S&P Global on Monday showed. The rate of expansion was the quickest since last July and outpaced its long-run average The figure had plunged to a 12-month low of 56 4 in December, down from 56 5 in November, even as it remained

above its long-run average of 54.1 thereby signalling a robust rate of growth.

As per the survey, with new orders rising at the quickest pace since last July, fuelled by the steepest upturn in exports in nearly 14 years, there was a stronger expansion in output January data also showed a pick-up in growth of buying levels and record job creation, it said “Cost pressures retreated to their weakest in 11months,butsellingpricesrosesolidly amid buoyant demand Meanwhile, business confidence strengthened,”

the release by S&P Global said. Pranjul Bhandari, Chief India Economist at HSBC, said, “India’s final manufacturing PMI marked a six month high in January. Domestic and export demand were both strong, supporting new orders growth The employment PMI suggested robust job creation in the manufacturing industry, as the index increased to its highest level since the series was created Input cost inflation eased for a second month, relieving pressure on manufacturers toraisefinaloutput prices ”

NEW DELHI: A 10% import tariff imposed by the US on China is being viewed as positive for made-in-India e l e c t r o n i c p r o d u c t s s u c h a s smartphones, laptops and tablets, analysts said The move is expected to benefit contract manufacturers like Dixon Technologies, Syrma SGS, Optiemus, as well as i P h o n e s contract manufacturers such as Foxconn

This is because a higher import tariff on Chinese goods would pave the way for Indian companies to export these products that do not attract tariffs. An increase in the demand for exports from India could thus boost business for the contract manufacturers

With the IT hardware productionlinked incentive (PLI) and the smartphone PLI schemes, many companies have started leveraging China Plus One opportunity to make products in India and export from the Country India’s total electronics production for FY24 stood at $115 billion, of which around $52 billion was mobile phones, according to India C e l l u l a r a n d E l e c t r o n i c s Association (ICEA) estimates.

The output may reach around $140 b i l l i o n i n F Y 2 5 . N o t a b l y, t h e government has a target to reach electronics production of $500 billion by 2030 For the same, domestic production of electronics components

and their exports will be critical to s

According to ICEA, electronics production in India will need to grow at an annual growth rate of 20-22% to reach the 2030 goal

“With on-going supply chain diversification and higher tariffs being imposed on Chinese imports by the US, India has a strong opportunity to increase its electronics exports to the US. Global businesses across segments are actively considering and executing China Plus one strategy,” said Satendra Singh, CEO of Syrma SGS.

According to Singh, Indian companies are expanding production capacities, improving technological expertise and enhancing supply chain efficiencies, making exports more competitive in international m

companies such as OnePlus may look at exporting their smartphones from the country and get benefits Tarun Pathak, Research Director at Counterpoint India, said, “While the first set of tariffs did not include India, this can create an opportunity for the country to become an alternate supplier In t h e e

have a mature assembly process and enough capacity.”According t

Dixon and Apple suppliers.

US President Donald Trump has imposed a levy of 25% on Canadian and Mexican imports, along with an additional 10% tax on Chinese goods, which would come into force on Tuesday The same has been done owing to the Washington’s concerns about illegal immigration and drug trafficking from those countries Officials said India can benefit from the move and the same will also boost value addition in the Country Faisal Kawoosa, Chief Analyst at Techarc, said, “Many electronics and smartphone companies who were not producing and exporting f r o m I n d i a m a y l o o k a t t h e opportunity ”

Experts believe that strong electronics manufacturing industry driven by high local and global demand will encourage component manufacturing in India, fueling further value addition in the country Notably, India is soon expected to come up with a component incentive scheme Singh, however, said the industry must focus on building w o r l d - c l a s s m a n u f a c t u r i n g capabilities and infrastructure to compete with the rest of the World. Further, simplification of regulatory processes and favorable bilateral trade agreements will help Indian companies access global markets, he added.

