AHMEDABAD: Shri Samir J. Shah, Chief Mentor and Director, JBS Academy Private Limited conferred with the European Continental University award for International Entrepreneurial Learning Excellence for Exceptional Innovativeness by Prof. Ralph Thomas, Executive Governor General and Trustee of UK Professional Awarding Institutions and Prof. Dr. Satish Visavadia,Dean/ViceChancellor... Cont’d. Pg. 10

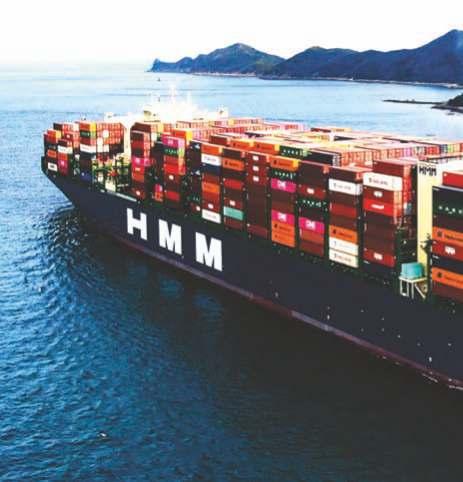

MUNDRA / GANDHIDHAM: Transworld Shipping and Logistics Ltd and their Principal Ignazio Messina & C, Spa, Genoa, achieved another milestone in project cargoshippingsolution,withhistoricloadingperformance onvesselJolly Quarzo at Mundra Port.

Pg. 10

MUMBAI: The Centre is planning to takeoverstatehighwayswithhigh-traffic density to develop 4 or 6 lane highways and then recover investments through toll collection within 12-13 years, UnionMinisterNitinGadkarisaid.

Addressing an event organised by Association of National Exchanges MembersOfIndia(ANMI),Gadkarisaid the Government is planning to construct a green express highway between Mumbai and Bangalore to reducejourneytimetofivehours.

“The Ministry of Road Transports and Highways is planning to take over the State Highways with high traffic

densityfromtheStateGovernmentsfor aperiodof25years.

“Thereafter, those State Highways will be converted into 4 or 6 lane highways and then the Centre will collect toll from those highways,” an officialstatementsaidquotingGadkari.

The Road Transport and Highways Minister said that as many as 27 green express highways are coming up in the Country.

“After a period of 12-13 years, the investmentswillbefullyrecoveredfrom those State Highways along with interest and land acquisition costs,” he added. As per the statement,

Gadkari urged that investments in the infrastructuresectoroftheCountrywill be risk-free and yield good returns and called for cooperation in the investment forinfrastructure.

“The financial markets need to come up with innovative models to fund India’s Infrastructure growth. We are invitinginvestmentsinthePPPmodel,” he said. The minister emphasised that the Centre has given the highest priority to the development of infrastructureintheCountry.

Gadkari also said that just like the National Water Grid, he wants to developaNationalHighwayGrid.

Cont’d. from Pg. 4

Transworld Shipping and Logistics Ltd., and Ignazio Messina Line, loaded 16 Steel Pressure Tanks weighing upto 50 M.T. on state of art RORO-Container ships that are world largest RORO - Container ship every deployed. The RORO-Container vessel Mv Jolly Quarzo Voy 265- Sailed from Mundra on 26th September 2022.ThisisthehighestvolumeofSteelPressure TankoverMAFIeverloadedpersinglevesselcall fromAdaniTerminalsinceitsinception.

Transworld Group and Messina Line with a mission to create value with innovation, service excellence and technology having Customer centrality as their core value offers greater ability and experience in developing avant-garde solution for shipping project and rollingcargooutofIndia.

Messina Line operates and serves Indian trade with State of Art and biggest RORO-CONTAINERSHIPS every deployed on regular service on Indian ports that offer larger loading capacity, more efficient solution for shipping complex and heavy project cargo with higherenvironmentalcare.

Transworld Group & Messina Line would like to express their sincere gratitude to Adani Ports, Mundra for wholehearted support &cooperation.

Transworld Shipping and Logistics Ltd, as Agents forMessinaLineofferregularservicestocatertoRolling

cargoes, Complex Project cargo, Static cargo on MAFI and containerized cargo out of India to various destinationsinMiddleEast-RedSeaArea,East/South/ WestAfrica,NorthAfricaandMedit-EuropeArea.

Award presented by Ralph Thomas, Execu�ve Governor General and Trustee of UK Professional Awarding Ins�tu�ons and Prof. Dr. Sa�sh Visavadia, Dean/ Vice Chancellor, London School of Media and Management Cont’d. from Pg. 4 ... London School of Media and Management on their visittoJBSAcademyPrivateLimitedatAhmedabad.

Prof. Ralph Thomas, Executive Governor General and Trustee of UK Professional Awarding Institutions and Prof. Dr. Satish Visavadia, Dean / Vice Chancellor, London School of Media and Management conferred on Shri Samir J. Shah, Chief Mentor and Director, JBS Academy Private Limited with the European Continental University award for International Entrepreneurial Learning Excellence for Exceptional Innovativeness.

On the occasion of the conferment ceremony Prof. Ralph Thomas profusely praising the passion of Shri Samir J. Shah, Chief Mentor and Director, JBS Academy Private Limited towards creating a professionally operated Logistics sector from essentially a family driven business through providing exclusive domain based skills training and his continuing stupendous efforts inspite of the not so encouraging

response mentioned that the purpose of his mission has led to the recognition on the recommendation of London School of Media and Management.

