MU MB AI : Re po rt ed Consolidated quarterly numbers for Total Transport Systems are: Net Sales at Rs 169.04 crore in September 2022 up 21.79% from Rs. 138.80 crore in September2021.

Quarterly Net Profit at Rs 1.70 crore in September 2022 down 24.41% from Rs 2.25 crore in September 2021 EBITDA stands at Rs. 5.18 crore in September 2022 up 21.31% from Rs.4.27croreinSeptember2021.

earn $58.9bn in Q3 : Report

NEW YORK: The John McCown’s Blue Alpha Capital estimatedcombinedearningsofContainerLines,boththose that publicly report results and privately held, at $58.9bn for thethirdquarteroftheyear Cont’d. Pg. 7

Vol.XXVIIINo.94 th WEDNESDAY 30 NOVEMBER 2022 KANDLA : (02836)222665/225790, E-Mail:dstimeskdl@gmail.com GUJARAT + NORTH INDIA AHMEDABAD : (079)26405551/52, E-Mail:dstgujarat@gmail.com MUMBAI : (022)22661756, 22691406/07/4491 www.dst.news YEARLY SUBSCRIPTION : 1600/-

Powered By HOTEL RADISSON KANDLA 20 20 FRIDAY January2023 BLOCK YOUR DATE See Pg. 4 Co-Presented By Co-Powered By Presents HOTEL RADISSON KANDLA 20 20 FRIDAY January2023 BLOCK YOUR DATE See Pg.4

Cont’d. Pg. 6

Total Transport Consolidated September 2022 Net Sales at Rs 169.04 crore, up 21.79% Y-o-Y Container Lines

GAC Group has announced new President Pontus Fredriksson

JEBEL ALI: GAC Group has announced the appointment of Pontus Fredriksson as its new Group President effective from January2023.

FredrikssonjoinedGACin2007andhasbeenGroupVice President of GAC’s Americas region since August 2019. He previously held various finance and managerial roles in the Middle East, including Managing Director of GACBahrain.

“His acumen and sound industry knowledge put him in a good position to lead the Group to further successes in a turbulent environment and I look forward to supporting him in his new role,” stated Bengt Ekstrand, Former Group President.

Ekstrand has held the position for the past 10 years and now is going to take on the role of

Executive Co Chairman alongside GAC’s long standing Executive ChairmanBjörnEngblom.

AccordingtoCACGroup,Ekstrand’s tenure began at a time of economic turmoil in the Eurozone and expanding armed conflicts in the Middle East. Sluggish oil prices would soon plunge to lessthanUS$45perbarrel

During that period, Ekstrand launched a wide ranging reform program within GAC known as Delta21 After that, significant structural and operational changes occurred, according to the group, making them more resilient, more efficient,andmoreprofitable.

Ekstrand leaves the position with GAC reporting record resultsinrecentyears.

30th NOVEMBER 2022 GUJARAT+NORTHINDIA 4

Mr.PontusFredriksson

Total Transport Consolidated September 2022 Net Sales at Rs 169.04 crore, up 21.79% Y-o-Y

Cont’d. from Pg. 2

Total Transport EPS has increased to Rs. 1.72 in September 2022 from Rs. 0.58 in September 2021. Total Transport shares closed at 176.35 on November 16, 2022 (NSE) and has given 179.92% returns over the last 6 months and 243.09% over thelast12months.

Total Transport Q2FY23

Earnings

• 21.8% YoY increase in revenue mainly on account of increaseinvolumeforSeaImport LCL and Sea Import FCL which are up by 19% and 4% respectively. Also, doubling of volume of FCL on CIS sector has resultedinincreaseinrevenue.

• 21.9% YoY increase in EBITDA mainly due to volume boostleadingtohigherrevenues.

Commenting on the results, Mr. Makarand Pradhan, MD, Total Transport Systems Ltd. Said, “I am happy to share that in the month of September 2022, our Company acquired 60% stake in R.N. Freight Forwarders Pvt. Ltd. Which is in

the business of Custom House Agents. This helps us diversify and add a new vertical to our current businessoperations.

Our last mile delivery business is taking shape and growing in line with our expectations. This quarter we purchased few e-scooters for smooth and

timely delivery of Amazon orders. We are taking all necessary steps to make sure our business model –Abhilaya reaches newer heights and is well recognizedbye-commerceplayers.”

First MSC Air Cargo Aircraft delivered

GENEVA: MSC has taken the next step in developing its Air Cargo solution with the delivery of the first MSC-branded aircraft, built by Boeing and operated by Atlas Air. The B777-200 Freighter will fly on routes betweenChina,theUS,MexicoandEurope.

Jannie Davel, Senior Vice President Air Cargo at MSC, said: “Our customers need the option of air solutions, which is why we’re integrating this transportation mode to complement our extensive maritime and land cargo operations. The delivery of this first aircraft marks the start of our long-term investmentinaircargo.”

Jannie Davel brings extensive air cargo experience, having worked in the sector for many years, most recently heading Delta’s commercial cargooperations,beforejoiningMSCin2022.

He said: “Since I started at MSC, I have spoken to numerous partners and customers right across the market and it is very clear that air cargo can enable a range of companies to meet their logistics needs. Flying adds options, speed, flexibility and reliability to supply chain management, and there are particular benefits for moving perishables, such as fruit and vegetables, pharmaceutical and other healthcare productsandhigh-valuegoods.

We are delighted to see the first of our MSC-branded aircraft take to the skies and we believe that MSC Air Cargo is developing from a solid

foundation thanks to the reliable, ongoing support fromouroperatingpartnerAtlasAir.”

Atlas Air, Inc., a subsidiary of Atlas Air Worldwide Holdings,Inc.(Nasdaq:AAWW),issupportingMSCon an aircraft, crew, maintenance and insurance (ACMI) basis. This aircraft is the first of four B777-200Fs in the pipeline, which are being placed on a long-term basis withMSC,providingdedicatedcapacitytosupportthe ongoingdevelopmentofthebusiness.

The B777-200F twin-engine aircraft has been commendedforitsadvancedfuelefficiencymeasures. It also has low maintenance and operating costs, and, with a range of 4,880 nautical miles (9,038 kilometres), it can fly further than any other aircraft in its class. It also meets quota count standards for maximum accessibility to noise sensitive airports around the globe.

30th NOVEMBER 2022 GUJARAT+NORTHINDIA 6

Container Lines earn $58.9bn in Q3 : Report

Cont’d. from Pg. 2

The Q3 2022 result was 22.4%, or $10.8bn higher than the $48.1bn profit the sector reported in the same quarter in 2021. It was, however, $4.4bn or 6.6% lower thantheprofitContainerLinesreportedinQ2thisyear

“The small downturn follows seven straight quarters of record net income for the sector driven by significant pricing increases across all container lanes,”thereportsaid.

Looking ahead McCown said: “There will be further declines from Q322 in quarters to come. Aggregate overall pricing in the sector eased slightly in the latest sequential quarterly comparison, but not nearly at the samelevelasvariousspotrateindices.”

The report noted that overall average contract rates remainednearpeaklevelsinQ322withaveragedatafor loadsintotheUSattheirhighesteverinthequarter.

McCown said that taking into account all factors including spot rate trends through to November the forecast for full year 2022 net income for container

shipping was lowered $223.4bn from $244.9bn. He said that no ea rn in gs co ll ap se w as imminent.

The peak in financial results from Container Lines shows roughly nine months – one yearlagtothepeakinspotrateindicesduetothenature oflong-termcontractnegotiationsondifferenttrades.

The sharp falls in spot rates will put carriers under pressure at the next round of contract negotiations with the impact likely to be seen first on Asia – Europe with annual contracts up at year end and in May/June on the Transpacific trade. The extent to which contract rates will in turn determine how quickly container line profitably tails off in the in the coming quarters.

CJ-I MV Alcyone I Chowgule Bros. 02/12

CJ-II MV Sea Champion Aditya Marine 06/12

CJ-III MV Suvari Kaptan DBC 02/12

CJ-IV MV Safeen AL Amal Interocean 01/12

CJ-V MV Bao Shun Rishi Shpg. 04/12

CJ-VI MV Sea Prajna Benline 03/12

CJ-VII MV Berge Snowdown Synergy Seaport 03/12

CJ-VIII VACANT

CJ-IX VACANT

CJ-X MV Jewel Of Sohar

CJ-XI MV TCI Express TCI Seaways 01/12

CJ-XII MV SSL Bharat Transworld 01/12

CJ-XIII MV Aggelos B Rishi Shpg. 03/12

CJ-XIV MV PVT Sapphire Cross Trade 04/12

CJ-XV MV Clipper Barola Chowgule Bros. 05/12

CJ-XVA MV Kapetan Sideris Chowgule Bros. 04/12

CJ-XVI MV Khalejia Ana 5Scorpio Shpg. 03/12

Tuna Tekra Steamer's Name Agent's Name ETD

VACANT

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I LPG Jag Vikram Nationwide 01/12

OJ-II MT Petalouda Interocean 01/12

OJ-III MT Oriental Hibiscus Allied Shpg. 01/12

OJ-IV MT Sea Ambition

OJ-V VACANT

OJ-VI MT APK Prestige

Stream

Stream MV Appaloosa Interocean Sudan 29,090 T. Sugar Bags 2022091338

Stream MV Appolo Bulker Samsara Mundra 11,000 T. SBM 2022111319

CJ-V MV Bao Shun Rishi Shpg. 18,601 CBM Logs 2022111238

Stream MV Chakravati Chowgule Bros. Cotonou 50,000 T. Rice Bags 2022111169

CJ-XV MV Clipper Barola Chowgule Bros. Vietnam 41,000 T. Sugar In Bulk 2022101373

