GANDHINAGAR: Cargo h a n d l e d b y p o r t s administered by the Gujarat Maritime Board (GMB) has h i t a n a l l - t i m e h i g h o f 449 million metric tonnes (MMT) in the 2023-24 financial year, up from 416 MMT in the previous year.

According to experts, growth in cargo handling came from the improved performance of private ports including Mundra. Crude, coal and containers contributed the most to cargo handled.

GMB has 48 Non-Major Ports in Gujarat.

According to sources, crude oil, coal, containers, LNG, iron ore, cement and clinker account for 82% of total cargo traffic at GMB ports. Private ports handled 247.51 MMT of cargo or 55% of total traffic at Non-Major Ports in Gujarat in FY24. This was 14.42% higher than in the previous financial year See Back Pg.

NEW DELHI: The first 100 million tonne took 14 years, the second 5 and the third 3 But the fourth took less than 2 years as Adani Ports and Special Economic Zone handled a record 420 million tonne of cargo in fiscal year ended March 31.

Cont’d Pg. 6

Cont’d from Pg. 4

In FY23, private ports handled 216.32 MMT and a c c o u n t e d f o r 5 2 % o f total traffic handled by Non-Major Ports in Gujarat.

Mundra handled the most cargo, 172.50 MMT in FY24, an 18% annual increase

Cargo handled at Dahej grew by 8% to 34.59 MMT. Pipavav Port handled 12.94 MMT, 13% more than in the previous year.

According to officials, captive jetties handled

167.84 MMT or 37.4% of total traffic at Non-Major Ports in FY24.

In FY23, captive jetties handled 164.43 MMT which was 39.5% of the total traffic. In FY24, cargo handling at captive jetties grew by 2.08%.

GMB-operated jetties handled 23.19 MMT in FY24, 8 34% lower than in the previous financial year

“Global supply chains were disrupted by Covid and this had affected ports After that there was a speedy recovery and due to improvement in cargo handling services, Gujarat Ports are seeing significant growth,” an official said.

Cargo handled by India's largest private port operator was up 24 per cent year on year, ofcials said.

This included international ports as well. SEZ's domestic ports handled over 408 million tonne of cargo in the fiscal, they said, adding that the company was changing the face of seaports, setting new milestones for operational excellence along the way.

Mundra, the first port of SEZ, welcomed its maiden ship in 1998. Since then, SEZ has built a network of 15 ports and terminals in the east and west coasts of India, redefining infrastructure and operational capabilities to drive maritime trade, both within and outside the country

SEZ's journey towards becoming the largest port operator in India has been marked by the acquisition of strategic assets across the country’s coasts.

Officials said in line with its vision for growth and innovation, the company has been identifying ports with the potential to help it expand its footprint and provide it with a platform for transforming these facilities.

Two examples of this are the Dhamra port in Odisha and Krishnapatnam in Andhra Pradesh.

Situated on the east coast of the country, Dhamra Port in Bhadrak district of Odisha has emerged as a critical hub for dry cargo shipment in the region.

The all-weather port, about a four-hour drive from the state capital Bhubaneswar, is capable of handling some of the largest vessels on the high seas Ten years ago, it handled just around 14 million tonne of cargo Now, its capacity has gone up to over 42 million tonne, a three-fold increase, according to officials.

About 1,200 km from Dhamra, Krishnapatnam Port in Nellore district of Andhra Pradesh is a multi-commodity facility It caters to the southern region of the country that has power, cement, and steel among other industries. In the past three years, the port's cargo handling capacity has gone up 17 per cent.

After their acquisition, SEZ studied the existing facilities at Dhamra and Krishnapatnam and addressed the gaps by implementing tried and tested systems, officials said.

From optimising port operations by improving processes for cargo handling and storage to streamlining logistics operations and building inland infrastructure to ensure seamless movement of cargo, SEZ has been constantly innovating and evolving to meet the changing needs of partners, customers, and stakeholders.

"While acquiring strategic assets, SEZ assesses the needs and potential for growth The emphasis is on improving infrastructure and upgrading them to improve efficiency, optimise resources and sweat the assets.

"For example, Dhamra port had two berths in 2014. Now, it has five. A single railway line was earlier used for the transportation of cargo; now, another line is being laid to connect it to the national railway network.

Similar infrastructure has been created to strengthen the road network," said an SEZ official.

The deep draft port, SEZ's first buy on the east coast, can accommodate capesize vessels and caters to industries in Odisha, Jharkhand and West Bengal.

