AHMEDABAD : The Adani

G r o u p i s h o n o u r e d t o b

T I M E ’ s

prestigious

World’s Best Companies of

2 0 2 4 l i s t , prepared in collaboration with Statista, a leading global industry ranking and statistics portal. This accolade highlights the Adani

G

sustainability

subsidiaries of these eight companies. The recognized companies include:

This is further validation of the Adani group’s hard work and continuous efforts to push boundaries and deliver excellence across businesses. The World’s Best Companies 2024 list is based on a rigorous analysis across three key dimensions : Employee Satisfaction: Surveys conducted in over 50 countries with around 170,000 participants assessed companies based on direct and indirect recommendations, work conditions, salary, equality, and overall company image.

Revenue Growth: Companies with revenues exceeding US$100 million in 2023 and demonstrated growth from 2021 to 2023 were evaluated. Sustainability (ESG): Companies were assessed based on standardized ESG KPIs from Statista’s ESG Database and targeted research.N

Adani portfolio companies were considered in this evaluation, reflecting a comprehensive performance across the group. The other three listed companies are

1. Adani Enterprises Ltd 2. Adani Ports and Special Economic Zone Ltd 3 Adani Green Energy Ltd 4. Adani Energy Solutions Ltd 5. Adani Total Gas Ltd 6 Ambuja Cements Ltd 7 Adani Power Ltd 8. Adani Wilmar Ltd

Headquartered in Ahmedabad, the Adani Group is India’s largest and fastest-growing portfolio of diversified businesses with interests across energy and utilities, transport and logistics, natural resources and the consumer sectors. The Adani Group has established a leadership position in the market in the industries it operates in. The Group’s success is driven by its core philosophy of ‘Nation Building’ and ‘Growth with Goodness,’ focusing on sustainable development. The Adani Group is committed to environmental stewardship and community improvement through its CSR programs, which are grounded in the principles of sustainability, diversity and shared values.

To commemorate this significant accomplishment, PSA Mumbai organized a celebratory team gathering, where employees were recognized for their contributions through appreciation awards. The event also featured speeches by management, a cake-cutting ceremony, and a team lunch, all of which highlighted the collective effort and dedication of the entire team in reaching this milestone.

M r. A n d y L a n e , E x e c u t i v e D i r e c t o r o f

PSA Mumbai, expressed his gratitude to all stakeholders and the entire PSA Mumbai family for their efforts. "This milestone is a testament to the incredible teamwork and dedication of everyone at PSA Mumbai. I foresee even more milestones and celebrations in our future, and I want to extend my heartfelt thanks

to all departments for their collaboration and contribution in making this achievement possible " The event was also attended by Mr Gobu Selliaya, Managing Director of PSA India, who congratulated the PSA Mumbai team on their achievement "This accomplishment goes beyond our expectations and is a result of the hard work and commitment of every individual. I look forward to continued success and many more celebrations as we progress together in this journey."

T h e 2 0 0 , 0 0 0 T E U m i l e s t o n e r e f l e c t s

PSA Mumbai’s ability to consistently raise the bar in container handling and trade operations, reinforcing its role as a critical hub in India's logistics network and facilitating seamless trade flows in India and beyond

Marathon Nextgen, Innova “A”-G01, Opp.Peninsula Corporate Park, Off.Ganpatrao Kadam Marg, Lower Parel(W), Mumbai-400013 Board Tel.:022-61657900, Fax: 022-61857299/98/97, E-Mail:info@evergreen-shipping.co.in, Website:http://www.shipmentlink.com/in

NHAVA SHEVA : 1st Flr, Anchorage Ship Ags. Premises Co-op Society, Plot No. 02, Sec-11, Dronagiri Node, Navi Mumbai-400707 Tel.: 022-27471601, Fax: 91-22-27246415, E-Mail: nxvlog@evergreen-shipping.co.in

NEW DELHI : 51, Okhla Industrial Estate, Phase - III, 1st Floor, New Delhi-110020 Tel.: 011-61657900 (Hunting), Fax: 011-66459698 / NDI Fax : 011-66459699, E-mail: ndibiz@evergreen-shipping.co.in

ETAETD VESSELS Voy V.I.A

23/0924/09

TBATBA CMA CGM Saigon 0QC1LW1 Q1394 1102299-06/09 CMA CGM CMA CGM Ag. Djibouti. (BIGEX 2)

28/0929/09 TBATBA Zhu Cheng Xin Zhou 0QC1HW1 TBN

MBK Line MBK Logistics Jeddah, Beldeport (India Med Service) MAS Diamond Marine TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN, RED

In Port 18/09 X-Press Altair 24011E Q1368 1101951-04/09 X-Press Feeders Sea Consortium Jeddah, Al Sokhna

28/0929/09 TBATBA SSL Brahmaputra 919E Q1424 Wan Hai Wan Hai Lines (I) (RGI / IM1)

05/1006/10

TBATBA X-Press Mekong 24008E

UnifeederUnifeeder 15/1016/10

TBATBA Wan Hai 316 210E

Emirates Emirates Shpg. 18/0919/09 18/09 2200 Wadi Duka 2417W Q1346 1101690-02/09 Asyad Line Seabridge Al Sokhna, Jeddah (IEX) 21/0922/09 TBATBA Maersk Pittsburgh 437W Q1384 1102208-05/09 Maersk Line Maersk India Algeciras (MECL) Maersk CFS

28/0929/09

24/0925/09

TBATBA Maersk Chicago 438W Q1408 1102387-06/09

TBATBA Konrad KON0524W Akkon Line Oasis Shpg. Aliaga Gemlik, Gebze (YIL Port), Ambarli, Felixstowe, Antwerp 27/0928/09 TBATBA Folk Jeddah IR2401W Folk Maritime Seastar Global Jeddah (IRS)

20/0921/09 18/09 1000 MSC Michaela IU437A Q1409 1102545-09/09 MSC

MSC Agency Haifa. (INDUS) Hind Terminal 20/0921/09 20/09 0900 MSC Ellen IP438A Q1416 1102587-09/09

MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals

27/0928/09 27/09 0900 MSC Maeva IP439A Q1465 1103400-16/06 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D). 04/1005/10 04/10 0900 MSC Abidjan IP440A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre 11/1012/10 11/10 0900 MSC Fairfield IP441A

COSCO COSCO Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. (EPIC / IPAK) Indial Indial Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Seahorse Ship UK, North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. Globelink Globelink WW UK, North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. UK, North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global UK, North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal UK, North Continent & Scandinavian Ports. Dronagiri-3 Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova. Safewater Safewater Lines UK, North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware 22/0923/09 22/09 1100 MSC Washington IS436A Q1415 1102549-09/09 MSC MSC Agency UK, North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 28/0929/09 28/09 1100 MSC Margrit IS437A SCI CMT Barcelona, Felixstowe, Hamburg, Rotterdam, Gioia Tauro, 09/1010/10 09/10 1100 MSC Rapallo IS439A UK, North Continent & Other Mediterranean Ports. HimalayaExpress

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. UK, North Cont., Scandinavian & Med. Ports. Dron.2&Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. UK, North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

18/0919/09 18/09 1500 CMA CGM Titus 0MXKDW1 Q1373 1102136-05/09 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 25/0926/09 TBATBA Koi 0MXKFW1 Q1428 1102884-11/09 CMA CGM CMA CGM Ag. Valencia, Cagliari. (IMEX Service) Dron-3&Mul 02/1003/10 TBATBA Cypress 0MXKJW1 COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 19/0920/09 19/09 1700 YokohamaExpress 4336W Q1362 1101929-04/09 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 26/0927/09

TBATBA Yung Tau Express 4337W Hapag ISS Shpg. UK, North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS 06/1007/10

TBATBA Frankfurt Express 4339W COSCO COSCO (I) UK, North Cont., Scandinavian, Red Sea & Med.Ports. 14/1015/10

TBATBA Seaspan Ganges 4340W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. 20/1021/10

TBATBA Mundra Express 4341W

Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS 26/0927/09

TBATBA Maersk Genoa 438W Q1405 1102390-06/09 Maersk Line Maersk India Jeddah, S.Canal, Port Said, Tangier, Algeciras, Maersk CFS 03/1004/10

TBATBA Maersk Guayaquil 439W Valencia, Geona (ME 2) TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN, RED SEA &

18/0919/09 18/09 0800 APL Salalah 0PEA9W1 Q1337 1101543-31/08 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 24/0925/09

TBATBA CMA CGM Gemini 0PEABW1 Q1393 1102298-06/09 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras. (EPIC) 20/0921/09 TBATBA Bertie 24032W Q1417 1102586-09/09 SeaLead SeaLead Shpg./ Aliaga, Gebze, Gemlik, Istanbul, Mersin, EL Dekheila, Casablanca, Giga Shpg. Venghazi, Algier, Raves, Constanta, Thessaloniki, Piraeus, Barcelona, Valencia, Misurata (West Asia Red Sea Med - WARM) 20/0921/09 TBATBA HMM Bangkok 0118W Q1305 HMM HMM Shpg. Jeddah, Damietta, Piraeus, Genoa,

20/0921/09 18/09 1000 MSC Michaela IU437A Q1409 1102545-09/09

CMA CGM Cendrillon 0INI1W1

APL Mexico City 0INI1W1

Line ONE (India) India America Express (INDAMEX)

12/1013/10 TBATBA APL Qingdao 0INI5W1 COSCO COSCO Shpg. (INDAMEX) Indial Indial Shpg. US East Coast & South America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. ConexTerminal

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

20/0921/09 20/09 0900 MSC Ellen IP438A Q1416 1102587-09/09 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals 27/0928/09 27/09 0900 MSC Maeva IP439A Q1465 1103400-16/06 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira, Paita, 04/1005/10 04/10 0900 MSC Abidjan IP440A

Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel 11/1012/10 11/10 0900 MSC Fairfield IP441A

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports. (EPIC / IPAK) AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America

22/0923/09 22/09 1100 MSC Washington IS436A Q1415 1102549-09/09 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, HindTerminals 28/0929/09 28/09 1100 MSC Margrit IS437A Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 09/1010/10 09/10 1100 MSC Rapallo IS439A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast.

