N AV I M U M B A I :

JNPA recently hosted Mr Bart De Jong, Consul General of

t h e K i n g d o m o f

t h e N e t h e r l a n d s with other dignitaries

f r o m M i n i s t r y o f

Infrastr ucture and Water Management (Martime Affairs), Netherlands JNPA Chairman, Shri Unmesh Sharad Wagh, IRS, greeted them on arrival.

Cont’d. Pg. 4

A H M E D A B A D : The Adani Group is considering building ships at its flagship Mundra Port in the Kutch, Gujarat.

Cont’d. Pg. 6 Mr.

Cont’d. from Pg. 2

“They were taken through a presentation during which our Chairman explained to them about the JNPA infrastructure projects, green port initiatives and Vadhvan Port.

In this meet, sustainability topics like use of zero emission vehicles in the port, facility of shore power supply, etc were discussed in detail.,” informs a recent communique from JNPA

Cont’d. from Pg. 2

This comes as other major ship building ports in China, Japan and South Korea are “booked out” till 2028 leaving a gap in demand for new vessels, it added. Notably, India is at present #20 in the global commercial ship building market (0.05 per cent share) and aims to be in the top 10 by 2030 and top 5 by 2047, per the ‘Maritime Amrit Kaal Vision 2047’ released by PM Shri Narendra Modi in January this year.

India’s potential for the market is pegged at around $62 billion net by 2047, as per a KPMG document on the industry, submitted to the Ministry of Ports, Shipping and Waterways earlier this month, it added. Further, the potential jobs creation is pegged at 12 million, as per the same document.

The Gautam Adani-led pivot to the shipbuilding also comes as the industry looks for green ships — with requirement numbered around 50,000 vessels over the next 30 years to replace all old-school ones, the report added.

Notably, Adani has the acreage and environment approvals due to its SEZ status to enter this heavy engineering sector fairly quickly, the report added. It is also better placed in terms of competing, as Indian shipyards are currently outbid by foreign shipyards due to as much as 35 per cent of “cost disadvantage”.

India has eight state-owned ship building yards (seven of which are Defence Ministry owned), and 20 private ones (where only L&T builds defence vessels). The KPMG document showed that most capacity at Indian yards was skewed towards naval vessels and not commercial ones, the report added.

THIRUVANANTHAPURAM: Vizhinjam, the country’s deepest transshipment hub, is set to welcome two back-to-back mother ships in July First to arrive is the mothership San Fernando, anchoring on the 10th. San Fernando, a vessel of the world’s second-largest shipping company Maersk, is 300 meters long and 48 meters wide.

Following the arrival of Maersk’s San Fernando, Vizhinjam Port will welcome a mothership from the world’s largest shipping company, MSC. This ship will be even larger, exceeding 400 meters in length, and will arrive with more than 2,000 containers.

Additionally, two feeder ships, Marin Azur and Seaspan Santos, will arrive to take the cargo delivered by San Fernando. One of these feeder ships is expected to

reach Vizhinjam on the 13th. Over the next two months, ships from world-class companies will be visiting Vizhinjam.

Cargo bound for other countries can also be unloaded at Vizhinjam, contributing to its growth as a global transshipment hub. Located just 10 nautical miles from international shipping lanes connecting Europe, the Gulf, and East Asian countries, Vizhinjam is strategically positioned for global trade.

In the first phase, 10 lakh containers will be brought to Vizhinjam, with the capacity expanding to 30 lakh containers when fully equipped. Ships will be controlled by a port navigation center running on software developed by IIT Madras, modeled after air traffic control to ensure safe anchorage and port operations.

NEW DELHI: India’s bid to take away transhipment business from established regional leader Sri Lanka is gaining steam.

Cochin Port Authority (CPA) in the far southwest of the country has outlined plans to deepen the channel leading to its International Container Transshipment Terminal (ICTT) from 14.5 m to 16 m in a bid to attract larger ships to call.

Cochin is fighting for box business both from Sri Lanka and Vizhinjam, a nearby port with depths of up to 20 m, set to launch in Q3 this year

Nearly 75% of India’s transhipped cargo is handled at

ports outside India. Colombo, Singapore and Port Klang handle more than 85% of this cargo, something New Delhi is keen to claw back onto home soil as it begins a mammoth period of ports construction over the next decade.

A long-planned mega port got the green light from New Delhi last month, the latest in a series of new terminal announcements The giant Vadhavan port, located some 125 km north of Mumbai on India’s West Coast, has been discussed for more than a decade, but finally, the Narendra Modi administration has approved the huge $9.1bn development.

T H I R U VA N A N T H A P U R A M : T h e K e r a l a Government announced that, with the commencement of operations at Vizhinjam International Port, shipping services will also be launched at other ports across the state. Minister for Ports V N Vasavan stated that the start of operations in Vizhinjam will strengthen the coastal shipping of goods in Kerala. The Kerala Maritime Board has already initiated discussions with private shipping companies to promote coastal shipping.

At present, services can be launched to Kollam, Beypore and Azhikode ports which have basic infrastructure facilities for the same, he told the state Assembly. Replying to a question, the Minister said

efforts have already begun to improve infrastructure facilities in such ports.

The Board has undertaken several measures in this regard including seeking necessary permission from the Union government, increasing the depths of ports and construction of additional wharfs, Vasavan said

Earlier, the port authorities said the Vizhinjam International Seaport here has received its location code, a key milestone towards the commencement of its operations as a major transshipment hub. In a Facebook post, the Vizhinjam International Seaport Limited (VISL) had said the port received its location code — INNYY1 fromtheIndiangovernmentonJune21, 2024.

LONDON: Trade from the Far East to a bloc of developing economies, especially South America, Africa and the Middle East/Indian Subcontinent, has risen dramatically and has emerged as a key driver of global container trade, according to a new report from Clarksons.

The world’s largest shipbroker said that trade between the Far East and these developing economies was up 16% year-on-year in the first four months of the year, and showed a 30% growth compared to 2019, the year before the Covid-19 pandemic hit.

After a stagnant 2023, in which container trade grew by just 0.6% from 2022, container shipments came up to 58 million TEU between January and April, an 8% increase from the year-ago period. This also marked the strongest start to container shipping in any year.

Clarksons analyst Mr Thomas Grant noted that several factors have supported trade between the Far East and this emerging bloc.

Mr Grant wrote, “Far East-Latin America trade has been aided by a notable increase in the exports of industrial goods, as well as strong vehicle/vehicle parts imports (partly aheadofplannedtariffhikesinBrazil),whiletradegrowthon the Far East-Middle East/Indian Subcontinent has been driven by firm economic growth in the region as well as increased investment in manufacturing facilities in India as US companies look to relocate manufacturing processes amidafocuson‘friendshoring’ ”

Far East-Africa volumes have been boosted by Africa becoming a new market for China’s finished goods exports, while the continent is growing as a source of raw materials.

Mr. Grant also wrote, “So, container trade appears to be on track for a stronger year after a challenging 2022-2023, with economic headwinds easing in key regions. Red Sea rerouting is having a profound impact in TEU-mile terms, but for underlying trade volumes, a number of rapidly emerging trade lanes are clearly coming to the fore.”

ETAETD VESSELS Voy V.I.A ROT.

