NEW DELHI: The Siemens-designed, 1,200horsepowertrains,withatopspeedof120km(75miles)/hr, will be assembled in the Indian Railways Factory in Gujarat state over the next 11 years, with deliveries startingin24months.

Siemens has signed a 3 billion euro ($3.25 billion) contract to supply and service freight trains in India, the German engineering company said today, the biggest locomotivedealinitshistory.

Siemens will deliver 1,200 electric locomotives and provide servicing for 35 years under the agreement, also itsbiggesteverinIndia.

TheSiemens-designed, 1,200-horsepower trains,witha top speed of 120 km (75 miles)/hr, will be assembled in the

Indian Railways Factory in Gujarat state over the next 11 years,withdeliveriesstartingin24months.

“These new locomotives … can replace between 500,000 to800,000 trucksovertheirlifecycle,” saidSiemens MobilityCEOMichaelPeter.

The order was a big step for Siemens in India, Michael Peter told Reuters, saying the company had previously been very strong in North America and central Europe in rolling stock but mainly provided components and infrastructureinIndia.

“India is looking for technology, better efficiency, and longer lifespan for its trains,” he said in an interview. “In the past India built their own trains, but they want to increasereliabilityandaveragespeeds.”

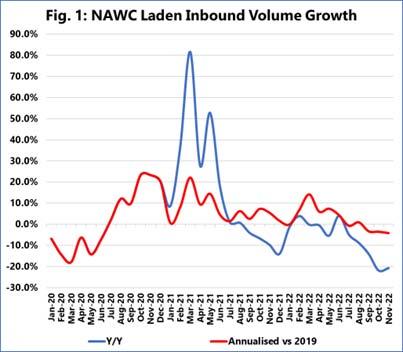

COPENHAGEN: Sea-Intelligence noted in its latest report that when annualised against 2019, volume growth on the North America West Coast (NAWC) stagnated during the first two months of the traditional peak season of the third quarter, while outright contracting in September2022.

“This trend continued into October and November,” pointedout Alan Murphy, CEO of Sea-Intelligence.

The figure shows the laden import volumes on both a year-on-year basis, as well as an annualised basis comparedto2019.

Sea-Intelligence’s analysts noted that “If we look across the latter metric [annualised basis compared to 2019], the growth rate has been on a downwards trend, from a peak of 14.2% in March 2022 to 4.4% in June, and then briefly dropping below 0% in July to -0.7%, before droppingagaininSeptemberto-3.3%.”

According to the report, in October and November, the growth rate continued to decline, dropping to -4.1% in November.

Sea-Intelligence notedthatliketotalhandlingvolumes, laden inbound volumes are now also firmly negative. “OnaY/Ybasis,ladenimportshavebeennegativeformost of the period since mid-2021, and have dropped below -20% inOctoberandNovemberof2022,”saidMurphy.

Furthermore, the decreasing trend in laden imports hints at a continued demand decrease into 2023, with additional contractions in demand across Chinese New Year highly likely. “With capacity levels already high, and additional capacity being released due to the reduction in bottlenecks, this drop in demand puts

pressure on the shipping lines to blank additional capacity during Chinese New Year to stop a potential acceleration infreightratedecline,”commentedMurphy.

CEO of Sea-Intelligence concluded that “a slight positive, however, is the increase in the laden-export-toempty-export ratio (improvement towards laden exports). While the ratio is still below 1 – favouring empty exports –it increased from 0.5 to 0.7 in November. The improvement isnotbecauseofasuddenburstofladenexports,whichare still contracting within -8% and -11%, but a slowdown in empty exports, the growth of which has now nearly stagnated.”

“All the states have come on board and are mapping some 29 essential data layers related to their infrastructure and logistics facilities/assets on the NMP,” Surendra Ahirwar, Joint Secretary

NEW DELHI: As the benefits of PM Gati Shakti National Master Plan — a digital platform mapping details of all infrastructure and logistic facilities in theCountryonageographicinformationsystem(GIS)map— becomes apparent, states are mapping their state-specific essential data, relevant for planning physical and social

SINGAPORE: PSAInternationalhas announced it handled 90.9 million TEUs at its port projects worldwide in 2022, which represents a 0.7% decline comparedwith2021boxvolumes.

The company’s flagship PSA Singapore reported 37millionTEUswiththeremainingterminalsofPSAoutside Singaporereaching53.9millionTEUs.

infrastructureontheNationalMasterPlan(NMP).

“AlltheStates have come onboard andaremapping some 29 essential data layers related to their infrastructure and logistics facilities/assets on the NMP,” Mr. Surendra Ahirwar, Joint Secretary (Logistics Division), DepartmentforPromotionofIndustryandInternalTrade (DPIIT) told.

Cont’d. Pg. 15

The FIT Alliance was formed in February 2022 with five founding members: BIMCO, DCSA, FIATA, ICC and SWIFT.

“The world experienced another challenging year in 2022 andalthoughmostcountrieswere emerging fromthe global pandemic, many continued to suffer from the negative aftershocks which were compounded by the war in Ukraine, higher energy prices, global inflation and supply chain disruptions,” stated Tan Chong Meng, GroupCEOofPSA.

Cont’d. Back Pg.

AMSTERDAM: The key objective of the Alliance is to raise awareness and encourage greater use of shipping standards and electronic bills of lading (eBLs) across all sectors of the shipping industry. In June, the Alliance issued a survey to members of its respective organisations to gauge awareness and adoption of eBLs, aswellasfactorsthathinderadoption.

Cont’d. Pg. 6

The FIT Alliance was formed in February 2022 with five founding members: BIMCO, DCSA, FIATA, ICC and SWIFT.

Cont’d. from Pg. 3

The survey results show some promise for growth in eBL use but clearly identify obstacles that the industry must address foreBLstogainmainstream acceptance. Thisvaluable input will assist the Alliance in ensuring the needs of its membership are met as it collaborates to standardise the digitisation ofinternationaltrade.

Howwidespread iselectronic billofladinguse?

Awareness of eBLs is high – three out of four respondents have heard at least some (up to a great deal) about them, and 94% have heard at least a little. A closer look at the numbers reveals that 28% of respondents already use eBLs in conjunction with paper. The task now becomes to accelerate adoption by this group, so they can join the 5% who have already made the full transition to eBL. Fortunately, a majority (58%) of those using only paper B/Ls report their organisations have plans to use eBLs in the future, but only just over a fifth (22%) saythiswillbewithinthenextsixto24months.

The advantages of digitisation are also well known. When asked what could be achieved through eBLs and wider trade digitisation, an overwhelming 86% of survey respondents identified increased speed, while 78% cited process efficiencies, 73% improved customer experience, and the same percentage, cost savings. Nearly nine in ten respondents (86%) said they believeeBLscan/willunlockwidertradedigitisation.

