GANDHIDHAM: The Gujarat Star Awards – Organised and Managed by Daily Shipping Timesis making a Proud Legacy of entering in its Tenth Year, honouring the successes and excellence of Top Performing Individuals and Companies who have been declared as final winner by the Eminent Jury based on their pastrecordoflastyear.

Gujarat Star Awards is now all set to Glitter Tomorrow at Radisson Hotel – Kandla, ClubLawnfrom5.30PMonwards.

We at Daily Shipping Times express our heartfelt Gratitude to the Trade for their invaluable support since the inception of GSA in the Year 2003 Your immense support and suggestion encourages us to give back to the industry by way of felicitating TopAchieversfromtheTrade.

Cont’d. Pg. 6

Cont’d. from Pg. 2

The Awards Ceremony will also witness an deliberation on “Technology & Digitization : An Inevitable Future” by some of the Eminent Panellists to be moderated by Globally Acknowledged Academician cum Partner of JBS Group of Companies ShriSamirJShah.

Eminent Panellists includes Shri Raju Anthony, Vice President, Abrao Group, Shri Ashish Sheth, Director, Chinubhai Kalidass & Bros. (CKB), Shri Shivaji Prasad, Managing Director, ISSGF India Pvt. Ltd., Shri Prashant Popat,

Director, Velji Dosabhai & Sons Pvt. Ltd. and Shri Dushyant Mulani, PresidentBrihanmumbai Custom Brokers Association (BCBA).

It is a must attend event given the fact this Awards Ceremony will see Top and Senior Most Bureaucrats from the Customs & Ports apart from leading Shipping Lines, Freight Forwarders, Customs Broker, Transporters, Members of Leading Commercial and Maritime Associations under one roof gracingtheTopAchieversoftheMaritimeTrade.

TheAwardsCeremonypresentsanExcellent Networking Opportunity given the presence of Who’sWhofromMaritimeandLogisticsdomain from across India. The Awards Ceremony will have a mix of Gala Entertainment ending withDinner.

*EntrybyInvitationOnly.

CJ-I MV Mercury J DBC 21/01

CJ-II MV Sai Sunshine Sai Shpg. 22/01

CJ-III MV Langcang River BS Shpg. 20/01

CJ-IV MV Altus ACT Infra 25/01

CJ-V MV Jaohar UK Interocean 23/01

CJ-VI MV Yangtze Happiness Arnav Shpg. 20/01

CJ-VII MV Market Porter Interocean 21/01

CJ-VIII MV Indus Victory Divine Shipping 23/01

CJ-IX VACANT

CJ-X MV Bhaskar II Inayat Cargo 22/01

CJ-XI MV Safeen Prize ULSSL 20/01

CJ-XII MV SCI Mumbai J M Baxi 20/01

CJ-XIII MV Clipper Palma ACT Infra 25/01

CJ-XIV MV Kenzen Chowgule Bros 20/01

CJ-XV MV NVL Sirus Cross Trade 24/01

CJ-XVA MV New Spirit BS Shpg. 23/01

CJ-XVI MV Obe Queen Ocean Harmony 24/01 Tuna

CJ-IV

CJ-XIII MV Clipper Palma ACT Infra Africa 30,000 T. Rice In Bags 2023011022

OJ-VI MT Dawn Mansarovar MK Shpg. 12,000 T. FO 2022121114

Stream MV Gautam Krishav Jeel Kandla Porbandar 2,100 T. Silica Sand In Bulk

CJ-V MV Jaohar UK Interocean Sudan 26,083 T. Sugar Bags 2022121114

CJ-XIV MV Kenzen Chowgule Bros. China 58,400 T. Salt 2023011119

Stream MV Mandovi Delta Waterways 2,000 T. Coke Breeze In Bulk

Stream MT MH Langoey Samudra Rabick 9 KT Caustic Soda

CJ-I MV Mercury J DBC Korea 27,150 T. Sugar In Bags 2023011012

Stream MV Neptune J DBC Sudan 23,000 T. Sugar Bags 2022121048

CJ-XV MV NVL Sirus Cross Trade 51,200 T. Salt 2023011162

CJ-XVI MV Obe Queen Ocean Harmony Sudan 40,205 T. Sugar Bags 2022121014

OJ-II MT Oriental Tulip Allied Shpg. Hazira 2,500 T. C. Oil 2022121417

Stream MV Panoria Arnav Shpg. Abidjahan 35,500/ 14,000 T. Rice Bags/Bulk 2022121287

CJ-II MV Sai Sunshine Sai Shpg. Saudi Arabia 17,948 T. Rice Bags (40 Kgs.) 2023011066

22/01 MV SV Aurora Tristar Logistics 18 Nos.Windmill Blade 2023011179

Stream MV TM Hai TA 988 Seacoast 55,000 T. Millscale 2023011198

Stream MV U Thar Chowgule Bros. 14,100 T. SBM 2023011175

Stream MV Yara J DBC Port Sudan 33,000 T. Sugar Bags (50 Kgs) 2022121415

Stream MV Akij Heritage GAC Shpg. Akaba 55,000 T. DAP 2023011058

CJ-X MV Bhaskar II Inayat Cargo Hazira 1,859 T. Coils 20/01 MV Glory Amsterdam Dariya Shpg. U.S.A. 23,000 T. Coal 2023011209

21/01 MV Hope 1 Mitsutor Shpg. 8,609 T. HR Coils

CJ-VIII MV Indus Victory Divine Shipping 87,600 T. Iron Ore 2023011069 20/01 MV Inuyama DBC Japan 1,155 T. CR Coils 2023011182 20/01 MV Iyo DBC Japan 1,477/483/60 T. CRC/S. Pipe/Pkgs. 2023011030 21/01 MV Magic Orion Dariya Shpg. U.S.A. 1,25,200 T. Coal Stream MV Mandovi Delta Waterways 2,000 T. Coal In Bulk 2023011080

