NAVI MUMBAI : PSA Mumbai clocked record annual throughput of 1.584 Million TEUs for the year 2022 with 35% YOY growth, informed a recent communique from PSA Mumbai. “We thank JNPA- Jawaharlal Nehru Port Authority, our Customers, Customs and other stakeholders for the supportextended,”addedthecommunique.

Cont’d Pg. 6

NEW DELHI : India has drawn up a list of over 35 items that are being examined for a possible customs duty increase in the upcoming budget, scheduled to be announcedonFebruary1.

Cont’d Pg. 6

NEW DELHI : Union Minister of Commerce and Industry Shri Piyush Goyal will be on a official visit to New York and Washington DC from 9-11 January 2023 to participate in India - US Trade Policy Forum.Inthe first leg of visit, Minister will interact with CEOs of reputed multinational enterprises, participate in community event, join roundtable meetings with business leaders and think tank and visitindustriesinNewYork.

He will attend the 13th Trade Policy Forum (TPF) meeting in Washington DC on 11th January 2023. Before delegation level talks he will also hold one to one meeting with USTR Ambassador Katherine Tai. The 12th

TPFMinisterial meetingwasheldon23 November 2021afteragapoffouryears in New Delhi. Working groups were re-activated after the last ministerial. TPF is a platform for continuous engagement between two countries in theareaoftradeandtofurtherthetrade and investment relations between the two countries. Both countries are looking forward to the meeting and confident of making progress on the trade issues. The TPF is chaired by Commerce and Industry Minister from IndiansideandUSTRfromtheUSside. In Washington DC, he will also have bilateral meeting with US Secretary of Commerce Gina Raimondo. There will also be interaction with some captains

ofIndustry.

Both India and USA are natural partners and have trade complementarities, long standing strategic and economic relationship, people to people contact, and both are vibrant democracies too. The two countries are also collaborating under the QUAD, I2U2 (India-Israel/ UAEUSA)andIPEF(Indo-PacificEconomic Framework). Regular exchanges at the leadership-level have been an integral element of the expanding bilateral engagement. The outcomes emerging from these visits have been instrumental in further strengthening the multifaceted ties between the two countries.

NEW DELHI - Union Minister for Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, Shri Piyush Goyal expressed confidence that the structural reforms taken by the Government in last 8 years will help India emerge among the top three developed economies in the world. He was interacting on the occasion of 27th edition of Wharton India Economic Forum via VC. The theme of today’s event was India leading innovation in theageofuncertainty.

Responding to a question of which sectors are strategic priorities for the Government, Shri Goyal said that infrastructure, Semiconductor, Domestic manufacturing are some of thepriority sectors. Healso pointed out that Prime Minister Narendra Modi's focus is on building a robust

infrastructureinIndia.Privatesectoris also contributing in this endeavour. Shri Goyal said Semiconductor is another critical sector for the Indian economy. Another important area is domestic manufacturing, and the Government has introduced PLI schemes to kickstart Indian manufacturing in over 14 sectors. The Minister mentioned the Government is also encouraging the Private sector/ industry associations to determine themselves what support in what areas itneedsfromtheGovernment.

Speaking on India’s renewed focus in signing free trade agreements in the past five years, Shri Goyal emphasised that India today has emerged out of the shadows of the past. India has recognized that multilateral engagements often lead to economic partnerships which may not be in the

bestinterestsofallthestakeholders.He citedtheexampleofIndiawalkingoutof Regional Comprehensive Economic Partnership (RCEP) because it was a very unfair, unbalanced agreement. He said India's interest is to enter into bilateralfreetradeagreementsthatare balanced, in the best interests of both countries. We are engaging with like minded countries particularly countries with a rules based order, transparent economic systems and entering into agreements which are a winwinforbothsides.

Speaking on challenges and opportunities for the next 25 years, Shri Goyal said one of the biggest challenges is going to be changing the mindset of the nation to recognize and value the importance of quality. He termed this as the defining factor for thefutureofIndia.

NEW DELHI : Overall Indian exports toBahraininthefirstsevenmonths(April – October) of the current fiscal reached USD $454.15 million, said the Indian exports apex body, the Federation of IndianExportOrganisations(FIEO).

“Bahrain is one of the key focus markets for India in the GCC as the country expands its free trade agreements in the region, particularly under the Comprehensive Economic PartnershipAgreement(CEPA).

Negotiations with GCC countries, including the Kingdom, is at an advanced stage, pointing to a robust growth future accelerating the pace of growth for regional trade relationships in the Gulf and the Middle East and Africa region,” said Dr Ajay Sahai, Director-General andCEOofFIEO.

Announcing the hosting of the multisector expo, Super Sourcing Arabia 2023, in the Kingdom, FIEO said the prospects

for Indian exports to Bahrain and GCC havebeenonanexponentialgrowthcurve and the expo will further help accelerate the trend benefitting the bilateral trade relations between both the countries.

Super Sourcing Arabia 2023, organised by the Dubai-based Verifair is a unique expo initsdiversityofproductbasket.

The show which will run from January8-10,2023atCrownPlazaBahrain will be a one-of—itskind opportunity for Bahrain’sandGCC’sretailindustryandecommerce stakeholders to engage with Indian exporters across multiple verticals, including food and non-food FMCGplayers,stationaryproducts,paper products and packaging, cosmetics, healthcare, home and living, safety equipment and fashion and lifestyle products,amongothers.

Super Sourcing Arabia 2023 will help Indian Exporters get connected with decision-makers in the supermarkets,

hypermarkets, retail chains, buying agents and importers in the Middle East, GCCandAfricanregion.

“The expo is happening at an opportune time of post-pandemic resurgence and rise in retail spending acrossthemarkets.

There have been robust indications on this front with export volumes continuing to surge. In 2021-22 fiscal Indian exports to GCC was at US$43.9 billion, a 44 per cent growth,” Dr. Sahai said, adding that apart from the sharp export growth to Bahrain, other GCC countries recorded substantial growth. According to FIEO, Indian exports to the UAE grew by 68 per cent, 49 per cent to Saudi Arabia, 33 per cent to Oman, 43 per cent to Qatar and 17 per cent to Kuwaitlastfiscal.

