MUMBAI : (022)22661756 / 1422, 22691407

AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com

MUMBAI : (022)22661756 / 1422, 22691407

AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com

AHMEDABAD: The Gujarat Infrastructure DevelopmentBoard’s(GIDB)governingboardhasokayed a proposal broadening the scope of projects that are coveredunderthelogisticssector.Ithassentaproposalto thiseffecttothestateindustriesandminesdepartmentfor makingnecessarychangestotheGIDAct,1999.

According to top govt sources, the phrase ‘Logistics

TAIWAN: Wan Hai Lines, Korea Marine Transport Co. and Interasia Lines will launch a new Southeast Asia –IndiaServiceVIIIon26April.

The service will be operated by four container vessels with a nominal capacity of 3,000 TEUs. Wan Hai Lines will deploy two boxships, while Korea Marine Transport Co. andInterasiaLineswilloperateonevesseleach.

The maiden voyage of the service will commence from Malaysia’s Port Kelang on 26 April and the service will havea28-dayfixedroundtripschedule.

The port rotation of the new service will be Jakarta (Indonesia) – Surabaya (Indonesia) – Singapore –Port Kelang North Port (Malaysia) – Mundra (India) –NhavaSheva(India)–PortKelangNorthPort–Jakarta.

Wan Hai Lines said it is confident that the new service will provide customers with better frequency and service coveragebetweenSoutheastAsiaandIndia.

Infrastructure and Facilities’ will be added to the list of specific logistics projects which have been mentioned. “With this modification, all sorts of projects related to logistics will get quicker approvals and incentives from govt. Addition of the phrase ‘Logistics Infrastructure and Facilities’ will ensure that private participation in the sectorwillgetaboost,”officialssaid.

Cont’d Pg. 21

“Mawani”: “Unifeeder” added New service “RGI” to Jeddah Islamic Port, connecting Kingdom to Indian Ports

RIYADH: The Saudi Ports Authority “Mawani” announced that “Unifeeder” added the new shippingservice“RGI”toJeddah Islamic Port, which connects the Kingdom to the ports of India, supporting trade between the two countries and contributing to providing fast and secure solutions for exportersandsuppliers.

This move reflects investors’ confidence in the Kingdom's ports, contributes to supporting maritime transport and logistics services, and confirms the status of Jeddah Islamic Port and its capabilities and advantages, as it is the Kingdom’s first port for exports and imports, and the first re-export point in the Red Sea, with 62 multi-purpose berths and a capacity of 130 million tons

Cont’d Pg. 6

Cont’d from Pg. 4

The new shipping service connects Jeddah Islamic Port to the ports of Mundra and Nhava ShevainIndia,JebelAliintheUAE, and Sokhna in Egypt, through regularweeklytrips,withacapacityofupto2,824TEUs.

It is worth noting that Jeddah Islamic Port witnessed the completion of improvement and development works

in the port’s North Container Terminal during the current year, with investments amounting to 6.6 billion riyals, enhancing its operational capabilities, increasing its capacity with a developed infrastructure, and improving its logistics services efficiency. This is in line with the objectives of the National Transport and Logistics Strategy (NTLS), to solidify the Kingdom’s standing as a global logistics hub bridging the three continents.

SINGAPORE: Ocean Network Express (ONE) is proud to announce its Transpacific service starting from February 2025. Through this redesigned suite of products, ONE aims to offer quality-focused, direct end-to-endservicewithsuperiorschedulereliability.

In alignment with our established planning cycle for the shipment year, services are typically unveiled in the fourth quarter. However, we acknowledge that many of our valued Transpacific customers possess contracts extendingbeyondFebruary2025.Hence,wewouldliketo present our 2025 Transpacific product overview in advance, ensuring clear visibility of our dedication in servingyourtransportationneeds.

TheTranspacificproductconsistsof16mainservices:

Asia - US West Coast South

FP1 (Far East – Pacic 1)

From Europe - Singapore - Kobe – Nagoya – Tokyo –Los Angeles/Long Beach – Oakland – Tokyo – Shimizu –Kobe–Nagoya–Tokyo–Singapore–ToEurope

PS3 (Pacic South 3)

Nhava Sheva – Pipavav – Colombo – Port Kelang –Singapore – Cai Mep – Haiphong – Yantian –Los Angeles/Long Beach – Oakland – Tokyo – Pusan –Shanghai (Waigaoqiao) – Ningbo – Shekou – Singapore –PortKelang–NhavaSheva

PS4 (Pacic South 4)

Xiamen – Yantian – Kaohsiung – Keelung –Los Angeles/Long Beach – Oakland – Keelung –Kaohsiung–Xiamen

PS6 (Pacic South 6)

