See Pg. 4

Vol.LXVNo.13

th MONDAY 20 JANUARY 2025

See Back Pg.

Tel : 2266 1756, 2266 1422, 2269 1407

See Pg. 4

Vol.LXVNo.13

th MONDAY 20 JANUARY 2025

See Back Pg.

Tel : 2266 1756, 2266 1422, 2269 1407

Smt. Mal�ben K. Maheshwari has kindly consented to be Chief Guest of the Event

GANDHIDHAM: The Most Awaited Awards Ceremony in the Maritime State of Gujarat known for Recognizing and Awarding Excellence in Maritime and Logistics Industry is BACK.

The 12th Edition - Gujarat Star Awards 2025, Organized and Managed by Daily Shipping Times, which has a proud legacy of over 65 years in serving the Trade of India, is set to take place on 14th February 2025 a t t h e m

from 5 PM onwards.

Cont’d. Pg. 6

G A N D H I N A G A R : The Gujarat Maritime Board ( G M B ) o r g a n i z e d a Stakeholder Consultation Workshop on the theme “Coastal Shipping Policy of Gujarat: Paradigm Shift in Supply Chains” at Mahatma Mandir, Gandhinagar

Cont’d. Pg. 10

Smt. Mal�ben K. Maheshwari has kindly consented to be Chief Guest of the Event

Cont’d. from Pg. 3

The Grand Awards Evening promises to be a Memorable one given the presence of High Profile Distinguished Personalities from within the Industry and Government.

Chief Guest: Smt. Maltiben K. Maheshwari

Smt. Maltiben K. Maheshwari, the Honorable Member of the Legislative Assembly (MLA) from Gandhidham has kindly consented to grace Awards Ceremony as the Chief Guest.

Guest of Honour: Shri Vishal P. Mehta

Shri Vishal P. Mehta, the Honorary Consul of the Republic of Djibouti in India and CEO of Rushabh Sealink & Logistic Pvt. Ltd., will be the Guest of Honour. With his extensive experience in International Trade and Logistics, Mr. Mehta’s presence underscores the importance of Global connectivity and Economic collaboration.

Special Guests

Adding to the grandeur to the Awards Ceremony are two Eminent Special Guests:

•Shri Sushil Kumar Singh, IRSME, Chairman of Deendayal Port Authority (DPA), who has been instrumental in enhancing the Port’s Infrastructure and Operational Efficiency

•Shri M. Ram Mohan Rao, IRS, Commissioner of Customs, Kandla, whose contributions to streamlining Customs operations and Trade facilitation are noteworthy

Given the presence of Who’s Who drawn from the Maritime and Logistics industry under one roof at Hotel Radisson, Kandla. Cheering and Applauding Great Achievements makes Gujarat Star Awards a must attend event on Friday 14th February 2025.

Like all years, this year too, the response from the Trade for Gujarat Star Awards 2025 is humongous.

With an Elite August Gathering of over 500 attendees from the Shipping and Logistics fraternity will make the Evening of Gujarat Star Awards a truly Special and Memorable one.

Attendees can look forward to a glamorous evening featuring:

• Insightful speeches by dignitaries.

• Thought Provoking Panel Discussion from Eminent Speakers

• Awards ceremony recognizing the Best Performers of Gujarat.

• Interacting and Networking opportunities with Industry Stalwarts and Government Officials.

• Gala Dinner.

MUMBAI: The Managing Director, PSA India

Shri Gobu Selliaya recently participated in a distinguished meeting with President of Singapore Shri Tharman Shanmugaratnam.

He stated, “Had the privilege of being part of a distinguished delegation of Singaporean Business

NEW DELHI: Shri TK Ramachandran, IAS, Secretary MoPSW, took a comprehensive review of Major Port operations & projects and interacted with key stakeholders in a meeting in New Delhi, informs a recent communique from MoPSW

Leaders that met with the President of Singapore, Shri Tharman Shanmugaratnam. Hosted by the Odisha State Government, the visit emphasized the region's promising potential for growth and collaboration, offering a glimpse into the opportunities that lie ahead ”

Cont’d. from Pg. 3

The event brought together participants, i n c l u d i n g i n d u s t r y leaders, policymakers, academia and maritime e x p e r t s , t o d i s c u s s strategies for boosting coastal shipping in Gujarat and integrating it into the national logistics framework.

The workshop, inaugurated by Shri Rajkumar Beniwal, IAS, Vice Chairman and CEO of GMB, aimed to gather insights and recommendations from a diverse range of stakeholders, including representatives from State Maritime Boards, Major Port Authorities, Government of India agencies and prominent private players.

Key Participants:

Prominent organizations such as DG Shipping, Deendayal Port Authority, Shipping Corporation of India, Kerala Maritime Board, Maharashtra Maritime Board, Adani Ports and Special Economic Zone Ltd (APSEZL), DP World, Ultratech Cement Ltd and Segal Group of Companies contributed valuable inputs to address challenges and shape the future of Coastal Shipping

Key Discussions:

The workshop highlighted Gujarat’s significant role in India’s Coastal Shipping sector. With 49 ports along its 1,600 km coastline, Gujarat accounts for 19% of India’s coastal cargo, handling 47.67 MMT of coastal cargo in FY 2023-24 and is targeting 140 MMT by 2047.

Speakers emphasized the cost-effectiveness and

environmental benefits of coastal shipping compared to road and rail transportation. Drawing parallels with China and the EU, they showcased how coastal shipping can lower logistics costs and carbon emissions.

The challenges discussed included high last-mile logistics costs, infrastructural gaps, and regulatory hurdles. Proposed solutions included:

• Development of dedicated coastal berths.

• Enhanced port and hinterland connectivity

• Integration of inland waterways

• Implementation of a carbon credit system.

• Collaboration with other coastal states for sustainable growth.

The Coastal Shipping Bill 2024, introduced by the Government of India, was recognized as a critical step toward addressing industry issues and fostering growth.

The workshop reaffirmed Gujarat’s commitment to becoming a regional maritime hub by enhancing infrastructure, reducing logistics costs and promoting eco-friendly cargo movement. This initiative aligns with the state's long-term vision for sustainable and inclusive economic growth.

28/0101/02 Nowowiejsk 140 1117786-07/01 Chipolbrok Samsara Houston.

28/0129/01 Hoegh Trooper 210 1117160-02/01 HoeghAutoliners Merchant Shpg. Kingston,Veracruz,Freeport,Mobile,Jacksonville,Baltimore& 15/0216/02 Hoegh Oslo 123 South American & Caribbean Ports via Kingston 04/0205/02 Arc Commitment(USA) 003

EukorCarCarrier Parekh Marine South, Central America & Caribbean Ports TO LOAD FOR FAR EAST / EAST, WEST & SOUTH AFRICA / AUSTRALIA & NEW ZEALAND PORTS 28/0101/02 Nowowiejsk 140 1117786-07/01 Chipolbrok Samsara Singapore, Shanghai, Xingang. 04/0205/02 Arc Commitment(USA) 003

EukorCarCarrier Parekh Marine Hongkong, Pyeongtaek. 15/0216/02 Hoegh Oslo 123

NOTICE TO CONSIGNEESNOTICECONSIGNEES NOTICE TO CONSIGNEESNOTICECONSIGNEES TO CONSIGNEES

HoeghAutoliners Merchant Shpg. Durban,Fremantle,Melbourne,PortKembla, AucklandviaDurban

The above vessels has arrived/is arriving at NSICT on above mentioned dates with Import Cargoes in containers. Consignees are requested to obtain the Delivery Order by surrendering ORIGINAL BILLS OF LADING duly discharged on payments of relative charges as applicable within 5 days or else detention charges will be applicable.

Consignees will please note that the carriers of their agents are not bound to send individual notification regarding arrival of the vessel or the goods. For detailed information on cargo availability, please contact our office.

