See Pg. 8 - 9

Vol.LXIVNo.187

th WEDNESDAY 16 OCTOBER 2024

Tel : 2266 1756, 2266 1422, 2269 1407

See Pg. 8 - 9

Vol.LXIVNo.187

th WEDNESDAY 16 OCTOBER 2024

Tel : 2266 1756, 2266 1422, 2269 1407

MUMBAI: Twenty-five years ago, exploring the business possibilities in a strategic location - Singapore, a vision was born. Today, Transworld Group Singapore stands as a testament to the power of perseverance, and commitment to excellence.

TGS celebrated its 25th anniversary with eminent personalities from Industry on Sep 25, 2024, in Mumbai, India Mr Mahesh Sivaswamy – Chairman, TGS, Ms Mala Mahesh, Mr. Murli Mahesh and the heads of all respective verticals were present along with their team to celebrate this important milestone. Everyone enjoyed the evening with great zeal. Our Chairman raised a Toast to embark this 25-year-long journey and thanked everyone for being a part of this journey.

Cont’d. Pg. 6

Cont’d. Pg. 27

MUMBAI: The meeting of the First Directors of the Board of Indian Maritime Centre (IMC) was held in Mumbai on 14 October 2024. The Indian Maritime Centre was incorporated on 27 September 2024, with its headquarters at Mumbai in the premises belonging to Maritime Training Institute of Shipping Corporation of India at Powai.

Cont’d. from Pg. 4

I t w a s i n July 1999 that M r M a h e s h S i v a s w a m y relocated to Singapore after gaining extensive experience in the various f i e l d s o f s h i p p i n g , l o g i s t i c s & international trading while working at his father’s office in India early in his career Now the company provides a comprehensive network of services

including Ship Owning, Ship Management, Feeder Services, Liner Shipping, Logistics & Agency Representation of major Shipping Lines, Inland Terminals and Wellness Services to seafarers.

While this milestone will always hold a special place in the journey of TGS, the company will continue “Voyaging in Resilience”.

Marathon Nextgen, Innova “A”-G01, Opp.Peninsula Corporate Park, Off.Ganpatrao Kadam Marg, Lower Parel(W), Mumbai-400013 Board Tel.:022-61657900, Fax: 022-61857299/98/97, E-Mail:info@evergreen-shipping.co.in, Website:http://www.shipmentlink.com/in

NHAVA SHEVA : 1st Flr, Anchorage Ship Ags. Premises Co-op Society, Plot No. 02, Sec-11, Dronagiri Node, Navi Mumbai-400707 Tel.: 022-27471601, Fax: 91-22-27246415, E-Mail: nxvlog@evergreen-shipping.co.in

NEW DELHI : 51, Okhla Industrial Estate, Phase - III, 1st Floor, New Delhi-110020 Tel.: 011-61657900 (Hunting), Fax: 011-66459698 / NDI Fax : 011-66459699, E-mail: ndibiz@evergreen-shipping.co.in

NEW DELHI: The Ministry of Electronics and IT (MeitY) will soon start consultations with the industry to finalise the contours of the g u i d e l i n e s f o r t h e i m p o r t management system for laptops and other IT hardware products, which needs to be put in place from January, officials said.

Currently, the Government has extended the ongoing import management scheme till December 31, which was earlier scheduled to end on September 30. The current regime requires IT hardware companies such as Lenovo, HP , Dell, Acer, etc, to only register with the Government

and declare the value and quantity of imports to get a permit.

Officials said the aim is to promote domestic manufacturing of IT hardware such as laptops. So far, the regime did not restrict the imports and based on the data of imports, further course of action will be decided.

The Government’s plan is to come up with an import authorisation mechanism and based on the local manufacturing of IT hardware by the companies, they will be allowed to import further

This could be a kind of credit-based system,whereinmanufacturerswillbe

assessed on three criteria: their past year’s imports, progress on domestic manufacturing of IT hardware products, and exports from India Based on their performance on these parameters, the Government may allot them credit points which can be used to import laptops and other IT hardwareproducts

In FY24, IT hardware imports stood at $8 4 billion against the authorisation of about $9.5 billion. Most of the imports were from China. India’s laptop and personal computer imports between April and July stood a t $ 1 . 7 b

Government data.

