NEW DELHI: Mr. Sudhanshu Pant, IAS, hasbeendesignatedastheOfficeron Special Duty, Ministry of Ports, Shipping and Waterways with effect from 1st December 2022. He will take over as the new Secretary, Ministry of Ports Shipping and Waterways from the current Secretary Mr. Sanjeev Ranjan upon his superannuationon31stJanuary2023.

Mr. Sudhansh Pant is an IAS officer of 1991 batch from the Rajasthan cadre and holdsaB.Tech(Hons.)degreefromIITKharagpur.Heholdsa B.Tech(Hons.)degreefromIITKharagpur. Cont’d. Pg. 8

MUMBAI: Adani Ports and Special Economic Zone said that in October 2022, the company has handed approximately 25 MMT cargo, which is marginally higher as compared with the same period lastyear. Cont’d. Pg. 9

GENEVA: Rice is a staple food for more than half of the world’s 8 billion population. It’s a fundamental source of energy and nutrition for people across Asia, Africa, NorthAmericaandmanyotherareas.

Amongst the world’s ten biggest rice producers, nine of them are located in Asia, including Thailand, where World Rice Conference 2022 will be held. Known for the quality of its rice, Thailand also made the list for the world’s top three exporters of this essential crop. With India, the world’s largest rice exporter, banning shipments of broken rice since September 2022 and imposing a significant export tax on numerous rice varieties, exports from Thailand are expectedtogrowtremendously.

ContainerisedShippingProtectsYourRiceCargo

Shipping rice requires an expert. This delicate and important crop is sensitive to temperature and moisture, and requires proficiency in perfect control throughout the entiretransportationprocess.

Compare with bulk shipping – where rice cargoes are susceptible to a range of problems from spoilage to theft –container shipping provides better protection for the precious cargo against high temperatures, wet damage, bad weather, stealing and other hazards. Additionally, containersalsoprovidemoreflexibilityforriceproducersas smallerquantitiescanbeshippedatatime.

From Paddy to Table with MSC’s Extensive Network, IntegratedSolutionsandComprehensiveInsurance

As the largest container shipping line with a wide global network of 675 offices, MSC is well-positioned to support the rising rice trades, by delivering them from paddy to table whilepreservingitsfragrance,flavor,shapeandtexture:

1. Extensive Network and Competitive Transit Times in Connecting Thailand with Africa, USA and Canada, SomeoftheWorld’sMajorRiceImporters

• West Africa: MSC’s Africa Express service offers competitive transit times between Asia and Ivory Coast, includinganewdirectcallatAbidjan.

• South Africa, East Africa and Indian Ocean Commission: The Ingwe service offers a direct call from Singapore, the world’s top transshipment hub, to Mundra (EAFR),PortLouis(IOC),DurbanandCoega.

• Sub-Saharan Region: MSC is grateful to have won the Asian Freight, Logistics and Supply Chain Awards for “Best Shipping Line: Asia – Africa” in three of the past fouryears.

• US West Coast: The Sentosa service connects Laem Chabang with Los Angeles and Oakland. Competitive transittimefromLaemChabangtoLosAngeles.

•USEastCoast:TheElephantservicedirectlyconnects LaemChabangwithNewYork,NorfolkandSavannah.

• Canada: The Maple service brings cargo from Shanghai, another major transshipment hub to Vancouver andPrinceRupert.

While ocean shipping is key, partnering with a company that can also organise inland and intermodal solutions is importantformanyshippers.

With its fast-growing road network and robust infrastructureoftrucks,MSCThailandseamlesslyconnects the cargo across road and sea by bringing them to the main portsofThailand.

3.PeaceofMindwithMSCCargoInsurance

To help customers stay ahead of the game when delivering goods as delicate as rice, MSC Cargo Insurance provides peace of mind that cargo is fully covered throughout the entire journey. Backed by first-class insurers, it safeguards against loss or damages caused by unforeseen circumstances from sudden port congestion to naturalevents.Competitivelypricedandfullycustomisedto the needs of the customers, this reliable insurance provides the widest possible coverage for maritime and inland transportation.

ALeadingSponsorofWorldRiceConference2022

From 15-17 November 2022, MSC will be at the premier World Rice Conference in Phuket, Thailand. Its dedicated team of rice experts will be on-site to showcase and advise on the best solutions, technologies and standards to meet theindividualisedbusinessneedsofitscustomers.

Gaspard Vandamme, Managing Director of MSCThailand said:“MSChasdevelopedastrongpresence in Thailand since 2001 and has decades of experience in transporting rice as an important source of energy to different parts of the world. There is a healthy and growing demand for rice from Thailand, and with our strong knowledge of the local market, comprehensive transport solutions and extensive global network, I am confident that we are the partner of choice for delivering this precious produce.”

MSC is also a leading sponsor of this prominent rice event that provides intelligence and meeting opportunities forbothriceexportersandimporters.

COPENHAGEN

“to

TradeLens, a neutral supply chain platform, utilizes blockchain technology to provide secure tracking and sharingofvitaltradeinformationinrealtime.

“We use the application of blockchain technology to helpussupporttradedocumentation,” saidSpalding,who was named TradeLens’ top executive following CEO Mike White’s retirement at the end of April. “It gives us a secure, immutable, traceable platform for transactions. That’sreallyimportanttoourcustomersandtotheirnetwork members because the transmission of documents and information,liketheelectronicbilloflading,issocritical.”

According to Spalding, TradeLens stands out from the competitionbyconsolidatingsupplychaindatapoints.

“Working directly with industry partners, continuing to

invest in the strong relationships with our carriers, terminals, ports, rails and so many members of our network, which brings direct-from-source data into the platform, helps us share that data across the industry to make [it] more efficient and helps us serve customers to make their supply chains better,” she said. “There are folks in the industry that are doing pieces of those individually, but bringing that all together and doing that in close partnership with the industry is, Ithink,special.”