*Note: The importers having AEO status and those who are availing DPD facility for containerized cargo are allowed to pay Terminal Handling Charges (THC) directly to Ports/Terminal through their P.D Accounts. Upon making THC payment importers are requested to submit proof of payment duly stamped and acknowledged by Port/Terminal to Unifeeder Global FZCO for issuance of Delivery Order (DO) without Unifeeder Global Fzco’s THC Invoice and Receipt. Visit our Website : www.avanalogistek.com for Import Vessel arrival & IGM details

As Agents of : UNIFEEDER GLOBAL FZCO Unit No. 2002-2004, 2201-2204 & 2103 on 20th Floor, 21st & 22nd Floor, Building 02, Aurum Q Parc, Gen 4/1, TIC, Ghansoli, Thane Belapur Road, Navi Mumbai 400701 • Email : dhirendra.singh@unifeeder.com

Sole General Agents in India :

Head Office - Mumbai :

Unit 802, B Wing, 8th Floor, Godrej Two, Pirojsha Nagar, Eastern Express Highway, Vikhroli (E), Mumbai, 400079, India

Tel: +91 022 61247300, Fax: +91 022 26665780

Delhi Office :

238, 3rd Floor Okhla Industrial Estate, Phase-3

New Delhi-110020, India

Tel: +91 011 66266627 / 66266625, 66266609, 66266628, 66266608 , 66266618

Mundra Office :

Second Floor, Plot No. 86, Sector 1A, Near Hero Motorcycle Showroom, Gandhidham – 370 201

(BIGEX 2)

TBATBA Zhu Cheng Xin Zhou 0QC25W1 Q2586 1118910-15/01 24/0125/01 TBATBA Hong Li Yuan Yang 25001W Q2338 1115515-19/12 Sealead Sealead Shpg Jeddah, Sokhna (RESIN Service) 01/0202/02 TBATBA Aydogan 2503W Q2557 MBK Line MBK Logistics Jeddah, Beldeport C Star Diamond Maritime (India Med Service)

21/0122/01 21/01 0500 X-Press Dhaulagiri 25001R Q2521 1117892-07/01 MSC MSC Agency King Abdullah, Jeddah. (Saudi Express) Hind Terminals

27/0128/01 TBA 0500 Dubai Tower 25002R

22/0123/01 22/01 0800 SSL Godavari 037E Q2449 1117030-31/12 X-Press Feeders Sea Consortium Jeddah, Al Sokhna

27/0128/01 TBATBA Wan Hai 501 253W Q2574 1118346-10/01 Wan Hai Wan Hai Lines (I) (RGI / IM1) 06/0207/02 TBATBA X-Press Altair 25002W UnifeederUnifeeder 10/0211/02 TBATBA SSL Brahmaputra 932W Emirates Emirates Shpg. 24/0125/01 25/01 0400 Wadi Duka 2502W Q2527 1118001-08/01 Folk Maritime Seastar Global Jeddah (IRSS)

01/0202/02 TBATBA Folk Jeddah 2505W Q2578 1118909-15/01 Asyad Line Seabridge 26/0127/01 TBATBA Maersk Kensington 503W Q2489 1117712-06/01 Maersk Line Maersk India Algeciras (MECL) Maersk CFS 01/0202/02 TBATBA Maersk Sentosa 504W Q2517 1117881-07/01

In Port 20/01 SCI Delhi IP503A Q2503 1117822-07/01 MSC MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals 24/0125/01 23/01 1500 MSC Lisbon IP504A Q2563 1118679-13/01 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D). 31/0101/02 31/01 0900 MSC Luciana IP505A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre COSCO COSCO Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Seahorse Ship UK, North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos.

04/02

Globelink Globelink WW UK, North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. UK, North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global UK, North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal UK, North Continent & Scandinavian Ports. Dronagiri-3 Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines UK, North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

UK, North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals

Ravenna IS503A Q2620 1119391-17/01 SCI CMT Barcelona, Felixstowe, Hamburg, Rotterdam, Gioia Tauro,

MSC Regulus IS504A UK, North Continent & Other Mediterranean Ports. HimalayaExpress

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service

Allcargo Allcargo Log. UK, North Cont., Scandinavian & Med. Ports. Dron.2&Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. UK, North Continent & Scandinavian Ports. JWR

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa. Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

In Port 21/01 Belita 0MXLFW1 Q2469 1117410-03/01 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 31/0101/02 TBATBA APL Phoenix(NSFT) 0MXLHW1 Q2579 1118917-15/01 CMA CGM CMA CGM Ag. Valencia, Cagliari. (IMEX Service) Dron-3&Mul 31/0101/02 TBATBA Yantian Express 2504W Q2555 1118393-10/01 COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 21/0122/01 21/01 0600 Haiphong Express 5302W Q2404 1116490-27/12 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 25/0126/01

TBATBA Osaka Express 5303W Q2552 1118387-10/01 Hapag ISS Shpg. UK, North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS 08/0209/02

TBATBA Seaspan Amazon 5304W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. Oceangate CFS

23/0124/01 22/01 1800 Maersk Stralsund 503W Q2490 1117711-06/01 Maersk Line Maersk India Port Tangiers, Algeciras, Rotterdam, Felixstowe Maersk CFS

30/0131/01 TBATBA W. Klaipeda 503W Q2528 1118060-08/01 (ME 2)

21/0122/01 TBATBA APL Barcelona 0PEB9W1 Q2519 1117887-07/01 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 28/0129/01 TBATBA CMA CGM Peypin 0PEBBW1 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras.(EPIC)

21/0122/01 21/01 1000 Hyundai Saturn 0048W Q2470 1117471-04/01 HMM HMM Shpg. Jeddah, Damietta, Piraeus, Genoa, Valencia, Barcelona, Seabird CFS ONE Line ONE (India) Algeciras (FIM West Bound)

22/0123/01 21/01 0500 Sheng Li Ji SEN0125W Q2592 1119041-16/01 Akkon Line Oasis Shpg. Aliaga Gemlik, Gebze (YIL Port), Ambarli, Felixstowe, Antwerp 23/0124/01 22/01 1800 TB Bright City 35INDSTP Q2451 1117077-04/01 MDL Line Hub & Links Alexandira & St. Petersburg

23/0124/01 23/01 0400 C Star Peter 0325W Q2550 1118386-10/01 CU Lines Seahorse Shpg. Djibouti, Jeddah, Aden. 24/0125/01 TBATBA EGL Guangzhou 2504E C Star Diamond Maritime (IMR1) UGL Seatrade Shipping UnifeederUnifeeder 24/0125/01

Kota Nanhai 0111W Q2560 1118663-13/01 PIL PIL India Djibouti, Berbeira (RGS)

24/0125/01 25/01 0400 Haian Mind 24003W Q2539 1118171-09/01 SeaLead SeaLead Shpg. Aliaga, Gebze, Gemlik, Istanbul, Mersin, EL Dekheila, Casablanca, 28/0129/01 TBATBA Feng Xin Da 29 25004W Volta Container Corten Shpg. Venghazi, Algier, Raves, Constanta, Thessaloniki, Piraeus, Reel Shpg. Corten Shpg. Barcelona, Valencia, Misurata (West Asia Red Sea Med - WARM) 12/0214/02 TBATBA Hyundai Tokyo 0156W HMM HMM Shpg. London Gateway, Rotterdam, Hamburg, Antwerp, Seabird CFS 19/0223/02 TBATBA One Recognition 006W ONE Line ONE (India) (INX) Yang Ming Yang Ming(I) Contl.War.Corpn.

08/0209/02

& Other Maersk CFS

TBATBA W. Kithira 505W US East Coast Ports.Middle East Container Lines(MECL) Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1

In Port 20/01 SCI Delhi IP503A Q2503 1117822-07/01 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals

24/0125/01 23/01 1500 MSC Lisbon IP504A Q2563 1118679-13/01 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira, Paita, 31/0101/02 31/01 0900 MSC Luciana IP505A Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK)

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3

Safewater Safewater Line US East Coast, South & Central America

23/0124/01 23/01 0800 MSC Rapallo IS502A Q2571 1118754-13/01 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, HindTerminals

29/0130/01 28/01 1000 MSC Ravenna IS503A Q2620 1119391-17/01

Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 05/0206/02 04/02 1000 MSC Regulus IS504A

Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express)

Globelink Globelink WW USA, East & West Coast.

23/0124/01 TBA 1000 MSC Maureen IU503A Q2561 1118671-13/01 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 30/0131/01

1000 Marianna IU504A Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 25/0126/01 TBATBA CMA CGM Manta Ray 0INTVW1 Q2570 1118753-13/01

CGM

Norfolk, Charleston, Savannah & Dron.-3 & Mul. 31/0102/02

APL Southampton 0INIZW1 Q2604 OOCL OOCL(I) Other US East Coast Ports. Dronagiri-2 ONE Line ONE (India) India America Express (INDAMEX) COSCO COSCO Shpg. Indial Indial Shpg. US East Coast & South America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. ConexTerminal Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

(* NSFT)

Reliablity 0012E Q2526 1118003-08/01

South & Central America 02/0203/02 TBATBA MOL Presence 0020E & Caribbean Ports, Canada.

TBATBA Dimitris Y 0251E

Globelink WW USA, Canada, Atlantic & Pacific, South American & 15/0117/01 TBATBA Cap Andreas 0018E West Indies Ports. (TIP Service)

TBATBA Zim Yantain 14E

TBATBA CMA CGM Vitoria 0UW92W1 Q2568 1118747-13/01 OOCL OOCL (I) (Bangladesh India Gulf Express) 22/0123/01

TBATBA SC Montreux 02SJVS1 Q2558 1118526-11/01 CMA CGM CMA CGM Ag. Khorfakkan, Jebel Ali (SWAX)

Dron-3&Mul 01/0202/02

TBATBA Zhong Gu In Chuan 25001W Q2466 1119066-16/01 SeaLead SeaLead Shpg. Dubai (ANIDEA) TO

20/0121/01 20/01 1400 Inter Sydney 0171 Q2435 1116869-30/12 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

21/0122/01

TBATBA Seatrade Peru 003W Q2418 1116642-28/12 ONE Line ONE (India) Jebel Ali. 28/0129/01

TBATBA Norderney 090W Q2540

UnifeederUnifeeder Jebel Ali. (MJI/ESX) Dronagiri 31/0101/02

TBATBA Oceana 933W Q2463 1117300-03/01 OOCL OOCL (I) Jebel Ali.