One Reliability 007E Q1435

27/0928/09

TBATBA Cap Andreas 014E & Caribbean Ports, Canada. (TIP Service) 29/0930/09

TBATBA X-Press Anglesey 24032E Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 13/1014/10

TBATBA MOL Presence 017E West Indies Ports.

24/0925/09 24/09 1700 OOCLLuxembourg 112E Q1420 1102685-10/09 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 02/1004/10 TBATBA Stratford 132E Q1432 1102732-10/09

East Coast & Other Inland Destinations. 13/1014/10 TBATBA Xin Da Yang Zhou 096E

COSCO Shpg. US West Coast.

18/1019/10

TBATBA Pusan 34E Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. 22/1023/10

29/0930/09

TBATBA Aka Bhum 024E

San Francisco Bridge 074 Q1413

29/0930/09

APL Cairo 0UW2HW1 Q1396 1102315-06/09

CMA CGM Zanzibar 0UW2NW1

OOCL (I) (Bangladesh India Gulf Express) 23/0924/09 TBATBA CMA CGM Saigon 0QC1LW1 Q1394 1102299-06/09 CMA CGM CMA CGM Ag.

In Port 18/09 X-Press Altair 24011E Q1368 1101951-04/09 X-Press Feeders Sea Consortium Jebel Ali 28/0929/09

TBATBA SSL Brahmaputra 919E Q1424 Wan Hai Wan Hai Lines (I) (RGI / IM1) 05/1006/10

TBATBA X-Press Mekong 24008E

UnifeederUnifeeder 15/1016/10

TBATBA Wan Hai 316 210E Emirates Emirates Shpg. 18/0919/09 18/09 2200 Wadi Duka 2417W Q1346 1101690-02/09 Asyad Line Seabridge Al Sokhna, Jeddah (IEX)

18/0919/09 Grasmere Maersk 438W Q1381 1102205-05/09 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile) Maersk CFS 25/0926/09 TBATBA Maersk Virginia 439W Q1401 1102384-06/09 19/0920/09 19/09 1200 Inter Sydney 0163 Q1308 1101223-27/08 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

20/0921/09

TBATBA Golbon 1334W Q1347 1101702-02/09 HDASCO Armita India Bandar Abbas, Chabahar. (IIX) 21/0922/09 TBATBA Maersk Pittsburgh 437W Q1384 1102208-05/09 Maersk Line Maersk India Salallah. (MECL) Maersk CFS 21/0922/09

22/0923/09

TBATBA BLPL Trust 1410W Q1421 1102730-10/09 BLPL Transworld GLS Jebel Ali.

TBATBA Maersk Cape Town 439S Q1385 1102216-05/09 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS 23/0924/09

TBATBA Celsius Edinburgh 002 Q1392 1102259-06/09 ONE Line ONE (India) Jebel Ali. 02/1003/10

TBATBA Oceana 930 Q1395 1102313-06/09 UnifeederUnifeeder Jebel Ali. (MJI)

29/0930/09 TBATBA Tonsberg OPUITS Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. (West Bound) RCL/CUL Line RCL/Seahorse KMTC KMTC (India)

In Port 18/09 SC Mara(NSFT) 24036 Q1330 1101515-30/08 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 23/0924/09

Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DR 26/0927/09 TBATBA Maersk Genoa 438W Q1405 1102390-06/09 Maersk Line Maersk

In Port 18/09 SSF Dream 072W Q1342 1101707-02/09 Safeen Fdrs. Sima Marine Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, 21/0922/09 TBATBA SSF Dynamic 076W Aqua Container Aqua Container Ajman, Umm Al Quwain, Ras Al Khaima. (UIG) 18/0919/09 18/09 1300 Oshairaij 2418W Q1340 1101621-02/09 QNL/Milaha Poseidon Shpg. Hamad. (NDX) Speedy CFS

Emirates Emirates Shpg. Jebel Ali, Sohar.

Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr.

Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports. LMT Orchid Gulf Ports.

Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Team Lines Team Global Log. Gulf Ports. Conex Terminal

20/0921/09 TBATBA HMM Bangkok 0118W Q1305 ONE Line ONE (India) Karachi (FIM West Bound) 20/0921/09 20/09

29/0930/09 TBATBA Dalian 2437W Q1388

Line

(India) Colombo. 05/1006/10 TBATBA Navios Verde 2438W

In Port 19/09 Maersk Iyo 437W Q1380 1102204-05/09

19/09 20/09 19/09 1500 Ever Ethic(NSIGT) 170E Q1324 1101435-30/08 Evergreen EvergreenShpg. Colombo. Balmer

23/0924/09 TBATBA Shimin 23E Q1360 1101925-23/08 UnifeederUnifeeder Colombo.

04/1005/10 TBATBA Seattle Bridge 092E ONE Line ONE (India) Colombo. (CISC Service) 07/1008/10 TBATBA Ever Sigma 129E

Seahorse Colombo. 24/0925/09 TBA 1000 MSC Yuvika V IV438A Q1411 1102553-09/09

In Port 18/09 MSC Sofia FD430E Q1258 1100683-22/08

CFS

Agency Colombo. (INDUSA)

Terminals 20/0921/09 18/09 1000 MSC Michaela IU437A Q1409 1102545-09/09

20/0921/09 TBATBA Interasia Amplify E001 Q1374 1102138-05/09 Wan Hai Wan Hai Lines Colombo. (CI2)

21/0922/09 21/09 1600 One Contribution 058E Q1379

Line ONE (India) Colombo. 01/1002/10 TBATBA Seaspan Adonis 076E Q1387 Yang Ming Yang Ming(I)

03/1005/10 TBATBA One Altair 066E Hapag/CSC ISS Shpg/Seahorse (PS3 Service)

CFS/ 14/1015/10 TBATBA One Arcadia 070E

HMM Shpg.

CFS 24/0925/09 24/09 1700 OOCLLuxembourg 112E Q1420 1102685-10/09 OOCL OOCL (I) Colombo. GDL 02/1004/10

TBATBA Stratford 132E Q1432 1102732-10/09 Star Line Asia Seahorse Yangoon.(CIX-3) Dronagiri-3 23/0925/09 TBATBA One Reliability 007E Q1435 ONE Line ONE (India) Colombo. 27/0928/09 TBATBA Cap Andreas 014E X-Press Feeders Sea Consortium Colombo. (TIP Service) Dronagiri 29/0930/09 TBATBA X-Press Anglesey 24032E CSC Seahorse Colombo. 13/1014/10 TBATBA MOL Presence 017E HMM HMM Shpg. Colombo. Seabird CFS TO

18/0920/09 18/09 1100 One Matrix 091E Q1331 1101969-04/09

20/0921/09 TBATBA X-Press Capella 24006E Q1358 1101931-04/09 X-Press Feeders Sea Consortium (CWX/CIX5)

29/0901/10 TBATBA TS Keelung 24004E TS Lines/PIL TS Lines(I)/PIL India Dronagiri-2/— 19/0920/09 19/09 1100 Kmarin Azur 438W Q1382 1102206-05/09 Maersk Line Maersk India Colombo (MW2) Maersk CFS 21/0922/09 19/09 1600 KMTC Dubai 2405E Q1341 1101618-02/09 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 02/1003/10 TBATBA Ever Elite 169E Q1440

KMTC/Gold Star KMTC(I)/Star Ship

Dronagiri-3/— 04/1005/10 TBATBA Monaco 109E

X-Press Feeders Sea Consortium (NIX Service) 11/1012/10 TBATBA ESL Busan 02438E

EmiratesEmirates

Dronagiri-2 22/0923/09 TBATBA Xin Beijing 147E Q1265 1100863-23/08

COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 27/0928/09

23/0924/09

TBATBA TS Dalian 012W Q1457

Samudera Samudera Shpg. Colombo (SIG)

TBATBA CMA CGM Cendrillon 0FFCME1 Q1431

CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou

Dronagiri

Dron-3 & Mul 02/1002/10

TBATBA APL Mexico City 0FFCOE1

RCL RCL Ag. (AS 1)

19/09 20/09 19/09 1500 Ever Ethic(NSIGT) 170E Q1324 1101435-30/08 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, BalmerLaw.CFSDron. 23/0924/09

TBATBA Shimin 23E Q1360 1101925-23/08 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 04/1005/10

TBATBA Seattle Bridge 092E

PIL/ONE PIL India/One(I)

—/— 07/1008/10

TBATBA Ever Sigma 129E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 14/1015/10

TBATBA Celsius Naples 905E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 21/1022/10

