NEW DELHI: With the World Bank looking to incorporate more data into its decision-making process for the International Logistics Performance Index (LPI), a key indicator of ease of trade, India has made its case for a better score to the multilateral financier citing several reforms.

I n d i a i s c u r r e n t l y r a n k e d 3 8 t h ( u p f r o m 44th earlier) in the LPI 2023, and it shares this rank with Portugal, Saudi Arabia, Turkey, and Lithuania.

The Centre has previously expressed its dissatisfaction with the index’s methodology. Singapore topped the index in 2023

“The World Bank is now utilising much more granular data and engaging in big data-oriented conversations with countries so that the upcoming index is more grounded in reality than subjectivity and perception, which formed a major part of the methodology,” a Government official aware of the developments said.

MUMBAI: Containers and coal shipments are expected to support cargo volume growth at the ports in FY25 by 6 -8 per cent. In the first 10 months of FY2024, cargo volumes witnessed a 7 6 per cent growth

Cargo volumes at the ports are expected to grow by 7-8 per cent in the current fiscal and volumes in FY2025 to grow by 6-8 per cent. This will be driven by healthy growth in the container and coal segments; slowdown in global economic growth and/or geo-political tensions impacting tradevolumesarethekeyrisks,accordingtoICRA

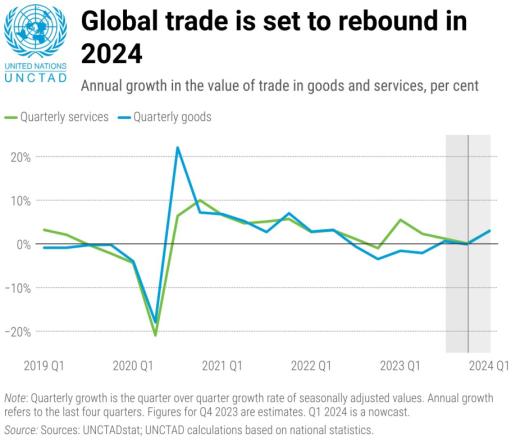

GENEVA: After facing declines over several quarters, international trade is poised for a rebound in 2024, according to the latest Global Trade Update from the United Nations Conference on Trade and Development (UNCTAD).

In 2023, global trade saw a 3% contraction, equalling roughly $1 trillion, compared to the record high of $32 trillion in 2022. Despite this decline, the services sector showed resilience with a $500 billion, or 8%, increase from the previous year, while trade in goods experienced a $1 3 trillion, or 5%, decline compared to 2022 Cont’d Pg.

PSA International Pte Ltd (“PSA”) handled 94 8 million Twentyfoot Equivalent Units (“TEUs”) for the year ended 31 December 2023, representing a growth of 4.3% compared to 2022.

PSA Singapore contributed 38.8 million TEUs, and PSA terminals outside Singapore delivered a total throughput of 56.0 million TEUs, both increasing 4.8% and 3.9% respectively from 2022.

PSA Group revenue decreased by 11 2% due to challenging market conditions and weak trade demand. Profit from operations decreased by 2.6%, while overall net profit for the year decreased by 6.3% partly due to cost inflation and higher finance cost. PSA’s balance sheet remains strong with a gross debt equity ratio of 0.46 times at the close of 2023.

“2023 was a year of transition amidst global trade uncertainty Inflation, rising interest rates, tight labour markets, geopolitical tensions, and ongoing wars impeded economic recovery worldwide. The PSA Group faced a challenging and constantly evolving business environment, but we continued to demonstrate resilience and grit while working alongside our customers, partners and stakeholders to navigate the unchartered waters. The Group delivered a credible performance in 2023 despite numerous challenges, registering 94.8 million Twenty-foot Equivalent Units (TEUs) of containers handled, S$7 billion in overall revenue and a net profit of S$1.5 billion. I would like to

thank our management, staff and unions for their steadfast dedication and commitment to service and operational excellence. I would also like to extend my appreciation to the PSA International Board of Directors for their expert guidance that has served as a compass, providing direction for the Group. In 2024, PSA is committed to staying the path and will continue to work closely with our customers, partners and stakeholders to grow our business and deliver sustainable value,” said, Mr Peter Voser, Group Chairman, PSA International.