Qingdao – Ningbo – Los Angeles/Long Beach –Oakland–Kobe–Qingdao

PS7 (Pacic South 7)

Singapore – Laem Chabang – Cai Mep – Shanghai (Yangshan) – Los Angeles/Long Beach – Oakland –Shanghai(Yangshan)–Singapore

PS8 (Pacic South 8)

Shanghai(Yangshan)–Ningbo –Kwangyang–Pusan – Los Angeles/Long Beach – Oakland – Pusan –Kwangyang–Incheon–Shanghai(Yangshan)

AP1 (Asia Pacic 1)

Haiphong – Cai Mep – Shekou – Xiamen – Taipei –Ningbo – Shanghai (Yangshan) – Los Angeles/ LongBeach–Oakland–Shekou–Haiphong

AHX (Asia Hawaii Express)

Pusan–Yokohama–Honolulu–Pusan

Asia - US West Coast North

PN1 (Pacic North 1)

Xiamen – Kaohsiung – Ningbo – Nagoya – Tokyo –Tacoma–Vancouver–Tokyo–Kobe–Nagoya–Xiamen PN2 (Pacic North 2)

Singapore – Laem Chabang – Cai Mep – Haiphong –

Yantian –Vancouver – Tacoma – Tokyo – Kobe –Shanghai (Yangshan)–Singapore

PN3 (Pacic North 3)

Qingdao – Ningbo – Shanghai (Yangshan) – Pusan –Vancouver–Tacoma–Pusan–Qingdao

Asia - US East Coast

EC1 (US East Coast 1)

Kaohsiung – Yantian – Shanghai (Yangshan) –Ningbo – Pusan – (Panama) - New York – Norfolk –Savannah–(Panama)–Balboa–Kaohsiung

EC2 (US East Coast 2)

Xiamen – Yantian – Ningbo – Shanghai (Yangshan) –Pusan–(Panama)–Manzanillo–Savannah–Charleston – Wilmington – Norfolk – Manzanillo – (Panama) – Pusan –Xiamen

EC5 (US East Coast 5)

Laem Chabang – Cai Mep – Singapore – Colombo –(Suez) – Halifax – New York – Savannah – Jacksonville –Charleston – Norfolk – New York – Halifax – (Suez) –Singapore–LaemChabang

EC6 (US East Coast 6)

Kaohsiung – Hong Kong – Yantian – Ningbo –Shanghai (Yangshan) – Pusan – (Panama) - Houston –Mobile–(Panama)–Rodman–Kaohsiung WIN (West India North America)

Bin Qasim – Hazira – Nhava Sheva – Mundra –Damietta – Algeciras – New York – Savannah –Jacksonville – Charleston – Norfolk – Damietta –Jeddah–BinQasim

“Following the long-term partnership with HMM and YML within THEA scope on the Pacific, and the addition of the already announced ONE independent WIN and AP1 services from April 2024, ONE will deploy 16 core weekly services on the Trans-Pacific trade from February 2025. The emphasis will be on quality end-toend direct services with high schedule reliability. The core products will include sufficient sea speed buffers and are designed so that the impact of Hapag's departure in 2025 will have a minimal impact on ONE's network and customers over the post CNY disengagementperiod.”Jeremy,CEOofONEsaid.

GENEVA: Stakeholders across the global supply chain are increasingly focusing on emissions reduction in their supply chain footprint. MSC, the world’s largest ocean carrier, has a critical role to play in deploying the assets, fuels and technologies to reduce its customers’ supply chain emissions while at the same time reducing its own carbonfootprint.

To this end MSC has been investing and innovating substantiallyinshipdesign,newbuildingandretrofitting, as well as cutting-edge technologies and digital applications to improve energy efficiency and ensure the readiness of its fleet of nearly 800 ships to adopt zerocarbon fuels as they become available. MSC has set the targetofnetzerodecarbonizationby2050.

In 2022 MSC launched our Journey to Net Zero programme that leverages both current as well as future alternative fuels through a carbon insetting system. Under this programme and upon the request of customers, we decided to offer MSC Biofuel Solution through which we bunker certified sustainable secondgeneration biofuel (predominantly Used Cooking Oil MethylEsther,orUCOME).

Apart from LNG and biofuel that have an expansive network of bunkering locations, most low-carbon fuels are not yet available at scale and are bunkered at a limited number of ports. This poses significant challenges for their wide deployment across our oceangoing fleet. To meet rising customer demands, MSC Biofuel Solution was launched to reduce their supply chainfootprint.

By opting for MSC Biofuel Solution shippers reap the associated carbon savings. Carbon insetting is an opportunity to partner with customers interested in reducing the carbon footprint of their supply chain. MSC has witnessed a growing interest in its biofuel

programme, reflecting customers’ increasingly ambitious decarbonisation targets, including freight forwarders and shippers seeking to reduce their Scope 3 emissions.