NEW DELHI: India is expected to benefit as the US imposes further restrictions on investments in strategic sectors in China This shift could lead global companies to reduce their exposure in China and redirect investments to other r e g i o n s , i n c l u d i n g I n d i a a n d S o u t h e a s t A s i a . I n d i a ’ s pharmaceutical and consumer electronics industries stand to gain the most from this change, as the c o u n t r y s t r e n g t h e n s i t s manufacturing competitiveness

As per reports, ASEAN nations and India are becoming more attractive to foreign investors due to their openness and improving

production capabilities. Indian pharmaceutical companies, already major suppliers of generic drugs to t h e U S , c o u l d s e e f u r t h e r opportunities if the US reduces its r e l i a n c e o n C h

Additionally, India and Vietnam are likely to benefit from increased investments in consumer electronics as companies diversify away from China.

Major firms like Foxconn and Pegatron have already set up facilities in India to manufacture iPhones, and Tata Electronics is expanding its production hub following its recent acquisition of

Wistron’s stake. Moody’s expects the “ C h i n a + 1 ” s t r a t e

y, w h e r e companies maintain a presence in China while expanding in other regions, to continue as businesses derisk over time.

W h i l e t h e s

v e l o p m e n t s present opportunities for India and ASEAN, reports cautioned that the full extent of the gains remains uncertain, as trade and investment shifts have been occurring since 2018. Fu r t h e r m o r e , i n c r e a s e d U S restrictions on China could slow China’s exports, which might negatively impact Asia-Pacific economies with strong ties to Chinese manufacturing.

NEW DELHI: The India-Russia working group on cooperation in the Northern Sea Route (NSR) held the first meeting last week and discussed targets for Indian-Russian cargo transit, possible training of Indian sailors for polar navigation and development of joint projects in Arctic s h i p b u i l d i n g , R o s a t o m s t a t e corporation of Russia said on Monday (October 14, 2024).

“The working group also drafted a memorandum of understanding between the Government of the R e p u b l i c o f I n d i a a n d t h e G o v e r n m e n t o f t h e R u s s i a n Federation for the development of cooperation in cargo shipping in the waters of the NSR,” Rosatom said in a statement In 2018, the Russian Government appointed Rosatom the infrastructure operator of the NSR.

The working group’s meeting was co-chaired by Rajesh Kumar Sinha, Additional Secretary in India’s

Ministry of Ports, Shipping and Waterways, and Vladimir Panov, Rosatom’s Special Representative for Arctic Development.

A joint statement issued following the meeting between Modi and Putin on July 9 said that the two sides will cooperate in “developing shipping between Russia and India via the Northern Sea Route”.

The Northern Sea Route is seen as t h e s h o r t e s t s h i p p i n g r o u t e connecting the western part of Eurasia and the Asia-Pacific. In 2018, the Russian Government appointed Rosatom, the state-run atomic energy agency, as the infrastructure operator for the Northern Sea Route.

The Indian side is interested in t w o p r o p o s e d t r a n s p o r t a t i o n corridors – the Northern Sea Route and the Eastern Maritime Corridor –b e c a u s e t h e y c a n e n s u r e uninterrupted energy supplies from Russia, two Indian officials from

different ministries said on condition of anonymity.

Popular maritime routes through the Suez Canal and the Red Sea have been frequently disrupted by ongoing geopolitical conflicts, hurting trade a n d l e a d i n g t o a s p i k e i n transportation costs because of soaring insurance premiums, one official said. “India cannot afford such frequent trade disruptions and is keen to develop all alternate routes that reduce time and cost overruns,” he said.

The second official, working in an economic ministry, said that the Northern Sea Route is more relevant now as bilateral merchandise trade between Russia and India has risen from $7.5 billion in 2016-17 to more than $65 billion in 2023-24, mainly due to India’s oil imports. “Imagine the savings when transportation cost and logistics time are significantly reduced,” the second official said.