“Although there was a collective push for economic recovery in many developed countries, the global economy remained fraught with volatility in 2023. Despite the challenges around the world which destabilised the outlook for recovery and disrupted supply chains, the PSA Group achieved a new record of handling 94.8 million Twenty-foot Equivalent Units (TEUs) of containers for the year ended 31 December 2023. I would like to express my deepest gratitude to our management, staff and unions who have worked tirelessly alongside our customers across PSA’s ports, supply chain, marine and digital businesses I am equally grateful for the unwavering support from our partners and stakeholders as we work closely together to keep cargo moving and trade flowing. Looking ahead to 2024, PSA will continue to focus on expanding our core business of ports and enabling more agile and resilient supply chains. In the face of uncertainties in the macroeconomic environment, PSA is committed to strengthening its fabric of port networks and supply chain services to support sustainable global trade flows,” said Mr Ong Kim Pong, Group CEO, PSA International.

RIYADH: The Kingdom, represented by the Saudi Ports Authority "Mawani," recorded 248 points according to the new methodology in the liner Shipping Connectivity Index, within the report of the United Nations Conference on Trade and Development "UNCTAD" issued during the first quarter of 2024. This achievement confirms the continuity of goods flow, ensuring supply chains, and logistic services. This step aligns with Mawani's keenness to maintain the achievements that have been made, as 31 new maritime shipping services have been launched with major global shipping lines during 2023. Since the beginning of 2024, adding 7 new shipping line services have been launched, and nine integrated logistics parks and hubs at Jeddah Islamic Port, King Abdul Aziz Port in Dammam, and King Fahd Industrial Port in Yanbu have been established and inaugurated, in cooperation with leading national and international companies, with investments exceeding 6 billion riyals. "Mawani" is developing the infrastructure of its ports by laying the cornerstone for the development and operation projects of the two container terminals at

King Abdul Aziz Port in Dammam, with an investment value of seven billion riyals, according to the (BOT) system. In addition to developing the Jeddah Islamic Port’s North Container Terminal, with investments of one billion riyals, to enhance the operational capabilities of the port, in line with the targets of the National Transport and Logistics Strategy (NTLS), to solidify the Kingdom’s standing as a global logistics hub bridging the three continents. Additionally, it enhances the efficiency of operational services, launches initiatives to automate port operations, uses modern operational equipment, and facilitates import and export procedures; to encourage national exports, support global maritime trade, reduce operational costs at ports, and attract regional and international shipping lines and giant ships. Notably, the United Nations Conference on Trade and Development "UNCTAD" recently made amendments to the "LSCI" index in 2024 to better reflect the current characteristics of container ports. This adjustment is applied to the approved previous calculation methodology to keep pace with the changes in the maritime transport and global shipping industry, and the growth of the logistics services sector.

AMSTERDAM: TPM24 was held 3-6 March this year and DCSA was delighted to attend. The theme of the event, organised by the Journal of Commerce as the premier conference for trans-Pacific and global container shipping and logistics, was ‘extreme normalisation fallout’. Extreme normalisation being a reversion to pre-pandemic freight rates and port fluidity in the first half of 2023, after the market impact of COVID-19; fallout being the false sense of security that has since been dashed by below normal schedule reliability, Panama Canal restrictions and attacks on shipping in the Red Sea.It is a clear reminder, if one is ever needed, that there will always be disruption. That in response, we need more agility in the supply chain. That inherent processes must be more resilient and flexible. For that, supply chain partners need actionable data and by actionable, we mean timely and communicated in ways and formats that all systems can process, to be shared unhindered between links in the supply chain.Digitalisation is central to achieving this vision So too is standardisation Digital standards in container shipping help overcome communication hurdles for more efficient and sustainable processes and a better overall customer experience.

The great news coming out of TPM is that DCSA standards adoption is happening. Awareness of the standards is good, and there is demand and support from within the ecosystem for digitalisation and interoperable data exchange. This is the era of adoption, with DCSA at the forefront of it, and if the panel discussions, keynote speeches and our networking are anything to go by, key industry stakeholders are willing and committed to implementing DCSA standards At TPM, DCSA had encouraging conversations about the electronic bill of lading (eBL), track and trace, and vessel schedules (both commercial and operational) Between them, these standards address significant communications challenges that we see today.An universal eBL uses open source Application Programming Interfaces (APIs) to enable straight-through processing of bill of lading (B/L) data so physical documents don’t have to be exchanged, paper and manual intervention can be eliminated from B/L processes, and interoperability can be achieved Track and trace (T&T) standards establish a technological foundation for continuous visibility into container whereabouts and operational events along the

end-to-end container journey. Current methods for generating and communicating operational data are antiquated, manual, unaligned and unpredictable, so data is often exchanged inconsistently, with delays or not at all. With all DCSA members now positioned to offer the T&T standard, it is imperative that the industry now moves towards a better, reliable and interoperable data format for key events and milestones. This will be enhanced further with the introduction of PUSH API, which was singled out as a key enabler for scaling adoption of DCSA standards.Vessel schedule standards enable the standardised sharing of vessel schedule data and exception-related information between carriers, operational and commercial partners, and their solution providers Leveraging a common structure for schedules, defined data attributes, and an API, DCSA standards clarify which information is associated with a vessel at service, voyage, and port call levels. Meanwhile, point-to-point multimodal routings for commercial schedules provide the means to exchange that information.

