SeeBackPg.

SeeBackPg.

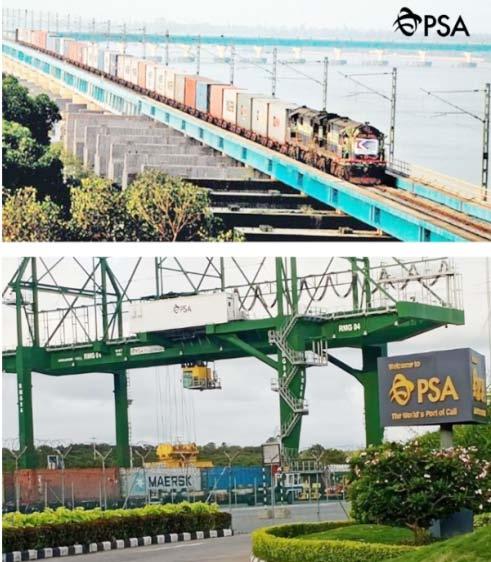

NA VI M UM BA I: PSA India has launched a new direct Southern Rail co nn ec ti on l in ki ng PSA Mumbai to the city of Cochin in Southwestern India, another innovative Rail Multimodal solution initiated by the PSA India team.

Cont’d. Pg. 27

Bhavani Group celebrates 15th Anniversary

MUMBAI: Bhavani Foundation heldits7thAnnualGeneralMeeting (AGM) on19th November 2022 amid the presence distinguished Guests present from the varied sectors who encouraged and appreciated the noble deeds that Foundation had successfully incorporated through different activities and projectssinceinception.

Cont’d. Pg. 6-7

• Bhavani Group celebrates 15th Anniversary

• Bhavani Founda�on is a sapling planted in 2014 which has now turned into a matured Banyan Tree suppor�ng several families

• Bhavani Founda�on stood strong in all cri�cal moments since incep�on and takes pride in serving society relentlessly

Cont’d. from Pg. 3 & 6

The AGM was graced by eminent guest including ShriSanjeevGaneshNaik(Shri Naik was Former Member of Parliament of Thane Lok Sabha Constituency and First Mayor of the Satellite City of Navi Mumbai), Shri Rajkiran Rai - (Managing Director of the National Bank for Financing Infrastructure & Development), Shri Anand M Shetty - (Founder/Chairman - Organic Industries Pvt. Ltd), Shri Jayakrishna A. Shetty(Founder of Jayashreekrishna Parisara Premi Samithi), Shri Nilesh Khare - (Editor and Business Head Zee24 Taas), Dr. Asha Sonawane - (Founder & Chairman of Nishad Foundation), Smt. Rasika Vijay Dhamankar-(TVSerialActress) amongothers.

Shri K. D. Shetty & Shri Jeekshith Shetty felicitated the HonorableGuestsShriAnni.C.Shetty-(PresidentShree Mookambika Devalaya, Ghansoli), Shri H.R. Chalwadi-(President-KarnatakVaibhavaSamasthe), Smt.ChitraRavirajShetty-(ViceChairperson,Ladies wing, Bunts Sangh, Mumbai, Founder President of Omshakthi Mahila Sanstha, Kalyan) for their commendable humanitarian efforts, working tirelessly to help the underprivileged during tough times and for imparting a message to society that we can make a

NEW DELHI: India and Iran recently agreed on continued cooperation for the development of the Shahid Behesti terminal of the Chabahar Port. The issue came up for discussion during the Foreign Office Consultations between an Iranian delegation led by Deputy Foreign Minister Ali Bagheri Kani and an Indian delegation led by ForeignSecretaryVinayMohanKwatra.

“During the delegation-level talks, both sides discussed the entire gamut of bilateral relations, including political, economic, cultural and consular engagement,” according to a statement issued by the MinistryofExternalAffairs(MEA).

The statement said the two sides reiterated their commitment to continuing the cooperation for the development of the Shahid Behesti terminal of the Chabaharport.

The two delegations led by Kani and Kwatra also exchanged views on regional and international issues, includingAfghanistan.

difference by helping the needy in our own ways. Kum. Chaitra Chalwadi - (SSC Topper from S. Nijalingappa Kannada Primary & Secondary School) was also felicitatedonthisoccasionforheracademicexcellence.

Adding spark to this AGM was a cultural event performed by Mr. Sameer Subhash Parab (Singer, Music Producer,LivePerformer)fromSangeetJallosh&Semiclassical performance by Bunts Sangha Mumbai, NaviMumbaiRegion.

Adding another feather in its cap was celebration of the 15th Anniversary of Bhavani Group. Everyone present on this occasion witnessed proud & overwhelming moment of felicitation of employees who completed10+,15+years&employeeswhostoodstrong inexemplaryjourneyofBhavaniGroup.

Bhavani Foundation ensures to recognize, be thankful and appreciate the hard work of team members and volunteers for the noble work and works towards makingeveryonearoundbelieveinkindness.

Bhavani Foundation thanks all their team members and guests for attending and making the event successful. Foundation is excited to continue this year & chase new avenues. Bhavani Group strongly believes that sky is the only limit & no Storm can neither disturb symphony of glorious journey nor can shake their determination, informed a communique from BhavaniGroup.

NEW DELHI: The central banks of India and UAE are discussing a concept paper on promoting bilateral trade in rupee and dirham with a view to reduce transaction cost, a topofficialsaid.

India'sAmbassador to the UAE Sunjay Sudhir said that the concept paper for trade in local currencies was shared by India. The central banks of both the countries will discuss the standard operating procedures and modalities,hetoldreportersinNewDelhi.Theobjectiveof theexerciseistoreducethecostoftransactions,headded.

India and the UAE had already signed a free trade agreement (FTA) in February to give a fillip to bilateral

tradeandeconomicties.

The free trade agreement was aimed at providing significant benefits to Indian as well as UAE businesses, includingenhancedmarketaccessandreducedtariffs.

Following the free trade pact, bilateral trade is expected to increase from the current USD 60 billion to USD100billioninthenextfiveyears.

Bilateral trade between India and the UAE stood at USD 43.3 billion in 2020-21. Exports were worth USD 16.7 billion and imports aggregated at USD 26.7 billion in 202021. The two-way commerce stood at USD 59.11 billion in 2019-20.

TIRUVALLUR: Kattupalli port located in Tiruvallur District and a part of Adani Ports,todayannouncedthatithadprocured 5 numbers of Electric Internal Terminal Vehicles(ITVs)whichwillbecommissioned shortly.Overaperiodoftime,theentirefleetofITVswillbe replaced by electric ITVs. Katupalli Port, has procured these electric Internal Terminal Vehicles (ITVs) for deployment for Container Operations. These ITVs are battery operated and have much lesser parts than a diesel trailer. Battery of these ITVs can be charged using fast chargers through grid as well as through renewable sources of energy – solar, wind etc. Earlier, for the Container movement within the port, vessel to yard or vice versa, and Container Freight Station (CFS) operations, wereservicedbydieselrunITVs

The purpose of introducing Electric ITVs is to boost efficiency, with the plan being to introduce autonomous vehicles and related technologies into the ports daily operations with the goal to further increase the overall efficiencyoftheterminal,inlinewithAdaniPorts’ambition oftransitioningtoCarbonNeutralOperations.