Prof.Ralphalsoacknowledgedthepivotalroleplayed by Shri Shah in establishing the Academy and his contribution to the Logistics fraternity. His vast experience and expertise have helped countless students gain a better understanding of the little known Logistics sector and its importance for the business operations.

ThiscertificateisatestamenttoMrShah'sdedication to his students and his commitment to providing them withthebestpossibleeducation.

We are proud to present him an award and look forward to see the growth story of JBS Academy and their students with the high-quality education and wishedhimagreatjourney.

CJ-I MV Venus J DBC 23/10

CJ-II MV Autumn Sea Aashirvad shpg. 26/10

CJ-III MV Suvari Kaptan DBC 22/10

CJ-IV MV Luzon Seacoast 27/10

CJ-V MV Silver Oak Aditya Marine 22/10

CJ-VI MV Hai Chang Arnav shpg. 23/10

CJ-VII MV Honwin Cross Trade 22/10

CJ-VIII MV Anne Chowgule Bros. 23/10

CJ-IX VACANT

CJ-X MV Gautam Ananya Ocean Harmony 23/10

CJ-XI VACANT

CJ-XII MV SSL Gujarat Transworld 22/10

CJ-XIII MV Chandrakant Chowgule Bros. 31/10

CJ-XIV MV AS Elenia Benline 24/10

CJ-XV MV Lagrange Cross Trade 22/10

CJ-XVA MV Fortune ARK Arnav shpg. 24/10

CJ-XVI MV Sagarjeet Mihir & Co. 22/10

Tuna Tekra Steamer's Name Agent's Name

MV Lausanne Dariya Shpg. 22/10

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I MT LPG/C Kruibeke

OJ-II MT Chemroad EcoJ M Baxi 22/10

OJ-III MT Chem Gallium Samudra 22/10

OJ-IV MT Silver Gertrude Interocean

21/10 MV Aktea R GAC Shpg.

6,000 T. SBM In Bulk 2022101166

Stream MV Amira Sara Interocean South Arabia 25,000 T. Sugar Bags 2022091221

CJ-VIII MV Anne Chowgule Bros. China 54,313 T Salt Stream MV Appaloosa Interocean 29,090 T. Sugar Bags 2022091338

CJ-II MV Autumn Sea Aashirvad shpg. 33,750 T. Rice in Bags 2022101110 2323984 CJ-XIII MV Chandrakant Chowgule Bros. West Africa 50,000 T. Rice In Bags 2322736 Stream MV Dawn Madurai MK Shpg 22,000 T. HSD Stream MV Golden Light 9 Mihir & Co. 27,000 T Salt CJ-VI MV Hai Chang Arnav shpg. Egypt 34,960 T. Coking Coal 2022101168 2324314 CJ-XV MV Lagrange Cross Trade 55,046 T Salt 2022101146 2324220 CJ-IV MV Luzon Seacoast 52,500 T. Rice In Bags Stream MV Majesty Star ACT Infra Africa 28,000/901 T. Bagged Rice/P Cargo Stream MV Massa J DBC Port Sudan 28,800 T. Sugar (50 Kgs.) 2022101029 2323357 02-Nov MT Oriental Cosmos Allied Shpg. Rotterdam 3,000 T. C. Oil 2022101156 22/10 MT Oriental Sakura Allied Shpg. Italy 15,000 T. C. Soda 2022101177 23/10 MV Pac Alcamar Tristar Shpg. 23/2,000/2,700 T.Wind Mill/I.Beams/S.Pipes 2022101064 25/10 MV Propel Glory ACT Infra U. A. E. 12,600/11,400/33,000 T.Feldspar/Kaolin/Ka 24/10 MV Propel Progress ACT Infra Tuticorin 15,000 T. Slab Stream MV Saga Morus Arnav shpg. U.S.A. 18 No. Wind Mill 2022101033 2323409 CJ-V MV Silver Oak Aditya Marine 5,000 / 5,500 T.Rice J Bags/Rice Bags 2323591 CJ-III MV Suvari Kaptan DBC Somalia 9,500 T. Rice/Sugar Bags 2022091349 2323057 Stream MV Tan Binh 135 Tauras 27,800 T. Iron Ore Fine CJ-I MV Venus J DBC Port Sudan 29,700 T. Sugar Bags 2022091150 2321750

Berth

Agent

From

24/10 MV Apollo Bulker Benline Port Sudan 31,783 T. S. Scraps CJ-XIV MV AS Elenia Benline 33,008 T. S. Scrap 2022101070 1549 2324225 22/10 MV Bao Jia MNK & Co. 38,500 T. Rock P. In Bulk 22/10 MV Capricorn Confidence Tauras 59,500 T. DAP CJ-XVA MV Fortune ARK Arnav shpg. Neitherland 38,380 T. Steel Scraps 2022101181 1567 2324459 CJ-X MV Gautam Ananya Ocean Harmony 2,099 T. Coal Fines CJ-VII MV Honwin Cross Trade 25,706/29,182 T. DAP/NPK 2022101145 1555 2324204 21/10 MV Hui Xin 18 B S Shpg. 33,822 T. GYPSUM Stream MV IYO DBC Japan 8,387/2,369/70/846 CRC/S 2022101137 1569 2324372 BAR/Coil /Machine Tuna MV Lausanne Dariya Shpg. 54,999 T. Petcoke 24/10 MV Lordship Tauras 1,25,056 T. Coal 2022101212 Stream MV Meghna Freedom Croos Trade 44,000 T. MOP Stream MV Sea Hero Rishi Shpg. Malaysia 23,432 CBM T Logs 2022101068 1531 2324100 22/10 MV Seastar Vulcan Interocean South Arabia 39,000 T. DAP

