MUMBAI: Importers in India last week took advantage of the rupee’s recovery against the dollar to hedge their future foreign currency obligations,datashowed.

Average dollar purchases by importers, beyond the spot date, rose to $1.64 billion last week from $1.14 billion the week before, latest data collated by The Clearing Corporation ofIndiaLtd(CCIL)revealed.

The CCIL publishes daily forward trades by clients with a two day lag on itswebsite.

Therupeehadjumped1.7%against the dollar in the week ended January 13,itsbestperformanceintwomonths, thankstobenignUSinflationprint.The data reinforced expectations that the

US Federal Reserve will opt for a smaller interest rate increase on February 1 and that it was near to haltingitsrate-hikingcycle.

“Theoutlookontherupeeremains challengingandthedip(onUSD/INR) was a good opportunity, so volumes returned after the quiet first week of the year,” a foreign exchange sales head at a private bank, who did not want to be named because he is not allowedtospeaktomedia,said.

The rupee’s outlook has been hurt by India’s high trade deficit and weak portfolio flows. Trade deficit, which has cooled from a record of near $30 billion in July, remains high by historicalstandards.

India on Monday, 16th January

reported December merchandise trade deficit of $23.76. Meanwhile, foreign investors have taken out about $2 billion from Indian equities anddebtsofarthismonth.

“Despite the better Fed outlook, therupeeisinadifficultspace,”Kunal Kurani, associate vice president at Mecklai Financial, who is advising clients to buy any significant dips on thedollar,said.

MosteconomistsexpecttheFedto raise rates by 25 basis points each at its next two policy meetings. Futures are pricing-in shallow rate cuts later this year. The importers he advises bought dollars selectively for nearterm maturities last week, from JanuarytoMarch,hesaid.

NEWDELHI:Indiaishopefulthat rupeetradewithRussiawillpickupin the future after the two sides recently spoke about facilitating trade in local currencies, a Commerce Ministry officialsaidrecently.

India has been exploring a rupee trade settlement mechanism with Russia since soon after Moscow invaded Ukraine in February but the

countries have not formalised the rulesyet.

New Delhi has become Moscow's largest oil buyer after China, buying discountedRussiancrudewellbelowa $60 price cap agreed by Western nations while also trying to close a growingtradedeficitwiththeCountry.

Indiaislookingtoenhanceexports of electronic items to Russia, Satya

Srinivas, a secretary at the trade ministry,toldreportersinNewDelhi.

The two countries are engaging "at all levels" to resolve issues related to trade barriers and a payments mechanism,Srinivassaid.

Russia, Sri Lanka, Mauritius and Bangladesharesomeofthecountries that are keen on rupee trade with India,headded.

NEW DELHI: India has contractedtoexportabout5.6million tonnes of sugar since the Government said late last year that mills could ship up to 6.1 million tonnes of the sweetener by May, Government, trade and industry sourcessaid.

Dealers have already shipped about 2.5 million tonnes of the total contracted quantity, said the sources, who asked not to be named because they are not authorised to talk to the media.

Indian mills have exported almost an equal amount of raw and white sugar, with the raw variety sold between$480and$510atonnefreeon board (FOB) and white sugar at $485$540atonneFOB,theysaid.

India, the world’s biggest producer of sugar and the second biggest exporter, sells the sweetener to countries across Asia, Africa and theMiddleEast.

After record exports of more than 11 million tonnes in the previous season to Sept. 30, 2022, the

government allowed mills to export only 6.1 million tonnes of the sweetenerinthecurrentseason.

Authorities said they could take a view on the second tranche of sugar exports after getting a clearer idea aboutlocalproduction.

The Government will assess production next month, the sources said.

The Indian Sugar Mills Association said that mills have producednearly4%moresugarsince thecurrentseasonstartedonOct.1.

MUMBAI: Bahri Line, one oftheworld’sleadingShipping and logistics companies, and the national carrier of Saudi Arabia, represented by Radiant Maritime India Pvt Ltd on a PAN India basis is set to commence a direct service to Jeddah and Europe from the Indian Subcontinentwithfleetofmultipurposevessels.

In an interview with Daily Shipping Times, Mr Rajith Aykkara, Director-Line, Bahri Line, elaborates on its services connecting India, initiatives andfutureplans.

... Refer Pg. 6

LE HAVRE: In an international context marked by numerous crises, HAROPA PORT has been progressing despite a market in downturn, demonstrating notable resilience, winning additional market share in the Northern Range and improving its modal shares on the Seine Axis. The port, which began its

transformation at the time of the merger in 2021, is now seeing the first significantly positive results with MSC’s historicdecisiontoinvestinreinforcing theSeinelogistics corridor. In 2023, France’s number 1 port intends to continueitsinvestmentanditstransformation,developing the first decarbonised industrial ecosystem and continuing the structural development of its multimodal logisticscorridor.

Cont’d. Back Pg.

10/01 TS Laem Chabang 23001W TS Lines TS Lines (I) N1874 262072 28/12 2382 06/01 10/01 Ever Ulysses 148E Evergreen Evergreen Shpg. N1801 261297 19/12 2385 09/01

12/01 Gulf Barakah 2235W Asyad Line Seabridge Marine N1850 261786 24/12 2395 10/01

13/01 GFS Pearl 2215E Global Feeder Sima Marine N1858 261856 26/12 2406 11/01

13/01 Halsted 301S Maersk Line Maersk India N1873 261371 20/12 2408 11/01

14/01 MSC Maria Elena IP302A MSC MSC Agency N1911 262330 31/12 2437 13/01

14/01 Maersk Brooklyn 302S Maersk Line Maersk India N1864 261372 20/12 2433 13/01

15/01 Songa Leopard 899E Unifeeder Feedertech/TSA N1893 262153 29/12 2447 13/01

15/01 Maersk Denver 301W Maersk Line Maersk India N1865 261373 20/12 2432 13/01 17/01 Celsius Naples 893E Unifeeder Feedertech/TSA N1924 262431 02/01 2454 16/01

08/01 Tsingtao Express 3301W Hapag Llyod ISS Shipping N1833 261584 22/12 2376 06/01 09/01 Navios Constellation 3101 Hapag Llyod ISS Shipping N1853 261843 26/12 2377 06/01 10/01 AS Emma IV301A MSC MSC Agency N1890 261916 26/12 2390 09/01 10/01 MSC Judith ZF250A MSC MSC Agency N1932 262474 03/01 2389 09/01 12/01 MSC Roma IM301A MSC MSC Agency N1921 262327 31/12 2403 11/01 13/01 MSC Tianping IU301A MSC MSC Agency N1891 261915 26/12 2404 11/01 14/01 MSC Virginia IS302A MSC MSC Agency N1910 262328 31/12 2436 13/01 17/01 GFS Prestige 2216E Global Feeder Sima Marine N1856 261854 26/12 2458 16/01

