MUMBAI : (022)22661756 / 1422, 22691407

GUJARAT + NORTH INDIA

AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com

KANDLA : (02836)222665/225790, E-Mail:dstimeskdl@gmail.com

With an eye on further strengthening its cargo reach, the

C R / A H M E D A B A D : J e e n a & Company, a global leader in freight forwarding and supply chain solutions, has announced the merger of the 67-yearold JBS Group based in Ahmedabad, Gujarat. This strategic move aims to provide comprehensive logistic services, encompassing both international and domestic sectors.

JBS Group, founded in 1957 by Mr. J B Shah, stands as an ISO-certified, AEO group with diverse entities specializing in Customs Clearance, Multimodal Transport Operations, and IATA cargo handling. JBS Group holds its own Customs Broking License, IATA accreditation, and nearly 30 years of experience in FMC registered Bill of Lading. This addition brings an extra 95 pin codes to the existing 300+ PAN-India pincodes.

Jeekshith K Shetty elected 1st Co-ordinator of Indian Bunts Chamber of Commerce and Industry - Youth Wing

Indian Bunts Chamber of Commerce and Industry Youth Conference held; Need to empower youth: K.C Shetty

MUMBAI : Indian Bunts Chamber of Commerce and Industry (IBCCI), a prestigious association of Buntara community businessmen, conducted an IBCCI Youth Conference recently under the Chairmanship of IBCCI Chairman K.C Shetty (Kutpadi Chandra Shetty) at Aden Banquet Hall, Hotel Suncity, Andheri East.

IBCCI Vice President S.B Shetty, Secretary Srinath Shetty, Treasurer Prasad Shetty, Joint Secretary Srinivas Shetty, Joint Treasurer Nishit Shetty and Directors Bharat Shetty (Adhiti), Balakrishna Shetty, Pradeep Shetty were present and K.C Shetty started the convention by lighting the lamp.

Cont’d Pg. 6

D E L H I N

www.dst.news YEARLY SUBSCRIPTION : 1600/Vol.XXXINo.30 th FRIDAY 12 APRIL 2024 Cont’d Pg. 5

company an�cipates 100% growth Jeena & Company merges with JBS Group Dr. Pramod Sant YOUR QUERIES OUR SOLUTION by Dr. Pramod Sant A distinguished Industry Expert Refer Pg. 7 Estd 1900 Delivering Service Excellence JBSGroup Mr. Sam Katgara, Partner, Jeena & Company and Mr. Samir J. Shah of JBS Group

Jeena & Company merges with JBS Group

Cont’d from Pg. 4

Po s t - m e r g i n g , J B Shah Logistics will assume the name J B S J E E N A Logistics, combining the esteemed legacies of the 67-yearold JBS Group and the 124-year-old Jeena Group With this development, JBS JEENA Logistics anticipates a 100% projected growth, leveraging the combined expertise and resources of both legacy entities.

As a part of the merger, Jeena & Company will acquire the customers, team, and assets of the JBS Group and expand its Custom Clearance footprint in Gujarat With JB Shah Logistics’ impactful presence in Gujarat, Jeena aims to leverage its freight forwarding business.

Speaking on this, Sam Katgara, Partner, Jeena & Co. said, "As a brand, we are moving in the direction that we envisaged and it is giving us positive results. With the merging of the JBS Group, we inked a partnership that brings together two esteemed, legacy organizations with a rich history and complementary capabilities, positioning us as a leading provider of end-to-end logistics solutions in the region. Together as JBS Jeena Logistics, we feel greatly confident to create value for our customers and stakeholders through our combined force."

JBS JEENA L ogistics is poised to offer a comprehensive suite of logistics activities, with a strategic emphasis on Projects, Coastal cargo movements, Warehousing featuring 3PL operations, Customs Clearance, and International Freight Forwarding through all modes of transport. This collaboration represents a forward-looking approach to meet the evolving demands of the logistics industry

Estd 1900 Delivering Service Excellence JBSGroup

Jeekshith K Shetty elected 1st Co-ordinator of Indian Bunts

Chamber of Commerce and Industry - Youth Wing

Indian Bunts Chamber of Commerce and Industry Youth Conference held; Need to empower youth: K.C Shetty

Cont’d from Pg. 4

Senior and respected businessmen of the Bunta community such as Tonse

A n a n d M . S h e t t y, E x e c u t i v e Chairman of Organic Industries Private Limited, B. Vivek Shetty, Executive Chairman of Vishwat Chemicals Limited, Triveni Group and Rupi Boss Executive Chairman CA. N.B Shetty and Chelladka Kusumodara Shetty (K.D Shetty), Executive Chairman of Bhavani Shipping Services India Pvt Ltd acted as resource persons to guide and advise the young entrepreneurs present.

K.C Shetty address on his Presidential speech said that it is truly a pleasure to see, such a dynamic young group of Bunts youth, representing the vibrant spirit and rich cultural heritage of our community As we continue to grow our Chamber of Commerce, we have realized the importance of actively involving the Bunts youth in the recent Industrial Tour to Karnataka, highlighted the

immense benefit of youth participation thereby gaining valuable insights and inspiration. Hence, we felt compelled to organize this Convention to encourage our next generation, nation builders to take the reins of the Chamber. Today, in our Chamber, we see the next young generation of Bunts actively involved in various activities This Convention presents a unique opportunity for our Bunts youth to connect with the stalwarts of business in our community

Anand Shetty said that it is very important to give exposure, build confident and groom the next generations to show the responsibility to take your organization to next level. I congratulate all of you young and bold stars for bunts for participating in this program. I know that all of you are ambitious, brilliant and preparing and ready to start journey for either to take over family business or to start new venture. Here I want state that today you have fabulous platform that enable you to achieve multiples what have been achieve by your father

J e e k h s h i t h K u s u m o d a r a S h e t t y , a Young Entrepreneur and Director of Bhavani Shipping Services India Pvt Ltd, was unanimously elected as the new coordinator of the IBCCI Youth Wing V i c e P r e s i d e n t S . B S h e t t y c o n d u c t e d t h e selection process among the office bearers

Working President K C Shetty congratulated all with flower boutique and handed over the power alongwith releasing the IBCCI Bulletin

Shantarama Shetty (Suncity), Advocate Ratnakar

V. Shetty, P.K Shetty, Karthik C. Shetty, Siddesh Shetty, IBCCI Ofce Manager Prajnya Shetty and other members were present. Srinivas Shetty proposed the vote of thank, informs the communique.

KPSAA extends warm welcome to New Traffic Manager, DPA

GANDHIDHAM: The Kandla Port Steamship

A g e n t s A s s o c i a t i o n

( K P S A A ) f e l i c i t a t e d

+Mr B Ratnasekhar Rao, the newly appointed Traffic Manager at the Deendayal Port Authority (DPA).

In a heartfelt gesture, President Mr. Bharat Gupta, Secretary Mr. Ebez Yesudas, and esteemed committee members Mr. K.M. Thacker, Mr. Satish Nair, Mr Madhu Menon, Mr Sabukuttan, and Mr Illa, Shri Giri Visweswarrao came together to extend a warm welcome to Mr.B. Ratnasekhar Rao.

The event took place at the TM’s office, where Mr B Ratnasekhar Rao was presented with a beautiful bouquet and a traditional shawl. The gesture symbolized the Association's eagerness to forge a harmonious relationship with the newly appointed Traffic Manager and to extend their support in his endeavours to contribute to the efficient functioning of the Deendayal Port.

closely with Mr B. Ratnasekhar Rao and the DPA to address any challenges and enhance the port's efficiency

Mr. Bharat Gupta, President of KPSAA, expressed his sincere appreciation for Mr. B. Ratnasekhar Rao's appointment and emphasized the importance of collaboration between the port authority and the associations for the smooth operation of port activities. Secretary Ebez Yesudas echoed these sentiments, reaffirming the Association's commitment to working

Mr. B. Ratnasekhar Rao expressed his gratitude for the warm welcome extended to him by the KPSAA members. He conveyed his eagerness to collaborate with the association and assured them of his full support in addressing their concerns and improving port operations.

The KPSAA looks forward to a fruitful partnership with Mr B. Ratnasekhar Rao and the Deendayal Port Authority, working together towards the shared goal of excellence in port management and service delivery

12thAPRIL2024 GUJARAT+NORTHINDIA 6

Mr. K.D Shetty addressing the gathering.

Mr. Jeekshith K Shetty addressing the gathering.

YOUR QUERIES - OUR SOLUTION

by Dr. Pramod Sant, A distinguished Industry Expert

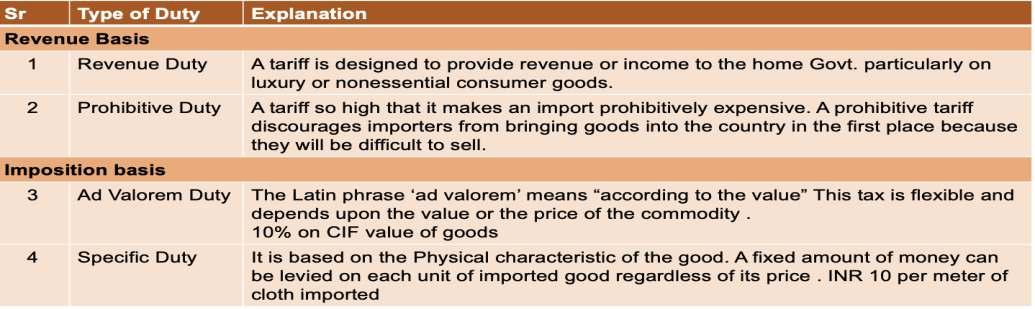

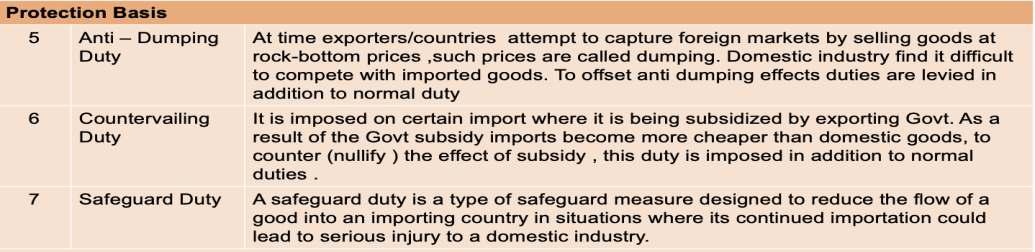

Question: What are tariff and non-tariff barriers?

what is the purpose of both and what are the types of TariffandNon-TariffBarriers?

SOLUTION: Thanks for asking fundamental questions, many times we are so busy with regular day-to-day operationsthatwehavenotimetounderstandthebasics. However, these basics are very interesting and give not onlyinsightsbutalsoanswersmanydailyissues. Your question requires a detailed explanation, and I will cover only the tariff part now and the balance partnextweek

WhatisTariff?

Letusunderstandafewdefinitions.

• A tariff is a form of tax imposed onimportedgoodsorservices.

• As per WTO - Customs duties on merchandise imports are calledtariffs.

• A schedule of duties imposed by a government on imported or in some countries exported goods.

WhyareTariffsimposed?

There are various reasons why governments impose tariffs on imported goods. Some of the

mostcommonreasonsare.