Adani Ports & SEZ, being aware of its environmental

responsibilities, has taken several process improvement and technology integration initiatives to reduce impact on the environment. This has been achieved by improving process efficiencies, investing in electrification of port infrastructure, and setting up renewable energy plants wherever feasible. Transitioning to clean energy is the key to minimize the environmental impact and pave the road towardsacarbonneutralfuture.

From a perspective of reduction of Green House Gas (GHG) emissions, it is envisaged that there would be approximately annual reduction of around 8.6 MT in CO2 emissionand487.7GJinenergyconsumptionperITV.

Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

01/1202/12

0900 MSC Joannah IU247A N1534 258882-14/11 MSC MSC Agency Haifa. (INDUS) Hind Terminals 02/1203/12 01/12 1200 MSC Regulus IS248A N1547 259203-18/11 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 09/1210/12 08/12 1200 MSC Sola IS249A SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 16/1217/12 15/12 1200 MSC Irene IS250A U. K. North Continent & Other Mediterranean Ports.

Himalaya

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1

Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa. Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 02/1203/12 TBA TBA Osaka Express 2346W N1562 259120-17/11 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 09/1210/12 TBA TBA Prague Express 2347W N1609 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 16/1217/12 TBA TBA Nagoya Express 2348W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 23/1224/12 TBA TBA One Henry Hudson 2349W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

29/1130/11 29/11 1400 Baltic Bridge OMXDHW1 N1554 1058704-16/11 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 06/1207/12 TBA TBA APL Antwerp OMXDJW1 N1598 259410-22/11 CMA CGM CMA CGM Ag. Valencia, Cagliari 2. (IMEX Service) Dron-3 & Mul 13/1214/12 TBA TBA Yantian Express 2245W COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 20/1221/12 TBATBA CMA CGM Titus 0MXDNW SarjakSarjak Genoa, Valencia & all other Inland Destinations in Italy Speedy

Dronagiri-2

(CISC Service) 02/1203/12 02/12 0900 MSC Eugenia IP248A N1599 259411-22/11 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals 09/1210/12 09/12 0900 MSC Lisbon IP249A

Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira,Paita, 16/1217/12 16/12 0900 MSC Letizia IP250A

Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC 1 / IPAK) Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America 04/1205/12 03/12 2000 Santa Rosa 247W N1580 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 11/1212/12 10/12 2000 Maersk Detroit 248W N1584 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 18/1219/12 17/12 2000 Maersk Sentosa 249W US East Coast Ports. Middle East Container Lines(MECL) 25/1226/12 24/12 2000 Maersk Chicago 250W Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1

28/11 29/11 28/11 1200 MSC Margrit IV247A N1569 259158-17/11 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 05/12 06/12 TBA 0900 MSC Silvia IV248A N1601 259419-22/11 12/12 13/12 TBA 0900 MSC Maeva IV249A 28/1129/11 Exress Athens 2147 N1520 258712-10/11 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 05/1206/12 TBA TBA One Altair 2148 N1578 259217-18/11 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 12/1213/12 TBA TBA CMA CGM Ivanhoe 2149

Hapag ISS Shpg. ULA CFS 18/1219/12 TBA TBA CMA CGM Butterfly 0IND7W1

India America

Express (INDAMEX)

ONE Line ONE (India)

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston.

JWR Logistics

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 01/1202/12 30/11 0900 MSC Joannah IU247A N1534 258882-14/11 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 08/1209/12 07/12 0900 Conti Courage IU248A N1608 259408-22/11 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 02/1203/12 01/12 1200 MSC Regulus IS248A N1547 259203-18/11 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 09/1210/12 08/12 1200 MSC Sola IS249A

Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 16/1217/12 15/12 1200 MSC Irene IS250A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast. (Himalaya Express)

In Port 28/11 Clemens Schulte 017E N1522 258738-10/11 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 04/1205/12 TBA TBA Seaspan Chiba 012E N1559 259106-17/11 & Caribbean Ports, Canada South & Central America. 11/1212/12 TBATBA Wide Juliet 025E Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 18/1219/12 TBA TBA X-Press Bardsey 22020E West Indies Ports. (TIP Service) 28/1129/11 TBA TBA Aka Bhum 010E N1523 258766-11/11 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 04/1205/12 TBA TBA OOCL New York 090E RCL RCL Ag USA East Coast & Other Inland Destinations. 12/1213/12 TBA TBA OOCL Hamburg 139E COSCO COSCO Shpg. US West Coast. 19/1220/12 TBA TBA OOCL Luxemburg 099E Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. (CIX-3) ICC

Dammam. (IEX) 09/12 10/12 TBA TBA Stephanie C 2215W N1617 259445-22/11 02/12 03/12 TBA TBA Arzin 1281W N1587 259302-21/11 HDASCO Armita India Bandar Abbas, Chabahar. (IIX) 02/1203/12 02/12 0900 MSC Eugenia IP248A N1599 259411-22/11 CMA CGM CMA CGM Ag. King Abdullah. Dron.-3 & Mul. 09/1210/12

(NMG) Emirates Emirates Shpg. Jebel Ali, Sohar. LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2

Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics 03/1204/12 TBA TBA GFS Giselle 0062 N1592 259338-21/11 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 10/1211/12

Global Feeder Sima Marine

Unifeeder Group Transworld Shpg. Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali.

Dronagiri

Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

Hapag ISS Shpg. (AIM) ULA CFS 09/12 10/12 TBATBA Stephanie C 2215W N1617 259445-22/11 Asyad Line Seabridge Karachi. (IEX)

28/11 29/11 28/11 1200 MSC Margrit IV247A N1569 259158-17/11 MSC MSC Agency Colombo. (INDUSA)

Hind Terminal 01/1202/12 30/11 0900 MSC Joannah IU247A N1534 258882-14/11 MSC MSC Agency Karachi. (INDUS) Hind Terminals

In Port 28/11 Clemens Schulte 017E N1522 258738-10/11 ONE Line ONE (India) Colombo. 04/1205/12 TBA TBA Seaspan Chiba 012E N1559 259106-17/11 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 11/1212/12 TBA TBA Wide Juliet 025E CSC Seahorse Colombo.

In Port 29/11 One Commitment 057E N1528 258811-11/11 ONE Line ONE (India) Colombo. 02/1204/12 TBA TBA MOL Creation 086E N1574 259213-18/11 Yang Ming Yang Ming(I)

Contl.War.Corpn. 18/1219/12 TBA TBA Conti Contessa 112E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 28/1129/11 TBA TBA Aka Bhum 010E N1523 258766-11/11 OOCL OOCL (I) Colombo. GDL 04/1205/12 TBA TBA OOCL New York 090E Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 29/1130/11 28/11 1800 Dallian (BMCT) 2208E N1561 259098-17/11 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 05/1206/12 TBA TBA X-Press Anglesey 22007E

X-Press Feeders Sea Consortium (CWX) 11/1212/12 TBA TBA TS Kelang 22008E TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/— 03/1204/12 TBA TBA X-Press Odyssey 22007E N1549 258984-15/11 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 09/1210/12 TBA TBA Zoi 20E

KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 16/1217/12 TBA TBA ESL Da Chan Bay 2247E