Whathinderselectronic billofladingadoption?

To close the gap between what respondents think eBLs can deliver and their actual usage of them, the industry must address the key factors that hinder adoption, which were also identified inthesurvey.

1. Concerns about technology, platform and lack of interoperability

The top reasons for not using eBLs, or not using them more, can be grouped as technology, platform or interoperability concerns. These concerns were cited by almost three-quarters (73%) of respondents. Whilst the concerns pointed to different factors such as the need for more education about the security and technology aspects, platform choices or costs, they illustrated that organisations are hesitant to move forward becausetheydonotwantto“choosewrong”oneBLsolutions.

Although there are currently seven well-established eBL platforms in the industry, each one is a “walled garden”, with its own proprietary technology and bylaws that govern the relationships between the stakeholders involved in a transaction.

What this means in practice is that parties that want to exchange aneBL must allsubscribe tothesame platform.Ifthe shipper uses platform A, the consignee platform B, the trade finance bank platformCand the carrier platformD,they cannot use an eBL, as it cannot be transferred between different platforms.

Signing up to use multiple platforms requires significant time and resources: getting the legal department to read through and approve the platform’s rulebook, and training personnel tousethenewplatform.

There is little doubt that interoperability between platforms would make the adoption of eBLs more appealing to a new generation of users. Technical interoperability is therefore key to both eliminating the need to sign up with multiple platforms andreducingthefearofvendorlock-in.

Technical standards areneededtocreateastructureforthe transfer of standards-based eBLs between platforms, and DCSA, along with carriers, solution providers and ExxonMobil, are working on an eBL interoperability proof of concept (POC) toputthesestandardsintopracticeinreal-life scenarios.

Prior to the interoperability POC, the FIT Alliance had already aligned onthebilloflading datastandards developed by BIMCO (for bulk and liquid shipping), DCSA (for container shipping) and FIATA (for B/Ls issued by freight forwarders). This was an important milestone in the FIT Alliance’s work to speed up adoption by ensuring that shippers and other stakeholders shipping different types of cargo can leverage the same set of data standards. In addition, BIMCO and SWIFT are

planning their own eBL interoperability POC based on DCSA standards.

Since an eBL must flow through the hands of many stakeholders, a hurdle to eBL adoption is insufficient adoption by other stakeholders in the ecosystem. A majority (63%) of our survey respondents cited lack of stakeholder readiness as a key reason for not using eBLs, or not using them more, making it thesecondmostcitedreason.

The solution to this standoff is simply for companies to embrace standardisation by actively contributing to and driving standards implementation within their own organisations. Shipping standards are available now, and the FIT Alliance’s mission is to drive rapid adoption of these standards within their member organisations, as well as industrywide, to accelerate maritime digitalisation and the benefits it will bring.

Those benefits are compelling. When asked what the most important advantages of eBLs compared to paper BLs are, participants identified increased speed, cost savings from process efficiencies, and improved data accuracy due to the elimination ofmanualdatainput.

At a global economic growth rate of 2.4% through 2030, DCSA estimates the container shipping industry could potentially save more than $4 billion per year with 50% eBL adoption. What’s more, a recent McKinsey analysis estimates that a commitment to 100% eBL adoption could unlock around $18bn in gains for the ecosystem through faster document handling and reduced human error among other improvements, and $30-40 bn in global trade as digitisation reducestradefriction.

With standards as a framework for digitisation, the industry has a clear path forward to widespread eBL adoption and a future empowered by paperless trade for more sustainable shipping.

3. Legalacceptance oftheelectronic billoflading

Legal gaps were the third most cited reason for not using eBLs, selected by 55% of survey respondents. The United Nations Commission on International Trade Law (UNCITRAL) Model Law on Electronic Transferable Records (MLETR) offers a legal framework that can be adopted by countries to enable electronic documents to be recognised as legally equivalent topaperdocuments.

In reality, even though MLETR is not yet widely adopted, it does not pose an obstacle to eBL adoption today. eBL solution providers already have legal frameworks inplace to enable eBL adoptionandlegalinteroperability.

Nonetheless, the world saw a significant and positive boost when the UK government announced its intention to legalise digital trade documentation. The Electronic Trade Documents Bill, currently making its way through UK parliament, will legally recognise digital trade documentation as equivalent to paper by mid-2023. This paves the way for widespread adoption ofeBL for allsectors andindustries using English law asabasis for international contracts, which includes 80% of bills of lading, muchofworldtradeandseveralleadingoceancarriers.

eBLsareanimportant partofthejourneytowards maritime digitisation. The COVID-19 pandemic highlighted the inefficiencies of the current paper-based system, but these inefficiencies must not be viewed in isolation. Switching from paper bills of lading to eBLs will benefit international trade in innumerable ways by increasing speed, lowering administrative burden,lessening legalrisk,andreducingillegal tradeandcarbonemissions.

Sending physical paper around the world is not sustainable – and today, completely unnecessary. Paperless trade enabled by 100% eBL adoption can save 28,000 trees per year, equivalent toaround39footballfieldsofforest.

Following the survey, the FIT Alliance is reaching out to survey respondents and other industry stakeholders to get a deeper understanding of their current challenges and collaborate onactionstomoveeBLadoptionforward.

NEW DELHI: Warehousing Development Regulatory Authority (WDRA) has signed a memorandum of understanding with State Bank of India to help farmers in gettinglowinterestrateloans.

The Memorandum of Understanding (MoU) was signed with the intent of promoting awareness about the new loan product called ‘Produce Marketing Loan’ to exclusively fund against e-NWRs (electronic Negotiable Warehouse Receipt) with features such as nil processing fee, no additional collateral and attractive interest rates, anofficialstatementsaid.

“It is envisaged that the product will have far reaching consequences with regard to acceptance of e-NWRs among small and marginal farmers. It has the potential to makesignificantimpactonthefinancesofruraldepositors by preventing distress sale and releasing better prices for theproduce,”itadded.

Combinedwiththeinherentsecurityandnegotiabilityof the e-NWR system, the ‘Produce Marketing Loan’ will go longwayinimprovingruralliquidityandincreasingfarmers income. The MoU was signed with the State Bank of India (SBI). In another statement, Food and Consumer Affairs ministry informed that a conference on “Digital financing against e-Negotiable Warehouse Receipts and way forward”washeldatNABARDHeadOfficeinMumbai.

The purpose of the conference was to interact with bankers to increase post-harvest pledge finance against e-NWRs issued by warehouses registered by WDRA and evolve mechanisms that would improve ease of doing business.

This would also help raise the post-harvest pledge financingfromcurrentlevels.

