AHMEDABAD: Adani Ports and Special Economic Zone Limited (APSEZ), India’s largest port developer-cumoperator, has demonstrated its leadership on investors engagement by making it to the honour list of the Institutional Investor Asia Pacific (ex-Japan) Executive TeamSurvey Inthetransportationsector,APSEZistheonly

NEW DELHI: Hon’ble Finance Minister recently met Exporters, Body for a pre-budget consultation. FIEO in its representation said that Exports have clocked a CAGR of 8.5% in last 6 years moving from US$ 478 Bn in FY18 to US$ 778 Bn in FY 24. We are now aiming to reach US$ 2 Trillion by FY 2030, which requires a CAGR of 14.4%, a challenging target but within the realm of the reach. This requires extra efforts by the exporters and an enabling and supportive ecosystem. Cont’d. Pg. 27

Indiancompanytofeatureonthelist,coming in at 2nd rank. A total of 1,669 companies from across Asia, broadly categorised across 18 sectors, were voted in by investors. With the top 2-4 companies in every sector making it to the honour list, the total count of companies on the list stands at 55

Cont’d. Pg. 6

Mr. Ashishkumar Chauhan, Managing Director and Chief Executive Officer of National Stock Exchange of India (NSE) to Grace the Awards Evening as Esteemed Chief Guest

MUMBAI: The 8th Ed India Maritime Awards will in a Grand Evening of 28th 2024 at Hotel Sahara 3rd Floor, Sapphire Ba from 5.30 pm onwards.

S h i p p i n g a n d I n d

Stalwarts, Policy Mak Bureaucrats, CEOs of L Maritime Companies, Pre of Leading Maritime Associations, Port & Customs Officials

g r a c i n g t h i s G r a n d A

C e r e m o n y – O r g a n i s e M a n a g e d b y I n d i a ’ s O Shipping Newspaper –serving the Maritime Trad

Mr. Ashishkumar Chauhan, and Chief Executive O Exchange of India (NSE), Evening as the Esteemed Chief

I n d i a M a r i t i m e Aw Thought-Provoking Panel the current Geo-politi Shipping” that will be Moderated Capt. Deepak Tewar

MSC Agency (India) Private Container Shipping Lines

He will be accompanied Trade Experts including -

• Mr Mukesh Oza, Gr Samsara Group

• Mr. Xerrxes Maste Managing Director, Master

• M r . K h a l i d K h a Vice-President, Fede Organisations

SEOUL: South Korean shipbuilder Hanwha Ocean has handed over a newbuild

LNG -ready 13,000 TEU containership, HMM Ruby, to compatriot shipping company HMM.

HMM revealed the ship’s delivery via social media update on June 24, stating that HMM Ruby is ready to embark on the PSX route (Pacific South Express, connecting South Korea and the United States) starting June 25.

Named after the birthstone of July, HMM Ruby is the seventh of twelve LNGready 13,000 TEU containerships ordered by the Korean shipping player at Hanwha Ocean and HD Hyundai Heavy Industries in 2021

Under the contract, each shipbuilder will construct six vessels with advanced energysaving technologies that are expected to increase fuel efficiency and reduce pollutant emissions. The ships come with LNG-ready structures for potential conversion to LNG propulsion.

Industries in January 2024.

The first unit from this series, HMM Garnet, was built and delivered by HD Hyundai Heavy

When the delivery of twelve 13,000 TEU ships is completed this year, HMM’s fleet capacity is forecast to reach a total of 1 million TEUs In particular, large containerships of more than 10,000 TEU will account for 80% of the shipowner’s entire fleet, enhancing cost structure and operational efficiency.

Cont’d. from Pg. 2

This includes only 4 from India, including APSEZ that scored 1st rank across four parameters –IR P rogram, ESG P rogram, IR team and IR Professionals – from the buy-side and sell-side combined. Also, the company’s board of directors received the 2nd rank and its CEO the top-rank from sell-side analysts.

A total of 4,943 buy-side professionals, managing an estimated USD 2 trillion in Asia (ex-Japan) equities, and 951 sell-side analysts voted for the 1,669 companies. The investors rated the companies on several areas, including financial disclosure, services and communication, ESG and Board of Directors as well as attributes for CEOs, CFOs and the Best IR Professionals.

For the Best Investor Relations Program, companies were evaluated on nine attributes: (1) consistency (2) granularity (3) timing to market (timeliness).

(4) accessibility of senior execs (5) business & market knowledge (6) responsiveness, (7) earnings calls, (8) IR team authority & credibility, and (9) roadshows / conferences / meetings.

C o m m e n t i n g o n t h e a c h i e v e m e n t , Mr. Ashwani Gupta, Chief Executive Ofcer & Whole Time Director of APSEZ, said, “We are pleased to feature on the honour list of companies across the entire Asia Pacific. This accomplishment is a testament to the quality of our Investor Engagement and ESG programs, alongside the commitment and dedication of our team to deliver exceptional service to stakeholders. I would like to thank the investor community for reposing their trust in us and recognising our efforts.”

by Dr. Pramod Sant, A distinguished Industry Expert

Question: We have been approached by Bankers regarding closing of IDPMS cases, On initial scrutiny it was found that most cases pertaining to samples which are imported FOC How to close these cases and avoid suchcasesinfuture?

SOLUTION: First let me comfort you by mentioning that you are not the only one who is facing this problem, there are large number of Importers who are facing sameproblem

What is IDPMS and why this challenge?

To enhance ease of doing business and facilitate efficient data processing for payment of import transactions and effective monitoring thereof, Import Data Processing and M o n i t o r i n g S y s t e m

( I D P M S ) h a s b e e n developed in consultation w i t h t h e C u s t o m s authorities and other stakeholders by RBI from October2016

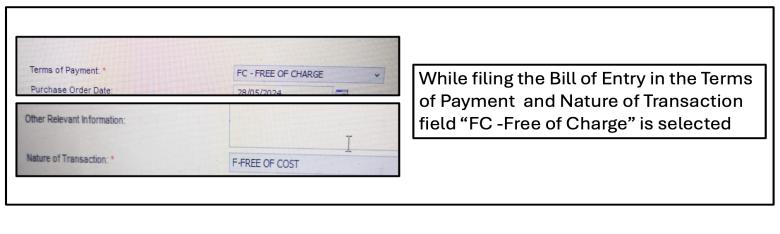

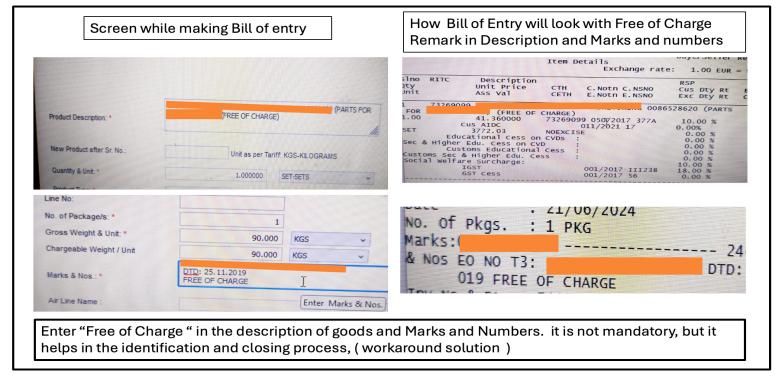

3. In description of Goods “Free of Charge samples” is entered which will reflect inBillofEntry

4 To be on safer side “Free of Charge samples” is entered inMarksandNumbers.

A l l B i l l s o f E n t r i e s processed by the Customs in EDI System are captured in IDPMS In case of all imports foreign exchange remitted paid for import into India, it is obligatory on the part of the bank to check BoE number, Port Code and Date under IDPMS Remittance is done based on Bill of Entry appearing in IDPMS

Now you will realise that as all Bill of Entries are captured in IDPMS, Bill of Entries for Free of charge (FOC) material (like Free Samples etc) also appears in IDPMS

These IDPMS records needs to be closed when Importer approach bank and submit evidence

What care needs to be taken while Importing FOC material/samples

PreparationStage

1. Ensure that there is clear communication with Supplier (Exporter) agreeing for sending FOCmaterial.

2 ValueofSampleagreedisfairmarketvalue.

3. Invoice must mention “Free of Charge samples / prototype, no commercial value, Value mentioned is forCustomsPurposeonly”

4 It is preferable to get “Value Evidence Certificate” which will help in case customs raises query on valuation.

5. IfrequiredcheckProformaInvoicebeforedispatch.

6 AgreementonModeofdispatch,forwardersetc

Filing ofBillofEntry

1. Customs Broker is given clear instruction about FOC Shipments.

2 While filing Bill of Entry in Terms of Payment and Nature of transaction field “FC -Free of Charge” is selected

Many times, Importers are not fully aware of samples imported and it is advisable to ask for first check of samplesshipmentsandcustomsexaminationisdone. Approaching BankforclosureofIDPMS

TohaverecordofallFOCshipments,thereisneedtohave selection criteria in Importers ERP /Web based system or whichwillhelptogivereportofallFOCshipmentsduring selectedperiod.

Alternatively make arrangement with Customs Broker whowillgivereportsofFOCshipments.