: New TradeLens CEO Kim Spalding said her goal is help drive digitization in the supply chain industry.”Cont’d. from Pg. 3

In the early years of his service, he has served as Collector & District Magistrate in the districts of Jaisalmer, Jhunjhunu, Bhilwara and Jaipur. He was also the Chairman and Managing Director of the State Power Transmission Corporation, the State Power Distribution Companies and the State Renewable Energy Corporation. He has been Secretary in the Mines and Petroleum Department in Government of Rajasthan besides having worked as Commissioner of the Jaipur Development Authority and Secretary in the Urban Local Bodes and Housing Department.

He has a long experience in working in the Cooperative Sector and has headed several Co-operative Federations.

He was also the Joint Secretary in the Department of Pharmaceuticals looking after Pharmaceuticals Policy, Planning,DevelopmentofPharmaIndustry,Researchand Development in Pharma sector, Pricing and International Cooperationissues.

He has received several awards from the Government of Rajasthan, Government of India and the Election Commission of India for meritorious achievement in differentfieldsduringthecourseofhiscareer.

PARADIP: Paradip Port will become a 500 MMT capacity Mega Port by 2047, PPA Chairman P.L. Haranadh said on Tuesday, 8th November. Addressing a function organised by PPA to observe the Port Day on the occasion of Kartika Purnima, Haranadh said the port is marching ahead to clock 125MMTCargoHandlingmarkinthecurrentfiscal.Withinthe next2yearsaround100MMTcapacityprojectswillbeawarded andthePortwillbecomeIndia’slargestcapacityPort.ThePort, hesaid,willbecomea500MMTMegaPortby2047.

Haranadh said under PM Gati Shakti Masterplan, Port connectivity projects like Rail, Road, Waterways, ConveyorandPipelinewillgetamassiveboostinsynergywith theStateandCentralgovernmentmachinery.

It will become a Smart Digital Port by 2025. Advance Gate Management System will be in place within a year, the PPA Chairman said adding under green Port initiative 1,07,000 saplings have been planted in this year till date. Hefurthersaidby2025,1millionplantationswillbedoneinthe vicinity. Recently three Mechanised Road Sweeping

Machines have been inaugurated. The township sewerage system has been recently connected with the STPs resulting inzerodischargeofwastewatertonearbynaturalstreams.

The PPA Board has recently approved Rs 30 crores for establishingamodernHospital.

NEW DELHI: The Directorate General of Foreign Trade (DGFT) has asked the Customs authorities to clear for shipments the consignments of broken rice that entered the container freight station (CFS) before the ban was imposed on the export of the cereal. Though the government has not specified the quantity held up at CFS, trade sources said it could be around 15,000 tonnes and these are over and above3.97lakhtonnes(lt)ofquotaissuedlastmonth

In a notification issued on November 7, the DGFT said, “where broken rice consignment has been handed over to the Customs before this notification (banning export) and is registered in their system…with verifiable evidence of date and time stamping of these commodities having entered the Customs Station prior to September 8,” shallbeallowed.

It has also asked the Customs to ensure that these are shipped by November 30

On October 12, the DGFT announced that 3.97 lt of fully broken rice would be allowed for exports till the end of the current fiscal Two days later, it issued procedures and had stipulated that online applications between October 16 and October 20 will only be considered for issuing the permits. It had asked exporters to file a separate application for each of the valid letter of Credit (LC) opened before September 8, whenthegovernmentbannedtheshipmentofbrokenrice.

The Country exported 89.57 lt of non-Basmati rice worth $3.21 billion (Rs.25,191 crore) in the first half (April-September) of the current fiscal, up by 9 per cent from 82.26 lt worth $2.97 billion in the year-ago period. However, there is a drop in price realisation by exporters to $358/tonne from $361/tonne

Cont’d. from Pg. 3

The company’s portfolio of ports handled cargovolumeof24.76MMTinOctober2021.

“The daily average run-rate of approximately 1 MMT in the second half of October reflects a pick-up in volumes versus the rate of September and the first half of October, AdaniPortssaid.

During April-October 2022, APSEZ clocked around 203 MMT of cargo volumes, up 10% YoY. During the seven months of FY22, the company had handled cargo volume of 184.67 MMT. In the initial 7 months of FY23, east coast volumes were up 11% YoY, supported by Krishnapatnam (+14%), Gangavaram (+4%) and Kattupalli & Ennore combined (+49%). The west coast volume jump of 9% is

supported by Mundra (6%), Dahej (64%), Tuna (10%), and Goa(17%),andHazira(3%).

This volume jump in FY23 is despite the extended monsoon, which adversely impacted the coal demand, higher duties on steel exports, and export ban on certain qualitiesofrice,thecompanyadded.

AdaniPorts&SpecialEconomicZoneisinthebusinessof development, operations and maintenance of port infrastructure (port services and related infrastructure development)andhaslinkedmultiproductSpecialEconomic Zone (SEZ) and related infrastructure contiguous to port at Mundra. The company’s consolidated net profit surged 65.5% toRs1,737.81croreon32.8%jumpinrevenuefromoperations toRs5,210.80croreinQ2FY23overQ2FY22.