11/0712/07 RC Ocean 034 Q0784 300238-28/06 MBK Line MBK Logistics Jeddah, Kumport (India Med Service)

19/0720/07

TBATBA Adyogan 2428W Q0719 1094885-21/06 MAS Diamond Marine

TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN,

In Port 11/07

17/0718/07

16/0717/07

19/0720/07

Grasmere Maersk 428W Q0744 299985-24/06 Maersk Line Maersk India Djibouti, King Abdullah, Jeddah (Blue Nile) Maersk CFS

TBATBA Maersk Virginia 429W Q0797

TBATBA Wadi Duka 2413W Q0651 1094192-13/06 Asyad Line Seabridge Jeddah (IEX)

TBATBA SSL Brahmaputra 917W Q0781 300185-27/06 X-Press Feeders Sea Consortium Jeddah, Al Sokhna 22/0723/07 TBATBA X-Press Mekong 24006W Wan Hai Wan Hai Lines (I) (RGI)

29/0730/07

TBATBA Addison 006 Q0621 299109-10/06 UnifeederUnifeeder TO

In Port 11/07 MSC Camille IS425A Q0737 1095144-24/06 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals

17/0718/07 16/07 1100 MSC Laurance IS426A Q0826 1095946-03/07 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 31/0701/08 31/07 1100 MSC Emanuela IS427A

U. K. North Continent & Other Mediterranean Ports. HimalayaExpress

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service

Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

11/0712/07 MSC Mundra VIII IU427A Q0792 1095777-01/07 MSC MSC Agency Haifa. (INDUS) Hind Terminals

12/0713/07 11/07 1600 MSC Mombasa IP428A Q0804 1095832-02/07 MSC MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals 19/0720/07 19/07 0900 MSC Ruby IP429A Q0866 1096406-09/07 Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D).

26/0727/07 26/07 0900 MSC Rikku IP430A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre (EPIC / IPAK)

COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos.

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware 13/0714/07 13/07 2200 Frankfurt Express(GTI) 4327W Q0778 300181-27/06 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 21/0722/07 TBATBA Kyoto Express 4328W Q0844 300695-05/07 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS (IOS) COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. Gold Star Star Ship Hamburg, Antwerp, Tilbury. Oceangate CFS

11/0712/07 11/07 0600 Cypress(NSICT) 0MXJVW1 Q0755 300075-25/06 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 18/0719/07 TBATBA Cautin 2426W Q0817 300511-03/07 CMA CGM CMA CGM Ag. Valencia, Cagliari. (IMEX Service) Dron-3 & Mul 24/0725/07

TBATBA Dalian Express 4329W Q0854 COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 11/0712/07 11/07 0600 Maersk Guayaquil 427W Q0743 299986-24/06 Maersk Line Maersk India Jeddah, S.Canal, Port Said, Tangier, Algeciras, Valencia, Maersk CFS 18/0719/07

TBATBA Maersk Gibraltar 428W Q0798 300347-01/07 Geona (ME 2) TO LOAD

11/0712/07 11/07 1000 Konrad(NSICT) 0324W Q0834 300579-04/07 Akkon Lines Oasis Shpg Aliaga, Gemlik, Gebze, Ambarli, Felixstowe, Antwerp 29/0730/07 TBATBA Sheng Li Ji 0524W (TIN) 13/0714/07 12/07 1600 CSCL Neptune 080W Q0782 300231-27/06 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 16/0717/07 TBATBA CMA CGM Titan OPE9LW1 Q0824 300514-03/07 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras. (EPIC) 16/0717/07 TBATBA Haian East 24023W Q0855 300815-08/07 SeaLead SeaLead Shpg./ Aliaga, Gebze, Gemlik, Istanbul, Mersin, EL Dekheila, Casablanca, Giga Shpg. Venghazi, Algier, Raves, Constanta, Thessaloniki, Piraeus, Barcelona, Valencia, Misurata (West Asia Red Sea Med - WARM)

18/0719/07 TBATBA Hyundai Jakarta 130W Q0775 300128-26/06 HMM HMM Shpg. Jeddah, Damietta, Piraeus, Genoa, Valencia, Barcelona, Seabird CFS (FIM West Bound) ONE Line ONE (India) Valencia, Barcelona, Genoa, Piraeus, Damietta, Algeciras

In Port 11/07 MSC Camille IS425A Q0737 1095144-24/06 MSC MSC Agency Novorossiysk, Burgas, Varna, Poti, Batumi, Constanza, Hind Terminals 17/0718/07 16/07 1100 MSC Laurance IS426A Q0826 1095946-03/07 SCI CMT Odessa (Himalaya Express) 12/0713/07 11/07 1600 MSC Mombasa IP428A Q0804 1095832-02/07 MSC MSC Agency Burgas, Varna, Poti, Batumi, Constanza, Illychevsk, Odessa. (EPIC / IPAK) AllcargoAllcargo CIS Destinations, Black Sea & East European. Dronagiri-2

12/0713/07 11/07 1500 MSC Barbados IV428A Q0808 1095847-02/07 MSC MSC Agency Freeport, Houston. Hind Terminal 19/0720/07 TBA 1000 MSC Bremen IV429A Q0852 1096268-08/07 (INDUSA) 13/0714/07 13/07 0600 Maersk Kensington 427W Q0741 299990-24/06 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS

W. Kithira 429W

Q0801

16/07 1100 MSC Laurance IS426A Q0826 1095946-03/07 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique,

31/07 1100 MSC Emanuela IS427A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast. (Himalaya Express) 11/0712/07 MSC Mundra VIII IU427A Q0792 1095777-01/07 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 18/0719/07 17/07 1000 MSC Pamela IU428A Q0851 1096267-08/07 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 12/0713/07 11/07 1600 MSC Mombasa IP428A Q0804 1095832-02/07 MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals

19/0720/07 19/07 0900 MSC Ruby IP429A Q0866 1096406-09/07 Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira,Paita, 26/0727/07 26/07 0900 MSC Rikku IP430A Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK)

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3

Safewater Safewater Line US East Coast, South & Central America

12/0713/07 12/07 0300 Seaspan Beacon(GTI) 4127 Q0810 300438-02/07 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah & Dron.-3 & Mul. 14/0715/07 14/07 0600 APL Le Havre OINHDW1 Q0763 300113-26/06 OOCL OOCL(I)

Other US East Coast Ports. Dronagiri-2 21/0722/07 TBATBA APL Qingdao OINGWE1 Q0860 300828-08/07 Hapag ISS Shpg. ULA CFS (INDAMEX)

ONE Line ONE (India) India America Express (INDAMEX)

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. Conex Terminal

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

11/0712/07 11/07 0600 Cypress(NSICT) 0MXJVW1 Q0755 300075-25/06 CMA CGM CMA CGM Ag.

Cautin 2426W Q0817 300511-03/07 ANL CMA CGM Ag. Itajai & other North American Ports. Dron.-3

24/0725/07 TBATBA Dalian Express 4329W Q0854 COSCO COSCO Shpg. 31/0701/08 TBATBA APL Phoenix 0MXK1W1 Hapag ISS Shpg.

14/0715/07 14/07 1100 One Reliability 005E Q0752 300081-25/06 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America

18/0719/07 TBATBA Cap Andreas 012E Q0753 300082-25/06 & Caribbean Ports, Canada. 21/0722/07 TBATBA X-Press Antlia 24004E Q0843 300690-05/07 Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 25/0726/07 TBATBA MOL Presence 015E West Indies Ports. (TIP Service) 15/0716/07 15/07 1000 Pusan 32E Q0718 299798-20/06 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 21/0722/07 TBATBA Aka Bhum 022E Q0822 300513-03/07 RCL RCL Ag USA East Coast & Other Inland Destinations. 23/0724/07 TBATBA OOCL Hamburg 151E COSCO COSCO Shpg. US West Coast. 01/0802/08 TBATBA OOCL Luxembourg 111E Yang Ming Yang

Q0818 300525-03/07 SeaLead SeaLead Shpg. Dubai 28/0729/07 TBATBA Contship Uno 24010W Q0857 300826-08/07 OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA -

In Port 11/07 Grasmere Maersk 428W Q0744 299985-24/06 Maersk Line Maersk India Jebel

11/0713/07 11/07 1100 AS Sicilia 935 Q0623 299108-10/06 ONE Line ONE (India) Jebel Ali. 14/0715/07 TBATBA AS Susanna 010W Q0838 UnifeederUnifeeder Jebel Ali. (MJI) Dronagiri

13/0714/07 Shamim 1329W Q0664 299437-14/06 HDASCO Armita India Bandar Abbas, Chabahar. (IIX)

15/0716/07

(MECL)

13/0714/07 13/07 0300 Tessa (GTI) 2404S Q0764 300105-26/06 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. 23/0724/07 TBATBA RDO Favour 02425S Q0820 300516-03/07 RCL/CUL Line RCL/Seahorse 30/0701/08

TBATBA ESL Kabir 02427S KMTC KMTC (India) Dronagiri-3 (West Bound) CMA CGM CMA CGM Ag.