With all relevant details like Bill of Entry, AWB/B/L, InvoiceyoucanmakerequesttoBanktocloseIDPMS ItisobservedthatBankhasmadetheirinternalprocesswhere some banks ask additional documents like CA certificate etc evenifsameisnotmandatedbyanyauthorities

Monitoring&Control

PeriodicallyimportanttoaskforlistofOpenIDPMScases from Bank and review same to ensure that there are nosurpriseslater

Most of time samples received are directly handed over to user and other formalities like making GRN (Goods Receipt Note) is not made. It is good practice to make GRN even for FOC samples and keep record in your ERP/system.

Review challenges faced in IDPMS internally with Trade compliance/Export Import dept, Accounting /Finance deptandrelatedstakeholders.

MakeIDPMSopenreportasmonthlyMIS/KPI.

Conclusion: Presently IDPMS has complete list of Bill of EntryincludingFOCandweneedtoworkwithsuchwork aroundsolutionandcloseIDPMS

Marathon Nextgen, Innova “A”-G01, Opp.Peninsula Corporate Park, Off.Ganpatrao Kadam Marg, Lower Parel(W), Mumbai-400013 Board Tel.:022-61657900, Fax: 022-61857299/98/97, E-Mail:info@evergreen-shipping.co.in, Website:http://www.shipmentlink.com/in

HAVA SHEVA : 1st Flr, Anchorage Ship Ags. Premises Co-op Society, Plot No. 02, Sec-11, Dronagiri Node, Navi Mumbai-400707 Tel.: 022-27471601, Fax: 91-22-27246415, E-Mail: nxvlog@evergreen-shipping.co.in

NEW DELHI : 51, Okhla Industrial Estate, Phase - III, 1st Floor, New Delhi-110020 Tel.: 011-61657900 (Hunting), Fax: 011-66459698 / NDI Fax : 011-66459699, E-mail: ndibiz@evergreen-shipping.co.in

NEW DELHI: S&P Global Ratings recently retained India’s GDP growth forecast for the current financial year at 6.8 per cent and said high interest rates and lower fiscal spur would temper demand.

In its economic outlook for Asia Pacific, S&P Global Ratings said India’s economic growth continues to surprise on the upside with the economy growing 8.2 per cent in fiscal year 2023-24.

“We expect growth to moderate to 6.8 per cent this fiscal year, with high interest rates and lower fiscal spur

agricultural sectors,” it said.

For the fiscal years 2025-26 and 2026-27, S&P projected growth rates of 6.9 per cent and 7 per cent, respectively

S&P’s estimates for FY’25 is lower than that of the Reserve Bank of India (RBI), which earlier this month projected the Indian economy to expand at 7.2 per cent in the current fiscal, on the back of improving rural demand and moderating inflation.

While another rating agency Fitch estimates India’s growth at 7.2 per cent

in FY’25, the Asian Development Bank (ADB) estimates India’s GDP to grow at 7 per cent Moody’s Ratings and Deloitte India estimates India’s GDP to grow at 6.6 per cent in 2024-25 fiscal, while Morgan Stanley projects growth rate of 6.8 per cent.

For China, S&P raised its 2024 GDP growth forecast to 4.8 per cent, from 4 6 per cent but sees a sequential slowdown in the second quarter The combination of subdued consumption and robust manufacturing investment will weighonpricesandprofitmargins,itsaid

NEW DELHI : The government is considering a proposal to set up a separate bank for direct lending to the micro, small and medium enterprises (MSMEs) to deepen credit flows to the under-penetrated sector and thereby boost economic activity and job creation.

Currently, the Small Industries Development Bank of India (SIDBI) provides largely refinance to banks that lend to MSMEs, letting the cost of finance to these units reduce State financial corporations and state industrial development corporations

among others lend directly to units in the MSME sector

According to a report, MSME credit penetration is still 14% in India compared with 50% in the US and 37% in China. There is a credit gap of Rs 25 trillion for the Indian MSME sector, reflecting the large untapped credit market.

“There is a need to set up a separate bank for the MSME sector to help address the direct credit shortages,” an official said, adding that such a proposal is under consideration. The government would take a call

on the proposal at an appropriate time, the official added. Among the details to be worked out is the ownership structure of the bank, which might include a hybrid (public-private partereship) model.

Access to adequate, timely and lowcost finance is seen as a key bottlenecks, stymeing MSMEs’ growth to bigger enterprises.

The outstanding credit to the MSMEs by scheduled commercial banks expanded by 20 9% annually to Rs 26 trillion at the end of December 2023.

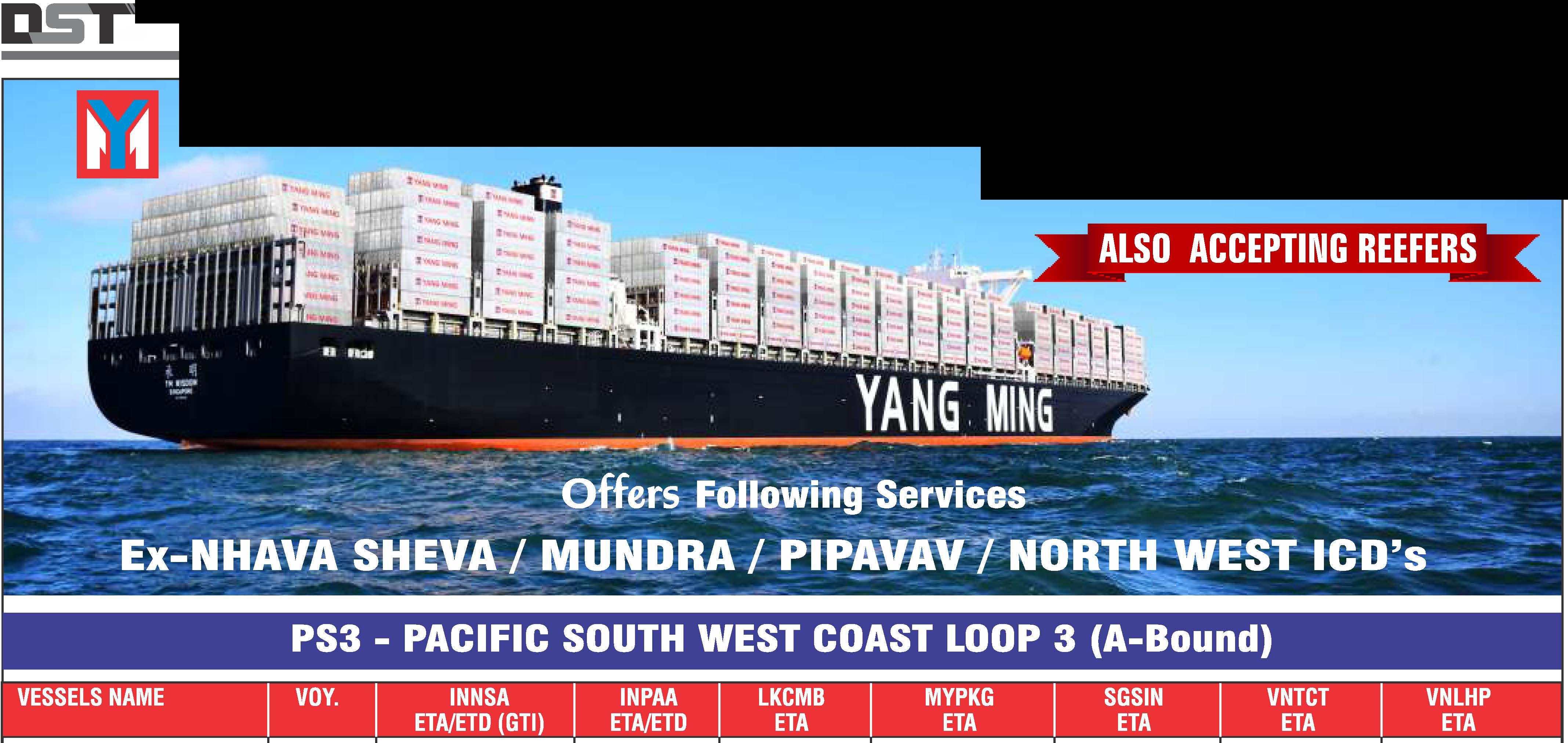

Worldwide Destination at a Glance via Colombo, Port Klang & Singapore

Australia : Brisbane, Sydney, Fremantle, Melbourne, Adelaide

US East Coast : New York, NY, Norfolk, VA, Savannah, GA, Charleston, SC, Jacksonville, FL, Halifax,CA

USWestCoast:LosAngeles, CA, Oakland, CA,Tacoma,WA,Vancouver, CA

South America East Coast : Santos, Navegantes, Paranagua, Rio Grande, Buenos Aires, Montevideo

SouthAmericaWest Coast: Manzanilla, Balboa, BuenaVentura,Callao, StAntonio, LazaroCardenas PuertoQuetzal Guayaquil

China ports: Shanghai, Ningbo,Xiamen, Qingdao,Yeuyang,Zhangijagang,Shekou, Lianyungang, Nansha, Nanjing, Yantian, Yangpu, Wuhu, Wuhan, Nantong, Chongqing,Yangzhou,Taicang,Changzhou,Changsha,Zhenjiang,Nanchang

Cambodia :Sihanoukville

Bangladesh : Chattogram Myanmar : Yangon East Malaysia : Sandakan, Tawau, Bintulu, Kuching

Southeast Asia : Indonesia Philippines Thailand, Singapore, Vietnam, Malaysia

Forfurtherdetailspleasecontact: YANG MING LINE (INDIA) Pvt LTD.