22/0123/01 22/01 0800 SSL Godavari 037E Q2449 1117030-31/12 X-Press Feeders Sea Consortium Jebel Ali

27/0128/01

06/0207/02

10/0211/02

TBATBA Wan Hai 501 253W Q2574 1118346-10/01 Wan Hai Wan Hai Lines (I) (RGI / IM1)

TBATBA X-Press Altair 25002W

TBATBA SSL Brahmaputra 932W

UnifeederUnifeeder

Emirates Emirates Shpg. 22/0123/01 22/01 0200 Garsmere Maersk 503W Q2491 1117713-06/01 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile)

29/0130/01 TBATBA Maersk Boston 504W Q2513 1117876-07/01

26/0127/01

Maersk CFS

TBATBA Marathopolis 505S Q2488 1117710-06/01 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS

26/0127/01 TBATBA Kashan 1342W Q2590 1119229-17/01 HDASCO Armita India Bandar Abbas, Chabahar. (IIX)

26/0127/01

10/0211/02

TBATBA Maersk Kensington 503W Q2489 1117712-06/01 Maersk Line Maersk India Salallah. (MECL) Maersk CFS

TBATBA Zhong Gu Chang Sha 02444S Q2594 1119075-16/01 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. 17/0218/02

TBATBA Zhong Gu Shen Yang 0PU45S1 RCL/CUL Line RCL/Seahorse 21/0222/02

TBATBA Zhong Gu Fu Zhou 0PU49S1 KMTC KMTC (India) (VGX West Bound) Dronagiri-3 27/0228/02

TBATBA Zhong Gu Kun Ming 0PU4DS1

SeaLead SeaLead Shpg Alligator Shpg. Aiyer Shpg. Jebel Ali, Dammam TO LOAD

In Port 20/01 SCI Delhi IP503A Q2503 1117822-07/01 CMA CGM CMA CGM Ag. King Abdullah.

& Mul. 24/0125/01

Khalifa, Jebel

TBATBA Zhong Gu Nan Ning 25001E Q2567 1118745-13/01 UnifeederUnifeeder Basra. (ASX) QNL/Milaha Poseidon Shpg. Jebel Ali, Bandar Abbas. Speedy CFS Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DR

In Port 21/01 MSC Brianna JU503R Q2498 1117738-06/01 MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam, Umm Qasr (UGE) Hind Terminal 20/0121/01 Interasia Traveller 25001W Q2506 1117839-07/01 RCL/BTL RCL Ag./Bharat Feeder Umm Qasr, Dubai. (RWG / IMI) 21/0122/01 21/01 1000 Hyundai Saturn 0048W Q2470 1117471-04/01 HMM HMM Shpg Karachi (FIM West Bound) 22/0123/01 21/01 1400 Sprinter 065W Q2564 COSCO COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain 29/0130/01 TBATBA Future 024W OOCL OOCL (I) (AGI-2) 22/0123/01 22/01 0400 Asterios 2505W Q2510 1117852-07/01 Folk Maritime Seastar Global Dammam, Umm Qasr, Riyadh(Via Dammam). 27/0128/01 TBATBA Borkum 2506W Q2582 1118923-15/01 (IGXS)

23/0124/01 23/01 0400 C Star Peter 0325W Q2550 1118386-10/01 CU Lines Seahorse Shpg. Jebel Ali. (IMR1)

23/0124/01 22/01 1800 TB Bright City 35INDSTP Q2451 1117077-04/01 MDL Line Hub & Links Jebel Ali. 23/0124/01 22/01 1700 SM Neyyar 503W Q2545 1118348-10/07 Maersk Line Maersk India Jebel Ali Maersk CFS

30/0131/01 TBATBA Seaspan Jakarta 0504W Q2514 1117878-07/01 Global Feeder Sima Marine Jebel Ali, Bandar Abbas. (SHE) Dronagiri Alligator Shpg. Aiyer Shpg. Jebel Ali

29/0130/01 TBATBA EF Olivia 0096W Q2538 1118160-09/01 Samudera Samudera Shpg. Jebel Ali, Dammam Dronagiri 01/0202/01

TBATBA TS Dalian 0016W ONE Line ONE (India) Jebel Ali, Dammam (SIG)

23/0124/01 23/01 1700 Oshairij 2501 Q2587 1118897-15/01 QNL/Milaha Poseidon Shpg. Hamad. (NDX) Speedy CFS Emirates Emirates Shpg. Hamad. Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr. Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports. LMT Orchid Gulf Ports.

Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Team Lines Team Global Log. Gulf Ports. Conex Terminal 24/0125/01 TBATBA

Ajman, Umm Al Quwain, Ras Al Khaima. (UIG)

TBATBA One Reliablity 0012E Q2526 1118003-08/01 ONE Line ONE (India) Colombo. 02/0203/02

MOL Presence 0020E

Feeders Sea Consortium Colombo. Dronagiri 07/0208/02 TBATBA Dimitris Y 0251E CSC Seahorse Colombo. 15/0117/01 TBATBA Cap Andreas 0018E

CFS 28/0129/01 TBATBA Zim Yantain 14E OOCL OOCL (I) Colombo. GDL 30/0131/01 TBATBA Xin Da Yang Zhou 098E Q2548 1118350-10/01 Star Line Asia Seahorse Yangoon. Dronagiri-3 TO LOAD FOR INDIAN SUB CONTINENT from BMCT 21/0122/01 20/01 1500 Beijing 107E Q2497 1117725-06/12 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 29/0130/01 TBATBA EF Olivia 0096W Q2538 1118160-09/01 Samudera Samudera Shpg. Colombo (SIG) Dronagiri 23/0124/01 TBATBA Kmarin Azur 504W Q2493 1117722-06/01 Maersk Line Maersk India Colombo (MW2) Maersk CFS

24/0125/01 23/01 1200 MSC Sariska V IW502A Q2534 1118159-09/01 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 27/0128/01 TBATBA Zhong Gu Gui Yang 02501E Q2543 1118246-09/01 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 04/0205/02

TBATBA Torrance 31E

KMTC/Gold Star KMTC(I)/Star Ship

Dronagiri-3/— 07/0208/02

TBATBA Zoi 119E X-Press Feeders Sea Consortium (NIX Service) 14/0215/02

TBATBA KMTC Dubai 2501E EmiratesEmirates

Dronagiri-2 04/0205/02 TBATBA One Reputiation 0006E ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3

05/0206/02 TBATBA X-Press Capella 25001E Q2566 1117846-13/01 X-Press Feeders Sea Consortium (CWX/CIX5) 08/0209/02

TBATBA TS Keelung 25001E TS Lines/PIL TS Lines(I)/PIL India

Dronagiri-2/— 12/0213/02 TBATBA Hyundai Oakland 133W HMM HMM Shpg. Colombo Seabird CFS ONE Line ONE (India) (INX)

In Port 20/01 CMA CGM Cleveland 0FFDRE1 Q2535 1118163-09/01 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou

27/0128/01 TBATBA APL Miami 0FFDME1 Q2569 1118752-13/01 RCL RCL Ag. (AS 1) 01/0202/02

TBATBA Zhong Gu In Chuan 25001W Q2466 1119066-16/01 SeaLead SeaLead Shpg. Shanghai (ANIDEA) TO LOAD FOR FAR EAST, CHINA & JAPAN

In Port 21/01 Celsius Naples 907E Q2462 1117302-03/01

TBATBA ESL Da Chan Bay 25001E Q2583 1118895-15/01 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 03/0204/02

TBATBA Ever Eagle 186E Q2602 PIL/ONE PIL India/One(I) —/— 10/0211/02

TBATBA Ever Ethic 173E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 17/0218/02

TBATBA Shimin 26E KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 24/0225/02

TBATBA Seattle Bridge 0095E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 (CISC Service) HMM HMM Shpg. P.Kelang(S),Singapore, Xiangang, Qingdao,Kaohsiung. Seabird CFS Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang Dronagiri CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. P Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS

21/0122/01 21/01 1500 MSC Rose FD449E Q2464 1117340-03/01 MSC MSC Agency Dalian, Shanghai, Ningbo, Yantian. (DRAGON EB) Hind Terminals 25/0126/01 TBATBA Zhong Gu Hang Zhou 24005E Q2479 1117645-06/01 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo Dronagiri 29/0130/01 TBATBA Varada 2501E Q2478 1117646-06/01 Heung A Line Sinokor India 07/0208/02 TBATBA GFS Giselle 2502E Q2483 1117654-06/01 Sinokor Sinokor India Seabird CFS (CSC)

TS Lines TS Lines (I) Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

23/0124/01 23/01 1800 One Arcadia 071E Q2477 1117626-06/01 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 30/0101/02 TBATBA Conti Conquest 030E Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 05/0206/02 TBATBA Conti Crystal 139E HMM HMM Shpg. Seabird CFS 13/0215/02 TBATBA One Competence 093E