“We are seeing the growth trend on the upswing this fiscal too,” the FIEO officialsaid.

Cont’d from Pg. 3

PSA Mumbai is located in Jawaharlal Nehru Port (JNP) in Maharashtra, India’s largest and premier container gateway. The terminal is equipped with the latest

technology to offer customers fast turnaroundoftheirvesselsandisalso well-connected by major highways and rail networks to key markets in Maharashtra, Gujarat, and the NationalCapitalRegionofIndia.

It serves the important industrial and manufacturing centres and cities in Northwest India, as well as India’s

largesthinterlandwithapopulationin excessof400million.

PSA Mumbai Phase 1 developmenthasaquaylengthof1000 metresandthedeepestberthsatJNP, capable of handling super postpanamax vessels. When fully completed, the terminal will have a berthlengthof2,000metres.

Cont’d from Pg. 3

Private jets, helicopters, high-end electronic items, plastic goods, jewellery, high-gloss paper and vitamins are among items that are on the list prepared by the Government. “Alisthasbeendrawnupbasedonthe inputs from various ministries that are being examined,” said a Government official. The move is aimed at curtailing imports and also to encourage local manufacturing of someoftheseproducts.

The commerce and industry ministry had in December asked various ministries to ready a list of non-essential items, imports of which need to be discouraged through importtariffhike.

India’s current account deficit (CAD) rose to a nine-year high of 4.4% of GDP in the quarter ended September from 2.2% of GDP in the precedingquarter.

A fall in global commodity prices may have eased some worries over

the widening CAD, but policymakers wanttobecautious.

Exports are expected to be under pressure in FY24 following demand contraction in advanced economies. Economists see CAD at 3.2-3.4% of GDP in the next fiscal. “With local demandsettooutpaceexportgrowth, the merchandise trade deficit could remain at $25 billion per month, translating into a CAD of 3.2-3.4% of GDP,” said chief economist Aditi Nayar.

MUMBAI : Reserve Bank of India (RBI) Governor Shaktikanta Das has said rupee settlement for crossborder trade has huge potential and added that the central bank has initiated talks with some nations in SouthAsiatofacilitatesuchtrade.

“We are already in discussions with some of the countries in this region to facilitate rupee settlement of cross-border trade in the South

Asian region. So, that can be another area which has a very big potential in theyearstocome,”hesaid.

Das was speaking at an event organised by the International MonetaryFund(IMF)inNewDelhi.

Other than rupee settlement, RBI is also keen on linking of UPI for cross-border transactions, the RBI governor said, adding that India has already signed agreements with the

neighbouring countries of Nepal and Bhutan.

Going ahead, the recently launched the central bank digital currency (CBDC) can also be explored for cross-border transactions, Das added. However, RBI will move cautiously in allowing CBDC for use in cross-border transactions as risks of cloning may arise,hesaid.

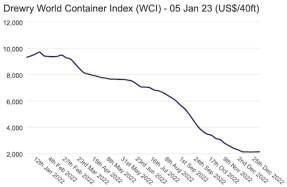

LONDON : Drewry’s composite World Container Index increased by 0.7% to $2,135.16per40ftcontainerlastweek.

• Thecompositeindexincreasedby0.7%lastweek,thefirstincrease in43weeks,buthasdroppedby77%whencomparedwiththesame weeklastyear.

• The latest Drewry WCI composite index of $2,1235 per 40-foot container is now 79% below the peak of $10,377 reached in September 2021. It is 21% lower than the 10-year average of $2,694, indicating a return to more normal prices, but remains 50% higher thanaverage2019(pre-pandemic)ratesof$1,420.

• The average composite index for the year-to-date is $2,135 per 40ft container, which is $559 lower than the 10-year average ($2,694 mentionedabove).

• The composite index increased by 0.7% to $2,135.16 per 40ft container, but is 77% lower than the same week in 2021. Freight ratesonShanghai–Rotterdamgained10%or$168to$1,874perfeu. SpotratesonShanghai–Genoaclimbed2%or$47to$2,926per40ft box. However, rates on Rotterdam – New York dropped 6% or $400 to $6,589 per 40ft container. Rates on Los Angeles – Shanghai and Shanghai – New York fell 3% each to $1,138 and $3,788 per 40ft box, respectively. Rates on New York – Rotterdam slid 2% to $1,243 per feu. Similarly, rates on Rotterdam – Shanghai and Shanghai – Los Angeles slipped 1% each to $785 and $1,964 per 40ft container, individually. Drewry expects small week-on-week reductions in ratesinthenextfewweeks.

Southampton, Helsingborg, Gothenburg & Red Sea, 27/0128/01

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports.

Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos

Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2

AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

11/01

IU301A N1891 261915-26/12 MSC MSC Agency Haifa. (INDUS) Hind Terminals 13/0114/01 12/01

Virginia IS302A N1910 262328-31/12

MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 20/0121/01 19/01

Rosa

IS303A SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 27/0128/01 26/01 1200 MSC Flavia IS304A U. K. North Continent & Other Mediterranean Ports.

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1

Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 13/0114/01 13/01 1200 Sofia Express 3302W N1882 262019-28/12 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 20/0121/01 TBATBA Kyoto Express 3303W N1948 262747-06/01 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 27/0128/01 TBATBA Budapest Express 3304W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 03/0204/02 TBATBA Osaka Express 3305W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports. AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America 15/0116/01 14/01 2000 Maersk Denver 301W N1865 261372-20/12 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 22/0123/01 21/01 2000 Maersk Hartford 302W N1863 261673-23/12 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 29/0130/01 28/01 2000 Maersk Columbus 303W N1904 262006-27/12

US East Coast Ports. Middle East Container Lines(MECL)

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 16/0117/01 TBATBA Celsius Naples 893E N1924 262431-02/01 TS Lines TS Lines (I) Vancouver Dronagiri-2 23/0124/01 TBATBA Shimin 22008E (CISC Service)