THIRUVANANTHAPURAM: The Kerala Government is preparing to m o v e f o r w a r d w i t h t h e commissioning of the first phase of the Vizhinjam International Seaport Ltd (VISL) for commercial operation on December 3, following successful trial runs.

A final decision will be made in consultation with Adani Vizhinjam Port Pvt Ltd, said officials. They said that port operations have advanced significantly during the trial period, and an announcement regarding the commissioning is expected soon.

The trial operations of the port began in July with the successful berthing of a mothership named San Fernando. Since then, the port has welcomed 20 ships.

V I S L , I n d i a ’ s f i r s t s e m i -

a u t o m a t e d c o n t a i n e r p o r t , demonstrated its capabilities by unloading over 60,503 TEUs (20-foot equivalent units) of cargo from the ship.

The port set a new record by handling 10,330 TEUs in a single vessel exchange with MSC ANNA, one of the largest container ships in the world, earlier this month. The most recent ship to berth was MSC LISBON, which departed the port on Sunday

The VISL is equipped with eight ship-to-shore cranes, including the largest in the category (1,620-tonne) in the country, and 23-yard cranes. The ship-to-shore cranes are used to lift the containers from the ship and place them in the terminal track.

Additionally, the port has received

regular International Ship and Port Facility Security (ISPS) Code certification, solidifying its status as a secure hub for global maritime trade. ISPS approval is mandatory for the service of international vessels.

The permanent certification follows provisional approval granted in March The marine merchant department, part of the Centre’s Ministry of Shipping and Ports, issued the certification in accordance with t h

Organisation, a specialised agency of the UN.

Recently, the port also obtained its navigational chart from the National Hydrographic Office, which serves as an authoritative guide containing

documents for ships.

MUMBAI: Minister of Road

T r a n

Nitin Gadkari recently announced the s a n c t i o n o f f u n d s f o r multiple projects in various states, including Maharashtra, Telangana, Andhra Pradesh and Goa.

In Maharashtra, Rs 809.77 crore has been sanctioned for rehabilitation and upgradation of two-lane along with paved shoulder on National Highway 63 from Udgir to Degalur and Adampur Fata to Sagroli Fata section This highway connects the border districts of Latur, Nanded in Maharashtra with Nizamabad district in Telangana.

The connectivity will give a boost to industrial agri-business activities in Udgir, Mukramabad and Degalur cities. The route will serve as an important link between the mineral-rich Marathwada and parts of Telangana, thus boosting

the development of the local economy and creating new jobs.

In Andhra Pradesh, Rs 400 crore has been sanctioned for the development of 13 state roads, spanning a total distance of 200.06 km, under the CRIF scheme. Additionally, we Rs 98 crore has been approved for the construction of a fourlane Sankar Vilas Road Over Bridge (ROB) on the Guntur-Nallapadu railway section in Guntur district.

Rs 516 crore has been sanction in Telangana for the construction of a 14 km long, four-lane bypass for Nalgonda Town, from the Nakrekal to Nagarjuna Sagar section of NH 565.

The existing section through Nalgonda Town experiences heavy mixed traffic, leading to congestion and long queues. This project will not only alleviate traffic in Nalgonda but also enhance road safety while improving

connectivity between Nakrekal and Nagarjuna Sagar

In Goa, Rs 557 crore has been approved for the four-lane construction of the 9.6 km stretch from Ponda to Bhoma on NH 748, to be executed on EPC mode. This section represents the missing four-lane link between the adjacent four-lane segments of Khandepar to Ponda and the Ribandar bypass.

It serves as a connection between the major towns of Panaji and Ponda. Additionally, this project will facilitate inter-state traffic from Karnataka and enhance connectivity to Dabolim Airport and Mormugao Port via NH 566 and NH 66. The current stretch suffers from significant congestion and frequent accidents. The 4- laning will ease traffic, decongest the area, and address four accident blackspots.

The updated rates and eligible items under Appendix 4R and 4RE will be available on the DGFT portal.