In 2014, it handled nearly 14.3 million tonne of cargo. In March 2024, it handled 42.8 million tonne, marking a 3X growth. Dhamra also has a Liquefied Natural Gas terminal of 5 million tonne capacity that helps fulfil the requirements of Assam, Bihar, Odisha, Uttar Pradesh, and West Bengal.

Krishnapatnam, an all-weather, deep-water port acquired by SEZ in 2020, is equipped to handle large vessels and offers multimodal connectivity through road and railway lines. Electrification of cranes has been one of the major upgrades at the facility

Its current capacity is 75 million tonne, a significant increase from 64 million tonne four years ago, officials said.

Apart from world-class infrastructure and dedicated storage facilities, it has mechanised cargo handling systems, which increase operational efficiency and reduce turnaround time.

"Mechanisation to facilitate loading and unloading of cargo through rakes, conveyer systems that ensure efficient movement of cargo from vessels and digitisation of processes reduce turnaround time at our ports. They drive competitiveness, enhance capacity and increase efficiency

And this has positioned SEZ as a preferred partner for shipping lines and cargo companies," the official said.

Karaikal port in Puducherry is in the vicinity of power plants and cement factories. Since it was taken over by SEZ in 2023, it has seen a significant turnaround in cargo volume. In FY23, it handled nearly 10 million tonne of cargo; in FY24, the number went up to 13 million tonne.

SEZ is known for its customer-centric approach, innovative logistics solutions, quick turnaround time and fast cargo and container evacuation processes. In fact, the learnings from Mundra - the use of technology, innovation and processes - have been replicated at all other ports owned by SEZ.

In one port, the turnaround time - a strong indicator of operational expertise - has been cut from 7 5 hours to 3 5 hours byimprovingprocessesanduseoftechnology,theysaid

Over the years, SEZ has successfully transformed its acquired assets into smart, technology-driven hubs with real-time tracking and monitoring solutions Through regular training programmes, it ensures optimal utilisation of resources and upskilling of manpower

"SEZ's journey shows how it has strived for operational excellence By leveraging operational capabilities and commitment to excellence, it has transformed ports and set new benchmarks for efficiency and productivity. As it continues its quest for growth and innovation, SEZ remains poised to shape the future of India’s maritime infrastructure and contribute to the nation's economic development and prosperity," said the official

CJ-XI

CJ-XII

CJ-XIII

CJ-XIV

CJ-XV

23/04

CJ-XVA Hosei 68 Seaworld 26/04

CJ-XVI Okinawa Chowgule Bros 28/04

TUNA VESSEL'S NAME AGENT'S NAME ETD

CS Nan Jing GAC Shpg. 23/04

OIL JETTY VESSEL'S

OJ-V VACANT

OJ-VI VACANT

OJ-VII Pacific Gold Interocean 23/04

MUMBAI: The Government has issued advisories to ship companies to enhance reporting, tracking and security protocols for vessels on West Asian routes and coming into Indian waters.

In a circular dated April 10, 2024, the Directorate General of Shipping (Mumbai) advised ship managers, ship masters and seafarers to enhance the mechanism for reporting and tracking maritime activities to safeguard the interest of merchant ships and their crews.

The ministry has identified sensitive zones that include the

Persian Gulf, Strait of Hormuz, Gulf of Oman, Arabian Sea, Gulf of Aden, Bab Al Mandeb Strait, Red Sea, Somali Basin and Arabian Sea region.

The circular said in the event of any incidents or security escalation due to incidents, all vessels transiting through these areas are requested to submit their details via the online Ship Reporting Form.

“This measure is critical for maintaining a comprehensive and upto-date vessel. database, which will facilitate easier tracking and coordination at the Centre if Indian Navy is required to respond to the

Incident,” it added.

According to the circular, in the event of a maritime security Incident, the vessel should contact the nearest Indian Navy vessel and coalition warship using VHF Channel 16, provide the current location, describe the situation, communicate the intended course of action and seek further guidance. Furthermore, the circular said it is advised to conduct comprehensive ship shore security drill encompassing all pertinent security scenarios, including but not limited to piracy and loitering munitions threat.

NEW DELHI : In its first official engagement with the Indian government, Elon Musk-led Tesla and other global automotive (auto) manufacturers sought clarification on the new electric vehicle (EV) policy, specifically regarding investment guidelines and the timeline for the domestic value addition (DVA) requirement.

