NEW DELHI: As many as nine special vostro accounts have been opened with two Indian banks after permission from the Reserve Bank of India to facilitate overseas trade in rupee, a top Government official said recently.

Sberbank and VTB Bank — the largest and second-largest banks of Russia, respectively — are the first foreign lenders to receive the approval after the RBI announced the guidelines onoverseastradeintherupeeinJuly.

Another Russian bank Gazprom –which does not have its bank in India –has also opened this account with Kolkata-basedUcoBank.

“Nine accounts have been opened. One in Uco Bank, one in Sber, one in VTB and 6 with IndusInd Bank. These six are different Russian banks,”

Commerce Secretary Sunil Barthwal toldreportersinNewDelhi.

The move to open the special vostro account clears the deck for settlement of payments in rupee for trade between IndiaandRussia,enablingcross-border trade in the Indian currency, which the RBI is keen to promote. The RBI has allowed the special vostro accounts to invest the surplus balance in Indian government securities to help popularisethenewarrangement.

UCO Bank already has a vostro account-based facility in Iran. Gazprombank, or GPB, is a privatelyowned Russian lender and the thirdlargestbankinthecountrybyassets.

Last month, the RBI and finance ministry asked the top management of banks and representatives of trade bodies to push export and import

transactions in the rupee. They want banks in India to connect with their foreign counterparts for opening special rupee vostro accounts to facilitate cross-border trade in the Indiancurrencyratherthanthepopular modeoftheUSdollar.

On when the rupee trade will begin withRussia,thesecretarysaidthereisa process involved in it and hopefully it wouldmaterialisesoon.

Barthwal said he held a meeting with officials of UCO Bank, RBI and the Department for Financial Services and discussedwaystopromoterupeetrade.

“We want to promote rupee trade because that is in the nation’s interest. We would also not be looking unnecessarily for dollars. To the extent, rupeetradeispossible,wewillgoforit,” headded.

NEW DELHI:

Mr Fırat Sunel, Ambassador, Embassy of Turkey in New Delhi, while emphasizing on the India-Turkey bilateral trade, said, "By the end of the year, our bilateral trade will almost be US$ 11 billion, and our new aim now is to reach US20billiondollars."

Addressing the 'India-Turkey Business Council', organized by FICCI, Ambassdor Sunel spoke about 2023 as a bright year for India-Turkey bilateral relations as India takes over the G20 Presidency and Turkey celebrating its 100threpublicyear.

He also invited Indian and Turkish companiestotakeadvantageoftheyear 2023 for fruitful business partnerships

betweenIndiaandTurkey.

Mr Arun Chawla, Director General,FICCI said, "India and Turkey share a strong and vibrant relationship under the leadership of our Heads of State translating a mutual desire of good relations and vast goodwill with peopletopeopleconnects."

He drew emphasis to the bilateral trade that has increased significantly from US$ 7.2 billion in 2017-18 to US$ 10.7billionin2021-22amidthepandemic that reflects a positive sign of enhanced relationshipbetweenIndiaandTurkey.

Ms Hulya Gedik, Chairperson of DEIK and Turkey-India Business Council said, "India has big investment opportunitiesandtodayDEiKandFICCI as a business council, we believe is the firststeptomakemorebusinessesinthe

nearfuture."She shared an introduction about DEiK and highlighted the need to enhance the trade volume between the twocountries.

A presentation by FICCI was made on India-Turkey Business relations that was followed by a round of introductions by Indian industry and Turkishindustryparticipants.

The meeting concluded with the signing of the MoU agreement between FICCI and DEiK to cement the commitment to promote investments betweenIndiaandTurkey.

“We want to promote rupee trade because that is in the nation’s interest. We would also not be looking unnecessarily for dollars. To the extent, rupeetradeispossible,wewillgoforit,” headded.

NEW DELHI: Mr. R. Lakshmanan, lAS (BH: 2004), has been appointed Joint Secretary, Ministry of Ports, Shipping and Waterways (MoPSW). His overall tenure is of five years from the date of assumption of charge of the post, or until further orders, informed an officialcommunique.

HAMBURG: Hapag-Lloyd CEO Rolf Habben Jansen put a positive spin on the container shipping downturn during a conferencecallThursdayashiscompanyloggedyetanother quarterfortherecordbooks.

“I don’t think the bottom is falling out of the market,” maintained the head of the world’s fifth-largest ocean carrier.

“When you look at volume and demand, we saw a very steep decline in weeks 34 and 35 [the last two weeks of August]. Then things rebounded a bit. Ever since Golden Week [the first week of October], it has been up and down. It was relatively weak last week. This week started stronger. It’squitevolatile.”

Container Trades Statistics reported a 25% year-on-year drop in trans-Pacific volumes and 9% drop in global volumes in September. “The global economy is certainly not shrinking 10-20%,” said Habben Jansen, who argued that “asignificantelementhereisacorrectionofinventory.”

“We had a long time where a lot of boxes got stuck in global supply chains. With the easing of congestion, those are now being delivered to the warehouses, which probably filled up quicker than anticipated. People logically reacted bysaying,‘I’dbetterslowdownabitwithneworders.’”

High inventories lead to a “short-term drop in volume,” he said. “There’s always the question: Is it mainly caused by an inventory correction or is it weakening demand? I’d say it’sprobablyalittleofboth.

People also ordered earlier for Christmas this year,” he added. “We saw very strong volume at the beginning of peak season and a slowdown after that. That’s why we see limited orders now, together with a weakening economy and the easingofcongestion.

“Looking ahead, the global economy is still expected to grow a couple of percentage points next year. So, one would normallyexpectsomewhatofabounce-back.”

In the second quarter of 2020, when demand was decimated by COVID lockdowns, ocean carriers kept spot rates from collapsing by “blanking” (canceling) sailings and bringing transport capacity down to match cargo demand.