Samudera Samudera Shpg. Dronagiri (PS3 Service) Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai OceanGate 22/0123/01 23/01 1800 GSL Eleni 503E Q2448 1117018-31/12 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS

22/0123/01 21/01 0900 X-Press Phoenix 504E Q2496 1117719-06/01 X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3) 28/0129/01

TBATBA GSL Christen 505E Q2511 1117869-07/01 Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS 22/0123/01 22/01 1000 Wan Hai 521 E030 Q2544 1118347-10/01 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Dronagiri-1 29/0130/01

TBATBA Wan Hai 505 E181 Q2607 Evergreen EvergreenShpg. Shekou. Balmer Law. CFS Dron. 04/0205/02

TBATBA Wan Hai 507 E229

Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 11/0212/02

24/0125/01

31/0101/02

TBATBA Wan Hai 511 E097 TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

TBATBA Wan Hai 508 E209 Q2546 1118349-10/01 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS

TBATBA Wan Hai 513 E098 Q2612 1119296-17/01 COSCO COSCO Shpg. Ningbo, Shekou. 07/0208/02

25/0126/01

TBATBA Aka Bhum E026 InterasiaInterasia (CI2) HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS

TBATBA One Reliablity 0012E Q2526 1118003-08/01 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 02/0203/02

TBATBA MOL Presence 0020E X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 07/0208/02

15/0117/01

TBATBA Dimitris Y 0251E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. (TIP Service) Dronagiri

TBATBA Cap Andreas 0018E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. 16/0117/01

TBATBA X-Press Anglesey 2001E HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS 28/0129/01

TBATBA Zim Yantain 14E OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, GDL/Dron-1 30/0131/01

TBATBA Xin Da Yang Zhou 098E Q2548 1118350-10/01 APL CMA CGM Ag. Ningbo. Dron.-3&Mul. 13/0215/02

TBATBA OOCL Hamburg 155E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 25/0226/02

TBATBA OOCL Luxembourg 115E

Gold Star Star Ship Singapore, Hong Kong, Shanghai. (CIX-3)

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3&Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

In Port 20/01 ESL Oman 2452E Q2392 1116355-26/12 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 23/0124/01 23/01 1200 KMTC Jebel Ali 2409E Q2507 1117840-07/01 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 06/0207/02

TBATBA Gu Ji Nan 24011E

COSCO COSCO Shpg. (AIS SERVICE)

Emirates Emirates Shpg. PortKelang,Hongkong,Qingdao,Kwangyang,Pusan,Ningbo,Shekou,Singapore Dronagiri-2

In Port 20/01 Zhong Gu Ri Zhao 24010E Q2381 1116266-26/12 Sinolines Transorient Shanghai, Ningbo, Shekou & Other Far East Ports. 30/0131/01 TBATBA Kumasi 25001E

SeaLead SeaLead Shpg. (CIW / FIX 2)

21/0122/01 20/01 1500 Beijing 107E Q2497 1117725-06/12 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 30/0131/01

TBATBA OOCL Atlanta 163E APL CMA CGM Ag. Nansha, Taichung, Kaohsiung.

Dron.-3 & Mul 02/0204/02

26/0127/01

30/0131/01

27/0128/01

TBATBA Xin Beijing 1502E

OOCL/RCL OOCL(I)/RCL Ag.

GDL/— (CI 1)

TBATBA Hyundai Pluto 0040E Q2369

TBATBA Hyundai Oakland 0131E

CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung.

HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Seabird CFS

Sinokor Sinokor India Shanghai (FIM East Bound) Seabird CFS

TBATBA Zhong Gu Gui Yang 02501E Q2543 1118246-09/01 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, BalmerLaw.CFSDron. 04/0205/02

07/0208/02

14/0215/02

TBATBA Torrance 31E

TBATBA Zoi 119E

TBATBA KMTC Dubai 2501E

KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay Dronagiri-3/—

X-Press Feeders Sea Consortium

Emirates Emirates Shpg

Dronagiri-2 21/0222/02

27/0128/01

30/0131/01

29/0130/01

01/0202/02

30/0131/01

30/0131/01

31/0101/02

04/0205/02

30/0131/01

31/0101/02

31/0101/02

TBATBA Ever Elite 172E

Pendulum Exp. Aissa Maritime (NIX Service) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

TBATBA Wan Hai 351 026 Q2581 1118919-15/01

TBATBA Interasia Progress E095

Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya

KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Surabaya (AIS5/SI8 Service)

TBATBA EF Olivia 0096W Q2538 1118160-09/01 ONE Line ONE (India) Singapore

TBATBA TS Dalian 0016W

TBATBA Interasia Elevate 048

Samudera Samudera Shpg. (SIG)

InterasiaInterasia Port Kelang, Ho Chi Min City, Laem Chabang (BTI)

Dronagiri-1

Dronagiri-3/—

Dronagiri

TBATBA Wan Hai 613 067E Q2549 1118351-10/01 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Seabird CFS

TBATBA Interasia Accelerate E004

TBATBA Northern Guard E929

Heung A Line Sinokor India Ningbo, Hongkong

Wan Hai Wan Hai Lines

CFS (CI6) InterasiaInterasia

Feedertech Feedertech/TSA

TBATBA Ever Excel E179 Q2541 1118189-09/01 RCL RCL Ag. Port Kelang, HaIphong, Nansha, Shekou.

TBATBA Hemma Bhum 004E Q2554 1118388-10/01 PIL PIL India (RWA/CIX 4)

TBATBA Kota Lima 0021E

TBATBA Jira Bhum 0001E Evergreen Evergreen Shpg.

CU Lines Seahorse Ship 08/0209/02

15/0217/02

TBATBA Interasia Amplify E005 InterasiaInterasia 22/0224/02

TBATBA Kota Cabar 0076E

Emirates Emirates Shpg. 04/0205/02

TBATBA One Reputiation 0006E ONE Line ONE (India) Port Kelang, 05/0206/02

TBATBA TS Keelung 25001E KMTC/TS Lines KMTC(I)/TS Lines(I) Shanghai,

TBATBA X-Press Capella 25001E Q2566 1117846-13/01 X-Press Feeders Sea Consortium Hongkong, 08/0209/02

15/0216/02

TBATBA Ever Lasting 081E Gold Star Star Ship Ningbo, (CWX/CIX5) RCL/PIL RCL Ag./PIL India Shekou Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 10/02 11/02

TBATBA Chang Shun Qian Cheng 2501 Q2482 1117652-06/01 Asyad Line Seabridge Shanghai, Ningbo, Shekou. (FEX)

02/0203/02

TBATBA MOL Presence 0020E Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 07/0208/02

28/0129/01

30/0131/01

TBATBA Dimitris Y 0251E

TBATBA Zim Yantain 14E

Ports. (TIP Service) JWR

TBATBA Xin Da Yang Zhou 098E Q2548 1118350-10/01 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 13/0215/02

TBATBA OOCL Hamburg 155E

Melbourne. (CIX-3) GDL 25/0226/02

TBATBA OOCL Luxembourg 115E

Ports. Dronagiri-2 (CIX-3)

Honiara Dronagiri-3

Derby D 02SK1S1

Other Ports

TBATBA Spil Kartika 2502 Q2502 ONE Line ONE (India) Durban, Cape Town, Tema, Tincan, Apapa. 30/0131/01 TBATBA Tema Express 2504W Hapag ISS Shpg. (AIM)

01/0202/02 TBATBA Zhong Gu In Chuan 25001W Q2466 1119066-16/01 SeaLead SeaLead Shpg. Mombasa, Dar Es Salaam (ANIDEA) 11/0213/02

TBATBA Zhong Gu Lin 25001W

21/0122/01 TBATBA Seatrade Peru 003W Q2418 1116642-28/12 ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI) 21/0122/01 21/01 1300 APL Holland 0MSKWW1 Q2536 1118162-09/01 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 28/0129/01 TBATBA Maersk Chennai 504W Q2512 1117879-07/01 CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3&Mul. 24/0124/01 TBATBA Halsted 503S Q2492 1117721-06/01 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3&Mul. 31/0101/02 TBATBA Bfad Pacific 504S Q2516 1117880-07/01 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS 07/0207/02

CMA CGM San Antonio 0MTJHW1

Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira. (MIDAS-2) 26/0127/01 TBATBA Marathopolis 505S Q2488 1117710-06/01 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 02/0203/02 TBATBA Maersl Cairo 506S Q2518 1117882-07/01 (MWE SERVICE)

In Port 20/01 SCI Delhi IP503A Q2503 1117822-07/01 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 24/0125/01 23/01 1500 MSC Lisbon IP504A Q2563 1118679-13/01 CMA CGM CMA CGM Ag. Dakar,Nouakchott,Banjul,Conakry, Freetown, Monrovia, Sao Tome,Bata, Dron.-3&Mul. 31/0101/02 31/01 0900 MSC Luciana IP505A Guinea Bissau,Nouadhibou, Dakar,Abidjan, Tema, Malabo & Saotome. (EPIC / IPAK) GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK)

23/0124/01 23/01 0800 MSC Rapallo IS502A Q2571 1118754-13/01 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 29/0130/01 28/01 1000 MSC Ravenna IS503A Q2620 1119391-17/01

Ports. (Himalaya Express) Pun.Conware

NEW DELHI: India’s outbound shipments to four of top 10 export destinations – United Arab Emirates (UAE), the Netherlands, China, and Singapore – contracted in December last year, which led to a decline of 1 per cent to $38 billion in the country’s overall merchandise exports, data from the commerce department showed.