CJ-VII MV Market Porter Interocean Saudi Arabia 46,966 T. Urea 2023011092

CJ-XVA MV New Spirit BS Shpg. 58,000 T. Aggregates 01-Feb MV Ocean Tianchen Tauras 10,915 T. MOP 2023011175

CJ-VI MV Yangtze Happiness Arnav Shpg. U.S.A. 29,917 T. Scrap 2023011118

OJ-I LPG/C Bastogne Nationwide 20/01

OJ-II MT Oriental Tulip Allied Shpg. 20/01

OJ-III MT Pacific Citrine Interocean 20/01

OJ-IV MT Exuberant Star

OJ-V MT Ginga Lynx GAC Shpg. 20/01

OJ-VI MT Dawn Mansarovar MK Shpg. 20/01

OJ-I LPG/C Bastogne Nationwide Ras Al Lafan 17,847 T. Propane/Butane 2023011088

Stream LPG/CBerlianEkuator Nationwide 20,000 T. Propane/Butane 2023011149

Stream MT Bow Tungsten GAC Shpg. 17,500 T. Chem. 2023011204

Stream MT Condor Trader Samudra Thailand 1,678 T. Chem. 2023011165 OJ-VI MT Dawn Mansarovar MK Shpg. 3,990 T. LSHS In Bulk 2022121189 22/01 MT Damsgaard J M Baxi Malaysia 19,000 T. Palm Oil

Stream MT Dolphin 03 Interocean 12,000 T. CPO 2023011146 19/01 MT DS Cougar Samudra Malaysia 3,500 T. Chem. 2023011172 24/01 MT Essie C Interocean 30,000 T. CDSBO 25/01 MT Eurochampion Interocean 23,000 T. CDSBO 21/01 MT Fairchem Grutto Shantilal Arjentina 23,160 T. CDSBO 25/01 MT Geum Gang Wilhelmsen South Korea 4,751 T. Chem.

Stream MT Gladys W Interocean Dumai 29,485 T. CDSBO 2023011150

OJ-V MT Ginga Lynx GAC Shpg. Malaysia 5,000 T. Chem. 2023011084 19/01 MT Gulf Mishref J M Baxi Indonesia 12,500 T. CDSBO 2023011185

Stream MT Hari Aradhana MK Shpg. 32,000 T. HSD In Bulk 2023012168

Stream MT Heung A Pioneer Samudra Singapore 8,000 T. Chem 2023011103

Stream LPG/C Jag Vikram Nationwide 20,055 T. Propane/Butane 2023011187

Stream MT MTM Yangon Seaport Brazil 28,000 T. CDSBO 2023011148

Stream MT Myri Joy J M Baxi Houston 18,742 T. Methanol 2023011132

OJ-III MT Pacific Citrine Interocean Arjentina 19,000 T. CDSBO 2022121160 21/01 MT PVT Estella Seaport Indonesia 4,500 T. Palm Prod. 21/01 MT Stolt Vision J M Baxi Dakar 4,952 T. Chem.

Stream MT Verige Interocean Arjentina 15,000 T. CDSBO 2023011163

230036 MSC MSC Agency Vietnam (RWA-1) 20/01 19/01 19/01-AM MSC Alizee III 302B 230186 MSC MSC Agency (I) Jebel Ali, Mombassa. (MOEX) 20/01 20/01 20/01-PM MSC Katrina 251A 230058 MSC MSC Agency (I) Jebel Ali, Abu Dhabi, Hamad, Ad Dammam, Umm Qasar(FAL WB) 21/01 20/01 20/01-AM MSC Mumbai VIII 302A

20/01 19/01-AM

22435

27/01

20/01 27/01 27/01-AM

LOAD FOR FAR EAST,

AUSTRALIA,

ZEALAND AND PACIFIC ISLANDS 21/01 21/01-AM Aka Bhum 11E 23008

& Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 21/01 25/01 25/01-AM OOCL New York 091E 23021

Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 25/01 21/01 21/01-AM MOL Courage 051E 23009 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 21/01 29/01 29/01-AM One Arcadia 063E 23015 Ningbo, Sekou, Cai Mep. (PS3) 29/01 22/01 22/01-AM BSG Bimini 303E 23005 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 22/01 29/01 29/01-AM Sofia 1 304E 23013 Ningbo, Tanjung Pelepas. (FM3) 29/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) (TIP) 30/01 26/01 26/01-AM Seamax Westport 084 23017 COSCO COSCO Shpg. Singapor, Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 26/01

20/01 20/01-AM BIG Dog 0302E23010 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam, Mundra (SHAEX) 20/01 20/01 19/01-AM Maersk Hartford 302W 22435 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 20/01 27/01 27/01-AM Maersk Columbus 303W 23011 (MECL) 27/01

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLSSLS Mangalore, Kandla, Cochin.(WCC)

21/01 21/01-AM Aka Bhum 11E 23008 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 21/01 22/01 22/01-AM BSG Bimini 303E 23005 SCI J. M Baxi Colombo. (FM3) 22/01 22/01 22/01-AM Irenes Ray 303S 23003 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 22/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) (TIP) 30/01 26/01 26/01-AM Seamax Westport 084 23017 COSCO COSCO Shpg. Karachi, Colombo (CI1) 26/01 TBA SCI J. M Baxi Mundra, Cochin, Tuticorin (SMILE) TBA SLSSLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1)

20/01 19/01-AM Maersk Hartford 302W 22435 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 20/01 27/01 27/01-AM Maersk Columbus 303W 23011 Safmarine Maersk Line India (MECL) 27/01 21/01 21/01-AM MOL Courage 051E 23009 ONE ONE (India) Los Angeles, Oakland. (PS3) 21/01 25/01 25/01-AM George Washington Bridge 018WE 23014 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 25/01 30/01 30/01-AM Clemens Schulte 019WE 23020 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 30/01

