MUMBAI : (022)22661756 / 1422, 22691407

+ NORTH INDIA

AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com

SUBSCRIPTION : 1600/-

KANDLA : (02836)222665/225790, E-Mail:dstimeskdl@gmail.com

MUMBAI : (022)22661756 / 1422, 22691407

+ NORTH INDIA

AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com

SUBSCRIPTION : 1600/-

KANDLA : (02836)222665/225790, E-Mail:dstimeskdl@gmail.com

G A N D H I N A G A R :

The Gujarat ports regulated, operated and facilitated by Gujarat Maritime Board

( G M B ) r e g i s t e r e d 1 5 % increase in cargo traffic at Gujarat’s non-major ports for the first quarter of the financial year 2025 (April - June 2024) Cargo traffic increased from approximately 106 million metric tons (MMT) in the first quarter of FY24 to an impressive 122 MMT in the same period of FY25. A comparison with the traffic figures posted by the Indian Port Association indicates that major ports experienced a growth rate of 3.9% during the same period.

This significant growth underscores the dynamic and

AHMEDABAD

Mr. GautamAdani

robust performance of Gujarat’s maritime sector

Private ports and captive jetties emerged as the primary contributors, handling over 90% of the total cargo at Gujarat’s non-major ports In the period of April - June 2023, the private facilities including the private ports and captive jetties handled 97 MMT of cargo out of the total 105.7 MMT This figure rose to 114.4 MMT out of 122 MMT during the same period in 2024.

Private ports demonstrated exceptional growth, with their share increasing from about 53% in FY24 to approximately 58% in FY25. They handled around 56.4 MMT in the first quarter of FY24, which surged to 70.7 MMT in the first quarter of FY25, marking an impressive increase of about 14 3 MMT, registering a growth of roughly 20%.

Cont’d. Pg. 6

Cont’d. Pg. 8

: The Adani Group i s c o n s i d e r i n g building ships at i t s f l a g s h i p Mundra Port in the Kutch, Gujarat This comes as other major ship building ports in China, Japan and South Korea are “booked out” till 2028 leaving a gap in demand for new vessels, it added Notably, India is at present #20 in the global commercial ship building market (0.05 per cent share) and aims to be in the top 10 by 2030 and top 5 by 2047, per the ‘Maritime Amrit Kaal Vision 2047’ released by PM Shri Narendra Modi in January this year.

MUMBAI: Able Shipping - providing Total Logistics Solutions under one roof –has completed 23 glorious years of operation today and is venturing into its 24th year Under the dynamic leadership of M r. G a n e s h B i n g i - M a n a g i n g D i r e c t o r & Mr. Shantaram Racha - Executive Director, Able Shipping has built an unshakable reputation for timely shipments with great efficiency and trust right from meticulous planning providing competitive rates and guaranteed shipments. The Management of Able Shipping has expressed its heartfelt gratitude to all its Well Wishers, Stakeholders and Customers for the immense support received all through these years in shaping Able Shipping what it is today

Cont’d. Pg. 19

BLR Logistiks celebrates 35 Years of Excellence in Logistics Refer Pg. 6

Cont’d. from Pg. 4

However, GMB-operated ports experienced a decline

o f a b o u t 9 % i n c a r g o handling, with the volume dropping from 6 04 MMT in the first quarter of FY24 to 5 53 MMT in the same period of FY25 Similarly, private jetties saw a reduction in traffic handling, with cargo volumes falling from 2 6 MMT in the first quarter of FY24 to 2 1 MMT in FY25, a decrease of approximately 23%

In contrast, captive jetties recorded a 7% increase in cargo traffic, handling 43.7 MMT in the first quarter of FY25 compared to 40.6 MMT in the same period of FY24.

This robust performance of Gujarat’s non-major

ports highlights the region's critical role in India’s maritime sector and reflects the port sector's ongoing efforts to enhance port infrastructure and operational efficiencies

“We are proud of this achievement,” said Shri Rajkumar Beniwal, VC & CEO of GMB. “The growth we have witnessed is not just a number; it represents the commitment and collaborative efforts of all the stakeholders We remain dedicated to driving further improvements and sustaining this growth trajectory.”