13th Floor, Centre I, World Trade Centre, Cuffe Parade, Mumbai -400 005. India. Tel.: 66221111 Emails: bom-cs@yml.in I bom-mkt@yml.in Ahmedabad: 079-40808800, Bangalore: 080-41122339, Baroda: 0265-2358167, Chennai / Krishnapatnam: 044-66991111, Hyderabad: 040-66339907, Kolkata: 033-40842828, Kochi: 0484-4077999, Ludhiana: 0161- 5060168/69/70, Mundra: 02836-272727, New Delhi: 011-46888800, Pipavav: 02794-286032,Tuticorin: 0461-2352921, Vizag: 0891 -2565775/2791631 YM Accepting Bookingsthrough YM NEW WEB BOOKING INTERFACE log on to : https://www.yangming.com/e-service/member_area/member_login.aspx

H.O.101, Steel Chambers, BroachStreet, CarnacSunder, Mumbai -400009. Tel.: 022-66665400 • Mob.: 09821354569 • Fax: 23480243

E-mail: cargo.rcm@gmail.com • Website: www.rashtriyacargomovers.com

ETAETD VESSELS Voy V.I.A ROT.

30/0602/07

TBATBA Cstar Peter 037 Q0715 299823-20/06 MBK Line MBK Logistics Jeddah, Kumport (India Med Service)

06/0707/07 TBATBA Adyogan Q0719 MAS Diamond Marine TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN, RED SEA & MED. PORTS from

26/0627/06

26/06 1600 Grasmere Maersk (NSIGT) 426W Q0590 298909-06/06 Maersk Line Maersk India Djibouti, King Abdullah, Jeddah (Blue Nile) Maersk CFS

03/0704/07

01/0702/07

07/0708/07

TBATBA Maersk Virginia 427W Q0698 299543-16/06

TBATBA Wan Hai 316 217W Q0672 299461-14/06 X-Press Feeders Sea Consortium Jeddah, Al Sokhna

TBATBA X-Press Altair 24009W Wan Hai Wan Hai Lines (I) (RGI)

22/0723/07 TBATBA SSL Brahmaputra 917W

06/0707/07

TO

TBATBA Addison 006 Q0621 299109-10/06

UnifeederUnifeeder

In Port 26/06 MSC Greenwich IP425A Q0634 1094003-11/06 MSC MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals

28/0629/06 27/06 1600 MSC Maeva IP426A Q0659 1094320-14/06 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D). 05/0706/07 05/07 0900 MSC Fie X IP427A Q0738 1095145-24/06 SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre (EPIC / IPAK)

COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos.

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2

AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3

Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

27/0628/06 27/06 1000 MSC Regulus IS423A Q0625 1093879-10/06 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 05/0706/07 05/07 1100 MSC Camille IS425A Q0737 1095144-24/06 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 08/0709/07 08/07 1100 MSC Ravenna IS424A

U. K. North Continent & Other Mediterranean Ports. HimalayaExpress

Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul.

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service

ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

30/0601/07 29/0623:59 Express Rome 4325W Q0649 299356-13/06 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 07/0708/07 TBATBA Sofia Express 4326W Q0729 299892-21/06 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS 13/0714/07

TBATBA Frankfurt Express 4227W

COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. (IOS) ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports.

Gold Star Star Ship Hamburg, Antwerp, Tilbury. Oceangate CFS 03/0704/07 03/07 1000 MSC Mundra VIII IU425A

MSC MSC Agency Haifa. (INDUS) Hind Terminals TO LOAD FOR U.K.,

In Port 27/06 CMA CGM Titus 0MXJPW1 Q0632 299195-11/06 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 03/0704/07 TBATBA Koi 0MXJRW1 Q0721 299855-21/06 CMA CGM CMA CGM Ag. Valencia, Cagliari. (IMEX Service) Dron-3 & Mul 10/0711/07

TBATBA Cypress 0MXJVW1

COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 27/0628/06 26/06 2200 Maersk Guatemala 425W Q0593 298910-06/06 Maersk Line Maersk India Jeddah, S.Canal, Port Said, Tangier, Algeciras, Valencia, Maersk CFS 04/0705/07

TBATBA Maersk Genoa 426W Q0696 299546-16/06 Geona (ME 2)

In Port 26/06 CMA CGM Gemini OPE9FW1 Q0643 299304-12/06 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 02/0703/07 TBATBA CMA CGM Pegasus OPE90W1 Q0723 299859-21/06 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras. (EPIC)

26/0627/06 A-Daisen 24020W Q0665 299408-13/06 SeaLead SeaLead Shpg./ Aliaga, Gebze, Gemlik, Istanbul, Mersin, EL Dekheila, Casablanca, 01/0702/07 TBATBA Feng Xin Da 29 24021W Q0714 299755-29/06 Giga Shpg. Venghazi, Algier, Raves, Constanta, Thessaloniki, Piraeus, Barcelona, Valencia, Misurata (West Asia Red Sea Med - WARM) 27/0628/06 27/06 0600 Hyundai Mars 048W Q0581 298779-04/06

05/0706/07

Maersk Kensington

TBA 1000 MSC Rochelle IV426A Q0639 1094066-12/06 MSC MSC Agency Freeport, Houston.

1000 MSC Sarah V IV427A (INDUSA) 05/0706/07 TBATBA Ever Sigma 127E Q0688 299601-18/06 TS Lines TS Lines (I) Vancouver

06/0708/07 TBATBA Seattle Bridge 090E Q0683 299496-15/06 (CISC Service)

In Port 26/06 MSC Greenwich IP425A Q0634 1094003-11/06 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals

28/0629/06 27/06 1600 MSC Maeva IP426A Q0659 1094320-14/06 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira,Paita, 05/0706/07 05/07 0900 MSC Fie X IP427A Q0738 1095145-24/06 Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK)

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports. AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America

27/0628/06 27/06 1000 MSC Regulus IS423A Q0625 1093879-10/06 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals

05/0706/07 05/07 1100 MSC Camille IS425A Q0737 1095144-24/06

Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 08/0709/07 08/07 1100 MSC Ravenna IS424A

Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express)

Globelink Globelink WW USA, East & West Coast.

Athens 4126 Q0652 299357-13/06 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah & Dron.-3 & Mul. OOCL OOCL(I) Other US East Coast Ports. Dronagiri-2 Hapag ISS Shpg. ULA CFS

ONE Line ONE (India) India America Express (INDAMEX)

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. Conex Terminal

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 03/0704/07 03/07 1000 MSC Mundra VIII IU425A MSC MSC Agency New York, Charleston, Huston, Freeport.

PORTS from GTI In Port 27/06 CMA CGM Titus 0MXJPW1 Q0632 299195-11/06 CMA CGM CMA CGM Ag. New York, Norfolk, Savannah, Miami, Santos,

03/0704/07 TBATBA Koi 0MXJRW1 Q0721 299855-21/06 ANL CMA CGM Ag. Itajai & other North American Ports. Dron.-3 &

10/0711/07 TBATBA Cypress 0MXJVW1 COSCO COSCO Shpg. Hapag ISS Shpg. ULA CFS Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 India Sub Cont. Med. Express (IMEX)

27/0628/06 27/0623:59 Dimitris Y 245E Q0599 298938-06/06 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 08/0709/07

TBATBA One Reliability 005E & Caribbean Ports, Canada. 11/0712/07 TBATBA Cap Andreas 012E Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 14/0715/07

29/0630/06

04/0705/07

TBATBA X-Press Antlia 24004E West Indies Ports. (TIP Service)

TBATBA Seamax Stratford 130E Q0661 299426-14/06 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL

TBATBA Xin Da Yang Zhou 094E Q0725 RCL RCL Ag USA East Coast & Other Inland Destinations.

08/0709/07 TBATBA Pusan Q0718 COSCO COSCO Shpg. US West Coast.

16/0717/07

TBATBA Aka Bhum 022E Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. ICC Line Neptune US East, West Coast, Canada, South & Central American Ports. GDL-3 & Dron-3 30/0601/07 TBATBA San Francisco Bridge 0073 Q0707 299732-19/06

CMA CGM Zanzibar 0UWSRW1 Q0731 299915-22/06 OOCL OOCL (I) (Bangladesh India Gulf Express) 04/0705/07 TBATBA Ren Jian 8 2427S Q0654 299366-13/06 CMA CGM CMA CGM Ag. Khorfakkan, Jebel Ali (SWAX)

26/0627/06 Terataki 2408W Q0631 1093979-11/06 Asyad Line Seabridge Sohar, Jebel Ali. (IEX)

Dron-3 & Mul

26/0627/06 26/06 1600 Grasmere Maersk (NSIGT) 426W Q0590 298909-06/06 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile) Maersk CFS

26/0627/06 27/06 0600 OEL Shasta 139 Q0506 298294-27/05 ONE Line ONE (India) Jebel Ali.

