Ltd, a unit of Mumbai-based J M Baxi Group, is set to win the rights to run the shallow water and coastal berths at State-owned Jawaharlal Nehru Port Authority (JNPA) on public-privatepartnership(PPP)mode.

J M Baxi Ports & Logistics placed a price bid of Rs84.4pertonneofcargohandledattheberths,toemerge the highest bidder, when the price bids were opened recently,multiplesourcesinformed.

GANDHINAGAR:Toexecute“PMGatiShaktiNational Master Plan” implemented by the Prime Minister, The PM Gati Shakti Gujarat portal was launched by the Chief Minister Shri Bhupendra Patel in a seminar organized under “Azadi @75 : PM Gati Shakti Gujarat” at Gift City, Gandhinagar. This portal will prove to be very vital to realize the vision of Prime Minister as well as for speedyimplementationofthismasterplan. Cont’d. Pg. 6 & 15

Port tenders at Major Ports (owned by the Centre) are decidedonthebasisofroyaltypertonne–theentitywilling to share the highest royalty per ton of cargo handled at the berthwiththeportauthoritywinsthedealfor30years.

This is the second contract win for J M Baxi Ports & Logistics at Jawaharlal Nehru Port and the third overall acrossMajorPorts,inrecentmonths.

In June, the firm led by Dhruv Kotak won the tender issued by Jawaharlal Nehru Port Authority (JNPA) to privatise the container handling terminal self-run by the State-owned port authority located near Mumbai.

Cont’d. Pg. 27

India to accord top priority to na�onal interest in FTA nego�a�ons; Government will not diverge from this approach for the sake of deadlines: Shri Piyush Goyal

NEW DELHI: The Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, Piyush Goyal recently said that India would accord top priority to national interest in FTA negotiations. FTAs to be entered into after thorough consultation with all stakeholders including industry and the Government will not diverge from thisapproachforthesakeofdeadlines,headded.

Cont’d. Pg. 17

Cont’d. from Pg. 2

Gujarat Chief Minister Shri Bhupendra Patel has clearly stated that, Under the leadership of Prime Minister Shri Narendra Modi, Gujarat has become a state that has brought about a large-scale change in the infrastructure landscapewiththe implementationof the Focused Targeted ActionPlaninvarioussectors.

Shri Bhupendra Patel proudly mentioned that “Gujarat has become the first state in India to launch Gati Shakti Portal at the state level under the strong guidance and directionofPrimeMinisterShriNarendraModi.”

Stating that Prime Minister Narendra Modi’s “PM Gati Shakti National Master Plan” willcontributesignificantlyto strengthening India’s infrastructure landscape, the Chief Minister added that, “This plan will ensure not only ease of

innovative initiative of “Pravasi Path” in the state. The initiative has benefited more than 24 districts of the state with concentrated investments of over Rs.2300crore“.

He added that through “Railway Connectivity”

Gujarat has been a pioneer in promoting development in the railwaysectoraswell.

doing business but also ease of living for the citizens”. He appealed to the participants of the seminar to explore the opportunities offered in the state and become partners in the growth of Gujarat and India as Gujarat offers immense opportunitiesforglobalbusinesswithitsfavourableindustrial ecosystem, huge potential market, political stability and reliablegovernance.

The Chief Minister further said that, the “Prime Minister has played a pivotal role in strengthening the balanced and regional development of Gujarat with his visionary reforms. The emphasis on enhancing connectivity in the state for economic prosperity and the implementation of focused targeted action plans for the same has resulted in a major transformationofthestate’sinfrastructurelandscape.”

Elaborating about the far-sighted initiatives, reforms and work plans implemented in Gujarat under the guidance of the Prime Minister, the Chief Minister said, “The “Pragati Path” scheme 9 high-speed corridors connecting the ends of the state will be made wider and strong. A total of 3710 km long highways will be prepared in this project at a total cost of Rs 2488 crore. Similarly, the “Vikas Path” program is operational to modernize state roads passing through municipalities, urban areas, citiesandbigcities”.

“The “Kisan Path” initiative has improved the quality of life of farmers and their farm produce and milk reaches the market more rapidly. Apart from this, the tourism industry has gained momentum with the improved connectivity between more than 60 tourist destinations through the

Under the guidance of the Prime Minister, Gujarat has developed an integrated state-wide gas grid on an open access-common carrier basis. A pipeline gas grid network in 25 districts connecting major industrial centres is operational in the state. Similarly, a mission mode project “Water Grid” has been undertaken to establish a state-wide water grid network of 75,000 km for distribution of water for irrigation and drinking water grid to supply water to over 14,000 villages and154towns.

He further added that, The state government has implementedthefirstportpolicyencouragingprivatesector participation for the development of ports. India’s first private port Pipavav in Gujarat was developed under the leadershipofthePrimeMinister.

Moreover, four green field port locations have been established in the state. On the other hand, in the power supply sector, Gujarat has made extensive improvements in power generation, transmission and distribution and achievedthestatusofPowerSurplusStatein2009andtoday, 24×7 uninterrupted quality power supply is being made availableinGujarat.

StatingthatGujaratisattheforefrontinthecountry when It comes to implementing of BharatNet Project, the Chief Minister said, “Gujarat has successfully implemented various digital reforms and projects like Digital Seva Setu Platform, GSWAN. Industrial infrastructure projects, 12-lane Delhi-Mumbai Expressway, rail corridors connecting major cities of Gujarat and Mumbai-Ahmedabad high speed rail projects have been undertaken to further acceleratethestate’sdevelopmentjourney”.

MUMBAI: The domestic road logistics sector is expected to continue its growth momentum in FY23 supported by the accelerated pace of business activities, following a healthy growth in FY22. Ratings agency, ICRA maintains its growth estimates of ~7%-9% in FY23 over FY22. The ability of the organised players to command a price premium because of fuel price inflation, along with cost reduction initiatives, willsupportoperatingprofitabilityinFY23.

However, the margin movement will continue to depend on customer demand attitudes, diesel price fluctuations, and the industry’s competitive intensity. As a result of the anticipated debt-financed capital expenditures for vehicle replacement required prior to the commencement of the scrappage policy and the rising interest rate environment, it is anticipated that debt coverage metrics will marginally weakeninFY23relativetoFY22levels.

The introduction of the National Logistics Policy (NLP), aimed at promoting seamless movement of goods, overcoming transport-related challenges, and encouraging digitization along with the significant reduction in time and cost,istargetedtoreducethelogisticscostsfrom~13%-14%of GDP to single digits. This augurs well for the road logistics sector, as it shall reduce the overdependence on road through better integration of different modes of transport and in turn improve demand identification and ensure better availability of trucks. The implementation, however, remains the key, given the coordination of multiple agencies, stakeholders, andphysicalentitiesinvolved.

Suprio Banerjee, Vice President and Sector Head –Corporate Ratings, ICRA Limited, said, “The logistics sector’s quarterly revenues increased by 5.8% in Q1 FY23 compared to Q4 FY22, thanks to solid and sustained demand from the manufacturing sector. The revenue remains close to

multi-year high quarterly revenues, supported by sustained recovery in industrial activities. This is also reflected by the stability in monthly e-way bill volumes as well as FASTag volumes during Q1 FY23, which also continue in the current quarter for July-Aug 2022. Following a 16.5% growth in FY22 (overpre-Covidlevels)anda5.8%growthinQ1FY23supported by a revival in economic activities and firm freight rates, ICRAexpectsthelogisticssectortogrowby7%-9%YoY.”

“On the other hand, elevated crude oil prices due to the Russia-Ukraine conflict witnessed from Q4 FY22 also had an impact on the margins of the sector. While the larger players have managed to hike rates to a large extent in FY22, their sustained ability to do the same rates remains to be seen. Most of the organised players were able to pass on the increase in fuel cost to its customers as reflected by healthy operating margins of 14.0% in FY22 and 13.5% in Q1 FY23 against12.1%inFY2021,”headded.

ICRA expects the aggregate operating profit margins of the sample to remain in the range of 12%-14% in FY23, compared to 14.0% in FY22. Revenue growth over the medium term would continue to be driven by demand from varied segments like e-commerce, FMCG, retail, chemicals, pharmaceuticals, and industrial goods coupled with the industry’sparadigmshifttowardsorganisedlogisticsplayers, post-GSTande-waybillimplementation.

Furthermore, multimodal offerings are likely to gain increased acceptance and traction going forward, given that players offering multimodal services had more flexibility. Given these factors, and the relatively higher financial flexibility available at large, organised players vis-à-vis their smaller counterparts, there is potential for increased formalisation in the sector going forward. In addition to these, timely and effective implementation of the National Logistics Policy would be key to providing a requisite impetus to thesector.

Dunkirk, Felixstowe,

Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS

COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP

TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2

AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3 Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports. Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

10/10 11/10 10/10 1200 MSC Flavia IV240A N1238 256280-30/09

MSC

MSC Agency Gioia Tauro, Valencia, Sines. (INDUSA)

17/10 18/10 TBA 0900 MSC Topaz IV241A N1277 256615-07/10 24/10 25/10 TBA 0900 MSC Maria Elena IV241A 12/1013/10 12/10 0900 MSC Ivana IU240A N1237 256278-30/09 MSC MSC Agency Haifa. (INDUS)

Hind Terminal

Hind Terminals

12/10 13/10 12/10 0900 Henrika Schulte IX239A N1236 256271-30/09 MSC MSC Agency Barcelona, Valencia, Sines, Gioia Tauro (INDUS 2) Hind Terminals 18/10 19/10

MSC Sariska IX240A N1117 255381-16/09 25/10 26/10

Bremerhaven IX241A N1231 256204-29/09 14/1015/10 13/10

Irene IS241A N1243 256386-03/10 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 21/1022/10 21/10

Tainaro IS242A N1279 256622-07/10 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, Himalaya Express U. K. North Continent & Other Mediterranean Ports.