1. Toprotectdomesticproducers

2 To protect domestic consumers

3. Topreservenationalsecurity

4. Toprotectinfantindustries

5. Sourceofrevenue

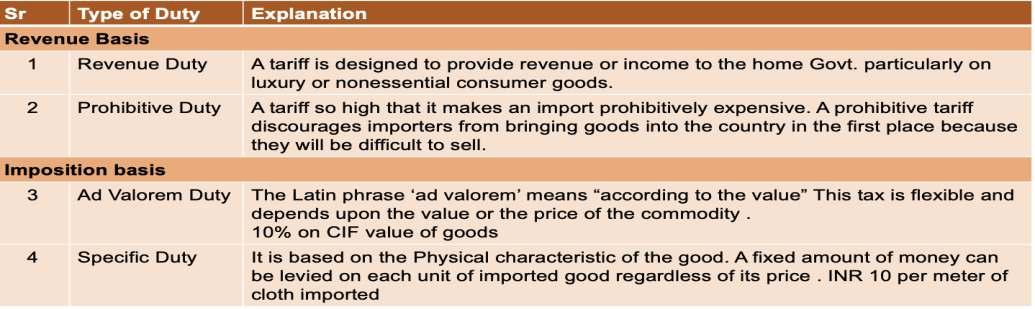

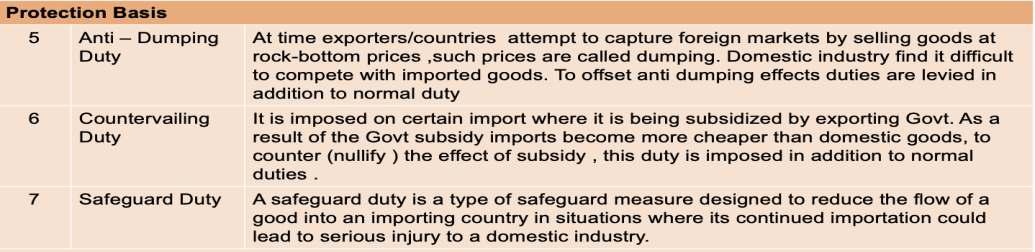

What are the kinds of Tariffs?

Dr. Pramod Sant

CustomsDuty/EntryDuty/BorderTaxthatisimposedby the country on the imported goods and services will be called a “Tariff Barrier” The below chart will give anideaaboutdifferentkindsofTariffs

You can send your Questions on Email : pramodsant@dailyshippingtimes.com

Let us understand the meaning of each kind in short In the next issue of Daily Shipping Times, we look at tariff examples and Non-Tariff Barriers. Tariffs Revenue basis Imposition basis Protection basis Tariff Colum basis Calculation basis Ad valorem Duty Specific Duty Safeguard Duty Counterva iling Duty Anti –Dumping Duty Compound Duty Single Column Duty Double column Duty Triple column Duty Single scale Duty Prohibitive Duty Revenue Duty GUJARAT+NORTHINDIA 12thAPRIL2024 7

US Container imports surge from India signalling Supply Chain pivot

NEW DELHI: India is finally m e e t i n g i t s c o m m i t m e n t o f transforming into a burgeoning manufacturing hub and an alternative to China, shifting container lines’ focus and capacity despite spottily improved port infrastr ucture This shift in focus towards India by major container lines reflects a compelling growth story.

The surge in US import volumes from India and the increasing share of inbound containers from the South Asian powerhouse indicate a pivotal moment is underway Major retailers and manufacturers (Tesla, Apple, a n d S a m s u n g ) a r e p o u r i n g investments into India, marking a clear departure from their reliance on China

D e s p i t e c h a l l e n g e s l i k e b u r e a u c r a t i c h u r d l e s a n d infrastructure disparities, India has e m e r g e d a s a m a n u f a c t u r i n g powerhouse in recent decades, gaining traction despite being overshadowed by countries like Vietnam and Mexico.

The share of imports from India at U S p o r t s h a s b e e n s t e a d i l y increasing, albeit from a modest base.

Over the last decade, US imports from India have doubled, reaching the 1 million TEU range, with East Coast ports reaping the largest gains Containerized shipments from India to the US East Coast swelled 132% over the last 10 years. The Port of New York and New Jersey is by far the

largest benefactor, handling nearly 300,000 TEU in 2023, followed by the Port of Savannah, with 170,000 TEU, and the Port of Virgina, at 155,000 TEU, according to PIERS.

Despite India’s current share being a fraction compared to China’s dominance, even marginal shifts away from China translate into significant volumes for ocean carriers and ports, particularly on the US East Coast.

To capitalize on India’s rising prominence, container lines are e x p a n d i n g s e r v i c e s a n d strengthening their presence Investments in Indian ports by global carriers like Mediterranean Shipping Co. (MSC), CGM, and Hapag-Lloyd highlight the growing importance of India in global supply chains.

Mediterranean Shipping Co (MSC) consolidated its marine terminal profile in India by acquiring a 49% stake in the Adani Ennore Container Terminal, near Chennai, for Rs. 247 crore ($30 million). This added to MSC’s 50/50 terminal joint venture with Adani Ports (APSEZ) at Mundra Port, with the largest market share there, and its 49% ownership of a container terminal at Tuticorin Port (South India) that came through the Bollore Africa deal in 2022.

CMA Terminals, which has had a terminal partnership with APSEZ at Mundra since 2017, recently secured concession rights for the oldest container terminal at Nhava Sheva

Port (JNPA) in a partnership with Mumbai-based JM Baxi Group. Last year, Hapag-Lloyd snagged 40% of JM Baxi Ports & Logistics—which has a growing business line for logistics verticals to pursue investment interests beyond port-toport shipping out of India.

Niche regional carriers are enhancing intra-Asia networks to support rising Indian manufacturing as local importers mostly lean on the Chinese market for inputs and also spot an opportunity to turn out finished products in the longer term. That market potential has also prompted mainliners to invest in standalone services connecting I n d i a n p o r t s t o m a j o r A s i a n destinations.

H o w e v e r, I n d i a s t i l l f a c e s challenges in delivering supply chain reliability comparable to its Southeast Asian counterparts or China Infrastructure enhancements and initiatives like dedicated rail corridors aim to bridge these gaps and support India’s expanding manufacturing base.

In conclusion, India’s emergence as a manufacturing and sourcing alternative to China is reshaping c o n t a i n e r g r o w t h d y n a m i c s While challenges persist, India’s economic momentum, backed by s i g n i f i c a n t i n v e s t m e n t s a n d improving infrastructure, positions it as a compelling destination for global trade and container shipping.

Indian Road Logistics industry revenues to grow at 3-6% in FY2025: ICRA

Operating profit margins to remain range-bound at 10.5-12.5% in FY2025 as concerns on cost inflation persist

MUMBAI: ICRA expects the revenues of the Indian road logistics industry to remain range-bound and grow at sedate pace of 3-6% in FY2025, given the limited ability of players to increase the freight rates, expected softening in Government capex during the elections (given the Model Code of Conduct requirements) and moderation in consumer demand sentiments amid high inflation and interest rates The outlook for the sector continues to be Stable, fuelled by a sustained momentum in economic activities, enhanced traction of organised trade and continued support from varied segments like e-commerce, FMCG, retail, pharmaceuticals, and industrial goods.

M r. S u p r i o B a n e r j e e , Vi c e President & Sector Head – Corporate Ratings, ICRA Limited, s a i d : “ICRA’s sample set1 witnessed a modest revenue growth of 2.3% in 9M FY2024 on a YoY basis amidst tapering demand due to high inflation, an uneven monsoon, a high interest rate regime and relatively muted festive season Thus, on an elevated base of FY2023,

ICRA estimates a low single digit growth of 2-5% in FY2024. The growth for road logistics sector in FY2025 is expected to be in the range of 3-6% , owing to the impact on demand from high inflation, high interest rate regime and soft (though improving) consumer sentiment. The industry operating profit margin contracted to 11 2% in 9M FY2024 (down ~150 bps YoY), on account of increase in operating costs (ex-fuel) due to the high inflationary regime, and pressure on realisations, given the sticky retail diesel rates, limiting any formula-driven price rise. ICRA expects the margins to remain in the range of 10.5-12.5% in FY2024 and FY2025 over 12.4% in FY2023 amidst inflationary headwinds and despite benefits of efficiency gains due to increasing digitalisation and valueadded service offerings of industry players. Key debt metrics like Total debt / OPBITDA is expected to have moderated marginally to 1 5x-1 7x in FY2024 from 1.4x in FY2023 with rising operating costs (ex-fuel), given the persistently high inflation levels and increase in debt due to debt-funded

capital expenditure for new vehicles, and anticipated rise in lease liabilities due to expanding branch network and technology investments.”

E-way monthly volumes remained largely stable in the last four months at above 85 million, post reporting all-time high volumes of 100 million in October 2023, signifying resilient domestic trade a n d t r a n s p o r t a t i o n a c t i v i t i e s The monthly FASTag volumes have also moved in tandem with the e-way bills, ranging from 295 to 350 million in the current fiscal, with an all-time peak of 348 million in December 2023, reflecting business continuity “Additionally, road logistics players also remain exposed to environmental and social risks

Tightening emission control norms necessitate alternative fuel vehicle investments or investments in the current fleet. They are also exposed to litigation / penalties arising from issues related to harmful emissions and waste, which may lead to financial implications and impact reputation. The social risk includes driver shortage, health, safety, and quality of work-life balance for drivers,” Mr. Banerjee added.

12thAPRIL2024 GUJARAT+NORTHINDIA 8

Terminal Investment gets security nod to buy 49% stake in APSEZ run Container Terminal at Kamarajar Port

I n v e s t m e n t L t d , a u n i t o f

Geneva-based Mediterranean Shipping Company S.A, the world’s biggest container shipping line, has received security clearance to acquire a 49 percent stake for Rs 247 crores in the container terminal run by Adani Ports and Special Economic Zone Ltd (APSEZ) in stateowned Kamarajar Port Ltd located in Tamil Nadu Terminal Investment Ltd, through its fully owned subsidiary Mundi Ltd, acquired a 49 percent stake in the 8 lakh twenty-foot equivalent units (TEUs) capacity Adani Ennore Container Terminal Pvt Ltd from APSEZ for Rs 247 crore, pegging the enterprise value of the terminal at Rs 1,211 crore, according to a 15 December 2023 announcement by the two companies

This deal was awaiting security clearance from the Union Government, per procedure framed for port contracts. “The Government has granted security clearance to Terminal Investment/Mundi for the stake

purchase,” a Government official was recently quoted as saying. “Kamarajar Port Ltd will now complete the formalities for share transfer in the terminal operating company as per the concession agreement,” said the official.

The transaction bolsters the strategic partnership between APSEZ and MSC which has an equal joint venture that runs a container terminal named Adani International Container Terminal Pvt Ltd (AICTPL), at Mundra Port, India’s largest commercial port and the flagship of APSEZ, located in Gujarat.

In 2014, APSEZ won the rights to build and operate a 1 4 million TEU-capacity container terminal for 30 years at Kamarajar Port Ltd (the only corporate port among the 12 owned by the Union government) after placing a revenue share of 37 %.

Adani Ennore Container Terminal Pvt Ltd currently has a quay length of 400 meters and an annual handling capacity of 8 lakh TEUs. The terminal handled 6,71,393 TEUs in FY24 from 5,50,000 TEUs in FY23.