CJ-I MV Massa J DBC 12/11

CJ-II MV Clipper Kalavryta Chowgule Bros. 12/11

CJ-III MV New Lotus Shantilal Shpg. 13/11

CJ-IV MV Thetis Seacoast 15/11

CJ-V VACANT 12/11

CJ-VI MV Murou DBC 12/11

CJ-VII MV Ken Colon Interocean 13/11

CJ-VIII MV Santa Maria Mitsutor 12/11

CJ-IX MV Global Effort DBC 12/11

CJ-X MV Sider Bear Chowgule Bros. 11/11

CJ-XI VACANT

CJ-XII MV Safeen Prize ULSSL 11/11

CJ-XIII MV Azisai Chowgule Bros. 12/11

CJ-XIV MV Propel Glory ACT Infra 12/11

CJ-XV MV Seacon 8 Mihir & Co. 12/11

CJ-XVA MV Ultra Tatio GAC Shpg. 13/11

CJ-XVI MV SSI Formidable Chowgule Bros. 13/11

Tuna Tekra Steamer's Name Agent's Name ETD

MV Agia Eirini Force GAC Shpg. 11/11

Corinthian Phoenix

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I LPG/C Symi Inchcape Shpg. 12/11

OJ-II MT Sea Delta J M Baxi 12/11

OJ-III MT Bow Platinum GAC Shpg. 12/11

OJ-IV MT T Vega J M Baxi 12/11

OJ-V MT Stolt Cedar J M Baxi 12/11

OJ-VI MT Sea Wolf

Stream

Salt 2022101370

Stream MV Clipper Barola Chowgule Bros. 41,000 T. Sugar In Bulk

CJ-II MV Clipper Kalavryta Chowgule Bros. Bangladesh 41,000 T. Sugar In Bulk

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335

Stream MV Dubai Sun Interocean 42,800 T. Rice Bags 2022101308

Stream MV Dubai Galactic Cross Trade 45,300 T. Salt 2022101352

12/11 MV Haseen Aqua Shpg. 45,000 T. Sugar In Bulk

CJ-I MV Massa J DBC Port Sudan 28,800 T. Sugar (50 Kgs.) 2022101029 2323357

CJ-III MV New Lotus Shantilal Shpg. 40,250 T. SBM

Stream MT Oriental Cosmos Allied Shpg. Rottardam 7,740 T. C. Oil

Stream MT Papillon J M Baxi Houston 14,295 T. Molasses

CJ-XIV MV Propel Glory ACT Infra 12,600/11,400/33,000 T.Feldspar/Kaolin 2022101222

Stream MV Regency MK Shpg. 7,000 T. FO

Stream MV Safeen AL Amal Interocean 33,000 T. Sugar Bags 2022111040

Stream MV Sea Way K DBC 11,000 T. Sugar Bags (25 Kgs.)

12/11 MV Singapore Bulker BS Shpg. 25,000 T. Rice In Bags

CJ-XVI MV SSI Formidable Chowgule Bros. China 59,125 T. Salt CJ-IV MV Thetis Seacoast 54,500 T. Rice In Bags

T. Scrap 2022111005

CJ-XVA MV Ultra Tatio GAC Shpg. 34,523 T. SH Scrap

Due/Berth

Stream MT Alpine Link Interocean 28,000 T. CDSBO 2022101330

Stream MT Argent Gerbera JM Baxi Durban 5,991 T. Chem. 2022101060 1483 2323599 10/11 LPG Bastogne Nationwide 20,000 T. Propane/ Butane

Stream LPG Berlian Ekuator Nationwide 21,000 T. Butane/Propane

Stream MT Bia Marine Links 16,956 T. Methanol 2022111061

OJ-III MT Bow Platinum GAC Shpg. 11,000 T. Chem. 11/11 MT Bow Santos GAC Shpg. 6,500 T. Chem.

Stream MT Bow Titanium GAC Shpg. 11,000 T. Chem.

Stream MT Chemroad Hope J M Baxi Durban 24,250 T. Chem.

Stream MT Chem Mercury Samudra 9,848 T. Chem.

Stream LPG/C IGLC Dicle Seaworld 16,230 T. Propane/ Butane 2022111011

Stream MT ES Valor Interocean 13,000 T. CPO 2022101329

Stream MT Fairchem Kiso Samudra Sohar 8,150 T. Chem.

Stream MT Ginga Merlin GAC Shpg. 5,000 T. Chem.

Stream MT Golden Ambrosia J M Baxi Indonesia 2,000 T. Palm Oil

Stream MT Indigo Ray Samudra 4,774 T. Chem 2022111049

Stream MT Merapi Interocean 32,000 T. MS

Stream MT MTM Mumbai Interocean Brazil 25,000 T. CDSBO 2022101133

10/11 MT Monax J M Baxi Houston 2,500 T. Chem.

Stream MT Saehan Jasper Samudra China 12,000 T. Chem. 2022101346 10/11 MT Saehan Liberty J M Baxi Indonesia 18,000 T. Palm 10/11 LPG/C Sakura Spirit Inchcape Shpg. 21,494

10/11 10/11-AM Xin Shanghai 139E 22355 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 10/11 14/11 14/11-AM Bangkok Bridge 138WE 22360 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 14/11 ONE ONE (India) (TIP)

14/11 14/11-AM Northern Diamond 245E 22350 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 14/10 22/11 22/11-AM ALS Apollo 246E 22352 Ningbo, Tanjung Pelepas. (FM3) 14/11 19/11 19/11-AM Zim Charleston 9E 22358 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 19/11 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 19/11 19/11-AM ONE Contribution 051E 22361 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 19/11 Ningbo, Sekou, Cai Mep. (PS3)

10/11 10/11-AM Montpellier 0023 22359 X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG) 10/11 11/11 11/11-AM Maersk Columbus 244W 22348 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 11/11 18/11 18/11-AM Maersk Seletar 245W 22357 (MECL) 18/11 14/11 14/11-AM SSL Kutch 244 22365 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 14/11 23/11 23/11-AM SCI Mumbai 552 22370 SCI J. M Baxi Jebel Ali. (SMILE) 23/11 TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