Service

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa. Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 14/1015/10

TBA TBA Nagoya Express 2340W N1227 256191-29/09 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 22/1023/10

Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 28/1029/10

TBA TBA One Henry Hudson 084W

TBA TBA Tsingtao Express 2342W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 04/1105/11

TBA TBA Sofia Express 2343W

ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

11/1012/10 11/10 2100 Yantian Express 2237W N1208 256024-27/09

TBA TBA CMA

Cagliari

(IMEX

&

Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 18/1019/10

25/1026/10

Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 01/1102/11

other Inland

ETAETD

TIME

V.I.A ROT.

No.No. No.&Dt.

11/1012/10 11/10 2300 Celsius Naples 891E N1184 255731-22/09 TS Lines TS Lines (I) Vancouver Dronagiri-2 15/1017/10 TBA TBA Shimin 22006E N1230 256194-29/09

(CISC Service)

MSC MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals 21/1022/10 21/10 0900 MSC Tianping IP242A

14/1015/10 14/10 0900 MSC Aino IP241A N1224 256170-28/09

Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira,Paita, 28/1029/10 28/10 0900 MSC Pina IP243A

Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC 1 / IPAK)

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America

Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 24/1025/10 23/10 2000 Maersk Pittsburgh 241W N1172 255325-15/09 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 31/1001/11 30/10 2000 Maersk Denver 242W N1166 US East Coast Ports. Middle East Container Lines(MECL)

17/1018/10 16/10 2000 Maersk Atlanta 240W N1176 255317-15/09

07/1108/11 06/11 2000 Maersk Hartford 243W

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1

In Port 10/10 CMA CGM Butterfly 0INCPW1 N1209 256026-27/09

CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 16/1017/10 TBA TBA Express Rome 2141 N1239 256298-30/09 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 23/1024/10 TBA TBA Navios Constallation 2142 N1276 Hapag ISS Shpg.

ULA CFS

30/1031/10

06/1107/11

TBA Athenian 2143

TBA CMA CGM Orfeo 2144

ONE Line ONE (India)

COSCO COSCO Shpg. India America Indial Indial Shpg. US East Coast & South America Express (INDAMEX)

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3

Team Lines Team Global Log. Norfolk, Charleston.

JWR Logistics

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 17/10 18/10 TBA 0900 MSC Topaz IV241A N1277 256615-07/10

10/10 11/10 10/10 1200 MSC Flavia IV240A N1238 256280-30/09

24/10 25/10 TBA 0900 MSC Maria Elena IV241A

11/10 12/10 12/10 0900 Henrika Schulte IX239A N1236 256271-30/09

MSC MSC Agency Halifax, Boston, Philadelphia, Baltimore, Evergrate, Hind Terminals 18/10 19/10 TBA 1500 MSC Sariska IX240A N1117 255381-16/09 Freeport, Huston. (INDUS 2) 12/1013/10 12/10 0900 MSC Ivana IU240A N1237 256278-30/09

MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 19/1019/10 TBA 0900 MSC Mumbai VIII IU241A N1274 256609-07/10 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 26/1027/10 TBA 0900 MSC Adonis IU242A 14/1015/10 13/10 1500 MSC Irene IS241A N1243 256386-03/10 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 21/1022/10 21/10 0700 Cape Tainaro IS242A N1279 256622-07/10 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, (Himalaya Express) Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel Globelink Globelink WW USA, East & West Coast. (Himalaya Express)

In Port 10/10 Kota Gabung 0096 N1198 255927-26/09

CU Lines Seahorse Ship Los Angeles. (RWA)

In Port 11/10 Aka Bhum 009E N1188 255733-22/09

OOCL OOCL(I)

USA East Coast & Other Inland Destinations. GDL 12/1013/10

RCL RCL Ag USA East Coast & Other Inland Destinations. 17/1018/10

TBA TBA OOCL New York 089E N1219 256089-27/09

COSCO COSCO Shpg. US West Coast. 26/1027/10

TBA TBA OOCL Hamburg 138E

TBA TBA OOCLLuxembourg 098E

Yang Ming Yang Ming(I)

Express III - (CIX-3) Contl.War.Corpn.

& Dron-3

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR CARTING DATE TIME NAME No.No. No.&Dt. POINT

In Port 11/10 SSL Mumbai(NSICT) 2204W N1228 256192-29/09 QNL/Milaha PoseidonShpg. Hamad, Jebel Ali.

Speedy CFS 15/1016/10 TBATBA Majd 2221W N1250 256404-03/10 (NDX)

12/10 13/10 12/10 1100 BFAD Atlantic 241W N1163 255310-15/09

Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile)

Maersk CFS 13/1014/10 TBA TBA Kashan 1276W N1245 256398-03/10 HDASCO Armita India Bandar Abbas, Chabahar. (IIX) 14/1015/10 14/10 0900 MSC Aino IP241A N1224 256170-28/09 CMA CGM CMA CGM Ag. King Abdullah. Dron.-3 & Mul. 21/1022/10 21/10 0900 MSC Tianping IP242A

MSC MSC Agency King Abdullah. Hind Terminals 28/1029/10 28/10 0900 MSC Pina IP243A

SCI J.M. Baxi Salallah (EPIC 1 / IPAK) 15/1016/10 15/10 0600 Lana 241S N1177 255315-15/09 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE)

Maersk CFS 17/1018/10 16/10 2000 Maersk Atlanta 240W N1176 255317-15/09 Maersk Line Maersk India Salallah. (MECL)

Maersk CFS 20/1021/10

Inter Sydney 0107 Lubeck Giga Shpg. Bandar Abbas, Chabahar (BMM) Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

10/10 11/10 10/10

12/1013/10

MSC Flavia IV240A N1238 256280-30/09

MSC Agency King Abdullah (INDUSA)

Abdullah, Abu Dhabi, Jebel Ali. (INDUS)

King Abdulah. (Himalaya

LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press

Terminal

Terminals

Terminal

Dronagiri

Jebel Ali, Bandar Abbas. Dronagiri

Hapag ISS Shpg. ULA CFS QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr Alligator Shpg. Aiyer Shpg. Jebel Ali. Unifeeder Unifeeder Ag. Umm Qasr, Sohar, Basra.

Dron.1 & Mul BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports.

Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2 Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics

Sea Consortium Khalifa, Jebel Ali. 22/1023/10

15/1016/10 TBA TBA Northern Practise

TBA GFS Giselle

Global Feeder Sima Marine Dronagiri (ASX) Unifeeder Unifeeder Ag. Basra. Dron.-1 & Mul Transworld FDRS Transworld Group Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

11/1012/10

Umm Qasr

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR CARTING DATE TIME NAME No.No. No.&Dt. POINT

CUT OFF TO LOAD FOR INDIAN SUB CONTINENT from NSICT

11/1012/10 Tema Express 2239W N1185 255730-22/09

ONE Line ONE (India) Colombo.

21/1022/10 TBA TBA Seaspan Lahore 2241W

Hapag ISS Shpg. (AIM)

ULA CFS 11/1012/10 11/10 2300 Celsius Naples 891E N1184 255731-22/09 Evergreen Evergreen Shpg. Colombo.

Balmer Law. CFS Dron. 15/1017/10

Dronagiri 29/1001/11 TBA TBA CSLSophie 912E

TBA TBA Shimin 22006E N1230 256194-29/09 Unifeeder Feedertech/TSA Colombo.

ONE Line ONE (India) Colombo. (CISC Service) 12/1115/11 TBA TBA Wide Alpha 232E CSC Seahorse Colombo. 11/1012/10 11/10 1300 Marathopolis 240W N1164

CMA CGM CMA CGM Ag. Colombo (MESAWA)

Dronagiri

10/10 11/10 10/10 1200 MSC Flavia IV240A N1238 256280-30/09

MSC MSC Agency Colombo. (INDUSA)

Hind Terminals

Hind Terminal 12/1013/10 12/10 0900 MSC Ivana IU240A N1237 256278-30/09 MSC MSC Agency Karachi. (INDUS)

In Port 11/10 Aka Bhum 009E N1188 255733-22/09

OOCL

OOCL (I) Colombo.

GDL 12/1013/10 TBA TBA OOCL New York 089E N1219 256089-27/09 Star Line Asia Seahorse Yangoon. (CIX-3)

Dronagiri-3 10/1011/10 10/10 1500 X-Press Bardsey 22018E N1197 255928-26/09

ONE Line ONE (India) Colombo. 16/1017/10 TBA TBA Bangkok Bridge 137E N1235 256209-29/09 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 23/1024/10 TBA TBA Clemens Schulte 016E CSC Seahorse Colombo. 12/1013/10 13/10 0001 One Continuity 061E N1123 255452-17/09

ONE Line ONE (India) Colombo.