Bankers present expressed their satisfaction with the e-NWR system established by WDRA as it provides them with considerable safety and comfort against loans advancedbythemagainstwarehousereceipts.

Loaning against e-NWRs has shown a steady growth over the years. During FY 2022-23, the loan figure has alreadycrossedRs1,500crore.

WDRA, as the regulator of the warehousing sector and the agency for establishing the Negotiable Warehouse Receipts (NWRs) in the country, assured the bankers present that it would extend all support to bankers to ensuresafetyofloansmadeagainstelectronicNWRs.

Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul

Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2

AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

19/0120/01

U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 27/0128/01 26/01 1200 MSC Flavia IS304A N2003 263383-15/01 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 03/0204/02 02/02 1200 MSC Cristina IS305A U. K. North Continent & Other Mediterranean Ports. Himalaya Express

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 20/0121/01 TBA TBA Kyoto Express 3303W N1948 262747-06/01 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 27/0128/01 TBA TBA Budapest Express 3304W N1944 263275-13/01 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 03/0204/02 TBA TBA Osaka Express 3305W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 10/0211/02 TBA TBA Prague Express 3306W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. 18/0219/02 TBA TBA Nagoya Express 3307W Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS 24/01 25/01 TBA 1200 MSC Shay IV303A N2001 263251-12/01 MSC MSC Agency Gioia Tauro, Valencia, Sines. (INDUSA) Hind Terminal 30/01 31/01

Safewater Safewater Line US East Coast, South & Central America 22/0123/01 21/01 2000 Maersk Hartford 302W N1863 261673-23/12 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 29/0130/01 28/01 2000 Maersk Columbus 303W N1904 262006-27/12 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 05/0206/02 04/02 2000 Northern Magnitude 304W US East Coast Ports. Middle East Container Lines(MECL)

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 23/0124/01 TBATBA Shimin 22008E N1957 262852-07/01 TS Lines TS Lines (I) Vancouver Dronagiri-2 30/0131/01 TBATBA Celsius Nairobi 892E N1952 262789-06/01 (CISC Service)

19/0120/01 18/01 0900 MSC Mundra VIII IU302A N1942 262531-03/01 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 26/0127/01 25/01 0900 MSC Tokyo IU303A N2002 263250-12/01 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 02/0203/02 TBA 0900 MSC Beijing IU304A 20/0121/01 19/01 1200 MSC Rosa M IS303A N1956 262861-08/01 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 27/0128/01 26/01 1200 MSC Flavia IS304A N2003 263383-15/01 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 03/0204/02 02/02 1200 MSC Cristina IS305A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel

Himalaya Express

Globelink Globelink WW USA, East & West Coast. (Himalaya Express) 22/0123/01 TBA TBA CMA CGM Orfeo 0INDFW1 N1950 262745-06/01 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 29/0130/01 TBA TBA OOCL Washington 3104 N2012 263441-16/01 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 06/0207/02 TBA TBA Express Athens 3105 Hapag ISS Shpg. ULA CFS 13/0214/02 TBA TBA One Altair 3106 ONE Line ONE (India) 20/0221/02 TBA TBA CMA CGM Ivanhoe 0INDNW1 COSCO COSCO Shpg. 27/0228/02 TBA TBA CMA CGM Butterfly 0INDPW1 Indial Indial Shpg. US East Coast & South America

India America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Express (INDAMEX) Team Lines Team Global Log. Norfolk, Charleston. JWR Logistics

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 24/01 25/01 TBA 1200 MSC Shay IV303A N2001 263251-12/01 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 30/01 31/01 TBA 1200 MSC Nao IV304A

18/0119/01 19/01 2200 Berlin Express 2302W N1917 262396-03/01 CMA CGM CMA CGM Ag. New York, Norfolk, Savannah, Miami, Santos, Dron.-3 & Mul. 24/0125/01 TBA TBA Koi 0MXDXW1 N1976 263080-11/01 ANL CMA CGM Ag. Itajai & other North American Ports. Dron.-3 & Mul. 31/0101/02 TBA TBA APL Antwerp 0MXDZW1 COSCO COSCO Shpg. 07/0208/02 TBA TBA Yantian Express 2305W Hapag ISS Shpg. ULA CFS 14/0215/02 TBATBA CMA CGM Titus 0MEFW1 Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 India Sub Cont. Med. Express (IMEX) 21/0122/01 21/01 1300 Aka Bhum 011E N1918 262381-02/01 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 24/0125/01 TBA

In Port 19/01 Montpellier

262750-06/01

Jebel Ali, Bandar Abbas. Dronagiri 25/0126/01

263011-11/01

Shpg. Jebel Ali, Bandar Abbas. (NMG) Emirates Emirates Shpg. Jebel Ali, Sohar. LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas.

Dronagiri Hapag ISS Shpg. ULA CFS QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2 Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics 21/0122/01

Unifeeder Group Transworld Shpg. Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL &

Seahorse Colombo. 24/0125/01 24/01 1300 CMA CGM Coral 0MSF3W1 N1953 262796-06/01 CMA CGM CMA CGM Ag. Colombo (MESAWA) Dronagiri

19/0120/01 18/01 0900 MSC Mundra VIII IU302A N1942 262531-03/01 MSC MSC Agency Karachi. (INDUS) Hind Terminals 24/01 25/01 TBA 1200 MSC Shay IV303A N2001 263251-12/01 MSC MSC Agency Colombo. (INDUSA) Hind Terminal

18/0120/01 18/01 0600 MOL Courage 051E N1936 262627-04/01 ONE Line ONE (India) Colombo. 26/0127/01 TBA TBA One Arcadia 063E N1958 Yang Ming Yang Ming(I) Contl.War.Corpn. 01/0202/02 TBA TBA One Continuity 062E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 21/0122/01 21/01 1300 Aka Bhum 011E N1918 262381-02/01 OOCL OOCL (I) Colombo. GDL 24/0125/01 TBA TBA OOCL New York 091E N1992 263291-13/01 Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 22/0122/01 TBA TBA TS Ningbo 23001E N1943 262728-05/01 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 30/0131/01 TBA TBA X-Press Kilimanjaro 23001E N2006 263432-16/01 X-Press Feeders Sea Consortium (CWX) 05/0206/02 TBA TBA Kota Megah 0142E TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/— 22/01 23/01 TBA TBA X-Pess Bardsey 23001E N1954 262827-07/01 ONE Line ONE (India) Colombo. 30/01 31/01 TBA TBA George Washington Bridge 018E N2025 263531-17/01 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 05/02 06/02 TBATBA Clemens Schulte 019E CSC Seahorse Colombo.

