YANG MING MARINE

CORP.

CORP.

AHMEDABAD:AdaniPortsandSpecial Economic Zone Ltd (“APSEZ”), India’s largest ports and logistics company and part of Adani Group, has received approvals from NCLT Ahmedabad and NCLT Hyderabad for acquiring the remaining 58.1% stake inGangavaramPortLimited(GPL)throughthecomposite schemeofarrangement.

With this stake purchase, GPL will become a 100% subsidiaryofAPSEZ.

Commenting on the occasion, Mr Karan Adani, CEO and Whole-time Director, APSEZ said, “Acquisition of

GPL is a key milestone in consolidating our position as India’slargesttransportutilityandinachievingEastCoast & West Coast parity. Gangavaram Port has excellent rail & road network connectivity and is the business gateway to the hinterland spread over eight states. The recent addition of a container handling terminal will enable us to accelerateourgrowthofcargovolumes”.

APSEZ also brings world-class logistics synergies to the table, which will propel Gangavaram Port to a potential cargo volume of 250 MMT. This will boost the pace of industrialization of Andhra Pradesh, added Mr Adani

GENEVA: Mediterranean Shipping Co. (MSC) CEO Soren Toft has warned of some difficult times ahead for the Container Shipping sector. Taking to social media to share his thoughts on how the market and MSC were developing at the end of the thirdquarterToft,CEOofMSC,commented thatthemarketwas“normalising”.

Fo ll ow in g un pr ec ed en te dl y high Container Shipping spot freight rates last driven by supply chain disruption rates on some trades have fallen by as much as two-thirds in recent months and this now bleeding into contract rates as shippers pushed for renegotiations.

AHMEDABAD:

Pr of . Ra lp h Thomas, Professor Emeritus, Lifelong Kn ow le dg e Le ar ni ng a nd Prof. Dr. Satish Visavadia, Dean/ Vice Chancellor, London School of Media and Management visit JBS Academy Private Limited to explore mutual cooperation avenues in knowledge sharing and skill development area and offering internationally valid certification.

Prof. Ralph Thomas, Executive Governor General and Trustee of UK Professional Awarding Institutions and Prof. Dr. Satish Visavadia, Dean/ Vice Chancellor, London School of Media and Management visited JBS Academy Private Limited on 10/10/22 with the objective to explore avenues for mutual cooperation between respective organisations towards facilitating knowledge sharing as also share expertise in skill developmentareas.

• Gets NCLT approval for the acquisi�on of Gangavaram Port

• With the acquisi�on of the remaining 58.1% stake, APSEZ will own 100% of Gangavaram Port; this stake purchase is through a share swap arrangement

• Gangavaram Port is the third largest Non-Major Port capable of handling fully laden super cape size vessels with nine berths and free hold land of 1800 acres

• It is an all-weather deep-water mul�purpose port with 64 MMT capacity and with concession period un�l 2059

• The port is a gateway for a hinterland spread over 8 States across Eastern, Southern and Central India

• In FY22, GPL handled 30 MMT cargo and reported revenue/EBITDA of Rs 1,206 / 796 crore; in the ini�al 6 months of FY23, the port has handled 17.3 MMT cargo

Cont’d. from Pg. 4 Gangavaram Port is located in the Northern part of Andhra Pradesh next to Vizag Port. It is the third largest Non-Major Port in Andhra Pradesh with a 64 MMT capacity established under concession from Government of Andhra Pradesh (GoAP) that extends till 2059. It is an all-weather, deep water, multipurposeportcapableofhandlingfullyladensupercape size vessels of up to 200,000 DWT. Currently, the port operates9berthsandhasfreeholdlandof~1,800acres.With a master plan capacity for 250 MMTPA with 31 berths, GPL hassufficientheadroomtosupportfuturegrowth.

The port handles a diverse mix of dry and bulk commoditiesincludingCoal,IronOre,Fertilizer,Limestone, Bauxite, Sugar, Alumina, and Steel. Gangavaram Port is the gateway port for a hinterland spread over 8 states across eastern,southernandcentralIndia.

GPL will benefit from APSEZ’s pan-India footprint, logistics integration, customer centric philosophy,

operational efficiencies, and strong balance sheet to deliver a combination of high growth by enhancing market share and add additional cargo types and improved margins and returns.

In FY2022, the port handled cargo volumes of around 30 million metric tonnes, generated revenue of Rs 1,206 crore and EBITDA of Rs 796 crore, which resulted in EBITDA margin of 66%. GPL is a debt-free company with acashbalanceofRs1,293croreasofMarch’22end.

The acquisition of GPL is priced at around Rs 6,200 crore (517mn shares @ Rs 120/share). APSEZ has already acquired 31.5% stake in the company from Warburg Pincus and another 10.4% from the Government of Andhra Pradesh during FY22. The acquisition of 58.1% stake from DVS Raju & family will be through a share swap arrangement and will result in issuance of around 47.7mn APSEZ shares to the erstwhile GPL promoters. The transaction implies an EV/EBITDA multiple of around 7.8x (FY22 EBITDA of Rs 796 crore), which is value accretive to APSEZ shareholdersfromdayoneitself.

TM

Cont’d. from Pg. 4

On the occasion of their visit Prof. Thomas and Prof. Dr. Visavadiaalso addressed students of BBA in Logistics the first degree programme launched by JBS Academy Private Limited and the Post- Graduate Diploma Students of Customs Clearance and Freight Forwarding programmes offered under Kaushalya- The Skill University a Government University. Both the visiting dignitaries explained in detail the virtues and benefits of Life Long Knowledge Learning and the value addition it provides tothetraditionalacademicqualifications.

London School of Media and Management was ready to offer their platform for courses offered by JBS Academy Private Limited in the Logistics sector on online mode, conduct assessment at the end of the training and award them Internationally valid and NSQF aligned Certificate of UK Certified Knowledge Association recognised by the Government of UK. London School of Media and Management will award the Certificates at Convocations organised at different citiesacrosstheglobe.

JBS Academy Private Limited will be benefited with the association as the Logistics courses across all the verticals will gain acceptance across the globe and the objective of providing professional workforce for the Logistics through employable education for the job aspirants and contribute meaningfully to the Skill India campaignwillbeachieved.

London School of Media and Management in turn will be offering in India their professional courses and internationalconsultancyandalsoCertificatewhichare globally valid, through the platform of JBS Academy Private Limited thus providing gainful employment to the

youth. This will be an opportunity for the Academy to diversifyitsbasketofskilldevelopmentactivities.