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335

OJ-II MT Devashree Samudra 6,000 T. Chem. 2022111299

Stream MV Elisar Ocean Harmony Durban 31,750 T. Sugar Bags 2022111243

30/11 MV Habco Aquila BS Shpg. Bangladesh 44,000 T. Salt 2022111316

Stream MT Hari Anand MK Shpg. 24,000 T. HSD 2022111320

CJ-XVA MV Kapetan Sideris Chowgule Bros. Vietnam 54,000 T. Salt 2022111280

CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 69,300 T. Laterite 30/11 MV Kosman Arnav Shpg. West Africa 24,500 T. Rice In Bags 2022111274

Stream MV My Lama Interocean Sudan 25,000 T. Sugar Bags 2022111127

Stream MV Obe Heart Interocean 25,000 T. Sugar Bags 2022111247

OJ-III MT Oriental Hibiscus Allied Shpg. Marseille 4,500 T. C. Oil 2022111156 03/12 MV Pac Adhil Tristar Shpg 2,500/1,500 T.M.Chloride/Sulphate & 18 2022111285

Stream MV Pegasus 01 DBC Somalia 8,000 T. Sugar Bags 2022111256

CJ-XIV MV PVT Sapphire Cross Trade 55,000 T. Salt 2022111248

CJ-IV MV Safeen AL Amal Interocean Sudan 33,000 T. Sugar Bags 2022111040

CJ-II MV Sea Champion Aditya Marine West Africa 30,460 T. Rice Bags 2022111178

30/11 MV Shail Al Khor Chowgule Bros. 69,250 T. Salt

Stream MV Stentor Interocean 27,450 T. Sugar In Bags 2022111187

CJ-III MV Suvari Kaptan DBC Somalia 9,500 T. Sugar Bags 2022111148

Stream MV Theotokos BS Shpg. Madgasakar 28,000 T. Rice Bags 2022111268

MV Berge Snowdown Synergy Seaport 36,355 T. CBM Pine Logs 2022111293 Stream MV Fan Zhou 6 Mystic Shpg. 343 (90/251/2 Blades/Access./SOC) 2022111123 30/11 MV Gautam Aarav Ocean Harmony Porbandar 2,097 T. Coal Fines 01/12 MV Iki DBC Japan 2,339 T. Steel 02/12 MV Ise DBC Japan 1,816/1,511/146 T. CRC/Bars/ S Pipes 02/12 MV Jimmy T Tauras 14,388 T. MOP 2022111004 Stream MV Josco Changzhou GAC Shpg. U.S.A. 52,533 T. Petcoke In Bulk CJ-XVI MV Khalejia Ana 5 Scorpio Shpg. 69,200 T. GYPSUM In Bulk 2022111257 05/12 MV Obe Grande Tauras 42,000 T. DAP CJ-VI MV Sea Prajna Benline 21,057/10,442 T. HMS/Sh Scrap 2022111263 07/12 MV Tian He JMBaxi China 5,926/1,244/238HRC/Plates/Wooden 06/12 MV True Courage Tauras 1,28,470 T. Coal Stream MV True Confidence Seascape 27,079 T. Met Coke 2022111125

30th NOVEMBER 2022 8 GUJARAT + NORTH INDIA SHIPPING MOVEMENTS AT DEENDAYAL PORT Time Height Time Height Hr. Min. Metres Hr. Min. Metres 01:14 1.16 07:34 6.59 14:27 1.75 20:01 5.54 TODAY’S TIDE 30/11/2022 SHIPS SAILED WITH NEXT EXPORT CARGOS DESTN. MV Tai Summit 29/11 MV Haseen 29/11 MV SSL Kutch 29/11 Coch./Tuti./Mang. MV Championship 29/11 MV Meghna Rose 29/11 Bangladesh MV Abigail 30/11 Vietnam Steamer's Name Agents Arrival on MV Stentor Interocean 16/11 MV Obe Heart Interocean 22/11 MV Elisar Ocean Harmony 22/11 MV Pegasus 01 DBC 24/11 MV Chakravati Chowgule Bros. 20/11 MV Appolo Bulker Samsara 27/11 Steamer's Name Agents Arrival on MV Fan Zhou 6 Mystic Shpg. 17/11 MV My Lama Interocean 19/11 MV Appaloosa Interocean 02/11 MV True Confidence Seascape 15/11 CJ-XIII MV Aggelos B Rishi Shpg. 36,306 T. CBM Logs

02/12 MV Armonia JMBaxi Indonesia

T. Petcoke In Bulk

CJ-VII

IN PORT & DUE FOR EXPORT LOADING Due Dt Vessel's Name Agents Will Load For Cargo Particulars VCN No. EDI Rot.No Due/Berth Vessels Name Agent From Cargo Details VCN No. Manual IGM EDI IGM

T. CDSBO Stream MT Berlian Ekuator Nationwide Ras Al Lafan 19,815 T. Propane/Butane 2022111301 07/12 MT Bow Cheetah GAC Shpg. 9,000 T. Chem. 01/12 MT Brave Interocean 6,100 T. CSSO 04/11 MT Celsius Birdie GAC Shpg. Malaysia 5,000 T. Chem. Stream MT Chem Sinyoo JMBaxi Malaysia 19,980 T. Palm Oil 2022113222 OJ-IV MT DM Condor Samudra 3,843 T. Chem. 2022111292 Stream MT FPMC 25 Interocean Singapore 31,181 T. MS 2022111191 OJ-V LPG Gas Venus Interocean 11,016 T. Ammonia 2022111324 01/12 MT Hansa Bergen Marine Links Malaysia 29,999 T. CPO Stream LPG/C IGLC Dicle Seaworld 21,600 T. Propane/Butane OJ-I LPG Jag Vikram Nationwide Ras Al Tanura 20,000 T. Butane/Propane 2022111226 Stream MT Liana MK Shpg. 25,000

08/12 MT Maersk Corsica Interocean

30/11 MT Myri

02/12 MT NCC Safa

Al Jubail

12/12 MT NCC Yanbu Interocean

OJ-II MT Petalouda Interocean

30/11 LPG/C Sakura Spirit ISS Shpg

Gas 01/12 MT Stolt Magnesium JMBaxi Dakar

Acid LIQUID CARGO VESSELS GENERAL CARGO VESSELS VESSELS IN PORT & DUE FOR IMPORT DISCHARGE Berth Vessels Name Agent From Cargo Details VCN No. Manual IGM EDI IGM

2022111168

53,360

2022111195

VESSELS

Stream MT Aquarius Wilhelmsen Russia 17,655

T. FO 2022111294

34,000 T. CPO

JMBaxi 11,017 T. Palm

GAC Shpg.

9,000 T. Chem.

21,000 T. CDSBO

32,343 T. CDSBO 2022111284

19,996 T. Propane

26,567 T. Phos

MV African Weaver GAC Shpg. 10,000 T. Bagged Rice 2022111290

CJ-I MV Alcyone I Chowgule Bros. China 41,000 T. Maize Bulk 2022111261

30/11 MV Arzin Armita Shpg. Bandar Abbas I/E800/800 TEUs. 2022111314 01/12 MV SSL Gujarat(PIC-I) Transworld Coch./Tuticorin/Mang. I/E1,800 TEUs. CJ-XII MV SSL Bharat(PIC-II) Chenn./Vishakha./ I/E2,000 TEUs. 2022111161 07/12 MV SSL Delhi Haldia I/E 1,600 TEUs. CJ-XI MV TCI Express 020 TCI Seaways Manglore/Cochin/ I/E 1,250 TEUs. 2022111321 02/12 MV TCI Anand 026 /Tuticorin I/E TEUs. ETA Vessels Name Agent To Cargo Details VCN No. Manual IGM EDI IGM KANDLA INTERNATIONAL CONTAINER TERMINAL (KICT) I.G.M. Nos. filed at Kandla Customs SHIPS NOT READY FOR BERTH Manual EDI Vessels Name Agent Cargo Steamer's Agent's ETD Jetty Name Name

SHIPS READY FOR BERTH 06-10-2022 1483 2323599 MT Argent Gerbera J M Baxi 17-10-2022 1567 2324459 MV Fortune ARK Arnav Shpg. 1571 2324507 MT Chemroute Pegasus J M Baxi 18-10-2022 1572 2324067 MT Star Ploeg Samudra 1573 2324426 LPG/C Kent Samudra

ADANI PORTS & SEZ LTD. (APSEZ) MUNDRA BERTH VESSEL'S NAME AGENT'S ETD SHIPPING MOVEMENTS AT ADANI PORT DRY & LIQUID VESSELS AT BERTH B-1 VACANT — B-2 VACANT — B-3 MV Basset Interocean 01/12 B-4 MT Loyalty ISS Shipping 01/12 B-5 VACANT — — B-6 VACANT — — B-7 VACANT — — B-8 VACANT — — B-9 MV African Kite Shaan Marine 01/12 B-10 MV Vishva Vijeta JM BAXI B-11 MV Draftzilla Interocean 01/12 BERTH VESSEL'S NAME AGENT'S ETD VESSEL’S NAME NEXT PORT SAILED MV BBC Topaz Mumbai 05-11-2022 MT T Arcturus Fujairah 06-11-2022 SHIPS SAILED WITH EXPORT CARGO VESSEL’S NAME NEXT PORT SAILED VESSELS DUE IN PORT FOR IMPORT DISCHARGE & EXPORT LOADING Due Date Vessel’s Name Agents I/E From / To Cargo Details VCN B-9 MV African Kite Shaan Marine I Vancouver 11,000 MT Crimson Lentils 223662 B-3 MV Basset Interocean I Nacala 28,335 MT Crude sunflower Oil 223751

