E-Mail: dailyshipping@gmail.com

E-Mail: dailyshipping@gmail.com

GANDHIDHAM: A proud legacy which goes beyond 6 Decades behind India’s Oldest Shipping Newspaper – Daily Shipping Times – adds another legacy of completing a full DecadeinrecognizingTopExcellence in the field of Maritime and Logistics bywayoforganisingandmanaging of Gujarat Star Awards th(GSA)10 GrandGalaEdition.

See Pg. 4 Cont’d. Pg. 6

Currently Samir J. Shah is Advisor to FFFAI; Hon General Secretary of ACAAI and Partner of JBS Group

TM

AHMEDABAD: The JBS Group takes great pride in informing that its Partner Mr. Samir J. Shah has been elected as the ViceChairman of the Customs Affairs Institute – FIATA International Federation of Freight ForwardersAssociations.

Cont’d. Pg. 6

Cont’d. from Pg. 3

Yes, this year Daily Shipping Timesisorganisingthe10thEditionof Gujarat Star Awards in the Maritime State of Gujarat – recognizing Top Achievers and Companies having performed their bestintheStateforthelastfinancialyear.

th This 10 Grand Gala Edition of Gujarat Star Awards will glitter on Friday 20th January 2023 at Hotel Radisson – Kandla amidst the presence of who’s who from the Maritime and Logistics fraternity 5.00PMonwards.

WinninganAwardatPrestigiousGujaratStarAwards not only enhances the Brand Value in the industry but also define the Awardee as being one of the most consistentandstellarperformerinthesector.

The event will be attended by Top and Senior Most Bureaucrats from the Customs & Ports apart from leading Shipping Companies, Freight Forwarders, CHAs, Transporters, Members of Leading Commercial and Maritime Associations under one roof gracing the Top achievers of the Maritime Trade.

This time, Gujarat Star Awards will be a more Special, as Daily Shipping Times will be felicitating the Top Achievers who have performed consistently overlast9years.

th

This year Gujarat Star Awards 10 Edition isamustattendevent.

The Awards ceremony comprising Gala Entertainment will conclude with Networking OpportunitiesandDinner.

TM

Cont’d. from Pg. 3 FIATA – Is an International Body of Freight Forwarders founded in 1926 with a membership from more than 150 countries headquartered in Geneva-Switzerland.

The

leveraging a partnership between global Customs authorities and Forwarders in protecting trade and industry from Customs related fraud and security threatstoimproveproductivityandrevenue.Itobserves, examines and influences all Customs security policies and works with WCO; WTO; UNECE; UNCTAD; ICC; IRUandotherrelevantbodiestopromoteandencourage closercoordinationwithCustomsauthorities.

NEW DELHI: India will launch the National Logistics Portal–MarinefromDecember5seekingtoactasaCentral system for electronic sharing and exchange with interoperability across ocean, inland waterways, and coastalmovementofgoods.

The national single window platform will be the first of its kindtoprovideB2B(BusinesstoBusiness)andB2G(Business to Government) services for marine trade stakeholders. The platform seeks to help exporters, importers, and service providers exchange documents seamlessly and transact businessinatransparentandquickmanner.

The Government has hired Portall Infosystems Pvt Ltd, a unit of Mumbai-based logistics conglomerate J M Baxi Group, to build and run the National Logistics Portal–Marine.

Portal Infosystems has partnered with Germany’s dbh Consulting GmbH and Inspirisys Solutions Ltd to build the platform. Inspirisys Solutions is a unit of Japan’s CAC HoldingsCorporation.

“It’s a big initiative by the Government; a massive step forward for India’s logistics and trade community,” an officialsaid.

“With the shift to NLP-Marine, the existing Port CommunitySystem(PCS1x)platformwillbeshutdownand will no longer be available from 2 December, 2200 hours,” an officialcircularsaid.ThePCSfunctionalitywillnowbeapart oftheNLP-Marineplatform.

Ease of doing business The NLP-Marine has been developed to facilitate ease of doing business and make India one of the most cost effective and competitive countries in international trade, promote transparency in accessing information across the supply chain for all stakeholders, remove bottlenecks, empower end users with real-time decision-making tools, give access to latest

technology to all stakeholders, thereby increasing competition,accordingtotheprojectscope.

The national single window logistics platform has been designed to perform all core activities of the importer, exporter and Customs broker such as domestic tracking of the shipment with notifications at each stage, undertake Customs clearance on their own, online transaction with custodians, remote electronic data interchange (EDI) system package – for Bill of Entry and Shipping Bill checklist plus EDI file generation and document management system to store all the important documents securelyoncloudstorage.

It will facilitate real time information of the activities which are generally not in reach of the importer, exporter, Customs broker including vessel related information, terminal gate, and container freight station (CFS) gate transactions. It will also enable digital transactions for all the payments which are required for the clearance process of import and export like CFS charges, shipping line charges,transportationchargesetc.

Many supply chain disruptions and logistical logjams can be eased through trade facilitation, especially in the developing and least developed countries, and particularly by digitalization which enhances transparency, speeds up clearance, allows for risk management and pre-arrival processing, and enables more responsive and agile processes, the United Nations Conference on Trade and Development (UNCTAD) wrote in its ‘Review of Maritime Transport2022’.

Maritime transport and trade, it said, will need to adjust and adapt to technology, and an important part of this is to defend information and communication systems and infrastructureagainsteverpresentthreatstocybersecurity.

Customs Affairs Institute works towardsNEW DELHI: The Government is doubling down on its disinvestment programme before the end of 2022-23 and is now looking to start roadshows for the divestment of the Shipping CorporationofIndia(SCI)inJanuary, peopleawareoftheprocesssaid.

“Discussions are ongoing with Islamic Republic of Iran Shipping Lines to transfer the stake of Irano Hind Shipping to SCILAL, and hopefully the demerger of Shipping CorpandSCILALwillbecompletedin early January,” one official aware of thediscussionssaid.

A joint venture with SCI, Irano Hind Shipping operates as a subsidiary of the Islamic Republic of IranShippingLines.

The SCI divestment process involvesthedemergerandtransferof non-core and land assets of the companyintoShippingCorporationof IndiaLandandAssets(SCILAL).