Exports to China witnessed the sharpest decline at 26.15 per cent, followed by the Netherlands at 25.89 per cent, UAE at 23 per cent, and S i n g a p o r e a t 1 0 9 5 p e r c e n t , respectively.

Alternatively, the US continued to

remain India’s largest export market followed by the UAE, and the Netherlands, despite the December contraction. Countries that saw an uptick in exports included the United States (8 49 per cent), United Kingdom (6.13 per cent), Saudi Arabia (50.46 per cent), Bangladesh (33.58 per cent), Germany (3.85 per cent), and Australia (45.86 per cent).

These 10 countries comprised 51 per cent of India’s total value of goods exported in December 2024.

On the other hand, in the same period, India’s overall imports witnessed 4 9 per cent growth at $59.95 billion, led by a jump in inbound

s h i p m e n t s f r o m

top 10 import destinations – China, Russia, Iraq, Switzerland, and the US.

Growth in the inbound shipments from Switzerland was the sharpest at 85.65 per cent in December, majorly driven by gold imports. It was followed by the US (9.88 per cent, China (9.14 per cent), Iraq (3.72 per cent), and Russia (0.96 per cent), the data showed.

India’s import dependency went down in some countries including–UAE (-2.97 per cent) Saudi Arabia (-15.49 per cent), Indonesia (-19.68 per cent), South Korea (-9.28 per cent), and Singapore (-17.38 per cent).

MUMBAI: Rail operators’ revenue is expected to grow into double-digit, while warehousing sector is projected to log a 3-5 per cent year-on-year growth in organic rentals this fiscal even as the demand for Grade-A space may remain intact, ratings agency India Ratings said on Friday

For sea transport, the ratings agency said, it is expecting port volumes will be supported by the coastal movement of goods and global container freight, with the easing of geopolitical tensions, including the Red Sea crisis and the normalisation of USbound traffic.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for container freight stations is expected to remain range-bound due to the increase in the proportion of direct port delivery and high competition intensity at large ports, according to Ind-Ra (India Ratings).

Ind-Ra has also assigned an improving outlook for the logistics industry for FY26 and said that macrotailwinds arising from the government’s multipolar investments across ports, rail, road, and air transport are expected to bode well for the industry

Sustained investments and the resultant increased scale of operations are expected to improve cost efficiency and operational flexibility which could lead to higher profitability for Ind-Rarated integrated logistics companies,

said Pratik Mundhada, Associate Director, Corporates, Ind-Ra.

“In Ind-Ra’s base case, we see double-digit revenue growth for rail operators in FY26, supported by huge private investments in rakes and dry terminals in 2024 For warehousing entities, we project organic rental growth of 3 -5 per cent year-on-year while demand for Grade-A spaces is expected to remain intact in Fy26,” he stated.

C o n t a i n e r f r e i g h t s t a t i o n s ’ profitability, according to Mundhada, is likely to remain subdued in this fiscal due to intense competition.

“Lastly, for freight forwarders, revenue growth and EBITDA are likely to be impacted by a moderation in the global freight rates,” he added.

The ratings agency noted that initiatives such as the National Logistics Policy and the PM Gati Shakti National Master Plan aim to enhance multimodal connectivity and foster interdisciplinary coordination.

Further, it stated that public-private partnerships are expected to expected to scale-up the ports portfolio.

Also, increased private capital expenditure towards the network expansion of trains, dry terminals, and warehousing will support the growth of the logistics market in India, it said and a d d e d t h a t I n d i a ’ s L o g i s t i c s Performance Index ranking improved to 38 in 2023 from 44 in 2018, with an

aspiration to break into the top 25 by 2030 as part of Maritime Vision 2030.

This will necessitate a reasonable budgetary allocation towards logistics infrastructure in the upcoming budget, it said.

Ind-Ra said it believes the full c o m m i s s i o n i n g o f t h e We s t e r n Dedicated Freight Corridor will improve the utilisation of rakes and terminals, thereby enhancing the operating profitability of container train operators.

O n t h e f l i p s i d e , i n c

d competition and revisions of haulage charges will remain key monitorable. The Eastern Dedicated Freight Corridor is likely to improve supply chain efficiency for thermal plants, led by increased speed and scheduled train operations, it said.

Ratings on logistics and supply chain companies are mostly on a “Stable Outlook”, given the sustenance of operational performance, while maintaining a comfortable leverage profile, Ind-Ra said.

“While we see capital investments by logistics infrastructure companies including warehousing, rail and dry terminals, their ability to raise longterm debt at a competitive pricing and Ind-Ra’s expectation that these companies will be able to optimise the asset utilisation are supporting their credit profile and thereby the Stable rating Outlook,” it said.

WASHINGTON : India’s Economic Growth is projected to remain steady at 6.7 per cent per annum for the next the two fiscals beginning April 2025, according to the World Bank‘s latest growth estimates for South Asia.

Growth in South Asia is expected to rise to 6.2 per cent in 2025-26, with the projected firm growth in India, the World Bank said on Thursday “In India, growth is projected to remain steady, at 6.7 per cent a year for the two fiscal years beginning in April 2025,” it said.

“The services sector is expected to enjoy sustained expansion, and manufacturing activity will strengthen, supported by government initiatives to improve the business environment. Investment growth is projected to be steady, with moderating public investment offset by rising private investment,” the bank said.

Growth in India is projected to soften to 6 5 per cent in fiscal year 2024/25 (April 2024 to March 2025), reflecting a slowdown in investment and weak manufacturing growth, it said.

“However, private consumption growth has remained resilient, primarily driven by improved rural incomes accompanied by a recovery of agricultural output,” the World Bank said.

Excluding India, growth in the region is estimated to have picked up to 3 9 per cent in 2024, mainly reflecting recoveries in Pakistan and Sri Lanka, supported by improved macroeconomic policies that were adopted to address earlier economic difficulties

M U M B A I : C o m m e r c e a n d

Industry Minister Piyush Goyal has asked the auto component industry to start manufacturing machines and reduce import dependency on foreign countries.

“Why should we be dependent on foreign countries, especially some c o u n t r i e s w i t h n o n - m a r k e t economies or non-transparent economic practices? Why should we be dependent on them for the equipment and machinery that our industry needs?” Goyal said at the Bharat Mobility Global Expo 2025 Components Show.

The Minister said that certain companies in India that are still importing automobile components

will be out of competition as domestic products are more competitive than foreign ones.

He further urged the industry to c o n s i d e r c o l l a b o r a t i o n s w i t h Switzerland, given the country’s expertise in building machines “Many of them are wanting to invest in India because they have a $100 billion investment commitment as foreign direct investment,” the Minister said.

Under the India-European Free Trade Association (EFTA) free trade agreement (FTA) signed last year, E F TA n a t i o n s h a v e m a d e a n investment commitment of $50 billion within 10 years of the agreement taking effect and an additional

$50 billion in the next five years. The bloc comprises Iceland, Switzerland, Norway, and Liechtenstein.

The Minister urged the industry to s c a l e u p t h e p r o d u c t i o n o f components for electric vehicles (EVs) as significant opportunities exist. “I do believe that the time is right to make a five-year action plan on how we are going to move to EVs and by 2030 demonstrate to the world that India is one country that, when we decide on something, we achieve it,” he said, adding that EVs address the challenge of climate change, reduce pollution, lessen India’s dependence on imported crude oil, help shape foreign exchange, and open new export markets.

MUMBAI: BW LPG Ltd, the world’s top owner and operator of LPG vessels, including Very Large Gas Carriers (VLGCs), will start test piling in February on what would be the largest liquefied petroleum gas (LPG) on shore import terminal in p a r t n e r s h i p w i t h C o n f i d e n c e Petroleum India Ltd and Ganesh Benzoplast Ltd at state-owned Jawaharlal Nehru Port near Mumbai, a top official has said.

“We are now in the final stages of putting all the parts of the puzzle together with Confidence Petroleum and Ganesh Benzoplast,” Mr Kristian Sørensen, Chief Executive Officer, BW LPG Ltd was recently quoted in an interview in Mumbai.

“Ganesh Benzoplast being a terminal operator already is a vital partner for us and the same is with Confidence Petroleum which has got the offtake volumes to support that kind of investment in the terminal. We hope to start construction sometime in Q2,” Sorensen revealed.