10/11 10/11-AM Xin Shanghai 139E 22355 COSCO COSCO Shpg. Karachi, Colombo (CI1) 10/11 13/11 13/11-AM Irenes Bay 245S 22351 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 13/11 14/11 14/11-AM Northern Diamond 245E 22350 SCI J. M Baxi Colombo. (FM3) 14/11 14/11 14/11-AM Bangkok Bridge 138WE 22360 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 14/11 ONE ONE (India) (TIP) 19/11 19/11-AM Zim Charleston 9E 22358 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 19/11

11/11 11/11-AM Maersk Columbus 244W 22348 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 11/11 18/11 18/11-AM Maersk Seletar 245W 22357 Safmarine Maersk Line India (MECL) 18/11 14/11 14/11-AM Bangkok Bridge 138WE 22360 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 14/11 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 19/11 19/11-AM ONE Contribution 051E 22361 ONE ONE (India) Los Angeles, Oakland. (PS3) 19/11

Cape Kortia IP246A COSCO COSCO Shpg. Antwerp, Felixstowe, Dunkirk, Le Havre, King Abdullah, Djibouti, 21/11 CMA CGM CMA CGM Ag. (I) Karachi-Port Muhammad Bin Qasim. (IPAK) 14/11 MSC Marina IX244A MSC MSC Agency Mundra, Hazira, Nhava Sheva, Colombo, King Abdullah, Damietta, Mersin, 15/11 Tekirdag, Valencia, Halifax, Baltimore, Savannah, Freeport Container Port (Indus 2) 14/11 Zim Vietnam 3E Zim/KMTC Zim Integrated/KMTC India Qingdao, Shanghai, Ningbo, Da Chan Bay, Port Klang, Nhava Sheva, 15/11 Evergreen Evergreen Shpg. AICTPL, Colombo, Port Klang, Singapore, Haiphong, Qingdao. RCL/Emirates RCL Ag./Emirates Shpg. (NIX / FIVE / CIX3) 14/11

MUMBAI: Even as merchandise exportgrowthfelltosingledigitsinthree months, services exports continued to remain robust and witnessed 25-30 per cent growth since the beginning of the current fiscal year (July-September), revealsGovernmentdata.

Notwithstanding the threat of a recession looming ahead for the developedeconomies,exporterssaythey expect a similar trend to continue in the second half of the year. Growth will be driven by sectors such as information technology(IT),accounting,engineering services,asIndiawillhavetheadvantage of low-cost services from skilled professionalsitoffers.

“Recession in the developed economies will only help increase services exports. In a bid to save cost, countries like the US have started

outsourcing their work, especially in sectors such as accounting, auditing, andlegalservices,”says SunilHTalati, Chairman, Services Export PromotionCouncil.

Talat expects IT exports to grow, regardless of recession fears, as certain services are required for systems to operate. Apart from IT, sectors such as hospitality, tourism, accounting, auditing, legal services, engineering, and architectural services are expected towitnessvigorousgrowth.

After sustained rise in merchandise exports,theexternaldemandforIndian goods has started decelerating. The International Monetary Fund last month said more than a third of the global economy is headed for contraction this year or the next, and the three biggest economies — US,

EuropeanUnion(EU),andChina—will continuetostall.

Basedonthecurrentmacroeconomics and global trends, the Department of Commerce on a conservative basis is lookingattheoverallexporttargettocross $750 billion in 2022-23 (FY23), compared with $676 billion in 2021-22. As far merchandise exports go, a target of $450 billionhasbeenset,therestwill be met by services exports. Talati hopes services exports will grow at a similar rate — of about 30 per cent — during the second half of FY23 and reach $350 billion in the currentfiscalyear.

Notwithstanding Talati’s optimism, economists warned that with imminent threat, the impact on IT services — which constitutes more than half of India’s services exports — can be seen onlyinthenextfiscalyear(2023-24).

Adani Ports and Special Economic Zone Ltd (APSEZ) said it would be “selective” in bidding for cargo handling contracts at Stateowned major ports after India’s top court lifted restrictions placed by some port authorities on the company’s participationintenders.

“The Supreme Court issued an order on 5 September restoring APSEZ’s right to participate in bidding for contracts at major ports, thereby putting to rest the wrong decision of certain port authorities on disqualifying APSEZ from the bidding process at Major Ports,” Karan Adani, Chief Executive Officer, APSEZ said during aninvestor’scallrecently.

Earlier this year, port authorities running major ports such those located at Kandla, Visakhapatnam, Paradip and Jawaharlal Nehru port blocked APSEZ from participating in cargo handling auctionsattheirrespectiveportscitinga tender condition that bar firms involved in contract termination at other ports from applying. A coal handling terminal runbyaunitofAPSEZatVisakhapatnam Port Authority was terminated in December 2020, a few years into its

30-yearconcession.

“An Applicant including any Consortium Member or Associate should, in the last three years, have neither failed to perform on any contract,asevidencedbyimpositionofa penalty by an arbitral or judicial authority or a judicial pronouncement or arbitration award against the Applicant, Consortium Member or Associate, as the case may be, nor been expelled from any project or contract by any public entity nor have had any contractterminatedbyanypublicentity for breach by such Applicant, Consortium Member or Associate,” according to clause 2.2.8 of the tender conditions.

“In major ports, we would look at (participating in bids) selectively based on the kind of footprint and strategically where we don’t have a presence. Those are the places we would look at to consolidate in terms of our market share. But it will be very selective in nature,”KaranAdaniadded.

APSEZ has filed initial bids on tenders floated by Deendayal Port Authority for building a mega container terminalandamultipurposecargoberth atitssatellitefacilityatTunaTekra.

Apart from the big private ports it

operates, APSEZ currently runs cargo terminals at three major ports – a dry bulk cargo terminal at Tuna-Tekra in Deendayal Port Authority (formerly Kandla Port), a coal terminal at Mormugao Port and a container terminalatKamarajarPortLtd.