19/0120/01 19/01 2300 Navios Indigo 5W N1907 262371-02/01 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 20/0121/01 20/01 1700 X-Press Odyssey 22008E N1960 262895-09/01 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 01/0202/02 TBA TBA Zoi 21E KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 05/0206/02 TBA TBA ESL Da Chan Bay 02254E X-Press Feeders Sea Consortium (CIX3 Service) 12/0213/02 TBA TBA KMTC Dubai 2301E EmiratesEmirates Dronagiri-2 21/0222/02 TBATBA BLPL Blessing 2303E BLPL Transworld GLS Chittagong, Yangoon 07/0308/03 TBA TBA BLPL Trust 1303E 22/0123/01 TBA TBA Najade E32 N1969 262395-09/01 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 23/0124/01 23/01 0700 Seamax Westport 084E N1951 262783-06/01 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 25/0126/01 24/01 1700 MSC Shaula IW303A N1979 263079-11/01 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal

18/0119/01 18/01 2000 Wadi Bani Khalid 2301E N1844 261698-23/12 Asyad Line Seabridge Singapore, Port Kelang. (IEX) 18/0119/01 TBA TBA Haian Mind 23001E N1616 259556-24/11 Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 28/0129/01 TBATBA Hansa Rotenburg 921E N1978 263086-11/01 X-Press Feeders Sea Consortium (SIS) 04/0206/02 TBA TBA Songa Leopard 921E 19/0120/01 19/01 0900 Vira Bhum 2252E N1919 262390-02/01 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang 26/0127/01 TBA TBA CUL Jakarta 2301E N1985 263134-11/01 CU Lines/KMTC Seahorse/KMTC(I) (VGX) 02/0203/02 TBA TBA Hunsa Bhum 2302E Emirates Emirates Shpg. 23/0124/01 TBA TBA Shimin 22008E N1957 262852-07/01 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 30/0131/01

CFS 20/0221/02 TBA TBA Wide Alpha 234E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 27/0228/02 TBA TBA Ever Useful 167E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 06/0307/03 TBA TBA Celsius Naples 894E

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. CISC Service BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 23/0123/01 TBA TBA Chennai Voyager 2213E N1906 262105-29/12 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 01/0202/02 TBA TBA Jakarta Voyager 2301E

Heung A Line Sinokor India 03/0204/02 TBA TBA Shangahi Voyager 2301E

Sinokor Sinokor India Seabird CFS 20/0221/02 TBA TBA GFS Pride 2301E

Sealead Giga Shpg. 23/0223/02 TBA TBA GFS Prestige 2302E

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports (CSC) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

26/0127/01

N1958

Shekou.

01/0202/02

062E Hyundai HMM Shpg.

CFS 05/0206/02 TBA TBA YM Ubiquity 056E Samudera Samudera Shpg. (PS3 Service)

17/0218/02 TBA TBA MOL Celebration 089E Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 20/0121/01 19/01 2100 BSG Bimini 303E N1867 261672-23/12 Maersk Line Maersk India

Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 27/0128/01 TBATBA Sofia I 304E N1902 262005-27/12 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 03/0204/02 TBA TBA Northern Diamond 305E N1983 (FM-3) 21/0122/01 21/01 1300 Aka Bhum 011E N1918 262381-02/01 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 24/0125/01 TBA TBA OOCL New York 091E N1992 263291-13/01 APL CMA CGM Ag. Dron.-3 & Mul. 31/0101/02 TBA TBA OOCL Hamburg 140E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 07/0208/02 TBA TBA OOCLLuxembourg 100E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 14/0215/02 TBA TBA Seamax Stratford 120E

Gold Star Star Ship Singapore, Hong Kong, Shanghai. 28/0201/03 TBA TBA Zim Cherleston 11E

ANL CMA CGM Ag. Port Kelang, Singapore

Dron.-3 & Mul. (CIX-3)

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 22/0122/01 TBA TBA TS Ningbo 23001E N1943 262728-05/01 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 30/0131/01 TBA TBA X-Press Kilimanjaro 23001E N2006 263432-16/01 X-Press Feeders Sea Consortium (CWX) 05/0206/02 TBA TBA Kota Megah 0142E

KMTC KMTC (India) Dronagiri-3 13/0214/02 TBA TBA Pontresina 239E

TS Lines TS Lines (I) Dronagiri-2 26/0227/02 TBA TBA X-Press Anglesey 23001E

RCL/PIL RCL Ag./PIL Mumbai (CWX)

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 22/01 23/01 TBA TBA X-Pess Bardsey 23001E N1954 262827-07/01 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 30/01 31/01 TBA TBA George Washington Bridge 018E N2025 263531-17/01 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 05/02 06/02 TBA TBA Clemens Schulte 019E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 12/02 13/02 TBATBA Seaspan Ciba 014E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. 19/02 20/02 TBA TBA Wide Juliet 027E 31/0101/02 TBA TBA Wan Hai 502 E109 N2015 263499-16/01 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 07/0208/02 TBA TBA Wan Hai 507 E209 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 14/0215/02 TBA TBA Ever Dainty E169 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 28/0201/03 TBATBA Argolikos E148 TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

Hyundai Singapore 0133E N1928 262479-03/01 Hyundai HMM Shpg. Port Kelang, Singapore, Laem Chabang, Caimep, Kaohsiung, Seabird CFS 24/0125/01 TBA TBA HyundaiHongkong 0140E N1966 262999-10/01 Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 31/0101/02 TBATBA Hyundai Busan 0142E TS Lines TS Lines (I) Singapore, Pusan, Shanghai,Ningbo, Shekou & South East Asia Dronagiri-2 09/0210/02 TBA TBA Hyundai Tokyo 0142E Far East & China Ports. China India Express Service (CIX/ICX) 12/0213/02 TBA TBA Hyundai Colombo 0130E Gold Star Star Ship Singapore, Kwangyang, Pusan, Shanghai, Ningbo Ocean Gate Sinokor Sinokor India Port Kelang, Singapore, Hong Kong, Kwangyang, Seabird CFS Busan, Shanghai, Ningbo & Other Inland Destination.

In Port 18/01

In Port 18/01 Calais Trader 022E N1792 261173-16/12 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 22/0123/01 22/01 1200 CUL Manila 2301E N1892 262122-29/12 CU Lines Seahorse Ship (RWA) 22/0123/01 21/01 1700 Interasia Engage E003 N1949 262752-06/01 Interasia Interasia (RWA) Emirates Emirates Shpg. In Port 18/01 TS Dubai 22008E N1889 262088-28/12 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 22/0123/01 TBA TBA Henrika 2250E N1845 261733-23/12 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 23/0124/01 TBA TBA ESL Kabir 22052E N1984 263137-11/01 COSCO COSCO Shpg. (AIS SERVICE) 28/0129/01 TBA TBA KMTC Mundra 2301E N1993 263195-12/01 Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2 CU Lines Seahorse Ship Port Kelang,Hongkong,Busan, Qingdao,Ningbo. 18/0119/01 18/01 1200 Marina Voyager E0111 N1974 263053-10/01 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 25/0126/01

263291-13/01

RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 31/0101/02 TBA TBA OOCL Hamburg 140E OOCL OOCL (I) Sydney, Melbourne. GDL 07/0208/02 TBA TBA OOCLLuxembourg 100E TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 28/0201/03 TBA TBA Zim Cherleston 11E Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 (CIX-3) Team Lines Team Global Log. Australia & New Zealand Ports.

