Vol.LXVNo.22

Tel : 2266 1756, 2266 1422, 2269 1407

Vol.LXVNo.22

Tel : 2266 1756, 2266 1422, 2269 1407

M U M B A I : A r k a s L i n e i s broadening its service network and entering new markets as part of its 2025 growth strategy. After recently adding new routes to its global shipping network with America and Red Sea Lines, the company is now f u r t h e r s t r e n g t h e n i n g i t s i n t e r n a t i o n a l p r e s e n c e b y extending its route to India.

Ranking 32nd on the World Shipowners List, Arkas Line is expanding its service network after s u c c e s s f u l o p e r a t i o n s i n t h e Mediterranean, Black Sea, Europe,

Africa, and the East Coast of America. Following its recent expansion through the Red Sea, the company i s n o w a d d i n g a n e w country to its network: India. Through this move, the company aims to both increase access to new markets and provide a service structure that better meets customer needs.

New Lines, Increasing Capacity T h e N e w S e r v i c e c a l l e d "India Med Service (IMS)" will commence on February 10, 2025, with four vessels, each having a capacity of 2,500-2,800 TEU. As of June 2025, the number of vessels in this service will increase to five, continuing to operate weekly Cont’d. Pg. 4

Cont’d. from Pg. 3

The route of the "India Med Service (IMS)" will cover the following Ports: Ambarli - Evyap - Aliaga - MersinAqaba - Jeddah - Nhava Sheva - Mundra - JeddahAqaba - Alexandria - Ambarli.

By utilizing rail connections from the Ports of Mundra and Nhava Sheva, the company will also facilitate the transportation of customers’ cargo to key trade centers in the inland regions of India.

New Service Structure / Restructuring in the Mediterranean

With the launch of the new "India Med Service (IMS)" line, there will be a restructuring of the service network in the Mediterranean. Arkas Line has decided to merge its existing GPS (Great Pendulum Service), EMS (East Med Morocco Service), and SEM (Spain-East Med) services. By introducing the new "Blue Med Service (BMS)", the company aims to strengthen its Mediterranean network with a more efficient and comprehensive service structure.

By having all its vessels operated by Arkas Line, the "Blue Med Service (BMS)” will solidify the company's position in the region With this new development, the Mediter ranean route will be as follows: Alexandria - Beirut - Lattakia - Mersin - Aliaga -

Genoa – La Spezia - Tangier - Casablanca - ValenciaBarcelona - Fos Sur Mer - Genoa - La Spezia - Salerno – Alexandria.

With the launch of the India Service, Arkas Line will operate in 27 countries, offering 33 services across 72 ports

Arkas Line CEO Mr. Can Atalay stated, "As Arkas Line, our efforts to expand into new geographies and increase the variety of services we offer to our customers, will continue in 2025. In line with our growth plans, we are restructuring our services for greater efficiency, entering new markets, and continuing our investments in fleet renewal to provide solutions that meet our customers’ needs.

Since June 2024, we have been operating our Red Sea service with two vessels, each with a capacity of 1,600 TEU Now, by extending this service to India, we are opening up to new geographies. Additionally, we are increasing the service capacity by deploying five vessels, each with a 2,800 TEU capacity, and launching the new direct service ‘India Med Service (IMS)’; from India to the Mediterranean.”

He continued, "To better connect the new 'India Med Service (IMS)' to the Mediterranean region, we are introducing a new service structure by merging our GPS, EMS, and SEM services, and launching the strengthened 'Blue Med Service (BMS)'.”

Parekh Marine Agencies Pvt. Ltd. are the Agents in India for Arkas Line.

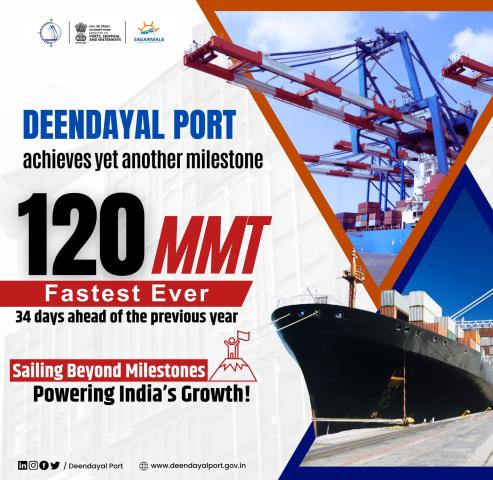

GANDHIDHAM: Deendayal Port Authority (DPA) Kandla is proud to announce that it has crossed the 120 MMT cargo handling mark on 28th January 2025—34 days ahead of the previous year’s milestone.

T h i s a c h i e v e m e n t u n d e r s c o r e s DPA’s commitment to efficiency, growth and progress!

MUMBAI : The Directorate General of Shipping strengthening ties with the International Marine Contractors Association (IMCA). The DG Shipping had the pleasure of welcoming Mr. Iain Grainger, CEO, IMCA; Mr. Alister Macleod, Diving Manager, IMCA; and Mr Christopher Rodricks, IMCA Representative for MEI, on 29th January, at their office.

Their visit marks an important step in fostering collaboration between IMCA and India’s maritime administration. IMCA’s global expertise and commitment to safety, innovation, and sustainability resonate with our shared vision of advancing India’s offshore and marine industries. Together, we strive to make India a leader in offshore safety, sustainability, and operational excellence.

CMA CGM CMA CGM Ag. Djibouti. (BIGEX 2) 08/0208/02

TBATBA CMA CGM India 0QC2DW1 06/0207/02

10/0211/02

TBATBA Aydogan 2503W Q2557 1118487-11/01 MBK Line MBK Logistics Jeddah, Beldeport

TBATBA Athena 0057 Q2632 1119667-20/01 C Star Diamond Maritime (India Med Service) 09/0210/02

TBATBA Ghibli 25005W Sealead Sealead Shpg Jeddah, Sokhna (RESIN Service)

01/0202/02 31/01 2300 Folk Jeddah 2505W Q2578 1118909-15/01 Folk Maritime Seastar Global Jeddah (IRSS) 12/0212/02

01/0202/02

08/0209/02

TBATBA Wadi Duka 2506W Q2725 1120903-28/01 Asyad Line Seabridge

TBATBA Maersk Sentosa 504W Q2517 1117881-07/01 Maersk Line Maersk India Algeciras (MECL) Maersk CFS

TBATBA W. Kithira 505W Q2643 1119701-20/01

05/0206/02 TBATBA Konard K0N0125W Akkon Line Oasis Shpg. Aliaga Gemlik, Gebze (YIL Port), Ambarli, Felixstowe, Antwerp

06/0207/02

TBATBA X-Press Altair 25002W Q2672 1120093-22/01 X-Press Feeders Sea Consortium Jeddah, Al Sokhna 10/0211/02 TBATBA SSL Brahmaputra 923W Q2635 1119685-20/01 Wan Hai Wan Hai Lines (I) (RGI / IM1) 25/0226/02 TBATBA SSL Godavari 039W

04/0305/03 TBATBA Wan Hai 501 254W

Emirates Emirates Shpg.

07/0208/02 TBA 0500 X-Press Dhaulagiri 25002R Q2695 MSC MSC Agency King Abdullah, Jeddah. (Saudi Express) Hind Terminals 14/0215/02 TBA 0500 Dubai Tower 25003R Q2742 1121075-29/01

In Port 01/02 MSC Lisbon IP505A Q2680 1120311-24/01 MSC

MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals 07/0208/02 07/02 0900 MSC Joanna IP506A Q2740 1121072-29/01 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D). 14/0215/02 14/02 0900 MSC Pamela IP507A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre (EPIC / IPAK)

COSCO COSCO Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Seahorse Ship UK, North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos.