Currently, second-generation biofuels provide immediate emission reductions without requiring adjustments to be made to existing onboard propulsion technologies in our ships. Our carbon insetting programme, MSC Biofuel Solution, is an example of how we are partnering with others across the supply chain to advance the transition towards zero-emission shipping.

MSC has also developed a transparent and robust accounting system for our Journey to Net Zero programme including our current offering MSC Biofuel Solution. In addition to providing documentation certifying the sustainability of the biofuel bunkered, customers also receive external verification of the accuracyandintegrityofthecarboninsettingprocess.

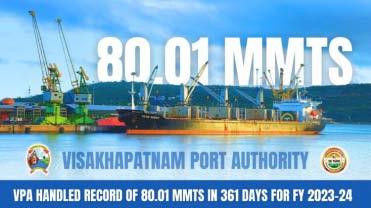

VISAKHAPATNAM: The Visakhapatnam Port Authority (VPA) has set a new cargo handling record by surpassing 80 million metric tonnes per annum (MMTPA) just four days before the end of the financial year 2023-24. This achievement exceeded the previous record of 73.75 MMTPA in 2022-23.

The Visakha Container Terminal (VCT) reported a notable 28% increase in container volumes,reaching665,000TEUs(TenEquivalentUnits).

Dr. A. Angamuthu, the Port Chairman, highlighted the growth in various cargo categories, including a 27% increase in POL and crude volumes, 12% in iron ore, and 6% in fertilizers. The port also handled a higher number of baby cape vessels up to 43 meters beam, contributing to a more than 35% increase in the number of vessels managed.

ThePortChairmancommendedtheteamforachieving the milestone and urged them to continue striving for excellence.Theport’sKeyPerformanceIndicators(KPIs) demonstrated significant improvements, with a 68% enhancement in Pre-berthing detention, 10% in TRT & OSBD,and8%inIdletimeatberth.

Notably, the VPA recorded the highest tonnage cargo handling every month in May, June, October 2023, and January 2024. Additionally, the port achieved a record for the highest daily cargo volume of 403,978 million tonnes on January 19, surpassing the previous record (401,875MT)setonJune17,2023.

DuringtheGlobalMaritimeIndia Summit (GMIS) 2023, the port signed 19 Memorandums of Understanding (MoUs) to enhance port management practicesandexplorenewtradeopportunities.TheVPA’s commitment to community development was emphasized by engaging in citizen-centric initiatives such as park development and road beautification to enhancethequalityoflifeforVisakhapatnamresidents.

The VPA’s commitment to sustainable development and the welfare of the local population was further demonstrated by its achievement of first place among all major ports in the Swachchta Pakhwada Awards 2023, which recognizes efforts in cleanliness and hygiene, as announced by the port secretary T Venu Gopal. This award underscores the VPA’s dedication to environmentalstewardshipandcommunitywell-being.

CJ-I

CJ-IV Nord Stark Interocean 06/04

CJ-V Nord Yilan Delta Waterways 05/04

CJ-VI VACANT

CJ-VII VACANT

CJ-VIII Hoihow Arnav Shpg. 06/04

CJ-IX VACANT

CJ-X Nazia Jahan Parekh Marine 05/04

CJ-XI Haian Mind ULSSL 02/04

CJ-XII Express Argentina Hapag Llyod 02/04

CJ-XIII Seastar Viking Synergy 06/04

CJ-XIV Eva Bristol Chowgule Bros. 04/04

CJ-XV Ertea Cross Trade 05/04

CJ-XVA Yangze 7 Aditya Marine 02/04

CJ-XVI Prinecss Boa Chowgule Bros. 03/04

TUNA VESSEL'S

OJ-II

OJ-III

OJ-IV AU Tauras

OJ-V VACANT

OJ-VI Swarna Pushp MK Shpg. 02/04

OJ-VII VACANT

MANILA:ThePhilippinesisseeking stronger maritime security cooperation with India to ensure the safety of seafarers from both nations as the world’s oceans are becoming more dangerous for commercial shipping, PresidentMarcossaid.

During a courtesy call of Indian Minister of External Affairs Subrahmanyam Jaishankar at Malacañang recently, Marcos stressed the importance of working together on maritime security amid concerns in the RedSea,theGulfofAdenandtheIndian Ocean. ‘That kind of partnership, we have just rationalized our –the system, the local system for the

support of our local seafarers because before,ithasbeenalittlebithaphazard, butnowIthinkwehave–wemadesome senseofitandIthinkwewillbegoingto be a little bit to a great advantage,’ MarcostoldJaishankar.