10/0711/07 TBATBA AS Sicilia 935 Q0623 299108-10/06 UnifeederUnifeeder Jebel Ali. (MJI) Dronagiri

28/0629/06 TBATBA Shamim 1329W Q0664 299437-14/06 HDASCO Armita India Bandar Abbas, Chabahar. (IIX)

29/0630/06

TBATBA Maersk Kinloss 425W Q0595 298913-06/06 Maersk Line Maersk India Salallah. (MECL)

Maersk CFS 30/0601/07 TBATBA Maersk Cape Town 427S Q0597 298914-06/06 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS 01/07 02/07 29/06 0200 Tonsberg OPU0DS1 Q0601 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. 11/0712/07

TBATBA Tessa 2404S RCL/CUL Line RCL/Seahorse 15/0716/07

01/0702/07

TBATBA RDO Favour 02425S KMTC KMTC (India)

Dronagiri-3 (West Bound) CMA CGM CMA CGM Ag.

SeaLead SeaLead Shpg

TBATBA Wan Hai 316 217W Q0672 299461-14/06 X-Press Feeders Sea Consortium Jebel Ali 07/0708/07

TBATBA X-Press Altair 24009W Wan Hai Wan Hai Lines (I) (RGI) 22/0723/07

TBATBA SSL Brahmaputra 917W UnifeederUnifeeder TO LOAD FOR WEST ASIA GULF

27/06 1600 MSC Maeva IP426A Q0659 1094320-14/06 MSC MSC Agency King Abdullah. Hind Terminals 05/0706/07 05/07 0900 MSC Fie X IP427A Q0738 1095145-24/06 SCI J.M. Baxi

27/0628/06 26/06 2200 Maersk Guatemala 425W Q0593 298910-06/06 Maersk Line Maersk India Salallah (ME 2) MaerskCFS0 02/0703/07 TBA 2000 Celsius Nairobi 0911 Q0711 299768-20/06 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 06/0707/07 TBATBA SC Mara 24023

UnifeederUnifeeder Basra. (ASX) QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DR

27/0628/06 27/06 0600 Hyundai Mars 048W Q0581 298779-04/06 ONE Line ONE (India) Karachi (FIM West Bound)

29/0630/06 28/06 2200 SSF Dynamic 071W Q0586 298809-05/06 Safeen Fdrs. Sima Marine Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, Ajman, 06/0707/07 TBATBA Safeen Power 070W Q0668 299445-14/06 Umm Al Quwain, Ras Al Khaima. (UIG)

29/0630/06 29/06 0600 San Pedro 091W Q0713 299785-20/06 COSCO COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain

06/0707/07 TBATBA Sprinter 055W Q0727 299888-21/06 OOCL OOCL (I) (AGI-2)

01/0702/07 TBATBA SM Neyyar 0425W Q0666 299442-14/06 Maersk Line Maersk India Jebel Ali Maersk CFS 04/0705/07

TBATBA Seaspan Jakarta 0426W Q0697 299547-16/06 Global Feeder Sima Marine Jebel Ali, Bandar Abbas. (SHE) Dronagiri 05/0706/07

TBATBA TS Dalian 009W Q0655 299370-13/06 Samudera Samudera Shpg. Jebel Ali, Dammam Dronagiri 12/0713/07

TBATBA Safeen Prism 010W OOCL OOCL (I) Jebel Ali, Dammam (SIG)

07/07 08/07 TBA 1200 MSC Brianna JU425R

MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam,Umm Qasr (UGE) Hind Terminal 13/07 14/07

07/0708/07

TBATBA MSC Rafaela JU427A

TBATBA Al Rumelia 2413 Q0708 299696-19/06 Global Feeder Sima Marine Hamad.

Dronagiri QNL/Milaha PoseidonShpg. Hamad. (IMX) Speedy CFS Emirates Emirates Shpg. Jebel Ali, Sohar.

X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr.

Alligator Shpg. Aiyer Shpg. Jebel Ali.

BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Team Lines Team Global Log. Gulf Ports. Conex Terminal

30/0601/07 TBATBA Groton 0UWSWW1 Q0675 299525-15/06

TBATBA CMA CGM Zanzibar 0UWSRW1 OOCL OOCL (I) (Bangladesh India Gulf Express) 06/0707/07

TBATBA Navios Verde 2425W ONE Line ONE (India) Colombo. 12/0713/07

TBATBA Dalian 2427W Q0682 299501-15/06 Hapag ISS Shpg. (AIM)

In Port 26/06 Maersk Chennai 425W Q0591 298908-06/06 CMA CGM CMA CGM Ag. Colombo (MESAWA)

03/0704/07

TBA 1000 MSC Rochelle IV426A Q0639 1094066-12/06

MSC Agency Colombo. (INDUSA) Hind Terminal

05/0706/07 TBATBA Ever Sigma 127E Q0688 299601-18/06 Evergreen Evergreen Shpg. Colombo. Balmer

TBATBA Seattle Bridge 090E Q0683 299496-15/06 UnifeederUnifeeder Colombo. Dronagiri 10/0711/07

TBATBA Celsius Naples 903E ONE Line ONE (India) Colombo. (CISC Service)

15/0716/07 TBATBA TS Hong Kong 24002E

26/0627/06

0900 MSC Mariagrazia FD419E

03/07 1000 MSC Mundra VIII IU425A

Colombo.

MSC Agency Colombo. (DRAGON EB)

(INDUS)

27/0628/06 27/0623:59 Dimitris Y 245E Q0599 298938-06/06 ONE Line ONE (India) Colombo. 08/0709/07 TBATBA One Reliability 005E X-Press Feeders Sea Consortium Colombo.

11/0712/07 TBATBA Cap Andreas 012E CSC Seahorse Colombo. (TIP Service) HMM HMM Shpg. Colombo.

Terminals

CFS 28/0630/06 29/06 1700 Wan Hai 369 E004 Q0685 299583-17/06 Wan Hai Wan Hai Lines Colombo. (CI2)

CFS 29/0630/06 TBATBA Seamax Stratford 130E Q0661 299426-14/06 OOCL OOCL (I) Colombo. GDL 04/0705/07 TBATBA Xin Da Yang Zhou 094E Q0725 Star Line Asia Seahorse Yangoon.(CIX-3) Dronagiri-3 01/0703/07 TBATBA Seaspan Adonis 0075E Q0646 299337-12/06 ONE Line ONE (India) Colombo. 08/0710/07

TBATBA One Altair 065E Q0701 299670-18/06 Yang Ming Yang Ming(I) (PS3 Service)

Contl.War.Corpn. 11/0713/07

TBATBA One Arcadia 069E Hapag/CSC ISS Shpg/Seahorse ULA CFS/ 20/0721/07 TBATBA One Theseus 088E HMM HMM Shpg.

Seabird CFS TO LOAD FOR INDIAN SUB CONTINENT from BMCT

In Port 26/06 Maersk Cuanza 425W Q0579 298716-03/06 Maersk Line Maersk India Colombo (MW2) Maersk CFS 28/0629/06 27/06 1800 Ever Elite 167E Q0630 299179-11/06 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 01/0702/07 TBATBA Monaco 107E KMTC/Gold Star KMTC(I)/Star Ship

Dronagiri-3/— 07/0708/07

TBATBA ESL Busan 02424E X-Press Feeders SeaConsortium (NIX Service) 26/0727/07 TBATBA Zoi 115E EmiratesEmirates

Dronagiri-2

28/0629/06 28/06 0800 TS Keelung 24002E Q0607 298964-07/06 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 09/0710/07 TBATBA X-Press Pisces 24005E Q0732 X-Press Feeders SeaConsortium (CWX/CIX5) 10/0711/07

05/0706/07

TBATBA Ever Envoy 189E

TS Lines/PIL TS Lines(I)/PIL India

Dronagiri-2/—

TBATBA TS Dalian 009W Q0655 299370-13/06 Samudera Samudera Shpg. Colombo (SIG) Dronagiri 10/0711/07 TBATBA Xin Hui Zhou 189 Q0681 299576-17/06 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) TBA MSC MSC Agency Colombo (SENTOSA SHIKRA) Hind Terminal

01/0702/07

TBATBA APL Antwerp 0FFBYE1 Q0705 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul (AS 1) RCL RCL Ag.