MUMBAI: Indian commodity exporters struggling with freight rates which are yet to get back to the pre-Covid levels and a slowdown in demand from the United States and Europefearthattheirmarginswillbe furthersqueezedbythewithdrawalof goods and services tax (GST) exemptiononoceanandairfreight.

The looming recession threat in western countries has already impacted India’s exports, which have declined in September after remaining flat in August 2022. Exports have shrunk by 3.52 percent in September 2022 to $32.62 billion from a year ago, according to Governmentdata.

The fall is steeper at 9.78 percent when non-petroleum and non-gems and jewellery exports for the month areconsidered.Thereasonattributed to the fall is the slowdown in demand in some developed economies and measures taken to contain domestic inflation and domestic food security concerns.

The Government has decided to discontinue GST exemption on ocean freight at 5 percent and air freight at 18 percent from October 1, 2022. The exemption has been in force since 2018, and it has been extended in the lastfewyearstillSeptember30,2022.

“It is a gross violation of norms thattaxesshouldnotbeexported.Ata time when India is looking to be a $5trillioneconomy,suchmeasureswill have a negative impact on the foreign exchange reserves,’’ said KK Pillai, Southern Regional Chairman of ExportPromotionCouncilforEOUs andSEZs(EPCES).

Both sea freight and air freight rates vaulted during the COVID-19 pandemic, which, together with container shortage, drove exporters to the wall. The sea freight has cooled off somewhat though it is still ruling

higherthanthepre-Covidlevel.

Air freight rates that went up during the pandemic have not come downyet.

“The GST, on top of this, will certainly reflect on our cost and we have no option but to raise our prices,’’ said Susil Adam, MD of Chennai-based JPH Sea Food, which exports live crabs by air to SingaporeandTaiwan.

‘Freightchargesstillveryhigh’

Air freight charges rose to Rs 150-170 per kg from Rs 110 per kg when COVID-19 struck and it still remains at that rate, Adam said. “At a time when our competitors like Sri Lanka, Thailand and Indonesia aregivinghugesubsidies,westandto lose market with such measures. Only a handful of live seafood exporters are left in the Country. Of these, more than half will have to windupifGSTisimposed,”headded.

Theseafreightratesforseafoodto the US have fallen from around $15,000 per 40ft container to around $10,000 nowbutisstillhigherthanthe $4,000 before the pandemic, said JagdishFofandi,PresidentofSeafood ExportersAssociationofIndia.

“The Government had withdrawn incentives like transport and marketing assistance (TMA). Already, we are expecting a dip of around 10 percent in seafood exports in the second quarter due to sluggish demand,’’Fofandinoted. Change in consumer behaviour inUS

The GST on freight will trouble exporters as most of them are seeing a decline in demand in the US and European markets. “Earlier, consumers in the US bought food without looking at the price. But that has changed now and they have become price-conscious,’’ said George Zachariah, CFO of Parayil Exports, which ships an array of food

products, including frozen ready-tocookvegetables,flour,curries,snacks anddesserts.

The raw material prices have increasedby25-30percentandlabour cost too has gone up. “But we are unable to hike prices as the buying power of consumers has dipped. We expect our margins to shrink,’’ hesaid.

Small exporters are certain to be the victims of the move to resume GST on freight rates as they will be hard up for working capital needs. Typically, it takes two to three months to get the refund. “I fail to understand the logic behind the step as the government imposes tax and then gives refunds,” said Ramesh Rajah, President of Coffee Exporters Association.

He said banks are now not keen to lend more funds for working capital needs and the interest rates too have gone up. The export market is also facing headwinds. “Already, customers in the UK are looking for cheaper coffee and if the trend spreads to Italy, India’s biggest coffee buyer, shipments will be hit,’” he pointedout.

The Federation of Indian Export Organisations (FIEO) has sought extension of the exemption for another year. “Agricultural exports are more affected as the value is less and rolling of money becomes difficult,’’ said FIEO President A Sakthivel.

At a time when competition from other countries such as China is becoming more intense and freight rates remain high, such measures will pull the country back in exports, Pillai, who is also the Director of Agricultural and Processed Food Products Export Development Authority (APEDA) and president, Cochin Special Economic Zone (CSEZ),said.

NEW DELHI : Food regulator

FSSAI has made it mandatory for foreign food manufacturing facilities to register with it for exporting products such as meat, milk and infant foods to India. This will be effective from February 1, 2023.

In an order issued recently, the Food Safety and Standards Authority

of India (FSSAI) said that it has been decided that registrations of foreign food manufacturing facilities, falling under five food categories, who are intended to export these products shallbemandatory.

These categories are milk and milk products; meat and meat products, including poultry, fish and their products; egg powder; infant

food;andnutraceuticals.

The FSSAI has requested all competent authorities of exporting countriestoprovidethelistofexisting manufacturers and those who are intended to export these food productstoIndia.

Based on information provided by them, the FSSAI will register these facilitiesonitsportal.

