See Back Pg.

Tel : 2266 1756, 2266 1422, 2269 1407

See Back Pg.

Tel : 2266 1756, 2266 1422, 2269 1407

NEW DELHI: Another milestone achieved by CONCOR, under the astute leadership of Shri Sanjay Swarup, CMD of CONCOR, who inaugurated the full integration of CONCOR’s e-billing system with the GeM Portal in real-time. This development is set to streamline procurement, enhancing transparency and efficiency. A proud leap forward in the digital transformation journey for public procurement, informs a recent communique from CONCOR.

NEW DELHI: The share of BRICS+ grouping in global merchandise exports can overtake the G7 bloc by 2026, EY India said on Wednesday. The October edition of EY Economy Watch reveals a significant shift in global trade dynamics, with the BRICS+ group rapidly increasing its share in merchandise exports and imports.

From 2000 to 2023, the BRICS+ group's share of global merchandise exports has risen from 10 7 per cent to 23 3 per cent, marking an impressive increase of 12 6 percentagepoints

In contrast, the G7's share has seen a notable decline, dropping from 45.1 per cent to 28.9 per cent. Meanwhile, the rest of the world has maintained a relatively stable share, increasing slightly from 44.2 per cent to 47.9 per cent. G7 is a grouping of advanced economies -- the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom.

This trend highlights the growing prominence of the BRICS+ group in the global trade arena, suggesting a potential shift towards a multipolar global economic landscape, EY India said.

COPENHAGEN: A.P Moller - Maersk (Maersk) has entered into a long-term bio-methanol offtake agreement with LONGi Green Energy Technology Co., L t d . T h e a g r e e m e n t w i l l contribute to lowering GHG emissions from Maersk’s growing fleet of dual-fuel methanol container vessels.

“Bio- and e-methanol continues to be the most promising alternative shipping fuels to scale up in this decade, and the agreement with LONGi serves as a testament to this Global shipping’s main net-zero challenge is the price gap between fossil fuels and the alternatives with lower greenhouse gas emissions

We continue to strongly urge the International Maritime Organization’s member states to level the playing field by adopting a global green fuel standard and an ambitious pricing mechanism which the industry urgently needs,”said, Rabab Raafat Boulos, Chief Operating Ofcer, A.P. Moller – Maersk.

With the addition of the LONGi volumes, Maersk is making progress in securing enough methanol for its owned dual-fuel methanol fleet of which 7 vessels are already in operation Maersk’s combined methanol

CMA CGM and

offtake agreements now meet more than 50% of the dual-fuel methanol fleet demand in 2027.

The agreement has evolved out of Maersk’s growing global alternative fuels portfolio of which several other methanol projects are cur rently in advanced stages of maturity

“While we believe that the future of global logistics will see several pathways to net-zero, this agreement underscores the continued momentum for methanol projects that are pursued by ambitious developers across markets. China continues to play a pioneering role, and it is encouraging to also see strong market developments in other geographies as well. One example is the US where we are engaging closely with several promising projects,” said, Emma Mazhari, Head of Energy Markets at A.P. Moller - Maersk.

The agreement with LONGi delivers bio-methanol produced at a facility in Xu Chang, Central China. The bio-methanol is produced from residues (straw and fruit tree cuttings). It will meet Maersk’s methanol sustainability requirements including at least 65% reductions in GHG emissions on a lifecycle basis compared to fossil fuels.

M

The CMA CGM Group, a global leader in sea, land, air, and logistics solutions, signed with Marsa Maroc, a national leader in port terminal management, a joint venture agreement to equip and operate for 25 years a 750-meter section of quay and 35 hectares of yard within the Nador West Med container terminal.

This joint venture, in which CMA CGM and Marsa Maroc will hold 49% and 51% respectively, will equip and operate 50% of the Nador West Med container terminal, i.e. 35 hectares of container yard and 750 meters of quay with a maximum draught of 18 meters.

Already present in Morocco in the Eurogate Tangiers and Casablanca container terminals (via SOMAPORT), the CMA CGM Group is pursuing with this strategic and operational agreement its development as a major player in the country's supply chain.

Signicant investments for optimum productivity and service quality

Within the framework of a 25-year sub-concession, the CMA CGM Group and Marsa Maroc will make major investments totaling $280 million, with the aim of achieving an annual terminal output of 1.2 million TEUs.

Capable of handling the world's largest container ships with a maximum draught of 18 meters, the terminal will eventually be equipped with 8 transshipment cranes, compared with 6 at present, and 24 electric RTGs, compared with 15 at present.

Ideally located in the strategic Gibraltar zone, in the Bay of Betoya, on the Oued Kert estuary, the port of “Nador West Med” has significant assets to complement the CMA CGM Group's terminals in the strategic Western Mediterranean zone.

Thanks to Morocco's green hydrogen production

sector, “Nador West Med” is also destined to become a maritime bunkering hub for new synthetic energies in the Mediterranean (emethane and e-methanol), notably for the CMA CGM Group's fleet of dualfuel gas and methanol vessels.

Rodolphe Saadé, Chairman and Chief Executive Ofcer of the CMA CGM Group, said: "Morocco is positioning itself as a strategic logistics and port hub with strong growth potential. The partnership we are entering into with Marsa Maroc marks a key step for the CMA CGM Group, strengthening our presence through the Nador West Med container terminal. Our ambition is to support the country's development, particularly in the forwardlooking sectors of logistics and alternative energies."

The CMA CGM Group, a major player in the Moroccan supply chain since 1983

Established in Morocco since 1983, the CMA CGM Group connects the country to the rest of the world. Morocco is of strategic importance, notably because of its dynamism and its role as a crossroads for trade between Europe, Africa and the Mediterranean Basin.

With its expertise and 1,300 employees in Morocco, the CMA CGM Group has become a leader in maritime transport and logistics, with 31 maritime services operating out of the three main Moroccan ports (Agadir, Casablanca, Tanger Med) and serving 81 ports directly from Morocco The Group offers its customers in Morocco end-to-end supply chain services via its subsidiary CEVA Logistics.

Through its subsidiary Terminal Link, the CMA CGM Group owns 100% of a Casab

(via SOMAPORT), as well as 40% of the Eurogate Tangiers terminal.

With La Méridionale, CMA CGM also operates a ferry service between Marseille and Tanger-Med.

06/1107/11 Nabucco 008 1107150-16/10 Eukor Car Carrier ParekhMarine South, Central America & Caribbean Ports

08/1109/11 Alliance Fairfax 117 1106219-09/10 Hoegh Autoliners MerchantShpg. Kingston,Veracruz,Freeport,Jacksonville&SouthAmerican&CaribbeanPortsviaKingston 17/1121/11 CP Pacific 45 Chipolbrok Samsara Houston. 24/1126/11 AAL Singapore 11E24 AAL MerchantShpg. Houston, New Orleans.

TO LOAD FOR FAR EAST / EAST, WEST & SOUTH AFRICA / AUSTRALIA & NEW ZEALAND PORTS

In Port 04/11 W Orkan 100 1108167-23/09 Chipolbrok Samsara Singapore, Vanphong, Shanghai. 06/1107/11 Nabucco 008 1107150-16/10 Eukor Car Carrier ParekhMarine Pyeongtaek. 08/1109/11 Alliance Fairfax 117 1106219-09/10 Hoegh Autoliners MerchantShpg. Durban,Dar-Es-Salaam,Maputo,Mombasa,Melbourne,PortKembla,Brisbane,T/SatDurban. 17/1121/11 CP Pacific 45 Chipolbrok Samsara Masan, Shanghai. 24/1126/11 AAL Singapore 11E24 AAL MerchantShpg. Singapore, Dung Quat, Shanghai, Taicang.

NOTICE TO CONSIGNEESNOTICE TO CONSIGNEES TO CONSIGNEES

The above vessel has arrived at GTI/NSICT on above mentioned dates with Import Cargoes in containers. Consignees are requested to obtain the Delivery Order by surrendering ORIGINAL BILLS OF LADING duly discharged on payments of relative charges as applicable within 5 days or else detention charges will be applicable.

Consignees will please note that the carriers of their agents are not bound to send individual notification regarding arrival of the vessel or the goods. For detailed information on cargo availability, please contact our office.

*Note: The importers having AEO status and those who are availing DPD facility for containerized cargo are allowed to pay Terminal Handling Charges (THC) directly to Ports/Terminal through their P.D Accounts. Upon making THC payment importers are requested to submit proof of payment duly stamped and acknowledged by Port/Terminal to Unifeeder Global FZCO for issuance of Delivery Order (DO) without Unifeeder Global Fzco’s THC Invoice and Receipt. Visit our Website : www.avanalogistek.com for Import Vessel arrival & IGM details

As Agents of : UNIFEEDER GLOBAL FZCO D:301-305, Level 3, Tower -II, Seawoods Grand Central, Plot No. R1, Sector 40, Nerul Node, Navi Mumbai 400706 • Email : dhirendra.singh@unifeeder.com

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR CARTING DATE TIME NAME No.No.No.&Dt. POINT TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN, RED SEA & MED. PORTS from NSFT

04/1105/11 Zhong Gu Tianjin 24009W Q1575 1104706-26/09 SeaLead SeaLead Shpg. Djibouti. (IDEA - INDIA DUBAI EAST AFRICA)

05/1106/11 05/11 1800 CMA CGM Vitoria 0QCSIW1 Q1756 1107516-18/10 CMA CGM CMA CGM Ag. Djibouti. (BIGEX 2)

16/1116/11

10/1111/11

17/1118/11

TBA TBA CMA CGM Diamond 0QC21W1

TBA TBA MYD Ningbo 0022 Q1741 1107378-17/10 MBK Line MBK Logistics Jeddah, Beldeport (India Med Service)

TBATBA RC Ocean 49W C Star Diamond Maritime TO LOAD FOR U.K., NORTH CONT., SCANDINAVIAN, RED SEA & MED. PORTS from

05/1106/11

TBA TBA X-Press Mekong 24009 Q1818 1108440-25/10 X-Press Feeders Sea Consortium Jeddah, Al Sokhna 18/1119/11

19/1120/11

28/1129/11

TBA TBA SSL Godavari 036E Wan Hai Wan Hai Lines (I) (RGI / IM1)

TBA TBA Wan Hai 316 221E

TBA TBA X-Press Altair 24013E

UnifeederUnifeeder

Emirates Emirates Shpg. 08/1109/11

TBA TBA Folk Jeddah 2405W Q1830 1108814-28/10

Folk Maritime Seastar Global Jeddah (IRSS) 18/1119/11

TBA TBA Wadi Duka 2406W Asyad Line Seabridge

09/1110/11 TBATBA Maersk Detroit 444W Q1797 1107951-22/10 Maersk Line Maersk India Algeciras (MECL) Maersk CFS

