See Pg. 33

See Pg. 33

AMTOI deliberates on ‘East India's Mul�modal Transforma�on: Collabora�on for Logis�cs Success’

KOLKATA: As part of AMTOI's Silver Jubilee celebrations, the Eastern Region Chapter hosted the Managing Committee meeting and a Seminar on ‘East India's Multimodal Transformation: Collaboration for Logistics Success’ on Wednesday, 12th June at Veedol100 banquets, of the iconic Tollygunge Club, Kolkata Mr. Brij Lakhotia, Convenor AMTOI – ERC, welcoming all present, said that as we navigate the increasingly complex and dynamic landscape of logistics, it has become evident that customers are seeking a unified and comprehensive solution that addresses all their logistics needs In today's fast-paced competitive era, freight forwarders must be willing to adapt and evolve, embracing multimodalism as a key strategy to remain relevant and stay ahead of the curve. The slogan at

AMTOI, 'Catalysing Multimodalism,' serves as a testament to the unwavering commitment to driving this transformation in the logistics industry, and the theme, 'East India's Multimodal Transformation,' underscores the region's dedication to fostering a collaborative environment where stakeholders from across the logistics community can come together to share knowledge, resources, and expertise.

Shipping Stalwarts and Industry Experts to enlighten on current scenario in an insightful Panel Discussion

MUMBAI: The anticipation

g e a r i n g u p f o r t h e awaited Industry Accl

I n d i a M a r i t i m e A w t h 8 E d i t i o n t o b e h e

H o t e l S a h a r a S

Sapphire Ball Room in Mumbai t h on Friday, 28 June from 5.30 pm onwards

S h i p p i n g a n d I n d Stalwarts, Policy Mak Bureaucrats, CEOs of L

M a r i t i m e C o m p a

P r e s i d e n t s o f L e a Maritime Associations, P C u s t o m s O f f i c i a l s w gracing this Grand A Ceremony – Organise Managed by India’s O

S h i p p i n g N e w s p a

D a i l y S h i p p i n g T i serving the Maritime since last 64 Years

Like all the years, this too, India Maritime Awards host a Thought Provoking Discussion on “Impact current Geo-political scenario on Global Shipping” to be Veteran Capt. Deepak Tewari, Managing Director MSC Agency (India) Private Container Shipping Lin He will be accompa Stalwarts and Industry Experts

• Mr. Mukesh Oza, Group Samsara Group

• Mr. Xerrxes Maste

Managing Direct Companies

• M r. K h a l i d K h a Vice-President, Fede Organisations

• Mr. Ajay Singh, Vice Management, Hindu Limited

• Mr. Abhijit Chaudhury (Digital Solutions-S

Port of Call : Shanghai, Higshi Harima, Saigon VT, Laem Chabang, Ennore,

Port of Call : Shanghai, Taicang, Ennore, Jeddah, Suez Canal, Alexandria, Montoir, Antwerp, Bremerhaven, Suez Canal, Jeddah

Capt. Jyothish Nair : +91 89289 52582 jyothish@radiant-india.net Flat No. 2, First Floor, Door 28/1 Rajarathinam Street, Kilpauk, Chennai - 600 008. Tel: +91 44 4592 7200 / 7222

Mr. Harish Kumar : +91 81049 71062 harish@radiant-india.net

Mr. Kishore Iyer : +91 88797 30536 csv.agency@radiant-india.net

Mr. Muralikrishna : +91 89399 90227 sales1chn@radiant-india.net

Mr. Anish Gopi : +91 74001 35099 anish@radiant-india.net

Mr. Zaffar Abbas : +91 89390 66659 zaffar@radiant-india.net Mr. S. Naveen Rao : +91 89398 87681 naveenrao@radiant-india.net

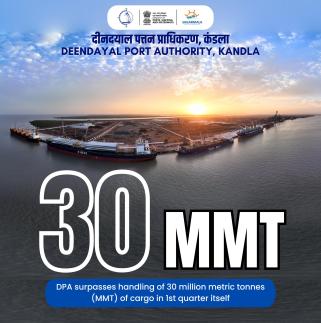

GANDHIDHAM: DPA has successfully surpassed the handling of 30 million metric tonnes (MMT) of cargo in 1st quarter itself. This significant milestone not only marks the fastest handling of 30 MMT of cargo in our history but also represents a substantial increase over the previous year’s volume of 3 3 MMT for the corresponding period.

This remarkable achievement is a testament to the d y n a m i c g u i d a n c e o f C h a i r p e r s o n a n d

Dy Chairperson & relentless efforts and dedication of our HODs and entire team, more particularly Traffic Manager Shri Ratna Sekhar Rao, who has been instrumental to a great extent in achieving this milestone.

Their hard work and commitment have enabled us to

reach new heights in our operational p e r f o r m a n c e

We e x t e n d o u r sincere Thanks for continuous support and guidance.

Chairman-DPA congratulated all the Stakeholders, Port Users, Trade Unions, Officials of Port, Employees and workers for their whole h

achievement.

MARSEILLE: CMA CGM will launch renewed INDAMEX shipping line to meet high demand between Indian Subcontinent and /to all main US East Coast, informs a recent communique from company

• Weekly fixed day sailings with 8,500-TEU vessels as from August 15th, departing from ISC to USEC,

• Using both ex/in India (Nhava Sheva) and in the US (NewYork)CMATerminalsdedicatedassetswithdedicated windows (berth on arrival, full priority 52 weeks/year)

• This extraordinary measure will maintain CMA CGM capacity on a highly demanded route,

• CMA CGM adapts its service offering to help alleviate supply chain pressures.

The INDAMEX will have a roundtrip rotation every 77 days via Cape of Good Hope between: Port Qasim –Nhava Sheva - Mundra – New York - Norfolk – Savannah –Charleston - back to ISC

The first departure of this ser vice will take place on August 15th, 2024 from Port Qasim with m/v "APL SOUTHAMPTON"

The implementation of this new service demonstrates CMA CGM’s ability to rapidly adapt its offerings to meet customer demand and support them in managing their supply chains in the context of disruptions to major maritime routes.

COPENHAGEN: Besides integrated logistics for conventional, containerized products, Maersk offers also out-of-gauge and special cargo shipments as part of its Maersk Project Logistics (MPL) business Another example for these heavy lift capabilities of Maersk is a new project from the leading Danish renewable energy company Vestas.

As a global leader in renewable energy solutions, Vestas has awarded Maersk with an important contract for transporting the extra heavy powertrains of its largest ever built wind turbine V236 This heart-piece of the 15MW turbine weighs 260 tons alone and will be installed in the nacelle in Vesta’s factory in Lindø, Denmark. Maersk will manage the transport with special equipment from the assembly site in Lommel, Belgium via Antwerp to the port of Lindø The powertrain is one of a number of large components of the nacelle. The final V236 nacelle has a total weight of more than 630 tons including the powertrain.

At a later stage, Maersk will also move the V236 powertrains to a new Vestas factory in Poland. Maersk is building a full supply chain solution for all cargo flows inbound manufacturing into both production sites in Denmark and Poland. Apart from heavy lift transports, Maersk is also taking care of Vesta’s containerized cargo as well as air freight, customs services, intermodal and

warehousing as part of a fully integrated logistics solution on a global scale.

“Since our cooperation started, Maersk has proven to be a very capable and optimal partner who can serve a lot of our logistics needs globally out of one hand. An integrated supply chain solution which is being designed and built together with a strategic partner adds visibility and thus resilience to our logistics operations as well as a lot of ease while executing our complex logistics business It has been an exciting joint journey which we will continue and expand,” said, Damien Lhors, Group Senior Vice President of Global Supply Chain and Transport at Vestas.

“For more than two years, we have been working for Vestas in a close partnership, developing exciting heavy lift projects as well as normal containerized cargo. We are extremely honoured about being the preferred and trusted partner for Vestas. The transport requires complex logistics capabilities and experience, which makes us even more proud to be selected by the world’s leading renewable energy company,” said, Claus Svane Schmidt, Global Head of Maersk Project Logistics.

Question: We are exporters to South Asian Countries and trying to expand exports to EU. Could you explain GSPand REXcertificationanditsapplicability

Solution:LastWednesday,welearnedabouttheGSP Now, let'sreviewtheREX.

WhatisREX?RegisteredExporter?

The EU has been continuously undertaking reforms to facilitate trade and reduce administrative burden and costs forexportersofitsGSPrulesoforigin.Onesuchreformisto theself-certificationoftherulesoforigincriteriabyexporters themselves.