MUMBAI/DELHI:

Gateway Distriparks

L i m i t e d ( G D L ) , a leading multimodal logistics company in India, has announced its financial results for the quarter ended 31st December 2024.

P r e m K i s h a n

D a s s G u p t a ,

C h a i r m a n & Managing Director, said, “Despite the Red Sea impact, especially in Q1, volumes and m a r g i n s h a v e

r e c o v e r e d a n d remained steady in Q2 and Q3 for the Company. There is a healthy pipeline as the focus remains on increasing our market share, especially in the Rail Vertical

We are hopeful that the Red Sea crisis will come to an end soon and if shipping lines start using this route again there will be a significant boost to Export Import volumes for India We continue to explore

opportunities for developing new rail terminals to further expand our network In December, GDL also met its target of crossing 50% shareholding in Snowman Logistics and is now a subsidiary ”

CJ-XVA

CJ-III Akson Sara ACT Infra

CJ-XVI

Stream

Stream

CJ-XIII

VACANT CJ-VII Zhong Hai Chang Yun 6 Dariya Shpg. 07/02

CJ-IX Aquila Shaan Marine 08/02 CJ-X VACANT

CJ-XI Xin Long Yun 58 ULSSL 06/02 CJ-XII TCI Express TCI Seaways 06/02 CJ-XIII DSI Pyxis Chowgule Bros 07/02 CJ-XIV IVS Prestwick Chowgule Bros 09/02

CJ-XV Eagle Shantilal Shpg. 07/02 CJ-XVA African Logrunner Cross Trade 08/02

CJ-XVI Amis Star Delta Waterways 08/02

Stratis Anline Shpg. 06/02

James Mackintosh 06/02

JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I VACANT

OJ-II Kurt Mas Samudra 06/02

OJ-III Regina Scorpio Shpg. 06/02

OJ-IV Calm Lake Samudra 06/02

OJ-V Oriental Ixia Allied Shpg. 06/02

OJ-VI Coronet Malara Shpg. 06/02

OJ-VII Emma Grace Interocean 06/02

Steamer's Name Arrival on Next Destn.

Seiyo Goddess 03/02

Deep Blue 03/02

Atlantic Ibis 03/02 Nhava ShevaJebel AliDammam-ShuibaUmm Qasr

AS Alexandria 03/02 Pipavav-CochinTuticorin-Kattupalli

Thames Trader 03/02

Propel Proseperity 03/02

SCI Mumbai 04/02 Pipavav-CochinTuticorin-Kattupalli

OJ-VI Coronet Malara Shpg.

Stream Daewon Wilhelmsen

OJ-VII Emma Grace Interocean San Lorenzo

OJ-II Kurt Mas Samudra Sohar Oman

07/02 MTM New Orleans Interocean Brazil 34,000 T. CDSBO

06/02 No.5 Ocean

Stream Orchid Sylt GAC Shpg.

05/02 Sakura Spirit ISS Shpg.

INIXY125012661

Jakarta (IEX)

04/02 GSL Phoenix (V-501W) 5010424 Maersk India Karachi 08/02 SSL Brahmaputra (V-923W) 5010507 Unifeeder Ag. Karachi 09/02 Maersk Cardiff (V-501E) 5010427 Maersk India Nhava Sheva

09/02 Interasia Accelerate (V-4E) 5010487 Interasia Line Nhava Sheva 14/02 GFS Giselle (V-2502) 5010569 Maersk India Nhava Sheva 19/02 Celsius Edinburgh (V-5S) 5010605 Unifeeder Ag Jebel Ali

CB-1 GSL Christen (V-501W) Maersk India 06/02 CB-2 Folk Jeddah (V-2505W) Seastar Global 06/02 Oceana (V-933S) Nhava Sheva 01-02-2025 Varada (V-2501) Karachi 02-02-2025 SM Mahi (V-505) Beherai 03-02-2025

10/02-AM One Reassurance 245 2500510 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX)