&

SeaLead SeaLead Shpg

15/0716/07 TBATBA Marathopolis 429S Q0740 299991-24/06 Maersk Line Maersk India Port Qasim, Salallah. (MWE

16/0717/07 TBATBA Wadi Duka 2413W Q0651 1094192-13/06 Asyad Line Seabridge Salallah. (IEX) 19/0720/07 TBATBA SSL Brahmaputra 917W Q0781 300185-27/06 X-Press Feeders Sea Consortium Jebel Ali 22/0723/07

TBATBA X-Press Mekong 24006W Wan Hai Wan Hai Lines (I) (RGI) 29/0730/07

TBATBA Addison 006 Q0621 299109-10/06 UnifeederUnifeeder 21/0722/07

26/0727/07

TBATBA Inter Sydney 0160 Q0849 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

TBATBA BLPL Trust 2407E BLPL Transworld GLS Jebel Ali. (SMI) 31/0701/08 TBATBA Sol Prime 5401W

In Port 11/07 MSC Camille IS425A Q0737 1095144-24/06 MSC MSC Agency Salallah, King Abdulah. (Himalaya Express) Hind Terminal 12/0713/07 11/07 1600 MSC Mombasa

055W Q0794 300364-01/07 OOCL OOCL (I) (AGI-2) 12/0713/07 12/07 0200 Safeen Prism 010W Q0815 300495-03/07 Samudera Samudera Shpg. Jebel Ali, Dammam Dronagiri 19/0720/07 TBATBA Dapane 010W Q0862 300857-08/07 OOCL OOCL (I) Jebel Ali, Dammam (SIG) 15/07 16/07 MSC Brianna JU425R Q0662 1094289-14/06 MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam,Umm Qasr (UGE) Hind Terminal 26/07 27/07 TBA 1200 MSC Rafaela JU429R Q0861 1096330-08/07 16/0717/07 TBATBA SSF Dream 069W Q0777 300172-27/06 Safeen Fdrs. Sima Marine Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, Ajman, 20/0721/07

TBATBA SSF Dyamic 072W Q0813 300476-02/07 Umm Al Quwain, Ras Al Khaima. (UIG) 18/0719/07 TBATBA Hyundai Jakarta 130W Q0775 300128-26/06 ONE Line ONE (India) Karachi (FIM West Bound) 18/0719/07

TBATBA Seaspan Jakarta 428W Q0799 Maersk Line Maersk India Jebel Ali Maersk CFS 02/0803/08

TBATBA SM Neyyar 0429W Q0863 300871-09/07 Global Feeder Sima Marine Jebel Ali, Bandar Abbas. (SHE) Dronagiri 27/0728/07

TBATBA Oshairij 2414W Global Feeder Sima Marine Hamad. Dronagiri QNL/Milaha PoseidonShpg. Hamad. (IMX) Speedy CFS

Emirates Emirates Shpg. Jebel Ali, Sohar.

X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri

Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr.

Alligator Shpg. Aiyer Shpg. Jebel Ali.

BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS

Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports.

Dronagiri-3

Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

ICC Line Neptune UAE & Upper Gulf Ports. GDL-5

Team Lines Team Global Log. Gulf Ports. Conex Terminal

14/0715/07 TBATBA APL Cairo 0UW82W1 Q0828 300350-03/07 OOCL OOCL (I) (Bangladesh India Gulf Express) 17/0717/07 TBATBA Navios Verde 2425W Q0788 ONE Line ONE (India) Colombo. 19/0720/07

TBATBA Seaspan Lahore 2428W Q0819 300515-03/07 Hapag ISS Shpg. (AIM)

12/0713/07 11/07 1500 MSC Barbados IV428A Q0808 1095847-02/07 MSC MSC Agency Colombo. (INDUSA) Hind Terminal

15/0716/07 14/07 2359 Celsius Naples 903E Q0710 299792-20/07 Evergreen Evergreen Shpg. Colombo. Balmer Law. CFS Dron. 19/0720/07

TBATBA TS Hong Kong 24002E Q0831 300552-03/07 UnifeederUnifeeder Colombo. Dronagiri 22/0723/07

TBATBA Ever Excel 175E Q0842 300673-05/07 ONE Line ONE (India) Colombo. (CISC Service) 01/0802/08 TBATBA Ever Ethic 169E CSC Seahorse Colombo. 16/0717/07 TBATBA Maersk Danube 428W Q0796 300342-01/07 CMA CGM CMA CGM Ag. Colombo (MESAWA)

11/0712/07 MSC Mundra VIII IU427A Q0792 1095777-01/07 MSC MSC Agency Karachi. (INDUS)

Dronagiri

Hind Terminals 23/0724/07 TBA 0900 MSC Carmelita FD422E Q0833 1096019-04/07 MSC MSC Agency Colombo. (DRAGON EB)

Hind Terminals TO LOAD FOR INDIAN SUB CONTINENT from GTI

In Port 12/07 One Altair 065E Q0701 299670-18/06 ONE Line ONE (India) Colombo.

15/0716/07

TBATBA One Arcadia 069E Q0787 Yang Ming Yang Ming(I) (PS3 Service) Contl.War.Corpn. 18/0720/07 TBATBA One Theseus 088E Hapag/CSC ISS Shpg/Seahorse

CFS/ 25/0727/07

Conti Conquest 028E HMM HMM Shpg.

CFS 14/0715/07 TBATBA Interasia Momentum E047 Q0793 3000367-01/07 Wan Hai Wan Hai Lines Colombo. (CI2)

Dron-1 & Mul CFS 14/0715/07 14/07 1100 One Reliability 005E Q0752 300081-25/06 ONE Line ONE (India) Colombo.

18/0719/07 TBATBA Cap Andreas 012E Q0753 300082-25/06 X-Press Feeders Sea Consortium Colombo. (TIP Service) Dronagiri 21/0722/07 TBATBA X-Press Antlia 24004E Q0843 300690-05/07 CSC Seahorse Colombo. 25/0726/07

TBATBA MOL Presence 015E HMM HMM Shpg. Colombo. Seabird CFS 15/0716/07 15/07 1000 Pusan 32E Q0718 299798-20/06 OOCL OOCL (I) Colombo. GDL 21/0722/07 TBATBA Aka Bhum 022E Q0822 300513-03/07 Star Line Asia Seahorse Yangoon.(CIX-3)

Dronagiri-3

In Port 12/07 X-Press Pisces 24005E Q0732 299956-23/06 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 13/0714/07 14/07 0600 Ever Envoy 189E Q0747 300037-25/06 X-Press Feeders SeaConsortium (CWX/CIX5) 26/0727/07 TBATBA Zhong Gu Nan Ning 2404E Q0868 300934-09/07 TS Lines/PIL TS Lines(I)/PIL India

Dronagiri-2/— 12/0713/07 12/07 0200 Safeen Prism 010W Q0815 300495-03/07 Samudera Samudera Shpg. Colombo (SIG)

Dronagiri 15/0716/07 15/07 0600 Xin Hui Zhou 189 Q0681 299576-17/06 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 15/0716/07 15/07 0200 Kmarin Azur 427W Q0695 299547-16/06 Maersk Line Maersk India Colombo (MW2) Maersk CFS 26/0727/07 TBATBA Zoi 115E Q0758 1095345-26/06 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 08/0809/08