The Registered Exporter system (the REX system) is a systemofcertificationoforiginofgoodsbasedonaprinciple of self-certification. The origin of goods is declared by economicoperators(Exporters)themselvesbymeansofsocalled statements on origin. As exporters are in the best positiontoassesstheoriginoftheirproducts,theEuropean Union considers it appropriate that the exporters directly providetheircustomersintheEUwithstatementsonorigin, which no longer need to be endorsed by exporters national authorities.However,forthispurpose,exporterswillneedto beregisteredbythecompetentauthoritiesinanelectronic system, named the REX system (Registered Exporter System). The economic operator will become a "registered exporter”.

TheREXsystemreferstotheentireframeworkforcertifying the origin of goods, not just the IT platform used for registeringexporters.

Itisimportanttonotethattherulesfordeterminingtheorigin of goods under the EU's GSP scheme remains unchanged withtheimplementationoftheREXsystem.Onlythemethod ofcertifyingtheoriginofgoodshaschanged.

REXITsystemFunctionalities

Registration of Exporters- Exporters apply to become registered exporters by filling in an application form and by returningittotheircompetentauthorities.

RexNumber

For India, the format of the 20-digit REX number where 6 to 15 digits are IEC number, and 16-17 digits denotes Local administration suchasDGFTetc.

Modification of registration data andRevocationofexporters.

TransitionbyEUtoREXsystem

TheREXsystem,whichstartedits implementation on January 1, 2017, has progressively replaced the former system of origin certificationbasedoncertificatesof origin(FormA). Countries like Bangladesh, Burkina Faso, Cambodia, Cabo Verde, Indonesia, Madagascar, the Philippines, and Vietnam were among those whose transition period ended on June 2020 Now, only statements on origin from registered exporters under the REX system are accepted for preferential tariff treatmentwithintheEU.

REXSystemImplementationinindia

REXSystemwasimplementedinIndiathroughDGFTPN No.51dated30.12.2016,w.e.f.01.01.2017.

Once the Exporter is registered with REX System and obtains REX number, Exporter shall be able to self-certify origin of goods by way of making Statement on Origin on Commercial Documents like Invoice instead of obtaining CertificateofOrigininFormA from EIA.

Procedure for Registration under REX System is explainedin

• DGFTPNNo.51dated.30.12.2017

• DGFTTradeNoticeNo.3dated.17.04.2017

CompetentAuthoritytoissueREXnumber

TheDepartmentofCommerceistheLocalAdministratorof India forAdministrative Cooperation (ADC) under the EU GSPself-certificationscheme.

• Approximately Sixteen Entities in the country act as LocalAdministratorsforRegistration.(REG)

• ThenameoftheseREGs,alongwiththenamesoftheir nodalofficers&contactdetails,ismadeavailableonthe DGFTwebsite

ValuecriteriaforREXcertification

Sr Value Criteria

1 Consignment lessthan€6000 StatementonOrigincan bemadebytheexporter, without beingregisteredunderREXSystem

2 Consignment morethan€ 6000 Registrationunder REXSystemismust forStatementon OriginbyExporter

“The exporter ……………………. (1) of the products covered by this document declares that, except where otherwise clearly indicated, these products are of Preferential origin (2) according to rules of origin of the Generalised System of Preferences of the European Union and that the origin of the Generalised System of Preferences of the European Union and that the origin criterion met is (3)”

1) Name, Full Address and REX number of Registered Exporter

2) Country of origin of export product

3) For products wholly obtained – enter letter “P”, For products sufficiently worked or processed – enter letter “W”, followed by a four digit code of export product For example “W”8546 In case of cumulation, refer indications such as In the case of bilateral cumulation: “EU cumulation etc

Conclusion:

ThisisgeneraloverviewofREXsystem;itisadvisabletoreferdetailsonEUwebsiteandDGFTaswellasconsultauthorities/ experts to fully understand and ensure compliance. It is also important to understand and check Rule of Origin. Cumulationandorigincriteriaismetbeforemaking“statementof origin”.

Marathon Nextgen, Innova “A”-G01, Opp.Peninsula Corporate Park, Off.Ganpatrao Kadam Marg, Lower Parel(W), Mumbai-400013 Board Tel.:022-61657900, Fax: 022-61857299/98/97, E-Mail:info@evergreen-shipping.co.in, Website:http://www.shipmentlink.com/in

HAVA SHEVA : 1st Flr, Anchorage Ship Ags. Premises Co-op Society, Plot No. 02, Sec-11, Dronagiri Node, Navi Mumbai-400707 Tel.: 022-27471601, Fax: 91-22-27246415, E-Mail: nxvlog@evergreen-shipping.co.in

NEW DELHI : 51, Okhla Industrial Estate, Phase - III, 1st Floor, New Delhi-110020 Tel.: 011-61657900 (Hunting), Fax: 011-66459698 / NDI Fax : 011-66459699, E-mail: ndibiz@evergreen-shipping.co.in

V.I.A

29/0630/06

TBATBA Cstar Peter 037 MBK Line MBK Logistics Jeddah, Kumport (India Med Service) MAS Diamond Marine

In Port 20/06 X-Press Mekong 240058 Q0573 298768-04/06 X-Press Feeders Sea Consortium Jeddah, Al Sokhna

01/0702/07 TBATBA Wan Hai 316 217W Q0672 299461-14/06 Wan Hai Wan Hai Lines (I) (RGI)

06/0707/07 TBATBA Addison 006 Q0621 299109-10/06 UnifeederUnifeeder

In Port 20/06 Maersk Virginia 425W Q0572 298709-03/06 Maersk Line Maersk India Djibouti, King Abdullah, Jeddah (Blue Nile) Maersk CFS 26/0627/06 TBATBA Grasmere Maersk 426W TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN,

In Port 19/06 MSC Rapollo IS422A Q0617 1093742-08/06 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 28/0629/06 28/06 1100 MSC Regulus IS423A Q0625 1093879-10/06 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 02/0703/07 02/07 1100 MSC Ravenna IS424A

U. K. North Continent & Other Mediterranean Ports. Himalaya Express NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service

Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

19/0620/06 19/06 1000 Kotka IU424A Q0626 1093888-10/06 MSC MSC Agency Haifa. (INDUS) Hind Terminals 20/0620/06 19/06 1500 MSC Greenwich IP425A Q0634 1094003-11/06 MSC MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals 28/0629/06 28/06 0900 MSC Maeva IP426A Q0659 1094320-14/06 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D).

05/0706/07 05/07 0900 MSC Fie X IP427A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre (EPIC / IPAK)

22/0623/06

30/0601/07

06/0707/07

06/0707/07

TBATBA Seaspan Hudson 4324W Q0613

COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos.

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul

TBATBA Express Rome 4325W Q0649 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS

TBATBA Torrente(GTI) 4220W

TBATBA Sofia Express 4326W

COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports.

ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. Oceangate CFS

19/0620/06 Ningbo Express 2422W Q0531 298442-30/05 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS

26/0627/06

TBATBA CMA CGM Titus 0MXJPW1 Q0632 299195-11/06 CMA CGM CMA CGM Ag. Valencia, Cagliari. (IMEX Service) Dron-3 & Mul 03/0704/07 TBATBA Koi 0MXJRW1 COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 20/0621/06 19/06 2100 Maersk Tukang 424W Q0575 298711-03/06 Maersk Line Maersk India Jeddah, S.Canal, Port Said, Tangier, Algeciras, Valencia, Maersk CFS 27/0628/06 TBATBA Maersk Guatemala 425W Q0593 298910-06/06 Geona (ME 2) 04/0705/07 TBATBA Maersk Genoa 426W TO LOAD FOR

In Port 19/06 APL Salalah OPE93W1 Q0560 298673-03/06 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 25/0626/06 TBATBA CMA CGM Gemini OPE9FW1 Q0643 299304-12/06 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras. (EPIC) 19/0620/06 19/06 1600 Hyundai Faith 109W Q0543 298540-31/05 HMM HMM Shpg. Jeddah, Damietta, Piraeus, Genoa, Valencia, Barcelona, Seabird CFS (FIM West Bound) ONE Line ONE (India) Valencia, Barcelona, Genoa, Piraeus, Damietta, Algeciras 20/0621/06

21/06 1700 Shimin 21E Q0511 298320-28/05

Maersk Chicago 424W Q0577

Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 29/0630/06 TBATBA Maersk Kinloss 425W Q0595 298913-06/06 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS

06/0707/07 TBATBA W. Kyrenia 426W US East Coast Ports. Middle East Container Lines(MECL)

13/0714/07 TBATBA Maersk Kensington 427W Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1

28/0629/06 TBA 1000 MSC Rochelle IV426A Q0639 1094066-12/06 MSC MSC Agency Freeport, Houston. Hind Terminal 05/0706/07 TBA 1000 MSC Barbados IV427A (INDUSA)

Port 19/06 MSC Rapollo IS422A Q0617 1093742-08/06 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals

28/0629/06 28/06 1100 MSC Regulus IS423A Q0625 1093879-10/06 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 02/0703/07 02/07 1100 MSC Ravenna IS424A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast.