Due/Berth Vessels Name Agent From Cargo Details

Stream MT Ardmore Encounter J M Baxi Malaysia 34,000 T. CDSBO 2022101189 Stream MT Argent Gerbera JM BAxi Durban 5,991 T. Chem. 2022101060 1483 2323599 21/10 LPG Berlian Ekuator Nationwide 20,000 T. Propane & Butane OJ-III MT Chem Gallium Samudra Rotterdam 4,201 T. Chem. 2022101111 1540 2324026 23/10 MT Chemroad Hawk J M Baxi Houston 5,900 T. Chem. 2022101190 OJ-II MT Chemroad Eco J M Baxi Malaysia 16,475 T. Palm Oil 2022091362 1442 2323313 23/10 MT Chemroad Quest Samudra Kuwait 14,458 T. Chem Stream MT Chemroute Pegasus J M Baxi Houston 23,000 T. Chem. 2022101118 1571 2324507 Stream MT Corona B S Shpg. 5,000/12,000/8,000 T. CPO/RBD/PFAD

Stream LPG/C IGLC Dicle Seaworld 21,400 T. Propane Butane 2022101167 1570 2324482 Stream LPG/C Eupen Nationwide 20,178 T. Propane/ Butane 2022091414

Stream MT Hafina Azurite Interocean Indonesia 16,500 T. Chem. 2022101127 1564 2324410 21/10 MT Hafinia Henriette Interocean Thailand 21,000 T. Naptha 25/10 MT Global Glory Delta Water 36,497 T. Phos. Acid 1547 2324218 Stream MT Kanazawa Samudra Sohar Oman 8,680 T. Chem. 2022091298

Stream LPG/C Kent Samudra Neitherland 11,166 T. Propane/ Butane 2022101185 1573 2324426 Stream MT Kokako Interocean Thailand 21,000 T. CPO 2022101049 1534 2324065

24/10 MTM Fairfield Jamesh Mack 9,500/7,000/1,500 T. CPO/PFAD/RBD

25/10 MT MTM Mumbai Interocean Brazil 25,000 T. CDSBO 2022101133 21/10 MT Navig 8 Gladiator Interocean Thailand 31,000 T. MS. Stream MT Nocturne GAC Shpg. Singapore 6,000 T. Chem. 2022101114 1546 2324216 22/10 MT Nord Stingray Interocean Argentina 31,500 T. CDSBO/CSFO Stream LPG/C Seasurfer Interocean Indonesia 10,237 T. Ammonia 2022101162 1563 2324322 OJ-IV MT Silver Gertrude Interocean Argentina 27,000 T. CPO/ RBD 2022101044 1508 2323820

Maverick Interocean 25,000 T. MS

Ploeg Samudra

Arctutus

5,477 T. Chem.

14,000 T.

B-12 VACANT

WB-01 MV Mandalena Oldendorff GAC Shipping WB-02 MV Falcon Confidence Taurus 23/10 WB-03 MV Kyla Fortune Taurus WB-04 VACANT

VESSEL'S AT SPM IOCL VACANT HMEL MT Leo II STS VACANT LNG VACANT

MV Parkgracht Mumbai 20-10-2022 MV Pietersgracht Singapore 21-10-2022

Antwerp 11,000 MT Bentonite In Bulk 223325 22/10 MV Avax Taurus

Singapore 71,880 MT Steam coal 223287 B-1 MV Atlanitc Falcon JM Baxi

Hazira 30,500 MT Crude Soyabean Oil 223304 WB-02 MV Falcon Confidence Taurus

Samarinda 1,54,000 MT Steam Coal 223200 22/10 MT Hua Wei 8 James Mackintosh

Hazira/.... 17,300 MT Crude Palm Oil 223333 WB-01 MV Mandalena OldendorffGAC Shipping I Nacala 1,87,357 MT Steam Coal 223299 23/10 MT MTM Mumbai Interocean

Paranagua 7,500 MT Crude Soyabean Oil 223288 WB-03 MV Kyla Fortune Taurus

Singapore 60,479 MT Steam Coal 223238 22/10 MT PVT Sunrise Admiral Shpg. I Mesaieed 994 MT Alphaplus(R) NAO1-Hexadecene 223337 24/10 MV Sfera Cross Trade I Suez Canal 03-Jan 223335 22/10 MV Thetis Admiral Shpg.

Jorf Lasfar 56,403 MT DAP 223313 24/10 MV Woohyun Sky GAC Shpg. I Mumbai 3,234 MT Steel Coils 223346

Port Tangier, Algeciras, Valencia. (ME-2)

241S 2093071 Maersk Line Maersk India Port Qasim, Salalah. (MAWINGU)

X-Press Euphrates 22041 2103212 Transworld Feeder Transworld Shpg Jebel Ali, Sohar (NMG)

Simatech MBK Logistics X-Press Feesder SC-SPL

Inter Sydney 0117 2093199 Interworld Efficient Marine cc, China. (BMM) 24/10

Maersk Genoa 242W 2103149 Maersk Line Maersk India Salalah. (ME-2) 25/10

25/10-AM Oceana 896S 2103247 Unifeeder Transworld Shpg. Jebel Ali (MJI) 26/10

25/10-AM Wadi Bani Khalid 2226 2093207 Oman Container Seabridge Marine Sohar, Jebel Ali, Dammam. (IEX) 26/10