11/02 11/02-AM X-Press Capella 25001E 2500434 KMTC /TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX) 12/02 13/02 12/02-PM Xin Fu Zhou 88E 2500550 Wan Hai Line Wan Hai Lines Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 14/02 19/02 18/02-PM Wan Hai 626 20E 2500619 COSCO/Evergreen

07/02 06/02-1800 W Kithira 506W 25048 Maersk Line Maersk India Algeciras

14/02 13/02-1800 Maersk Detroit 507W 25049 (MECL)

21/02 20/02-1800 Maersk Karachi 508W 25059

In Port —/— Xin Da Yang Zhou 098E 25037 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 05/02 11/02 11/02-0600 OOCL Jakarta 180E 25046 Gold Star / RCL Star Shpg/RCL Ag. Nansha New Port (CIXA)

20/02 20/02-0600 OOCL Hamburg 155E 25058

In Port —/— OOCL Atlanta 163E 25043 COSCO COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 05/02 06/02 05/02-0900 Xin Beijing 150E 25044 Nansha, Port Kelang (CI1) 07/02 05/02 05/02-1900 GSL Nicoletta 506E 25047 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 06/02 13/02 13/02-0300 X-Press Odyssey 507E 25056 X-Press Feeders Merchant Shpg. Ningbo. (NWX) 13/02 Sinokor/Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan. 11/02 11/02-1100 X-Press Anglesey 25001E 25057 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 12/02 22/02 22/02-1100 One Reliability 0013E ONE ONE (India) (TIP)

05/02-0900 Xin Beijing 150E 25044

06/02 06/02-0600 SCI Mumbai 2501 25055 SCI J M Baxi Mundra, Cochin,

(V-2504W) Hapag

C C Fort Diamant (V-0FFDOE1)

11/02 Ghibli (V-25004W)

08/02 Ren Jian 8 (V-02SJ2S1)

12/02 Derby D (V-Q2SKIS1)

05/02 Spil Citra (V-OUW90W1)

11/02 C C Mendelssohn (V-OUW94W1)

CB-1 Zhong Gu In Chuan (V-25001W)

07/02 C C San Antonio (V-OMTJHW1) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa

21/02 Celsius Edenburg (V-005W) Unifeeder/One Unifeeder/One India Gulf 22/02 10/02 Ever Ethic (V-173E) Unifeeder/KMTC Unifeeder/KMTC(I) Far East & 11/02 17/02 Shimin (V-26E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo 18/02 ONE/TS Lines ONE (I)/TS Lines(I) CB-5 Grasemere Maersk (V-506W) Maersk Line Maersk India U.K. Cont. 1119684 06/02 11/02 GFS Giselle (V-2502E) Global Fdr/TS Lines Sima Marine/TS Lines (I) Far East

15/02 Grace Bridge (V-2501E) Sinokor/Heung A Line Sinokor India

06/02 Inter Sydney (V-0172) Interworld Efficient Marine Gulf

05/02 Konard (V-KON0125W) AKKON Oasis Shipping Europe/Med.

Car.CB-5 Maersk Iyo (V-505W)(Sailed) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India Africa

09/02 Maersk Cape Town (V-507S) Maersk Line Maersk India Africa

07/02 MSC Bremen (V-IV506A) MSC MSC Agency

07/02 Sol Prime (V-1501E)(Sailed) Transworld Transworld GLS Far

08/02 Shamim (V-1343W) HDASCO Armita India Gulf

08/02 W Kithiria (V-505W) Maersk Line Maersk

12/02 Wadi Dukka (V-2506W) Folk Maritime/Asyad Seastar Global/Seabridge Jeddah

06/02 X-Press Altair (V-25002W) Wan Hai/Unifeeder Wan Hai Lines (I)/Unifeeder Jebel Ali

10/02 SSL Bramhaputra (V-923W) X-Press Feeder Sea Consortium

09/02 Zhong Gu Chang Sha (V-2444S)

18/02 Zhong Gu Shen Yang (V-OPU45S1)