‘Which means we’re ready to join up and if there are opportunities for us to work together. It is at a crisis point of shipping. And maybe we can find something that we can do together to ease the situation at least a little bit until it becomes – the conflict becomes less heated,’ he said. While India and the Philippines are non-traditional partners intermsofmaritimeissues,Marcossaid ‘it serves a purpose for us to start

thinking about that, because the world is likethatalready,verycloselyconnected.’

Marcos highlighted the important contribution of Filipino seafarers manning the world’s merchant ships, whether tankers, cruise ships or other vessels.

Agreeing with Marcos, the Indian official said the two countries should startlookingforwheretheycandomore toworktogether.

In a separate meeting with Foreign Affairs Secretary Enrique Manalo on Tuesday, Jaishankar emphasized India’s readiness to build on its existing maritime partnerships with the Philippines.

Cont’d from Pg. 4

A meeting was held recently in Gandhinagar, where GIDB board members authorized the Chief Executive Officer to the following proposal to the industries and mines department for approval: “Logistics infrastructure and facilities’, including but not limited to integrated logistics park, multi modal logistics park, inland container depot, freight terminal, container freight station, air freight station, air cargo

complex, cold chain facility, warehouse, truck terminal, silos, and thelikeinfrastructure.”

Officialssaidthattheadditionofthe phrase ‘Logistics infrastructure and facilities’ will enable logistics infrastructure to be included in the prioritysector,wheregovtisentitledto take decisions to expedite projects through incentives. “It will also enable logistics projects to be implemented through the PPP (public private participation)model,”sourcessaid.

Officials said that a number of companies, including those based in Gujarat have shown keen interest in investing in Gujarat’s logistics sector even as the DMIC (Delhi-Mumbai Industrial Corridor) and the DFC (dedicated freight corridor) are passingthroughthestate.

“Govt will now be in a position to provideconcessionstoindustriesthat are interested in taking up projects related to the logistics sector,” officialssaid.

NEW DELHI: India’s trade policy is calibrated with its economic growth trajectory as it aims to achieve a target of $2 trillion in exports by 2030, Commerce and Industry Minister Piyush Goyal said recently. “Our trade policy is calibratedbasedonourdevelopment journey, yet open for expansion. We will be doing $2 trillion of exports by 2030 and I have no doubt we will achieve it,” the Minister said at a mediaeventinNewDelhi.

Goyal said that India had pulled out of the Regional Comprehensive

Economic Partnership (RCEP) in 2019 due to stakeholder concerns and to protect the Indian market from being flooded by cheap Chinese goods.

He further stated that if India had not withdrawn from the RCEP, the country would not have scripted the growthstoryithasinrecentyears.

The flood of sub-standard, lowquality goods coming in from certain geographies would have killed the investment climate in the country, he added.

Goyal pointed out that even

America and Europe still levy high tariffsonseveralproducts.

At the same time, he said that India needs to internationalize its economy and look at a greater degree of engagement with the world and high growth in exports. The minister cited the recently signed European Free Trade Association (EFTA), in which Iceland, Liechtenstein, Norway, and Switzerland, have committed an investment of $100 billiontocreate1milliondirectjobsin India in the next 15 years in exchange formarketaccess.

NEW YORK: On March 26, the Francis Scott Key Bridge in Baltimore collapsed after being struck by containership MV Dali operated by APMollerMaerskA/Sonaninternational routebetweentheUSeastcoastandAsia. The collapse blocks the main access to the port of Baltimore and traps six bulk carriersandtwonavyvessels.

According to Mr. Chris Rogers, Head of Supply Chain Research, S&P GlobalMarketIntelligence:

“The bridge collapse is the latest challenge for northeast US supply chains, including access to the Red Sea and Panama Canal as well as the prospect of port strikes later in mid2024. Both bridge reconstruction and cargo delays are likely to be extensive. However, some freight across containerized and bulk modes could reroute to nearby ports in Wilmington,

Delaware and Philadelphia, Pennsylvania.

“The port handled around 3% of all US east and gulf coast imports and 10% of US northeast imports of containerizedfreightinthe12monthsto Jan.31,2024.Itisparticularlyimportant for the wood (39% of northeast ports’ imports),constructionmachinery(31%) and steel/aluminum (20%) sectors. Consumer goods exposures including home appliances (16%) and furniture (9%).

“The port is also one of the largest handlers of specialty wheeled transport shipments (cars and trucks) in the US, though one of the major terminals is located oceanside from the bridge and somayfacelessdisruption.”

Disruptions to 10% of northeast imports:Supplychainimpact

The Port of Baltimore handled

650,897 TEUs of inbound traffic and 272,8590 TEUs of outbound shipments in the 12 months to Jan. 31, 2024, accounting for 2.8% and 3.1% of the US east and Gulf Coast total, respectively, according to S&P Global Market Intelligencedata.