X-Press Salween 303E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 22/01 X-Press Feeders Sea Consortium Doha (Arabian Star) 22/01 Northern Jamboree IE302A MSC MSC Agency King Abdulla, Sakac, Alexandria El Dekheila, Tekirdag, Aliaga, Mersin. 23/01 29/01 MSC Houston IE303A (India to East Med SVC) 30/01 22/01 MSC Fairfield IP303A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 23/01 29/01 MSC Esthi IP304A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 30/01 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK) 22/01 Seaspan Emerald 13E Zim/KMTC

WASHINGTON: The Biden-led US Government will not remove the higher import duties imposed by the Trump regime on Indian steel and aluminium products until the “fundamental issue’’ of excess capacity and the behaviours that gave rise to the problem are addressed, a senior US Government officialhassaid.

Washington has, however, taken note of the delays in issuance of visas due to disruptions caused by the Covid19pandemicandisdoublingdirecthires at its embassy in India to speed up the process, said Arun Venkataraman, US Assistant Secretary of Commerce for Global Markets, at a media briefing in NewDelhi.

Venkataraman said Washington was upbeat about its growing economic relations with New Delhi and the forthcoming visit of US Commerce Secretary Gina Raimondo in March — to convene the India-US CEO Forum and the US-India Commercial Dialogue with her Indian counterpart Piyush

Goyal — will be a launchpad for significantly enhanced engagement betweenthetwoGovernments.

The new PSE policy, detailed in the FY22 Budget, aims to minimise the presence of CPSEs, including financial institutions, and create a new investmentspacefortheprivatesector Indo-US trade crossed the $160billion threshold in 2021, but both governmentsbelieveitisfarshortofthe potential,hesaid.

“…we are working with the private sector to identify what are the strategic elements that we can change, to create theenvironmenttonotjusthitthat$500billion (India-US bilateral trade) target but move well past that in the long term… what barriers we can remove and what steps the governments can take… It’s our job as government to maximise the opportunities for businesses,”hesaid.

On the long-pending issue of resolvingtheadditionalimportdutiesof

25 per cent and 10 per cent imposed by the Trump Government on certain steel and aluminium products, respectively, from India and some other countries in 2018, Venkataraman said the US was committed to working with all its tradingpartnerstoaddresstheproblem atitssource.

“The situation that gave rise to the duty is a global situation caused by very few players that have distorted the global market through non-market practices, and, as a result, have created a situation of global excess capacity. The Section 232 investigations in the US identified the global excess capacity and the consequences for how steel from other countries was being pushed into the USasanationalsecuritythreat,posing an existential crisis for our steel and aluminium industry. The duties have been put in place to address those concerns and to ensure a certain capacity utilisation on the part of those industries,”hesaid.

NEW DELHI: India has contracted to export about 5.6 million tonnes of sugar since the Government said late last year that mills could ship up to 6.1 million tonnes of the sweetener by May, Government, trade and industry sourcessaid.

Dealers have already shipped about 2.5milliontonnesofthetotalcontracted quantity, said the sources, who asked not to be named because they are not authorisedtotalktothemedia.

Indian mills have exported almost

anequalamountofrawandwhitesugar, with the raw variety sold between $480 and $510 a tonne free on board (FOB) and white sugar at $485-$540 a tonneFOB,theysaid.

India, the world’s biggest producer of sugar and the second biggest exporter, sells the sweetener to countries across Asia, Africa and the MiddleEast.

After record exports of more than 11 million tonnes in the previous season to Sept. 30, 2022, the government allowed

mills to export only 6.1 million tonnes of thesweetenerinthecurrentseason.

Authorities said they could take a view on the second tranche of sugar exports after getting a clearer idea aboutlocalproduction.

The Government will assess production next month, the sources said.

The Indian Sugar Mills Association said that mills have produced nearly 4% more sugar since the current season startedonOct.1.

The above vessel is arriving at MUNDRA PORT 24-01-2023 with Import Cargo in containers.

BL NOS. No. of 20’ 40’

ZIMUBGI0094224 5—

ZIMUCHI904906 —1

ZIMUIAH935566 —5

ZIMUTRT919333 —1

ZIMUTRT919334 —1

ZIMUTRT919336 —1 ZIMUTRT919337 —2 ZIMUTRT919414 —1

BL NOS. No. of 20’ 40’

ZIMUVAN0086776 1

ZIMUVAN951382 —1

ZIMUVAN951449 10

ZIMUVAN951450 —4 ZIMUVAN95145001 —6 ZIMUVAN951474 10 ZIMUVAN951518 —1

BL NOS. No. of 20’ 40’

ZIMUVAN951529 —1

ZIMUVAN951607 —1

ZIMUVAN951709 —2

ZIMUVAN951710 —3

ZIMUVAN951877 —1 ZIMUVAN951916 1— ZIMUVAN951921 2—

Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS OF LADING, duly discharged and on payment of applicable charges. Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods. As Agents :

First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201 Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836) 230433

Export Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@zim.com Mr. Trinath Pal 9824504315 Email:pal.trinath@zim.com

Import Marketing Queries : Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: imp@starship-knd.zim.com

m.v. “ MSC MICHIGAN VII” Voy : XA303A I.G.M. NO. 2332469 (EDI) Dtd. 13-01-2023 Exch Rate 84.16

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804 As Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com

NEW DELHI: As the benefits of PM Gati Shakti National Master Plan — a digital platform mapping details of all infrastructure and logistic facilities in the Country on a geographic information system (GIS) map — becomes apparent, states are mapping their state-specific essential data, relevant for planning physical and social infrastructure on the National MasterPlan(NMP).