08/02 CMA CGM Dolphin (V-OINJ1W1) CMA CGM/OOCL CMA

15/02 CMA CGM Palleas (V-OINJ3W1) COSCO/ONE COSCO

06/02 MSC Barcelona (V-IU505A) MSC

(V-IS504A)

(V-IP506A)

(V-FD451E) MSC

09/02 Nagoya Express (V-5106W) Hapag

14/02 Zhong Gu Nan Ning (V-25002E) QNL/Milaha Poseidon

(V-505E)

GTI-1 MOL Presence (V-0020E) ONE ONE (I) Far

07/02 Dimitries Y (V-0251E) X-Press Feeder Sea Consortium

09/02 One Reassurance (V-245E) ONE ONE (I) USA

HMM HMM Shpg. 17/02 One Competence (V-093E) ONE/HMM ONE (I)/HMM Shpg. Far East &

18/02 Conti Crystal (V-139E) Yang Ming Line Yang Ming Line (I) China 19/02 09/02 Seaspan Amazon (V-5304W) COSCOCOSCO Shpg. U.K. Cont.

12/02 Houston Express (V-506W) Hapag / ONE ISS Shpg./ONE(I) 13/02 CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I)

Car.GTI-2 Wan Hai 513 (V-E098)(Sailed) Wan Hai Wan Hai Lines (I) Colombo & 1119296 05/02

07/02 Aka Bhum (V-E026) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East

GTI-2 Wan Hai 507 (V-E229) Hapag/Evergreen ISS Shpg/Evergreen China

16/02 Wan Hai 511 (V-E097) Wan Hai Wan Hai Lines (I) 18/02

Car.GTI-1 Xin Da Yang Zhou (V-098E)(Sailed) RCL/OOCL RCL Ag./OOCL(I) Far East 1118350 05/02 13/02 OOCL Hamburg (V-155E) Zim/COSCO Zim Int./COSCO Shpg. 15/02

10/02 Asterios (V-2507W) Folk Maritime Seastar Global

16/02 Advance (V-065W) COSCO/OOCL COSCO Shipping/OOCL (i)

10/02 Chang Shun Qian Cheng (V-2501E) Asyad/QNL/Milaha Seabridge/Poseidon Gulf

BMCT-1 CMA CGM Thalassa (V-OPEBDW1) CMA CGM/APL CMA CGM Ag. (I) U.K. Cont. 1119472 05/02 COSCO / OOCL COSCO Shpg./OOCL(I) 09/02 C Star Voyager (V-002WN) Cstar Diamond Maritime Red Sea/Gulf 10/02

14/02 Daphane (V-0872W) One Line/Samudera One India/Samudera Far East 15/02 07/02 HMM Promise (V-044W) HMM HMM Shpg. Far East

08/02 08/02 Hyundai Courage (V-0017E) One Line One India Mediterranean 09/02

Car.BMCT-3 Hemma Bhum (V-004E)(Sailed) RCL/PIL/CU Lines RCL Ag./PIL India/Seahorse Far East 1118388 04/02

09/02 Jira Bhum (V-0001E) Interasia/Evergreen Interasia Shpg./Evergreen Shpg. 10/02

BMCT-2 Interasia Elevate (V-048) Interasia Line Interasia Shpg. Far East 1119669 05/02

Car.BMCT-2 Interasia Progress (V-3095)(Sailed) Wan Hai /KMTC Wan Hai Line (I)/KMTC (I) Far East 1119653 04/02 07/02 Interasia Traveller (V-25002W) RCL/BTL RCL Agency/Bharat Feeder Gulf 08/02

BMCT-3 Interasia Accelerate (V-E004) Sinokor/Heung A Sinokor India Far East

07/02 13/02 Northern Guard (V-E929) Interasia Line Interasia Shpg. 14/02 Unifeeder/Wan Hai Unifeeder/Wan Hai Lines (I) 05/02 Kumasi (V-25001E) Sino Lines/SeaLead Transorient/SeaLead Shpg. Far East