Officials said that the original equipment manufacturers (OEMs) tried to understand whether the complete investment would be made within three or five years and the duration they would have to

achieve the 50 per cent DVA

“The consultation meeting was convened to address queries from auto OEMs. We answered the queries regarding the timeline for investment and DVA,” Hanif Qureshi, Additional S s e c r e t a r y, M i n i s t r y o f H e a v y Industries (MHI), told.

The new EV policy announced last month allows reduced import taxes on OEMs that commit to investing at least $500 million (Rs 4,150 crore) and establishing a manufacturing plant within three years. Additionally, they are also required to achieve a

25 per cent DVA within the initial three years and 50 per cent by their fifth year of operations in the country.

Tesla was represented by its advisor, The Asia Group (TAG) India, at the stakeholder consultation meeting with the MHI.

Other global companies, including VinFast, Mercedes-Benz, BMW, Kia, Volkswagen, Toyota, Hyundai, and R e n a u l t - N i s s a n , w e r e a l s o i n attendance. Additionally, Indian car makers such as Tata Motors, Maruti Suzuki, and Mahindra & Mahindra were present at the meeting.

NEW DELHI: The Government is working on easing the ‘related party transaction’ clause under the Goods and Ser vices Tax (GST), for foreign companies in India.

This is likely to happen within 100 days after the elections, which will exempt airlines and shipping lines from paying GST at the time of import of services, but which they can pay at the time of disbursal of services, a senior Government official said.

As per GST laws, related party transaction refers to the transfer of goods or services between entities which are under common ownership or management.

“All companies with related party transactions, including airlines, shipping lines, import supplies from their parent company outside India U n d e r G S T, t h e r e l a t e d p a r t y transaction is taxable at 18 percent and its compliance is very stringent for foreign companies. For ease of doing business and reducing compliances, the government is discussing easing it Discussion is happening on these lines,” the official said.

The Tax Department had sent out several notices to all airlines and shipping lines, who have their parent company outside India, for non-payment of GST on import of services. All foreign airlines such as Finnair, KLM Royal Dutch Airlines, Qatar Airways, Virgin Atlantic, Etihad, Emirates, Saudi Airlines, Air Arabia, Oman Air, and Kuwait Airways and British Airways and foreign shipping lines have received GST notices in this regard. What relief is the Government considering Compliance relief is likely for c o m p a n i e s w i t h r e l a t e d p a r t y transactions as an evolution of GST. The government is currently discussing exempting payment of GST for related party transactions, wherein full input t a x c r e d i t ( I T C ) i s e l i g i b l e The subsidiary companies will thus be allowed payment of GST later, at the t i m e o f d i s c h a r g e o f s e r v i c e s . Any change in law, if required for this, may also be examined, he said. The issue will be examined in detail by the GST’s fitment committee and will

be placed before the Council just after general elections, he said.

“Easing of the related party clause under GST is likely, if they are getting full ITC Else, it is increasing their c o m p l i a n c e b u r d e n T h e G S T authorities are discussing how this c l a u s e i s b e i n g i n t e r p r e t e d b y companies and the Tax Department,” the official said.

Most of the airlines said that instead of contesting the tax demand they intended to pay up the GST demand and claim the entire amount as input tax credit later

What does the relief imply

If a subsidiary Indian company is importing services from the parent company and does not pay GST on it, the tax authorities detect it and send a demand notice. The deemed supply is taxable at 18 percent for which input tax credit may be received later at the time of further supplies by the company. But if the Indian company is not paying GST on import of services, and is paying the entire tax later at the time of supply of services, the tax department should not bother, the official explained.

Indian Economy will be $34.7 Trn by 2047 with a per capita be $21K : PHDCCI

NEW DELHI : Indian Economy will attain the size of $34.7 trillion by 2047, with per capita income of $21,000, a report by PHD Chamber of Commerce and Industry (PHDCCI) on ‘Viksit Bharat @2047’ said recently. The report projected that the share of agriculture in total gross domestic product (GDP) would come down to 12 per cent in FY47 from 20 per cent during the previous year, while the share of industry would rise from 26 per cent to 34 per cent during the same period.

The share of the manufacturing sector is projected to grow from 16-25 per cent between FY23 and FY47. However, services contribution

to total GDP is expected to remain the same, at 54 per cent in FY47.

“Going by the growth paradigms and support of the economy, various facilitations, and measures taken by the Government, India will be $7 trillion economy by 2030 and $34.7 trillion by 2047, “ said S P Sharma, Chief Economist, PHDCCI.

The report added that India’s exports will reach $10 trillion by 2047 and the contribution of exports to GDP would rise to 30 per cent by 2047 from 21 per cent in the previous year.