26/0627/06 Terataki 2408W Q0631 1093979-11/06 Asyad Line Seabridge Haiphong, Shekou, Laem Chabang. (IEX)

26/0627/06 26/06 0700 Ren Jian 23 2407E Q0587 298810-05/06 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 02/0703/07

TBATBA Zhong Gu Hang Zhou 24001E Q0656 299373-13/06 Heung A Line Sinokor India 11/0712/07

TBATBA Beijng Bridge 2404E Sinokor Sinokor India Seabird CFS (CSC)

TS Lines TS Lines (I) Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water PoseidonShpg. Shanghai, Ningbo, Qingdao. Speedy CFS

26/0627/06 TBA 0900 MSC Mariagrazia FD419E Q0691 MSC MSC Agency Dalian, Shanghai, Ningbo, Yantian. Hind Terminals 07/0708/07

TBATBA MSC Maria Saveria FD420E Q0734 1095127-24/06 (DRAGON EB) 05/0706/07

TBATBA Ever Sigma 127E Q0688 299601-18/06 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 06/0708/07

TBATBA Seattle Bridge 090E Q0683 299496-15/06 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 10/07 111/07

TBATBA Celsius Naples 903E

PIL/ONE PIL India/One(I) —/— 15/0716/07

TBATBA TS Hong Kong 24002E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 22/0723/07

TBATBA Ever Excel 175E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 29/0730/07

TBATBA Ever Ethic 169E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 (CISC Service)

HMM HMM Shpg. P.Kelang(S), Singapore, Xiangang,Qingdao, Kaohsiung. Seabird CFS Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 06/0707/07

TBATBA BLPL Blessing 2413E Q0667 299441-14/06 BLPL Transworld GLS Far East Ports. (SM1)

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR CARTING DATE TIME NAME No.No. No.&Dt. POINT

26/0628/06 26/06 1800 Wan Hai 521 E024 Q0628 299177-11/06 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dronagiri-1 02/0703/07

TBATBA Argolikos E162 Q0669 299446-14/06 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 09/0710/07

TBATBA Wan Hai 502 E124

Hapag/RCL ISS Shpg./RCL Ag. (CIX)

ULA-CFS/ 16/0717/07

TBATBA Wan Hai 507 E224

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 27/0628/06 27/06 0600 ESL Nhava Sheva(NSICT) O2421N Q0589 298886-05/06

RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang, Cai Mep 30/0601/07 29/06 0100 Zhong Gu Shen Yang O2420E Q0585 298808-05/06 CU Lines/KMTC Seahorse/KMTC(I) 16/0717/07

TBATBA Tonsberg OPUOENW1

SeaLead SeaLead Shpg. (VGX) 27/0628/06 27/0623:59 Dimitris Y 245E Q0599 298938-06/06 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 08/0709/07

TBATBA One Reliability 005E

X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 11/0712/07

TBATBA Cap Andreas 012E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 14/0715/07

TBATBA X-Press Antlia 24004E

RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service) 21/0722/07

TBATBA MOL Presence 015E

HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS 28/0629/06 28/06 2100 X-Press Cassiopeia 24026E Q0638 299253-11/06 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS

01/0702/07

TBATBA X-Press Phoenix 24027E

X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3)

Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS

28/0630/06 29/06 1700 Wan Hai 369 E004 Q0685 299583-17/06 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 05/0706/07

TBATBA Wan Hai 501 E248 Q0733 299968-24/06 COSCO COSCO Shpg. Ningbo, Shekou. 12/0713/07

TBATBA Interasia Momentum E047 InterasiaInterasia 19/0720/07

29/0630/06

TBATBA Wan Hai 515 E092

HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS (CI2) CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai.

TBATBA Seamax Stratford 130E Q0661 299426-14/06 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 04/0705/07

TBATBA Xin Da Yang Zhou 094E Q0725 APL CMA CGM Ag. Dron.-3 & Mul. 08/0709/07

TBATBA Pusan Q0718 ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 16/0717/07

TBATBA Aka Bhum 022E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3)

Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore

Dron.-3 & Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

01/0703/07

TBATBA Seaspan Adonis 0075E Q0646 299337-12/06 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 08/0710/07

TBATBA One Altair 065E Q0701 299670-18/06 Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou.

Contl.War.Corpn. 11/0713/07

TBATBA One Arcadia 069E HMM HMM Shpg. Seabird CFS 20/0721/07

TBATBA One Theseus 088E

Samudera Samudera Shpg.

Dronagiri (PS3 Service)

Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate

26/0627/06 26/06 0300 Interasia Enhance E035 Q0637 299243-11/06 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 03/0704/07

TBATBA Wan Hai 523 E030 Q0678 299553-17/06 Heung A Line Sinokor India Hongkong 09/0710/07

TBATBA Northern Guard E924

Wan Hai Wan Hai Lines

Dron-1 & Mul CFS 16/0719/07 TBATBA Wan Hai 510 E180 InterasiaInterasia (CI6) Feedertech Feedertech/TSA Dronagiri 28/0629/06 TBATBA Zhong Gu Gui Yang 02422E Q0614 299025-07/06 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 30/0601/07

TBATBA KMTC Colombo 0204E Q0684 299580-17/06 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 07/0708/07

TBATBA Ian H 02402E COSCO COSCO Shpg. (AIS SERVICE) 15/0716/07

TBATBA Zhong Gu Ji Nan 2004E

Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2 28/0629/06 27/06 1800 Ever Elite 167E Q0630 299179-11/06 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 01/0702/07 TBATBA Monaco 107E

KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay Dronagiri-3/— 07/0708/07

TBATBA ESL Busan 02424E

X-Press Feeders Sea Consortium 26/0727/07 TBATBA Zoi 115E

Emirates Emirates Shpg Dronagiri-2 02/0803/08

TBATBA KMTC Dubai 2404E

Pendulum Exp. Aissa Maritime (NIX Service)

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 28/0629/06 28/06 0800 TS Keelung 24002E Q0607 298964-07/06 ONE Line ONE (India) Port Kelang, 09/0710/07

TBATBA X-Press Pisces 24005E Q0732

X-Press Feeders SeaConsortium Hongkong, 10/0711/07

TBATBA Ever Envoy 189E

KMTC/TS Lines KMTC(I)/TS Lines(I) Shanghai, Ningbo,

Dron-3/Dron-2 17/0718/07

TBATBA Zhong Gu Nan Ning 2404E

Gold Star Star Ship Shekou (CWX/CIX5)

RCL/PIL RCL Ag./PIL India

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao.

Speedy CFS 29/0630/06

TBATBA Wan Hai 309 022 Q0671 299456-14/06 Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya

Dronagiri-1 04/0705/07

01/0702/07

TBATBA Interasia Progress E088 Q0722

KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Dronagiri-3/— (AIS5/SI8 Service) Surabaya

TBATBA COSCO Istanbul 073E Q0712 299788-20/06 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 04/0705/07

TBATBA Xin Cang Zhou 261E Q0700 299660-18/06 APL CMA CGM Ag. Nansha, Taichung, Kaohsiung. Dron.-3 & Mul 10/0711/07

02/0703/07

04/0705/07

10/0711/07

TBATBA Xin Hui Zhou 189 Q0681 299576-17/06 OOCL/RCL OOCL(I)/RCL Ag.

GDL/— (CI 1) CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung.

TBATBA Hyundai Brave 0110E Q0580 298780-04/06 HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai Seabird CFS (FIM East Bound) Sinokor Sinokor India Seabird CFS

TBATBA Vira Bhum 115E Q0648 299347-13/06 RCL/PIL RCL Ag./PIL Port Kelang, HaIphong, Nansha, Shekou.

TBATBA Ever Dainty 179E CU Lines Seahorse Ship 16/0717/07

TBATBA API Bhum 009E Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 21/0722/07

TBATBA Kota Loceng 147E InterasiaInterasia (RWA / CIX 4) Emirates Emirates Shpg. 05/0706/07

TBATBA TS Dalian 009W Q0655 299370-13/06 ONE Line ONE (India) Singapore 12/0713/07

TBATBA Safeen Prism 010W Samudera Samudera Shpg. (SIG) Dronagiri 07/0708/07

TBATBA Chang Shun Qian Cheng 2402 Q0636 299252-11/06 QNL/Milaha PoseidonShpg. Shanghai, Ningbo, Shekou. Speedy CFS

TBA MSC MSC Agency Port kelang, Singapore, Tanjung Pelepas, Laem Chabang, Hind Terminal (SENTOSA SHIKRA) Vung Tau, Da Chan Bay, Shekou.

TBATBA Wan Hai 502 E124

TBATBA Wan Hai 507 E224 (CIX) 27/0628/06 27/0623:59 Dimitris Y 245E Q0599 298938-06/06 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, Auckland, Lyttleton.

08/0709/07

TBATBA One Reliability 005E

Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 11/0712/07

29/0630/06

TBATBA Cap Andreas 012E GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR

TBATBA Seamax Stratford 130E Q0661 299426-14/06 ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 04/0705/07

TBATBA Xin Da Yang Zhou 094E Q0725 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 08/0709/07

TBATBA Pusan Q0718 OOCL OOCL (I) Sydney, Melbourne. GDL 16/0717/07

TBATBA Aka Bhum 022E TS Lines TS Lines (I) Australian Ports. Dronagiri-2 (CIX-3) Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3

Zhong Gu Gui Yang 02422E Q0614

In Port 26/06 Maersk Chennai 425W Q0591 298908-06/06 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 03/0704/07 TBATBA Maersk Iyo 426W Q0699 299542-16/06 CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3 & Mul. 25/0626/06 26/06 1600 Halsted 424S Q0576 298713-03/06 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3 & Mul. 01/0702/07 TBATBA BFAD Pacific 425S Q0594 298912-06/06 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS (MIDAS-2) DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira.