TBATBA ESL Dachan Bay 24005E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 (CISC Service) HMM HMM Shpg. P.Kelang(S),Singapore, Xiangang, Qingdao,Kaohsiung. Seabird CFS

Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang Dronagiri

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. P Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS

In Port 18/09 MSC Sofia FD430E Q1258 1100683-22/08 MSC MSC Agency Dalian, Shanghai, Ningbo, Yantian. Hind Terminals 26/0927/09 26/09 1000 MSC Maureen FD432E Q1455 1103193-13/09 (DRAGON EB) 23/0924/09

TBATBA Grace Bridge 2406E Q1296 1101087-26/08 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo Dronagiri 08/1009/10 TBATBA Zhong Gu Hang Zhou 24003E

Heung A Line Sinokor India 11/1012/10

TBATBA Beijing Bridge 2406E Sinokor Sinokor India Seabird CFS 20/1021/10 TBATBA SM Mahi 2411E

TS Lines TS Lines (I) (CSC)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR

DATE TIME NAME No.No. No.&Dt. POINT

In Port 18/09 Wan Hai 502 E126 Q1359 1101938-04/09 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Dronagiri-1 24/0925/09

TBATBA Wan Hai 507(BMCT) E226 Q1402 1102388-06/09 Evergreen Evergreen Shpg. Shekou. Balmer Law. CFS Dron. 02/1004/10

TBATBA Ital Unica E179 Q1436 1102890-11/09 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 08/1009/10

TBATBA Wan Hai 521 E027 TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 23/0924/09

TBATBA Zhong Gu Shen Yang 02433N Q1207 1100062-16/08

RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang, 07/1008/10

TBATBA Tonsberg Q1458

CU Lines/KMTC Seahorse/KMTC(I) Cai Mep (VGX) SeaLead SeaLead Shpg. 20/0921/09

TBATBA Interasia Amplify E001 Q1374 1102138-05/09 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 27/0928/09

TBATBA Wan Hai 501(BMCT) E250 Q1433 1102896-11/09

COSCO COSCO Shpg. Ningbo, Shekou. 04/1005/10

TBATBA Interasia Momentum E049

InterasiaInterasia (CI2)

21/0922/09 21/09 1600 One Contribution 058E Q1379

01/1002/10

TBATBA Seaspan Adonis 076E Q1387

HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS

CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai.

ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep,

Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 03/1005/10

TBATBA One Altair 066E

HMM HMM Shpg. Seabird CFS 14/1015/10

TBATBA One Arcadia 070E

Samudera Samudera Shpg. Dronagiri (PS3 Service)

Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai OceanGate

23/0925/09

TBATBA One Reliability 007E Q1435

ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 27/0928/09

29/0930/09

TBATBA Cap Andreas 014E

TBATBA X-Press Anglesey 24032E

X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang.

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 13/1014/10

TBATBA MOL Presence 017E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service) HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS 24/0925/09 24/09 1700 OOCLLuxembourg 112E Q1420 1102685-10/09 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, GDL/Dron-1 02/1004/10

TBATBA Stratford 132E Q1432 1102732-10/09 APL CMA CGM Ag. Ningbo. Dron.-3 & Mul. 13/1014/10

TBATBA Xin Da Yang Zhou 096E ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 18/1019/10

TBATBA Pusan 34E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 22/1023/10

TBATBA Aka Bhum 024E Gold Star Star Ship Singapore, Hong Kong, Shanghai. 05/1106/11

TBATBA OOCL Hamburg 153E ANL CMA CGM Ag. Port Kelang, Singapore (CIX-3) Dron.-3 & Mul. (CIX-3)

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 24/0925/09

01/1002/10

TBATBA X-Press Carina 439E Q1412

TBATBA X-Press Cassiopeia 440E

Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS

X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3) 14/1015/10

TBATBA X-Press Phoenix 442E

Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS

18/0919/09 18/09 0100 Interasia Enhance E037 Q1355 1101794-03/09 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 25/0926/09

TBATBA Wan Hai 523 E032 Q1403 1102385-06/09 Heung A Line Sinokor India Hongkong 02/1003/10

TBATBA Northern Guard E926

Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 09/1010/10

TBATBA Wan Hai 510 E182

InterasiaInterasia 16/1017/10

TBATBA Wan Hai 506 E236

Feedertech Feedertech/TSA

18/0920/09 18/09 1100 One Matrix 091E Q1331 1101969-04/09 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 20/0921/09

TBATBA X-Press Capella 24006E Q1358 1101931-04/09 X-Press Feeders SeaConsortium (CWX/CIX5) 29/0901/10

TBATBA TS Keelung 24004E

KMTC/TS Lines KMTC(I)/TS Lines(I)

Dronagiri

Dron-3/Dron-2 06/1007/10 TBATBA Ever Legion 056E Gold Star Star Ship 06/1007/10 TBATBA X-Press Pisces 24007E RCL/PIL RCL Ag./PIL India

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao.

Speedy CFS 20/0921/09 20/09 1100 Abrao Cochin 0021 Q1311 1101277-28/08 QNL/Milaha Poseidon Shpg. Shanghai, Ningbo, Shekou. Speedy CFS (MGX-2)

20/0921/09 20/09 1200 Xin Pu Dong 276 Q1390 1102227-05/09

KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 21/0922/09

TBATBA KMTC Delhi 2405E Q1418 1102596-09/09 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 (AIS SERVICE) COSCO COSCO Shpg.

Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore Dronagiri-2 21/0922/09 19/09 1600 KMTC Dubai 2405E Q1341 1101618-02/09 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, BalmerLaw.CFSDron. 02/1003/10

TBATBA Ever Elite 169E Q1440

KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay Dronagiri-3/— 04/1005/10

TBATBA Monaco 109E X-Press Feeders Sea Consortium (NIX Service) 11/1012/10

TBATBA ESL Busan 02438E

Emirates Emirates Shpg Dronagiri-2 18/1019/10

TBATBA Torrance 29E Pendulum Exp. Aissa Maritime 31/1001/11

TBATBA Zoi 117E

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 20/0921/09 19/09 1800 KMTC Yokohama 2408E Q1375

Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya

Dronagiri-1 29/0930/09

TBATBA Wan Hai 309 025E Q1434 1102843-11/09

KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Surabaya (AIS5/SI8 Service)

Dronagiri-3/— 22/0923/09 21/09 1200 Hemma Bhum 001E Q1389 1102221-05/09 RCL/PIL RCL Ag./PIL Port Kelang, HaIphong, Nansha, Shekou. 26/0927/09

TBATBA Ever Ulysses 162E Q1357 1101795-03/09 CU Lines Seahorse Ship 03/1004/10

06/1007/10

18/1019/10

TBATBA Kota Manis 413E Evergreen Evergreen Shpg.

TBATBA Vira Bhum 117E InterasiaInterasia (RWA / CIX 4)

TBATBA Kota Gadang 228E Emirates Emirates Shpg. 22/0923/09

TBATBA Xin Beijing 147E Q1265 1100863-23/08 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 23/0924/09

Balmer Law. CFS Dron.

TBATBA Xin Ya Zhou 164E Q1244 1100530-21/08 APL CMA CGM Ag. Nansha, Taichung, Kaohsiung. Dron.-3 & Mul 06/1007/10

TBATBA Beijing 105E OOCL/RCL OOCL(I)/RCL Ag. (CI 1) GDL/— CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung. 27/0928/09

TBATBA TS Dalian 012W Q1457 ONE Line ONE (India) Singapore 12/1013/10

TBATBA Daphne 868W Samudera Samudera Shpg. Dronagiri 18/1019/10

TBATBA EF Olivia 093W (SIG) 01/1002/10

TBATBA Hyundai Tokyo 0152E Sinokor Sinokor India Shanghai (FIM East Bound) Seabird CFS

TBATBA Hyundai Mars 0048E Q1348 HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Seabird CFS 07/1008/10

24/0925/09

TBATBA Wan Hai 507(BMCT) E226 Q1402 1102388-06/09 Auckland, Tauranga, Madang, Port Lae, Rabaul, Port Moresby 02/1004/10

TBATBA Ital Unica E179 Q1436 1102890-11/09 TS Lines TS Lines (I) Australian Ports. Dronagiri-2 08/1009/10

TBATBA Wan Hai 521 E027 (CIX) 23/0925/09

27/0928/09

TBATBA One Reliability 007E Q1435

ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, Auckland, Lyttleton.