GMB continues to focus on strategic initiatives to further boost the capabilities and efficiencies of Gujarat’s ports, ensuring they remain pivotal to India’s maritime industry.

MUMBAI: BLR Logistiks

I Ltd , a leading logistics and sup

company, announced the successful completion of 35 years in business.

Founded in July 1989 as a trucking company, BLR Logistiks has evolved into a comprehensive 3PL Service Provider, offering a wide range of services including Custom Clearance, Freight Forwarding, Warehousing and Multi-modal Transportation.

Over the years, the company has built a reputation for its commitment to quality, reliability, and customer satisfaction.

With a strong network and infrastructure in place, BLR Logistiks is well-positioned to achieve its goal of reaching a turnover of 1000 crores by 2026.

"We are grateful to o u r v e n d o r s , c u s t o m e r s , a n d well-wishers for their support and trust in us," said Mr. Ashok Goyal, Managing D i r e c t o r , B L R Logistiks . "Our journey has been remarkable, and we look forward to many more years of growth and success."

BLR Logistiks' 35-year milestone is a testament to the company's dedication to excellence and its ability to adapt to the changing needs of the industry

Cont’d. from Pg. 4

Potential Growth Market

India’s potential for the market is pegged at around $62 billion net by 2047, as per a KPMG document on the industry, submitted to the Ministry of Ports, Shipping and Waterways earlier this month, it added. Further, the potential jobs creation is pegged at 12 million, as per the same document.

The Gautam Adani-led pivot to the shipbuilding also comes as the industry looks for green ships with requirement numbered around 50,000 vessels over the next 30 years to replace all old-school ones,

the report added

Notably, Adani has the acreage and environment approvals due to its SEZ status to enter this heavy engineering sector fairly quickly, the report added. It is also better placed in terms of competing, as Indian shipyards are currently outbid by foreign shipyards due to as much as 35 per cent of “cost disadvantage”.

India has eight state-owned ship building yards (seven of which are Defence Ministry owned), and 20 private ones (where only L&T builds defence vessels). The KPMG document showed that most capacity at Indian yards was skewed towards naval vessels and not commercial ones, the report added.

NEW DELHI: India and Russia have agreed to enhance bilateral trade to over USD 100 billion by 2030, with a focus on investments, national currency usage for trade, and cooperation across various sectors such as energy, agriculture, and infrastructure. This decision emerged from the 22nd Annual Bilateral Summit in Moscow, where Russian President Vladimir Putin and Indian Prime Minister Narendra Modi reiterated their commitment to a "special and privileged strategic partnership "

The two sides agreed on nine key areas of cooperations that spanned trade, trade settlement using national currencies, increased cargo turnover through new routes

such as the North-South Transport Corridor, raising volume of trade in agri products, food and fertiliser, deepening cooperation in the energy sector, including nuclear energy, strengthening interaction for infrastructure development, promotion of investments and joint projects across digital economy, collaborating on supply of medicines and development of humanitarian cooperation.

The leaders agreed to aspire "for elimination of nontariff trade barriers related to bilateral trade between India and Russia" and continue "dialogue in the field of liberalisation of bilateral trade, including the possibility of the establishment of the EAEU-India Free Trade Area".

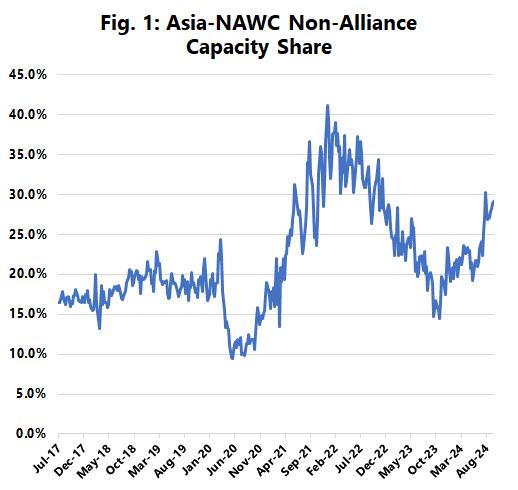

COPENHAGEN: The initial disruptions to global supply chains triggered by t h e p a n d e m i c h a d a profound impact on nonalliance services those operated independently of existing alliance structures. Many of these services ceased operations on major East-West trade routes.