10/01 11/01 AS Emma IV301A N1890 261915-26/12 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 17/01 18/01 16/01 1200 MSC Melissa IV302A N1941 262530-03/01 23/01 24/01 TBA 1200 MSC Charleston IV303A 12/0113/01 11/01 0900 MSC Tianping IU301A N1891 261915-26/12 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 19/0120/01 TBA 0900 MSC Mundra VIII IU302A N1942 262531-03/01 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 13/0114/01 12/01 1200 MSC Virginia IS302A N1910 262328-31/12 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 20/0121/01 19/01 1200 MSC Rosa M IS303A Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 27/0128/01 26/01 1200 MSC Flavia IS304A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel Himalaya Express Globelink Globelink WW USA, East & West Coast. (Himalaya Express) 15/0116/01 14/01 2300 Athenian 3102 N1913 262379-02/01 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 22/0123/01 TBATBA CMA CGM Orfeo 0INDFW1 N1950 262745-06/01 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 29/0130/01 TBATBA OOCL Washington 3104

Hapag ISS Shpg. ULA CFS 06/0207/02 TBATBA Express Athens 3105

ONE Line ONE (India) 13/0214/02 TBATBA One Altair 3106

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America Express (INDAMEX)

India America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3

Team Lines Team Global Log. Norfolk, Charleston.

JWR Logistics

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

11/0112/01 11/01 2000 Dalian Express 2301W N1878 261943-27/12 CMA CGM CMA CGM Ag. New York, Norfolk, Savannah, Miami, Santos, Dron.-3 & Mul. 17/0118/01 TBATBA Berlin Express 2302W N1917 262396-03/01 ANL CMA CGM Ag. Itajai & other North American Ports. Dron.-3 & Mul. 24/0125/01 TBATBA Baltic Bridge 0MXDXW1 COSCO COSCO Shpg. 31/0101/02 TBATBA APL Antwerp 0MXDZW1

Hapag ISS Shpg. ULA CFS Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 India Sub Cont. Med. Express (IMEX) 12/0113/01 12/01 1200 Dalian 2209E N1841 261645-22/12 TS Lines TS Lines (I) Vancouver Dronagiri-2 16/0118/01 TBATBA X-Press Anglesey 22008E N1914 262389-02/01 (CWX) 12/0113/01 11/01 0900 APL Florida 0IX2ZW1 N1883 261977-27/12 CMA

(MWE SERVICE)

Maersk CFS 15/0116/01 14/01 2000 Maersk Denver 301W N1865 261372-20/12 Maersk Line Maersk India Salallah. (MECL)

Maersk CFS 16/0117/01 16/01 0200 Bertie 5

Lubeck Giga Shpg. Bandar Abbas, Chabahar 20/0121/01 20/01 0200 Libra 0132 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar. 18/0119/01 TBATBA Arzin 1285W N1912 262377-02/01 HDASCO Armita India Bandar Abbas, Chabahar. (IIX) 21/0122/01 TBATBA Haian East 23001E Sealead Giga Shpg. Dubai 26/0127/01 TBATBA SC Memphis 23002W OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA - INDIA DUBAI EAST AFRICA) GDL/—

11/0112/01

Sohar.

LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr

Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2 Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics 14/0115/01

Unifeeder Group Transworld Shpg. Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

10/0111/01 10/01 1300 ALS Flora 301W N1849 261774-24/12

Colombo (MESAWA)

16/0117/01 TBATBA Celsius Naples 893E N1924 262431-02/01 Evergreen Evergreen Shpg. Colombo. Balmer Law. CFS Dron. 23/0124/01 TBATBA Shimin 22008E Unifeeder Feedertech/TSA Colombo. Dronagiri 30/0131/01 TBATBA Celsius Nairobi 892E N1952 262789-06/01 ONE Line ONE (India) Colombo. (CISC Service) 06/0207/02 TBATBA Ever Ursula 184E CSC Seahorse Colombo. 20/0121/01 19/01 1900 AS Cypria 2302W N1899 262278-30/12 ONE Line ONE (India) Colombo. 03/0204/02 TBATBA Irenes Resolve 2304W Hapag ISS Shpg. (AIM) ULA CFS

10/01 11/01 AS Emma IV301A N1890 261915-26/12 MSC MSC Agency Colombo. (INDUSA)

12/0113/01 TBATBA MOL Courage 051E N1936 262627-04/01 ONE Line ONE (India) Colombo. 19/0120/01 TBATBA One Arcadia 063E Yang Ming Yang Ming(I)

Hind Terminals

Hind Terminal 12/0113/01 11/01 0900 MSC Tianping IU301A N1891 261915-26/12 MSC MSC Agency Karachi. (INDUS)

Contl.War.Corpn. 26/0127/01 TBATBA One Continuity 062E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 12/0113/01 12/01 1200 Dalian 2209E N1841 261645-22/12 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo

—/Dron-3 16/0118/01 TBATBA X-Press Anglesey 22008E N1914 262389-02/01 X-Press Feeders SeaConsortium (CWX) 24/0125/01 TBATBA TS Ningbo 23001E N1943 262728-05/01 TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/— 13/0114/01 13/01 2300 Zim Charleston 10E N1834 261586-22/12 OOCL OOCL (I) Colombo. GDL 15/0116/01 15/01 0800 OOCL Genoa 061E N1866 261912-26/12 Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 15/01 16/01 15/01 2000 Wide Juliet 026E N1930 262520-03/01 ONE Line ONE (India) Colombo. 22/01 23/01 TBATBA X-Pess Bardsey 23001E N1954 262827-07/01 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 29/01 30/01 TBATBA George Washington Bridge 018E CSC Seahorse Colombo.