LPG/C Claudia Gas ISS Shipping I Sohar 8,395 MT LPG/C Butane / Propane

MT Corona Admiral Shipping I Port Kelang 22,000 MT RBD Palm oil / Strein / Olein

MV Draftzilla Interocean I Fujairah 52,500 MT

MV Frontier Wave Taurus I Singapore

MT Steam

LPG/C Gas Beryl Nationwide I Dahej

MT LPG/C

/

MV Iki DBC I Mumbai

MV Ise DBC I Mumbai

MT

MT Jag Lakshya JM Baxi I Port Said

MT Loyalty ISS Shipping I New Mangalore

MV Parkgracht JM Baxi E Mumbai

MT

MV Sentosa GAC Shipping

B-12

Parekh

WEST

WB-01

— WB-02

— —

— —

IOCL

— STS

LNG

SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXT PORT SAILING DATE MSC Susanna (V-247A) Salalah 28-11-2022 Hyundai Singapore (V-132) Port Kelang 29-11-2022 MSC Paris (V-247A) Antwerp 29-11-2022 MSC Melissa (V-246A) Valencia 29-11-2022 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME AGENT FROM SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXT PORT SAILING DATE VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD CB-3 CB-4 Ever Utilt (V-172E) Evergreen Shipping 01/12 B-5 Henrika (V-2243E) Emirates Shipping 01/12 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ADANI MUNDRA CONTAINER TERMINAL (AMCT) ETA VESSEL’S NAME AGENT FROM VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD SB-6 MSC Caledonia II (V-247A) MSC Agency 01/12 SB-7 SM Neyyar (V-0042) Samsara Shpg. 01/12 SB-8 MSC Stella (V-247A) MSC Agency 01/12 SB-9 TRF Partici (V-13W) Zim Integrated 01/12 01/12 MSC Gina (V-248R) MSC Agency Mombasa 01/12 SCI Chennai (V-540) JM Baxi Tuticorin 02/12 MSC Joanna (V-247A) MSC Agency Nhava Sheva In Port SM Neyyar (V-0042) Samsara Shpg. Karachi In Port MSC Stella (V-247A) MSC Agency Bin Qasim In Port MSC Caledonia II (V-247A) MSC Agency Bin Qasim ETA VESSEL’S NAME AGENT FROM SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXTPORT SAILING DATE CMA CGM Lebu (V-W1MA) Matadi 27-11-2022 Ikaria (V-009W) New York 29-11-2022 Bfad Pacific (V-243N/247S) Reunion 30-12-2022 ADANI CMA MUNDRA CONTAINER TERMINAL PVT LTD (ACMTPL), MUNDRA VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD SB-04 ESL Asante (V-02247S) CMA CGM 01/12 SB-05 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME AGENT FROM ETA VESSEL’S NAME AGENT FROM 05/12 APL California (V-W1MA) CMA CGM Jebel Ali 06/12 Fayston Farms (V-244N/248S) Maersk India Nhava Sheva ETA VESSEL’S NAME AGENT FROM ADANI INTERNATIONAL CONTAINER TERMINAL (AICT) 01/12 Celsius Naples (V-892E) Transworld Nhava Sheva 05/12 Osaka Express (V-2348W) Hapag Llyod Hazira 05/12 Northern Discovery (V-2247W) Hapag Llyod Khalifa In Port Pontresina (V-237E) Star Shipping Nhava Sheva 30/11 Ever Uranus (V-154E) Emirates Shipping Karachi 01/12 AS Alva (V-914W) Tranworld Jebel Ali In Port ESL Asante (V-02247S) CMA CGM Nhava Sheva 02/12 Xin Yan Tai (V-224W) COSCO Nhava Sheva Ever Uberty (V-179E) Port Kelang 27-11-2022 Brilliant Ace (V-96A) Mumbai 27-11-2022 Northern Dexterity (V-2246W) Rotterdam 28-11-2022 Budapest Express (V-2347W) Jeddah 29-11-2022 30th NOVEMBER 2022 9 GUJARAT + NORTH INDIA

Stream

223758 Stream

223724 B-11

Urea 223708 05/12

82,500

Coal 223468 Stream

22,684

Butane

Propane 223771 01/12

6,315 MT Steel Coils 223725 03/12

3,886

Steel Pipes / Steel coils 223732 02/12

1,40, 000 MT Crude Petrolleum Oil 223779 B-4

38,000 MT Superior Kerosene/High Speed Diesel 223769 02/12

979

Project Cargo 222963 Stream

I Mumbai 14,228 MT Steel Plates 223723 B-12 MV Trader 8 Parekh Marine I Mumbai 4,054 MT Steel Plates 223714 Stream MV Ultra Lion Cross Trade E Singapore 76,751 MT Industrial salt 223745 B-10 MV Vishva Vijeta JM BAXI I SUR 44,000 MT Urea 223763 MV Fulvia New Orleans 16-11-2022 MV Grace Houston 17-11-2022

MV Trader 8

Marine

BASSIN

VACANT

VACANT

WB-03 VACANT

VESSEL'S AT SPM

VACANT HMEL VACANT

VACANT

VACANT

TO LOAD FOR EAST, WEST, NORTH & SOUTH AFRICAN PORTS

TO LOAD

ETA CutOff/Dt.Time Vessels Name Voy VCN LINE AGENT WILL LOAD FOR ETD SHIPPING MOVEMENTS AT GUJARAT PORTS DP WORLD MUNDRA CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME VCN NO. AGENTS FROM SAILED WITH EXPORT CARGO VESSEL'S NAME NEXT DEST. SAILED ON VESSELS AT BERTH BERTH VESSEL'S NAME AGENT ETD VESSEL'S NAME NEXT DEST. SAILED ON ETA VESSEL’S NAME VCN NO. AGENTS FROM ADANI CMA MUNDRA CONTAINER TERMINAL PVT LTD (ACMTPL), MUNDRA In Port Majd (V-2224E) 2113657 Poseidon Shpg Doha In Port GFS Pride (V-2213) Sima Marine Nhava Sheva 01/12 Lisa (V-247S) 2113547 Maersk India Nhava Sheva 03/12 EM Astoria (V-248S) Maersk India Port Qasim 02/12 Jan Ritcher (V-907E) 2123697 WHL Nhava Sheva 05/12 Cap San juan (V-245E) 2113615 Maersk India Jebel Ali CB-1 Majd (V-2224E) Poseidon Shpg 01/12 CB-2 GFS Pride (V-2213) Sima Marine 01/12 ADANI MUNDRA AUTMOBILE TERMINAL TO LOAD FOR MEDITERRANEAN PORTS, U.K., NORTH CONTINENT, SCANDINAVIA ETA CUT OFF VESSEL’S NAME VOY NO VCN LINE AGENTS WILL LOAD FOR QUANTITY 30/11 30/11-AM Dugong Ace 34A 223770 MOL MOL Shipping Mumbai (PCC) 1,000 Teus. 05/12 05/12-AM Aquarius Ace 0089A 223747 MOL MOL Shipping Dijbouti (PCC) 1,000 Teus. TO LOAD FOR U. K. NORTH CONTINENT, MEDITERRANEAN, BLACK SEA, RED SEA, EAST EUROPE & CIS PORT 05/12 04/12-PM Cap San Juan 245E 2113615 Maersk Line Maersk India Port Tangier, Algeciras, Valencia. (ME-2) 06/12 TO LOAD FOR WEST ASIA GULF PORT In Port Majd 2224E 2113657 Milaha Poseidon Shpg Jebel Ali, Doha. (NDX)

03/12-PM Northern Dedication 2203E 2113744 QN Line/Seaglider Seatrade/Seaglider

Lisa 247S 2113547 Maersk Line Maersk India Port Qasim, Salalah. (MAWINGU)

X-Press Xuphrates 22047 Transworld Feeder Transworld Shpg Jebel Ali, Sohar (NMG) 03/12 09/12 09/12-PM Montpellier 25 2113766 Simatech MBK Logistics 10/12 X-Press Feesder SC-SPL 01/12 01/12-AM Bertie 002M Interworld Efficient Marine cc, China. (BMM) 02/12 05/12 04/12-PM Cap San Juan 245E 2113615 Maersk Line Maersk India Salalah. (ME-2) 06/12 05/12 05/12-AM Marsa Iris 2213 2113762 TSS Line Sai Shipping Jebel Ali (JKX)

Gulf Barakah 2229 Oman Container Seabridge Marine Sohar, Jebel Ali, Dammam. (IEX) 06/12

AS Sicilia 912S 2113703 Unifeeder Transworld Shpg. Jebel Ali (MJI) 07/12 — TBA Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (IRS) — TBA Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (GIX)