28/1129/11 TBA TBA Maersk Atlanta 446W 17/1118/11 TBATBA Sheng Li JI SEN0824W

Line Oasis Shpg. Aliaga Gemlik, Gebze (YIL Port), Ambarli, Felixstowe, Antwerp TO

06/1107/11 06/11

1100 MSC Laurence IS443A Q1770 1107791-21/10 MSC MSC Agency UK, North Cont., Scandinavian, Red Sea & Med Ports. Hind Terminals 13/1114/11 13/11

1100 MSC Thais IS444A SCI CMT Barcelona, Felixstowe, Hamburg, Rotterdam, Gioia Tauro, 24/1125/11 24/11

1100 MSC Emanuela IS445A UK, North Continent & Other Mediterranean Ports. HimalayaExpress NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. UK, North Cont., Scandinavian & Med. Ports. Dron.2&Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. UK, North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware 08/1109/11 TBA 1000 Karlskrona IU444A Q1827 1108712-28/10 MSC

MSC Agency Haifa. (INDUS) Hind Terminal 08/1109/11 08/11 0900 MSC Rania IP445A Q1764 1107734-21/10 MSC

MSC Agency Antwerp, Le Havre, Rotterdam, Dunkirk, Felixstowe, Southampton, Hind Terminals 15/1116/11 15/11 0900 Conti Courage IP446A Helsingborg, Gothenburg & Red Sea, Med, Gioia Tauro (D). 22/1123/11 21/11 0900 TBN IP447A SCI CMT Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre (EPIC / IPAK)

COSCO COSCO Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. UK, North Cont, Scandinavian, Red Sea & Med. Ports. Seahorse Ship UK, North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. Globelink Globelink WW UK, North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens.

TSS L'Global Ag. UK, North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global UK, North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal UK, North Continent & Scandinavian Ports. Dronagiri-3 Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines UK, North Continent, Red Sea & Med. Ports. Team Global Team Global Log. UK, North Continent & Scandinavian Ports. Pun.Conware

06/1107/11 TBA TBA Osaka Express 4343W Q1784 1107870-22/10 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 15/1116/11 TBA TBA Seaspan Amazon 4344W Hapag ISS Shpg. UK, North Cont., Scandinavian, Red Sea & Med.Ports. ULA CFS (IOS) COSCO COSCO (I) UK, North Cont., Scandinavian, Red Sea & Med.Ports.

ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports.

Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

06/1107/11 TBA TBA Yantian Express 0MXKTW1 Q1783 1107869-22/10 Hapag ISS Shpg. Suez, Port Said, La Spezia, Genoa. Fos, Barcelona, ULA CFS 13/1114/11 TBA TBA Valence 0MXKXW1

CMA CGM CMA CGM Ag. Valencia, Cagliari. (IMEX Service) Dron-3&Mul 20/1121/11

TBA TBA Value 0MXKVW1

COSCO COSCO Shpg. P Said, La Spezia, Livorno, Genoa, Fos, Barcelona, Valencia, Algeciras 07/1108/11

TBATBA Cap San Juan 444W Q1792 1107933-22/10 Maersk Line Maersk India Port Tangiers, Algeciras, Rotterdam, Felixstowe Maersk CFS 14/1115/11

TBATBA CCNI Angol 445W (ME 2)

04/1105/11 04/11 1100 CMA CGM Congo 0PEANW1 Q1724 1106980-15/10 CMA CGM CMA CGM Ag.(I) Southampton, Bremerhaven, Rotterdam, Antwerp, Dron-3 & Mul 12/1113/11

TBA TBA APL Gwangyang 0PEARW1 Q1819 1108459-25/10 COSCO COSCO (I) Le Havre, Jeddah, Tangier, Algeciras. (EPIC) 05/1106/11 TBA TBA Haian East 24027W Q1778 1107830-21/10 SeaLead SeaLead Shpg. Aliaga, Gebze, Gemlik, Istanbul, Mersin, EL Dekheila, Casablanca, 12/1113/11 TBA TBA Zagor 24039W Volta Container Corten Shpg. Venghazi, Algier, Raves, Constanta, Thessaloniki, Piraeus, Reel Shpg. Corten Shpg. Barcelona, Valencia, Misurata (West Asia Red Sea Med - WARM)

06/1107/11 06/11 1700 TB Fengze 31INDSTP Q1750 1107435-18/10 MDL Line Hub & Links Alexandira & St. Petersburg 07/1108/11 TBA TBA HMM Oakland 013W Q1824 HMM HMM Shpg. Jeddah, Damietta, Piraeus, Genoa, Valencia, Barcelona, Seabird CFS 15/1116/11 TBATBA Hyundai Mars 049W

ONE Line ONE (India) Valencia, Barcelona, Genoa, Piraeus, Damietta, Algeciras (FIM West Bound) 08/1109/11

In Port 04/11 Tucapel 4144W Q1761 1107553-18/10 Hapag ISS Shpg. New York, Norfolk, Charleston, Savannah ULA CFS 18/1119/11 TBATBA Tolten 4146W (TPI/INDAMEX)

06/1107/11 06/11 1100 MSC Laurence IS443A Q1770 1107791-21/10

Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, HindTerminals 13/1114/11 13/11 1100 MSC Thais IS444A

Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 24/1125/11 24/11 1100 MSC Emanuela IS445A

Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express)

Globelink Globelink WW USA, East & West Coast.

08/1109/11 08/11 0900 MSC Rania IP445A Q1764 1107734-21/10 MSC

MSC Agency Boston, Philadelphia, Miami, Coronel, Guayaquil, Cartagena, Hind Terminals 15/1116/11 15/11 0900 Conti Courage IP446A Indial Indial Shpg. San Antonio,Arica,Buenaventura,Callao,La Guaira,Paita, 22/1123/11 21/11 0900 TBN IP447A Puerto Cabello, Puerto Angamos, Iquique Santiago De Cuba, Mariel (EPIC / IPAK)

Globelink Globelink WW USA,Canada,Atlantic & Pacific,South American & West Indies Ports.

AMI Intl. AMI Global South American Ports Via Antwerp (Only LCL). Dronagiri-3

Safewater Safewater Line US East Coast, South & Central America

08/1109/11 TBA 1000 Karlskrona IU444A Q1827 1108712-28/10 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 14/1115/11

TBATBA MSC Rikku IU445A

Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 09/1111/11

TBATBA APL Southampton 0INIBW1 Q1821 1108488-25/10 CMA CGM CMA CGM Ag. New York, Norfolk, Charleston, Savannah & Dron.-3 & Mul. 16/1117/11

TBATBA CMA CGM Pelleas 0INIDW1 OOCL OOCL(I) Other US East Coast Ports. Dronagiri-2 30/1101/12

TBATBA CMA CGM Otello 0INIIHW1 ONE Line ONE (India) India America Express (INDAMEX) (INDAMEX)

COSCO COSCO Shpg.

Indial Indial Shpg. US East Coast & South America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Team Lines Team Global Log. Norfolk, Charleston. ConexTerminal Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast

In Port 06/11 OOCL Hamburg 153E Q1777 1107824-21/10 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 19/1120/11 TBATBA OOCL Luxembourg 113E Q1826 1108709-28/10 RCL RCL Ag USA East Coast & Other Inland Destinations. 26/1127/11 TBATBA Stratford 133E

COSCO COSCO Shpg. US West Coast. Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. ICC Line Neptune US East, West Coast, Canada, South & Central American Ports. GDL-3 & Dron-3 04/1105/11 X-Press Anglesey 24033W Q1762 1107616-19/10 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America

18/1119/11

TBATBA MOL Presence 018E & Caribbean Ports, Canada. (TIP Service) 22/1123/11

TBATBA Dimitris Y 249E

Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 24/1125/11

TBATBA One Responsibility 001E West Indies Ports. 06/1107/11

TBATBA Yantian Express 0MXKTW1 Q1783 1107869-22/10

Valence 0MXKXW1

Q1756

TBATBA Navios Dorado 2443W Q1760 1107556-18/10 Hapag ISS Shpg. Jebel Ali, Dammam, Shuaiba, UMM Qasr. (IG1) ULA CFS 12/1113/11

TBATBA Safeen Power 2444W Q1780

Aqua Container Aqua Container 07/1108/11

TBATBA Grand Mariner 22 Q1812

Lubeck Giga Shipping Bundar Abbas 07/1108/11

TBATBA Ren Jian 8 02SIXS1 Q1757 CMA CGM CMA CGM Ag. Khorfakkan, Jebel Ali (SWAX)

In Port 04/11 Artabaz 1336W Q1728 1107022-15/10 HDASCO Armita India Bandar Abbas, Chabahar. (IIX) 04/1105/11 Inter Sydney 0166 Q1740 1107379-17/10 Interworld Efficient Marine Bandar Abbas, Chabahar (BMM) Alligator Shpg. Aiyer Shpg. Bandar Abbas, Chabahar.

05/1106/11

TBATBA X-Press Mekong 24009 Q1818 1108440-25/10 X-Press Feeders Sea Consortium Jebel Ali 18/1119/11

TBATBA SSL Godavari 036E Wan Hai Wan Hai Lines (I) (RGI / IM1) 19/1120/11

TBATBA Wan Hai 316 221E

UnifeederUnifeeder 28/1129/11

TBATBA X-Press Altair 24013E Emirates Emirates Shpg. 06/1107/11

06/1107/11

13/1114/11

07/1108/11

TBATBA Asterios 2404W Folk Maritime Seastar Global Dammam, Umm Qasr. (IGXS)

TBATBA Maersk Danube 445W Q1791 1107923-22/10 Maersk Line Maersk India Jebel Ali, Salallah (Blue Nile)

TBATBA Grasmere Maersk 446W

TBATBA Celsius Edinburgh 003W Q1700 1106573-11/10 ONE Line ONE (India) Jebel Ali. 13/1113/11

Maersk CFS

TBATBA Oceana 931W Q1779 1107867-22/10 UnifeederUnifeeder Jebel Ali. (MJI) Dronagiri 09/1110/11

TBATBA Maersk Detroit 444W Q1797 1107951-22/10 Maersk Line Maersk India Salallah. (MECL) Maersk CFS 10/1111/11

TBATBA Maersk Cairo 446S Q1798 1107952-22/10 Maersk Line Maersk India Port Qasim, Salallah. (MWE SERVICE) Maersk CFS 10/1111/11

TBATBA Zhong Gu Kun Ming 2442S Q1814 1108281-24/10 Emirates Emirates Shpg. Jebel Ali, Damman, Sohar. (West Bound) RCL/CUL Line RCL/Seahorse KMTC KMTC (India) Dronagiri-3 CMA CGM CMA CGM Ag. Dron-3&Mul SeaLead SeaLead Shpg 11/1112/11 TBATBA Terataki 2414W Asyad Line Seabridge Sohar, Jebel Ali, Dammam. (FEX)