“All the States have come on board andaremappingsome29essential data layers related to their infrastructure and logistics facilities/assets on the NMP,” Mr. Surendra Ahirwar, Joint Secretary (Logistics Division), Department for Promotion of Industry and Internal Trade (DPIIT) told.

The data includes those related to land records, forest, wildlife, eco sensitive zones, Coastal Regulation Zone, reserve forest, water resources, rivers, embankments, canals, reservoirs dams, soil type seismicity, flood map, power transmission and distribution, mining areas, roads, water supply pipelines, sewer lines among others.

The logistics division of DPIIT is pilotingtheGatiShaktiMission.

A majority of the states, Ahirwar said, have also set up the institutional mechanism on the lines of PM Gati Shakti such as the empowered group of state secretaries and the Network Planning Group (NPG) to oversee the work that is being done. Under the PM Gati Shakti Mission, right at the top, there is an empowered group of secretaries headed by the cabinet secretary.

Next,thereisabodycalledtheNPG, which has the planning in-charges of seven infrastructure ministries as members. The body meets once a fortnight to look at all project proposals fromacoordinationpointofview.

“The states have set up their empowered group of secretaries and NPG.TheyhavealsocreatedtheirState Master Plan portal, which will eventually be integrated with the NationalMasterPlan,”hesaid.

Mapping the data layers, Ahirwar added, will help states plan their complementary infrastructure better. “For instance, if the PWD plans to lay a new road, it will be able to see in the

StateMasterPlanifthealignmentofthe proposed road is passing through a revenue land, reserve forest or eco sensitive zones. If it falls in some reserve forest land, the alignment can be altered at the planning stage itself. This will help cut delays and ensure smoothimplementationoftheproject.”

The Centre is hand-holding the states in readying their Master Plan and mapping data layers on it. Earlier this month, the Union Finance Ministry allocatedapproximately

Rs 5,000 crore of the Rs 1 lakh crore earmarked under the ‘Scheme for Special Assistance to States for Capital Investment for 2022-23’ to the states for undertaking infrastructure projects underthePMGatiShaktiMission.

So far, 28 states have submitted over 190 projects amounting to Rs 5,000 crore for approval to DPIIT. The projects include multimodal logistics parks, modern aggregation centres, critical connectivity infrastructure for providing last and first mile connectivity to industrial parks, economic zones, developmentofcitylogisticsplan,setting upofPMGatiShaktidatacentresamong others.

NEW DELHI : Responding to December, 2022 Trade Data, FIEO President, Dr A Sakthivel said that merchandise exports in negative territory is on expected lines as the challenges continue due to recession like situation, slowdown and rising inflation in most economies across the globe. Decline in merchandise exports is a reflection of the toughening global trade conditions on account of high inventories, economies entering recession, high volatility in currencies and geopolitical tensions. The drop in commodity prices and restriction on some exports, with a view to stem the price increase in the domestic market, have also affected the

growth numbers. Flight of capital from the market has also impacted the growth process. FIEO President is of the view that the coming months would be quite challenging unless both global economic growth and geopolitical situationimprovesdrastically.

However, decrease in imports is a good sign, which will put less burden on trade deficit front. We hope that the energy prices will come down further to providemorerelief,opinedFIEOChief.

Dr Sakthivel added that in the current situation, the focus should be on providing easy liquidity at competitive cost, extension of ECLGS for one more year till 31.3.2024 by suitably enhancing the moratorium period, restoration of the Interest Equalization support to 5%

and 3% respectively, IGST exemption on freight on exports, which lapsed on 30th September, extension of tenure of PCFC from180daysto365daysandnotification of RoDTEP rates for the holders of Advance Authorization, DFIA and EOU units. Further, the Federation is also of the view that the new TMA scheme for agri exporters and announcement on allocation of export development fund withacorpusofRs5000Crforaggressive overseas marketing by MSME to showcaseIndianproductsgloballyinthe upcoming budget is the need of the hour. He stressed on the need to support exports at the district level with sizeable budgetary support for the District as an Export Hub scheme to bridge the supply sidegaps.

MUMBAI : The leading classification society, Indian Register of Shipping (IRS), is providing classification services for two major newconstruction‘naval’projectsatGoa Shipyard Ltd. A 120m long Floating Dock is being built for the Sri Lankan Navy, under a grant from India. The design and construction of the Floating Dock will be certified by IRS, which will

bring to bear its prior experience in certificationoffloatingdocks.

The second project comprises “New Generation” Offshore Patrol Vessels (NGOPVs) for the Indian Navy. These ships are designed to strengthen maritime security by undertaking a multitude of operational roles, both in ‘blue water’ and in the littorals. These roles include seaward defence,

protectionofoffshoreassets,EEZpatrol, mine warfare, and anti-piracy missions. The vessels will be built as per GSL’s inhouse design and fitted with the most modern equipment. The design of the NGOPVs also incorporates complex navalcombatantvesselfeatures.

The vessels will be validated by a well-qualified IRS team, experienced in technicalanalysisandstealthstudies.