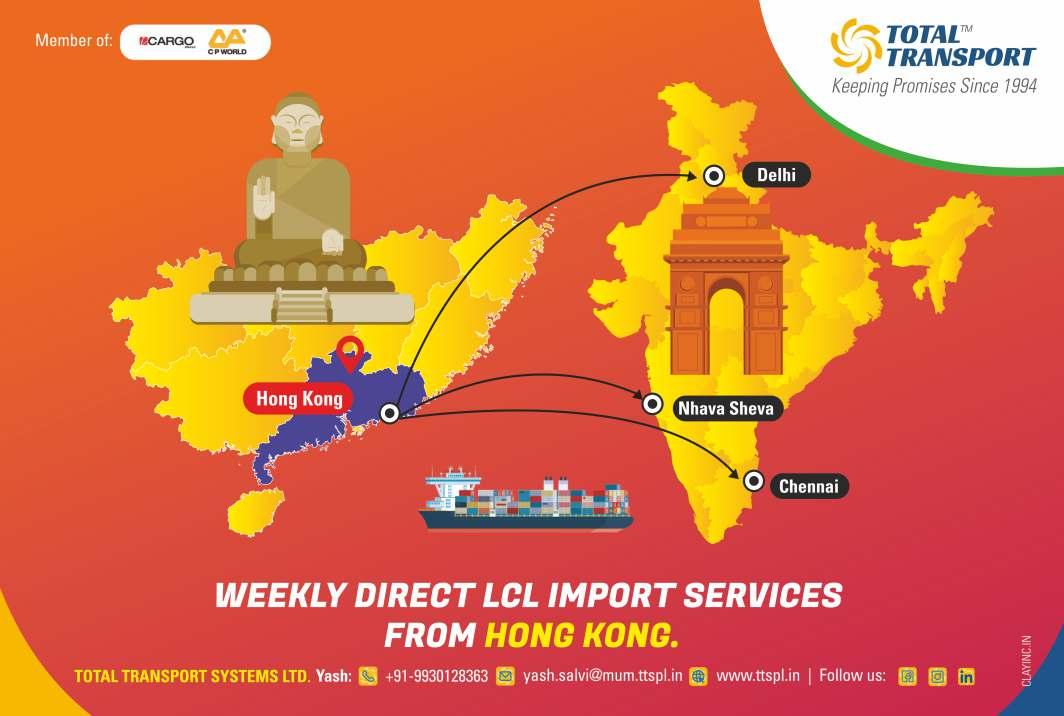

DOHA: A circular service connecting Hamad Port with India, Gulf–India Express 2 (GIX2), has started operations, a move that ought to further enhance and strengthen Doha’s traderelations.

The new service at Hamad Port is operated by Aladin Express, said QTerminals, a joint venture between MwaniQatarandMilaha,inatweet.

The port rotation of the new service is Mundra Port (India) – King Abdulaziz Port (Saudi Arabia) – Khalifa Bin Salman Port (Bahrain) – Hamad Port (Qatar) – Jebel Ali

Port (the UAE) – Mundra Port (India).

The service, which started on September 23 with the 1,740TEU (twenty foot equivalent unit) GREEN ACE, will provide increased opportunities for trade between the countries through direct service and shorter transit time

It will complement the Gulf India Express (GIX) that was launched on April this year with 510TEU URANUS, calling at Mundra, Sohar, Mundra, Sohar, Jebel Ali, Ajman, Ras Al Khaimah,andMundra.

COCHIN: With the Church-led action council hardening its stand, Adani Port, which is implementing the deep-sea Vizhinjam Port project, has served a notice on the Government seeking a compensation of Rs 78.7 crore for the loss incurred due to the protest which has stalled construction works.

Sources said the Adani port has incurred a loss of Rs 78.8 crore till September 30 and the total loss has crossed Rs 100 croreasonOctober8,the53rddaysincetheworkwasstopped due to protest. Meanwhile, Minister for Ports Ahammed Devarkovil expressed confidence that the efforts to find an amicablesolutiontotheprotestwillbearfruitsoon.

CJ-I MV Majesty star ACT Infra

CJ-II

Captain Khaldoun Mystics Shpg.

CJ-III VACANT

CJ-IV MV Daytona Beach Trinity Shpg. 15/10

CJ-V MV IVS Phinda Mihir & Co. 14/10

CJ-VI MV Navios Amber Seascape 15/10

CJ-VII MV Dariya Heera Dariya Shpg. 16/10

CJ-VIII MV Venus Halo DBC 14/10

CJ-X MV Inuyama DBC 15/10

CJ-XI VACANT

CJ-XII MV SSL Kutch Transworld 14/10

CJ-XIII MV Chandrakant Chowgule Bros. 14/10

CJ-XIV MV Hongxin Ocean Chowgule Bros. 15/10

CJ-XV MV Sea Hero Rishi Shpg. 15/10

CJ-XVA MV Bulk Polaris Interocean 18/10

CJ-XVI MV Bellemar Interocean 15/10

Tuna Tekra Steamer's Name

Oil Jetty Steamer's Name

OJ-I LPG/C Berlin Ekuator Nationwide 14/10

OJ-II MT Tong Yong Wilhelmsen 14/10

OJ-III MT Argent Gerbera J M Baxi 14/10

OJ-IV MT PVT Orian

OJ-V MT Stolt Dugong J M Baxi 14/10

OJ-VI MT Dawn Mansarovar MK Shpg. 14/10

MV

MT

Steamer's

MV

MV

MV

MV

MV

MV Silver Oak Aditya Marine

MV Hongxin Ocean Chowgule Bros. 10/10

MV Gautam Ananya Ocean Harmony 11/10

MV China Spirit Chowgule Bros.

MV MSM

MV GCL

MV

Shpg. 10/10

15/10 MV Aktea R GAC Shpg. 6,000 T. SBM In Bulk

Stream MV Amira Sara Interocean South Arabia 25,000 T. Sugar Bags

Stream MV Autumn Sea Aashirvad shpg. 33,750 T. Rice in Bags

CJ-XVA MV Bulk Polaris Interocean Port Sudan 61,020 T. Sugar Bags

CJ-II MV Captain Khaldoun Mystics Shpg Africa 9,900 T. Rice In Bags

CJ-XIII MV Chandrakant Chowgule Bros. West Africa 50,000 T. Rice In Bags

Stream MV China Spirit Chowgule Bros. 34,000 T Salt

OJ-VI MT Dawn Mansarovar MK Shpg. 27,000 T. FO

CJ-IV MV Daytona Beach Trinity Shpg. 25,600 T. Rice In Bags

13/10 MT Elandra Sea Interocean 32,000 T. Naptha

Stream MV GCL Ganga Chowgule Bros. 1,03,800 T Salt In Bulk

14/10 MV Global Unity Aqua Shpg. 44,000 T. Ball Clay In Bulk

CJ-XIV MV Hongxin Ocean Chowgule Bros. 30,000 T Salt Stream MV Luzon seacoast 52,500 T. Rice In Bags

CJ-I MV Majesty star ACT Infra 28,000 / 1,500 T.Bagged Rice / P.Cargo Stream MV Massa J DBC Port Sudan 28,800 T. Sugar (50 Kgs.)