APSEZ has recently signed a concession agreement to mechanise one of the berths at Haldia Dock Complex in Syama Prasad Mookerjee PortAuthority(formerlyKolkataPort).

That aside, APSEZ has set up or acquired big private ports close to some of the major ports such as Mundra port near Deendayal port, Dhamra near Paradip port, Gangavaram near Visakhapatnam port, Dighi near Jawaharlal Nehru port and Kattupalli nearChennaiandKamarajarports.

The company controlled by billionaire Gautam Adani has recently won a deal to construct a new private port at Tajpur in West Bengal, a State where Syama Prasad Mookerjee Port Authority (formerly Kolkata Port) is the onlymaritimegateway.

APSEZ’s 12 facilities spread across the Western and Eastern seaboards have a capacity to handle 538 mt of cargo. By 2025, APSEZ aims to handle 500mtofcargo.

NEW DELHI:

Gateway Distriparks Limited has become the first Indian rail operator to join TradeLens, an open and neutral supply chain industry platform solution underpinned by blockchain technology, jointly developed by A.P. Moller –MaerskandIBM.

TradeLens is a platform that combines data from the entire global supply chain ecosystem and allows its network partners to modernize manual and paper-based documents by

replacing them with blockchainenabled digital solutions. It helps service providers like GDL to give their customers deeper visibility into their cargo’s entire journey from origin to destination.

Many major shipping lines are already on this platform, such as Maersk, CMA-CGM, ONE, HapagLloyd, MSC, ZIM, Hamburg-Sud, and more.TradeLensisgrowingitsnetwork rapidly, and various stakeholders are joining the platform globally, including oceancarriers,customsauthorities,rail logistics service providers, inland

container depots, ports, and financial institutions.

The platform also helps service providers to offer their customers electronic Bills of Lading using blockchain technology integrated with trade finance companies and true endto-end visibility in addition to digital documentation. This helps the end customersreducetheirtransactioncost for logistics, minimise detention & demurrage, and make the planning of their supply chain more efficient while improving the carbon footprint of all networkpartnersinthechain.

NEW DELHI: India has concluded trial runs for trans-shipment of cargo to connect northeastern states with the rest of the country using two major Bangladeshiports,officialssaid.

The fourth and final trial run to connectChittagongandMonglaportsto NE states via India-Bangladesh Protocol Route concluded after a tea container from Assam for Goodricke reached Kolkata docks via land and sea portsoftheneighbouringcountry.

“The trials were supposed to be completed by December but it is

completed well ahead of schedule. The initiativewillhelpboostbusinessflowto the northeast on inland waterways via the Indo-Bangladesh Protocol Route and help reduce the cost of freight,” ChairmanofSyamaPrasadMookherjee Port(SMP),LHaranadh,said.

The SMP, formerly the Kolkata Port Trust, was entrusted with executing the trial runs via the protocol route. The decision to conduct these trials was taken at the 13th India-Bangladesh Joint Group of Customs meeting held in March.

The trial movement of Indian cargo from West Bengal to northeastern states such as Tripura, Assam, and Meghalaya and vice versa was successfully carried out, SMP Deputy ChairmanSamratRahisaid.

The trial runs were meant for connecting Bangladesh’s land and sea portsMongla,Tambil,Chittagong,Seola and Bibirbazar with northeastern states.

India has offered a grant to Bangladesh to support dredging to smoothenthemovement.

NEW DELHI: Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, Shri Piyush Goyal reviewed the sectoral progress in exports with Export Promotion Council's and Industry Bodies in New Delhi.

Minister of State for Textiles, Ms. Darshana Jardosh, Secretary, Department of Commerce, Shri Sunil Bartwal, Secretary Textiles, Ms. Rachna Shah, Representatives of the Export Promotion Councils, Industry Associations and senior officials from DepartmentofCommerce,Department for Promotion of Industry and Internal Trade (DPIIT) and other departments werepresentatthereviewmeeting.

The Minister exhorted the export promotion bodies to give an active push to exports and maintain the momentum of healthy growth recorded in the previousyear.

Shri Goyal asked the various sectoral leaders to utilize the disruptions in the global trade in their favor by occupying the space yielded by some countries. He asked Indian industry to support each other to create synergies and promote growth in a spiritofnationalism.

He told industry to strive to retain export markets even if they are to make temporary changes in their pricing structure to accommodate short term challenges.Heencouragedexportersto explore unique products with good export potential such as castor and

instructed officials of the Ministry to act proactivelytopromotetheseproducts.

The Commerce Minister also asked officials to analyze export data on the basis of sectors, commodities and markets to find out areas of opportunity for Indian exports. The Minister called for open channels of communication between export promotion bodies and industry bodies with the government so that issues being faced may be flagged andresolvedattheearliest.

Commerce Secretary, Shri Sunil Bartwal gave the opening remarks at the review meeting and elaborated upon the various steps taken by the Ministry to push exports. Director General of Foreign Trade, Shri Santosh Sarangi made a presentation on latest exporttrendsandprospects.

NEW DELHI: The Logistics

Division of the Department for Promotion of Industry and Internal Trade under the Ministry of Commerce and Industry in October released the annual ‘Logistics Ease Across Different States’ or LEADS 2022 Survey which assesses the logistics performance of individual states and union territories and suggests measures for improvement inlogisticsinfrastructure.

One of the key suggestions of LEADS 2022 Survey for states and union territories is the need for the preparation of a comprehensive ‘City Logistics Plan’ for coordinated cargomovementthroughefficientlong distance and last mile transportation whileminimisingthenegativeimpacts offreightmovementinthecity.

Dr Surendra Kumar Ahirwar, JointSecretary,(LogisticsDivision), Department for Promotion of Industry and Internal Trade, said that the Government in collaboration with a German entity GIZ India is preparing a model city logistics plan, which can be presented to the states andUTsasareferencemodel.