TBATBA Cap Andreas 014E Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 29/0930/09

TBATBA X-Press Anglesey 24032E

Global Log. Australia & New Zealand Ports. (TIP Service) JWR 24/0925/09 24/09 1700 OOCLLuxembourg 112E Q1420 1102685-10/09

02/1004/10

TBATBA Stratford 132E Q1432 1102732-10/09

TBATBA Xin Da Yang Zhou 096E

TBATBA Pusan 34E

Aka Bhum 024E

OOCL Hamburg 153E

Haian East 24027W

29/0930/09 TBATBA Dalian 2437W Q1388 ONE Line ONE (India) Durban, Cape Town, Tema, Tincan, Apapa. 05/1006/10 TBATBA Navios Verde 2438W Hapag ISS Shpg. (AIM)

In Port 19/09 Maersk Iyo 437W Q1380 1102204-05/09 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 25/0926/09 TBATBA Maersk Cubango 438W Q1400 1102376-06/09 CMA CGM CMA CGM Ag. Cotonou (Direct), Port

Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3&Mul. 27/0928/09 TBATBA Stanley A 0MTIFW1 Q1425 1102762-10/09 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS 04/1004/10 TBATBA CMA CGM Valparaiso 0MTIHW1 DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira. (MIDAS-2) 22/0923/09 TBATBA Maersk Cape Town 439S Q1385 1102216-05/09 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 29/0930/09

TBATBA Maersk Cabo Verde 440S Q1407 1102386-06/09 (MWE SERVICE) 23/0924/09 TBATBA Celsius Edinburgh 002 Q1392 1102259-06/09 ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI)

20/0921/09 18/09 1000 MSC Michaela IU437A Q1409 1102545-09/09 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Oran, Hind Terminals 27/0928/09 TBA 1000 Kotka IU438A Q1464 1103396-16/09 Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa (INDUS) 20/0921/09 20/09 0900 MSC Ellen IP438A Q1416 1102587-09/09 MSC

MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 27/0928/09 27/09 0900 MSC Maeva IP439A Q1465 1103400-16/06 CMA CGM CMA CGM Ag. Dakar,Nouakchott,Banjul,Conakry, Freetown, Monrovia, Sao Tome,Bata, Dron.-3&Mul. 04/1005/10 04/10 0900 MSC Abidjan IP440A Guinea Bissau,Nouadhibou, Dakar,Abidjan, Tema, Malabo & Saotome. 11/1012/10 11/10 0900 MSC Fairfield IP441A

GlobelinkGlobelink West & South African Ports. (EPIC / IPAK)

Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK)

22/0923/09 22/09 1100 MSC Washington IS436A Q1415 1102549-09/09 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 28/0929/09 28/09 1100 MSC Margrit IS437A

Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware

22/0923/09 TBATBA OOCLLuxembourg 112E

COSCO COSCO Shpg. West African Ports. (CIX-3) 24/0925/09 TBATBA X-Press Carina 439E Q1412

CMA CGM CMA CGM Ag. Beira, Maputo, Nacala, Tanga, Lilongwe & Harare. Dron.-3&Mul. 01/1002/10 TBATBA X-Press Cassiopeia 440E (NWX/FI-3)

19/0920/09 19/09 1100 Kmarin Azur 438W Q1382 1102206-05/09 Maersk Line Maersk India Tema, Lome, Abidjan (MW2) Maersk CFS 26/0927/09 TBATBA Maersk Aras 439W Q1406 1102383-06/09

MUMBAI: The Agricultural and Processed Food Products Export Development Authority (APEDA), under the Ministry of Commerce & Industr y, Gover nment of India, s i g n e d a M e m o r a n d u m o f Understanding (MoU) with LuLu Group International (LLC), a leading retail chain in the Middle East and Asia, in the presence of His Excellency Dr. Thani bin Ahmed Al Zeyoudi, Minister of State for Foreign Trade and Minister in charge of Talent Attraction and Retention, Ministry of Economy, UAE, in Mumbai on 10th September 2024.

As part of the agreement, LuLu Group will showcase a wide range of certified Indian organic products in its stores across the United Arab Emirates (UAE) APEDA will support these efforts by facilitating connections

between organic growers in India

Producer Companies (FPCs) and cooperatives and LuLu Group. This will ensure that Indian organic products reach a wider global audience.

The MoU outlines several key initiatives, including dedicated shelf space in LuLu hypermarkets for Indian organic products certified under the National Programme for Organic Production (NPOP), promotional campaigns such as product sampling, interactive events and consumer feedback drives, Buyer-Seller Meets (BSM), B2B meetings and trade fairs to further boost organic exports and create greater awareness about the benefits of Indian organic products, exposure visits for Indian FPOs/ FPCs/

infrastructure in UAE to enhance understanding of international retail markets.

This partnership is expected to significantly expand the global reach of Indian organic products and contribute to the growth of organic farming in India by creating stronger linkages between

consumers. APEDA is responsible for promoting the export of scheduled agricultural and processed food products from India. It also serves as the Secretariat for the National Programme for Organic Production (NPOP), the regulatory framework governing organic exports from India.

This strategic partnership aims to promote Indian organic products in international markets through LuLu

NEW DELHI : Increasing freight costs, shortage of containers and dependence on major shipping hubs and foreign carriers pose serious challenges to the country’s exports, think tank GTRI said recently

To address these challenges, the Global Trade Research Initiative (GTRI) recommended that India implement several strategies to boost domestic container production, enhance the role of local shipping companies, promote the use of domestic containers, and strengthen local shipping firms.

“India can lower its risk of global supply chain disruptions by boosting domestic container production, encouraging the use of locally made containers, and increasing the use of Indian shipping companies for transporting goods,” GTRI Founder Mr. Ajay Srivastava said

Between 2022 and 2024, shipping rates for a 40-foot container have fluctuated significantly

It said that in 2022, the average cost was $ 4,942 due to the lingering effects of the covid pandemic, while by 2024, the rate had stabilized around USD 4,775, it said adding that these rates are still significantly higher than pre-pandemic levels, where the cost was $ 1,420 in 2019. “The elevated freight rates reflect the persistent supply chain challenges that continue to burden global trade,” Mr Srivastava said.

He added that there had been unverified reports of China hoarding containers to maximize its exports to the US and Europe ahead of potential trade restrictions and a hike in duties on solar panels, electric vehicles, steel, and aluminium manufactured by Chinese firms located in China or elsewhere like in ASEAN (Association of Southeast Asian Nations) countries.

However, the real container shortage issue likely stems from broader logistical inefficiencies like port congestion and Red Sea disruptions rather than deliberate stockpiling, Mr Srivastava said.

Freight costs for Indian exporters shipping goods to Europe and the US have more than doubled in the past year, driven by disruptions in the Red Sea

The GTRI said that last month, delays in ship arrivals at India port were caused by congestion at Singapore port.

“Indian exporters may soon face another disruption if the US-China trade war escalates in the coming months,” it said.

The global container shortage, first triggered by the COVID-19 pandemic, may soon reemerge, causing severe difficulties for Indian exporters.

“To minimise Trade Disruptions Due to US-China Trade War Escalation and other geopolitical events, India must invest in Container Production and Domestic Shipping,” it added.

It also said that India’s dependence on major shipping hubs and foreign carriers significantly increases costs and risks.

“To cut costs and minimise risks, three key logistics challenges need urgent attention. First, 90-95 per cent of India’s cargo is transported by foreign shipping liners, giving them control over access and freight rates, limiting India’s ability to manage costs and schedules,” it suggested.

About 25 per cent of India’s cargo is transshipped through hubs like Colombo, Singapore, and Klang, increasingtransittimeandfreightcosts

India depends heavily on containers made in China, making it vulnerable to s u p p l y d i s r u p t i o n s a n d p r i c e fluctuations, it said adding “India’s dependence on major shipping hubs and foreign carriers significantly increases costs and risks”.

The shipping container industry is critical to global trade, and India has been making efforts to expand its container production.

However, the GTRI said that current output is insufficient to meet growing demand.

India produces between 10,000 and 30,000 containers annually, while China,

the global leader, produces around 2.5 to 3 million containers per year.

This leaves India with less than 1 per cent of the global market share, making it vulnerable to disruptions in container availability

T h e o w n e r s h i p o f s h i p p i n g containers is dominated by major shipping lines and leasing companies with negligible share of India. Companies like Maersk (Denmark), Mediterranean Shipping Company (Switzerland), and CMA CGM (France) are among the top owners of containers, with millions of TEUs (Twenty-foot Equivalent Units) in their fleets,” the GTRI said.

Additionally, China’s state-owned shipping giant, COSCO, holds a significant share of global container ownership.

“

production costs of USD 3,500 to USD 4,000 per 40-foot container, which is higher than China’s cost of USD 2,500 to USD 3,000 As a result, Indian businesses remain dependent on imported containers, primarily from China. This reliance makes the country susceptible to global supply chain disruptions,” Srivastav said.

Key production hubs in India are emerging in Bhavnagar ( Gujarat ) and Chennai (Tamil Nadu), but significant investments and policy support are required to scale up co

production.

In addition to container shortages, India is heavily dependent on foreign shipping companies for its international trade. About 90-95 per cent of India’s total cargo is carried by foreign lines, such as Maersk, MSC, and COSCO

“This reliance on foreign shipping exposes India to rising freight costs, geopolitical risks, and logistical uncertainties. With escalating trade tensions between the US and China, and the increasing cost of shipping, India must urgently develop its domestic shipping industry to handle a larger share of its export and import cargo,” it added.

NEW DELHI: The Narendra Modil e d G o v e r n m e n t a p p r o v e d infrastructure projects worth Rs. 3 lakh crore in the first 100 days of its third term, aimed at enhancing connectivity, facilitating economic growth and job creation, and enhancing the ease of living.

In the ports sector, approval was recently granted to a major project at Va d h a v a n , M a h a r a s h t r a , t o b e constructed at an estimated cost of Rs. 76,200 crore. Once complete, it will be one of the world’s top 10 ports and is expected to give a push to infrastructure in the country

Further, central assistance of Rs. 49,000 crore was approved under the Pradhan Mantri Gram Sadak Yojana –IV (PMGSY-IV) for construction of 62,500 km of roads connecting 25,000 habitations and construction or upgradation of bridges on the new connectivity roads. The Government also approved eight national high-speed road corridor projects, spanning 936 km, at an estimated cost of Rs. 50,600 crore.