“We are hoping to list Shipping Corporation of India Land and Assets

onthestockexchangesbyJanuary,”a secondgovernmentofficialsaid.

Financial bids from potential investors are expected to be invited following the demerger and relisting ofSCILAL,headded

A senior executive from the company confirmed that SCI had in October secured backing from its lenders on the demerger scheme. “Banks have cleared the demerger scheme and the transfer to Rs 1,000 crore from Shipping Corp’s cash to SCILAL,”theofficialsaid.

The Ministry of Ports, Shipping and Waterways had in April asked SCI to expedite the process of demerger of its non-core assets to SCILAL and also requested the board to review the demergerschemeforhivingoffthenoncore assets, including Shipping House, the building housing SCI’s registered office,andsubsidiaryMaritimeTraining Institute,bothinMumbai.

In May, the SCI board had approved an updated demerger

schemetohiveoffthenon-coreassets of SCI to SCILAL. As per the SCI balance sheet, the value of non-core assets held for demerger as on September 30, 2022, stood at Rs 2,392 crore.

The largest Indian shipping company in India reported a 48.81 percentdeclineinitsconsolidatednet profit to Rs 124 crore for the quarter ended September 2022, despite its total income rising 12.5 percent to Rs 1,458 crore during the quarter. SCI saiditsshareholdershaveapproveda dividendofRs0.33perequityshareof facevalueRs10each.

The Department of Investment and Public Asset Management in December 2020 had invited expressions of interest for the strategic disinvestment of its entire 63.75 percent stake in SCI, along with the transfer of management. The cabinet in November 2020 had given in-principle approval for the strategic divestmentofSCI.

Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

Courage IU248A N1608 259408-22/11 MSC MSC Agency Haifa. (INDUS) Hind Terminals 09/1210/12

Sola IS249A N1643 259856-29/11 MSC MSC Agency U.K., North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 16/1217/12 15/12

Irene IS250A SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 23/1224/12 22/12 1200 MSC Benedetta IS251A U. K. North Continent & Other Mediterranean Ports.

Himalaya Express

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa. Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 09/1210/12 09/12 0700 Osaka Express 2346W N1562 259120-17/11 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 16/1217/12 TBATBA Prague Express 2347W N1609 259472-23/11 Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 23/1224/12 TBATBA Nagoya Express 2348W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 30/1231/12 TBATBA One Henry Hudson 2349W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

06/1207/12 05/12 2100 APL Antwerp OMXDJW1 N1598 259410-22/11 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 13/1214/12 TBATBA Yantian Express 2245W N1636 259777-28/11 CMA CGM CMA CGM Ag. Valencia, Cagliari 2. (IMEX Service) Dron-3 & Mul 20/1221/12 TBATBA CMA CGM Titus 0MXDNW COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 27/1228/12 TBATBA XIN YAN Tian 075E SarjakSarjak Genoa,

1

Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3 Safewater Safewater Line US East Coast, South & Central America 11/1212/12 10/12 2000 Maersk Detroit 248W N1584 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 18/1219/12 17/12 2000 Maersk Sentosa 249W Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 25/1226/12 24/12 2000 Maersk Chicago 250W US East Coast Ports. Middle East Container Lines(MECL) 01/0102/01 31/12 2000 Maersk Atlanta 251W

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1

In Port 05/12 Exress Athens 2147 N1520 258712-10/11 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah Dron.-3 & Mul. 11/1212/12 TBATBA One Altair 2148 N1578 259217-18/11 OOCL OOCL(I) & Other US East Coast Ports. Dronagiri-2 18/1219/12 TBATBA CMA CGM Ivanhoe 2149 Hapag ISS Shpg. ULA CFS 25/1226/12 TBATBA CMA CGM Butterfly 0IND7W1

ONE Line ONE (India) 01/0102/01 TBATBA X-Press Rome 2151 COSCO COSCO Shpg.

India America Indial Indial Shpg. US East Coast & South America Express (INDAMEX)

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3

Team Lines Team Global Log. Norfolk, Charleston. JWR Logistics

Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 05/12 06/12 05/12 1200 MSC Silvia IV248A N1601 259419-22/11 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 12/12 13/12 TBA 0900 MSC Maeva IV249A N1632 259854-29/11 19/12 20/12 TBA 0900 MSC Tresea IV258A 08/1209/12 07/12 0900 Conti Courage IU248A N1608 259408-22/11 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 15/1216/12 14/12 0900 MSC Shanghai IU249A N1657 259985-01/12 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 09/1210/12 08/12 1200 MSC Sola IS249A N1643 259856-29/11 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 16/1217/12 15/12 1200 MSC Irene IS250A Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 23/1224/12 22/12 1200 MSC Benedetta IS251A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast. (Himalaya Express)

In Port 05/12 Seaspan Chiba 012E N1559 259106-17/11 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 11/1212/12 TBATBA Wide Juliet 025E N1655 259929-30/11 & Caribbean Ports, Canada South & Central America. 18/1219/12 TBATBA X-Press Bardsey 22020E Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & (TIP Service) West Indies Ports. (TIP Service)

Port 06/12

Anglesey

N1594 259328-21/11

Emirates Emirates Shpg. Jebel Ali, Sohar.

LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS

QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2

Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics 10/1211/12 TBATBA

0029 N1639 259788-28/11 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 17/1218/12 TBATBA

Global Feeder Sima Marine Dronagiri

Unifeeder Group Transworld Shpg. Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

259700-25/11 ONE Line ONE (India) Colombo. 30/1231/12 TBATBA Seaspan Lahore 2251W Hapag ISS Shpg. (AIM) ULA CFS

05/12 06/12 05/12 1200 MSC Silvia IV248A N1601 259419-22/11 MSC MSC Agency Colombo. (INDUSA)

Hind Terminals

Hind Terminal 08/1209/12 07/12 0900 Conti Courage IU248A N1608 259408-22/11 MSC MSC Agency Karachi. (INDUS)

In Port 05/12 Seaspan Chiba 012E N1559 259106-17/11 ONE Line ONE (India) Colombo. 11/1212/12 TBATBA Wide Juliet 025E N1655 259929-30/11 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 18/1219/12 TBATBA X-Press Bardsey 22020E CSC Seahorse Colombo.