TBATBA KMTC Dubai 2404E

KMTC/Gold Star KMTC(I)/Star Ship

Dronagiri-3/— 09/0810/08

TBATBA Ever Elite 168E

X-Press Feeders SeaConsortium (NIX Service) 16/0817/08

TBATBA Monaco 108E

EmiratesEmirates

Dronagiri-2 TBA MSC MSC Agency Colombo (SENTOSA SHIKRA) Hind Terminal

15/0716/07 14/07 2100 Interasia Accelerate 0FF2CE1 Q0765 300111-26/06 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul RCL RCL Ag. (AS 1)

15/0716/07 14/07 2359 Celsius Naples 903E Q0710 299792-20/07 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 19/0720/07 TBATBA TS Hong Kong 24002E Q0831 300552-03/07 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 22/0723/07

TBATBA Ever Excel 175E Q0842 300673-05/07 PIL/ONE PIL India/One(I) —/— 01/0802/08

TBATBA Ever Ethic 169E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 05/0806/08

TBATBA Shimin 22E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 (CISC Service) TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2

HMM HMM Shpg. P.Kelang(S), Singapore, Xiangang,Qingdao, Kaohsiung. Seabird CFS

Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS

15/0716/07 15/07 2359 Beijng Bridge(NSIGT) 2404E Q0767 1095399-26/06 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 27/0728/07

01/0802/08

TBATBA GFS Giselle 2408E Q0776 300171-27/06 Heung A Line Sinokor India

TBATBA Grace Bridge 2405E

Sinokor Sinokor India Seabird CFS (CSC)

TS Lines TS Lines (I)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water PoseidonShpg. Shanghai, Ningbo, Qingdao. Speedy CFS

23/0724/07

TBA 0900 MSC Carmelita FD422E Q0833 1096019-04/07 MSC

MSC Agency Dalian, Shanghai, Ningbo, Yantian. Hind Terminals (DRAGON EB)

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR

DATE TIME NAME No.No. No.&Dt. POINT

In Port 12/07 One Altair 065E Q0701 299670-18/06 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 15/0716/07

TBATBA One Arcadia 069E Q0787 Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 18/0720/07

TBATBA One Theseus 088E HMM HMM Shpg.

Seabird CFS 25/0727/07

TBATBA Conti Conquest 028E

Samudera Samudera Shpg. Dronagiri (PS3 Service) Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate In Port 12/07 Wan Hai 502 E124 Q0768 300129-26/06 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dronagiri-1 16/0717/07

TBATBA Wan Hai 507 E224 Q0809 300421-02/07 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 24/0726/07

TBATBA Ital Unica 177E Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 30/0731/07

TBATBA Wan Hai 521 E025

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 14/0715/07

TBATBA Interasia Momentum E047 Q0793 3000367-01/07 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 19/0720/07

TBATBA Wan Hai 515 E092 Q0841 300668-05/07 COSCO COSCO Shpg. Ningbo, Shekou. 26/0727/07

02/0803/08

TBATBA Wan Hai 373 E001 InterasiaInterasia

TBATBA Jeju Island E406

HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS (CI2) CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai.

14/0715/07 14/07 1100 One Reliability 005E Q0752 300081-25/06 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 18/0719/07

TBATBA Cap Andreas 012E Q0753 300082-25/06 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 21/0722/07

TBATBA X-Press Antlia 24004E Q0843 300690-05/07 Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 25/0726/07

TBATBA MOL Presence 015E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service)

HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS

15/0716/07 15/07 1000 Pusan 32E Q0718 299798-20/06 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 21/0722/07

TBATBA Aka Bhum 022E Q0822 300513-03/07 APL CMA CGM Ag.

Dron.-3 & Mul. 23/0724/07

TBATBA OOCL Hamburg 151E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 01/0802/08

TBATBA OOCL Luxembourg 111E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3)

Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

17/0718/07

TBATBA Tonsberg OPUOEN1 Q0814 300479-21/07 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang, Cai Mep 31/0701/08

TBATBA Tessa 24004N

CU Lines/KMTC Seahorse/KMTC(I) 08/0809/08

TBATBA ESL Kabir 02427N

SeaLead SeaLead Shpg. (VGX) 19/0720/07

TBATBA GSL Nicoletta 429E Q0795

Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 26/0727/07

TBATBA CCNI Angol 430E X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3) 05/0806/08

TBATBA X-Press Carina 24032E

Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS

In Port 12/07 Ian H 02402E Q0762 300107-26/06 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 20/0721/07

TBATBA Zhong Gu Ji Nan 2004E Q0829 300554-03/07 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 20/0721/07

TBATBA Zhong Gu Fu Zhou 2401E Q0858 300849-08/07 COSCO COSCO Shpg. (AIS SERVICE) 02/0803/08

TBATBA Xin Pu Dong 275E Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2 In Port 12/07 X-Press Pisces 24005E Q0732 299956-23/06 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 14/0715/07 14/07 0600 Ever Envoy 189E Q0747 300037-25/06 X-Press Feeders SeaConsortium (CWX/CIX5)

26/0727/07

TBATBA Zhong Gu Nan Ning 2404E Q0868 300934-09/07 KMTC/TS Lines KMTC(I)/TS Lines(I)

Dron-3/Dron-2 26/0727/07

TBATBA One Matrix 090E Gold Star Star Ship 01/0802/08

TBATBA X-Press Capella 24005E

RCL/PIL RCL Ag./PIL India 08/0810/08

TBATBA TS Keelung 24003E

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 12/0713/07 12/07 0200 Safeen Prism 010W Q0815 300495-03/07 ONE Line ONE (India) Singapore 19/0720/07 TBATBA Dapane 010W Q0862 300857-08/07 Samudera Samudera Shpg. (SIG)

Dronagiri 13/0715/07 13/07 1600 Ever Dainty 179E Q0736 299970-24/06

RCL/PIL RCL Ag./PIL Port Kelang, HaIphong, Nansha, Shekou. 24/0725/07

TBATBA API Bhum 009E Q0821 300518-03/07 CU Lines Seahorse Ship 30/0731/07

TBATBA Kota Loceng 147E

Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 09/0810/08

TBATBA Ever Ulysses 161E InterasiaInterasia (RWA / CIX 4) 11/0812/08

TBATBA Vira Bhum 116E Emirates Emirates Shpg. 15/0716/07 15/07 0600 Xin Hui Zhou 189 Q0681 299576-17/06 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 27/0729/07

TBATBA Xin Beijing 146E APL CMA CGM Ag. Nansha, Taichung, Kaohsiung. Dron.-3 & Mul (CI 1)

OOCL/RCL OOCL(I)/RCL Ag. GDL/— CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung. 15/0716/07 15/07 0800 Najade E062 Q0783 300236-28/06 Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya Dronagiri-1 20/0721/07 TBATBA KMTC Yokohama E2406 Q0827 300541-03/07 KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Surabaya (AIS5/SI8 Service) Dronagiri-3/— 17/0718/07

TBATBA Wan Hai 510 E180 Q0840 300367-05/07 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 23/0725/07

TBATBA Wan Hai 506 E234

Heung A Line Sinokor India Hongkong 30/0701/08

TBATBA Yeosu Voyager E406

Wan Hai Wan Hai Lines

Dron-1 & Mul CFS 06/0808/08

TBATBA Interasia Enhance E036

InterasiaInterasia (CI6)

Feedertech Feedertech/TSA Dronagiri 20/0721/07

24/0725/07

TBATBA Al Rumeila 2414W

QNL/Milaha PoseidonShpg. Shanghai, Ningbo, Shekou. Speedy CFS (GIX)

TBATBA Hyundai Premium 093E Q0774 300126-26/06 HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai Seabird CFS 03/0804/08

TBATBA Hyundai Bangkok 0117

Sinokor Sinokor India (FIM East Bound) Seabird CFS 26/0727/07

TBATBA Zoi 115E Q0758 1095345-26/06 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 08/0809/08

TBATBA KMTC Dubai 2404E

KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay

Dronagiri-3/— 09/0810/08

TBATBA Ever Elite 168E

X-Press Feeders Sea Consortium 16/0817/08

TBATBA Monaco 108E

Emirates Emirates Shpg Dronagiri-2 23/0824/08

TBATBA ESL Busan 02431E

Pendulum Exp. Aissa Maritime (NIX Service) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS TBA MSC MSC Agency Port kelang, Singapore, Tanjung Pelepas, Laem Chabang, Hind Terminal (SENTOSA SHIKRA) Vung Tau, Da Chan Bay, Shekou.