However, the subsequent surge in demand for goods, coupled with rising spot rates, prompted a significant influx of non-alliance capacity into the market. So much so, that even on Asia-North Europe, which had predominantly been an alliance operated trade, saw the entry of several niche carriers offering solitary services.

Figure 1 shows the historical share of non-alliance capacity in the Asia to North America West Coast trade, as well as 12 weeks into the future, based on current deployment plans from the shipping lines As such, the Asia-North America West Coast trade lane is poised to see a sharp increase in the capacity share of non-alliance services in the coming months The data shows that nearly 30% of the deployed capacity on the trade lane is scheduled to be offered on services that are operated outside of the alliance structures. We see a similar pattern for Asia-North Europe, but less so for Asia-North America East Coast and AsiaMediterranean. On Asia-North Europe, if the current 12-week outlook holds, we will see record levels (touching 12%) of nonalliance capacity on the trade lane.

Across the main East-West trades, it is clear that the main driver of the non-alliance share is spot rates; a sharp increase in spot rates during the pandemic triggered a sharp increase in non-alliance services, and vice versa when the spot rates collapsed in the second half of 2022. This pattern is now repeating again, as the sharp spot rate increases seen in recent months, once again coincide with an increase in nonalliance services.

GANDHIDHAM: Adani Ports and Special Economic Zone Ltd (APSEZ), India’s biggest private port operator, is set to win the rights to run a 5.7 million tonne (mt) capacity multipurpose terminal for handling clean cargo including containers at state-owned Deendayal Port for 30 years by placing the highest royalty of Rs200 per ton when the price bids were opened last week.

The contract win will help APSEZ strengthen its presence in Deendayal Port (formerly Kandla Port) –India’s second biggest state-owned port by volumes handled – where it runs a dry bulk cargo terminal at Tuna Tekra, a satellite facility.

The Berth No 13 has a 300 metres

long quay that can accommodate a single large vessel of 75,000 dead weight tons (dwt) with draft of 14.5 metres and is currently being run by the Deendayal Port Authority. The berth is being privatised through the public-private-partnership (PPP) route in line with the National M

(NMP) program of the government.

operational infrastructure assets

partnership route.

The optimal capacity of the facility will be 5.7 mt comprising 4.2 mt of dry bulk (including break bulk), clean cargo and 0.10 million twenty-

foot equivalent units or TEU’s.

The multipurpose terminal is expected to handle machinery (project cargo), Ro-Ro cargo, sugar, salt, wooden logs, silica sand and containers.

The successful bidder will have to i n

equipment such as rubber tyred gantry cranes, reach stackers, spreaders as well as dry bulk handling gears including payloaders, forklifts, dumpers, trailers, grab along with development of storage yard, covered sh

additional internal road and rail infrastructure.

The private operator will be free to set rates based on market conditions.

Committee on Economic Affairs ( C C E A ) h a

d Jawaharlal Nehru Port Authority

n

guarantee” while raising funds for

building a mega port at Vadhavan near Dahanu in Maharashtra’s Palghar district with an investment of Rs76,220 crore.

The CCEA said that a corporate guarantee by Jawaharlal Nehru Port

Authority to raise debt for the project will “lead to the creation of contingent liability on the Government of India”, particularly when the Government is not providing any budgetary support for the project, multiple sources said.

NEW DELHI : State-

o w n e d C o n t a i n e r Corporation of India Ltd (CONCOR) on Monday (July 8) reported updates for the first quarter of FY25, with total volumes rising by 6% year-on-year (YoY) to 11 59 lakh twenty-foot equivalent units (TEUs) compared to 10.93 lakh TEUs in the same period last year

The domestic segment’s volumes increased by 15% YoY to 2.90 lakh

TEUs, up from 2.52 lakh TEUs. The export-import segment also showed steady improvement, registering a 3 30% rise in volumes to 8 69 lakh TEUs compared to 8.42 lakh TEUs in the previous year.

Q4 gures

CONCOR’s net profit jumped nearly 10% on year to Rs. 301.25 crore in the fourth quarter of FY24, helped by the growth in volume and higher market share. The company had

reported a consolidated net profit of Rs 274 14 crore in Q4 of FY23 CONCOR’s consolidated revenue from operations was Rs 2,417 87 crore in the quarter under review CONCOR is a prominent player in the transportation and handling of containers. The company’s network comprises 66 inland container depots and container freight stations across the country, including 62 terminals and three strategic tie-ups.