In Port 06/12 X-Press Anglesey 22007E N1594 259328-21/11 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 11/1212/12 TBATBA TS Kelang 22008E N1637 259764-28/11 X-Press Feeders SeaConsortium (CWX) 18/1219/12 TBATBA X-Press Kilimanjaro 22007E TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/— 05/1206/12 05/12 2300 OOCL New York 090E N1627 259708-26/11 OOCL OOCL (I) Colombo. GDL 12/1213/12 TBATBA OOCL Hamburg 139E

Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 07/1208/12 07/12 0800 MOL Creation 086E N1574 259213-18/11 ONE Line ONE (India) Colombo. 18/1219/12 TBATBA Conti Contessa 112E Yang Ming Yang Ming(I) Contl.War.Corpn. 05/0107/01 TBATBA One Competence 089E Hapag/CSC ISS Shpg/Seahorse (PS3 Service)

ULA CFS/ 10/1211/12 TBATBA Zoi 20E N1629 259723-26/11 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 16/1217/12 TBATBA ESL Da Chan Bay 2247E

KMTC/Gold Star KMTC(I)/Star Ship

Dronagiri-2

Dronagiri-3/— 24/1225/12 TBATBA KMTC Dubai 2207E X-Press Feeders SeaConsortium (CIX3 Service) 30/1231/12 TBATBA Zim Norfolk 7E EmiratesEmirates

07/1208/12 06/12 1700 MSC Leandra IW248A N1631 259852-29/11 MSC MSC Agency Colombo (IAS SERVICE) Hind Terminal 08/1209/12 TBATBA Seamax Westport 083E N1604 259425-22/11 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 08/1209/12 TBATBA Najade E031 N1591 259312-21/11 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 13/1214/12 TBATBA BLPL Faith 3220E BLPL Transworld GLS Chittagon, Yangoon 19/1220/12 TBATBA Kota Lagu 8W N1640 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS

05/1206/12 Shimin 22007E N1602 259420-22/11 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, Balmer Law. CFS Dron. 12/1213/12 TBATBA Celsius Nairobi 892E N1645 259859-29/11 Unifeeder Feedertech/TSA Qingdao, Shanghai, Ningbo. Dronagiri 02/0103/01 TBATBA Wide Alpha 233E PIL/ONE PIL Mumbai/ONE(I) —/— 09/0110/01 TBATBA Ever Ulysses 148E Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 16/0117/01 TBATBA Celsius Naples 893E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 CISC Service TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS 08/1209/12 08/12 0100 GFS Pearl 2246E N1596 259370-21/11 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang 15/1216/12

TBATBA Vira Bhum 2247E N1635 259763-28/11 CU Lines/KMTC Seahorse/KMTC(I) (VGX) 22/1223/12

TBATBA CUL Jakarta 2248E Emirates Emirates Shpg. 10/12 11/12

TBATBA Wadi Bani Khalid 2230E N1595 259361-21/11 Asyad Line Seabridge Singapore, Port Kelang. (IEX) 17/1218/12

TBATBA Hansa Rottenburg 919E N1634 259749-28/11 Unifeeder Feedertech/TSA Singapore, Port Kelang Dronagiri 24/1225/12

TBATBA Songa Leopard 898E X-Press Feeders SeaConsortium (SIS) 31/1201/01

TBATBA Haian Mind 2202E 21/1222/12 TBATBA Shanghai Voyager 2210E N1660 259963-30/11 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 05/0106/01

TBATBA GFS Pride 2215E Heung A Line Sinokor India 11/0112/01 TBATBA GFS Priestige 2216E Sinokor Sinokor India Seabird CFS (CSC) Sealead Giga Shpg. Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

In Port 05/12

Seaspan Chiba 012E N1559 259106-17/11 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 11/1212/12 TBATBA Wide Juliet 025E N1655 259929-30/11 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 18/1219/12 TBATBA X-Press Bardsey 22020E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 25/1226/12 TBATBA Bangkok Bridge 0139E

RCL RCL Ag. Port Kelang, Singapore, Laem Chabang.

In Port 06/12 X-Press Anglesey 22007E N1594 259328-21/11 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 11/1212/12 TBATBA TS Kelang 22008E N1637 259764-28/11 X-Press Feeders SeaConsortium (CWX) 18/1219/12 TBATBA X-Press Kilimanjaro 22007E

KMTC KMTC (India)

Dronagiri-3 31/1201/01 TBATBA Kota Megah 0141E

TS Lines TS Lines (I) Dronagiri-2 03/0104/01 TBATBA Pontresina 238E

RCL/PIL RCL Ag./PIL Mumbai (CWX) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 07/1208/12 07/12 0800 MOL Creation 086E N1574 259213-18/11 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 20/1222/12 TBATBA Conti Contessa 112E Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 05/0107/01 TBATBA One Competence 089E Hyundai HMM Shpg. Seabird CFS (PS3 Service) Samudera Samudera Shpg. (PS3 Service) Dronagiri

Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 05/1206/12 05/12 2300 OOCL New York 090E N1627 259708-26/11 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo, GDL/Dron-1 12/1213/12 TBATBA OOCL Hamburg 139E

APL CMA CGM Ag. Dron.-3 & Mul. 19/1220/12 TBATBA OOCLLuxembourg 099E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 26/1227/12 TBATBA Seamax Stratford 119E COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3) Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 06/1210/12 08/12 1200 Ital Unica 155E N1572 259119-17/11 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 12/1214/12 TBATBA Argolikos E146 N1653 259914-30/11 Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 27/1228/12 TBATBA Wan Hai 502 E108 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 03/0104/01 TBATBA Wan Hai 507 E208

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 08/1210/12 TBATBA BSG Bimini 249E N1586 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 16/1217/12 TBATBA Sofia 1 250E CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 23/1224/12 TBATBA Northern Diamond 251E (FM-3) 10/1211/12 TBATBA Uru Bhum 112E N1612 259476-23/11 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 11/1212/12 TBATBA CUL Nansha 2247E N1613 259485-23/11 CU Lines Seahorse Ship (RWA) 17/1218/12 TBATBA Interasia Engage E002 InterasiaInterasia Emirates Emirates Shpg. 10/1211/12 TBATBA Zoi 20E N1629 259723-26/11 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, Balmer Law. CFS Dron. 16/1217/12 TBATBA ESL Da Chan Bay 2247E KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Dai Chen Bay