01/12 03/12

04/12 01/12 01/12-AM

02/12 02/12 02/12-AM

06/12 05/12 04/12-PM

06/12 06/12-AM

01/12 01/12-AM Lisa 247S 2113547 Maersk Line Maersk India Port Casina, Mombasa (MAWINGU) 02/12 06/12 06/12-AM AS Sicilia 912S 2113703 Unifeeder Transworld Shpg. Maputo (MJI) 07/12 — TBA MSR Line Master Logistics Mombasa (JAMBO)

FOR FAR EAST JAPAN, CHINESE PORTS & AUSTRALIAN PORTS In Port GFS Pride 2213 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) 01/12 02/12 01/12-PM Jan ritcher 907E 2123697 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16) 03/12 05/12 05/12-AM Songa Leopard 897E 2123699 Feedertech FS India Singapore, Port Kelang (SIS) 06/12 TO LOAD FOR INDIAN SUB CONTINENT In Port GFS Pride 2213 Global Feeder Sima Marine Colombo (CSC) 01/12 03/12 02/12-PM EM Astoria 248S Maersk Line Maersk India Colombo (JADE) 04/12 ETA Cut Off Vessel’s Name Voy No. VCN Line Agents Will Load For ETD TO LOAD FOR MEDITERANEAN PORTS, U.K., NORTH CONTINENT, SCANDINAVIA, BLACK SEA, EAST EUROPEAN & CIS DESTINATIONS 02/12 02/12-PM Xin Yan Tai 224W 223688 CMA CGM CMA CGM Ag. (I) Tangier, Southamton,Bremer Haven, Rotterdom, Antwerp, Le Harve.(EPIC-III) 03/12 — TBA CMA CGM/Hapag CMA CGM /ISS Shpg. Jeddah, Tangier, Rotterdam, Hamburg, Lonoon Gateway, — COSCO COSCO (I) Antwerp, Le Havre. (EPIC-II) TO LOAD FOR WEST ASIA GULF & RED SEA PORTS In Port ESL Asante 02247S 223625 CMA CGM CMA CGM Ag. Jebel Ali, Khorfakan. (SWAX) 01/12 02/12 02/12-PM Northern Vigour S1MA 223736 Emirates Shpg. Emirates Shpg 03/12 02/12 02/12-PM Xin Yan Tai 224W 223688 CMA CGM CMA CGM Ag. (I) Jebel Ali .(EPIC-III) 03/12 03/12 02/12-PM CMA CGM Tosca E1MA 223651 COSCO/Maersk COSCO Shpg./Maersk Port Qasim. (CIMEX2K) 04/12 14/12 14/12-PM CMA CGM Rabelais E1MA 223735 CMA CGM CMA CGM Ag. (I) 15/12 TO LOAD FOR U.S.A, CANADA, ATLANTIC, PACIFIC & SOUTHERN AMERICA 05/12 04/12-PM APL California W1MA 223669 Hapag Lloyd Hapag Lloyd New York, Norfolk, Savannah, Charleston.(INDAMEX 2) 06/11 06/12 06/12-PM Express Athens 2147 223498 CMA CGM CMA CGM Ag. (I) New York, Norfolk, Charleston, Other USA East Cost Ports 07/12 Hapag / OOCL Hapag / OOCL Destinations. (INDAMEX) TO LOAD FOR EAST, SOUTH & WEST AFRICAN PORTS In Port ESL Asante 02247S 223625 CMA CGM CMA CGM Ag. Mombasa, Dar Es Salaam. (SWAX) 01/12 02/12 02/12-PM Northern Vigour S1MA 223736 Emirates Shpg. Emirates Shpg 03/12 05/12 05/12-AM Leonidio 242E-248W 223550 CMA CGM CMA CGM Ag. (I) Tema, Libreville, Doula (Direct), Boma, Lonito, Durban, Apapa, 06/12 Maersk Line Maersk India Tincan, Point Noire, Cotonou, Port Elizabeth. (MESAWA) 06/12 05/12-PM Fayston Farms 244N-248S 223548 CMA CGM CMA CGM Ag. (I) Reunion, Durban, Point Desgalets, Walvis Bay, Luanda, 07/12 Maersk Line Maersk India Cintan Apapa, Tema, Cotonou, Lome, Capetown. (MIDAS-2) — TBA PIL PIL Mumbai Cotonou, Matadi, Lome, Luanda, Point Noire, Apapa, Apapa, CMA CGM CMA CGM Ag. Tincan, Abidjan. (MIDAS) TO LOAD FOR FAR EAST JAPAN, CHINESE PORTS & AUSTRALIAN PORTS — TBA YML / OOCL MCS(I)/OOCL (I) Penang, Singapore, Hongkong, Shanghai (CPX) — TO LOAD FOR INDIAN SUB-CONTINENT 03/12 02/12-PM CMA CGM Tosca E1MA 223651 Maersk /Cosco Maersk India/COSCO Karachi. (CIMEX2K) 04/12 14/12 14/12-PM CMA CGM Rabelais E1MA 223735 CMA CGM CMA CGM Ag. (I) 15/12 — TBA PIL PIL Mumbai Colombo, Karachi. (MIDAS) CMA CGM CMA CGM Ag. (I) 30th NOVEMBER 2022 10 GUJARAT + NORTH INDIA Hochiminh Voyager (V-2208E) Singapore 25-11-2022 Maersk Brooklyn (V-246S)Port Qasim 25-11-2022 Montpellier (V-0024) Jebel Ali 26-11-2022 Irenes Ray (V-247S) Colombo 27-11-2022 Hansa Rotenburg (V-0918E) Singapore 29-11-2022 Traiguen (V-247W) Port Tangler 29-11-2022

TO

FOR WEST ASIA GULF PORTS

TO LOAD FOR FAR EAST, JAPAN, CHINESE PORTS & AUSTRALIAN PORTS

ETA Cut Off Vessel’s Name Voy No. VCN Line Agents Will Load For ETD TO LOAD FOR U. K. NORTH CONTINENT, MEDITERRANEAN, BLACK SEA, RED SEA, EAST EUROPE & CIS PORT ADANI MUNDRA CONTAINER TERMINAL (AMCT) NB:We request Liners/Agents to check the loading ports. If there are any corrections/ changes please contact us on our • Tel.:22661422/22694491 • E-Mail:dailyshipping@gmail.com 01/12 01/12-PM Baltic Bridge W1MA 223542 Hapag Lloyd ISS Shipping La Spezia, Barcelona, Valencia, Tangier, Fos Sur Mer, Genoa, 02/12 08/12 08/12-PM APL Antwerp W1MA 223570 CMA CGM CMA CGM Ag. (I) Marsaxlokk. (IMEX) 09/12 05/12 05/12-AM Osaka Express 2348W 223639 CMA CGM CMA CGM Ag. (I) Jeddah, Tangier, Rotterdam, Hamburg, Lonoon Gateway, 06/12 COSCO/Hapag COSCO(I)/Hapag-Lloyd Antwerp, Le Havre. (EPIC-II)

30/11 29/11-PM GFS Giselle 0062 223654 X-Press Feeder Sea Consortium Jebel Ali, Khalifa, Khorfakkan. (ASX GULF) 01/12 06/12 05/12-PM Northern Practise 0029 223730 Transworld Feeder Transworld Group 07/12 01/12 01/12-PM Baltic Bridge W1MA 223542 Hapag-Lloyd ISS Shipping Khor Fakkan, Jebel Ali, Jeddah. (IMEX) 02/12 01/12 30/11-PM AS Alva 914W 223621 PIL PIL Mumbai Jebel Ali, Aden, P. Sudan, Djibouti. (RGS) 02/12 05/12 04/12-PM Northern Discovery 2247W 223638 Hapag Lloyd ISS Shipping Rotterdam,Jebel Ali, Khorfakan, Sohar, Qaboos, Bahrrain, Jubail, Jeddah, 06/12 19/12 19/12-PM Northern Dexterity 2249W 223785 COSCO COSCO Yanbu, Port Said, Mersin, Istanbul, Izmit, Ambarli, Izmir (AGIS) 20/12 TBA Purdential Global Master Marine Sohar, Jebel Ali & other Gulf Ports. —

LOAD

In Port Henrika 02243E 223551 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao, Pusan, Kwangyang, Ningbo, 01/12 01/12 01/12-AM TS Dubai 22007E 223667 TS Lines Samsara Shpg Singapore, Shekou. (AIS) 02/12 In Port Ever Utile 172E 223556 Wan Hai Wan Hai Lines Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 01/12 03/12 02/12-PM Wan Hai 627 002E 223611 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX) 04/12 30/11 30/11-PM Ever Uranus 154E 223563 Feedertech Feedertech Port Kelang, Singapore, Leam Chabang.(AGI)

30/11 30/11-PM Pontresina 237E 223648 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 01/12 03/12 03/12-AM Dalian 2208E 223717 KMTC / KMTC India Dubai, Colombo, Port Kellang, Hongkong, Sanghai, Ningbo.

TS Line TS Line (I) Colombo, Port Kellang, Hongkong, Sanghai, Ningbo.