N E W D E L H I : Te r m i n a l

CJ-VII VACANT

CJ-VIII Summer Sky Interocean 14/04

CJ-IX Al Saad Genesis 15/04

CJ-X

CJ-XV Chang Yang Jin Hua Jeel Kandla 16/04

CJ-XVA Darya Rani Dariya Shpg. 16/04

CJ-XVI Norse New Haven Mihir & Co. 18/04

TUNA VESSEL'S NAME AGENT'S NAME ETD

Amilla Cross Trade 13/04

CSSC ImminghamAmbica

OIL

OJ-II

OJ-IV Benten Galaxy GAC Shpg. 13/04

OJ-V VACANT

OJ-VI VACANT

OJ-VII Stavanger Poseidon Interocean 13/04

Tuna Amilla Cross Trade 52,300 T. Urea In Bulk 2024041083

CJ-IX Al Saad Genesis 57,115

LIQUID CARGO VESSELS

12th APRIL 2024 12 GUJARAT + NORTH INDIA Steamer's Name Agents Arrival on Time Height Time Height Hr. Min. Metres Hr. Min. Metres 04:10 6.46 10:51 0.07 17:04 6.88 23:32 1.47 TODAY’S TIDE 12/04/2024 Stream Anika J M Baxi 11,992 T. Palm Oils In Bulk 2024041054 OJ-IV Benten Galaxy GAC Shpg. Taiwan 19,000 T. Chem In Bulk 2024031346 Stream Bow Cedar GAC Shpg. Al Jubail 7,000 T. Chem In Bulk 2024031330 Stream Bow Endeavor GAC Shpg. 9,000 T. Chem In Bulk 2024031348 Stream Bow Panther GAC Shpg. China 1,925 T. Chem In Bulk 2024031331 21/04 Bow Trident Interocean 29,000 T. CDSBO In Bulk 2024041057 13/04 Champion Pula GAC Shpg. Argentina 4,000 T. CDSBO In Bulk 2024041026 15/04 CNC Dream Samudra 5,000 T. Chemicals 18/04 Eco Lod Angeles Interocean 13,000 T. CDSBO In Bulk 2024041085 Stream F Mumbai Samudra China 5,900 T. Chem In Bulk 2024041066 Stream Ginga Jaguar GAC Shpg. Thailand 6,654 T. Chem In Bulk 2024041017 Stream Ginga Kite GAC Shpg. Thailand 6,931 T. Chem In Bulk 2024041028 12/04 Glenda Melody Interocean San Lorenzo 20,000 T. CDSBO In Bulk 2024041048 14/04 Marigold Wilhelmsen 3,000 T. CPO In Bulk 2024041061 Stream Orlando Interocean Taman 15,000 T. CSFO/CDSBO In Bulk 2024031336 15/04 Pacific Gold Interocean Rio Grande 45,322 T. CDSBO In Bulk 2024031338 Stream Rose Gas ISS Shpg. Ruwais 20,776 T. Propane/Butane 2024031286 OJ-I Sakura Spirit ISS Shpg. 19,685 T. Propane/Butane 2024041077 Stream Sanmar Songbird J M Baxi 20,049/7,812 T. Naptha/MS 2024041069 Stream Seamaid GAC Shpg. Ras Al Khair 25,287 T. Ammonia 2024041092 OJ-VII Stavanger Poseidon Interocean San Lorenzo 19,453 T. CDSBO In Bulk 2024031323 Stream Stolt Lerk J M Baxi Dakar 2,001 T. Chem In Bulk 2024041101 17/04 Viva Interocean 15,000 T. CDSBO 13/04 XT Prosperity Samudra Al Jubail 7,800 T. Chemicals SHIPS SAILED WITH NEXT EXPORT CARGOS DESTN. Oriental Cosmos 10/04 Rotterdam Sea Libra 10/04 Doula TCI Anand 11/04 Manglore/ Cochin/Tuticorin AS Alexandria 11/04 Jebel Ali D Queens 11/04 Abu Dhabi Darya Jamuna 11/04 African Buzzard 11/04 China I.G.M. Nos. filed at Kandla Customs Manual EDI Vessels Name Agent SHIPS NOT READY FOR BERTH Vessel's Name Agents Arrival On Alora Shantilal Shpg. 19/03 VESSELS IN PORT & DUE FOR EXPORT LOADING Due Dt Vessel's Name Agents Will Load For Cargo Particulars VCN No. EDI Rot.No CJ-III Adonnis DBC Somalia 10,000 T. Sugar In Bags 2024031271 13/04 Agios Porfyrios J M Baxi Turkey 16,800 T. Rice/Chickpeas In J Bags & 4 pkgs. 2024031069 Stream Alora Shantilal Shpg. Iran 43,000 T. SBM In Bulk 2024031161 15/04 Aqua Regia DBC Brazil 33,000 T. GSSP In Bulk 2024021311 CJ-II Beyond 2 DBC 31,000 T. GSSP In Bulk 2024031342 Stream BBC Coral Marcons Saudi Arabia 492 T. P Cargo (11 Pkgs/3,262 CBM) 2024031312 CJ-IV Bright Comet Arnav Shpg. Persian Gulf 18,800 T. SBM In Bulk 2024031351 CJ-XV Chang Yang Jin Hua Jeel Kandla Maldip 33,000 T. M . Sand In Bulk 2024031265 Stream Elias Inayat Cargo 25,000 T. Stone Aggregate Stream Gautam Rehansh Ocean Harmonny 2,100 T. Salt CJ-XIII Louisianna Mama Cross Trade 42,750 T. Salt In Bulk 2024041084 Stream Meghna Paradise BS Shpg. 55,000 T. Salt 15/04 Rudolf J M Baxi Singapore 9,696/2,189/581 T/2,758 CBM Proj. C. 2024031288 Cargo Steamer's Agent's ETD Jetty Name Name CJ-I Poavosa Brave DBC 15/04 CJ-II Beyond 2 DBC 15/04

Adonnis DBC 15/04

Bright Comet Arnav Shpg. 16/04

CJ-III

CJ-IV

DBC 15/04

CJ-V Imari

Rishi Shpg. 17/04

CJ-VI Pavida Naree

Jin Bi

Marine 16/04

Aditya

CJ-XI VACANT

CJ-XII VACANT

Trade 14/04

CJ-XIII Louisianna Mama Cross

13/04

CJ-XIV Berden BS Shpg.

Log. 13/04

JETTY VESSEL'S NAME AGENT'S NAME ETD

Sakura Spirit ISS Shpg. 13/04

OJ-I

Lila Frontier

OJ-III Ocean Agalia

T. Natural GYPSUM In Bulk 2024041089 Tuna CSSC Immingham Ambica Log. USA 1,14,031 T. US Coal In Bulk 2024031315 CJ-XVA Darya Rani Dariya Shpg. 60,538 T Yellow Peas In Bulk 2024041055 CJ-V Imari DBC 6,160/61/40/223 T. CRC/Skids/W.Coils 2024031356 CJ-X Jin Bi Aditya Marine 55,800 T.GYPSUM In Bulk 2024041105 Stream Motaro Benline 37,900 T. Kiyzassky MV PCI Coal 2024041100 CJ-XVI Norse New Haven Mihir & Co. 41,486 CBM Pine Logs 2024041044 CJ-VI Pavida Naree Rishi Shpg. 32,398 JAS Logs 2024041019 CJ-I Poavosa Brave DBC Australia 28,720 T. JAS Aus Logs 2024041032 CJ-VIII Summer Sky Interocean Odessa 59,306 T. Peas Large Yellow In Bulk 2024041001

IMPORT DISCHARGE Berth Vessels Name Agent From Cargo Details VCN No. Manual IGM EDI IGM SHIPS READY FOR BERTH SHIPPING MOVEMENTS AT GUJARAT PORTS DEENDAYAL PORT ETA Vessels Name Agent To Cargo Details VCN No. Manual IGM EDI IGM KANDLA INTERNATIONAL CONTAINER TERMINAL (KICT) 13/04 SCI Chennai (SMILE) J M Baxi Jebel Ali I./E. 1,500/1,100 TEUs. 2024031219 13/04 Touska (IIX) Armita India Bandar Abbas I./E. 1,000/800 TEUs. 2024041060 16/04 Azargoun (IIX) I./E. TEUs. 16/04 TCI Express 037 TCI Seaways Manglore/Cochin/ I./E. TEUs. TBA Tuticorin I./E. TEUs. 12/04 Safeen Power (UIG) ULSSL Abu Dhabi I./E. 500 TEUs. 15/04 Hansa Europe (IG1) Hapag Llyod Jebel Ali I./E. TEUs. 21/04 Express Argentina (IG1) I./E. TEUs. Due/Berth Vessels Name Agent From Cargo Details VCN No. Manual IGM EDI IGM

GENERAL CARGO VESSELS VESSELS IN PORT & DUE FOR

BERTH VESSEL'S NAME AGENT'S ETD SHIPPING MOVEMENTS AT ADANI PORTS & SEZ LTD. (APSEZ) MUNDRA DRY & LIQUID VESSELS AT BERTH B-1 VACANT B-2 Sinar Malahayati J M Baxi B-3 VACANT B-4 VACANT B-5 VACANT B-6 Asphalt Alliance Preetika Shipping B-7 VACANT B-8 VACANT B-9 LB Green Cross Trade 13/04 B-10 Al Hadbaa J M Baxi BERTH VESSEL'S NAME AGENT'S ETD VESSEL’S NAME NEXT PORT SAILED Limra Jebel Ali 06-04-2024 Sunrise Hamad 06-04-2024 SHIPS SAILED WITH EXPORT CARGO VESSEL’S NAME NEXT PORT SAILED VESSELS DUE IN PORT FOR IMPORT DISCHARGE & EXPORT LOADING Due Date Vessel’s Name Agents I/E From / To Cargo Details VCN B-11 Panagia Kanala ACT Infraport 15/04 B-12 Bos Boutros Aries Marine 13/04 WEST BASSIN WB-01 Maran Courage GAC Shipping WB-02 Paul Oldendorff Ambica Shipping WB-03 Kmax Vision Taurus Shipping 13/04 VESSEL'S AT SPM IOCL VACANT HMEL New Legend Admiral Shipping STS VACANT LNG VACANT B-10 Al Hadbaa J M Baxi I Port Kelang 15,211 MT Steel Billets 2401391 13/04 Andros Navigator Taurus Shipping I/E Singapore / .... 1,57,800 MT Steam Coal 2401381 B-6 Asphalt Alliance Preetika Shipping I Mumbai 1,500 MT Bitumen 2401387 13/04 Bellina Colossus Parekh Marine I Singapore 9,104 MT Steel Coils 2401364 B-12 Bos Boutros Aries Marine I/E Hairza / Dammam 18,000 MT Fly Ash 2401395 13/04 Dara GAC Shipping I Port Said 88,000 MT Steam Coal 2401420 13/04 Gu Imabari Taurus Shipping I/E Singapore/Mundra 74,519 MT Steam Coal 2401370 18/04 Kai Rui Taurus Shipping I Singapore 73,271 MT Steam Coal 2401442 WB-03 Kmax Vision Taurus Shipping I Port Said 82,500 MT Steam Coal 2401264 B-9 LB Green Cross Trade I Port Of UST Luga 32,945 MT Nitro Phosphate with Potash 2401399 WB-01 Maran Courage GAC Shipping I Singapore 1,86,102 MT Steam Coal 2401392 Stream Michalis JR Taurus Shipping I Krishnapatnam 84,020 MT Steam Coal 2401293 HMEL New Legend Admiral Shipping I Novorossiysk 1,39,296 MT Crude Petroleum Oil 2401443 15/04 New Optima Samsara Shipping I Mumbai 3,618 MT Steel Coils 2401424 B-11 Panagia Kanala ACT Infraport E Dhuba 10,000 MT Steel Pipes 2401368 14/04 Parnassos DBC I Mumbai 9,988 MT Steel Coils 2401422 WB-02 Paul Oldendorff Ambica Shipping I Nacala 1,08, 636 MT Steam Coal 2401332 Stream Rasha Interocean I Gresik 27,749 MT Ammonium Phosphate Sulphate 2401365 B-2 Sinar Malahayati J M Baxi I Mumbai 10,002 MT Crude Pal Oil 2401426 13/04 Sterling Freia Interocean I Necochea 66,000 MT Barley In Bulk 2401273 SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXTPORT SAILING DATE CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME AGENT FROM SHIPS SAILED WITH EXPORT CARGO VESSEL NAME NEXT PORT SAILING DATE VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD CB-3 Express Rome (V-4310W) Hapag Llyod 13/04 CB-4 Morning Capo (V-99) Parekh Marine 13/04 B-5 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ADANI MUNDRA CONTAINER TERMINAL (AMCT) ETA VESSEL’S NAME AGENT FROM VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD 14/04 MSC Tokyo (V-GA415R) MSC Agency Colombo 14/04 Hyundai Hongkong (V-151W) Seabridge Marine Karachi 17/04 SM Mahi (V-69) MBK Logistics Mandalore In Port MSC Heidi (V-IP414A) MSC Agency Hazira 13/04 MSC Bremen (V-IV415A) MSC Agency Nhava Sheva 13/04 MSC Irene (V-IS412A) MSC Agency Jebel Ali ETA VESSEL’S NAME AGENT FROM SHIPS SAILED WITH EXPORT CARGO ADANI CMA MUNDRA CONTAINER TERMINAL PVT LTD (ACMTPL), MUNDRA VESSELS AT BERTH BERTH VESSEL’S NAME AGENT ETD CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME AGENT FROM ETA VESSEL’S NAME AGENT FROM ETA VESSEL’S NAME AGENT FROM ADANI INTERNATIONAL CONTAINER TERMINAL (AICT) 15/04 Xin Chang Shu (V-85E) Cosco Shipping Karachi 18/04 Celsius Nairobi (V-907) Unifeeder Agency Sohar 20/04 Cypress (V-OMXHYW) CMA CGM Agency Nhava Sheva Dalian (V-2414W) Hazira 10-04-2024 Ever Utile (V-183E) Colombo 10-04-2024 GFS Sapphire (V-20) Jeddah 10-04-2024 SC Mara (V-24015) Hazira 11-04-2024 VESSEL NAME NEXT PORT SAILING DATE MSC Krystal (V-IV414A) Port of Freeport 10-04-2024 SM Manali (V-40) Beherai 11-04-2024 MSC Lagos X (V-GA414R) Karachi 12-04-2024 Safeen Power (V-66W) Kandla 12-04-2024 SB-6 MSC Heidi (V-IP414A) MSC Agency 13/04 SB-7 MSC Regina (V-OM414A) MSC Agency 13/04 SB-8 MSC Azra (V-FD408E) MSC Agency 13/04 SB-9 14/04 Yokohama Star (V-2415S) Hapag Llyod Nhava Sheva 16/04 Maersk Iyo (V-415W) Maersk India Jebel Ali In Port Express Rome (V-4310W) Hapag Llyod Nhava Sheva 12/04 TS Ningbo (V-24002E) TS Lines Nhava Sheva 14/04 AS Alva (V-937W) PIL India Berbera Cosco America (V-86W) Damietta 10-04-2024 Maersk Chennai (V-414W) Nhava Sheva 11-04-2024 APL California (V-OIX5QE) Nhava Sheva 12-04-2024 15/04 CMA CGM Musset (V-OIX6BW) CMA CGM Agency Port Bi Qasim 19/04 CSCL Neptune (V-79W) OOCL India Nhava Sheva SB-04 CMA CGM Kailas (V-ONLGAN) (Adhoc) CMA CGM Agency 13/04 SB-05 W Huang Pu Penang 08-04-2024 Talbot Singapore 09-04-2024 12th APRIL 2024 13 GUJARAT + NORTH INDIA