15/1116/11 15/11 0900 Conti Courage IP446A

07/1108/11 TBATBA Cap San Juan 444W Q1792 1107933-22/10 Maersk Line Maersk India Salallah (ME 2) Maersk CFS 09/1110/11

TBATBA Celsius Nairobi 0920

X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 16/1117/11 TBATBA SCI Mumbai 24044 UnifeederUnifeeder Basra. (ASX) QNL/Milaha Poseidon Shpg. Jebel Ali, Bandar Abbas. Speedy CFS Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DR

In Port 04/11 Advance 060W Q1746 1107323-17/10 COSCO COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain 09/1110/11 TBATBA Future 060W Q1775 1107816-21/10 OOCL OOCL (I) (AGI-2)

06/1107/11 TBATBA TB Fengze 31INDSTP Q1750 1107435-18/10 MDL Line Hub & Links Jebel Ali. 06/1107/11 TBATBA Seaspan Jakarta 444W Q1793 1107937-22/10 Maersk Line Maersk India Jebel Ali Maersk

SM Neyyar 0445W

HMM Oakland 013W Q1824

08/1109/11

Line

(India) Karachi (FIM West Bound)

TBATBA Vira Bhum 119W Q1801 1107986-22/10 RCL RCL Ag. Umm Qasr, Dubai.(RWG)

08/1109/11 TBATBA CUL Laem Chabang 4324W Q1766 1107953-22/10 CU Lines Seahorse Shpg. Jebel Ali. (IMR1)

09/1110/11

09/1110/11

TBATBA SSF Dynamic 078W Q1786 1107898-22/10 Safeen Fdrs. Sima Marine Sharjah, Khalifa, Bahrain, Dammam, Umm Qasr, Aqua Container Aqua Container Ajman, Umm Al Quwain, Ras Al Khaima. (UIG)

TBATBA Oshairaij 2422 Q1800

QNL/Milaha Poseidon Shpg. Hamad. (NDX) Speedy CFS Emirates Emirates Shpg. Hamad. Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam, Jubail, Hamad, Bahrin, Shuaiba, Shuwaikh, Sohar, Umm Qasr. Alligator Shpg. Aiyer Shpg. Jebel Ali.

BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS

Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports. Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC,GDL&DRT

ICC Line Neptune UAE & Upper Gulf Ports. GDL-5

Team Lines Team Global Log. Gulf Ports. Conex Terminal

11/1112/11

TBATBA Daphne 869W Q1806

Samudera Samudera Shpg. Jebel Ali, Dammam Dronagiri 15/1116/11

TBATBA Alexandria Bridge 075W

OOCL OOCL (I) Jebel Ali, Dammam (SIG) 12/1113/11

TBATBA Abrao Cochin 22

QNL/Milaha Poseidon Shpg. Sohar, Dammam, Hamad. Speedy CFS

Asyad Line Seabridge (MGX-2/FEX) 14/1115/11

TBATBA MSC Monica III JU444R

MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam, Umm Qasr (UGE) Hind Terminal

11/1112/11 TBATBA CMA CGM Mendelssohn OUW25W1

11/1112/11 TBATBA Shimin 24E Q1781 1107871-22/10

18/1119/11 TBATBA Seattle Bridge 093E

Line ONE (India) Colombo. (CISC Service) 25/1126/11

TBATBA Ever Sigma 130E

04/11 05/11 MSC Giovalla VII XA442A

MSC Agency Colombo. (DRAGON EB)

Terminals 04/1105/11 TBATBA BLPL Blessing 2416E Q1803 1108017-22/10

05/1106/11

TBATBA Maersk Zambezi 444W Q1790 1107931-22/10 CMA CGM CMA

1000 MSC Mexico V IV445A

1000 Karlskrona IU444A Q1827 1108712-28/10

In Port 06/11 OOCL Hamburg 153E Q1777 1107824-21/10

19/1120/11 TBATBA OOCL Luxembourg 113E Q1826 1108709-28/10 Star

04/1105/11 X-Press Anglesey 24033W Q1762 1107616-19/10

Line ONE (India) Colombo. 18/1119/11 TBATBA MOL Presence 018E X-Press Feeders Sea Consortium Colombo. (TIP Service) Dronagiri 22/1123/11

TBATBA Dimitris Y 249E CSC Seahorse Colombo. 24/1125/11

TBATBA One Responsibility 001E HMM HMM Shpg. Colombo. Seabird CFS 04/1105/11 Conti Conquest 029E Q1823 ONE Line ONE (India) Colombo. 06/1107/11

TBATBA Conti Crystal 138E Yang Ming Yang Ming(I)

Contl.War.Corpn. 12/1114/11

TBATBA One Competence 092E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 18/1120/11

TBATBA One Hangzhou Bay 057E HMM HMM Shpg. Seabird CFS 08/1109/11

TBATBA Wan Hai 360 E011 Q1811 1108252-24/10 Wan Hai Wan Hai Lines Colombo. (CI2)

Dron-1 & Mul CFS

04/1105/11 Zoi 117E Q1711 1106767-14/10 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 10/1111/11

TBATBA KMTC Dubai 2406E Q1767 1107758-21/10 KMTC/Gold Star KMTC(I)/Star Ship

Dronagiri-3/— 15/1116/11

TBATBA Ever Elite 170E X-Press Feeders Sea Consortium (NIX Service) 22/1123/11

TBATBA Monaco 110E EmiratesEmirates Dronagiri-2 04/1106/11

TBATBA One Matrix 092E Q1739 1107348-17/10 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 07/1108/11

TBATBA X-Press Capella 24007E Q1763 1107615-19/10 X-Press Feeders Sea Consortium (CWX/CIX5) 11/1112/11

TBATBA TS Keelung 24005E TS Lines/PIL TS Lines(I)/PIL India

Dronagiri-2/— 07/1108/11

TBATBA Maersk Cuanza 445W Q1795 1107939-22/10 Maersk Line Maersk India Colombo (MW2) Maersk CFS 11/1112/11

TBATBA Daphne 869W Q1806 Samudera Samudera Shpg. Colombo (SIG) Dronagiri 15/1116/11

TBATBA Xin Ya Zhou 165 Q1758 1107518-18/10 COSCO COSCO Shpg. Karachi, Colombo. (CI 1)

In Port 05/11 ALS Clivia 0FFCYE1 Q1776 1107814-21/10 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 18/1119/11

TBATBA APL Antwerp 0FFD2E1

RCL RCL Ag. (AS 1)

In Port 05/11 Ever Ethic 171E Q1733 1107119-16/10 Evergreen Evergreen Shpg. P.Kelang, Tanjun, Pelepas, Singapore, Xingang, BalmerLaw.CFSDron. 11/1112/11

TBATBA Shimin 24E Q1781 1107871-22/10 UnifeederUnifeeder Qingdao, Shanghai, Ningbo. Dronagiri 18/1119/11

TBATBA Seattle Bridge 093E

PIL/ONE PIL India/One(I) —/— 25/1126/11

TBATBA Ever Sigma 130E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 02/1203/12

TBATBA Celsius Naples 906E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 09/1210/12

TBATBA ESL Da Chan Bay 24006E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 (CISC Service) HMM HMM Shpg. P.Kelang(S),Singapore, Xiangang,Qingdao, Kaohsiung. Seabird CFS

Samudera Samudera Shpg. P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang Dronagiri CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. P Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS

04/1105/11

TBATBA BLPL Blessing 2416E Q1803 1108017-22/10 BLPL Transworld GLS Far East Ports.

04/11 05/11 MSC Giovalla VII XA442A

MSC MSC Agency Dalian, Shanghai, Ningbo, Yantian. Hind Terminals

26/11 27/11 25/11 0900 MSC Fatma FD441E (DRAGON EB)

08/1109/11

TBATBA Grace Bridge 2407E Q1822 1108522-25/10 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo Dronagiri 09/1110/11

21/1122/11

TBATBA Mogral 2411E Q1817 1108439-25/10 Heung A Line Sinokor India

TBATBA Melbourne Bridge 2407E

Sinokor Sinokor India Seabird CFS (CSC)

TS Lines TS Lines (I)

Cordelia Cordelia Cont. Port Kelang, Far East & China Ports

Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

ETAETD VESSELS Voy V.I.A ROT. LINE AGENTS WILL LOAD FOR CARTING DATE TIME NAME No.No. No.&Dt. POINT

In Port 06/11 X-Press Odyssey 445E Q1809 1108138-23/10 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 11/1112/11

TBATBA X-Press Carina 446E Q1829 1108776-28/10 X-Press Feeders Sea Consortium Kwangyang, Pusan, Hakata, Shanghai. (NWX/FI-3) 18/1119/11

TBATBA X-Press Cassiopeia 447E

Sinokor/Heung A Sinokor India Port Kelang, Singapore, Qingdao, Xingang, Pusan Seabird CFS In Port 06/11 OOCL Hamburg 153E Q1777 1107824-21/10 OOCL/RCL OOCL(I)/RCL Ag Port Kelang, Singapore, Hong Kong, Shanghai, GDL/Dron-1 19/1120/11

TBATBA OOCL Luxembourg 113E Q1826 1108709-28/10 APL

CMA CGM Ag. Ningbo. Dron.-3&Mul. 26/1127/11

TBATBA Stratford 133E

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 05/1206/12

TBATBA Xin Da Yang Zhou 097E

04/1105/11 X-Press Anglesey 24033W Q1762 1107616-19/10

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. Gold Star Star Ship Singapore, Hong Kong, Shanghai. ANL CMA CGM Ag. Port Kelang, Singapore (CIX-3) Dron.-3&Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 18/1119/11

TBATBA MOL Presence 018E

X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. 22/1123/11

24/1125/11

TBATBA Dimitris Y 249E

TBATBA One Responsibility 001E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri

RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. (TIP Service)

04/1105/11 Conti Conquest 029E Q1823

HMM HMM Shpg. Port Kelang(N), Port Kelang(W), Singapore. Seabird CFS

ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 06/1107/11

TBATBA Conti Crystal 138E

Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 12/1114/11

TBATBA One Competence 092E

HMM HMM Shpg. Seabird CFS 18/1120/11

TBATBA One Hangzhou Bay 057E

Samudera Samudera Shpg. Dronagiri (PS3 Service)

Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai OceanGate 05/1106/11

TBATBA Seaspan Brisbane E003 Q1751 1107507-18/10

Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Dronagiri-1 12/1113/11

TBATBA Wan Hai 521 E028

Evergreen Evergreen Shpg. Shekou. Balmer Law. CFS Dron. 19/1120/11

TBATBA Argolikos E166

Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 26/1127/11

TBATBA Wan Hai 502 E128

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 08/1109/11

TBATBA Wan Hai 360 E011 Q1811 1108252-24/10

Wan Hai Wan Hai Lines Penang, Port Kelang, Hongkong, Qingdao, Shanghai, Dron-1 & Mul CFS 15/1116/11

TBATBA Interasia Momentum E050 COSCO COSCO Shpg. Ningbo, Shekou. 22/1123/11

TBATBA Wan Hai 515 E095 InterasiaInterasia (CI2) 29/1130/11

TBATBA Wan Hai 373 E004 HMM HMM Shpg. Port Kelang, Singapore, Hongkong, Kwangyang, Pusan, Shanghai, Ningbo Seabird CFS 12/1113/11

TBATBA APL Oregon OPUSYN Q1748 1107331-17/10 RCL/Global Fdr. RCL Ag./Sima Marine Port Kelang, Ho Chi Minh City, Laem Chabang, (VGX) CU Lines/KMTC Seahorse/KMTC(I) Cai Mep SeaLead SeaLead Shpg.