06/01 Irenes Rythm 2302W Asyad Line Seabridge Marine N1879 261938 27/12 2343 04/01 07/01 Shijing 301E Maersk Line Maersk India N1818 260926 14/12 2354 05/01 08/01 Northern Practise 0031 Transworld Fdrs. Transworld Group N1852 261851 26/12 2371 06/01 11/01 Ital Unica E156 Evergreen Evergreen Shpg. N1822 261478 21/12 2398 10/01 12/01 Dalian Express 2249W Hapag Llyod ISS Shipping N1878 261943 27/12 2405 11/01 12/01 APL Florida OIX2ZW1 CMA CGM CMA CGM Ag. (I) N1883 261977 27/12 2409 11/01 13/01 Dalian 2209E KMTC KMTC (I) N1841 261645 22/12 2418 12/01 14/01 Seaspan Lumaco 302E Maersk Line Maersk India N1842 261573 20/12 2417 12/01 17/01 Wide Juliet 026E ONE Line ONE (I) N1930 262520 03/01 2449 13/01

11/01 BLPL Trust 1211E BLPL Singapore Transworld GLS N1840 261530 12/12 2393 09/01 11/01 Calliope 2301W QNL/Milaha Poseidon Shpg. N1885 262032 28/12 2386 09/01 11/01 COSCO Vietnam 088E COSCO COSCO Shipping N1855 261857 26/12 2400 10/01 12/01 ESL Asante 2301 Emirates Emirates Shipping N1805 261316 19/12 2411 11/01 12/01 Jan Ritscher E908 Feedertech Feedertech N1882 261941 27/12 2399 10/01 13/01 Ever Uberty 180E Evergreen Evergreen Shpg. N1787 260983 14/12 2416 12/01 13/01 Cap San Sounio 301W Maersk Line Maersk India N1880 261369 20/12 2407 11/01 14/01 Anbien Bay E008 Interasia Interasia Shipping N1897 262217 30/12 2415 12/01

15/01 Uru Bhum 022E RCL RCL Agencies N1876 261944 27/12 2431 13/01 16/01 MSC Vidhi IW301A MSC MSC Agency N1854 261875 26/12 2438 13/01 18/01 Calais Trader 022E RCL RCL Agencies N1792 261173 16/12 2453 16/01

The captioned vessel is due to arrive at MUMBAI Port on 25.01.2023 with import cargo from SHANGHAI (CHINA).

Consignee expecting import cargoes on the captioned vessel are requested to present the ORIGINAL BILLS OF LADING duly discharged and obtain delivery orders. In the event of Mumbai Port Trust directing the shifting of the cargo from quay to a storage area within the docks, the same will be undertaken by the vessel agents at the consignees risks and costs.

"Stamp duty" is payable as per the directive of the Superintendent of stamps.

Consignees will please note that the carrier and/or their agents are not bound to send individual notification regarding the arrival of the vessel or their cargo.

Consignees are requested to arrange for clearance of the cargo at the earliest on presentation of the PACKING LIST to our attending surveyors, as it is noticed that the cargo is arriving without proper Marks & Numbers and the same is also not indicated in the Bills of Lading for which the Vessel/Owners/Agents will not be held responsible for consequences arising thereof.

In view of the customs notification in respect to the amendments to the manifest, the consignees are requested to contact the vessel agents office atleast 2 working days prior vessels arrival to verify and confirm that the declarations in the manifest to be filed are in conformity with the bills of lading issued and in possession of the consignees.

In the event of the consignees fail to present their documents for verification and confirm the correctness of the manifest prior filing of the same, the onus of any amendment that will be required after the filing of the manifest with the customs will be on the consignee/receivers who will be responsible for all risk, costs and consequences that may arise. Consignees requiring a steamer survey to be conducted for goods discharged may contact the agents office for the same..

Ready Money Mansion Bldg., 2nd Floor, 43 Veer Nariman Road, Near Fountain, Next to Akbarallys, Mumbai 400001 Tel : 91-22-61388177, 61388142, 61388140 / 98704 55206 / 98704 55209 • Fax : 91-22-22040382 Email: jmbdocumentation-mumbai@jmbaxi.com / enq@jmbaxi.com

NEW DELHI: India is likely to substantially top up the allocation for ongoing Production-Linked Incentive (PLI) schemes in the February 1 budget after seeing good results, said people with knowledge of the matter. Some new sectors may be included in the programme that seeks to reignite manufacturing in India and boost exports,alongwithothermeasuresto spurinvestments.

Allocations for sectors that have seen a high impact on the ground under active PLI schemes such as electronic manufacturing and IT hardware could be raised. Finance minister Nirmala Sitharaman had in the FY22 budget announced �1.97 lakh crore for PLI schemes that now cover 14 key sectors. This incentive amount, which is for the five-year

periodbeginningFY22,mayberaised inthebudget.

"Overall allocation under PLI could be enhanced... It is a scheme thatisseentobemakinganimpacton the ground," said one of the persons citedabove.

Won'thavebigimpactonFinances India is keen to send strong signals to global manufacturers eyeing supply chain diversification under their China+1 strategy about its intent to offer an attractive factory ecosystem.

The budget may also extend the lower corporate tax rate of 15% available for new manufacturing investmentsforafewmoreyears.

"Measures to encourage private investment will be one of the areas in focus," said the person cited above,

adding that expanding PLIs is one such measure being actively considered. This would be complemented by easing compliances in multiple areas, the personsaid.

Experts said the government should look at building upon the successoftheprogramme.

"In a short span of time PLI schemes have evinced good interest from businesses and investors," said Vikas Vasal, national managing partner, tax, Grant Thornton Bharat. "There is a need to increase the coverage by adding more sectors to boost manufacturing and exports, besides increasing the outlay in some oftheexistingsectors."

Additionalfundingwon'thaveabig impactonfinances.

NEW DELHI: An increase in the export of rapeseed meal and soyabean meal helped India record a 60 per cent growth in the export of oilmeals during the first nine monthsof2022-23.

According to the data available with Solvent Extractors’ Association (SEA) of India, the country exported 28.25 lakh tonnes (lt) of oilmeals durung April-December of 2022-23 against 17.67 lt in the corresponding

periodof2021-22,recordingagrowthof 60percent.

Export of oilmeals was provisionallyreportedat4.33ltduring December 2022 when compared to 1.70 lt in December 2021, an increase of153.66percent.

BV Mehta, Executive Director of SEA of India, said the export of rapeseed meal has set a new record of 16.71 lt during first nine months of 2022-23, and broke the earlier

record of 12.48 lt in 2011-12. India had exported 7.13 lt of rapeseed meal during April-December of 2021-22.

Currently, India is the most competitive supplier of rapeseed meal to South Korea, Vietnam, Thailand and other Far East countries at $255 a tonne (FOB India) while rapeseed meal (Hamburg ex-mill) is quoted at $405 atonne,hesaid.

