NEWDELHI:IndiawillsoonbeintroducingitsLogistics costindexthatwillprovidegranulardataandhelpinvestors and policymakers formulate projects and interventions to improve efficiency, informed officials in the Department for Promotion of Industry and Internal Trade (DPIIT) According to the officials, the work on putting a framework fordevisingalogisticscostindexisinthefinalstages.

Under the initiative, multiple indexed data will be provided to capture product-wise as well as region-wide logisticscostmovementonaforthrightlyormonthlybasison thelinesofWPIandCPI,theofficialsquotedabovesaid.

The DPIIT will also bring annual, all-encompassing, national logistics cost data based on Indian systems to provideatruerpictureofthecostsinvolvedinmovinggoods andservicesacrossthecountry.

Cont’d. Pg. 15

NEW YORK: The John McCown’s Blue Alpha Capital estimatedcombinedearningsofContainerLines,boththose that publicly report results and privately held, at $58.9bn for thethirdquarteroftheyear

The Q3 2022 result was 22.4%, or $10.8bn higher than the $48.1bn profit the sector reported in the same quarter in2021.

Cont’d. Pg. 15

GENEVA: MSC has taken the next step in developing its Air Cargo solution with the delivery of the first MSC-branded aircraft, built by Boeing and operated by Atlas Air. The B777-200 Freighter will fly on routes betweenChina,theUS,MexicoandEurope.

Jannie Davel, Senior Vice President Air Cargo at MSC, said: “Our customers need the option of air solutions, which is why we’re integrating this transportation mode to complement our extensive maritime and land cargo operations. The delivery of this first aircraft marks the start of our long-term investmentinaircargo.”

Jannie Davel brings extensive air cargo experience, having worked in the sector for many years, most recently heading Delta’s commercial cargooperations,beforejoiningMSCin2022.

He said: “Since I started at MSC, I have spoken to numerous partners and customers right across the market and it is very clear that air cargo can enable a range of companies to meet their logistics needs. Flying adds options, speed, flexibility and reliability to supply chain management, and there are particular benefits for moving perishables, such as fruit and vegetables, pharmaceutical and other healthcare productsandhigh-valuegoods.

We are delighted to see the first of our MSC-brandedaircrafttaketotheskiesandwebelieve that MSC Air Cargo is developing from a solid

foundation thanks to the reliable, ongoing support fromouroperatingpartnerAtlasAir.”

Atlas Air, Inc., a subsidiary of Atlas Air Worldwide Holdings,Inc.(Nasdaq:AAWW),issupportingMSCon an aircraft, crew, maintenance and insurance (ACMI) basis.ThisaircraftisthefirstoffourB777-200Fsinthe pipeline, which are being placed on a long-term basis withMSC,providingdedicatedcapacitytosupportthe ongoingdevelopmentofthebusiness.

The B777-200F twin-engine aircraft has been commendedforitsadvancedfuelefficiencymeasures. It also has low maintenance and operating costs, and, with a range of 4,880 nautical miles (9,038 kilometres), it can fly further than any other aircraft in its class. It also meets quota count standards for maximum accessibility to noise sensitive airports around the globe.

NEW DELHI: India bought about 40% of all Urals seaborne export volumes loading in November, outperforming other states as buyers, Reuters calculations based on Refinitiv and traders’ data showed on Monday, 28thNovember.

Russian Urals oil shipments to India accounted for about 40% of the total sea exports of Urals in November,notincludingthetransitof oil from Kazakhstan, which is sold as

KEBCO, Reuters calculations showed.

Atthesametime,shipmentsofthe grade to Europe, which was previously the largest consumer of seaborne Urals, in November amounted to slightly less than a quarter.Almosttheentirevolumewas delivered to refineries, in which Russianoilcompaniesholdshares.

The total volume of shipments of Urals oil from the Russian ports in November amounted to 7.5 million

tonnes,excludingthetransitvolumes ofKazakhstan.

On Dec. 5, the European Union imposes an embargo on the supply of seaborneshipmentsofRussianoil.

Accordingtotraders,thevolume of supplies of Urals oil to Europe may be further reduced in December, since the embargo involves a ban on the supply of Russian oil even by Russian companies to their remaining refiningassetsintheEU.

MANGALORE: New Mangalore Port,welcomedthefirstcruiseshipof the current cruise season on 28th November 2022. The cruise ship “MSEUROPA2”berthedat0630HRS at Berth No. 04 carrying 271 passengers & 373 crew members sailing under the flag of Malta (Europe). Its carrying capacity is 42,830GrossTonnageandhercurrent draught is reported to be 6.3 meters. Her length overall (LOA) is 224.38 metersandherwidthis29.99meters.

Thecruisevessel’slastPortofcall was Mormugao in Goa. After its stay in Mangalore, the next Port it will be calling is Cochin Port. On the

directions of Chairman, NMPA the Port Officials made all possible arrangements for the comfort and better experience of the cruise passengers as the cruise season has re-opened after a gap of two years since COVID pandemic shook the world.

NMPA’s international cruise terminal was prepped up for the welcome of cruise passengers, arrangements were done for medical screening of passengers, 11 immigrations and 04 customs counters were set, 06 coaches of bus and cars, 15 prepaid taxis, were kept ready for the passengers.

Ameditationcentrewasalsosetupby Department of AYUSH and cultural programmes portraying the Indian mythology for the passenger’s experience.

The passengers visited various tourist points in and around Mangalore such as; St. Aloysius, Kadri temple, Kudroli Temple, local market, cashew factory, Udupi temple, Gomateshwara, 1000 Pillar Temple & Forum Fiza Mall. After savoring the ethnic tradition and cultural experience the passengers embarked back to their ship and the cruise vessel sailed at 1500HRS towardsitsnextstopatCochinPort.

Southampton, Helsingborg, Gothenburg & Red Sea, 16/1217/12

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

Maeva IV249A N1632 259854-29/11 01/1202/12 30/11 0900 MSC Joannah IU247A N1534 258882-14/11 MSC MSC Agency Haifa. (INDUS) Hind Terminals 02/1203/12 01/12 1200 MSC Regulus IS248A N1547 259203-18/11 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 09/1210/12 08/12 1200 MSC Sola IS249A N1643 259856-29/11 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 16/1217/12 15/12 1200 MSC Irene IS250A

U. K. North Continent & Other Mediterranean Ports.

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul.