“We are just going to give a kind of a suggestive plan, or a Model Plan, which can act as a reference,” said DrAhirwar.

“Bangalore (Bengaluru) and Delhi have been identified for a pilot project for the purpose of development… and we may come out withamodelcityplan,”headded.

However, Dr Ahirwar emphasized that cities need not adopt the model logisticsplanasitis,highlightingthat theCentralGovernmentwillonlyhelp with an enabling framework with the responsibility being either on the city

administration or the state administration, as every city has its own unique set of problems and issuesrelatedtologistics.

The need for efficient cargo movement within cities has grown in importance with the rapid advent of ecommerce business. According to a Ministry of Commerce and Industry statement in July 2021, demand for urban freight is expected to grow by 140percentoverthenext10yearsand final-mile freight movement in Indian cities is currently responsible for50percentoftotallogisticscostsin India’s growing e-commerce supply chains.

“Currently infrastructure development in cities is primarily focussed around mobility of people, while cargo transportation is consideredasaproblem,”hesaid.

Dr Ahirwar outlined that the biggest takeaway from the LEADS 2022 Survey has been the adoption of objective assessment based on hard data obtained from either the state governments, the industry, or various organizationsinthelogisticssector.

“…wehavegenerallyintheprevious reports been depending on the surveys which were all subjective or perception based. Therefore, there was no objective measurement of the (states) performance…,”saidDrAhirwar.

With regard to hard data points, whichhavebeennowincorporatedfor assessment,DrAhirwaroutlinedthat states have shared the quantum of investment, the quantum of increase in their infrastructure capacities, amongsomeofthebroaddatapoints.

“States have shared whatever infrastructure changes which have

happened during one year period and changes from the previous year. Changes in the services and then the investmentorthecapitalexpenditure the states have done either from the public exchequer or if there has been a private investment for development ofinfrastructure,”headded.

While the recently unveiled National Logistics Policy aims to bring down India’s cost of logistics operationsfrom13-14percentofgross domestic product to single digit by 2030, Dr Ahirwar outlined that the government was also aiming to assess state-specific reduction in logisticscost.

“We may come out with some index, maybe pick some parameters in the next LEADS report, which will measure the logistics cost, reduction orefficiencyimprovement,”hesaid.

The performance of states will be crucial for the country as a whole to achieve the target of bringing down thelogisticscosttosingledigits.

LEADS 2022 Survey has also advisedthatstatesandUTsdevelopa monitoring framework including KPIs or Key Performance Indicators for assessing their respective performance.

“Thisisaworkinprogress,weare formulating or devising some framework for assessment of the outcome, or you can say the outputoutcomeframework,”hesaid.

“The larger objective of this outcome assessment will be the efficiency which has been brought in thelogisticssector,throughwhatever meansorwhateverinitiative,theones undertaken by the states,” DrAhirwarsaid.

NEW DELHI: Even as the Government looks to fix age limits for ships operating in Indian waters, to ensure overall safety and protect the marine environment from pollution caused by mishaps, it is mulling a proposal to give moretimetoexistingvesselstoconformtothenewnorms.

Government officials aware of the development said that a plan is being developed to evolve a stringent fitness regime that would allow even older ships to operate with proper health certification, thereby giving more time to thefleetoperatorstoconformtoanynewagelimitnorms.

Industry chambers PHDCCI in a representation to Union Minister of Ports, Shipping and Waterways and Minister of Ayush Shri Sarbananda Sonowal, suggested calibrated introduction of age limits for vessels and rather a stricter health check regime may be formulated first in consultation with the industry and class authorities for vesselsthatareaboveacertaincut-offage.

“These vessels should be allowed to operate as long as they meet the stringent health check regime. This will result in incentivizing companies to spend money on their older vessel to ensure these vessels can be operated safely as possible,” the industry body has said in its representation.

Currently, the age limit for registration of vessels operating in Indian waters is 25 years. But, there is no age

restriction after registration. Government is looking to fix this loophole. The discussion is to bring down the age of registration and fix some age restriction for both Indian andforeignvesselsthatoperatehere.

PHDCCI in its representation has also suggested to bring a sunset clause for phasing out of old vessels like –three years from the date of the age circular coming into force. This will give enough time to ship owners to make their contingency plans and renew their fleets, the industrybodyhassaid.

Since the Shipping industry is very heavy capital intensive, it won’t be possible for any company to renew their fleet without giving suitable time. Giving a very short period for renewing the fleet will send the market for second-hand vessels soaring high which will be harmfultoIndianShippingIndustry,PHDCCIhassaid.

New shipbuilding takes 18-30 months depending on the kind of ship being built. So a sunset clause before operationalising age restriction will give necessary breathertotheindustry.

“Irrespective of the Sunset clause, ongoing contracts with PSUs / Government Authorities, etc, as on the date of coming into force of the circular, should be allowed to be completed irrespective of the age of the vessel,” the industrybodysaid.

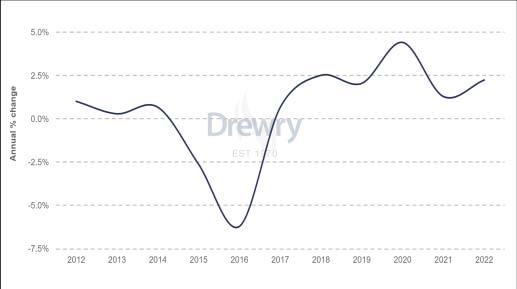

LONDON: Vessel operating cost inflation has accelerated in 2022 on mounting worldwide macroeconomic price pressures, despite some receding of Covid-19 related costs, according to the latest Ship Operating Costs Annual Review and Forecast 2022/23 report published by global shipping consultancyDrewry

Drewryestimatesthataveragedailyoperatingcosts across the 47 different ship types and sizes covered in the report rose for the fifth consecutive year to reach $7,474 in 2022, a rise of 2.2%. This compares with a much smaller 1.3% increase last year and a pre-pandemic trend of flatlining or declining costs (see chart). While broader pricing pressures remain, vessel opex inflation is forecast to moderate over the medium term (seechart).