A joint venture – 55 percent owned by BW Confidence Enterprise Pvt Ltd and 45 percent by Ganesh Benzoplast Ltd – will fund the construction of the

120,000 cubic metres (cbm) capacity terminal for handling and storing propane and butane.

When completed, the facility will be able to fully offload the latest fourth generation Very Large Gas Carriers (93,000 cbm) in a single discharge operation within 24 hours and will also have the potential to connect to the Uran Chakan pipeline to ensure competitive and efficient supply of LPG into India.

The consortium will utilise the LPG jetty run by state-owned Bharat Petroleum Corporation Ltd (BPCL) at J N Port for importing LPG.

“BPCL has one unloading arm at the jetty, and we will be installing two of our own unloading arms along with laying the pipelines to the storage tanks to be constructed at the location of Ganesh Benzoplast’s tank farm in JN Port,” Sorensen said.

BW Confidence Enterprise Pvt Ltd is an equal joint venture formed by Oslo and New York-listed BW LPG and Mumbai-listed Confidence P e t r o l e u m I n d i a t o e x p l o r e investment opportunities in onshore LPG import infrastructure. The JV will collaborate with BW LPG’s

trading division as well as its India subsidiary, BW Product Services and BW LPG India respectively, to source a n d d e l i v e r L P G f r o m t h e international markets to meet Confidence Petroleum and India’s growing LPG import needs.

N

Petroleum currently runs 68 LPG bottling and blending plants and about 287 auto LPG dispensing stations across India, making it the largest private player in auto gas and LPG bottling plants Confidence Petroleum plans to scale up the auto LPG dispensing stations to about 500 over the next few years.

M u m b a i - l i s t e d G a n e s h

Benzoplast is one of India’s top liquid storage facility providers with a total tankage capacity of 3.3 lakh kilo litres across three ports. It is the single largest logistics service provider in liquid commodities in the Mumbai region.

BW LPG India, a subsidiary of BW LPG, runs a fleet of eight LPG carriers and is the largest owner and operator of Indian-flagged Very Large Gas Carriers (VLGCs).

N E W D E L H I - T h e I n d i a n Ambassador to Myanmar reviewed the operations of the Kaladan Project at the Sittwe Port in Myanmar’s Rakhine province. The port is a key component of the India-assisted K a l a d a n M u l t i - M o d a l Tr a n s i t Transport Corridor (KMMTTC) Project. Accompanied by officials from the Indian Embassy in Yangon, the Consulate General in Sittwe, and

India Ports Global Limited (IPGL), the Indian ambassador met with local leadership to discuss bilateral d e v e l o p m e n t i n i t i a t i v e s a n d community-focused programs. T h e v i s i t i n c l u d e d a comprehensive review of Sittwe Port, which has handled over 150 vessels since its inauguration in May 2023. These vessels transported a variety of cargo, including food, agricultural

commodities, medicines, fuel, vehicles, and construction materials. During a meeting, both Indian and Myanmar sides underscored the importance of aligning development projects with local needs to benefit the people of Rakhine. They also stressed the significance of “early return to peace and stability,” necessary for maximising the Kaladan Project’s potential.

TEXAS: Tech billionaire Elon Musk told a delegation of leading Indian business figures at his SpaceX Starbase facility in Texas recently that he believes India-US ties are "trending positive" and that he favours an enhanced trade partnership between t h e t w o n a t i o n s T h e I n d i a n entrepreneurs, led by India Global Fo r u m ( I G F ) t o m a r k t h e U Kheadquartered policy and events platform's expansion into the US this week, toured the company's cuttingedge space exploration facilities and witnessed the successful launch of SpaceX's Starship Flight 7.

During a moderated discussion, Musk emphasised the potential for deeper collaboration between the United States and India, particularly in the technology and space exploration sectors.

"Things are trending positive. I'm certainly in favour of lowering trade

barriers to increase commerce between the US and India," Musk was quoted as saying during the session.

He went on to describe India as "one of the ancient civilisations and a very great and very complex one".

T h e

automotive major Tesla and social media platform X interacted with Indian business chiefs from across diverse sectors on the role of technology and India's growing role in the global innovation landscape.

The meeting comes just days before the inauguration of Donald Trump as US President for a second term on Monday and Musk's proposed role in his top team as co-chair of the Department of Government Efficiency (DOGE).

"This event underscores the growing importance of collaboration between India and global pioneers in shaping a sustainable and technology-driven future,"saidIGFFounderManojLadwa

"As the world's most powerful democracy transitions to a Trump presidency, meaningful dialogue is more important than ever in these challenging times," he said.

"At India Global For um, our mission is to bring together global leaders and innovators to tackle the defining challenges of our time I believe India's rise presents limitless opportunities, and this meeting signifies the potential for powerful partnerships," he added

The IGF delegation to Musk's Starbase in Texas included Prashant Ruia, Director - Essar Capital; Jay Kotak, Co-Head - Kotak811; Ritesh Agarwal, Founder & Group CEO - OYO; Kalyan Raman, CEO - Flipkart; Aryaman Birla, Director - Aditya Birla Management Corporation Private Limited; Nilesh Ved, ChairmanApparel Group; and bestselling author Amish Tripathi, among others.

MUMBAI: Trade restrictions planned by the incoming US President Donald Trump could lead to aggressive exports by China to other Asian markets, including India, according to a report by Crisil.

This shift is likely to create tough competition for Indian exporters in both regional and global markets, potentially slowing India's export growth.

The report highlighted that "in view

of the proposed steep tariff hikes on Chinese goods by the incoming United States President, coupled with the expected slowdown in the Chinese economy, this will trigger aggressive exports from there to the Asian markets, including India."

G e o p o l i t i c a l u n c e r t a i n t i e s , including the US-China trade tensions, continue to pose risks for global trade. Meanwhile, India's trade deficit has

widened this fiscal as imports have consistently outpaced exports.

The report added that India's export performance has remained unstable during the current fiscal year. While merchandise exports showed steady growth in the first quarter, they contracted in the second quarter There was a brief recovery in October 2024, but exports declined again in November and December

NEW DELHI: The weaker rupee will push the country’s import bill due to higher payments for crude oil, coal, v e g e t a b l e o i l , g o l d , d i a m o n d s , electronics, machinery, plastics, and chemicals, economic think tank Global Trade Research Initiative (GTRI) said on Friday (January 17, 2025).

Citing an example, it said the depreciating domestic currency will increase India’s gold import bill, especially as global gold prices have jumped 31.25%,, rising from $65,877 per kg in January 2024 to $86,464 per kg in January 2025.

Since January 16, last year, the Indian Rupee (INR) has weakened by 4 71% against the U S dollar, falling from Rs. 82.8 to Rs. 86.7.

In the last ten years, between

January 2015 and 2025, the INR has weakened by 41 3% against the U S dollar, falling from Rs. 41.2 to Rs. 86.7, the GTRI said in its report.

In comparison, the Chinese Yuan depreciated by 3.24%, from Yuan 7.10 to Yuan 7.33.

“Overall, weaker INR will inflate import bills, raise energy and input prices, leading to an overheated economy Past ten-year export data says that weak INR does not help exports contrary to what economists say,” GTRI

Founder Ajay Srivastava said.

He added that while conventional wisdom suggests that a weaker currency should boost exports, India’s decade-long data tells a different story: high-import sectors are thriving, while labour-intensive, low-import industries

like textiles are floundering.

The think tank also said that for sectors relying heavily on imports, a depreciating rupee against the U.S. dollar increases input costs, reducing competitiveness.

In theory, sectors with low import dependence, like textiles, should gain the most from a weaker rupee, while high-import sectors like electronics should benefit the least.

“However, trade data from 2014 to 2024 tells a different story. During the 2014 to 2024 period, overall merchandise exports grew by 39%, but high-import sectors like electronics, machinery, and computers saw much higher growth,” he said adding electronics exports surged by 232.8%, and machinery and computer exports grew by 152.4%.

THIRUVANANTHAPURAM :

The State Government of Kerala is d e t e r m i n e d i n i t s v i s i o n t o transform the State into a Hub of Maritime Excellence. As part of this vision, the Kerala Maritime Board is advancing coastal shipping and non-major port operations through i n n o v a t i v e P u b l i c - P r i v a t e Partnership models at Vizhinjam, Kollam, Beypore and Azhikkal p o r t s , G o v e r n o r R a j e n d r a Vishwanath Arlekar said during the

policy address at the Stae Assembly here

Steps have been taken to register and survey mechanised inland vessels, and ensure safety and security for crew, passengers and tourists, apart from enhancing the State’s maritime infrastructure

T h e Vi z h i n j a m I n t e r n a t i o n a l

Multipurpose Seaport, a landmark achievement for Kerala, began commercial operations on December 3, 2024, becoming India’s first

deepwater international container transshipment terminal.

By reducing logistics costs and i n c r e a s i n g I n d i a ’ s e x p o r t competitiveness, Vizhinjam is emerging as a pivotal global trade hub. The State government is committed to leveraging Vizhinjam’s thriving commercial ecosystem to drive industrial production, stimulate economic growth and to mark Kerala’s presence in the global maritime sector, he said.