Himalaya Express

ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 02/1203/12 TBA TBA Osaka Express 2346W N1562 259120-17/11 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 09/1210/12 TBA TBA Prague Express 2347W N1609 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 16/1217/12 TBA TBA Nagoya Express 2348W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 23/1224/12 TBA TBA One Henry Hudson 2349W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

In Port 30/11 Baltic Bridge OMXDHW1 N1554 1058704-16/11 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 06/1207/12 TBA TBA APL Antwerp OMXDJW1 N1598 259410-22/11 CMA CGM CMA CGM Ag. Valencia, Cagliari 2. (IMEX Service) Dron-3 & Mul 13/1214/12 TBA TBA Yantian Express 2245W N1636 259777-28/11 COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 20/1221/12

& Central America 04/1205/12 03/12 2000 Santa Rosa 247W N1580

Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 11/1212/12 10/12 2000 Maersk Detroit 248W N1584 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 18/1219/12 17/12 2000 Maersk Sentosa 249W US East Coast Ports. Middle East Container Lines(MECL) 25/1226/12 24/12 2000 Maersk Chicago 250W Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 05/1206/12 04/12 2300 Shimin 22007E N1602 259420-22/11 TS Lines TS Lines (I) Vancouver Dronagiri-2 12/1213/12 TBATBA Celsius Nairobi 892E (CISC Service)

In Port 30/11

IV247A N1569 259158-17/11 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 05/12 06/12

Silvia IV248A N1601 259419-22/11 12/12 13/12

Maeva IV249A N1632 259854-29/11 01/1202/12 30/11

MSC Joannah IU247A N1534 258882-14/11 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 08/1209/12 07/12 0900 Conti Courage IU248A N1608 259408-22/11 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 15/1216/12 TBA TBA MSC Rania IU249A N1646 259855-29/11 02/1203/12 01/12 1200 MSC Regulus IS248A N1547 259203-18/11 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 09/1210/12 08/12 1200 MSC Sola IS249A N1643 259856-29/11 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 16/1217/12 15/12 1200 MSC Irene IS250A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast. (Himalaya Express) 04/1205/12 03/12 1600 Exress Athens 2147 N1520 258712-10/11 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 11/1212/12 TBA TBA One Altair 2148 N1578 259217-18/11 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 18/1219/12 TBA TBA CMA CGM Ivanhoe 2149 Hapag ISS Shpg. ULA CFS 25/1226/12 TBA TBA CMA CGM Butterfly 0IND7W1

ONE Line ONE (India) India America

COSCO COSCO Shpg. Express (INDAMEX)

Indial Indial Shpg. US East Coast & South America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3

Team Lines Team Global Log. Norfolk, Charleston. JWR Logistics Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

In Port 30/11 Baltic Bridge OMXDHW1 N1554 1058704-16/11 CMA CGM CMA CGM Ag. New York, Norfolk, Savannah, Miami, Santos, Dron.-3 & Mul. 06/1207/12 TBA TBA APL Antwerp OMXDJW1 N1598 259410-22/11 ANL CMA CGM Ag. Itajai & other North American Ports. Dron.-3 & Mul. 13/1214/12 TBA TBA Yantian Express 2245W N1636 259777-28/11

Emirates Emirates Shpg. Jebel Ali, Sohar.

LMR Logistic Ser. Jebel Ali, Bandar Abbas.

X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr

Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2

Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics

X-Press Feeders Sea Consortium Khalifa, Jebel Ali.

Unifeeder Group Transworld Shpg. Basra.

Emirates Emirates Shpg. Jebel Ali.

Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

259700-25/11 ONE Line ONE (India) Colombo. 30/1231/12 TBATBA Seaspan Lahore 2251W Hapag ISS Shpg. (AIM) ULA CFS

In Port 30/11 MSC Margrit IV247A N1569 259158-17/11 MSC MSC Agency Colombo. (INDUSA)

Hind Terminals

Hind Terminal 01/1202/12 30/11 0900 MSC Joannah IU247A N1534 258882-14/11 MSC MSC Agency Karachi. (INDUS)

01/1202/12 30/11 2100 Aka Bhum 010E N1523 258766-11/11 OOCL OOCL (I) Colombo. GDL 05/1206/12 TBA TBA OOCL New York 090E N1627 259708-26/11 Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 03/1204/12 03/12 1200 X-Press Odyssey 22007E N1549 258984-15/11 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 09/1210/12 TBA TBA Zoi 20E N1629 259723-26/11 KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 16/1217/12 TBA TBA ESL Da Chan Bay 2247E X-Press Feeders Sea Consortium (CIX3 Service) 23/1224/12 TBA TBA KMTC Dubai 2207E EmiratesEmirates Dronagiri-2 04/1205/12 TBA TBA Seaspan Chiba 012E N1559 259106-17/11 ONE Line ONE (India) Colombo. 11/1212/12 TBA TBA Wide Juliet 025E X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 18/1219/12 TBA TBA X-Press Bardsey 22020E CSC Seahorse Colombo. 05/1207/12 TBA TBA MOL Creation 086E N1574 259213-18/11 ONE Line ONE (India) Colombo. 18/1219/12 TBA TBA Conti Contessa 112E Yang Ming Yang Ming(I) Contl.War.Corpn. 05/0107/01 TBA TBA One Competence 089E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 05/1206/12 TBA TBA X-Press Anglesey 22007E N1594 259328-21/11 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 11/1212/12 TBA TBA TS Kelang 22008E N1637 259764-28/11 X-Press Feeders Sea Consortium (CWX) 18/1219/12 TBATBA X-Press Kilimanjaro 22007E TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/—

01/1202/12 30/11 1700 Anbien Bay E007 N1567 259113-17/11 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 03/1204/12 02/12 2300 TRF Partici 13W N1529 258855-12/11 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 07/1208/12 06/12 1700 MSC Leandra IW248A N1631 259852-29/11 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 08/1209/12 TBA TBA Seamax Westport 083E N1604 259425-22/11 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 13/1214/12 TBATBA BLPL Faith 3220E BLPL Transworld GLS Chittagon, Yangoon

Sealead Giga Shpg.

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 03/1204/12 TBA TBA Songa Leopard 897E N1571 259201-18/11 Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 17/1218/12 TBA TBA Hansa Rottenburg 919E N1634 259749-28/11 X-Press Feeders Sea Consortium (SIS) 05/1206/12 04/12 2300 Shimin 22007E N1602 259420-22/11 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 12/1213/12 TBA TBA Celsius Nairobi 892E

Unifeeder Feedertech/TSA Qingdao, Shanghai, Ningbo. Dronagiri 02/0103/01 TBA TBA Wide Alpha 233E

PIL/ONE PIL Mumbai/ONE(I) —/— 09/0110/01 TBA TBA Ever Ulysses 148E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 16/0117/01 TBA TBA Celsius Naples 893E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 CISC Service

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo.

BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 10/12 11/12 TBATBA Wadi Bani Khalid 2230E N1595 259361-21/11 Asyad Line Seabridge Singapore, Port Kelang. (IEX)

Hapag/RCL ISS Shpg./RCL Ag. (CIX)

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 01/1202/12 30/11 2100 Aka Bhum 010E N1523 258766-11/11 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 05/1206/12 TBA TBA OOCL New York 090E N1627 259708-26/11 APL CMA CGM Ag. Dron.-3 & Mul. 12/1213/12 TBA TBA OOCL Hamburg 139E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 19/1220/12 TBA TBA OOCL Luxemburg 099E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 26/1227/12 TBA TBA Seamax Stratford 119E Gold Star Star Ship Singapore, Hong Kong, Shanghai. (CIX-3)

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul.