TPM also taught us that there is appetite for the internet of things (IoT) to make containers intelligent and usher in an era of smart containers. IoT can provide visibility at the holistic level – for compliance and inter modal transport Smart containers open up opportunities for enhanced supply chain management through sensors that can feed real-time data back to shippers and carriers so they can take appropriate action. Data can include location, status and events, such as containers being accessed en route IoT standards support an uninterrupted flow of information on container whereabouts and the status of their contents at any point along container journeys.

We are confident, from conversations at TPM, that stakeholders recognise their roles in digitalisation and in adopting digital standards Last year, our mission at TPM was to gain support for standards implementation, this year we see it happening, and next year we expect to see benefits realisation as the industry gets data flowing.It will take collaboration, and everyone taking responsibility to make logistics better There will always be disruption, and challenges to keep addressing, including sustainability The industry must strengthen its communication and processes to take on these challenges and it will do so by collaborating on digitalisation and standardisation.

CJ-VIII

CJ-IX Senorita Interocean 27/03

CJ-X Princess Layla BS Shipping 28/03

CJ-XI Neshat (IIX) Armita India 27/03

CJ-XII Hansa Europe (IG1) Hapag Llyod 27/03

CJ-XIII VACANT

CJ-XIV Borkum JMBaxi 27/03

CJ-XV Yangze 7 Aditya Marine 01-Apr

CJ-XVA Bentley Cross Trade 30/03

CJ-XVI Figec Mihir & Co. 30/03

TUNA VESSEL'S

OJ-IV Hua Wei 8 JMBaxi 27/03

OJ-V VACANT

OJ-VI VACANT

OJ-VII

Arzin 20/03 Bandar Abbas

AS Alexandria 20/03 Jebel Ali

Pegasus 02 20/03 Somalia

Eider S 21/03 Iran

GF Trader 21/03 Yemen

Crested Eagle 21/03 China

TCI Express 22/03 Manglore/ Cochin/Tuticorin

Safeen Power 22/03 Abu Dhabi

Princess Mariam 22/03 Somalia

Obession 22/03

T Procyon 22/03

BBC Russia 22/03 USA

Jaador 22/03

Jairan 23/03 Bandar Abbas

TCI Anand 23/03 Manglore/ Cochin/Tuticorin

ER Maden 23/03 Tanzania

Jupiter 24/03 Sudan

PVT Aroma 23/03 Mina Saqr

Obession 23/03 China

Suvari Kaptan 25/03 Somalia

Vega Stetind 25/03 China

MUMBAI: India’s foreign exchange reserves rose for a fourth straight week to hit a record high of $642.49 billion as of March 15, central bank data showed The reserves rose by $6.4 billion in the reporting week, after rising $20 billion in the previous three weeks.

The Indian economy is seen growing at 7.6% this year, one of the fastest among major global economies. This helped draw $20.7 billion in overseas equity flows in 2023 and $1 85 billion so far this year In addition, India’s inclusion on global bond indexes has drawn

over $10 billion since late September.

The Reserve Bank of India (RBI) has chosen to absorb most of these flows to avoid a sharp appreciation in the rupee, adding to its reserves, analysts said. A large reserves pile gives the central bank the ability to manage the currency during periods of market volatility.

India’s forex reserves, including the central bank’s forward holdings, can now cover more than 11 months of imports, a nearly two-year peak.

The above vessel has arrived on 24-03-2024 at MUNDRA PORT with Import cargo from BARCELONA, DERINCE. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 24-03-2024 at MUNDRA PORT with Import cargo from HALIFAX, MONTREAL, VALENCIA, NAPLES.

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 24-03-2024 at MUNDRA PORT with Import cargo from HALIFAX, MONTREAL, BARCELONA, VALENCIA, CAGLIARI, CIVITAVECCHIA, GENOA, NAPLES, RAVENNA, LA SPEZIA, TRAPANI, VENICE, KING ABDULLAH PORT, ALIAGA, GEMLIK, MERSIN, TEKIRDAG (ASYAPORT).