X-Press Feeders Sea Consortium (CIX3 Service) 23/1224/12 TBATBA KMTC Dubai 2207E EmiratesEmirates Dronagiri-2

In Port 28/11 Xin Hongkong 058E N1535 258825-11/11 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 28/1129/11 28/11 0700 MSC Shanelle IW247A N1533 258881-14/11 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 01/1202/12 30/11 1700 Anbien Bay E007 N1567 259113-17/11 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 03/1204/12 02/12 2300 TRF Partici 13W N1529 258855-12/11 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 13/1214/12 TBATBA BLPL Faith 3220E BLPL Transworld GLS Chittagon, Yangoon

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 CISC Service TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 01/1202/12 TBA TBA Apollon D 2245E N1552 259013-15/11 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang 08/1209/12 TBA TBA GFS Pearl 2246E N1596 259370-21/11 CU Lines/KMTC Seahorse/KMTC(I) (VGX) Emirates Emirates Shpg. 03/1204/12 TBA TBA Songa Leopard 897E Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 17/1218/12 TBA TBA Hansa Rottenburg 919E X-Press Feeders Sea Consortium (SIS) 07/12 08/12 TBATBA Wadi Bani Khalid 2230E N1595 259361-21/11 Asyad Line Seabridge Singapore, Port Kelang. (IEX)

In Port 28/11 Clemens Schulte 017E N1522 258738-10/11

ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 04/1205/12 TBA TBA Seaspan Chiba 012E N1559 259106-17/11 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 11/1212/12 TBA TBA Wide Juliet 025E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 18/1219/12 TBA TBA X-Press Bardsey 22020E

RCL RCL Ag. Port Kelang, Singapore, Laem Chabang.

In Port 29/11 One Commitment 057E N1528 258811-11/11 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 02/1204/12 TBA TBA MOL Creation 086E N1574 259213-18/11 Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou.

Hyundai HMM Shpg. Seabird CFS

Contl.War.Corpn. 18/1219/12 TBA TBA Conti Contessa 112E

(PS3 Service)

Samudera Samudera Shpg. (PS3 Service) Dronagiri Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 01/1202/12 30/11 2100 Aka Bhum 010E N1523 258766-11/11 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 04/1205/12 TBA TBA OOCL New York 090E

APL CMA CGM Ag. Dron.-3 & Mul. 12/1213/12 TBA TBA OOCL Hamburg 139E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 19/1220/12 TBA TBA OOCL Luxemburg 099E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 26/1227/12 TBA TBA Seamax Stratford 119E Gold Star Star Ship Singapore, Hong Kong, Shanghai. (CIX-3)

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul.

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 28/1130/11 28/11 1000 Wan Hai 507 E207 N1506 258628-09/11 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 06/1207/12 TBA TBA Ital Unica 155E N1572 259119-17/11 Evergreen Evergreen Shpg.

BalmerLaw.CFSDron. 12/1214/12 TBA TBA Argolikos E146 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 27/1228/12 TBA TBA Wan Hai 502 E108

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 29/1130/11 28/11 1800 Dallian (BMCT) 2208E N1561 259098-17/11 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 05/1206/12 TBA TBA X-Press Anglesey 22007E X-Press Feeders Sea Consortium (CWX) 11/1212/12 TBA TBA TS Kelang 22008E KMTC KMTC (India) Dronagiri-3 18/1219/12 TBA TBA X-Press Kilimanjaro 22007E TS Lines TS Lines (I) Dronagiri-2 29/1230/12 TBA TBA Kota Megah 0141E RCL/PIL RCL Ag./PIL Mumbai 02/0103/01 TBA TBA Pontresina 238E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 01/1202/12 01/12 0400 Calais Trader 021E N1539 258890-14/11 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 10/1211/12 TBA TBA Uru Bhum 112E N1612 259476-23/11 CU Lines Seahorse Ship (RWA) 11/1212/12 TBA TBA CUL Nansha 2247E InterasiaInterasia 17/1218/12 TBA TBA Interasia Engage E002 Emirates Emirates Shpg. 03/1204/12 TBA TBA Grace Bridge 248E N1513 258367-04/11 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 08/1210/12 TBATBA BSG Bimini 249E N1586 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 16/1217/12 TBA TBA Sofia 1 250E (FM-3) 03/1204/12 TBA TBA X-Press Odyssey 22007E N1549 258984-15/11 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 09/1210/12 TBA TBA Zoi 20E KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Dai Chen Bay Dronagiri-3/— 16/1217/12 TBA TBA ESL Da Chan Bay 2247E X-Press Feeders Sea Consortium 23/1224/12 TBA TBA KMTC Dubai 2207E Emirates Emirates Shpg (CIX3 Service) Dronagiri-2 30/1231/12 TBA TBA Zim Norfolk 7E Pendulum Exp. Aissa Maritime 06/0107/01 TBATBA Ever Uberty 180E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

In Port 28/11 Xin Hongkong 058E N1535 258825-11/11 COSCO COSCO Shpg. Shanghai, Laem Chabang. 06/1207/12 TBA TBA Seamax Westport 083E APL CMA CGM Ag. (CI 1) Dron.-3 & Mul 18/1219/12 TBA TBA Xin Shanghai 140E OOCL/RCL OOCL(I)/RCL Ag. GDL/— (CI 1) CU Lines Seahorse Ship Singapore,Shanghai,Ningbo,Shekou,Nansha,Port Kelang 28/1129/11 TBA TBA CMA CGM Tosca 0FF7EE1 N1480 258331-04/11 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 12/1213/12 TBA TBA CMA CGM Rabelais 0FF7IE1 N1624 259663-25/11 RCL RCL Ag. (AS1) 30/1101/12 29/11 1400 Jan Ritscher E907 N1544 258944-14/11 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 07/1208/12 TBA TBA Marina Voyager E010 N1588 259314-21/11 Heung A Line Sinokor India Hongkong 18/1219/12 TBA TBA Gabriel A E007 Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 21/1222/12 TBA TBA Jakarta Voyager E2210 InterasiaInterasia Unifeeder Feedertech/TSA Dronagiri 01/1202/12 30/11 1700 Anbien Bay E007 N1567 259113-17/11 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 08/1209/12 TBA TBA Najade E031 N1591 259312-21/11 COSCO COSCO Shpg. Ningbo, Shekou. 16/1217/12 TBA TBA Kumasi E006 InterasiaInterasia (CI2) (CI2)

Hyundai HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai. 03/1204/12 TBA TBA HyundaiHongkong 0139E N1593 259330-21/11 Hyundai HMM Shpg. Port Kelang, Singapore, Laem Chabang, Caimep, Kaohsiung, Seabird CFS 09/1210/12 TBA TBA Hyundai Busan 0141E Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 19/1220/12 TBATBA Hyundai Colombo 0129E

TS Lines TS Lines (I) Singapore, Pusan, Shanghai,Ningbo, Shekou & South East Asia Dronagiri-2 Far East & China Ports. China India Express Service (CIX/ICX)

Gold Star Star Ship Singapore, Kwangyang, Pusan, Shanghai, Ningbo Ocean Gate Sinokor Sinokor India Port Kelang, Singapore, Hong Kong, Kwangyang, Seabird CFS Busan, Shanghai, Ningbo & Other Inland Destination.