Dronagiri-3/— 24/1225/12 TBATBA KMTC Dubai 2207E X-Press Feeders Sea Consortium 30/1231/12 TBATBA Zim Norfolk 7E Emirates Emirates Shpg (CIX3 Service) Dronagiri-2 06/0107/01 TBATBA Ever Uberty 180E Pendulum Exp. Aissa Maritime 20/0121/01 TBATBA X-Press Odyssey 22008E Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

In Port 05/12 HyundaiHongkong 0139E N1593 259330-21/11 Hyundai HMM Shpg. Port Kelang, Singapore, Laem Chabang, Caimep, Kaohsiung, Seabird CFS 09/1210/12 09/12 0500 Hyundai Busan 0141E N1644 259860-29/11 Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 19/1220/12 TBATBA Hyundai Colombo 0129E TS Lines TS Lines (I) Singapore, Pusan, Shanghai,Ningbo, Shekou & South East Asia Dronagiri-2 Far East & China Ports. China India Express Service (CIX/ICX) Gold Star Star Ship Singapore, Kwangyang, Pusan, Shanghai, Ningbo Ocean Gate Sinokor Sinokor India Port Kelang, Singapore, Hong Kong, Kwangyang, Seabird CFS Busan, Shanghai, Ningbo & Other Inland Destination. 05/1206/12 05/12 1000 ESL Kabir 2245E N1610 259482-23/11 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 07/1208/12

Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS

CU Lines Seahorse Ship Port Kelang(N), Hongkong, Qingdao, Shanghai. 08/1209/12

TBATBA Seamax Westport 083E N1604 259425-22/11 COSCO COSCO Shpg. Shanghai, Laem Chabang. 18/1219/12

TBATBA Xin Shanghai 140E

TBATBA COSCO Thailand 090E

APL CMA CGM Ag. (CI 1)

Dron.-3 & Mul 26/1227/12

OOCL/RCL OOCL(I)/RCL Ag.

CU Lines Seahorse Ship Singapore,Shanghai,Ningbo,Shekou,Nansha,Port Kelang 12/1213/12

GDL/— (CI 1)

TBATBA CMA CGM Rabelais 0FF7IE1 N1624 259663-25/11 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou

Dron-3 & Mul 19/1220/12

TBATBA Cypress 0FF7ME1 RCL RCL Ag. (AS1)

Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) (TIP Service) GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR 05/1206/12 Shimin 22007E N1602 259420-22/11 TS Lines TS Lines (I) Australian Ports. (CISC Service) Dronagiri-2 05/1206/12 05/12 2300 OOCL New York 090E N1627 259708-26/11

ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 12/1213/12

TBATBA OOCL Hamburg 139E

RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 19/1220/12 TBATBA OOCLLuxembourg 099E OOCL OOCL (I) Sydney, Melbourne. GDL 26/1227/12 TBATBA Seamax Stratford 119E TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 (CIX-3) Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 Team Lines Team Global Log. Australia & New Zealand Ports. JWR Logistics 06/1210/12 08/12 1200 Ital Unica 155E N1572 259119-17/11 ANL CMA CGM Ag. Fremantle, Melbourne, Sydney, Adelaide, Brisbane, Dron.-3

12/1213/12

Taipan 136 260071-02/12 Eukor Car Carr Parekh Marine Europe and Mediterranen Ports. 27/1228/12 Morning Peace 053

TO

11/1212/12 Bahri Yanbu 026

TO

Bahri Logistics Radiant Maritime Genoa, Alexandria, Suez Canal, Jeddah, Abu Dhabi, Jebel Ali, Dammam.

12/1213/12 Taipan 136 260071-02/12 Eukor Car Carr Parekh Marine USA South America & Caribbean Ports. 08/1212/12 CP Moon 94 1058107-21/11 Chipolbrok Samsara Houston. 10/0114/01 Pederewski 26

11/1212/12 Bahri Yanbu 026

Bahri Logistics Radiant Maritime Pensacola, Houston, Wilmington, Baltimore, Cartagena. 17/1218/12 Hoegh Kobe 74/75 1059888-28/11 Hoegh Autoliners Merchant Shpg. Kingston, Veracruz, Freeport, Jacksonville. 25/0126/01 Alliance St Louis 45

In Port 05/12 Yangtze Venus 2206 257394-24/10

Mitsutor Peria. 12/1213/12 Taipan 136 260071-02/12 Eukor Car Carr Parekh Marine Singapore, Laem Chabang, Pyungtaek (Direct) & other Far East, African Ports 27/1228/12 Morning Peace 053 08/1212/12 CP Moon 94 1058107-21/11 Chipolbrok Samsara Singapore, Batangas, Huang Pu, Shanghai. 11/1212/12 Bahri Yanbu 026

Bahri Logistics Radiant Maritime Jakarta, Vietnam, Shanghai, Taicang. 17/1218/12 Hoegh Kobe 74/75 1059888-28/11 Hoegh Autoliners Merchant Shpg. Durban, Tema, Dakar 25/0126/01 Alliance St Louis 45 10/0114/01 Pederewski 26

Chipolbrok Samsara Singapore, Kaohsiung, Shanghai. 13/0114/01 Hoegh Tracer 40

Hoegh Autoliners Merchant Shpg. Singapore.

m.v. “X-PRESS ANGLESEY ” (ZIM VOY HV1 13/E)

The above vessel has arrived at NHAVA SHEVA (GTI) on 05/12/2022 with Import Cargo in containers.

Item Nos. B/L NOS. Item Nos. B/L NOS. Item Nos. B/L NOS. 1. GOSUSNH20774244 2. GOSUSNH20774265 3. GOSUNGB9959907

Consignees are requested to obtain DELIVERY ORDERS on presentation of ORIGINAL BILLS of LADING and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable. If there is any delay in CY-CFS movement due to port congestion Line/Agent are not responsible for the same. Consignees will please note that the Carriers and/or their Agents are not bound to send Individual Notifications regarding the arrival of the vessel or the goods.