19/1020/10

TBA TBA Y M Ubiquity 055E N1251 256421-03/10

Yang Ming Yang Ming(I)

Contl.War.Corpn. 03/1104/11 TBA TBA MOL Celebration 0088E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 13/1014/10

TBA TBA Kota Megah 0139E N1113 255393-16/09 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 18/1019/10

TBA TBA Dalian 2207E N1253 256268-30/09 X-Press Feeders SeaConsortium (CWX)

23/1024/10 TBA TBA X-Press Angelsey 22006E N1271 256546-06/10 TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/— 18/1019/10 TBA TBA X-Press Odyssey 22006E N1213 256088-27/09 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 21/1022/10 TBA TBA Zoi 19E N1266 256474-04/10 KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 04/1105/11 TBA TBA KMTC Dubai 2206E X-Press Feeders SeaConsortium (CIX3 Service) 13/1114/11 TBATBA Akinada Bridge 2241E EmiratesEmirates Dronagiri-2

In Port 10/10 Wan Hai 175 E091 N1128 255491-19/09 Wan Hai Wan Hai Lines Colombo. (CIS) Dron-1 & Mul CFS 10/1011/10 10/10 1500 Xin Hong Kong 057E N1193 255792-23/09 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 14/10 15/10 14/10 1500 Gulf Barakah 2227W N1140 255546-19/09

Asyad Line Seabridge Karachi. (IEX) 14/1015/10 13/10 2300 Bach 47W N1213 256064-27/09 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 16/1017/10 15/10 1700 MSC Denmark IW241A N1244 256387-03/10 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 22/1023/10 TBATBA BLPL Trust 1207E N1273 256511-06/10 BLPL Transworld GLS Chittagon, Yangoon

14/1016/10

TBA TBA TS Dubai 22006E N1187 255729-22/09

KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 18/1020/10

TBA TBA ESL Kabir 22038E N1240 256293-30/09 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 23/1025/10

TBA TBA Xin Yantian 073E COSCO COSCO Shpg. (AIS SERVICE) (AIS SERVICE) Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2 CU Lines Seahorse Ship Port Kelang,Hongkong,Busan, Qingdao,Ningbo.

In Port 10/10

Stephanie C 2209E N1165 255648-21/09 Asyad Line Seabridge Singapore, Port Kelang. (IEX)

In Port 10/10 APL Oregon 0FF6YE1 N1207 255960-26/09

CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 17/1018/10

ETAETD

14/1016/10

CUT

TBA TBA TS Dubai 22006E N1187 255729-22/09

TS Lines TS Lines (I) Australia & New Zealand Ports. (AIS SERVICE) Dronagiri-2

In Port 11/10 Aka Bhum 009E N1188 255733-22/09

ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 12/1013/10

RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 17/1018/10

TBA TBA OOCL New York 089E N1219 256089-27/09

TBA TBA OOCL Hamburg 138E

OOCL OOCL (I) Sydney, Melbourne. GDL 26/1027/10

TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 07/1108/11

TBA TBA OOCLLuxembourg 098E

TBA TBA Seamax Stratford 117E

Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 (CIX-3)

Team Lines Team Global Log. Australia & New Zealand Ports. JWR Logistics

10/1011/10

10/10 1500 X-Press Bardsey 22018E N1197 255928-26/09

ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, 16/1017/10

TBA TBA Bangkok Bridge 137E N1235 256209-29/09 Auckland, Lyttleton. 23/1024/10

Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 30/1031/10

TBA TBA Clemens Schulte 016E

TBA TBA Seaspan Chiba 011E

11/1012/10 11/10 2300 Celsius Naples 891E N1184 255731-22/09

GLS Global Log. Australia & New Zealand Ports. (TIP Service)

TS Lines TS Lines (I) Australian Ports. (CISC Service)

JWR

Dronagiri-2

11/1012/10 TBATBA Argolikos E144 N1141 255564-20/09

ANL

CMA CGM Ag. Fremantle, Melbourne, Sydney, Adelaide, Brisbane, Dron.-3 & Mul. 18/1020/10

TBA TBA Wan Hai 502 E106 N1220 256150-28/09 Auckland, Tauranga, Madang, Port Lae, Rabaul, Port Moresby 24/1025/10 TBATBA Wan Hai 507

Dronagiri-2

11/1012/10

Cape Town, Tema, Tincan, Apapa. 21/1022/10

11/1012/10

(MESAWA)

CFS

14/10

N1224 256170-28/09

Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 21/1022/10

CGM Ag. Dakar, Nouakchott, Banjul, Conakry, Freetown,Monrovia, Sao Tome, Bata, Dron.-3 & Mul. 28/1029/10

Pina IP243A

Bissau, Nouadhibou, Dakar, Abidjan, Tema, Malabo & Saotome. (EPIC 1 / IPAK) Globelink Globelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC 1 / IPAK)

15/1016/10 15/10 0600 Lana 241S N1177 255315-15/09 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 22/1023/10 22/10 0600 Maersk Brooklyn 242S N1173 255323-15/09 (MWE SERVICE) 29/1030/10 29/10 0600 Lisa 243S N1168

12/1013/10 12/10 0900 MSC Ivana IU240A N1237 256278-30/09 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Hind Terminals 19/1019/10 TBA 0900 MSC Mumbai VIII IU241A N1274 256609-07/10

Oran, Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa 14/1015/10 13/10 1500 MSC Irene IS241A N1243 256386-03/10 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 21/1022/10 21/10 0700 Cape Tainaro IS242A N1279 256622-07/10 Team Global Team Global Log. East, West & South African Ports. Himalaya Express Pun.Conware 14/1015/10 13/10

BFAD Pacific 240S N1178 255313-15/09 CMA CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3 & Mul. 21/1022/10 20/10

Fayston Farms 241S N1174 255322-15/09 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Maersk CFS 28/1029/10 27/10

CMA CGM Qulimane 242S Capetown. (MIDAS) (MIDAS)

DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira.

In Port 11/10 Asiatic Neptune 84W N1210 256030-27/09

Gold Star Star Shpg. Mombasa, Dar ES Salaam. (IAX) 19/1020/10

TO LOAD FOR UK, NORTH CONT, SCAN, BLACK SEA, EAST EUROPE & CIS PORTS

25/1026/10 Morning Concert 153

Eukor Car Carr Parekh Marine Europe and Mediterranen Ports.

TO LOAD FOR USA, CANADA, ATLANTIC & PACIFIC, SOUTH-CENTRAL AMERICAN & WEST INDIES PORTS

25/1026/10 Morning Concert 153

Eukor Car Carr Parekh Marine USA South America & Caribbean Ports. 29/1030/10 Alliance St. Louis 143

Hoegh Autoliners Merchant Shpg. Kingston, Veracruz, Freeport, Jacksonville. 27/1128/11 Alliance Fairfax 103

12/10 16/10 Paranadowski 57

Chipolbrok Samsara Houston. 14/1118/11 Adam Asnyk 60

12/1016/10 Paranadowski 57

Chipolbrok Samsara Singapore, Merak, Kwangyang, Shanghai. 25/1026/10 Morning Concert 153 Eukor Car Carr Parekh Marine Singapore, Laem Chabang, Pyungtaek (Direct) & other Far East, African Ports 29/1030/10 Alliance St. Louis 143

Hoegh Autoliners Merchant Shpg. Durban, Tema, Dakar 27/1128/11 Alliance Fairfax 103

08/1109/11 Alliance Norfolk 124 Hoegh Autoliners Merchant Shpg. Singapore. 14/1118/11 Adam Asnyk 60 Chipolbrok Samsara Port Kelang, Singapore, Shanghai.

“BIG LILLY” V-6E I.G.M. No. 2323780 Dtd. 07-10-2022

above vessel has arrived at NHAVA SHEVA (BMCT) on 09/10/2022 with Import Cargo in containers.

Nos. B/L NOS.

GOSUCHZ1087395

SZYC22070748

SZYC22070818

JOC22070128

CLSL22070027

CLSL22070022

NOS.

CLSHSE22070240

CLSHSE22070078

HS22070283B

HS22070175

NOS.

Nos. B/L NOS.

GOSUSNH8352731

GOSUXIA8276263

GOSUXIA8279725

GOSUXNG1236067

SZOE22050650

GOSUSNH1588683

Consignees are requested to obtain DELIVERY ORDERS on presentation of ORIGINAL BILLS of LADING and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

there is any delay in CY-CFS movement due to port congestion Line/Agent are not responsible for the same. Consignees will please note that the Carriers and/or their Agents are not bound to send Individual Notifications regarding the arrival of the vessel or the goods.

detailed information on cargo availability please contact our office.

any charges enquiries, Please contact on our Import Hotline No. : 4252 4444 Container Movement to : OCEAN GATE CONTAINER TERMINAL PVT. LTD.

As Agents :

Centre-Point, 3rd Floor, 294, C.S.T. Road, Near Mumbai University, Kalina, Santacruz (East), Mumbai - 400 098. Tel : 91-22-4252 4301 Fax : 91-22-4252 4142

above vessels

Cargoes in

requested to obtain

mentioned

LADING

discharged

be applicable.

will please note that the carriers

their

not bound to send individual notification regarding arrival of the vessel or the

MUMBAI ETA ETD Vessel's Voy Rot CartingLine Agents Will Load ForCont’d. from Pg. 6

CM Shri Bhupendra Patel also said, “Gujarat has consistently recorded an annual GDP growth rate of over 10% over the past decade, contributing over 8.28% to India’s GDP. The state government has also taken significant initiatives in the areas of ease of doing business reforms, digital governance, policy initiatives and employment, making Gujarat a leading state in the country. Gujarat is the first state to launch “Integrated Logistics and Logistics ParkPolicy”.

The Minister of State for Industries Shri Jagadish Vishwakarma said, “Under the visionary leadership of Prime Minister Shri Narendra Modi, the PM Gati Shakti National Master Plan was launched a year ago to accelerate the construction of infrastructural facilities in the country and to work in accord. Today, Gujarat has launched PM Gati ShaktiPortalforthefirsttimeinthecountrywhichwillgivea new direction to the coordinated development of Gujarat in the coming years. Not only that, but because of implementation of this master plan which will ensure that citizens’ money will not be wasted and holistic development can be achieved through coordination between various departments”.