Globelink Globelink WW UK, North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. UK, North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global UK, North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal UK, North Continent & Scandinavian Ports. Dronagiri-3 Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines UK, North Continent, Red Sea & Med. Ports. Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

UK, North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals

Barcelona, Felixstowe, Hamburg, Rotterdam, Gioia Tauro,

Laurence IS506A UK, North Continent & Other Mediterranean Ports. HimalayaExpress NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1

Allcargo Allcargo Log. UK, North Cont., Scandinavian & Med. Ports. Dron.2&Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. UK, North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa. Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

In Port 31/01 W. Klaipeda 503W Q2528 1118060-08/01 Maersk Line Maersk India Port Tangiers, Algeciras, Rotterdam, Felixstowe Maersk CFS 06/0207/02 TBATBA GSL Eleni 505W Q2640 1119703-20/01 (ME 2) 01/0202/02 31/01 2200 Osaka Express 5303W Q2552 1118387-10/01 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 07/0208/02 TBATBA Seaspan Amazon 5304W Q2659 1119915-21/01 Hapag ISS Shpg. UK, North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS 12/0213/02 TBATBA Houston Express 506W Q2741 1121074-29/01 ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. Oceangate CFS

In Port 31/01 Kota Naluri 2351W Q2614 1119324-17/01 PIL PIL India Djibouti, Berbeira (RGS)

06/0207/02 TBATBA Kota Naga 2250W Q2687 1120553-25/01

03/0204/02

TBATBA HMM Promise 044W Q2666 1119928-21/01 HMM HMM Shpg. Jeddah, Damietta, Piraeus, Genoa, Valencia, Barcelona, Seabird CFS 15/0216/02

04/0205/02

TBATBA HMM Ocean 001W ONE Line ONE (India) Algeciras (FIM West Bound)

TBATBA Zagor 25005W Q2720 1120897-28/01 SeaLead SeaLead Shpg. Aliaga, Gebze, Gemlik, Istanbul, Mersin, EL Dekheila, Casablanca, 17/0218/02

04/0205/02

TBATBA Haian East 25006W Volta Container Corten Shpg. Venghazi, Algier, Raves, Constanta, Thessaloniki, Piraeus, Reel Shpg. Corten Shpg. Barcelona, Valencia, Misurata (West Asia Red Sea Med - WARM)

TBATBA CMA CGM Thalassa 0PEBDW1 Q2625 1119472-18/01 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 11/0212/02

TBATBA CMA CGM Columba 0PEBJW1 Q2685 1120539-25/01 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras.(EPIC) 05/0206/02 TBATBA C Star Voyager 002WN Q2610 1119210-16/01 CU Lines Seahorse Shpg. Djibouti, Jeddah, Aden. 07/0208/02 TBATBA KR Tasman 2506W Q2710 1120697-27/01 C Star Diamond Maritime (IMR1) UGL Seatrade Shipping UnifeederUnifeeder 06/0207/02

1000 MSC Mexico V IV505A Q2688 1120447-25/01 MSC MSC Agency Freeport, Houston.

1000 MSC Bremen IV506A (INDUSA)

02/02 2359 Ever Eagle 186E Q2602 1119139-16/01

Ever Ethic 173E Q2657 1119910-21/01 (CISC

In Port 01/02 MSC Lisbon IP505A Q2680 1120311-24/01 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals

07/0208/02 07/02 0900 MSC Joanna IP506A Q2740 1121072-29/01 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira, Paita, 14/0215/02 14/02 0900 MSC Pamela IP507A Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK) Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports. AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America

31/0102/02 31/01 2100 APL Southampton 0INIZW1 Q2604 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah & Dron.-3 & Mul. 08/0209/02 TBATBA CMA CGM Dolphin 0INJ1W1 Q2719 OOCL OOCL(I) Other US East Coast Ports. Dronagiri-2

ONE Line ONE (India) India America Express (INDAMEX)

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. ConexTerminal Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

02/0203/02 01/02 2300 Tolten 5105 Q2608 1119188-16/01 Hapag ISS Shpg. New York, Norfolk, Charleston, Savannah ULA CFS 09/0210/02 TBATBA Nagoya Express 5106 Q2698 1120545-25/01 (TPI/INDAMEX)

06/0207/02 TBA 1000 MSC Barcelona IU505A Q2711 1120721-27/01 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 13/0214/02 TBA 1000 Karlskrona IU506A Q2735 1121010-28/01 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS)

21/0222/02 TBA 1000 Conti Courage IU505A 06/0207/02 05/02 1000 MSC Regulus IS504A Q2630 1119666-20/01 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, HindTerminals 14/0215/02 13/02 1000 MSC Luciana IS505A Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 18/0219/02 17/02 1000 MSC Laurence IS506A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast.

In Port 30/01 One Thesues 090E Q2623 1119470-18/01 ONE Line ONE (India) New York, Jacksonville, Savannah, Charleston, 09/0210/02 TBATBA One Reassurance 245E Q2699 HMM HMM Shpg. Norfolk (WIN/IAX) Seabird CFS 30/0131/01 TBATBA Xin Da Yang Zhou 098E Q2548 1118350-10/01 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 13/0215/02

TBATBA OOCL Hamburg 155E Q2653 RCL RCL Ag USA East Coast & Other Inland Destinations. 25/0226/02 TBATBA OOCL Luxembourg 115E COSCO COSCO Shpg. US West Coast. (CIX-3) Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. ICC Line Neptune US East, West Coast, Canada, South & Central American Ports. GDL-3 & Dron-3

04/0205/02 04/02 1400 MOL Presence 0020E Q2576 1118908-15/01 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 07/0208/02 TBATBA Dimitris Y 0251E Q2689 & Caribbean Ports, Canada. 15/0217/02 TBATBA Cap Andreas 0018E Globelink Globelink

11/0212/02 TBATBA C.C.Mendelssohn 0UW94W1 Q2737 1121037-29/01 OOCL OOCL (I) (Bangladesh India Gulf Express) 08/0209/02 TBATBA Ren Jian 8 02SJZS1 Q2644 1119734-20/01 CMA CGM CMA CGM Ag. Khorfakkan, Jebel Ali (SWAX) Dron-3&Mul 04/0205/02 TBATBA Atlantic Ibis 2504W Q2705 1120674-27/01 Hapag ISS Shpg. Jebel Ali, Dammam, Shuaiba, UMM Qasr. (IG1) ULA CFS 11/0212/02 TBATBA Source Blessing 2505W Q2736 1121032-29/01 Alligator Shpg. Aiyer Shpg. Jebel Ali, Shuaiba, UMM Qasr. TO LOAD FOR

In Port 31/01 Norderney 090W Q2540 1118293-10/01 ONE Line ONE (India) Jebel Ali. 03/0104/02 03/01 1200 Oceana 933W Q2463 1117300-03/01 UnifeederUnifeeder Jebel Ali. Dronagiri (MJI/ESX) OOCL OOCL (I) Jebel Ali.

01/0202/02 TBATBA Maersk Sentosa 504W Q2517 1117881-07/01 Maersk Line Maersk India Salallah. (MECL)

Maersk CFS

02/0203/02 02/02 1000 Maersk Cairo 506S Q2518 1117882-07/01 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS

04/0204/02 03/02 2000 Nadia 20 Q2674 1120106-22/01 Lubeck Giga Shipping Bandar Abbas

05/0206/02 05/02 1700 Shamim 1343W Q2706 1120674-27/01 HDASCO Armita India Bandar Abbas, Chabahar. (IIX)

05/0206/02

05/0206/02

TBATBA Inter Sydney 0172 Q2649 1119926-21/01 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

TBATBA Garsmere Maersk 506W Q2639 1119684-20/01 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile) Maersk CFS 12/0213/02

06/0207/02

TBATBA Maersk Boston 507W Q2660 1119916-21/01

TBATBA X-Press Altair 25002W Q2672 1120093-22/01 X-Press Feeders Sea Consortium Jebel Ali 10/0211/02

TBATBA SSL Brahmaputra 923W Q2635 1119685-20/01 Wan Hai Wan Hai Lines (I) (RGI / IM1) 25/0226/02

TBATBA SSL Godavari 039W UnifeederUnifeeder 04/0305/03

TBATBA Wan Hai 501 254W Emirates Emirates Shpg. 09/0210/02

TBATBA Terataki 2502W Q2673 1120114-22/01 Asyad Line Seabridge Jebel Ali. (FEX) 10/0211/02

TBATBA Zhong Gu Chang Sha 02444S Q2594 1119075-16/01 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. 17/0218/02

TBATBA Zhong Gu Shen Yang 0PU45S1 RCL/CUL Line RCL/Seahorse 21/0222/02

TBATBA Zhong Gu Fu Zhou 0PU49S1 KMTC KMTC (India) (VGX West Bound) Dronagiri-3 27/0228/02

TBATBA Zhong Gu Kun Ming 0PU4DS1 CMA CGM CMA CGM Ag. Dron-3&Mul SeaLead SeaLead Shpg Alligator Shpg. Aiyer Shpg. Jebel Ali, Dammam TO LOAD FOR WEST ASIA GULF PORTS From NSIGT

In Port 01/02 MSC Lisbon IP505A Q2680 1120311-24/01 CMA CGM CMA CGM Ag. King Abdullah. Dron.-3 & Mul. 07/0208/02 07/02 0900 MSC Joanna IP506A Q2740

In Port 31/01 W. Klaipeda 503W Q2528 1118060-08/01 Maersk Line Maersk India Salallah (ME 2) Maersk CFS 31/0101/02 01/02 1200 Zhong Gu Nan Ning 25001E Q2567 1118745-13/01 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 07/0208/02 TBATBA Celsius Nairobi 0925 Q2724 1120922-28/01 UnifeederUnifeeder Basra. (ASX) QNL/Milaha Poseidon Shpg. Jebel Ali, Bandar Abbas. Speedy CFS Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DR