NEW DELHI: Maruti Suzuki India Limited (MSIL) reaffirmed its commitment to green logistics by surpassing a landmark of 2 million cumulative vehicle dispatches using railways This feat makes Maruti Suzuki, India’s first automobile company to attain this eco-milestone. The company has rapidly scaled up its vehicle dispatches through railways from 65,700 units in FY 2014-15 to 447,750 units in F Y 2 0 2 3 - 2 4 R a i l w a y s o f f e r a congestion free, safer, and energye f f i c i e n t a l t e r n a t i v e t o r o a d t r a n s p o r t a t i o n o f v e h i c l e s . Today, the company dispatches vehicles to 20 destinations, serving over 450 cities using Indian railways

Speaking on the milestone, Mr. Hisashi Takeuchi, Managing Director & CEO, Maruti Suzuki India Limited said, “Maruti Suzuki pioneered the use of railways for vehicle dispatches over a decade ago by becoming the first company in India to obtain the AutomobileFreight-Train-Operator license. Since then, the company has systematically increased its share of vehicle dispatches using railways Through our sustained efforts in green logistics, we have achieved outstanding results including cumulative reduction of 10,000 metric t o n n e o f C O 2 e m i s s i o n s a n d 270 million Litre of cumulative fuel savings. With our production capacity

nearly doubling from about 2 million units to 4 million units by FY 2030-31, we plan to augment the use of railways in vehicle dispatches, close to 35% over the next 7-8 years We s t a n d c o m m i t t e d t o t h e Government of India’s Net zero emissions target by 2070.”

Earlier this year, under the P M G a t i S h a k t i p r o g r a m m e , H o n ’ b l e P r i m e M i n i s t e r Shri Narendra Modi inaugurated India’s first automobile in-plant railway siding at Maruti Suzuki’s Gujarat facility This facility has a capacity to dispatch ~300,000 vehicles per annum. The next in-plant railway siding is in progress at Manesar facility and will be operational soon.

Cargo Steamer's Agent's ETD

Jetty Name Name

CJ-I Doris Arnav Shpg. 14/07

CJ-II Doctor O DBC 12/07

CJ-IIA Global Asphalt Preetika Shpg. 12/07

CJ-III Haj Abdallah T DBC 13/07

CJ-IV Fuji Harmony Upasana Shpg. 14/07

CJ-V DL Marigold Arnav Shpg. 12/07

CJ-VI African Gannet DBC 14/07

CJ-VI Efe Bosphorus Dariya Shpg. 15/07

CJ-VIII VACANT

CJ-IX Evanthia TM International 13/07

CJ-X VACANT

CJ-XI TCI Anand 009 TCI Seaways 12/07

CJ-XII VACANT

CJ-XIII Billy Jim Interocean 17/07

CJ-XIV Propel Success ACT Infra 14/07

CJ-XV SW South Wind Synergy Seaport 15/07

CJ-XVA Thor Friend Chowgule S. 13/07

CJ-XVI Hampton Ocean Shantilal Shpg. 17/07

TUNA VESSEL'S NAME AGENT'S NAME ETD KM Osaka Taurus 12/07

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I VACANT

OJ-II Ocean Thalia

OJ-III Lavendar Ray Samudra 12/07

OJ-IV Sanmar Santoor

OJ-V Stolt Focus JMBaxi 12/07

OJ-VI Dhan Laxmi

OJ-VII Siya Ram Marinelinks 12/07

Defne 06/07 Jeddah

Pera 06/07 Germany

Diva 07/07 Antwerp

Ultra Ocelet 07/07 Netharland

MK Lamis 08/07 Somalia

Source Blessing 09/07 Jebel Ali

SCI Mumbai 10/07 Jebel Ali

TCI Express 10/07 Manglore/ Cochin/Tuticorin

Patriot 10/07

Mercury 10/07 Sudan

CMB Jordaens 10/07 China

16/07 AL Mothanna Malara Shpg. Dji Bouti

CJ-VI African Gannet DBC Australia 35,100 CBM P. Logs 2024061304 11/07 African Piper Synergy Seaport Uruguay 32,139 CBM Pine Logs 12/07 African Raptor Dariya Shpg. Indonesia 59,350 Coal In Bulk