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 01/1202/12 01/12 0400 Calais Trader 021E N1539 258890-14/11 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 11/1212/12 TBA TBA CUL Nansha 2247E

CU Lines Seahorse Ship (RWA) 12/1213/12 TBA TBA Uru Bhum 112E N1612 259476-23/11 InterasiaInterasia 17/1218/12 TBA TBA Interasia Engage E002

Emirates Emirates Shpg. 03/1204/12 TBA TBA Grace Bridge 248E N1513 258367-04/11 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 08/1210/12 TBATBA BSG Bimini 249E N1586 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 16/1217/12 TBA TBA Sofia 1 250E (FM-3) 03/1204/12 03/12 1200 X-Press Odyssey 22007E N1549 258984-15/11 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 09/1210/12 TBA TBA Zoi 20E N1629 259723-26/11 KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Dai Chen Bay

Dronagiri-3/— 16/1217/12 TBA TBA ESL Da Chan Bay 2247E

X-Press Feeders Sea Consortium 23/1224/12 TBA TBA KMTC Dubai 2207E Emirates Emirates Shpg (CIX3 Service) Dronagiri-2 30/1231/12 TBA TBA Zim Norfolk 7E Pendulum Exp. Aissa Maritime 06/0107/01 TBA TBA Ever Uberty 180E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 04/1205/12 TBA TBA Seaspan Chiba 012E N1559 259106-17/11 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 11/1212/12 TBA TBA Wide Juliet 025E X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 18/1219/12 TBA TBA X-Press Bardsey 22020E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 25/1226/12 TBA TBA Bangkok Bridge 0139E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. 05/1206/12 TBA TBA X-Press Anglesey 22007E N1594 259328-21/11 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 11/1212/12 TBA TBA TS Kelang 22008E N1637 259764-28/11 X-Press Feeders Sea Consortium (CWX) 18/1219/12 TBA TBA X-Press Kilimanjaro 22007E KMTC KMTC (India) Dronagiri-3 29/1230/12 TBA TBA Kota Megah 0141E TS Lines TS Lines (I) Dronagiri-2 02/0103/01 TBA TBA Pontresina 238E RCL/PIL RCL Ag./PIL Mumbai (CWX) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 05/1207/12 TBA TBA MOL Creation 086E N1574 259213-18/11 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 20/1222/12 TBA TBA Conti Contessa 112E Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 05/0107/01 TBA TBA One Competence 089E Hyundai HMM Shpg. Seabird CFS (PS3 Service) Samudera Samudera Shpg. (PS3 Service) Dronagiri Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate

30/1101/12 29/11 2300 Jan Ritscher E907 N1544 258944-14/11 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 06/1208/12 TBA TBA Marina Voyager E010 N1588 259314-21/11 Heung A Line Sinokor India Hongkong 16/1217/12 TBA TBA Gabriel A E007 Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 21/1222/12 TBA TBA Jakarta Voyager E2210 InterasiaInterasia Unifeeder Feedertech/TSA Dronagiri 01/1202/12 01/12 1200 CMA CGM Tosca 0FF7EE1 N1480 258331-04/11 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 12/1213/12 TBA TBA CMA CGM Rabelais 0FF7IE1 N1624 259663-25/11 RCL RCL Ag. (AS1) 01/1202/12 30/11 1700 Anbien Bay E007 N1567 259113-17/11 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 08/1209/12 TBA TBA Najade E031 N1591 259312-21/11 COSCO COSCO Shpg. Ningbo, Shekou. 16/1217/12 TBA TBA Kumasi E006

InterasiaInterasia (CI2) (CI2)

Hyundai HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai. 02/1204/12 TBA TBA ESL Kabir(BMCT) 2245E N1610 259482-23/11 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 07/1209/12

Chabang, Caimep, Kaohsiung, Seabird CFS 09/1210/12 TBA TBA Hyundai Busan 0141E

Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 19/1220/12 TBATBA Hyundai Colombo 0129E

Pusan,

12/1214/12 TBA TBA Argolikos E146 TS Lines TS Lines (I) Australian Ports. (CIX) Dronagiri-2 01/1202/12 30/11 2100 Aka Bhum 010E N1523 258766-11/11 ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 05/1206/12 TBA TBA OOCL New York 090E N1627 259708-26/11 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 12/1213/12 TBA TBA OOCL Hamburg 139E OOCL OOCL (I) Sydney, Melbourne. GDL 19/1220/12 TBA TBA OOCL Luxemburg 099E

TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 26/1227/12 TBA TBA Seamax Stratford 119E Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 (CIX-3) Team Lines Team Global Log. Australia & New Zealand Ports. JWR Logistics 04/1205/12

Cont’d. from Pg. 3

“The artificial neural network method that is a system used globally to determine logistics cost relies largely on international data sets of things coming from outside or business trying to happen with India and things that move out from here. So, international estimates on logistics cost in India is largely based on the cost of moving in and out of trading ports in the country that is determined by global shipping lines” said Surendra Ahirwar,JointSecretary,DPIIT.

“It is here that determination of logistics costs based on the Indian system and involving actual cost within the country will bring out truer estimates on this critical data that has wide-scale ramifications.

The cost indexes will further strengthen estimates on logistics,” headded.

“We will soon have a consultation meeting with experts from industry, academic, and government on domestic logistics cost index. There is an internal cost and a domestic cost. Much of the transportation cost by the shipping lines and they are not in any sovereigncontrol.”

The Logistics cost in India is unorganized and fragmented, leading to high logistics costs estimatedas14-15%ofGDP,against78% in developed nations such as Singapore and the US, which leverageittoboostexports.

Launched in September, the National Logistics Policy (NLP)

aims to bring down logistics costs and address logistical challenges. TheNLPaimstobringdownIndia’s logistics cost to 8% in the next five years.

Due to the fragmented logistics in the country, about 16% of India’s agri-production is wasted at different stages of the supply chain and the new policy seeks to limit losses incurred while transporting perishable commodities to under 5% by improving the warehouse facilitiesandcoldchainefficiency.

The PM GatiShakti National Master Plan, aimed at bringing logistics costs on a par with developed nations, would save the government Rs. 10 trillion annually, Commerce and Industry Minister ShriPiyushGoyalhassaid.

Cont’d. from Pg. 3

It was, however, $4.4bn or 6.6% lower than the profit Container LinesreportedinQ2thisyear.

“The small downturn follows seven straight quarters of record net income for the sector driven by significant pricing increases across allcontainerlanes,”thereportsaid.

Looking ahead McCown said: “Therewillbefurtherdeclinesfrom Q322 in quarters to come. Aggregate overall pricing in the sector eased slightly in the latest sequential quarterly comparison, but not nearly at the same level as variousspotrateindices.”

The report noted that overall average contract rates remained

near peak levels in Q322 with averagedataforloadsintotheUSat theirhighesteverinthequarter.

McCown said that taking into account all factors including spot rate trends through to November the forecast for full year 2022 net income for container shipping was lowered $223.4bn from $244.9bn. He said that no earnings collapse was imminent.

The peak in financial results from Container Lines shows roughly nine months – one year lag to the peak in spot rate indices due to the nature of long-term contract negotiationsondifferenttrades.

The sharp falls in spot rates will put carriers under pressure at the

next round of contract negotiations withtheimpactlikelytobeseenfirst on Asia – Europe with annual contracts up at year end and in May/JuneontheTranspacifictrade. The extent to which contract rates will in turn determine how quickly container line profitably tails off in theinthecomingquarters.