In Port 31/01 Kota Naluri 2351W Q2614 1119324-17/01 PIL PIL India Jebel Ali (RGS) 01/02 02/02 31/02 2200 Vira Bhum 123W Q2572 1118786-13/01 RCL/BTL RCL Ag./Bharat Feeder Umm Qasr, Dubai. (RWG / IMI)

01/02 1700 Spirit of Kolkata 2502W Q2654 1119908-21/01 QNL/Milaha Poseidon Shpg. Hamad. (NDX) Speedy CFS Emirates Emirates Shpg. Hamad. Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr. Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports. LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Team Lines Team Global Log. Gulf Ports. Conex Terminal

01/0202/02 01/02 1100 SSF Dynamic 082W Q2565 1118708-16/01 Safeen Fdrs. Sima Marine Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, 08/0209/02 TBATBA SSF Dream 079W Q2670 1120046-22/01 Alligator Shpg. Aiyer Shpg. Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, 15/0216/02 TBATBA Al Rawdah 010W Q2714 1120726-27/01 Aqua Container Aqua Container Ajman, Umm Al Quwain, Ras Al Khaima. (UIG) 01/0202/01 01/02 0001 TS Dalian 0016W Q2696 Samudera Samudera Shpg. Jebel Ali, Dammam Dronagiri 14/0215/02

MSC Monica III JU505R Q2645 1119735-20/01 MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam, Umm Qasr (UGE) Hind Terminal 03/0204/02 TBATBA HMM Promise 044W Q2666 1119928-21/01

Advance 065W Q2646 1119773-20/01

COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain 11/0212/02 TBATBA Sprinter 066W OOCL OOCL (I) (AGI-2) 05/0206/02 TBATBA C Star Voyager 002WN Q2610 1119210-16/01 CU Lines Seahorse

01/02 02/02 01/02 0800 BLPL Trust 1501E Q2605 1119167-16/01 BLPL Transworld GLS Colombo 02/0203/02 TBA

10/0211/02 TBATBA Ever Ethic 173E Q2657 1119910-21/01 UnifeederUnifeeder Colombo.

Shimin 26E Q2501 1117818-07/01

MSC Conakry IV OM505A Q2669

In Port 01/02 Conti Conquest 030E Q2621 1118921-15/01

(India) Colombo. 12/0214/02 TBATBA Conti Crystal 139E Q2701

Xin Da Yang Zhou 098E Q2548 1118350-10/01

13/0215/02 TBATBA OOCL Hamburg 155E Q2653 Star Line Asia Seahorse Yangoon. Dronagiri-3 04/0205/02 04/02 1400 MOL Presence 0020E Q2576 1118908-15/01 ONE Line ONE (India) Colombo. 07/0208/02 TBATBA Dimitris Y 0251E Q2689

Feeders Sea

Colombo. Dronagiri 15/0217/02

Cap Andreas 0018E

16/0217/02 TBATBA X-Press Anglesey 2001E

In Port 31/01 Maersk Aras 505W Q2515 1117877-07/01 Maersk Line Maersk India Colombo (MW2) Maersk CFS 01/0202/01 01/02 0001 TS Dalian 0016W Q2696 Samudera Samudera Shpg. Colombo (SIG) Dronagiri 02/0203/02 02/02 0700 OOCL Atlanta 163E Q2597 1119109-16/01 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 04/0205/02 03/02 1200 MSC Mundra VIII IW504A Q2678 1120200-23/01 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 05/0206/02 TBATBA X-Press Capella 25001E Q2566 1117846-13/01 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 09/0210/02

TBATBA One Reputiation 0006E Q2577 X-Press Feeders Sea Consortium (CWX/CIX5) 12/0213/02 TBATBA TS Keelung 25001E TS Lines/PIL TS Lines(I)/PIL India

Dronagiri-2/—

07/0209/02 TBATBA Torrance 31E Q2619 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 11/0212/02 TBATBA Zoi 119E Q2690 KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 14/0215/02 TBATBA KMTC Dubai 2501E

Feeders Sea Consortium (NIX Service) 21/0222/02 TBATBA Ever Elite 172E EmiratesEmirates Dronagiri-2 12/0213/02

from

03/0204/02 03/02 1200 Zhong Gu Yin Chuan 25001W Q2466 1119066-16/01 SeaLead SeaLead Shpg. Shanghai (ANIDEA) 07/0208/02 TBATBA CMA CGM Fort Diamant 0FFDOE1 Q2618 CMA

10/0211/02

TBATBA ALS Clivia 0FFDQE1

P.Kelang, Tanjun, Pelepas,

Xingang, Balmer Law. CFS Dron. 10/0211/02

TBATBA Ever Ethic 173E Q2657 1119910-21/01 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 17/0218/02

TBATBA Shimin 26E Q2501 1117818-07/01 PIL/ONE PIL India/One(I) —/— 24/0225/02

TBATBA Seattle Bridge 0095E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 10/0311/03

TBATBA Celsius Naples 908E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 17/0318/03

TBATBA ESL Da Chan Bay 25002E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 (CISC Service) HMM HMM Shpg. P.Kelang(S),Singapore, Xiangang, Qingdao,Kaohsiung. Seabird CFS Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang Dronagiri CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. P Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 04/0205/02 03/02 0900 MSC Natasha XIII FD451E Q2734 1120996-28/01 MSC MSC Agency Dalian, Shanghai, Ningbo, Yantian. (DRAGON EB) Hind Terminals 07/0208/02

TBATBA Sol Prime 5501E Q2675 1120111-22/01 BLPL Transworld GLS Far East Ports. 11/0212/02

TBATBA GFS Giselle 2502E Q2483 1117654-06/01 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo Dronagiri 15/0216/02

TBATBA Grace Bridge 2501E Heung A Line Sinokor India (CSC/SIS2)

Sinokor Sinokor India Seabird CFS TS Lines TS Lines (I)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

In Port 01/02 Conti Conquest 030E Q2621 1118921-15/01 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 12/0214/02 TBATBA Conti Crystal 139E Q2701 Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 17/0219/02 TBATBA One Competence 093E HMM HMM Shpg. Seabird CFS 27/0228/02

TBATBA YM Maturity 100E Samudera Samudera Shpg. Dronagiri (PS3 Service) Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai OceanGate 31/0101/02 31/01 1400 GSL Christen 505E Q2511 1117869-07/01 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS

04/0205/02

TBATBA GSL Nicoletta 506E Q2636 1119688-06/01 X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3) 10/0211/02

TBATBA X-Press Odyssey 507E Q2727 1120931-28/01 Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS

02/0203/02 02/02 1500 Wan Hai 505 E181 Q2607 1119242-17/01 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Dronagiri-1 04/0205/02 05/02 0400 Wan Hai 507 E229 Q2682 1120312-24/01 Evergreen EvergreenShpg. Shekou. Balmer Law. CFS Dron. 11/0212/02

TBATBA Wan Hai 511 E097 Q2709 1120696-27/01 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 18/0219/02

TBATBA Seaspan Brisbane 006E TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

03/0204/02 03/02 1500 Wan Hai 513 E098 Q2612 1119296-17/01 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS

07/0208/02

TBATBA Aka Bhum E026 Q2647 1119844-21/01

COSCO COSCO Shpg. Ningbo, Shekou. 14/0215/02

TBATBA Wan Hai 515 E097 InterasiaInterasia (CI2) 21/0222/02

03/0204/02

TBATBA Wan Hai 502 E131 HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS

TBATBA Xin Da Yang Zhou 098E Q2548 1118350-10/01

OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, GDL/Dron-1 13/0215/02

TBATBA OOCL Hamburg 155E Q2653 APL CMA CGM Ag. Ningbo. Dron.-3&Mul. 25/0226/02

TBATBA OOCL Luxembourg 115E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3) Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore

Dron.-3&Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

04/0205/02 04/02 1400 MOL Presence 0020E Q2576 1118908-15/01 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 07/0208/02

TBATBA Dimitris Y 0251E Q2689 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 15/0217/02

TBATBA Cap Andreas 0018E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 16/0217/02 TBATBA X-Press Anglesey 2001E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service) HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS

In Port 31/01 Wan Hai 351 026 Q2581 1118919-15/01 Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya

02/0203/02 02/02 1000 Interasia Progress E095 Q2627 1119653-20/01 KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Surabaya (AIS5/SI8 Service)

In Port 01/02 Ever Excel E179 Q2541 1118189-09/01

Kelang, 01/0202/02 01/02 0700 Kota Lima 0021E Q2624 1119469-18/01 PIL PIL India HaIphong, 03/0204/02 02/02 2200 Hemma Bhum 004E Q2554 1118388-10/01 CU Lines Seahorse Ship Nansha, 09/0210/02 TBATBA Jira Bhum 0001E Q2684 1120289-23/01 Evergreen Evergreen Shpg. Shekou.