Stream MV Momentum Phonix Genesis 20,750 T. Coking coal

Stream MV MSM Doura Scorpio Shpg. 5,500 T. Aggregate J Bags

13/10 MT Oriental Jasmine Allied Shpg. Hazira 12,700 T. C. Oil 15/10 MV Pac Alcamar Tristar 23/2,000/2,700 T.Wind Mill/I.Beams/S.Pipes

Stream MV Pegasus 1 GAC Shpg. U.A.E. 5,000 T. Rice In Bags

Stream MV Rasha DBC 27,000 T. Sugar Bulk Stream MV Saga Morus Arnav shpg. 18 No. Wind Mill Stream MV Silver Oak Aditya Marine 5,000/5,500 T.Rice J Bags/Rice

13/10 MV Aquavictory Dariya Shpg. Indonesia 75,000 T. IND Coal CJ-XVI MV Bellemar Interocean Brazil 76,610 T. Sugar Stream MV Chamchuri Naree Mihir & Co. 31,476 CBM T Logs

CJ-VII MV Dariya Heera Dariya Shpg. 60,500 T. Coal Stream MV Gautam Ananya Ocean Harmony 2,098 T. Coal Fines CJ-X MV Inuyama DBC Japan 1,144 / 213 T.CR Coils/Steel Pipes

CJ-V MV IVS Phinda Mihir & Co. Uruguay 31,485 CBM Pine Logs CJ-VI MV Navios Amber Seascape 31,476 CBM T Logs CJ-XV MV Sea Hero Rishi Shpg. 23,432 CBM T Logs CJ-VIII MV Venus Halo DBC Australia 36,394 T. Jas Pine Logs 14/10 MV Yu Long Ling ACT Infra 960/7,457/240/88 T.S.Bars/S Pipes/S Coils

Due/Berth Vessels

Name Agent

From Cargo Details VCN No. Manual IGM EDI IGM

Stream MT Andes Samudra 5,001 T. Chem. 13/10 MT Arahan Wilhelmsen 5,623 T. Chem. 15/10 MT Arctutus J M Baxi Malaysia 14,000 T. Palm

Stream MT Ardmore Chippewa J M Baxi Indonesia 15,000 T. Palm OJ-III MT Argent Gerbera J M Baxi Durban 5,991 T. Chem.

Stream LPG/C Bastogne Nationwide 20,000 T. Propane/ Butane OJ-I LPG/C Berlin Ekuator Nationwide 20,000 T. Propane / Butane

Stream MT Bow Flora GAC Shpg. 5,000 T. Chem. 14/10 MT Chem Gallium Samudra 4,201 T. Chem. 14/10 MT Chemroad Echo J M Baxi Malaysia 16,475 T. Palm Oil Stream LPG/C Cheshire Nationwide 20,000 T. Propane / Butane Stream LPG/C Eupen Nationwide 20,178 T. Propane/ Butane 15/10 MT Grand Ace 9 Interocean 20,634 T. MS Stream MT Kanazawa Samudra Sohar Oman 8,680 T. Chem. 13/10 MT Kokako Interocean Thailand 21,000 T. CPO Stream MT Kratos Marine Links 5,811 T. Chem. Stream MV Mild Bloom J M Baxi 16,500 T. Palm 2022101043 Stream MT MTM RotterdamInterocean Argentina 9,999 T PFAD Stream MT Monax J M Baxi Houston(USA) 3,352 T. Chem.

Stream MT Nave Cosmos Interocean Indonesia 23,000 T. CPO Stream MT Silver Gertrude

OJ-V MT Stolt Dugong

15/10

Baxi

Argentina 27,000 T. CPO/ RBD

30,000 T. Phos.

B-12

Meghna Rose BS Shpg. 14/11

WB-01 MV Luise Oldendorff

VESSEL'S AT SPM

Shpg.

MV Silver Oak Mombasa 08-10-2022

12-10-2022

Yamal Orlan

Stream

15/11

Stream

MT Steel Coils 223208

MT Propane / Butane 223257

Tuticorin 19,000 MT Murite of Potash 223166

WB-01 MV Luise Oldendorff GAC Shpg. I Singapore 1,86,807 MT Steam Coal 223204

14/11 MV Lydia Oldendorff Taurus I Singapore 1,65,000 MT Steam coal 223211

B-10 MV Morea Cross Trade I Egypt 60,405 MT Nitro Phosphate with potash/DAP 223163

B-11 MV Parandowski Samsara I Mumbai 281 MT Project cargo 223215

Stream MV Parkgracht JM Baxi E Mumbai 988 MT Project Cargo 222963

Stream MV Pietersgracht JM Baxi E Singapore 822 MT Project Cargo 223187

Stream MV progress Anchor shpg. E Mumbai 3,950 MT S.Bars/Miscellaneous Packages 223233

B-2 MT Radiant Pride Interocean I Port said 31,000 MT Carbon Black feed Stock 223213

B-1 MT Solar Roma GAC Shpg. I Hamriya 5,000 MT Base Oil 223246

B-4 MT Swarna Pushp ISS Shpg. I Vizhinjam port 40,000 MT High speed Diesel 223184

B-9 MV TBC Badrinath Delta Waterways

Tuticorin 33,000 MT Wheat 223235

Tangier, Algeciras, Valencia. (ME-2) 18/10

In Port SSL Mumbai 2204E 2093019 Milaha Poseidon Shpg Jebel Ali, Doha. (NDX) 14/09

18/10 18/10-AM Majd 2221E 2103210 QN Line/Seaglider Seatrade/Seaglider 19/10

13/10 13/10-AM Rosa 210S 2093002 Maersk Line Maersk India Port Qasim, Salalah. (MAWINGU) 14/10

13/10 13/10-AM Contship Lex 2207M 2093139 Prudential Global Master Logistics Sohar, Jebel Ali & Other Gulf Ports. (IRS) 14/10

14/10 14/10-PM Montpellier 0021 2103176 Transworld Feeder Transworld Shpg Jebel Ali, Sohar (NMG) 15/10

21/10 21/10-AM X-Press Euphrates 22041 2103212 Simatech MBK Logistics 22/10 X-Press Feesder SC-SPL

16/10 16/10-AM Gulf Barakah 2227 2103209 Oman Container Seabridge Marine Sohar, Jebel Ali, Dammam. (IEX) 17/10

17/10 17/10-AM Maersk Rubicon 241W 2093202 Maersk Line Maersk India Salalah. (ME-2) 18/10

17/10 17/10-AM Ornella 9 04W 2093110 Unifeeder Transworld Shpg. Jebel Ali (MJI) 18/10

18/10 18/10-PM Inter Sydney 0117 2093199 Interworld Efficient Marine cc, China. (BMM) 19/10

— TBA TSS Line Sai Shipping Jebel Ali (JKX)

— TBA Prudential

13/10 13/10-AM

Mombasa (MAWINGU) 14/10

Traiguen(V-240W) Valencia 11-10-2022

13/10 13/10-PM Yantian Express 2240W 223065 Hapag Lloyd

Shipping La Spezia, Barcelona, Valencia, Tangier, Fos Sur Mer, Genoa, 14/10 CMA CGM

CGM Ag. (I) Marsaxlokk. (IMEX)