In Port 10/01 BLPL Trust 1211E N1840 261530-21/12 BLPL Transworld GLS Chittagong, Yangoon 13/0114/01 12/01 1700 MSC Vidhi IW301A N1854 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 13/0114/01 12/01 2300 Navios Indigo 5W N1907 262371-02/01 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 13/0114/01 13/01 0900 OOCL Atlanta 151E N1908 262356-01/01 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 13/0114/01 12/01 1800 Ever Uberty 180E N1787 260983-14/12 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 13/0114/01 TBATBA Seaspan Emerald 13E N1939 KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 21/0122/01 TBATBA X-Press Odyssey 22008E X-Press Feeders SeaConsortium (CIX3 Service) 27/0128/01 TBATBA Zoi 21E EmiratesEmirates Dronagiri-2 15/0116/01 TBATBA Anbien Bay E08 N1897 262217-30/12 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS

10/0111/01 10/01 0400 GFS Pride 2215E N1691 260294-06/12 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 14/0115/01 TBATBA GFS Prestige 2216E N1856 261854-26/12 Heung A Line Sinokor India 18/0119/01 TBATBA Chennai Voyager 2213E N1906 Sinokor Sinokor India Seabird CFS (CSC) Sealead Giga Shpg. Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 12/0113/01 12/01 0300 GFS Pearl 2251E N1858 261856-26/12 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang 19/0120/01 19/01 0900 Vira Bhum 2252E N1919 262390-02/01 CU Lines/KMTC Seahorse/KMTC(I) (VGX) 26/0127/01 TBATBA CUL Jakarta 2301E Emirates Emirates Shpg. 14/0115/01 14/01 0400 Songa Leopard 899E N1893 262153-29/12 Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 18/0119/01 TBATBA Haian Mind 23001E N1616 259556-24/11 X-Press Feeders SeaConsortium (SIS) 16/0117/01 16/01 0900 Wadi Bani Khalid 2301E N1844 261698-23/12 Asyad Line Seabridge Singapore, Port Kelang. (IEX) 16/0117/01 TBATBA Celsius Naples 893E N1924 262431-02/01 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 23/0124/01 TBATBA Shimin 22008E Unifeeder Feedertech/TSA Qingdao, Shanghai, Ningbo. Dronagiri 30/0131/01 TBATBA Celsius Nairobi 892E N1952 262789-06/01 PIL/ONE PIL Mumbai/ONE(I) —/— 06/0207/02 TBATBA Ever Ursula 184E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 13/0214/02 TBATBA Bahamas 888E KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 20/0221/02 TBATBA Wide Alpha 234E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 27/0228/02 TBATBA Ever Useful 167E

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. CISC Service BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS

In Port 11/01

E156 N1822 261478-21/12 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 17/0118/01 TBATBA Argolikos E147 N1915 262394-02/01 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 31/0101/02 TBATBA Wan Hai 502 E109

Hapag/RCL ISS Shpg./RCL Ag. (CIX)

ULA-CFS/ 07/0208/02 TBATBA Wan Hai 507 E209

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 12/0113/01 TBATBA MOL Courage 051E N1936 262627-04/01 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 19/0120/01 TBATBA One Arcadia 063E

Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 26/0127/01 TBATBA One Continuity 062E

Hyundai HMM Shpg.

Seabird CFS (PS3 Service)

Samudera Samudera Shpg. (PS3 Service) Dronagiri Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 12/0113/01 12/01 1200 Dalian 2209E N1841 261645-22/12 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 16/0118/01 TBATBA X-Press Anglesey 22008E N1914 262389-02/01 X-Press Feeders SeaConsortium (CWX) 24/0125/01 TBATBA TS Ningbo 23001E N1943 262728-05/01 KMTC KMTC (India)

Dronagiri-3 28/0129/01 TBATBA X-Press Kilimanjaro 23001E TS Lines TS Lines (I) Dronagiri-2 05/0206/02 TBATBA Kota Megah 0142E RCL/PIL RCL Ag./PIL Mumbai 13/0214/02 TBATBA Pontresina 239E

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 13/0114/01 13/01 2300 Zim Charleston 10E N1834 261586-22/12 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 15/0116/01 15/01 0800 OOCL Genoa 061E N1866 261912-26/12 APL CMA CGM Ag. Dron.-3 & Mul. 16/0117/01 TBATBA Aka Bhum 011E N1918 262381-02/01 ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 23/0124/01 TBATBA OOCL New York 091E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3) Gold Star Star Ship Singapore, Hong Kong, Shanghai. ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 13/0114/01 13/01 0900 Seaspan Lumaco 302E N1842 261573-20/12 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 20/0121/01 TBATBA BSG Bimini 303E N1867 261672-23/12 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 27/0128/01 TBATBA Sofia I 304E N1902 262005-27/12 (FM-3)

15/01 16/01 15/01 2000 Wide Juliet 026E N1930 262520-03/01 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 22/01 23/01 TBATBA X-Pess Bardsey 23001E N1954 262827-07/01 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 29/01 30/01 TBATBA George Washington Bridge 018E Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri (TIP Service) RCL RCL Ag. Port Kelang, Singapore, Laem Chabang.

11/0112/01 11/01 0300 Jan Ritscher E908 N1882 261941-27/12 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 18/0119/01 TBATBA Marina Voyager E0111 Heung A Line Sinokor India Hongkong 25/0126/01 TBATBA Gabriela A E008 Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS InterasiaInterasia Unifeeder Feedertech/TSA Dronagiri 13/0114/01 12/01 1800 Ever Uberty 180E N1787 260983-14/12 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 13/0114/01 TBATBA Seaspan Emerald 13E N1939 KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Dai Chen Bay Dronagiri-3/— 21/0122/01 TBATBA X-Press Odyssey 22008E X-Press Feeders Sea Consortium 27/0128/01 TBATBA Zoi 21E Emirates Emirates Shpg (CIX3 Service) Dronagiri-2 03/0204/02 TBATBA ESL Da Chan Bay 02254E Pendulum Exp. Aissa Maritime (CIX3 Service) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 13/0114/01 13/01 0900 OOCL Atlanta 151E N1908 262356-01/01 COSCO COSCO Shpg. Shanghai, Laem Chabang. 18/0119/01 TBATBA Seamax Westport 084E APL CMA CGM Ag. (CI 1) Dron.-3 & Mul 06/0207/02 TBATBA OOCL Memphis 077E OOCL/RCL OOCL(I)/RCL Ag. GDL/— CU Lines Seahorse Ship Singapore,Shanghai,Ningbo,Shekou,Nansha,Port Kelang 14/0115/01 TBATBA Uru Bhum 022E N1876 261944-27/12 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 17/0118/01 TBATBA Calais Trader 022E N1792 261173-16/12 CU Lines Seahorse Ship (RWA) 15/0116/01 TBATBA CUL Manila 2301E N1892 262122-29/12 InterasiaInterasia 22/0123/01 TBATBA Interasia Engage E003