19/0220/02

22/0224/02

TBATBA Interasia Amplify E005 InterasiaInterasia (RWA/CIX 4)

TBATBA Kota Cabar 0076E Emirates Emirates Shpg. 01/0202/01 01/02 0001 TS Dalian 0016W Q2696 ONE Line ONE (India) Singapore 14/0215/02

TBATBA Daphne 0872W Samudera Samudera Shpg. (SIG) Dronagiri 02/0203/02 02/02 0700 OOCL Atlanta 163E Q2597 1119109-16/01 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 04/0205/02

TBATBA Xin Beijing 150E Q2638 1119687-20/01 APL CMA CGM Ag. Nansha, Taichung, Kaohsiung. Dron.-3 & Mul 10/0211/02

TBATBA Xin Dan Dong Q2694

OOCL/RCL OOCL(I)/RCL Ag. GDL/— (CI 1) CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung.

03/0204/02 04/02 0700 Interasia Elevate 048 Q2639 1119669-20/01 InterasiaInterasia Port Kelang, Ho Chi Min City, Laem Chabang (BTI) 03/0204/02 03/02 1900 Kumasi 25001E Q2615 1119327-17/01 Sinolines Transorient Shanghai, Ningbo, Shekou & Other Far East Ports. 12/0213/02

TBATBA An Tong Fu Zhou 2501E SeaLead SeaLead Shpg. (CIW / FIX 2) 16/0217/02

TBATBA An Tong Dalian 2501E 05/0206/02

09/0210/02

TBATBA X-Press Capella 25001E Q2566 1117846-13/01 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou

TBATBA One Reputiation 0006E Q2577 X-Press Feeders Sea Consortium 12/0213/02

18/0219/02

TBATBA TS Keelung 25001E

KMTC/TS Lines KMTC(I)/TS Lines(I)

TBATBA Ever Lasting 081E Gold Star Star Ship 22/0223/02

06/0207/02

TBATBA KMTC Mundra 2501E

Dron-3/Dron-2

RCL/PIL RCL Ag./PIL India (CWX/CIX5) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

TBATBA Zhong Gu Ji Nan 24011E Q2668

KMTC KMTC (India) Port Kelang(W) Hongkong, Qingdao, Kwangyang, Dronagiri-3 16/0217/02

TBATBA Xin Pu Dong 279E TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 21/0222/02

TBATBA KMTC Nhava Sheva 2501E

COSCO COSCO Shpg. (AIS SERVICE)

Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore Dronagiri-2 07/0208/02

TBATBA Interasia Accelerate E004 Q2652 1119866-21/01 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 13/0214/02

TBATBA Northern Guard E929

Heung A Line Sinokor India Hongkong 19/0220/02

TBATBA Wan Hai 516 E081

Wan Hai Wan Hai Lines Dron-1 & Mul CFS (CI6) InterasiaInterasia Feedertech Feedertech/TSA Dronagiri 07/0209/02

TBATBA Torrance 31E Q2619

Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, BalmerLaw.CFSDron. 11/0212/02

TBATBA Zoi 119E Q2690

KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay Dronagiri-3/— 14/0215/02

TBATBA KMTC Dubai 2501E

X-Press Feeders Sea Consortium 21/0222/02

TBATBA Ever Elite 172E Emirates Emirates Shpg Dronagiri-2 28/0201/03

08/0209/02

TBATBA Colorado 6E

Pendulum Exp. Aissa Maritime (NIX Service) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

TBATBA Hyundai Courage 0117E

HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Seabird CFS 12/0213/02

TBATBA Hyundai Platinum 089E

Sinokor Sinokor India Shanghai (FIM East Bound) Seabird CFS 09/02 10/02

TBATBA Stephenie C 2502 Q2671 1120074-22/01 Asyad Line Seabridge Shanghai, Ningbo, Shekou. (FEX)

CMA CGM Ag. Australia & New Zealand Ports. Dron.-3&Mul. 13/0215/02

TBATBA OOCL Hamburg 155E Q2653 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 25/0226/02

TBATBA OOCL Luxembourg 115E OOCL OOCL (I) Sydney, Melbourne. (CIX-3) GDL (CIX-3) TS Lines TS Lines (I) Australian Ports. Dronagiri-2 Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 Team Lines Team Global Log. Australia & New Zealand Ports. ConexTerminal

04/0205/02 04/02 1400 MOL Presence 0020E Q2576 1118908-15/01 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, Auckland, Lyttleton.

07/0208/02 TBATBA Dimitris Y 0251E Q2689 Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 15/0217/02

TBATBA Cap Andreas 0018E GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR

Zhong Gu Lin Yi 25001W

12/0213/02

Derby D 02SK1S1

19/0220/02 TBATBA Tacoma Star 2508

In Port 31/01 Norderney 090W Q2540 1118293-10/01 ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI) 02/0203/02 02/02 1000 Maersk Cairo 506S Q2518 1117882-07/01 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 09/0210/02 TBATBA Maersk Cape Town 507S Q2642 1119704-20/01 (MWE SERVICE) 04/0205/02 TBATBA Maersk Iyo 505W Q2637 1119686-20/01 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 11/0212/02 TBATBA Maersk Cubango 506W Q2658 1119911-21/01 CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3&Mul. 07/0207/02 TBATBA CMA CGM San Antonio 0MTJHW1 Q2686 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3&Mul. 14/0215/02 TBATBA Fayston Farms 506S Q2662 1119919-21/01 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS 21/0221/02 TBATBA APL Cairo 0MTJLW1

Durban, Port Elizabeth, Capetown, Maputo, Beira. (MIDAS-2)

In Port 01/02 MSC Lisbon IP505A Q2680 1120311-24/01 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 07/0208/02 07/02 0900 MSC Joanna IP506A Q2740 1121072-29/01 CMA CGM CMA CGM Ag. Dakar,Nouakchott,Banjul,Conakry, Freetown, Monrovia, Sao Tome,Bata, Dron.-3&Mul. 14/0215/02 14/02 0900 MSC Pamela IP507A Guinea Bissau,Nouadhibou, Dakar,Abidjan, Tema, Malabo & Saotome. (EPIC / IPAK)

GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK)

02/0203/02 TBATBA MSC Conakry IV OM505A Q2669 1119966-21/01 MSC MSC Agency Dar Es Salamm, Mombasa. (EAST AFRICA EXPRESS) Hind Terminal 06/0207/02 TBA 1000 MSC Barcelona IU505A Q2711 1120721-27/01 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Oran, Hind Terminals 13/0214/02 TBA 1000 Karlskrona IU506A Q2735 1121010-28/01 Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa (INDUS)

06/0207/02 05/02 1000 MSC Regulus IS504A Q2630 1119666-20/01 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 14/0215/02 13/02 1000 MSC Luciana IS505A Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware

31/0101/02 31/01 1400 GSL Christen 505E Q2511 1117869-07/01 CMA CGM CMA CGM

Maputo, Nacala, Tanga, Lilongwe & Harare. Dron.-3&Mul. 04/0205/02 TBATBA GSL Nicoletta 506E Q2636 1119688-06/01 (NWX/FI-3)

NEW DELHI: The approval of the Mutual Credit Guarantee Scheme for M S M E s ( M C G S - M S M E ) i s a landmark decision, said Mr Ashwani Kumar, President, FIEO. This will significantly enhance the financial accessibility of our micro, small and medium enterprises, particularly those engaged in manufacturing and exports. Lack of adequate financing for capital investments has long been a challenge for MSMEs, restricting their ability to scale and compete in global markets.

With 60% guarantee coverage by the National Credit Guarantee Trustee Company Limited (NCGTC) and a credit facility of up to 100 crore, said FIEO Chief, will provide MSMEs now much-needed support to invest in modern machinery and equipment. This move aligns perfectly with the ‘Make in India, Make for the World’ vision, enabling our enterprises to boost production, improve quality, and expand their global footprint.

The flexible repayment terms and zero annual guarantee fee in the first

year make this scheme even more attractive It will encourage more MSMEs to upgrade technology, enhance productivity, and integrate into global supply chains, positioning India as a preferred manufacturing hub.

President, FIEO welcomes this initiative and urge the government to ensure seamless implementation, faster loan approvals, and broad awareness among MSMEs, so that they can fully leverage the benefits of this scheme.

BHUBANESHWAR:

A d a n i G r o u p h a s committed to investing Rs 2.3 lakh crore over the next five years across power, cement, industrial parks, aluminium and city gas expansion in Odisha. According to a statement by the group, the investment commitment was made during Utkarsh Odisha 2025 –the state’s investor meeting.