19/0620/06 19/06 1000 Kotka IU424A Q0626 1093888-10/06 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 03/0704/07 03/07 1000 MSC Mundra VIII IU426A Kotak Global Kotak Global US East, West & Gulf Coast (INDUS)

20/0620/06 19/06 1500 MSC Greenwich IP425A Q0634 1094003-11/06 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals 28/0629/06 28/06 0900 MSC Maeva IP426A Q0659 1094320-14/06 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira,Paita, 05/0706/07 05/07 0900 MSC Fie X IP427A Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK)

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3

Safewater Safewater Line US East Coast, South & Central America 23/0624/06 TBATBA Navios Constellation 4125 Q0615 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah & Dron.-3 & Mul. OOCL OOCL(I) Other US East Coast Ports. Dronagiri-2

Hapag ISS Shpg. ULA CFS

ONE Line ONE (India) India America Express (INDAMEX)

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3

Team Lines Team Global Log. Norfolk, Charleston. Conex Terminal

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1

Kotak Global Kotak Global US East, West & Gulf Coast

20/0621/06

TBATBA Dimitris Y 245E Q0599 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 07/0708/07 TBATBA One Reliability 005E & Caribbean Ports, Canada.

11/0712/07

TBATBA Cap Andreas 012E

Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 14/0715/07

23/0624/06

30/0601/07

28/0629/06

TBATBA X-Press Antlia 24004E West Indies Ports. (TIP Service)

TBATBA ONE Recommendation 0002 Q0611

TBATBA San Francisco Bridge 0073

ONE Line ONE (India) New York, Jacksonville, Savannah, Charleston, Norfolk

HMM HMM Shpg. (WIN/IAX)

TBATBA Seamax Stratford 130E OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 04/0705/07

TBATBA Xin Da Yang Zhou 094E RCL RCL Ag USA East Coast & Other Inland Destinations. 10/0711/07

16/0717/07

TBATBA Torrance 28E COSCO COSCO Shpg. US West Coast.

TBATBA Aka Bhum 022E Yang Ming Yang Ming(I) US West

DUBAI EAST AFRICA)

(IDEA)

In Port 20/06 Maersk Virginia 425W Q0572 298709-03/06 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile) Maersk CFS In Port 20/06 X-Press Mekong 240058 Q0573 298768-04/06 X-Press Feeders Sea Consortium Jebel Ali 01/0702/07 TBATBA Wan Hai 316 217W Q0672 299461-14/06 Wan Hai Wan Hai Lines (I) (RGI)

06/0708/07 TBATBA Addison 006 Q0621 299109-10/06 UnifeederUnifeeder

19/0620/06 19/06 1800 Shabgoun 1326NQ0295 296494-29/04 HDASCO Armita India Bandar Abbas, Chabahar. (IIX) 19/0620/06 TBATBA OEL Shasta 139 Q0506 298294-27/05 ONE Line ONE (India) Jebel

Feng Xin Da 29 24009 SeaLead SeaLead Shpg. Sohar, Jebel Ali. 23/0624/06 23/04 1200 Abrao Cochin 019E Q0641 299277-11/06 Blue Water Lines PoseidonShpg. Sohar, Jebel Ali, Dammam. (GIX) Speedy CFS 22/0623/06 TBATBA Maersk Chicago 424W Q0577 298715-03/06 Maersk Line Maersk India Salallah. (MECL)

CFS 22/0623/06 TBATBA Inter Sydney 0158 Q0588 1093496-06/06 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar. 23/0624/06

TBATBA Maersk Cairo 426S Q0578 298717-03/06

Terataki 2408W Q0631 1093979-11/06 Asyad Line Seabridge Sohar, Jebel Ali. (IEX) 27/06 28/06 TBATBA Tonsberg OPU0DS1 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. 09/0710/07 TBATBA Tessa 2404S RCL/CUL Line RCL/Seahorse

Ajman, 25/0626/06 TBATBA SSF Dynamic 071W Q0586 298809-05/06 Umm Al Quwain, Ras Al Khaima. (UIG) 26/0627/06 TBATBA Advance 054W Q0640 COSCO COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain 29/0630/06 TBATBA San Pedro 091W

OOCL (I) (AGI-2) 03/07 04/07 TBA 1200 MSC Brianna JU425R

MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam,Umm Qasr (UGE) Hind Terminal 05/0706/07 TBATBA TS Dalian 009W Q0655 299370-13/06 Samudera Samudera Shpg. Jebel Ali, Dammam Dronagiri

06/0707/07

07/0708/07

TBATBA Safeen Prism 010W OOCL OOCL (I) Jebel Ali, Dammam (SIG)

TBATBA Oshairaj 2413 Q0653 299358-13/06 Global Feeder Sima Marine Hamad. Dronagiri QNL/Milaha PoseidonShpg. Hamad. (IMX) Speedy CFS

Emirates Emirates Shpg. Jebel Ali, Sohar. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr. Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports. LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Team Lines Team Global Log. Gulf Ports. Conex Terminal

TBATBA Navios Verde 2424W

Seaspan Lahore 2425W

TBATBA Seattle Bridge 090E

TBATBA Ever Sigma 127E

Colombo.

Line ONE (India) Colombo. (CISC Service) 08/0709/07

TBATBA Celsius Naples 903E CSC Seahorse Colombo. 25/0626/06

TBATBA Maersk Chennai 425W Q0596 298911-06/06 CMA CGM CMA CGM Ag. Colombo (MESAWA) Dronagiri

28/0629/06 TBA 1000 MSC Rochelle IV426A Q0639 1094066-12/06

MSC Agency Colombo. (INDUSA)

Hind Terminal TO LOAD FOR INDIAN SUB CONTINENT from NSIGT

19/0620/06 19/06 1000 Kotka IU424A Q0626 1093888-10/06 MSC MSC Agency Karachi. (INDUS)

Hind Terminals 21/0622/06 19/06 1200 MSC Virginia FD418E Q0644 1094088-12/06 MSC MSC Agency Colombo. (DRAGON EB) Hind Terminals

In Port 19/06 One Contribution 0057E Q0571 298750-04/06 ONE Line ONE (India) Colombo. 25/0627/06

TBATBA Seaspan Adonis 0075E Q0646 299337-12/06 Yang Ming Yang Ming(I) Contl.War.Corpn. 03/0704/07 TBATBA One Altair 065E Hapag/CSC ISS Shpg/Seahorse (PS3 Service)

CFS/ 11/0712/07

TBATBA One Arcadia 069E HMM HMM Shpg. Seabird CFS

20/0621/06 TBATBA Dimitris Y 245E Q0599 ONE Line ONE (India) Colombo.

07/0708/07 TBATBA One Reliability 005E X-Press Feeders Sea Consortium Colombo. Dronagiri 11/0712/07 TBATBA Cap Andreas 012E CSC Seahorse Colombo. (TIP Service) HMM HMM Shpg. Colombo.

22/0623/06 22/06 1200 Jeju Island E405 Q0569 298739-04/06 Wan Hai Wan Hai Lines Colombo. (CI2)

Seabird CFS

& Mul CFS 28/0629/06

TBATBA Seamax Stratford 130E Q0661 OOCL OOCL (I) Colombo. GDL 04/0705/07

TBATBA Xin Da Yang Zhou 094E

Star Line Asia Seahorse Yangoon.(CIX-3) Dronagiri-3 TO

20/0621/06 19/06 1500 Xin Ya Zhou 162E Q0564 298695-03/06 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 21/0622/06 21/06 1700 One Matrix 089E Q0519 298361-28/05 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo

—/Dron-3 22/0623/06 22/06 1200 X-Press Capella 24004E Q0561 298675-03/06 X-Press Feeders SeaConsortium (CWX/CIX5) 27/0628/06 27/06 0300 TS Keelung 24002E Q0607 298964-07/06 TS Lines/PIL TS Lines(I)/PIL India

Dronagiri-2/— 24/0625/06 24/06 0700 Maersk Cuanza 425W Q0579 298716-03/06 Maersk Line Maersk India Colombo (MW2)

28/0629/06

TBATBA Ever Elite 167E Q0630 Evergreen Evergreen Shpg. Colombo

Maersk CFS

Balmer Law. CFS Dron. 28/0629/06 TBATBA Monaco 107E

KMTC/Gold Star KMTC(I)/Star Ship

06/0707/07

TBATBA ESL Busan 02424E X-Press Feeders SeaConsortium (NIX Service) 12/0713/07 TBATBA Zim Tempa 21E EmiratesEmirates