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804 As Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100

Cont’d from Pg. 4

In 10M FY2024, cargo volumes witnessed a 7.6 per cent growth after growing 8.3 per cent in FY2023. Coal and container volumes have grown at a healthy pace of 8.4 per cent and 10.5 per cent respectively, although container volumes have witnessed slowdown amid the Red Sea crisis in the last couple of months. Petroleum product volumes witnessed modest growth.

Going forward in FY2025, volume growth of 6-8 per cent is expected, supported by continued healthy coal imports, while container segment growth is expected to moderate amid the Red Sea crisis resulting in elevated freight rates.

Further, new projects are also being awarded in line with growth envisioned in Maritime Vision 2030. A large capex has been planned for the next decade to augment port capacity and infrastructure. Project execution is expected to pick up pace, going forward Aggressive capacity additions may lead to supply-demand mismatches in a few clusters leading to increased competition and pricing pressure for ports in those clusters. The sector witnessed consolidation in the last few years with acquisition of smaller or standalone players by larger groups and this consolidation trend in the sector is expected to continue.

• Interna�onaltradeisexpectedtoreboundin2024a�erexperiencingdeclinesforseveralquarters.

• Preliminaryfiguresindicatea$1trillioncontrac�oninglobaltradein2023,drivenprimarilybysubdued demand indevelopedna�onsandweakertradewithinEastAsiaandLa�nAmericanregions.

• While trade in goods decreased during 2023, trade in services con�nued to grow, signalling resilience amidstchallengingcondi�ons.

Cont’d from Pg. 4

The fourth quarter of 2023 marked a departure from previous quarters, with both merchandise and services trade stabilizing quarter-over-quarter Developing countries, especially those in the African, East Asian and South Asian regions, experienced growth in trade during this period.

Regional dynamics

While major economies generally saw a decline in merchandise trade throughout 2023, certain exceptions emerged, like the Russian Federation, which exhibited notable volatility in trade statistics. Towards the end of 2023, trade in goods saw growth in several major economies, including China (+5% imports) and India (+5% exports), although it declined for the Russian Federation and the European Union.

Regionally, trade between African economies bucked the global trend by increasing 6% in 2023, whereas intraregional trade in East Asia (-9%) and Latin America (-5%) lagged behind the global average.

Prospects for 2024

Available data for the first quarter of 2024 suggests a continued improvement in global trade, especially considering moderating global inflation and improving economic growth forecasts. Additionally, rising demand for environmental goods, particularly electric vehicles, is expected to bolster trade this year.

However, geopolitical tensions and supply chain disruptions persist as pivotal factors influencing bilateral trade trends and require ongoing scrutiny Disruptions in shipping routes, particularly those related to security issues in the Red Sea and the Suez Canal, as well as adverse climate effects on water levels in the Panama Canal, carry the potential to escalate shipping costs, prolong voyage times and disrupt supply chains.

NEW DELHI: Continued shipping disruptions due to the ongoing crisis in the Red Sea pose upside risk to inflation and may also hit economic growth, Union Finance Ministry said in its monthly economic review

Around 80% of India’s merchandise trade with Europe passes through the Red Sea, with key products such as crude oil, auto & auto ancillaries, chemicals, textiles, and iron & steel being affected. The combined impact of higher freight costs, insurance premiums, and longer transit times could make imported goods significantly more expensive.

The Finance Ministry noted that the ongoing conflict in the Middle East and the Red Sea has impacted India’s import of fertiliser from the Middle East India’s import of the Muriate of Potash from Jordan and

Israel has also been affected

“The combined impact of higher freight costs, insurance premiums, and longer transit times could make imported goods significantly more expensive,” it said.

“Asian economies such as China, Japan, India, and South Korea are among the largest net oil importers globally Hence continued shipping disruptions could hit Asia. A rise in oil prices may pose upside risks to inflation and, consequently, to growth,” the report stated.

Due to the ongoing crisis in the Red Sea shipping route, container ships are forced to take a longer route through the Cape of Good Hope in southern Africa. By the first half of February 2024, container tonnage crossing the Suez Canal fell by 82%, while vessel tonnage passing through the Cape of Good Hope increased by 60%.

I.G.M. NO. 2372209 DT 22-MAR-24 Exch rate 85.44

The above vessel has arrived on 24-03-2024 at MUNDRA PORT with Import cargo from SHUWAIKH. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

As Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board)

E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com

H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com • www.msc.com

The

at MUNDRA PORT with Import cargo from NEW YORK. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 24-03-2024 at MUNDRA PORT with Import cargo from BOSTON, NEW YORK. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

-

NEW DELHI: The Centre has notified an interest subsidy cap of Rs. 2.5 crore for individual export units in the first quarter of the forthcoming fiscal 2024-25 under the popular interest equalisation scheme (IES) for identified sectors and MSMEs. This is in continuation of its capping policy, introduced this fiscal, to ensure that more units can benefit from the scheme, sources said.