CJ-XIII Billy Jim Interocean San Lorenzo 75,100 T. Sugar Bulk 2024061362

CJ-V DL Marigold Arnav Shpg. USA 19,604/9,661 T. SSS/HMS INIXY124070018

CJ-VI Efe Bosphorus Dariya Shpg. South Africa 59,090 T. SA Steam Coal In Bulk

CJ-IX Evanthia TM International 15,750 T. HRC INIXY124070036

CJ-IIA Global Asphalt Preetika Shpg. 4,481 T. Bitumen In Bulk INIXY124070043

Stream Global Crest Preetika Shpg. 2,001 T. Bitumen In Bulk

11/07 Gramba Synergy Seaport New Zealand 43,055 CBM Pine Logs 2024061361

12/07 Hai Phoung 87 Chowgule S. Indonesia 5,051 T. Wood Pulp 2024061329

15/07 Jal Kamal Dariya Shpg. Indonesia 35,800 T. Coal In Bulk

Tuna KM Osaka Taurus USA 59,136 T. US Steam Coal In Bulk INIXY124070024

11/07 Ram Commander Mystic Shpg. China 17 Nos Wind Mill Blades/ INIXY124070006 Accessories/1 SOC Container (216 PKGS-1046 T)

11/07 Taokas Wisdom Synergy Seaport Surinam

CJ-XVA Thor Friend Chowgule S. Indonesia

13/07 Wu Yang Glory Dariya Shpg. Russia

T. Russian Coal In Bulk 12/07 Yin Xing Hu Dariya Shpg. Indonesia

Stream Elandra Sea Interocean Bintulu

12/07 Forshun Samudra Saudi Arabia

CDSBO 2024061274

Chem. 14/07 Fulda Scorpio Shpg.

15/07 Furano Galaxy GAC Shpg.

Stream Korea Chemi Samudra Taiwan

Stream Kruibeke Seaworld Shpg

OJ-III Lavendar Ray Samudra China

Stream Maersk Belfast Interocean Brazil

18/07 Seapromise Interocean San

13/07 Silver Valerie Interocean

OJ-VII Siya Ram Marinelinks Malaysia

14/07 Southern Shark GAC Shpg.

OJ-V Stolt Focus J M Baxi

T. Phos Acid

INIXY124070050

2024061352

Propane/Butane 2024070066

T. Chem In Bulk INIXY124070021

CDSBO 2024061318

INIXY124070055

2024061337

INIXY124070002

INIXY124070032

11/07-PM Maersk Cabo Verde 428S 4062356 Maerssk Line Maersk India Port Casina, Mombasa (MAWINGU)

13/07 13/07-AM AS Susanna 10 4062346 Unifeeder Transworld Shpg. Maputo (MJI)

15/07-PM Kmarin Azur 427W 4062350 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA)

TO LOAD FOR FAR EAST JAPAN,

& AUSTRALIAN

11/07-AM X-Press Phoenix 4027E 4062396 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 12/07 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

12/07 11/07-PM Inter Sydney 159 4070159 Interworld Efficient Marine China (BMM)

12/07 12/07-AM Northern Guard 924E 4062493 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16) 13/07 16/07 16/07-AM Beijing Bridge 2404 4072582 Global Feeder Sima

TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, Port Kelang (FEX1)

TBA Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, (FEX) TO LOAD FOR INDIAN SUB CONTINENT

15/07 15/07-PM Kmarin Azur 427W 4062350 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA)

12/07 Northern Guard (V-924E) 4062493 Unifeeder Agency Nhava Sheva 12/07 Maersk Cabo Verde (V-428S) 4062356 Maersk India Port Qasim 13/07 Seaspan Jakarta (V-428W) MBK Logistics Jebel Ali

X-Press Cassiopeia (V-4026E) Colombo 08-07-2024 AL Rumeila (V-2413W) Nhava Sheva 08-07-2024 Zhong Gu Hang Zhou (V-24001E) Colombo 08-07-2024