ETA CutOff/Dt.Time Vessels Name Voy VCN LINE AGENT WILL LOAD FOR ETD

TO LOAD FOR U. K. NORTH CONTINENT, MEDITERRANEAN, BLACK SEA, RED SEA, EAST EUROPE & CIS PORT 12/04 —/— Maersk Cape Town 415S 4031117 Maersk Line Maersk India Port Qasim, Salalah. (MAWINGU) 13/04 13/04 13/04-AM Wadi Duka 2407 4031101 Asyad Line Seabridge Marine Jeddah, Salalah, Sokhna (REX) 14/04 15/04 14/04-PM Maersk Genoa 415W 4031114 Maersk Line Maersk India Port Tangier, Algeciras, Valencia. (ME-2) 16/04 16/04 16/04-AM X-Press Altair 24007W 4041313 X-Press Feeder Sea Consortium Jeddah, Al Sokhna. (RGI) 17/04 TO LOAD FOR WEST ASIA GULF PORT In Port —/— Majd 2407E 4031274 Milaha/QN Line Poseidon Shpg. Jebel Ali, Hamad, Dammam. (IMX) 13/04 19/04 19/04-AM Zhong Gu Bo Hai 4015 —/— X-Press Feeder Sea Consortium 20/04 13/04 13/04-AM AS Clarita 2407 4031080 Oman Container Seabridge Marine Sohar, Jebel Ali, Hamad, Dammam (IEX) 14/04 14/04 14/04-AM GFS Prestige 415 4041382 Maersk Line Maersk India Jebel Ali, Dammam (SHAHEEN) 15/04 Sima Marine MBK Logistics 15/04 15/04-AM AS Sicilia 933S 4041340 Unifeeder Transworld Shpg. Jebel Ali (MJI) 16/04 15/04 14/04-PM Maersk Genoa 415W 4031114 Maersk Line Maersk India Salalah. (ME-2) 16/04 16/04 16/04-AM X-Press Altair 24007W 4041313 X-Press Feeder Sea Consortium Jebel Ali, (RGI) 17/04 TO LOAD FOR EAST, WEST, NORTH & SOUTH AFRICAN PORTS 12/04 —/— Maersk Cape Town 415S 4031117 Maerssk Line Maersk India Port Casina, Mombasa (MAWINGU) 13/04 14/04 14/04-AM Rhine Maersk 415W 4031201 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA) 15/04 15/04 15/04-AM AS Sicilia 933S 4041340 Unifeeder Transworld Shpg. Maputo (MJI) 16/04 TO LOAD FOR FAR EAST JAPAN, CHINESE PORTS & AUSTRALIAN PORTS 12/04 12/04-AM Wan Hai 317 7218E 4031261 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16) 13/04 13/04 13/04-AM Terataki 2405 4021003 Asyad Line Seabridge Marine Haiphong, Laem Chabang, Jakarta (IEX) 14/04 14/04 14/04-AM GSL Nicoletta 415E 4031116 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 15/04 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX) 18/04 18/04-AM Inter Sydney 154 4031158 Interworld Efficient Marine China (BMM) 19/04 28/04 27/04-PM GFS Giselle 2404 —/— Global Feeder Sima Marine Port Kelang, Busan, Gwangyang (CSC) 29/04 TBA Oman Container Seabridge Marine Haiphong, Shekou, Laem Chabang, Port Kelang (FEX1) TO LOAD FOR INDIAN SUB CONTINENT 14/04 14/04-AM Rhine Maersk 415W 4031201 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA) 15/04 17/04 17/04-AM Wadi Duka 2407 4031101 Asyad Line Seabridge Marine Karachi (REX) 18/04 28/04 27/04-PM GFS Giselle 2404 —/— Global Feeder Sima Marine Karachi (CSC) 29/04 CONTAINER VESSELS DUE / IN PORT FOR IMPORT DISCHARGE ETA VESSEL’S NAME VCN NO. AGENTS FROM SAILED WITH EXPORT CARGO VESSEL'S NAME NEXT DEST. SAILED ON VESSELS AT BERTH BERTH VESSEL'S NAME AGENT ETD VESSEL'S NAME NEXT DEST. SAILED ON ETA VESSEL’S NAME VCN NO. AGENTS FROM ADANI CMA MUNDRA CONTAINER TERMINAL PVT LTD (ACMTPL), MUNDRA 12/04 Wan Hai 317 (V-7218E) 4031261 Parekh Marine Nhava Sheva 12/04 Maersk Cape Town (V-415S) 4031117 Maersk India Port Qasim 14/04 GFS Prestige (V-415) 4041382 Maersk India Jebel Ali 14/04 Rhine Maersk (V-415W) 4031044 Maersk India Nhava Sheva 15/04 Maersk Genoa (V-415W) 4031114 Maersk India Jebel Ali 28/04 GFS Giselle (V-2404) —/— MBK Logistix Nhava Sheva Interasia Enhance(V-33E) Port Kelang 10-04-2024 Nara (V-224E) Nhava Sheva 11-04-2024 Beijing Bridge (V-2402) Karachi 10-04-2024 ADANI MUNDRA AUTOMOBILE TERMINAL TO LOAD FOR MEDITERRANEAN PORTS, U.K., NORTH CONTINENT, SCANDINAVIA ETA CUT OFF VESSEL’S NAME VOY NO VCN LINE AGENTS WILL LOAD FOR QUANTITY In Port Morning Capo 99 2401394 PMS Parekh Marine Services Singapore (PCC) 4,000 Teus TBA MOL MOL Shipping Jebel Ali (PCC) Teus CB-1 Majd (V-2407E) Poseidon Shpg 13/04 CB-2 Kapitan Abonosimov (V-2401W) Oasis Shipping 13/04 ETA Cut Off Vessel’s Name Voy No. VCN Line Agents Will Load For ETD TO LOAD FOR MEDITERANEAN PORTS, U.K., NORTH CONTINENT, SCANDINAVIA, BLACK SEA, EAST EUROPEAN & CIS DESTINATIONS 15/04 14/04-PM CMA CGM Musset OIX6BW 2401155 Hapag LloydHapag Lloyd Jeddah (INDAMEX 2) 16/04 19/04 18/04-PM CSCL Neptune 79W 2401196 CMA CGM CMA CGM Ag. (I) Jeddah, Suez Canal, Tangier, Southamton, Rotterdom, 20/04 26/04 25/04-PM CMA CGM Titan OPE91W 2400821 COSCO COSCO Shpg. Bremer Haven, Antwerp, Le Harve. (EPIC-III) 27/04 TO LOAD FOR WEST ASIA GULF & RED SEA PORT 14/04 14/04-PM Groton OUW25W 2401221 CMA CGM CMA CGM Ag. (I) Jebel Ali, Abu Dhabi (BIGEX) 15/04 OOCL OOCL (I) 16/04 15/04-PM Yokohama Star 2415S 2401180 CMA CGM CMA CGM Ag. Jebel Ali, Khorfakan. (SWAX) 17/04 20/04 19/04-PM CMA CGM Lebu 02SHFS 2401249 Emirates Shpg. Emirates Shpg 21/04 17/04 17/04-PM Lotus A OFFBCE 2401025 COSCO/Maersk COSCO Shpg./Maersk Port Qasim. (CIMEX2K) 18/04 CMA CGM CMA CGM Ag. (I) TO LOAD FOR U.S.A, CANADA, ATLANTIC, PACIFIC & SOUTHERN AMERICA 15/04 14/04-PM CMA CGM Musset OIX6BW 2401155 Hapag LloydHapag Lloyd New York, Norfolk, Savannah, Charleston.(INDAMEX 2) 16/04 16/04 16/04-PM Navious Constellation 4115 2401207 CMA CGM CMA CGM Ag. (I) New York, Norfolk, Charleston, Other USA East Cost Ports 17/04 Hapag / OOCLHapag / OOCL Destinations. (INDAMEX) TO LOAD FOR EAST, SOUTH & WEST AFRICAN PORTS 16/04 15/04-PM Yokohama Star 2415S 2401180 CMA CGM CMA CGM Ag. Mombasa, Dar Es Salaam. (SWAX) 17/04 20/04 19/04-PM CMA CGM Lebu 02SHFS 2401249 Emirates Shpg. Emirates Shpg 21/04 16/04 15/04-PM Maersk Iyo 415W 2401125 CMA CGM CMA CGM Ag. (I) Reunion, Durban, Point Desgalets, Walvis Bay, Luanda, 17/04 17/04 15/04-PM Stanley A OMTH9W 2400879 Maersk Line Maersk India Apapa, Tema, Cotonou, Lome, Capetown. (MIDAS-2 / MESAWA) 18/04 TBA CMA CGM CMA CGM Ag. (I) Tema, Libreville, Doula (Direct), Boma, Lonito, Durban, Apapa, Maersk Line Maersk India Tincan, Point Noire, Cotonou, Port Elizabeth. (MIDAS) Oceana (V-922) Jebel Ali 09-04-2024 Maersk Guatemala (V-414W) Nhava Sheva 09-04-2024 OEL Shasta (V-137) Nhava Sheva 09-04-2024 12th APRIL 2024 14 GUJARAT + NORTH INDIA