26/0627/06 27/06 0600 OEL Shasta 139 Q0506 298294-27/05 ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI) 30/0601/07 TBATBA Maersk Cape Town 427S Q0597 298914-06/06 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 07/0708/07 TBATBA Maersk Cabo Verde 428S Q0694 299549-16/06 (MWE SERVICE)

In Port 26/06 MSC Greenwich IP425A Q0634 1094003-11/06 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 28/0629/06 27/06 1600 MSC Maeva IP426A Q0659 1094320-14/06 CMA CGM CMA CGM Ag. Dakar, Nouakchott, Banjul, Conakry, Freetown, Monrovia, Sao Tome, Bata, Dron.-3 & Mul. 05/0706/07 05/07 0900 MSC Fie X IP427A Q0738 1095145-24/06 Guinea Bissau, Nouadhibou, Dakar, Abidjan,Tema, Malabo & Saotome. (EPIC / IPAK) GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK)

27/0628/06 27/06 1000 MSC Regulus IS423A Q0625 1093879-10/06 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 05/0706/07 05/07 1100 MSC Camille IS425A Q0737 1095144-24/06 Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware

01/0702/07 30/06 TBA MSC Nora III IB425A MSC MSC Agency Port Louis, Durban. (ILANGA EXPRESS) Hind Termina 16/0717/07 15/07 TBA MSC Monica III IB426A

03/0704/07 03/07 1000 MSC Mundra VIII IU425A MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Hind Terminals (INDUS) Oran, Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa

28/0629/06 28/06 2100 X-Press Cassiopeia 24026E Q0638 299253-11/06

01/0702/07 TBATBA X-Press Phoenix 24027E (NWX/FI-3) 29/0630/06 TBATBA Seamax Stratford 130E Q0661 299426-14/06 COSCO COSCO Shpg. West African Ports. (CIX-3)

SOUTH

from

In Port 26/06 Maersk Cuanza 425W Q0579 298716-03/06 Maersk Line Maersk India Tema, Lome, Abidjan (MW2) Maersk CFS 27/0628/06 27/06 1200 Maersk Chachai 426W Q0596 298911-06/06

PUNE: India's rice export prices rose to a near three-month peak this week as demand picked up and the g o v e r n m e n t r a i s e d p a d d y procurementpriceforthenewseason India recently raised the price at which it will buy new-season common

r i c e p a d d y f r o m f a r m e r s b y 5.4 per cent to 2,300 rupees ($27) per 100 kg.

"With the hike in paddy prices, export prices of rice will also go up. Overseas buyers will still make purchase. Even after factoring in the hike, Indian rice is cheaper than rice from other origins," a Mumbai-based trader said.

Top exporter India's 5 per cent broken parboiled variety was quoted

at $544-$552 per ton, up from last week's $539-$546.

"Trading activity is weak as buyers are halting their purchases to wait for the Philippines to officially cut its import tariff on rice," a trader based in the Mekong Delta said.

"We heard the Philippines' decision to cut the tariff is pending final approval from its president, likely in July or September."

Traders said export prices are a l s o m o v i n g i n t a n d e m w i t h domestic paddy prices amid an ongoing harvest in the Mekong Delta area, which will end in early July.

Thailand's 5 per cent broken rice

slipped to $615-$620 per ton from last week's $630.

Prices came down slightly due to weaker demand because Thai rice prices were higher than Vietnam, a Bangkok-based trader said.

A second crop coming out next month should have good yield due to good rainfall, another trader said, adding that prices could weaken to $610-$615.

Meanwhile, in northeastern Bangladesh, large swathes of land have been submerged due to flash floods from heavy rainfall and u p s t r e a m w a t e r f r o m I n d i a , potentially jeopardising rice crops if the water remains for an extended period, officials said.

NEW DELHI: Indian steel exports are struggling and are likely to face continued challenges, as overcapacity and weak domestic demand in China prompt the world’s second-largest economy to flood the global market with ultra-cheap steel.

India’s steel exports in May 2024 were recorded at 0 5 million tonnes (mt), nearly 25% lower month-on-month (m-o-m) from around 0.66mt in April, per provisional data available

“The steel export market is c u r r e n t l y d i s t o r t e d a n d l a c k s attractiveness due to China’s continued strategy of flooding the global market with low-priced steel Low domestic demand in China is leading to substantial exports at prices below the cost of production,” Ranjan Dhar, Director and Vice-President, sales & marketing, ArcelorMittal Nippon Steel India (AM/NS India).

According to a report by BigMint,

export prices of hot-rolled coil coming from China have fallen to $520 per tonne from $525 per tonne within a week, leading to a continued pressure on global steel prices. In comparison, Indian export prices hovered in a range of $650-$660 ( Rs.54,500-Rs.55,000) per tonne, higher than China’s rates.

China’s crude steel production rose 8 1% m-o-m to 92 86mt in May, from 85 94mt in April In May last year, China’s crude steel production stood at 90.4mt.

China exported around 94mt of iron and steel products globally in the calendar year 2023, a 38% increase over 2022, according to a recent Crisil report “This number may likely rise to more than 100mt this calendar year,” said Dhar

This also means an uptick in exports from China to India. According to a steel ministry report, value of Chinese steel exports to India rose from $391 67 million in March to

01 million in April this year

government data, India’s finished steel imports stood at 8.3mt in FY24, up 38%.

China, South Korea, Japan and Vietnam were the major contributors, the Crisil’s report on the sector said.

Weak global demand and falling input costs have weighed on steel prices. Coking coal prices fell 7% weekon-week to $239 per tonne FOB (free on board) on 21 June, according to BigMint.

This has prompted Indian steel mills to focus on domestic demand, as exports remain a margin-dampening prospect. While competitive prices in West Asia and Southeast Asia remain a concern, the situation in Europe is deteriorating due to weak demand and a rigorous regulatory environment in play

N E W D E L H I : T h e U n i t e d Kingdom (UK) has overtaken China to become India’s fourth-largest export market in May 2024, commerce department data showed The UK was India’s sixth-largest export destination in May last year While exports to the UK grew by a third to $1 37 billion in May, the shipments to China saw 3 per cent growth at $1.33 billion last month. Exports to the UK

The disaggregated data for May wasn’t immediately available, but trends over the past few months showed that exports to the UK were d o m i n a t e d b y i t e m s s u c h a s m a c h i n e r y , f o o d i t e m s , pharmaceutical products, textiles, jewellery, iron, and steel, among other items. Commerce department data showed that India’s top 10 key export markets witnessed positive growth in May, reversing the trend when

exports to some of these countries contracted for more than a year. T

se 52 per cent of the country’s total value o f g o o d s

India’s merchandise exports grew 9.13 per cent in May to $38 billion. This came in after several months of tepid growth in outbound shipments, amid volatile global demand and uneven economic recovery.

Export to the other Countries

Export to the Netherlands, which is also India’s third-largest export market, soared to $2.19 billion with nearly 44 per cent growth in May Other countries that showed positive growth include Saudi Arabia (8.46 per cent), Singapore (4.64 per cent), B

(

, Germany (6.74 per cent), France (36.94 per cent). The United States (US) continued to remain India’s

with 13 per cent growth, followed by the United Arab Emirates (UAE), which saw 19 per cent jump.

India’s Import market

Out of India’s top 10 import markets, inbound shipments from only Saudi Arabia and Switzerland in May contracted 4 11 per cent and 32.33 per cent, respectively, the data showed T

g e

ht witnessed growth in May, in line with the overall merchandise imports that rose 7.7 per cent to $61.91 billion. Imports from Russia grew 18 per cent to $7.1 billion, mainly due to India’s dependency on crude oil. The country continued to remain India’s secondlargest import destination, after China. In the case of China, the rise was 2 81 per cent at $8 48 billion Imports from Switzerland, which is mainly driven by gold imports, contracted by nearly a third to $1.52 billion.

NEW DELHI: Stocks from the logistics segment may well have seen a slowdown of sorts in the last couple of years, but a large section of market participants believe that the time has come for the sector to rebound.

Stocks like Container Corporation of India, Delhivery, TCI Express, and Mahindra Logistics, among others, are on analysts’ radars, and while many feel that valuations may appear cheap in certain cases, investors need to be careful and look at stocks from a long-term growth potential.

Interestingly, a report released in April by domestic brokerage major Prabhudas Lilladher stated that the logistics sector in India “is a dynamic yet complex ecosystem and key enabler for economic growth, that caters to a variety of industries and their unique needs,” while highlighting the fact that about 71 percent of the volume and around 65-70 percent of the transportation revenue currently comesfromroadlogistics

In a similar context, Harshal M e h t a , R e s e a r c h A n a l y s t a t Prabhudas Lilladher, notes that they expect that the next two years

(FY25 and FY26) could be better for logistics firms after a slowdown over the last few years.

“Listed logistics companies are mostly asset-light, relying on vendors for trucks and assets like warehouses, but they are undertaking capex for warehouse automation, and building IT assets. The industry has slowed down since H2FY23, but we see green shoots in FY25 due to a growing manufacturing index, improvement in consumption on the back of (expected) good rainfall, and a normal festive season,” explains Mehta.