“All the states have come on board and are mapping some 29 essential data layers related to their infrastructure and logistics facilities/assets on the NMP,” Surendra Ahirwar, Joint Secretary

m.v. “MSC MUMBAI VIII” Voy : IE301A

I.G.M. NO. 2332367 (EDI) Dtd. 12-01-2023 Exch Rate 85.21

The above vessel has arrived on 14-01-2023 at MUNDRA PORT with Import cargo from SHUWAIKH, HOUSTON. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Item No. B/L No. Item No. B/L No. 173 MEDUDF124512 174 MEDUKW265350

The above vessel has arrived on 14-01-2023 at MUNDRA PORT with Import cargo from CHARLESTON, HOUSTON. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Item No. B/L No. Item No. B/L No. Item No. B/L No. 162 MEDUD6863846 163 MEDUD6863663 164 MEDUD6907650 165 MEDUD6907619 166 MEDUD6873902 167 MEDUDF125998

Item No. B/L No. 168 MEDUDF126004

The above vessel has arrived on 14-01-2023 at MUNDRA PORT with Import cargo to MUNDRA from SHUWAIKH, HAMAD, MESAIEED, JUBAIL, CHARLESTON, HOUSTON, NEW YORK. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Item No. B/L No. Item No. B/L No. Item No. B/L No. 1 MEDUD6922154 10 DAL206071224 11 MEDUDF082462 12 MEDUDF080193 13 MEDUDF077561 14 MEDUDF079963 15 MEDUDF063082 16 MEDUDF075169 17 MEDUDF083593 18 MEDUDF069741 19 MEDUDF083601 2 MEDUD6906496 20 MEDUDF056102 202 MEDUD6685249 21 MEDUDF046947 22 MEDUDF075672 23 MEDUDF125980

24 MEDUDF077298 25 MEDUDF080391 26 MEDUDF071887 27 MEDUDF080706 28 MEDUDF060963 29 MEDUDF079328 3 MEDUD6908096 30 MEDUDF071861 31 MEDUDF075912 32 MEDUDF077314 33 MEDUDF072042 34 MEDUDF078528 35 MEDUDF077355 36 MEDUDF077231 37 MEDUDF083742 38 MEDUDF079781 39 MEDUDF081951

4 MEDUD6891342 40 MEDUDM479959 41 MEDUDM478407 42 MEDUDM480338 43 MEDUDM479124 44 MEDUDM479033 45 MEDUDM480452 46 MEDUDM477342 47 MEDUDM480429 48 MEDUDM480197 49 MEDUDO335787 5 MEDUD6902933 50 MEDUDO335795 51 MEDUDO335803 52 MEDUD6822123 53 MEDUD6682519

Item No. B/L No.

54 MEDUD6682170 55 MEDUD6789686 559 MEDUDM480742 56 MEDUD6797705 57 MEDUD6692286 58 MEDUD6683715 59 MEDUKW264858 6 MEDUD6793480 60 MEDUKW265103 61 MEDUKW265046 62 MEDUKW265855 63 MEDUKW265640 64 MEDUKW263157 7 MEDUD6845934 8 MEDUDO334210 9 US100990543

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com • www.msc.com

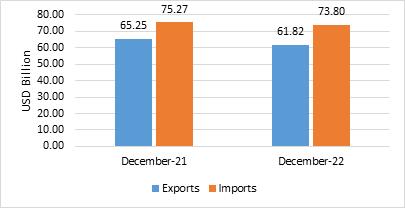

NEW DELHI: India’s merchandise exports declined by 12.2 percent to $34.48 billion in December 2022, as against $39.27 billion recorded in the same month of the preceding year, as per the government data shared on January 16. This comesaftera0.6percent riseinexports inNovember anda12 percentcontractioninOctober.

India’s overall exports (Merchandise and Services combined) in April-December 2022 is estimated to exhibit a positive growth of 16.11 per cent over the same period last year (April-December 2021). As India’s domestic demand has remained steady amidst the global slump, overall imports in April-December 2022 is estimated to exhibit a growth of 25.55 percentoverthesameperiodlastyear.

India’s overall export (Merchandise and Services combined) of USD 61.82 Billion in December 2022. The exports exhibited a negative growth of (-) 5.26 per cent over the same period last year. Overall import in December 2022 is estimated to be USD 73.80 Billion, exhibiting a negative growthof(-)1.95percentoverthesameperiodlastyear.

Fig1:Overall Trade during December 2022*

• Non-petroleum and non-gems & jewellery exports during April-December 2022 was USD 233.50 Billion, as comparedtoUSD229.95BillioninApril-December2021.

• Non-petroleum, non-gems &jewellery(gold,silver& precious metals) imports were USD 330.78 Billion in AprilDecember 2022 as compared to USD 266.86 Billion in AprilDecember2021

• The estimated value of services export for December 2022 is USD 27.34 Billion, as compared to USD 25.98BillioninDecember2021.

• The estimated value of services import for December 2022isUSD15.56BillionascomparedtoUSD14.94 BillioninDecember2021.

• The estimated value of services export for AprilDecember 2022* is USD 235.81 Billion as compared to USD 184.65BillioninApril-December2021.

• The estimated value of services imports for AprilDecember 2022* is USD 134.99 Billion as compared to USD 105.45BillioninApril-December2021.

• The services trade surplus for April-December 2022*is estimated at USD 100.82 Billion as against USD 79.20 BillioninApril-December2021.

• India’s overall exports (Merchandise and Services combined) in April-December 2022 are estimated to be USD 568.57 Billion. Overall imports in April-December 2022 are estimatedtobeUSD686.70Billion MERCHANDISE TRADE

• Merchandise exports in December 2022 were USD 34.48 Billion, as compared to USD 39.27 Billion in December 2021.

• Merchandise imports in December 2022 were USD 58.24 Billion, as compared to USD 60.33 Billion in December 2021.

Fig2:Merchandise Trade during December 2022

TheresilientgrowthoftheIndianeconomyduringthefirst half of the current financial year, the fastest among major economies, bespeaks strengthening macroeconomic stability. However, global growth forecasts indicate downturn in global economic activity and trade. As per Global Composite PMI report (January 2023), new export orders have been contracting for the tenth successive month in December. The report also indicated that India and Ireland were the only nations to register growth of economic activity inDecember2022.

In spite of the high base, highest ever record of exports last year, India’s overall exports (Merchandise and Services combined) in April-December 2022 is estimated to exhibit a positive growth of 16.11 per cent over the same period last year (April-December 2021). December last year has been the second highest monthly export (Merchandise and Services) during 2021-22. As such, due to high base effect, the overall export (Merchandise and Services combined) of USD 61.82 Billion in December 2022 exhibited a negative growth of (-) 5.26 per cent over the same period last year (December2021).