But the government is not yet ready to consider the demand made by exporters to increase the subsidy rates despite several submissions by exporters, an official tracking the matter said.

The DGFT issued a notification on Wednesday clarifying that a cap of Rs. 2.50 crore per IEC is imposed till June 30, 2024, for the quarter starting from April 1, 2024.

“Last May, the government introduced a cap of Rs. 10 crore

per importer exporter code (IEC) on the annual net subvention amount. All disbursements made from April 1, 2023, onwards were counted towards the IEC for the current financial year. The latest notification is to clarify that the cap will continue in the new fiscal as well As the extension of the scheme is till first quarter of 2024-25, t h e c a p h a s b e e n c a l i b r a t e d accordingly,” the official said.

The subsidy cap for individual exporters would ensure that a greater number of eligible exporters can benefit from the scheme instead of the amount getting concentrated in the hands of few, per the government.

The IES was first implemented in April 2015. Under the scheme, exporters are extended credit by banks at a reduced rate (the rate of interest subsidy is determined by the government). The banks are later

reimbursed by the government for their lower interest earnings.

In December last year, the Union Cabinet approved an additional allocation of Rs. 2,500 crore for continuation of the scheme beyond the current fiscal, till June 30, 2024. The scheme would continue for all the targetted beneficiaries which include merchant exporters of the identified 410 tariff lines and all manufacturer exporters from MSME sectors.

The rates of subsidy were at 3 per cent for MSME sectors and 2 per cent for the rest.

Last month, the Reserve Bank of India officially extended the scheme through a notification “Although exporters have been making a case for increased rate of subvention, due to low global demand owing to economic slowdown and geopolitical problems, an immediate increase seems unlikely,” the official said.

MUMBAI: Some of the potential bidders participated in a Roadshow held by the pre-bid meeting called by V O Chidambaranar Port Authority on 18 March in Mumbai to build a 4 million twenty-foot equivalent units (TEUs) capacity container terminal in the port’s outer harbour with an investment of Rs 7,055.95 crores.

Adani Ports and Special Economic Zone Ltd (APSEZ), Singapore’s PSA

I n t e r n a t i o n a l P t e L t d , J S W Infrastructure Ltd and J M Baxi Ports and Logistics Ltd were among the four major port operators that participated in the pre-bid meeting.

Potential bidders are calling for “re-working” the project cost estimated by the Port Authority in a

global tender which some say was lesser by “at least 50 percent.”

The port authority has sought bids based on the lowest viability gap funding (VGF) quoted by bidders for developing the project, marking a departure from the model followed so far by the Union government owned major ports wherein cargo handling contracts are finalised on the basis of the highest royalty per twenty-foot equivalent unit (TEU) or per ton of cargo quoted by the bidders.

“The VGF shall constitute the sole criteria for evaluation of bids: The project shall be awarded to the bidder quoting the lowest VGF,” the port authority wrote in the tender documents.

The VGF has been capped at Rs1,950 crores or actual quote, whichever is lower

With the Cabinet clearing the project in the last week of February, re-working the cost estimates looks unlikely

M r. T K R a m a c h a n d r a n , Secretary, Ministry of Ports, Shipping and Waterways who was instrumental in pushing the muchdelayed project during his time as Chairman of VOC Port Authority, assured potential developers during the Mumbai road show that the government has “built in necessary provisions in the sanction orders which enables us to be more flexible” to make the project work.

MUMBAI: A recovery in tourism and higher electronics exports will give India and other South Asian economies an additional lift from the pandemicinduced slowdown and its aftershocks, Moody’sAnalyticssaidinarecentreport

“India and Southeast Asia have seen some of the largest output losses globally,” said the report, titled ‘Global Outlook: Taking Stock’, “but stronger growth in the latter half of 2023 has allowed them to make back some lost ground”.

Electronic goods, which account for 6% of India’s total export value, clocked significant growth in April-January of FY24, coming in at $22.64 billion from $18.78 billion a year ago. But India’s

export values across all commodities declined to $351 billion during AprilJanuary from $366 billion a year ago, underlining the impact of the global economic slowdown and the tightening of interest rates in Western countries.