In Port 04/11 MSC London QS442R Q1747 1107326-17/10 MSC MSC Agency Port kelang, Singapore, Tanjung Pelepas, Laem Chabang, Hind Terminal Vung Tau, Da Chan Bay, Shekou. (SHIKRA)

04/1105/11 Zoi 117E Q1711 1106767-14/10 Evergreen Evergreen Shpg. Port Kelang, Singapore, Haipong, Qingdao, Shanghai, BalmerLaw.CFSDron. 10/1111/11

TBATBA KMTC Dubai 2406E Q1767 1107758-21/10 KMTC/Gold Star KMTC(I)/Star Ship Ningbo, Da Chan Bay

Dronagiri-3/— 15/1116/11

TBATBA Monaco 110E Emirates Emirates Shpg

TBATBA Ever Elite 170E X-Press Feeders Sea Consortium 22/1123/11

Dronagiri-2 (NIX Service) Pendulum Exp. Aissa Maritime Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 05/1106/11 05/11 1400 Hemma Bhum 002E Q1772 1107798-21/10 RCL RCL Ag. Port Kelang, HaIphong, Nansha, Shekou. 09/1111/11

TBATBA Kota Manis 414E Q1828 1108710-28/08 PIL PIL India 16/1118/11

TBATBA Araya Bhum 019E

CU Lines Seahorse Ship (RWA / CIX 4) 23/1124/11

30/1101/12

04/1106/11

TBATBA Interasia Amplify E003

TBATBA Kota Lawa 091E

Evergreen Evergreen Shpg.

InterasiaInterasia Emirates Emirates Shpg.

TBATBA One Matrix 092E Q1739 1107348-17/10 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 07/1108/11

TBATBA X-Press Capella 24007E Q1763 1107615-19/10 X-Press Feeders SeaConsortium 11/1112/11

TBATBA TS Keelung 24005E

KMTC/TS Lines KMTC(I)/TS Lines(I) Dron-3/Dron-2 22/1123/11

TBATBA Ever Legion 057E

Gold Star Star Ship 28/1129/11

08/1109/11

TBATBA Zhong Gu Nan Ning 2407E

RCL/PIL RCL Ag./PIL India (CWX/CIX5) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao.

TBATBA Interasia Progress E092 Q1805 1108090-23/10

Wan Hai Wan Hai Lines Port Kelang, Jakarta, Surabaya

Speedy CFS

Dronagiri-1 15/1116/11

TBATBA Big Breezy E045

KMTC/Interasia KMTC(I)/Interasia Port Kelang, Jakarta, Surabaya (AIS5/SI8 Service)

Dronagiri-3/— 06/1107/11

TBATBA Wan Hai 523 E030 Q1771 1107792-21/10

Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 15/1116/11

TBATBA Northern Guard E927

Heung A Line Sinokor India Hongkong 19/1121/11

TBATBA Wan Hai 627 E019

Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 26/1127/11

TBATBA Wan Hai 511 E095

InterasiaInterasia 03/1206/12

TBATBA Beijing Bridge E407 Feedertech Feedertech/TSA

Dronagiri 07/1108/11

TBATBA Xin Pu Dong 277E Q1769 1107779-21/10 KMTC KMTC (India) Port Kelang(W), Hongkong, Qingdao, Kwangyang, Dronagiri-3 08/1109/11

TBATBA KMTC Delhi 2406E Q1808 1108190-23/10 TS Lines TS Lines (I) Pusan, Ningbo, Shekou, Singapore. Dronagiri-2 (AIS SERVICE)

COSCO COSCO Shpg. Emirates Emirates Shpg. Port Kelang, Hongkong, Qingdao, Kwangyang, Pusan,Ningbo, Shekou, Singapore Dronagiri-2 10/1111/11

TBATBA Kumasi 24001E Q1765 1107757-21/10 Sinolines Transorient Shanghai, Ningbo, Shekou & Other Far East Ports. CU Lines Seahorse Shpg. (CIW) 11/1112/11

TBATBA Daphne 869W Q1806

ONE Line ONE (India) Singapore 15/1116/11

TBATBA Alexandria Bridge 075W Samudera Samudera Shpg. (SIG) Dronagiri 12/1113/11

TBATBA Abrao Cochin 22

Asyad Shpg. Seabridge Shanghai, Ningbo, Shekou. (FEX) 15/1116/11

TBATBA Xin Ya Zhou 165 Q1758 1107518-18/10 COSCO COSCO Shpg. Singapore, Hongkong, Shanghai, Ningbo, Shekou, 27/1128/11

TBATBA Beijing 106 APL CMA CGM Ag. Nansha, Taichung, Kaohsiung. Dron.-3 & Mul 03/1204/12

TBATBA Xin Beijing 149 OOCL/RCL OOCL(I)/RCL Ag. (CI 1) GDL/— CU Lines Seahorse Ship Singapore, Shanghai, Ningbo, Hongkong, Taichung, Kaohsiung. 15/1116/11

TBATBA Hyundai Brave 0111E Q1726

HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Seabird CFS 24/1125/11

TBATBA Hyundai Saturn 0047E Sinokor Sinokor India Shanghai Seabird CFS 30/11 01/12

TBATBA HMM Promise 0043E (FIM East Bound)

TBATBA Xin Da Yang Zhou 097E

Lines

Lines (I) Australian Ports. (CIX-3) Dronagiri-2 Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 Team Lines Team Global Log. Australia & New Zealand Ports. ConexTerminal

04/1105/11 X-Press Anglesey 24033W Q1762 1107616-19/10 ONE Line ONE (India) Sydney, Melbourne, Fremantle, Adelaide, Brisbane, Auckland, Lyttleton. 18/1119/11

TBATBA MOL Presence 018E Allcargo Allcargo Log. Melbourne, Sydney, Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 22/1123/11

TBATBA Dimitris Y 249E GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR 05/1106/11

TBATBA Seaspan Brisbane E003 Q1751 1107507-18/10 ANL CMA CGM Ag. Fremantle, Melbourne, Sydney, Adelaide, Brisbane, Dron.-3 & Mul. 12/1113/11

TBATBA Wan Hai 521 E028 Auckland, Tauranga, Madang, Port Lae, Rabaul, Port Moresby 19/1120/11

26/1127/11

TBATBA Argolikos E166 TS Lines TS Lines (I)

TBATBA Wan Hai 502 E128

07/1108/11 TBATBA Xin Pu Dong 277E Q1769 1107779-21/10

10/1111/11

TBATBA Kumasi 24001E Q1765 1107757-21/10 Sinolines Transorient

Sydney, Brisbane (CIW / FIX 2) SeaLead SeaLead Shpg. CU Lines Seahorse Shpg.

04/1105/11 Zhong Gu Tianjin 24009W Q1575 1104706-26/09 SeaLead SeaLead Shpg. Mombasa, Dar Es Salaam 06/1107/11 TBATBA Haian Mind 24013W Q1752 1107483-18/10 OOCL/TS Lines OOCL(I)/TS Lines(I) (IDEA

EAST

07/1108/11 TBATBA Ren Jian 8 02SIXS1 Q1757 CMA CGM CMA CGM Ag. Longoni, Dar Es Salaam, Zanzibar, Nacala, P.Victoria Dron.-3 & Mul. 13/1114/11

TBATBA GH Tramotane 02SJ1S1 Hapag ISS Shpg. & Other Ports

(SWAX) Emirates Emirates Shpg.

Tema Express 2443W

CMA CGM San Antonio 442S Q1755 1107515-18/10

CGM CMA CGM Ag. Reunion, Durban, Pointe Desgalets, Walvis Bay, Luanda, Dron.-3&Mul. 08/1109/11 TBATBA Fayston Farms 443S Q1794 1107938-22/10 Maersk Line Maersk India Pointe Noire, Tincan, Apapa, Tema, Cotonou, Lome, Capetown. Maersk CFS DAL Seatrade Durban, Port Elizabeth, Capetown, Maputo, Beira. (MIDAS-2) 05/1106/11

TBATBA Maersk Zambezi 444W Q1790 1107931-22/10 Maersk Line Maersk India Durban, Luanda, Pointe Noire, Aapapa, Tincan, Maersk CFS 19/1120/11 TBATBA Maersk Chennai 446W CMA CGM CMA CGM Ag. Cotonou (Direct), Port Elizabeth, Port Louis (MESAWA) Dron.-3&Mul.

Maersk Cairo 446S Q1798 1107952-22/10 Maersk Line Maersk India Mombasa, Victoria. Maersk CFS 17/1118/11

TBATBA Maersk Cape Town 447S (MWE SERVICE)

06/1107/11 06/11 1100 MSC Laurence IS443A Q1770 1107791-21/10 MSC MSC Agency Tema, Abidjan, Khoms, Tripoli, Misurata, Tunis Hind Terminals 13/1114/11 13/11 1100 MSC Thais IS444A Team Global Team Global Log. East, West & South African Ports. (Himalaya Express) Pun.Conware 08/1109/11 TBA 1000 Karlskrona IU444A Q1827 1108712-28/10 MSC MSC Agency San Pedro, Monrovia, Dakar, Freetown, Alger, Annaba, Bejaia, Oran, Hind Terminals 14/1115/11 TBATBA MSC Rikku IU445A Casablanca, Nouakchott, Nouadhibou, Cotonou, Tincan/Apapa (INDUS) 08/1109/11 08/11 0900 MSC Rania IP445A Q1764 1107734-21/10 MSC MSC Agency Khoms, Tripoli, Misurata, Tunis Hind Terminals 15/1116/11 15/11 0900 Conti Courage IP446A

CMA CGM

CMA CGM Ag. Dakar,Nouakchott,Banjul, Conakry, Freetown, Monrovia, Sao Tome,Bata, Dron.-3&Mul. 22/1123/11 21/11 0900 TBN IP447A Guinea Bissau, Nouadhibou, Dakar,Abidjan,Tema, Malabo & Saotome. (EPIC / IPAK)

GlobelinkGlobelink West & South African Ports. Safewater Safewater Lines East, South & West African Ports (EPIC / IPAK)

In Port 06/11 X-Press Odyssey 445E Q1809 1108138-23/10 CMA CGM CMA CGM Ag. Beira, Maputo, Nacala, Tanga, Lilongwe & Harare. Dron.-3&Mul. 11/1112/11 TBATBA X-Press Carina 446E Q1829 1108776-28/10 (NWX/FI-3) In Port 06/11 OOCL Hamburg 153E Q1777 1107824-21/10 COSCO COSCO Shpg. West African Ports. (CIX-3)

DTD. 29-10-24

The above vessel has arrived at NSIGT (NHAVA SHEVA) with import cargo from AUCKLAND, BLUFF, BRISBANE, BUENOS AIRES, COTONOU, DAKAR, DAMMAM, DOUALA, FREMANTLE, LOME, LYTTELTON, MALE, MAPUTO, MELBOURNE, MOMBASA, MONROVIA, NACALA, NAPIER, NAV EGANTES, PARANAGUA, POINTE NOIRE, PORT LOUIS, RODMAN, SALVADOR, SANPEDRO, SANTOS, SYDNEY, TAKORADI, TAMATAVE, TAURANGA, TEMA, TINCAN/LAGOS, WELLINGTON

Please note the item Nos. against the B/L Nos. for NSIGT (NHAVA SHEVA) delivery.