India’s merchandise exports exhibited a positive (y-o-y) growth in11outof30sectors inDecember ascompared tothe same period last year and imports have increased in 17 out of 30sectors(y-o-y).AmongtheQEcommodity groups,IronOre (185.76%), Oil Meals (53%), Electronic Goods (36.96%), Other Cereals (16.87%), Tea (15.97%), Rice (13.3%), Tobacco (13.07%), Ceramic Products & Glassware (11.67%), Fruits & Vegetables (8.03%), Cereal Preparations & Miscellaneous Processed Items (4.9%), RMG Of All Textiles (1.02%), registeredpositivegrowth(y-o-y)inDecember2022.

• Merchandise exports for the period April-December 2022 were USD 332.76 Billion as against USD 305.04 Billion duringtheperiodApril-December2021.

• Merchandise imports fortheperiod April-December 2022 were USD 551.70 Billion as against USD 441.50 Billion duringtheperiodApril-December2021.

• The merchandise trade deficit for April-December 2022 was estimated at USD 218.94 Billion as against USD 136.45BillioninApril-December2021.

• Non-petroleum and non-gems &jewelleryexports in December 2022 were USD 27.00 Billion, compared to USD 29.52BillioninDecember2021.

• Non-petroleum, non-gems &jewellery(gold,silver& precious metals) imports in December 2022 were USD 36.93, comparedtoUSD35.95BillioninDecember2021.

The exports of Electronic goods during the period April –December 2022 recorded USD 16.67 billion as compared to USD 10.99 billion during the same period last year registering a growth of 51.56%. Exports of petroleum products in April –December 2022 was USD 70.28 billion registering a growth of 52.15% over USD 46.19 billion in April – December 2021. More than USD 6 Billion worth of Smartphones were exported duringtheperiodApril-November2022.

In the Textile sector, Cotton yarns exports declined because there was continuous price rise of raw materials throughout 2022. Exports ofIndian Textile apparels and RMG textiles got a major hit due to recessionary trend in major economies.

Given thecumulative growth until December 2022andthe indicatorsoftheslowdowninglobaleconomicactivity,thereis cautiousoptimismoninternationaltradeinthelastquarterof thecurrentfinancialyear.

m.v. “MSC MARIA ELENA” Voy : IP302A I.G.M. NO. 2332652 Dtd. 15-01-2023 Exch Rate 85

The above vessel has arrived on 17-01-2023 at MUNDRA PORT with Import cargo from NEW YORK. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 17-01-2023 at MUNDRA PORT with Import cargo from NEW YORK. Please note the item Nos. against the B/L Nos. for MUNDRA delivery

The above vessel has arrived on 17-01-2023 at MUNDRA PORT with Import cargo to MUNDRA from MONTREAL, SKIKDA, BARCELONA, PIRAEUS, THESSALONIKI, TRIESTE, AL 'AQABAH, LOS ANGELES, NEW YORK, NORFOLK, SAVANNAH. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Item No. B/L No. Item No. B/L No. Item No. B/L No. 1 MEDUJO132628 10 MEDUQ8044180 11 MEDUQ8044164 12 MEDUD6995507 13 MEDUD6982935 14 MEDUD6986381 15 MEDUD6979394 16 MEDUD6982323 17 MEDUD6974411 18 MEDUD6838228 19 MEDUD6972936 2 MEDUJO132164 20 MEDUD6971490 21 MEDUD6983917 22 MEDUD6992413 23 MEDUD6986696

39 MEDUD6986555 4 MEDUJO132347 40 MEDUD6988585 41 MEDUD6989583 42 MEDUD6934753 43 MEDUD6970708 44 MEDUD6986076 45 MEDUD6987041 46 MEDUD6845348 47 MEDUD6845363 48 MEDUD6988304 49 MEDUDF071218 5 MEDUJO133006

50 MEDUDF079435 51 MEDUDF056359

Item No. B/L No.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com

MUMBAI: Importers in India last week took advantage of the rupee’s recovery against the dollar to hedge their future foreign currency obligations,datashowed.

Average dollar purchases by importers, beyond the spot date, rose to $1.64 billion last week from $1.14 billion the week before, latest data collated by The Clearing Corporation ofIndiaLtd(CCIL)revealed.

The CCIL publishes daily forward trades by clients with a two day lag on itswebsite.

Therupeehadjumped1.7%against the dollar in the week ended January 13,itsbestperformanceintwomonths, thankstobenignUSinflationprint.The data reinforced expectations that the

US Federal Reserve will opt for a smaller interest rate increase on February 1 and that it was near to haltingitsrate-hikingcycle.

“Theoutlookontherupeeremains challengingandthedip(onUSD/INR) was a good opportunity, so volumes returned after the quiet first week of the year,” a foreign exchange sales head at a private bank, who did not want to be named because he is not allowedtospeaktomedia,said.

The rupee’s outlook has been hurt by India’s high trade deficit and weak portfolio flows. Trade deficit, which has cooled from a record of near $30 billion in July, remains high by historicalstandards.

India on Monday, 16th January

reported December merchandise trade deficit of $23.76. Meanwhile, foreign investors have taken out about $2 billion from Indian equities anddebtsofarthismonth.

“Despite the better Fed outlook, therupeeisinadifficultspace,”Kunal Kurani, associate vice president at Mecklai Financial, who is advising clients to buy any significant dips on thedollar,said.

MosteconomistsexpecttheFedto raise rates by 25 basis points each at its next two policy meetings. Futures are pricing-in shallow rate cuts later this year. The importers he advises bought dollars selectively for nearterm maturities last week, from JanuarytoMarch,hesaid.