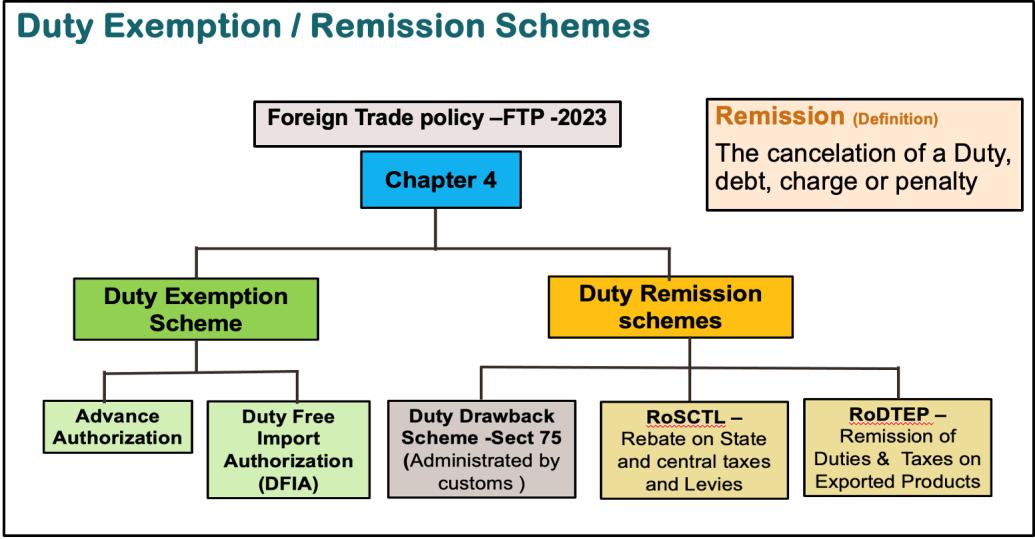

NEW DELHI: In a significant move aimed at supporting India’s export sector, the Directorate General of Foreign Trade (DGFT) has announced an extension of the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme. The scheme, designed to refund taxes and duties to pharma exporters, has been a critical policy f o r p r o m o t i n g I n d i a ’ s e x p o r t competitiveness.

According to the notification, the RoDTEP scheme will continue for exports of products manufactured by Domestic for Advance Authorization holders (except deemed exports), Export Oriented Units (EOUs), and

Special Economic Zone (SEZ) Units until December 31, 2024.

This decision, taken under the authority of Section 5 of the Foreign Trade (Development and Regulation) Act, 1992, and in accordance with Para 1 02 of the Foreign Trade Policy (FTP) 2023, reflects the government’s commitment to sustaining the benefits of the RoDTEP scheme for Indian exporters. However, the notification also includes provisions to ensure that the scheme’s benefits remain within the limits of the approved budget, as per Para 4 54 of the FTP 2023 As a result, adjustments such as revisions or deletions in the list of eligible RoDTEP export items, rates, and

value caps may be implemented as needed

The notification specifies that the new RoDTEP rates, recommended by the RoDTEP Committee, will come into effect on October 10, 2024, through revised Appendix 4R (for Domestic Tariff Area (DTA) units) and Appendix 4RE (for AA holders, EOUs, and SEZ Units). For exports made between October 1, 2024, and October 9, 2024, the existing rates, as mentioned in Notification No. 70/2023 dated March 8, 2024, will continue to apply

The updated rates and eligible items under Appendix 4R and 4RE will be available on the DGFT portal.

17/10 MSC Berangere (V-FW433E) MSC Agency Singapore

17/10 SSF Dynamic (V-77) MBK Logistix Abu Dhabi

18/10 Cul Jakarta (V-24035M) Master Logitech Jebel Ali

VESSEL’S NAME AGENT FROM SHIPS SAILED WITH EXPORT CARGO

19/10 19/10-AM Zhong Gu Hang Zhou24003E 4093600 Global Feeder Sima Marine Port Kelang, Busan, Gwangyang (CSC)

Ningbo, Hongkong (C16)

20/10 19/10-PM X-Press Phoenix 442E 4103617 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 21/10 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

TBA Asyad Line Seabridge Marine Shangai, Ningbo, Shekou (FEX)

TBA Asyad Line Seabridge Marine Haiphong, Laem Chaban, Jakarta (IEX) TO LOAD FOR INDIAN SUB CONTINENT