CHENNAI: Despite being the largest producer of bananas in the world, India is ranked 20th in exports and has a meagre 0.6 per cent share in the global banana trade. If India adopts an export-oriented strategy to upgrade the value chain, the country can increase its exports by four-fold and grab a spot among the toptenexporters.

India’s exports of bananas in FY22 was $160.52 million against global exports of $14.5 billion— a share of 0.6 per cent. Even, the world’s fifth largest producer Ecuadorhasa24percentshare.

According to K. Unnikrishnan, Joint Director General of the Federation of Indian Export

Organisations, or FIEO, India can reach at least $500 million exports within five years to grab a 3 per cent share in global trade and be one of the top 10 exporters if it improves production, post-harvest handling andphytosanitarystandards.

“Our research institutions and other stakeholders should come forward to provide solutions to increase shelf-life, reduce skin damages and improve technology andinfrastructureforpre-andpostharvestprocesses,”hesaid.

The government should encourage major retailers and department stores in India to invest in post-harvest channels to procure banana and sell through stores with specified standards, branding and packaging.

“We need branding of bananas and the state governments should come forward to create state-specific brands and promote them in major markets. State Governments should also provide support for creating procurement, sorting, packing and processingcentres,”hesaid.

Globally, bananas are exported entirely by sea-freight. However, in India, more than 60 per cent is exported through air. This costlier mode restricts marketability of Indian bananas. There is a need for closer association with major shippinglines.

The UAE, Iran and Saudi Arabia together contributed 80 per cent of India’s banana exports during 2021-22.

TAIPEI : Wan Hai Chairman Chen Bo-ting believes the freight market will turn around in mid-2023, as concerns over Russia’s invasion of Ukraine and Covid-19 should ease bythen.

Since the middle of the year, freight rates have fallen from historical highs and are expected to reach the low levelsseenbeforeCovid-19hitin2020.

Chen said, “Overall, things aren’t as bad as what many people imagine. Today’s situation isn’t as bad as the 2008 global financial crisis. Now that it’s year-end, employees are wonderingabouttheirbonusesbutwewilldoourbest.”

Speaking at a community event, Chen pointed out that theglobaleconomyisaffectedbythreefactors.

Thefirstissubstantialcostscausedbyinflation,asthisis putting the brakes on consumption growth, leading to a decline in container cargo volumes. The second factor is psychological expectations, and the third is structural problems brought about by geopolitics and epidemic preventionpolicies.

Alluding to psychological factors, Chen mentioned that the supply chain bottlenecks saw the rise of emerging industries such as Uber Freight, which has led to the crowding out effect and caused manpower shortage in the manufacturing chain. However, Chen thinks the overcapacity can be adjusted in the next six months to twelvemonths.

Chen believes that concerns over the Russia-Ukraine conflict and pandemic preventions should ease in 2023, as more economies are reopening and people get accustomed totheimpactoftheconflict.

Speakingatthesameevent, Wan Hai General Manager Tommy Hsieh said that half of the company’s revenue on Transpacific routes comes from long-term shipping contracts.

Hsieh said, “There’s no doubt about making a profit in the fourth quarter of this year. As for the market situation next year, it still needs to be observed, and it is estimated thattherewillbenolosses.”

NEW DELHI: A month wise action plan will be created for 235 road and highway connectivity projects yet to be awarded with specific focus on maximizing award by December 2022 andMarch2023.Areviewmeetingofthe PM GatiShakti National Master Plan (NMP)saidthisistoaddressthecritical infrastructuregapprojects.

A Transport Ministry order said that theseidentifiedprojectsspreadoverthe Ministries of Steel, Fertilizers, Ports, ShippingandWaterways,andDefence.

The maximum number of roads needtobebuiltfortheDefenceMinistry with168projectsbeingidentified.

Ports, Shipping and Waterways

Ministry comes next with 61 projects, Steel has five, while Fertilizer has one project. The National Highway Authority of India (NHAI), National Highways & Infrastructure Development Corporation Limited (NHIDCL), and Border Roads Organisation (BRO) need to implement theseprojects.Thestatusoftheseroads willalsobetrackedonamonthlybasis.

It has also been decided that geotagged data of Automated Testing Stations and Registered Vehicle Scrapping Facilities will be uploaded on thePMGatiShaktiNMPPortal.Further, mapping of potential sites for these facilitieswillalsobeaddedtoit.

A slowed pace of road construction this year has prompted the Centre to undertake a comprehensive review to identify the shortcomings and hasten implementation of national highway projects.

According to official data, 4,060 kilometres (KMs) of national highways were constructed during the current financial year till Octoberend. This is 10.7% lower than the 4,550 KMs built during the same months of fiscal 2021-22. The centre has also awarded 5,007 KMs of highways till October-end, up from 4,913 KMs during the comparable period of the previous year.

MUMBAI: Welspun One Logistics

Parks has committed 100 per cent of its Rs 500 crore corpus across six investments to create a portfolio of Rs2,300crorespanningfivecities–MMR, NCR, Bengaluru, Chennai and Lucknow– aggregating to about 6.6 millionsquarefeetofgrossleasablearea.

Last year, the firm raised India’s first alternative investment fund (AIF) focusing on warehousing development. Ofthe6.6millionsqft,onemillionsqftof area has been delivered and an additionaltwomillionsqftisexpectedto be delivered in the second quarter of calendaryear2023,thecompanysaid.

Fifty per cent of the firm’s funds portfoliowillbedelivered,operationaland rent generating in a little over two years from its first close, said the company.

Notably, about 60 per cent of the portfolio is already pre-leased to a blue-chip roster of tenants such as Delhivery, Flipkart, FM Logistics, Tata Croma, and Ecom Express, with significant scope for leasing of the balanceportfolio.

Welspun One was among the first players in the country to spot an opportunity for domestic capital to invest in India’s growing warehousing sector. While the sector had attracted close to $6 billion in FDI over the past 3-4 years, there was no avenue for domestic investors to participate in this space in a hassle free, transparent and institutionalmanner.

Welspun One provided financialisation of real estate by launching India’s first AIF focussed on

warehousing development. It has also raised Rs 500 crore of capital commitments, from a set of high net worth investors including marquee individualsandfamilyoffices.

Over the next five years, the company expects to develop a portfolio of 20-25 million sq ft across “first mile” and “last mile/city centre” facilities in leading Tier-1 and Tier-2/3 cities panIndia.

India’s warehousing industry continues to show strong growth with an expected CAGR of 18 per cent over thenext3-4years.

The company is an integrated fund and development management platform, which delivers grade-A logistics and industrial parks across India.

MUMBAI: Container freight rates on major trades out of India have hit new lows in November amid falling cargo volumes, according to sources.

On the Westbound India-Europe trade, average contract rates from West India [Jawaharlal Nehru Port (JNPT)/Nhava Sheva or Mundra Port] to Felixstowe/London Gateway (UK) or Rotterdam (the Netherlands) have plunged to US$2,300 per 20-foot container and US$2,450/40-foot container, from US$3,500 and U$4,000, respectively,inthelastweekofOctober.