Emirates Emirates Shpg. 14/0115/01 TBATBA Hyundai Bangkok 014E N1835 261595-22/12 Hyundai HMM Shpg. Port Kelang, Singapore, Laem Chabang, Caimep, Kaohsiung, Seabird CFS 17/0118/01 TBATBA Hyundai Singapore 0133E Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 24/0125/01 TBATBA HyundaiHongkong 0140E TS Lines TS Lines (I) Singapore, Pusan, Shanghai,Ningbo, Shekou & South East Asia Dronagiri-2 30/0131/01 TBATBA Hyundai Busan 0142E Far East & China Ports. China India Express Service (CIX/ICX) Gold Star Star Ship Singapore, Kwangyang, Pusan, Shanghai, Ningbo Ocean Gate Sinokor Sinokor India Port Kelang, Singapore, Hong Kong, Kwangyang, Seabird CFS Busan, Shanghai, Ningbo & Other Inland Destination. 15/0116/01 TBATBA Anbien Bay E08 N1897 262217-30/12 Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 22/0123/01 TBATBA Najade E32

COSCO COSCO Shpg. Ningbo, Shekou. 26/0127/01 TBATBA Kumasi E007

InterasiaInterasia (CI2) 02/0203/02

TBATBA Delaware Trader TBA

Hyundai HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS (CI2)

CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai. 16/0117/01 TBATBA Henrika 2250E N1845 261733-23/12 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 17/0118/01 TBATBA TS Dubai 22008E N1889 262088-28/12 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 23/0124/01 TBATBA ESL Kabir 22052E

COSCO COSCO Shpg. (AIS SERVICE)

Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore. Dronagiri-2

CU Lines Seahorse Ship Port Kelang,Hongkong,Busan, Qingdao,Ningbo. 16/0117/01

TBATBA CMA CGM Tosca 0FF7QE1 N1810 261364-20/12 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 23/0124/01 TBATBA CMA CGM Rabelais 0FF7UE1

RCL RCL Ag. (AS1)

TBATBA Argolikos E147 N1915 262394-02/01 Auckland, Tauranga, Madang, Port Lae, Rabaul, Port Moresby 31/0101/02 TBATBA Wan Hai 502 E109 TS Lines TS Lines (I) Australian Ports. (CIX) Dronagiri-2 13/0114/01 13/01 2300 Zim Charleston 10E N1834 261586-22/12 ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 15/0116/01 15/01 0800 OOCL Genoa 061E N1866 261912-26/12 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 16/0117/01 TBATBA Aka Bhum 011E N1918 262381-02/01 OOCL OOCL (I) Sydney, Melbourne. GDL 23/0124/01 TBATBA OOCL New York 091E

TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 (CIX-3) Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 Team Lines Team Global Log. Australia & New Zealand Ports.

JWR Logistics 15/01 16/01 15/01 2000 Wide Juliet 026E N1930 262520-03/01 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, 22/01 23/01 TBATBA X-Pess Bardsey 23001E N1954 262827-07/01 Auckland, Lyttleton. 29/01 30/01 TBATBA George Washington Bridge 018E Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) (TIP Service) GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR

Nouadhibou, Dakar, Abidjan,Tema, Malabo & Saotome.

GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC 1 / IPAK) 14/0115/01 14/01

1

Brooklyn 302S N1864 261372-25/12 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 21/0122/01 21/01 0600 Lisa 303S N1872 261671-23/12 (MWE SERVICE) 28/0129/01 28/01 0600 Maersk Boston 304S N1903 262004-27/12 16/0117/01 TBATBA Celsius Naples 893E N1924 262431-02/01 TS Lines TS Lines (I) Australian Ports. (CISC Service) Dronagiri-2 21/0122/01 TBATBA Haian East 23001E Sealead Giga Shpg. Mombasa, Dar Es Salaam 26/0127/01 TBATBA SC Memphis 23002W OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA - INDIA DUBAI EAST AFRICA) GDL/— 20/0121/01 19/01 1900 AS Cypria 2302W N1899 262278-30/12 ONE Line ONE (India) Durban, Cape Town, Tema, Tincan, Apapa. 03/0204/02 TBATBA Irenes Resolve 2304W Hapag ISS Shpg. (AIM) ULA CFS

NEW DELHI - The Government is likely to announce adjustments in the duty structure for the $200-billion Indian apparel and textile sector in the Union budget next month in a bid to improve Indian competitiveness in cash-strapped Western markets, a seniorGovernmentofficialsaid.

Textile manufacturers say they have beenforcedtocutproductiondaysdueto high cotton prices At the same time, exports of cotton yarn a key raw material are expected to register a degrowth of 28-30% in FY23 due to weakeningglobaldemand “Ourthinking is to avoid inverted [duty] structure in trade and to make sure that if it is necessary to import raw material, the price should not be excessive, which will make our final product uncompetitive,”

saidtheofficialcitedabove.

Tobesure,highercottonproduction in the new cotton season of 2022-23 couldyeteasecottonprices.

Mismatch in demand and supply during the ongoing financial year had driven Indian cotton prices to a record highof?1lakhpercandyatonepoint.As a result, imports recorded a sharp growth. Imports of ‘Cotton Raw & Waste’ jumped 260% to $1.3 billion between April and November 2022, compared to $361.83 million during the comparable period a year ago “Meanwhile, we are taking steps to boost the production of cotton by implementing newer techniques for efficient farming. Branding activity of Indian varieties of cotton, such as ‘Kasturi cotton’ is also taken up in

collaboration with the industry, which willhavealong-termpositiveimpacton the industry Free trade agreements, especially with the EU, UK and Australia,willopenuplargemarketsfor Indian textile products,” the official added.