“Theriseinopexwasdrivenmainlybypriceinflation ingoodsandservicesacrosstheshippingsector,aswell as supply chain disruption induced by the Covid-19 pandemic,” said Latifat Igbinosun, head of vessel opex research at Drewry. “Cost inflation was restrained last year, especially for repair and maintenance, as owners took advantage of the resumption in trade growth and rising vessel earnings to keep ships in service for longer. However, vessels returned to yards this year, pushingupcosts.”

A high proportion of the 2022 opex increase was driven by lubricating oil costs, which surged 15% due to limited refinery supply and high oil prices. Costs also increased for marine insurance cover which rose 8% on average, following a 7% uplift in 2021, driven by a hardening insurance market and higher vessel values insomesectorswhichpushedupH&Mpremiums.

Costinflationwasalsoevidentinotheropexheadline items. For instance, dry-docking costs rose 6% in 2022 due to limited slots as shipyards opted for profitable new orders and retrofitting projects.

Meanwhile, stores and spares costs increased 2% apiece, while manning costs flatlined due to the unwindingofsomeCovid-19-relatedcosts.

The rise in costs was broad-based across all the main cargo carrying sectors. The latest assessments include vessels in the container, dry bulk, product, crude, LNG, LPG, general cargo, reefer, ro-ro, and car carriersectors.

Looking ahead, over the near term, a slowdown in many seaborne trades is anticipated with the exception of the energy-related commodity trades such as oil and gas, which will significantly affect available budgets for spending on vessel operations over the next few years. Drewry expects downside pressure on costs to remain in those areas where vessel owners have greater control, but tightening seafarer availability and ongoing decarbonisation regulations are expected to add to owners’costburdenoverthemediumterm.

“The outlook for vessel operating costs remains uncertain, given ongoing geopolitical risks, rising inflationary pressures and deteriorating economic outlook,”addedIgbinosun.“ButDrewryforecastssome moderation in opex inflation as pressures on certain cost heads such as marine insurance and dry docking recede, despite the risk of rising seafarer wage costs in lightofaloomingofficershortage.”

m.v. “KMTC COLOMBO” V-2206E The above vessel has arrived at Mundra on 10/11/2022 as per following details.

Item Nos. B/L NOS.

29

30

31

32

33

Item Nos. B/L NOS. Item Nos. B/L NOS. 1 SZPE22102073 2 SZPE22101617 3 YSNBF22102090 4 YSNBF22102089 5 JAM222593 6 39030056142 7 EPIRCHNCWA227761 8 EPIRCHNCWA227762 9 EPIRCHNCWA227767 10 EPIRCHNCWA227770 11 EPIRCHNCWA227771 12 EPIRCHNCWA227774 13 EPIRCHNCWA227775 14 EPIRCHNCWA227777

43 EPIRCHNQGA227551 44 EPIRKRFGCL231329 45 EPIRKRFGCL231331 46 EPIRKRFGCL231332 47 EPIRKRFGCL231353 48 EPIRKRFGCL231408 49 EPIRKRFGCL231409 50 EPIRKRFGCL231410 51 EPIRKRFGCL231447 52 EPIRVNESHN202355 53 EPIRVNESHN202356 54 EPIRVNESHN202357 55 EPIRVNESHN202370 56 EPIRVNESHN202383

RAJKAMAL-II, Office No. 103, 1st Floor, Plot No. 342, Ward - 12/B, Gandhidham - 370201. India. In case of any query kindly contact the below E-mail IDS & Phone Numbers :

IMPORT related : ravi.vaghela@in.emiratesline.com Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : benoy.varghese@in.emiratesline.com Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89800 25092

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

m.v. “MSC SAMU” Voy :JC244R I.G.M. NO. 2326354 (MUNDRA EDI) Dtd. 07-11-2022 Exch Rate 84.83

The above vessel has arrived on 09-11-2022 at MUNDRA PORT with Import cargo from JUBAIL. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

The above vessel has arrived on 09-11-2022 att MUNDRA PORT with Import cargo from JUBAIL. Please note the item Nos. against the B/L Nos. for MUNDRA delivery

Item No. B/L No. Item No. B/L No. Item No. B/L No. 1 MEDUDM453707 10 MEDUDM455199 11 MEDUDM454150

Item No. B/L No. 12 MEDUDM455215 2 MEDUDM453905 3 MEDUDM453913

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804 As Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com

m.v. “HANSA ROTENBURG” V-917E

The above vessel has arrived at Mundra on 07/11/2022 as per following details.

Item Nos. B/L No. Item Nos. B/L No. 1 EPIRCHNXIA209071 2 VHFLJKT022100101

RAJKAMAL-II, Office No. 103, 1st Floor, Plot No. 342, Ward - 12/B, Gandhidham - 370201. India.