98 MEDUPL404324

134 MEDUQL418116

183 MEDUQL445622 126 MEDUT1271278 129 MEDUT1273373

MEDUUL709844 13 MEDUUL711972

MEDUUL713440

141 MEDUUL715098

9 MEDUUL723134

15 MEDUAZ602106

176 MEDUAZ613400

23 MEDUCM262100

17 MEDUCT149456

214 MEDUE8405452

207 MEDUE8413803

59 MEDUE8416772

206 MEDUE8416947

63 MEDUE8418562

199 MEDUE8425773

145 MEDUE8434635

196 MEDUE8434718

195 MEDUE8453577

190 MEDUE8453627

55 MEDUEZ095229

53 MEDUEZ100235

220 MEDUEZ103262

165 MEDUFX096169

164 MEDUFX126362

168 MEDUFX134879

162 MEDUGR647751

223 MEDUGR656851

184 MEDUGR661208

222 MEDUGR664749

229 MEDUGT621026 27 MEDUGT625357 76 MEDUHI007772

85 MEDUHI008515

132 MEDULG484479

211 MEDULO304512

39 MEDULO305584

32 MEDULO306095

42 MEDUM3065114

45 MEDUM3065890

210 MEDUM9058311

Consignees are requested to kindly note that the above item nos. are for the B/L Nos. arrived for NHAVA SHEVA delivery. Consignees are requested to collect Delivery Order for all imports delivered at NHAVA SHEVA from our Import Documentation Dept. at Andheri-Kurla Road, Andheri-East MSC House - 400059 on presentation of duly discharged Original Bill of Lading and payment of relevant charges.

The container detention charges will be applicable after standard free days from the discharge of containers meant for delivery at NHAVA SHEVA .

The containers meant for movement by road to inland destinations will be dispatched upon receipt of required documents from consignees/receivers and the consignees will be liable for payment of port storage charges in case of delay in submission of these documents. Our Surveyors are M/s. Zircon Marine Services Private Limited. and usual survey conditions will apply. Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

Incase of any query, kindly contact Import Customer Service - prasad.pfol@gmail.com

Get IGM No. / ITEM No. /CFS details on our 24hrs computerized helpline No. (IVRS No.) 8169256872

You can also visit our website: www.msc.com/ind/help-centre/tools/import-general-manifest-information

Invoices and Delivery order request must only be done in ODEX portal uploading all supporting documents.

Cont’d. from Pg. 3

“Given the present trends

a n d t h e likelihood of several new members joining the BRICS+ group being strong, the share of BRICS+ in global merchandise exports can overtake that of the G7 group by 2026," EY India Chief Policy Advisor DK Srivastava said.

BRICS,, consisting of Brazil, Russia, India, China and South Africa, has now expanded with five additional members - Egypt, Ethiopia, Iran, Saudi Arabia and the UAE.

Central to this transformation are India and China, two key members of the BRICS+ alliance In 2023, t h e y r a n k e d t h i r d a n d f i r s t , respectively, globally in terms of purchasing power parity (PPP), both countries are projected to retain these positions by 2030.

China's contribution to BRICS+ exports has surged dramatically, increasing from 36 1 per cent in 2000 to 62.5 per cent in 2023. India has also made significant strides, contributing 7.9percenttoBRICS+exportsin2023.

EY's analysis further underscores the increasing importance of hightech exports from BRICS+ countries.

The group's share of global hightech exports has risen significantly, from just 5 per cent in 2000 to 32.8 per cent in 2022.

This shift reflects a strategic move t o w a r d t e c h n o l o g y - i n t e n s i v e products, positioning BRICS+ nations as vital players in the global high-tech market, it added.

In addition to trade dynamics, the currencies of BRICS+ nations are gaining traction in the global economy. The Yuan has remained stable, with slight appreciation, while t h e I n d i a n r

depreciation, particularly since 2018.

Notably, the share of the US dollar as a global reserve currency has declined from 71.5 per cent in 2000 to 58 2 per cent in 2024, signalling a potential shift toward a more multipolar currency framework.

"As geopolitical tensions continue, the coordinated policies among BRICS+ members may challenge the established dominance of the G7 and the US dollar, paving the way for a new m u l t i p o l a r g l o b a l e c o n o m i c landscape," Srivastava said.

The BRICS+ group is establishing a p l a t f o r m f o r c o n d u c t i n g international trade and investment transactions, which could become a low-cost alternative to the existing SWIFT platform.

The group is also developing a trade and reserve currency, backed by gold and other select commodities, Srivastava added.

NEW DELHI: India wants to boost domestic manufacturing of IT hardware products like laptops, tablets and servers. The Government is likely to offer some concessions in import quotas to electronic hardware manufacturing companies that can step up domestic production under the production-linked incentive (PLI) scheme for information technology (IT) hardware,according to sources. The government first imposed import restrictions on laptops, tablets, all-inone personal computers, ultra-small form factor computers and servers on August 3, 2023.

The Government is also targeting

80% local value addition in IT gear in 5-10 years. Not just IT hardware, India is trying to manufacture many other goods domestically Recently Prime Minister Narendra Modi inaugurated the TATA Advanced Systems Limited (TASL) Campus in Vadodara which will manufacture C-295 defence transport aircraft in collaboration with Airbus, the first private sector final assembly line for military aircraft in India Under the C-295 programme, 16 aircraft will be delivered directly by Airbus from Spain and remaining 40 will be made in India. TASL is responsible for

making these 40 aircrafts in India in partnership with Airbus The local manufacturing of this aircraft will add to India's growing aviation industry and expand the aviation manufacturing ecosystem which is v

manufacturing commercial aircraft domestically.

The aircraft plant comes after another big Make in India project for semiconductors under which India Semiconductor Mission has approved five semiconductor units which will all receive central and state government subsidies with a total outlay of Rs 76,000 crore.

NEW DELHI : Apple’s iPhone exports from India surged by a third i n t h e s i x m o n t h s e n d i n g i n September, reinforcing the tech giant’s strategic move to boost manufacturing in India while r e d u c i n g r e l i a n c e o n C h i n a . India-made iPhone exports reached n e a r l y $ 6 b i l l i o n , m a r k i n g a significant jump from last year The robust growth trajectory suggests Apple (NASDAQ:AAPL) is on track to exceed $10 billion in iPhone exports in the fiscal year 2024

This uptick follows Apple’s broader efforts to leverage India’s workforce, subsidies, and burgeoning technology ecosystem as tensions between the US and China intensify

manufacturing to hit $10B

Apple’s strategic shift to Indian manufacturing has been accelerated by three of its primary suppliers: Foxconn Technology Group, Pegatron Corp., and Tata Electronics. Together, they are ramping up iPhone assembly i n I n d i a ’ s s o u t h e r n r e g i o n s , particularly around Chennai and Karnataka.

Foxconn, Apple’s leading supplier in India, accounts for half of the c o u n t r y ’ s i P h o n e e x p o r t s Tata Electronics, which acquired its iPhone production unit from Wistron last year, exported about $1.7 billion worth of iPhones from Karnataka from April to September, becoming

Apple’s first Indian assembly partner Apple’s rapid growth in India aligns well with Prime Minister Shri Narendra Modi’s “Make in India” initiative, which has encouraged international businesses to invest in local manufacturing.

T h

assemble high-end iPhone models, such as the iPhone 16 Pro and Pro Max, domestically.

The push to localize production has not only boosted Apple’s India e x p o r t s b u t a l s o p r o p e l l e d smartphones to become the country’s top export category to the US, totaling $2 88 billion in just five months this fiscal year

M U M B A I : Transindia Real Estate Limited has announced its financial results for the quarter ended 30th September, 2024.

Jatin Chokshi, Managing Director, Transindia Real Estate Limited said, “Transindia is a leading developer of Grade A Warehousing in India. After exiting a substantial portion of its completed warehousing portfolio last year, the company currently has a portfolio of completed assets which has potential to earn a

rental income of about Rs 65 crore annually More importantly, the company has recently invested the divestment proceeds to acquire new land parcels in Bangalore, Kolkata and Bhiwandi to develop new projects, for further growth The company is also exploring other assets such as residential and other real estate products.”

N E W D E L H I : F r e e Tr a d e agreements (FTA) have emerged as a m

especially between the developing countries as multilateral agreements are often viewed as too much inclined in favour of the developed countries. T h e p r o t r a c t e d a n d p r o l o n g e d negotiations and failure to resolve several key financial issues at p l a t f o r m s l i k e Wo r l d Tr a d e Organisation (WTO) have further given a fillip to FTAs.

India has used this instrument too; it has signed 13 FTAs so far. The negotiations are on for a few others. The Global Trade Research Initiative ( G T R I ) h a s a n a l y s e d I n d i a ’ s performance in three key FTAs signed with ASEAN, South Korea and Japan.

GTRI compared India’s trade with these FTA partners during the pre‐FTA era (2007‐09) and current trade (2019‐21). The results show two major trends. One, India’s cumulative merchandise trade deficit with these 3 FTA partners increased at a much higher rate than India’s global trade d e f i c i t : A S E A N - 2 0 1 . 5 % , S o u t h K o r e a ‐ 1 4 2 5 % , a n d Japan‐120 6% The deficit with the world grew by 43.1%.

Two, India’s exports to the three FTA partners have grown at a rate much lower than its imports. This is evident from the cumulative export and import growth during the pre‐FTA a n d c u r r e n t p e r i o d s : A S E A N (exports 104 4 %, imports 131 4%), Japan (exports 47.8%, imports 84.0%), and South Korea (exports 62 6 %, imports 106.0%).