25/10-AM SSL Mumbai 2205E 2103258 Milaha Poseidon Shpg Jebel Ali, Doha. (NDX) 26/10 QN Line/Seaglider Seatrade/Seaglider

26/10-AM MPV Clio 2202M 2103003 Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (IRS) 27/10

— TBA TSS Line Sai Shipping Jebel Ali (JKX)

— TBA Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (GIX)

In Port Lana 241S 2093071 Maersk Line Maersk India Port Casina, Mombasa (MAWINGU) 22/10 In Port Contship lex 22007M 2093139 MSR Line Master Logistics Mombasa (JAMBO) 22/10

25/10-AM Oceana 896S 2103247 Unifeeder Transworld Shpg. Maputo (MJI) 26/10

Port Kelang,

Port Qasim. (CIMEX2K)

LOAD FOR U.S.A,

Jebel

(C16)

23/10

24/10

New

(INDAMEX

18-10-2022

Antwerp, Le Havre. (EPIC-II)

Khor Fakkan, Jebel Ali, Jeddah. (IMEX) 22/10

Jebel Ali, Aden, P. Sudan, Djibouti. (RGS) 22/10

Istanbul,Jeddah, Durban, Moputo, Dar-Es-Salaam, Mombasa(INDME) 25/10

Rotterdam,Jebel Ali, Khorfakan, Sohar, Qaboos, Bahrrain, Jubail, Jeddah, 25/10

Yanbu, Port Said, Mersin, Istanbul, Izmit, Ambarli, Izmir (AGIS) 31/10

0026 223268 X-Press Feeder Sea Consortium

Jebel Ali, Khalifa, Khorfakkan. (ASX GULF) 26/10

Transworld Feeder Transworld Group TBA Purdential Global Master Marine Sohar, Jebel Ali & other Gulf Ports.

0139E

073E

One/X-Press

SC-SPL

Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 22/10 KMTC / KMTC India Dubai, Colombo, Port Kellang, Hongkong, Sanghai, Ningbo. TS Line TS Line (I) Colombo, Port Kellang, Hongkong, Sanghai, Ningbo.

KMTC/COSCO

/ COSCO Shpg.

Port Kelang, Hongkong, Qingdao, Pusan, Kwangyang, Ningbo, 25/10 TS Lines Samsara Shpg Singapore, Shekou. (AIS)

223158 Feedertech Feedertech

181 223159 Wan Hai Wan Hai Lines

Port Kelang, Singapore, Leam Chabang.(AGI) 26/10

Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 28/10 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX)

01/11-PM CSL Sophie 912E 223310 Evergreen/ONE Evergreen Shpg/ONE Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 03/11 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC)

05/11-PM KMTC Dubai 2206E 223303 Interasia/GSL Aissa M./Star Shpg

Port Kelang,Singapore, Tanjung Pelepas, Xingang, Qingdao, 06/11 Evergreen/KMTCEvergreen/KMTC (FIVE) TBA RCL RCL Agency Port Kelang, Halphong, Nansha (RWA 1) —

In Port Kota Megah 0139E 223076 One / X-Press One India / Sea Consortium Karachi, Colombo. (CWX) 22/10 KMTC / TS Line KMTC India/TS Line (I)

In Port CMA CGM Titus W1MA 222828 Hapag Lloyd ISS Shipping Colombo (IMEX) 22/10 28/10 28/10-AM Xin Pu Dong 261W 223237 CGM CGM CMA CGM Ag. (I) 29/10 24/10 23/10-PM Xin Yan Tian 073E 223239 KMTC/COSCO KMTC / COSCO Shpg. Colombo (AIS) 25/10 TS Lines Samsara Shpg 25/10 24/10-PM Cosco Hamburg 259 223158 Feedertech Emirates Shipping Colombo.(AGI) 26/10 27/10 27/10-AM Cosco Antwerp 181 223159 Wan Hai Wan Hai Lines Colombo 28/10 COSCO/Evergreen COSCO /Evergreen (PMX) 02/11 01/11-PM CSL Sophie 912E 223310 Evergreen / ONE Evergreen / ONE Colombo.(CISC) 03/11 Feedertech / TSLFeedertech / TSL 02/11 02/11-AM AS Cypria 2243 223265 Hapag ONE Line (I)/ISS Shpg Colombo (MIAX) 03/11 05/11 05/11-PM KMTC Dubai 2206E 223303 Interasia/GSL Aissa M./Star Shpg Colombo (FIVE) 06/11 Evergreen/KMTC Evergreen/KMTC

ETA Cut Off/Dt.Time Vessels Name Voy VCN LINE AGENT WILL LOAD FOR ETD TO LOAD FOR MED., BLACK SEA, U.K., NORTH CONTINENT AND

21/10 21/10-AM Maersk Pittsburgh 241W 22321 Maersk Line Maersk India Algeciras 21/10 28/10 28/10-AM Maersk Denver 242W 22330 (MECL) 28/10

West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 22/10 05/11 05/11-AM MOL Celebration 088E 22341 Ningbo, Sekou, Cai Mep. (PS3) 05/11 23/10 23/10-AM Grace Bridge 242E 22324 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 23/10 06/11 06/11-AM Sofhia I 244E 22342 Ningbo, Tanjung Pelepas. (FM3) 06/11 24/10 24/10-AM Seaspan Chiba 011WE 22336 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 24/10 31/10 31/10-AM Conti Annapurna 017WE 22340 ONE ONE (India) (TIP) 31/10 27/10 27/10-AM OOCL Luxembourg 98E 22339 APL/OOCL DBC & Sons/OOCL(I)

Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 27/10 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 29/10 29/10-AM Seamax Westport 082E 22335 COSCO COSCO Shpg. Singapor, Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 29/10

Salalah, Jebel Ali, Port Qasim. 21/10 28/10 28/10-AM Maersk Denver 242W 22330 (MECL) 28/10 27/10 273/10-AM Montpellier 0022 22337 X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG) 27/10 27/10 27/10-AM SCI Chennai 539 22343 SCI J. M Baxi Jebel Ali. (SMILE) 27/10

21/10 21/10-AM Maersk Pittsburgh 241W 22321 Maersk Line Maersk India

TBA SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC) 17/10

24/10 24/10-AM Seaspan Chiba 011WE 22336 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 24/10 31/10 31/10-AM Conti Annapurna 017WE 22340 ONE ONE (India) (TIP) 31/10 23/10 23/10-AM Grace Bridge 242E 22324 SCI J. M Baxi Colombo. (FM3) 23/10 23/10 23/10-AM EM Astoria 242S 22325 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 23/10 27/10 27/10-AM OOCL Luxembourg 98E 22339 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 27/10 29/10 29/10-AM Seamax Westport 082E 22335 COSCO COSCO Shpg. Karachi, Colombo (CI1) 29/10

TO LOAD FOR US & CANADA WEST COAST 21/10 21/10-AM Maersk Pittsburgh 241W 22321 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 21/10 28/10 28/10-AM Maersk Denver 242W 22330 Safmarine Maersk Line India (MECL) 28/10 22/10 22/10-AM YM Ubiquity 055E 22333 ONE ONE (India) Los Angeles, Oakland. (PS3) 22/10 24/10 24/10-AM Seaspan Chiba 011WE 22336 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 24/10 31/10 31/10-AM Conti Annapurna 017WE 22340 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 31/10

Doha (Arabian

Mundra, King

Gioia Tauro, Tangier, Southampton, Rotterdam,

COSCO

Zim

Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti,

Karachi-Port Muhammad Bin Qasim. (IPAK)

NSICT, Jebel Ali, Salalah, Djibouti, King Abdullah, Port Jeddah, Salalah 25/10 (Blue Nile Express)

Qingdao, Shanghai, Ningbo, Da Chan Bay, Port Klang, Nhava Sheva, 26/10

Evergreen Shpg. AICTPL, Colombo, Port Klang, Singapore, Haiphong, Qingdao. 12/10 RCL/Emirates RCL Ag./Emirates Shpg. (NIX / FIVE / CIX3)

Jebel Ali, Khor Fakkan, AMCTPL, Hazira, GTI, Abu Dhabi 27/10

(ASX) 03/11 Hapag

ISS Shpg./CMA CGM Ag. (I)

HMM

Singapore, Da Chan Bay, Busan, Kwangyang, Shanghai. (CIX) 08/11 HMM HMM Shpg. Santos, Paranagua, Buenos Aires, Itajai, Montevideo. (FIL)

MSC MSC Agency Mundra, Hazira, Nhava Sheva, Colombo, King Abdullah, Damietta, Mersin, Tekirdag, Valencia, Halifax, Baltimore, Savannah, Freeport Container Port (Indus 2)

MSC MSC Agency Abudhabi, AICTPL, Colombo, Iskederan, Tekirdag, Gioia Tauro. (IMED)

Hapag / ONE ISS Shpg./One (I) Mundra, Jeddah, Tangier, Rotterdam, Hamburg, London Gateway, CMA CGM CMA CGM Ag. (I) Antwerp,Tangier, Jeddah, Jebel Ali, Karachi, Nhava Sheva (IOS /EPIC 2)

above vessel has

the

on 20-10-2022

against the B/L

ETA

on 17-10-2022

QTY(m.t.)

In Port Jabal Harim Overseas LLP Indonesia Coal 62775

In Port Golden Day Ambica Logistics Indonesia Coal 73150

In Port Limnos Overseas LLP Indonesia Coal 56200

In Port Star Subaru Overseas LLP Indonesia Coal 40950

In Port Great Pioneer Overseas LLP Coal Indonesia 63053

In Port Star Zulu Samsara Shpg. Metcoke Poland 65000

In Port Huan Hang 99 Samsara Shpg. Coal Russia 75000

In Port Zheng Kai Samsara Shpg. Coal Russia 75000

At

Himani Shpg.

Samsara Shpg.

Shpg.

Interocean Shpg. Urea 45406.327

72500

Saldanha Himani Shpg.

for

from

from

the

for

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

As Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to

NEWDELHI:ThePrimeMinister, Shri Narendra Modi reviewed the work in progress at the site of the National Maritime Heritage Complex at Lothal, Gujarat with the help of a droneviavideoconferencing.

Addressing the gathering, the Prime Minister expressed happiness about the rapid pace of the project. Recalling his address from the ramparts of the Red Fort where he spoke about the ‘Panch Pran’, the Prime Minister underlined ‘prideforourheritage’andstatedthat our maritime heritage is one such heritage handed down by our ancestors.Hepointedout,“Thereare many such tales of our history, which have been forgotten and ways have not been found to preserve them to pass them on to the next generation. How much can we learn from those events of history? India's maritime heritage is also a topic that has been talked about inadequately”, he said. The Prime Minister highlighted the vast spread of India's trade and business in old times and its relations with every civilization of the world. However, the Prime Minister lamented that thousand years of slavery not only broke that tradition but we also grew indifferent towards ourheritageandcapabilities.