Ital Unica 177E TS Lines TS Lines (I)

Ports. Dronagiri-2 30/0731/07 TBATBA Wan Hai 521 E025 (CIX) 14/0715/07 14/07 1100 One Reliability 005E Q0752 300081-25/06 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, Auckland, Lyttleton. 18/0719/07

TBATBA Cap Andreas 012E Q0753 300082-25/06 Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 21/0727/07

TBATBA X-Press Antlia 24004E Q0843 300690-05/07 GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR 15/0716/07 15/07 1000 Pusan 32E Q0718 299798-20/06 ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 21/0722/07 TBATBA Aka Bhum 022E Q0822 300513-03/07 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 23/0724/07

TBATBA OOCL Hamburg 151E OOCL OOCL (I) Sydney, Melbourne. GDL

01/0802/08 TBATBA OOCL Luxembourg 111E TS Lines TS Lines (I) Australian Ports. Dronagiri-2

01/0802/08 TBATBA OOCL Luxembourg 111E Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 (CIX-3) Team Lines Team Global

12/0713/07 11/07 2000 Hongkong Bridge 02SHTS1 Q0756 300078-25/06 CMA CGM CMA CGM

Yokohama Star 2429S Q0823 300519-03/07 Hapag

(SWAX) Emirates Emirates Shpg. Longoni, Dar Es Salaam, Zanzibar, Nacala &

13/0714/07 13/07 1800 Future 018W Q0818 300525-03/07 SeaLead SeaLead Shpg. Mombasa, Dar Es Salaam 28/0729/07 TBATBA Contship Uno 24010W Q0857 300826-08/07 OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA - INDIA DUBAI EAST AFRICA) GDL/— 17/0717/07 TBATBA Navios Verde 2425W Q0788 ONE Line ONE (India) Durban, Cape Town, Tema, Tincan, Apapa. 19/0720/07 TBATBA Seaspan Lahore 2428W Q0819 300515-03/07 Hapag ISS Shpg. (AIM) ULA

11/0713/07 11/07 1100 AS Sicilia 935 Q0623 299108-10/06 ONE Line ONE (India) Mombassa, Beira, Maputo. (MJI) 15/0716/07 TBATBA Marathopolis 429S Q0740 299991-24/06 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 21/0722/07 TBATBA Maersk Cairo 430S Q0802 (MWE SERVICE) 16/0717/07 TBATBA Maersk Danube 428W Q0796 300342-01/07 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 23/0724/07 TBATBA Maersk Florence 429W CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3 & Mul. 19/0720/07 TBATBA Fayston Farms 427S Q0742 299989-24/06 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3 & Mul. 25/0726/07

TBATBA AS Christiana 428S Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS (MIDAS-2) DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira.

In Port 11/07 MSC Camille IS425A Q0737 1095144-24/06 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 17/0718/07 16/07 1100 MSC Laurance IS426A Q0826 1095946-03/07 Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware 11/0712/07 MSC Mundra VIII IU427A Q0792 1095777-01/07 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Oran, Hind Terminals 18/0719/07 17/07 1000 MSC Pamela IU428A Q0851 1096267-08/07 Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa (INDUS) 12/0713/07 11/07 1600 MSC Mombasa IP428A Q0804 1095832-02/07 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 19/0720/07 19/07 0900 MSC Ruby IP429A Q0866 1096406-09/07 CMA CGM CMA CGM Ag. Dakar, Nouakchott, Banjul, Conakry, Freetown, Monrovia, Sao Tome, Bata, Dron.-3 & Mul. 26/0727/07 26/07 0900 MSC Rikku IP430A Guinea Bissau, Nouadhibou, Dakar, Abidjan,Tema, Malabo & Saotome. (EPIC / IPAK) GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK) 28/0729/07 27/07 TBA MSC Monica III IB428A Q0789 1095739-01/07 MSC MSC Agency Port Louis, Durban. (ILANGA EXPRESS) Hind Termina

15/0716/07

• HongKongandVietnamwitnessthebiggestmonth-on-monthspikeinaveragecontainerpricesinJune

• Chinaexperiencesthe largestcontainerpricehikesinceHouthiattacks,upby78%sinceOctober2023

• Market Outlook for H2 indicates cooling of container rates

HAMBURG: Container xChange, the leading digital marketplace for container trading and leasing, has released its mid-year container market forecaster The analysis delves into container price developments in H1 2024 and offers a market outlook for H2 2024.

"As we move into July, we're seeing a continued rise in freight rates, container prices, and leasing rates, driven by ongoing geopolitical tensions and resulting supply chain disruptions. The diversions around the Cape of Good Hope and the resulting congestion in major ports have created a perfect storm, causing importers in the US and Europe to pull forward orders in H1 typically reserved for Q3 This has led to a notable supply-demand imbalance While we might see a peak in July followed by a reduction in freight rates due to easing congestion and reduced demand, the ongoing conflict in the Middle East and potential new disruptions, such as labor strikes, could prolong these challenges. The container shipping industry remains on high alert, adapting to an ever-changing landscape." Inferred Christian Roeloffs, cofounder and CEO, Container xChange.

Globally, shipping costs have surged in the first half of 2024, defying the traditional off-season lull Asia and Middle East and ISC region were the regions that witnessed a significant uptick in container prices since October 2023 due to the Houthi attacks.

On the other hand, container prices remained stable or decreased, reflecting an abundance of containers in traditional import destinations. These prices have now begun to move upwards. Our mid-year forecaster gives a review of global container price developments to offer greater visibility into the trends observed during the first half of the year

Main destinations that experienced signicant container price upticks in H1’2024

Average container prices continue to rise through May and in June. Hong Kong and Vietnam experienced the biggest month on month percentage spike of 35% from May to June for trading containers, followed by China (27%), Russia (24%), Taiwan (23%) and Malaysia (23%).

India also faced a rise in average container prices spiking by 21% from May to June 2024. In Singapore, while there has been a steady rise of 31% in container prices since October 2023, the increase from May to June 2024 was a more moderate 7%.

In terms of the impact of the Houthi attacks, China stood out by a significant leap at 78% container price hike from October’23 to June’24, followed by Hong Kong (77%), Spain (42%), Uzbekistan (40%) and Thailand (35%).

Malysia (29%), Netherlands (29%), Taiwan (28%) and Vietnam followed the pack of biggest price increases since October for container prices. (40 ft high cube, cargo worthy containers)

China and Hong Kong have the highest average container prices currently across the world, namely, $3600 and $3124, respectively

Market Outlook: H2 2024

The market outlook for the second half of the year is heavily contingent on a revival in consumer demand Several factors will influence this period, including ongoing geopolitical disruptions and potential labor unrest.

Firstly, we foresee the Houthi attacks to continue and disrupt supply chains with no foreseeable resolution, exacerbating market uncertainties Additionally, labor unrest in the US east and gulf ports remains a significant potential disruption, with the possibility of flare-ups impacting supply chains further in the latter half of 2024

However, if the current market conditions persist without major changes, we expect container rates to ease. This reduction in rates could trigger an uptick in container buyer activity, as the buyer side is currently waiting for prices to decline before resuming trading and leasing activities.