JWR Logistics 22/01 23/01 TBATBA X-Pess Bardsey 23001E N1954 262827-07/01 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, 30/01 31/01 TBA TBA George Washington Bridge 018E N2025 263531-17/01 Auckland, Lyttleton. 05/02 06/02 TBA TBA Clemens Schulte 019E

Allcargo

West & South African Ports. (EPIC 1 / IPAK) Safewater Safewater Lines East, South & West African Ports (EPIC 1 / IPAK) 21/0122/01 21/01 1800 Haian East 23001E N1990 263037-10/01 Sealead Giga Shpg. Mombasa, Dar Es Salaam 26/0127/01 TBA TBA SC Memphis 23002W OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA - INDIA DUBAI EAST AFRICA) GDL/— 21/0122/01 21/01 0600 Lisa 303S N1872 261671-23/12 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 28/0129/01 28/01 0600 Maersk Boston 304S N1903 262004-27/12 (MWE SERVICE) 04/0205/02 04/02 0600 Lana 305S 23/0124/01 TBA TBA Shimin 22008E N1957 262852-07/01 TS Lines TS Lines (I) Australian Ports. (CISC Service) Dronagiri-2 24/0125/01 24/01 1300 CMA CGM Coral 0MSF3W1 N1953 262796-06/01 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 31/0101/02 31/01 1300 Maersk Cabo Verde 304W CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis Dron.-3 & Mul. 07/0208/02 07/02

MUMBAI: Chinese manufacturer BYD has kicked off the delivery of a batch of 304 electric trucks to India’s Adani Group. The BYD Q1R electric trucks are now on their way by sea to four Adani Group ports in India, where theywillbe usedasterminaltractors.

In total, the Adani Group has ordered 400 BYD electric trucks, all of which are scheduled to enter service later this year. These are to be put into operation at ports in Ennore, Katupalli, Hazira and Mundra. Five of the electric trucks have already reached Katupalli portandstartedoperation.

The Adani Group is an Indian

multinational company, famous for coal mining activities, among other things. The group is also the largest port developerandoperatorinIndia.

The BYD Q1R is a nearly six-meterlong tractor with an unladen weight of eight tons and a gross vehicle weight of nearly 42 tons. Since the Q1R is not designed for longer distances but only such distribution and logistics operations, a 217 kWh battery (as usual with LFP cells at BYD) is sufficient for a range of 100 kilometres. Charging takesplacewith40kWAC(sixhours)or up to 120 kW DC (two hours). The permanently excited synchronous motor produces 180 kW andoffers1,500Nmoftorque.

This is BYD’s first major order for heavy-duty electric trucks for port

operations in India. Liu Xueliang, General Manager of BYD AsiaPacific Auto Sales Division, stated: “BYD’s green new energy technology applied to the ports of Adani will help Indian ports and the Indian market to achieve carbon neutrality as soon as possible, and achieve a sustainable and zero-emission development. This is of great significance to, as well as a starting point for BYD’s electric truck businessdevelopmentinIndiaandeven intheAsia-Pacificregion.”

Adani Group plans to deploy all 400 electric tractors in 2023. According to BYD when announcing the large order, Adani Group claims to want to operate its ports “sustainably” by 2025 buthasnotgivenspecificfurtherdetails onwhatthisentails.

KOLKATA: Decks have been cleared for the development of the first multi modal logistic park (MMLP) in Bihar.

The State Cabinet in its meeting held on 13 January approved the acquisitionof100acresoflandinFatuha near capital Patna for the state’s first MMLP.

The State Government will incur an expenditure of Rs 168.93 crore for the landacquisition.

Fatuha is an important industrial centre known for small industries and its handloom industries, and lies 24 km eastofPatna.

The cabinet also gave its nod for signing a memorandum of

understanding (MoU) with theNational Highway Logistics Management Limited (NHLML) which is the nodal agency for implementing the MMLP projectsinthecountry.

Patna MMLP will have both road and rail links and will reduce cost of transport of goods in and out of Bihar significantly.

The Ministry of Road Transport & Highways (MoRTH), under the first phase of Bharatmala Pariyojana, is constructing 35 MMLPs at some of the highest freight movement regions in thecountry.

These MMLPs are targeted to reduce logistics costs to less than 10

per cent of the gross domestic product (GDP). Currently, logistics account for 14 per cent of GDP — making India far less competitive on the globalstage.

Out of 35 MMLPs approved for implementation, five are in the state of Gujarat, followed by four in Maharashtra, three in Punjab, and two each in Andhra Pradesh, Haryana, Madhya Pradesh, Odisha, Rajasthan andTamilNadu.

OneMMLPeachhasbeenapproved in the states of Assam, Bihar, Chhattisgarh, Goa, Himachal Pradesh, Karnataka, Kerala, Telangana, West Bengal and the UT of Delhi and Jammu andKashmir.

Cont’d. from Pg. 3

The data includes those related to land records, forest, wildlife, eco sensitive zones, Coastal Regulation Zone, reserve forest, water resources, rivers, embankments, canals, reservoirs dams, soil type seismicity, flood map, power transmission and distribution, mining areas, roads, water supply pipelines,sewerlinesamongothers.

The logistics division of DPIIT is pilotingtheGatiShaktiMission.

A majority of the states, Ahirwar said, have also set up the institutional mechanism on the lines of PM Gati Shakti such as the empowered group of state secretaries and the Network Planning Group (NPG) to oversee the work that is being done. Under the PM Gati Shakti Mission, right at the top, there is an empowered group of secretaries headed by the cabinet secretary.

Next, there is a body called the

NPG, which has the planning incharges of seven infrastructure ministries as members. The body meets once a fortnight to look at all project proposals from a coordination pointofview.

“The states have set up their empowered group of secretaries and NPG. They have also created their State Master Plan portal, which will eventually be integrated with the NationalMasterPlan,”hesaid.

Mapping the data layers, Ahirwar added, will help states plan their complementary infrastructure better. “For instance, if the PWD plans to lay a new road, it will be able to see in the State Master Plan if the alignment of the proposed road is passing through a revenue land, reserve forest or eco sensitive zones. If it falls in some reserve forest land, the alignment can be altered at the planning stage itself. This will help cut delays and ensure smooth

implementationoftheproject.”