18/10 18/10-AM Marsa Neptune 2410 4103674 Sai ShippingSai Shipping Karachi (JKX) 19/10 19/10 19/10-AM Zhong Gu Hang Zhou24003E 4093600 Global Feeder Sima Marine Karachi (CSC)

20/10 20/10-AM Maersk Cadiz 442W 4093618 Maersk Line Maersk India Colombo (MW2 MEWA)

TBA Asyad Line Seabridge Marine Karachi (REX)

17/10 Wan Hai 510 (V-182E) 4093659 Wan Hai Line Nhava Sheva 18/10 Maersk Cairo (V-442S) 4103502 Maersk India Port Qasim 19/10 Zhong Gu Hang Zhou (V-24003E) 4093600 MBK Logistix Nhava Sheva

ETA VESSEL’S NAME VCN NO. AGENTS FROM SAILED WITH EXPORT CARGO

CB-1 Euphoria (V-4406E) Efficient Marine 17/10 CB-2 SM Neyyar (V-441) MBK Logistics 17/10

Wan Hai 316 (V-220W) Nhava Sheva 13-10-2024 Oshairij (V-2420W) Nhava Sheva 13-10-2024 Northern Guard (V-926E) Port Klenag 13-10-2024

21/10 APL Miami (V-0FFCUE1)

21/10 Contship Uno (V-24012)

27/10 Zhong Gu Tianjing (V-24043W)

17/10 Hansa Europe (V-2440W) Hapag

CB-1 Hongkong Bridge (V-2433)

25/10 ESL Asante (V-2442)

17/10 RC Ocean (V-46W)

19/10 Seaspan Lahore (V-2440W)

23/10 Spil Citra (V-0UW38W1)

Vadi AL Rayan (V-0QCITW1)

21/10 Artam (V-1335W) HDASCO Armita India Gulf

24/10 APL Holand (V-OPU2DS) Emirates / KMTC Emirates Shipping / KMTC India Gulf

07/11 Zhong Gu Kun Ming (V-02448S) RCL RCL Agency

19/10 Celsius Naples (V-905E) Unifeeder/KMTC Unifeeder/KMTC(I) Far East & 20/10 24/10 ESL Dachan Bay (V-24005E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo 25/10 ONE/TS Lines ONE (I)/TS Lines(I) CB-5 Grasemere Maersk (V-442W) Maersk Line Maersk India U.K. Cont. 2390678 17/10

19/10 Halsted (V-440S) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa 20/10 18/10 Hedwig Schulte (V-441W) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India Africa

20/10 Inter Sydney (V-0165) Interworld Efficient Marine Gulf

31/10 Konard (V-KONO624W) Akkon Oasis Shipping Europe/Med.

17/10 MSC Barbadose (V-IV442A) MSC MSC Agency U.S.A.

21/10 Maersk Capetown (V-443S) Maersk Line Maersk India Africa

19/10 Maersk Kensington (V-441W)(NSIGT) Maersk Line Maersk India Mediterranean

04/11 Seatrade Peru (V-001W) Unifeeder/One Unifeeder/One India Gulf

Car.CB-5 SOL Prime (V-5404W)(Sailed) Transworld Transworld GLS

Car.CB-4 Wan Hai 316 (V-210E)(Sailed) Wan Hai/Unifeeder Wan Hai Lines (I)/Unifeeder

25/10 X-Press Altair (V-24012W) X-Press Feeder

17/10 Zhong Gu Hang Zhou (V-24003E) Global Fdr/TS Lines Sima Marine/TS

22/10 Beijing Bridge (V-2406E) Sinokor/Heung

19/10 APL Qingdao (V-OINI5W1) CMA CGM/OOCL CMA CGM Ag.(I)/OOCL(I) U.S.A.

26/10 CMA CGM Don Pasculeae (V-OINI7W1) COSCO/ONE COSCO Shpg/One India

Car.CB-6 Kyoto Express (V-4141W)(Sailed) Hapag ISS

17/10 MSC Lisbon(V-IU441A)

CB-6 MSC Regulus (V-IS440A)

18/10 SCI Delhi (V-IP442A) MSC/Hapag MSC

17/10 Dimitra C (V-441W)

23/10 Dimitris Y (V-248E) ONE

28/10 Cap Andreas (V-015E) X-Press Feeders

17/10 Mundra Express(V-4340W) COSCO COSCO Shpg. U.K. Cont.