The PM also laid the foundation s t o n e o f S h i n k h u n L a Tu n n e l , connecting Ladakh with Himachal Pradesh, which is expected to boost

allweather connectivity in difficult terrain.

Also, eight new railway line projects were approved in the first 100 days to make railway journeys faster, smoother and more convenient.

The Government estimates that the new railway lines will also create direct and indirect jobs of 4.42 crore mandays. With focus on enhancing airport infrastr ucture, the Government recently approved the development of Lal Bahadur Shastri International Airport in Varanasi, along with new civil enclaves at Bagdogra airport in West Bengal and Bihta in Bihar

Launches Department of Commerce’s Jan Sunwai Portal, designed to streamline communica�on between stakeholders and authori�es

NEW DELHI: Union Minister of C o m m e r c e a n d I n d u s t r y, Shri Piyush Goyal, chaired the third meeting of the reconstituted Board of Trade at Mumbai. Shri Piyush Goyal reaffir med the Gover nment’s commitment to drive economic growth through robust partnerships with state governments.

The Minister emphasized that initiatives of the Government are instrumental in guiding India towards a more transparent, efficient, and sustainable trade environment, benefiting the country’s broader economic landscape.

S h r i G o y a l l a u n c h e d t h e Department of Commerce’s Jan S u n w a i P o r t a l , d e s i g n e d t o streamline communication between stakeholders and authorities, providing a direct and transparent channel for addressing trade and industry-related issues. This portal offers on-demand video conferencing services, in addition to fixed video c o n f e r e n c e l i n k s f o r r e g u l a r, scheduled interactions. The portal’s accessibility extends across various offices and autonomous bodies under the Department of Commerce, such as the DGFT, Coffee Board, Tea Board, Spices Board, Rubber Board, APEDA, MPEDA, ITPO, and EIC.

S h r i P i y u s h G o y a l a l s o inaugurated ECGC’s new online service portal, alongside a revamped in-house SMILE-ERP system

These innovations mark a significant leap towards paperless processing and faceless ser vice delivery, benefiting both exporters and banks. This transformation will not only streamline customer services but a l s o e n h a n c e E C G C ' s c o r e operational efficiency Key outcomes include full automation of processes, business process integration, quicker c

operational control, and a meaningful reduction in the carbon footprint to support sustainability goals. ECGC’s e

operational excellence, and customer satisfaction, ensuring world-class services for Indian exporters.

Discussions in the meeting centred around critical initiatives aimed at fostering employment across states and enhancing the role of the Department of Commerce in promoting state-level economic growth.

T h e s e s s i o n a l s o f e a t u r e d interactive presentations from the State Governments of Uttar Pradesh, Karnataka, Tamil Nadu, Telangana and Madhya Pradesh, showcasing their achievements in export promotion and ease of doing business (EODB), interventions, and ongoing state-level initiatives. Best practices for export promotion were shared across the board, providing valuable

i n s i g h t s f o r p e e r s t a t e s . The participation and suggestions from the states of Assam, Tripura, and Sikkim are expected to lead to higher export potential from the North East region.

In the realm of E-Commerce exports, the Board of Trade was informed by officials from the Central Board of Indirect Taxes & Customs (CBIC) that effective immediately, RoDTEP, RoSCTL, and Drawback benefits will be extended to all exports made via Courier Plans to extend these benefits to postal route exports are also in the pipeline, creating a more equitable environment for E-Commerce exporters utilizing the courier and postal mode.

The Board of Trade functions as a key platform for collaboration, d i s c u s s i o n , a n d p o l i c y recommendations to bolster the growth of India's international trade. Bringing together representatives from the Industry Ministry, State Governments, industry stakeholders, and trade organizations, this advisory body seeks to shape a thriving trade ecosystem.

S e c r e t a r y, D e p a r t m e n t o f Commerce, Shri Sunil Barthwal, Additional Secretary and Director General, DGFT, Shri Santosh Sarangi a n d o t h e r s

o f Government of India and State/UT Governments also attended the meeting.

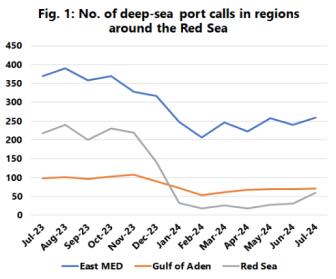

COPENHAGEN: We are now more than half a year on from the beginning of the Red Sea crisis, and the severe impact on the Container S h i p p i n g i n d u s t r y c o n t i n u e s unabated.

Figure 1 shows the number of deep-sea port calls in the major regions closest to the Suez Canal –East Mediterranean (East MED), Gulf of Aden, and the Red Sea itself. While the total number of monthly deep-sea port calls in East MED were already trending downwards precrisis, the M/M drop in January 2024 was quite significant at -22%. Compared to the pre-crisis average, the drop in 2024 has been -33%. A similar -33% drop in the average monthly calls was also seen for the Gulf of Aden, from roughly 100 monthly calls to 60-70 in 2024. Like East MED, port calls in the region have been recovering, albeit very slowly The Red Sea saw the most

severe impact of the crisis, with a -85% drop in the average number of deepsea port calls in 2024. The figure dropped from over 200 calls per month, to under 40 in January-June 2024. The figure rose to 60 calls in July 2024, which was a double that of the previous months. However, it remains to be seen if this will continue, or if this is a temporary uptick.

In the Red Sea, the most impacted ports were Jeddah and King Abdullah Port. Carriers stopped calling King Abdullah Port on their deep-sea services from January 2024 onwards, while Jeddah saw the sharpest decline of -74% M/M from December 2023 to January 2024. Even after a slight improvement in July 2024, the port is averaging just 37 calls per month compared to the pre-crisis average of 135 monthly calls. In East MED, Piraeus and Port Said were the most impacted, while in the Gulf of Aden, Salalah saw deep-sea

port calls drop by nearly -50% in January-February 2024. In terms of schedule reliability, Red Sea and East Mediterranean are back to the per-crisis levels, while the Gulf of Aden is still lagging. Additionally, an improvement was recorded across all three regions in the average delay of late vessel arrivals, which, after a very sharp increase to 10-14 days in January 2024, dropped back down to pre-crisis levels of 4-5 days.

PANAJI: The 20th Maritime State

D e v e l o p m e n t C o u n c i l ( M S D C ) , Goa concluded with remarkable outcomes for India’s maritime sector This two-day event saw the resolution of over 80 critical issues between the Central Government, States, and Union

Te r r i t o r i e s , f o c u s e d o n p o r t

i n f r a s t r u c t u r e m o d e r n i z a t i o n , connectivity, statutory compliances, maritime tourism, navigation projects, sustainability, and port security

During the 20th MSDC, over 100 issues from various states were deliberated and successfully resolved. Several new and emerging challenges were also addressed, including the establishment of Places of Refuge (PoR) for ships in distress, the development of Radioactive Detection Equipment (RDE) infrastructure at ports to enhance security, and the facilitation of seafarers by recognizing them as key essential workers, ensuring better working conditions and access to shore leave. Additionally, the meeting discussed the implementation of a State Ranking Framework and a Port Ranking System to foster healthy competition and drive performance improvements across India's maritime sector

The meeting was graced by the Union Minister of Port Shipping and Waterways Shri Sarbananda Sonowal; MoS, MoPSW, Shri Shantanu Thakur; M i n i s t e r o f C a p t a i n o f Po r t s , Government of Goa, Shri Aleixo Sequeira; Shri Devendra Kumar Joshi, LG, Andaman & Nicobar; Shri Mankala S Vaidya, Minister of Fisheries, Ports, a n d I n l a n d Wa t e r Tr a n s p o r t , Government of Karnataka; Thiru E.V Velu, PWD Minister, Tamil Nadu; Shri TK Ramachandran, Secretary, MoPSW and various other dignitaries.

Union Minister of Ports, Shipping and Waterways, Shri Sarbananda Sonowal, emphasized the significance of MSDC’s contribution, ‘The MSDC has been instrumental in aligning policies and initiatives like the Indian Ports Bill and the Sagarmala program By resolving key issues between the Central Government, states, and maritime boards, the Council has ensured the seamless development of India’s maritime infrastructure, enabling coastal states to capitalize on emerging opportunities. The MSDC’s

efforts over the past two decades have facilitated the growth of over 50 non-major ports, which now handle more than 50% of India’s annual cargo As major ports approach saturation, these non-major ports will play a crucial role in the future of India’s maritime sector’.

‘Under the leadership of PM Modi the Indian Maritime sector is growing like never before. Recently, PM Shri Narendra Modi Ji laid the foundation stone of India’s 13th Major Port worth Rs 76,220 crores at Vadhavan in Maharashtra 30th August 2024 The government has also designated Galathea Bay in the Andaman & Nicobar Islands as a 'Major Port'. This Rs 44,000 crore project will be developed under a public-private partnership m o d e l a n d a i m s t o c a p t u r e transshipped cargo currently handled outside India The first phase is expected to be operational by 2029’, added Shri Sonowal.

The Sagarmala program, approved by the Union Cabinet in 2015, envisions a total of 839 projects with an estimated investment of Rs 5.79 lakh crore, slated for completion by 2035. Out of these, 262 projects, amounting to approximately Rs 1.40 lakh crore, have already been completed, while another 217 projects, valued at around Rs 1.65 lakh crore, are currently under active implementation. These projects span multiple sectors and involve the coordinated efforts of central ministries, state governments, major ports, and various other agencies, reflecting a comprehensive approach to t r a n s f o r m i n g I n d i a ’ s m a r i t i m e infrastructure.