Container freight accounted for 75% of volumes handled through the port in the past 12 months, with autos and roll-on, roll-off capacity representing another 18%, while bulk shipments of steel and forestry products accounted for much of the remainder.

The port is also one of the largest handlers of specialty wheeled transport shipments (cars and trucks) in the US, though one of the major terminals is located oceanside from the bridge and so may face less disruption.

NEW YORK: Maryland Governor Wes Moore warned recently of a “very long road ahead” to recover from the loss of Baltimore’s Francis Scott Key Bridge as the Biden administration approved $60 million in immediate federalaidafterthedeadlycollapse.

Massive barges carrying cranes streamed toward the site to begin the challenging work of removing twisted

metal and concrete as a first step toward reopening a key shipping route blockedbythewreckageofthespan.

Moore promised that “the best minds in the world” were working on planstoclearthedebris,movethecargo ship that rammed into the bridge from the channel, recover the bodies of the fourremainingworkerspresumeddead andinvestigatewhatwentwrong.

“Government is working hand in hand with industry to investigate the area, including the wreck, and remove the ship,” said Moore, a Democrat, who said quick aid is needed to “lay the foundation for a rapid recovery”. President Joe Biden has pledged the federal government would pay the full cost of rebuilding the bridge.

NEWDELHI:TheDepartmentfor Promotion of Industry and Internal Trade(DPIIT)isplanningtoengagea research firm to prepare the Logistics Ease Across Different States and Union Territories for the nextthreeyears.

Every year, the department releases a Logistics Ease Across Different State (LEADS) report, ranking states and Union Territories (UTs) on the basis of their logistics ecosystem and highlights the key logistics-related challenges faced by stakeholders and includes suggestive recommendations.

The index is an indicator of the efficiency of logistical services necessary for promoting exports and economicgrowth.

The DPIIT has floated a request for proposal for the appointment of

consultantforrankingofstatesonthe basis of their logistics efficiency (LEADS report for 2024, 2025, and 2026).

“The DPIIT intends to engage a research organisation/consulting or market research firm/ academic institution (Consultant) with experience in preparing national/international level reports based on robust data based analysis in the logistics / transport / infrastructure sector for the period of 36monthstoprepare,LEADSreports for 2024, 2025, and 2026,” according to therequestforproposaldocument.

The objective of the current assignment for the consultant is to prepare the reports taking into account the methodology developed inthepreviousversionsofLEADS.

The consultant, it said, is expected

to review the LEADS methodology, identify potential enhancements, and propose a plan for data collection; and conduct perception-based surveys acrossthelogisticsecosysteminIndia, developing a sampling frame, survey instruments,andobjectivedatasets.

It is also expected to analyse collected data using robust statistical methodologies, visualise findings using data tools and derive the LEADS Index; and draft a comprehensive LEADS report for each year, including actionable recommendations tailored for states/UTs.

According to the fifth LEADS 2023 report, Andhra Pradesh, Karnataka, TamilNadu,Gujarat,andChandigarh are among the 13 states and UTs that have again been categorised as “achievers”.

NEW DELHI: India’s steel trade deficit has come down to Rs. 10,411 crore ($1,258 million) for the April–February period, down 10 per cent sequentially, on the back of improving exports, and stable imports during February, a report of theSteelMinistry,

TradedeficitwasRs.11,564crorein theApril–Januaryperiodofthefiscal.

Import of finished steel stood at 7.6 million tonnes (mt), and was valued at Rs. 63,432 crore ($7,663 million) while exports were at 6.6 mt and valued at Rs. 53,021 crore ($6,405 million). India was a net importer, with shipments coming-in exceeding outboundshipmentsbynearly1mt.

Imports increased 29 per cent YoY and remained at January levels (with no significant increase) for February at 0.8 mt. Exports, on the other hand, increasedby78percentYoYandby21

per cent sequentially in February to over1mt,theMinistryreportsaid.

“Volume-wise hot rolled coil / strip – at 3.4 mt – was the most imported item accounting for 45 per cent share (with China being the largest seller), accountingfor2.5mtoftheshipments comingin,”thereportmentioned.

Hotrolledcoilsandstripswerethe highest exported item accounting for 2.6 mt or nearly 39 per cent of the volumes. Flat product exports increasedby16percentYoYto5.9mt, while non-flat products saw a 7percentYoYdeclineto0.7mt.

According to the Ministry report, Italy, Spain and Belgium were the three top buyers; and Europe accounted for 45 per cent of the exportsfromIndia.

Shipments to Italy — the largest market—stoodat1.5mt,up85percent YoY. Exports in the year-ago-period

were 0.8 mt and valued at $1,228 million,up43percent,YoY.