Challenges such as the geopolitical tensions in Ukraine and West Asia, and trade route disruptions in the Red Sea region have exacerbated the situation by increasingoilpricesandtransportcosts

Meanwhile, the Indian hotel i n d u s t r y i s e x p e c t e d t o r e p o r t 7-9% revenue growth in FY25, with occupancy likely to be at decadal highs, ratings agency ICRA said in a recent report. The report added that the sustenance of domestic leisure and

business travel, and demand from meetings, incentives, conferences, and exhibitions (MICE) are likely to drive demand in FY25 despite a lull during the Lok Sabha elections.

As things stand, India remains the world’s fastest-growing major economy

In December the Reserve Bank of India (RBI) revised its growth forecast for the economy in FY24 to 7%, up from its p r e v i o u s p r o j e c t i o n o f 6 5 % This revision was due to higher-thananticipated growth in the first two quarters of the financial year The union government’s estimate for GDP growth in FY24 is higher at 7.6% on the back of better-than-expected growth during the first three quarters.

The above vessel has arrived at Mundra on 24-03-2024 as per following details.

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws.

Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Aura Commercial Building, Ward 6, Plot No. 23 Commercial, Office No. S/3 & 4, 2nd Floor, Aerodrome Road, Opp. Om Cineplex, Gandhidham, Gujarat - 370201.

In case of any query kindly contact the below E-mail IDS & Phone Numbers :

IMPORT related : ravi.vaghela@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : hardik.jadeja@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 98980 76324

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

The above vessel is arriving at Mundra on 26-03-2024 as per following details.

18

19

20

21

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws. Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Aura Commercial Building, Ward 6, Plot No. 23 Commercial, Office No. S/3 & 4, 2nd Floor, Aerodrome Road, Opp. Om Cineplex, Gandhidham, Gujarat - 370201.

In case of any query kindly contact the below E-mail IDS & Phone Numbers :

IMPORT related : ravi.vaghela@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : hardik.jadeja@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 98980 76324

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

NEW DELHI: India’s trade dependence on China and the EU increased in 2023 while it reduced on Saudi Arabia, the United Nations C o n f e r e n c e o n T r a d e a n d Development (UNCTAD) said. In its Global Trade Update, it said that trade in goods resumed growth in some of the major economies such as India and China in the fourth quarter of 2023 even as trade in services may have reached a plateau.

As per the report, India’s trade dependence on China and the EU increased 1.2% each in 2023 while it reduced 0 6% on Saudi Arabia

Trade interdependence between China and the US decreased further in 2023.

“Quarter-over-quarter statistics indicate return to growth in some major economies, including China and India,” UNCTAD said.

As per the report, towards the end of 2023, trade in goods saw growth in several major economies, including China with a 5% rise in imports) and India with a 5% growth in exports.

The fourth quarter of 2023 marked a departure from previous quarters, with both merchandise and ser vices trade stabilizing

quarter-over-quarter

“Developing countries, especially those in the African, East Asian and South Asian regions, experienced growth in trade during this period,” UNCTAD said.

In 2023, global trade saw a 3% contraction, equaling roughly $1 trillion, compared to the record high of $32 trillion in 2022. Despite this decline, the services sector showed resilience with a $500 billion, or 8%, increase from the previous year, while trade in goods experienced a $1.3 trillion, or 5%, decline compared to 2022.

NEW DELHI: Bank loans to exporters reached its highest level in the past 12 months in line with renewed global demand for Indian goods despite the Red Sea crisis, which attracted military response from several countries, impacting trade.

Outstanding export credit for Indian banks was seen at Rs 20489 crore at the end of January 26, rising 5% this financial year, data from Reserve Bank of India showed This was the highest sinceFebruarylastyear.

“Export growth will be largely driven by global demand and as we do expect global growth to be steady, we can expect a recovery here. This will be reflected also in growth in export credit,” Bank of Baroda chief economist Madan Sabnavis said.

India’s merchandise exports surged 11 9% year- on-year in February to $41.4 billion – the fastest growth since June 2022 – after growing 3.1% in January With this, exports grew for the third consecutive m o n t h , i n d i c a t i n g s u s t a i n e d momentum, Crisil said.

“The near-term challenge to India’s exports due to the Red Sea crisis has been limited so far,” the rating company observed.

The Red Sea crisis started on 19 October 2023, when Yemen’s Houthi launched missiles and armed drones at cargo vessels operated by Israeli companies, demanding an end to the invasion of the Gaza Strip.

“How the crisis impacts prices when export contracts are renewed will be a key monitorable. Barring this

hiccup, the recent healthy export momentum and forecasts by major multilateral organisations of better trade growth this year over last year are encouraging,” it said.