DP WORLD MUNDRA

ETA Cut Off Vessel’s Name Voy No. VCN Line Agents Will Load For ETD TO LOAD FOR U. K. NORTH CONTINENT, MEDITERRANEAN, BLACK SEA, RED SEA, EAST EUROPE & CIS PORT

NB:We request Liners/Agents to check the loading ports. If there are any corrections/ changes please contact us on our • Tel.:22661422/22691407 • E-Mail:dailyshipping@gmail.com In Port —/— Express Rome 4310W 2401063 CMA CGM CMA CGM Ag. (I) Jeddah, Suez Canal, Tanger, Rotterdam, Hamburg, 13/04 15/04 15/04-AM Sofia Express 4311W 2401181 COSCO/Hapag COSCO(I)/Hapag-Lloyd London Gateway, Antwerp, (EPIC-II) 16/04 20/04 20/04-AM Cypress OMXHYW 2400892 Hapag Lloyd ISS Shipping La Spezia, Barcelona, Valencia, Tangier, Fos Sur Mer, Genoa, 21/04 CMA CGM CMA CGM Ag. (I) Marsaxlokk. (IMEX) 25/04 25/04-AM Elona II 31 2401331 MBK Line MBK Logistics Jeddah, Kumport. (IMS) 26/04 TO LOAD FOR WEST ASIA GULF PORT 13/04 12/04-PM Monaco 204W 2401252 ONE Line ONE India Jebel Ali, Dammam (SIG) 14/04 15/04 14/04-PM AS Alva 937W 2401318 PIL PIL India Jebel Ali, Aden, P. Sudan, Djibouti. (RGS) 16/04 17/04 17/04-AM TS Kwangyang 24002W 2401240 MSR Master Logitech Dubai (IDEA) 18/04 18/04 18/04-PM Celsius Nairobi 907 2401386 X-Press Feeder Sea Consortium Jebel Ali, Khalifa, Khorfakkan. (ASX GULF) 19/04 Transworld Feeder Transworld Group 20/04 20/04-AM Cypress OMXHYW 2400892 Hapag-Lloyd ISS Shipping Khor Fakkan, Jebel Ali, Jeddah. (IMEX) 21/04 TO LOAD FOR FAR EAST, JAPAN, CHINESE PORTS & AUSTRALIAN PORTS 12/04 —/— Zhong Gu Ji Nan 24002E 2401287 KMTC/COSCO KMTC / COSCO Shpg. Port Kelang, Hongkong, Qingdao. (AIS) 13/04 14/04 14/04-AM KMTC Manila 2402E 2401376 TS Lines Samsara Shpg 15/04 12/04 —/— TS Ningbo 24002E 2401262 Evergreen/ONE Evergreen Shpg/ONE Port Kelang, Tanjin Pelepas, Singapore, Xingang, Qingdao, Ningbo 13/04 18/04 18/04-AM Ever Excel 173E 2401355 Feedertech/TS Lines Feedertech / TS Line Shanghai (CISC) 17/04 15/04 15/04-AM Xin Chang Shu 85E 2401309 Wan Hai Wan Hai Lines Port Kleang (W), Hong Kong, Qingdao, Kwangyang, Pusan, 16/04 19/04 19/04-AM Wan Hai 625 11E 2401323 COSCO/Evergreen COSCO / Evergreen Ningbo, Shekou, Singapore, Shanghai (PMX) 20/04 15/04 15/04-AM Rotterdam 76E 2401183 Interasia/GSL Aissa M./Star Shpg Port Kelang,Singapore, Tanjung Pelepas, Xingang, Qingdao, 16/04 23/04 23/04-PM Zoi 113E 2401403 Evergreen/KMTCEvergreen/KMTC (FIVE) 24/04 16/04 16/04-AM Ever Envoy 187E 2401174 One/X-Press Feeder OneIndia / SC-SPL Port Kelang, HongKong, Shanghai, Ningbo, Shekou. (CWX) 17/04 KMTC /TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX) 16/04 16/04-PM Northern Practise 29E 2401203 FeedertechFeedertech Port Kelang, Singapore, Leam Chabang.(AGI) 17/04 TO LOAD FOR INDIAN SUB CONTINENT 12/04 —/— Zhong Gu Ji Nan 24002E 2401287 KMTC/COSCO KMTC / COSCO Shpg. Colombo (AIS) 13/04 14/04 14/04-AM KMTC Manila 2402E 2401376 TS Lines Samsara Shpg 15/04 12/04 —/— TS Ningbo 24002E 2401262 Evergreen / ONEEvergreen / ONE Colombo (CISC) 13/04 18/04 18/04-AM Ever Excel 173E 2401355 Feedertech / TSLFeedertech / TSL 19/04 13/04 12/04-PM Monaco 204W 2401252 ONE Line ONE India Colombo (SIG) 14/04 15/04 15/04-AM Xin Chang Shu 85E 2401309 Wan Hai Wan Hai Lines Colombo 16/04 19/04 19/04-AM Wan Hai 625 11E 2401323 COSCO/Evergreen COSCO / Evergreen (PMX) 20/04 15/04 15/04-AM Rotterdam 76E 2401183 Interasia/GSL Aissa M./Star Shpg Colombo. (FIVE) 16/04 23/04 23/04-PM Zoi 113E 2401403 Evergreen/KMTCEvergreen/KMTC 24/04 16/04 16/04-PM Northern Practise 29E 2401203 FeedertechFeedertech Colombo.(AGI) 17/04 16/04 16/04-AM Ever Envoy 187E 2401174 One/X-Press Feeder One India / Sea Consortium Karachi, Colombo. (CWX) 17/04 KMTC / TS Line KMTC India/TS Line(I) 20/04 20/04-AM Cypress OMXHYW 2400892 Hapag Lloyd ISS Shipping Colombo (IMEX) 21/04 CMA CGM CMA CGM Ag. (I) 22/04 15/04-PM Volans 2416W 2401244 Hapag Lloyd ONE Line (I)/ISS Shpg Colombo (MIAX) 23/04 ADANI INTERNATIONAL CONTAINER TERMINAL PVT LTD. (AICT) TO LOAD FOR U.K. NORTH, MED., BLACK SEA, RED SEA, EAST EUROPE & CIS PORTS In Port —/— MSC Heidi IP414A 2401257 MSC/COSCO MSC Ag / COSCO Shpg. Gioia Tauro,Tangier,Southamton,Rotterdam,Antwerp, Felixstowe. Dunkirk, Le Havre 13/04 16/04 15/04-PM MSC United VIII IP415A 2401334 CMA CGM CMA CGM Ag.(I) & Other Inland Destination in Europe, Med,Red Sea, Black Sea Adriatic Ports (EUROPE) 17/04 13/04 13/04-PM MSC Bremen IV415A 2401337 MSC MSC Agency Barcelona, Valencia (INDUSA) 14/04 13/04 13/04-AM MSC Irene IS412A 2401144 MSC/SCI MSC Ag / J.M.Baxi Gioia Tauro, Feixstowe, Hamburg, Antwerp & Other Inland Destn.(HIMEXP) 14/04 14/04 13/04-PM Hyundai Hongkong 151W 2401202 Hyundai Seabridge Maritime Jeddah, Damietta, Piraeus, Genoa, Valencia, Barcelona (FIM) 15/04 23/04 23/04-AM Jolly Rosa 85 2401300 Mesiina Transworld Group Istanbul, Jeddah, Nisurata (Libya), Castellon (Spain), Geneo, Naples, Iskderon (INDME) 24/04 TBA MSR Master Logitech Jeddah, Damietta (WARM) TO LOAD FOR WEST ASIA GULF PORT In Port —/— MSC Heidi IP414A 2401257 MSC MSC Agency King Abdullah & Salallah (EUROPE) 13/04 In Port —/— MSC Regina OM414A 2401259 MSC MSC Agency Salalah, King Abdulla (EAF) 13/04 13/04 —/— MSC Silvana IU414A 2401333 MSC MSC Agency Salalah (INDUS) 14/04 14/04 13/04-PM MSC Brianna JU414R 2400973 MSC MSC Agency Sohar, Jebel Ali, Abu Dhabi, Dammam, Umm Qasr (UGEXP) 15/04 16/04 15/04-PM SSF Dynamic 68W 2401402 Safeen Feeders Samsara Shpg. Khalifa, Jebel Ali, Bahrain, Dammam, Jubair (UIG) 17/04 Yang Ming Line Yang Ming Line 17/04 17/04-AM MSC Positano JD413A 2401283 MSC MSC Agency Bahrain, AL Jubail, Hamad, Abu Dhabi, (MEF 4) 18/04 TO LOAD FOR

PORTS In Port —/— MSC Regina OM414A 2401259 MSC MSC Agency Dar Es Salaam, Mombasa (EAF) 13/04 13/04 13/04-AM MSC Irene IS412A 2401144 MSC MSC Agency Cape Town,East Town,Walvis Bay,Luanda,Namibie,Douala,Lome,Durban, 14/04 15/04 15/04-AM MSC Aries IS413A 2401214 Coega,Port Louis,Beira,Maputo, Nucal,Quelimane,Pemba, Majunga (HIMEXP) 16/04 14/04 14/04-PM MSC Wind II IB414A 2401073 MSC MSC Agency Port Louis, Durban (ILEX) 15/04 23/04 23/04-AM Jolly Rosa 85 2401300 Mesiina Transworld Group Durban, Maputo, Dar Es Salaam, Mombasa (INDME) 24/04 TBA MSC MSC Agency Port Louis, Tema, Lome, Cotonou (IAS) TBA MSR Master Logitech Dar Es Salaam, Mombasa (WARM) TO LOAD FOR U.S.A, CANADA, ATLANTIC, PACIFIC & SOUTHERN AMERICA In Port —/— MSC Heidi IP414A 2401257 MSC MSC Agency U.S.A., Mexico, Carribean, South America, East & West Coast (EUROPE) 13/04 13/04 13/04-PM MSC Bremen IV415A 2401337 MSC MSC Agency New York,, Norfolk, Savannah (INDUSA) 14/04 13/04 —/— MSC Silvana IU414A 2401333 MSC MSC Agency Charleston, New York, Norfolk, Free Port USA South & Central America(INDUS) 14/04 TO LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND & PACIFIC ISLANDS 13/04 13/04-AM Kota Layang 94E 2401127 PIL / RCL PIL (I) / RCL Agency Port klang, Shekou, Singapore, Haiphong, Sanghai (RWA2) 14/04 22/04 22/04-AM Api Bhum 7E 2401315 Interasia Interasia Shipping 23/04 14/04 13/04-PM Hyundai Hongkong 151W 2401202 Hyundai Seabridge Maritime Port klang, Singapore, Shekou, Ningbo, Shangai, Kwangyang, Busan (FIM) 15/04 14/04 13/04-PM MSC Tokyo GA415R 2401223 MSC MSC Agency Port klang, Singapore, Tanjung Pelepas, Laem Chabang, 15/04 Vung Tau, Da Chan Bay, Shekou (SHIKRA) TO LOAD FOR INDIAN SUB CONTINENT In Port —/— MSC Regina OM414A 2401259 MSC MSC Agency Karachi (EAF) 13/04 13/04 13/04-PM MSC Bremen IV415A 2401337 MSC MSC Agency Colombo (INDUSA) 14/04 13/04 13/04-AM Kota Layang 94E 2401127 PIL / RCL PIL (I) / RCL Agency Karachi (RWA2) 14/04 22/04 22/04-AM Api Bhum 7E 2401315 Interasia Interasia Shipping 23/04 14/04 13/04-PM MSC Tokyo GA415R 2401223 MSC MSC Agency Colombo (SHIKRA) 15/04 14/04 13/04-PM Hyundai Hongkong 151W 2401202 Hyundai Seabridge Maritime Karachi (FIM) 14/04 17/04 16/04-PM SM Mahi 69 2401404 Simatech MBK Logistics Cochin, Colombo, Chennai, Visakhapatnam (CCG) 18/04 TBA MSC MSC Agency Colombo (IAS) TBA SCI J M Baxi & Co. Colombo (SMILE C) 12th APRIL 2024 15 GUJARAT + NORTH INDIA