Furthermore, according to Alphaliner, the global container fleet grew by 10.6% between June 1, 2023, and June 1, 2024. We anticipate that the introduction of more container fleets into the market will help alleviate some of the price pressures, potentially stabilizing the market and fostering increased trading activity.

NEW DELHI: India and Russia have agreed to enhance bilateral trade to over USD 100 billion by 2030, with a focus on investments, national currency usage for trade, and cooperation across various sectors such as energy, agriculture, and infrastructure. This decision emerged from the 22nd Annual Bilateral Summit in Moscow, where Russian President Vladimir Putin and Indian Prime Minister Narendra Modi reiterated their commitment to a "special and privileged strategic partnership "

The two sides agreed on nine key areas of cooperations that spanned trade, trade settlement using national currencies, increased cargo turnover through new routes

such as the North-South Transport Corridor, raising volume of trade in agri products, food and fertiliser, deepening cooperation in the energy sector, including nuclear energy, strengthening interaction for infrastructure development, promotion of investments and joint projects across digital economy, collaborating on supply of medicines and development of humanitarian cooperation.

The leaders agreed to aspire "for elimination of nontariff trade barriers related to bilateral trade between India and Russia" and continue "dialogue in the field of liberalisation of bilateral trade, including the possibility of the establishment of the EAEU-India Free Trade Area".

COPENHAGEN: The initial disruptions to global supply chains triggered by the pandemic had a profound impact on non-alliance services those operated independently of existing alliance structures. Many of these services ceased operations on major East-West trade routes. However, the subsequent surge in demand for goods, coupled with rising spot rates, prompted a significant influx of non-alliance capacity into the market. So much so, that even on Asia-North Europe, which had predominantly been an alliance operated trade, saw the entry of several niche carriers offering solitary services.

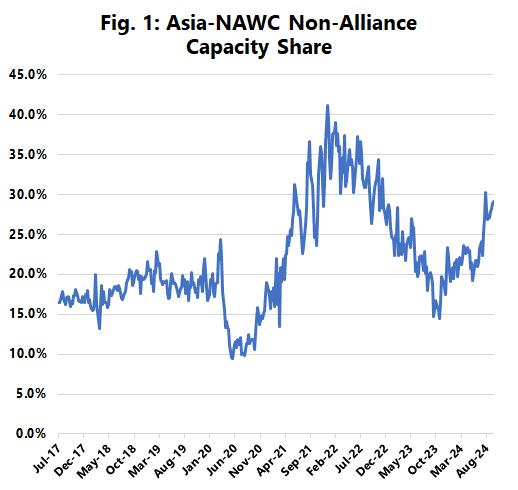

Figure 1 shows the historical share of non-alliance capacity in the Asia to North America West Coast trade, as well as 12 weeks into the future, based on current deployment plans from the shipping lines. As such, the Asia-North America West Coast trade lane is poised to see a sharp increase in the capacity share of non-alliance services in the coming months. The data shows that nearly 30% of the deployed capacity on the trade lane is scheduled to be offered on services that are operated outside of the alliance structures. We see a similar pattern for AsiaNorth Europe, but less so for Asia-North America East Coast and Asia-Mediterranean. On Asia-North Europe, if the current 12-week outlook holds, we will see record levels (touching 12%) of non-alliance capacity on the trade lane.

Across the main East-West trades, it is clear that the main driver of the non-alliance share is spot rates; a sharp

increase in spot rates during the pandemic triggered a sharp increase in non-alliance services, and vice versa when the spot rates collapsed in the second half of 2022. This pattern is now repeating again, as the sharp spot rate increases seen in recent months, once again coincide with an increase in non-alliance services.

NOIDA: Greater Noida’s Dadri will be seeing the development of a multi-modal logistics hub (MMLH) with an investment of Rs 7,064 crore from the UP Government as part of its commitment to attain a $1 trillion economy goal The hub will be covering an area of 823 acres, with 455 acres being the core development area.

Under this, developments are in progress for commercial and administrative facilities spanning 17.5 acres, along with a rail yard and additional projects covering 350 acres A detailed action plan has been designed, in accordance with Chief Minister Yogi Adityanath’s directives, aiming to expedite all the initiatives.

The action plan aims to transform the Dadri multi-modal logistics hub into a world-class freight handling facility Functioning as a dry port, it will ensure the swift transit of goods and raw materials. This ambitious project is set to become India’s largest logistics hub

Located on the eastern and western dedicated freight corridors, the multi-modal logistics hub of Dadri, will serve as a central hub for services including container handling, warehousing, cold storage, processing, de-stuffing, stuffing, and value-added packing.

Providing seamless rail connectivity, it will include essential amenities such as rail platforms, customs clearance facilities, cargo segregation areas, truck parking zones, and extensive green spaces.

The development of the MMLH in Dadri is advancing under the Public-Private Partnership (PPP) model, overseen by the Greater Noida Industrial Development Authority and adhering to the guidelines of the National Industrial Corridor Development and Implementation Trust (NICDIT).

KOLKATA : Shri Rahi

Samrat, Dy. Chairman, SMP Kolkata, extended a w a r m w e l c o m e t o t h e Bangladesh Delegation led by Joint Secretaries at Kolkata Airport.

The delegates came for a visit to the Kolkata Dock System & Haldia Dock Complex between July 9 & 12, 2024. This visit strengthens IndiaBangladesh ties.

NEW DELHI: In a potential shift of policy, India, the world’s leading rice exporter, is contemplating the relaxation of restrictions on certain rice varieties, according to sources close to the matter This move is being considered to prevent a domestic surplus as the new harvest approaches in October

Under consideration are plans to permit white rice exports with a fixed duty, and to replace the current 20 per cent tax on parboiled rice exports with a fixed levy

The latter change aims to discourage under-invoicing of shipments. These modifications, if implemented, could have a cooling effect on benchmark Asian rice prices, which reached a 15-year high in January following India’s export restrictions initiated in 2023.

Such policy adjustments could bring relief to countries in West Africa and the Middle East, which heavily depend on India for their rice supplies.

Recent data reveals a significant decline in India’s rice

exports. In the first two months of the fiscal year beginning April 1, total rice exports dropped 21 per cent year-on-year to 2.9 million tons.

Non-basmati rice exports saw an even steeper decline of 32 per cent, totalling 1.93 million tons during the same period. Meanwhile, India’s agricultural sector is in the midst of the main rice sowing season, coinciding with the onset of the monsoon.

Planting is expected to peak in July, with harvesting scheduled to commence in late September As of July 8, the rice acreage stood at 6 million hectares, marking a 19 per cent increase from the previous year

This growth is attributed to a recovery in monsoon rains following a deficit in the previous month.

These developments in India’s rice export policies and domestic production could have significant implications for global rice markets and food security in rice-importing nations.

HAMBURG: Plans to increase capacity of the Middle Corridor rail freight route from China to Europe, as reports, are likely to be far more important to Central Asian shippers than the European importers using it as an alternative to sea freight.

“Land will never be an alternative to sea, or even air, on the Asia-Europe trades,” Verspucci Maritime’s Lars Jensen told delegates at last month’s TOC Europe event in Rotterdam.

“I’m sorry, but it’s a niche – these rail services aren’t going to replace shipping because of the sheer volume of goods that are moving around the world.

“A 1km-long train can carry 100 teu, 200 teu if it is doublestacked, which means a 1,000km train would equal one ship – I see this as niche products that will play a role for a subset of shippers,” he explained.

Maersk is one carrier that has been offering shippers and for warders the Middle Corridor option, although Irakli Danelia, its Central Asia & Caucasus Region Business Development Manager, admitted that the carrier’s capacity from China to Europe was limited.