K a r a n A d a n i , M a n a g i n g Director of Adani Ports and SEZ Limited (APSEZ), met state Chief Minister Mohan Charan Majhi and exchanged MoUs for investment in Odisha over the next five years, it added.

“The Adani Group committed to invest Rs 2.3 lakh crore over the next

five years across power, cement, industrial parks, aluminium, city Gas etc,” the statement said.

“This is the biggest investment intent by any group in Utkarsh Odisha 2025.” Also, the first test flight landed at Dhamra Airstrip successfully on Tuesday

Additionally, on the occasion of Utkarsh Odisha, six projects of ATGL in Odisha were commissioned. These include an EV charging station at Bhubaneswar airport and the completion of the city gate station cum mother station project.

Other projects include the

groundbreaking for an LNG cum multi-fuel hub at Bhadrak, a CNG station in Balasore, the first domestic piped cooking gas charging and

burner in Bhadrak and a CNG station project completion at Rairangpur (1st in the city) of Mayurbhanj district.

HONG KONG: In its latest Global Freight Monitor HSBC Global Research says its base case is that lines to take until the mid-2025 to revert their networks between Asia –Europe/Med and US East Coast to transiting via the Red Sea and Suez Canal rather than diverting via the Cape of Good Hope, which help keep the supply of tonnage tight in the first six months of the year

Spot rates have fallen sharply in recent weeks ahead of the current LunarNewYearholidaysinAsia Ontop of this the report by HSBC noted, “The recent ceasefire in Gaza, the pause in

merchantshipattacksintheRedSeaby the Houthis, and the release of Galaxy Leader crew by the Houthis will likely firm up sentiment towards peace being restored in the region and weigh further on spot freight rates.”

However, while these factors have weighed on container shipping spot rates in recent weeks the report points to a number of factors that should stem the tide and give “decent” H1 profits for lines.

“Beyond the LNY (Lunar New Year), we argue that blank sailings, alliance reshuffle, and uncertainties around Trump’s tariffs could likely

cushion against a hard landing in spot rates. With little incentive for liners to revert to the Red Sea, we think liners could still see decent 1H25 earnings but profits should deteriorate in 2H25,” HSBC said.

Certainly, major lines including Maersk, MSC, Hapag-Lloyd, and CMA CGM have indicated that they will not be making an immediate return to Red Sea transits.

Working on a base case of midyear return to the Red Sea HSBC said that 10.5% capacity growth is implied for 2025 versus a volume growth of 2.7% and reduction in teu miles.

• Loans upto Rs. 100 crore for purchase of Plant and Machinery / Equipment are eligible for guarantee coverage givingaboosttomanufacturingsector

• Scheme offers 60% guarantee coverage to Member Lending Ins�tu�ons (MLIs*) for credit facility upto Rs.100croresanc�onedtoeligibleMSMEs

NEW DELHI: GoI has approved introduction of Mutual Credit Guarantee Scheme for MSMEs (MCGS- MSME) for providing 60% guarantee coverage by National Credit Guarantee Trustee Company

Limited (NCGTC) to Member Lending Institutions (MLIs) for credit facility upto Rs.100 crore sanctioned to eligible MSMEs under MCGSMSME for purchase of equipment / machinery.

Salient Features of The Scheme

• Borrower should be an MSME with valid Udyam Registration Number;

• Loan amount guaranteed shall not exceed Rs.100 crore

• Project Cost could be of higher amounts also

• Minimum cost of equipment /machinery is 75% of project cost

• Loan upto Rs.50 crore under the Scheme shall have repayment period of upto 8 years with upto 2 years moratorium period on principal instalments For loans

a b o v e R s . 5 0 c r o r e , h i g h e r

r e p a y m e n t s c h e d u l e a n d moratorium period on principal instalments can be considered.

• Upfront (initial) contribution of 5% of the loan amount shall be

deposited at the time of application of guarantee cover

• Annual Guarantee Fee on loan under the Scheme shall be Nil during the year of sanction. During the next 3 years, it shall be 1.5% p.a. of loan outstanding as on March 31 of previous year. Thereafter, Annual Guarantee Fee shall be 1% p.a. of loan outstanding as on March 31 of previous year The Scheme will be applicable to all loans sanctioned under MCGSMSME during the period of 4 years from the date of issue of operational guidelines of the scheme or till cumulative guarantee of Rs. 7 lakh crore are issued, whichever is earlier Major Impact

Manufacturing sector currently comprises 17% of the nation’s GDP and over 27 3 million workers

Hon’ble Prime Minister’s has given a call for ‘Make in India, Make for the World’ and has signalled that India is ready and keen to increase the share of manufacturing to 25% of GDP The Mutual Credit Guarantee Scheme for MSMEs (MCGS-MSME) is expected to facilitate the availability of credit for purchase of Plant and Machinery / Equipment by MSMEs

manufacturing and thereby to Make in India Background G

a r e realigning. India is emerging as an alternative supply source given its raw materials, low labour costs, growing manufacturing knowhow, and entrepreneurial ability One of the m a j o r c o s t s i n v o l v e d i n manufacturing is the fixed cost of Plant and Machiner y (P&M)/ Equipment’s With availability of credit to expand the installed capacity of manufacturing units, it can be expected that the manufacturing will grow at a faster pace. Also, the need for a credit guarantee scheme for the manufacturing units, particularly for the enterprises in the medium category has been raised by industry associations from time to time. So, to give a boost to manufacturing by facilitating the availability of credit for purchase of Plant and Machinery / E q u i p m e n t , ‘ M u t u a l C r e d i t Guarantee Scheme for MSMEs (MCGS-MSME) is being introduced. The scheme will facilitate collateral free loans by banks and financial institutions to MSMEs who are in need of debt capital for their expansion and growth.

NEW DELHI: Amid a tug of war on artificial intelligence (AI) supremacy between the US and China, Union Minister Ashwini Vaishnaw has announced that India will develop its own generative AI model.

The initiative was announced by the minister at the Utkarsh Odisha Conclave. He said that the model will be powered by the India AI Compute

Facility, which has secured 19,000 GPUs to develop a large language model (LLM) designed specifically for the country. Out of these, 15,000 are high-end. With this, the government has over reached its target of 10,000 GPUs.

At least six developers have been identified who can roll this out in 8-10 months.

Foundation models are AI models trained on vast repositories of data, which can be used as the base for other applications.

"Cost of compute — GPU access per hour after the 40% govt incentive will be less than a dollar in India, the lowest in the world," the minister said in a press conference regarding the India AI Mission.

OSLO: Donald Trump returned to the White House this week and, perhaps unsurprisingly, raised more questions than answers regarding his America First policy towards trade and import tariffs.

Below, Xeneta Chief Analyst Peter Sand shares his advice on how shippers can mitigate geo-political risks through an ocean freight tender strategy that keeps supply chains moving while also managing spend. What has Trump said?

On the day of Trump’s inauguration on Monday, he stated he is ‘thinking about’ introducing a 25% tariff on imports from Mexico and Canada on 1 February

He did not immediately go ahead with vows made during the election campaign of 60% tariffs on goods from China and 1020% from the rest of the world, instead ordering a probe into ‘trade deficits and unfair trade practices and alleged currency manipulation by other countries. How serious is the risk?

Xeneta data shows the last time Trump ramped up tariffs on China imports during the trade war in 2018, average spot rates spiked more than 70% on the critical trade from China to the US West Coast.

Current spot rates from China to US West Coast stand at USD 5 104 per FEU. This is 24% higher than 12 months ago, primarily due to the impact of conflict in the Red Sea. If rates increase by the same magnitude as they did back in 2018, the market would hit an all-time high, surpassing the previous record set during Covid-19.

On the other hand, the tariff regime may not turn out as harsh as feared, while the potential for a full scale return of container ships to the Red Sea would see overcapacity flood the market and rates to collapse.

This demonstrates the extreme ends of the scale of uncertainty shippers are facing in 2025. Previous rules on freight procurement no longer apply

You need to think differently How can shippers tender against this backdrop of uncertainty?

Keep calm and do not do anything that limits your options down the line.

You cannot base your freight procurement strategy on political rhetoric. We know tariffs on US imports are going to come, but we don’t know when, where, or what goods will be impacted.

More and more shippers are using index-linked contracts to manage this unpredictability, whereby the rate paid tracks the market at agreed thresholds.

For example, if freight rates rise due to Trump announcing tariffs against China, the rate the shipper pays increases at a pre-agreed threshold. On the other hand, if the recent ceasefire agreement in the Middle East sees a largescale return of ships to the Red Sea and the market collapses, the rate the shipper pays will fall.

In both scenarios the shipper can benefit. In a falling market they don’t want to be stuck in a long term contract paying over the odds. Even in a rising market, if their contract rates are too low, they risk having cargo rolled – as we saw during 2024 in the wake of the Red Sea crisis.