ADANI MUNDRA CONTAINER TERMINAL (AMCT)

EAST, SOUTH & WEST AFRICAN

OTHER PORTS OF GUJARAT (As on 12-04-2024) JAMNAGAR (BEDI) PORT EXPORT / IMPORT EXPORT VESSELS AGENTS ETA TO COMMODITY QTY.(m.t.) ETD IMPORT VESSELS AGENTS ETA FROM COMMODITY QTY.(m.t.) ETD NB The data in this Daily pertaining to Ports Information is received by us, sometimes even at the eleventh hour by telephonic messages from the concerned Steamer Agents. Therefore, there is every likelihood of last minute change in the data published the Management of Daily Shipping Times exercise every necessary care & attention in collecting every data & getting it published accurately Inspite of this, if any ommission, inaccuracy or printing error occur in the data published in this daily, the Management of Daily Shipping Times is not responsible or liable. IMPORT ETA Vessel’s Name Agent From Commodity Quantity ETD COASTAL ETA Vessel’s Name Agent From Commodity Quantity ETD (As on 12-04-2024) MULDWARKA PORT PIPAVAV PORT ETA Cut Off/Dt.Time Vessels Name Voy VCN LINE AGENT WILL LOAD FOR ETD TO LOAD FOR MED., BLACK SEA, U.K., NORTH CONTINENT AND SCANDINAVIAN PORTS In Port —/— Maersk Sentosa 414W 24131 Maersk Line Maersk India Algeciras 12/04 19/04 18/04-1800 Seaspan Jakarta 415W 24127 (MECL) 20/04 TO LOAD FOR FAR EAST, CHINA, JAPAN, AUSTRALIA, NEW ZEALAND AND PACIFIC ISLANDS 15/04 14/04-20:30 Cap Andreas 010E 24126 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 16/04 20/04 20/04-02:30 San Fracisco Bridge 071E 24136 ONE ONE (India) (TIP) 21/04 18/04 18/04-1700 One Arcadia 068E 24130 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 19/04 25/04 25/04-1700 Conti Conquest 0027E HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3) 26/04 17/04 17/04-1500 Tina 1 416E 24123 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 18/04 24/04 24/04-1500 X-Press Odyssey 24018E X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 25/04 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan 17/04 16/04-1900 OOCL Hamburg 149E 24128 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 18/04 24/04 24/04-1900 OOCL Luxemburg 109E 24129 Gold Star / RCL Star Shpg/RCL Ag. (CIXA) 25/04 18/04 18/04-1300 Xin Beijing 144E 24106 COSCO COSCO Shpg. Singapor, Cai Mep,Hongkong, Shanghai,Ningbo,Shekou, Nansha (CI1) 19/04 18/04 18/04-1300 Xin Fei Zhou 093E 24121 19/04 TO LOAD FOR WEST ASIA GULF, RED SEA & EAST AFRICAN PORTS In Port —/— Maersk Sentosa 414W 24131 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 12/04 16/04 16/04-0400 GFS Prestige 415E 24133 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX) 17/04 23/04 23/04-0400 Johannes Maersk 416E 24134 24/04 TO LOAD FOR INDIAN SUB CONTINENT PORTS & COASTAL SERVICE In Port —/— SM Manali 040 24124 CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, 13/04 Krishnapatanam, Cochin, Mundra. (CCG) 13/04 13/04-0800 SCI Chennai 2402 24108 SCI J M Baxi Mundra, Cochin, Tuticorin (SMILE) 13/04 15/04 14/04-20:30 Cap Andreas 010E 24126 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo. 16/04 20/04 20/04-02:30 San Fracisco Bridge 071E 24136 ONE ONE (India) (TIP) 21/04 17/04 16/04-1900 OOCL Hamburg 149E 24128 COSCO/OOCL COSCO Shpg./OOCL(I) Colombo. (CIXA) 18/04 17/04 17/04-1500 Tina 1 416E 24123 Maersk Line Maersk India Colombo. (NWX) 18/04 18/04 18/04-0500 SSL Bharat 152 SLSSLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 19/04 18/04 18/04-1300 Xin Beijing 144E 24106 COSCO COSCO Shpg. Karachi, Colombo (CI1) 19/04 18/04 18/04-1300 Xin Fei Zhou 093E 24121 19/04 TO LOAD FOR US & CANADA WEST COAST In Port —/— Maersk Sentosa 414W 24131 Maersk Line Maersk Line India Newark, Charleston, Savannah, Houston, Norfolk. 12/04 19/04 18/04-1800 Seaspan Jakarta 415W 24127 Safmarine Maersk Line India (MECL) 20/04 15/04 14/04-20:30 Cap Andreas 010E 24126 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 16/04 20/04 20/04-02:30 San Fracisco Bridge 071E 24136 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 21/04 18/04 18/04-1700 One Arcadia 068E 24130 ONE ONE (India) Los Angeles, Oakland. (PS3) 19/04 SHIPPING MOVEMENTS AT ADANI HAZIRA PORT ETA/Berth Vessel’s Name Voy VCN Line Agents Will Load For ETD In Port Dalian 2414W 2400377 Hapag ISS Shpg. Colombo, Durban, Tema, Tincan, Apapa & Other South African, 12/04 24/04 Volans 2416W 2400414 One ONE (I) West African & Middle East Ports (MIAX / AIM) 25/04 12/04 MSC Wind II IB414A 2400397 MSC MSC Agency Colombo, Port Louis, Duban, Jebel Ali (ILANGA EXPRESS) 13/04 12/04 Sprinter 051W 2400404 OOCL/COSCO OOCL (I)/COSCO Shpg. Khalifa, Jebel Ali, Sharjah, Bahrain. (AGI2) 13/04 13/04 Rotterdam 76E 2400330 Zim/KMTC Zim Integrated/KMTC India Far East & South East Asia 14/04 20/04 Zoi 113E Evergreen/Emirates Evergreen Shpg./Emirates Shpg. (NIX / FIVE / CIX3) 21/04 27/04 KMTC Dubai 2402E X-Press Feeders Sea Consortium 28/04 14/04 SC Mara 24015 2400398 UnifeederUnifeeder Jebel Ali, Port Khalifa. (ASX) 15/04 21/04 Celsius Nairobi 097 X-Press Feeders Sea Consortium 22/04 14/04 MSC United VIII IP415A 2400403 MSC MSC Ag Europe, South Central America, US, Gulf (IPAK) 15/04 21/04 MSC Vilda X IP416A 22/04 15/04 Grasmere Maersk 416W 2400383 Maersk Line Maersk India Mediterranean, Europe, South Central America, 16/04 22/04 Maersk Virginia 417W 2400418 US, Gulf & Africa (Blue Nile Express) 23/04 15/04 Terataki 2405E 2400384 Asyad Seabridge Far East. (FEX) 16/04 15/04 SSL Gujarat 151 2400373 Shreyas Transworld Group Coastal & Mundra Transhipment for Mediterranean, Europe, 15/04 16/04 SSL Visakhapatanam 186 2400413 Hapag/CMA CGM ISS Shpg./CMA CGM Ag.(I) South Central America, US, Gulf & Africa. (WCC) 17/04 12th APRIL 2024 16 GUJARAT + NORTH INDIA

duly discharged and on payment of applicable charges.

Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods.

As Agents :

BL NOS. No. of 20’ 40’ BL NOS. No. of 20’ 40’ BL NOS. No. of 20’ 40’ Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS OF LADING, duly discharged and on payment of applicable charges. Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods. As Agents : STAR SHIPPING SERVICES (INDIA) PVT. LTD. First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201 Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836) 230433 Export Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@zim.com Mr. Vijay Anand - 9824504315 Email : anand.vijay@zim.com Import Marketing Queries : Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: imp@starship-knd.zim.com GOSUSNH1525789 —1 GOSUSNH1825299 —2 GOSUSNH1911634 1— GOSUSNH1912635 1— GOSUSNH1912672 1— GOSUSNH1912744 —1 GOSUSNH1912981 —2 NOTICE TO CONSIGNEES m.v. “XIN BEIJING” V - 144 The

GOSUSNH20878792 1— GOSUSNH20878795 1— GOSUSNH20878808 1— BL NOS. No. of 20’ 40’ ZIMUSAV9056361 —1

OF

above vessel is arriving at PIPAVAV on 19-04-2024 with Import Cargo in containers.

Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS

LADING,

ZIM INTEGRATED SHIPPING SERVICES (INDIA) PVT. LTD. First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201 Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836)

Export

: Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: imp@starship-knd.zim.com NOTICE TO CONSIGNEES m.v. “SM MAHI” V - 0069 The above vessel is arriving at

ZIM

HH We are not responsible for any mistake. ALL RATES ARE PROVISIONAL. The rates in this column are only meant for guidance. AUSTRALIANDOLLARAUSTRALIANDOLLAR AUSTRALIAN DOLLAR 56.1056.10 56.10 53.7053.70 BAHRAINIDINARBAHRAINIDINAR BAHRAINIDINARBAHRAINIDINAR BAHRAINI DINAR 230.05230.05 230.05 213.30213.30 CANADIANDOLLARCANADIANDOLLAR CANADIANDOLLARCANADIANDOLLAR CANADIAN DOLLAR 62.7562.75 62.75 60.7560.75 CHINESEYUANCHINESEYUAN CHINESEYUANCHINESEYUAN CHINESE YUAN 11.7511.75 11.7511.75 11.75 11.3511.35 11.3511.35 DANISHKRONERDANISHKRONER DANISH KRONER 12.3012.30 12.3012.30 12.30 11.9511.95 11.9511.95 EUROEURO EURO 92.0592.05 92.05 88.9588.95 HONG KONG DOLLARHONGDOLLAR HONG DOLLAR 10.8010.80 10.80 10.5010.50 KUWAITIDINARKUWAITIDINAR KUWAITIDINARKUWAITIDINAR KUWAITI DINAR 280.2280.2 280.2280.2 280.2 262.80262.80 262.80262.80 NEW ZEALAND DOLLARNEW ZEALAND DOLLAR NEW ZEALAND DOLLARNEW ZEALAND DOLLAR NEW DOLLAR 51.4551.45 51.4551.45 51.45 49.1049.10 49.1049.10 NORWEGIANKRONERNORWEGIANKRONER NORWEGIAN KRONER 7.907.90 7.90 7.707.70 POUNDSTERLINGPOUNDSTERLING POUNDSTERLINGPOUNDSTERLING POUND STERLING 107.35107.35 107.35 103.90103.90 QATARIRIYALQATARIRIYAL QATARI RIYAL 23.6523.65 23.6523.65 23.65 22.2522.25 22.2522.25 SAUDI ARABIAN RIYALSAUDIRIYAL SAUDI ARABIAN RIYAL 23.0023.00 23.0023.00 23.00 21.6521.65 21.6521.65 SINGAPOREDOLLARSINGAPOREDOLLAR SINGAPOREDOLLARSINGAPOREDOLLAR SINGAPORE DOLLAR 62.9062.90 62.90 60.9560.95 SOUTH AFRICAN RANDSOUTH AFRICAN RAND SOUTH AFRICAN RAND 4.604.60 4.60 4.354.35 SWEDISHKRONERSWEDISHKRONER SWEDISH KRONER 7.957.95 7.95 7.757.75 SWISSFRANCSWISSFRANC SWISS FRANC 94.1594.15 94.15 90.7090.70 TURKISHLIRATURKISHLIRA TURKISH LIRA 2.702.70 2.702.70 2.70 2.552.55 2.552.55 UAEDIRHAMUAEDIRHAM UAE DIRHAM 23.4523.45 23.45 22.0522.05 USDOLLARUSDOLLAR USDOLLARUSDOLLAR US DOLLAR 84.3584.35 84.3584.35 84.35 82.6082.60 82.6082.60 JAPANESE YEN (100)JAPANESE(100) JAPANESE YEN 55.8555.85 55.8555.85 55.85 54.2054.20 54.2054.20 KOREAN WON (100)KOREAN WON (100) KOREAN (100) 6.406.40 6.40 6.006.00 TT Selling RatesTTRates TT Selling RatesTTRates Selling Rates BillSellinBillSellin BillSellinBillSellin Bill Sellingg gg g TT Buying RatesTT Buying Rates TT Buying RatesTT Buying Rates Buying Rates BillBuyingBillBuying BillBuyingBillBuying Bill Buying NAME OF THENAME OF THE NAME OF THENAME OF THE OF THE forCleanforClean forCleanforClean for Clean RatesforRatesfor RatesforRatesfor Rates for forCleanforClean forCleanforClean for Clean RatesforRatesfor RatesforRatesfor Rates for CURRENCYCURRENCY CURRENCYCURRENCY CURRENCY RemittanceRemittance RemittanceRemittance Remittance IMPORTIMPORT IMPORTIMPORT IMPORT RemittanceRemittance RemittanceRemittance EXPORTEXPORT EXPORTEXPORT EXPORT OutwardsOutwards Outwards InwardsInwards InwardsInwards Inwards MKTMKT MKTMKT MKT MKTMKT MKT MKTMKT MKT U.S. Dollar 83.595083.762582.862582.8100 U.K. Pound 106.3800106.5925104.6200104.5500 Euro 90.947591.127589.635089.5700 Japanese Yen(100) 55.267555.377554.465054.4250 Swiss Franc 92.935093.120091.315091.2525 Swedish Kroner 7.96757.98507.80257.7975 Canadian Dollar 61.827561.952560.895060.8525 Australian Dollar 55.652555.762554.557554.5200 Singapore Dollar 62.570062.695061.277561.2350 Hong Kong Dollar 10.740010.762510.522510.5150 UAE Dirham 22.907522.952522.440022.4250 H CUSTOM EXCHANGE RATES ALL RATES PER UNIT W. E. F. 05-04-2024 ON 10-04-2024 ´´ ´´ ´ FOREIGN EXCHANGE RATES ´´ ´´ ´ CURRENCY IMPORT EXPORT 17 12th APRIL 2024 GUJARAT + NORTH INDIA