R e a s o n s f o r I n d i a ’ s W e a k

Performance

The prime reason for this trend is high tariffs in India and significantly lower tariffs in its FTA partners.

Thus, India gains little from eliminating import duties for the partner countries under FTAs, as most imports take place at zero or low MFN (Most Favoured Nation) duties

For example, consider the trade weightage applied MFN duties of I n d i a ’ s F T A p a r t n e r s

‐Singapore‐0%, Japan‐2 4%, Malaysia‐3 5%, Viet Nam‐5 3%, M a u r i t i o u s ‐ 1 . 1 % , UA E ‐ 3 . 5 % , Australia‐2 6% Many firms avoid using the FTA route when import duties a r e l o w a s t h e F TA ‐ r e l a t e d compliance cost does not justify the benefits arising from tariff benefits, says the GTRI report.

Fu r t h e r, t h e r e p o r t s a y s ,

“Most trade happens at zero MFN duties in India’s partner countries For example, we list the percentage of global imports happening at MFN zero duty in India’s FTA partner countries: Singapore‐99 8%, Malaysia‐82%, J a p a n ‐ 8 1 % , V i e t n a m ‐ 6 1 4 % , South Korea-41.7%. In such cases, FTAs offer no additional market access to Indian exporters.”

New FTAs in Pipeline

The same lessons can be applied to the FTAs in pipeline as India has been negotiating several F TAs with countries of the Western world. Here one needs to highlight a significant shift in India’s approach on FTAs. Over the last few years, India has shifted its focus from ‘East’ to the ‘West’ and is looking at countries of the developed world as new partners under the FTAs. However, that also brings into the picture the issue of non-tariff barriers.

T h e s t r i n g e n t l a b o u r a

e n v i r o n m e n t a l n o r m s a n d t h e contentious issue of intellectual property rights can lead to these potential partners imposing non-tariff barriers on Indian exports once the FTAs are signed. Also, as the GTRI report mentions that the factors (low MFN import duties and most imports already at zero or low duties in FTA partner countries) that resulted in India’s weak export performance to the 3 FTA partners (ASEAN, Japan, and South Korea) continue to be relevant for new FTA partners as well.

India’s potential FTA partners already have low trade weightage applied MFN duties, as evidenced from the following: United Kingdom‐ 4.1%, C a n a d a ‐ 3 3 % , I s r a e l ‐ 3 7 % , United States of America‐2.3%, and European Union‐3.2%. On the other

hand, India’s trade‐weighted MFN duty is 12.6%.

Also, a substantial share of their imports is already at zero MFN duties, as would be clear from the following details: Canada‐ 70.8%, Switzerland‐61%, USA‐ 58.7%, UK‐ 52%, EU‐ 51.8 % In contrast, in India only 6.1 % of global imports are undertaken at zero MFN duty, says the report.

Cautious Approach

Ashwani Mahajan, Co-convenor of Swadeshi Jagaran Manch(SJM), says that India needs to adopt a cautious approach and especially keep out those sectors from the scope of the FTAs which provide large scale employment and can get severely impacted due to lowering of import duties For example, while the negotiations for signing FTA with Australia were going on, there was a huge push back from the Indian dairy industry as it faced existential threat from the low-cost imports of Australian dairy products. Finally, the dairy sector was kept out of this FTA, says Mahajan. He added, currently the government of India gives preference to Indian companies, especially the micro, small and medium enterprises (MSME) w h e n i t c o m e s t o G o v e r n m e n t procurement This rule has been brought by the Modi government to benefit the local players While the WTO agreements do not mandate the government of India to change such rules, the FTAs put pressure to change such rules.

So far, the FTAs have been a mixed bag for India. While the import burden has increased with most of the partners under already signed FTAs, the exports have also been boosted though at a much slower pace than the desired level The Modi government has adopted a cautious approach regarding this issue. Its decision to withdraw from Regional Comprehensive Economic Partnership (RCEP) negotiations in November 2019 to safeguard India’s interests shows its intent It is important that India recalibrates its strengths and weaknesses in context of the FTAs before we move further ahead.

NEW DELHI: India’s exports of agricultural and processed food products declined marginally (1%) to $ 12.13 billion in the first half of FY25, owing to sharp fall of 17% in nonbasmati rice shipments.

Shipments of basmati rice, buffalo meat and fresh fruits, however rose during April-September, 2024-25 compared to the same period in Fy24.

Exports of aromatic and longgrain basmati rice saw a sharp spike of 11% on year to $ 2 87 billion i n A p r i l - S e p t e m b e r o f F Y 2 5 The minimum export price (MEP) of $ 950/tonne imposed in October, 2023 was removed last month, which is expected to boost shipment of high value rice.

With removal of restrictions on rice exports, agri-exports are expected to rebound in the second half of the FY25, officials said. Last month, the government removed virtually all

restrictions on basmati as well as nonbasmati rice exports imposed last year by removing minimum export price andexportduties

Although non-basmati rice exports declined by 17% to $ 2 25 billion in April – September, because of restrictions on shipment which are likely to get a boost with removal of export duties and MEP .

Trades sources said that India’s dominance in global rice trade is expected to be restored with a spike in shipment especially to Africa and south-east Asian countries

The shipment of buffalo meat rose by 4% on year to $ 1.8 billion during April-September of the current fiscal a g a

p o r t s $ 1.73 billion during the same period in 2022-23.

The exports of fresh fruits in the April-September period of the current fiscal rose marginally to $ 0.4 billion

compared to the same period last year, Fresh vegetables shipment declined by 4% to $ 0.43 billion in the first half of curent fiscal on year

Officials said that there has been r i s i n g d e m a n d f o r s e v e r a l agricultural products such as bananas, mangoes, processed fruits and juices, fruits and vegetables seeds and processed vegetables across the world.

India’s exports of agricultural and processed food products in FY24 declined by 6% to $25.01 billion on year because of a drop in rice exports because of restrictions imposed last year. APEDA has set an export target of $ 28.72 billion for FY25.

The share of exports of products under the APEDA basket is around 51% in the total shipment of agriproduce. Rest of the agricultural products exports include marine, tobacco, coffee and tea.

NEW DELHI: India and Russia are accelerating efforts to establish a rupee-ruble trade mechanism, aiming to reduce reliance on the US dollar amid growing global financial complexities The two nations are working to create a direct payment system in their respective currencies, a step that could redefine their trade relationship by fostering greater financial independence However, Indian banks’ caution in handling transactions with Russia, influenced by US scrutiny and sanctions threats, remains a major challenge.

Whilethelackofadirectrupee-ruble exchange mechanism is an issue, Russian Ambassador Denis Alipov clarified that the main obstacle is the “over-cautiousness” of Indian banks “The problem is not the exchange rate,” Alipov stated, “the biggest challenge is the over-cautiousness of Indian banks regarding transactions with Russia ” He attributed this reluctance to US pressures, noting, “The US has been

meticulous in tracking transactions between India and Russia, even threatening sanctions.” According to Alipov, these pressures hinder India’s ability to freely engage with Russia and could restrict other partnerships if unchecked

Alipov also voiced concerns over the long-term implications of US-led sanctions, arguing that India should not be bound by the strategic interests of another country “Today, it is necessary for India to settle its relationship with Russia; tomorrow, the US might ask India to curb its relationship with Bangladesh,” he said, pointing to an ongoing need for India to safeguard its economic autonomy The ambassador added that the growing pressure highlights the importance of creating a sustainable payment mechanism that bypasses dollar dependence and strengthens India-Russia ties.

This financial push aligns with a broader movement within the BRICS

alliance to reshape global finance and elevate voices from the Global South. “It is necessary for India, Russia, China, and other members…to have an equal voice in various issues of global financial cooperation,” Alipov said, calling BRICS an essential platform for equitable international engagement. The ambassador expressed optimism that India’s banking sector would become more flexible in supporting transactions with Russia, stressing, “India does n o t s u p p o r t t h o s e s a n c t i o n s , and it should stay as such.”

A d d i t i o n a l l y, t h e I n

a n government has shown growing interest in projects within Russia’s Far East and Arctic regions, areas abundant in resources and promising for trade. “India is expressing huge interest in mutual projects in the Russian Far East,” Alipov remarked, highlighting that cooperation in these regions could pave the way for enhanced economic engagement.

MUMBAI: The country's gold imports, which have a bearing on the country's current account deficit (CAD), rose by 21.78 per cent to USD 27 billion during April-September this fiscal due to strong domestic demand, according to the government data.

The imports stood at USD 22.25 billion in April-September 2023-24.

An industry expert said that the ongoing festival demand is helping the increase in imports. In 2023-24, India's gold imports surged 30 per cent to USD 45.54 billion.

Switzerland is the largest exporter of gold, with about 40 per cent share, followed by the UAE (over 16 per cent) and South Africa (about 10 per cent). The precious metal accounts for over 5 per cent of the country's total imports.

Cargo Steamer's Agent's ETD Jetty Name Name

CJ-I Yassin Bey Aditya Marine 07/10

CJ-II Neptune J DBC 06/10

CJ-III Suvari Reis DBS 08/10

CJ-IV Nada Kashmira Shpg. 07/10

CJ-V Vantage Rose JMBaxi 06/10

CJ-VI Top Brilliance Cross Trade 06/10

CJ-VII Dara Chowgule Bros 05/11

CJ-VIII VACANT

CJ-IX Blue Voyage Ocean Harmony 06/10

CJ-X Ras Ghumays I Ocean Harmony 06/10

CJ-XI TCI Express TCI Seaways 05/11

CJ-XII VACANT

CJ-XIII Gloria M JMBaxi 07/10

CJ-XIV An Hai Confidence 4 Jeel Kandla 05/11

CJ-XV Daiwan Hero DBC 06/10

CJ-XVA Shi Zi Feng Mihir & Co. 07/10

CJ-XVI Tientsin DBC 05/11

TUNA

ETD

05/11

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I Kruibeke Seaworld 05/11

OJ-II Maritime Meridian Samudra 05/11

OJ-III Solar Roma JMBaxi 05/11

OJ-IV T Vega Samudra 05/11

OJ-V VACANT

OJ-VI Sanman Sitar Malara Shpg. 05/11

OJ-VII Sky Runner JMBaxi 05/11

SHIPS SAILED WITH NEXT

Source Blessing 29/10 Nhava ShevaJebel Ali-DammamShuiba-Umm Qasr

Haci Ali Sari

29/10 West Africa

AS Alexandria 30/10 Pipavav-CochinTuticorin-Kattupalli

Xin Long Yun 55 30/10 Karachi-Jebel Ali

Hamburg Eagle 30/10

Meghna Rose 30/10

Bloom Halo 30/10 China

G Pacific 31/10

Rize 31/10 USA

Steamer's Name Agents Arrival on Moonlit Anline Shpg. 13/10

Golden Tide Parekh Marine 05/10

Haj Ali DBC 23/10

Prince Khaled DBC 24/10

ST Andrew B S Shipping 16/10

Eleen Sofia ACT Infraport 18/10

Fuat Bey Parekh Marine 26/10

Kurobe DBC 26/10

Suzy Synergy 27/10

Clipper Brunello B S Shipping 26/10

Prashad Genesis 28/10

Gautam Rehansh Ocean Harmony 28/10

Lista Cross Trade 28/10

African Grouse Synergy 28/10

Darya Heera Cross Trade 28/10

African Loon Aditya Marine 14/10

Mandarin Phoenix Chowgule Bros 29/10

Steamer's Name Agents Arrival on Ruby Confidence BS Shipping 19/10 Obe Heart ACT Infraport 29/10

CJ-XIV An Hai Confidence 4 Jeel Kandla

Stream

Stream

Stream

Stream

Stream

Stream

CJ-XV

Stream Georgia M Dariya Shpg.