For West India-Genoa (the West Mediterranean) cargo, carriers are accepting bookings at US$2,200/20-foot boxandUS$2,500/40-footbox,compared with the October levels of US$3,750/20footboxandUS$4,100/40-footbox.

Eastbound cargo rates for these port pairings have, however, seen no changes month-on-month –continuing to hover at US$1,400/20-foot container and US$1,500/40-foot container for bookings from Felixstowe/Rotterdam

and at US$1,150/20-foot and US$1,400/40-foot containers to West India(NhavaSheva/Mundra).

Average short-term contract prices offered by leading liners for Indian cargo moving to the US East Coast (New York) have also crashed significantly from the October levels –downtoUS$4,750per20-footbox,versus US$6,350, and US$6,350 per 40-foot box, from US$8,350, and at US$3,650/20-foot container, from US$4,500, and US$4,850/40-foot box, down from US$6,050, for shipments to theUSWestCoast(LosAngeles).

For the West India-US Gulf Coast trade, rates have fallen to US$4,750 per 20-foot and US$6,850 per 40-foot container, compared with US$6,900 and US$9,050, respectively, at the end of October.

On the return direction, average contract rates have not changed from the levels maintained by major operators last month – pegged at US$1,075/20-foot box and US$1,434/40foot box from USEC; at US$2,484/20-foot

box and US$ 3,193/40-foot box from USWC; and at US$1,770/20-foot and US$1,843/40-foot box from the Gulf Coast, into West India (Nhava Sheva/Mundra).

Average contract rates offered by major carriers to regular clients for bookings from West India (Nhava Sheva/JNPT or Mundra) to Shanghai (Central China) now stand at US$150per20-footcontainerandatUS$250 per40-footbox,versusUS$350andUS$450, respectively, a month earlier. For Indian cargo to Tianjin (North China), rates are downtoUS$200/20-footandUS$350/40-foot container, from US$350 and US$400 in October.

For Indian shipments to Hong Kong, average rates are hovering at US$150/20-foot container and US$200/40-foot container, down from US$300 and US$400, according to the analysis.

Rates on West India-Singapore cargo have collapsed to US$50/20-foot container and US$100/40-foot box, from US$150andUS$250lastmonth.

m.v

” V- XA246A I.G.M. No. 2328091 Dt. 27-11.2022 Exch. Rate 84.31

The above vessel has arrived on 28-11-2022 at NHAVA SHEVA (BMCT) with import cargo to NHAVA SHEVA from ANTWERP, FREEPORT, GRAND BAHAMA,CORNER BROOK, MONTREAL, VANCOUVER, DJIBOUTI, CAUCEDO, SOKHNA PORT, BARCELONA, CARTAGENA, VALENCIA, LONDON GATEWAY PORT, AL 'AQABAH, COLOMBO, KLAIPEDA, ALTAMIRA, ENSENADA, VERACRUZ, MAPUTO, GDYNIA, JUBAIL, KING ABDULLAH PORT, GAVLE, NORRKOPING, DAR ES SALAAM, BALTIMORE, BOSTON, JACKSONVILLE, MIAMI, MOBILE, NEW YORK, OAKLAND, NORFOLK, PORT EVERGLADES,PHILADELPHIA, SAVANNAH, SEATTLE.

Please note the item Nos. against the B/L Nos. for NHAVA SHEVA (BMCT) delivery.

Item No. B/L No.

MEDUD6122029 MEDUD6433178 MEDUU6431040 MTYSAVERIALOCAL 100 MEDUDM457062 101 MEDUDM457120 102 MEDUDM457625 103 MEDUDM455371 104 MEDUDM457740 105 MEDUDM455496 106 MEDUDM456627 107 MEDUJ4045319 108 MEDULS002763 109 EXP021403A 110 1049268027 111 EXP021072A 112 HEYSXJ049899 113 MEDUIW441980 114 MEDUIW328203 115 MEDUIW339614 116 MEDUIW400697 117 MEDUIW400705 118 MEDUIW376715 119 MEDUIW390609 120 MEDUIW459321 121 MEDUIW481663 122 MEDUIW483420 123 MEDUIW405886 124 MEDUIW269829 125 MEDUIW439398 126 MEDUIW438580 127 MEDUIW481333 128 MEDUIW441147 129 MEDUIW510727 130 MEDUM3041164 131 MEDUM3041297 132 MEDUD6327800 133 MEDUD6333063 134 MEDUD6291899 135 MEDUD6323742 136 MEDUD6324294 137 MEDUD6323783 138 MEDUD6296971 139 MEDUD6341934 140 MEDUD6360207 141 MEDUD6358490 142 MEDUD6371428 143 CLOLX220570 144 BANQ1047625915 145 MEDUML991996 146 MEDUML981245

Item No. B/L No. Item No. B/L No.

Item No. B/L No. Item No. B/L No. 147 MEDUML996912 148 IWWS00006859 149 MEDUD6203373 150 MEDUD6145020 151 MEDUD6055419 152 MEDUD6138108 153 MEDUD6051673 154 MEDUD6041336 155 MEDUD6070772 156 MEDUU6965849 157 MEDUD6039074 158 MEDUD6072927 159 MEDUD6097270 16 MEDUJO129376 160 MEDUU6911868 161 MEDUD6071093 162 MEDUD6061771 163 MEDUD6061581 164 MEDUD6097262 165 MEDUD6064163 166 MEDUD6140567 167 MEDUD6123985 168 MEDUU6997586 169 MEDUD6073727 17 MEDUJO129400 170 MEDUU6752270 171 MEDUD6138900 172 MEDUU6805441 173 MEDUD6139411 174 MEDUD6122573 175 MEDUD6048604 176 MEDUU6990318 177 MEDUU6540527 178 MEDUU6742891 179 MEDUD6140583 18 MEDUX5082789 180 MEDUD6047226 181 MEDUD6210634 182 MEDUD6057167 183 MEDUD6170366 184 MEDUD6054529 185 MEDUU6999954 186 MEDUU6998543 187 MEDUD6130733 188 MEDUD6024431 189 MEDUD6011305 19 MEDUX5078365 190 MEDUD6055195 191 MEDUD6001413 192 MEDUD6206533 193 MEDUD6024746

194 MEDUD6202920 195 MEDUD6058264 196 MEDUU6850199 197 MEDUD6046517 198 MEDUD6171901 199 MEDUD6172040 20 MEDUX5084264 200 MEDUD6172032 201 MEDUD6138587 202 MEDUD6095415 203 MEDUU6715194 204 MEDUD6228966 205 MEDUD6268905 206 MEDUD6243247 207 MEDUD6243262 208 MEDUD6213240 209 MEDUD6242975 21 MEDUX5091129 210 MEDUD6274085 211 MEDUD6272956 212 MEDUD6252685 213 MEDUU6611146 214 MEDUD6212994 215 MEDUU6841479 216 MEDUD6246711 217 MEDUD6239369 218 MEDUTX701799 219 MEDUTX719908 22 HAMSE22100136 220 MEDUD6181025 221 MEDUD6220500 222 MEDUD6180530 223 MEDUD6197864 224 MEDUD6285859 225 MEDUD6274242 226 MEDUD6228735 227 MEDUD6369885 228 MEDUD6198003 229 MEDUD6211806 23 MEDUD7167577 230 MEDUD6228834 231 MEDUD6190471 232 MEDUD6222795 233 MEDUD6242645 234 MEDUD6190851 235 IWWS00006812 236 MEDUD6396276 237 MEDUD6450826 238 MEDUD6047614 239 MEDUD6523986 24 MEDUAV540540