‘India's maritime sector stands at a pivotal moment of transformation Through the initiatives launched at the MSDC, we are not only advancing infrastructure and safety but also c r e a t i n g a n e n v i r o n m e n t t h a t encourages innovation, collaboration, and growth The inclusion of digital platforms and enhanced ease of doing business initiatives are key steps in making India a leader in global maritime trade. The future of India's maritime landscape is bright’, said Shri Shantanu Thakur, Minister of State for Ports, Shipping, and Waterways.

In a major initiative to further improve the ease of doing business in the maritime sector, the MSDC launched the National Safety in Ports Committee (NSPC) application on the National Single Window System platfor m. T

streamline regulatory processes, improving efficiency and reducing costs for stakeholders. The platform allows for real-time performance monitoring, which will significantly enhance the operational efficiency of various departments through well-coordinated information sharing.

The plans for a Mega Shipbuilding Park, spanning multiple states, were discussed during the Maritime State Development Council (MSDC) meeting. This ambitious initiative aims to consolidate shipbuilding capabilities across regions, fostering greater e

n B y integrating resources and expertise from various states, the park is set to become a key hub for the maritime sector, driving growth and reinforcing I n d i a ' s p o s i t i o n o n t h e g l o b a l shipbuilding stage.

Additionally, the launch of the Indian International Maritime Dispute Resolution Centre (IIMDRC) marks a significant milestone. This specialized platform will offer merit-based and industry-governed solutions to resolve m a r i t i m e d i s p u t e s e f f i c i e n t l y, addressing the multi-modal, multicontract, multi-jurisdictional, and multi-national nature of maritime transactions. IIMDRC positions India as a global hub for arbitration, aligning with the "Resolve in India" initiative.

Another noteworthy launch was the Indian Maritime Centre (IMC), a Policy Think Tank designed to bring together maritime stakeholders currently operating in silos IMC will foster innovation, knowledge sharing, and strategic planning, driving growth and development across India’s maritime sector.

NEW DELHI: The Union Home M i n i s t e r a n d M i n i s t e r o f Cooperation, Shri Amit Shah, has stated that under the leadership of Prime Minister Shri Narendra Modi, the government is boosting exports to ensure that farmers receive a fair price for their crops, allowing them to earn maximum value for their produce.

In a post on ‘X’ platform, Shri Amit Shah mentioned that keeping the

welfare of farmers paramount, the Modi Government has made three important decisions:

1. The Modi Government has decided to remove the Minimum Export Price (MEP) on onions and reduce the export duty from 40% to 20%. This will increase onion exports, resulting in a rise in income for onionproducing farmers.

2 The Government has also decided to remove the MEP on

Basmati rice, enabling Basmati riceproducing farmers to export and earn higher profits.

3 . A d d i t i o n a l l y, t h e M o d i government has decided to increase the duty on the import of crude palm, soyabean, and sunflower oils from 12.5% to 32.5% and on their refined oils from 13 75% to 35 75% This will ensure that Indian soybean farmers receive better prices for their crops, thus increasing their income.

NEW DELHI: In a significant step to boost export of basmati rice, a premier GI variety rice of India, the Government of India has decided to remove the floor price on export of basmati rice.

In response to ongoing trade concerns and adequate domestic availability of rice, the Government of India has now decided to completely remove the floor price on Basmati

India’s import

Rice exports. The Agricultural and Processed Food Products Export Development Authority (APEDA) will closely monitor export contracts to prevent any non-realistic pricing of b a s m

n d e n s u r e transparency in export practices.

As a background, a floor price of $1,200 per metric ton (MT) was introduced in August 2023 as a temporary measure in response to

rising domestic rice prices in the wake of tight domestic supply situation of rice and to curb any possible misclassification of non-basmati rice as basmati rice during exports, in view of the export prohibition on NonBasmati White rice Following representations from trade bodies and stakeholders, the government had then rationalized the floor price to $950 perMTinOctober, 2023.

CHENNAI: India’s import duties are too high and must come down, feels Dr V Anantha Nageswaran, Chief Economic Adviser to the Government of India.

Describing high import duties as a “challenge”, Nageswaran said that tariffs must come down to keep the cost of imported input materials down; only then would India be able to become a major exporting nation.

Giving some data, the Chief Economic Adviser said that the average applied tariff for all merchandise products was (in 2021) 8.3 per cent, compared with 13.6 per cent in South Korea, 11.5 per cent in Thailand, 9.6 per cent in Vietnam, 7.5 per cent in China and going all the way down to 3 4 per cent in the US Likewise, the average applied tariff

for non-agricultural products was 14.9 per cent in India, compared with 8.4 per cent in Vietnam, 7.1 per cent in Thailand and 3.1 per cent in the US.

“In the absence of domestic capacity, the cost of production increased due to tariffs on inputs in the supply chain, raising the total bill of materials,” he said.

B y w a y o f a n e x a m p l e , Nageswaran noted that although iPhones were produced in India, they cost more in India than in other countries. The price of iPhone 16, as of September 11, was 79,900 in India, higher than the US, UK, Dubai, China, Vietnam, Thailand and Canada.

Cognizant of this, the Budget for 2024-25 had brought down tariffs on many key components, he said.

Starting his lecture on why it is

tougher for India to become a developed country than for China, Nageswaran noted that when China grew in the last three decades, it had a growing global economy and did not h a v e t o

geopolitical tensions. Nor did China have to concern itself much with climate change, but India would have to now Also, India has to face competition from China, whereas China did not have such a competitor, he said.

G

atmosphere is not so conducing, India will have to look at the domestic market for growth, he said, dilating on

LONDON: The Cargo Integrity Group is issuing an urgent reminder of the need for an emergency contact telephone number to be provided for shipments of dangerous goods, following recent experiences reported by its partner organizations.

Transport of dangerous goods is essential to the production and distribution of many products on a global scale. The Inter national Maritime Dangerous Goods (IMDG) Code1 is in force worldwide to ensure the safety and security of people, the environment and assets, and must be followed by all parties. Recommended industry practices have also been

developed for the packing and securing of goods in cargo transport units, such as the CTU Code2.

The majority of dangerous goods shipments are carried and handled without incident. Nonetheless, should an incident occur despite all safety precautions, it is essential that the necessary steps to respond to the dangers can be taken swiftly and reliably by those attending the scene.

A requirement of many national dangerous goods regulations for transport by sea, in order to comply with i n t e r n a t i o n a l d a n g e r o u s g o o d s regulations, including the IMDG Code, is that a suitable 24-hour emergency

response number be provided within shipping documentation, safety data sheetsorothercompliantmeansforeach shipment of dangerous goods. The phone number must be answered by a person who is knowledgeable of the dangerous g o o d s b e i n g s h i p p e d a n d h a s comprehensive emergency response and incident mitigation information for the product or products in the shipment, or has immediate access to a person who has that information This phone number must not have a call-back function, such as the use of voicemail or pager, nor be a general answering service. The number must be current during the shipment and monitored 24 hours a day.

NEW DELHI: Efficient logistics and a paperless system are critical to boost international trade, and strong connectivity is key to foster trade and economic development, Commerce Secretary Sunil Barthwal has said. However, while making such efforts to bolster connectivity projects, it is essential to build trust as well as transparency in the cooperative efforts, he said addressing a meeting of Ministers of Shanghai Cooperation Organization(SCO)

The secretary noted that it is of utmost importance that "we uphold the

principles of SCO Charter including respect for sovereignty and territorial integrity of the member states."

" B a r t h w a l f o c u s e d o n t h e importance of efficient logistics for international trade, in which, paperless trading is a critical step towards s t r e a m l i n i n g c r o s s - b o r d e r transactions," the commerce ministry said in a statement. He congratulated Pakistan for its Presidency of the Heads of Gover nment of the SCO and welcomed Belarus on becoming the new member of the organisation.

"It was also highlighted that any

effort towards fair trade practices cannot be complete without collective effort of the member states within the economies and more transparency to ensure wider economic outcome in the region," it said.

During the meeting, the ministers approved three documents covering different areas of cooperation, including the Framework for Cooperation of the SCO Member States in the sphere of Development of the Creative Economy, and the Concept of Cooperation b e t w

n Organizations of the members

M U M B A I : R B I g o v e r n o r Shaktikanta Das said that India's growth potential is around 7.5% or more, higher than the central bank's 7.2% forecast for the current financial year.

The potential growth rate refers to the rate at which the economy can grow over the long term without triggering inflation The governor made this statement at the Bretton Woods Committee's annual Future of Finance Forum in Singapore, as reported by Reuters The comments were made outside of his prepared speech, which was released.

Das said that RBI expects the economy to record 7.2% growth by the

end of the year, attributing slower growth in the first quarter to low govt expenditure during the national election. In his speech, he also said that the adverse spillovers from the 'higher for longer' interest rate scenario remain a contingent risk. "While quite a few central banks have started treading the path of rate cuts on account of recession worries, many still continue to maintain restrictive stances and refrain from reducing policy rates so as to break the back of inflation persistence decisively," Das said He added that RBI's projections indicate that inflation is likely to ease further from 5.4% in 202324 to 4.5% in 2024-25 and 4.1% in 2025-26.