(FIVE) 13/07 11/07-AM Najade 62E 2402479 Wan Hai Line Wan Hai Lines Port Kelang, Jakarta, Surabaya. (SI8 / JAR)

17/07 16/07-PM KMTC

HongKong, Shanghai, Ningbo, Shekou. (CWX)

Felixstowe. Dunkirk, Le Havre 12/07 16/07 16/07-PM MSC Mombasa IP428A 2402491 CMA CGM CMA CGM Ag.(I) & Other Inland Destination in Europe, Med,Red

Hamburg, Antwerp & Other Inland Destn.(HIMEXP) 15/07 14/07 14/07-AM MSC Barbados IV428A 2402296 MSC MSC Agency Barcelona, Valencia (INDUSA) 15/07 17/07 14/07-AM Jolly

27/07-2000 CCNI Angol 430E 24241 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan

13/07 13/07-1030 Cape Andreas 012E 24221 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang.

COSCO Shpg. Singapor, Cai Mep, Hongkong, Shanghai, Ningbo, Shekou, 16/07 Nansha, Port Kelang (CI1)

12/07 11/07-1800 Maersk Kensigton 427W 24223 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL)

15/07-0300

NEW DELHI: Cargo handling, i n c l u d i n g C o n t a i n e r t r a f f i c movement, across India’s major ports has seen a 4 per cent rise y-o-y to 209 million tonnes (mt) in AprilJune of this fiscal year (Q1FY25), primarily on account of higher coking coal imports and an increase in container handling In the yearago quarter, traffic across these 12 ports stood at 200 55 mt

Tr a f f i c w a s u p 6 p e r c e n t sequentially in June to 69 mt, compared with May, when it was 64.69 mt, according to data from the Indian Ports Association.

India has 12 Major Ports: Kolkata, Paradip, Vizag, Ennore, Chennai, V O C h i d a m b a r a n a r, C o c h i n , N e w M a n g a l o r e , M o r m u g o a , Mumbai, JNPA, and Deendayal.

Coking coal imports stood at 15.83 mt for April-June, up 6 per cent,

from 14.9 mt in the year-ago period. Paradip port saw the highest coking coal shipments (4.3 mt).

Container cargo movement saw an over 5 per cent rise in tonnage for the first quarter, while in terms of TEUs (twenty equivalent units), the segment saw a 9 per cent rise quarter-on-quarter

Iron ore exports were down 2 25 per cent, with a reported slowdown in China, the prime buyer.

Iron ore shipments were down to 13.6 mt for April-June 2024, as against 13.9 mt in the year-ago period.

Interestingly, finished fertiliser imports saw a major decline, down by over 31 per cent to 1.74 mt.

Port-wise break-up

As per the data, three ports — Kolkata and Haldia dock systems, which together come under the Syamaprasad Mookerjee Port,

New Mangalore and Mormugao witnessed a drop in cargo traffic.

In the case of Kolkata dock, the decline was to the tune of 10 per cent or 3.6 mt, in Q1FY25 compared with 4.0 mt in the year-ago period. For the Haldia dock, there was over a 6 per cent y-o-y decline, or 10.6 mt for April–June, compared with 11.3 mt in the year-ago period.

For New Mangalore, the cargo traffic in Q1FY25 was at 10.8 mt, down 4.5 per cent. In the year-ago period, the cargo handled was 11.3 mt.

In Mormugoa, traffic was down 4.7 mt, 6 per cent y-o-y; as against the year-ago period when it was 5 mt.

Amongst other ports, Vizag saw the highest increase in cargo traffic handled — up nearly 9 per cent for Q1FY25 —whereas Chennai saw an over 8 per cent increase in cargo handling.

NEW DELHI : The Ministry of Commerce and Industry recently organised a meeting to discuss export targets for key sectors for 2029-30, with representatives from export promotion councils in attendance. The meeting led by Union Minister of Commerce and Industry, Shri Piyush Goyal, aimed to set ambitious targets for various industries, including electronics, textiles, pharmaceuticals, organic and inorganic chemicals, and agriculture

In electronics, the goal is to reach US$ 100 billion in exports by FY30, a significant increase from US$ 29.1 billion in FY24. Most current exports are in mobile devices, with a target of

US$ 60 billion by FY30 The India Cellular and Electronics Association is working towards a steeper target of US$ 150 billion in FY30. With Apple Inc. planning to shift 25% of its global iPhone production to India by FY26, the industry is confident of surpassing the US$ 100 billion target.