49 MEDUD6278151 50 MEDUV8104014 51 623517224 52 MEDUSD132578 53 MEDUSD129673 54 MEDUSD130358 55 MEDUSD130689 56 MEDUSD132511 57 MEDUMC631261 58 MEDUMC631485 59 MEDUTZ097634 60 MEDUTZ097675 61 MEDUTZ097691 62 MEDUTZ097642 63 MEDUTZ097444 64 MEDUTZ097618 65 MEDUTZ096669 66 MEDUTZ097584 67 MEDUAA108268 68 MEDUAA108813 69 MEDUAA108409 70 MEDUX5074760 71 MEDUF0007155 72 GOT0093420 73 MEDUTX696650 74 MEDUTX723918 75 MEDUTF825383 76 OCGSZZ30003116 77 OCGSZZ30003117 78 PLGDY0000024475 79 MEDUTX834723 80 MEDUTX888133 81 MEDUTX883811 82 MEDUTX880452 83 MEDUTX874869 84 MEDUTX875866 85 MEDUTX873325 86 MEDUTX873416 87 MEDUTX635104 88 BANQ1048668252 89 MEDUD6353509 90 MEDUD6355975 91 BAFCO22110125 92 10634560 93 10636389 94 10639602 95 10639874 96 MEDUDM458110 97 MEDUDM458664 98 MEDUDM458573 99 MEDUDM458003

Consignees are requested to kindly note that the above item nos. are for the B/L Nos. arrived for Nhava Sheva delivery. Separate IGM will be lodged with Mulund, Mumbai customs for CFS Mulund & MbPT delivery respectively

Consignees are requested to collect Delivery Order for all imports delivered at Nhava Sheva from our Import Documentation Dept. at Nhava Sheva - DN210 / DN211 / DN212, D-Wing, 2nd Floor, NMSEZ Commercial Complex, Plot No. 6, Sector - 11, Opp. JNPT Township, Dronagiri Node, Navi Mumbai - 400 707 , India and Mumbai - 1st Floor, MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400059 on presentation of duly discharged Original Bill of Lading and payment of relevant charges.

The container detention charges will be applicable after standard free days from the discharge of containers meant for delivery at Nhava Sheva. The containers meant for movement by road to inland destinations will be dispatched upon receipt of required documents from consignees/receivers and the consignees will be liable for payment of port storage charges in case of delay in submission of these documents. Our Surveyors are M/s. Zircon Marine Services Private Limited. and usual survey conditions will apply. Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo. Incase of any query, kindly contact Import Customer Service - (022) 66378123; IN363-imports.mumbai@msc.com Get IGM No. / ITEM No. /CFS details on our 24hrs computerized helpline No. 8169256872

visit our website: www.msc.com/ind/help-centre/tools/import-general-manifest-information As Agents :

AGENCY (INDIA)

LIMITED H.O. & Regd. Off: MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059. Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IND-info@msc.com; Website : www.msc.com

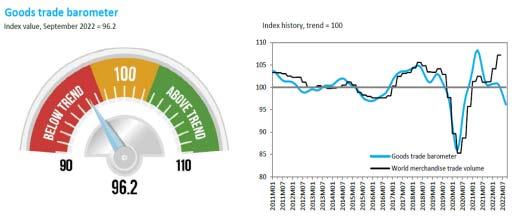

GENEVA: Trade growth is likelytoslowintheclosingmonths of 2022 and into 2023, according to the latest WTO Goods Trade Barometer released on 28 November, as the global economy continues to be buffeted by strong headwinds. The current reading of 96.2 is below both the baseline value for the index and the previous reading of 100.0, reflecting cooling demand fortradedgoods.

The Goods Trade Barometer is a composite leading indicatorforworldtrade,providingreal-timeinformationonthe trajectory of merchandise trade relative to recent trends. Values greater than 100 signal above-trend expansion while values less than 100 indicate below-trend growth. The barometer index (represented by the blue line above) has fallen below the merchandise trade volume index (the black line), which shows actual trade developments through the second quarter. The latter should eventually follow the barometer index down once quarterly trade statistics for the second half of 2022 are available. Recent divergence between the indices, as seen in 2021 and 2022, could be explained by delayed shipments of goods stemming from supply chain disruptionssincethepandemic.

The downturn in the goods barometer is consistent with the WTO's trade forecast of 5 October, which predicted merchandise trade volume growth of 3.5% in 2022 and 1.0% in 2023 due to several related shocks including the war in

Ukraine, high energy prices, and monetary tightening in major economies. Merchandise trade posted a 4.7% year on year increase in the second quarter after growing 4.8% in the first quarter. For the forecast to be realised, trade growthwouldhavetoaveragearound2.4%year-on-yearinthe secondhalfof2022.

The barometer index was weighed down by negative readings in sub-indices representing export orders (91.7), air freight (93.3) and electronic components (91.0). Together, these suggest cooling business sentiment and weaker global import demand. The container shipping (99.3) and raw materials (97.6) indices finished only slightly below trend but have lost momentum. The main exception is the automotive productsindex(103.8),whichroseabovetrendduetostronger vehicle sales in the United States and increased exports from Japanassupplyconditionsimprovedandastheyencontinued todepreciate.

UNCTAD’s Review of Mari�me Transport 2022, an annual comprehensive review of global mari�me transport, warns that the mari�me sector will require greater investment in infrastructure and sustainability to weather future supply chain crises.

GENEVA:TheUNConferenceonTradeandDevelopment (UNCTAD)initsflagship"ReviewofMaritimeTransport2022" has called for increased investment in maritime supply chains.Ports,shippingfleetsandhinterlandconnectionsneed to be better prepared for future global crises, climate change andthetransitiontolow-carbonenergy.

Thesupplychaincrisisofthelasttwoyearshasshownthat amismatchbetweendemandandsupplyofmaritimelogistics capacity leads to surges in freight rates, congestion, and critical interruptions to global value chains. Ships carry over 80% of the goods traded globally, with the percentage even higher for most developing countries, hence the urgent need to boost resilience to shocks that disrupt supply chains, fuel inflationandaffectthepoorestthemost.

“We need to learn from the current supply chain crisis and prepare better for future challenges and transitions. This includes enhancing intermodal infrastructure, fleet renewal and improving port performance and trade facilitation,"

UNCTAD Secretary-General Rebeca Grynspan said. "And wemustnotdelaythedecarbonizationofshipping,"sheadded.

Investment is needed in maritime transport systems to strengthenglobalsupplychains

Logistics supply constraints combined with a surge in demand for consumer goods and e-commerce pushed container spot freight rates to five times their pre-pandemic levels in 2021, reaching a historical peak in early 2022 and sharply increasing consumer prices. The rates have dropped since mid-2022 but they remain high for oil and natural gas tankercargoduetotheongoingenergycrisis.