One issue for supply chain planners is there seems to be considerable disparity over transit times – Chinese media has reported that it is 12 days from China to Istanbul, while Mr Daniela contends it is rather longer

“20-23 days from Xian to Ambarli [Istanbul’s container terminals] is theoretically possible, and if we compare the setup with 2020, at that time the corridor was subsidised by China, but now it is both time- and cost-competitive The transit time has shrunk from 32 days to 15 to get to Poti, and if capacity rises we will be able to provide greater flows.”

He explained that Maersk, in cooperation with stateowned rail companies across Central Asia, was now operating four block trains a month, each with 100-110 teu capacity, and the future success of the route would depend on those

countries expanding their rail freight capacity – both on land and on the Caspian Sea transit. And coordination between China, Kazakhstan and Georgia was also crucial to the corridor’s development, he said.

“They have already cleared the budget to add more rail platforms at the Caspian ports, and we understand that larger rail-ferry vessels will come into service in December 2025. The ships are owned by the state rail firms so we are very much reliant on them,” he added.,

Nonetheless, he had high hopes for sustained volume growth on the route, but explained that its long-term future was as a trade artery for Central Asia itself, given that at some point the Russia-Ukraine war will come to an end, and with it the prospect of fully reopening the Trans-Siberian Railway to European importers.

“We are expecting to see volume growth of up to 33% by the end of this year, and we are also hoping to develop the Central Asia market itself.

“One of the main issues we are facing is the lack of containerisation in the region. If the Russia-Ukraine war stops there will still be a need for this service, as we don’t want to focus on Asia-Europe FAK traffic – we are, instead, looking for stable cargo into and out of these countries, especially if we can containerise their exports,” he said.

Mr Jensen noted that land-based corridors were equally exposed to geopolitics, as well as maritime trade, and “you can’t move rail once it is built”, he added. What had previously attracted shippers to Asia-Europe rail services was largely determined in the shipping market, he said.

“During the pandemic the move to rail was because the rates were the same as shipping, and it is quicker and less prone to port congestion.

“This is less an alternative corridor and more a primary means of serving Central Asia.”

Cargo Steamer's Agent's ETD

Jetty Name Name

CJ-I Doris Arnav Shpg. 14/07

CJ-II Doctor O DBC 12/07

CJ-IIA Global Asphalt Preetika Shpg. 12/07

CJ-III Haj Abdallah T DBC 13/07

CJ-IV Fuji Harmony Upasana Shpg. 14/07

CJ-V DL Marigold Arnav Shpg. 12/07

CJ-VI African Gannet DBC 14/07

CJ-VI Efe Bosphorus Dariya Shpg. 15/07

CJ-VIII VACANT

CJ-IX Evanthia TM International 13/07

CJ-X VACANT

CJ-XI TCI Anand 009 TCI Seaways 12/07

CJ-XII VACANT

CJ-XIII Billy Jim Interocean 17/07

CJ-XIV Propel Success ACT Infra 14/07

CJ-XV SW South Wind Synergy Seaport 15/07

CJ-XVA Thor Friend Chowgule S. 13/07

CJ-XVI Hampton Ocean Shantilal Shpg. 17/07

TUNA VESSEL'S NAME AGENT'S NAME ETD KM Osaka Taurus 12/07

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I VACANT

OJ-II Ocean Thalia

OJ-III Lavendar Ray Samudra 12/07

OJ-IV Sanmar Santoor

OJ-V Stolt Focus JMBaxi 12/07

OJ-VI Dhan Laxmi

OJ-VII Siya Ram Marinelinks 12/07

Defne 06/07 Jeddah

Pera 06/07 Germany

Diva 07/07 Antwerp

Ultra Ocelet 07/07 Netharland

MK Lamis 08/07 Somalia

Source Blessing 09/07 Jebel Ali

SCI Mumbai 10/07 Jebel Ali

TCI Express 10/07 Manglore/ Cochin/Tuticorin

10/07

10/07 Sudan CMB Jordaens 10/07 China

CJ-VI African Gannet DBC Australia 35,100 CBM P. Logs 2024061304 11/07 African Piper Synergy Seaport Uruguay 32,139 CBM Pine Logs 12/07 African Raptor Dariya Shpg. Indonesia 59,350 Coal In Bulk

CJ-XIII Billy Jim Interocean San Lorenzo 75,100 T. Sugar Bulk 2024061362

CJ-V DL Marigold Arnav Shpg. USA 19,604/9,661 T. SSS/HMS INIXY124070018

CJ-VI Efe Bosphorus Dariya Shpg. South Africa 59,090 T. SA Steam Coal In Bulk

CJ-IX Evanthia TM International 15,750 T. HRC INIXY124070036

CJ-IIA Global Asphalt Preetika Shpg. 4,481 T. Bitumen In Bulk INIXY124070043

Stream Global Crest Preetika Shpg. 2,001 T. Bitumen In Bulk

11/07 Gramba Synergy Seaport New Zealand 43,055 CBM Pine Logs 2024061361

12/07 Hai Phoung 87 Chowgule S. Indonesia 5,051 T. Wood Pulp 2024061329

15/07 Jal Kamal Dariya Shpg. Indonesia 35,800 T. Coal In Bulk Tuna KM Osaka Taurus USA 59,136 T. US Steam Coal In Bulk INIXY124070024

11/07 Ram Commander Mystic Shpg. China 17 Nos Wind Mill Blades/ INIXY124070006 Accessories/1 SOC Container (216 PKGS-1046 T)

11/07 Taokas Wisdom Synergy Seaport Surinam 15,252 CBM T. Logs

CJ-XVA Thor Friend Chowgule S. Indonesia

T. Ferro Nickel In J Bags INIXY124070037

13/07 Wu Yang Glory Dariya Shpg. Russia 73,269 T. Russian Coal In Bulk 12/07 Yin Xing Hu Dariya Shpg. Indonesia

T. Metcoke In Bulk

12/07 Forshun Samudra Saudi Arabia

14/07 Fulda Scorpio Shpg.

15/07 Furano Galaxy GAC Shpg.

Stream Korea Chemi Samudra Taiwan

Stream Kruibeke Seaworld Shpg

OJ-III Lavendar Ray Samudra China

Stream Maersk Belfast Interocean Brazil

18/07 Seapromise Interocean San

13/07 Silver Valerie Interocean

OJ-VII Siya Ram Marinelinks

14/07 Southern Shark GAC Shpg.

OJ-V Stolt Focus J M Baxi

2024061372

CDSBO 2024061274

Chem In Bulk INIXY124070050

Chem In Bulk 2024061352

Propane/Butane 2024070066

T. Chem In Bulk INIXY124070021

CDSBO 2024061318

INIXY124070055

2024061337

INIXY124070002

Phos Acid INIXY124070032

11/07-PM Maersk Cabo Verde 428S 4062356 Maerssk Line Maersk India Port Casina, Mombasa (MAWINGU)

13/07 13/07-AM AS Susanna 10 4062346 Unifeeder Transworld Shpg. Maputo (MJI)

15/07-PM Kmarin Azur 427W 4062350 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA)

TO LOAD FOR FAR EAST JAPAN,

& AUSTRALIAN PORTS

11/07-AM X-Press Phoenix 4027E 4062396 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 12/07 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

12/07 11/07-PM Inter Sydney 159 4070159 Interworld Efficient Marine China (BMM)

12/07 12/07-AM Northern Guard 924E 4062493 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16) 13/07 16/07 16/07-AM Beijing Bridge 2404 4072582 Global Feeder Sima

TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, Port Kelang (FEX1)

TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, (FEX) TO LOAD FOR INDIAN SUB CONTINENT

15/07 15/07-PM Kmarin Azur 427W 4062350 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA)

12/07 Northern Guard (V-924E) 4062493 Unifeeder Agency Nhava Sheva 12/07 Maersk Cabo Verde (V-428S) 4062356 Maersk India Port Qasim