The minister added that, Prime Minister Shri Narendra Modi during his tenure as Chief Minister of Gujarat laid a strong foundation for the development of the state. Today Chief Minister Shri Bhupendra Patel is carrying forward the same foundation in a very commanding manner. Prime Minister Shri Narendra Modi gave a new direction through Chintan Shibir to coordinate amongdepartmentstospeedupthedevelopmentjourneyof the state. The same innovative approach has benefited the country today with PM Gati Shakti National Master Plan which is a matter of pride for us. Under this plan, more than 16 departments of the central government, various state governments and various agencies have participated which willacceleratethedevelopmentinthefuture.

Minister Shri Vishwakarma further said that, “Under the leadership of the Chief Minister of the state Shri Bhupendra Patel, Gujarat is moving steadily in the direction of ‘Atmanirbhar Gujarat to Atmanirbhar Bharat’. While Gujarat has emerged as the ‘Best Preferred Business Destination’, the state’s incentive policies are attracting investors from across the globe. Apart from that, Gujarat’s 2.20 lakh km long road infrastructure, 5200 km long rail network, 19 airports, 48 ports, best power capacity, expert skills, productive government, safe and secured place are many factors which is why huge investments are done in Gujarat. As a result of these facilities, today Gujarat is manufacturingeverythingfrompinstoplanes”.

Chief Secretary Shri Pankaj Kumar said, “PM Gati Shakti Portal was launched by Prime Minister Shri Narendra Modi one year back which provides vast opportunitiesinBusinessProcessEngineering”.

“Thisportalisnotjustadigitalapplication,accuratedata collection or digital data integration, but it will connect the upcoming infrastructure projects with logistics, which will helpinreducingtransportationcostsinthecomingyears”.

Shri Pankaj Kumar further said that “PM Gati Shakti Gujarat Portal will prove to be a game changer in the state. It is a powerful tool that will redefine infrastructure planning as well as ease of doing business. This portal is a foolproof system. PM Gati Shakti Gujarat Portal is such a powerful tool, which will prove to be very useful in decision making and monitoring. The Chief Secretary said that industrial facilitation including land acquisition, inter-departmental coordination can be done through this portal”.

Additional Chief Secretary, Ports and Transport Department Shri M. K. Das said, “As India today leads the fourth industrial revolution, Gujarat, the industrial leader, is playing an important role. In the manufacturing sector, India has left behind America and secured the second position. In research, India has made rapid progress from 81st position to 41st position. In the next 25 years, the country will become a 20 trillion dollar economy and will be the third largest economy in the world after the US and China. Shri Das said that to achieve this goal and for Gujarat to achieve faster progress, the need of the hour is to invest 6timesininfrastructure”.

Quoting the CII report, he said, Today the per capita income of the country has reached about 10 thousand. Recently Union Minister Shri Piyush Goyal reviewed this portal of the state and said that there is no other tool like PM Gati Shakti-Gujarat Portal covering various departmentsintheworld.

Smt. Avantika Singh, Additional Chief Secretary and Chief Executive Officer of Gujarat Infrastructure Development Board said, “Gujarat is proving to be the launchpad in building a self-reliant India. After the first workshop on PM Gati Shakti of West Zone held in November, 2021, initiatives have been taken in this direction immediately. Gujarat is the first state to launch the Gati Shakti portal. This is a GIS based portal with more than 500 layers. It includes more than 21 government departments and fifty-two sub-divisions of the state and more than 25 departments of the Central. Effective implementation of this portal will help in building a better andsmartergovernment“.

In this seminar, Additional Chief Secretary of Ports and Transport Department Shri M. K. Das chaired sessions on various state government initiatives in logistics infrastructure, Dholera (SIR) Special Investment Region, benefits of PM Gati Shakti Terminal at Bedi and Morbi. While sessions on PM Gati Shakti and National Logistics Policy, last mile connectivity from industry point of view, importance of PM Gati Shakti to increase logistic capacity were held under the chairmanship of National Industrial Corridor Development Corporation Limited Vice Chairman Shri AbhishekChaudhary.

On this occasion Additional Chief Secretary to Chief Minister Shri Pankaj Joshi, Additional Chief Secretary Home Department Shri Raj Kumar, Gujarat Maritime Board Vice Chairman and CEO Shri R. B. Barad, CII Gujarat Council Vice Chairman Shri Darshan Shah werepresent.

MUMBAI: Foreign exchange reserves fell by $4.85 billion to $532.66 billion for the week ending Sep 30, according to data released today by the Reserve Bank of India.

The foreign exchange reserves fell to their lowest level since July 2020 and also marked the ninth consecutiveweekoffall.

The fall in the foreign exchange reserves can be attributed to a fall in the Foreign Currency Assets (FCA), which is a major component of the overall reserves. Foreign currency assets dropped $4.41 billion to $472.81 billion for the same period. Gold reserves fell $281 million to $37.61 billion.

AHMEDABAD: With the National Master Plan for Multi-Modal Connectivity in place, AhmedabadheadquarteredAdaniGroup is set to give momentum to its logistic business by commissioning six more Multi-ModalLogisticsParks(MMLPs)in the next two years across five states, including Uttar Pradesh, Haryana, Rajasthan,GujaratandTelangana.

“Adani Group is already operating as many as five MMLPs in different parts of the country. We are in the process to commission six more parks – two in Gujarat (Sanand and Ankleshwar), one each at Dadri in UP, Panipat in Haryana, near Rajasthan capital Jaipur and Hyderabad. PM Gati Shakti –Master Plan for Multi-Modal Connectivity wouldhelpustoimplementtheseprojects on fast-forward mode,” said VikramJaisinghani,ManagingDirector and CEO of Adani Logistics (ALL).

Talking after the National Launch of Integrated Master Plan – PM Gati Shakti

Gujarat Jaisinghani said that due to the PM Gati Shakti initiative developers of logisticsparkswouldgetspeedyapproval from a single platform which would help themexecutetheirprojectsfaster.

At present, ALL is operating nine MMLPs at Patli, Kishangarh, Kilaraipur, Kanech, Malur, Nagpur, Mundra, Taloja and Vap. Adani Logistics would inaugurate MMLP near Sanand in April2023ontheoutskirtsofAhmedabad.

The Gujarat government signed a memorandum of understanding (MoU) with Adani Ports and SEZ in January 2021 for establishing India’s biggest Multi-Modal Logistics Park at Virochan Nagar, near Sanand in Ahmedabad. The park is spread across 1,450 acres. As per the MoU, the park will attract an investmentofRs50,000croreandprovide direct and indirect employment to 25,000people.

“In the next three years, ALL is lookingtoexpandwarehousingcapability from existing 10 million sq ft to as high as 60 million sq ft. At present, we are having

around20-grainterminalswhichwewant to enhance up to 100 in the next couple of years,”headded.

ALL, a subsidiary of Adani Ports and SEZ the most diversified end-to-end logistics service provider in the country with a presence across all major markets. Thecompanyisinthebusinessofhandling varied customers across segments like retail, industrial, container, bulk, breakbulk,liquids,autoandgrain.

Another Adani Group company Adani Agri Logistics (AALL) has also signed an exclusive service agreement withtheFoodCorporationofIndiaforthe handling of the food grains, right from receiving at base depots, cleaning and drying as well as storage and transportation to field depots is carried out in bulk form, thus minimising the losses. These units are notified of procurement centres of FCI, where farmers deliver their produce directly in bulk form. The project has been implemented at a total cost of nearly Rs700crore.

NEW DELHI: The headwinds in global trade is equally reflected in the WTO forecast for 2023, released two days back,whichhasprojectedittogrowat1% only. However, the forecast for 2022 has been improved from 3% to 3.5% primarily duetobetterperformanceinthefirsthalf of 2022. India, being a domestic demand driven economy, will not be much impacted by these developments though we will not be insulated either. While global developments will affect our exports performance particularly as commodity prices and of late crude prices have started moving in southwards directions, which will affect our raw material exports and some value added exports as well. However, at the same time, the demand for low price products will keep our exports afloat as India is gaining from China's loss. We are also looking up additional exports in Russia through Rupee Payment Mechanism and would request the Hon'ble Minister to look into extending this mechanism for exports to countries having acute forex shortage. Sanctions on Russia by the EU will provide some additional exports to India in European markets. The market access through CEPA with UAE, ECTA with Australia andFTA with UK, whichwe are sure that our most capable and efficient CIM will deliver by Diwali, will further push our exports in challenging times. FTAs with Canada, GCC and EU will further facilitateourexports.

Sir,theneedofthehourisaconcerted effort by all stakeholders to push exports as a national agenda. We request you to kindly appeal to the Hon'ble Prime Minister to address all the stakeholders including exporters, supporting institutions, Indian Missions and States so as to reiterate the proactive support required in current challenging times. The Prime Minister, in his last address,

made us to believe that US$400 Bn is achievable and we achieved it. Indian Missionsmayalsosensitiseusonmarket opportunities for emerging products so that we may build further on them throughmarketstudy/marketsurveys.