I n c i d e n t a l l y, e v e n a s s e t management companies (AMCs) appear bullish on the segment with five fund houses — Aditya Birla Sun Life MF, UTI MF, HDFC MF, Bandhan MF and ICICI Prudential MF — focussing on the logistics space Indeed, this has not deterred Kotak M u t u a l Fu n d f r o m f i l i n g t h e documents for an NFO (new fund offer) with SEBI, to launch a transportation and logistics fund.

Container Corporation of India (Concor) seems to be the favourite of many analysts. The stock has gained

68 percent over the last one year and currently around 12 analysts have a buy call on the stock, along with 1 1 h o l d c a l l s a n d f i v e s e l l recommendations.

Rajarshri Maitra, Associate Director at InCred Research Services, is of the view that the company is a top pick in the segment as it could be a direct beneficiary of the dedicated freight corridor (DFC), and volumes can rise 50 percent over the next three years. The DFC is a dedicated network solely for freight trains.

Apart from Concor, Delhivery (the stock has gained a mere 2 percent in the past year) is also seeing a lot of traction in the analyst community, with 18 buy calls, four hold calls, and three sell recommendations.

In a recent report, analysts at Prabhudas Lilladher noted that B2C logistics companies like Delhivery stand to gain significantly from the recalibration of online and retail supply chains in India, while adding that despite increasing competition, Delhivery is expected to grow at 18 percent CAGR over FY24-26E.

NEW DELHI: The export data for the month of May showed that India’s textile exports increased by 11.2% compared to the previous year, marking the highest growth in 18 months and the best since November 2022.

Sivaramakrishnan Ganapathi, Vice Chairman and Managing Director of Gokaldas Exports, and

P Sundararajan, Chairman and Managing Director of SP Apparels, discussed whether the textile export market is getting better or not.

Gokaldas Exports, also announced a strategic stake of Rs. 350 crore in BRFL Textiles Private Limited (BTPL) which is a separate entity of Bombay Rayon Fashions Limited (BFRL).

Mr Ganapathi was quoted as saying that the diversification away from China started with a little more aggression and that is because when the brands were buying less there was very little to diversify away from, but now that they are buying again, they are looking at increasing the allocation for Indian region.

Cargo Steamer's Agent's ETD

CJ-I ASL Rose DBC 28/06

CJ-II Chang Sheng Marinelinks 27/06

CJ-III Sea Eagle Shantilal Shpg. 29/06

CJ-IV AC Kathryn Mihir & Co. 30/06

CJ-V Mariam DBC 27/06

CJ-VI Genco Freedom Dariya Shpg. 28/06

CJ-VII Hampton Ocean Chowgule S. 28/06

CJ-VIII VACANT

CJ-IX ND Maritsa MNK & Co. 29/06

CJ-X VACANT

CJ-XI Grand Mariner Master Logitech 27/06

CJ-XII SSF Dynamic ULSSL 27/06

CJ-XIII APJ Jai Cross Trade 28/06

CJ-XIV Amazing Salute Chowgule S. 30/06

CJ-XV VACANT

CJ-XVA Super Arteta Interocean 01/07

CJ-XVI Globe Aliki Mihir & Co. 28/06

TUNA VESSEL'S NAME AGENT'S NAME ETD

Nord Adriactic Benline 27/06

Royal Jade Taurus 27/06

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I Rose Gas

OJ-II Peace One

OJ-III Bow Elm GAC Shpg. 27/06

OJ-IV Ocean Agalia Samudra 27/06

OJ-V Seasurfer GAC Shpg. 27/06

OJ-VI Dawn Mansarovar Malara Shpg. 27/06

OJ-VII Falcon Majestic Interocean 27/06

Hansa Europe 25/06

TCI Anand 25/06 Manglore/ Cochin/Tuticorin

Lord H 25/06 Somalia

Trawind Glory 25/06 Dammam

Akson Serin 25/06 Ravenna

Milos 25/06

Belray 25/06 China

Erdek 25/06 Romania

MK Lamis 25/06 Somalia

MY Zeynep 26/06

Stream

Stream

Stream AL Mothanna Malara Shpg. Dji Bouti

CJ-XIV Amazing Salute Chowgule S.

CJ-XIII APJ Jai Cross Trade

Maersk Cuanza 425W 4052038 Maersk Line Maersk

In Port Grace Bridge (V-2404) 4062191 MBK Logistix Nhava Sheva

26/06 Maersk Cuanza (V-425W) 4052038 Maersk India Nhava Sheva

26/06 SM Neyyar (V-425) 4062312 MBK Logistics Jebel Ali

Majd (V-2411E) Jebel Ali 19-06-2024 Wan Hai 506 (V-6233E) Port Kelang 20-06-2024 Wadi Duka (V-2411) Karachi 21-06-2024

12/07 11/07-1800 Maersk Kensigton 427W 24223

In Port —/— BLPL Trust 1406E

04/07 04/07-1500 X-Press Phoenix 24027E 24225 X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 05/07 10/07 10/07-1700 Maersk Frankfurt 428E 24220 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan

03/07 02/07-1900 Seaspan Adonis 075E 24211 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 04/07

06/07 06/07-1700 One Altair 065E 24217 HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3) 07/07

03/07 03/07-0100 One Reliability 0054E24213 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 04/07

07/07 07/07-2200 Cape Andreas 012E ONE ONE (India) (TIP) 08/07

04/07 03/07-1300 Seamax Startford 130E 24215 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 05/07

07/07 06/07-1800 Xin Da Yang Zhou 094E Gold Star / RCL Star Shpg/RCL Ag. (CIXA) 08/07 TBA COSCO COSCO Shpg. Singapor, Cai Mep,Hongkong, Shanghai,Ningbo,Shekou, Nansha (CI1)

27/06 27/06-1700 SM Neyyar 0425E24214 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX)

02/07 02/07-1700 Seaspan Jakarta 426E 24218

28/06 27/06-1800 Maersk Kinloss 425W 24205 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 29/06 TO LOAD FOR INDIAN SUB CONTINENT PORTS & COASTAL SERVICE

In Port —/— SCI Chennai 2406 24209 SCI J M Baxi Mundra, Cochin, Tuticorine. (SMILE)

03/07 03/07-0900 SCI Mumbai 174 24224

30/06 30/06-1100 X-Press Cassiopeia 24026E 24210 Maersk Line Maersk India Colombo. (NWX)

30/06 30/06-1500 SSL Gujarat 154 SLSSLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1)

03/07 03/07-0100 One Reliability 0054E24213 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo.

07/07 07/07-2200 Cape Andreas 012E 24221 ONE ONE (India) (TIP)

04/07 03/07-1300 Seamax Startford 130E 24215 COSCO/OOCL COSCO Shpg./OOCL(I) Colombo. (CIXA)

06/07-1800 Xin Da Yang Zhou 094E

05/07 04/07-0900 SM Manali 0043 24222 CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, 06/07 Krishnapatanam, Cochin, Mundra. (CCG)

Colombo (CI1)

Maersk Kinloss

Groton (V-OUWSWW1)

29/06 Lobivia (V-OQCONW1)

TBN Blue Water/SeaLead Posiedon/SeaLead Agency Gulf 06/07 BLPL Blessing (V-2413E) BLPL Transworld

05/07 Ever Sigma (V-127E) Unifeeder/KMTCUnifeeder/KMTC(I)

06/07 Seattle Bridge (V-090E) Hapag/Evergreen ISS Shipping/Evergreen

10/07 Celsius Naples (V-903E) ONE/TS Lines

26/06 Grasemere Maersk (V-426W)(NSIGT) Maersk Line Maersk

(V-0158)(Sailed) Interworld Efficient

03/07 MSC Rochelle (V-IV426A) MSC MSC

01/07 MSC Nora III (V-IB425A)

(V-425W)

26/06 OEL Shasta (V-139W) Unifeeder/One

26/06 Ren Jian 23 (V-2407E)

02/07 Zhong Gu Hong Zhou (V-24001E)

28/06 Shamim (V-1329W)

03/07 MSC Mundra VIII (V-IU425A) MSC

CB-6 MSC Greenwich (V-IP425A) MSC/Hapag MSC Ag/ISS Shpg.

Regulas (V-IS423A) MSC/SCI

Mariagranzia (V-FD419E) MSC MSC

30/06 Express Athens (V-4126) CMA-CGM/APL CMA CGM Ag.(I)

10/07 Seaspan Beacon (V-4127) Hapag/OOCL ISS Shpg /OOCL (I)

Car.CB-6 Seaspan Hudson (V-4324W)(Sailed) COSCO COSCO Shpg.