Dry bulk freight rates increased due to the war in Ukraine and related economic measures, as well as the prolonged COVID-19 pandemic and supply chain disruptions. An UNCTAD simulation projects that higher grain prices and dry bulk freight rates can lead to a 1.2% increase in consumer food prices, with higher increases in middle- and low-income countries.

KABUL: The Afghan Ministry of Industry and Commerce (MoIC) said that it has signed a new Air Corridor Agreement withIndiatoenableairtradebetweenthetwocountries.

Trade between the two South Asian neighbours had come to a standstill after the Taliban fighters took over Afghanistan in August 2021 following withdrawal by the American and NATOtroops.

Afghan news agency Ariana News quoted MoIC spokesperson Abdul Salam Jawad as saying that export of “Afghanistan’s commercial commodities to India continues through Wagah port and that in the past year, the country has exported more than 14 billion afghanis via the port”. India is a

bigimporterofsaffron,dryfruitsandasafoetida.

Jawad added that cargo flights between Afghanistan and India will increase exports of fresh and dry fruits, handicrafts and other commercial items, giving a boost to the Afghan economy.

Before the Taliban takeover, the two countries carried out trade through two air routes – Kabul-Delhi and also KabulMumbai. The second route had been opened only in December 2017 for India to import fresh fruits and medicinal plants from Afghanistan. This was started after observing the success of the Kabul-Delhi route inaugurated by then Afghan presidentAshrafGhaniinJune-2017.

CJ-I MV Alcyone I Chowgule Bros. 02/12

CJ-II MV Sea Champion Aditya Marine 06/12

CJ-III MV Suvari Kaptan DBC 02/12

CJ-IV MV Safeen AL Amal Interocean 01/12

CJ-V MV Bao Shun Rishi Shpg. 04/12

CJ-VI MV Sea Prajna Benline 03/12

CJ-VII MV Berge Snowdown Synergy Seaport 03/12

CJ-VIII VACANT

CJ-IX VACANT

CJ-X MV Jewel Of Sohar

CJ-XI MV TCI Express TCI Seaways 01/12

CJ-XII MV SSL Bharat Transworld 01/12

CJ-XIII MV Aggelos B Rishi Shpg. 03/12

CJ-XIV MV PVT Sapphire Cross Trade 04/12

CJ-XV MV Clipper Barola Chowgule Bros. 05/12

CJ-XVA MV Kapetan Sideris Chowgule Bros. 04/12

CJ-XVI MV Khalejia Ana 5Scorpio Shpg. 03/12

Tuna Tekra Steamer's Name Agent's Name ETD VACANT

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I LPG Jag Vikram Nationwide 01/12

OJ-II MT Petalouda Interocean 01/12

OJ-III MT Oriental Hibiscus Allied Shpg. 01/12

OJ-IV MT Sea Ambition

OJ-V VACANT

OJ-VI MT APK Prestige

Stream

CJ-I MV Alcyone I Chowgule Bros. China 41,000 T. Maize Bulk 2022111261

Stream MV Appaloosa Interocean Sudan 29,090 T. Sugar Bags 2022091338

Stream MV Appolo Bulker Samsara Mundra 11,000 T. SBM 2022111319

CJ-V MV Bao Shun Rishi Shpg. 18,601 CBM Logs 2022111238

Stream MV Chakravati Chowgule Bros. Cotonou 50,000 T. Rice Bags 2022111169

CJ-XV MV Clipper Barola Chowgule Bros. Vietnam 41,000 T. Sugar In Bulk 2022101373

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335

OJ-II MT Devashree Samudra 6,000 T. Chem. 2022111299

Stream MV Elisar Ocean Harmony Durban 31,750 T. Sugar Bags 2022111243

30/11 MV Habco Aquila BS Shpg. Bangladesh 44,000 T. Salt 2022111316

Stream MT Hari Anand MK Shpg. 24,000 T. HSD 2022111320

CJ-XVA MV Kapetan Sideris Chowgule Bros. Vietnam 54,000 T. Salt 2022111280

CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 69,300 T. Laterite 30/11 MV Kosman Arnav Shpg. West Africa 24,500 T. Rice In Bags 2022111274

Stream MV My Lama Interocean Sudan 25,000 T. Sugar Bags 2022111127

Stream MV Obe Heart Interocean 25,000 T. Sugar Bags 2022111247

OJ-III MT Oriental Hibiscus Allied Shpg. Marseille 4,500 T. C. Oil 2022111156 03/12 MV Pac Adhil Tristar Shpg 2,500/1,500 T.M.Chloride/Sulphate & 18 2022111285

Stream MV Pegasus 01 DBC Somalia 8,000 T. Sugar Bags 2022111256

CJ-XIV MV PVT Sapphire Cross Trade 55,000 T. Salt 2022111248

CJ-IV MV Safeen AL Amal Interocean Sudan 33,000 T. Sugar Bags 2022111040

CJ-II MV Sea Champion Aditya Marine West Africa 30,460 T. Rice Bags 2022111178

30/11 MV Shail Al Khor Chowgule Bros. 69,250 T. Salt

Stream MV Stentor Interocean 27,450 T. Sugar In Bags 2022111187

CJ-III MV Suvari Kaptan DBC Somalia 9,500 T. Sugar Bags 2022111148

Stream MV Theotokos BS Shpg. Madgasakar 28,000 T. Rice Bags 2022111268

CJ-XIII

B Rishi Shpg. 36,306 T. CBM

JMBaxi Indonesia 53,360 T. Petcoke In Bulk 2022111195

2022111168 02/12

Synergy Seaport 36,355 T. CBM Pine Logs 2022111293 Stream MV Fan Zhou 6 Mystic Shpg. 343 (90/251/2 Blades/Access./SOC) 2022111123 30/11 MV Gautam Aarav Ocean Harmony Porbandar 2,097 T. Coal Fines 01/12 MV Iki DBC Japan 2,339 T. Steel 02/12 MV Ise DBC Japan 1,816/1,511/146 T. CRC/Bars/ S Pipes 02/12 MV Jimmy T Tauras 14,388 T. MOP 2022111004 Stream MV Josco Changzhou GAC Shpg. U.S.A. 52,533 T. Petcoke In Bulk CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 69,200 T. GYPSUM In Bulk 2022111257 05/12 MV Obe Grande Tauras 42,000 T. DAP CJ-VI MV Sea Prajna Benline 21,057/10,442 T. HMS/Sh Scrap 2022111263 07/12 MV Tian He JMBaxi China 5,926/1,244/238HRC/Plates/Wooden 06/12 MV True Courage Tauras 1,28,470 T. Coal Stream MV True Confidence Seascape 27,079 T. Met Coke 2022111125

Rosa 247W 22382

02/12 02/12-AM

Algeciras 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 (MECL) 09/12 TO LOAD FOR FAR EAST, CHINA,

30/11 30/11-AM One Commitment 057E 22373 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 30/11 08/12 08/12-AM MOL Creation 086E 22385 Ningbo, Sekou, Cai Mep. (PS3) 08/12 01/12 01/12-AM Aka Bhum 010E 22378 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 01/12 06/12 03/12-AM OOCL New York 090E 22393 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 06/12 04/12 04/12-AM Grace Bridge 248E 22379 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 04/12 11/12 11/12-AM BSG Bimini 249E 22387 Ningbo, Tanjung Pelepas. (FM3) 11/12 05/12 05/12-AM Wide Juliet 025WE 22390 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 05/12 ONE ONE (India) (TIP) 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 10/12