A big focus now is whether carriers can once again blank sailings to put a floor on rates. There have already been considerable cancellations. Ocean carrier Maersk estimated that 15% of both Asia-Europe and Asia-U.S. capacity has already been removed. But some analysts believecarriershavenotpulledcapacityoutfastenough.

“We have not taken out a lot so far,” Habben Jansen conceded. The reason, he said, is “because our first priority right now is to get all the ships back in position.” Port congestion is easing but fallout on service schedules is notover.

“We have sailings that have slid [were pushed to the following week] because ships stuck in Northern Europe came back to Asia later than originally anticipated,” he said. Once schedules are back on track, capacity will be reduced asneededasacost-savingsmeasure.

Keepinmindthatofallthecostsyouhavewhenyousaila ship, about 60% to 65% are variable costs. That means we would never sail two ships with 50% [utilization]. We would always sail one ship with 100%, simply because we can take out a tremendous amount of costs. Especially with ships getting bigger over the years, that is a lot of money in absoluteterms.

“And from a cash perspective it is even higher [than 65% of variable costs], so you will always try to take out that cost becauseithelpsyouretaincash.”

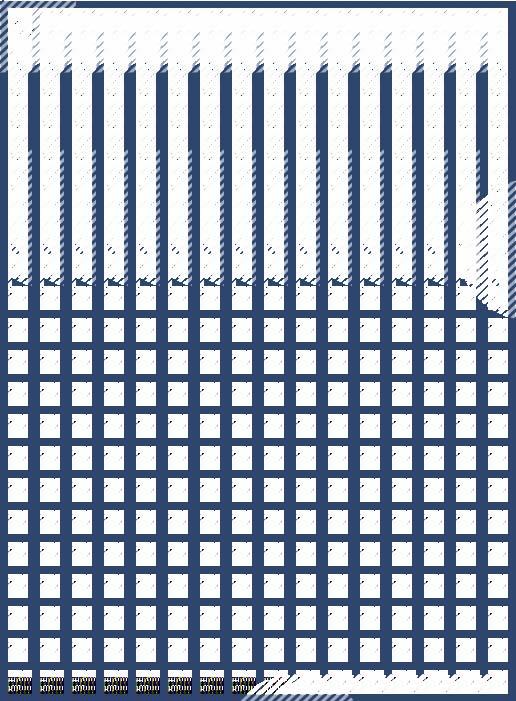

NEW DELHI: India’s overall exports (Merchandise and Services combined) in October 2022 are estimated to be USD 58.36 Billion, exhibiting a positive growth of 4.03 per cent over the same period last year. Overall imports in October 2022 are estimated to be USD 73.00 Billion, exhibiting a positive growth of 11.82 per cent over the same period last year

Fig 1: Overall Trade during October 2022

Merchandise imports for the period April-October 2022 were USD 436.81 Billion as against USD 328.14 Billion during the period April-October 2021.

The merchandise trade deficit for April-October 2022 was estimated at USD 173.46 Billion as against USD 94.16 Billion in April-October 2021.

Fig 4: Merchandise Trade during April-October 2022

India’s overall exports (Merchandise and Services combined) in April-October 2022 are estimated to be USD 444.74 Billion, exhibiting a positive growth of 19.56 per cent over the same period last year Overall imports in April-October 2022 are estimated to be USD 543.26 Billion, exhibiting a positive growth of 33.80 per cent over the same period last year.

Fig 2: Overall Trade during April-October 2022

Non-petroleum and non-gems & jewellery exports in October 2022 were USD 21.72 Billion, compared to USD 26.15 Billion in October 2021.

Non-petroleum, non-gems & jewellery (gold, silver & precious metals) imports were USD 34.40 Billion, compared to USD 32.88 Billion in October 2021.

Non-petroleum and non-gems & jewellery exports during April-October 2022 was USD 182.05 Billion, as compared to USD 176.52 Billion in April-October 2021.

Non-petroleum, non-gems & jewellery (gold, silver & precious metals) imports were USD 258.30 Billion in April-October 2022 as compared to USD 198.58 Billion in April-October 2021.

The estimated value of services export for October 2022 is USD 28.58 Billion, as compared to USD 20.37 Billion in October 2021.

Merchandise exports in October 2022 were USD 29.78 Billion, as compared to USD 35.73 Billion in October 2021.

Merchandise imports in October 2022 were USD 56.69 Billion, as compared to USD 53.64 Billion in October 2021.

Fig 3: Merchandise Trade during October 2022

The estimated value of services import for October 2022 is USD 16.30 Billion as compared to USD 11.64 Billion in October 2021.

Merchandise exports for the period April-October 2022 were USD 263.35 Billion as against USD 233.98 Billion during the period April-October 2021.

The estimated value of services export for April-October 2022 is USD 181.39 Billion as compared to USD 138.01 Billion in April-October 2021.

The estimated value of services imports for April-October 2022 is USD 106.45 as compared to USD 77.89 Billion in April-October 2021.

The services trade surplus for April-October 2022 is estimated at USD 74 93 Billion as against USD 60.12 Billion in April-October 2021.

The new ocean shipping service aims to provide a quicker and more predictable connec�on to its customers, especially for the trade between India and Gulf markets

Cont’d. from Pg. 3

The ‘Shaheen Express’ will rotate between Mundra, Pipavav, Jebel Ali, Dammam, and Jebel Ali and back to Mundra, creating a stable and reliable service for the India-UAE-Saudi Arabia corridor. The new service will primarily aim at addressing rising demand for customers trading between the Indian and theGulfmarkets.

“The markets have started stabilising, and the ocean networks are normalising after over two years of disruptionscausedbytheCovid-19pandemic.Duringthis time, not only did we strive hard to ensure we addressed all our customers’ challenges, but we also got a chance to look ahead and understand what their requirements would be in the future,” said Bhavan Vempati, Head of RegionalOceanManagement,MaerskWest&Central Asia. He added, “Through our customer conversations, wewere abletomakeamoremeaningfulforecastaround therisingdemandandproactivelydeployanewserviceto createasupplyofspaceforthisdemand.”