BENGALURU : India’s Regulatory system is ensuring a robust and transparent process for exports of high-tech goods, a senior official said on Thursday.

Director General of Foreign Trade (DGFT) Santosh Kumar Sarangi said that IT-enabled processes, seamless licensing, and industry outreach will drive these exports while maintaining strong regulatory oversight.

Speaking at the National Conference on Strategic Trade Controls (NCSTC) 2025 at Bengaluru, Sarangi “emphasized the importance of India’s export control system in ensuring a robust, transparent process for high-tech exports”.

As part of the country’s strategic trade control system and in consonance with the provisions of international conventions, India regulates the exports of dual-use items, nuclear-related products, and military goods, including software and technology under the list. This list is notified by the DGFT under the Foreign Trade Policy.

According to an official statement, the conference focuses on underscoring the importance of effective strategic trade controls, showcasing India’s legal and regulatory system in this context, and exchanging best practices and relevant information on strategic trade controls, towards preventing the proliferation of Weapons of Mass Destruction (WMD) and their delivery systems

Further, it will facilitate dialogue between government authorities and industry stakeholders, assessing and mitigating emerging risks associated with the export of these sensitive goods and technologies.

The export of dual-use SCOMET (Special chemicals, organisms, materials, equipment and technologies ) items has seen substantial growth in the last few years with the value of the authorisations issued doubling in 2024 compared to 2023.

U n d e r S C O M E T,

USD 2.8 billion have been issued by the DGFT as compared to USD 1 4 billion issued in 2023

N E W D E L H I : S h r i T . K . Ramachandran, Secretary, MoPSW, met with a delegation from Hanwha Ocean, South Korea, to discuss potential shipbuilding collaborations between India & Korea The meeting also explored opportunities to enhance partnerships between Indian shipyards & Hanwha Ocean.

High-ranking delegates from Korean shipbuilder Hanwha Ocean met with Indian shipbuilding authorities, raising expectations of potential collaboration to boost India’s shipbuilding industry.

The Ministry of Ports, Shipping and Waterways announced Wednesday on social media that Hanwha’s delegation led by Senior Vice President Lee Jin-su visited the Ministry’s Secretary Shri T.K. Ramachandran to discuss o p p o r t u n i t i e s f o r s t r e n g t h e n i n g partnerships between the company and Indian shipyards.

The meeting came after the Korean delegation visited Hindustan Shipyard, a state-run shipbuilding company in Andhra Pradesh, eastern India, earlier this week.

However, some industry insiders believe it is premature to anticipate Korean companies engaging in joint shipbuilding operations in India They cite that similar expectations of significant progress in shipbuilding collaboration arose when Prime Minister Shri Narendra Modi visited HD Hyundai Heavy Industries shipyard in Ulsan in 2015.

“India is seeking a model to learn from to boost its shipbuilding industry, and its close contact with Korean industries may stem from the fact that Korea is the only country with a strong shipbuilding capability following its rise as an advanced nation,” said an industry insider.

Stream

Stream An Hai Pearl Chowgule

CJ-XIV Beauty Jasmine Cross

Stream CS Sarafina ACT Infra

Stream Dragon Malara Shpg. Nakala

20/01 Ginga Cougar GAC Shpg.

Stream Glamor Anline Shpg.

Stream Jingling Confidence Delta Waterways

20/01 Limco Gold Chowgule

Stream

Stream

Stream Somnath Ocean

Stream

Stream Suvari Kaptan DBC

Cheetah GAC Shpg. 21/01

OJ-IV Snarth

OJ-V Stolt Sagaland JMBaxi 21/01

OJ-VI VACANT

OJ-VII Stena Important Interocean 21/01

Steamer's Name Arrival on Next Destn.

Royal O 15/01 Yemen AS Alexandria 15/01

Safeen Power 15/01 Nhava ShevaJebel AliDammamShuiba-Umm Qasr

Theoskepasti 15/01

TCI Express 17/01 Manglore-CochinTuticorin-Chennai

Zhe Hai 522 18/01

Meghna Harmony 18/01

Daiwan Infinity 19/01

Lila Cumberland 19/01

Oslo Eagle 19/01 China

Siya Ram 19/01

Sofia II 19/01 Somalia

B-1

Heung A / WHL Sinokor (I) / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16)

27/01-AM X-Press Phoenix 24056E 5010367 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

24/01 24/01-AM Zhong Gu Hang Zhou24005E 5010191 Global Feeder Sima

Port —/— Maersk Chachai 503W 4120135 Maersk Line Maersks India Colombo (MW2 MEWA)

24/01 24/01-AM Zhong Gu Hang Zhou24005E 5010191 Global Feeder Sima Marine Karachi (CSC)

TBA Sai ShippingSai

19/01 Seatrade Peru (V-3W) 4120041 Unifeeder Ag Jebel Ali 19/01 Maersk Chachai (V-503W) 4120135 Maersk India Nhava Sheva 20/01 Maersk Stralsund(V-503W) Maersk India Jebel Ali

21/01 Beijing Bridge (V-2408) 5010271 Parekh Marine Nhava Sheva 22/01 GSL Eleni (V-503E) 4120132 Maersk India Karachi 25/01 Wan Hai 501 (V-253W) 4010267 Wan Hai Line Karachi

CB-1 Maersk Chachai (V-503W) Maersk India 21/01 CB-2 Seatrade Peru (V-3W) Orient Overseas 21/01 Spirit of Kolkata (V-2501W) Nhava Sheva 16-01-2025 Folk Jeddah (V-2503W) Salalah 17-01-2025 SM Neyyar (V-503) Beherai 18-01-2025

KMTC Mundra 2407E 2500284 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 24/01 KMTC /TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX)

27/01-AM Wan Hai 351 26E 2500359 Wan Hai Line Wan Hai Lines Port Kelang, Jakarta, Surabaya. (SI8 / JAR)

KMTC / Interasia KMTC (I) / Interasia

28/01-PM Xin Chang Shu 91E 2500192 Wan Hai Line Wan Hai Lines Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 29/01 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX) 30/01 29/01-PM Zhong Gu Gui Yang 2501E 2500253 Interasia/GSL Aissa M./Star Shpg Port Kelang, Singapore, Tanjung Pelepas, Xingang, Qingdao, 31/01 sEvergreen/KMTC Evergreen/KMTC (FIVE) TO LOAD FOR INDIAN SUB CONTINENT

23/01-AM

24/01 23/01-1800 Maersk Kensington 503W 25025 Maersk Line Maersk India Algeciras

31/01 30/01-1800 Maersk Sentosa 504W 25031 (MECL)

07/02 06/02-1800 W Kithira 505W

21/01 21/01-0900 Beijing 017E 25029 COSCO COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 22/01 Nansha, Port Kelang (CI1)

23/01 23/01-1200 X-Press Phoenix 504E 25026 Maersk Line Maersk IndiaSingapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 24/01 23/01 23/01-1900 GSL Eleni 503E 25019 X-Press Feeders Merchant Shpg. Ningbo. (NWX) 24/01

29/01 29/01-1900 GSL Christen 505E 25035 Sinokor/Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan. 30/01

26/01 26/01-1000 One Arcadia 071E 25028 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 27/01 01/02 01/02-1000 Conti Conquest 030E 25041 HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3)

28/01 27/01-2230 MOL Presence 020E X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 29/01 ONE ONE (India) (TIP) 30/01 29/01-0600 Yantian 1 14E 25038 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai,

APL Oregon (V-OPUSYS1)(Sailed) Emirates / KMTC Emirates Shipping / KMTC India Gulf

10/02 Zhong Gu Chang Sha (V-2444S) RCL/Global Feeder RCL Agency / Sima Marine

21/01 APL Holand (V-OMSKWW1) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India Africa

30/01 BLPL Trust (V-1501E) Transworld Transworld GLS Far East

Car.CB-4 CMA CGM Valparaiso (V-OMTJBW1)(Sailed) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa

CB-5 Celsius Naples (V-907E) Unifeeder/KMTC Unifeeder/KMTC(I) Far East &

27/01 ESL Da Chan Bay (V-25001E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo

ONE/TS Lines ONE (I)/TS Lines(I) 22/01 Grasmere Maersk (V-504W) Maersk Line Maersk India U.K. Cont.

20/01 Inter Sydney (V-0171) Interworld Efficient Marine Gulf

Car.CB-5 Maersk Cabo Verde (V-504S)(Sailed) Maersk Line Maersk India Africa

20/01 MSC Rochelle (V-IV503A) MSC MSC Agency U.S.A.

21/01 Seatrade Peru (V-003W) Unifeeder/One Unifeeder/One India Gulf

22/01 Sheng Li Ji (V-SEN125W)(BMCT) Akkon Oasis Shipping Europe/Med.