This strategy is aimed at retaining as much control as you can in a world of chaos. It also helps procurement professionals to explain internally to the CFO and wider executive team why freight spend is fluctuating by millions of dollars (up or down) against budget.

What if my business isn’t ready for an index-linked contract?

You can insert a clause into your new long term agreement, linked to Xeneta data, that will trigger a renegotiation if the market rises or falls by an agreed percentage or USD amount.

While requiring manual renegotiation rather than the automatic adjustments in a full index-linked contract, this is still a sensible option that offers peace of mind that the service provider mustreturntothetableifthecircumstancesdemandit What else can shippers do?

In the short term you could frontload imports ahead of tariffs – as we know some shippers have done in 2024, initially in response to Red Sea disruption and more latterly to deal with the tariff threat. But this costs money in terms of shipping goods on elevated freight rates, warehousing costs and bloated

inventories tying up working capital – and we still don’t even know if the goods you are frontloading will be in scope of the tariffs you are guarding against.

However, will you have any more certainty on these geopolitical factors in a few months’ time? Probably not. How does geo-politics cause supply chains to shift?

Global supply chains are fluid and constantly evolving to threats and opportunities. We saw this following the escalation of the US-China trade war in 2018 during Trump’s first term as President.

Ramping up of tariffs on US imports from China prompted shippers to consider their options, such as importing goods into the US via Mexico and Canada.

This contributed to extraordinary growth in TEU (20ft equivalent container) volumes shipped from China to Mexico –up 76% between 2019 and 2024. Into Canada, TEU volumes increased 54% in the same period.

Geo-politics may put up barriers to trade but, ultimately, goods will always find their way from one place to another if there is a demand for them.

Will shippers shift supply chains during Trump’s next term in ofce?

That is the multi-million-dollar question.

Perhaps the ferocious growth in volumes into Mexico and Canada may taper off if tariffs make it a less attractive back door into the US, but shippers aren’t going to abandon this route after spending years setting it up and investing in infrastructure such as logistics centers.

Additionally, Trump has threatened even harsher tariffs on China at 60% and blanket tariffs of 10-20% from the rest of the world. If shippers are going to shift supply chains to avoid tariffs, it may be a case of identifying the least-worst option.

It should be noted that it is generally easier to shift the import destination than it is to change the export origin Importing into Mexico for onward transportation into the US adds complexity to supply chains but pales in comparison to the upheaval caused by moving exports away from China and dismantling well-established manufacturing set-ups.

What are the risks and opportunities of shifting global trade patterns?

Assessing supply chain risk and freight tender strategies should be an ongoing and integral part of a shipper’s businessas-usual workstream.

Identifying alternatives and having contingency plans in place requires a clear understanding of ocean container networks across and beyond the trade lanes you currently utilize.

Let’s say you currently ship containers from China to US East Coast but want to understand the implications of shifting some export volumes to India. Do you think average spot rates alone are enough to base such a major strategic decision?

Xeneta data shows current average spot rates from China to US East Coast stand at 6446 per FEU (40ft container) From India to the US East Coast average spot rates are USD 4827 per FEU.

In the example below using actual Xeneta data, a shipper may select Carrier A which offers rates at USD 265 below the market average rather than Carrier B with rates USD 50 above the average.

If the shipper turns attention to the India to US East Coast trade, Carrier A is now the more expensive at USD 2187 above the market average, with Carrier B now sitting USD 2648 below the average.

Clearly, without this data, a shipper would not be able fully assess the implications of shifting volumes across these trades – or indeed realise the commercial opportunity if they aren’t able to identify the right service provider What next?

Keep calm. It can take years for trade patterns to evolve as different geo-political threats emerge and recede. In four years’ time there may be a new inhabitant of the White House with a different trade policy to Trump.

The smart shippers don’t wait for a threat such as Trump’s tariffs to emerge before they leap into action. They already have a deep understanding of ocean container shipping and an agile freight strategy that keeps options open so they can adjust to these geo-political forces in the short and long term.

• 9M FY25 revenue grew 14%, EBITDA grew 19%, and PAT was up 32% YoY

• EBITDA margin increased to 62% (from 60% in 9M FY24)

• Closed Gopalpur and Astro Offshore transac�ons worth over Rs 4,600 crores in Q3

• Net debt to TTM EBITDA at 2.1x vs. 2.3x in FY24

• Started Trucking Management Solu�on (TMS), driven by a technology pla�orm

• FY25 EBITDA guidance increased to Rs 18,800-18,900 crores (from Rs 17,000-18,000 crores)

• S&P Global CSA ranked APSEZ among the Top 10 most sustainable global companies in the transport and transport infrastructure industry

AHMEDABAD: Adani Ports and Special Economic Zone Limited (APSEZ) announced its results for the quarter and nine months ending 31st December 2024.

"I am excited to share the fantastic momentum we have achieved during 9M FY25, driven by exceptional execution across 3 key areas of our business - market share gains coupled with volume-price mix increase, traction in logistics vertical, and operational efficiencies along with technologyled gains. On the logistics front, in line with our commitment earlier in the year, we launched a new trucking platform, which is being integrated across the rest of the logistics value chain and will make us a true integrated Transport Utility. We have also upgraded our FY25 EBITDA forecast to Rs 18,800-18,900 crores. Moreover, it is incredibly gratifying to be recognized by S&P Global CSA as one of the Top 10 companies globally in the transport industry This prestigious recognition reflects our focus on imbibing sustainability across our operations,” said Mr. Ashwani Gupta, Whole-time Director & CEO, APSEZ.

Strategic highlights

• Started Trucking Management Solution (TMS), a technology platform that acts as a transformational marketplace + fulfilment solution to streamline supply chain for customers

• TMS offers an easy-to-use marketplace interface, handles end-to-end trucking workflows, can be seamlessly integrated with client systems, enables realtime tracking, and includes analytical tools for pricing and operational insights. TMS incorporates SLA-based fulfilment assurance across a wide range of fleet options, including full-load and partial-load shipments

• Closed Gopalpur and Astro Offshore transactions worth over Rs 4,600 crores

• Signed 30-year concession agreement to manage container terminal at Dar es Salaam Port, Tanzania

• Vizhinjam port commenced commercial operations, post extensive trials. During the trial period, the port handled 70+ vessels and 147,000+ containers

• Commenced O&M operations at Syama Prasad Mookerjee Port’s Netaji Subhas dock

• Placed India’s largest order for eight harbour tugs with Cochin Shipyard. The contract value is estimated at Rs 450 crores and deliveries are scheduled to begin in December 2026 and continue until May 2028

Operational highlights

• APSEZ clocked 332 MMT (+7% YoY) cargo volume in 9M FY25 led by growth in containers (+19% YoY), liquids and gas (+8% YoY) and dry and dry bulk cargo (iron ore, limestone, minerals, coking coal, etc.), partially offset by decline in imported non-coking coal

• All-India cargo market share for 9M FY25 stood at 27.2% (up from 26.5% in FY24). Container market share for 9M FY25 stood at 45.2% (up from 44.2% in FY24)

• Logistics continued to demonstrate momentum with growth across container volume (0.48 Mn TEUs, +9% YoY), bulk cargo (16.1 MMT, +13% YoY) and container volume handled at MMLPs (3,33,419 TEUs, +19% YoY)

•During November ’24, Mundra handled 396 vessels and executed 845 vessel movements, making it the highest ever monthly achievement by the port Mundra port also exported a record breaking 5,405 cars in a single consignment during the month

•Gangavaram port launched container terminal operations with the inaugural Export Import vessel call of MV Synergy Keelung

Financial highlights

• Operating revenue grew by 14% YoY to Rs 22,590 crores. Ports revenue increased by 11% YoY to Rs 17,172 crores; Logistics revenue increased by 22% to Rs 1,852 crores

• EBITDA (excluding forex) increased 19% to Rs 14,019 crores. EBITDA margin increased to 62% (from 60% during 9M FY24).

• FY25EBITDAguidancerevisedtoRs18,800-18,900crores

• APSEZ continues to maintain excellent financial discipline - net debt to TTM EBITDA stood at 2.1x (vs 2.3x in FY24)

• ICRA Limited reaffirmed the credit rating of long-termfund based/non-fund-based limit and non-convertible debentures as [ICRA] AAA; stable and commercial paper as [ICRA] A1+

• India Ratings & Research reaffirmed the credit rating of non-convertible debentures and bank loans (long-term) as IND AAA/Stable and commercial paper and bank loans (short-term) as IND A1+

• S&P Global Ratings reaffirmed its rating at BBB- and revised outlook to “Negative” during the quarter Moody’s Ratings reaffirmed investment grade rating ‘Baa3’ and revised its outlook to negative during the quarter

• Fitch Ratings reaffirmed APSEZ rating at BBB- and placed the long-term foreign-currency issuer rating and US dollar senior unsecured bonds on Rating Watch Negative during the quarter

ESG highlights

• APSEZ was ranked among the Top 10 global transportation and transportation infrastructure companies in the 2024 S&P Global Corporate Sustainability Assessment (CSA - scores as of 31st December), with a score of 68 (out of 100)—three points improvement over last year APSEZ is now placed in the 97th percentile within the sector, improving from the 96th percentile in 2023.