India-UAE Comprehensive Economic Partnership Agreement (CEPA) entered into force in May 2022, which is steadily boosting the volumes of trade between the two countries. The main commodities moving between these two countries that will benefit from the increased capacity include FMCG (fast moving

The'ShaheenExpress'willofferimprovedtransittime and better predictability between Indian ports and Gulf portsascomparedtotheexistingservices.

Bhavan Vempati further added, “We remain committed to our customers in West & Central Asia and want to bring reliable service to them. We will continue building robust partnerships with our customers and design solutions that create value for their business and contributetotheoveralleconomicgrowthoftheregion.”

The ‘Shaheen Express’ will include two vessels with a nominalcapacityof1,700TEUsperweek.

HAMBURG: Portchain has announced a five-year global partnership with Hapag-Lloyd to deploy Portchain Connect across the Germanoceancarrier’sglobaloperations.

Portchain Connect digitises the process of aligning berths between carriers and terminals, enabling them to makeearlierandmorefrequentschedulingdecisions.

Using Portchain Connect, Hapag-Lloyd’s goal is to transform traditional email and phone communication into a digital information flow for aligning berth arrival information with terminals, giving its terminal network immediate access to schedule updates and key vessel call informationontheplatform.

The alignment process enables the opportunity to capture the benefits of Just-In-Time (JIT) arrivals, which the International Maritime Organization (IMO) estimates can reduce CO2 emissions and bunker consumption by 5.9% inthe24hoursleadinguptoarrival.

“We are delighted to be working with Portchain on digitising and streamlining our berth alignment processes and look forward to creating value for our important Terminal partners throughout our network,” commented AndrewAllen,director–terminalpartnering,Hapag-Lloyd.

He added, “We believe in the power of leveraging automated data flows to optimize our Port Calls and create transparency and efficiency for our valued Marine and Port Operationsteamsglobally.’’

NEWDELHI:ContainerCorporationofIndia (CONCOR), in a view to support the export-import trade in the hinterlands, has announced additional discount scheme on empty containers moved from various Gateway Ports/Portside CFSs to hinterland terminals for export purpose based on the incremental import volumes offeredbytheShippingLines.

Thehighlightsofthescheme:

• The average import loaded volume of any shipping line booked from various gateway Ports to hinterland terminals on monthly basis from November 2020 to March 2021 and November 2021 to March 2022 will be considered for ascertaining the incremental import

volume for the respective months from November 2022 to March2023.

• For the incremental volume of import so offered by any shipping line in any month, they will be offered an additional discount by way of refund of average empty rail freight collected towards repositioning of empty containers from various Gateway Ports/Portside CFSs to hinterland terminals/CRTs/Pvtsidingsduringthesamemonth.

• The refund of empty rail freight will be done on weighted averagebasisforfreightcollectedtowardsemptycontainers repositioned from various Gateway Ports/Portside CFSstohinterlandlocationsduringthemonth.

• The scheme is offered for a period from November 2022 toMarch2023.

consumer goods) such as electronics, perishables such as foodstuff, retail goods including textile and apparel, and chemicals. The ‘Shaheen Express’ will benefit the exporters of the petrochemical sector from the eastern provinceofSaudiArabia.Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2

AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

18/1119/11

MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 25/1126/11

Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 02/1203/12 01/12 1200 MSC Margrit IS248A U. K. North Continent & Other Mediterranean Ports.

Himalaya Express

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 18/1119/11 18/11 1200 Kyoto Express 2344W N1461 258182-02/11 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 25/1126/11 TBATBA Budapest Express 2345W N1507 258640-09/11 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 02/1203/12 TBATBA Osaka Express 2346W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 09/1210/12 TBATBA Prague Express 2347W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS 21/11 22/11 21/11 1200 MSC Azov IV246A N1496 258553-07/11 MSC MSC Agency Gioia Tauro, Valencia, Sines. (INDUSA) Hind Terminal 28/11 29/11 TBA 0900 MSC Regulus IV247A N1547 258970-15/11 05/12 06/12 TBA 0900 MSC Silvia IV247A 22/1123/11 22/11 0900 MSC Lucy IX245A N1495 258554-07/11 MSC MSC Agency Barcelona, Valencia, Sines, Gioia Tauro (INDUS 2) Hind Terminals 29/1130/11 29/11 0900 MSC Melissa IX246A 23/1123/11 TBA 0900 MSC Susanna IU246A N1490 258549-07/11 MSC MSC Agency Haifa. (INDUS) Hind Terminals

Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC 1 / IPAK) Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports. AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America 20/1121/11 19/11 2000 Maersk Seletar 245W N1383 257560-22/10 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 27/1128/11 26/11 2000 Maersk Kinloss 246W N1436 257573-22/10 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 04/1205/12 03/12 2000 Santa Rosa 247W

US East Coast Ports. Middle East Container Lines(MECL) Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 21/1122/11 TBATBA Ever Ulysses 147E N1468 258251-03/11 TS Lines TS Lines (I) Vancouver Dronagiri-2 28/1129/11 TBATBA Celsius Naples 892E N1543 258942-14/11

(CISC Service)

18/1119/11 17/11 1500 MSC Gaia IS246A N1492 258547-07/11 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 25/1126/11 24/11 1200 MSC Paris IS247A N1530 258880-14/11 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 02/1203/12 01/12 1200 MSC Margrit IS248A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast. (Himalaya Express) 20/1121/11 19/11 2300 OOCL Washington 2146 N1462 258194-02/11 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 27/1128/11 TBATBA Exress Athens 2147 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 05/1206/12 TBATBA One Altair 2148 Hapag ISS Shpg. ULA CFS 12/1213/12 TBATBA CMA CGM Ivanhoe 2149 ONE Line ONE (India)

India America

COSCO COSCO Shpg.