Highlighting the rich and diverse maritime heritage of India that has been around for thousands of years, the Prime Minister talked about the

Chola Empire, Chera Dynasty, and Pandya Dynasty from South India who understood the power of marine resources and took it to unprecedented heights. The Prime Minister further added that it led to thestrengtheningofthenavalpowers of the country while also expanding trade from India to all parts of the globe. The Prime Minister also spoke of Chhatrapati Shivaji Maharaj who formed a strong navy and challenged foreign invaders. “All this is such a proud chapter in the history of India, whichwasignored”,ShriModiadded. The Prime Minister recalled the time when Kutch used to flourish as a manufacturing hub for building big shipsandstressedthecommitmentof the Government to revamp sites of historical significance. “Large ships made in India were sold all over the world. This indifference towards heritage did a lot of damage to the country. This situation needs to be changed.”

The Prime Minister mentioned that archaeological excavations have unearthed several sites of historical relevance. “We decided to return these centres of India's pride, DholaviraandLothal,totheformthey were once famous for. Today we are seeing rapid work on that mission”, he said. Lothal, he continued, was a thriving centre of India's maritime capability. Recently, during the excavationnearVadnagar,thetemple

of Sinkotar Mata has been unearthed. Some such evidence has also been found from which information about maritime trade from here in ancient times is available. Similarly, evidence ofhavingalighthouseinJhinjhuwada village of Surendranagar has been found,headded.

The Prime Minister remarked thatalotcanbelearnttodayfromthe urban planning of the remains of the cities, ports and markets recovered in the excavation from Lothal. “Lothal was not only a major trading centre of the Indus Valley Civilization, but it was also a symbol of India's maritime power and prosperity”, he said. He noted the grace of both Goddess Laxmi and Goddess Saraswati on the area and said that there was a time when Lothal port was marked by the flags of84countriesandValabhiwashome tostudentsfrom80countries.

The Prime Minister assured that theNationalMaritimeMuseumbeing builtinLothalwillbeamatterofpride for every Indian when it comes to the maritime heritage of the country.

“IamsuretheLothalwillcomebefore the world with its old splendour”, thePrimeMinisterconcluded.

Chief Minister of Gujarat, Shri Bhupendra Patel was present ontheoccasionwith UnionMinisters Shri Mansukh Mandaviya and Shri Sarbananda Sonowal joining theeventviavideoconferencing.

RIYADH: The Saudi Ports Authority (Mawani) has announced the addition Aladin Express DMCC's shipping service, Gulf-India Express 2 (GIX2), to King Abdulaziz Port in Dammam in a bid to boost direct trade and shipping between the Kingdom and the rest of the world.

The new service will connect the capital of the Kingdom's Eastern Province to the ports of Jebel Ali in the UAE, Khalifa Bin Salman in Bahrain, Hamad in Qatar, and Mundra in Indiaevery two weeks via the vessel Green Ace, which has a carryingcapacityof1740TEUs.

This step is part of the developmental drive undertaken by Saudi ports to elevate ports and the maritime transport sector as well as upgrade its portfolio of services to importers, exporters, and shipping

agents in what is an extension to Mawani's pursuit of strengthening the logistics industry through building world-class logistics parks within and beyond port areas. Similarly, measures such as launching the Smart Ports initiative to deploy and accelerate 5G-enabled digital transformation in local ports fall in line with the goals of the National Transport and Logistics Strategy (NTLS) to position the Kingdom as a global logistics hub linkingthreemajorcontinents.

Last December saw global shipping lines such as Pacific International Lines (PIL), Regional Container Lines (RCL), and China United Lines (CUL) start a weekly shipping service from China to King Abdulaziz Port in collaboration with Saudi Global Ports (SGP). The port's competitiveness and expansionary

plans were further bolstered with the addition of Shanghai and Singapore to PIL's service in June this year, therefore enhancing importandexportoperations.

As part of a recent deal between ShanghaiZhenhuaHeavyIndustries Company (ZPMC) and SGP under the auspices of Mawani, the Chinese state-owned port equipment maker will manufacture three state-of-the-art quay cranes to enable King Abdulaziz Port to receivegiantvessels.

The Port, which ranked fourteenth in the World Bank's Container Port Performance Index (CPPI) for 2021, handled a record 199,609 TEUs last August, thanks to its best-in-class operating and logistical capabilities, continuing development streak, and resolve to scale greater heights in productivity andperformance.

GANDHIDHAM: The port’s infrastructure upgrade will boost the overall economic growth of the region The Centre is looking to upgrade facilities at the Deendayal Port (DP) in Kandla, Gujarat, and has announced projects worth nearly Rs. 300 crore. This investment under the Sagarmala project is expected to reduce the turnaround time, lead to faster evacuation of cargo while enabling mechanisedoperations.

“The infrastructure upgrade at DP port will boost its performanceandimproveoveralleconomicgrowthforthe hinterlandandregion,”aseniorportofficialsaid.

The projects include construction of dome shaped warehouse inside the cargo jetty area entailing a project cost of Rs. 70 crore. The structure has been specially designed to allow extended working height so that there is “more cargo handling capacity”. It will help unload bulk cargo through the use of hydraulics by transport vehicles

Upgrade of plots and storm-water drains in the cargo jetty area will be taken up at a cost of Rs. 80 crore and include addition of utility services. The area under upgradewillbe66hectares.