01/12-AM Celsius Naples 892E 223635 Evergreen/ONE Evergreen Shpg/ONE Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 02/12 07/12 07/12-AM Shimin 22007E 223704 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC) 08/12

05/12-AM X-Press Odyssey 22007E 223700 Interasia/GSL Aissa M./Star Shpg Port Kelang,Singapore, Tanjung Pelepas, Xingang, Qingdao, 06/12 Evergreen/KMTCEvergreen/KMTC (FIVE) TBA RCL RCL Agency Port Kelang, Halphong, Nansha (RWA 1) — TO LOAD FOR INDIAN SUB CONTINENT In Port Henrika 02243E 223551 KMTC/COSCO KMTC / COSCO Shpg. Colombo (AIS) 01/12 01/12 01/12-AM TS Dubai 22007E 223667 TS Lines Samsara Shpg 02/12 In Port Ever Utile 172E 223556 Wan Hai Wan Hai Lines Colombo 01/12 03/12 02/12-PM Wan Hai 627 002E 223611 COSCO/Evergreen COSCO /Evergreen (PMX) 04/12 30/11 30/11-PM Ever Uranus 154E 223563 Feedertech Emirates Shipping Colombo.(AGI) 01/12 30/11 30/11-PM Pontresina 237E 223648 One / X-Press One India / Sea Consortium Karachi, Colombo. (CWX) 01/12 03/12 03/12-AM Dalian 2208E 223717 KMTC / TS Line KMTC India/TS Line (I)

NYK paula 2247 223673 Hapag ONE Line (I)/ISS Shpg Colombo (MIAX)

Celsius Naples 892E 223635 Evergreen / ONE Evergreen / ONE Colombo.(CISC)

Shimin 22007E 223704 Feedertech / TSLFeedertech / TSL

Baltic Bridge W1MA 223542 Hapag Lloyd ISS Shipping Colombo (IMEX)

APL Antwerp W1MA 223570 CMA CGM CMA CGM Ag. (I)

X-Press Odyssey 22007E 223700 Interasia/GSL Aissa M./Star Shpg Colombo (FIVE)

Evergreen/KMTCEvergreen/KMTC ADANI INTERNATIONAL CONTAINER TERMINAL PVT LTD. (AICT) TO LOAD FOR U.K. NORTH, MED., BLACK SEA, RED SEA, EAST EUROPE & CIS PORTS In Port TRF Partici 13W 223620 ZIM Line Zim Integrated Haifa, Mersin, Istanbul (ZMI) 01/11 In Port MSC Stella 247A 223591 MSC/COSCO MSC Ag/COSCO Shpg. Gioia Tauro,Tangier,Southamton,Rotterdam,Antwerp, Felixstowe. Dunkirk, Le Havre 01/12 05/12 05/12-PM MSC Eugenia 248A 223681 CMA CGM CMA CGM Ag.(I) & Other Inland Destination in Europe, Med,Red Sea, Black Sea Adriatic Ports.(EUROPE) 06/12 02/12 01/12-PM Hermann Schulte 247A 223606 MSC MSC Agency (I) Valencia (INDUS-2) 01/12 02/12 01/12-PM MSC Silvia 248A 223645 MSC MSC Agency (I) Barcelona, Valencia (INDUS-A) 03/12 04/12 04/12-AM MSC Regulus 248A 223588 MSC/SCI MSC Ag/J.M. Baxi Gioia Tauro, Feixstowe, Hamburg, Antwerp & Other Inland Destn.(HIMEXP) 05/12 TBA Messina Transworld Group Nisurata(Libya), Castellon(Spain), Geneo, Naples, Iskderon (INDME) — TBA MSC MSC Agency (I) Port Said West, Mersin, Istanbul, Tekirdag, Piraeus, Iskenderun (IMED) — TO LOAD FOR WEST ASIA GULF PORT2 In Port MSC Stella 247A 223591 MSC SC Agency (I) King Abdullah & Salallah (EUROPE) 01/12 In Port MSC CaledoniaII 247A 223537 MSC MSC Agency (I) Jebel Ali, Mombassa. (MOEX) 01/12 01/12 01/12-AM Safeen Prize 045W 223642 Safeen Feeders Samsara Shpg. Khalifa, Jebel Ali, Bahrain, Dammam, Jubair (UIG) 02/12 01/12 01/12-AM MSC Gina 248R 223683 MSC MSC Agency Salalah, King Abdulla (EAF) 02/12 02/12 02/12-AM MSC Joanna 247A 223608 MSC MSC Agency (I) Salalah (INDUS) 03/12 02/12 02/12-AM MSC Topaz 245A 223107 MSC MSC Agency (I) Jebel Ali, Abu Dhabi, Hamad, Ad Dammam, Umm Qasar(FAL WB) 03/12 03/12 03/12-AM Calais Trader 021E 223633 MSC MSC Agency Vietnam (RWA-1) 04/12 05/12 05/12-PM MSC Helena III 247R 223684 MSC MSC Agency (I) Bahrain, AL Jubail, Hamad, Abu Dhabi (MEF-3) 06/12 TBA Messina Transworld Group Istanbul,Jeddah, Durban, Moputo, Dar-Es-Salaam, Mombasa (INDME) — TBA MSC MSC Agency (I) Jebel Ali, Abu Dhabi (IMED) — TO LOAD FOR EAST, SOUTH & WEST, AFRICAN PORTS In Port MSC CaledoniaII 247A 223537 MSC MSC Agency (I) Mombassa. (MOEX) 01/12 01/12 01/12-AM MSC Levina 248R 223718 MSC MSC Agency Dar Es Salaam, Mombasa (EAF) 02/12 02/12 01/12-PM MSC Ermania 248A 223665 MSC MSC Agency Port Louis, Tema, Lome, Cotonou (IAS) 03/12 04/12 04/12-AM MSC Regulus 248A 223588 MSC MSC Agency (I) Cape Town, East Town, Walvis Bay,Luanda,Namibie,Douala,Lome,Durban 05/12 Coega, Port Louis, Beira,Maputo, Nucal, Quelimane, Pemba, Majunga(HIMEXP) 06/12 06/12-AM MSC Aby 246A 223726 MSC MSC Agency (I) Mombasa, Mogadischu, Kismayu (INGWE) 07/12 TO LOAD FOR U.S.A, CANADA, ATLANTIC, PACIFIC & SOUTHERN AMERICA In Port MSC Stella 247A 223591 MSC MSC Agency U.S.A., Mexico, Carribean, South America, East & West Coast (EUROPE) 01/12 02/12 02/12-AM MSC Joanna 247A 223608 MSC MSC Agency Charleston, New York, Norfolk, Free Port USA South & Central America (INDUS) 03/12 02/12 01/12-PM MSC Silvia 248A 223645 MSC MSC Agency (I) New York, Norfolk, Savannah (INDUS-A) 03/12 02/12 01/12-PM Hermann Schulte 247A 223606 MSC MSC Agency (I) New York, Norfolk (INDUS-2) 01/12 TO LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND & PACIFIC ISLANDS 03/12 03/12-AM Calais Trader 021E 223633 RCL RCL Agency Port Kelang, Halphong, Nansha (RWA 1) 04/12 06/12 06/12-AM Hyundai Hongkong 139 223764 Hyundai Seabridge Maritime Port Kelang, Hong Kong, Kwangyang, Pusan, Ningbo, Shekou, 07/12 GSL Star Shipping Singapore, Sanghai (CIX) TO LOAD FOR INDIAN SUB CONTINENT In Port TRF Partici 13W 223620 ZIM Line Zim Integrated Colombo (ZMI) 01/12 In Port SM Neyyar 0042 223612 Simatech MBK Logistics Cochin, Colombo, Chennai, Visakhapatnam (CCG) 01/12 01/12 01/12-AM SCI Chennai 540 223690 SCI J M Baxi & Co. Colombo (SMILE C) 02/12 01/12 01/12-AM MSC Levina 248R 223718 MSC MSC Agency (I) Karachi (EAF) 02/12 02/12 01/12-PM MSC Ermania 248A 223665 MSC MSC Agency Colombo (IAS) 03/12 02/12 01/12-PM MSC Silvia 248A 223645 MSC MSC Agency (I) Colombo (INDUS-A) 03/12 02/12 01/12-PM Hermann Schulte 247A 223606 MSC MSC Agency (I) Colombo (INDUS-2) 03/12 30th NOVEMBER 2022 11 GUJARAT + NORTH INDIA

01/12

04/12

01/12

05/12

04/12 01/12 01/12-AM

02/12 01/12 01/12-AM

02/12 07/12 07/12-AM

08/12 01/12 01/12-PM

02/12 08/12 08/12-PM

09/12 05/12 05/12-AM

06/12

PORT PIPAVAV

Rosa 247W 22382

02/12 02/12-AM

Algeciras 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 (MECL) 09/12 TO LOAD FOR FAR EAST, CHINA,

JAPAN, AUSTRALIA,

NEW

ZEALAND AND PACIFIC ISLANDS

30/11 30/11-AM One Commitment 057E 22373 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 30/11 08/12 08/12-AM MOL Creation 086E 22385 Ningbo, Sekou, Cai Mep. (PS3) 08/12 01/12 01/12-AM Aka Bhum 010E 22378 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 01/12 06/12 03/12-AM OOCL New York 090E 22393 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 06/12 04/12 04/12-AM Grace Bridge 248E 22379 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 04/12 11/12 11/12-AM BSG Bimini 249E 22387 Ningbo, Tanjung Pelepas. (FM3) 11/12 05/12 05/12-AM Wide Juliet 025WE 22390 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 05/12 ONE ONE (India) (TIP) 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Singapor, Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 10/12

TO LOAD FOR WEST ASIA GULF, RED SEA & EAST AFRICAN PORTS

30/11 30/11-AM SSL Gujarat 1291A 22396 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 30/11 02/12 02/12-AM Santa Rosa 247W 22382 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 (MECL) 09/12

TBA SCI J. M Baxi Jebel Ali. (SMILE)