Express (INDAMEX) Indial Indial Shpg. US East Coast & South America ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. JWR Logistics Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 21/11 22/11 21/11 1200 MSC Azov IV246A N1496 258553-07/11 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 28/11 29/11 TBA 0900 MSC Regulus IV247A N1547 258970-15/11 05/12 06/12 TBA 0900 MSC Silvia IV247A 23/1123/11 TBA 0900 MSC Susanna IU246A N1490 258549-07/11 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 30/1101/12 TBA 0900 MSC Joannah IU247A N1534 258882-14/11 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS)

19/1120/11 18/11 2000 Zim Charleston 9E N1454 258128-01/11 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 22/1123/11 TBATBA OOCL Genoa 060E N1475 258313-04/11 RCL RCL Ag USA East Coast & Other Inland Destinations. 28/1129/11 TBATBA Aka Bhum 010E COSCO COSCO Shpg. US West Coast. 04/1205/12 TBATBA OOCL New York 090E Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. (CIX-3) ICC Line Neptune US East, West Coast, Canada, South & Central American Ports. GDL-3 & Dron-3 19/1120/11 20/11 0600 Kota Megah 0140E N1478 258321-04/11 TS Lines TS Lines (I) Vancouver Dronagiri-2 23/1124/11 TBATBA Pontresina 237E N1493 258502-07/11 (CWX) 20/1121/11 20/11 0900 Bangkok Bridge 0138E N1465 258204-02/11

In Port 18/11

18/1119/11

539 N1502 258511-07/11

Kortia IP246A N1491 258550-07/11

Hamad

King Abdullah.

25/1126/11 25/11

IP247A N1532 258878-14/11

Agency King Abdullah. Hind Terminals 02/1203/12 02/12 0900 MSC Eugenia IP248A SCI J.M. Baxi Salallah (EPIC 1 / IPAK) 19/1120/11 19/11 0600 Maersk Brooklyn 246S N1385 257556-22/10 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS 20/1121/11 19/11 2000 Maersk Seletar 245W N1383 257560-22/10 Maersk Line Maersk India Salallah. (MECL) Maersk CFS 23/1124/11 TBATBA Inter Sydney 0120 N1519 258727-10/11 Lubeck Giga Shpg. Bandar Abbas, Chabahar (BMM) Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar. 23/11 24/11 TBATBA Kashin 1280W N1487 258492-07/11 HDASCO Armita India

Unifeeder Group Transworld Shpg. Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali.

Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT 23/1124/11 TBATBA Montpellier 024E N1521 258741-10/11 Global Feeder Sima Marine Jebel Ali, Bandar Abbas. Dronagiri 30/1101/12 TBATBA X-Press Euphrates 22046E N1548 258983-15/11 Unifeeder Group Transworld Shpg. Jebel Ali, Bandar Abbas. (NMG) Emirates Emirates Shpg. Jebel Ali, Sohar.

LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS

QNL/Milaha Poseidon Shpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports.

Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2

Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics

CGM CMA CGM Ag. Colombo (MESAWA) Dronagiri 07/1208/12 TBATBA Stephanie C 2215W Asyad Line Seabridge Karachi. (IEX)

21/11 22/11 21/11 1200 MSC Azov IV246A N1496 258553-07/11 MSC MSC Agency Colombo. (INDUSA)

Hind Terminal 23/1123/11 TBA 0900 MSC Susanna IU246A N1490 258549-07/11 MSC MSC Agency Karachi. (INDUS) Hind Terminals

In Port 19/11 One Contribution 051E N1457 258173-01/11 ONE Line ONE (India) Colombo. 27/1129/11 TBATBA One Commitment 057E N1528 Yang Ming Yang Ming(I) Contl.War.Corpn. 02/1204/12 TBATBA MOL Creation 086E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 19/1120/11 18/11 2000 Zim Charleston 9E N1454 258128-01/11 OOCL OOCL (I) Colombo. GDL 22/1123/11 TBATBA OOCL Genoa 060E N1475 258313-04/11 Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 19/1120/11 20/11 0600 Kota Megah 0140E N1478 258321-04/11 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 23/1124/11 TBATBA Pontresina 237E N1493 258502-07/11 X-Press Feeders Sea Consortium (CWX) 01/1203/12 TBATBA Dallian 2208E

TS Lines/PIL TS Lines(I)/PIL Mumbai

Dronagiri-2/— 20/1121/11 20/11 0900 Bangkok Bridge 0138E N1465 258204-02/11 ONE Line ONE (India) Colombo. 27/1128/11 TBATBA Clemens Schulte 017E N1522 258738-10/11 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 04/1205/12 TBATBA Seaspan Chiba 012E CSC Seahorse Colombo. 21/1122/11 21/11 0200 Ever Uberty 179E N1453 258112-01/11 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 02/1203/12 TBATBA X-Press Odyssey 22007E N1549 258984-15/11 KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 09/1210/12 TBATBA Zoi 20E X-Press Feeders Sea Consortium (CIX3 Service) 16/1217/12 TBATBA ESL Dachan Bay 2247E EmiratesEmirates Dronagiri-2

In Port 18/11 Wan Hai 175 E092 N1441 258043-31/10 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 18/1119/11 18/11 0800 COSCO Thailand 089E N1466 258195-02/11 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 19/1120/11 19/11 1500 BLPL Blessing 2214E N1455 257895-28/10 BLPL Transworld GLS Chittagon, Yangoon 21/1122/11 21/11 0700 MSC Shaula IW246A N1494 258551-07/11 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 25/1126/11 24/11 2300 Rena P 42W N1501 258491-07/11 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS

In Port 18/11

Delhi 2206E N1388 257619-24/10

(India)