13/07 Seaspan Jakarta (V-428W) MBK Logistics Jebel Ali

X-Press Cassiopeia (V-4026E) Colombo 08-07-2024 AL Rumeila (V-2413W) Nhava Sheva 08-07-2024 Zhong Gu Hang Zhou (V-24001E) Colombo 08-07-2024

(FIVE) 13/07 11/07-AM Najade 62E 2402479 Wan Hai Line Wan Hai Lines Port Kelang, Jakarta, Surabaya. (SI8 / JAR)

17/07 16/07-PM KMTC

(CWX)

Felixstowe. Dunkirk, Le Havre 12/07 16/07 16/07-PM MSC Mombasa IP428A 2402491 CMA CGM CMA CGM Ag.(I) & Other Inland Destination in Europe, Med,Red

Hamburg, Antwerp & Other Inland Destn.(HIMEXP) 15/07 14/07 14/07-AM MSC Barbados IV428A 2402296 MSC MSC Agency Barcelona, Valencia (INDUSA) 15/07 17/07 14/07-AM Jolly

27/07-2000 CCNI Angol 430E 24241 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan

13/07 13/07-1030 Cape Andreas 012E 24221 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang.

15/07-1300

COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 16/07 Nansha, Port Kelang (CI1)

12/07 11/07-1800 Maersk Kensigton 427W 24223 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL)

15/07-0300

11/07

11/07 AS Sicilia (V-935W) Unifeeder/One Unifeeder/One India Gulf

27/07 BLPL Trust (V-2407E) BLPL Transworld GLS Far East

15/07 Beijing Bridge V-2404E)(NSIGT) Global Fdr/TS Lines Sima Marine/TS Lines (I) Far East

27/07 GFS Giselle (V-2408E) Sinokor/Heung A Line Sinokor India

Car.CB-4 CMA CGM San Antonio (V-426S)(Sailed) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa 2381943 11/07 CB-5 Grasemere Maersk (V-428W) Maersk Line Maersk India U.K. Cont. 2381985 11/07 21/07 Inter Sydney (V-0160) Interworld Efficient Marine Gulf 22/07 11/07 Konrad (V-0324W) Akkon Lines Oasis Shipping Europe/Med. 12/07 12/07 MSC Barbados (V-IV428A) MSC MSC Agency U.S.A. 2382117 13/07

Car.CB-5 Maersk Cubango (V-427W)(Sailed) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India Africa 2381880 11/07 15/07 Marathopolis (V-429S) Maersk Line Maersk India Africa 16/07 13/07 Maersk Kensington (V-427W) Maersk Line Maersk India Mediterranean 14/07 13/07 Shamim (V-1329W) HDASCO Armita India Gulf 14/07 Car.CB-5 Ever Sigma (V-127E)(Sailed) Unifeeder/KMTCUnifeeder/KMTC(I) Far East & 2381682 10/07

15/07 Celsius Naples (V-903E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo

19/07 TS Hongkong (V-24002E) ONE/TS Lines ONE (I)/TS Lines(I)

19/07 SSL Brahmputra (V-917W) Wan Hai/Unifeeder Wan Hai Lines (I)/Unifeeder Jebel Ali

22/07 X-Press Mekong (V-24006W) X-Press Feeder Sea Consortium

13/07 Tessa (V-2404S) (GTI)

16/07 Wadi Duka (V-2413W)

11/07 MSC Mundra VIII (V-IU427A) MSC

12/07 MSC Mombasa (V-IP428A) MSC/Hapag MSC Ag/ISS Shpg.

CB-6 MSC Camille (V-IS425A) MSC/SCI MSC

23/07 MSC Camelita (V-FD422E) MSC MSC

28/07 MSC Monica III (V-IB428A) MSC

12/07 Seaspan Beacon (V-4127)(GTI) CMA-CGM/APL CMA CGM Ag.(I)

14/07 APL Le Havre (V-OINHDW1) Hapag/OOCL

Car.CB-6 Sofia Express (V-4326W)(Sailed) COSCO COSCO Shpg.

13/07 Frankfurt Express (V-4327W)(GTI) Hapag / ONE ISS Shpg./ONE(I)

20/07 Kyoto Express (V-4328W) CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I)

COSCO/ONE COSCO Shpg./ONE (I)

18/07 Cautin (V-OMXJXW1)

17/07 Celsius Nairobi (V-0912)

14/07 Interasia Momentum (V-E047)

19/07 Wan Hai 515 (V-E092)

11/07 Maersk Guayaquill (V-427W) Maersk

Car.GTI-2 Maersk Frankfurt (V-24028E)(Sailed) Maersk Line Maersk India Far East

19/07 GSL Nicoletta (V-429) X-Press Feeder Sea Consortium

14/07 One Reliability (V-005E) ONE ONE (I) Karachi &

18/07 Cap Andreas (V-012E) X-Press Feeders Sea Consortium Far

GTI-1 One Altair (V-065E) ONE/HMM ONE (I)/HMM Shpg. Far East &

15/07 One Arcadia (V-069E) Yang Ming Line Yang Ming Line (I) China

14/07 Hyundai Hongkong (V-0001) ONE/HMM ONE (I)/HMM Shpg. USA

17/07 Tonsberg (V-OPUOEN1) Global Fdrs./CU Lines Sima Marine/Seahorse Gulf

31/07 Tessa (V-24004N) Emirates/KMTC Emirates Shpg./KMTC (I)

RCL/CMA CGM RCL Ag./ CMA CGM Ag.(I)

GTI-2 Wan Hai 502 (V-E124) Hapag/Evergreen ISS Shpg/Evergreen China

16/07 Wan Hai 507 (V-A224) Wan Hai Wan Hai Lines (I)

15/07 Pusan (V-32E) RCL/OOCL RCL Ag./OOCL(I) Far East

21/07 Aka Bhum (V-022E) Zim/COSCO Zim Int./COSCO Shpg.

20/07 Al Rumelia (V-2414) QNL/Milaha Poseidon Far East/

27/07 Oshairij (V-2414W) X-Press Feeder Sea Consortium Gulf

13/07 CSCL Neptune (V-080W) CMA CGM/APL CMA CGM Ag. (I) U.K.

16/07 CMA CGM Titan (V-OPE9LW1) COSCO / OOCL COSCO Shpg./OOCL(I)

13/07 Ever Dainty (V-179E) RCL/PIL/CU Lines RCL Ag./PIL India/Seahorse Far East

24/07 API Bhum (V-009E) Interasia/Evergreen Interasia Shpg./Evergreen Shpg.

16/07 Haian East (V-24023W) Sealead Sealead Shipping Mediterranean

18/07 Hyundai Jakarta (V-130W) HMM/TS Lines HMM Shpg./TS Lines(I)

24/07 Hyundai Premium (V-093E)

BMCT-3 Ian H (V-02420E) KMTC/TS Lines KMTC(I)/TS Lines(I) Far East

20/07 Zhong Gu Ji Nan (V-2004E) COSCO/Emirates COSCO Shpg./Emirates Shpg.

Car.BMCT-3

15/07 Kamrin Azur (V-427W) Maersk Maersk India

15/07 MSC Brianna (V-JU425R) MSC MSC Agency

Car.BMCT-2 Northern Guard (V-E921)(Sailed) Sinokor/Heung A Sinokor India Far East

17/07 Wan Hai 510 (V - E180) Interasia Line Interasia Shpg.

Unifeeder/Wan Hai Unifeeder/Wan Hai Lines (I) 13/07 Seaspan Jakarta (V-0428W) Maersk/Safeen Feeders Maersk India/Sima Marine Jebel Ali

02/08 SM Neyyar (V-0427W)

BMCT-1 Sprinter (V-055W) COSCO/OOCL COSCO Shipping/OOCL (i) Gulf