15/10 15/10-AM Jolly Cobalto 0288 223080 Messina Transworld Group Nisurata(Libya), Castellon(Spain), Geneo, Naples, Iskderon (INDME) 16/10 16/10 16/10-AM Nagoya Express 2339W 223090 CMA CGM CMA CGM Ag. (I) Jeddah, Tangier, Rotterdam, Hamburg, Lonoon Gateway, 17/10 COSCO/Hapag COSCO(I)/Hapag-Lloyd Antwerp, Le Havre. (EPIC-II)

13/10 13/10-PM Yantian Express 2240W 223065 Hapag-Lloyd ISS Shipping Khor Fakkan, Jebel Ali, Jeddah. (IMEX) 14/10

15/10 15/10-AM Jolly Cobalto 0288 223080 Messina Transworld Group Istanbul,Jeddah, Durban, Moputo, Dar-Es-Salaam, Mombasa(INDME) 14/10

17/10 16/10-PM Northern Dexterity 2240W 223093 Hapag Lloyd ISS Shipping Rotterdam,Jebel Ali, Khorfakan, Sohar, Qaboos, Bahrrain, Jubail, Jeddah, 18/10

COSCOCOSCO Yanbu, Port Said, Mersin, Istanbul, Izmit, Ambarli, Izmir (AGIS) 18/10 18/10-AM GFS Geselle 0059 223205 X-Press Feeder Sea Consortium Jebel Ali, Khalifa, Khorfakkan. (ASX GULF) 19/10 Transworld Feeder Transworld Group

22/10 22/10-AM Kota Nekad 0175W 223232 PIL PIL Mumbai Jebel Ali, Aden, P. Sudan, Djibouti. (RGS) 23/10 TBA Purdential Global Master Marine Sohar, Jebel Ali & other Gulf Ports. —

14/10 14/10-AM Ever Ursula 182E 223039 Wan Hai Wan Hai Lines Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 15/10 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX)

14/10 14/10-AM Celsius Naples 890E 223135 Evergreen/ONE Evergreen Shpg/ONE

Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 15/10

19/10 19/10-AM Shimin 22006E 223108 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC) 20/10

15/10 15/10-AM TS Dubai 22006E 223103 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao, Pusan, Kwangyang, Ningbo, 16/10

19/10 19/10-PM ESL Kabir 2238E 223129 TS Lines Samsara Shpg Singapore, Shekou. (AIS) 20/10

16/10 16/10-AM X-Press Odyssey 22006E 223121 Interasia/GSL Aissa M./Star Shpg Port

25/10 24/10-PM

Pelepas, Xingang, Qingdao, 17/10

Leam Chabang.(AGI) 26/10

Shekou. (CWX) 17/10 KMTC / KMTC India Dubai, Colombo, Port Kellang, Hongkong, Sanghai, Ningbo. TS Line TS Line (I) Colombo, Port Kellang, Hongkong, Sanghai, Ningbo.

TBA RCL RCL Agency Port Kelang, Halphong, Nansha (RWA 1) —

13/10 13/10-PM Yantian Express 2240W 223065 Hapag Lloyd ISS Shipping Colombo (IMEX) 14/10 CGM CGM CMA CGM Ag. (I)

14/10 14/10-AM Celsius Naples 890E 223135 Evergreen / ONE Evergreen / ONE Colombo.(CISC) 15/10

19/10 19/10-AM Shimin 22006E 223108 Feedertech / TSLFeedertech / TSL 20/10

14/10 14/10-AM Ever Ursula 182E 223039 Wan Hai Wan Hai Lines Colombo 15/10 COSCO/Evergreen COSCO /Evergreen (PMX)

15/10 15/10-AM TS Dubai 22006E 223103 KMTC/COSCO KMTC / COSCO Shpg. Colombo (AIS) 16/10

19/10 19/10-PM ESL Kabir 2238E 223129 TS Lines Samsara Shpg 20/10

16/10 16/10-AM X-Press Odyssey 22006E 223121 Interasia/GSL Aissa M./Star Shpg Colombo (FIVE) 17/10 Evergreen/KMTCEvergreen/KMTC

16/10 16/10-AM Kota Megah 0139E 223076 One / X-Press One India / Sea Consortium Karachi, Colombo. (CWX) 17/10 KMTC / TS Line KMTC India/TS Line (I)

18/10 17/10-PM Seaspan Lahore 2241W 223095 Hapag ONE Line (I)/ISS Shpg Colombo (MIAX) 19/10 25/10 24/10-PM Cosco Hamburg 259 223158 Feedertech Emirates Shipping Colombo.(AGI) 26/10

15/10

16/10

In Port Hansa Colombo

14/10 14/10-AM Safeen Prestige

(RWA-1) 14/10

ETA Cut Off/Dt.Time

LINE

WILL LOAD FOR

LOAD FOR MED., BLACK SEA, U.K., NORTH CONTINENT AND SCANDINAVIAN PORTS

15/10 15/10-AM Maersk Atlanta 240W 22314 Maersk Line Maersk India Algeciras 15/10 21/10 21/10-AM Maersk Pittsburgh 241W 22321 (MECL) 21/10

TO LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND AND PACIFIC ISLANDS

29/10 29/10-AM Seamax Westport 082E 22335 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 29/10 13/10 13/10-AM OOCL New York 089E 22320 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 13/10 20/10 20/10-AM OOCL Hamburg 138E 22334 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 20/10

15/10 15/10-AM One Continuity 061E 22311 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 15/10 22/10 22/10-AM YM Ubiquity 055E 22333 Ningbo, Sekou, Cai Mep. (PS3) 22/10

16/10 16/10-AM Shijing 241E 22322 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 16/10

23/10 23/10-AM Grace Bridge 242E 22324 Ningbo, Tanjung Pelepas. (FM3) 23/10

18/10 18/10-AM Clemens Schulte 016WE 22328 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 18/10 ONE ONE (India) (TIP)

13/10 13/10-AM Montpellier 0021 22326 X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG) 13/10

15/10 15/10-AM Maersk Atlanta 240W 22314 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 15/10

21/10 21/10-AM Maersk Pittsburgh 241W 22321 (MECL) 21/10

19/10 19/10-AM SCI Mumbai 550 22329 SCI J. M Baxi Jebel Ali. (SMILE) 19/10

TBA SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

13/10 13/10-AM OOCL New York 089E 22320 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 13/10

16/10 16/10-AM Shijing 241E 22322 SCI J. M Baxi Colombo. (FM3) 16/10

16/10 16/10-AM Irenes Bay 241S 22317 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 16/10

18/10 18/10-AM Clemens Schulte 016WE 22328 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 18/10 ONE ONE (India) (TIP)