The textile sector is also expected to play a significant role, with a target of US$ 100 billion in exports by FY30, up from US$ 34 43 billion in FY24. Ready-made gar ments, cotton, manufactured yarns, and fabrics are expected to drive this growth Pharmaceutical exports are targeted to double by FY30 to US$ 55 billion, while organic and inorganic chemical exports aim to

reach US$ 65 billion The agriculture and allied sectors are expected to reach US$ 85 billion in exports by FY30, compared to US$ 50 billion in FY24. These targets are ambitious but achievable, with the Government and industry stakeholders working together to drive growth and i n c r e a s e I n d i a ’ s g l o b a l competitiveness

KOLKATA: The Engineering Export Promotion Council (EEPC India) has urged the government to revive the interest subvention s c h e m e f o r e x p o r t e r s i n i t s pre-budget recommendations EEPC India Chairman Arun Kumar Garodia emphasised the scheme’s importance, especially with rising interest rates.

He called for restoring the three per cent subvention rate for specific tariff lines and a 5 per cent rate for MSME exporters across all product categories. The recent exclusion of merchant exporters from the Interest

Equalisation Scheme (IES) raised concerns. EEPC India argued that merchant exporters, with low profit margins, are significantly impacted by credit costs They proposed extending the IES benefits to them with a three per cent subvention rate.

A government notice extended the IES for two months, but only for MSMEs. This left merchants and large exporters ineligible after June 30. The apex engineering exports promotion body warned this e x c l u s i o n c o u l d h u r t t h e s e businesses, especially those in competitive sectors.

The recommendations also included reinstating a 150 per cent w e i g h t e d d e d u c t i o n f o r R & D expenses, offering 100 per cent depreciation for MSME investments in solar power generation and implementing a 25 per cent income tax slab for MSME manufacturing units with reinvestment conditions

EEPC India said it represents nearly 9,500 member companies (over 60 per cent MSMEs), and the industry is a major contributor, accounting for 25 per cent of total exports and the highest foreign exchange earner.

m.v. “MSC RAVENNA” Voy : IS424A

I.G.M. NO. 2381872 Dtd. 07-07-24 Exch rate 86.05

The above vessel has arrived on 09-07-2024 at MUNDRA PORT with Import cargo from JEBEL ALI, SHUWAIKH. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

has arrived on 09-07-2024 at MUNDRA PORT with Import cargo from JEBEL ALI, THESSALONIKI, MUNDRA, UMM QASR PT, SHUWAIKH, BEIRA, MAPUTO, MESAIEED,

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

Cont’d. from Pg. 4

Over the years it has steadily progressed into a market leader for the Gulf and CIS destinations. L ast year, the company commenced

New Air Division Institute of Shipment to look after Air shipments operations flowing from India to Worldwide destinations and vice-versa, informed the company release

P I PAVAV: A P M Te r m i n a l s i n association with Pipavav Customs Brokers Association (PCBA) and JBS Academy is proud to conduct an extensive training program focusing on c u s t o m s c l e a r a n c e a n d f r e i g h t forwarding regulations, including process and documentation.

A large number of participants have taken advantage of this valuable training session at Pipavav Port. (DTD.5-6 & 12-13 July-24).

Dr. Darshan Mashroo is leading the training, providing all the essential insights on the subject.

GANDHIDHAM: Shri Sushil Kumar Singh, IRSME has been appointed as Chairperson in DPA w e f 1st July 2024 for a term of 3 Years and he was welcomed by all office bearers of Kandla Port Karmachari Sangh

Shri M K Aswani President, KPKS and his team arranged a grand welcome to the newly appointed Chairperson who was Jt. Secretary in MoPS&W, New Delhi for 3 years. Union expected several employment in the administration under his leadership in the coming days

KPKS Union is also planning to discuss various important issues to ensure that port administration brings more development to meet requirements of shipping companies, welfare for port workers

Civil Engineering Department. KPKS Union will also submit core issues after 1 month to gate old issues to be settled