30/06 Express Rome (V-4325W) Hapag / ONE ISS Shpg./ONE(I)

07/07 Sofia Express (V-4326W) CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I)

Unifeeder/QNL/Milaha Unifeeder/Poseidon

27/06 Dimitris Y (V-245N) ONE ONE (I)

08/07 One Reliability (V-005E) X-Press Feeders Sea Consortium

27/06 ESL Nhava Sheva (V-O2421N) Global Fdrs./CU Lines Sima Marine/Seahorse

30/06 Zhong Gu Shen Yang (V-O2420E) Emirates/KMTC Emirates Shpg./KMTC (I)

RCL/CMA CGM RCL Ag./ CMA CGM Ag.(I) Car.GTI-1 Ital Unica (V-E176)(Sailed) Hapag/Evergreen ISS Shpg/Evergreen China

26/06 Wan Hai 521 (V-E024) Wan Hai Wan Hai Lines (I)

27/06 Maersk Guatemala (V-425W) Maersk Line Maersk India Mediterranean

Car.GTI-2 ONE Recommendation (V-0002)(Sailed) ONE/HMM ONE (I)/HMM Shpg. USA

01/07 Seaspan Adonis (V-0075E) ONE/HMM ONE (I)/HMM Shpg. Far East &

08/07 One Altair (V-065E) Yang Ming Line Yang Ming Line (I) China

29/06 Seamax Stratford (V-130E) RCL/OOCL RCL Ag./OOCL(I) Far East

04/07 Xin Da Yang Zhou (V-02422E) Zim/COSCO Zim Int./COSCO Shpg.

28/06 Wan Hai 369 (V-E004) Wan Hai Wan Hai Lines (I) Colombo &

05/07 Wan Hai 501 (V-E248) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East

28/06 X-Press Cassiopiea (V-24026E) Maersk Line Maersk India Far East

01/07 X-Press Phoenix (V-24027E) X-Press Feeder Sea Consortium

26/06 A-Daisen (V-24020W) Sealead Sealead Shipping

BMCT-1 CMA CGM Gemini (V-OPE9FW1) CMA CGM/APL CMA CGM Ag. (I) U.K.

02/07 CMA CGM Pegasus (V-OPE90W1) COSCO / OOCL COSCO Shpg./OOCL(I)

07/07 Chang Shun Qian Cheng (V-2402) QNL/Milaha Poseidon Far East/

07/07 Al Rumelia (V-2413) X-Press Feeder Sea Consortium Gulf

01/07 COSCO Istanbul (V-073E) COSCO COSCO Shpg. Far East

04/07 Xin Chang Zhou (V-261E) Zim/Goldstar Zim Integrated/Star Ship.

28/06 Ever Elite (V-167E) Evergreen / X-Press Feeders Evergreen/Sea Consortium Far East

01/07 Monaco (V-107E) KMTC/HMM KMTC (I)/HMM Shpg.

07/07 ESL Busan (V-02424E) Emirates/Gold Star Emirates Shpg./Star Ship.

27/06 Hyundai Mars (V-048W) HMM/TS Lines HMM Shpg./TS Lines(I) Far East/

02/07 Hyundai Brave (V-0110E) Mediterranean

26/06 Interasia Enhance (V-E035) Sinokor/Heung A Sinokor India

03/07 Wan Hai 523 (V-E030) Interasia Line Interasia Shpg.

Unifeeder/Wan Hai Unifeeder/Wan Hai Lines (I) Car.BMCT-1 MSC Rania (V-FD417E)(Sailed)

Cont’d. from Pg. 2

China plus one policy of the global players is helping our exports. The US is consciously making an attempt for realignment of GVCs, by passing China, in which India is destined to play a major role as we have the potential, resources and capability to replace China. The aggressive FTA strategy, focusing on complementary economies and important export destinations, is providing much better market access to our exports.

The Special Rupee Vostro Account (SRVA) mechanism, though starting slowly, will enormously help exports in next 2 to 3 years once such a mechanism is put into place with all the countries covered under SRVA. The PLI scheme will push our exports in technology and knowledge driven sectors like machinery, electronics, electricals, pharma, medical & diagnostic equipment as global imports of such products are growing at a much faster pace.

FIEO’s suggestions and requests to further support exports:

(I) R&D and innovation are key to sustain exports. R&D globally is incentivized. 35 out of 38 OECD countries provide either lower tax or higher deduction on R&D expenditure We request that the weighted tax deduction under Section 35(2AB) may be increased to 250-300% and the benefit under Section 35(2AB) may also be extended to Limited Liability Partnership (LLP), Partnership Firms and Proprietary firms, as MSME units largely fall in these categories.

(ii) We appreciate the Government initiative for facilitating

container manufacturing in the country to become Atma Nirbhar, which has stabilized container charges in the country. We request a similar focus for developing an Indian Shipping Line of global repute. India’s outward remittance on transport services is increasing with rising exports We remitted over US$ 109 Bn as transport service charge in 2022. As the country moves towards the goal of US$ 1 Trillion, this will touch US$ 200 Bn by 2030. A 25% share by the Indian Shipping Line can save US$ 50 Bn year on year basis. This will also reduce arm twisting by foreign Shipping Lines, particularly of our MSMEs.

(iii) The Interest Equalisation Scheme is helping exports a lot. We request the scheme which is valid till 30th June, 2024 may be extended for a period of 5 years. Looking into the rise in interest rates consequent to increase in Repo rate from 4 4% to 6 5% in the last 2 years, The subvention rates may be restored back from 3% to 5% for manufacturers in MSMEs and from 2% to 3% for all in respect of 410 tariff lines.

(iv) The marketing support provided through the Market access initiative (MAI) of the DoC with a corpus of Rs 200 Cr is grossly inadequate to support the big target for exports. We request that a recurring budget of Rs 500 Cr annually may be provided to the DoC so that our products and services are showcased at the global platforms.

(v) Lastly The zero rating of exports is an avowed Policy of the Government and this should not be limited to budget constraints.

OSLO: Höegh Autoliners was granted NOK 109,4million in increased Enova funding as part of its “Ammonia fuelled vessel programme” to ensure that four of Höegh Autoliners’ Aurora Class vessels can run fully on ammonia when they are delivered in 2027. The company will in total receive NOK 255,4 million in Enova funding.

The funding is part of the largest ever Enova funding round supporting the green maritime transition. The purpose of the funding is to establish the first functioning value chains for ammonia and hydrogen for maritime purposes.

"At Höegh Autoliners, we take leadership by actively collaborating with a wide range of highly qualified and dedicated suppliers to make clean ammonia viable as a zeroemission shipping fuel. We believe it is important for shipping companies to send a clear signal to the rest of the value chain that the technology can be realized in a short time and that there will be demand for carbon-neutral fuel. Almost all Höegh Autoliners vessels sail under the Norwegian flag and have significant Norwegian content from the Norwegian cluster The support from Enova, together with our innovative multifuel vessel design, significantly helps derisking the choice of bringing the first zero-carbon vessels to our industry," says CEO of Höegh Autoliners, Andreas Enger. Höegh Autoliners granted Enova-funding in March 2024

Höegh Autoliners has a total of 12 Aurora Class vessels on order The vessels transport rolling cargo such as cars, agricultural machinery, and mining equipment, as well as general solo cargo needing to be shipped.

The first 8 Aurora Class vessels will run on LNG, with the first one being delivered in August These vessels are designed to be converted to run on ammonia. The ammonia engine technology will be ready in 2026, allowing us to build the last 4 vessels to run on ammonia from the start. These vessels will be delivered in 2027 and will be groundbreaking, becoming the world's first emission-free vessels in our segment.

In March this year, Höegh Autoliners was granted NOK 146 million in Enova funding for two Aurora Class vessels to reduce the additional cost of this solution compared to a vessel that would be "ammonia ready". The Aurora Class vessels will significantly contribute to the company's goal of achieving net zero emissions by 2040. Höegh Autoliners, as one of the first

and few shipping companies globally, has secured access to the first ammonia 2-stroke engines delivered by MAN.

“With this support, Norway as a maritime nation, is sending a strong sustainability message. This is important for the whole Norwegian maritime cluster and for our continuous efforts to lead the way to more sustainable deep-sea transportation and a greener maritime sector It is visionary and a key component in the green maritime transition becoming a reality Höegh Autoliners is grateful for Enova's support, which we view as a strong endorsement of our newbuild project. We aim at a net zero emissions future by 2040 and our Aurora Class vessels, the largest and most environmentally friendly PCTC vessels ever built, will be the first zero-carbon vessels in our industry able to run on ammonia by 2027. To get to net zero, we must make clean ammonia, perfect for long-distance transportation with our two-stroke engines, viable as the future shipping fuel, and send a clear signal to the rest of the value chain that the technology can be developed and implemented in a short time. Public-private collaboration is crucial for advancing the maritime green transition, particularly in implementing mechanisms to lower the cost of sustainable fuels until they reach parity with fossil fuels in the years to come” says COO of Höegh Autoliners, Sebjørn Dahl.

Norwegian maritime cluster leading the way

Höegh Autoliners is one of 7 companies granted the Enova funding, that will support both hydrogen vessels and ammonia vessels. Today, shipping accounts for roughly 3% of global greenhouse gas emissions. 90% of that comes from deep-sea shipping. The Enova funding will raise the demand for zeroemission fuels and thereby help establishing a wellfunctioning first market for zero-emission transport at sea creating a green tipping point for the maritime sector

“The competition was fierce, and there were many good projects that unfortunately did not quite make it. It bodes very well for the further investment and the next round of applications. With this and the other pioneering projects that are now being awarded, Norway is leading the way, and we see that the maritime industry is at a tipping point where the transition can accelerate from here,” says CEO of Enova, Nils Kristian Nakstad.