The Centre is hand-holding the states in readying their Master Plan and mapping data layers on it. Earlier this month, the Union Finance Ministryallocatedapproximately Rs 5,000 crore of the Rs 1 lakh crore earmarked under the ‘Scheme for Special Assistance to States for Capital Investment for 2022-23’ to the states for undertaking infrastructure projects under the PM Gati Shakti Mission.

So far, 28 states have submitted over 190 projects amounting to Rs 5,000 crore for approval to DPIIT. The projects include multimodal logistics parks, modern aggregation centres, critical connectivity infrastructure for providing last and first mile connectivity to industrial parks, economic zones, development of city logistics plan, setting up of PM Gati Shakti data centres among others.

NEW DELHI : Responding to December, 2022 Trade Data, FIEO President, DrASakthivel said that merchandise exports in negative territory is on expected lines as the challenges continue due to recession like situation, slowdown and rising inflation in most economies across the globe. Decline in merchandise exports is a reflection of the toughening global trade conditions on account of high inventories, economies entering recession, high volatility in currencies and geopolitical tensions. The drop in commodity prices and restriction on some exports, with a view to stem the price increase in the domestic market, havealsoaffected the

growth numbers. Flight of capital from the market has also impacted the growth process. FIEO President is of the view that the coming months would be quite challenging unless both global economic growth and geopolitical situationimprovesdrastically.

However, decrease in imports is a good sign, which will put less burden on trade deficit front. We hope that the energy prices will come down further to providemorerelief,opinedFIEOChief.

Dr Sakthivel added that in the current situation, the focus should be on providing easy liquidity at competitive cost, extension of ECLGS for one more year till 31.3.2024 by suitably enhancing the moratorium period, restoration of the Interest Equalization support to 5%

and 3% respectively, IGST exemption on freight on exports, which lapsed on 30th September, extension of tenure of PCFC from180daysto365daysandnotification of RoDTEP rates for the holders of Advance Authorization, DFIA and EOU units. Further, the Federation is also of the view that the new TMA scheme for agri exporters and announcement on allocation of export development fund withacorpusofRs5000Crforaggressive overseas marketing by MSME to showcaseIndianproductsgloballyinthe upcoming budget is the need of the hour. He stressed on the need to support exports at the district level with sizeable budgetary support for the District as an ExportHubschemetobridgethesupply sidegaps.

MUMBAI : The leading classification society,Indian Register of Shipping (IRS), is providing classification services for two major newconstruction‘naval’projectsatGoa Shipyard Ltd. A 120m long Floating Dock is being built for the Sri Lankan Navy, under a grant from India. The design and construction of the Floating Dock will be certified by IRS, which will bring to bear its prior experience in certificationoffloatingdocks.

Thesecond project comprises “New

Generation” Offshore Patrol Vessels (NGOPVs) for the Indian Navy. These ships are designed to strengthen maritime security by undertaking a multitude of operational roles, both in ‘blue water’ and in the littorals. These roles include seaward defence, protection of offshore assets, EEZ patrol, mine warfare, and anti-piracy missions.Thevesselswillbebuiltasper GSL’s in-house design and fitted with the most modern equipment. The design of the NGOPVs also

incorporates complex naval combatant vesselfeatures.

The vessels will be validated by a well-qualified IRS team, experienced in technicalanalysisandstealthstudies.

Cdr KK Dhawan, Head Defence IRS said “This is a testimony to the close professional cooperation between Goa Shipyard Ltd and IRS. IRS is increasingly expanding its role in India’s defence sector and these new projects are another significant step forward.”

“All the states have come on board and are mapping some 29 essential data layers related to their infrastructure and logistics facilities/assets on the NMP,” Surendra Ahirwar, Joint Secretary

NEW DELHI: India’s merchandise exports declined by 12.2 percent to $34.48 billion in December 2022, as against $39.27 billion recorded in the same month of the preceding year, as per the government data shared on January 16. This comesaftera0.6percentriseinexportsinNovemberanda12 percentcontractioninOctober

India’s overall exports (Merchandise and Services combined) in April-December 2022 is estimated to exhibit a positive growth of 16.11 per cent over the same period last year (April-December 2021). As India’s domestic demand has remained steady amidst the global slump, overall imports in April-December 2022 is estimated to exhibit a growth of 25.55 percentoverthesameperiodlastyear

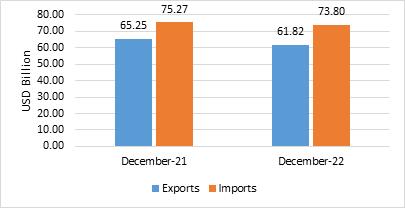

India’s overall export (Merchandise and Services combined) of USD 61.82 Billion in December 2022. The exports exhibited a negative growth of (-) 5.26 per cent over the same period last year Overall import in December 2022 is estimated to be USD 73 80 Billion, exhibiting a negative growthof(-)1.95percentoverthesameperiodlastyear Fig1:OverallTradeduringDecember2022*

• Non-petroleum and non-gems & jewellery exports during April-December 2022 was USD 233 50 Billion, as comparedtoUSD229.95BillioninApril-December2021.

• Non-petroleum, non-gems&jewellery(gold,silver& precious metals) imports were USD 330.78 Billion in AprilDecember 2022 as compared to USD 266.86 Billion in AprilDecember2021

• The estimated value of services export for December 2022 is USD 27.34 Billion, as compared to USD 25.98BillioninDecember2021.

• The estimated value of services import for December2022isUSD15.56BillionascomparedtoUSD14.94 BillioninDecember2021.

• The estimated value of services export for AprilDecember 2022* is USD 235.81 Billion as compared to USD 184.65BillioninApril-December2021.

• The estimated value of services imports for AprilDecember 2022* is USD 134.99 Billion as compared to USD 105.45BillioninApril-December2021.

• The services trade surplus for April-December 2022*is estimated at USD 100.82 Billion as against USD 79.20 BillioninApril-December2021.

• India’s overall exports (Merchandise and Services combined) in April-December 2022 are estimated to be USD 568.57 Billion. Overall imports in April-December 2022 are estimatedtobeUSD686.70Billion MERCHANDISETRADE

• Merchandise exports in December 2022 were USD 34.48 Billion, as compared to USD 39.27 Billion in December 2021.

• Merchandise imports in December 2022 were USD 58.24 Billion, as compared to USD 60.33 Billion in December 2021.