Seeking an exemption from import duty on cotton, Atul S. Ganatra, president of the Cotton Association of India, said, “the government has imposed an 11% import duty on cotton from 2 February 2021 This has drastically eroded the competitiveness of our value-added products in the international markets, and our textile industry, which is the second largest employment provider in the country, is now constrained to work with only 50% ofitsinstalledcapacity.”

NewDelhi-Indiawillbecome amajor exporteroftelecomequipmentinthenext two to three years and the Government is working to achieve that goal, communications minister Ashwini VaishnawsaidonSaturday

The statement from the minister follows the government’s meeting with 42 companies including Nokia, Samsung, Jabil, HFCL and Tejas Networks, among others, lastmonth, which gotapproval for

the production linked incentive (PLI) and design-linkedincentive(DLI)schemesfor domestic manufacturing of telecom and networkingequipments.

“Electronics manufacturing in India has come to that level that the country todayisthesecondlargestmanufacturer of mobile phones in the world Similarly, in the next two to three years it will emerge as a major exporter of telecom equipments as well,” Vaishnaw said at

In February 2021, the government had introduced the PLI scheme for manufacturing of telecom and networking equipment with an outlay of Rs 12,195 crore over a five-year period The government in June last year approved 31 companies, including Dixon Technologies, Nokia India and Foxconn, to manufacture telecom equipment underthescheme

NEW DELHI : The Centre has revised the format for consultations on National Highway projects. The move thatisaimedatofferingcomprehensive operational estimates so that road assets under Gati Shakti can be better monetised.

As per the revised standard operating procedure (SoP) and consultation format, national highway (NH) project proposals should now include operational assessment on aspects such as estimated traffic and how it will lead to reduced logistics costs Furthermore, the proposals should also include details on how the project will boosteconomicactivityandaidinbetter connectivity.

In an official communique last month, the Ministry of Road Transport and Highways (MoRTH) informed about the revised SoP and format for submission of proposals for consultation on NH projects in the networkplanninggroup(NPG).

The NPG is a group of officials from ministries and departments related to infrastructureandistaskedwithunified planningandintegrationofproposals.It also assists the empowered group of

secretaries (EGoS) on the Gati Shakti National Master Plan (NMP).

As part of the Gati Shakti NMP , MoRTH plans to develop 22 greenfield expressways, 23 key infrastructure and other highway projects and 35 multimodallogisticsparks.

Fo r p r o j e c t s s u b m i t t e d subsequently by Ministries, it should include advantages which the project will accrue to industries and economic activities in the region The ministry/department should explain how the project will contribute to multimodal connectivity, connect manufacturing and economic zones to infrastructural connectivity CompliancetotheGatiShakticonceptis critical and accordingly it is required to justify the Gati Shakti concept fulfilment, the communique said. The proposals should include information on the types of commodities and their estimated quantity that is likely to be generated from economic zones, clustersorports.

“Analyticalsubstantiationofreduced logistics cost, estimated traffic likely to be induced along with probable traffic distribution and its impact on NH corridors (on corridors being discussed

inNPGandotheradjacentNHcorridors) alsoneedstobeincluded,”itadded Inducing growth

Welcoming the development, Jagannarayan Padmanabhan, Director and Practice Leader, Crisil Market Intelligence and Analytics, pointed out that around 85 per cent of tollrevenueiscontributedbythefreight segment on national highways. By providing granular information on the typeofcommodityandeconomicimpact that NH will have, the confidence of investorsonthestretchandbidgoesup manifold.

“Whenever a transportation linkage gets established, it always results in inducedgrowthtotheeconomythrough which it passes. Calling this out at the time of project implementation gives more clarity and the indirect and allied infraandindustriescanalsobeplanned inadvance,”headded.

For instance, Padmanabhan says, if there is an expectation that warehousing can get a boost because of NH connectivity getting established, it can then lead to development of other support services in the area like third party logistics providers, freight forwardingandclearinghouseagents.

20/0121/01 Hoegh Tracer 41

Hoegh Autoliners Merchant Shpg. Lazaro Cardenas, Kingston, Veracruz, Freeport. 25/0129/01 Pederewski 26

Chipolbrok Samsara Houston. 28/0204/03 Lila Mumbai 225 29/01 30/01 Alliance St Louis 145

Hoegh Autoliners Merchant Shpg. Kingston, Veracruz, Jacksonville. 27/0228/02 Alliance Fairfax 105

20/0121/01 Hoegh Tracer 41

Hoegh Autoliners Merchant Shpg. Singapore, Laem Chabang, Masan. 25/0226/01 Hoegh Trident 201

Hoegh Autoliners Merchant Shpg. Singapore, Laem Chabang. 25/0129/01 Pederewski 26

Chipolbrok Samsara Singapore, Kaohsiung, Shanghai. 29/01 30/01 Alliance St Louis 145

Hoegh Autoliners Merchant Shpg. Durban, Tema*, Dakar 27/0228/02 Alliance Fairfax* 105 31/0101/02 Asian Majesty(KR) 206

Eukor Car Carr Parekh Marine Singapore. 28/0204/03 Lila Mumbai 225

Chipolbrok Samsara Singapore, Shanghai, Busan.

The above vessel is arriving at NHAVA SHEVA (GTI) on 12/01/2023 with Import Cargo in containers.

Item Nos. B/L NOS. Item Nos. B/L NOS. Item Nos. B/L NOS. 255 GOSUNGB1153619 256 GOSUNGB1153620 257 GOSUNGB1153621

Item Nos. B/L NOS. 258 GOSUSIN8134658 259 GOSUSIN8134749 260 GOSUSNH1689787

261 GOSUSNH1706797 262 GOSUSNH1706799 263 GOSUSNH8431284

264 GOSUSNH8431322 265 GOSUSNH1710636 266 GOSUSNH1710641

Consignees are requested to obtain DELIVERY ORDERS on presentation of ORIGINAL BILLS of LADING and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS movement due to port congestion Line/Agent are not responsible for the same.

Consignees will please note that the Carriers and/or their Agents are not bound to send Individual Notifications regarding the arrival of the vessel or the goods.