Exports to Belgium increased 37percentYoYto0.8mtor$646million, up 6 per cent. Shipments made past yearwas0.53mt,thereportmentioned.

The other big buyer, Spain, saw an over 100 per cent increase in exports to 0.63 mt for April–February period, whichwasat0.3mtinthesameperiod last fiscal. Exports were valued at $527million,up65percentYoY.

Other European buyers were France, Germany and Greece, and shipments stood at around 29,000 tonnes, 31,300 tonnes and 42,400 tonnes, respectively, the report showed.

Other major buyers were Nepal and UAE, where exports stood at 0.6 mt, up 14 per cent ($340 million) and 0.5 mt, down 28 per cent ($442million),respectively.

GANDHINAGAR: To provide last mile connectivity to employees and visitors in GIFT City, the government is working on a pilot project for operating pod taxis that will operate on elevated corridors and provide crucial connectivity between high-rise buildings and metro stations within the 1000-acre oddcampusinGujarat.

“The Personal Rapid Transit (PRT) system will be the last mile connectivity between the metro rail and the offices in GIFT City. A proof of concept has been madewheretheprojectwillbeexecutedin asmallportionandlaterscaledup.Aspart of the pilot project we will lay a couple of

kilometers of tracks in the Special EconomicZone(SEZS)foroperatingpod taxis that will begin from the metro station in GIFT City. Consultants have also been appointed to conduct a feasibility study for the project,” aseniorofficialofGIFTCitytold.

Italy-basedM/sRinaConsultingand Ahmedabad-based M/s CASAD Consultants Pvt. Ltd. have been appointed as consultants for carrying out a detailed feasibility study for development of Personal Rapid Transit (PRT) System in GIFT City, sources added. The National Highway Logistics Management Ltd (NHLML) in early

2023 had floated a Request for Proposal (RFP) for carrying out a feasibility study for development of Personal RapidSysteminGIFTCity.NHLMLisa 100 percent owned special purpose vehicle of National Highway Authority ofIndia(NHAI).

“The pod taxis that will run on dedicated tracks,” the official added. The tracks have been proposed to be built on an elevated corridor over utility tunnels that cross GIFT City and connect all the high-rise buildings. The tentative length of the pilot project mentioned in the RFP floated by NHLMLisabout4.6kilometers.

MUMBAI: Other than elongated transit times, Asia-Europe container supply chains may be so far largely unscathed by the Red Sea crisis and vessel diversions around the Cape of Good Hope – but for European exporters to the Middle East and Indian subcontinent, it has been a disaster.

Massively increased transit time and sky-rocketing freight rates on both headhaul and backhaul trades have led more and more Indian businesses to turn to Far East suppliers to source materials, according to a new analysis by maritimeconsultancyMSI.

“Following a solid 2023, where it expanded by 11%, the Far EastMiddle East/India trade recorded a massive 34.5% year-on-year expansion in January,” it notes in the March edition of its Horizon Monthly Containershipsreport.

“Indiahasbeentheprimarydriver of this growth since it is by far the region’s largest importer.

The booming Indian economy has led to increased demand for containerisedimports,”itsaid.

In terms of volumes, in Q1 22, the FarEast-MiddleEast/Indiatradewas around twice the size of the EuropeMiddle East/India trade, at 1.89m teu and905,000teu,respectively.

Two years later, it is now around three times the size. MSI’s firstquarter 2024 volume estimates is for Far East-Middle East/India trade to see 2.24m teu, representing year-onyear growth of 16.4%, while the Europe-Middle East/India trade is expected to show an 11.8% year-onyearcontraction,to785,000teu.

During S&P Global’s recent TPM24 conference in Long Beach, Vespucci Maritime’s Lars Jensen reiterated his view that the Indian Ocean Rim would become a major growth market for carriers and freightserviceproviders.

He told delegates: “Partly this is the result of the slow migration of manufacturing from China; India is

where China was 25 years ago, especially in terms of cheap labour. Now it needs the infrastructure to servethat.”

And the new data from MSI would appear to support this, with the primary commodities India now imports from China comprising manufacturing material, rather than theconsumergoodsthatdominatethe Asia-Europeandtranspacifictrades.

“Estimated Indian imports of “container-relevant” products from China have skyrocketed since 2020. In2023, importsgrew byanestimated 21.6% year on year,” said MSI. “This was driven predominantly by imports ofplastics,machinery,glassproducts, metal,andsemi-finishedtextiles.

“Consumer confidence has also bounded back strongly from the pandemic lows and is rising every quarter. We expect India to continue to record strong import growth from theFarEast,mergingasabrightspot for container carriers,” MSI concluded.