“The future holds a promising outlook for India’s export trajectory as the government is proactively implementing reforms, increasing

E a s e o f D o i n g B u s i n e s s , strengthening supply chains and becoming increasingly supportive of free trade while the rest of the world is heading toward protectionism,” said the PHDCCI report India has recently concluded free trade agreements with the European Union Free Trade Association, following those with Australia and the UAE.

“Measures undertaken by the Government, such as the launch of t h e N a t i o n a l S i n g l e -Wi n d o w system and enhancement in the FDI ceiling through the automatic route, have played a significant role in facilitating investment,” the report said.

NEW DELHI: India’s exports to China increased by 8.74% from $15.33 billion in FY23 to $16.67 billion in FY24, according to Commerce Ministry data, while imports from China rose 3.29% to $101.75 billion in FY24 from $98.51 billion in FY23

Mr. Ajay Srivastava, Founder of Global Trade Research Initiative (GTRI), said, “India’s trade with China is a continued concern. In FY24, India’s exports to China were $16.67 billion, even lower than in FY19, and consisted mainly of raw materials and minerals.” Meanwhile, imports from China grew from $70.3 billion in FY19 to $101.75 billion in FY24. Over the past five years, India’s trade deficit with China has totalled more than $387 billion, he said.

“India’s reliance on China is expected to increase due to rising imports of materials for solar energy, electronics and electric vehicles

A d d i t i o n a l l y, m a n y C h i n e s e companies in India are likely to prefer buying supplies from China,” Srivastava added.

For FY24 as a whole, India’s merchandise exports stood at $437.06 billion, down from $451 07 billion during the previous fiscal. Goods imports fell to $677 24 billion from

$715 97 billion in FY23 The main drivers of merchandise export growth during FY24 were electronic goods, d r u g s a n d p h a r m a c e u t i c a l s , engineering goods, iron ore, cotton yarn/ fabric, handloom products, and ceramic products & glassware.

China’s economy has been grappling with significant challenges of late, including declining property investment, accumulating debt risks, and weak consumption growth

In calendar year 2023, China’s merchandise exports contracted in dollar terms for the first time since 2016, with overall exports declining by 4.6%, the Commerce Ministry data indicated.

Total merchandise imports by China also declined 5 5% in 2023 Key items exported to China that saw significant growth in FY24 included iron ore, cotton yarn, cotton, quartz, unwrought aluminium and sanitary items.

India’s merchandise trade deficit narrowed to $15 6 billion in March from $18.71 billion in February and $16.02 billion in January, the ministry data showed. This was the lowest in 11 months. The last time the deficit w a s l o w e r w a s i n A p r i l 2 0 2 3 , when it came in at $14 44 billion

India has been trying to shift its trade strategy from east to west by looking to sign free-trade agreements with major economies Negotiations are underway with countries such as the US, UK, Australia, Japan, Peru, Chile and Asean countries By the end of 2024, India could sign, or be close to s i g n i n g , F TA s w i t h a l l m a j o r economies except China. India and China trade under the Asia-Pacific Trade Agreement (APTA), which providesconcessionsoncertaingoods.

To meet the increasing demand for goods and services and promote the ‘Make in India’ initiative, the Government has implemented various measures to boost domestic m a n u f a c t u r i n g a n d r e d u c e dependence on imports One such initiative is the production-linked incentive (PLI) schemes in 14 critical sectors including electronics, pharmaceuticals, white goods, telecom and networking products, which are heavily dependent on imports.

These initiatives have reduced India’s dependence on imports, the Government said, adding that imports of mobile handsets decreased from Rs. 48,609 crore in FY15 to around Rs 6,685 crore in FY23

NEW DELHI: India’s exports to its largest markets, Europe and the US, remained flat as its global shipments declined in FY24 on account of falling demand and gepolitical flare-ups.

While India’s overall exports dropped by about 2.4% annually in value terms during FY24, its exports to the US declined by 1%, and those to Europe rose by only 1.47%, according to official data from the Commerce Ministry.

The staples of Indian exports — gems and jewellery, ready-made garments, chemicals, cotton yarn and handloom products – declined to Europe (including the UK) But e n g i n e e r i n g g o o d s , p e t r o l e u m products, drugs and pharmaceuticals and electronic goods exports saw a rise.

India’s exports to Europe have been steadily rising since FY21, in tandem with the global economy emerging from the pandemic.

India’s exports to Europe, in value terms, stood at $55.32 billion in FY21. It rose to $85.20 billion in FY22, $97.45 billion in FY23, and $98.88 billion in FY24.