"Inflation has moderated from its peak of 7 8% in April 2022 into the tolerance band of +/- 2% around the target of 4%, but we still have a distance to cover and cannot afford to look the other way," Das said, adding, "The momentum of global disinflation is slowing, warranting caution in easing monetary policy."

He said that monetary policy management by central banks has to be prudent and that supply-side measures by govts have to be proactive.

According to Das, the impending monetary policy pivot in the US, with a likely soft landing, raises hopes for sustained global inflation reduction

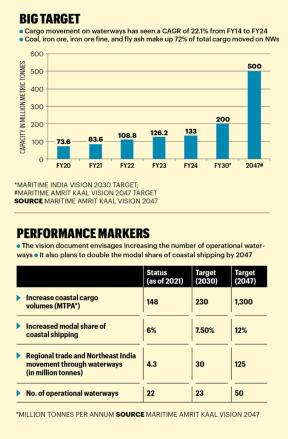

NEW DELHI : India’s coasts have seen many eras when commerce and culture have blossomed over millennia. But maritime freight movement has dropped in recent years, even t h o u g h t h i s i s t h e c h e a p e s t m o d e o f transportation.

Aware of the vast potential here, the Union Government has highlighted the blue economy as one of the 10 core motors of economic growth in its ‘Vision 2030’ document. There is also the Maritime Amrit Kaal Vision 2047, a subsidiary of the Amrit Kaal Vision 2047, that focusses on enhancing ports’ capacity and promoting inland water transport and coastal shipping with a proposed investment of Rs 80 lakh crore.

By channelling technology, digitisation, and renewable energy, the government is looking to give ports a facelift and make them safe, smart, secure, and sustainable. There are proposals to increase the capacity of existing ports, develop new ones and maritime clusters, and enhance the efficiency of ports with the incorporation of the latest technology

Through these measures, the government hopes to improve multi-modal connectivity at the ports and subsequently improve the modal share of coastal shipping and inland waterways.

Logistics Push

Amit Tandon, CEO & Managing Director of supply chain and logistics provider Asia Shipping India, says the role of waterways in logistics services is projected to expand substantially over the next 23 years as the Indian Government strives to position the country as a global leader in maritime innovation and growth. He adds that the significance of the Maritime Amrit Kaal Vision 2047 is underscored by the monumental investment commitments witnessed during the Global Maritime India Summit 2023 Memoranda of Understanding (MoUs) worth about Rs 10 lakh crore were inked, heralding a new era of port modernisation, green initiatives, and infrastructural development.

“These investments, coupled with public-private partnerships (PPPs) and targeted policy interventions, are poised to revolutionise India’s maritime landscape, bolstering its position as a global maritime powerhouse,” says Tandon.

I n a f u r t h e r p u s h t o m o d e r n i s e t h e maritime sector, the government has launched the National Logistics Portal-Marine (NLP Marine). India’s port-led industrialisation scheme aims to reduce logistics costs by locating industries near ports under the Sagarmala initiative.

It’s not just coastal trade that the government is looking to spur The Amrit Kaal Vision also focusses on the inland waterways sector, with an ambitious plan to invest Rs 35,000 crore by 2047 to establish a robust network.

U n d e r t h e N a t i o n a l Wa t e r w a y s A c t , 111 waterways have been designated as National Waterways (NWs) to promote inland water transport (IWT). The key developments include the construction of terminals along the Ganga and Brahmaputra rivers and the implementation of the Indo-Bangladesh Protocol (IBP) route, which opens up alternative connectivity corridors, particularly benefiting the Northeast region.

Ketan Kulkarni, Deputy Managing Director, Gati Express and Supply Chain Pvt. Ltd, says as t h e g o v e r n m e n t a i m s t o b o o s t l o g i s t i c s competitiveness, robust waterway infrastructure can reduce costs, achieve efficiency, and build an effective modal mix.

“It will positively impact companies from the freight-intensive sectors such as manufacturing, construction, retail, etc Moreover, optimised coastal shipping and waterways pave the way for a robust multimodal transport ecosystem, the vision of the PM Gati Shakti National Master Plan,” Kulkarni says. Beyond logistics, the Government is also looking to promote ocean, coastal, and river cruises.

However, the journey ahead is fraught with challenges.

India’s 7,500-km coastline, along with 12 major and 187 minor ports, makes it an emerging hub for shipping and transshipment. Waterways are the cheapest mode of transport, costing Rs 1 19 per tonne km compared to Rs. 2.28 on highways and Rs 1.5 via railways.

What the current infrastructure requires now is a continued policy push “There are infrastructure limitations when it comes to storage at ports and terminals, first- and last-mile connectivity, water channel depth, technology adoption in port operations, etc.,” says Kulkarni. But, he notes, it’s encouraging that policymakers are addressing these challenges.

Competing with road and rail transport for a share of the cargo movement requires strategic planning and upgrading infrastructure, streamlining regulatory frameworks, and addressing environmental concerns, say industry players. Additionally, developing a skilled workforce will be essential to supporting operations.

“Through concerted efforts in infrastructure development, policy reforms, and technological innovation, India’s maritime sector is on the cusp of a transformational journey towards prosperity and progress With prudent policies, funding mechanisms, and a focus on green transport, our waterways can revolutionise logistics for both inward shipments and exports,” explains Tandon.

Such efforts can also have potential knock-on effects like boosting trade and connectivity and driving economic growth in inland areas Additionally, international funding agencies like the World Bank and the Asian Development Bank, and instruments like green bonds, are providingcrucialfundingforsuchinfrastructureprojects

Flying the Flag

The Government’s vision document also lays strong emphasis on ensuring an increase in the Indian-flagged fleet and reducing dependency on foreign-flagged vessels. This is expected to give the shipbuilding, recycling, and repair ecosystem in India a boost. According to the government, the share of the cargo carried by Indian-owned or flagged vessels has been dropping over the past decade and currently stands at only about 5.4%.

Shipping reforms are expected to generate significant employment opportunities and strengthen India’s maritime capabilities with the cruise, shipbuilding, and ship repair industries, leading to huge job creation.

The growth of Indian-flagged shipping tonnage has not kept up with the pace of local trade needs. Though the number of ships flying the Indian flag has grown over the years, the share of the fleet as a percentage of the world’s fleet remains near a paltry 1%. In contrast, leading nations such as China and Singapore have a share of 5% and 6.5%, respectively, in the world’s tonnage.

The government has cautioned that if corrective action is not undertaken, then this share may fall further, resulting in Indian-owned or built ships having no play even in the domestic shipping market.

With that in mind, the government is planning to launch a shipbuilding and repair policy This would ensure that the growing demand that’s coming from the Indian shipping market is met in Indian shipyards. That opportunity has been pegged at more than Rs 20 lakh crore by 2047.

To improve tonnage, the Government is also looking at initiatives providing fiscal incentives, such as revisiting the applicability of TDS on wages paid to Indian seafarers and allowing input tax credit on the fuel and spares procured for vessels It is also considering waiving GST on reverse charge for MRO (maintenance, repair, and overhaul) for Indian ships for services consumed outside India and granting infrastructure status to the shipping industry That would open up other sources of financing to vessel owners, such as alternative investment funds. Besides, it is also looking to remove restrictions on ship leasing by insurance companies.

Taken together, these initiatives have the potential of establishing India as a maritime hub and making it a key coastal business centre. That will be another factor driving the country’s economic growth.

Cargo Steamer's Agent's ETD

Jetty Name Name

CJ-I AG Valiant Interocean 19/09

CJ-II Obe Dinares Interocean 20/09

CJ-III Howes Joanna Trueblue 19/09

CJ-IV Libra Anline Shpg. 21/09

CJ-V Hai Nam 89 J M Baxi 20/09

CJ-VI Union Glory J M Baxi 19/09

CJ-VII Marwah Island Seascape 19/09

CJ-VIII VACANT

CJ-IX Wonderful SW DBC 20/09

CJ-X ZX Glory Asia Shpg. 19/09

CJ-XI VACANT

CJ-XII VACANT

CJ-XIII Seastar Viking Synergy 19/09

CJ-XIV SSI Resolute Cross Trade 19/09

CJ-XV Da Hong Xia Mystic Shpg. 21/09

CJ-XVA Bulk Mustique Cross Trade 22/09

CJ-XVI VACANT

TUNA VESSEL'S NAME AGENT'S NAME ETD Alan Seascape 22/09

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I Jag Vikram

OJ-II Hanyu Azalea Seaport 19/09

OJ-III Maritime Varity GAC Shpg. 19/09

OJ-IV Marmotas

OJ-V VACANT

OJ-VI Sanman Santoor

OJ-VII UACC Manama

SHIPS SAILED WITH NEXT EXPORT CARGOS DESTN.

Propel Proseperity 13/09 Abu Dhabi

Star Copenhagen 13/09

Stolt Kashi 13/09 Mumbai

Sea Falcon 14/09

Swarna Pusph 14/09 Banglore

African Roller 15/09 Montevideo

Senorita 15/09 China

Koga Royal 15/09 Germany

Oriental Cosmos 15/09

Glovis Maple 15/09

TCI Express 16/09 Manglore-CochinTuticorin-Chennai

Source Blessing 16/09 Nhava ShevaJebel Ali DammamShuiba-Umm Qasr

Steamer's Name Agents Arrival on Golden ID DBC 30/08

Suvari Kaptan DBC 09/09

FPMC B 201 Trueblue 13/09

SHIPS NOT READY FOR BERTH

Steamer's Name Agents Arrival on

African Avocet Aditya Marine 01/09

Ru Yi II Rishi Shpg. 09/09

I.G.M. Nos. filed at Kandla Customs

Manual EDI Vessels Name Agent

Stream African Avocet Aditya Marine

CJ-I AG Valiant Interocean

CJ-XVA Bulk Mustique Cross

CJ-XV Da Hong Xia Mystic Shpg.