230433

Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@zim.com Mr. Vijay Anand - 9824504315 Email : anand.vijay@zim.com Import Marketing Queries

MUNDRA PORT on 17-04-2024 with Import Cargo in containers.

INTEGRATED SHIPPING SERVICES

CONCOR to gain from dedicated freight corridor : Motilal Oswal Research

M U M B A I : C o n t a i n e r C o r p o r a t i o n o f I n d i a L t d (CONCOR) will be a key beneficiary of the Dedicated Freight Corridor (DFC), which is likely to result in volume growth driven by a modal shift and enhanced operating efficiencies, according to stock brokerage firm Motilal Oswal Securities Ltd. (MOSL).

The DFC connects Dadri to Mundra. The company, according to the brokerage firm, could also benefit

from the shift in volumes from Gujarat ports to JNPT after the entire DFC commissioning, which is likely to be completed in FY2026.

T h e 9 M F Y 2 0 2 4 d o m e s t i c container volumes grew 11 percent YoY, while export import volumes rose 6 percent in the same period. While weak trade volumes due to the geopolitical headwinds hit the export import volumes, the brokerage believes that domestic operations will scale up due to the addition of new

services/commodities for multiple sectors, and a strong network of terminals as well as strategic initiatives such as addition of FMCGled cargo etc. The brokerage expects the company to report blended volumes of around 10 percent CAGR during the FY2024-26 period.

In Q3FY24, Concor reported a 9.5 percent YoY increase in net profit to Rs 333 67 crore in Q3FY24 Q3 revenues also rose 10.3 percent YoY to Rs 2,210.57 crore.

Maharashtra, Karnataka and Gujarat to be $1 trillion economy by FY39: Ind-Ra

MUMBAI: Maharashtra, Karnataka and Gujarat are likely to hit the $1 trillion economy mark by FY39 if the pace of growth in these states remain similar to what was recorded in the past seven years, India Ratings and Research (Ind-Ra) said in a recent report.

To achieve the $1 trillion-mark, Karnataka would require a nominal gross state domestic product (GSDP) growth (in USD terms) of 8.4% annually till the financial year 2038-39. Between FY16 to FY23, Karnataka posted an average annual GSDP growth of 8.4% in nominal dollar terms.

Maharashtra, which is the biggest state economy, can achieve the $1 trillion GSDP feat by FY39 with an average annual growth of 5.5%, while Gujarat requires a growth of 8 3%

These are the same growth that these states have recorded between FY16 to FY23, said Paras Jasrai, Senior Analyst at Ind-Ra.

After Maharashtra, Karnataka and Gujarat, Tamil Nadu would be the next to reach $1 trillion in FY41, if it sustains the estimated nominal GSDP growth (USD terms) of 7.2% same as during FY16-FY23 in the coming years.

However, all these states have set targets to achieve a $1 trillion economy much ahead.

The Maharashtra government has set a target to reach $1 trillion by FY28 To achieve this, Maharashtra’s nominal GSDP (in USD terms) will have to grow at a staggering CAGR of 18.0% during FY24-FY28. Similarly, Gujarat and Karnataka are aiming to reach the $1 trillion mark by FY31 and

FY33, respectively This would require their nominal GSDP (in USD terms) to grow at a CAGR of 17 4% and 13 5%, respectively, from FY24.

Tamil Nadu aims to attain the $1 trillion mark by FY31, for which its nominal GSDP (in USD terms) has to grow at a CAGR of 16.6% from FY24.

Ind-Ra’s estimates show that India w o u l d h a v e e i g h t s u b - n a t i o n a l economies which would hit the $1 trillion mark by FY47.

Uttar Pradesh is estimated to reach $1 trillion by FY42, subject to its nominal GSDP growth (USD terms) growing at an estimated CAGR of 7 1%, like during FY16-FY23 UP though is targeting to attain it by FY28 For this, its nominal GSDP (in USD terms) will have to grow at a CAGR of 29.0% from FY24

Local production of Electronics parts gets a boost, Import of smart phones declines 40%

C H E N N A I : I n d i a ’ s l o c a l manufacturing of electronics is expanding every year, with a significant decrease in imports of key components such as mechanics, vibrator motors, charger adapters, and plastic parts According to commerce ministry data, imports of fully assembled electronics like smartphones dropped by 40% in the period from April to January FY 2023-24. The government’s decision to reduce import duty on components from 15% to 10% in the recent budget aimed to boost local manufacturing competitiveness

Charger adapters imports witnessed a significant 72% decrease in volume but a

slight 1 3% increase in value from April to January 2024 compared to FY23. Market analysts noted that chargers account for about 2 5% of the total production cost of mobilephones While high-value items such as camera modules, display assemblies, and battery packs were imported in larger quantities last year, there is a growing need to enhance local value a d d i t i o n f o r i m p r o v e d e x p o r t competitiveness Camera module imports increased by 2.3% in volume but decreased by 5 3% in value, while battery pack imports rose by 12% in volume but fell by 13% in value.

The revised HSN code for display assemblies in 2023 led to a significant 200% surge in imports. Semiconductor imports also saw an increase, driven by the demand for premium electronic goods and higher wafer costs.

In the first nine months of the fiscal year, India’s electronics exports soared by 22.24% to surpass the $20-billion m a r k , p r i m a r i l y d u e t o r o b u s t smartphone exports by leading brands like Apple and Samsung.

Notably, iPhones accounted for $7 billion in exports in December 2023, representing 35% of total electronics exports.

ADB raises India's GDP growth forecast for FY25 to 7%

MANILA: The Asian Development Bank (ADB) recently raised India's GDP growth forecast for the current fiscal to 7 per cent from 6 7 per cent earlier, saying the robust growth will be driven by public and private sector investment demand and gradual improvement in consumer demand.

The 2024-25 growth estimate is, however, lower than 7 6 per cent projected for the 2022-23 fiscal Strong investment drove GDP growth in the 2022-23 fiscal as consumption was muted, the ADB said The ADB had in December last year projected the Indian economy to expand 6.7percentinthe2024-25fiscal.

Growth will be robust despite moderating in FY2024 and FY2025, it said. For the 2025-26 fiscal, the ADB has projected India's growth at 7.2 per cent.

The ADB said exports are likely to be relatively muted this fiscal as growth in major advanced economies slows down but will improve in FY2025.

12thAPRIL2024 GUJARAT+NORTHINDIA 18

Skill development crucial in setting up efficient logistics: DPIIT

VADODARA: Capacity building and skill development play a crucial role in establishing efficient and costeffective logistics and infrastructure systems, an official statement said recently

Speaking at a workshop in Va d o d a r a , S e c r e t a r y i n t h e Department for P romotion of Industry and Internal Trade (DPIIT) Rajesh Kumar Singh highlighted on i n t e g r a t i n g l o g i s t i c s a n d infrastructure development courses into the curriculum of Central Training Institutes (CTIs), State Administrative Training Institutes (ATIs).

It would help officers to better prepare to tackle the complexities of infrastructure development, enhance logistical efficiencies, and contribute significantly to India’s economic growth and development agenda.

As part of efforts to strengthen India’s logistics and infrastructure sectors, the DPIIT, in collaboration with Gati Shakti Vishwavidyalaya ( G S V ) i n Va d o d a r a , G u j a r a t , organised the workshop.

The workshop was organised with the objective of integrating the principles of PM GatiShakti National Master Plan (PMGS-NMP) and the National Logistics Policy (NLP) into the educational curriculum and training of CTIs and State ATIs.

The workshop aimed to provide a common platform for brainstorming on the pedagogical strategies, curriculum development, and the integration of real-world logistics and infrastructure challenges into administrative training discourse of government officials.

Singh “emphasised the crucial role of capacity building and skill

development in the logistics sector to establish efficient and cost-effective logistics and infrastructure systems”, the commerce and industry ministry said in a statement.

L ogistics Human Resource Development and Capacity Building is one of the important action items identified under the National Logistics Policy (NLP).

Government officials at all levels have a critical role to play in the successful implementation of the PMGS-NMP and NLP .

To widely propagate the essential principles of the PM GatiShakti, v a r i o u s m e a s u r e s h a v e b e e n undertaken so far, one of which is onboarding of CTIs and ATIs to institutionalise and regularise training and capacity building of government officials on PMGS-NMP principles.

India to continue surpassing China’s GDP growth rate for next few years, claims European expert

HAMBURG: Angelos Delivorias, a p o l i c y e x p e r t a t E u r o p e a n Parliamentary Research (EPRS), has predicted that India’s GDP growth rate would continue to be better than that of China for the next few years.

He made the remarks in an interview by EPRS on the rise of ‘India, why it matters, and what this means for the EU.’ EPRS provides comprehensive research and analytical support to the Members of the European Parliament.

“India has surpassed the growth rate of China, and experts think that it will continue doing so, at least in the

short term,” Delivorias was quoted by ANI as saying.

Delivorias highlighted that India’s growth would be fuelled by its comparatively younger population as compared to that of China.

“From the economic perspective, the fact that India is the largest population on the planet, but also its population is younger, if we see the demographic pyramid of India, we see that it’s younger than China’s, implies that it has more people in the labour market and it has less expenditures in the health sectors or for pensions,

which means it can keep growing its GDP in the next few years,” he added Notably,India’sGDPgrowthaveraged over7.5percentin2023,whileChina’swas 5 2 per cent India’s GDP growth rate is expected to reach 7 per cent by 2026, while China’s GDP growth rate is expected to reach 4.6 per cent. The IMF projects China’s 2024 growth at 4 6 per cent, declining towards 3.5 per cent in 2028.

Delivorias also talked about the initiatives being taken today which will help sustain India’s economic growth. He hailed India’s infrastructure investments.