Military confontrations in the Red Sea region, a major trade route to Europe, have also hurt exports.

Meanwhile, India’s exports to the US, its second-largest export market after Europe, fell to $77 52 billion in FY24 from $78 31 billion in FY23

India’s exports to the US stood at $75.60 billion in FY22 and $51.63 billion in FY21.

In the US, exports of gems and j e w e l l e r y, e n g i n e e r i n g g o o d s , ready-made garments, organic and inorganic chemicals, and marine products, among others, saw a decline, while drugs & Pharmaceutical and petroleum products saw a slight rise.

India’s trade performance in 2024 was influenced by global events like the Red Sea impasse leading to higher freight and disruption of supply chains, expensive crude oil on account of the continuing Russia-Ukraine war, the US-China trade tensions leading to more expensive value chains and the EU’s proposed Carbon Tax and Forest regulations, economy think tank Global Trade Research Initiative (GTRI) said in a recent report on India’s trade.

“India should deal with each of these with a transactional approach But as India’s share in world trade is just 2%, focus on enhancing sectoral competitiveness in labour-intensive sectors, diversification of services sectors and honest ease of doing business initiatives can surprise us with some good export performance,” it added.

During FY24, India’s merchandise exports stood at $437.06 billion, down from $451.07 billion during the previous fiscal Goods imports fell to $677 24

billion from $715 97 billion recorded during the same period.

India’s service exports stood at $339.62 billion in FY24, up from $325.33 billion in the previous fiscal while imports fell to $177 56 billion from $182.05 billion in the same period.

The overall trade deficit, including merchandise and services, shrank to $78.12 billion in FY24 from $121.62 billion in FY23.

The silver lining is that the World Trade Organization expects global goods trade to recover gradually during 2024, following a downturn in 2023 due to high energy prices and inflation.

As economic pressures ease and incomes rise, the volume of global merchandise trade will increase by 2.6% in 2024 and 3.3% in 2025, the WTO said in its Global Trade Outlook and Statistics report earlier in April.

During 2023, global trade declined 1.2% amid geopolitical and economic turmoil, after registering a 3% growth in 2022.

In value terms, the decline in merchandise exports was more pronounced in 2023, declining 5% to $24.01 trillion.

However, regional conflicts, geopolitical tensions and economic policy uncertainty pose substantial downside risks to the forecast, the WTO report added.

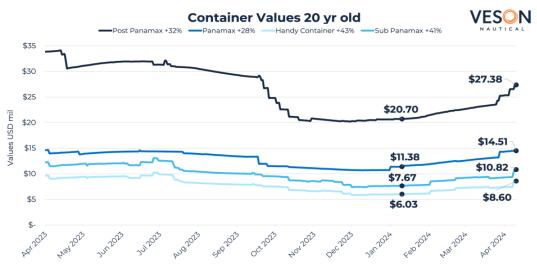

L O N D O N : C o n t a i n e r values have risen significantly across almost all sectors and age categories since the start of the year.

Following an extended period of declines, where values fell steadily for this sector af ter reaching a r e c o r d p e a k d u r i n g t h e Container boom at the end of Q1 2022. However, since January 2024, values have taken a turn in the opposite direction and older vessels have shown the most strength, with values for 20-year-old Handy Containers of 1,750 TEU up by as much as 43% since the new year from US$6 99 million to US$8.6 million.

The increase in values has been supported by climbing earnings since the start of the year. For example, in the Handysize sector period, earnings for one year have jumped by c.39.4% from US$9,280/Day on the first of January 2024 to US$12,940/Day today

This is largely due to the ongoing

disruption in the Red Sea By rerouting around the Cape of Good Hope, vessels a r e t r a v e l l i n g l o n g e r distances, reducing available vessels and therefore pushing u p r a t e s A c c o r d i n g t o VesselsValue trade data, Container journeys transiting around the Cape of Good Hope have increased by nearly 200% in Q1 2024 vs. Q1 2023.

H o w e v e r, t h e l a t e s t forecast from Veson’s Market Outlook predicts that, despite the ongoing conflict, as more and more Container new buildings hit the water, vessel supply will continue to outpace demand and going forward this will put pressure on rates.

NEW DELHI: India’s textile exports took another hit in the 2023-24 fiscal y e a r , d r o p p i n g b y o v e r USD 1 billion or 3 per cent from the previous year to USD 34.4 billion.

Compared to 2021-22’s exports of USD 41 billion, the decline was a steeper 16.3 per cent.