1.Sir, the increase in repo rate last Friday will have its bearing on the base rate of banks and consequent to lending rates for export credit. The base rate of SBI prior to increase was 8.7% which is likely to go to 9.4% after increase in the repo rate. The base rate of many banks will be much above the base rate of SBI pushing the export credit rate in Rupee. We request you to kindly consider requesting RBI for introducing “Export Refinance Facility” to banks so that the value of credit provided to the export sectorinIndianRupeemayberefinanced by the RBI to banks at which it lends to banks. Such a measure will be extremely beneficial for our small exporters as the interest rates in many competing countries are much lower than in India and the double whammy is the loss on account of exchange rate as Indian Rupee remains one of the comparatively strongcurrenciesglobally.

2. The non-extension of notification relating to GST exemption on freight for exports has caused panic and uncertainty adding to the liquidity challenges of the exporters. Sir, You are aware that overseas freights have gone up by 300-350% from pre-covid level and though there is little correction in the freight rate recently, freights are still 200-250% more than at 2019 level. Therefore, payment of GST on such high freight rates will affect the liquidity of the exporterstoalargeextentparticularlyas the interest rates have also moved northward with recent hike by the RBI. The payment of GST on export freight and subsequent refund particularly through ITC mechanism comes with

a time lag of generally 2-3 months or so, though refund through IGST mechanism is faster. GST on exports freight is revenue neutral as exporters will pay the same and subsequently get a refund through a refund mechanism. The withdrawal of exemption may augment the liquidity of the Government butatthecostoftheexporters. Sincethe cost of credit for the exporters is very high, an exemption will help the export sector to have better liquidity, which is theneedofthehour.

3.While we appreciate application of domestic regulations on imports meant for the domestic economy, the same should not apply on imports meant for exports affected through advance authorisations, EOU and other mechanisms. In many cases, buyers ask for import of a particular material from a particular supplier to be used in exports. The specified supplier, looking into the small quantities involved, is not interested in getting approval from BIS andothersimilaragencies.Thisdeprives such orders to Indian exporters. Since the inputs are meant for exports only , the exemption from domestic standards should be applicable to imports for exports purposes imported under Advance Authorisations or similar mechanism.

4. The better market access provided by the Government is to be backed by aggressive marketing strategy. Government may bring a planned scheme with the objective of taking exports to US$1 Trillion both for goods and services respectively by 2030. The scheme should look for a corpus of Rs 1000 Cr. Besides, overseas marketing may be encouraged with 200% tax deductions so that for every dollar spent on overseas marketing (with defined components), two dollars are allowed as taxdeduction.

India to accord top priority to na�onal interest in FTA nego�a�ons; Government will not diverge from this approach for the sake of deadlines: Shri Piyush Goyal

Cont’d. from Pg. 2

The Minister was speaking at the meeting held to review India’s Export Performance in the first six months of this financial year with key representatives from Export Promotion Councils and Industry AssociationsinNewDelhi.

At the meeting, the Minister emphasised on sustaining the export momentum and said that the interaction with Export Promotion Councils has given the confidence that Indian exports will be able to wither the global headwinds and will surpass last year’s exports by a big margin. He added that India must keep prospecting for new opportunities in the world market and utilize all such possible chances to expand trade. He also emphasised on doing a deep dive of services import andseetheareas/sectorsinwhichtheyareincreasing.

The industry participants were assured that Government is committed to address the issues raised by them. While concluding the session, the Commerce and Industry Minister urged the trade and industry to implement innovative ways of marketing, increase quality standards and take full benefit of Free Trade Agreements to achieve higher export growth in this financialyear.

At the review meeting, the Director General of Foreign Trade (DGFT) gave a presentation on year-onyear export trends vis-à-vis the major export markets of India, along with sectoral growths. The leading and laggard export markets/ sectors were specifically

highlighted for specific attention and possible corrective actions.

Industry was apprised on the healthy growth of around 15.5 % seen in the first six months of this financial year, as compared to previous year. The industry however was alerted on the dip in export performance in September 2022. Highlighting the healthy growth seen in some markets such as Latin America and Africa, it was informed that the evolving economic and geo-political environment required the industry to be attentive and optimistic so that growth opportunities in such new markets are not missed.

An engaging round of discussion was held subsequently with EPCs and industry representatives on challenges, opportunities and way forward for increasing exports from India. Industry has flagged certain issues related to the rising of cost of raw materials and subdued demand in certain key export marketsduetohighinventorylevels.Industryrequested for including left out sectors under RoDTEP and rationalisation of existing RoDTEP rates, exploring possibility for increased support under Interest Equalisation Scheme (IES) and under Market Access Initiative (MAI), and operationalisation of ProductionLinkedIncentive(PLI)Schemesforadditionalsectors.

The meeting was also attended by the Minister of State for Commerce & Industry, Smt. Anupriya Patel andCommerceSecretary, ShriSunilBarthwal.

COPENHAGEN:-

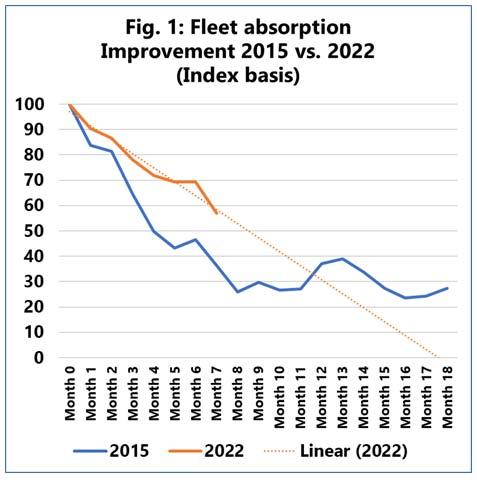

With the continued gradual improvement in schedule reliability in August 2022 and the resultant improvement in vessel delays, the global fleet that was unavailable due to these delays dropped to 7.9%, according to the latest report by Danish shipping data analysis company, Sea-Intelligence, while the peak of13.8%wasinJanuary2022.

“Keepinginmindthebaselineunavailablecapacityof 2% (as there are always some delays), at the height of delays in January 2022, an additional 11.8% of capacity wasbeingabsorbed,”saidSea-Intelligence’sanalysts.

Since that level is down to 5.9% additional capacity in August 2022, this essentially means that the congestion issues have been cut in half, compared to the situation in January2022.

Danishfirmnotesthesignificantinjectionofreleased capacity has led to a situation, where the physical shortage of capacity, which drove the freight rates up, is nolongeranissueinmosttrades.

“The question is then, how long will it take for this gradual improvement to get to a point, where the market is fully back to normal?” asks Alan Murphy, CEO of SeaIntelligence, only for him to answer that there are multipledifferentwaystolookatthis.

Murphy went on to explain, “The first way is to look at the pace of worsening in 2020-2021, and the pace of improvement in 2022. The rate of change for both is quite similar, which means that using this methodology, a full reversal to normality should come in March 2023. The second way is to compare the current rate of improvement, with the improvement after the congestion problems in 2015. While the rate of improvement in 2022 is faster, it is also starting from a higherlevel,puttingarecoveryalsobyMarch2023.”

The third way, as shown in the figure, is to normalise

the developments in 2015 and 2022 down to the same baseline and create an absorption index equalling 100 points at the respective peaks, according to SeaIntelligenceCEO.

“In this case, we can see that in relative terms, the pace of improvement in 2022 is less than in 2015, but the indication is also that the current situation will come down to meet the 2015 developments by January 2023,” hesaid.

In summary, all three models suggest we should be back at the “normal” 2% capacity loss baseline by early 2023, assuming the current pace continues, and there any no new major supply chain disruptions, according to Sea-Intelligence.

“XIN HONG KONG” V-057 I.G.M. No. 2323817 Dtd. 07-10-2022

The above vessel is arriving at NHAVA SHEVA (BMCT) on 10/10/2022 with Import Cargo in containers.

Item Nos. B/L NOS. 4 ZIMUSNT8066729

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS movement due to port congestion Line/Agent are not responsible for the same. Consignees will please note that the Carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods. For detailed information on cargo availability please contact our office. For any charges enquiries, Please contact on our Import Hotline No. : 4252 4444

Container Movement to OCEANGATE CONTAINER TERMINAL PVT. LTD. As Agents

Raheja Centre-Point, 3rd Floor, 294, C.S.T. Road, Near Mumbai University, Kalina, Santacruz (East), Mumbai - 400 098. Maharashtra, India. Tel : 91-22-4252 4301 Fax : 91-22-4252 4142

The above vessel has arrived at NHAVA SHEVA (BMCT) on 10/10/2022 with Import Cargo in containers.

Nos. B/L NOS.

DKA2209009

GOSUNGB1147737

GOSUNGB1147740

GOSUNGB1147743

B/L NOS.

GOSUNGB1147744

NOS.

Nos. B/L NOS.

GOSUQIN6406466

Consignees are requested to obtain DELIVERY ORDERS on presentation of ORIGINAL BILLS of LADING and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS movement due to port congestion Line/Agent are not responsible for the same. Consignees will please note that the Carriers and/or their Agents are not bound to send Individual Notifications regarding the arrival of the vessel or the goods.

detailed information on cargo availability please contact our office.

any charges enquiries, Please contact on our Import Hotline No. : 4252 4444 Container Movement to : OCEAN GATE CONTAINER TERMINAL PVT. LTD.

Agents :

Centre-Point, 3rd Floor, 294, C.S.T. Road, Near Mumbai University, Kalina, Santacruz (East), Mumbai - 400 098. Tel : 91-22-4252 4301 Fax : 91-22-4252 4142

TO CONSIGNEES

“XIN HONG KONG” V-057 I.G.M. No. 2323817 Dtd. 07-10-2022

NEW DELHI: Cargo handling at India’s Major Ports continues to be on the growth trajectory as there was a 11 per cent increase in traffic in the first half of this fiscal to 384 million tonnes (mt) as against 346 mt in the same period last year. The increased handling of POL and coal, and easing ofthesupplychaingloballyhavehelpedintheincreasedcargo handling.