Paradip Port Advances into Port 4.0 with ID Tech's Innovative Automation Solutions

GURUGRAM: Paradip Port, a pivotal maritime hub, is embracing the future of port operations with ID Tech, a leader in advanced automation. In a transformative collaboration, Paradip Port is leveraging ID Tech's cuttingedge solutions to usher in the era of Port 4.0 innovation. This partnership marks a significant milestone in the port's journey towards modernization and efficiency

Paradip Port Authority (PPA) recognizes the need for seamless management of men, material, and vehicles round-the-clock. To meet this demand, PPA has embarked on a m i s s i o n t o m o d e r n i z e g a t e management systems and optimize c a r g o m o v e m e n t u s i n g l a t e s t technologies. Leveraging ID Tech's solutions, PPA aims to establish intelligent traffic management across the port, significantly elevating operational performance.

modernized the tracking of inward and outward cargo movement by rail/road and movement of people at Paradip Port through the implementation, operation, and management of RFID -based Access Control System along with cloud-based Harbour Entry Permit application software This innovative solution ensures real-time monitoring and recording of cargo movements, and the system also facilitates 24x7x365 movement of men, material, and vehicles while ensuring stringent security measures are in place enabling efficient management and optimization of port activities.

The solution includes Harbour Entry Permit Application Software hosted on main and local servers, facilitating the issuance of RFID-based p e r m i t s a t v a r i o u s p o r t g a t e s Enhanced security is ensured through RFID readers installed at each gate for identification and recording of each v

premises. Furthermore, modernization of weighbridges is achieved with boom barriers and vehicle positioning systems installed at each weighbridge to facilitate seamless and rapid movement of vehicles through the unmanned facility

As Paradip Port embraces the future of port operations, this collaboration with ID Tech Solutions underscores a commitment to innovation and excellence. Together, they are paving the way for a more efficient, productive, and technologicallyadvancedmaritimehub

Mr Saurav Khemani, Managing Director of ID Tech Solutions Pvt. Ltd., emphasized the significance of this collaboration, stating, "Our partnership with Paradip Port marks a significant s t e p t o w a r d s a d v a n c i n g p o r t o p e r a t i o n s B y l e v e r a g i n g o u r innovative automation solutions, we are simplifying processes and driving efficiency, thereby contributing to the realization of Port 4.0 objectives."

GUJARAT+NORTHINDIA 12thAPRIL2024 19

I D Te c h h a s s i m p l i f i e d a n d

ehicle/individual entering the

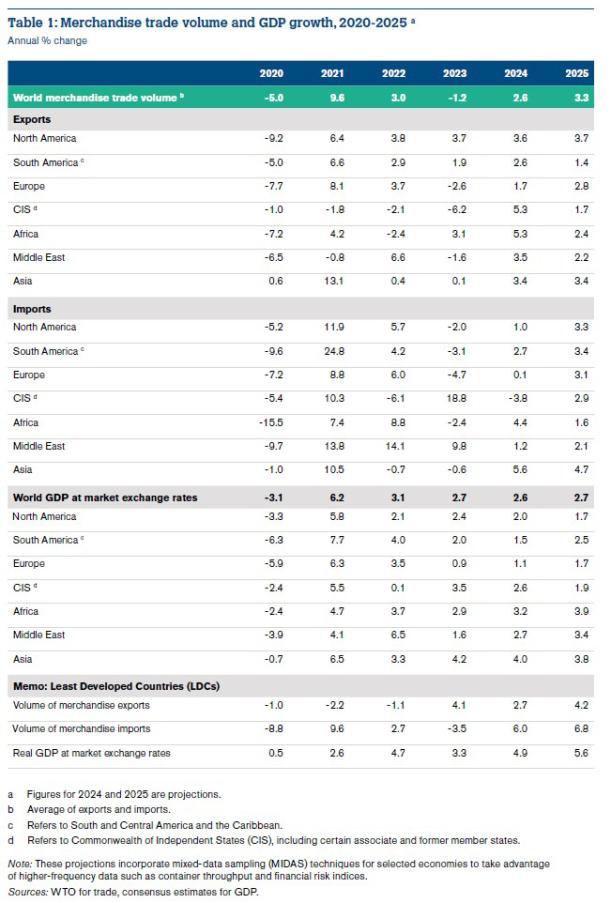

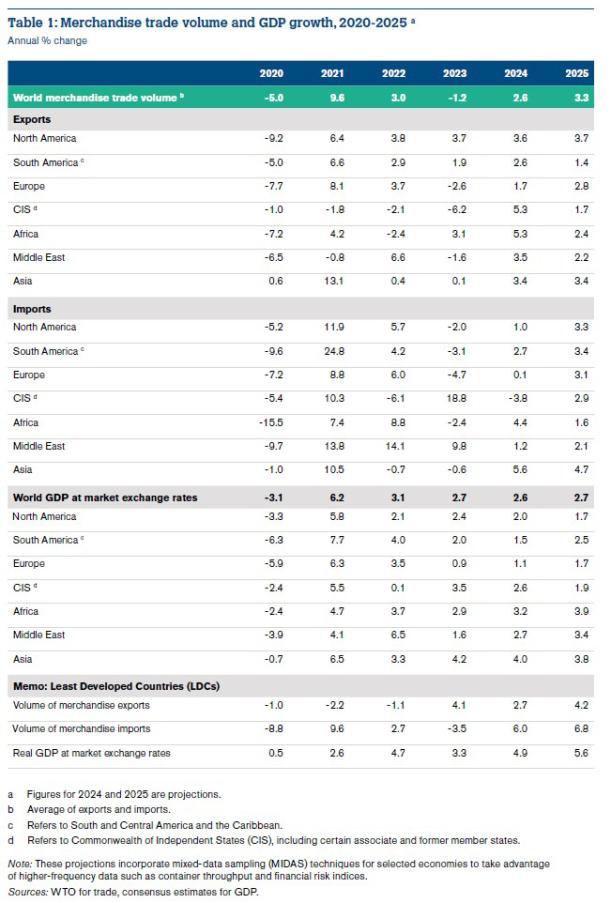

WTO forecasts rebound in Global Trade but warns of downside risks

BRUSSELS: In the latest “Global Trade Outlook and Statistics” report, WTO economists note that inflationary pressures are expected to abate this year, allowing real incomes to grow again particularly in advanced economies — thus providing a boost to the consumption of manufactured goods. A recovery of demand for tradable goods in 2024 is already evident, with indices of new export orders pointing to improving conditions for trade at the start of the year.

WTO Director-General Ngozi Okonjo-Iweala said: “We are making progress towards global trade recovery, thanks to resilient supply chains and a solid multilateral trading framework which are vital for improving livelihoods and welfare. It's imperative that we mitigate risks like geopolitical strife and trade fragmentation to maintain economic growth and stability.”

High energy prices and inflation continued to weigh heavily on demand for manufactured goods, resulting in a 1.2% decline in world merchandise trade volume for 2023. The decline was larger in value terms, with merchandise exports down 5% to US$ 24 01 trillion Trade developments on the services side were more upbeat, with commercial services exports up 9% to US$ 7.54 trillion, partly offsetting the decline in goods trade.

Downside Risks

Moving forward, the report warns that geopolitical tensions and policy uncertainty could limit the extent of the trade rebound. Food and energy prices could again be subject to price spikes linked to geopolitical events. The report's special analytical section on the Red Sea crisis notes that while the economic impact of the Suez Canal disruptions stemming from the Middle East conflict has so far been relatively limited, some sectors, such as automotive products, fertilisers and retail, have already been affected by delays and freight costs hikes.

The report furthermore presents new data indicating that geopolitical tensions have affected trade patterns marginally but have not triggered a sustained trend toward de-globalization. Bilateral trade between the United States and China, which reached a record high in 2022, grew 30% less in 2023 than did their trade with the rest of the world. Moreover, for the whole of 2023, global trade in nonfuel intermediate goods — which provides a useful gauge of the status of global value chains — was down 6%.

WTO Chief Economist Ralph Ossa said: “Some governments have become more sceptical about the benefits of trade and have taken steps

aimed at re-shoring production and shifting trade towards friendly nations. The resilience of trade is also being tested by disruptions on two of the world's main shipping routes: the Panama Canal, which is affected by freshwater shortages, and the diversion of traffic away from the Red Sea. Under these conditions of sustained disruptions, geopolitical tensions, and policy uncertainty, risks to the trade outlook are tilted to the downside.”

Regional Trade Outlook

If current projections hold, Africa's exports will grow faster than those of any other region in 2024, up 5.3%; this however is from a low base, since the continent's exports remained depressed after the COVID-19 pandemic. The CIS(1) region's expected growth is just slightly below 5.3%, also from a reduced base after the region's exports plunged following the war in Ukraine. North America (3.6%), the Middle East (3.5%) and Asia (3.4%) should all see moderate export growth, while South America is expected to grow more slowly, at 2.6%. European exports are once again expected to lag behind those of other regions, with growth of just 1.7%.

Strong import volume growth of 5.6% in Asia and 4.4% in Africa should help prop up global demand for traded goods this year. However, all other regions are expected to see below average import growth, including South America (2.7%), the Middle East (1.2%), North America (1.0%), Europe (0.1%) and the CIS region (-3.8%).

Merchandise exports of least-developed countries (LDCs) are forecasted to grow 2.7% in 2024, down from 4.1% in 2023, before growth accelerates to 4.2% in 2025. Meanwhile, imports by LDCs should grow 6.0% this year and 6.8% next year following a 3.5% contraction in 2023.

12thAPRIL2024 GUJARAT+NORTHINDIA 20

DPA, Kandla showcased it’s Float/Rath in the Cheti Chand Procession

GANDHIDHAM: DPA, Kandla showcased it’s Float/Rath in the Cheti Chand Procession organized on the occasion of Sindhi New Year, CHETICHAND. It was indeed a splendid feat considering the galaxy of floats vying for top position. More than 25,000 people joined to witness and bless the occasion.

Shukla, IRTS, Dy. Chairman; Shri C. Harichandran, Secretary; Shri V. Raveendra Reddy, Chief E n g i n e e r ; C a p t . Pr a d e e p M o h a n t y, D y. Conservator; Shri Ratnakar Rao, Trafc Manager; Shri Susil Chandra Nahak, Chief Mechanical Engineer, Dr Anil Chellani, Chief Medical Ofcer; Shri Yogesh Kumar Singh, Sr Dy Secretary, other senior officials, employees along with family members and general public at large.

Maersk enhances Middle East to Europe Services (ME2)

COPENHAGEN: Maersk h a s i n f o r m e d a b o u t t h e e n h a n c e m e n t s t o i t s ME2 service, which will now extend its coverage to North Europe. “As Maersk we continuously strive to improve our services and provide you with better options for your cargo transportation need,” informs a recent communique from Maersk.

“The ME2 service, previously turning in the Mediterranean (Algeciras and Tangiers), is now expanding its reach. This new and improved service will offer extended coverage from West India into North Europe, providing you with more

CONCOR achieves New Milestones in 2023-24

NEW DELHI: CONCOR has achieved a New Milestone of highest ever Throughput of 4 7 2 M n T E U s i n 2 0 2 3 - 2 4 registering a growth of almost 8 0 2 % o v e r i t s p r e v i o u s corresponding period. It also created a New Milestone of loading and moving highest ever Containerized Cargo of 51.67 MT during the last fiscal year In all 5540 Double stack Trains were moved by CONCOR in last fiscal representing an overall growth of 33 % over its previous corresponding year.

CONCOR also ranked 248th amongst Top 500 companies in the coveted list of Fortune 500 companies of India, informed a recent communique from the company.

comprehensive shipping solutions.”

New ME2 Rotation:

Jebel Ali – Mundra - Jawaharlal Nehru –Port Tangiers - Algeciras – Rotterdam – Felixstowe –Bremerhaven – Port Tangiers - Salalah.

GUJARAT+NORTHINDIA 12thAPRIL2024 21

Shri S.K. Mehta, IFS, Chairman-DPA aggedoff the procession in the presence of Shri Nandeesh