WASHINGTON:TheBiden-ledUS Government will not remove the higher import duties imposed by the Trump regime on Indian steel and aluminium products until the “fundamental issue’’ of excess capacityandthebehavioursthatgave rise to the problem are addressed, a senior US Government official has said.

Washington has, however, taken note of the delays in issuance of visas due to disruptions caused by the Covid-19 pandemic and is doubling direct hires at its embassy in India to speed up the process, said Arun Venkataraman, US Assistant Secretary of Commerce for Global Markets, at a media briefing in NewDelhi.

Venkataraman said Washington was upbeat about its growing economic relations with New Delhi and the forthcoming visit of US CommerceSecretaryGinaRaimondo in March — to convene the India-US CEO Forum and the US-India CommercialDialoguewithherIndian

counterpart Piyush Goyal — will be a launchpad for significantly enhanced engagement between the two Governments.

ThenewPSEpolicy,detailedinthe FY22 Budget, aims to minimise the presence of CPSEs, including financial institutions, and create a new investment space for the private sector

Indo-US trade crossed the $160billion threshold in 2021, but both governments believe it is far short of thepotential,hesaid.

“…we are working with the private sectortoidentifywhatarethestrategic elementsthatwecanchange,tocreate the environment to not just hit that $500-billion (India-US bilateral trade) target but move well past that in the long term… what barriers we can remove and what steps the governmentscantake…It’sourjobas government to maximise the opportunitiesforbusinesses,”hesaid.

On the long-pending issue of resolving the additional import duties

of25percentand10percentimposed by the Trump Government on certain steel and aluminium products, respectively, from India and some other countries in 2018, Venkataraman said the US was committed to working with all its trading partners to address the problematitssource.

“The situation that gave rise to the duty is a global situation caused by very few players that have distorted the global market through non-market practices, and, as a result, have created a situation of global excess capacity. The Section 232 investigations in the US identified the global excess capacity and the consequences for how steel from other countries was being pushed into the US as a national security threat, posing an existential crisis for our steel and aluminium industry. The duties have been put in place to address those concerns and to ensure a certain capacity utilisation on the part of those industries,”hesaid.

Cont’d. from Pg. 3

Edited excerpts of the Interview-

Q. What is your sense of current Shipping market in general for entire maritime industry and Bahri Line in particular?

This present shipping market we can see lot of opportunities to expand, Bahri Line is taking these opportunities to grow in to different tradelines and offer our customer an unique services to design the supply chain in a betterway.

Q. Bahri Line recently inked a pact with International Maritime Industries at Saudi Maritime Congress 2022? Can you throw some light on how it will be helpful for yourcompanyasawhole?

To align the Saudi Arabia vision 2030 and Saudi Arabia to be the logistics hub of the region Bahri is taking lot of initiatives to achieve the goal, part of the strategic approach we had our strong presents in Saudi Maritime Congress 2022,beinganationalflagcarrierofSaudiArabia, weareputtingextraeffortstoachieveourgoals.

Q. Digitization is being adopted in full force by the Maritime Industry in general and Shipping Lines in particular? Can you enlighten our readerswithDigitizationdriveatBahriLine?

Digitization and automation are important need of our industry, Bahri Line is heavily investingonourdigitalization plan,ourapproach is to be maximum automation with transparency andvisibilityoncompleteactivity.

Q. What is your take on Indian Market given the fact that it is one of the fastest growing Major Economies of the World fuelling Global Growth?

As Bahri Line is the one of the largest project cargo vessel operator in the world connecting Asia, Europe, Africa, North America, South America, Bahri Line is offering direct service to India and from India to all this continents with regular and reliable service, looking at the growth of India economies and need of connecting the world Bahri Line plays very strategical roletomakesureourserviceconnect Indiaportstomajorportsintheworld.

Q. What are the unique offerings available to an Indian customer from the stable of BahriLine?

BahriLineisthemajorproject cargooperator in the world, the project cargo world keeping Bahri Line as carrier of choice due to Bahri Line service reliability, transparency and commitmenttothetradeandcustomers.

Q. How does Bahri Line connect India to the rest of the world? What are the ports of call in India?

All our major services are connecting India, our North America service is starting from Middle East directly to India then, India to Jakarta (Indonesia) SPCT(Vietnam), Shanghai (China), Taicang (China), Lazaro Cardenas (Mexico), Pensacola, Houston, Wilmington, Baltimore (USA), Genoa (Italy) Alexandria (Egypt) all major Middle East Ports. Our Europe servicewillstartfromShanghai(China),Taicang (China) directly in to Ennore (India) after Ennore vessel will call Jeddah (Saudi Arabia), Montoir (France), Bremerhaven (Germany), Antwerp(Belgium)backtoJeddahthenChina.

Q. What are your future expansion plans in generalandIndiainparticular?

Bahri Line major focus is to expand the network globally and offer multiple service network in to the trade, Bahri Line going to offer connecting multiple continents to Indian ports withmoreRoconvessels.

Q. What is your message to the Indian Trade?

The world is amazed by looking at the growth of Indian economy, shipping industry is playing major role in this and believe there is more opportunities and growths are coming to Indian market.

Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D). 10/0211/02

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul

Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports. Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

Tauro,

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Himalaya Express Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. Service ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3

GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 20/0121/01 TBA TBA Kyoto Express 3303W N1948 262747-06/01 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 27/0128/01 TBA TBA Budapest Express 3304W N1944 263275-13/01 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 03/0204/02 TBA TBA Osaka Express 3305W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 10/0211/02 TBA TBA Prague Express 3306W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. 18/0219/02 TBA TBA Nagoya Express 3307W Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS 24/01 25/01 23/01 1200 MSC Shay IV303A N2001 263251-12/01 MSC MSC Agency Gioia Tauro, Valencia, Sines. (INDUSA) Hind Terminal 30/01 31/01 TBA 1200 MSC Nao IV304A

Line US East Coast, South & Central America 22/0123/01 21/01 2000 Maersk Hartford 302W N1863 261673-23/12 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 29/0130/01 28/01 2000 Maersk Columbus 303W N1904 262006-27/12 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 05/0206/02 04/02 2000 Northern Magnitude 304W

US East Coast Ports. Middle East Container Lines(MECL) Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 23/0124/01 TBATBA Shimin 22008E N1957 262852-07/01 TS Lines TS Lines (I) Vancouver Dronagiri-2 30/0131/01 TBATBA Celsius Nairobi 892E N1952 262789-06/01 (CISC Service)

In Port 20/01

IS306A

Globelink Globelink WW USA, East & West Coast. (Himalaya Express) 22/0123/01 TBA TBA CMA CGM Orfeo 0INDFW1 N1950 262745-06/01 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 29/0130/01 TBA TBA OOCL Washington 3104 N2012 263441-16/01 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 06/0207/02 TBA TBA Express Athens 3105 Hapag ISS Shpg. ULA CFS 13/0214/02 TBA TBA One Altair 3106 ONE Line ONE (India) 20/0221/02 TBA TBA CMA CGM Ivanhoe 0INDNW1 COSCO COSCO Shpg. 27/0228/02 TBA TBA CMA CGM Butterfly 0INDPW1

Indial Indial Shpg. US East Coast & South America India America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Express (INDAMEX) Team Lines Team Global Log. Norfolk, Charleston. JWR Logistics Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 24/01 25/01 23/01 1200 MSC Shay IV303A N2001 263251-12/01 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 30/01 31/01 TBA 1200 MSC Nao IV304A 06/02 07/02 TBA 1200 MSC Charleston IV305A

Unifeeder Group Transworld Shpg. Basra.

Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali.

Cordelia Cordelia Cont. West Asia Gulf Ports.

Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT 25/0126/01 TBA TBA X-Press Altair 23001E N1967 263011-11/01 Global Feeder Sima Marine Jebel Ali, Bandar Abbas. Dronagiri 31/0101/02 TBA TBA Montpellier 029E

Unifeeder Group Transworld Shpg. Jebel Ali, Bandar Abbas. (NMG) Emirates Emirates Shpg. Jebel Ali, Sohar.

LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS

Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr

Alligator Shpg. Aiyer Shpg. Jebel Ali.

BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports.

Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2

Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics

CGM CMA CGM Ag. Colombo (MESAWA) Dronagiri

In Port 20/01 MSC Mundra VIII IU302A N1942 262531-03/01 MSC MSC Agency Karachi. (INDUS)

Hind Terminals 24/01 25/01 23/01 1200 MSC Shay IV303A N2001 263251-12/01 MSC MSC Agency Colombo. (INDUSA) Hind Terminal

In Port 20/01 MOL Courage 051E N1936 262627-04/01 ONE Line ONE (India) Colombo. 26/0127/01 TBA TBA One Arcadia 063E N1958 Yang Ming Yang Ming(I) Contl.War.Corpn. 01/0202/02 TBA TBA One Continuity 062E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 21/0122/01 21/01 1300 Aka Bhum 011E N1918 262381-02/01 OOCL OOCL (I) Colombo. GDL 24/0125/01 23/01 2300 OOCL New York 091E N1992 263291-13/01 Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 22/01 23/01 23/01 0600 X-Pess Bardsey 23001E N1954 262827-07/01 ONE Line ONE (India) Colombo. 30/01 31/01 TBA TBA George Washington Bridge 018E N2025 263531-17/01 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 05/02 06/02 TBA TBA Clemens Schulte 019E CSC Seahorse Colombo. 25/0126/01 25/01 0900 TS Ningbo 23001E N1943 262728-05/01 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 30/0131/01 TBA TBA X-Press Kilimanjaro 23001E N2006 263432-16/01 X-Press Feeders SeaConsortium (CWX) 05/0206/02 TBATBA Kota Megah 0142E TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/—

19/0120/01 19/01 2300 Navios Indigo 5W N1907 262371-02/01 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 20/0121/01 20/01 1700 X-Press Odyssey 22008E N1960 262895-09/01 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 01/0202/02 TBA TBA Zoi 21E KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 05/0206/02 TBA TBA ESL Da Chan Bay 02254E X-Press Feeders SeaConsortium (CIX3 Service) 12/0213/02 TBA TBA KMTC Dubai 2301E EmiratesEmirates Dronagiri-2 21/0222/02 TBATBA BLPL Blessing 2303E BLPL Transworld GLS Chittagong, Yangoon 07/0308/03 TBA TBA BLPL Trust 1303E 22/0123/01 TBA TBA Najade E32 N1969 262395-09/01 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 23/0124/01 23/01 0700 Seamax Westport 084E N1951 262783-06/01 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 25/0126/01 24/01 1700 MSC Shaula IW303A N1979 263079-11/01 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal

In Port 19/01 Wadi Bani Khalid 2301E N1844 261698-23/12 Asyad Line Seabridge Singapore, Port Kelang. (IEX) 19/0120/01 19/01 0900 Vira Bhum 2252E N1919 262390-02/01 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang 26/0127/01 TBA TBA CUL Jakarta 2301E N1985 263134-11/01 CU Lines/KMTC Seahorse/KMTC(I) (VGX) 02/0203/02 TBA TBA Hunsa Bhum 2302E Emirates Emirates Shpg. 22/0123/01 22/01 1000 Haian Mind 23001E N1616 259556-24/11 Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 28/0129/01 TBATBA Hansa Rotenburg 921E N1978 263086-11/01 X-Press Feeders SeaConsortium (SIS) 04/0206/02 TBA TBA Songa Leopard 921E 23/0124/01 TBA TBA Shimin 22008E N1957 262852-07/01 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 30/0131/01 TBA TBA Celsius Nairobi 892E N1952 262789-06/01 Unifeeder Feedertech/TSA Qingdao, Shanghai, Ningbo. Dronagiri 13/0214/02 TBA TBA Navios Bahamas 888E PIL/ONE PIL Mumbai/ONE(I) —/— 14/0215/02 TBA TBA Ever Ursula 184E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 20/0221/02 TBA TBA Wide Alpha 234E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 27/0228/02 TBA TBA Ever Useful 167E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 06/0307/03 TBA TBA Celsius Naples 894E

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo.

BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 23/0123/01 TBA TBA Chennai Voyager 2213E N1906 262105-29/12 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 03/0204/02 TBA TBA Shangahi Voyager 2301E

CISC Service

Heung A Line Sinokor India 20/0221/02 TBA TBA GFS Pride 2301E

Sinokor Sinokor India Seabird CFS 23/0223/02 TBA TBA GFS Prestige 2302E

Sealead Giga Shpg. (CSC)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao.

Maersk CFS 27/0128/01 TBATBA Sofia I 304E N1902 262005-27/12 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai.

Dron.-3 & Mul. 03/0204/02 TBA TBA Northern Diamond 305E N1983 (FM-3) 21/0122/01 21/01 1300 Aka Bhum 011E N1918 262381-02/01 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 24/0125/01 23/01 2300 OOCL New York 091E N1992 263291-13/01 APL CMA CGM Ag. Dron.-3 & Mul. 31/0101/02 TBA TBA OOCL Hamburg 140E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 07/0208/02 TBA TBA OOCLLuxembourg 100E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 14/0215/02 TBA TBA Seamax Stratford 120E Gold Star Star Ship Singapore, Hong Kong, Shanghai. 28/0201/03 TBA TBA Zim Cherleston 11E

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul.