Dronagiri-3/—

Dronagiri-2 05/0706/07

24/0625/06

TBATBA TS Dalian 009W Q0655 299370-13/06 Samudera Samudera Shpg. Colombo (SIG) Dronagiri TO

TBATBA CMA CGM Attila 0FFBWE1 Q0600 298937-06/06 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 01/0702/07

TBATBA APL Antwerp 0FFBYE1 RCL RCL Ag. (AS 1) TO LOAD FOR FAR EAST, CHINA & JAPAN PORTS from NSICT

20/0621/06 19/06 1300 BLPL Trust 1406E Q0598 298924-06/06 BLPL Transworld GLS Far East Ports. 21/0622/06 19/06 1200 MSC Virginia FD418E Q0644 1094088-12/06 MSC MSC Agency Dalian, Shanghai, Ningbo, Yantian. Hind Terminals 27/0628/06 TBA 0900 MSC Darlene FD417E (DRAGON EB)

21/0622/06

TBATBA Grace Bridge 2404E Q0513 298349-28/05 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 26/0627/06

TBATBA Ren Jian 23 2407E Q0587 298810-05/06 Heung A Line Sinokor India

27/0628/06 TBATBA Zhong Gu Hang Zhou 24001E

Sinokor Sinokor India Seabird CFS (CSC) TS Lines TS Lines (I)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports

Blue Water PoseidonShpg. Shanghai, Ningbo, Qingdao. Speedy CFS 22/0623/06 21/06 1700 Shimin 21E Q0511 298320-28/05 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 27/0628/06 TBATBA Seattle Bridge 090E

UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 04/0705/07

TBATBA Ever Sigma 127E

PIL/ONE PIL India/One(I) —/— 08/0709/07

15/0716/07

TBATBA Celsius Naples 903E

TBATBA TS Hong Kong 24002E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS

KMTC KMTC (I)

P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 22/0723/07

TBATBA Ever Excel 175E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 29/0730/07

TBATBA Ever Ethic 169E

HMM HMM Shpg. P.Kelang(S), Singapore, Xiangang,Qingdao, Kaohsiung. Seabird CFS (CISC Service)

Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 25/0626/06

TBATBA Terataki 2408W Q0631 1093979-11/06

Asyad Line Seabridge Haiphong, Shekou, Laem Chabang. (IEX) 03/0704/07

TBATBA BLPL Blessing 2413E

BLPL

Transworld GLS Far East Ports. (SM1)

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR CARTING DATE TIME NAME No.No. No.&Dt. POINT

In Port 19/06 One Contribution 0057E Q0571 298750-04/06

ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 25/0627/06

TBATBA Seaspan Adonis 0075E Q0646 299337-12/06 Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 03/0704/07

TBATBA One Altair 065E

HMM HMM Shpg. Seabird CFS 11/0712/07

TBATBA One Arcadia 069E

Samudera Samudera Shpg. Dronagiri (PS3 Service) Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 20/0621/06

TBATBA Dimitris Y 245N Q0599

ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 07/0708/07

TBATBA One Reliability 005E

X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 11/0712/07

TBATBA Cap Andreas 012E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 14/0715/07

TBATBA X-Press Antlia 24004E

RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service) 21/0722/07

TBATBA MOL Presence 015E

HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS 22/0623/06

TBATBA Zhong Gu Shen Yang O2420E Q0585 298808-05/06 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang, Cai Mep 24/0625/06

TBATBA ESL Nhava Sheva O2421N Q0589 298886-05/06 CU Lines/KMTC Seahorse/KMTC(I) 09/0710/07

TBATBA Tonsberg OPUOEW1

SeaLead SeaLead Shpg. (VGX)

22/0623/06 22/06 1200 Jeju Island E405 Q0569 298739-04/06 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS

28/0630/06

TBATBA Wan Hai 369 E004 Q0671 299456-14/06 COSCO COSCO Shpg. Ningbo, Shekou. 05/0706/07

TBATBA Wan Hai 501 E248 InterasiaInterasia (CI2) 12/0713/07

19/0720/07

TBATBA Interasia Momentum E047 HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS

TBATBA Wan Hai 515 E092 CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai.

23/0624/06 22/06 2300 X-Press Carina 24025E Q0562 298674-03/06 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS

25/0626/06

01/0702/07

TBATBA X-Press Cassiopea 24026E X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3)

TBATBA X-Press Phoenix 24027E

Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS 24/0626/06

TBATBA Ital Unica E176 Q0557 298616-03/06 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dronagiri-1 25/0626/06

TBATBA Wan Hai 521 E024 Q0628 299177-11/06 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 02/0703/07

TBATBA Argolikos E162 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 09/0710/07

TBATBA Wan Hai 502 E124 TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 28/0629/06

TBATBA Seamax Stratford 130E Q0661

OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 04/0705/07

TBATBA Xin Da Yang Zhou 094E APL CMA CGM Ag. Dron.-3 & Mul. 10/0711/07

TBATBA Torrance 28E ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 16/0717/07

TBATBA Aka Bhum 022E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3)

Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

In Port 20/06 Yeosu Voyager E405 Q0603 298954-06/06 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 26/0627/06

TBATBA Interasia Enhance E035 Q0637 299243-11/06 Heung A Line Sinokor India Hongkong 03/0704/07

TBATBA Wan Hai 523 E030 Q0678 299553-17/06 Wan Hai Wan Hai Lines (CI6)

09/0710/07 TBATBA Northern Guard E924 InterasiaInterasia

Dron-1 & Mul CFS

16/0719/07 TBATBA Wan Hai 510 E180 Feedertech Feedertech/TSA Dronagiri 20/0621/06 19/06 1500 Xin Ya Zhou 162E Q0564 298695-03/06 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 22/0623/06 21/06 0200 Xin Hong Kong 071E Q0548 298620-03/06 APL CMA CGM Ag. Nansha, Taichung, Kaohsiung.

Dron.-3 & Mul (CI 1)

OOCL/RCL OOCL(I)/RCL Ag.

GDL/— CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung.

21/0622/06 21/06 1700 One Matrix 089E Q0519 298361-28/05 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou

22/0623/06 22/06 1200 X-Press Capella 24004E Q0561 298675-03/06 X-Press Feeders SeaConsortium 27/0628/06 27/06 0300 TS Keelung 24002E Q0607 298964-07/06 KMTC/TS Lines KMTC(I)/TS Lines(I) (CWX/CIX5)

Dron-3/Dron-2 09/0710/07

TBATBA X-Press Pisces 24005E

Gold Star Star Ship 10/0711/07

TBATBA Ever Envoy 189E

RCL/PIL RCL Ag./PIL India 17/0718/07 TBATBA Zhong Gu Nan Ning 2404E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 21/0622/06 21/06 0200 SM Tianjin 2420E Q0549 298623-03/06 RCL/PIL RCL Ag./PIL Port Kelang, 01/0702/07

TBATBA Vira Bhum 115E Q0648 299347-13/06 CU Lines Seahorse Ship HaIphong, 07/0708/07

TBATBA Ever Dainty 179E Evergreen Evergreen Shpg. Nansha, Shekou. BalmerLaw.CFSDron. 14/0715/07

TBATBA API Bhum 009E InterasiaInterasia (RWA / CIX 4) 21/0722/07

TBATBA Kota Loceng 147E

Emirates Emirates Shpg. 22/0623/06 21/06 1200 KMTC Yokohama 2405 Q0612 298998-07/06 Wan Hai Wan Hai Lines Port Kelang, Jakarta, Dronagiri-1 29/0630/06

TBATBA Wan Hai 309 022 Surabaya 04/0705/07

26/0627/06

TBATBA Interasia Progress E088

KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Dronagiri-3/— (AIS5/SI8 Service) Surabaya

TBATBA Zhong Gu Gui Yang 02422E

KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 29/0630/06

TBATBA KMTC Colombo 0204E

TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 07/0708/07

TBATBA Ian H 02402E

COSCO COSCO Shpg. (AIS SERVICE)

Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2 28/0629/06

28/0629/06

TBATBA Ever Elite 167E Q0630

TBATBA Monaco 107E

Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron.

KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay Dronagiri-3/— 06/0707/07

TBATBA ESL Busan 02424E

X-Press Feeders Sea Consortium 12/0713/07

TBATBA Zim Tempa 21E

Emirates Emirates Shpg

Dronagiri-2 26/0727/07

TBATBA Zoi 115E

Pendulum Exp. Aissa Maritime (NIX Service)

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 02/0703/07

TBATBA Hyundai Brave 0110E

HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai Seabird CFS (FIM East Bound)

Sinokor Sinokor India Seabird CFS 05/0706/07

TBATBA TS Dalian 009W Q0655 299370-13/06 ONE Line ONE (India) Singapore 06/0707/07

TBATBA Safeen Prism 010W

Samudera Samudera Shpg. (SIG) Dronagiri

20/0621/06

24/0626/06

TBATBA Dimitris Y 245E Q0599

One Reliability 005E

TBATBA Cap Andreas 012E

TBATBA Ital Unica E176 Q0557 298616-03/06

& Mul. 25/0626/06

02/0703/07

09/0710/07

28/0629/06

TBATBA Wan Hai 521 E024 Q0628 299177-11/06 Auckland, Tauranga, Madang, Port Lae, Rabaul, Port Moresby

TBATBA Argolikos E162

TS Lines TS Lines (I) Australian Ports. Dronagiri-2

TBATBA Wan Hai 502 E124 (CIX)

TBATBA Seamax Stratford 130E Q0661 ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 04/0705/07

TBATBA Xin Da Yang Zhou 094E

RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 10/0711/07

TBATBA Torrance 28E

OOCL OOCL (I) Sydney, Melbourne. GDL 16/0717/07

TBATBA Aka Bhum 022E

26/0627/06

TS Lines TS Lines (I) Australian Ports. Dronagiri-2 (CIX-3)

Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3

Team Lines Team Global Log. Australia & New Zealand Ports. Conex Terminal

TBATBA Zhong Gu Gui Yang 02422E

TS Lines

19/0620/06 ESL Asante 2425S Q0554 298638-03/06

TBATBA Ren Jian 8 2427S Q0654

(SWAX)

Shpg. Longoni, Dar

Zanzibar, Nacala &

TBATBA Navios Verde 2424W ONE Line ONE (India) Durban, Cape Town, Tema, Tincan, Apapa. 30/0601/07 TBATBA Seaspan Lahore 2425W Hapag ISS Shpg. (AIM)

23/0624/06 22/06 1500 Contship Uno 24013 Q0568 SeaLead SeaLead Shpg. Mombasa, Dar Es Salaam 26/0627/06 TBATBA TS Kwangyang 23004 Q0606 298963-07/06 OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA - INDIA DUBAI EAST AFRICA) GDL/—

19/0620/06 TBATBA OEL Shasta 139 Q0506 298294-27/05 ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI)

21/0622/06

TBATBA Halsted 424S Q0576 298713-03/06 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3 & Mul. 28/0629/06

TBATBA BFAD Pacific 425S Q0594 298912-06/06 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS (MIDAS-2) DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira. 23/0624/06

TBATBA Maersk Cairo 426S Q0578 298717-03/06 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS

30/0601/07 TBATBA Maersk Cape Town 427S Q0597 298914-06/06 (MWE SERVICE) 07/0708/07

TBATBA Maersk Cabo Verde 428S 25/0626/06

TBATBA Maersk Iyo 426W CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3 & Mul.

TBATBA Maersk Chennai 425W Q0596 298911-06/06 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 03/0704/07

In Port 19/06 MSC Rapollo IS422A Q0617 1093742-08/06 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 28/0629/06 28/06 1100 MSC Regulus IS423A Q0625 1093879-10/06 Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware 19/0620/06 19/06 1000 Kotka IU424A Q0626 1093888-10/06 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Hind Terminals (INDUS) Oran, Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa

20/0620/06 19/06 1500 MSC Greenwich IP425A Q0634 1094003-11/06 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 28/0629/06 28/06 0900 MSC Maeva IP426A Q0659 1094320-14/06 CMA CGM CMA CGM Ag. Dakar, Nouakchott, Banjul, Conakry, Freetown, Monrovia, Sao Tome, Bata, Dron.-3 & Mul. 05/0706/07 05/07 0900 MSC Fie X IP427A Guinea Bissau, Nouadhibou, Dakar, Abidjan,Tema, Malabo & Saotome. (EPIC / IPAK) GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK)

30/0601/07 TBATBA MSC Nora III IB425A MSC MSC Agency Port Louis, Durban. (ILANGA EXPRESS) Hind Termina

23/0624/06 22/06 2300 X-Press Carina 24025E Q0562 298674-03/06 CMA CGM CMA CGM Ag. Beira, Maputo, Nacala, Tanga, Lilongwe & Harare. Dron.-3 & Mul.

25/0626/06 TBATBA X-Press Cassiopea 24026E (NWX/FI-3)

28/0629/06 TBATBA Seamax Stratford 130E Q0661

24/0625/06 24/06 0700 Maersk Cuanza 425W Q0579 298716-03/06

27/0628/06 27/06 1200 Maersk Chachai 426W Q0596

MUMBAI: Inflation looks to be easing across the developed world, except for one glaring pocket of hot prices: cargo costs on the high seas

Spot rates for full-size shipping containers to the US and Europe from Asia rose again in the most recent data, with three key routes all topping $6,000 for a 40-foot equivalent unit, according to the Drewry World Container Index, released recently They’ve all tripled since the end of 2023, though the pace of increases is moderating.

Nearly six months of regular attacks on vessels in the Red Sea has stretched capacity in an industry responsible for moving about 80% of all international goods trade,

disrupting the normal flow and leading to bottlenecks in some of Asia’s biggest ports Singapore’s maritime gateway, among the world’s most vital crossroads for s e a b o r n e f r e i g h t , i s f a c i n g a sustained period of congestion The waiting time for berth space there is nearing five days, according to industry estimates, and it’s ranging from one to four days in the Chinese ports of Ningbo, Shanghai and Qingdao

On top of stretched supply, demand for goods is solid especially in the US Imports at the Port of Los Angeles, the busiest seaport in the US, remained above the prepandemic peak in the first five months of 2024 despite ticking down in May

According to Drewry, the cost of a 4 0 - f o o t c o n t a i n e r t o m o v e merchandise to Los Angeles from Shanghai last week rose 0.8% to $6,025. That was the sixth straight week of gains. The charge for Shanghai to Rotterdam increased 2.4% to $6,177, the highest level since September 2022.

From Shanghai to Genoa, Italy, in the Mediterranean Sea — among the routes hardest hit by the shipping industry’s avoidance of the Red Sea the rate rose by 3% to $6,862, according to Drewry. That was also the highest since September 2022. Drewry said it “expects that freight rates from China will continue to rise next week due to congestion issues at Asian ports.”

NEW DELHI: Despite a recordbreaking harvest and a significant increase of nearly 14.1 million tonne in foodgrain production, farmers continue to face distress, thanks to the ban on the export of key agricultural commodities to contain inflation during the elections.

According to farmers, traders, food policy experts and other stakeholders, it is the ban on nonbasmati rice, sugar and wheat that has led to 6.36 per cent decline in the country’s agricultural exports, bringing it to $25,016.05 million in 2023-24 from $26,717 72 million in 2022-23.

Over the past three years, the export ban has resulted in

a cumulative loss of $4,880 million, according to data from the Ministry of Commerce and Industry The ban has resulted in the financial loss of $6,193 million to all stakeholders in the last fiscal alone.

Non-basmati rice exports fell sharply from $6,356 million to $4,573 m i l l i o n , w h i l e s u g a r e x p o r t s decreased from $5,770 million to $2,824 million. Wheat exports, which faces a complete ban, plummeted from $1,520 million to just $56 million.

Over the past three years, the export ban has resulted in a cumulative loss of $4,880 million, according to data from the Ministry of Commerce and Industry The ban has resulted in the financial loss of $6,193

million to all stakeholders in the last fiscal alone.

Non-basmati rice exports fell sharply from $6,356 million to $ 4 , 5 7 3 m i l l i o n , w h i l e s u g a r exports decreased from $5,770 million to $2,824 million Wheat exports, w h i c h f a c e s a c o m p l e t e b a n , plummeted from $1,520 million to just $56 million.

Experts and traders stress a pro-farmer export policy is essential to address the issue of declining agricultural income. Although major political parties have promised to boost farmers’ earnings, none has emphasised the critical need to overhaul the export policy to effectively tackle the issue.

NEW YORK: Fitch Ratings raised India's growth forecast to 7.2 per cent from 7 per cent for the ongoing financial year on the back of a rapid growth seen in recent quarters underpinned by a 'fast expansion' in investment, per June Global Economic Outlook released recently

Indian economy grew 7.8 per cent in the final quarter of FY24, higher than Fitch Ratings' expectations, while it grew 8.2 per cent in FY24 overall.

"Falling indirect taxes net of subsidies have boosted GDP growth relative to gross value-added at basic prices. The latter is currently a better guide to underlying momentum and has been growing at just over 7 per cent," Fitch said.

T h e r a t i n g a g e n c y e x p e c t s investment to continue rising in Prime Minister Narendra Modi's third term, however, more slowly than seen in recent quarters. It also expects consumer spending to recover owing to elevated consumer confidence.