The dip is attributed to ongoing geopolitical tensions and a struggling global economy that has dampened consumer demand. However, one bright spot was the cotton yarn, fabrics, madeups and handloom segment, which saw

exports increase by USD 740 million year-over-year

“The overall western economy has taken a hit, especially in terms of recession in some parts of the globe. This has caused a drop in consumer confidence in those countries,” said Israr Ahmed, Vice President of the Fe d e r a t i o n o f I n d i a n E x p o r t Organisations (FIEO) He cited surging freight costs due to the Red Sea crisis as another factor.

North America remained the top export destination at USD 11 billion,

followed by Europe at USD 10 billion and WestAsia/NorthAfricaatUSD4billion

The readymade garment category, comprising 42 per cent of total textile exports, declined by 10 per cent to USD 14.5 billion in 2023-24.

“The past two months have seen a recovery despite global headwinds. The industry is bullish that the value of exports will reach USD 20 billion in the current fiscal,” said Mithileshwar T h a k u r o f t h e A p p a r e l E x p o r t Promotion Council, pointing to recent free trade agreements.

MUMBAI: States, rather than the Indian government, need to push on promoting ease of doing business to reach the $30 trillion economy target, said India’s G20 Sherpa, Amitabh Kant, in an interview, ahead of the 2024 Lok Sabha elections.

“More than the Government of India, the real action is now in the states, states should push,” Kant said on the sidelines of the We Made in India Conference in Mumbai on April 18.

K a n t b e l i e v e s t h a t i n t h e next 10 years India needs at least 10 to 12 states growing at over

10 percent for the country to become a $30 trillion economy Kant, India’s ace policy maker, is behind several iconic reforms and has also served as the CEO of NITI Aayog.

“India also needs many large companies to grow in within the country. Without large companies in India, you will not be able to create a tier two, three and four structure and ecosystem,” he added.

This comes at a time when the Union Council of Ministers, under the leadership of Prime Minister Narendra Modi, have deliberated on a 100-day

agenda for quick implementation if they come back to power in May 2024.

During a keynote speech earlier, Kant also highlighted the importance of domestic funds to contribute to the growth of Indian companies. “We need a lot of funds from India to get into the startup movement because today almost 75 percent of funding is coming from international sources,” he said.

Kant added that India needs insurance companies, pension funds and high-net worth individuals to take risk and invest in India’s startup movement.

CHENNAI: Tamil Nadu continues to consolidate its position as India’s leading exporter of electronic products with its share constituting a whopping one-third of India’s total electronic goods value of $29 12 billion during FY24.

Breaking the news of the State’s shattering records in electronics exports, TN Industry Minister TRB Rajaa posted on‘X’:“TamilNaduhasachievedarecordbreaking $9 56 billion in electronics exportsinFY2023-24 That’saremarkable 32.84 per cent of the total national share.

Lastyear,weclocked$5 37billionandrose to the top This year, we met the $9 billion target, estimated a few months ago, and surpassed it ” An interesting aspect of the milestone is that TN appears to have left alltheotherstateswellbehind Karnataka, which reported $4.60 bn, a 15.78 per cent share of the country’s electronics exports, is the next biggest exporter, reflecting the wide gap between TN and its neighbouring State, while Uttar Pradesh at $4 46 billion (15 per cent) is the third best performer in this category. Maharashtra at

$3.09 billion (10.6 per cent), Gujarat at $2.75 billion (9.43 per cent) and Delhi at $1.51 billion (5.18 per cent) are the other three states that have breached the billion dollar mark, as per the data.

As per Thursday’s market estimate, 1 US dollar equals to Rs 83.58.

From April 2023 to October 2023, the State had recorded $4.78 billion.

I n d i a ’ s t o t a l e x p o r t v a l u e between April 2023 and March 2024 stood at $437 06 bn It exports to 200 countries/territories across 31 commodities.

MOSCOW: Russia is pressing ahead with the construction of two new transport corridors linking Asia and Europe, seeking to weaken sanctions over its war in Ukraine at the same time as Middle East turmoil is disrupting global trade.

The shipping and rail networks via Iran and an Arctic sea passage could strengthen Moscow’s pivot toward Asian powerhouses China and India and away from Europe. They have the potential to embed Russia at the heart of much of international trade even as the US and its allies are trying to isolate President Vladimir Putin over the war

The routes could cut 30%-50% off transit times compared to the Suez Canal and avoid security problems plaguing the Red Sea as Houthi rebels

attack international shipping over Israel’s war against Hamas in Gaza. Iran’s missile and drone strikes aimed at Israel have added to the regional turbulence.