06/02 08/02 Kota Naga (V-2250W) PIL PIL India Red

06/02 Maersk Cardiff (V-506W) Maersk Maersk India

Car.BMCT-3 MSC Monica III (V-JU505R)(Sailed) MSC MSC Agency Gulf

06/02 MSC Mundra VIII (V-IW504A) MSC MSC Agency Africa

10/02 NZ Ningbo (V-36INDSTP)

Kumasi (V-25001E) Transorient 1119327 17/01

Tolten (V-5105W) ISS

Vessel Name (Voy) Sailing Dt.

APL Miami (V-0FFDME1) 28-01-2025 ACMTPL Hansa Europe (V-2503W) 29-01-2025 Jebel Ali CMA CGM Vitoria (V-OUW92W1) 30-01-2025 Karachi APL Phoenix (V-OMXLHW1) 01-02-2025 AICT Tema Express (V-2504W) 01-02-2025 Colombo Zhong Hang Sheng (V-OQCSOW1) 03-02-2025 Jebel Ali

Norderney (V-090W) 01-02-2025 Jebel Ali Folk Jeddah (V-2505W) 01-02-2025 Mundra BLPL Trust (V-1501E) 02-02-2025 Colombo Maersk Sentosa (V-504W) 02-02-2025 Salalah Maersk Cairo (V-506S) 03-02-2025 Port Qasim Oceana (V-933W) 03-02-2025 Jebel Ali Ever Eagle (V-186E) 04-02-2025 AMCT Maersk Iyo (V-505W) 05-02-2025 Pointe Noire

MSC Lisbon (V-IP505A) 01-02-2025 Hazira APL Southampton (V-OINT2W1) 02-02-2025 ACMTPL Tolten (V-5105W) 03-02-2025 Mundra MSC Mexico V (V-IV505A) 04-02-2025 Mundra

Conti Conquest (V-030E) 01-02-2025 Pipavav Osaka Express (V- 5303W) 02-02-2025 ACMTPL Zhong Gu Nan Ning (V-25001E) 02-02-2025 Jebel Ali Wan Hai 505 (V-E181) 03-02-2025 Port Kelang Xin Da Yang Zhou (V-098E) 05-02-2025 Pipavav Wan Hai 513 (V-E098) 05-02-2025 Cochin

Dalian (V-0016W) 01-02-2025 Mundra

Bhum (V-153W) 01-02-2025 Umm Qasar

Lime (V- 0021E) 02-02-2025 AICT

of Kolkatta (V-2502W) 02-02-2025 MICT

Atlanta (V-163E) 04-02-2025 Pipavav

Bhum (V-004E) 04-02-2025 AICT

Progress (V-309S) 04-02-2025 Port Kelang

Monica III (V-JU505R) 04-02-2025 Jebel Ali

Nicoletta 05-02-2025 Pipavav

(V-008) 09-11-2024 Pyeongtaek

22-11-2024 Singapore

(V-45) 07-12-2024 Singapore

(V-008) 12-12-2024 Pyeongtaek

Hoegh London (V-47) 22-12-2024 Singapore

Alliance Norfolk (V-140) 30-12-2024 Durban

Morning Lisa (V-147) 01-01-2025 Pyeongtaek

Hoegh Trooper (V-210) 29-01-2025 Kingston Nowowiejsk (V-140) 04-02-2025 Singapore

M U M B A I :

Mr. Suresh Kumar R, Managing Director, Allcargo Terminals Limited in his reaction to Budget opined, “The budget has set the roadmap for long-term economic growth by catalysing consumption, manufacturing as well as infrastructure development Budget proposals to strengthen ease of doing business and relax regulatory

r e f o r m s w i l l f u r t h e r i m p r o v e t h e investment prospect and boost private investments in logistics as well as other sectors.