Qingdao, Kwangyang, Dronagiri-3 23/1125/11

In Port 18/11 CUL Jakarta 2243E N1448 258093-31/10 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang 24/1125/11 TBATBA CUL Yang Pu 2244E N1517 258726-10/11 CU Lines/KMTC Seahorse/KMTC(I) (VGX) 01/1202/12 TBATBA Apollon

2245E N1552 259013-15/11

Emirates Shpg. 20/11 21/11 TBATBA Stephanie C 2213E N1419 257878-28/10 Asyad Line Seabridge Singapore, Port Kelang. (IEX) 21/1122/11 TBATBA Haian Mind 22018E N1479 258344-04/11 Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 26/1127/11 TBATBA Hansa Rotenburg 917E N1542 258940-14/11 X-Press Feeders Sea Consortium (SIS) 21/1122/11 TBATBA Ever Ulysses 147E N1468 258251-03/11 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 28/1129/11 TBATBA Celsius Naples 892E N1543 258942-14/11 Unifeeder Feedertech/TSA Qingdao, Shanghai, Ningbo. Dronagiri 05/1206/12

TBATBA Shimin 22007E PIL/ONE PIL Mumbai/ONE(I) —/— 12/1213/12

TBATBA Celsius Nairobi 892E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 02/0103/01

TBATBA Wide Alpha 233E

CISC Service

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo.

BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 22/1123/11 21/11 1500 Ho Chi Minh Voyager 2208E N1452 258122-01/11 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 27/1128/11

TBATBA GFS Pride 2213E N1481 258354-04/11 Heung A Line Sinokor India 03/1204/12 TBATBA GFS Priestige 2211E N1483 Sinokor Sinokor India

Seabird CFS (CSC)

Sealead Giga Shpg.

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao.

Speedy CFS

27/1129/11 TBATBA

057E N1528

Ming

Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 02/1204/12 TBATBA MOL Creation 086E Hyundai HMM Shpg. Seabird CFS 18/1219/12 TBATBA Conti Contessa 112E Samudera Samudera Shpg. (PS3 Service) Dronagiri (PS3 Service) Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 18/1119/11 17/11 2100 ALS Apollo 246E N1384 257557-22/10 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 25/1126/11 TBATBA Shijing 247E N1434 257570-22/10 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 03/1204/12 TBATBA Grace Bridge 248E N1513 258367-04/11 (FM-3) 19/1120/11 18/11 2000 Zim Charleston 9E N1454 258128-01/11 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 22/1123/11 TBATBA OOCL Genoa 060E N1475 258313-04/11 APL CMA CGM Ag. Dron.-3 & Mul. 28/1129/11 TBATBA Aka Bhum 010E N1523 258766-11/11 ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 04/1205/12 TBATBA OOCL New York 090E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3)

Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul.

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 19/1120/11 20/11 0600 Kota Megah 0140E N1478 258321-04/11 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 23/1124/11 TBATBA Pontresina 237E N1493 258502-07/11 X-Press Feeders Sea Consortium (CWX) 01/1203/12 TBATBA Dallian 2208E

KMTC KMTC (India)

Dronagiri-3 04/1205/12 TBATBA X-Press Anglesey 22007E

TS Lines TS Lines (I) Dronagiri-2 11/1212/12 TBATBA TS Kelang 22008E RCL/PIL RCL Ag./PIL Mumbai (CWX) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 20/1121/11 20/11 0900 Bangkok Bridge 0138E N1465 258204-02/11 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 27/1128/11 TBATBA Clemens Schulte 017E N1522 258738-10/11 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 04/1205/12 TBATBA Seaspan Chiba 012E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. 21/1122/11 21/11 0200 Ever Uberty 179E N1453 258112-01/11 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 02/1203/12 TBATBA X-Press Odyssey 22007E N1549 258984-15/11 KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Dai Chen Bay Dronagiri-3/— 08/1209/12 TBATBA Zoi 20E X-Press Feeders Sea Consortium 16/1217/12 TBATBA ESL Dachan Bay 2247E

Emirates Emirates Shpg (CIX3 Service) Dronagiri-2 24/1226/12 TBATBA KMTC Dubai 2207E Pendulum Exp. Aissa Maritime 30/1231/12 TBATBA Zim Norfolk 7E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 22/1123/11 21/11 2100 Kota Gabung 097E N1498 258514-07/11 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 27/1128/11 TBATBA Calais Trader 021E N1539 258890-14/11 CU Lines Seahorse Ship (RWA) 04/1205/12 TBATBA Uru Bhum 112E InterasiaInterasia (RWA) Emirates Emirates Shpg. 22/1123/11 TBATBA Wan Hai 502 E107 N1446 258043-31/10 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 28/1130/11 TBATBA Wan Hai 507 E207 N1506 258628-09/11 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 06/1207/12 TBATBA Ital Unica E155 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 13/1214/12 TBATBA Argolikos E146 TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

In Port 18/11 Wan Hai 175 E092 N1441 258043-31/10 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 24/1125/11 TBATBA Box Endeavour E132 N1510 258625-09/11 COSCO COSCO Shpg. Ningbo, Shekou. 01/1202/12 TBATBA Anbien Bay E007 InterasiaInterasia (CI2) 08/1209/12 TBATBA Najade E031 Hyundai HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS (CI2) CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai. 17/1118/11 17/11 2200 Interasia Catalyst E019 N1428 258325-04/11 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 19/1120/11 19/11 1500 Big George E004 N1444 258039-31/10 Heung A Line Sinokor India Hongkong 30/1101/12 TBATBA Jan Ritscher E907 N1544 258944-14/11 Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 06/1207/12 TBATBA Marine Voyager E010 InterasiaInterasia Unifeeder Feedertech/TSA Dronagiri 18/1119/11 18/11 0800 COSCO Thailand 089E N1466 258195-02/11 COSCO COSCO Shpg. Shanghai, Laem Chabang. 21/1122/11 TBATBA Xin Hongkong 039E N1535 258825-11/11 APL CMA CGM Ag. (CI 1) Dron.-3 & Mul 05/1206/12 TBATBA Seamax Westport 083E

OOCL/RCL OOCL(I)/RCL Ag.