This is also good news for India’s current account, as with robust services trade surplus and healthy remittances.

E x p o r t s o f d r u g s a n d pharmaceuticals rose 22.2% year-onyear in February against 6.8% in January while exports of engineering goods grew 15.9%, organic and inorganic chemicals 33% and readymade garments 4.9%. Exports of petroleum products showed a slight slowdown in growth as it rose 5.1% in February against 6.6% in the previous month). Exports of gems and jewellery however shrunk by 11.3%.

HYDERABAD: The Federation of Telangana Chambers of Commerce and Industry (FTCCI) with the support of the MSME Department of the Govt of India hosted a second edition of the International Conference on Shipping and Logistics (ICSL) at HICC in Madhapur recently

Dr Vishnu Vardhan Reddy, IFS, Special Secy (Investment Promotion & External Engagement), VC & MD Te l a n g a n a S t a t e I n d u s t r i e s Infrastructure Corporation (TSIIC), Government of Telangana; Mr. Sanjay S w a r u p , I R T S , C h a i r m a n & Managing Director, Container Corporation of India Limited; Mr. Pradeep Panicker, Chief Executive O f c e r , G M R H y d e r a b a d International Airport Ltd graced the inaugural function.

Giving his keynote address, Dr Vishnu Vardhan Reddy said cities and civilisations rise, grow, and fall because of one thing that controls global trade. And Logistics is a lifeline of global

trade New centres of power are emerging In the complex world of supply chain management, the geopolitical situations are creating disruption, causing ripples across industries. These shifts are affecting the availability, cost, and reliability of essential goods and services, he said. Besides this, he spoke about two other disruptions, the impact of Technology and Climate Change on the sector

He further said the Government of India is focusing on reducing the cost of logisticsfromdoubledigitsto8to9%tobe globally competitive. Accordingly, the government has planned major projects such as Bharatmala which aims for road connectivity across the country while the other hand Sagarmala Project aims for the development of modernised ports along the coastline. And still, there is a lot tobedone

The industry must support the adaptation of technology and encourage startups in Logistics. Startups play a c r u c i a l r

Vishnuvardhan said Speaking about the status of the sector in Telangana, he said besides facing the above three challenges, Telangana also faces the challenge of being a landlocked state. We are focusing on infrastructure while closely working with the union government. Being a landlocked state, Telangana is coming out with a Dry Port in the northern corridor of the state. The land required for it is procured. We are also working on two to three additional dry ports to come up in future.

M r. S a n j a y S w a r u p , I R T S Chairman & Managing Director, Container Corporation of India (CCI) Limited said we have introduced LNG trucks for the first and last-mile movement of containers and EVs (Electric Vehicles) for inter nal movement in terminals. Telangana doesn’t have an LNG pump. Once LNG pumps come up, we will deploy LNG vehicles in Telangana. We are keen to be part of Telangana’s growth story and will increase our presence.

The above vessel has arrived at Mundra on 25-03-2024 as per following details.

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws. Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Aura Commercial Building, Ward 6, Plot No. 23 Commercial, Office No. S/3 & 4, 2nd Floor, Aerodrome Road, Opp. Om Cineplex, Gandhidham, Gujarat - 370201. In case of any query kindly contact the below E-mail IDS & Phone Numbers :

IMPORT related : ravi.vaghela@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : hardik.jadeja@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 98980 76324

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

The above vessel has arrived at Mundra on 26-03-2024 as per following details.

327 PLISZ4F02927

328 EPIRCHNQGA249484

329 EPIRCHNCWA254632

330 JAM241893

331 39130150075

343 EPIRMYPKGE214967

344 QDDR2402098

325 GZPE24030358A

326 GZPE24030358B

371 EPIRCHNQGA249445

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws. Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Aura Commercial Building, Ward 6, Plot No. 23 Commercial, Office No. S/3 & 4, 2nd Floor, Aerodrome Road, Opp. Om Cineplex, Gandhidham, Gujarat - 370201.

In case of any query kindly contact the below E-mail IDS & Phone Numbers :

IMPORT related : ravi.vaghela@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : hardik.jadeja@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 98980 76324

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

MUMBAI: India’s merchandise exports surged 11.9 per cent on-year in February to $41.4 billion, displaying strong momentum amid the ongoing Red Sea crisis and uneven economic growth outcomes among trade partners.

This has been the fastest since June 2022 after a growth of 3.1 per cent in January. With this, the exports grew for the third consecutive month, indicating sustained momentum.