For detailed information on cargo availability please contact our office. For any charges enquiries, Please contact on our Import Hotline No. : 4252 4444 Container Movement to : OCEAN GATE CONTAINER TERMINAL PVT. LTD. As Agents :

Raheja Centre-Point, 3rd Floor, 294, C.S.T. Road, Near Mumbai University, Kalina, Santacruz (East), Mumbai - 400 098. Tel : 91-22-4252 4301 Fax : 91-22-4252 4142

Gold Star Line Ltd.

The above vessel is arriving at NHAVA SHEVA (GTI) on 06/12/2022 with Import Cargo in containers.

Consignees are requested to obtain

MUMBAINEW DELHI: The Government is looking at giving a major push to shipping and port infrastructure through planned upgrades at an estimated cost of around $25 billion, accordingtoareport.

These planned upgrades to the sector will be prioritized for completion under the PM Gatishakti National Master Plan. The ports at Paradip, Visakhapatnam, and Kolkata are prioritized with the most projects.

The PM Gatishakti National MasterPlanlaysthefoundationofthe overall infrastructure in the country and provides an integrated and holisticpathtotheeconomy.Itaimsto

provide systematic multimodal connectivity to various economic zones for the seamless movement of people, goods, and services across India.

The Centre has set up the Empowered Group of Secretaries (EGoS) to monitor the implementation of the Gatishakti National Master Plan. This Group includes Secretaries of 20 Infrastructure and Economic User Ministries and is headed by the CabinetSecretary.

There are 102 critical projects underGatishaktiworth$7.67billionto be completed by 2024. Out of 102criticalprojects,Maharashtrahas

31 projects, Karnataka 17 projects, Gujarat 16 projects, Andhra Pradesh 14 projects, Tamil Nadu/W Bengal 7 projects and Kerala/Odisha 5projects.

According to Minister of Ports, Shipping, and Waterways Shri Sarbananda Sonowal, the government has identified a pipeline 81 public private partnership (PPP) projects worth $5.18 billion to develop berths and terminals across major portsby2024-25.

Further, new road alignments, upgradation of existing roads, and new rail projects to manage freight traffic are also being identified by the ShippingMinistry.

NEW DELHI: The world, includingIndia’spartnersintheIndoPacific QUAD, including the United States, Japan and Australia are closely monitoring New Delhi’s move asitstartsgettingimportordersfrom Russia. Sources said India’s exports to Russia, notwithstanding the sanctions, will rise in the coming months as the two countries inch closer to kick off the rupee ruble paymentmechanism.

According to a Reuters report, Moscow is already looking to purchase at least 500 different productswhichincludepartsforcars, aircraft and trains from India, which has discounted purchasing oil from Russia.

Russian energy major Gazprom has already opened a special rupee account with public sector UCO Bank to ease transactions in the Indian currency. India has been purchasing Russian oil at a discounted rate but once the mechanism kicks off, Moscow’s imports from New Delhi willincrease.

External Affairs Minister S Jaishankar who visited Moscow last month to attend a meeting of the bilateral Inter-Governmental Commission on Trade, Economic Scientific, Technological and Cultural Cooperation (IRIGC-TEC),

underlined the need to boost exports toRussia.

Ajay Sahai, director general and CEO, Federation of Indian Export Organisations (FIEO) said that Indian exporters have started getting “enquiries” but for these to materialise into trade pacts, the payments framework has to be in place.

“Indian exporters are still unsure about the sanctions. There are several Russian entities which are under sanctions, so our exporters are doing their due diligence before signing up,” Sahai said, adding that eventually Russian imports would havetoincreaseoncetherupee-ruble paymentsystemstarts.

A report published by the Observer Research Foundation (ORF) highlighted that “New Delhi will have to continue to navigate its partnerships at a time when trust between Russia and the West has plummeted to its nadir.” “When Prime Minister Narendra Modi publicly told Russian President Vladimir Putin that now was ‘not a time for war’ on the sidelines of the Shanghai Cooperation Organization’s summit in September, it was widely reported across the world and was quoted by many western leaders to underscore the pressure the world

wasunderduetotheconflict.

The Russian government on its official website has emphasised that enhancing trade and economic cooperation between New Delhi and Moscowwillremain“akeypriorityfor the political leadership of both the countries”.

While the two countries had set a target of increasing bilateral investment to $50 billion and bilateral trade to $30 billion by 2025, sources said that these would be achieved muchearlier.

Meanwhile, Russia Briefing noted that the Eurasian Economic Union (EAEU)comprisingRussia,Armenia, Belarus, Kazakhstan and Kyrgyzstan is also exploring the possibility of carving out a common payment system with the BRICS block. Brazil, Russia, India, China and South Africa aremembersofthis“informal”block.

The EAEU’s regulatory body envisages the issuance of a single payment card within the two trade blocs. That would unite the national payment systems of its member states,includingRussia’sMir,China’s UnionPay,India’sRuPay,Brasil’sElo andothers,itsaid.

Amid shifting geopolitics, the importanceofBRICSisrisingdespite severe issues relating to the tension betweenIndiaandChina.

MUMBAI: The Reserve Bank of India’s (RBI’s) foreign exchange reserves rose by $2.9 billion to $550.14 billion in the week ended November 25, thelatestCentralBankdatashowed.

The data marks the third

consecutive week in which the RBI’s reserveshaveincreased.

The rise in reserves last week was on accountofanincreaseintheRBI’sforeign currency assets, which jumped $3 billion to$487.29billion,thedatashowed.

Reserves worth $530 billion were equivalent to 8.6 months of imports projected for the current year, the RBI had said earlier this month. The level of reserves in September 2021 accounted foralmost15monthsofimports.

KARAIKAL: Adani Ports & SEZ Limited (APSEZ) has won the bid for Karaikal Port with a Rs. 1,200-crore offerthatsurpassedtheonefromrival Vedanta, said people aware of the development.

Bidding for the port was conducted under the Insolvency and Bankruptcy Code (IBC) guidelines. ThelenderstoKaraikalPortmetlast week to approve APSEZ’s offer, which will now be taken to the National Company Law Tribunal (NCLT) for the final approval, said thepeople.

The 600-acre port, built under a public-private partnership between the government of Puducherry and Chennai-based MARG Limited, faced

financial constraints which resulted in the outstanding debt ballooning to Rs. 3,000 crore due to defaults and delaysinrepayments.