21/10 Seaspan Ganges(V-4341W) Hapag / ONE ISS Shpg./ONE(I)

CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I) 20/10 One Modern (V-072E) ONE/HMM ONE (I)/HMM Shpg. USA

GTI-1

One Altair (V-066E) ONE/HMM ONE (I)/HMM Shpg. Far East & 2390546

23/10 One Arcadia (V-070E) Yang Ming Line Yang Ming Line (I) China

21/10 RDO Favour (V-02436N) Global Fdrs./CU Lines Sima Marine/Seahorse Gulf

Emirates/KMTC Emirates Shpg./KMTC (I) 22/10 Sofia Express (V-2441W) Hapag/COSCO ISS Shpg./COSCO Shpg. USA, Gulf &

24/10 APL Phoenix (V-OMXKPW1) CMA CGM CMA CGM Ag. (I) Far East

19/10 SCI Mumbai (V-24040) Unifeeder/ Unifeeder/ Gulf

26/10 Celsius Nairobi (V-0918) QNL/Milaha Poseidon

16/10 Wan Hai 515 (V-E094) Wan Hai Wan Hai Lines (I) Colombo &

18/10 Wan Hai 373 (V-E003) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East

18/10 Xin Da Yang Zhou (V-096E) RCL/OOCL RCL Ag./OOCL(I) Far East

25/10 Pusan (V-34E) Zim/COSCO Zim Int./COSCO Shpg.

21/10 Zhong Gu Chong Qing (V-443E) Maersk Line Maersk India Far East

28/10 GSL Nicoletta (V-444E) X-Press Feeder Sea Consortium

Car.BMCT-2 Advance (V-059W) (Sailed) COSCO/OOCL COSCO Shipping/OOCL (i) Gulf

16/10 Car.BMCT-3 Beijing (V-105E) (Sailed) COSCO COSCO Shpg. Far East

22/10 OOCL Atlanta (V-061E) Zim/Goldstar Zim Integrated/Star Ship.

BMCT-3 Big Breezy (V-E044) Wan Hai /KMTC Wan Hai Line (I)/KMTC (I) Far East

18/10 CSCL Neptune (V-081) CMA CGM/APL CMA CGM Ag. (I) U.K. Cont.

22/10 APL Barcelona (V-OPEAHW1) COSCO / OOCL COSCO Shpg./OOCL(I)

BMCT-2 CUL Jakarta (V-24035W) Sealead Sealead Shipping Mediterranean

22/10 Chang Shun Qian Chang (V-2404) Asyad/QNL/Milaha Seabridge/Poseidon Gulf 23/10 19/10 Cstar Peter (V-2441W) CU Lines Seahorse Shipping Red Sea/Gulf 20/10 16/10 Daphne (V-868W) One Line/Samudera One India/Samudera Far East 17/10 21/10 ESL Busan (V-02438E) Evergreen / X-Press Feeders Evergreen/Sea Consortium Far East

29/10 Torrance (V-29E) KMTC/HMM KMTC (I)/HMM Shpg.

31/10 Zoi (V-117E) Emirates/Gold Star Emirates Shpg./Star Ship.

17/10 Hyundai Jakarta (V-0130E) HMM HMM Shpg. Far East

24/10 Honrise (V-30INDSTP)

25/10 Jong Gu Ri Zhou (V-24408E)

Karun (V-441W)

B.P.Extn.