NEW DELHI: India has identified five priority issuesgrowth and prosperity, Resilient Global Value Chains, MSMEs, Logistics, and WTO Reform-under its G20 PresidencyfromDecember1,2022toNovember30,2023.

The Commerce and Industry Ministry, which is the nodal agency for the G20 Trade and Investment Working Group (TIWG), is likely to propose a common digital platform for ease of cross-border trade, a legal aid system for developing countries for dispute settlement in WTO, ways to eliminate distortionary non-tariff measures for developing countries and LDCs, and a framework to address crucial issues at the WTO in clearly defined circumstancesliketheCovid-19pandemic.

“Issues are evolving and we want a good outcome in G20,” said an official. Establishing an online digital portal that offers integrated trade and business information for market research by MSMEs is another suggestion on whichdiscussionscouldtakeplace.

“G20 could deliberate upon a possible framework for addressing the issues of global relevance for enabling members to go beyond the general exceptions under the WTO agreements, in very narrow and clearly defined circumstances like the pandemic,” the Ministry has proposed.

It has also proposed evolving common principles to facilitate decentralised trading, an inclusive trade action plan that defines clear objectives for driving inclusion in

goods and services trade, and evolving principles to ensure foodsecuritythroughremunerativepricesoffarmgoods.

Geospatial mapping of global value chains (GVCs) for critical and essential sectors, network restructuring, supply chain management solutions and building awareness of risks of acute supply chain disruptions is anotherpriorityarea.Theemphasisonglobalvaluechains is key as in its issue note for the TIWG, the Ministry has said that the path to recovery from the pandemic has been “slowandfragile”andhasbeen“complicatedbythesupply shocks triggered due to fraught geopolitical tensions, whichhaveledtowidespreadfoodinsecurityandacost-oflivingcrisis”.

NEW DELHI: India’s reliance on trade with China continuestobeontherise–irrespectiveofthepoliticaland diplomaticstand-offbetweenthetwonations.Eventhough Prime Minister, Narendra Modi, did shake hands with China’s President, Xi Jingping, in Bali during the G20 Summit, India is trying its best to shake off its dependence onChina.

“IndiaandChina’stradehasincreasedby14.6percent during the first nine months of the ongoing year to reach $103.6 billion,” reiterated China’s Foreign Ministry spokesperson, Zhao Lijan. The spokesperson also said that China’s trade with South Asian countries nearly doubled from what it was a decade ago. One of the largest contributors to this increase was India. “India has been trying to boost domestic manufacturing and is also trying tobuyfromothermarkets,buteconomiesofscaleandcost effectivenessgiveChinaanedge,”saysources.

India’s currently has a Free Trade Agreement (FTA) with the United Arab Emirates (UAE); has finalised one

with Australia and one in the pipeline with the United Kingdom (UK) that will lead to a reduction in trade dependenceonChina,butitwilltakeafewyearsbeforethe results begin to show. There is also a trade imbalance as while imports from nations increased, but exports from Indiahavegonedown.LastyearChina’sexportsincreased by over 30 per cent whilst India’s exports declined by over 35 per cent. India exports raw materials to China but importsprimarilyfinishedgoods.

“China’s trade with South Asian countries nearly doubled compared to a decade ago and totalled $187.5 billion in 2021, up by over $50 billion than the pre-COVID number in 2019. In particular, trade between China and India in the first nine months this year reached $103.6 billion, up 14.6 percent year-on-year,” says China’s foreign ministry spokesperson adding that the China-Pakistan Economic Corridor, the Port City Colombo project and the Hambantota Port in Sri Lanka and other connectivity cooperationprojectsareallmakingsteadyprogress.

NEW DELHI: India is well placed to grow at a moderately brisk rate in the coming years on the back of macroeconomic stability, despite the global monetary tightening, it said. So far in the current year, India’s food security concerns have been addressed and will continue to receive the utmost priority from the Government, accordingtothereport.

“A rapid deterioration in global growth prospects, coupled with high inflation and worsening financial conditions, has increased fears of an impending global recession. The global slowdown may dampen India’s exports businesses outlook; however, resilient domestic demand, a re-invigorated investment cycle, along with strengthenedfinancialsystemandstructuralreforms,will provide impetus to economic growth going forward,”

according to Finance Ministry’s latest monthly economic reviewreport.

Merchandise exports declined 16.7% on year in October, the first drop in 20 months and the worst slide since May 2020, when a nationwide lockdown was imposed to contain the Covid outbreak. The World Trade Organisation recently warned of a darkened 2023 and projectedthatglobaltradegrowthwilldroptoonly1%next yearfrom3.5%in2022.

Continued macroeconomic stability, of which fiscal prudence is a part, and execution of various path-breaking policies such as the Gati Shakti, National Logistics Policy andtheProduction-LinkedIncentiveschemestoboostthe manufacturingshareofemploymentlendfurtherupsideto India’sgrowthprospects,itsaid.

MUMBAI: India’s outbound shipments could slow amid the global recession and uncertainties, Commerce and Industry Minister PiyushGoyalsaidonNovember24.

In October, the country’s exports declined sharply 17 percent, the first shrinkageinnearlytwoyears.Thetrade deficit widened sharply. India’s current account deficit will beach the red line of 3 percent of gross domestic product this fiscal year, primarily because of the tradegap.

India’s trade deficit has ballooned in recentmonthsamidelevatedcommodity prices and a recovering domestic economy which has boosted imports. Meanwhile, a slowing global economy

haspressuredoutboundshipments.

The Country is on the path of rapid recovery. India is seen a global bright spot and is evincing interest from companies that is seeking to shift away from China, the Minister said. While the trade deficit has widened, the trajectory isundercontrol,headded.

As such, the import basket comprises large chunks of raw materials, intermediate and capital goods, as well as crude oil, shipments of which indicate higher domestic activity, accordingtotheMinister.

Capacity utilization of over 80 percent in most industries is a sign of upcominginvestments,Goyalsaid.

WhileIndiawillbeamongthefastest

growing major economies this year, growth forecasts have been slashed in recent weeks. However, the Government is hopeful of a sustained medium-termgrowthtrajectory.

India was expected to sign the free trade pact with the United Kingdom by Diwali this year but the process was stalled due to change in leadership in the UK. Responding to a question on whether the trade talks would be prolonged, Goyal said that the negotiations were underway and decisionswouldnotbetakeninahurry.

“Everything is on the table… until yousignonthedottedline,everythingis open,”headded.

FTA will significantly expand and diversify India’s trade with its largest trading bloc GCC

NEW DELHI: Shri Piyush Goyal, Minister of Commerce and Industry, Consumer Affairs, Food, and Public DistributionandTextiles,Government of India, and His Excellency Dr. Nayef FalahM.Al-Hajraf,SecretaryGeneral, Gulf Cooperation Council (GCC), held aJointPressConference,inNewDelhi recently, to announce the intent to pursue negotiations on the India-GCC FTA.

With forward-looking and solution-oriented deliberations, bilateral engagements witnessed significant progress on all matters of mutual interest across the entire gamut of bilateral economic relations betweenIndiaandtheGCCnations.