The Adani Group, which has been scaling up its ports business, sees the southern port located in Pondicherry as a natural fit. Vedanta pursued the bid process because it moves significantquantitiesofrawmaterials and finished goods for its metals and miningbusinesses.

APSEZisthelargestportoperator in India and owns 12 ports including Mundra Port, the largest private port in the country. The company recently acquiredGangavaramPortinAndhra Pradesh for Rs. 6,200 crore. The acquisitionofKaraikalPortwillbethe firstsuchacquisitionundertheIBC.

The port received initial bids from

five applicants – JSW Infra, Jindal Power, APSEZ, Vedanta and a consortium of RKG Fund and Sagacious Capital. APSEZ and Vedanta eventually submitted binding financial bids whereas the othersdidnot.

The NCLT admitted Karaikal Port for insolvency proceedings on April 29 and appointed Rajesh Sheth as the resolution professional to run the company till its debt resolution is finalised.

A group of 11 lenders, all of which are public sector banks or financial institutions,hadoriginallysanctioned a loan of Rs 1,362 crore to Karaikal Port.Theloanballoonedtoitscurrent size as interest and penalties were added following irregular repayments.

NEW DELHI: Russia is amongst thetopfourexportersoffinishedsteel to India registering an over 333 per cent rise for the April–October FY23 to 0.15 million tonnes (mt), as per a report by the Steel Ministry. Imports fromthecountryinthecorresponding periodlastfiscalwere0.034mt.

Discountedofferings,distresssale by mills there and lower price compared to offerings within India andfromotherimportingnationssaw imports rise. Trade sources said this is among the highest imports than have come into the country over the lastfewyears.

India’s steel imports for AprilOctober rose 14.5 per cent to 3.1 mt, with India turning net importer of steel for October – the second time this fiscal, after July. Imports were valued at Rs. 35,711 crore ($4518 million).

Russiaaccountsforjust5percent of the imports by India, as per the

Ministry data. Around 0.96 mt of hot rolled coils / strips and 0.44 mt of flat sheers were the major items that camein.

According to a senior official of JSWSteel,priceoffershavestabilised and imports are expected to even out thisquarter.“Wedon’tseetoomuchof imports coming in since the viability of the international market and supply at low prices is very limited,” theofficialsaid.

Volume-wise, HR Coil/Strip (1.015 mt) was the item most imported (32 percentshareintotalfinishedsteel).

Korea was the largest exporter to India in volume terms accounting for 41percentoftheimportshare.Nearly 1.3 mt of finished steel came in and roseby10percentYoY.

OthermajornationsincludeChina (0.75 mt) accounting for 24 per cent of the share; Japan (0.38 mt) at 12 per cent; and Indonesia (0.13 mt) or 4 per

cent of the share. Exports from China rose 53 per cent Y-o-Y and from Indonesia was by 17 per cent, respectively. Shipments from Japan dropped10percentodd.

“Octoberhasbeenoneoftheworst months in terms of export orders. There were practically not many because of high price and poor demand. Accordingly, exports dropped55percentduringthemonth. Ontheotherhand,importsroseinthe downstream segment that include coated offerings,” official of an Indian steel company said. India did away with its export duty on steel and steel makingproductsearlierinNovember.

In terms of port-wise break-up, most of the imports came in from the Mumbai sea at 1mt (up 22 per cent YoY), followed by Chennai sea at 0.7 mt (up 32 per cent) and Mundra at 0.6 mt (up 22 per cent). Shipments throughDeendayaldroppedby35per cent,theMinistrydatashow.

NEW DELHI: On mission mode, Indian Railways' Freight loading for firsteightmonthsofthisfinancialyear 2022-23crossedlastyear’sloadingand earningsforthesameperiod.

On cumulative basis from April –Nov. 22, freight loading of 978.72 MT was achieved against last year loading of 903.16 MT during the same period, an improvement of 8%. Railways have earned Rs 105905 crore against Rs 91127 crore over last year which is an improvement of 16%

ascomparedtothesameperiodoflast year.

DuringthemonthofNovember22, Originating freight loading of 123.9 MT has been achieved against loading of 116.96 MT in Nov. 21, which is an improvement of 5 % over last year. Freight revenue of Rs. 13560 crore have been achieved against Rs 12206 crore freight earnings in October 21, thereby showing an improvementof11%overlastyear.

Following the Mantra, “Hungry

For Cargo”, IR has made sustained efforts to improve the ease of doing business as well as improve the service delivery at competitive prices which has resulted in new traffic coming to railways from both conventional and non-conventional commodity streams. The customer centric approach and work of Business Development Units, backed up by agile policy, making helped Railways towards this landmark achievement.

NEWDELHI:TheNationalSingle Window System (NSWS) currently accepts applications for 248 G2B clearness from 26 Central Ministries/ Departments, in addition to different State/UT Level clearances in 16 States/UTs.

The portal is rapidly gaining traction amongst the investors community and as of date has about 3.7 lakh plus unique visitors. 44,000+ approvals have been facilitated throughNSWSand28,000+approvals are currently under process. The portal will progressively onboard a greater number of approvals and licenses, based on user /industry

feedback. The Government is committed to reforms and other bold measures for creating a conducive business and investment environmentinallsectors.

NSWS was soft launched to all stakeholders and the public on the 22nd of September 2021 by the Union Minister of Commerce and Industry, Consumer Affairs, Food and Public DistributionandTextiles,ShriPiyush Goyal. NSWS was created by Department for Promotion of Industry and Internal Trade (DPIIT) as per the budget announcement of creation of an Investment Clearance Cell(ICC)toprovideasingleplatform

to enable the identification and obtainingofapprovalsandclearances needed by investors, entrepreneurs, andbusinessesinIndia.

The system is envisioned to reduce duplicity of information submission to different ministries, reduce compliance burden, promote sector specific reforms and schemes, reduce gestation period of projects, and promote ease of starting and doing business. NSWS enables the identification, applying and subsequent tracking of approvals for all integrated States and Central Departments, making it a true NationalSingleWindowSystem.

The Kerala State Government told the High Court recently that they are ready to hand over the security of the Vizhinjam Port area to the central forces. Now, after the Pinarai Vijayan Government’s approval, the Kerala HC has sought the Centre’s stand on the issue.