GDL/— (CI 1) CU Lines Seahorse Ship Singapore,Shanghai,Ningbo,Shekou,Nansha,Port Kelang 21/1122/11

TBATBA Hyundai Bangkok 0113E N1469 258261-03/11 Hyundai HMM Shpg. Port Kelang, Singapore, Laem Chabang, Caimep, Kaohsiung, Seabird CFS 24/1125/11 TBATBA Hyundai Singapore 0132E N1546 258949-14/11 Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 03/1204/12

TBATBA Hyundai Hongkong 0139E

TS Lines TS Lines (I) Singapore, Pusan, Shanghai, Ningbo, Shekou & South East Asia Dronagiri-2 07/1208/12

TBATBA Hyundai Busan 0141E Far East & China Ports. China India Express Service (CIX/ICX)

Gold Star Star Ship Singapore, Kwangyang, Pusan, Shanghai, Ningbo Ocean Gate Sinokor Sinokor India Port Kelang, Singapore, Hong Kong, Kwangyang, Seabird CFS Busan, Shanghai, Ningbo & Other Inland Destination. 29/1130/11

TBATBA CMA CGM Tosca 0FF7EE1 N1480 258331-04/11 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 12/1213/12

TBATBA CMA CGM Rabelais 0FF7IE1 RCL RCL Ag. (AS1)

258128-01/11

Australia & New Zealand Ports. Dron.-3 & Mul. 22/1123/11

OOCL

060E N1475 258313-04/11

RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 28/1129/11 TBATBA Aka Bhum 010E N1523 258766-11/11 OOCL OOCL (I) Sydney, Melbourne. GDL 04/1205/12 TBATBA OOCL New York 090E

TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 (CIX-3) Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 Team Lines Team Global Log. Australia & New Zealand Ports. JWR Logistics 20/1121/11 20/11 0900 Bangkok Bridge 0138E N1465 258204-02/11 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, 27/1128/11 TBATBA Clemens Schulte 017E N1522 258738-10/11 Auckland, Lyttleton. 04/1205/12

TBATBA Seaspan Chiba 012E

Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR 21/1122/11 TBATBA Ever Ulysses 147E N1468 258251-03/11 TS Lines TS Lines (I) Australian Ports. (CISC Service) Dronagiri-2 22/1123/11 TBATBA Wan Hai 502 E107 N1446 258043-31/10 ANL CMA CGM Ag.

BHUBANESWAR:AtwodaySummitonPrimeMinister Gati-Shakti Multimodal Maritime was inaugurated in Bhubaneswar under the joint aegis of Paradip Port Authority, State and Central Government. Addressing the Summit as Chief Guest, Chief Secretary Sri Suresh ChandraMahapatra said,“OdishaisamaritimeState,and has strategic location for coastal shipping. Our Coastal line isquitesuitablefordevelopmentofdeepPorts.Easternpart ofIndiaincludingOdishaisgrowingatafastrate. Odishais supplyingThermalCoal,IronOreandManganesetoalarge number of States in India. The growth rate will be faster in comingyears”.

Mahapatraadded,“ThePMGati-ShaktiisaPanIndian platform that would address to the critical issues of reducing logistic cost of mineral transport substantially, andwouldacceleratethegrowthofCoastalShipping.Itisa comprehensive and converged platform of all the related departments in both State and Central Government along withothermajorStakeholders”.

With uploading of information by all concerned, the planning and decision making for the Sector would be more perfect andfaster.Itwouldalsobringtherealeaseof doing business for the investors. Mahapatra opined, Odisha would soon become one of the biggest hubs in Coastal Shipping of the minerals and finished products. Mahapatra assured that State Government would extend allhelpforimplementationoftherecommendationsofthis twodaySummit.

Joining the inaugural session as Guest of honour, Divisional Railway Manager Rinkesh Roy said, “East cost railway is No-1 freight loading zone in the entire Railways. Paradip is the 2nd largest Port in terms of the volume handled through Rail link network. The region has huge Mining and Industrial belt”. He said that East Coast railway was on its path for augmentation of its Railnetwork in Odisha from Mining and Industrial points to thePort.

Addressing the Summit, Joint Secretary Sagarmala Projects of Govt of India Bhusan Kumar gave a blue print of the converged mechanism put in place for successful implementation of Gati Shakti projects. He said

that the Ministry of Ports, Shipping & Waterways prioritized improvement of connectivity to more than 50 plusnon-majoroperativePortsthroughPMGatiShakti.In this comprehensive port connectivity plan, more than 107 connectivity gaps were identified for abridging port connectivity.

Chairman Paradip Port Authority Shri P.L. Haranadh said, that Paradip Port in its 56 years of Cargo handling service would attain a record 125 MMT annual traffic in FY 2022-23. He added, “During the Amrit Kal, Paradip will be the Port of the Millennium by having a capacity of more than 500 MMT by 2047”. PM Gati-Shakti would be the prime mover of this transformation. He stressed the need to augment capacity of Rail, Road and Waterways to match the capacity augmentation plans of Paradipport.DeputyChairmanParadipPortAuthorityAK Bose presented the past, present and future prospects of ParadipPortandofferedthevoteofthanks.

Deputy Chairman Paradeep Port Trust AK Bose presented the past, present and future prospects of ParadipPort.

The inaugural session was followed by two technical sessions namely Gati-Shakti platform- Creating synergy among departments; and, Potential opportunities in logistic eco-system for sustainable Industrial development

NEW DELHI: The trade body All Industries & Trade Forum (AITF) has urged Prime Minister Narendra Modi to impose import restrictions on China and Association of Southeast Asian Nations (ASEAN) as the imports may cross 20 lakh crore this year from the region which are proving detrimental to micro, small and medium enterprise (MSME) industries,saidareport.