Both sides agreed to expedite conclusion of the requisite legal and

technical requirements for formal resumption of the FTA negotiations. The FTA is envisaged to be a modern, comprehensive Agreement with substantial coverage of goods and services. Both sides emphasized that the FTA will create new jobs, raise living standards, and provide wider social and economic opportunities in India and all the GCC countries. Both sides agreed to significantly expand and diversify the trade basket in line with the enormous potential that exists on account of the complementary business and economicecosystemsofIndiaandthe GCC.

It may be noted that the GCC is currently India’s largest trading partner bloc with bilateral trade in FY

2021-22 valued at over USD 154 billion with exports valued at approximately USD 44 billion and imports of around USD 110 billion (non-oil exports of USD 33.8 Billion and non-oil imports of USD 37.2 Billion). Bilateral trade in services between India and the GCC wasvaluedataroundUSD14billionin FY 2021-22, with exports valued at USD 5.5 Billion and imports at USD 8.3Billion.

GCC countries contribute almost 35% of India’s oil imports and 70% of gas imports. India’s overall crude oil imports from the GCC in 2021-22 were about $48 billion, while LNG and LPG imports in 2021-22 were about $21 billion. Investments from the GCC in India are currently valued at over USD18billion.

NEW DELHI: The Indian Sugar Mills Association (ISMA) said India is likely to extend the limit of sugar exports by 2-4 million tonnes in the 2022-23 season. The move will leave total exports at 8-10 million tonnes andbelowlastyear’slevel.

Rahil Shaikh, Vice-President of the All India Sugar Traders Association, talked about the agreements with various mills for the export of a total of 60 lakh tonne of sugar which would be completed by December while the physical deliveries to be executed by March-end.

India, which is the world’s biggest sugar producer and the second biggest exporter after Brazil, exported over 11 million tonnes of sugar in the October-September

NEW YORK: A recession is unlikely in the APAC region in the coming year, although the area will face headwinds from higher interest rates and slower global trade growth, Moody’s Analytics said recently. In its analysis titled ‘APAC Outlook: A Coming Downshift’, Moody’s said Indiaisheadedforslowergrowthnext year more in line with its long-term potential.

On the upside, inward investment and productivity gains in technology as well as in agriculture could accelerate growth. But, if high inflationpersists,theReserveBankof India would likely take its repo rate well above 6 per cent, causing GDP growth to falter. In August, Moody’s

seasonof2021-22.

The Government earlier this month approved a first tranche of exports for 2022/23 at 6 million tonnes in a move that helped cap recent upward pressure on benchmark ICE sugarprices.

After last year’s record 112 lakh tonneofexports,Indianmillerstalked about another year of good overseas sales. The Government had issued a mill-wisequotaforexportswithatotal 60 lakh tonne of sugar expected to be shipped out in the first tranche. The industry hopes that the government wouldallowexportsof20lakhtonneof further exports once the first lot is exportedout.

Shaikh, who is also the MD of MEIRcommodities,anexport-import

firm, said they have seen good demand from countries like China, BangladeshandcountriesintheHorn ofAfrica.

“Definitely there will be a second tranche…between2-4milliontonnes, depending on production,” quoted Aditya Jhunjhunwala, President of ISMA, as saying on the sidelines of the International Sugar Organisation seminarinLondon.

He said India would likely produce 36 million tonnes of sugar and 5 milliontonnesofethanol.

Indian consumption is at around 27-27.5 million tonnes, so that leaves 8.5-9milliontonnesforexport,hesaid, adding mills have already signed contracts to export 4 million tonnes of sugar.

had projected India’s growth to slow to 8 per cent in 2022 and further to 5 per cent in 2023, from 8.5 per cent in 2021.

It said the economy of the AsiaPacific (APAC) region is slowing and this trade-dependent region is feeling the effects of slower global trade. Global industrial production has remained “fairly level” since it peaked in February just prior to Russia’s invasion of Ukraine. “China is not the only weak link in the global economy. The other giant of Asia, India, also suffered a year-to-year decline in the value exports in October. At least India relies less on exports as an engine of growth than does China,” Moody’s Analytics

On the regional outlook, Moody’s said even though India, as well as other major economies of APAC regionareexpandingduetotheirown delayed reopening from pandemicrelated shutdowns, the expected slowdowns in Europe and North America, along with China’s sluggish economy, will cause 2023 to be a slower year than 2022 for economic growth.

“That said, a recession is not expected in the APAC region in the coming year, although the area will face headwinds from higher interest rates and slower global trade growth,”Cochraneadded.

m.v “ISE” V-135 I.G.M. No. 2327926 Dtd. 25/11/2022

The above vessel is arriving at MUMBAI PORT on 30/11/2022 with import cargoes from FUKUYAMA and KOBE.

Consignees expecting import cargoes on the captioned vessel are requested to present their ORIGINAL BILLS OF LADING duly discharged and obtain Delivery Orders. In the event of Mumbai Port Trust directing the shifting of the cargo from quay to a storage area within the docks, the same will be undertaken by the vessel agents at the consignee’s risks and costs.

“Stamp duty” is payable as per the directive of the Superintendent of stamps.

Consignees will please note that the Carriers and/or their agents are not bound to send the individual notifications regarding the arrival of the vessel or their cargo.

Consignees are requested to arrange for clearance of the cargo at the earliest on presentation of the packing list to our attending surveyors, as it is noticed that the cargo is arriving without proper Marks & Numbers and the same is also not indicated in the Bills of Lading for which the vessel/Owners/Agents will not be held responsible for the consequences arising thereof.

Consignees requiring steamer survey to be conducted for the goods discharge may contact the agents office for the same.

The company’s Surveyors are M/S. AINDLEY MARINE PVT. LTD.,9 Kamanwala Chambers, 1st Floor, Sir P. M. Road, Fort, MUMBAI - 400001. Tel: +91-22-66359901/2/3 Email: ops@aindley.com and the usual survey conditions will apply General Agent

TO

Gold Star Line Ltd.

“SINAR BANGKA” (ZIM VOY WRG 448/E) The above vessel is arriving at NHAVA SHEVA (BMCT) on 29/11/2022 with Import Cargo in containers.

1 GOSUBKK80251976 2

3

4

5 GOSUGZH0272229 6 GOSUGZH02722291 7

8 GOSUGZH02722293 9 GOSUHAI80059638 10 GOSUHAI80059741 11

12 GOSUHCM80307431 13 GOSUHKG83390892 14 GOSUHKG83391968 15 GOSUHKG83393525 16 GOSUJKT000063374 17 GOSUJKT8086527 18 GOSUJKT8086528 19 GOSUJKT8086529 20

21

22 GOSUJKT8086532 23

Item Nos. B/L

Item Nos. B/L

72

73

74

75

76

77

78

79

24 GOSUJKT8086534 25 GOSUJKT8086536 26 GOSUJKT8086702 27 GOSUJKT8086781 Item Nos. B/L NOS. 28 GOSUJKT8086841 29

30 WFNS2210166 31 WFNS2210179 32 SZYC22101404 33 WOLSZSE22103096 34 VINSA2210025 35 VINSA2210026 36 VSNSA2211001 37 HKC2022021008 38 HKC2022021008A 39 LW2022100385 40 CANNAV07714 41 CANNAV07744 42 CANNAV07742 43 PCNVS22110008 44 KHNNAV05403 45 BJKT11311NSA 46 JKTNHV2201091 47 WTLQGD22100024B 48 WTLQGD22100024A 49 SUBNSA22110002 50 SZYC22101423A 51 SZYC22101423B 52 SZYC22100759 53 SZYC22100872 54 SZYC22100834 55 SZYC22101197 56 SZYC22101327 57 SZYC22101610 58 SZYC22100924 59 SZYC22100421 60 RSJ2200397 61 WTLSZN22100008 62 WTLSZN22100020 63 BKK206014073 64 LW2022100320 65 GSZS0075706 66 GOSUQIN6310845 67 GOSUQIN6310860 68 GOSUQIN6707229