GANDHIDHAM: Under the Leadership of President Shri Bharat Gupta, following Office Bearers & Committee Members were elected / selected for the term 2024-25 :

PRESIDENT

VICE PRESIDENT

SECRETARY

JOINT SECRETARY

TREASURER

COMMITTEE MEMBERS

Mr. BHARAT GUPTA

M/s. AQUA SHIPPING

Mr AASHISH S JOSHI M/s. MALARA SHIPPING PVT LTD

Mr. PRANESH RATHOD

Mr VIKRAM SINGH

Mr SAHIL DATTA

Mr K.M.THAKKER

Mr SABUKUTTAN

Mr RAJUBHA B SODHA

Mr RATTAN B DHAWAN

Mr TAPAS SAMAL

M/s. SEACOAST SHIPPING SERVICES

M/s. SAMSARA SHIPPING PVT LTD

M/s. TAURUS SHIPPING SERVICES

M/s. KRISHNA SHIPPING & ALLIED SERVICES

M/s. ATLANTIC GLOBAL SHIPPING PVT LTD

M/s. MASTER LOGITECH PRIVATE LIMITED

M/s. SHANTILAL SHIPPING & CHARTERING PVT LTD

M/s. MERCHANT SHIPPING PRIVATE LIMITED

Cont’d. from Pg. 4

In the meeting held on 14-10-2024, the Board of Directors elected Mr. Devki Nandan as Chairman and Mr Shankar Shinde as Vice Chairman of Board of Directors Capt Sankalp Shukla will act as Secretary and Capt Vikas Vij as Treasurer. Mr R. Ravi Kumar, Secretary General of IPPTA, has been appointed as Acting CEO. It was also decided to accept the applications of the Association of Container Train Operators (ACTO) and Indian RegisterofShipping)IRClassIRSasmembersofIMC.

The Maritime India Vision 2030 envisaged by the Ministry of Ports, Shipping and Waterways (MoPSW) identified the need to create an integrated Apex Maritime Body called the ‘India Maritime Centre’. A High-Level Task Force was formed under the Chairmanship of Addl. Secretary, MoPSW towards development of the same.

IMC will play a defining role to have a unified approach to maritime policy across different subsectors focussing on building an integrated Indian Maritime Ecosystem, unified representation of the Indian maritime sector at international forums like IMO and relationship with global maritime community, integrated approach for creating global visibility and strong brand for Indian maritime sector and act as a think tank for the entire Indian maritime Industry.

The Directors profusely thanked Mr Bhushan Kumar, former Joint Secretary (Sagar Mala) who played a stellar role in the formation of IMC.

Speaking on the occasion on behalf of the Directors, Mr Devki Nandan stated that “It is a privilege and honour for me to serve as Chairman of IMC. We pledge to work towards promoting, developing and facilitating domestic and international maritime trade fostering economic growth in India and abroad The upcoming years promise to be exciting for the Indian Maritime Sector, with significant investments in pipeline to incorporate cutting-edge technology, capacity building, and adopting the best international standards We pledge our unwavering

• Mr Devki Nandan, President, Indian Private Ports and Terminals Association (IPPTA)

• Mr. Shankar Shinde, Immediate Past Chairman, Federation of Freight Forwarders Associations in India (FFFAI)

• Capt. Vikas Vij, President, ICC Shipping Association (ICCSA)

• Capt. Sankalp Shukla, Chairman, Foreign Owners representatives and Ship Managers Association (FOSMA)

• Mr. Arjun Ashok Chowgule, President, Shipyards Association of India (SAI)

• Mr. Maneesh Pradhan, Chairman, Maritime Association of Shipowners, Ship Managers and Agents (MASSA)

• Mr Rahul Modi, President, Coastal Container Transporters Association (CCTA)

assistance to the Government in developing and implementing policies in respect of maritime sector to achieve the goals of Maritime India Vision 2030 & Maritime Amrit Kal Vision 2047 and make India as a growth engine for the world. We as an industry, have a huge responsibility to shape the future in a meaningful and impactful manner This Apex body will assist Govt and all subsectors to adopt the uniform policies and make this sector as a role model.”

All the Trade associations, Major Ports, Maritime State Governments, State Maritime Boards, organisations, companies, institutions, bodies, esteemed maritime professionals and other stakeholders who are directly or indirectly connected with the Indian maritime trade are welcome to apply for joining IMC with a view to achieve the above objectives through the collective efforts of those in the trade itself.

Port of Call : Shanghai, Taicang, Ennore, Jeddah, Suez Canal, Alexandria, Tilbury, Antwerp, Bremerhaven