The counsel representing the Adani group contended in court that the construction of the port in Vizhinjamisbeinghamperedandthat the state is not providing security to allow construction to proceed, and hence central forces should be assigned.

Meanwhile, amidst criticism for not being able to provide adequate

protection to the Adani group employees, Kerala Chief Minister Pinarayi Vijayan said that the project will be realised despite the ongoing protests.

Vijayan also said the agitations were with an “intention to destroy peace in the area” and assured stern action against those who were involvedintheviolence.

GUWAHATI: National industry body Confederation of Indian Industries (CII) is organizing the first edition of the Northeast Logistics Conclave in Guwahati on December 5 - 6, 2022. It is being organized in partnership with the Department for Promotion of Industry and Internal Trade, Ministry of Commerce & Industry,GovernmentofIndia.

Under the theme “Creating Logistics Capitals in the Northeast”,

the conclave aims to bring all stakeholders at the highest level, on one platform to look for avenues to take forward the Northeast development agenda, identify logistics & supply chain, & connectivity with neighbouring stakeholderscountries.

Thisconclaveaimstohighlightthe vision of the Prime Minister to create innovative&impactfulinitiativesthat would greatly strengthen

infrastructure delivery in India & drive its future growth. It aligns with thePM’s GatiShaktiprogramme.

India’s Northeastern Region is expected to be a key beneficiary of the PM Gati Shakti initiative & the participation of stakeholders including, Industry and Logistics supply chain providers, would help to catalyze its potential, and align itself with the National logistic policy.

JAKARTA : Indonesian government food distribution company Bulog has approached rice exporting nations, barring India, to buy the cereal to meet its domestic demand, triggering a surprise among Indian shippers.

However,Bulogwantsbroken rice from India since the variety is unavailable elsewhere, trading sources said. The Indonesian agency enteredthemarketlastweektobuyat least0.5milliontonnes(mt).

Jakarta’s food distribution company’s move has caused pain

among Indian exporters, who have now taken up the issue with the Indonesian ambassador in New Delhi. A delegation of The Rice Exporters Association (TREA) will meet the ambassador on December 5 to express their concern over Bulog ignoringIndianrice.

CJ-I MV My Lama Interocean 07/12

CJ-II MV True Confidence Seascape 08/12

CJ-III MV SSI Diligent Chowgule Bros. 09/12

CJ-IV MV Appaloosa Interocean 08/12

CJ-V MV Sentosa Aries Marine 07/12

CJ-VI MV Khadeejah Jahan II Ambica 09/12

CJ-VII MV Kennadi

CJ-VIII MV Belinda Ambica 09/12

CJ-IX VACANT

CJ-X MV Armonia J M Baxi 06/12

CJ-XI MV TCI Anand TCI Seaways 06/12

CJ-XII VACANT

CJ-XIII MV Big Glory Chowgule Bros. 10/12

CJ-XIV MV Theotokos BS Shpg. 07/12

CJ-XV MV Sea Prajna Benline 15/12

CJ-XVA MV African Petral Synergy Seaport 15/12

CJ-XVI MV Fan Zhou 6 Mystic Shpg. 09/12

Tuna Tekra Steamer's Name Agent's Name ETD

MV Samjohn Solidarity Dariya Shpg. 08/12

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I MT Berlian Ekuator Nationwide 06/12

OJ-II MT Brave Interocean 06/12

OJ-III MT Corona

OJ-IV MT SC Tauras Wilhelmsen 06/12

OJ-V MT Stolt Cedar J M Baxi 06/12

OJ-VI MT Jag Pankhi J M Baxi 06/12

Stream

CJ-IV

Stream

Appolo Bulker Samsara Mundra 11,000 T. SBM 2022111319

Stream MV Bao Shun Ashirvad Shpg. 22,500 T. Bags 2022111238

CJ-XIII MV Big Glory Chowgule Bros. 59,850 T. Salt 2022111366

Stream MV Chakravati Chowgule Bros. Cotonou 50,000 T. Rice Bags 2022111169

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335

Stream MV Elisar Ocean Harmony Durban 31,750 T. Sugar Bags 2022111243

Stream MV Flag Gangos Seacoast 32,000 T. Bagged Rice

Stream MV Jupiter DBC Port Sudan 23,000 T. Sugar Bags

Stream MV Kosman Arnav Shpg. West Africa 24,500 T. Rice In Bags 2022111274

Stream MV Lady Moon DBC Somalia 24,900 T. Sugar Bags

CJ-I MV My Lama Interocean Sudan 25,000 T. Sugar Bags 2022111127

Stream MV Obe Heart Interocean 25,000 T. Sugar Bags 2022111247

Stream MV Obe Queen Ocean Harmony 40,100 T. Sugar In Bags

08/12 MV Pac Adhil Tristar Shpg 2,500/1,500 T.M.Chloride/Sulphate & 18 2022111285

Stream MV Pegasus 01 DBC Somalia 8,000 T. Sugar Bags 2022111256

Stream MV Propel Progress DBC 25,000 T. Sugar Bags

Stream MV PVT Sapphire Cross Trade 55,000 T. Salt 2022111248

Stream MV Sai Sunshine Sai Shpg. 15,000 T. Rice In Bags

CJ-V MV Sentosa Aries Marine 22,500 T. Stone Boulders In Bulk 2022111396

Stream MV Stentor Interocean 27,450 T. Sugar In Bags 2022111187

CJ-III MV SSI Diligent Chowgule Bros. 60,500 T. Salt CJ-XIV MV Theotokos BS Shpg. Madgasakar 28,000 T. Rice Bags 2022111268

T. CRC/Bars/ S Pipes

Stream MV Jimmy T Tauras 14,388 T. MOP 2022111004

CJ-VI MV Khadeejah Jahan II Ambica Indonesia 53,800 T. IND Coal

Stream MV Minoan Grace Seascape Indonesia 16,500 T. IND Coal Stream MV Mirabella Genesis 27,000/12,400 T. Metcoke/GYPSUM 05/12 MV Navigare Boreas Benline 59,100 t. Petcoke In Bulk 05/12 MV Obe Grande Tauras 42,000 T. DAP Stream MV Owl Interocean 50,903 T. Urea Tuna MV Samjohn Solidarity Dariya Shpg. 1,26,713 T. Coal CJ-XV MV Sea Prajna Benline Chittagong 21,057/10,442 T. HMS/Sh Scrap 2022111263 07/12 MV Tian He J M Baxi China 5,926/1,244/238HRC/Plates/Wooden 06/12 MV True Courage Tauras 1,28,470 T. Coal CJ-II MV True Confidence Seascape 27,079 T. Met Coke 2022111125 Stream MV Ultra Wollongong Interocean 47,250 T. Urea In Bulk