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

TO LOAD FOR INDIAN SUB CONTINENT PORTS

01/12 01/12-AM Aka Bhum 010E 22378 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 01/12 04/12 04/12-AM EM Astoria 248S 22380 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 04/12 04/12 04/12-AM Grace Bridge 248E 22379 SCI J. M Baxi Colombo. (FM3) 04/12 05/12 05/12-AM Wide Juliet 025WE 22390 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 05/12 ONE ONE (India) (TIP) 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Karachi, Colombo (CI1) 10/12

TO LOAD FOR US & CANADA WEST COAST

30/11 30/11-AM One Commitment 057E 22373 ONE ONE (India) Los Angeles, Oakland. (PS3) 30/11 02/12 02/12-AM Santa Rosa 247W 22382 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 02/12 09/12 09/12-AM Maersk Detroit 248W 22381 Safmarine Maersk Line India (MECL) 09/12 05/12 05/12-AM Wide Juliet 025WE 22390 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 05/12 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP)

Northern Practise 0029 X-Press Feeders/ONE Sea Consortium/ONE(I) (ASX) 08/12 Hapag / CMA CGM ISS Shpg./CMA CGM Ag. (I) 02/12 Xin Yan Tai 224W Hapag / COSCO ISS Shpg./COSCO Shpg. Jeddah, Tanger, Southampton, Rotterdam, Bremerhaven, Antwerp, 02/12 CMA CGM/OOCL CMA CGM Ag.(I)/OOCL(I) Le Havre, Algeciras (EPIC) 03/12 Green Pole 248E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 04/12 X-Press Feeders Sea Consortium Doha (Arabian Star) 03/12 MSC Eugenia IP248A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 04/12 10/12 MSC Lisbon IP249A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 11/12 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK) 05/12 Hyundai Hongkong 0139E HMM HMM Shpg. Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai. (CIX) 05/12 11/12 Hyundai Busan 0141E HMM HMM Shpg. Santos, Paranagua, Buenos Aires, Itajai, Montevideo. (FIL) 11/12

Vessels Name Voy VCN LINE AGENT WILL LOAD

BLACK

U.K., NORTH CONTINENT AND SCANDINAVIAN PORTS

SHIPPING MOVEMENTS AT GUJARAT PORTS

ETA Cut Off/Dt.Time

FOR ETD TO LOAD FOR MED.,

SEA,

Santa

Maersk Line Maersk India

EXPORT ETA ETD VESSEL'S NAME AGENT CARGO QUANTITY IMPORT ETA ETD VESSEL'S NAME AGENT CARGO QUANTITY In Port Parkgracht J M Baxi Project Cargo 1367.464 In Port New Spirit Taurus Shpg. Coal 58000 In Port SSI Diligent Interocean Shpg. Crimson 33500 In Port Easterly Beech Galaxy Atlantic Shpg. Methanol 9597.896 In Port Maritime Suzanne Atlantic Shpg. Methanol 22838.196 24/11 Om Borneo Interocean Shpg. Sunflower Oil 5750 HAZIRA PORT (As on 24-11-2022) NB The data in this Daily pertaining to Ports Information is received by us, sometimes even at the eleventh hour by telephonic messages from the concerned Steamer Agents. Therefore, there is every likelihood of last minute change in the data published the Management of Daily Shipping Times exercise every necessary care & attention in collecting every data & getting it published accurately Inspite of this, if any ommission, inaccuracy or printing error occur in the data published in this daily, the Management of Daily Shipping Times is not responsible or liable. OTHER PORTS OF GUJARAT SHIPPING MOVEMENTS AT ADANI HAZIRA PORT ETA/Berth Vessel’s Name Voy Line Agents Will Load For ETD 30/11 Melissa IX246A MSC MSC Agency Mundra, Hazira, Nhava Sheva, Colombo, King Abdullah, Damietta, Mersin, 01/12 06/12 Hermann Schulte IX247A Tekirdag, Valencia, Halifax, Baltimore, Savannah, Freeport Container Port (Indus 2) 07/12 01/12 SSL Visakhapatnam 151 Shreyas Transworld Group Europe, US East Coast, Med, East Africa, West Africa, East & West Coast 02/12 Hapag/CMA CGM ISS Shpg./CMA CGM Ag.(I) ONE/COSCO ONE (I)/COSCO Shpg. (WCC) 01/12 GFS Giselle 0062 Global Feeder/Transworld Feeders Sima Marine/Transworld Group Jebel Ali, Khor Fakkan, AMCTPL, Hazira, GTI, Abu Dhabi 01/12 08/12

05/12 BFAD Atlantic 248W Maersk Line Maersk India

12/12 Rio Centaurus 249W

07/12 X-Press Odyssey 22007E Zim/KMTC Zim Integrated/KMTC India Qingdao, Shanghai,

Port

14/12 Zoi 20E Evergreen Evergreen Shpg. AICTPL, Colombo, Port Klang, Singapore, Haiphong, Qingdao. 15/12 18/12 ESL Da Chan Bay 2247E RCL/Emirates RCL Ag./Emirates Shpg. (NIX / FIVE / CIX3) 19/12 TBA MSC MSC Agency Abudhabi, AICTPL, Colombo, Iskederan, Tekirdag, Gioia Tauro. (IMED) (As on 30-11-2022) JAMNAGAR (BEDI) PORT EXPORT VESSELS AGENTS ETA TO COMMODITY QTY.(m.t.) ETD —` IMPORT VESSELS AGENTS ETA FROM COMMODITY QTY.(m.t.) ETD —` IMPORT ETA Vessel’s Name Agent From Commodity Quantity ETD —` COASTAL ETA Vessel’s Name Agent From Commodity Quantity ETD (As on 30-11-2022) MULDWARKA PORT 30th NOVEMBER 2022 12 GUJARAT + NORTH INDIA

NSICT, Jebel Ali, Salalah, Djibouti, King Abdullah, Port Jeddah, Salalah 06/12

(Blue Nile Express) 13/12

Ningbo, Da Chan Bay,

Klang, Nhava Sheva, 08/12

In

In

In

In

In

In

In

NOTICE TO

IMPORT

33000

55622

70,000

The above vessel has arrived on 28-11-2022 at MUNDRA PORT with Import cargo from LE HAVRE. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 28-11-2022 at MUNDRA PORT with Import cargo from LE HAVRE, KLAIPEDA. Please note the item Nos. against the B/L Nos. for MUNDRA delivery

KANDLA-SEZ/GANDHIDHAM

MUNDRA

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing

OTHER PORTS OF GUJARAT

ETA ETD VESSEL'S NAME AGENT FROM COMMODITY QTY(m.t.)

Port Lily Rising Overseas Maritime Indonesia Coal

54600

Port Aries Karin Seascape Shpg. Indonesia

Coal 60000

Port PVT Sapphire Samsara Shpg. UAE

Lime Stone 50000

Port Alliance Overseas Maritime UAE

LNG 142657.900

Port Bahjat DBC

& Sons Gypsum

Port Royal

Chiba Seascape Shpg. Indonesia Coal

Port Rex

PORT EXPORT ETA ETD VESSEL'S NAME AGENT FROM COMMODITY QTY(m.t.) In Port Agia Erini Force Samsara Shpg. Vizag Iron Ore Pellets 51000

on

) SHIPS FOR DEMOLITION AT ALANG Due/Arrived Name of Vessels Agents Type LDT Plot 1 Stream Tampen Sahjanand OSV 2882 Stream LS 2 Sahjanand Crane Vsl 18597 VESSELS ARRIVED AT ALANG ANCHORAGE PORBANDAR PORT (As on 29-11-2022) EXPORT ETA ETD VESSEL'S NAME AGENT TO COMMODITY QTY. IMPORT ETA ETD VESSEL'S NAME AGENT FROM COMMODITY QTY. EXPORT At Jetty ETA ETD VESSEL'S NAME AGENT COMMODITY QTY(m.t.) GCPTCL In Port Sea Fortune Seaworld Shpg. Chemicals 10000 IMPORT At Jetty ETA ETD VESSEL'S NAME AGENT COMMODITY QTY(m.t.) DHIL In Port Big Glory Himani Shpg. Copper Conc. 57466.190 APPPL In Port Golden Amreen Taurus Shpg. Coal 77100 PLL In Port Raahi J.M. Baxi LNG 135000 GCPTCL Stream BW Oak Overseas Maritime Chemicals 25000 GCPTCL Stream Gas Beryl Atlantic Shpg. Chemicals 25000 DAHEJ PORT (As on 24-11-2022) (As on

) 30th NOVEMBER 2022 13 GUJARAT + NORTH INDIA NAVLAKHI PORT (As on 29-11-2022) VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL'S NAME AGENT FROM COMMODITY QUANTITY ETD — VESSELS AT ANCHORAGE ETA ETD Vessels' Name Agent Qty. Cargo — BHAVNAGAR PORT (As on 29-11-2022) ETA Vessel's Name AGENT CARGO Qty. — VESSELS EXPECTED TO ARRIVE

Oldendroff Samsara Shpg. Poland Metcoke

MUGDALLA

(As

24-11-2022

28-11-2022

Rate

CONSIGNEES m.v. “MSC STELLA” Voy : IP247A I.G.M. NO. 2327923 (EDI) Dtd. 25-11-2022 Exch

84.1

As Agents

MSC AGENCY (INDIA) PRIVATE LIMITED Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward

6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com • www.msc.com The above vessel has arrived on 28-11-2022 at MUNDRA PORT with Import cargo from ANTWERP, LE HAVRE, LONDON GATEWAY PORT, PORTBURY, GDYNIA. Please note the item Nos. against the B/L Nos. for MUNDRA delivery. Item No. B/L No. Item No. B/L No. Item No. B/L No. 1 MEDUAV420636 10 MEDUIW443317 11 MEDUIW391516 Item No. B/L No. Item No. B/L No. MUNDRA PORT SEZ Item No. B/L No. 46 AME65ME227298 12 MEDUIW454124 13 MEDUIW421586 2 MEDUTX876583 3 MEDUTX874851 4 MEDUTX873861 5 MEDUTX844425 Item No. B/L No. Item No. B/L No. 41 MEDULS001369 42 MEDUAV458636 6 MEDUIW448175 7 MEDUIW439646 8 MEDUIW395129 9 MEDUIW406645 SANGHI PORT EXPORT/ IMPORT ETA Vessel’s Name Agent To Commodity Quantity ETD (As on 29-11-2022)

point enquiries can also be done at our computerized helpline No.(079) 40072804

:

-

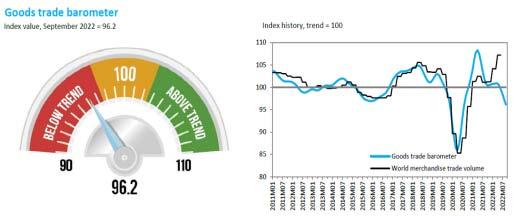

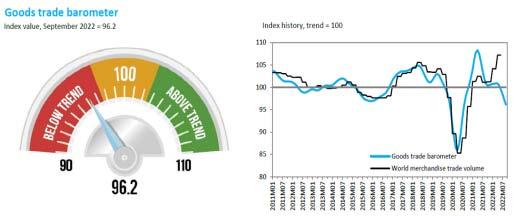

WTO : Goods barometer sinks below trend as Global import demand weakens

GENEVA: Trade growth is likelytoslowintheclosingmonths of 2022 and into 2023, according to the latest WTO Goods Trade Barometer released on 28 November, as the global economy continues to be buffeted by strong headwinds. The current reading of 96.2 is below both the baseline value for the index and the previous reading of 100.0, reflecting cooling demand fortradedgoods.

The Goods Trade Barometer is a composite leading indicatorforworldtrade,providingreal-timeinformationonthe trajectory of merchandise trade relative to recent trends. Values greater than 100 signal above-trend expansion while values less than 100 indicate below-trend growth. The barometer index (represented by the blue line above) has fallen below the merchandise trade volume index (the black line), which shows actual trade developments through the second quarter. The latter should eventually follow the barometer index down once quarterly trade statistics for the second half of 2022 are available. Recent divergence between the indices, as seen in 2021 and 2022, could be explained by delayed shipments of goods stemming from supply chain disruptionssincethepandemic.

The downturn in the goods barometer is consistent with the WTO's trade forecast of 5 October, which predicted merchandise trade volume growth of 3.5% in 2022 and 1.0% in 2023 due to several related shocks including the war in

Ukraine, high energy prices, and monetary tightening in major economies. Merchandise trade posted a 4.7% year on year increase in the second quarter after growing 4.8% in the first quarter. For the forecast to be realised, trade growthwouldhavetoaveragearound2.4%year-on-yearinthe secondhalfof2022.

The barometer index was weighed down by negative readings in sub-indices representing export orders (91.7), air freight (93.3) and electronic components (91.0). Together, these suggest cooling business sentiment and weaker global import demand. The container shipping (99.3) and raw materials (97.6) indices finished only slightly below trend but have lost momentum. The main exception is the automotive productsindex(103.8),whichroseabovetrendduetostronger vehicle sales in the United States and increased exports from Japanassupplyconditionsimprovedandastheyencontinued todepreciate.

UNCTAD calls for investment in Maritime Supply Chains to boost sustainability and resilience to future crises

UNCTAD’s Review of Mari�me Transport 2022, an annual comprehensive review of global mari�me transport, warns that the mari�me sector will require greater investment in infrastructure and sustainability to weather future supply chain crises.

GENEVA:TheUNConferenceonTradeandDevelopment (UNCTAD)initsflagship"ReviewofMaritimeTransport2022" has called for increased investment in maritime supply chains.Ports,shippingfleetsandhinterlandconnectionsneed to be better prepared for future global crises, climate change andthetransitiontolow-carbonenergy.

Thesupplychaincrisisofthelasttwoyearshasshownthat amismatchbetweendemandandsupplyofmaritimelogistics capacity leads to surges in freight rates, congestion, and critical interruptions to global value chains. Ships carry over 80% of the goods traded globally, with the percentage even higher for most developing countries, hence the urgent need to boost resilience to shocks that disrupt supply chains, fuel inflationandaffectthepoorestthemost.

“We need to learn from the current supply chain crisis and prepare better for future challenges and transitions. This includes enhancing intermodal infrastructure, fleet renewal and improving port performance and trade facilitation,"

UNCTAD Secretary-General Rebeca Grynspan said. "And wemustnotdelaythedecarbonizationofshipping,"sheadded.

Investment is needed in maritime transport systems to strengthenglobalsupplychains

Logistics supply constraints combined with a surge in demand for consumer goods and e-commerce pushed container spot freight rates to five times their pre-pandemic levels in 2021, reaching a historical peak in early 2022 and sharply increasing consumer prices. The rates have dropped since mid-2022 but they remain high for oil and natural gas tankercargoduetotheongoingenergycrisis.

Dry bulk freight rates increased due to the war in Ukraine and related economic measures, as well as the prolonged COVID-19 pandemic and supply chain disruptions. An UNCTAD simulation projects that higher grain prices and dry bulk freight rates can lead to a 1.2% increase in consumer food prices, with higher increases in middle- and low-income countries.

India and Afghanistan to restart Trade under new Air Corridor arrangement

KABUL: The Afghan Ministry of Industry and Commerce (MoIC) said that it has signed a new Air Corridor Agreement withIndiatoenableairtradebetweenthetwocountries.

Trade between the two South Asian neighbours had come to a standstill after the Taliban fighters took over Afghanistan in August 2021 following withdrawal by the American and NATOtroops.

Afghan news agency Ariana News quoted MoIC spokesperson Abdul Salam Jawad as saying that export of “Afghanistan’s commercial commodities to India continues through Wagah port and that in the past year, the country has exported more than 14 billion afghanis via the port”. India is a

bigimporterofsaffron,dryfruitsandasafoetida.

Jawad added that cargo flights between Afghanistan and India will increase exports of fresh and dry fruits, handicrafts and other commercial items, giving a boost to the Afghan economy.

Before the Taliban takeover, the two countries carried out trade through two air routes – Kabul-Delhi and also KabulMumbai. The second route had been opened only in December 2017 for India to import fresh fruits and medicinal plants from Afghanistan. This was started after observing the success of the Kabul-Delhi route inaugurated by then Afghan presidentAshrafGhaniinJune-2017.

30th NOVEMBER 2022 GUJARAT+NORTHINDIA 14

Logistics Cost Index of India to be released soon : DPIIT

NEW DELHI: India will soon be introducing its Logistics cost index that will provide granular data and help investors and policymakers formulate projects and interventions to improve efficiency, informed officials in the Department for Promotion of Industry and Internal Trade (DPIIT). According to the officials, the work on putting a framework for devising a logistics costindexisinthefinalstages.

Under the initiative, multiple indexed data will be provided to capture product-wise as well as region-wide logistics cost movement on a forthrightly or monthly basis on the lines of WPI and CPI, the officials quotedabovesaid.

The DPIIT will also bring annual, all-encompassing, national logistics cost data based on Indian systems to provide a truer picture of the costs involved in moving goods and servicesacrossthecountry.

“The artificial neural network method that is a system used globally to determine logistics cost relies

largely on international data sets of things coming from outside or business trying to happen with India and things that move out from here. So, international estimates on logistics cost in India is largely based on the cost of moving in and out of trading ports in the country that is determined by global shipping lines” said Surendra Ahirwar, Joint Secretary,DPIIT.

“It is here that determination of logistics costs based on the Indian system and involving actual cost within the country will bring out truer estimatesonthiscriticaldatathathas wide-scale ramifications. The cost indexes will further strengthen estimatesonlogistics,”headded.

“We will soon have a consultation meeting with experts from industry, academic, and government on domesticlogisticscostindex.Thereis an internal cost and a domestic cost. Muchofthetransportationcostbythe shipping lines and they are not in any sovereigncontrol.”

The Logistics cost in India is

unorganized and fragmented, leading to high logistics costs estimated as 14-15%ofGDP,against7-8%indeveloped nations such as Singapore and the US, whichleverageittoboostexports.

Launched in September, the National Logistics Policy (NLP) aims to bring down logistics costs and address logistical challenges. The NLP aims to bring down India’s logistics cost to 8% in the next five years.

Due to the fragmented logistics in the country, about 16% of India’s agriproduction is wasted at different stagesofthesupplychainandthenew policy seeks to limit losses incurred while transporting perishable commodities to under 5% by improving the warehouse facilities andcoldchainefficiency.

The PM GatiShakti National Master Plan, aimed at bringing logisticscostsonaparwithdeveloped nations, would save the government Rs. 10 trillion annually, Commerce and Industry Minister Shri Piyush Goyalhassaid.