Stream

Stream Steller Enguri JMBaxi

Stream Suzy Synergy Malaysia

Stream Argent Sunrise GAC Shpg. 9,836 T. Chemicals

Stream Bow Endeavor GAC Shpg. Singapore 9,500 T. Chem In Bulk INIXY124101360

Stream Fulda V Ocean 16,500 T.

OJ-I Kruibeke Seaworld

I/E TEUs.

Stream Navios Dorado (IG1) Hapag Llyod Nhava Sheva-Jebel I/E TEUs. 10/11 Safeen Power(IG1) Ali-Dammam-Shuiba- I/E TEUs. Umm Qasr

Stream BLPL Blessing (SMI) Transworld Global Nhava Sheva - Chittagong- I/E TEUs. Port Klang

09/11 Xin Long Yun 55 (KGS) Kashmira Shpg. Karachi-Jebel Ali I/E 395 TEUs.

06/11-AM Oshairij 2422W 4103995 Milaha/QN Line Poseidon Shpg. Hamad. (NDX)

X-Press Feeder Sea Consortium 06/11 06/11-AM Celsius Edinburgh 3S 4103721 Unifeeder Transworld

10/11 10/11-AM Maersk Cuanza 445W 4103907 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA)

TO LOAD FOR FAR EAST JAPAN, CHINESE PORTS

Gwangyang (CSC)

09/11 09/11-AM Wan Hai 523 2033E 4103975 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16) 10/11

TBA X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

TBA Asyad Line Seabridge Marine Shangai, Ningbo, Shekou (FEX)

TBA Asyad Line Seabridge Marine Haiphong, Laem Chaban, Jakarta (IEX) TO LOAD FOR INDIAN SUB CONTINENT

06/11 06/11-PM Mogral 2411 Global Feeder Sima Marine Karachi (CSC)

10/11 10/11-AM Maersk Cuanza 445W 4103907 Maersk Line Maersk India Colombo (MW2 MEWA) 11/11

TBA Sai ShippingSai Shipping Karachi (JKX)

TBA Asyad Line Seabridge Marine Karachi (REX)

In Port Cap San Juan (V-444W) Maersk India Jebel Ali 06/11 Celsius Edinburgh (V-3S) 4103721 Unifeeder Ag Jebel Ali 06/11 Mogral (V-2411) MBK Logistix Nhava Sheva

VESSEL’S NAME VCN NO. AGENTS FROM SAILED WITH EXPORT CARGO

Giselle (V-2412) Karachi

Interasia Enhance (V-2411) Port Kelang

seaspan Jakarta(V-444W) Pipavav

05/11 05/11-PM Celsius Nairobi

04/11-PM Xin Fu Zhou 86E 2403900 Wan Hai Line Wan Hai Lines Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 05/11 12/11 11/11-PM Wan Hai 626 18E 2403933 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX) 13/11

06/11 06/11-PM Ever Ethic 171E 2403804 Evergreen/ONE Evergreen Shpg/ONE Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 07/11 13/11 13/11-PM Shimin 24E 2403984 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC) 14/11 07/11 07/11-PM One Matrix 92E 2403931 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 08/11 KMTC /TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX) 05/11 05/11-AM Zoi 117E 2403894 Interasia/GSL Aissa M./Star Shpg Port Kelang, Singapore, Tanjung Pelepas, Xingang, Qingdao, 06/11 Evergreen/KMTCEvergreen/KMTC (FIVE)

09/11 05/11-PM Ever Utile 188E 2403870 FeedertechFeedertech Port Kelang, Singapore, Leam Chabang.(AGI) 10/11 11/11 10/11-PM Xin Pu Dong 277E 2403977 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao. (AIS) 12/11 TS Lines Samsara Shpg 12/11 12/11-AM Hyundai Brave 111E 2403820 Hyundai Seabridge Maritime Singapore, Da Chan Bay, Busan, Kwangyang, Shangai. (FIM EAST)

(SI8

Tauro, Feixstowe, Hamburg, Antwerp & Other Inland Destn.(HIMEXP) 05/11 12/11 12/11-AM MSC Rania IP443A 2404022 MSC/COSCO MSC Ag / COSCO Shpg.

Adriatic Ports (EUROPE) ‘

Safeen Feeders Samsara Shpg. Khalifa, Jebel Ali, Bahrain, Dammam, Jubair (UIG) Yang Ming Line Yang Ming Line

TBA Mesiina Transworld Group Durban, Maputo, Dar Es Salaam, Mombasa (INDME)

TBA MSR Master Logitech Dar Es Salaam, Mombasa (WARM)

TBA

TBA MSC

Port Louis, Tema, Lome, Cotonou (IAS)

29/11 30/11-0001 Maersk Atlanta 446W (MECL)

TO LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND AND PACIFIC ISLANDS

05/11 04/11-2000 Conti Conquest 029E 24359 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 06/11 09/11 08/11-2000 Conti Crystal 138E 24361 HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3) 10/11

06/11 05/11-1900 X-Press Odyssey 2405E24358 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 07/11 13/11 12/11-1900 X-Press Carina 2406E24364 X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 14/11 Sinokor/Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan.

06/11 06/11-1400 OOCL Hamburg 153E 24356 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 07/11 20/11 20/11-1400 OOCL Luxembourg 113E Gold Star / RCL Star Shpg/RCL Ag. (CIXA) 21/11 12/11 12/11-0400 MOL Presence 018E 24362 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 13/11 16/11 16/11-0400 Dimitris Y 249E ONE ONE (India) (TIP) 17/11 17/11 16/11-2100 Xin Ya Zhou 165E 24360 COSCO COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 18/11 Nansha, Port Kelang (CI1)

TO LOAD FOR WEST ASIA GULF, RED SEA & EAST AFRICAN

05/11 05/11-0300 Seaspan Jakarta 0444W 24351 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX) 06/11 08/11 07/11-1800 Maersk Detroit 444W 24352 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 09/11 TO LOAD FOR INDIAN SUB CONTINENT PORTS & COASTAL SERVICE

04/11 04/11-1700 SCI Chennai 2413 24355 SCI J M Baxi Mundra, Cochin, Tuticorine. (SMILE)

06/11 06/11-1400 OOCL Hamburg 153E 24356 COSCO/OOCL COSCO Shpg./OOCL(I) Colombo. (CIXA)

06/11 05/11-1900 X-Press Odyssey 2405E24358 Maersk Line Maersk India Colombo. (NWX)

12/11 12/11-0400 MOL Presence 018E 24362 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo.

16/11 16/11-0400 Dimitris Y 249E ONE ONE (India) (TIP)

17/11 16/11-2100 Xin Ya Zhou 165E 24360 COSCO COSCO Shpg. Karachi, Colombo (CI1)

22/11 21/11-1900 SM Manali 0048 24363 CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, 23/11 Krishnapatanam, Cochin, Mundra. (CCG) TBA 162 24354 SSLSSL Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) TO

05/11 04/11-2000 Conti Conquest 029E 24359 ONE ONE (India) Los Angeles, Oakland. (PS3) 06/11 08/11 07/11-1800 Maersk Detroit 444W 24352 Maersk Line

MOL

16/11 16/11-0400 Dimitris Y 249E ONE ONE (India) Norforlk, Charleston, Halifax. (TIP)

04/11 Advance 060W COSCO/OOCL COSOC Shpg./OOCL (I)

11/11 Grasmere Maersk 446W Gulf & Africa (Blue Nile Express) 12/11 04/11 Zoi 117E 2401217 Zim/KMTC Zim Integrated / KMTC India Far East & South East Asia

09/11 KMTC Dubai 2406E Evergreen/Emirates Evergreen Shpg./Emirates Shpg. (NIX / FIVE / CIX3) 10/11 17/11 Ever Elite 170E X-Press Feeders Sea Consortium 18/11 07/11 SSL Visakhapatnam 201 Hapag/CMA

09/11 Tema Express 2443W Hapag ISS Shpg. Colombo, Durban, Tema, Tincan, Apapa & Other South African, 10/11 One ONE (I) West African & Middle East Ports (MIAX / AIM) 09/11 One Reassurance 244E HMM HMM Shpg. New York, Savannah, Jacksonville, Charleston, Norfolk. 10/11 One ONE (I) (WIN / IAX) 10/11 MSC Rania IP445A MSC MSC Ag. Europe, South Central America, US Gulf (IPAK) 11/11 17/11 Conti Courage IP446A 18/11

CB-1 ALS Clivia (V-0FFCYE1) CMA CGM/Gold Star CMA CGM Ag.(I)/Star Shpg. Far

04/11 AS Paola (V-0UW2LW1)

Car.CB-1 Cstar Favroniya (V-47W)Sailed) Seastar

05/11 CMA CGM Vitoria (V-0UCSIW1)

Car.CB-1 Osaka (V-2442W)(Sailed)

Car.CB-1 Spil Kartika (V-2441W)

06/11 Ren Jian 8 (V-02SIXS1)

13/11 GH Tramontane (V-02SJIS1)

05/11

Navios Dorado (V-2443W)

04/11 Zhong Gu Tianjin (V-24009W)

0/11 Zhong Gu Zhu Hai (V-24044W)

CB-4 Artabaz (V-1336W) HDASCO Armita India Gulf

Car.CB-5 APL Holand (V-OPU2DS)(Sailed) Emirates / KMTC Emirates Shipping / KMTC India Gulf

10/11 Zhong Gu Kun Ming (V-02448S) RCL RCL Agency

Car.CB-4 BFAD Pacific (V-441S)(Sailed) Maersk Line/CMA CGM Maersk India/CMA CGM Ag.(I) Africa

07/11 Celsius Edinburg (V-003W) Unifeeder/One Unifeeder/One India Gulf

CB-5 Ever Ethic (V-171E) Unifeeder/KMTC Unifeeder/KMTC(I) Far East &

11/11 Shimin (V-24E) Hapag/Evergreen ISS Shipping/Evergreen Shpg. Colombo 12/11 ONE/TS Lines ONE (I)/TS Lines(I) 08/11 Folk Jeddah (V-2405W) Folk Maritime Seastar Global Jeddah

Car.CB-5 GFS Gissele (V-2402E)(Sailed) Global Fdr/TS Lines Sima Marine/TS Lines (I) Far East

05/11 Varada (V-2411E) Sinokor/Heung A Line Sinokor India

04/11 Inter Sydney (V-0166) Interworld Efficient Marine Gulf 05/11 Car.BMCT-2 Konard (V-KONO624W)(Sailed) Akkon Oasis Shipping Europe/Med. 01/11 05/11 Maersk Zambezi (V-444W) CMA CGM/Maersk Line CMA CGM Ag.(I)/Maersk India Africa 06/11 06/11 Maersk Danube (V-445W) Maersk Line Maersk India U.K. Cont.