• APSEZ was ranked among the Top 12 companies in transportation infrastructure by ISS ESG and was awarded ‘Prime’ status for the first time (making APSEZ equity and bond instruments eligible for responsible investments)

• APSEZ is targeting Net Zero by 2040. The company is on track to add 1,000 MW of new renewable capacity

• Krishnapatnam port received the 18th ICC Environment Excellence Award 2024 in the Platinum category demonstrating commitment to sustainability and responsible practices.

CJ-XIII African Avocet Aditya Marine 21 Nos. Windmill

Stream Akson Sara ACT Infra 30,000 T. Rice Bags

Stream Amis Star Delta Waterways

Stream BBG Ocean Chowgule Bros China

T. SBM

T. Salt Bulk 01/02 Bocehm Oslo J M Baxi USA 10,900 T.

Stream Corsica Mystic Shpg.

CJ-XVI De Xin Fu Xin Chowgule Bros China

CJ-XIV Deep Blue B S Shpg.

Stream Dragon Malara Shpg. Nakala

Stream Eagle Shantilal Shpg.

Stream Haj Ali DBC

Stream Prince Khalid DBC

Stream Propel Proseperity ACT Infra

CJ-V Seiyo Goddess Mitsutor

CJ-VIII Sea Brave Mihir & Co.

Stream Soul Mercy Anline Shpg.

T. Salt In Bulk INIXY125012588

Bleached HW Kraft Pulp

T. F'Spar(7,700T)/Clay (14,300T) INIXY125012490

T. Sugar Bags INIXY124111812

CJ-III Suvari Kaptan DBC Somalia 9,500 T. Sugar Bags

Stream Sole B S Shpg.

CJ-XV Thames Trader Cross Trade

Mihir & Co. 02/02

CJ-IX V Star Ambica Log. 01/02

CJ-X Penelope L Mihir & Co. 03/02

CJ-XI Lan hai Zhu Yuan Kashmira Shpg. 01/02

CJ-XII TCI Anand TCI Seaways 01/02

CJ-XIII African Avocet Aditya Marine 01/02

CJ-XIV Deep Blue B S Shpg. 02/02

CJ-XV Thames Trader Cross Trade 03/02

CJ-XVA Aquila Shaan Marine 02/02

CJ-XVI De Xin Fu Xin Chowgule Bros 01/02

TUNA VESSEL'S NAME AGENT'S NAME ETD Van Hannah Benline 01/02 Gul Bano Taurus 01/02 African Kite James Mackintosh 01/02

OIL

OJ-I

OJ-II

GAC Shpg. 01/02 OJ-III Tsurugi Galaxy GAC Shpg. 01/02

OJ-IV Stolt Argon J M Baxi 01/02

OJ-V Lila Confidence GAC Shpg. 01/02

OJ-VI VACANT

Steamer's Name Arrival on Next Destn.

Hansa Europe 27/01 Nhava ShevaJebel Ali-DammamShuiba-Umm Qasr

New Dicoverer 27/01 Karachi-Jebel Ali

SSL Bharat 27/01 Cochin-TuticorinManglore

African Bari Bird 28/01 USA

Boa 28/01 China

Vita Harmony 28/01

SCI Chennai 29/01 Pipavav-CochinTuticorin-Kattupalli

Kathy Ocean 29/01

Glamor 30/01

Tokyo Spirit 30/01

Amoy Fortune 30/01

Steamer's Name Agents Arrival on Soul Mercy Anline Shpg. 30/11

Prince Khalid DBC 01/01

Sole B S Shpg. 23/01

KS Grace Interocean 22/01 Haj Ali DBC 21/01

SHIPS NOT READY FOR BERTH

Steamer's Name Agents Arrival on Dragon Malara Shpg. 05/01

Amis Star Delta Waterways 25/01

BBG Ocean Chowgule Bros 24/01 Nadeen Arnav Shpg. 28/01

T. Rice Bags INIXY125012549

T. Salt Bulk

Chemicals 03/02 Daewon Wilhelmsen

T. Chemicals 01/02 Emma Grace Interocean San Lorenzo

T. CDSBO/CFSO Stream Ginga Hawk GAC Shpg. Singapore

Chemicals OJ-V Lila Confidence GAC Shpg.

Oriental Ixia Allied Shpg.

T. Chemicals 05/02 Oriental Sakura Allied Shpg.

T. Chemicals 02/02 Orchid Sylt GAC Shpg. Singapore

T. Chemicals 01/02 Paramita Interocean

INIXY125012576

Tuticorin-Kattupalli

CJ-XII TCI Anand 030 TCI Seaways Manglore-Cochin- I/E 1,500 TEUs. TBA Tuticorin-Chennai I/E TEUs. 10/02 SSL Bharat (PIC1) Unifeeder Group Cochin-Tuticorin-Manglore I/E TEUs. 09/02 SSL Kaveri (PIC2) I/E TEUs.

Stream Kashan (IIX) Armita India Bandar Abbas-Jebel Ali- I/E 1,700 TEUs.

Stream Artabaz (IIX) Constanta-Chabahar I/E 750 TEUs. 05/02 Daisy (IIX) I/E TEUs.

Stream Marsa Neptune (IRX) Sai Shipping Jebel Ali-Jeddah-Aden I/E TEUs.

Stream TSS Amber (IG1) Hapag Llyod Nhava Sheva-Jebel Ali- I/E TEUs. 02/02 Atlantic Ibis (IG1) Dammam-Shuiba-Umm Qasr I/E TEUs.

CJ-XI Lan hai Zhu Yuan (KGS) Kashmira Shpg. Karachi-Jebel Ali I/E 850 TEUs.

Stream Libra (BMM) Emirates Shpg. Nhava Sheva-Bandar Abbas I/E 500 TEUs.

04/02 Xin Long Yun 58 (KSS) ULSSL Port Klang-Colombo- I/E TEUs. Jebel Ali-Khor Al FakkanNhava Sheva-Mundra-Aliga

07/02 Nadia (PGI) Master Logitech Khor Al Fakkan-Nhava Sheva I/E TEUs.

Ningbo, Hongkong (SIS1)

04/02-AM GSL Christen 501W 5010424 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 05/02 Heung A/Sinokor Sinokor (I) Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

05/02-AM Interasia Elevate 48E 5010470 InterasiaInterasia Port Kelang, Ho Chi Min City, Laem

02/02-AM Maersk Aras 452E 5010425 Maersk Line Maersks

01/02 Oceana (V-933S) 5010290 Unifeeder Ag Jebel Ali 01/02 Wan Hai 613 (V-67E) 5010414 Wan Hai Line Nhava Sheva 02/02 Maersk Aras (V-452E) 5010425 Maersk India Nhava Sheva

03/02 GSL Eleni (V-505W) Maersk India Jebel Ali 03/02 X-Press Altair(V-25002W) 5010482 X-Press Feeder Karachi 04/02 GSL Phoenix (V-501W) 5010424 Maersk India Karachi

Kmarin Azur(V-504W) Colombo 28-01-2025 Asterios (V-2505W) Ad Dammam 29-01-2025 Wadi Duka (V-2502W) Salalah 29-01-2025

Pelepas, Xingang, Qingdao, 02/02

05/02-AM Ever Eagle 186E 2500451 Evergreen/ONE Evergreen Shpg/ONE Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 06/02 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC) 08/02 08/02-PM Zhong Gu Ji Nan 25001E 2500493 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao. (AIS)

TS Lines Samsara Shpg 10/02 10/02-AM One Reputation 6E 2500491 One/X-Press Feeder OneIndia / SC-SPL Port

Conti Conquest 030E 25041 ONE ONE (India)

Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 02/02 15/02 15/02-1000 Conti Crystal 139E 25054 HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3) 16/02 02/02 02/02-0900 GSL Christen 505E 25035 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 03/02 05/02 05/02-1900 GSL Nicoletta 506E 25047 X-Press Feeders Merchant Shpg. Ningbo. (NWX) 06/02 13/02 13/02-0300 X-Press Odyssey 507E Sinokor/Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan. 13/02 03/02 02/02-0900 OOCL Atlanta 163E 25043 COSCO COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 04/02 06/02 05/02-0900 Xin Beijing 150E 25044 Nansha, Port Kelang (CI1) 07/02 04/02 04/02-2230 Dimitris Y 0251E24045 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 05/02 12/02 12/02-2230 Cap Andreas 0018E

