GENEVA: MSC Mediterranean Shipping Company is pleased to announce the launch of a new direct service, India – West Med service, connectingIndiawiththeWestMediterranean, startingmid-December.

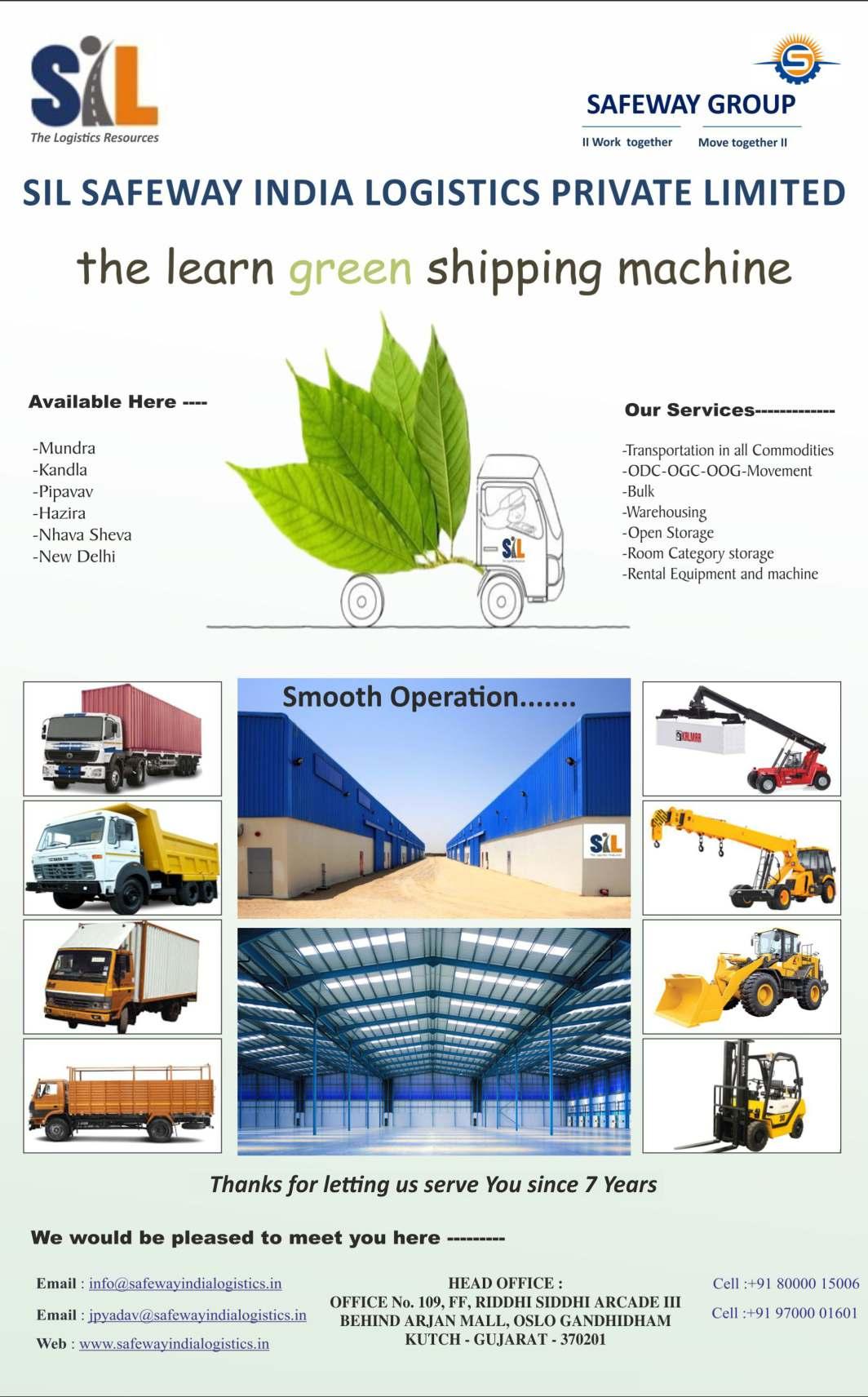

By offering direct connection between the two regions, MSCwillreducetransshipmentforcustomersandproviding expedited transit times. The service will offer Mundra to Genoa in 19 days, Valencia in 23 days and Nhava Sheva to Barcelona in 16 days, with no transshipment required betweenloadanddischargeports.

Cont’d. Pg. 6

Cont’d. Pg. 6

GA ND HI DH AM : Deendayal Port Authority, Kandla is organising two day training program on RTIActfrom7thDecember, 2022.

Cont’d. from Pg. 4

The India – West Med service connects with MSC’s broad intermodal networks in Genoa and Valencia, opening new opportunities for exporters across the region and enhancing support for automotive, apparel and pharmaceuticals industries

betweentheIndiaandtheWestMediterranean.