Centre prepares monthly plan under Gati Shakti for awarding 235 critical Road projects

NEWDELHI:Amonthwiseaction plan will be created for 235 road and highway connectivity projects yet to be awarded with specific focus on maximizing award by December 2022 and March 2023. A review meeting of the PM GatiShakti National Master Plan(NMP)saidthisistoaddressthe criticalinfrastructuregapprojects.

A Transport Ministry order said that these identified projects spread over the Ministries of Steel, Fertilizers, Ports, Shipping and Waterways,andDefence.

The maximum number of roads need to be built for the Defence Ministry with 168 projects being identified.

Ports, Shipping and Waterways Ministry comes next with 61 projects, Steelhasfive,whileFertilizerhasone project. The National Highway Authority of India (NHAI), National Highways & Infrastructure Development Corporation Limited (NHIDCL), and Border Roads Organisation (BRO) need to implement these projects. The status oftheseroadswillalsobetrackedona monthlybasis.

It has also been decided that geotagged data of Automated Testing Stations and Registered Vehicle Scrapping Facilities will be uploaded on the PM GatiShakti NMP Portal. Further,mappingofpotentialsitesfor

thesefacilitieswillalsobeaddedtoit.

Aslowedpaceofroadconstruction this year has prompted the Centre to undertakeacomprehensivereviewto identify the shortcomings and hasten implementation of national highway projects.

According to official data, 4,060 kilometres (KMs) of national highways were constructed during thecurrentfinancialyeartillOctoberend.Thisis10.7%lowerthanthe4,550 KMs built during the same months of fiscal 2021-22. The centre has also awarded 5,007 KMs of highways till October-end, up from 4,913 KMs during the comparable period of the previousyear.

Banana exports can rise four-fold : FIEO

CHENNAI: Despite being the largest producer of bananas in the world, India is ranked 20th in exports and has a meagre 0.6 per cent share in the global banana trade.IfIndiaadoptsanexport-oriented strategy to upgrade the value chain, the country can increase its exports by four-fold and grab a spot among the top tenexporters.

India’s exports of bananas in FY22 was $160.52 million against global exports of $14.5 billion—a share of 0.6 per cent. Even, the world’s fifth largest producer Ecuador has a 24percentshare.

According to K. Unnikrishnan, Joint Director General of the

Federation of Indian Export Organisations, or FIEO, India can reach at least $500 million exports within five years to grab a 3 per cent share in global trade and be one of the top 10 exporters if it improves production, post-harvest handling and phytosanitarystandards.

“Ourresearchinstitutionsandother stakeholders should come forward to provide solutions to increase shelf-life, reduce skin damages and improve technology and infrastructure for preandpost-harvestprocesses,”hesaid.

The government should encourage major retailers and department stores in India to invest in post-harvest channels to procure banana and sell through stores with specified

standards,brandingandpackaging.

“We need branding of bananas and the state governments should come forward to create state-specific brands and promote them in major markets. State governments should also provide support for creating procurement, sorting, packing and processing centres,”hesaid.

Globally, bananas are exported entirely by sea-freight. However, in India, more than 60 per cent is exported through air. This costlier mode restricts marketability of Indian bananas. There is a need for closer association withmajorshippinglines.

The UAE, Iran and Saudi Arabia together contributed 80 per cent of India’sbananaexportsduring2021-22.

GUJARAT+NORTHINDIA 30th NOVEMBER 2022 15

Freight rates on Indian trades hit new lows amid weakening demand

MUMBAI: Container freight rates on major trades out of India have hit new lows in November amid falling cargovolumes,accordingtosources.

On the Westbound India-Europe trade, average contract rates from West India [Jawaharlal Nehru Port (JNPT)/Nhava Sheva or Mundra Port] to Felixstowe/London Gateway (UK)orRotterdam(theNetherlands) have plunged to US$2,300 per 20-foot container and US$2,450/40-foot container,fromUS$3,500andU$4,000, respectively, in the last week of October.

For West India-Genoa (the West Mediterranean) cargo, carriers are accepting bookings at US$2,200/20foot box and US$2,500/40-foot box, compared with the October levels of US$3,750/20-footboxandUS$4,100/40footbox.

Eastbound cargo rates for these port pairings have, however, seen no changes month-on-month –continuing to hover at US$1,400/20foot container and US$1,500/40-foot container for bookings from Felixstowe/Rotterdam and at US$1,150/20-foot and US$1,400/40-foot containers to West India

(NhavaSheva/Mundra).

Average short-term contract prices offered by leading liners for Indian cargo moving to the US East Coast (New York) have also crashed significantlyfromtheOctoberlevels–down to US$4,750 per 20-foot box, versus US$6,350, and US$6,350 per 40-foot box, from US$8,350, and at US$3,650/20-foot container, from US$4,500, and US$4,850/40-foot box, down from US$6,050, for shipments to theUSWestCoast(LosAngeles).

For the West India-US Gulf Coast trade, rates have fallen to US$4,750 per 20-foot and US$6,850 per 40-foot container, compared with US$6,900 and US$9,050, respectively, at the end ofOctober.

On the return direction, average contract rates have not changed from the levels maintained by major operators last month – pegged at US$1,075/20-footboxandUS$1,434/40foot box from USEC; at US$2,484/20foot box and US$ 3,193/40-foot box from USWC; and at US$1,770/20-foot and US$1,843/40-foot box from the Gulf Coast, into West India (Nhava Sheva/Mundra).

Intra-Asia trades out of India have

seen sharp declines this month from theOctoberaverages,withdepressed tradevolumes.

Average contract rates offered by major carriers to regular clients for bookings from West India (Nhava Sheva/JNPT or Mundra) to Shanghai (Central China) now stand at US$150 per 20-foot container and at US$250 per 40-foot box, versus US$350 andUS$450,respectively,amonthearlier. For Indian cargo to Tianjin (North China),ratesaredowntoUS$200/20-foot and US$350/40-foot container, from US$350andUS$400inOctober.

For Indian shipments to Hong Kong, average rates are hovering at US$150/20-foot container and US$200/40-foot container, down from US$300 and US$400, according totheanalysis.

Rates on West India-Singapore cargo have collapsed to US$50/20-foot container and US$100/40-foot box, fromUS$150andUS$250lastmonth.

Contract rate levels on the return leg have fallen measurably month on month,withtheslideaveragingabout 30% for bookings from Shanghai/Tianjin to West India, theanalysisshows.

Welspun One Logistics Parks Fund 1 commits Rs 500 crore warehousing AIF

MUMBAI: Welspun One Logistics Parks has committed 100 per cent of its Rs 500 crore corpus across six investments to create a portfolio of Rs2,300crorespanningfivecities–MMR, NCR, Bengaluru, Chennai and Lucknow– aggregating to about 6.6 millionsquarefeetofgrossleasablearea.

Last year, the firm raised India’s first alternative investment fund (AIF) focusing on warehousing development. Ofthe6.6millionsqft,onemillionsqftof area has been delivered and an additionaltwomillionsqftisexpectedto be delivered in the second quarter of calendaryear2023,thecompanysaid.

Fifty per cent of the firm’s funds portfoliowillbedelivered,operationaland rent generating in a little over two years from its first close, said the company.

Notably, about 60 per cent of the portfolio is already pre-leased to a blue-chip roster of tenants such as Delhivery, Flipkart, FM Logistics, Tata Croma, and Ecom Express, with significant scope for leasing of the balanceportfolio.

Welspun One was among the first players in the country to spot an opportunity for domestic capital to invest in India’s growing warehousing sector. While the sector had attracted close to $6 billion in FDI over the past 3-4 years, there was no avenue for domestic investors to participate in this space in a hassle free, transparent and institutionalmanner.

Welspun One provided financialisation of real estate by launching India’s first AIF focussed on

warehousing development. It has also raised Rs 500 crore of capital commitments, from a set of high net worth investors including marquee individualsandfamilyoffices.

Over the next five years, the company expects to develop a portfolio of 20-25 million sq ft across “first mile” and “last mile/city centre” facilities in leading Tier-1 and Tier-2/3 cities panIndia.

India’s warehousing industry continues to show strong growth with an expected CAGR of 18 per cent over thenext3-4years.

The company is an integrated fund and development management platform, which delivers grade-A logistics and industrial parks across India.

India purchased 40% of seaborne Russian Urals oil in November: Report

NEW DELHI: India bought about 40% of all Urals seaborne export volumes loading in November, outperforming other states as buyers, Reuters calculations based on Refinitiv and traders’ data showed on Monday, 28thNovember.

Russian Urals oil shipments to India accounted for about 40% of the total sea exports of Urals in November, not including the transit of oil from Kazakhstan, which is sold as KEBCO,

Reuterscalculationsshowed.

At the same time, shipments of the grade to Europe, which was previously thelargestconsumerofseaborneUrals, in November amounted to slightly less than a quarter. Almost the entire volume was delivered to refineries, in which Russian oil companies hold shares.

The total volume of shipments of Urals oil from the Russian ports in November amounted to 7.5 million

tonnes, excluding the transit volumes of Kazakhstan.

On Dec. 5, the European Union imposes an embargo on the supply of seaborneshipmentsofRussianoil.

According to traders, the volume of supplies of Urals oil to Europe may be further reduced in December, since the embargo involves a ban on the supply of Russian oil even by Russian companies to their remaining refining assets in the EU.

30th NOVEMBER 2022 GUJARAT+NORTHINDIA 16