Fig2:MerchandiseTradeduringDecember2022

TheresilientgrowthoftheIndianeconomyduringthefirst half of the current financial year, the fastest among major economies, bespeaks strengthening macroeconomic stability However, global growth forecasts indicate downturn in global economic activity and trade As per Global Composite PMI report (January 2023), new export orders have been contracting for the tenth successive month in December The report also indicated that India and Ireland were the only nations to register growth of economic activity inDecember2022.

In spite of the high base, highest ever record of exports last year, India’s overall exports (Merchandise and Services combined) in April-December 2022 is estimated to exhibit a positive growth of 16.11 per cent over the same period last year (April-December 2021) December last year has been the second highest monthly export (Merchandise and Services) during 2021-22 As such, due to high base effect, the overall export (Merchandise and Services combined) of USD 61 82 Billion in December 2022 exhibited a negative growth of (-) 5.26 per cent over the same period last year (December2021).

India’s merchandise exports exhibited a positive (y-o-y) growthin11outof30sectorsinDecemberascomparedtothe same period last year and imports have increased in 17 out of 30sectors(y-o-y).AmongtheQEcommoditygroups,IronOre (185.76%), Oil Meals (53%), Electronic Goods (36.96%), Other Cereals (16 87%), Tea (15 97%), Rice (13 3%), Tobacco (13.07%), Ceramic Products & Glassware (11.67%), Fruits & Vegetables (8.03%), Cereal Preparations & Miscellaneous Processed Items (4 9%), RMG Of All Textiles (1 02%), registeredpositivegrowth(y-o-y)inDecember2022.

• Merchandise exports for the period April-December 2022 were USD 332.76 Billion as against USD 305.04 Billion duringtheperiodApril-December2021.

• Merchandise importsfortheperiodApril-December 2022 were USD 551.70 Billion as against USD 441.50 Billion duringtheperiodApril-December2021.

• The merchandise trade deficit for April-December 2022 was estimated at USD 218.94 Billion as against USD 136.45BillioninApril-December2021.

• Non-petroleum andnon-gems &jewelleryexports in December 2022 were USD 27.00 Billion, compared to USD 29.52BillioninDecember2021.

• Non-petroleum, non-gems&jewellery(gold,silver& precious metals) imports in December 2022 were USD 36.93, comparedtoUSD35.95BillioninDecember2021.

The exports of Electronic goods during the period April –December 2022 recorded USD 16.67 billion as compared to USD10.99billion duringthesameperiodlastyearregistering a growth of 51.56%. Exports of petroleum products in April –December 2022 was USD 70.28 billion registering a growth of 52.15% over USD 46.19 billion in April – December 2021. More than USD 6 Billion worth of Smartphones were exported duringtheperiodApril-November2022.

In the Textile sector, Cotton yarns exports declined because there was continuous price rise of raw materials throughout 2022.Exports ofIndianTextileapparels andRMG textiles got a major hit due to recessionary trend in major economies.

Giventhecumulative growthuntilDecember2022andthe indicatorsoftheslowdowninglobaleconomicactivity,thereis cautiousoptimismoninternationaltradeinthelastquarterof thecurrentfinancialyear

CJ-IV

2023011119

CJ-I MV Mercury J DBC 19/01

CJ-II MV U Thar Chowgule Bros 22/01

CJ-III MV Langcang River BS Shpg. 21/01

CJ-IV MV Altus ACT Infra 25/01

CJ-V VACANT

CJ-VI VACANT

CJ-VII MV Market Porter Interocean 20/01

CJ-VIII MV Yangtze Happiness Arnav Shpg. 20/01

CJ-IX VACANT

CJ-X VACANT

CJ-XI MV SSL Vishakhapatnam Transworld 19/01

CJ-XII MV SSL Krishna Transworld 19/01

CJ-XIII MV Clipper Palma ACT Infra 22/01

CJ-XIV MV Kenzen Chowgule Bros 22/01

CJ-XV MV Sai Sunshine Sai Shpg. 22/01

CJ-XVA MV New Spirit BS Shpg. 23/01

CJ-XVI MV Obe Queen Ocean Harmony 24/01

Tuna Tekra Steamer's Name Agent's Name ETD

MV Kypros Bravery Interocean 19/01

MV Dionysus Benline 19/01

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I LPG/C Symi ISS Shpg. 19/01

OJ-II MT Oriental Tulip Allied Shpg. 19/01

OJ-III MT Pacific Citrine Interocean 19/01

OJ-IV MT Exuberant Star

OJ-V MT Chem Jupiter Samudra 19/01

OJ-VI MT Sanman Sitar MK Shpg. 19/01

Stream MV Mandovi Delta Waterways 2,000 T. Coke Breeze In Bulk 18/01 MT MH Langoey Samudra 9 KT Caustic Soda

CJ-I MV Mercury J DBC Korea 27,150 T. Sugar In Bags 2023011012

Stream MV Neptune J DBC Sudan 23,000 T. Sugar Bags 2022121048

Stream MV NVL Sirus Cross Trade 51,200 T. Salt 2023011162

CJ-XVI MV Obe Queen Ocean Harmony Sudan 40,205 T. Sugar Bags 2022121014

OJ-II MT Oriental Tulip Allied Shpg. Hazira 2,500 T. C. Oil

Stream MV Panoria Arnav Shpg. Abidjahan 35,500/ 14,000 T.Rice Bags/Bulk 2022121287

CJ-XV MV Sai Sunshine Sai Shpg. 17,948 T. Rice Bags (40 Kgs) 2023011119 22/01 MV SV Aurora Tristar Logistics 18 Nos.Windmill Blade

Stream MV Yara J DBC 33,000 T. Sugar Bags (50 Kgs)

Stream MV Akij Heritage GAC Shpg.

Akaba 55,000 T. DAP 2023011058

Tuna MV Dionysus Benline 51,600 T. Petcoke 2023011009

20/01 MV Glory Amsterdam Dariya Shpg. 23,000 T. Coal

Stream MV Indus Victory Divine Shipping 87,600 T. Iron Ore 20/01 MV Inuyama DBC 1,155 T. CR Coils 21/01 MV Iyo DBC 1,477/483/60 T. CRC/S. Pipe/Pkgs.

Tuna MV Kypros Bravery Interocean Fantos 73,292 T. Sugar Bulk 2023011114

21/01 MV Magic Orion Dariya Shpg. 1,25,200 T. Coal

Stream MV Mandovi Delta Waterways 2,000 T. Coal In Bulk 2023011080

CJ-VII MV Market Porter Interocean Saudi Arabia 46,966 T. Urea 2023011092

Stream MV Mineral Ghent (OTB) Dariya Shpg. Indonesia 55,150 T. INDO Coal CJ-XVA MV New Spirit BS Shpg. 58,000 T. Aggregates

CJ-II MV U Thar Chowgule Bros 14,100 T. SBM 2023011175

CJ-VIII MV Yangtze Happiness Arnav Shpg. U.S.A. 29,917 T. Scrap 2023011118

Due/Berth

Stream LPG/C Bastogne Nationwide Ras Al Lafan 17,847 T. Propane/Butane 2023011088

Stream LPG/C Berlian Ekuator Nationwide 20,000 T. Propane/Butane

Stream MT Bow Tungsten GAC Shpg. 17,500 T. Chem.