80

81

82 GOSUSNH1608477 83 GOSUSNH20820387 84 GOSUSUB8080888 85 GOSUSUB8080967 86 GOSUSUB8080969 87 GOSUSUB8080984 88 GOSUHCM80305839 89 GOSUJKT000063385 90 GOSUJKT8086933 91 GOSUJKT8086976 92 GOSUJKT8087047 93 GOSUSNH20820495 94 GOSUIAU3024167 95 GOSUJKT8086483 96 GOSUSHH30958949 97 GOSUSNH1683448 98 GOSUJKT8087000 99 GOSUCGP8354058 100 GOSUCGP8354143 101 GOSUSHH30959680 102 GOSUGZH0272143 103 SZYC22101254 104 GOSUSHH30963571 105 GOSUSHH309635711 106 GOSUSHH309635712 107 LNLUPKL8113703 108 LNLUPKL8113704

Consignees are requested to obtain DELIVERY ORDERS on presentation of ORIGINAL BILLS of LADING and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS movement due to port congestion Line/Agent are not responsible for the same. Consignees will please note that the Carriers and/or their Agents are not bound to send Individual Notifications regarding the arrival of the vessel or the goods.

For detailed information on cargo availability please contact our office. For any charges enquiries, Please contact on our Import Hotline No. : 4252 4444 Container Movement to : OCEAN GATE CONTAINER TERMINAL PVT. LTD. As Agents : STAR SHIPPING SERVICES (INDIA) PVT. LTD.

Raheja Centre-Point, 3rd Floor, 294, C.S.T. Road, Near Mumbai University, Kalina, Santacruz (East), Mumbai - 400 098. Tel : 91-22-4252 4301 Fax : 91-22-4252 4142

PARADIP: Paradip Port has witnessed a surge in coal handling on the back of an increase in Coastal Shippingofthermalcoalandimports.

According to P L Haranadh, Chairman of Paradip Port Authority, Coastal Shipping of thermal coal is up by nearly 60 per cent so far this year and expected to cross 40 million tonne (mt) as against 28 mt during last year. Coal imports from countries such as Australia, Indonesia and South Africa has also beenhappeninginabigway.

Paradip Port undertakes Coastal Shipping of thermal coal to gencos in Tamil Nadu, Andhra Pradesh and Karnataka. Coal from Mahanadi Coalfields, which is situated around 200 kms away from Paradip, comes by rail to the port. This works out to be much cheaper as compared to all rail routes,directlyuptodestinations.

“We have seen a massive jump in coastal shipping of thermal coal becauseourratesarecheaperandwe have been able to create the necessary operational ease. The capacity to handle at our terminals has increased to close to around 55 rakes now as compared to around20rakesearlier.Thishasbeen possible due to commissioning of new terminal and improvement of operational procedures at old terminal,”Haranadhsaid.

This apart, there has been a surge in demand for both coking coal for steel manufacturing units and thermal coal for power plants during the year in anticipation of higher demand . Coking coal from Australia and South Africa and thermal coal from South Africa and Indonesia has been“cominginabigway”,hesaid.

Paradip Port has brought about substantial improvement in operations, thereby enabling better traffic handling. The overall productivity of the port has gone up to around 30,000 tonnes a day as against closeto25,000tonnesadayearlier.

“The improved productivity is mainly due to streamlining of processes by improving crane availability, bringing in berth mechanisation and putting in place improved railway loading system. So we are able to handle more traffic. This year we also plan to coastal ship thermal coal to gencos, located on the west coast, for the first time in the historyoftheParadipPort,”hesaid.

Paradip Port which had handled close to 116 mt of cargo in 2021-22, is expecting to be able to handle more than 125 mt of cargo this year on the backofhugesurgeincoalhandling.

NEW DELHI: The construction work at India’s first Multi-Modal Logistics Park (MMLP) in Assam’s Jogighopa is nearly complete, Govt officialssaidrecently.Thepark,under theCentre’s‘BharatmalaPariyojana’, will provide direct air, road, rail and waterwaysconnectivitytotheregion.

“The first phase was scheduled to be completed by 2023. As of now, it is nearly complete. Some minor works are left and within next two-three months, it will be finalised,” official awareofthemattersaid.

The park is being constructed by the National Highways and

Infrastructure Development Corporation (NHIDCL) in 317-acre land along the Brahmaputra river. Union Minister for Road Transport and Highways Nitin Gadkari laid the foundation stone for the project in October2020.

According to the Ministry documents, the project is expected to generate revenue worth around Rs 1,000croreinthefirstthreeyearsfrom start of operation. Also, according to the Detailed Project Report, the estimated total employment to be generatedafterthecommencementof MMLPis11,521jobs.

The Government plans to build 35 suchMMLPsacrosstheCountry. MMLPinChennai

The official also said the work for another MMLP, situated in Chennai, will be the first MMLP that will be developed on public private partnership (PPP) model. The Jogighopa MMLP is being developed bytheMinistry,theofficialclarified.

Prime Minister Narendra Modi laid the foundation stone of this projectinChennaiinMay2022.

“MoRTHisdeveloping35MMLPs. At least 15 of these are prioritised for thenextthreeyears,”hesaid.

Group developed The Kerala government’s ambitious Rs 7,500 crore Vizhinjam Seaport, in the Southernmost part of the Kerala State,hasbeenfacingdeadlockdueto the over 100-day protest by the locals led by the leadership of the LatinCatholicArchdiocesehere.

Keen to finish the project as early as possible, the state government has appealed to the church authorities to end the protest as it was crucial for bringingchangestotheindustrialand economic sector of the country. The Vizhinjam International Transhipment Deepwater Multipurpose Seaport is being developed in a landlord model with a Public Private Partnership

componentonadesign,build,finance, operate and transfer (“DBFOT”) basis at an estimated cost of Rs7,525crore.

The Government claimed it has accepted almost all demands of the protesters. However, the protesters are not ready to budge, alleging the project will adversely affect the livelihood of the fishermen, coastal eco-system and the ecology of the Western Ghats due to mining of granitestonesforthesame.

The agitators also alleged the governmenthasnotgivenanywritten assurances on their demands even after many Minister-level discussions.

Adani Vizhinjam Port Private Limited, the private partner,

commencedtheconstructionworkon December 5, 2015. The port authoritiesclarifiedthat70percentof the work has now been completed but for the last few months, the construction was halted due to the protests.

The protesters have been demanding the construction of the deepwater port be stopped as it has affectedthecoastaleco-system.

They have urged the Government to conduct a proper environmental impact study of the project, besides putting forward six other demands including rehabilitation of families who lost their homes to sea erosion, steps to mitigate coastal erosion and financial assistance to fisherfolk on daysweatherwarningsareissued.