Fitch expects the 'above normal' monsoon forecast for June-September to limit risks from food price spikes.

Fitch expects headline inflation in India to decline to 4.5 per cent by the end of 2024 and average 4.3 per cent in 2025 and 2026.

Fitch on global growth prospects

Meanwhile, it said that the global growth is expected to slow in 2025 despite monetary easing in 2024.

"The global monetary policy cycle is

entering a new phase, in which rates will be falling slowly but to levels that will still be restricting demand. We expect the ECB to cut rates twice more this year, and the Fed to start cutting rates in September with another cut in December This is later than we had expected, reflecting stalled disinflation momentum in the first four months of the year But US wage growth is gradually cooling," said in a report.

"Nevertheless, central banks remain cautious about loosening policy too rapidly, particularly in light of high services inflation Pressures from rising labour costs and housing rents and the normalisation of relative price trends are keeping services inflation elevated," it further said.

LONDON: Since early May, shippers, forwarders/NVOs, ocean carriers and ports have experienced a return to capacity challenges, soaring spot freight rates, chronic port delays and a surge of traffic volumes.

Some shippers are having issues securing capacity at agreed contract rates. The Drewry World Container Index, a weighted average of spot rates on 8 East-West routes, had declined steadily from $3,964/40ft container in January to $2,705 in late April, as carrier networks appeared to settle down after the start of Red Sea attacks. But spot rates then surged 74% between late April and early June – and we know from shippers that many are asked to pay Peak Season Surcharges.

Drewry has previously identified 4 causal factors behind the recent problems:

1.Stagnant capacity

2.Very strong demand growth

3.Shipper behaviour

4.Operational disruption

Here is our latest independent assessment of these factors and their durations.

Stagnant capacity

Drewry data shows that carriers have added many ships into their East-West services to compensate for the longer routes now used by nearly all the former Suez Canal-dependent carriers. On the Asia-North Europe route, according to Drewry Container Forecaster data, carriers have increased their number of ships 24% and their total capacity 17%

But this large addition of ships resulted in only a 2% increase in the monthly effective capacity per month, to 1.1 mteu, because these assets are now sailing over longer distances and are less productive than before the Red Sea attacks started.

On the Asia-East Coast of North America route, carriers increased their number of ships 9% during the same period, but their effective capacity per month increased… 0%.

This is a key factor behind the current tight capacity: about 1 million teu of ship capacity was delivered in the first 4 months of 2024, but this made zero difference to the monthly effective capacity provided to the market.

In our analysis of capacity problems, Drewry considers that the remaining capacity due to be delivered during 2024 will, finally, have

an expansionary effect on effective capacity It will not be a repeat of merely correcting the need for more ships after the Red Sea diversions. Very strong demand growth

Data for May is still limited, but it is clear that transpacific volumes and volumes on several other routes are stronger than a year ago.

According to the National Retail Federation, US containerised imports in May were forecast to reach 2.1 mteu, an increase of 8% from the 1.9 mteu of May 2023.

We note that, back in May 22, during the pandemic, US imports totalled 2.4 mteu, so the May 24 figure is still 12% lower than during the previous troublesome volume peak.

Shipper behaviour

A s u r v e y o f D r e w r y Benchmarking Club members –a group of 100+ multinationals –f o u n d t h a t a p r o p o r t i o n o f international shippers are indeed shipping early, this year This precautionary policy, often intended to ensure that shipments arrive in time, may intentionally cause capacity issues and delays, because the capacity and infrastructures are stressed.

In our analysis of the market, we consider that an early peak season is both a short-term change in the market and a signal that there will be a volume vacuum when the peak volumes have been completed.

Operational disruption

Port productivity has also taken a hit in recent months. The time spent by ships waiting before berthing at high-volume ports tracked by Drewry increased 43% between 3Q23 and 2Q24 – to over 400,000 hours. We heard that a major transhipment port in Asia is experiencing a density of shipping containers in their terminals close to the records of the pandemic. Port strikes on the US East and Gulf coasts could widen the operational disruptions

T h e r e f o r e , t h e l a r g e - s c a l e changes in liner networks and the relocation of much transhipment activity to new locations have still not normalised.

It is now clear that operational d i s r u p

e l y constraining supply According to preliminary numbers from the Drewry Container Forecaster (2Q-24 Edition currently being finalised) –

the supply-demand balance in the g l o b a l c o n t a i n e r m a r k e t h a s increased.

With all these moving pieces, Drewry is now considering the likely duration of the Red Sea diversions and the impact of port congestion on s u p p l y a n d s u p p l y D i f f e r e n t scenarios must be considered, and some negative factors are expected to continue after the end of this year

Of the 4 factors causing the current capacity and efficiency issues, only some look to last longer than a year The end of the peak season, the continuous delivery of new ships and the re-opening of the Suez Canal route could all help redress the current supply-demand problems.

Frankly, nobody can answer when normal shipping operations will resume (i.e. when the Suez Canal will be back in full-scale use) with any degree of confidence, but Drewry has tried to harness the collective wisdom of our customers, many of which are involved at the coal face, to at least formulate an educated guess and get a sense of the range of opinions.

The survey results are quite bleak, w i t h l e s s t h a n 1 7 % o f t h e 90 respondents anticipating an end to Red Sea diversions before 2024 is out.

While 2H24 was the second favoured option, it was a long way behind the clear favourite, 1H25, which garnered a clear majority of 60%. The third most popular choice was 2H25 with 14.4%, followed by 1H26 with 5 6% Only 3% of respondents were so pessimistic that they couldn’t see an end to the situation before the end of 2026.

Responses to the ancillar y question on how long it will take liner operations to normalise once the Red Sea diversions are over, suggests that things will not snap back into p l a c e n e a t l y s t r a i g h t a w a y Most respondents (43%) opted for a 3-month normalisation period, followed by “longer than 3 months” at 27% and 2-months at 25%.

Drewry’s View

There is no consensus expectation that the Red Sea crisis will end this year, despite diplomatic talks concerning Gaza Shippers should expect the continuation of long transit times and higher risks of transport and supply chain disruptions, plus continued capacity challenges in the short term.

(As Agent of NYK Bulk & Project Carriers Ltd.) (Formerly known as NYK Auto Logistics (India) Private Limited, in which NYK Line (India) Private Limited has been merged) CIN No.: U63000MH2004PTC143860 / PAN No. AAACH7663P

The captioned vessel is arriving at MUMBAI on 21/06/2024 with Import cargo.

Consignees expecting import cargoes on the captioned vessel are requested to present their ORIGINAL BILLS OF LADING duly discharged and obtain Delivery Orders. In the event of Mumbai Port Trust directing the shifting of the cargo from quay to a storage area within the docks, the same will be undertaken by the vessel agents at the consignee’s risks and costs.

“Stamp duty” is payable as per the directive of the Superintendent of stamps.

Consignees will please note that the Carriers and/or their agents are not bound to send the individual notifications regarding the arrival of the vessel or their cargo.

Consignees are requested to arrange for clearance of the cargo at the earliest on presentation of the packing list to our attending surveyors, as it is noticed that the cargo is arriving without proper Marks & Numbers and the same is also not indicated in the Bills of Lading for which the vessel/Owners/Agents will not be held responsible for the consequences arising thereof.

Consignees requiring steamer survey to be conducted for the goods discharge may contact the agents office for the same.

The company’s Surveyors are M/S. AINDLEY MARINE PVT. LTD. 9 Kamanwala Chambers, 1st Floor, Sir P. M. Road, Fort, MUMBAI- 400001 Tel: +91-22-66359901/2/3 E-mail : Email: ops@aindley.com and the usual survey conditions will apply General Agent

Unit No 1205-1208, 12th Floor, Windfall Sahar Plaza Complex, Sir M. V. Road, J.B. Nagar, Andheri-Kurla Road, Andheri (East), Mumbai - 400 059. Contact details: Board : +91 22 - 4613 8181 Website : www.nyklineindia.com

m.v. “MSC VIRGINIA” V- FD418E I.G.M. No. 2380072 Dtd. 18-06-24 Exch rate 85.99

The above vessel is arriving on 21-06-2024 at NHAVA SHEVA (NSIGT) with import cargo from CORONEL, ALEXANDRIA EL DEKHEILA, MALAGA, SANTA CRUZ DE TENERIFE, VALENCIA, FOS-SUR-MER, HAIFA, ANCONA, AUGUSTA PORT OF CATANIA, BARI, GIOIA TAURO, GENOA, PALERMO, RAVENNA, LA SPEZIA, TRIESTE, VENICE, SINES, PORT SUDAN, KOPER, TUNIS, ALIAGA.

Please note the item Nos. against the B/L Nos. for NHAVA SHEVA (NSIGT) delivery.