Stream Dawn Haridwar Interocean

Stream Doctor O DBC

Stream FPMC B 201 Trueblue

Stream Golden ID DBC

25/09 Haje Nafela DBC

CJ-III Howes Joanna Trueblue

Stream Kathy Ocean Upsana Shpg.

CJ-IV Libra Anline Shpg.

Stream Lila Frostburg Interocean

Stream Mohsen Ilyas Seacoast

Stream MO Joud DBC

CJ-II Obe Dinares Interocean

In Bags INIXY124080641

Stream Prince Khaled DBC Somalia 7,700 T. Rice & Sugar In Bags (25/50 Kgs)

Stream Ru Yi II Rishi Shpg.

CJ-XIV SSI Resolute Cross Trade

Stream Suvari Kaptan DBC

Tuna Alan Seascape

Stream Great Beauty Mitsutor 7,661 Bleached Hard Wood

CJ-V Hai Nam 89 J M Baxi

18,786/3258/421/247 T. Alumina Ball (J.Bags) INIXY124080482

Stream Infinity K TM International Paradip 6,221 T. HR Coils

Stream Kurushima DBC Japan 3,867/742/409 T. CRC/S. Bars/Prj Cargo INIXY124090794

Stream Kuwana DBC Japan 1,415/3,843 T.CRC/Pkgs(175/423Pcs) INIXY124090804

Stream Lignum Network Taurus 12,178 T. Mop In Bulk INIXY124080666

CJ-VII Marwah Island Seascape 59,835 T. GYPSUM

CJ-XIII Seastar Viking Synergy Malaysia 34,716 CBM T. Logs

CJ-VI Union Glory J M Baxi China 14,102/5,903/5,258/1,917/204 INIXY124080667 T. Plates/CRC/HRC

CJ-IX Wonderful SW DBC Malaysia 28,371 CBM P Logs

CJ-X ZX Glory Asia Shpg. 8,354/3,416/906 T. PVC Resin Bags/ INIXY124080695 Polyvinyl Chloride Bags/ Pkgs

Stream Bochem Bayard GAC Shpg. Singapore

T. Chem In Bulk INIXY124090806

18/09 Bow Agathe GAC Shpg. USA 12,500 T. Chemicals

20/09 Bow Palladium GAC Shpg. Singapore

OJ-II Hanyu Azalea Seaport

Stream Horin Trader Samudra Taiwan

Stream Ginga Saker GAC Shpg. Kuwait

18/09 Hakone Galaxy GAC Shpg.

Chem In Bulk INIXY124090735

T. Chem In Bulk INIXY124090779

Chem In Bulk INIXY124090796

T. Chem In Bulk 19/09 Nordic Callao GAC Shpg.

18/09 Nord Miyako Interocean Santos Brazil

20/09 Paramita Wilhelmsen Singapore

Stream PS Queen Interocean Karachi

Stream Rayyan Gas Delta Waterways

Stream Sakura Spirit ISS Shpg.

27/09 Seaways Hercules Interocean

Stream Tatlisu Samudra Taiwan

Stream XT Brightness Samsara Shpg. Fujairah

T. Chemicals

T. CDSBO In Bulk INIXY124090802

Chem In Bulk INIXY124090821

CDSBO In Bulk

Ammonia

T. Propane/Butane

T. CDSBO

T. Chem In Bulk INIXY124090736

T. Chemicals

4083145 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16)

21/09-PM X-Press Odyssey 24038E 4093423 X-Press

TBA Asyad Line Seabridge Marine Shangai, Ningbo, Shekou (FEX)

TBA Asyad Line Seabridge Marine Haiphong, Laem Chabang, (IEX) TO LOAD FOR INDIAN SUB CONTINENT

In Port —/— GFS Giselle 2410 4093365 Global

TBA Asyad Line Seabridge Marine Karachi (REX)

In Port GFS Giselle (V-2410) 4093365 MBK Logistix Nhava Sheva

17/09 Maersk Chachai (V-437W) 4083200 Maersk India Nhava Sheva 18/09 Maersk Guatemala (V-437W) 4083140 Maersk India Jebel Ali

SM Mahi (V-2409) Karachi 12-09-2024 SSL Godavari (V-34W) Nhava Sheva 12-09-2024 Marathopolis (V-437S) Salalah 14-09-2024

Kwangyang, Pusan, 19/09 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX)

Zhong Gu Nan Ning 2405E 2403317 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 19/09 KMTC /TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX) 18/09 18/09-PM KMTC Yokohama 2408E 2403349 Wan Hai Line Wan Hai Lines Port Kelang, Jakarta, Surabaya. (SI8 / JAR) 19/09 KMTC / Interasia KMTC (I) / Interasia 19/09 19/09-AM Zoi 116E 2403187 Interasia/GSL Aissa M./Star Shpg Port Kelang, Singapore, Tanjung Pelepas, Xingang, Qingdao, 20/09 27/09 26/09-PM KMTC Dubai 2405E 2403383 Evergreen/KMTCEvergreen/KMTC (FIVE)

27/09 26/09-1800 Maersk Chicago 438W 24309

TO LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND AND PACIFIC ISLANDS

In Port —/— One Reliability 007E 24301 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 18/09 21/09 21/09-1000 Cap Andreas 014E 24307 ONE ONE (India) (TIP)

23/09 23/09-1000 X-Press Anglesey 24032E

In Port —/— X-Press Odyssey 24038E 24306 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 19/09 26/09 26/09-0200 X-Press Carina 24039E 24311 X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 27/09 Sinokor/Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan.

23/09 23/09-2200 Xin Ya Zhou 164E 24281 COSCO COSCO Shpg. Singapor Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 24/09 Nansha, Port Kelang (CI1)

23/09 23/09-0400 One Contribution 058E 24308 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 24/09 02/10 02/10-0400 Seaspan Adonis 076E HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3)

23/09 23/09-2100 OOCL Luxembourg 112E 24305 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 24/09 04/10 04/10-2100 Stratford 132E 24312 Gold Star / RCL Star Shpg/RCL Ag. (CIXA)

14/10

19/09-1800 Maersk Pittsburb 437W 24299 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 21/09 24/09 24/09-1700 Seaspan Jakarta 438W Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX)

In Port —/— One Reliability 007E 24301 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo.

21/09-1000 Cap Andreas 014E 24307 ONE ONE (India) (TIP)

In Port —/— X-Press Odyssey 24038E 24306 Maersk Line Maersk India Colombo. (NWX)

In Port —/— SSL Gujarat 159 24302 SLSSLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 18/09 23/09 23/09-2200 Xin Ya Zhou 164E 24281 COSCO COSCO Shpg. Karachi, Colombo (CI1)

23/09 23/09-2100 OOCL Luxembourg 112E 24305 COSCO/OOCL COSCO Shpg./OOCL(I) Colombo. (CIXA)

04/10 04/10-2100 Stratford 132E 24312 05/10 02/10 02/10-1200 SCI Chennai 2411 SCI J M Baxi Mundra, Cochin, Tuticorine. (SMILE) 03/10 TBN CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, Krishnapatanam, Cochin, Mundra. (CCG)

In Port —/— One Reliability 007E 24301

Car.CB-2 C C Lome (V-OQC17W1)(Sailed)

29/09 Dalian (V-2437W)

Car.CB-2 Haian West (V-24014W)(Sailed)

19/09 Contship Uno (V- 24011W)

Car.CB-2 RC Ocean (V-43W)(Sailed)

Car.CB-2 Spil Citra (V-OUW8AW1)(Sailed)

Car.CB-2 Safeen Power (V-2435W)(Sailed)

18/09 Yokohama Star (V-2429S)

25/09 Ren Jian 8 (V-02ISLS1)

23/09 Celsius Edenburgh (V-002W) Unifeeder/One Unifeeder/One India Gulf

Car.CB-5 ESL Nhava Sheva (V-2434S)(Sailed) Emirates / KMTC Emirates Shipping / KMTC India Gulf

RCL RCL Agency 19/09 Ever Ethic (V-170E)(NSIGT) Unifeeder/KMTC Unifeeder/KMTC(I) Far East &

23/09 Shimin (V-23E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo

04/10 Seattle Bridge (V-092E) ONE/TS Lines ONE (I)/TS Lines(I)

19/09 Fayston Farms (V-435S) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa

Car.CB-4 GFS Gissele (V-2410E)(Sailed) Global Fdr/TS Lines Sima Marine/TS Lines (I) Far East

16/09 23/09 Grace Bridge (V-2406E) Sinokor/Heung A Line Sinokor India

20/09 Golbon (V-1334W) HDASCO Armita India Gulf

18/09 Grasemere Maersk (V-438W) Maersk Line Maersk India U.K. Cont. 19/09 19/09 Inter Sydney (V-0163) Interworld Efficient Marine Gulf 20/09 24/09 Konrad (V-KONO524W) Akkon Oasis Shipping Europe/Med. 25/09

CB-5 Maersk Iyo (V-437W) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India