29/10 29/10-AM Seamax Westport 082E 22335 COSCO COSCO Shpg. Karachi, Colombo (CI1) 29/10

15/10 15/10-AM One Continuity 061E 22311 ONE ONE (India) Los Angeles, Oakland. (PS3) 15/10 15/10 15/10-AM Maersk Atlanta 240W 22314 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 15/10 21/10 21/10-AM Maersk Pittsburgh 241W 22321 Safmarine Maersk Line India (MECL) 21/10 18/10 18/10-AM Clemens Schulte 016WE 22328 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 18/10 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP)

ETA/Berth Vessel’s Name Voy Line Agents Will Load For

ETD

In Port SSL Ganga 110 Shreyas Transworld Group Europe, US East Coast, Med, East Africa, West Africa, East & West Coast 13/10 Hapag/CMA CGM ISS Shpg./CMA CGM Ag.(I) ONE/COSCO ONE (I)/COSCO Shpg. (WCC)

13/10 Northern Practise 0025 Global Feeder/Transworld Feeders Sima Marine/Transworld Group Jebel Ali, Khor Fakkan, AMCTPL, Hazira, GTI, Abu Dhabi 13/10 20/10 GFS Giselle 0059 X-Press Feeders/ONE Sea Consortium/ONE(I) (ASX) 20/10 Hapag / CMA CGM ISS Shpg./CMA CGM Ag. (I)

15/10 Maersk Phuket 241E Maersk Line/Hapag Maersk India/ISS Shpg Colombo, Port Klang, Singapore, Tanjug, Pelepas, Jebel Ali, Dammam, 16/10 22/10 Nagoya Tower 242E X-Press Feeders Sea Consortium Doha (Arabian Star) 23/10

15/10 MSC Aino IP241A MSC MSC Agency Mundra, King Abdullah, Gioia Tauro, Tangier, Southampton, Rotterdam, 16/10 22/10 MSC Pina IP242A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 23/10 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK)

16/10 MSC Sariska IX240A MSC MSC Agency Mundra, Hazira, Nhava Sheva, Colombo, King Abdullah, Damietta, Mersin, 17/10 Tekirdag, Valencia, Halifax, Baltimore, Savannah, Freeport Container Port (Indus 2)

18/10 Roo Centaurus 242W Maersk Line Maersk India NSICT, Jebel Ali, Salalah, Djibouti, King Abdullah, Port Jeddah, Salalah 18/10 25/10 Northern Dependant 243W (Blue Nile Express) 25/10

18/10 X-Press Odyssey 2206E Zim/KMTC Zim Integrated/KMTC India Qingdao, Shanghai, Ningbo, Da Chan Bay, Port Klang, Nhava Sheva, 19/10 25/10 Zoi

12/11 KMTC

MSC Bremerhaven

Evergreen Evergreen Shpg. AICTPL, Colombo, Port Klang, Singapore, Haiphong, Qingdao. 26/10

RCL/Emirates

Ag./Emirates Shpg. (NIX / FIVE / CIX3) 12/11

Abudhabi, AICTPL, Colombo, Iskederan, Tekirdag, Gioia Tauro. (IMED) 20/10

In

ETA

In Port Honey Island Overseas Maritme Indonesia Coal 55000

In Port One Hope Overseas LLP Indonesia Coal 32800

In Port Golden Day Ambica Logistics Indonesia Coal 73,150

In Port Kiran Australia Overseas LLP Indonesia Coal 63,100

In Port VIMC Green Kshitij Marine Sohar Gypsum 46,600

In Port Limnos Overseas LLP Indonesia Coal 56,200

Stream Jabal Harim Overseas LLP Indonesia Coal 62,775

Stream Star Subaru Overseas LLP Indonesia Coal 40,950

GANDHINAGAR : Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, Shri Piyush Goyal reviewed the functioning of the GIFT Special Economic Zone and issues with respect to regulatory aspects of operation of SEZ and the office of the DC GIFT in Gujarat. The Minister interacted with industry representativesatGIFTCity.

“Held a fruitful interaction with industry representatives at GIFT City. Discussed benefits of setting up units here. Received excellent suggestions including those on exports promotion and ‘Make in India’ in manufacturing”, Shri Goyal tweetedonthemeeting.

The Minister had interactions at the International Bullion Exchange (IIBX) in GIFT City to understand issues with respect to trading of Gold; operationalising the Gold Spot exchange and reducing the cost of gold metal loans for jewelleryexportersthroughGiftIFSC.

“India International Bullion Exchange (IIBX), GIFT City is one of its kind globally. Urged representatives of Jewellery sector to discover competitive prices for gold through IIBX.

Also explained how India-UAE CEPA is a huge window of opportunityforthem”,hetweeted.

He also issued directions to improve the trading of Gold on the IIBX, including enabling the utilisation of the TRQ on gold obtainedinUAEFTAbeoperatedfromIIBX.

Shri Goyal met representatives of International Financial Services Centres Authority (IFSCA) at GIFT City and resolved various administrative issues with the office of the DCGIFTSEZandIFSCA.

IFSCA is to participate in periodic review of exports with EPCandexportersdonebytheMinistertocheckastohowthe IFSC financial infrastructure can be leveraged to increase exports. “IFSC will be a key driver of economic growth with enhanced Ease Of Doing Business for global investors who will gain from the India growth story”, the Minister tweetedonthemeeting.

The Minister also gave directions to Department for Promotion of Industry and Internal Trade (DPIIT) to explore whether the Start up ecosystem can benefit from the facilities availableatGIFTcity.

NEW DELHI: The Ministry of Railways has issued a detailed circular on land management policy with a new leasing policy under which even existing players can get a 35-yeartenure.

The new circular follows the recent decision by the Union Cabinet and is expected to give more clarity to bidders forthedisinvestmentofrailwayPSUConcor.

“All entities currently using railway land for cargo activities will continue to be governed by railway’s extant policies, that is annual lease/license charges at six per cent of market value of land with annual escalation of seven per cent

for the remaining lease/license period or 35 years or period as mutuallydecidedwhicheverisearlier,”saidthecircular.

However, the existing entities will be given option to migrate to the new policy regime on transparent competitive bidding process as applicable for new cargo terminals providedtherearenooutstandingdues,itfurthersaid.

New cargo terminals, sidings, goods shed and other cargo related facilities can get a lease tenure upto 35 years. The lease charge for these entities is fixed at 1.5 per cent of market value of land per annum with annual escalation of six per cent.