5181960361

5182160362

0924300135

00243002821

0924300136

0924300137

5134659742

ITBLQ0000019706

S04307974

2024ME00174104

S00168537

5185660329

2109

2111

2112

S00167801

Consignees are requested to kindly note that the above item nos. are for the B/L Nos. arrived for Nhava Sheva delivery. Consignees are requested to collect Delivery Order for all imports delivered at Nhava Sheva from our Import Documentation Dept. at Nhava Sheva - DN210 / DN211 / DN212, D-Wing, 2nd Floor, NMSEZ Commercial Complex, Plot No. 6, Sector - 11, Opp. JNPT Township, Dronagiri Node, Navi Mumbai - 400 707 , India and Mumbai - 1st Floor, MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400059 on presentation of duly discharged Original Bill of Lading and payment of relevant charges.

The container detention charges will be applicable after standard free days from the discharge of containers meant for deliver y at Nhava Sheva. The containers meant for movement by road to inland destinations will be dispatched upon receipt of required documents from consignees/receivers and the consignees will be liable for payment of por t storage charges in case of delay in submission of these documents. Our Sur veyors are M/s. Zircon Marine Services Private Limited. and usual survey conditions will apply. Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo. Incase of any query, kindly contact Import Customer Service - (022) 66378123; IN363-imports.mumbai@msc.com Get

No. / ITEM No. /CFS

No. (IVRS No.) 8169256872 You can also visit our

NEW DELHI: India’s coal import rose by 13.2 per cent to 26.10 million tonne (MT) in April 2024 as buyers took fresh positions amid early onset of summer. The country had imported 23.05 MT of coal in the year-ago period, a c c o r ding t o da t a c o m pile d b y B2B e-commerce company mjunction services ltd.

This comes amid coal and mines minister G Kishan Reddy stating that India should increase domestic

production of the fossil fuel and reduce coal imports “India’s coal and coke imports in April 2024 through the major and non-major ports increased by 13.2 per cent over April 2023,” the data showed Of the total import in April, non-coking coal import stood at 17 40 MT against 15 15 MT in the yearago month Coking coal import was 4 97 MT against 4 77 MT “ T h e r e w a s a n i n c r e a s e i n volumes…Going ahead, there may be

continued demand from both the power and non-regulated sectors due to pre-monsoon restocking,” mjunction MD & CEO Vinaya Varma said. Coal imports in April were up by 8.93 per cent as against March when imports stood at 23.96 MT India’s coal import rose by 7.7 per cent to 268.24 MT in FY24 driven by softness in seaborne prices and likelihood of increase in power demand during summer The country’s coal import was 249.06 MT in FY23.

NEW DELHI: In FY24, Indian red chilli exports have soared to a record $1.509 billion, pushed by high demand from China and Bangladesh This is around 15% higher over the pervious year when exports stood at $1.30 billion. In volume terms chilli exports in FY24 were 6.01 lakh tonnes, a 15% growth over 5.24 lakh tonnes. In FY24, China

has been the top importer of Indian chilli with imports exceeding 1.79 lakh tonnes valued at over Rs. 4,123 crore.

The second-largest buyer of Indian chillies in value terms is Thailand, as it imported Rs. 1,404 crore worth of the agri commodity, up 10 6% from the previous year’s Rs 1,269 crore In volume terms, chilli exports during

2023-24 grew by around a tenth at 59,838 tonnes from the previous year’s 54,512 tonnes. During the past financial year, shipments to Bangladesh grew by 67% to about 90,570 tonnes from the previous year’s 53,986 tonnes. In value terms, chilli exports to Bangladesh were up 35 per cent at Rs. 1,210 crore from the previous year’s Rs. 892 crore.

LONDON: Using SMART port technologies to facilitate ‘just in time’ ship arrivals has the potential to reduce g r e e n h o u s e a n d p o l l u t a n t g a s emissions significantly at global container ports. Drewry’s latest r e s e a r c h s h o w s t h a t t a r g e

w

m

h a disproportionate amount of waiting time will generate the highest benefits for the industry as a whole.

Shipping accounts for almost 3% of g l o b a l g r e e n h o u s e g a s ( G H G ) emissions and for ports ocean-going vessels are typically one of the major contributors to GHG and pollutant emissions in the port area Notably, ocean-going vessels and inland transport generate significantly higher emissions than the harbour-based support craft (i.e. tugs, pilot boats, etc) and cargo handling equipment that is under the direct control of companies situated within the port.

Ports have a significant role as facilitators of the decarbonisation of the shipping industry and in particular initiatives to reduce emissions originated by the operations mentioned above are essential. Considering oceangoing vessels, navigating, approaching and waiting are the key areas where emissions savings could be made.

A major element of avoidable GHG emissions in ports is the time vessels spend waiting at anchor before moving onto a berth. Using its proprietary AIS model, Drewry has analysed the performance of 193 of the world’s largest container ports, accounting for over 85% of global container trade, and showed that in 2023 total pre-berth waiting time remained 40% above 2019 levels There is also considerable regional variation, driven by differences in traffic levels and port congestion.

In container shipping, berths are usually allocated on the basis of prebooked slots (i.e. berthing windows), with multi-port schedules developed to

enable on-time arrival at each port Drewry’s analysis shows that despite a recovery from the supply chain disruptions incurred during the pandemic, a significant number of vessels have continued to operate on the basis of ‘sail-fast-then-wait’ which results in the earliest arrival time at the port, no matter whether a berth is available or not.

‘Just in time’ (JIT) arrival systems aim to reduce waiting by aligning vessel speed on inbound voyages with berth availability They support the reduction of speed, lowering fuel consumption and emissions on the main voyage, and reducing the time spent and emissions generated at port anchorage zones.

D r e w r y ’ s t r a c k i n g o f p o r t

congestion shows that pre-berth waiting delays vary widely between ports in its global ranking, based on a combination of both total pre-berth waiting time and average pre-berth waiting time per 1,000 teu port throughput.

To illustrate the potential benefits of JIT arrival systems, Drewry analysed congestion hotspot Dar es Salaam, where last year vessels waiting at anchor for over one week accounted for almost 70% of total waiting time incurred at the port – which in 2023 totalled almost 2,000 days. We looked at what effect reducing the average speed on the inbound voyage would have on time spent in the port’s anchorage zones (speed reduction only applied to vessels incurring 8 hours or more of waiting time upon arrival at the port). The results indicated that capping average inbound voyage speed to 10 knots during congested periods would have generated waiting time savings of 31% – equivalent to 23,000 CO2eq of emissions A more conser vative scenario whereby average inbound voyage speed was capped at 12 knots generated waiting time savings of 16% (or 11,800 CO2eq).

typically call at multiple ports in a coastal or regional range, with order of port calls often dictated by geography. Greater coordination between these ports could help reduce their respective emissions from ocean-going vessels, particularly where voyage durations are relatively short, such as on the US East Coast. This would enable vessels to be given notice of berth availability conditions for their next port of call before departing their current call.

Drewry ’s analysis of vessels departing from the US port of Norfolk with next port of call Savannah, which is located 450 nautical miles to the south, suggests that a selective speed reduction to achieve a 10-knot average speed (as a proxy for JIT) during congested periods could have reduced pre-berth waiting at Savannah by 24%, equating to a saving of almost 7,250 tonnes CO2eq A 12-knot threshold would have generated waiting time savings of 6% or 1,800 tonnes CO2eq.

Implementing JIT arrival systems requires integration of port, terminal and carrier management systems, as well as the capability to interface with other service providers which play a key role in supporting ship arrivals and departures at each port Hence, o r g a n i s

i o n a l c h a

e n g e s t o implementing these systems are high, especially in emerging markets. Many of the ports with the highest potential to benefit are also likely to be the least prepared to implement these solutions.

While the potential for significant emission reductions are reduced if the underlying causes of longer waiting time, such as low berth productivity, are not addressed, Drewry’s view is that JIT arrival systems are well placed to deliver emissions reduction in the near term, and targeting investment towards ports with a disproportionate amount of waiting time will generate the highest benefits for the industry as a whole.