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 22/01 23/01 23/01 0600 X-Pess Bardsey 23001E N1954 262827-07/01 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 30/01 31/01 TBA TBA George Washington Bridge 018E N2025 263531-17/01 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 05/02 06/02 TBA TBA Clemens Schulte 019E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 12/02 13/02 TBATBA Seaspan Ciba 014E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. 19/02 20/02 TBA TBA Wide Juliet 027E 25/0126/01 25/01 0900 TS Ningbo 23001E N1943 262728-05/01 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 30/0131/01 TBA TBA X-Press Kilimanjaro 23001E N2006 263432-16/01 X-Press Feeders SeaConsortium (CWX) 05/0206/02 TBA TBA Kota Megah 0142E KMTC KMTC (India) Dronagiri-3 13/0214/02 TBA TBA Pontresina 239E TS Lines TS Lines (I) Dronagiri-2 26/0227/02 TBA TBA X-Press Anglesey 23001E RCL/PIL RCL Ag./PIL Mumbai (CWX) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 31/0101/02 TBA TBA Wan Hai 502 E109 N2015 263499-16/01 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 07/0208/02 TBA TBA Wan Hai 507 E209 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 14/0215/02 TBA TBA Ever Dainty E169 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 28/0201/03 TBATBA Argolikos E148

(CIX-3)

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

In Port 18/01 TS Dubai 22008E N1889 262088-28/12 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 22/0123/01 TBA TBA Henrika 2250E N1845 261733-23/12 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 23/0124/01 TBA TBA ESL Kabir 22052E N1984 263137-11/01 COSCO COSCO Shpg. (AIS SERVICE) 28/0129/01 TBA TBA KMTC Mundra 2301E N1993 263195-12/01 Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2 CU Lines Seahorse Ship Port Kelang,Hongkong,Busan, Qingdao,Ningbo.

In Port 19/01 Marina Voyager E0111 N1974 263053-10/01 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 25/0126/01 TBA TBA Gabriela A E008 N2014 263454-16/01 Heung A Line Sinokor India Hongkong 31/0101/02 TBA TBA Jakarta Voyager E301 Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 07/0208/02 TBA TBA Interasia Catalyst E021 InterasiaInterasia Unifeeder Feedertech/TSA Dronagiri 20/0121/01 20/01 1700 X-Press Odyssey 22008E N1960 262895-09/01 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 01/0202/02 TBA TBA Zoi 21E KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Dai Chen Bay Dronagiri-3/— 05/0206/02 TBA TBA ESL Da Chan Bay 02254E X-Press Feeders Sea Consortium 12/0213/02 TBA TBA KMTC Dubai 2301E Emirates Emirates Shpg (CIX3 Service) Dronagiri-2 17/0218/02 TBA TBA Zim Europe 75E Pendulum Exp. Aissa Maritime 24/0225/02 TBA TBA Ever Uberty 181E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 21/0122/01 21/01 1700 Interasia Engage E003 N1949 262752-06/01 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 22/0123/01

RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 31/0101/02 TBA TBA OOCL Hamburg 140E OOCL OOCL (I) Sydney, Melbourne. GDL 07/0208/02 TBA TBA OOCLLuxembourg 100E TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 28/0201/03 TBA TBA Zim Cherleston 11E Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 (CIX-3) Team Lines Team Global Log. Australia & New Zealand Ports.

JWR Logistics 22/01 23/01 23/01 0600 X-Pess Bardsey 23001E N1954 262827-07/01 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, 30/01 31/01 TBA TBA George Washington Bridge 018E N2025 263531-17/01 Auckland, Lyttleton. 05/02 06/02 TBA TBA Clemens Schulte 019E Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 12/02 13/02

Guinea Bissau, Nouadhibou, Dakar, Abidjan,Tema, Malabo & Saotome. 10/0211/02

IP305A GlobelinkGlobelink West & South African Ports. (EPIC 1 / IPAK) Safewater Safewater Lines East, South & West African Ports (EPIC 1 / IPAK) 20/0121/01 19/01

Cypria 2302W N1899 262278-30/12 ONE Line ONE (India) Durban, Cape Town, Tema, Tincan, Apapa. 03/0204/02 TBA TBA Irenes Resolve 2304W Hapag ISS Shpg. (AIM) ULA CFS 21/0122/01 21/01 1800 Haian East 23001E N1990 263037-10/01 Sealead Giga Shpg. Mombasa, Dar Es Salaam 26/0127/01 TBA TBA SC Memphis 23002W OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA - INDIA DUBAI EAST AFRICA) GDL/— 21/0122/01 21/01 0600 Lisa 303S N1872 261671-23/12 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 28/0129/01 28/01 0600 Maersk Boston 304S N1903 262004-27/12 (MWE SERVICE) 04/0205/02 04/02 0600 Lana 305S 23/0124/01 TBA TBA Shimin 22008E N1957 262852-07/01 TS Lines TS Lines (I) Australian Ports. (CISC Service) Dronagiri-2 24/0125/01 24/01 1300 CMA CGM Coral 0MSF3W1 N1953 262796-06/01 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 31/0101/02 31/01 1300 Maersk Cabo Verde 304W CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis Dron.-3 & Mul. 07/0208/02 07/02

22/0124/01 Hoegh Tracer 41 263297-13/01 Hoegh Autoliners Merchant Shpg. Lazaro Cardenas, Kingston, Veracruz, Freeport. 29/0102/02 Pederewski 26 Chipolbrok Samsara Houston. 29/01 30/01 Alliance St Louis 145 1061525-12/01 Hoegh Autoliners Merchant Shpg. Kingston, Veracruz, Jacksonville. 27/0228/02 Alliance Fairfax 105

In Port 22/01 Han Yi (Sing) 2221 262924-09/01 Mitsutor Mitsutor Laem Chabang. 22/0124/01 Hoegh Tracer 41 263297-13/01 Hoegh Autoliners Merchant Shpg. Singapore, Laem Chabang, Masan. 25/0226/01 Hoegh Trident 201 Hoegh Autoliners Merchant Shpg. Singapore, Laem Chabang. 29/0102/02 Pederewski 26 Chipolbrok Samsara Singapore, Kaohsiung, Shanghai. 29/01 30/01 Alliance St Louis 145 1061525-12/01 Hoegh Autoliners Merchant Shpg. Durban, Tema*, Dakar 27/0228/02 Alliance Fairfax* 105 01/0202/02 Asian Majesty(KR) 206

Eukor Car Carr Parekh Marine Singapore, (Shanghai). 04/0308/03 Herbert 6 Chipolbrok Samsara Singapore.

m.v. “MSC MUNDRA VIII” V- IU302A I.G.M. No. 2332831 Dt. 17-01.2023 Exch. Rate 85.39

The above vessel has arrived on 19-01-2023 at NHAVA SHEVA (NSIGT) with import cargo to NHAVA SHEVA from ABU DHABI, JEBEL ALI, BAHRAIN, SALALAH, CHARLESTON, NEW YORK, NORFOLK, SAVANNAH.

Please note the item Nos. against the B/L Nos. for NHAVA SHEVA (NSIGT) delivery

40 MEDUDV042830

MEDUAD366749

MEDUAD368257

MEDUAD367515

MEDUAD368281

BANQ1049372128

CLTOE11320

MEDUDF012964

No. B/L No. Item No. B/L No.