NEW DELHI: Department for Promotion of Industry and Internal Trade (DPIIT) conducted a National Workshop on ‘EaseofDoingBusiness’inNewDelhi.

The Keynote address at the Workshop was delivered by Shri Parameswaran Iyer, CEO Niti Aaayog. He highlighted the importance of India’s performance on global indices. He underscored how Ease of Doing Business took the center stage as one of the most important pillars along with other programs, towards developing India as a preferred investment destination. Shri Iyer also spoke of the vision of Prime Minister Shri Narendra Modi for ease of living and Ease of Doing Business. He suggested that focus should be on achieving the whole-of-government approach by learning fromeachother.

Shri Amitabh Kant, G 20 Sherpa emphasized the role of Ease of doing business in transforming India. He reiterated that complacency with improvement of India’s rank is not desirable. De-novo thinking on the very need of certain processes, permissions, renewals is necessary to attain Ease of Doing business in its true spirit. Enabling a change in mindset within the country to accept the new ways is also essential,hesaid.

Shri Ramesh Abhishek, former Secretary, DPIIT highlighted the vision for Ease of Doing Business 2.0, wherein a framework to be drafted for all public authorities including State and regulators. Study of global Best Practices should be undertaken by Government Departments. Very need for license/ approvals / renewals should be examined and any requirement of the same should be justified. It should also be examined if licenses/approvals can be replaced with mere registration/intimationtoGovernmentauthorities.

The above vessel is arrivig at PIPAVAV PORT 15-10-2022 with Import Cargo in containers.

BL NOS.

No. of 20’ 40’

GOSUSNH1606753 —1

GOSUSNH1635402 12

GOSUSNH1635425 1—

GOSUSNH20770158 —2

GOSUSNH1685135 —3

GOSUSNH5480586 2—

GOSUSNH1606754 1—

GOSUSNH1606750 —1

GOSUSNH1685661 —1

BL NOS.

No. of 20’ 40’ BL NOS. No. of 20’ 40’

GOSUSNH1685724 1—

GOSUSNH1685659 1—

GOSUSNH1606539 —2

GOSUZAP922127 —8

GOSUZAP922128 —8

GOSUZAP922129 —2

GOSUSNH1606751 —1

GOSUSNH1606752 1—

GOSUSNH1522239 —1

GOSUSNH1522358 —1

GOSUSNH1635401 —1

GOSUSNH20770157 —2

GOSUSNH1635419 —1

GOSUSNH1635414 —1

GOSUSNH1685731 1—

GOSUSNH1636243 1—

Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS OF LADING, duly discharged and on payment of applicable charges. Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods.

As Agents :

First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201

Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836) 230433

Export Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@in.zim.com Mr. Trinath Pal 9824504315 Email:pal.trinath@zim.com

Import Marketing Queries : Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: rajgor.mitesh@in.zim.com

cargo from MERSIN, SAMSUN.

PORT SEZ

IZMIR, MERSIN, SAMSUN.

Nos.arrived for Mundra Delivery.

IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be

BL NOS.

GOSUBKK002076706 —6

GOSUCGP8353015 —1

GOSUCGP8353321 —2

GOSUCGP8353363 —2

GOSUDAL872270 2—

GOSUDAL872271 3—

GOSUHAI80058985 —1

GOSUHCM80301282 —2

GOSUJKT000063290 1—

GOSUJKT8085782 —6

GOSUJKT8085810 6—

GOSUNGB1147606 —1

GOSUNGB1147615 —1

GOSUNGB1147640 —3

GOSUNGB1147643 —1

GOSUNGB1147645 1—

GOSUNGB1147646 1—

GOSUNGB1147664 2—

GOSUNGB1147685 11

GOSUNGB1153011 —1

GOSUNGB20053614 1—

GOSUNGB20053623 —1

GOSUNGB20053624 11

GOSUNGB20053639 1—

GOSUNGB20090333 —1

GOSUNGB20090334 —1

GOSUNGB20090335 —1

GOSUNGB20090336 —1

GOSUNGB20090339 —1

GOSUNGB20090340 —1

GOSUNGB20090344 —1

GOSUNGB20090347 1—

GOSUNGB20090349 —1

GOSUNGB20090350 —1

GOSUNGB20090351 —1

GOSUNGB20090353 —1

GOSUNGB20090354 —1

GOSUNGB20090355 —1

GOSUNGB20090356 1—

GOSUNGB20090358 —1

GOSUNGB20090359 —1

GOSUNGB20090364 —2

GOSUNGB20090371 —1

GOSUNGB20090378 —2

GOSUNGB20090379 1—

GOSUNGB20090380 1—

GOSUNGB20090384 —2

GOSUNGB9615147 15

GOSUNGB9615148 8—

GOSUNGB9615149 —2

GOSUNGB9853770 —1

GOSUNGB9853771 —2

GOSUNGB9908479 —1

GOSUNGB9945053 4—

GOSUNGB9956182 —1

GOSUNGB9956183 —1

GOSUNGB9956233 —1

GOSUNGB9959644 —3

GOSUNGB9961986 —1

GOSUNGB9961987 —1

GOSUNGB9961997 —1

GOSUNGB9961998 —1

No. of 20’ 40’ BL NOS. No. of 20’ 40’

GOSUNGB9962000 —1

GOSUNGB9964682 —2

GOSUNGB9964686 14

GOSUNGB9964687 —1

GOSUNGB9964702 1—

GOSUNNJ1089265 —2

GOSUNNJ1312974 1—

GOSUNNJ1313043 —1

GOSUOCQ6021534 —1

GOSUOCQ6080464 1—

GOSUSHH30936872 2—

GOSUSNH1522389 1—

GOSUSNH1522396 1—

GOSUSNH1558254 —1

GOSUSNH1558276 —2

GOSUSNH1558312 2—

GOSUSNH1558325 —1

GOSUSNH1558350 —1

GOSUSNH1558352 —2

GOSUSNH1558386 —1

GOSUSNH1558420 —1

GOSUSNH1606709 5— GOSUSNH1606712 —1

GOSUSNH1606720 1—

GOSUSNH1606726 1—

GOSUSNH1606733 1—

GOSUSNH1606734 3—

GOSUSNH1606778 2—

GOSUSNH1606779 —1

GOSUSNH1606780 2—

GOSUSNH1606781 1—

GOSUSNH1636214 —1

GOSUSNH1636216 —3

GOSUSNH1636242 1— GOSUSNH1636244 1— GOSUSNH1636358 —1 GOSUSNH1636384 —1

GOSUSNH1636437 1—

GOSUSNH1685466 —4

GOSUSNH1685576 1— GOSUSNH1685713 2— GOSUSNH1685718 —1

GOSUSNH1685729 1—

GOSUSNH1685732 11

GOSUSNH1685733 —1 GOSUSNH1685892 1—

GOSUSNH1685901 —1

GOSUSNH1685903 1— GOSUSNH1685945 1— GOSUSNH1688051 —2 GOSUSNH1688109 1— GOSUSNH1696130 —1 GOSUSNH1703881 7— GOSUSNH20758834 1— GOSUSNH20759050 1— GOSUSNH20759143 1— GOSUSNH20759159 1—