Except for Mormugao Port, all the other Major Ports reported a positive growth in the first six months of this fiscal, accordingtodatabyIndianPortsAssociation.

Kamarajar Port reported the highest growth in traffic with 16.40percent,followedbyVisakhapatnam(15.39percent)and Paradip(13.48percent).

ThefallinMormugao’strafficwasduetoasharpdeclinein handling of iron ore, including pellets, to 8 lakh tonnes as against2.2mtinthesameperiodlastyear,thedatasaid.

The healthy growth in volumes at major ports are mainly drivenbyrecoveryindemandforPOLandcoalsegment,which had been subdued in the last two years due to several factors including the impact of Covid-19 pandemic. The increase in demand for imported coal due to coal shortage for power production also resulted in higher volumes, said Sai Krishna,

Vice-PresidentandSectorHead,CorporateRatings,ICRA.

The performance of Mormugao Port has however been adversely impacted by decline in iron ore and pellet volumes asthetradeinthesegmenthasbeenimpactedbygovernment regulations.Forthefullyear,ICRAexpectstheoverallvolume growth at Indian Ports to be around 6-8 per cent on year-onyearbasis(includingNon-MajorPorts),hesaid.

Jagannarayan Padmanabhan, Practice leader and Director – Transport logistics and Mobility, CRISIL, said that there has been a secular growth in ports traffic across both major and non-major ports. Supply chain-related issues have eased significantly and easing of charter rates can act as a tailwindforIndianportoperators.

In the Non-Major Ports, Adani Ports and SEZ said that in thefirsthalfofthisfiscalithandled177.5mtofcargo,whichisa 11percentincreaseyearonyear.

During the first half, east coast port volumes were up 13 per cent year on year, supported by Krishnapatnam (+13 per cent growth), Gangavaram (+9 per cent) and Kattupalli and Ennore combined (+51 per cent). The west coast volume jump of 10 per cent is supported by Mundra (+8 per cent), Dahej (+65 per cent), Tuna (+19percent)andGoa(+22percent),saidAdanigroupdata.

GENEVA: The World Customs Organization (WCO) and the United Nations Conference on Trade and Development (UNCTAD) signed a Memorandum of Understanding (MoU) to update the MoU between the two organizations dating back to2013.

The Secretary-General of UNCTAD, Rebeca Grynspan, andtheSecretaryGeneraloftheWCO,KunioMikuriyasigned the MoU, which marks an important step towards deepening thelong-standingcooperationbetweenthetwoorganizations.

The MoU aims to support Customs modernization by enabling interoperability between the UNCTAD’s Automated System for Customs Data (ASYCUDA) and the WCO Cargo Targeting System (CTS), National Customs Enforcement Network (nCeN) and Time Release Study (TRS). UNCTAD andtheWCOarecommittedtoenhancingCustoms’capability in managing risks by utilizing information and technology while streamlining and simplifying data collection and eliminatingredundancies.

UNCTAD and the WCO agreed to collaborate further to accelerate harmonized supply chain digitalization through the implementation of international standards for data exchange, such as the WCO Data Model. In addition to increasing data quality and accuracy, the initiative aims to enhance trade facilitation by providing consistency and predictabilityrelatedtocross-borderdatarequirements.

InlinewiththeWCO’sDataStrategy,therevisedMoUlays the foundation for the two organizations to embrace a data culture and build data ecosystems by using Customs

statistics. Under this initiative, UNCTAD and the WCO will develop a harmonized methodology for statistics data collection/sharing.

“The revised Memorandum of Understanding is a robust foundation towards closer cooperation with the UNCTAD in implementing our data strategy as well as supporting supply chain digitalization, trade facilitation and effective Customs control.Customshaslongledbordermodernization,andthisnew partnership is expected to enhance this potential further and bringitontoanewlevel,”statedSecretaryGeneralMikuriya.

UNCTAD Secretary-General, Ms Rebeca Grynspan, noted that this MoU would ensure that ASYCUDA systems are fully compliant with the international instruments and standards developed by the WCO. The collaboration between thetwoorganizationswouldbeinstrumentalinthesuccessful deliveryofrespectivegoalsandactivities.

The WCO represents 184 Customs administrations across theglobethatcollectivelyprocessapproximately98%ofworld trade. It is the only international organization competent in Customs matters and its mission is to enhance the effectivenessandefficiencyofCustomsadministrations.

UNCTADistheUN’sleadinginstitutiondealingwithtrade and development. It is a permanent intergovernmental body established by the United Nations General Assembly in 1964. UNCTAD is part of the UN Secretariat and has a membership of195countries,oneofthelargestintheUNsystem.UNCTAD supports developing countries to access the benefits of a globalizedeconomymorefairlyandeffectively.

AHMEDABAD:RiceexportersinGujarataretakingheart from a Gujarat High Court order granting interim relief to an exporter who had challenged the duty on exports of nonbasmati rice on the grounds that his shipping bills were registeredbefore8Sept,whenthe20%dutywasimposed.

The Gujarat order followed an Andhra Pradesh HC judgment last month allowing three rice exporters to ship out rice subject to certain conditions. Hundreds of thousands of tonnes of rice got stuck at ports after the Union government decided to regulate rice exports citing domestic food security concerns. “Merely because the goods could not be sailed in the vessel, the customs authorities were not justified in taking to levy the duty,” the Gujarat HC said. The rice consignments which were destined for Ghana belonged to Kunvarji Comtrade.Thecompanyarguedthatitsgoodswereinspected

and allowed for “Let Export” on 5 Sept by Customs. “Interimorderisjustatemporarything.Itcouldgoeitherway. So if the decision is in favour of the government on the justification that they give, exporters will have to repay the duty. As far as shipping bills are concerned, in the rice business these bills are made much earlier. We don’t know what will be the final decision,” said Vinod Kaul, Senior ExecutiveDirector,AllIndiaRiceExportersAssociation.

“These orders are high court orders and so will be applicable to those particular states alone—in this case, Andhra Pradesh and Gujarat. And of course other exporters in the region will be able to take the benefit of the same. But it will be important to see if the government challenges the order,” said Ajay Sahai, Director-general of Federation ofIndianExportOrganizations.

CJ-I

CJ-II

CJ-III

CJ-IV

Manta Hacer

CJ-V VACANT

CJ-VI MV China Spirit Rishi Shpg. 11/10

CJ-VII

CJ-VIII

Phinda Mihir

Co. 12/10

Venus Halo DBC 11/10

CJ-IX VACANT

CJ-X MV Genava Taurus 13/10

CJ-XI MV TCI Anand (V-020) TCI Seaways 11/10

CJ-XII MV Mohsen Ilyas Seacoast 11/10

CJ-XIII MV Appaloosa Genesis 14/10

CJ-XIV MV SN Harmony Chowgule Bros. 11/10

CJ-XV MV Sagarjeet Cross Trade 14/10

CJ-XVA MV Bulk Polaris Interocean 18/10

CJ-XVI MV Bellemar Interocean 15/10

Tuna Tekra Steamer's Name Agent's

VACANT

Oil Jetty Steamer's Name

OJ-I MT ES Valor Interocean 11/10

OJ-II MT Champion Tide

OJ-III MT Southern Puma GAC Shpg. 11/10

OJ-IV MT PK Marit Samudra 11/10

OJ-V MT Oriental Sakura Allied Shpg. 11/10

OJ-VI MT Symphony J M Baxi 11/10

Stream MV Amira Sara Interocean South Arabia 25,000 T. Sugar Bags

CJ-XVA MV Bulk Polaris Interocean Port Sudan 61,020 T. Sugar Bags

Stream MV Captain Khaldoun Mystics Shpg Africa 9,900 T. Rice In Bags

Stream MV Chandrakant Chowgule Bros. West Africa 50,000 T. Rice In Bags

Stream MV China Spirit Chowgule Bros. 34,000 T Salt

Stream MV Daytona Beach Trinity Shpg. 25,600 T. Rice In Bags

Stream MV Luzon Seacoast 52,500 T. Rice In Bags

CJ-I MV Majesty star ACT Infra 28,000/1,500 T.Bagged Rice/P.Cargo

CJ-III MV Manta Hacer ACT Infra Somalia 32,000 T. Rice/Sugar Bags 2317524

Stream MV Massa J DBC Port Sudan 28,800 T. Sugar (50 Kgs.)