30/11 30/11-AM SSL Gujarat 1291A 22396 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 30/11 02/12 02/12-AM Santa Rosa 247W 22382 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 (MECL) 09/12

TBA SCI J. M Baxi Jebel Ali. (SMILE)

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

01/12 01/12-AM Aka Bhum 010E 22378 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 01/12 04/12 04/12-AM EM Astoria 248S 22380 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 04/12 04/12 04/12-AM Grace Bridge 248E 22379 SCI J. M Baxi Colombo. (FM3) 04/12 05/12 05/12-AM Wide Juliet 025WE 22390 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 05/12 ONE ONE (India) (TIP) 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Karachi, Colombo (CI1) 10/12

30/11 30/11-AM One Commitment 057E 22373 ONE ONE (India) Los Angeles, Oakland. (PS3) 30/11 02/12 02/12-AM Santa Rosa 247W 22382 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 Safmarine Maersk Line India (MECL) 09/12 05/12 05/12-AM Wide Juliet 025WE 22390 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 05/12 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP)

Northern Practise 0029 X-Press Feeders/ONE Sea Consortium/ONE(I) (ASX) 08/12 Hapag / CMA CGM ISS Shpg./CMA CGM Ag. (I) 02/12 Xin Yan Tai 224W Hapag / COSCO ISS Shpg./COSCO Shpg. Jeddah, Tanger, Southampton, Rotterdam, Bremerhaven, Antwerp, 02/12 CMA CGM/OOCL CMA CGM Ag.(I)/OOCL(I) Le Havre, Algeciras (EPIC) 03/12 Green Pole 248E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 04/12 X-Press Feeders Sea Consortium Doha (Arabian Star) 03/12 MSC Eugenia IP248A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 04/12 10/12 MSC Lisbon IP249A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 11/12 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK) 05/12 Hyundai Hongkong 0139E HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai. (CIX) 05/12 11/12 Hyundai Busan 0141E HMM HMM Shpg. Santos, Paranagua, Buenos Aires, Itajai, Montevideo. (FIL) 11/12

• Two in one Metaverse based solution claims top prize offering virtual method for on-the-job training and deploying experts to work on real-time challenges.

• Eight finalists, including six from Indian Universities, will enjoy an exclusive two-month internship where they will discover how technology is changing the face of global trade

DUBAI: An Indian student studying in the UAE, Dhanalaxmi Gaddam has been announced as the winner of the first edition of DP World’s BIG TECH PROJECT, claiming the top prize for a virtual solution that could enhance productivity and efficiency at ports and terminals aroundtheworld.

DP World, a leading provider of smart logistics with operations across the globe, including a technology hub in India, challenged students from all over India and the UAE to design solutions that answer one question -- How would you solve trade challenges through the power of the Metaverse?

of accidents on site by facilitating virtual inductions and increase efficiencybystreamliningtraining.

Dhanalaxmi said: “We are very proud of our solution. It might not be the biggest idea, but we would like people to know that technologies can help companies to work smarter. We wanted to understand the challenges that the logistics industry faces and howtechnologycanalleviategenuine issuesacompanylikeDPWorldexperiences.

“We couldn’t have done this without our mentor Mostafa ElSayed from DP World. He gave us the understanding of the industry that we initially did not have, helped to polish our ideas, and also helped us to see how being process driveniscriticaltocomingupwithtechnologicalsolutions.

“It is very encouraging to witness that companies like DP World are focused on using the Metaverse and other futuristic technologies for solutions to their challenges and our experience has given us a feel of what working with the company would be like. We would definitely want to work with the company in the future as they are committed to using technological solutions to solve a range of pressing challengestheindustryandtheworldfacestoday.”

Theexpertpanelofjudgesassessingthefourshortlisted solutions felt that the Metaverse based solutions created by students from some of India and the UAE’s leading universities have the potential to change the face of global tradeinthefuture.

Hailing from Hyderabad, India’s bedrock for tech talent, Dhanalaxmi Gaddam, currently studying at Mohamed bin Zayed University of Artificial Intelligence in Abu Dhabi, UAE, along with her teammate Abass Bamidele Abdulsalam overcame stiff competition from three other teams, including Akshat Garg and Agrim Jain from International Institute of Information Technology Bangalore, India (IIITB), who took the runner up spot. Other teams from IIIT, Bangalore and IIT, Kharagpur, India, made up the remainingfinalists.

All the finalists will now be offered an exclusive two-month internship and private mentoring with DP World where they will be introduced to staff leading the development of cutting-edge applications in heavy automation, artificial intelligence, machine learning and robotics to change how trade flows. The winner will also receive a top-of-the-line Macbook and a $5,000cashprize,whiletherunnerupwillreceive$3,000.

Dhanalaxmi, a Masters Student in Machine Learning and Abbas Bamidele Abdulsalam, pursuing his M.Sc. in Computer Vision, describe their winning solution as two ideas in one; using 3D immersive experiences via VR, MR andARtechnologiestobetterimprovesupplychains.

The first idea is a virtual training simulation using Oculusthatgivesnewemployeestheopportunitytogainongroundexperienceandtrainingwithouthavingtophysically visit the terminals. Additionally, the team also developed a second virtual solution using Google Glass that enhances efficiency and maintenance at ports and terminals by providing easy to access instructions for work done in real worldoperations.Together,thesolutionswillreducetherisk

Pradeep Desai, DP World’s Chief Technology Officer, who was part of the judging panel said: “The metaverse is obviously very new and we cannot predict exactly how it couldbeutilisedinourindustryinfuture,buttheideasthese inspiring students put forward have the potential to change the face of global trade. We were impressed by what we saw and are really looking forward to the students joining us for theirinternship.”

By digitising a traditionally analogue industry, DP World aims to make trade smarter, keep it flowing, increase visibility and minimise disruption. Its tech hubs in India and the talent it recruits are crucial to the company’s

commitment to digitisation. DP World recently established three new tech centres at Bengaluru, Hyderabad and Gurgaon, and continues to expand its tech centres worldwide.

Throughtechnologyintegrationandsolutions,DPWorld is working to streamline operating systems that drive warehousing, inland container depots, container freight stations, railway or ocean terminals to deliver a seamless experience throughout the supply chain for cargo owners andendcustomers.

Desai added: “At DP World we are focused on making trade flow seamlessly through technological innovations and solutions. We believe that technology will make trade more resilient by infusing flexibility, resilience and transparencyintothelogisticsecosystem.

“This event has demonstrated the power of fresh, innovative thinking and we are confident that the internship will benefit the students as well as our organisation as we work together in changing what’s possible in trade and logistics.”

The Inaugural Big Tech Project challenged students from the top universities in UAE and India to reimagine global supply chains and create new technology-driven solutions. The event witnessed participation from major universitiesinIndiaandtheUAE,beforethefinalfourteams weretreatedtoanall-expensespaidtriptoDubai.