MSMEs are facing frequent closures and they are likely to go bankrupt if the government does not impose import restrictions,statedAITFinalettersenttoPMModi,lastweek.

The trade body has also appealed for an inquiry from the Central Bureau of Investigation (CBI) to unearth the alleged scam of huge imports from ASEAN and under invoicing from China,thereportsaid.

Badish Jindal, National President, AITF said, “China is cleverly sending such goods to India through ASEAN and underdeveloped countries, this is the reason that India’s import from ASEAN countries increased to Rs 5,07,968 crore by 2021-22 and surprisingly these countries exported Rs 3,05,117 crore to India in the first four months

of the financial year 2022-23.”

TheletterfurthersaidthattheIndianbusinessmencannot import steel from China and the country can send only manufactured goods to India, referring to the Bureau of IndianStandards(BIS)conditionimposedonsteel.

“TodaythereisadifferenceofRs15,000pertoninthesteel priceofIndiaandChina.Hence,duetosuchpoliciesinsteadof raw materials China is dumping the finished products in India,”saidJindal.

This lopsided dynamics have impacted Amritsar, Chandigarh, Chennai and Rajkot and thousands of units manufacturing all fasteners and screws and led them to closure,headded.

Meanwhile, India’s trade deficit with China had increased to $72.9 billion in FY22 amid a 44 per cent surge in imports to $94.16billionfromthepreviousyear.

Reportedly,inFY21,India’simportsfromChinaamounted to $65.21 billion, while exports in both FY21 and FY22 remained stagnant at about $25.2 billion, as per the officialdata.

Odisha has poten�al to grow as Coastal Shipping

On the eve of Shri Narendra Modi’s visit to the city of Vizag, Adani port has organized an employee volunteering initiative the ‘Swachh Bharat, Swachh Port’ to maintain the cleanliness in and around the port complex. As a part of the program over 200 employees of Adani, Gangavaram Port volunteered and cleared roads anddrainsofplastic&otherwastedebris.

Some of the activities undertaken as a part of ‘Swachh Bharat, Swachh Port’ initiative are cleaning and repairing sheds, and port roads, painting road signs, zebra crossing, pavement edges, modernizing and cleanliness of toilet complexes, placement of dustbins, beautification, and cleaning parks.

Apart from this, fixing boards with cleanliness messages, cleaning and repairing all drainages and water systems, and tree plantation in and around the port were also done.

Speaking on the occasion Shri. BG. Gandhi, CEO, Adani Gangavaram Port said, “It is everyone’s responsibility to keep the city clean and preserve the natural beauty of the communities where we live and work. We at Adani Gangavaram Port are committed to improving the community infrastructure and maintaining cleanliness. ‘The Swachh Bharat, Swachh Port’ is a continuous program where every employee at the port volunteers in maintaining a clean port area.”

CJ-I MV Massa J DBC 18/11

CJ-II VACANT

CJ-III MV Singapore Bulker BS Shpg. 20/11

CJ-IV VACANT

CJ-V MV Anna Elisabeth BS Shpg. 28/11

CJ-VI MV True Confidence Seascape 19/11

CJ-VII MV Sider Bear BS Shpg. 19/11

CJ-VIII MV Aspen J M Baxi 19/11

CJ-IX VACANT

CJ-X MV Gautam Aarav Ocean Harmony 19/11

CJ-XI MV SSL Gujarat Transworld 18/11

CJ-XII MV TCI Anand TCI Seaways 18/11

CJ-XIII MV Guo Giang 8 Chowgule Bros. 18/11

CJ-XIV MV Wookyan Sky Jeel Kandla 19/11

CJ-XV MV Dubai Sun Interocean 20/11

CJ-XVA MV Imperial Eagle Arnav Shpg. 20/11

CJ-XVI MV Darya Gometi Genesis 21/11

TunaTekra

OJ-I LPG/C IGLC Dicle Seaworld 18/11

OJ-II MT Chem Mercury Samudra 18/11

OJ-III MT Torm Troilus Jamesh Mack 18/11

OJ-IV MT Indigo Ray Samudra 18/11

OJ-V MT Seashine

OJ-VI MT Stolt Noraland JMBaxi 18/11

Stream

Stream MV Appaloosa Interocean Sudan 29,090 T. Sugar Bags 2022091338

Stream MV Clipper Barola Chowgule Bros. 41,000 T. Sugar In Bulk

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335

CJ-XV MV Dubai Sun Interocean 42,800 T. Rice Bags 2022101308

Stream MV Golden Zhejiang Aditya Marine 57 Nos. Wind Mill Blade 2022111054

CJ-XIII MV Guo Giang 8 Chowgule Bros. 61,500 T. Salt

Stream MV Haseen Aqua Shpg. 45,000 T. Sugar In Bulk

CJ-I MV Massa J DBC Port Sudan 28,800 T. Sugar (50 Kgs.) 2022101029 2323357 21/11 MV Meghna Rose BS Shpg. Bangladesh 55,000 T. Sugar Bulk 19/11 MV My Lama Interocean 25,000 T. Sugar Bags 2022111127

Stream MT Oriental Cosmos Allied Shpg. Rottardam 7,740 T. C. Oil 23/11 MT Oriental Hibiscus Allied Shpg. 4,500 T. C. Oil

Stream MV Pac Alcamar Tristar Shpg. 23 Windmill Blade 2022101064

Stream MV Safeen AL Amal Interocean 33,000 T. Sugar Bags 2022111040

CJ-VII MV Sider Bear BS Shpg. Italy 40,000 T. Ball In Clay 2022111005

CJ-III MV Singapore Bulker BS Shpg. Madgasakar 25,000 T. Rice In Bags 2022111065 18/11 MT Star Ploeg Samudra 5,000 T. Chem.