12/10 MT Oriental Jasmine Allied Shpg. Hazira 12,700 T. C. Oil

Stream MV Pegasus 1 GAC Shpg. U.A.E. 5,000 T. Rice In Bags

Stream MT PVT Dawn Samudra Bangladesh 6,600 T. Molasses

CJ-II MV Rasha DBC Jebel Ali 27,000 T. Sugar Bulk

Stream MV Saga Morus Arnav shpg. 18 No. Wind Mill

CJ-XV MV Sagarjeet Cross Trade 57,750 T. Salt Stream MV Sheng Ji Hai Chowgule Bros. 55,500 T. Salt In Bags Stream MV Silver Oak Aditya Marine 5,000/5,500 T.Rice J Bags/Rice Bags Stream MV Suvari Kaptan DBC Somalia 9,500 T. Rice/Sugar Bags Stream MV Soldoy Chowgule Bros. China 54,910 T. Salt Stream

Venus

Sudan 29,700 T. Sugar Bags

Stream

VTC

Trade 18,000 T. Copper Con. In Bulk Stream

Yara

sudan 33,000 T. Sugar

31,485

Shpg. Baltimore(USA) 1,30,010 T. Coal 10/10

Jag Aglaia(OTB)

48,488 T. Petcoke In Bulk

Harmony Chowgule Bros. U.S.A. 19,278/11,000 T. HMS/S Scrap

Australia 36,394 T. Jas Pine Logs

Due/Berth Vessels Name Agent From Cargo Details VCN No. Manual IGM EDI IGM 13/10 MT Arahan Wilhelmsen 5,623 T. Chem. 10/10 MT Ardmore Chippewa J M Baxi Indonesia 15,000 T. Palm Stream MT Argent Gerbera JM BAxi Durban 5,991 T. Chem. Stream LPG/C Bastogne Nationwide 20,000 T. Propane/ Butane Stream LPG/C Berlin Ekuator Nationwide 20,000 T. Propane / Butane 10/10 MT Bow Flora GAC Shpg. 5,000 t. Chem. Stream MT Chem Pluto Samudra 6,717 T. Chem. Stream LPG/C Cheshire Nationwide 20,000 T. Propane / Butane

OJ-I MT ES Valor Interocean Brazil 12,999 T. CPO Stream LPG/C Eupen Nationwide 20,178 T. Propane/ Butane Stream MT Gran Couva J M Baxi Malaysia 13,050 T. Palm Oil Stream MT Jishun J M Baxi 13,394 T. Chem. Stream MT Kanazawa Samudra Sohar Oman 8,680 T. Chem. 13/10 MT Kokako Interocean Thailand 21,000 T. CPO

Stream MT MTM Rotterdam Interocean Argentina 9,999 T PFAD 12/10 MT Monax J M Baxi Houston(USA) 3,352 T. Chem.

Stream MT Nave Cosmos Interocean Indonesia 23,000 T. CPO OJ-V MT Oriental Sakura Allied Shpg. Antwerp 1,996 T. Chem. Stream MT Pacific Gold Interocean Brazil 22,000 T. CDSBO OJ-IV MT PK Marit Samudra Sohar Oman 12,075 T. Chem Stream MT PVT Neptune James Mackintos 9,999 T. RBD Palm Oil 11/10 MT Silver Gertrude Interocean Argentina 27,000 T. CPO/ RBD OJ-III MT Southern Puma GAC Shpg. Singapore 9,000 T. Chem. Stream MT Southern Unicorn James Mackintos Dumai 9,999/8,000 T. RBD/CPO 12/10 MT Stolt Dugong J M Baxi Dakar 30,000 T. Phos. Acid 12/10

Stream

OJ-VI

Stream

Stream

Stream

Stolt Sequoia

Stolt Tenaity

Baxi Dakar 35,645 T. Phos Acid

Baxi

35,980 T. Phos Acid

Baxi 21,000 T. MS

Malaysia 13,000 T. Chem.

6,000 T. Chem.

Baxi Hometown 11,719 T. Chem.

10/10

B-12 MV Inuyama DBC

WEST BASSIN

WB-01 VACANT

WB-02 MV Star Borneo

WB-03 MV Venia Taurus

IOCL

MV Parkgracht Mumbai 04-10-2022

MV Silver Oak Mombasa 08-10-2022

B-12

Crude Petrolleum Oil 223092

MT Steel Pipes / Steel Coils 223141

12/10 MV Luise Oldendorff GAC Shpg. I Singapore 1,86,807 MT Steam Coal 223204

14/10 MV Lydia Oldendorff Taurus I Singapore 1,65,000 MT Steam coal 223211

B-10 MV Morea Cross Trade I Egypt 60,405 MT Nitro Phosphate with potash/DAP 223163

B-2 MT MTM Rotterdam Interocean I Port Kelang 8,150 MT Crude palm oil/Fatty acid/glycerin 223201

B-11 MV Parkgracht JM Baxi E Mumbai 988 MT Project Cargo 222963

B-9 MV Pietersgracht JM Baxi E Singapore 822 MT Project Cargo 223187

12/10 MT Radiant Pride Interocean I Port said 31,000 MT Carbon Black feed Stock 223213

B-1 MT seaharvest Admiral Shpg. i Hazira 950 MT Styrene Monomaer 223206

11/10 MV Swarna Pushp ISS Shpg. I Vizhinjam port 40,000 MT High speed Diesel 223184

WB-03 MV Venia Taurus I Taboneo 48,000 MT Steam Coal 223217

TO

10/10

EAST

Line Maersk India Port Tangier, Algeciras, Valencia. (ME-2) 11/10

In Port MPV Clio 2206M Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (IRS) 11/10

10/10 09/10-PM Csav Traiguen 240W 2093000 Maersk Line Maersk India Salalah. (ME-2) 11/10

11/10 14/10-AM Ornella 9 04W 2093110 Unifeeder Transworld Shpg. Jebel Ali (MJI) 12/10

12/10 12/10-AM SSL Mumbai 2204E 2093019 Milaha Poseidon Shpg Jebel Ali, Doha. (NDX) 13/09

QN Line/Seaglider Seatrade/Seaglider

13/10 13/10-AM Rosa 210S 2093002 Maersk Line Maersk India

Port Qasim, Salalah. (MAWINGU) 14/10

14/10 14/10-PM Montpellier 0021 2103176 Transworld Feeder Transworld Shpg Jebel Ali, Sohar (NMG) 15/10 Simatech MBK Logistics X-Press Feesder SC-SPL 19/10

16/10 16/10-AM Gulf Barakah 2227 2103209 Oman Container Seabridge Marine Sohar, Jebel Ali, Dammam. (IEX) 17/10

18/10 18/10-PM Inter Sydney 0117 Interworld Efficient Marine cc, China. (BMM) 11/10

— TBA TSS Line Sai Shipping Jebel Ali (JKX) 08/10

— TBA Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (GIX)

11/10 14/10-AM

09-10-2022

Bani Khalid(V-2224) Sohar 10-10-2022

In Port Prague Express 2338W

Jeddah, Tangier, Rotterdam, Hamburg, Lonoon Gateway, 11/10 16/10 16/10-AM Nagoya Express 2339W

Antwerp, Le Havre. (EPIC-II) 17/10 13/10 12/10-PM Jolly Cobalto

Nisurata(Libya), Castellon(Spain), Geneo, Naples, Iskderon (INDME) 14/10 14/10 14/10-PM Yantian Express 2240W

La Spezia, Barcelona, Valencia, Tangier, Fos Sur Mer, Genoa, 15/10

CMA CGM CMA CGM Ag. (I) Marsaxlokk. (IMEX)

In Port Osaka 905W 223099 Hapag Lloyd ISS Shipping Rotterdam,Jebel Ali, Khorfakan, Sohar, Qaboos, Bahrrain, Jubail, Jeddah, 11/10 17/10 16/10-PM Northern Dexterity 2240W 223093 COSCO COSCO Yanbu, Port Said, Mersin, Istanbul, Izmit, Ambarli, Izmir (AGIS) 18/10 10/10 10/10-AM Kota Nilam 0181W 223088 PIL

Mumbai Jebel Ali, Aden, P. Sudan, Djibouti. (RGS) 11/10 11/10 10/10-PM Northern Practise 0025 223091 X-Press Feeder

Consortium Jebel Ali, Khalifa, Khorfakkan. (ASX GULF) 12/10 Transworld Feeder Transworld Group

13/10 12/10-PM Jolly Cobalto 0288 223080 Messina Transworld Group

Istanbul,Jeddah, Durban, Moputo, Dar-Es-Salaam, Mombasa(INDME) 14/10 14/10 14/10-PM Yantian Express 2240W 223065 Hapag-Lloyd ISS Shipping Khor Fakkan, Jebel Ali, Jeddah. (IMEX) 15/10 TBA Purdential Global Master Marine Sohar, Jebel Ali & other Gulf Ports. —

In Port Henrika 2236E 223037 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao, Pusan, Kwangyang, Ningbo, 11/10

13/10 13/10-AM TS Dubai 22006E 223103 TS Lines Samsara Shpg Singapore, Shekou. (AIS) 14/10

11/10 11/10-PM Northern Guard 897E 223097 Feedertech Feedertech

13/10 13/10-PM Ever Ursula 182E 223039

Port Kelang, Singapore, Leam Chabang.(AGI) 12/10

Wan

Lines

Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 14/10 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX)

13/10 13/10-AM Celsius Naples 890E 223135 Evergreen/ONE Evergreen Shpg/ONE Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 14/10

19/10 19/10-AM Shimin 22006E 223108 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC) 20/10

16/10 16/10-AM X-Press Odyssey 22006E 223121 Interasia/GSL Aissa M./Star Shpg Port Kelang,Singapore, Tanjung Pelepas, Xingang, Qingdao, 17/10 Evergreen/KMTCEvergreen/KMTC (FIVE)

16/10 16/10-AM Kota Megah 0139E 223076 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 17/10

KMTC / KMTC India Dubai, Colombo, Port Kellang, Hongkong, Sanghai, Ningbo.

TS Line TS Line (I) Colombo, Port Kellang, Hongkong, Sanghai, Ningbo.