OJ-V MT Chem Jupiter Samudra 8,207 T. Chem.

Stream MT Chem Sol GAC Shpg. Singapore 4,656 T. Chem.

Stream MT Condor Trader Samudra 1,678 T. Chem.

Stream MT Dawn Mansarovar MK Shpg. 3,990 T. LSHS In Bulk 2022121189

Stream MT Dolphin 03 Interocean 12,000 T. CPO 25/01 MT DS Cougar Samudra Malaysia 3,500 T. Chem. 24/01 MT Essie C Interocean 30,000 T. CDSBO 20/01 MT Eurochampion Interocean 23,000 T. CDSBO 21/01 MT Fairchem Grutto Shantilal 23,160 T. CDSBO

Stream MT Forman Samudra Singapore 6,999 T. Chem. 25/01 MT Geum Gang Wilhelmsen South Korea 4,751 T. Chem.

Stream MT Gladys W Interocean Dumai 29,485 T. CDSBO

Stream MT Ginga Lynx GAC Shpg. Malaysia 5,000 T. Chem. 18/01 MT Gulf Mishref J M Baxi 12,500 T. CDSBO

Stream MT Hari Aradhana MK Shpg. 32,000 T. HSD In Bulk 2023012168

Stream MT Heung A Pioneer Samudra 8,000 T. Chem

Stream LPG/C Jag Vikram Nationwide 20,055 T. Propane/Butane

Stream MT MTM Yangon Seaport 28,000 T. CDSBO

Stream MT Myri Joy J M Baxi 18,742 T. Methanol

OJ-III MT Pacific Citrine Interocean Arjentina 19,000 T. CDSBO 2022121160

OJ-VI MT Sanman Sitar MK Shpg. 14,721 T. HSD In Bulk 21/01 MT Stolt Vision J M Baxi Dakar 4,952 T. Chem.

OJ-I LPG/C Symi ISS Shpg. 19,862 T. Propane/Butane 2023011098 18/01 MT Verige Interocean Arjentina 15,000 T. CDSBO

20/01 19/01-AM

Hartford 302W 22435

Algeciras 13/01 27/01 27/01-AM Maersk Columbus 303W 23011 (MECL) 27/01

LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND AND PACIFIC

21/01 21/01-AM Aka Bhum 11E 23008 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 21/01 25/01 25/01-AM OOCL New York 091E 23021 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 25/01 21/01 21/01-AM MOL Courage 051E 23009 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 21/01 29/01 29/01-AM One Arcadia 063E 23015 Ningbo, Sekou, Cai Mep. (PS3) 29/01 22/01 22/01-AM BSG Bimini 303E 23005 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 22/01 29/01 29/01-AM Sofia 1 304E 23013 Ningbo, Tanjung Pelepas. (FM3) 29/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) (TIP) 30/01 26/01 26/01-AM Seamax Westport 084 23017 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 26/01

20/01 20/01-AM BIG Dog 0302E 23010 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam, Mundra (SHAEX) 20/01 20/01 19/01-AM Maersk Hartford 302W 22435 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 20/01 27/01 27/01-AM Maersk Columbus 303W 23011 (MECL) 27/01

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

21/01 21/01-AM Aka Bhum 11E 23008 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 21/01 18/01 18/01-AM SSL Krishna 052 23018 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 18/01 22/01 22/01-AM BSG Bimini 303E 23005 SCI J. M Baxi Colombo. (FM3) 22/01 22/01 22/01-AM Irenes Ray 303S 23003 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 22/01 18/01 18/01-AM SCI Mumbai 2301 23016 SCI J. M Baxi Mundra, Cochin, Tuticorin (SMILE) 18/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) (TIP) 30/01 26/01 26/01-AM Seamax Westport 084 23017 COSCO COSCO Shpg. Karachi, Colombo (CI1) 26/01

20/01 19/01-AM Maersk Hartford 302W 22435 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 20/01 27/01 27/01-AM Maersk Columbus 303W 23011 Safmarine Maersk Line India (MECL) 27/01 21/01 21/01-AM MOL Courage 051E 23009 ONE ONE (India) Los Angeles, Oakland. (PS3) 21/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 25/01

Cont’d. from Pg. 3

According to Tan Chong Meng, PSA widened its focus on enabling more agile, resilient and sustainable supply chains coupled with the acquisition of

BDPInternationallastyear.

Meanwhile, earlier in December 2022, PSA Antwerp signed a deal to upgrade civil and electrical infrastructure for the first stage of the works at PSA Antwerp’s Europa TerminalinBelgium.

BEIJING: To support the Science-Based Targets Initiative (SBTi), COSCO SHIPPING Logistics has recently submitted to the organization a 1.5°C pathway-based scientific emission reduction target for COSCO SHIPPING LogisticsChongqing.

Asanorganizationco-initiatedbyfourNGOs,SBTifocuses on encouraging companies to set GHG emission reduction targetsbasedonclimatescience,helpingthemshifttothelowcarbon economy and enhance their competitive advantage. With COSCO SHIPPING Logistics Chongqing as the project subject, COSCO SHIPPING Logistics has been vigorously exploringanewpathofgreendevelopmentinordertopromote itshigh-qualitydevelopment.

In the early stage, China Standard Inspection (a subsidiary of COSCO SHIPPING Logistics), worked efficiently with the company’s Container Logistics Business Division to formulate an overall project promotion plan according to the requirements of the enterprise’s scientific-based target; meanwhile, as a greenhouse gas verification organization and a product and management system certification body registered with the Certification and Accreditation Administration of China (CNCA), China Standard Inspection carried out Scope 1, Scope 2 and Scope 3 GHG emission accounting work based on the international GHG accounting system (GHG Protocol) for COSCO SHIPPING Logistics Chongqing. In line with the 1.5ºC

temperature rise target specified in the Paris Agreement, it set immediate and long-term (net-zero) emission reduction targets for the company by taking the Absolute Contraction Approach and Sectoral Decarbonization Approach based on the relevant SBTi tools and methodological requirements, andsuccessfullysubmittedthetargettoSBTi.

COSCO SHIPPING Logistics will further implement the concept of green development, strengthen innovation, operate with more stringent standards, and make great strides forward on the road of low-carbon sustainable development.