Another 40-odd hectare will be upgraded at an estimated cost of Rs. 47 crore and it will include improvement in handling and storage capacity inside the custom bonded area. This will boost import-export of drycargoandleadtoincreaseincapacityto8.8lakhtonne.

Doubling of two lanes to four lanes inside the port at an estimated Rs. 87 crore will result in faster cargo evacuation. “It will provide better connectivity to the port from the National Highway and give a face-lift to approach roadstotheport.Theprojectwillalsobenefittheproposed jetties to be developed by the Deendayal Port Authority on aPPPbasis,”atradesourcesaid.

The DP port recorded a growth of 17.22 per cent cargo handling in the first two quarters of FY23, to70.14milliontonnesofcargo.

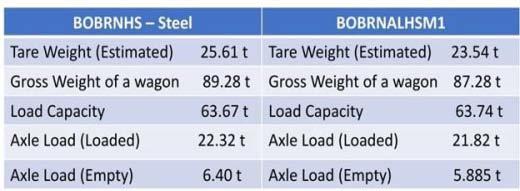

BILASPUR: Union Minister for Railways, Communications and Electronics & Information Technology, Shri Ashwini Vaishnaw inaugurated India’s First Aluminum Freight Rake - 61 BOBRNALHSM1 at Bhubaneswar Railway Station. The rake’s destination is Bilaspur.

ThisisadedicatedeffortforMakeinIndiaprogramasit has been fully designed and developed indigenously in collaborationwithRDSO,HINDALCOandBescoWagon.

• Fully Lockbolted construction with no welding on superstructure.

• The reduced tare will reduce carbon footprint as lower consumption of fuel in empty direction and more transport of freight in loaded condition. A single rake cansaveover14,500tonnesofCO2overitslifetime.

• 80%isresalevalueoftherakes.

• Cost is 35% higher as the superstructure is all aluminium.

• Lower maintenance cost due to higher corrosion and abrasionresistance.

• The tare is 3.25 tons lower than normal steel rakes, 180 ton extra carrying capacity resulting in higher throughputperwagon.

• Higherpayloadtotareratio2.85.

Iron industry consumes a lot of Nickel and Cadmium which comes from import. So, proliferation of Aluminum wagons will result in less import. At the same time, thisisgoodforlocalaluminumindustry.

NEWDELHI:GovernmentofIndiahasallowedexportoriented units and the firms set up in Special Economic Zones to export flour made from imported wheat, a government order said, conceding to the demands of food processorstoallowshipmentsofvalue-addedproducts.

India will allow food processors to import duty-free wheatagainstacommitmenttoexportflour,theordersaid. After a sudden rise in temperatures in mid-March shrivelled the wheat crop, India, the world’s secondbiggestproducerofthegrain,bannedoverseassalesofthe stapletosecuresuppliesforits1.4billionpeople.

Wheat exports from India, also the world’s second biggest consumer of the staple, surged after Russia’s invasionofUkrainehitsuppliesfromtheBlackSearegion,

resultinginajumpinglobalprices.

AfterbanningwheatexportsinMay,thegovernmentof PrimeMinisterShriNarendraModirestrictedwheatflour exportsinAugusttokeepalidonlocalprices.

The ban on wheat exports boosted demand for Indian wheat flour and the country’s flour exports jumped 200% during April-July 2022 from a year earlier, lifting prices in thelocalmarket.

Closeontheheelsofthebanonoverseassalesofwheat, India restricted rice exports as scant rains in the east affected plantingofthemostwater-thirstycrop.

India’s protectionist measures have stoked fears of food shortages in some of the world’s most needy and vulnerablecountriesinAsiaandAfrica.

MUMBAI: Leasing of industrial and warehousing space rose 9 per cent during January-September to 17.5 million square feet across five cities on better demand, according to ColliersIndia.

The gross leasing stood at 16 million square feet across five majorcitiesintheyear-agoperiod.

As per the data, the leasing of industrial and warehousing space in Bengaluru rose 2 per cent to 2.3 million square feet in JanuarySeptember from 2.2 million square feetintheyear-agoperiod.

Chennai saw a 31 per cent decline in leasing to 2.2 million square feet from3.1millionsquarefeet.

The leasing of industrial and warehousing in Delhi-NCR rose 42percentto6.8millionsquarefeetin January-September from 4.8 million squarefeetayearago.

In Mumbai, the leasing went up by 39 per cent to 2.6 million square feet from1.9millionsquarefeet.

Leasing of industrial and warehousingspaceinPunefell11 per cent to 3.6 million square feet during January-September from 4 million square feet in the corresponding periodofthepreviousyear.

Colliers India noted that thirdparty logistics players (3PLs) remained the top occupiers of warehousing space, contributing to

overhalfofthetotaldemand.

Improved retail market sentiment amid the festive season and higher online spending continue to support warehousing growth and is expected toaddtoshort-termdemandaddition.

Tauru road and Luhari remained the most active micro-markets in Delhi-NCR, while Chakan-Talegaon continued to attract industrial occupiersinPune.

“Continued leasing momentum is expectedinthewarehousingsegment with various retail clients in active discussion to consolidate their footprints in large-size mega distribution centres,” said Shyam Arumugam, Managing Director, Industrial & Logistics Services,ColliersIndia.

The National Logistics Policy is expected to have a great positive impact on the logistics sector in the mediumtolongterm,headded.