08/11 MSC Mexico V (V-IV445A) MSC MSC Agency U.S.A.

Car.CB-5 Marathopolis (V-445S)(Sailed) Maersk Line Maersk India Africa

Car.CB-4 SOL Prime (V-5404E)(Sailed) BLPL Transword GLS Far East

Car.CB-5 SSL Brahmaputra (V-920W)(Sailed) Wan Hai/Unifeeder Wan Hai Lines (I)/Unifeeder Jebel Ali

05/11 X-Press Mekong (V-24009W) X-Press Feeder Sea Consortium

Car.CB-5 W Kithiria (V-443W)(Sailed) Maersk Line Maersk India Mediterranean

Car.CB-6 C C Don Pasculeae (V-OINI7W1)(Sailed) CMA CGM/OOCL CMA CGM Ag.(I)/OOCL(I) U.S.A.

09/11 CMA CGM Pellesa (V-OINIBW1) COSCO/ONE COSCO Shpg/One

Car.CB-6 MSC Pamela (V-IU443A)(Sailed) MSC

06/11 MSC Laurance (V-IS443A) MSC/SCI MSC

08/11 MSC Rania (V-IP445A) MSC/Hapag MSC Ag/ISS Shpg. U.K.

CB-6 Tucapel (V-4145W) Hapag ISS Shipping

18/11 Tolten (V-4146W)

04/11 X-Press Anglesey (V-24033E)

Car.GTI-1 Maersk Straslund (V-443W) Maersk

07/11 Cap San Juan (V-444W)

06/11 Osaka Express (V-4343W) COSCO

15/11 Seaspan Amazon (V-4344W) Hapag / ONE ISS Shpg./ONE(I)

CMA CGM / OOCL CMA CGM Ag.(I)/OOCL(I)

Car.GTI-1 One Reinforcement (V-003E)(Sailed) ONE/HMM ONE (I)/HMM Shpg. USA

Car.GTI-1 One Theseus (V-089E)(Sailed) ONE/HMM ONE (I)/HMM Shpg. Far East &

03/11 One Conquest (V-029E) Yang Ming Line Yang Ming Line (I) China

GTI-1 OOCL Hamburg (V-153E) RCL/OOCL RCL Ag./OOCL(I) Far East

19/11 OOCL Luxembourg (V-113E) Zim/COSCO Zim Int./COSCO Shpg.

Car.GTI-2 SCI Mumbai (V-24043)(Sailed) Unifeeder/ Unifeeder/ Gulf

09/11 Celsius Nairobi (V-0919) QNL/Milaha Poseidon

Car.GTI-2 Wan Hai 361 (V-E016)(Sailed) Wan Hai Wan Hai Lines (I) Colombo & 03/11 08/11 Wan Hai 360 (V-E011) COSCO/Interasia Line COSCO Shpg./Interasia Shpg. Far East 09/11 Car.GTI-2 Wan Hai 507 (V-E227)(Sailed) Hapag/Evergreen ISS Shpg/Evergreen China

31/10 05/11 Seaspan Brisbane (V-E003) Wan Hai Wan Hai Lines (I)

GTI-2 X-Press Odyssey (V-445E) Maersk Line Maersk India Far East

11/11 X-Press Carina (V-446E) X-Press Feeder Sea Consortium

06/11 Yantian Express (V-OMXKTW1) Hapag/COSCO ISS Shpg./COSCO Shpg. USA, Gulf & 07/11 13/11 Valence (V-OMXKXW1) CMA CGM

BMCT-1 Advance (V-060W) COSCO/OOCL COSCO Shipping/OOCL (i)

Car.BMCT-1 AL Rawdah (V-005W)(Sailed) Safeen Feeders Sima Marine Gulf

04/11 CMA CGM Congo (V-OPEANW1) CMA CGM/APL CMA CGM Ag. (I) U.K. Cont.

12/11 APL Gwangyang (V-OPEARW1) COSCO / OOCL COSCO Shpg./OOCL(I)

08/11 CUL Laem Chabang (V-4324W) CU Lines Seahorse Shipping Red Sea/Gulf

11/11 Daphne (V-869W) One Line/Samudera One India/Samudera Far East

Car.BMCT-1 Ever Excel (V - 177E)(Sailed) RCL/PIL/CU Lines RCL Ag./PIL India/Seahorse Far East

04/11 Hemma Bhum (V-002E) Interasia/Evergreen Interasia Shpg./Evergreen Shpg.

Car.BMCT-1 Hyundai Courage (V-117W)(Sailed) HMM HMM Shpg. Far East

07/11 Hyundai Oakland (V-013W) One Line One India Mediterranean

05/11 Haian East (V-24027W) Sealead Sealead Shipping Mediterranean

10/11 Kumasi (V-24001E) Sino Lines Transorient Far East

Car.BMCT-2 MSC Brianna (V-JU443R)(Sailed) MSC MSC Agency Gulf

07/11 Maersk Kuanza(V-445W) Maersk Maersk India Africa

Car.CB-6 MSC Giovanna VII (V-XA442A)(Sailed) MSC MSC Agency Far East

Car.BMCT-1 MSC Mara (V-QS441R)(Sailed) MSC MSC Agency Far East 2391803

BMCT-2 MSC London (V-QS442R)

09/11 Oshairij (V-2422) QNL/Milaha Poseidon Far East/Gulf

04/11 One Matrix (V-092E) Gold Star/KMTC Star Shpg./KMTC (I) Far East

07/11 X-Press Capella (V-24007E) X-Press Fdrs/ONE Sea Consortium/ONE (I)

TS Lines/PIL TS Lines(I)/PIL India

Car.BMCT-3 Stephanie C (V-10W)(Sailed) Asyad/QNL/Milaha Seabridge/Poseidon Gulf

Car.BMCT-3 SM Neyyar (V-0443W)(Sailed) Maersk/Safeen Feeders Maersk India/Sima Marine Jebel

Fengze (V-31INDSTP)

08/11 Vira Bhum (V-119W) RCL

06/11 Wan Hai 523 (V-E030)

19/20 W Orkan Samsara 21 Belle Plaine

NEW DELHI: Exciting development from CONCOR are underway “Under the leadership of CMD of CONCOR, we have launched online registration for Customer and PDA (Pre-Deposit Account) services, designed to simplify processes and promote ease of doing business,” informs a recent communique from CONCOR.

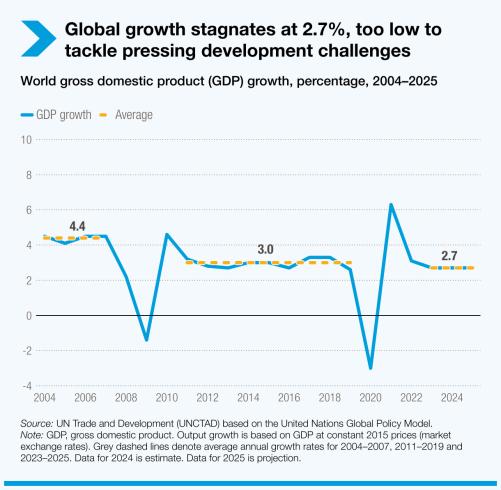

GENEVA: UN Trade and Development (UNCTAD) projects global economic growth to stagnate at 2.7% in 2024 and 2025, marking a sustained drop from the 3% annual average seen between 2011 and 2019 and well below the 4.4% average in the years before the 2008 financial crisis.

The organization’s Trade and Development Report 2024 warns that this new “low normal" growth is insufficient to tackle pressing development and climate goals or help ease widespread discontent amidst a global cost-of-living crisis that has left many households in vulnerable positions.

While the global South experienced robust annual growth rates of 6.6% between 2003 and 2013, that figure has fallen to 4.1% over the past decade, making it harder for nations to expand social services, cover rising energy transition costs and manage mounting public debt Excluding China, the economies of the global South have grown at 2.8% on average for the past decade.

High interest rates in advanced economies and depreciating currencies in developing countries are driving up the cost of foreign debt, forcing many governments to redirect export earnings away from development and toward debt payments. A shift in the structure of global trade

Another key issue is trade’s stalling growth relative to GDP . Between 1995 and 2007, trade grew at twice the rate of global GDP, but since the 2008 financial crisis, that momentum has stalled. In 2023, for the first time in history, merchandise trade contracted (-1.2%) despite global economic growth.

Meanwhile, services are emerging as a potential growth engine, expanding at 5% annually and now accounting for 25% of global trade by 2022.

While this shift brings promise, it also carries risks for global inequalities. Developing countries account for less than 30% of global services export revenues.

The uneven playing field is clear in the creative services sector, valued at $1 4 trillion in 2022, where advanced economies account for 80% of exports. The growing importance of intangible assets like brands, software, data and patented technologies in global supply chains heighten the risks further In 2023, investment in intangible assets grew three times faster than physical assets, reaching $6.9 trillion.

Urgent reforms needed to get on the right track

The report calls for urgent policy shifts to reverse rising inequality, stagnant wages, and jobless growth, particularly in developing countries Traditional manufacturing-led growth is no longer sufficient, and while the services sector is growing, it has not been able to generate enough quality jobs.

Key recommendations include:

• Adopt a balanced approach to inflation. The report warns that prolonged monetary tightening to curb post-pandemic inflation has only been partially

effective and has exacerbated economic challenges. It advocates for a mix of fiscal, monetary and regulatory policies to address inflation, including efforts to curb anti-competitive practices and reduce corporate concentration.

• Implement comprehensive debt reforms. UNCTAD proposes reforms across the debt cycle to reduce risks and vulnerabilities in developing countries.

• Diversify economies. Addressing inequality and jobless growth requires industrial policies that promote diversification beyond manufacturing and consider environmental, financial and technological shifts.

• Foster regional trade and integration. Leveraging agreements like the African Continental Free Trade Agreement (AfCFTA) and ASEAN Economic Community can help developing countries build more resilient economies.