MEDUAD367051

MEDUAD366764

MEDUAD367259

MEDUAD368422

MEDUAD367077

MEDUAD368265

MEDUAD367382

MEDUAD366400

MEDUAD367861

MEDUAD367069

MEDUAD367655

MEDUAD368331

MEDUAD366913 3 MEDUAD367168 30 MEDUAD367135 31 MEDUAD368463 32 MEDUAD367614 33 MEDUBH241862 34 MEDUBH241540 35 MEDUBH242605 36 MEDUBH242985

MEDUDF155805 38 MEDUDV042616 39 MEDUDV041469 4 MEDUAD367200

MEDUDF019449

MEDUDF009523

MEDUDF009028 47 MEDUDF034349 48 MEDUDF013921 49 MEDUDF014572 5 MEDUAD366996 50 MEDUDF098294 51 MEDUDF122748 52 MEDUDF098716 53 MEDUDF086539 54 MEDUDF094947 55 MEDUDF094921

56 MEDUDF101668 57 MEDUDF115833 58 MEDUDF102856 59 MEDUDF052770 6 MEDUAD366806 60 MEDUDF110636 61 MEDUDF103789 62 MEDUDF094509 63 MEDUDF109166 64 MEDUOM208767 65 MEDUOM208437 66 MEDUOM208775 67 MEDUOM208213 68 INDA06002 69 INDA06537 7 MEDUAD367226

70 MEDUDF146739 71 MEDUDF158965 72 MEDUDF172909 73 MEDUDF172164 74 MEDUDF201153 75 MEDUDF152695 76 MEDUDF207465 77 MEDUDF200155 78 MEDUDF205261 79 MEDUDF198219 8 MEDUAD367648 80 MEDUDF198318 81 MEDUDF153503 82 MEDUDF205196 83 MEDUDF202011 9 MEDUAD367119

Consignees are requested to kindly note that the above item nos. are for the B/L Nos. arrived for Nhava Sheva delivery.

Consignees are requested to collect Delivery Order for all imports delivered at Nhava Sheva from our Import Documentation Dept. at Nhava Sheva - DN210 / DN211 / DN212, D-Wing, 2nd Floor, NMSEZ Commercial Complex, Plot No. 6, Sector - 11, Opp. JNPT Township, Dronagiri Node, Navi Mumbai - 400 707 , India and Mumbai - 1st Floor, MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400059 on presentation of duly discharged Original Bill of Lading and payment of relevant charges.

The container detention charges will be applicable after standard free days from the discharge of containers meant for delivery at Nhava Sheva. The containers meant for movement by road to inland destinations will be dispatched upon receipt of required documents from consignees/receivers and the consignees will be liable for payment of port storage charges in case of delay in submission of these documents. Our Surveyors are M/s. Zircon Marine Services Private Limited. and usual survey conditions will apply. Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

Incase of any query, kindly contact Import Customer Service - (022) 66378123; IN363-imports.mumbai@msc.com Get IGM No. / ITEM No. /CFS details on our 24hrs computerized helpline No. (IVRS No.) 8169256872 You can also visit our website: www.msc.com/ind/help-centre/tools/import-general-manifest-information As Agents :

Cargo

CJ-I MV Mercury J DBC 21/01

CJ-II MV Sai Sunshine Sai Shpg. 22/01

CJ-III MV Langcang River BS Shpg. 20/01

CJ-IV MV Altus ACT Infra 25/01

CJ-V MV Jaohar UK Interocean 23/01

CJ-VI MV Yangtze Happiness Arnav Shpg. 20/01

CJ-VII MV Market Porter Interocean 21/01

CJ-VIII MV Indus Victory Divine Shipping 23/01

CJ-IX VACANT

CJ-X MV Bhaskar II Inayat Cargo 22/01

CJ-XI MV Safeen Prize ULSSL 20/01

CJ-XII MV SCI Mumbai J M Baxi 20/01

CJ-XIII MV Clipper Palma ACT Infra 25/01

CJ-XIV MV Kenzen Chowgule Bros 20/01

CJ-XV MV NVL Sirus Cross Trade 24/01

CJ-XVA MV New Spirit BS Shpg. 23/01

CJ-XVI MV Obe Queen Ocean Harmony 24/01

Tuna

OJ-I LPG/C Bastogne Nationwide 20/01

OJ-II MT Oriental Tulip Allied Shpg. 20/01

OJ-III MT Pacific Citrine Interocean 20/01

OJ-IV MT Exuberant Star

OJ-V MT Ginga Lynx GAC Shpg. 20/01

OJ-VI MT Dawn Mansarovar MK Shpg. 20/01

CJ-IV MV Altus ACT Infra Lome 47,000 T. Rice Bags 2023011076

CJ-XIII MV Clipper Palma ACT Infra Africa 30,000 T. Rice In Bags 2023011022

OJ-VI MT Dawn Mansarovar MK Shpg. 12,000 T. FO 2022121114

Stream MV Gautam Krishav Jeel Kandla Porbandar 2,100 T. Silica Sand In Bulk

CJ-V MV Jaohar UK Interocean Sudan 26,083 T. Sugar Bags 2022121114

CJ-XIV MV Kenzen Chowgule Bros. China 58,400 T. Salt 2023011119

Stream MV Mandovi Delta Waterways 2,000 T. Coke Breeze In Bulk

Stream MT MH Langoey Samudra Rabick 9 KT Caustic Soda

CJ-I MV Mercury J DBC Korea 27,150 T. Sugar In Bags 2023011012

Stream MV Neptune J DBC Sudan 23,000 T. Sugar Bags 2022121048

CJ-XV MV NVL Sirus Cross Trade 51,200 T. Salt 2023011162

CJ-XVI MV Obe Queen Ocean Harmony Sudan 40,205 T. Sugar Bags 2022121014

OJ-II MT Oriental Tulip Allied Shpg. Hazira 2,500 T. C. Oil 2022121417

Stream MV Panoria Arnav Shpg. Abidjahan 35,500/ 14,000 T. Rice Bags/Bulk 2022121287

CJ-II MV Sai Sunshine Sai Shpg. Saudi Arabia 17,948 T. Rice Bags (40 Kgs.) 2023011066 22/01 MV SV Aurora Tristar Logistics 18 Nos.Windmill Blade 2023011179

Stream MV TM Hai TA 988 Seacoast 55,000 T. Millscale 2023011198

Stream MV U Thar Chowgule Bros. 14,100 T. SBM 2023011175

Stream MV Yara J DBC Port Sudan 33,000 T. Sugar Bags (50 Kgs) 2022121415

Stream MV Akij Heritage GAC Shpg. Akaba 55,000 T. DAP 2023011058

CJ-X MV Bhaskar II Inayat Cargo Hazira 1,859 T. Coils 20/01 MV Glory Amsterdam Dariya Shpg. U.S.A. 23,000 T. Coal 2023011209 21/01 MV Hope 1 Mitsutor Shpg. 8,609 T. HR Coils