Additionally, the announcement of a Rs. 25,000 crore

Maritime Development Fund for long-term financing in the maritime industry, with up to 49% government contribution and the remainder mobilized from ports and private sector, is a welcome step toward promoting competition and distributed support Making PM Gati Shakti data accessible to private players is an excellent move which will drive superior project p

In addition, by fostering an ecosystem for new-age innovation through AI and deep tech, the budget will usher the next phase of efficiency, resilience and capacity utilisation for the logistics industry.''

NEW DELHI: India has significantly reduced its average customs duty rate to 10.65% from 11.65%, which is at the same levels as prevalent in the Southeast Asian countries, Sanjay Kumar Agarwal, Chairman, Central Board of Indirect Taxes & Customs (CBIC) said at a CII-event on Monday

Agarwal noted the rate rationalisation exercise in the Budgetwascarriedoutwiththeobjectiveofmakingthetariff structure simple, ensuring competitiveness of Indian industry and simplifying the tax regime, and added that the exercise was important for dispelling the narrative that Indiahasoneofthehighesttariffstructuresintheworld

The Government has rationalised basic customs duty rates, slashing the number of levies to just 8, but has kept

the effective duty rates on most items the same by adjusting cess to further ease of doing business (EODB).

Finance Minister Nirmala Sitharaman removed seven tariff rates in the 2025-26 Budget. This is over and above the seven tariff rates removed in the 2023-24 budget. After this, there will be only eight remaining tariff rates, including a ‘zero’ rate to further EoDB.

Further, Agarwal said the thrust in the budget was to ensure adequate availability of the items which are critical for manufacturing in the country like critical minerals. These minerals, he said, are required for manufacturing areas like semiconductors, for transitioning to clean energy and for space programmes, he added.

D O H A : Q a t a r N a v i g a t i o n

Q.P.S.C. (“Milaha”) announced its financial results for the year ended December 31, 2024.

Key nancial highlights:

•Operating revenues of QR 2.840 billion for the year ended December 31, 2024, compared to QR 2.942 billion for the same period in 2023

•Operating profit before impairments of QR 536 million for the year ended December 31, 2024, compared to QR 436 million for the same period in 2023

•Net profit of QR 1.122 billion for the year ended December 31, 2024, compared to QR 1.030 billion for the same period in 2023

•Earnings per share of QR 0.99 for the year ended December 31, 2024, compared to QR 0.91 for the same period in 2023

Milaha Maritime & Logistics’ net profit increased by QR 45 million compared to the same period in 2023, led by stronger performance from our container shipping

unit from the deployment of new vessel routes & services.

Milaha Gas & Petrochem’s net profit increased by QR 52 million compared to the same period in 2023, driven by strong results from our associate and joint venture companies.

Milaha Offshore’s net profit increased by QR 24 million compared to the same period in 2023, driven by enhanced operating margins and strong growth in Qatar’s oil & gas sector

Milaha Capital’s net profit decreased by QR 3 million compared to the same period in 2023, as an impairment charge in our real estate unit more than offset higher investment income.

Milaha Trading’s bottom line decreased by QR 27 million compared to the same period in 2023, mainly as a result of declining sales of heavy equipment, bunker & related ancillary services, along with a write-down in the value of associated spare parts.

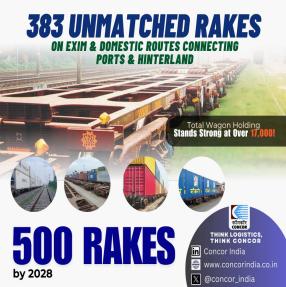

NEW DELHI: CONCOR is pleased to add another Rake in the service of customers, surpassing a total holding of 17,000 wagons.

“With 383 cargo rakes in motion, connecting ports and the hinterland,

we're ensuring faster deliveries, topn o t c h c u s t o m e r s e r v i c e , a n d seamless Logistics solutions. By prioritizing rail transportation, CONCOR is actively contributing to reducing the carbon footprint,” informs a recent communique from CONCOR.