Cargo Steamer's Agent's ETD Jetty Name Name

CJ-I VACANT

CJ-II Mohsen Ilyas Seacoast 20/06

CJ-III Suvari Kaptan DBC 22/06

CJ-IIIA IMA Glory DBC

CJ-IV VACANT

CJ-V Belray Taurus 22/06

CJ-VI Eraclea Ocean Harmony 20/06

CJ-VII Star Fighter Samsara Shpg. 21/06

CJ-VIII VACANT

CJ-IX AC Glorious Seascape 21/06

CJ-X VACANT

CJ-XI VACANT

CJ-XII TCI Express TCI Seaways 20/06

CJ-XIII VACANT

CJ-XIV Sarocha Naree Cross Trade 24/06

CJ-XV TS Golf Arnav Shpg. 23/06

CJ-XVAVACANT

CJ-XVI Hydrabad Chowgule S. 24/06

TUNA VESSEL'S NAME AGENT'S NAME ETD Amazing Salute

OIL JETTY VESSEL'S

OJ-I Jag Vikram

OJ-II Joanna Samudra 20/06

OJ-III Clarity

OJ-IV Fortune Glory

OJ-V Fulda Scorpio Shipping 20/06

OJ-VI Hari Priya Malara Shpg. 20/06

OJ-VII High Loyalty

Arzin 16/06 Bandar Abbas

Shabgoun (IIX) 16/06 Bandar Abbas

SJ Lily 17/06 Mozambique

Princess Mariam 18/06 Dji Bouti

Chang Sheng 19/06

Pegasus 02 19/06 Somalia

My Lama 19/06

Jal Kalpatru 19/06

Blue Cecil 19/06

SCI Mumbai 19/06 Jebel Ali

Source Blessing 19/06 Jebel Ali

Yue Li 19/06

Chang Sheng 19/06

Stream Adonnis Arnav Shpg.

25/06 AL Mothanna Malara Shpg. Dji Bouti

Stream Beauty Peony Chowgule S.

Stream Bulk Bequia Marcons USA

20/06 Defne J M Baxi Jeddah

Stream Doctor O DBC Hodeidah

CJ-IIIA

T.

2024051308

2024061142

2024061101 Stream Nazenin Sai Shpg.

19/06-AM Wan Hai 506 6233E 4062136 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16)

23/06-PM Grace Bridge 2404 4062191 Global Feeder Sima Marine Port Kelang, Busan, Gwangyang (CSC)

25/06-AM Inter Sydney 158 4052200 Interworld Efficient Marine China (BMM)

27/06-AM Terataki 2408 4062185 Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, Port Kelang (FEX1) 28/06 30/06 30/06-AM X-Press Cassiopeia 4026E 4062228 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 01/07 Maersk Line Maersk India s Ningbo, Tanjung, Pelepas, Port Kelang (NWX) TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, (FEX) TO LOAD FOR INDIAN SUB CONTINENT

20/06 20/06-AM Wadi Duka 2411 4051970 Asyad Line Seabridge Marine Karachi (REX)

Maersk 424W 4052034 Maersk Line Maersk India

Grace Bridge 2404 4062191 Global

19/06 Wan Hai 506 (V-6233E) 4062136 Wan Hai Line Nhava Sheva

21/06 Marathopolis (V-425S) 4052039 Maersk India Port Qasim 22/06 Grace Bridge (V-2404) 4062191 MBK Logistix Nhava Sheva

Maersk Cabo Verde(V-424S) Salalah 15-06-2024 Seaspan Jakarta (V-422W) Pipavav 16-06-2024 X-Press Odyssey (V-24024E) Karachi 16-06-2024

20/06 20/06-0600 One Contribution 057E 24198 ONE ONE (India) Port Kelang,

(PS3)

21/06 21/06-0700 Dimitris Y 245E 24202 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 22/06 01/07 01/07-0700 One Reliability 0054E24213

23/06-0800 X-Press Carina 24025E 24201 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 24/06 26/06 26/06-1700 X-Press Cassiopeia 24026E 24210 X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 27/06 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan 01/07 30/06-1800 Seamax Startford 130E 24215 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 02/07 07/07 06/07-1800 Xin Da Yang Zhou 094E Gold Star / RCL Star Shpg/RCL Ag. (CIXA) 08/07 13/07 13/07-0600 Xin Hongkong 072E 24207 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Shekou,Nansha (CI1) 14/07

21/06 20/06-1800 Maersk Chicago 424W 24195 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 16/06 27/06 27/06-1700 SM Neyyar 0425E24214 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX) 28/06 TO LOAD FOR INDIAN SUB CONTINENT PORTS & COASTAL SERVICE

20/06 20/06-1300 SCI Chennai 2406 24209 SCI J M Baxi Mundra, Cochin, Tuticorine. (SMILE)

20/06-1900 Mogral 0083 24207 CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, 22/06 Krishnapatanam, Cochin, Mundra. (CCG) 21/06 21/06-0700 Dimitris Y 245E 24202 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo.

01/07 01/07-0700 One Reliability 0054E24213 ONE ONE (India) (TIP)

23/06-0800 X-Press Carina 24025E 24201 Maersk Line Maersk India Colombo. (NWX)

24/06-0600 SSL Visakhapatnam 191 SLSSLS

20/06 BLPL Trust (V-1406E) BLPL Transworld GLS Far East

Car.CB-5 C C Lekki (V-OMSJ5W1)(Sailed) CMA CGM/Maersk Line CMA

20/06 Feng Xin Da 29 (V-24009)

(V-2404E)

26/06 Ren Jian 23 (V-2407E)

(V-424S)

Line/CMA CGM Maersk India/CMA CGM Ag.(I)

22/06 Inter Sydney (V-0158) Interworld Efficient

CB-5 Maersk Virginia (V-425W) Maersk Line Maersk India

28/06 MSC Rochelle (V-IV426A) MSC MSC Agency

23/06 Maersk Cairo (V-426S) Maersk Line Maersk

Maersk Chicago (V-2424W) Maersk Line Maersk

19/06 OEL Shasta (V-139W)

19/06 Shabgoun (V-1326N) HDASCO Armita India Gulf

22/06 Shimin (V-21E) Unifeeder/KMTCUnifeeder/KMTC(I) Far East &

27/06

(V-090E)

(V-2408)

20/06 Dimitris Y (V-245N)

24/06 Ital Unica (V-E176) Hapag/Evergreen ISS Shpg/Evergreen China

25/06 Wan Hai 521 (V-E024) Wan Hai Wan Hai Lines (I)

22/06 Jeju Island (V-E405) Wan Hai Wan Hai Lines (I) Colombo &

28/06 Wan Hai 369 (V-E004) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East

20/06 Maersk Tukang (V-424W) Maersk Line Maersk India Mediterranean

19/06 Ningbo Express (V-2422W) Hapag/COSCO ISS Shpg./COSCO Shpg. USA, Gulf &

26/06 CMA CGM Titus (V-OMXJPW1) CMA CGM CMA CGM Ag. (I) Far East

23/06 ONE Recommendation (V-0002) ONE/HMM ONE (I)/HMM Shpg. USA

GTI-1 One Contribution (V-0057E) ONE/HMM ONE (I)/HMM Shpg. Far East &

25/06 Seaspan Adonis (V-0075E) Yang Ming Line Yang Ming Line (I) China

28/06 Seamax Stratford (V-130E) RCL/OOCL RCL Ag./OOCL(I) Far East

04/07 Xin Da Yang Zhou (V-02422E) Zim/COSCO Zim Int./COSCO Shpg.

23/06 X-Press Carina (V-24025E) Maersk Line Maersk India Far East

25/06 X-Press Cassiopiea (V-24026E) X-Press Feeder Sea Consortium

22/06 Zhong Gu Shen Yang (V-O2420E) Global Fdrs./CU Lines Sima Marine/Seahorse Gulf

24/06 ESL Nhava Sheva (V-O2421N) Emirates/KMTC Emirates Shpg./KMTC (I)

RCL/CMA CGM RCL Ag./ CMA CGM Ag.(I)

25/06 CMA CGM Gemini (V-OPE9FW1) COSCO / OOCL COSCO Shpg./OOCL(I)

26/06 Advance (V-054W) COSCO/OOCL COSCO

(V-167E)

28/06 Monaco (V-107E)

26/06 Zhong Gu Gui Yang (V-02422E)COSCO/Emirates COSCO Shpg./Emirates Shpg.

Yokohama (V-E2405)

03/07 MSC Brianna (V-JU425R) MSC

24/06 Maersk Cuanza (V-425W) Maersk Maersk India

07/07 Oshairaj (V-2413) QNL/Milaha Poseidon

X-Press Feeder Sea Consortium 21/06 One Matrix (V-089E) Gold Star/KMTC Star Shpg./KMTC

B.Pier

B.P. Extn.

NSD-3 Bow Titanium GAC

Coastal Danaya Naree J M Baxi

LB-1 South Ocean Link 1 Samudra

LB 1 North Aviva Interocean

LB-2 Ginga Hawk GAC

LB-3 Citrine J M Baxi

JNP

CB-1

CB-2 Source Blessing ISS Shipping NSICT / NSIGT

CB-4 X-Press Mekong Sea Consortium

CB-5 Maersk Virginia Maersk India

CB-6 MSC Rapallo MSC Agency GTI

GTI-1

GTI-2 Celcius Nairobi Unifeeder BMCT