While the US and its Western allies are shunning the Russia-backed routes despite potential cost savings, major Asian and Gulf economies have shown interest.

Still, significant hurdles remain. Outdated Iranian infrastructure is holding up the development of the I n t e r n a t i o n a l N o r t h S o u t h Transportation Corridor connecting India to the European part of Russia. And even as accelerating climate change melts Arctic ice to make the Norther n Sea Route, or NSR, a more viable option, formidable logistical challenges remain along

Russia’s remote coastline.

Russia issued a 1.3 billion euro ($1.4 billion) loan to Iran last May to build a vital missing rail link that will stretch 162 kilometers (101 miles) to connect the city of Rasht along the Caspian Sea coast to Astara on the border with Azerbaijan. Once completed, the railway will allow cargo supplies from St. Petersburg to Bandar Abbas, Iran’s main export port on the Persian Gulf.

“Its construction will allow us to create direct and uninterrupted railway transportation along the entire length of the North-South route,” Putin said during a video conference with Iranian counterpart Ebrahim Raisi “This will help considerably diversif y global transport flows.”

NEW DELHI: The National Capital Region in the first quarter of calendar 2024 added 2.3 million square feet of fresh Grade A industrial and warehousing space to take the overall supply to nearly 7 million square feet across the top-5 markets, according to a new report released by property consultancy Colliers.

Gross absorption of real estate within the segment during the January-March period matched supply at 7 million square feet, the report added.

“With a Grade A supply pipeline of about 23-25 mn sq ft for the year 2024, supply is likely to closely follow demand trends across the top five cities of the country,” said Vimal Nadar, who is a senior director and head of research at Colliers India.

Meanwhile, vacancy levels increased by 120 basis points quarter-

on-quarter to 11 per cent on account of “churn and exits in the industrial and warehousing space,” the report noted.

Demand was led by third party logistics players, which accounted for o v e r 4 0 p e r c e n t o f t h e t o t a l warehousing space taken up during the quarter

Interestingly, the cumulative share of retail, engineering and automobile players rose to 40 per cent during the three month period, from 26 per cent in the corresponding quarter of 2023.

“ T h i s s i g n i f i e s c h a n g i n g consumption patterns and hints at opportunities emerging in the sector f r o m t h e s t e a d y d e m a n d diversification,” Vijay Ganesh, managing director for industrial and logistics services at Colliers India, underscored.

The report highlighted that the ecommerce segment has exhibited robust growth post the Covid-19 pandemic with 2 3 times leasing during Q1 2024 versus the same quarter in the year-ago period.

“With increased focus on digital i n f r a s t r u c t u r e a n d c h a n g i n g consumption patter ns, the ecommerce segment is further likely to warm up and create more demand for warehouses,” the report said, adding that the rise of quick commerce players is also likely to catalyse demand for bigger hub-warehouses.

G e o g r a p h i c a l l y, l e a s i n g i n Chennai stood out with space take-up during the first quarter at almost twice the figure in the corresponding period of 2023. Overall, Bhiwandi in Mumbai was the most active market with 1.7 million square feet of Grade A warehousing demand in Q1 2024.

NEW DELHI: The head of the International Maritime Organisation (IMO) is “very confident” that the shipping industry is on track to finalise by next year how it will reach goals to reducegreenhouseemissions

“ E v e r y t h i n g i s m o v i n g i n accordance to the timetable, and then we will make the decisions in 2025,” Mr Arsenio Dominguez told reporters in an interview on April 19 to wrap up the Singapore Maritime Week.

The global shipping industry is aiming to achieve net-zero emissions by 2050, and has set emissions targets for 2030 and 2040.

These targets are up from those set out in 2018, which called for a 50 per cent cut in greenhouse gas emissions and had no absolute

emission reduction targets for the years before 2050.

IMO had announced its revised strategy to cut greenhouse gases in 2023. The measures that will be taken in the intermediate term are due to be approved in 2025, and come into force in 2027.

Net-zero emissions mean the overall balance of greenhouse emissions produced is equal to the amount of such emissions being taken out of the atmosphere.

Mr Dominguez, who became IMO’s secretary-general on Jan 1, 2024, said the agency is working with external consultants to analyse the impact of different scenarios for the industry to achieve its target.

This is while discussions are

ongoing with stakeholders to understand their concerns.

The IMO is also developing the technical and financial framework to enable the industry to achieve the targets, he added.

As an agency under the United Nations, IMO is the global standardsetting authority for safety, security and environmental performance of international shipping It has 176 member states, including Singapore, which joined in 1966.