CJ-VIII MV Indus Victory Divine Shipping 87,600 T. Iron Ore 2023011069 20/01 MV Inuyama DBC Japan 1,155 T. CR Coils 2023011182 20/01 MV Iyo DBC Japan 1,477/483/60 T. CRC/S. Pipe/Pkgs. 2023011030

21/01 MV Magic Orion Dariya Shpg. U.S.A. 1,25,200 T. Coal

Stream MV Mandovi Delta Waterways 2,000 T. Coal In Bulk 2023011080

CJ-VII MV Market Porter Interocean Saudi Arabia 46,966 T. Urea 2023011092

CJ-XVA MV New Spirit BS Shpg. 58,000 T. Aggregates 01-Feb MV Ocean Tianchen Tauras 10,915 T. MOP 2023011175

CJ-VI MV Yangtze Happiness Arnav Shpg. U.S.A. 29,917 T. Scrap 2023011118

OJ-I LPG/C Bastogne Nationwide Ras Al Lafan 17,847 T. Propane/Butane 2023011088

Stream LPG/CBerlianEkuator Nationwide 20,000 T. Propane/Butane 2023011149

Stream MT Bow Tungsten GAC Shpg. 17,500 T. Chem. 2023011204

Stream MT Condor Trader Samudra Thailand 1,678 T. Chem. 2023011165

OJ-VI MT Dawn Mansarovar MK Shpg. 3,990 T. LSHS In Bulk 2022121189 22/01 MT Damsgaard J M Baxi Malaysia 19,000 T. Palm Oil

Stream MT Dolphin 03 Interocean 12,000 T. CPO 2023011146 19/01 MT DS Cougar Samudra Malaysia 3,500 T. Chem. 2023011172 24/01 MT Essie C Interocean 30,000 T. CDSBO 25/01 MT Eurochampion Interocean 23,000 T. CDSBO 21/01 MT Fairchem Grutto Shantilal Arjentina 23,160 T. CDSBO 25/01 MT Geum Gang Wilhelmsen South Korea 4,751 T. Chem.

Stream MT Gladys W Interocean Dumai 29,485 T. CDSBO 2023011150

OJ-V MT Ginga Lynx GAC Shpg. Malaysia 5,000 T. Chem. 2023011084 19/01 MT Gulf Mishref J M Baxi Indonesia 12,500 T. CDSBO 2023011185

Stream MT Hari Aradhana MK Shpg. 32,000 T. HSD In Bulk 2023012168

Stream MT Heung A Pioneer Samudra Singapore 8,000 T. Chem 2023011103

Stream LPG/C Jag Vikram Nationwide 20,055 T. Propane/Butane 2023011187

Stream MT MTM Yangon Seaport Brazil 28,000 T. CDSBO 2023011148

Stream MT Myri Joy J M Baxi Houston 18,742 T. Methanol 2023011132

OJ-III MT Pacific Citrine Interocean Arjentina 19,000 T. CDSBO 2022121160 21/01 MT PVT Estella Seaport Indonesia 4,500 T. Palm Prod. 21/01 MT Stolt Vision J M Baxi Dakar 4,952 T. Chem.

Stream MT Verige Interocean Arjentina 15,000 T. CDSBO 2023011163

20/01 19/01-AM

27/01

20/01 27/01 27/01-AM

LOAD FOR FAR EAST,

AUSTRALIA,

ZEALAND AND PACIFIC ISLANDS 21/01 21/01-AM Aka Bhum 11E 23008

& Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 21/01 25/01 25/01-AM OOCL New York 091E 23021

Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 25/01 21/01 21/01-AM MOL Courage 051E 23009 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 21/01 29/01 29/01-AM One Arcadia 063E 23015 Ningbo, Sekou, Cai Mep. (PS3) 29/01 22/01 22/01-AM BSG Bimini 303E 23005 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 22/01 29/01 29/01-AM Sofia 1 304E 23013 Ningbo, Tanjung Pelepas. (FM3) 29/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) (TIP) 30/01 26/01 26/01-AM Seamax Westport 084 23017 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 26/01

20/01 20/01-AM BIG Dog 0302E 23010 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam, Mundra (SHAEX) 20/01 20/01 19/01-AM Maersk Hartford 302W 22435 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 20/01 27/01 27/01-AM Maersk Columbus 303W 23011 (MECL) 27/01

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

21/01 21/01-AM Aka Bhum 11E 23008 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 21/01 22/01 22/01-AM BSG Bimini 303E 23005 SCI J. M Baxi Colombo. (FM3) 22/01 22/01 22/01-AM Irenes Ray 303S 23003 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 22/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) (TIP) 30/01 26/01 26/01-AM Seamax Westport 084 23017 COSCO COSCO Shpg. Karachi, Colombo (CI1) 26/01 TBA SCI J. M Baxi Mundra, Cochin, Tuticorin (SMILE) TBA SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1)

20/01 19/01-AM Maersk Hartford 302W 22435 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 20/01 27/01 27/01-AM Maersk Columbus 303W 23011 Safmarine Maersk Line India (MECL) 27/01 21/01 21/01-AM MOL Courage 051E 23009 ONE ONE (India) Los Angeles, Oakland. (PS3) 21/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 30/01

21/01 X-Press Salween 303E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 22/01 X-Press Feeders Sea Consortium Doha (Arabian Star) 22/01 Northern Jamboree IE302A MSC MSC Agency King Abdulla, Sakac, Alexandria El Dekheila, Tekirdag, Aliaga, Mersin. 23/01 29/01 MSC Houston IE303A (India to East Med SVC) 30/01 22/01 MSC Fairfield IP303A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 23/01 29/01 MSC Esthi IP304A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 30/01 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK) 22/01 Seaspan Emerald 13E Zim/KMTC Zim Integrated/KMTC India Qingdao, Shanghai, Ningbo, Da Chan Bay, Port Klang, Nhava Sheva, 23/01 25/01

Cont’d. from Pg. 3

Seahorse Ship Agencies Pvt. Ltd“In 2022, the global economy was impacted by Russia’s invasion of Ukraine, combined with the ongoing effects of the Covid-19 pandemic and inflation, which has reached levels not seen for several decades. And despite this, for HAROPA PORT, the year has been one of a change in scale and striking resistance to these headwinds in the context of strategic focuses approved by its Supervisory Board. These encouraging results andtheconsolidation oftheport’sstrategy makeHAROPAPORT an effective project for local regions and a key component of France’s international outreach and sovereignty. This encourages us to pursue the transformation of France’s number 1 port.” said Cédric Virciglio, HAROPA PORT Strategic Planning Director.

1. Fast deployment of a decarbonised industrial ecosystem

As a major pillar of HAROPA PORT’s strategic project, the ecological and energy transition account for 16% of the port's investments in2022 andwill increase to19%in2023. Notably based on a number of calls for project proposals, the port is affirming its ambition to create a cutting-edge, decarbonised industrial cluster on theSeineAxis:

• As part of a call for project proposals by the French energy and environment agency, ADEME, HAROPA PORT and its three port/industrial zones, working through the nonprofits Synerzip –LH, Incase –Industrie Caux Seine and Upside Boucles deRouen, submitted a joint response for the creation of the ZIBAC project (Zones Industrielles Bas Carbone/Low-Carbon Industrial Zone) on the Seine Axis, a project aimed at fostering development of low-carbon port/industrial zones. The project partners established a provisional list of studies costing over �10m for the preparation of the decarbonisation of industrial and logistics operations.