GOSUSNH20759174 1—

GOSUSNH20759267 —1 GOSUSNH20759274 —1 GOSUSNH20759275 1—

GOSUSNH20759277 —1

GOSUSNH20759285 1—

GOSUSNH20759286 —4

GOSUSNH20759294 —1

GOSUSNH20759298 1—

GOSUSNH20759309 1—

GOSUSNH20759310 1—

GOSUSNH20759311 1—

GOSUSNH20759341 —1

GOSUSNH20759344 1—

GOSUSNH20759356 1—

GOSUSNH20759357 1—

GOSUSNH20759360 1—

GOSUSNH20759382 1—

GOSUSNH20759548 1—

GOSUSNH5480575 1—

GOSUSNH5480577 1—

GOSUSNH5480578 1—

GOSUSNH5480583 1—

GOSUSNH5480591 —1

GOSUSNH5480594 1—

GOSUSNH5480595 1—

GOSUSNH5480602 1—

GOSUSNH5480603 1—

GOSUSNH5480604 2—

GOSUSNH5480606 1—

GOSUSNH5480607 —1

GOSUSNH5480608 1—

GOSUSNH5480610 1—

GOSUSNH5480611 1—

GOSUSNH5480612 1—

GOSUSNH5480613 —2

GOSUSNH5480616 —1

GOSUSNH8282832 1—

GOSUSNH8282837 1—

GOSUSNH8318763 1—

GOSUSNH8351487 2—

GOSUSNH8351513 1—

GOSUSNH8351527 1—

GOSUSNH8400718 1—

GOSUSNH8413939 1—

GOSUSNH8413948 —4

GOSUSNH8413960 17

GOSUSNH8413961 1—

GOSUSNH8413962 —2

GOSUSNH8413963 —2

GOSUSNH8413973 —1

GOSUSNH8414020 —1

GOSUWZU996923 —1

GOSUWZU996924 —1

GOSUWZU996942 —1

GOSUWZU996970 —1

GOSUWZU996971 —1

GOSUWZU996980 —1

GOSUWZU996981 —1

GOSUWZU996982 2—

GOSUWZU996983 1—

GOSUWZU996984 —1

GOSUYEY9202054 —2

GOSUYIH9505424 2—

GOSUZAP922187 —1

Cont’d. from Pg. 4

Toft also noted external macro-economic pressures which will put pressure on cargo shopping. “But we are also seeing rising inflation, rising interest rates and rising energy prices, so there will no doubt be some difficultquartersahead,”hewarned.

MSChasbeenactingtocutcapacitywithblanksailings and at the end of last month announced it would be suspending its Sequoia service as part of the 2M alliance linking China and Korea with US West Coast ports. The company noted “significantly reduced demand

forshipmentsintotheUSWestCoastduringthepastweeks”.

AlthoughwarningofdifficultquartersaheadToftalso flagged MSC’s continued expansion with the “big news” of Q3 being the move to develop MSC Air Cargo. “It adds anewdimensiontothecompany,”hesaid.

Lookingaheadtheexpansionofservicesthatconnect to ocean shipping by MSC are set to continue. “However, there are lots of reasons to stay positive, and we are developingothersolutions,notonlyaircargo,butalsoon the land side to expand our service offering further,” Toftsaid.

HONG KONG: COSCO-owned container line Orient Overseas Container Line (OOCL) has announced its total revenues increased by 16.9% in the third quarter of the year, compared with 2021 sameperiod,surpassingUS$5 billion.

At the same time, the carrier’s total liftings and loadable capacity decreased by 3.4% and 1.8% respectively. The overall load factor was 1.4% lower than inthesameperiodin2021,whileoverallaveragerevenue per TEU increased by 21.1% compared to the third quarteroflastyear.

OOCL reported that for the nine months ended on 30 September 2022, total revenues recorded growth of 43.4% and total liftings decreased by 6.2% over the same period last year. During the same period, the company’s loadable capacity decreased by 4.9% and its overall load

factor was 1.2% lower than in the same period in 2021. OOCL’s average revenue per TEU increased by 52.9% comparedtothesameperiodlastyear.

THE HAGUE: To strengthen its focus on business transformation supporting its Safer, Better, Bigger strategy, APM Terminals appoints Charlotte Guillaumie as its Head of Strategy and Transformation, reporting to the companyCEO.

Charlotte Guillaumie joins APM Terminals from Philips, where, as Transformation Leader, she was responsible for the global delivery of strategic initiatives that have helped Philips transition from a conglomerate toahealthtechnologyfocusedcompany.

“Delivering on our Safer, Better, Bigger strategy requires significant business transformation and having an experienced leader that can drive strategy formulation, deployment and execution is key. I am therefore delighted to have Charlotte join APM Terminals Management Team on October 17th, where her experience and passion will be a tremendous asset”,shares KeithSvendsen,APMTerminalsCEO.

Prior to her time at Philips, Charlotte Guillaumie servedasGlobalHeadofOperationalExcellenceatSITA - the world’s leader in Software Solutions & Communications for the Air Transport industryyu. AtSITA,Charlotteusedherbusinesstransformationand

change management experience to improve and revamp existing standard processes and help the organisation become bestinclass.

“I am thrilled about mynewadventurewith APM Terminals, as the company progresses on its journey to become the world’s best terminal company, strongly focused on its people, customers, communities and sustainability. This is an exciting industry and I very much look forward my new endeavours”, comments CharlotteGuillaumie.

A French citizen, Charlotte Guillaumie has lived and workedinFrance,SwitzerlandandTheNetherlands.She holds a master’s degree from Kedge Business School in Marseille, France with a specialisation in Supply Chain Management and has received professional training in Lean, Problem Solving, design thinking, product managementandmanyotherareas.Inhernewrolewith APM Terminals, she will be based at the company’s headquartersinTheHague,TheNetherlands.