For detailed information on cargo availability please contact our office. For any charges enquiries, Please contact on our Import Hotline No. : 4252 4444 Container Movement to : OCEAN GATE CONTAINER TERMINAL PVT. LTD.

As Agents :

Raheja Centre-Point, 3rd Floor, 294, C.S.T. Road, Near Mumbai University, Kalina, Santacruz (East), Mumbai - 400 098. Tel : 91-22-4252 4301 Fax : 91-22-4252 4142

m.v. “AS EMMA” V- IV301A I.G.M. No. 2332001 Dt. 09-01-2023 Exch. Rate 85.3

The above vessel is arriving on 10-01-2023 at NHAVA SHEVA (NSIGT) with import cargo to NHAVA SHEVA from ADELAIDE, BELL BAY, FREMANTLE, SYDNEY Please note the item Nos. against the B/L Nos. for NHAVA SHEVA (NSIGT) delivery

Consignees are requested to kindly note that the above item nos. are for the B/L Nos. arrived for Nhava Sheva delivery. Separate IGM will be lodged with Mulund, Mumbai customs for CFS Mulund & MbPT delivery respectively

Consignees are requested to collect Delivery Order for all imports delivered at Nhava Sheva from our Import Documentation Dept. at Nhava Sheva - DN210 / DN211 / DN212, D-Wing, 2nd Floor, NMSEZ Commercial Complex, Plot No. 6, Sector - 11, Opp. JNPT Township, Dronagiri Node, Navi Mumbai - 400 707 , India and Mumbai - 1st Floor, MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400059 on presentation of duly discharged Original Bill of Lading and payment of relevant charges.

The container detention charges will be applicable after standard free days from the discharge of containers meant for delivery at Nhava Sheva. The containers meant for movement by road to inland destinations will be dispatched upon receipt of required documents from consignees/receivers and the consignees will be liable for payment of port storage charges in case of delay in submission of these documents. Our Surveyors are M/s. Zircon Marine Services Private Limited. and usual survey conditions will apply. Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo. Incase of any query, kindly contact Import Customer Service - (022) 66378123; IN363-imports.mumbai@msc.com Get IGM No. / ITEM No. /CFS details on our 24hrs computerized helpline No. (IVRS No.) 8169256872

MUMBAICargo

CJ-I VACANT

CJ-II MV Lady Demet DBC 11/01

CJ-III MV Mont Blanc Hawk Interocean 16/01

CJ-IV MV Tai Harvest BS Shpg. 14/01

CJ-V VACANT

CJ-VI MV Star Altair Genesis 12/01

CJ-VII MV Run Chen 2 Mihir & Co. 15/01

CJ-VIII VACANT

CJ-IX VACANT

CJ-X VACANT

CJ-XI MV TCI Express TCI Seaways 11/01

CJ-XII MV SSL Bharat Transworld 11/01

CJ-XIII VACANT

CJ-XIV MV Kang Hong Chowgule Bros 12/01

CJ-XV MV Obe Queen Ocean Harmony 12/01

CJ-XVA MV Jaohar UK Interocean 12/01

CJ-XVI VACANT

Tuna

MV African Harrier Tauras 11/01

MV Katya ATK GAC Shpg. 12/01

MV True Cardinal Tauras 12/01

MV Oriental Vesta Tauras 11/01

Stream MV Clipper Palma ACT Infra 30,000 T. Rice In Bags 2023011022

Stream MT Dawn Mansarovar MK Shpg. 12,000 T. FO 2022121114 10/01 MV Elpida GR BS Shpg. 19,000 T. Rice In Bags CJ-XVA MV Jaohar UK Interocean Sudan 26,500 T. Sugar In Bags 2022121114

Tuna MV Katya ATK GAC Shpg. U.S.A. 11,000 T. SBM 2022121380

CJ-II MV Lady Demet DBC Sudan 29,000 T. Sugar Bags (50 Kgs) 2022121157

Stream MV Mandovi Delta Waterways 2,000 T. Coke Breeze In Bulk

Stream MV Mercury J DBC Sudan 27,150 T. Sugar In Bags 2023011012

CJ-III MV Mont Blanc Hawk Interocean Indonesia 71,780 T. Sugar Bulk 2022121042

Stream MV Neptune J DBC Sudan 23,000 T. Sugar Bags 2022121048

CJ-XV MV Obe Queen Ocean Harmony Sudan 40,100 T. Sugar In Bags 2022121014

Stream MV Ocean Future ACT Infra 24,771/10,034 T. Rice 2022121092

14/01 MT Oriental Tulip Allied Shpg. Hazira 2,500 T. C. Oil

OJ-II MT Oriental Viola Allied Shpg. Rottardam 14,800 T. C. Oil

Stream MV Panoria Arnav Shpg. Abidjahan 35,500/14,000 T.Rice Bags/Bulk 2022121287

CJ-IV MV Tai Harvest BS Shpg. Madgaskar 20,850/16,000 T. Rice Bags 25kg/1 2022121351

Stream MV Teacher O DBC Somalia 11,000 T. Rice Bags (25 Kgs) 2022121351

Stream MV Wooyang Dandy Chowgule Bros 54,600 T. Salt 2022121358

Oil

OJ-I LPG/C Kruibeke

OJ-II MT Oriental Viola Allied Shpg. 11/01

OJ-III MT Nord Victorius Interocean 11/01

OJ-IV MT PK Marit Samudra 11/01

OJ-V MT Stolt Maple JMBaxi 11/01

OJ-VI VACANT

Samudra

Chem. 11/01 MT Avior James Mackintosh 12,000 T. RBD Stream MT Blue Ocean V-Ocean Shpg. 22,544 T. Methanol 2023011057

Stream MT Bow Emma GAC Shpg. Malaysia 7,500 T. Chem. 14/01 MT Chem Sol GAC Shpg. 4,656 T. Chem. 16/01 MT Chem Ranger GAC Shpg. 5,000 T. Chem.