• The largest multimodal platform of the Greater Paris area will soon be producing green energy using biowaste. PAPREC, a company, has been selected to design and operate the future methanisation plant to process household biowaste from the ParisareaattheportofGennevilliers. Thisplanthasacapacity of 50,000 tonnes and, starting in 2025, will generate biogas for injection into the Paris area supply network, in addition to farm fertiliser.

• Following the deployment of a network of LNG service stations, a newgenerationofmultienergystationswillbesetupatmultimodal platforms in the Paris area at Gennevilliers, Bonneuil-sur-Marne, Limay, Bruyères and Montereau. These facilities will be able to distribute decarbonised hydrogen to meet the needs of road transport,aswellasrivertransportinalaterphase.

• At the Port-Jérôme port/industrial zone a new industrial cluster – “Plastic Valley” – dedicated to recycling and producing latest-generation renewable plastic is currently being organised, most notably around the projects of Eastman and Futerro. The site will also see production of renewable hydrogen with Air Liquide’s Normand’Hy project, which has an unprecedentedcapacityof200MW.

• And lastly, the decision on the award following the Grand Canal callforproject proposals inLeHavre, tobeannounced during the first quarter of 2023, will come as confirmation of this strategic focus.

• Intotalin2022, 590mofpublicandprivate-sector investment will have been devoted to building this decarbonised industrial cluster.

2. Strong structural development of a multimodal corridor, with major milestones already achieved With their merger, the three ports of Le Havre, Rouen and Paris demonstrated their determination to develop a logistics corridor capable of carrying goods from around the world into the heart of France’sbiggestconsumercatchmentarea.

• In 2022, shippers grasped the opportunity to use Seine Axis rail and river transport as an alternative to road for their goods imports and exports: the modal shares of rail and river rose from 12% to 13.3% for containers exiting Le Havre as of end October, and at Paris Terminal SA on the river, inland waterway activity handled increased by 25%, boosted by the launch of new riverbasedservices(Greenmodal/Hapag LloydinSeptember2022and Fluviofeeder/MarfretinNovember2022).

• On January 6, HAROPA PORT awarded the Bruyères-sur-Oise terminal to MEDLOG in order to support the implementation of MSC’sinvestment atPort2000. Thisproject comprises atrimodal terminal, combining rail and river, dedicated to container services in the Greater Paris region and nearby consumer catchment areas, which should enable a million road journey to beavoidedoveraten-yearperiod.

• New strategic port infrastructure will enable development of the logistic corridor over the medium term: this is true of

PSMO (Port Seine Métropole Ouest/West Metropolitan Seine Port), the construction work for which is to begin in 2023, and the “cat flap” project (Port 2000 direct river access) for which the relevant public consultation process ended today. This direct river connection between the terminals of Port 2000 and Le Havre’s historical port, scheduledtoenterintoservicein 2024, will encourage further expansion of the modal share of river transport along the Seine Axis.

• Work on Port 2000 berths 11 and 12 (adding an extra 700m of quay span to the existing 3,500m) will be completed where port infrastructure is concerned and delivered to the operator in 2023 to enable the latter to carry out its own work as required for use ofthefutureterminal.

• Alongside this, HAROPA PORT continues to foster innovation and work towards tomorrow’s urban river logistics, as exemplified by IKEA, which has been making deliveries to its Paris customers by river and electric vehicle since last December, thereby avoiding an annual 300,000km of road journeysbetweenitsGennevilliers depotandParis.

• In October 2022, the cities of Le Havre, Rouen, Paris, in conjunction with HAROPA PORT, selected 21 submissions in response to the first call for declarations of interest for the development of decarbonised urban river logistics at 32 locations alongtheSeineAxis.

• On 6 January 2023, following a call for Austerlitz project proposals, HAROPA PORT’s management board selected SOGARIS for the development of a sustainable urban logistics operation that also encourages a mix of site uses and integration ofurbanportsintothecapitalcityenvironment.

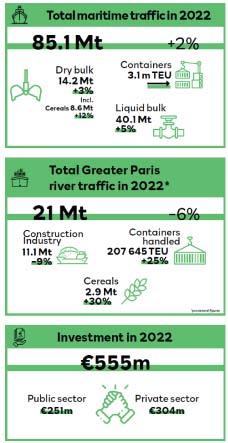

3. Progression of maritime traffic: 2% growth.

In 2022 maritime traffic stood at 85.1Mt, an increase of 2% on the back of an exceptional trading year for cereals and a rise in liquid bulkflows.

• Container traffic remains at the record level achieved in the previous year, registering throughput of 3.1m TEU, surpassing the symbolic figure of 3m TEU. HAROPA PORT is consolidating its position in an uncertain economic environment. HAROPA’s market share has progressed in a context marked by a general downturnincontainertrafficattheNorthernRangeports.

• Liquid bulk ended the year up 5% (40.1Mt) buoyed by an expansion in crude oil traffic (+23% at 18.8Mt) thanks to the operation at full capacity of the two Seine Axis refineries despite theinternationalcontextrequiringchangesinproductsourcing.

• Dry bulk saw growth of 3% (at 14.2Mt), boosted by a grain trading yearupby12%(8.6Mt). Theconflict inUkrainegenerated notonly additionaldemand,butalsodemandfromcountriesrarelyserved in recent years, especially in the second half of 2022, when 5Mt was shipped, a record for this part of the year. Traffic in aggregates was down by 4 % due to the current situation of certain major construction projects on the Seine Axis, these havingenteredphasesthatrequirelessconstructionwork.

• Ro-ro traffic fell back by 11% (265,000 vehicles). Adapting to a volatile market, the port switched from an export-led market to one dominated by imports, which required an overhaul of its parkingareas.

• Cruises stayed on a positive heading with 171 port calls and 301,000 passengers but did not return to their 2019 level. Cruise programming for 2023 points to a level close to benchmark years beforetheCovidcrisis,whentherewereover220portcallsandmore than450,000passengers.

“Eighteen months after its creation and following a historic year in which the symbolic level of 3m TEU was surpassed, HAROPA PORT has consolidated its positioning. In addition to the remarkable resistance shown by traffic levels, key milestones have been achieved, foremost among them the announcement by MSC TiL last July that they would be investing 700m over the period to 2028 to triple their container volume, making us a major port of entry for France and Europe and giving us the means to develop river-based services to the Paris basin, said Kris Danaradjou, HAROPA PORT Deputy General Manager.

Seahorse Ship Agencies Pvt Ltd represent HAROPA Ports, for commercial and promotional activities In India.