Stream MV Suvari Kaptan DBC Somalia 9,500 T. Sugar Bags 2022111148

Stream MV Tai Summit ACT Infra 40,100 T. Rice Bags 30/11 MV Theotokos BS Shpg. Madgasakar 28,000 T. Rice Bags CJ-VII MV Wookyan Sky Jeel Kandla Chennai 31,000 T. Silica Sand

CJ-VIII MV Aspen JMBaxi Izrail 45,175 T. MOP

Stream MV Bhaskar Aries Marine 1,856 T. S. Scrap 2022111149 18/11 MV Dato Success JMBaxi China 14,375/977 T. HR Coils/Pipes 2022110066

CJ-XVI MV Darya Gometi Genesis 31,930 T. S. Scrap 2022111052

Stream MV Esperance Ray Benline 23,952 T. Steel Scrap Stream MV Fan Zhou 6 Mystic Shpg. 343(90/251/2Blades/Access./SOC) 17/11 MV Frosso K Chowgule Bros. Indonesia 55,000 T. INDO Coal 2022111110

CJ-XVA MV Imperial Eagle Arnav Shpg. 36,744/5,250 T. HMS/SH Scrap 2022111112 28/11 NV Jimmy T Tauras 14,388 T. MOP 18/11 MV Ocean Bridge JMBaxi China 153/5,170 T. Equip/Steel Cargo

Stream MV Smew Benline 31,497 T. S. Scrap

Stream MV Tan Zhou Lun Chowgule Bros. 56,000 T. Salt In Bulk 2022111053

CJ-VI MV True Confidence Seascape 27,079 T. Met Coke 2022111125 22/11 MV VGS Dream United Safeway 7,250 T. Lime Stone

Stream MT Argent Gerbera JM Baxi Durban 5,991 T. Chem. 2022101060 1483 2323599

Stream MT Asia Liberty JMBaxi Malaysia 28,999 T. CPO Stream LPG Bastogne Nationwide 20,000 T. Propane/ Butane Stream LPG Berlian Ekuator Nationwide 21,000 T. Butane/Propane

Stream MT Bow Santos GAC Shpg. 6,500 T. Chem.

OJ-II MT Chem Mercury Samudra 9,848 T. Chem.

OJ-I LPG/C IGLC Dicle Seaworld 16,230 T. Propane/ Butane 2022111011 20/11 LPG/C Gas Utopia Interocean 9,999 T. Ammonia 2022111151

Stream MT GH Austen Seaworld 32,000 T. MS 23/11 MT Glen Cove JMBaxi Dakar 24,000/2,100 T. Phos Acid/Chem.

OJ-IV MT Indigo Ray Samudra 4,774 T. Chem 2022111049 20/11 LPG Jag Vikram Nationwide 20,000 T. Butane/Propane Stream MT Maersk Barry Interocean 27,000 T. CPO

Stream MT Merapi Interocean 10,000 T. MS 2022111048

Stream MT Patroit MK Shpg. 18,922 T. HSD

Stream MT Saehan Liberty JMBaxi Indonesia 18,000 T. Palm Stream LPG/C Sakura Spirit Inchcape Shpg. 21,494 T. Propane/ Butane

Stream MT Saver 1 Samudra 3,996 T. Chem. 2022111063 18/11 MT Snow Ploeg Samudra 3,403 T. Chem. 2022111152

Stream MT Southern Quokka GAC Shpg. 3,000 T. C Oil OJ-VI MT Stolt Noraland JMBaxi Dakar 34,022 T. PHOS Acid OJ-III MT Torm Troilus Jamesh Mack 20,100 t. PAL Oil

TO

18/11 18/11-AM

COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 18/11 19/11 19/11-AM Zim Charleston 9E 22358 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 19/11 25/11 25/11-AM OOCL Genoa 060E 22374 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 25/11 19/11 19/11-AM ONE Contribution 051E 22361 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 19/11 29/11 29/11-AM ONE Commitment 057E 22373 Ningbo, Sekou, Cai Mep. (PS3) 29/11 21/11 21/11-AM Clemens Schulte 017WE 22371 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 21/11 28/11 28/11-AM Seaspan Chiba 012WE 22377 ONE ONE (India) (TIP) 28/11 22/11 22/11-AM ALS Apollo 246E 22352 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 22/11 28/11 28/11-AM Shijing 247E 22368 Ningbo, Tanjung Pelepas. (FM3) 28/11

18/11 18/11-AM Maersk Seletar 245W 22357 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 18/11 25/11 25/11-AM Maersk Kinloss 246W 22363 (MECL) 25/11 20/11 20/11-AM SSL Gujarat 129 22372 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 20/11 23/11 23/11-AM SCI Mumbai 552 22370 SCI J. M Baxi Jebel Ali. (SMILE) 23/11 24/11 24/11-AM Montpellier 0024 22375 X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG) 24/11 TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

18/11 18/11-AM COSCO Thailand 089E 22369 COSCO COSCO Shpg. Karachi, Colombo (CI1) 18/11 19/11 19/11-AM Zim Charleston 9E 22358 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 19/11 20/11 20/11-AM EM Astoria 246S 22364 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 20/11 21/11 21/11-AM Clemens Schulte 017WE 22371 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 21/11 28/11 28/11-AM Seaspan Chiba 012WE 22377 ONE ONE (India) (TIP) 28/11 22/11 22/11-AM ALS Apollo 246E 22352 SCI J. M Baxi Colombo. (FM3) 22/11

18/11 18/11-AM Maersk Seletar 245W 22357 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 18/11 25/11 25/11-AM Maersk Kinloss 246W 22363 Safmarine Maersk Line India (MECL) 25/11 19/11 19/11-AM ONE Contribution 051E 22361 ONE ONE (India) Los Angeles, Oakland. (PS3) 19/11 21/11 21/11-AM Clemens Schulte 017WE 22371 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 21/11 28/11 28/11-AM Seaspan Chiba 012WE 22377 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 28/11

(NIX

/

Sheva, 20/11