C l e a n e r m a r i n e f u e l s l i k e methanol are seen as a way for the industry to cut emissions. Using such fuels requires different engine technologies and infrastructure, and operators must also know how to handle the fuels safely.

m.v. “MSC ANITA” Voy : FD411E

I.G.M. NO. 2374639 Dtd. 19-APR-24 Exch rate 85.94

The above vessel has arrived on 21-04-2024 at MUNDRA PORT with Import cargo from BARCELONA, GENOA. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 21-04-2024 at MUNDRA PORT with Import cargo from VALENCIA. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 21-04-2024 at MUNDRA PORT with Import cargo from HALIFAX, MONTREAL, VALENCIA. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 21-04-2024 at MUNDRA PORT with Import cargo from ITAPOA, NAVEGANTES, PARANAGUA, MONTREAL, DJIBOUTI, ORAN, SOKHNA PORT, BARCELONA, VALENCIA, LIVERPOOL, PORTBURY, RIJEKA, ANCONA, CAGLIARI, CIVITAVECCHIA, GENOA, NAPLES, LA SPEZIA, TRAPANI, TRIESTE, VENICE, AL 'AQABAH, KOPER, TUNIS, MERSIN, SAMSUN.

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo. - Charges enquiry on land line -

MUMBAI: A.P. MollerMaersk (Maersk) announces a significant upgrade to its ME2 ocean service. As of third week of April, the ME2 service will include port calls to key destinations in North Europe, namely Rotterdam, Felixstowe, and Bremerhaven.

The future port rotation of the ME2 service will be Port Tangier – Algeciras – Rotterdam – Felixstowe –Bremerhaven – Port Tangier – Salalah – Jebel Ali –Mundra – Nhava Sheva – Port Tangier.

This strategic extension of the ME2 service to key destinations in North Europe will benefit North India’s exporters, particularly those in the lifestyle and retail sectors With upgraded service, manufacturers and exporters will get expedited access to important consumer markets in North Europe. The transit times for ocean transports between Mumbai ports and North Europe will be shortened by five to seven days. In the same way, on the backhaul from North Europe to India, the importers for the automotive sector will benefit from quicker transit times for automotive components coming into India.

“Maersk is committed to delivering faster and more reliable ocean services. With the enhancements made to the ME2 service, we are emphasising our commitment towards one of the most important trade routes

By adding port calls to key destinations in North Europe, we are empowering our customers with faster access to the vital market, thereby enabling them to capitalise on b u s i n e s s o p p o r t u n i t i e s a n d i n c r e a s e t h e i r competitiveness,” said, Morten Juul, Head of R e g i o n a l O c e a n M a n a g e m e n t f o r I n d i a n Subcontinent, Middle East & Africa at Maersk.

Despite the expansion, the nominal capacity of the weekly ME2 ser vice will remain unchanged Maersk will add two additional vessels to the rotation t o a c c o m m o d a t e t h e e x t e n d e d c o v e r a g e i n North Europe. This commitment underscores Maersk’s unwavering dedication to providing efficient and reliable logistics solutions that consistently meet its customers’ evolving needs

M U M B A I : T h e Jawaharlal Nehru Port

A u t h o r i t y ( J N PA ) , a l e a d i n g c o n t a i n e r handling Port in India, marked a significant milestone in its journey towards sustainability with the announcement of its Zero Emission Trucking (ZET) initiative

The Chairman of JNPA, Mr. Unmesh Sharad Wagh, participated in a Round Table Convening on Zero Emission Trucking, an event aimed at fostering collaboration among stakeholders involved in designing and implementing ZET port pilots. This initiative underscores JNPA's commitment to reducing carbon emissions and improving air quality in and around its operations.

Recognizing the critical role of decarbonizing truck movements, especially within port premises, JNPA has embarked on an ambitious plan to transition its truck fleet from diesel to electric power Currently, the majority of trucks operating within JNPA run on diesel, contributing to emissions and pollution. By transitioning to Zero Emission Trucks (ZETs), JNPA aims to achieve its vision of a fully electrified port, aligning with national sustainability goals such as the Harit Sagar guidelines and MIV 2030.

JNPA is actively incorporating green energy for terminal operations and replacing diesel-operated Internal Terminal Vehicles (ITVs) with Electric ITVs (E-ITVs) to further reduce carbon emissions. The 15+ trucks plying on ITRHO handling Inter Terminal Rail Operations will be converted to E-ITVs within the next six months, followed by the conversion of