The near-term challenge to India’s exports due to the Red Sea crisis has been limited so far, however, the key monitorable going forward will be how the crisis will impact prices when export contracts are renewed, said CRISIL. Barring this hiccup, CRISIL stated, the recent healthy export momentum and forecasts by major multilateral organisations of better trade growth this year over last year are encouraging. “The current account remains in a safe zone with robust services trade surplus and healthy remittances,” it said.

On a seasonally adjusted basis, exports grew 5.4 per cent on-month after declining 2.6 per cent in January

M a n y c o r e e x p o r t i t e m s s u c h a s pharmaceuticals, engineering goods, organic and inorganic chemicals and readymade garments recorded a surge in February, said CRISIL. Chemical exports picked up pace swiftly, growing 33 per cent on-year after recording mild growth of 0.3 per cent on-year in January and remaining in negative territory for the previous 15 consecutive months. On the whole, core (non-oil, non-gold) exports grew 17.2 per cent on-year in February compared with 2.5 per cent in January, registering the highest growth since April 2022. That said, exports of gems and jewellery remained in negative territory for the second consecutive month.

M e r c h a n d i s e e x p o r t s d o w n 3 . 4 5 % , merchandise imports down 5.32% in AprilFebruary period

Cumulatively, India’s merchandise exports fell 3.45 per cent on-year to $394.99 billion in the AprilFebruary period this fiscal compared with $409.11 billion a year ago. Merchandise imports grew faster than exports in February, surging 12.2 per cent onyear to $60.1 billion compared with 1 per cent the previous month.

Core imports grew 5.2 per cent on-year after declining 1.1 per cent on-year on average in the November 2023 to January 2024 period due to a sharp surge in gems & jewellery imports (94.4 per cent on-year) primarily led to a higher merchandise import bill in February

The merchandise trade deficit widened to $18.71 billion in February from $16.57 billion a year ago and $16.46 billion the previous month.

Cumulatively, merchandise imports contracted 5 32 per cent on-year to $620 19 billion in April-February this fiscal, helping narrow the

merchandise trade deficit to $225.2 billion from $245.94 billion in the corresponding period the previous fiscal.

India’s services exports continued to grow, rising 10.8 per cent on-year in January 2024, while imports saw mild hardening to 0.1 per cent. As a result, the services trade surplus rose to $16.17 billion in January from $13.17 billion a year ago and $15.98 billion the previous month.

India’s export performance rebounded from August 2023 through February 2024, registering average growth of 2.7 per cent compared with a 13 per cent decline in the first four months of this fiscal (April-July 2023).

Exports and imports data highlights:

Exports of major items such as drugs and pharmaceuticals (22.2 per cent on-year in February vs 6 8 per cent in January), engineering goods (15.9 per cent), organic and inorganic chemicals (33 per cent) and readymade gar ments (4 9 per cent) displayed robust growth, while petroleum products (5.1 per cent vs 6.6 per cent) showed a slight slowdown. Meanwhile, exports of gems and jewellery (-11.3 per cent vs -1.3 per cent) remained in the red.

Exports of labour-intensive sectors such as carpets (14.6 per cent v 9.4 per cent), cotton, yarn, fabrics, madeups, handloom products and others (17 1 per cent), handicrafts (87 per cent v -16.6 per cent) improved further compared with the previous month Ceramic products and glassware (9.8 per cent), plastic and linoleum (22 1 per cent) and readymade garments (4 9 per cent) also exhibited positive growth

Agricultural exports have gained momentum, driven by fruits and vegetables, oil seeds, rice, spices and tobacco. However, exports of cashew and oil meals slowed.

Meanwhile, oil imports turned positive, increasing 0.1 per cent on-year to $16.89 billion in February from $15.53 billion in January in line with an increase in Brent crude oil prices to $83.8 per barrel from $80.2 per barrel the previous month

Imports of gold (133.8 per cent v 173.6 per cent) and silver (13234.4 per cent v 323.5 per cent) increased on-year While growth in silver imports was supported by a significantly low base, the same cannot be said about gold, which faced an unfavourable base, stated CRISIL. Pearl, precious and semi-precious stones showed weak growth.

Core imports (non-oil and non-gold) rose 5.2 per cent on-year compared with a 2.3 per cent decline in January.

Import growth of industrial products such as iron and steel (9.5 per cent v -7.5 per cent) and machine tools (24.9 per cent v 0.1 per cent) was positive and strong. Coal, coke and briquettes (2.1 per cent v 21.2 per cent) saw positive, but slower growth compared with the previous month.