MUMBAI: India can achieve a growth rate of 10 per cent in the next decade and become the second-largest economyby2032andthelargestby2050, given the energies and transformation driving the nation to overcome its challenges, said RBI Deputy Governor Michael Debabrata Patra. He was delivering a keynote address on The Indian Economy: Opportunities and Challenges at Nomura's 40th Central Bankers Seminar in Kyoto, JapanonMarch25.

India'sgrowthtrendisonthecuspof a post-pandemic upshift, with early signs of it rising above 7 per cent recorded during the 2000s before COVID-19struck,hesaid.

"India's recent growth performance

has surprised many, triggering a flurry of upgrades. For instance, the InternationalMonetaryFund(IMF)has cumulatively revised its forecast for 2023 upwards by 80 basis points between April 2023 and January 2024," Patrasaid.

In its latest update, IMF expects India to contribute 16 per cent of global growth, the second largest share in the world in terms of market exchange rates.

By this metric, India is the fifth largest economy in the world and positioned to overtake Germany and Japanwithintheensuingdecade.

In purchasing power parity (PPP) terms, the Indian economy is already thethirdlargestintheworld.

The tailwinds driving the growth, the deputygovernorsaid,includefavourable demography, the rupee being among the least volatile currencies in 2023, and transformative change leveraged on technology.

"Given the innate strengths, I described and the energies and transformation that are driving the nation to overcome its challenges and achieve its aspirational goals, it is possible to imagine India striking out into the next decade with a growth rate of10percent.

"Ifthisisachieved,Indiawillbecome thesecondlargesteconomyintheworld not by 2045 as shown earlier, but by 2032 and the largest economy by 2050," Patrasaid.

NEW DELHI: The Expert Committee on developing the Gujarat International Finance Tech-City InternationalFinancialServicesCentre (GIFT IFSC) as ‘Global Finance and Accounting Hub’ has submitted its report to Chairperson, International Financial Services Centre Authority, (IFSCA)on26thMarch,2024.

The Expert Committee was constituted pursuant to the notification issued by Ministry of Finance on 18th January, 2024 wherein book-keeping, accounting, taxation and financial crime compliance were notified as ‘financial

services’underSec3(1)(e)(xiv)ofIFSCA Act, 2019. The Expert Committee was chaired by the President of the Institute ofCharteredAccountantsofIndia(ICAI). The committee comprised of experts from the industry, academia and the Government.

The Expert Committee has recommended a comprehensive regulatory regime for undertaking bookkeeping, accounting, taxation and financial crimes compliance services from IFSC in India. Additionally, the Committee has also made several recommendations for the promotion

and development of GIFT IFSC as ‘Global Finance and Accounting Hub’, including measures for enhancing the skills and competencies of the workforce.

In its report, the Committee has highlighted the potential for GIFT IFSC to become a global hub for bookkeeping, accounting, taxation and financial crime compliance services, which would create large employment opportunities for the talented workforce.

The report of the Expert Committee canbeaccessedonIFSCAwebsite.

The above vessel has arrived on 31-03-2024 at MUNDRA PORT with Import cargo from ANTWERP, ROTTERDAM. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 31-03-2024 at MUNDRA PORT with Import cargo from ANTWERP, RODMAN. Please note the item Nos. against the B/L Nos. for MUNDRA delivery

The above vessel has arrived on 31-03-2024 at MUNDRA PORT with Import cargo from ANTWERP. Please note the item Nos. against the B/L Nos. for MUNDRA delivery

The above vessel has arrived on 31-03-2024 at MUNDRA PORT with Import cargo from ANTWERP, HAMBURG, COPENHAGEN, TALLINN, HELSINKI, RAUMA, LE HAVRE, FELIXSTOWE, LONDON GATEWAY PORT, TEESPORT, DUBLIN, CORK, KLAIPEDA, RIGA, ROTTERDAM, OSLO, RODMAN, GDYNIA, HALMSTAD.

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

84 MEDUEI389903

85 MEDUEI450705

86 MEDUEI363775

87 MEDUEI386321

88 MEDUEI387543

89 MEDUEI293196

9 MEDUEI330139

90 MEDUEI467238

91 MEDUEI424833

92 MEDUEI473657

93 MEDUEI360672

94 MEDUEI404546

95 MEDUEI383575

96 MEDUEI453428

97 MEDUEI387501

98 MEDUEI398979

99 MEDUEI384102

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized

GANDHIDHAM: Intending to integrate Markets and Manufacturing Sectors worldwide, Mr. Joachim Rocha – Trade Commissioner, Ministry of Canada has visited the leading Trade and Industry organization of Kutch – The Gandhidham Chamber of Commerce to establishcollaborationandpromoteTradewithCanada.