Stream MT Dawn Mansarovar MK Shpg. 3,990 T. LSHS In Bulk 2022121189 16/01 MT Dolphin 03 Interocean 12,000 T. CPO Stream MT ES Valor Interocean Indonesia 13,000 T. CPO 2023011007 20/01 MT Essie C Interocean 30,000 T. CDSBO Stream LPG/C IGLC Dicle Seaworld Shpg. 21,500 T. Propane & Butane 2022121399 15/01 MT Gladys W Interocean Dumai 29,485 T. CDSBO 16/01 MT Ginga Lynx GAC Shpg. 5,000 T. Chem. 10/01 MT Golden Lotus J M Baxi Indonesia 6,004 T. CPO 2022121401 11/01 MT MTM Yangon Seaport 28,000 T. CDSBO OJ-III MT Nord Victorius Interocean Arjentina 30,500 T. CDSBO/CSFO 10/01 MT Ocean Pioneer Delta Waterways 4,860 T. Acetic Acid 11/01 MT Oriental Jasmine Allied Shpg. Rottardam 4,000 T. Chem. Stream MT Ouranos Samudra 4,749 T. Chem. 10/01 MT Pacific Citrine Interocean Arjentina 19,000 T. CDSBO 2022121160 OJ-IV

13/01 13/01-AM

(MECL) 20/01

Algeciras 13/01 20/01 19/01-AM

LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW

AND PACIFIC

Atlanta

13/01 13/01-AM

23001

COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 13/01 15/01 15/01-AM Seaspan Lumaco

22431

Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 15/01 22/01 22/01-AM BSG Bimini 303E 23005 Ningbo, Tanjung Pelepas. (FM3) 22/01 11/01 10/01-AM Zim Charleston 10E 22427

DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 11/01 15/01 15/01-AM OOCL Genoa 061 23007 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 15/01 16/01 16/01-AM X-Press Bardsey 23001E 23004 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 16/01 ONE ONE (India) (TIP) 10/01 10/01-AM One Competence 083E 22415 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 10/01 18/01 18/01-AM MOL Courage 051E 23009 Ningbo, Sekou, Cai Mep. (PS3) 18/01

11/01 11/01-AM SSL Bharat 123 23002 SLS SLS

Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 11/01 13/01 13/01-AM Maersk Denver 301W 22426 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 13/01 20/01 19/01-AM Maersk Hartford 302W 22435 (MECL) 20/01 13/01 13/01-AM AS Alexandria 0301E 23006 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam, Mundra (SHAEX) 13/01

TBA SCI J. M Baxi Jebel Ali. (SMILE)

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

11/01 10/01-AM Zim Charleston 10E 22427 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 11/01 13/01 13/01-AM OOCL Atlanta 151 23001 COSCO COSCO Shpg. Karachi, Colombo (CI1) 13/01 15/01 15/01-AM Seaspan Lumaco 302E 22431 SCI J. M Baxi Colombo. (FM3) 15/01 16/01 16/01-AM X-Press Bardsey 23001E 23004 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 16/01 ONE ONE (India) (TIP) 22/01 22/01-AM Irenes Ray 303S 23003 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 22/01 TO LOAD

10/01 10/01-AM One Competence 083E 22415 ONE ONE (India) Los Angeles, Oakland. (PS3) 10/01 13/01 13/01-AM Maersk Denver 301W 22426 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 13/01 20/01 19/01-AM Maersk Hartford 302W 22435 Safmarine Maersk Line India (MECL) 20/01 16/01 16/01-AM X-Press Bardsey 23001E 23004 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 16/01 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP)

Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK) 14/01 Celsius Nicosia 302E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 15/01 X-Press Feeders Sea Consortium Doha (Arabian Star)

15/01 Hyundai Bangkok 014E HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai. (CIX) 16/01 HMM HMM Shpg. Santos, Paranagua, Buenos Aires, Itajai, Montevideo. (FIL) 15/01 SSL Visakhaptnam 154 Shreyas Transworld Group Europe, US East Coast, Med, East Africa, West Africa, East & West Coast 16/01 Hapag/CMA CGM ISS Shpg./CMA CGM Ag.(I) ONE/COSCO ONE (I)/COSCO Shpg. (WCC)

BIEJING:Relyingonitsportresources, COSCO SHIPPING Logistics has been promoting the innovation of transportation mode through innovative measures for the management, service, and marketing of bulk grain logistics business with a view to maintaining an unimpeded channel for food transportation to safeguard nationalfoodsecurity.

More efficient food transportation through platformbased operations

By taking advantage of its platform-based operation to integrate all kinds of logistics resources and reduce grain circulation costs, BFT Logistics is able to provide customers with integrated grain logistics solutions with full traceability from the place of origin to the transportation hub and destinationofmarketing,andopenuplogisticschannelsfrom NortheastChinatoSouthChinaandSouthwestChina.

Relying on its independently designed and developed intelligent business system, BFT Logistics improved the efficiency of field operation by nearly 30% to greatly increase its transshipment operation capacity. Meanwhile, the application of the intelligent business system also enabled customerstolearnaboutthecargostatus,operationdataand vehicle information in real time, so that they could promptly adjusttheoperationplanaccordingtotheactualsituationwith higher communication efficiency. The service offered by BFT Logisticswashighlypraisedandrecognizedbythecustomers.

Recently, COSCO SHIPPING BFT Logistics (Yingkou) Co., Ltd., a subsidiary of COSCO SHIPPING Logistics, successfully completed the transfer and shipment of 1,136 trucks, 316 trains and 160 containers of grain through close cooperation with port terminals, truck fleets, railroads, and customers. By overcoming various problems caused by the mixed application of transportation modes and simultaneousstock-inandstock-outoperations,thecompany formulated a specialized operation solution, which helped it transship more than 70,000 tons of grain in different operationalmodeswithinfivedays.

In two and a half months, since the harvest of autumn grain in Northeast China this year, BFT Logistics has transshipped760,000tonsofgraintovariousportsinthesouth throughitsplatform,withamonthlyaveragetransitvolumeof 300,000 tons. By early December, it has transshipped more than 1.9 million tons of grain this year, an increase of 35% year-over-year.