“Largedealswillcontinuetodrive the warehousing market as e-commerce and 3PL players plan remarkable expansion to enhance efficiency,”Arumugamsaid.

New supply weakened during January-September to 15 million square feet, declining by 20 per cent year-on-year.

Developersremainedcostcautious and were waiting for input pricing to reducefurther,ColliersIndiasaid.

This led to delays in project completion.

In Bengaluru, new supply rose 64percentto1.8millionsquarefeetin January-September from 1.1 million squarefeetintheyear-agoperiod.

In Pune, new supply increased 87 per cent to 2.7 million square feet from1.4millionsquarefeet.

However, in Chennai, the supply fell 23 per cent to 2.2 million square feetfrom2.9millionsquarefeet.

NewsupplyinDelhiNCRdeclined 41 per cent to 5.8 million square feet from9.8millionsquarefeet.

Mumbai witnessed a 27 per cent fallinnewsupplyto2.5millionsquare feet during January-September this yearfrom3.4millionsquarefeetinthe corresponding period of the previous year.

Amid moderate supply and robust demand for industrial and warehousing facilities, overall vacancy levels lowered during the quarter.

The consultant expects rents to firm up in the next few quarters across preferred micro markets in keycitiesowingtostrongdemandand limitedavailabilityofqualitysupply.

“India’s warehousing sector is gradually picking up pace with massive growth in 3rd party logistics,” said Vimal Nadar, Senior Director,ColliersIndia.

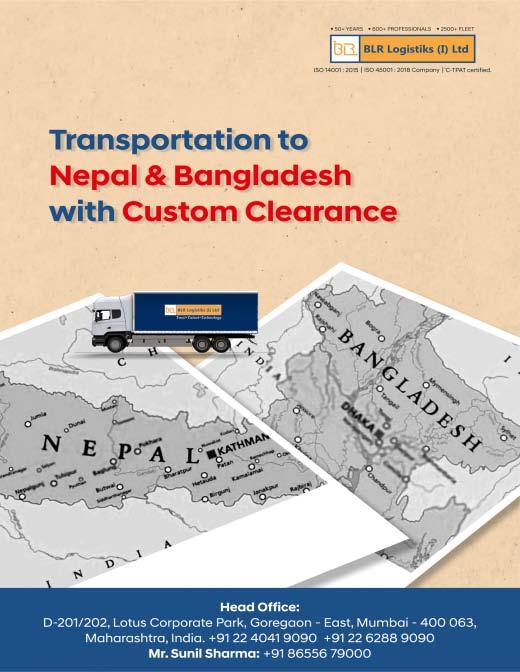

NEW DELHI: Exports to South Asian nations have faltered this fiscal as key markets of Bangladesh and Nepal have restricted purchases mainly to essential products in the wake of foreign exchange crises there. It has added to the woes of Indian exporters as they battle a demand slowdown in major economiesliketheUS,EUandChina.

Latest data showed exports to South Asia contracted 10.5% in August from a year before to $2.1billion.Outboundshipmentsuntil August grew 10.7% to $11.9 billion, underperforming the growth in overall merchandise exports. India’s goods exports rose 10.6% in Augustto$36.9billionand19.5%inthe first five months of this fiscal to $196.4 billion. These nations include Bangladesh, Nepal, Sri Lanka, Pakistan, Afghanistan, Bhutan and Maldives.BarringPakistan,Indiahas been a major supplier to rest of these countries.

Exports to Bangladesh shrank 22.7% in August to $0.89 billion and recorded only an 8.7% rise in the first five months of FY23 to $5.82 billion. Similarly, despatches to Nepal

contracted 11.3% in August to $0.69 billion,whichweigheddowngrowthin supplies until August to just 3% to $3.65billion.

While exports to Pakistan grew 35.9% until August to $304 million, they were primarily driven by a low base and remained way below the level witnessed before the 2019 Pulwama terror attacks that also hit bilateraltraderelations.

Interestingly, India’s exports to crisis-ridden Sri Lanka still grew 39% until August this fiscal, primarily due toNewDelhi’screditlinetotheisland nationforpurchasesofIndiangoods.

New Delhi has extended assistance, including credit lines and currency swaps, worth nearly $4billiontoColombosinceJanuaryto bail out the island nation of its worst forex/economic crisis in about 70 years. While the forex problems of Bangladesh and Nepal are less severeinmagnitude,theyhavereined in imports to conserve dollars, hurtingIndia’sexportprospects.

Given the expected slowdown in global trade, Indian exporters have been bracing for a rough sail particularly in the second half of this

fiscal. From the International Monetary Fund (IMF) to the World Trade Organization (WTO), multilateral bodies have trimmed their global trade forecasts for 2022 and 2023 and even warned of a possible economic recession nextyear.

The IMF has pegged global trade growth at 4.3% for 2022, down from 10.1% in the previous year. Worse, it has forecast a meagre 2.5% growth rate for 2023. The WTO has put out more conservative estimates, as it warned of a “darkened 2023”. It now expects merchandise trade volumes to grow 3.5% in 2022 and just 1%in2023.

Subdued global trade growth will weigh on India’s exports and complicate the country’s efforts to replicate its FY22 stellar performance in this fiscal as well.

India’s exports had hit a record $422 billion in FY22, far exceeding the previousbestof$330billion.Domestic exporters had cashed in on an industrial resurgence in advanced economies last fiscal, which has now lost momentum due to a slowdown in economicgrowth.