CJ-I MV Aggelos B Rishi Shpg. 30/11

CJ-II MV Tai Summit ACT Infra 04/12

CJ-III MV Haseen Aqua Shpg. 01/12

CJ-IV MV Safeen AL Amal Interocean 01/12

CJ-V MV Smew Benline 29/11

CJ-VI MV Anthos Dariya Shpg. 30/11

CJ-VII MV Venture Grace Cross Trade 29/11

CJ-VIII MV Berge Snowdon Synergy Seaport 01/12

CJ-IX VACANT

CJ-X MV Tan Binh 135

CJ-XI MV TCI Express TCI Seaways 29/11

CJ-XII MV SSL Kutch Transworld 29/11

CJ-XIII MV Dioni Cross Trade 30/11

CJ-XIV MV Abigail Shantilal Shpg. 01/12

CJ-XV MV Clipper Barola Chowgule Bros. 29/11

CJ-XVA MV Amarnath Aditya Marine 30/11

CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 30/11

Tuna Tekra Steamer's Name Agent's Name ETD

MV Championship Tauras 30/11

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I MT Silver Belle Seaworld 29/11

OJ-II MT Shandong Zihe

OJ-III MT Devashree Samudra 29/11

OJ-IV MT Chemroute Oasis

OJ-V MT Stolt Lerk J M Baxi 29/11

OJ-VI MT GH Austen Seaworld 29/11

CJ-XIV

Interocean Sudan 29,090 T. Sugar Bags 2022091338 28/11 MV Bao Shun Rishi Shpg. 18,601 CBM Logs 2022111238

Stream

Stream MV Chakravati Chowgule Bros. Cotonou 50,000 T. Rice Bags 2022111169

CJ-XV MV Clipper Barola Chowgule Bros. Vietnam 41,000 T. Sugar In Bulk 2022101373

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335 OJ-III MT Devashree Samudra 6,000 T. Chem. CJ-XIII MV Dioni Cross Trade 57,000 T. Salt In Bulk 2022111198

Stream MV Elisar Ocean Harmony Durban 31,750 T. Sugar Bags 2022111243 28/11 MV Habco Aquila BS Shpg. Bangladesh 44,000 T. Salt 2022111316 CJ-III MV Haseen Aqua Shpg. 45,000 T. Sugar In Bulk 2022111121

Stream MV Kapetan Sideris Chowgule Bros. Vietnam 54,000 T. Salt 2022111280 CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 69,300 T. Laterite 29/11 MV Kosman Arnav Shpg. West Africa 24,500 T. Rice In Bags 2022111274 28/11 MV Meghna Rose BS Shpg. Bangladesh 55,000 T. Sugar Bulk 2022111157

Stream MV My Lama Interocean Sudan 25,000 T. Sugar Bags 2022111127

Stream MV Obe Heart Interocean 25,000 T. Sugar Bags 2022111247

Stream MT Oriental Hibiscus Allied Shpg. Marseille 4,500 T. C. Oil 2022111156 03/12 MV Pac Adhil Tristar Shpg 2,500/1,500 T.M.Chloride/Sulphate & 18

Stream MV Pegasus 01 DBC 8,000 T. Sugar Bags 2022111256

Stream MV PVT Sapphire Cross Trade 55,000 T. Salt 2022111248

CJ-IV MV Safeen AL Amal Interocean Sudan 33,000 T. Sugar Bags 2022111040

Stream MV Sea Champion Aditya Marine West Africa 30,460 T. Rice Bags 2022111178

Stream MV Stentor Interocean 27,450 T. Sugar In Bags 2022111187

Stream MV Suvari Kaptan DBC Somalia 9,500 T. Sugar Bags 2022111148

CJ-II MV Tai Summit ACT Infra 30,250/10,500 T. Rice Bags 2022111089

30/11 MV Theotokos BS Shpg. Madgasakar 28,000 T. Rice Bags 2022111268

B Rishi Shpg. 36,306

31,300 T.

2022111272

Anthos Dariya Shpg. Russia 69,690 T. Coal 2022111244 30/11

Armonia J M Baxi Indonesia 53,360 T. Petcoke In Bulk 2022111195 CJ-VIII MV Berge Snowdon Synergy Seaport 36,355 CBM Logs Tuna MV Championship Tauras 1,03,788 T. Coal 2022111201 Stream MV Fan Zhou 6 Mystic Shpg. 343 (90/251/2 Blades/Access./SOC) 2022111123 02/12 MV Jimmy T Tauras 14,388 T. MOP 2022111004 30/11 MV Josco Changzhou GAC Shpg. U.S.A. 52,533 T. Petcoke In Bulk CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 69,200 T. GYPSUM In Bulk 2022111257 28/11 MV Moana Infinity TM International Indonesia 52,500 T. INDO Coal 2022111270 05/12 MV Obe Grande Tauras 42,000 T. DAP Stream MV Panorea Dariya Shpg. 37,010 T. Coal Stream MV Sea Prajna Benline 21,057/10,442 T. HMS/Sh Scrap 2022111263 CJ-V MV Smew Benline 31,497 T. S. Scrap 06/12 MV True Courage Tauras 1,28,470 T. Coal Stream MV True Confidence Seascape 27,079 T. Met Coke 2022111125 CJ-VII MV Venture Grace Cross Trade 43,200 T. MOP 2022111132 Stream MV VGS Dream United Safeway 7,250 T. Lime Stone 2022101371

28th NOVEMBER 2022 21

B-12 SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXT PORT SAILING DATE VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD CB-3 Northern Dexterity (V-2246W) Hapag Llyod 29/11 CB-4 Brilliant Ace (V-96A) MOL Shipping 29/11 B-5 Pontresina (V-237E) Star Shipping 29/11 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE

BASSIN WB-01 MV Malene Oldendorff GAC Shipping WB-02 VACANT 28/11 MSC Stella (V-247A) MSC Agency Bin Qasim 29/11 MSC CaledoniaII (V-247A) MSC Agency Bin Qasim 30/11 SM Neyyar (V-0042) Samsara Shpg. Karachi

In Port Pontresina (V-237E) Star Shipping Nhava Sheva In Port Northern Dexterity (V-2246W) Hapag Llyod Khalifa 28/11 Budapest Express (V-2347W) Hapag Llyod Hazira In Port Ikaria (V-009W) Hapag Lloyd Jebel Ali 29/11 Bfad Pacific (V-243N/247S) Maersk Nhava Sheva

STS VACANT LNG VACANT ADANI INTERNATIONAL CONTAINER TERMINAL (AICT)

MV Trawind Roc Samsara Shpg. ADANI MUNDRA CONTAINER TERMINAL (AMCT) ETA VESSEL’S NAME AGENT FROM VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD SB-6 MSC Michigan VII (V-244A) MSC Agency 29/11 SB-7 MSC Teresa (V-245A) MSC Agency 29/11 SB-8 Hyundai Singapore (V-132) Seabridge Maritime 29/11 SB-9 01/12 SCI Chennai (V-540) JM Baxi Tuticorin 02/12 MSC Joanna (V-247A) MSC Agency Nhava Sheva 01/12 MSC Levina (V-247R) MSC Agency Mombasa