NEWDELHI:Indiaishopefulthat rupeetradewithRussiawillpickupin the future after the two sides recently spoke about facilitating trade in local currencies, a Commerce Ministry officialsaidrecently.

India has been exploring a rupee trade settlement mechanism with Russia since soon after Moscow invaded Ukraine in February but the

countries have not formalised the rulesyet.

New Delhi has become Moscow's largest oil buyer after China, buying discountedRussiancrudewellbelowa $60 price cap agreed by Western nations while also trying to close a growingtradedeficitwiththeCountry.

Indiaislookingtoenhanceexports of electronic items to Russia, Satya

Srinivas, a secretary at the trade ministry,toldreportersinNewDelhi. The two countries are engaging "at all levels" to resolve issues related to trade barriers and a payments mechanism,Srinivassaid.

Russia, Sri Lanka, Mauritius and Bangladesharesomeofthecountries that are keen on rupee trade with India,headded.

NEW DELHI: India is likely to substantially top up the allocation for ongoing Production-Linked Incentive (PLI) schemes in the February 1 budget after seeing good results, said people with knowledge of the matter. Some new sectors may be included in the programme that seeks to reignite manufacturing in India and boost exports,alongwithothermeasuresto spurinvestments.

Allocations for sectors that have seen a high impact on the ground under active PLI schemes such as electronic manufacturing and IT hardware could be raised. Finance minister Nirmala Sitharaman had in the FY22 budget announced �1.97 lakh crore for PLI schemes that now cover 14 key sectors. This incentive amount, which is for the five-year

period beginning FY22, may be raised inthebudget.

"Overall allocation under PLI could be enhanced... It is a scheme thatisseentobemakinganimpacton the ground," said one of the persons citedabove.

India is keen to send strong signals to global manufacturers eyeing supply chain diversification under their China+1 strategy about its intent to offer an attractive factory ecosystem.

The budget may also extend the lower corporate tax rate of 15% available for new manufacturing investmentsforafewmoreyears.

"Measures to encourage private investment will be one of the areas in focus," said the person cited above,

adding that expanding PLIs is one such measure being actively considered. This would be complemented by easing compliances in multiple areas, the personsaid.

Experts said the government should look at building upon the successoftheprogramme.

"In a short span of time PLI schemes have evinced good interest from businesses and investors," said Vikas Vasal, national managing partner, tax, Grant Thornton Bharat. "There is a need to increase the coverage by adding more sectors to boost manufacturing and exports, besides increasing the outlay in some oftheexistingsectors."

Additionalfundingwon'thaveabig impactonfinances.

NEW DELHI: An increase in the export of rapeseed meal and soyabean meal helped India record a 60 per cent growth in the export of oilmeals during the first nine months of 2022-23.

According to the data available with Solvent Extractors’ Association (SEA) of India, the country exported 28.25 lakh tonnes (lt) of oilmeals durung April-December of 2022-23 against

17.67 lt in the corresponding period of 2021-22,recordingagrowthof60percent.

Export of oilmeals was provisionally reported at 4.33 lt during December 2022 when compared to 1.70 lt in December 2021, an increase of 153.66 percent.

BV Mehta, Executive Director of SEA of India, said the export of rapeseed meal has set a new record of 16.71 lt during first nine months of 2022-

23, and broke the earlier record of 12.48 lt in 2011-12. India had exported 7.13 lt of rapeseed meal during April-December of2021-22.

Currently, India is the most competitive supplier of rapeseed meal to South Korea, Vietnam, Thailand and other Far East countries at $255 a tonne (FOB India) while rapeseed meal (Hamburg ex-mill) is quoted at $405 a tonne,hesaid.

m.v “ZIM ATLANTIC” V-8W

The above vessel is arriving at MUNDRA PORT on 24-01-2023 with Import Cargo in containers.

BL NOS. No. of 20’ 40’ BL NOS. No. of 20’ 40’ BL NOS. No. of 20’ 40’

ZIMUANR81058081 —1

ZIMUHFA384306 1—

ZIMUHFA384540 1—

ZIMURTM81025362 —2 ZIMUFLX09072840 1—

ZIMUIZM22981131 1—

ZIMUIZM22981354 1—

ZIMUMER22981518 6— ZIMUMER22981534 11 ZIMUMER22983011 1—

ZIMUANR81058007 —2 ZIMUFLX09072703 —1 ZIMUFLX09072704 —1 ZIMUIST22981400 11 ZIMURTM0125283 10

ZIMUFLX09072884 —4 ZIMUIST22978788 53 ZIMUCPN106184 —6 ZIMUANR81058034 10 ZIMUFLX090725791 —1

ZIMUFLX090728252 —3 ZIMUHAM81041050 —1 ZIMUIST22980656 2— ZIMURTM81025421 1— ZIMUIST22981812 2— ZIMUIST22980014 6— ZIMUIST22981380 5— ZIMUIZM22981585 4— ZIMUMER22982630 21 ZIMUMER22982644 4— ZIMUMER22982719 15 ZIMUIST22980951 2— ZIMUIST22980968 6— ZIMUIST22981382 3— ZIMUIST22981800 6— ZIMUIST22981804 7— ZIMUMER22982578 3— ZIMUANR81058105 15 ZIMURTM0125482 —1 ZIMUHAM81041058 —2 ZIMUGDY024134 14

ZIMUANR81057945 1— ZIMUZUR801139 11 ZIMURTM0245362 —3 ZIMUZUR801140 14 ZIMUZUR801141 12 ZIMUANR81040541 1 12 ZIMURTM81025526 —1 ZIMUFLX09073013 —4 ZIMUMER22982330 3— ZIMUCST0096109 —4

ZIMUIST22980673 8— ZIMUIST22980868 1— ZIMUIST22981179 12 ZIMUIST22981329 2— ZIMUMER22981726 4— ZIMUANR81058101 —2 ZIMUANR81057854 —1 ZIMUFLX09072843 16 ZIMUFLX09072847 —4