09/12 09/12-AM

16/12 16/12-AM

249W 22392 (MECL) 16/12

LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND AND PACIFIC

06/12 03/12-AM OOCL New York 090E 22393 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 06/12 14/12 14/12-AM OOCL Hamburg 139E 22399 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 14/12 08/12 08/12-AM MOL Creation 086E 22385 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 08/12 Ningbo, Sekou, Cai Mep. (PS3) 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 10/12 11/12 11/12-AM BSG Bimini 249E 22387 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 11/12 18/12 18/12-AM SOFIA I 250E 22394 Ningbo, Tanjung Pelepas. (FM3) 18/12 12/12 12/12-AM X-Press Bardsey 22020E 22398 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 12/12 ONE ONE (India) (TIP)

06/12 06/12-AM SCI Chennai 540 22386 SCI J. M Baxi Jebel Ali. (SMILE) 06/12 09/12 09/12-AM SSL Bharat 121 22397 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 09/12 09/12 09/12-AM Maersk Detroit 248W 22381 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 09/12 16/12 16/12-AM Maersk Sentosa 249W 22392 (MECL) 16/12

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

06/12 03/12-AM OOCL New York 090E 22393 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 06/12 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Karachi, Colombo (CI1) 10/12 11/12 11/12-AM IRENES RAY 249S 22388 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 11/12 11/12 11/12-AM BSG Bimini 249E 22387 SCI J. M Baxi Colombo. (FM3) 11/12 12/12 12/12-AM X-Press Bardsey 22020E 22398 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 12/12 ONE ONE (India) (TIP)

08/12 08/12-AM MOL Creation 086E 22385 ONE ONE (India) Los Angeles, Oakland. (PS3) 08/12 09/12 09/12-AM Maersk Detroit 248W 22381 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 09/12 16/12 16/12-AM Maersk Sentosa 249W 22392 Safmarine Maersk Line India (MECL) 16/12 12/12 12/12-AM X-press Bardsey 22020E 22398 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 12/12 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP)

BHUBANESHWAR: Adani Group, owned by Asia’s richest man Mr. Gautam Adani, will invest 600 billion Indian rupees ($7.39 billion) over the next 10 years in the mineral-rich state of Odisha,atopexecutivesaidrecently.

The group will commission a liquefied natural gas (LNG) terminal with 5 million tons of capacity in Dhamra Port in the state this month and plans to double thiscapacitywithinthenextfiveyears, Mr.KaranAdani, Chief Executive Officer of Adani Ports and Special Economic Zone, said in a speech during an investment summitinthestate.

“OurcontinuingcommitmenttoOdishaisshowcased in our planned capital investment that will exceed Rs 60,000 Cr over the next ten years. I anticipate this will create tens of thousands of direct and indirect jobs,” Adanisaidinhisspeech.

Mr. Gautam Adani, whose empire spans gas and

power projects as well as a ports and logistics business, said in September his company would invest more than $100billionoverthenextdecade,with70%earmarkedfor theenergytransitionspace.

PARADIP: Paradip Multipurpose Clean Cargo Terminalsuccessfullyhandled30,912.7MTofsteelbillets for export on the vessel M. V. Lucky Glory for the customer Jindal Steel & Power Ltd. The terminal achievedarecord-breakingloadingrateof17,175.7MTin 24 hours on 17th November, 2022. With this, the terminal surpasseditsowndailyloadingrateforsteelbillets.

The previous best was 14,089.6 MT in 24 hours on 22nd March, 2021 for loading steel billets on the vessel M.V.PearlIvy.

This performance is another testimony to the operational excellence and services at the J M Baxi ParadipTerminal.

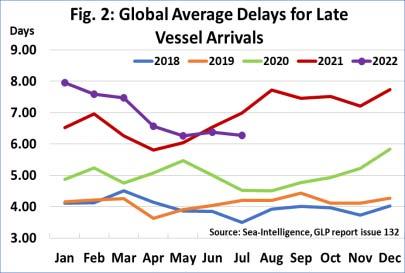

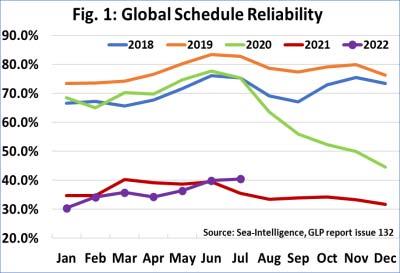

BALTIMORE: SeaIntelligence has publishedissue132ofthe Global Liner Performance (GLP) report, with schedule reliability figures up to and including July 2022. As the report itself is quite comprehensive and covers schedule reliability across 34 different trade lanes and 60+ carriers, this press release will only cover the global highlights from the fullreport.

Global schedule reliability continues to trend upwards, increasing by 0.5 percentage points M/M in July 2022 to 40.5%.Thisisnowthe secondtimesincethestartofthepandemicthatschedule reliability improved Y/Y. The average delay for LATE vessel arrivals have been dropping sharply so far this

year, tapering off a little in the past few months. In July 2022, average delay improved by -0.09 days M/M, which means that the delay figure is now firmly below the 7-day mark,andanimprovementovertherespective2021figure.

With schedule reliability of 48.0%, Maersk was the most reliable carrier in July 2022, followed by Evergreen with 44.3%. CMA CGM also recorded schedule reliability of over 40%. There were 9 carriers with schedule reliability of 30%-40% and only two with schedule reliabilityof20%-30%.InJuly2022,onceagain,alotofthe carriers were very close to each other in terms of schedulereliability,with10carrierswithin10percentage points of each other. ZIM had the lowest schedule reliability in July 2022 of 26.6%. On a Y/Y level, 11 of the top-14 carriers recorded an improvement in schedule reliability in July 2022, with 7 carriers recording doubledigitimprovements.