WB-03 VACANT ETA VESSEL’S NAME AGENT FROM SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXTPORT SAILING DATE OOCL Washington (V-072W) New York 24-12-2022 Koi (V-W1MA) Jebel Ali 26-12-2022 CMA CGM Lebu (V-W1MA) Matadi 27-12-2022

VACANT HMEL MT Besiktas Dardanelles Interocea ETA VESSEL’S NAME AGENT FROM

Kyoto Express (V-2346W) Jeddah 26-11-2022 Triumph Ace (V-171A) Mumbai 26-11-2022 Berlin Express (V-2245W) Barcelona 27-11-2022 Ever Uberty (V-179E) Port Kelang 27-11-2022

30/11 Ever Uranus (V-154E) Emirates Shipping Karachi 30/12 AS Alva (V-914W) Tranworld Jebel Ali 01/12 Celsius Naples (V-892E) Transworld Nhava Sheva

VESSEL'S AT SPM ADANI CMA MUNDRA CONTAINER TERMINAL PVT LTD (ACMTPL), MUNDRA VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD SB-04 Ikaria (V-009W) Maersk India 29/11 SB-05 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME AGENT FROM ETA VESSEL’S NAME AGENT FROM 29/11 ESL Asante (V-02247S) CMA CGM Nhava Sheva 02/12 Xin Yan Tai (V-224W) COSCO Nhava Sheva

02/12 02/12-AM

02/12 09/12 09/12-AM

248W

(MECL) 09/12 TO LOAD FOR FAR EAST, CHINA, JAPAN,

NEW

28/11 28/11-AM Xin Hong Kong 058 22376 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 28/11 28/11 28/11-AM Seaspan Chiba 012WE 22377 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 28/11 05/12 05/12-AM Wide Juliet 025WE 22390 ONE ONE (India) (TIP) 05/12 30/11 30/11-AM

Commitment 057E 22373 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 30/11 08/12 08/12-AM MOL Creation 086E 22385 Ningbo, Sekou, Cai Mep. (PS3) 08/12 01/12 01/12-AM Aka Bhum 010E 22378 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 01/12 06/12 03/12-AM OOCL New York 090E 22393 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 06/12 04/12 04/12-AM Grace Bridge 248E 22379 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 04/12 11/12 11/12-AM BSG Bimini 249E 22387 Ningbo, Tanjung Pelepas. (FM3) 11/12

28/11 28/11-AM SSL Kutch 245 22383 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 28/11 29/11 29/11-AM SCI Mumbai 552 22370 SCI J. M Baxi Jebel Ali. (SMILE) 29/11 02/12 02/12-AM Santa Rosa 247W 22382 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 (MECL) 09/12

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

28/11 28/11-AM Xin Hong Kong 058 22376 COSCO COSCO Shpg. Karachi, Colombo (CI1) 28/11 28/11 28/11-AM Seaspan Chiba 012WE 22377 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 28/11 05/12 05/12-AM Wide Juliet 025WE 22390 ONE ONE (India) (TIP) 05/12 01/12 01/12-AM Aka Bhum 010E 22378 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 01/12 04/12 04/12-AM EM Astoria 248S 22380 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 04/12 04/12 04/12-AM Grace Bridge 248E 22379 SCI J. M Baxi Colombo. (FM3) 04/12

28/11 28/11-AM Seaspan Chiba 012WE 22377 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 28/11 05/12 05/12-AM Wide Juliet 025WE 22390 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 05/12 30/11 30/11-AM One Commitment 057E 22373 ONE ONE (India) Los Angeles, Oakland. (PS3) 30/11 02/12 02/12-AM Santa Rosa 247W 22382 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 Safmarine Maersk Line India (MECL) 09/12

08/12 Northern Practise 0029 X-Press Feeders/ONE Sea Consortium/ONE(I) (ASX) 08/12 Hapag / CMA CGM ISS Shpg./CMA CGM Ag. (I) 02/12 Xin Yan Tai 224W Hapag / COSCO ISS Shpg./COSCO Shpg. Jeddah, Tanger, Southampton, Rotterdam, Bremerhaven, Antwerp, 02/12 CMA CGM/OOCL CMA CGM Ag.(I)/OOCL(I) Le Havre, Algeciras (EPIC) 03/12 Green Pole 248E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 04/12 X-Press Feeders Sea Consortium Doha (Arabian Star) 03/12 MSC Eugenia IP248A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 04/12 10/12 MSC Lisbon IP249A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 11/12 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK)

Cont’d. from Pg. 3

The new service provides a comprehensive suite of services for customers – from Rail booking and the transportation of Direct Port Delivery (DPD) boxes from PSA Mumbai to Deshabhimani Publications’ factory in Cochin, returning the destuffed empty containers to PSA Mumbai before trucking to an empty container depot at NhavaSheva.

This Multimodal solution was established to service the needs of Deshabhimani Publications, a major Indian paper importer. The maiden Rail Freight Service carried 40 FEUs (forty-foot equivalent units) of cargo from PSA Mumbai to the India Gateway Terminal (IGT) in Cochin, thus creating a new Sea-Rail-Road mode of transport to move cargo directly to the end factory instead of transportingcargoviaseatoCochin,reducingthetransit timefromaround70daysto40daysfromtheportoforigin inSt.Petersburg,Russia.

PSA India has continuously been developing key rail corridors between north and central India and PSA Mumbai. The new rail connections have been introduced at a time when many companies are opting for more environmentally sustainable transport solutions, shiftingcargotorailtolowertheircarbonemissions.

MUMBAI:A.P.Moller–Maersk(Maersk),theintegrated logistics company, continues to design and implement logisticssolutionsthataddresstheever-evolvingneedsofits customers. Building further on its strong commitment towards developing a robust rail service network in India, Maersk flagged off yet another weekly, dedicated rail service, the ‘Pratigya Express’, from Sonipat Inland Container Depot (ICD) in NCR to APM Terminals Pipavav Port on the westerncoastofIndiainGujarat.

“TheNCRisabundantwithretailandriceexporterswho need a regular connection from their manufacturing facilities to the consumers in the western market. Through our dialogues with our customers, we realised that they facedtwochallenges-eithertheydon’thaveafixedschedule fordeparturefromSonipatICD,andoncetheygetit,theydo not necessarily make it to the right vessel connection at the port,” said Major Jyoti Joshi Mitter, Head of Rail, Maersk India. She added, “Our ambition was to address both these problems with a single solution - we launched a dedicated weekly rail service that gives the exporters a fixed visibility on departure from the origin and then connects to a fixed vessel connection at the APM Terminals PipavavPort.”

The ‘Pratigya Express’ will move cargo from Sonipat ICD to APM Terminals Pipavav Port with a transit time of two and half days. From there, the cargo will have the option

to connect on services such as the Shaheen Express, which will be launched in the coming days or the MECL. Both of these services will then be able to take the cargo to the Middle Eastern or European markets. Studies show that cargo moved on rail insteadof road has advantages in terms of both cost-savings and time-savings. These two benefits eventuallyalsocontributetoreducingcarbonfootprint.

Maersk’s new ‘Pratigya Express’ service on the Western Dedicated Freight Corridor (DFC) will move 90 TEUs (twenty feet equivalent units of containers) every week. APM Terminals Pipavav Port also plays an important role by being the first port to be connected to the DFC and has excellent connectivity to the hinterland throughitsrailheadandroadinfrastructure.