ZIMUFLX09073010 —2 ZIMUFLX09073023 —5 ZIMUFLX09073027 —2 ZIMUFLX09072887 —3 ZIMUCST0096165 —1 ZIMUANR81057876 —1 ZIMUHAM81040626 26 ZIMUANR2100590 —1 ZIMUANR2100592 —1 ZIMUANR81057874 —1 ZIMUMER22982232 10 ZIMUCST00084512 —1 ZIMUANR81058053 —1 ZIMUFLX09072881 —4 ZIMUVAR017603 —1 ZIMUVAR017604 —1 ZIMUVAR017605 —1 ZIMUVAR017606 —1 ZIMUVAR017607 —1 ZIMUVAR017608 —1 ZIMUVAR017609 —1

ZIMUVAR017610 —1

ZIMUHAM81039752 —1

ZIMUIST22981158 3—

ZIMUHAM81040938 —5

ZIMURTM0125282 —4

ZIMUMER22982711 3—

ZIMUHAM0245317 25

ZIMUFLX09072921 14 ZIMUIST22980772 1— ZIMUGDY9001430 —1

ZIMUANR2100599 —1

ZIMURTM81025337 7— ZIMUCST0096182 —5 ZIMUHAM81040733 —1

ZIMUHAM81041010 —1 ZIMUCST0095946 —6

ZIMUIZM22980722 7— ZIMUIZM22980723 8— ZIMUMER22982052 4—

ZIMUMER22982320 4— ZIMUFLX09072794 —2 ZIMUGDY024854 2— ZIMUFLX09072825 —8 ZIMUFLX090728251 —5 ZIMUHFA4296147 —1 ZIMUIST22980449 6— ZIMUIST22980605 8—

ZIMUIST22981087 4— ZIMUIST22981182 2—

ZIMUIST22981272 4— ZIMUIST22981298 4— ZIMUIST22981550 6— ZIMUIST22981552 5— ZIMUIST22981842 2— ZIMUMER22980753 7— ZIMUMER22981474 6— ZIMUMER22982337 3— ZIMUIST22981790 5— ZIMUIST22981791 5— ZIMUHAM81040440 —1

Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS OF LADING, duly discharged and on payment of applicable charges.

Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods.

As Agents :

First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201 Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836) 230433

Export Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@zim.com Mr. Trinath Pal 9824504315 Email:pal.trinath@zim.com

Import Marketing Queries : Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: imp@starship-knd.zim.com

PIPAVAV: APM

terminals Pipavav, one of India’s most efficient ports is pleased to announce the appointment of Mr. Girish Aggarwal as the Managing Director of the company. Mr. Girish Aggarwal has worked in leadership roles in multiple industries such as logistics, IT, consultancy services, and FMCG. He is an experienced leader with proven track record in strategic planning, business performance, supply chain management, stakeholder management during the career spanning morethan25years.

In his previous stint as COO of APM Terminals Mumbai [GTI- Gateway Terminal of India], India’s busiest gateway container terminal, he has delivered strategic and operational progress of the terminal delivering value for the stakeholders, building unified culture with utmost focus on customer satisfaction and safetyattheterminal.

An engineer and IIM-Bangalore pass out, he has

worked in

Commenting on his appointment, Mr. Girish Aggarwal said,“Iamhumbled andexcited tobeapartof APM Terminals Pipavav’s next phase of growth. Our customers and partners have tremendous trust in our capabilities, and we will continue to raise the bar higher byofferingseamlesstradeexperience.”

MUMBAI: Mr. Rajiv Agarwal, Operating Partner (Infrastructure), Essar and Managing Director, Essar Ports in his budget wish list comments : “As Global supply chains reorient in the wake of global events, India is expected to play a huge role as it charts its way to USD 5 Trillion economy andmore. Infrastructure andLogistics sector is expected to play a pivotal role for Manufacturing & Services. They need to be supplemented with enabling policy frameworks and

ensuring availability of low cost borrowing for long gestation projects. The Budget should also look at rationalization of taxes which can not only boost savings & domestic consumption but also investment in new Projects as private sector is expected to play a key role in various projects identified by our Government to makean“AtmaNirbharBharat”.

SINGAPORE: PSA Cargo Solutions participated in the MaritimeONE Digital Challenge in Singapore as part of on-going outreach efforts to engage the community and share about PSA’s supply chain journey, with supportfromthePSAGroupHRteam.

Organised by the Singapore Maritime Foundation (SMF), the Digital Challenge allows industry players likePSACargoSolutions toofferchallenge statements totertiarystudents. Through solving real-life business challenges, the students had the opportunity to be mentored by experienced professionals, gained exposure to key industry players and increased their understandingoftheindustry.

Morethan140studentsfromSingapore’suniversities and polytechnics across diverse fields, such as data science & analytics, logistics & supply chain management, and game design & development, took part in the challenge statements from three participating companies. 11 teams took on the PSA Cargo Solutions challenge! A team from PSA Cargo Solutions and PSA Singapore, led by Eddie Ng, Group Cargo Solutions’ Head of Digital and Data Strategy, mentored and judged the shortlisted teams through to

theGrandFinals.

Through this Digital Challenge, the PSA Cargo Solutions team were able toengage and tap into youthful innovators and problem-solvers in our transformation journey. Students shared that they were better able to “appreciate the importance of decarbonisation and time optimisation when shipping goods”. Eddie Ng added, “We have also gained fresh perspectives from the students in tackling some of the challenges faced by the industry, which will augment our continuous efforts in developing innovative solutions to enable agile, resilient andsustainablesupplychains.”

leadership roles with companies such as Unilever India, Ariba [part of SAP], Genpact, and Arvind GrouppriortojoiningMaersk.