TBA RCL RCL Agency Port Kelang, Halphong, Nansha (RWA 1)

In Port Henrika 2236E 223037 KMTC/COSCO KMTC / COSCO Shpg. Colombo (AIS) 11/10

13/10 13/10-AM TS Dubai 22006E 223103 TS Lines Samsara Shpg 14/10

11/10 11/10-PM Northern Guard 897E 223097 Feedertech Emirates Shipping Colombo.(AGI) 12/10

13/10 13/10-PM Ever Ursula 182E 223039 Wan Hai Wan Hai Lines Colombo 14/10 COSCO/Evergreen COSCO /Evergreen (PMX)

13/10 13/10-AM Celsius Naples 890E 223135 Evergreen

Colombo.(CISC) 14/10 19/10 19/10-AM Shimin 22006E 223108

20/10 14/10 14/10-PM Yantian Express 2240W 223065 Hapag Lloyd

Shipping Colombo (IMEX) 15/10 CGM CGM

CGM Ag. (I)

16/10 16/10-AM X-Press Odyssey 22006E 223121 Interasia/GSL Aissa M./Star Shpg Colombo (FIVE) 17/10 Evergreen/KMTCEvergreen/KMTC 16/10 16/10-AM Kota Megah 0139E 223076 One / X-Press One India / Sea Consortium Karachi, Colombo. (CWX) 17/10 KMTC / TS Line KMTC India/TS Line (I)

18/10 17/10-PM Seaspan Lahore 2241W 223095 Hapag ONE Line (I)/ISS Shpg Colombo (MIAX) 19/10

In Port MSC Sola 240A 222989 MSC/SCI MSC Ag/J.M. Baxi Gioia Tauro, Feixstowe, Hamburg, Antwerp & Other Inland Destn.(HIMEXP) 11/10

11/10 11/10-AM Bach 47W 223066 ZIM Line Zim Integrated Haifa,

(ZMI) 12/10

(INDUS-2) 13/10

16/10

18/10

In Port Hong chang

Cut Off/Dt.Time Vessels Name Voy VCN LINE AGENT WILL LOAD FOR ETD

TO LOAD FOR MED., BLACK SEA, U.K., NORTH CONTINENT AND SCANDINAVIAN PORTS

15/10 15/10-AM Maersk Atlanta 240W 22314 Maersk Line Maersk India Algeciras 15/10

21/10 21/10-AM Maersk Pittsburgh 241W 22321 (MECL) 21/10

10/10 10/10-AM Aka Bhum 009E 22316 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 10/10

13/10 13/10-AM OOCL New York 089E 22320 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 13/10

10/10 10/10-AM Bangkok Bridge 137WE 22312 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 10/10 18/10 18/10-AM Clemens Schulte 016WE 22328 ONE ONE (India) (TIP) 18/10

12/10 12/10-AM Xin Hong Kong 057E 22318 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 12/10 15/10 15/10-AM One Continuity 061E 22311 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 15/10 Ningbo, Sekou, Cai Mep. (PS3)

16/10 16/10-AM Shijing 241E 22322 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 16/10 23/10 23/10-AM Grace Bridge 242E 22324 Ningbo, Tanjung Pelepas. (FM3) 23/10

12/10 12/10-AM SSL Kutch 242 22323 SLS SLS

Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 12/10

13/10 13/10-AM Montpellier 0021 22326 X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG) 13/10

15/10 15/10-AM Maersk Atlanta 240W 22314 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 15/10

21/10 21/10-AM Maersk Pittsburgh 241W 22321 (MECL) 21/10

19/10 19/10-AM SCI Mumbai 550 22329 SCI J. M Baxi Jebel Ali. (SMILE) 19/10

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

10/10 10/10-AM Aka Bhum 009E 22316 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 10/10

10/10 10/10-AM Bangkok Bridge 137WE 22312 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 10/10 18/10 18/10-AM Clemens Schulte 016WE 22328 ONE ONE (India) (TIP) 18/10 12/10 12/10-AM Xin Hong Kong 057E 22318 COSCO COSCO Shpg. Karachi, Colombo (CI1) 12/10 16/10 16/10-AM Shijing 241E 22322 SCI J. M Baxi Colombo. (FM3) 16/10 16/10 16/10-AM Irenes Bay 241S 22317 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 16/10

10/10 10/10-AM Bangkok Bridge 137WE 22312 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 10/10 18/10 18/10-AM Clemens Schulte 016WE 22328 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 18/10 15/10 15/10-AM One Continuity 061E 22311 ONE ONE (India) Los Angeles, Oakland. (PS3) 15/10 15/10 15/10-AM Maersk Atlanta 240W 22314 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 15/10 21/10 21/10-AM Maersk Pittsburgh 241W 22321 Safmarine Maersk Line India (MECL) 21/10

ETA/Berth Vessel’s Name Voy Line Agents Will Load For

ETD

10/10 Henrika Schulte IX239A MSC MSC Agency Mundra, Hazira, Nhava Sheva, Colombo, King Abdullah, Damietta, Mersin, 11/10 16/10 MSC Sariska IX240A Tekirdag, Valencia, Halifax, Baltimore, Savannah, Freeport Container Port (Indus 2) 17/10 11/10 SSL Visakhapatnam 147 Shreyas Transworld Group Europe, US East Coast, Med, East Africa, West Africa, East & West Coast 12/10 12/10 SSL Ganga 110 Hapag/CMA CGM ISS Shpg./CMA CGM Ag.(I) 13/10 ONE/COSCO ONE (I)/COSCO Shpg. (WCC)

11/10 BFAD Atlantic 241W Maersk Line Maersk India NSICT, Jebel Ali, Salalah, Djibouti, King Abdullah, Port Jeddah, Salalah 11/10 18/10 Roo Centaurus 242W (Blue Nile Express) 18/10

13/10 Northern Practise 0025 Global Feeder/Transworld Feeders Sima Marine/Transworld Group Jebel Ali, Khor Fakkan, AMCTPL, Hazira, GTI, Abu Dhabi 13/10 20/10 GFS Giselle 0059 X-Press Feeders/ONE Sea Consortium/ONE(I) (ASX) 20/10 Hapag / CMA CGM ISS Shpg./CMA CGM Ag. (I)

15/10 Maersk Phuket 241E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 16/10 22/10 Nagoya Tower 242E X-Press Feeders Sea Consortium Doha (Arabian Star) 23/10

15/10 MSC Aino IP241A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 16/10 22/10 MSC Pina IP242A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 23/10 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK)

18/10 X-Press Odyssey 2206E Zim/KMTC Zim Integrated/KMTC

Nhava Sheva,

Cont’d. from Pg. 2

The concession agreement for this terminal was signedon29July.InAugust,theportoperatorwonthebid to convert the dry bulk cargo Berth No 9 at V O C Port Authorityintoacontainerterminalwithprivatefunds.

The concession agreement for this project was signedinearlySeptember.

All the three port projects are part of the National Monetisation Pipeline (NMP), wherein operational infrastructure assets including port terminals will be privatised through the public-private-partnership (PPP) route.

The 4.5 million tonne (mt) a year capacity shallow water berth has a length of 445 metres with a depth of 10 metres, capable of handling container, cement, generalcargo,andliquidcargovessels.

The construction of the dedicated berth for Coastal Shippingwastakenupunderthe‘Sagarmala’programof the Ministry of Ports, Shipping, and Waterways to provideaboosttocoastalcargomovement.

The coastal berth has the capacity to handle about

2.5 million tonnes of coastal cargo like break bulk, dry bulk etc. The berth has a back-up area of 11 hectares to store cargo. JNPA also plans to set up silos for storage ofcementwhichwillenablefasterturnaroundofvessels.

Thecoastalberth,whichwascompletedinNovember 2020, aims to provide better infrastructure for Coastal Shippinganddecongestrailandroadnetworks,ensuring cost-competitive and effective Multi-Modal Transportationsolutions.

The construction of the dedicated berth is in line with the Government’s policy to promote coastal shipping to shift freight from road to an environment-friendly and cost-effectivemodeoftransport.

The coastal berth will aid smooth and faster coastal movement of cargo through a green channel and help increase the share of Coastal Shipping in the domestic cargo movement and as well as facilitate the export importcommunity.

J M Baxi Ports & Logistics runs Container Terminals atVisakhapatnamPort,DeendayalPort(Kandla),Haldia Dock Complex, a multiple purpose terminal at Paradip Port, container freight stations, inland container depots, bulk logistics, rail logistics (container trains), cold chain logisticsandheavyprojectlogistics.

The company adheres to the transparent process and supplier code of conduct in line with global parentage for vendor onboarding and awarding projects

PIPAVAV: APM Terminals Pipavav strongly believes in strengtheningvendorecosystemtransparentlythatallowsall suppliers to participate without any bias. Skilled and experiencedvendorsareimportanttoensurequalitysupplies for enhancing the infrastructural capabilities of the Port. Vendors contribute significantly in improving the overall operationalefficiencybyensuringqualityandtimelysupplies.

Adhering to the AP Moller Maersk's stringent safety, vendor on-boarding and suppliers’ code of conduct; the Port is aiming at providing equal opportunity to all vendors. The Port adopts transparent process of on-boarding vendors and their participation in upcoming projects or tenders. The selection of vendors is based on their financial stability, project deliverable success rate, work evaluation,

relevantexperience,andtechnicalrequirements,asapplicable.

Linkforparticipationcanbeviewedon: https://www.apmterminals.com/en/pipavav/practicalinformation/procurement-tenders

For the new vendors who are interested in registering with the Company to explore new projects, following link provides opportunity to register themselves with the Port authority.

https://www.apmterminals.com/en/pipavav/practica l-information/supplier-database

Also, the Company expects all suppliers to adhere to the ‘Maersk Supplier Code of Conduct’ (https://www.maersk.com/sustainability/supplier-codeof-conduct).