In Port —/— Maersk Sentosa 504W 25031 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 01/02 05/02 04/02-1900 SM Mahi 505 25052 Global Feeder Sima Marine Sohar, Jabel Ali (SHAEX)

08/02 08/02-0300 HT Capricon 506 25053 Maersk Maersk India Sohar, Jabel Ali (NSHEX)

15/02 15/02-0300 Seaspan Jakarta 507 25050

In Port —/— Mogral 0089 25042 CCG Sima

04/02 Atlantic Ibis (V-2504W) Hapag

07/02 C C Fort Diamant (V-0FFDOE1)

Ghibli (V-25005W)

08/02 Ren Jian (V-02SJ2S1)

12/02 Derby D (V-Q2SKIS1)

04/02 Spil Citra (V-OUW90W1)

11/02 C C Mendelssohn (V-OUW94W1)

31/01 Tema Express (V-2504W)

03/02 Zhong Gu In Chuan (V-25001W)

02/02 Zhong Hang Sheng (V-OQCSOW1)

01/02 BLPL Trust (V-1501E) Transworld Transworld GLS Far East 1119167 02/02

Car.CB-4 BFAD Pacific (V-404S)(Sailed) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa 1117880 31/01 03/02 Ever Eagle (V-186E) Unifeeder/KMTC Unifeeder/KMTC(I) Far East & 1119139 04/02 10/02 Ever Ethic (V-173E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo 11/02 ONE/TS Lines ONE (I)/TS Lines(I)

01/02 Folk Jeddah (V-2505W) Folk Maritime/Asyad Seastar Global/Seabridge Jeddah 1118909 02/02

05/02 Inter Sydney (V-0172) Interworld Efficient Marine Gulf 06/01 05/02 Konard (V-KON0125W) AKKON Oasis Shipping Europe/Med. 06/02 Car.CB-5 Maersk Boston (V-505W)(Sailed) Maersk Line Maersk India U.K. Cont. 1117876 30/01 04/02 Maersk Iyo (V-505W) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India Africa 05/02 02/02 Maersk Cairo (V-506S) Maersk Line Maersk India Africa

02/02 MSC Mexico V (V-IV505A)(NSIGT) MSC MSC Agency U.S.A. 03/02 01/02 Maersk Sentosa (V-504W) Maersk Line Maersk India Mediterranean

CB-4 Norderney (V-090W) Unifeeder/One Unifeeder/One India Gulf

31/01 05/02 Shamim (V-1343W) HDASCO Armita India Gulf 06/02 Car.CB-6 Varada (V-2501E)(Sailed) Global Fdr/TS Lines Sima Marine/TS Lines (I) Far East

11/02 GFS Giselle (V-2502E) Sinokor/Heung A Line Sinokor India

05/02 X-Press Altair (V-25002W) Wan Hai/Unifeeder Wan Hai Lines (I)/Unifeeder Jebel Ali

10/02 SSL Bramhaputra (V-923W) X-Press Feeder

Dhaulagiri (V-25002R)

10/02 Zhong Gu Chang Sha (V-2444S) Emirates / KMTC Emirates Shipping

17/02 Zhong Gu Shen Yang (V-OPU45S1)

31/01 APL Southampton (V-OINT2W1) CMA CGM/OOCL CMA CGM Ag.(I)/OOCL(I) U.S.A.

08/02 CMA CGM Dolphin (V-OINJ1W1) COSCO/ONE COSCO Shpg/One India

Car.CB-6 Marianna I (V-IU504A)(Sailed) MSC MSC Agency

06/02 MSC Regulus (V-IS504A) MSC/SCI MSC Agency/CMT

CB-6 MSC Lisbon (V-IP505A) MSC MSC Ag

04/02 MSC Natasha XIII (V-FD451E) MSC MSC Ag Far East

02/02 Tolten (V-5105W) Hapag ISS Shipping

Dimitries Y (V-0251E) X-Press Feeder

01/02 Osaka Express (V-5303W) COSCO COSCO Shpg.

07/02 Seaspan Amazon (V-5304W) Hapag / ONE ISS Shpg./ONE(I) 08/02 CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I) Car.GTI-2 One Thesues (V-090E)(Sailed) ONE ONE (I) USA

30/01 09/02 One Reassurance (V-245E) HMM HMM Shpg. 10/02 GTI-2 W.Klaiepeda (V-503E) Maersk Line Maersk India Mediterranean 1118060 31/01 03/02 Wan Hai 513 (V-E098) Wan Hai Wan Hai Lines (I) Colombo & 1119296 04/02 07/02 Aka Bhum (V-E026) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East 08/02 02/02 Wan Hai 505 (V-E181) Hapag/Evergreen ISS Shpg/Evergreen China 1119242 03/02 04/02 Wan Hai 507 (V-E229) Wan Hai Wan Hai Lines (I) 05/02 03/02 Xin Da Yang Zhou (V-098E) RCL/OOCL RCL Ag./OOCL(I) Far East 1118350 04/02 13/02 OOCL Hamburg (V-155E) Zim/COSCO Zim Int./COSCO Shpg. 15/02 01/02 Zhong Gu Nan Ning (V-2500IE) Unifeeder/X-Press feeder Unifeeder/Sea Consortium Gulf 1118745 02/02 07/02 Celsius Nairobi (V-0925W) QNL/Milaha Poseidon 08/02

10/02 Asterios (V-2507W) Folk Maritime Seastar Global Gulf

10/02 Chang Shun Qian Cheng (V-2501E) Asyad/QNL/Milaha Seabridge/Poseidon Gulf 11/02 04/02 CMA CGM Thalassa (V-OPEBDW1) CMA CGM/APL CMA CGM Ag. (I) U.K. Cont. 05/02 COSCO / OOCL COSCO Shpg./OOCL(I) 05/02 C Star Voyager (V-002WN) Cstar Diamond Maritime Red Sea/Gulf 06/02 BMCT-3 Ever Excel (V-E179) RCL/PIL/CU Lines RCL Ag./PIL India/Seahorse Far East 1118189 01/02 03/02 Hemma Bhum (V-004E) Interasia/Evergreen Interasia Shpg./Evergreen Shpg. 1118388 04/02 Car.BMCT-2 Future (V-024W)(Sailed) COSCO/OOCL COSCO Shipping/OOCL (i) Gulf

31/01 Car.BMCT-3 Feng Xin Da 29 (V-25004W)(Sailed) SeaLead SeaLead Shipping Mediterranean

30/01 03/02 HMM Promise (V-044W) HMM HMM Shpg.

08/02 Hyundai Courage (V-0017E) One Line

03/02 Interasia Elivate (V-048) Interasia Line Interasia Shpg. Far

03/02 Kumasi (V-25001E) Sino Lines/SeaLead

Car.BMCT-3 Kota Naluri (V-2350W)(Sailed) PIL PIL

04/02 MSC Mundra

(V-505W)

01/02 TS Dalian (V-0016W)

07/02 Torrance (V-31E) Evergreen / X-Press

Spil Kartika (V-2502W) 24-01-2025 Colombo Hong Li Yuan Yang (V-25001W) 25-01-2025 Jeddah Zhu Cheng Xin Zhou 26-01-2025 Mundra APL Miami (V-0FFDME1) 28-01-2025 ACMTPL Hansa Europe (V-2503W) 29-01-2025 Jebel Ali CMA CGM Vitoria (V-OUW92W1) 30-01-2025 Karachi

Kashan (V-1342W) 27-01-2025 Bandar Abbas Wadi Duka (V-2502W)

MSC Ravenna (V-IP504A) 28-01-2025 Mundra MSC Barbados (V-IV504A) 29-01-2025 Freeport Marianna I (V-IU504A) 30-01-2025 Mundra Varada (V-2501E) 31-01-2025 MICT

One Reliability (V-0012E) 27-01-2025 Colombo Celsius Nairobi (V-0924W) 27-01-2025 Jebel Ali Wan Hai 508 (V-E0209) 28-01-2025 Cochin Yantian 1 (V-107E) 29-01-2025 Pipavav Yantian Express (V-2504W) 30-01-2025 AICT One Thesues (V-090E) 30-01-2025 Mundra

Haian Mind (V-25003W) 27-01-2025 Mundra Hyundai Earth (V-001W) 28-01-2025 Karachi MSC Martina (V-JU504R) 28-01-2025 Jebel Ali Zhong Gu Gui Yang (V-02501E) 29-01-2025 Hazira Wan Hai 613 (V-067E) 29-01-2025 MICT EF Olivia (V-96W) 29-01-2025