InameetingheldwithHon.SecretaryofGandhidham Chamber Mr. Mahesh Tirthani and Canadian Trade Commissioner Mr. Joachim Rocha, the Canadian Commissioner expressed the willingness and gave detailed information about the special approach of the CanadianGovernmenttoconnecttheTradeandIndustry ofKutchwiththeTradeNetworkofCanada.

TheHon.SecretaryofTheGandhidhamChamberMr. Mahesh Tirthani has informed him about the rapid developmentandprogressofKutchaftertheearthquake and discussed in detail the vast potential of Kutch for increasing International Trade Networks in Oil, Timber, Salt, Handloom-handicraft, Steel, Cement, Minerals, Plywood, Furniture, Agro products, and various Industries.

Mr.MaheshTirthanihasfurtherstatedthatduetothe 2 major ports of Kutch, approximately 45% of the country’s total import-export business is being done throughthesePortssoKutchisconsideredasaShipping and logistics hub of the Nation. Also, the Mega Container Terminal Project of Govt. of India at Tuna Tekra, which was recently awarded to the world’s Top Port InfrastructureCompany-DPWorldwillmakeitdoublein volume after it is operational, which will make a significant contribution to the economy of the entire country and especially the social and economic sector of Kutch.

The Canadian Trade Commissioner was impressed by the extensive information about the unprecedented

progress in the trade-industry sector of Kutch, He has proposed to arrange a joint meeting with trade industry representatives from various sectors, chambers, youth wing members, and entrepreneurs to connect the tradeindustry network of Kutch with Canada. In response, Chamber Secretary Mr. Mahesh Tirthani welcomed the proposal and assured that the Gandhidham Chamber would play a pivotal role in promoting the trade network of both countries by holding such a special meeting. The Canadian Trade Commissioner said they will make a detailed study of this and coordinate with their Canada Govt.toarrangeajointmeetingshortly.

After that, the Gandhidham Chamber Hon Secretary Mr. Mahesh Tirthani presented to them the Coffee Table Book of the Gandhidham Chamber, which showed huge potential and detailed information about the present business and industry of Kutch. In this press release, the Chamber Hon Secretary Mr. Mahesh Tirthani informed that our Chamber is always active with this kind of Trade Promotion Mission to connect the Trade and Industry of Kutch to the International level and take the country’s economy to a new height by holding a meeting with the Trade and preparing an elaborate road map in this regard.

NEWDELHI:TherecentdepreciationseeninJapanese yen is not expected to impact India’s exports to that country as they are not competing with domestic manufacturers, but it could jack up Indian imports of electronics, machineryandautocomponents,accordingtoFederationof IndianExportOrganisations.

“India’s exports to Japan are largely of goods like apparel and marine products that they (Japanese companies)donotproducelocallysotheseproductsarenot competing with the domestic manufacturers. So despite the depreciation there would not be any impact even though these products may get costly for consumers there,” Director General and Chief Executive Ofcer of FIEO AjaiSahai said.

The yen dropped to its lowest level in 34 years early Wednesday,tradingnear152tothedollar.Thefreshroundof depreciation of yen has been sparked off by the Bank of Japanendingitsnegativeinterestratepolicy.

Sahai,however,saidthatbecauseofthedepreciatingyen Japaneseexportswillgetcheaperandmorecompetitive.

The depreciating yen might see Indian companies increasing their imports of electronics, machinery and auto components from Japan so there could be some shift away fromothersources,hesaid.

ChairmanoftheEngineeringExportPromotionCouncil EEPC Chairman Arun Kumar Garodia also said that there would be no impact on engineering sector exports to Japan

duetoyendepreciation.

He said the border impact of the recent developments in Japan would not be felt on larger exports as most of Indian exports are invoices in dollars and euros. Garodia said that though the exports are immune from recent developments in Japan, it will hurt some of the bigger Indian companies whohaveborrowedabroadinyen.

Within the engineering sector, which accounts for close to 25% of exports, India exported $ 322.24 million worth of electrical machinery in the last financial year. Exports of iron and steel stood at $268.21 million and aluminium at $291.59million.

In 2022-2023, Japan‘s bilateral trade with India was $21.96 billion, with Japan exporting $16.49 billion and Indiaimporting$5.46billion.

India’s main exports to Japan also include refined petroleum ($379 million), Crustaceans ($332 million), chemicals ($734 million), iron and steel ($268 million), other machinery($430.7million)andvehicles($405.14million).

India’s imports from Japan are machinery ($2.8 billion), metals (2.1 billion), electrical machinery ($ 1.7 billion) and ironandsteel($1.3billion).

India and Japan also have a Comprehensive Economic Partnership Agreement (CEPA) between them which was signed. India is seeking a review of some elements of the agreement as it feels that the pact has benefitted Japan morethanIndia.