In case of any query kindly contact the below E-mail IDS & Phone Numbers :

IMPORT related : ravi.vaghela@in.emiratesline.com Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : benoy.varghese@in.emiratesline.com Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89800 25092

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

m.v. “MSC CHARLESTON” Voy : IV245A Exch Rate 84.83

The above vessel has arrived on 08-11-2022 at MUNDRA PORT with Import cargo from CONAKRY. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Item No. B/L No. 45 MEDUCN036495

The above vessel has arrived on 08-11-2022 att MUNDRA PORT with Import cargo from MELBOURNE, ABIDJAN, SAN-PEDRO, LIBREVILLE, TEMA, CONAKRY, NOUAKCHOTT, LYTTELTON, TAURANGA, LOME. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

MUNDRA

Item No. B/L No. Item No. B/L No. Item No. B/L No. 1 MEDUAB297508 10 MEDULJ055432 11 MEDULJ055101 12 MEDULJ054450 13 MEDULJ054773 14 MEDULJ054427 15 MEDULJ055226 16 MEDULJ055424 17 MEDULJ055135 18 MEDULJ054781 19 MEDULJ055085

Item No. B/L No. 2 MEDUAB298449 20 MEDULJ055457 21 MEDULJ055382 22 MEDULJ055168 23 MEDULJ054898 24 MEDULJ055663 25 MEDULJ054765 26 MEDULJ055416 27 MEDULJ055234 28 MEDULO153190 29 MEDULO150519

3 MEDUAB297938 30 MEDULO152077 31 MEDULO152507 32 MEDUAI630123 33 MEDUAE775658 34 MEDUNU007054 35 MEDUNU007005 36 MEDUPD185328 37 MEDUPD184545 38 MEDUPD184974

39 MEDUAI620348 4 MEDUAB295288 40 MEDUAI620330 41 MEDUTM231428 42 MEDUTM231618 5 MEDUCN036529 6 MEDUCN036826 7 ACLBVMUN0634 8 ACLBVMUN0633 9 MEDULJ055440

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

As Agents :

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com

• The three-storied facility is expected to go live by December 2022 and will help in addressing the warehousing capacity crunch faced by exporters out of Cha�ogram, Bangladesh.

• Maersk’s total warehousing footprint in Bangladesh will cross 300,000 sq. �. with this new facility.

DHAKA: A.P. Moller –Maersk (Maersk), the integrated logistics company, is expanding its warehousing footprint in Bangladesh with a brand new 100,000 sq. ft. facility being built in Chattogram. The upcoming facility is strategicallylocatedclosetotheChattogramPortandeasily connected to the Dhaka-Chattogram Highway through the Outer Ring Road and Karnaphuly Tunnel, giving easy access to Bangladesh’s garment exporters based out of the nearbymanufacturinghubs.

Bangladesh is witnessing impressive growth in garments exports. However, the warehousing footprint in Chattogram has not increased proportionally. Angshuman Mustafi, Head of Maersk, Bangladesh, commented, “The last two to three years have been extremely challenging for Bangladesh’s exporters. The Covid-19 pandemic caused many disruptions in the supply chains. The acute imbalance in demand and supply of goods, bottlenecks in the logistics ecosystem, displaced workforce and congestion at ports and warehouses led to unforeseen challenges in Bangladesh.” He added, “However, the pandemic also presented us with the opportunity to have meaningful dialogues with our customers and look into the future. We realised that the demand for warehousing space was rising and decided to undertake measures that could addressthisrequirementproactively.”

Maersk Bangladesh has partnered with Vertex Off-Dock Logistics Services Limited to commission the new threestoried facility. The lift, conveyor belt and slider-operated warehouse will ensure higher productivity. Internal and external parking facilities will allow for a higher number of trucks and vans to be accommodated within the warehouse. While the current facility will be 1000,000 sq. ft., Maersk has accesstomorespaceincaseofexpansioninthefuture.

Imran Fahim Noor, Managing Director,Vertex Off-Dock Logistics Services, said, “Through our collaborationwithMaersk,wearebuildingafacilitythathas a modern integrated installation. By building efficient warehouses, we are catering to the demand of the country’s exporters and addressing their requirements to the level of internationalstandards.”

As an integrator of logistics, Maersk is developing and providing solutions ranging from ocean transportation to landside and air transportation, contract logistics including warehousing & distribution (W&D) and depots, custom clearances, visibility solutions and so on. Maersk’s resilient end-to-end solutions ensure customers’ cargo is kept moving in case of unforeseen challenges. With the expansion of warehousing facilities, Maersk is strengthening its position further by providing a larger arrayofservicesthroughasinglewindowtoitscustomers.

Ocean shipping and landside logistics & distribution have traditionally been shared amongst multiple stakeholdersresultingincomplexsupplychains.Tocreatea seamlessexperienceandintegratedlogisticssolutionforits customers, Maersk is strategically investing in W&D facilities along with providing ocean and landside transportation.

HONG KONG: Orient Overseas Container Line Ltd. (OOCL) is delighted to have been named the “Best Green Shipping Line” at the 2022 Asian Freight, Logistics and Supply Chain (AFLAS)Awards.

Hosted by leading shipping and logistics publication AsiaCargoNews,theannualAFLASAwardsisoneofthe most anticipated industry events in the Asia Pacific region. The awards recognize service providers from different categories for their excellent performance and achievements across a range of criteria. Award winners are determined by a 3-step assessment process, involving more than 15,000 voters, which makes the awardsresultsatruereflectionofuseropinion.

The Best Green Shipping Line award pays tribute to the liner company that outperformed its peers in several areas, such as compliance with regulations and environmental standards, investment in green initiatives, strategic planning, policy setting in order to reduce emissions from operations, and ongoing staff training. The award win recognizes OOCL’s efforts and

resolute commitment to achieving environmental excellence and sustainability.

Commenting on the award win, Mr. Michael Fitzgerald, Deputy Chief FinancialOfficerofOOCL said, “We would like to thankAsiaCargoNews,our customers, and our business partners for their support to OOCL and for therecognitiongiventoour sustainability efforts. In addition to OOCL’s consistent and effective green initiatives already in place, our recent breakthroughs in the trial use of biofuel and in the ordering of seven methanol-compatible vessels have further demonstrated our commitment to caring for the environment. We will continue our decarbonization journeytowardsabetterandgreenerfuture.”