Car.CB-4 Shamim (V-1341W)(Sailed) HDASCO Armita India Gulf

22/01 SSL Godavari (V-037W) Wan Hai/Unifeeder Wan Hai Lines (I)/Unifeeder Jebel Ali

27/01 Wan Hai 501 (V-253W) X-Press Feeder Sea Consortium

Car.CB-5 W Kyrenia (V-502W)(Sailed) Maersk Line Maersk India Mediterranean

24/01 Wadi Duka (V-2502W) Folk Maritime/Asyad Seastar Global/Seabridge Jeddah

21/01 X-Press Dhaulagiri (V-25001R) X-Press Feeder/MSC Sea Consortium/MSC Ag Red Sea

25/01 Zhong Gu Hang Zhou (V-24005E) Global Fdr/TS Lines Sima Marine/TS Lines (I) Far East

29/01 Varada (V-2501E) Sinokor/Heung

Car.CB-6 C.C. Don Pascuale (V-OINIVW1)(Sailed)

25/01 CMA CGM Manta Ray (V-OINTVW1) COSCO/ONE

Car.CB-6 Kleven (V-IU502A)(Sailed)

Car.CB-6 MSC Paloma (V-IS501A)(Sailed) MSC/SCI

CB-6 SCI Delhi (V-IP503A) MSC

20/01 Tucapel (V-5103W) Hapag

Hapag / ONE ISS Shpg./ONE(I)

CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I) Car.GTI-2 Interasia Horizon (V-E043)(Sailed) Wan Hai Wan Hai Lines (I) Colombo &

24/01 Wan Hai 508 (V-E0209) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East

25/01 Maersk Stralsund (V-503E) Maersk Line Maersk India Mediterranean

30/01 W.Klaiepeda (V-503E)

GTI-2 One Reinforcement (V-004E) ONE ONE (I) USA

28/01 One Thesues (V-090E) HMM HMM Shpg.

23/01 One Arcadia (V-071E) ONE/HMM ONE (I)/HMM Shpg. Far East &

29/01 Conti Conquest (V-030E) Yang Ming Line Yang Ming Line (I) China

Car.GTI-1 Stratford (V-134E)(Sailed) RCL/OOCL RCL Ag./OOCL(I) Far East

28/01 Yantian 1 (V-107E) Zim/COSCO Zim Int./COSCO Shpg.

22/01 Wan Hai 521 (V-E030) Hapag/Evergreen ISS Shpg/Evergreen China

29/01 Wan Hai 505 (V-E181) Wan Hai Wan Hai Lines (I)

Car.GTI-2 X-Press Anglesey (V-24035E)(Sailed) ONE ONE (I) Far East

Car.GTI-1 Cap Andreas (V-017E)(Sailed) X-Press Feeder Sea Consortium

21/01 APL Barcelona (V-OPEB9W1) CMA CGM/APL

COSCO / OOCL COSCO Shpg./OOCL(I) 22/01 Asterios (V-2505W) Folk Maritime Seastar Global Gulf

Car.BMCT-1 Beijing Bridge (V-2408E)(Sailed) Sinokor/Heung A Sinokor India Far East

30/01 Wan Hai 613 (V-067E) Interasia Line Interasia Shpg.

Unifeeder/Wan Hai Unifeeder/Wan Hai Lines (I) Car.BMCT-2 Bertie (V-25002W)(Sailed) SeaLead SeaLead Shipping

21/01 Beijing (V-107E) COSCO COSCO Shpg. Far East

30/01 OOCL Atlanta (V-163E) Zim/Goldstar Zim Integrated/Star Ship.

10/02 Chang Shun Qian Cheng (V-2501E) Asyad/QNL/Milaha Seabridge/Poseidon Gulf

23/01 Cstar Peter (V-2501W) CU Lines Seahorse Shipping Red Sea/Gulf

29/01 EF Olivia (V-96W) One Line/Samudera One India/Samudera Far East

30/01 Ever Excel (V-E179) RCL/PIL/CU Lines RCL Ag./PIL India/Seahorse Far East

31/01 Hemma Bhum (V-004E) Interasia/Evergreen Interasia Shpg./Evergreen Shpg.

BMCT-1 ESL Oman (V-02452E) KMTC/TS Lines KMTC(I)/TS Lines(I) Far

23/01 KMTC Jebel Ali (V-2409E) COSCO/Emirates COSCO Shpg./Emirates Shpg.

21/01 Hyundai Saturn (V-0048W) HMM HMM Shpg. Far

26/01 Hyundai Pluto (V-0040E)

Mundra Ghibli (V-25002W) 16-01-2025 Jeddah Osaka (V-2501W) 17-01-2025 Colombo Safeen Power (V-2501W) 18-01-2025 Jebel Ali ESL Asante (V-2502S)

MICT MSC Paloma (V-IS501A) 18-01-2025 Mundra Kleven (V-IU502A) 18-01-2025 Mundra CMA CGM Don Pascuale(V-OINWW1) 19-01-2025 ACMTPL

Seaspan Brisban (V-005E) 16-01-2025 Port Kelang

Cap San Vincent (V-502W) 17-01-2025 Port Tangiers Stratford (V-134E) 18-01-2025 Pipavav Interasia Horizon (V-E043) 18-01-2025 Cochin Cap Andreas (V-017E) 20-01-2025 Colombo X-Press Anglesey (V-24035E) 20-01-2025 Colombo

Seaspan Jakarta (V-0502W) 16-01-2025

OSLO: Höegh Autoliners (ticker code: HAUTO) has s e c u r e d t w o l o n g - t e r m contracts with two major international car producers.

• The first contract extends until April 2029

• The second contract is for 2 years, with an option to extend for another 2 years

• Both contracts reflect current market rates and terms

• Shipments under the new agreements will commence in January and May 2025

Mr Andreas Enger, CEO of Höegh Autoliners, says: “We are pleased to be chosen again as the preferred shipping partner for these two world-leading car producers, with whom we have a long-standing relationship. These contracts represent another important milestone in our ongoing efforts to build a solid contract backlog and support strategically important customers. Höegh Autoliners has taken a leading role in the deep-sea car transportation industry in reducing our and our customers' carbon footprint.

With four Aurora class vessels in full operation and eight more to enter the fleet over the next 2-3 years, we are confident in offering our customers one of the industry's most sustainable and environmentally friendly transport solutions.”

This announcement highlights our dedication to transparency by disclosing contracts exceeding a total value of USD 100 million, informs a recent communique from the company.

COPENHAGEN : Maersk and Hapag-Lloyd, recently stated that they are not thinking of an immediate return to Red Sea after the ceasefire between Hamas and Israel was announced.

Both companies said they would be closely monitoring the situation in the Middle East and would return to the Red Sea once it will be safe to do so.

“The agreement has only just been reached. We will closely analyze the latest developments and their impact on the security situation in the Red Sea,” a Hapag-Lloyd spokesperson told Reuters.

“It is still too early to speculate about timing,” a Maersk spokesperson said.

Hapag-Lloyd had already flagged in June that a ceasefire would not mean an immediate resume of passage through the Suez Canal, as attacks from Yemenbased Houthi militants could still be possible.

Rearranging the schedule would take between four and six weeks, a company spokesperson said at the time.

Disruptions in the Middle East have caused shipping companies to divert their vessels towards longer routes, often forcing their container ships around Africa’s Cape of Good Hope, pushing freight rates higher and disrupting global ocean shipping.

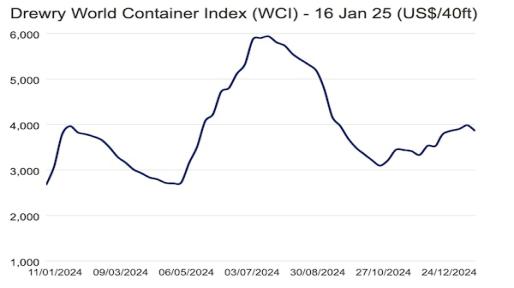

LONDON : Drewry’s World Container Index decreased 3% to $3,855 per 40ft container last week.

Drewry’s detailed assessment for Thursday, 16 January 2025

•The Drewry WCI composite index decreased 3% to $3,855 per 40ft container, 63% below the previous pandemic peak of $10,377 in September 2021, but was 171% higher than the average $1,420 in 2019 (pre-pandemic).

•The average YTD composite index is $3,915 per 40ft container, $1,045 higher than the 10-year average of $2,871 (inflated by the exceptional 2020-22 Covid period).

•Freight rates from Shanghai to Los Angeles decreased 5% or $248 to $5,228 per 40ft container.

Similarly, rates from Shanghai to New York fell 4% or $260 to $6,825 per 40ft container Likewise, rates from Shanghai to Rotterdam dropped 3% or $144 to $4,231 per 40ft container Those from Shanghai to Genoa also reduced 2% or $124 to $5,086 per 40ft container, and rates from Rotterdam to Shanghai shrank 1% or $4 to $518 per 40ft container. Conversely, spot rates from Rotterdam to New York increased 4% or $100 to $2,798 per 40ft container. Similarly, rates from Los Angeles to Shanghai rose 1% or $6 to $725 per 40ft container. Meanwhile, rates from New York to Rotterdam remained stable Drewry expects spot rates to decrease slightly in the coming weeks due to increased capacity