The first sailing will be with MSC SHANGHAI from Abu Dhabi on 19 December and will rotate as follows: Abu Dhabi – Jebel Ali – Mundra – Nhava Sheva –Djibouti – Gioia Tauro – Genoa –Barcelona – Valencia – Salerno –Gioia Tauro – Marsaxlokk – King Abdullah –Jeddah–AbuDhabi.

Cont’d. from Pg. 4 Dy. Chairman, Shri Nandeesh Shukla, IRTS, inaugurated the programe. Dr. S.N. Venkatesan from Chennai, a renowned Trainer on RTI Act, has been invited as faculty. 37 nos. CPIOs, PSs & PAs, are attending program.

NEW DELHI: Freight traffic handled by 12 Major Ports in India jumped by 8.8 per cent year-on-year to 507.12 million ton in the Apr-Nov of this financial year, according to data released by the Indian Ports Association.

The rise in freight traffic was majorly because of growth in traffic of crude and petroleum products, and coal thermal, which went up by 8.2 per cent and 36.2 per cent year-on-year, respectively, in Apr-Nov. The traffic of crude and petroleum products was at 153.86 million tonnes, and that of coal thermal was at 87.03milliontonnes.

Among the top ports, Deendayal Port at Kandla handled the highest traffic in the first eight months at 93.34 millionton, followed by the Paradipport at 84.21 millionton,andtheJawaharlalNehruPortAuthorityat 53.58millionton.

The association does not give out detailed monthly data. However, based on the cumulative data, the freight traffic increased by 2.0 per cent year-on-year in November,comparedto3.6percentamonthearlier.

Traffic of miscellaneous cargo was up 14.3 per cent year-on-yearat61.05milliontoninApr-Nov.

On the other hand, iron ore traffic contracted 25.8 per cent year-on-year to 25.00 million ton in Apr-Nov.

CJ-I

CJ-II MV African Weaver GAC Shpg. 12/12

CJ-III MV My Lama Interocean 11/12

CJ-IV MV Ultra Wollongong Interocean 11/12

CJ-V VACANT

CJ-VI MV Obe Grande Tauras 10/12

CJ-VII MV Feng Li Hai V-Oeacn 09/12

CJ-VIII MV Navigare Boreas Benline 09/12

CJ-IX VACANT

CJ-X MV Khadeejah Jahan II Asia Shpg. 12/12

CJ-XI VACANT

CJ-XII VACANT

CJ-XIII MV Theotokos BS Shpg. 10/12

CJ-XIV MV Minoan Grace Chowgule Bros. 12/12

CJ-XV MV Arion Cross Trade 13/12

CJ-XVA MV African Petral Synergy Seaport 13/12

CJ-XVI MV True Confidence Seascape 10/12

Tuna Tekra Steamer's Name Agent's Name ETD

MV Samjohn Solidarity Dariya Shpg. 09/12

MV Owl Interocean 09/12

MV Appolo Bulker Samsara 09/12

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I MT Cheshire Nationwide 09/12

OJ-II MT SC Tauras

OJ-III MT Aquarius Wilhelmsen 09/12

OJ-IV MT Chem Sinyoo J M Baxi 09/12

OJ-V MT G Bright

OJ-VI MT Jag Pankhi J M Baxi 09/12

Stream

Stream

Tuna

CJ-XV

2022121017

Stream MV Armonia ACT Infra Africa 34,000 T. Rice In Bags 2022111195

Stream MV Bao Shun Ashirvad Shpg. 22,500 T. Bags 2022111238

Stream MV Chakravati Chowgule Bros. Cotonou 50,000 T. Rice Bags 2022111169

Stream MV Dawai BS Shpg. Chennai 10,000 T. Silica Sand In Bulk 2022101335

Stream MV Elisar Ocean Harmony Durban 31,750 T. Sugar Bags 2022111243

Stream MV Flag Gangos Seacoast 32,000 T. Bagged Rice 2022121026

Stream MV IBI Tauras 14,000 T. SBM In Bulk

Stream MV IKI DBC Singapore 14,000 T. SBM In Bulk 2022111309

08/12 MV Jaohar UK Interocean 26,500 T. Sugar In Bags

Stream MV Jupiter DBC Port Sudan 23,000 T. Sugar Bags 2022121036

CJ-X MV Khadeejah Jahan II Asia Shpg. 53,000 T. Iron Ore Pallets 2022111315

Stream MV Kosman Arnav Shpg. West Africa 24,500 T. Rice In Bags 2022111274

Stream MV Lady Moon DBC Somalia 24,900 T. Sugar Bags 2022111377

CJ-XIV MV Minoan Grace Chowgule Bros. China 54,700 T. Salt in Bulk 2022111355

Stream MV Mont Blanc Hawk Interocean Sudan 71,000 T. Sugar In Bulk 2022121042

CJ-III MV My Lama Interocean Sudan 25,000 T. Sugar Bags 2022111127

Stream MV Obe Heart Interocean 25,000 T. Sugar Bags 2022111247

Stream MV Obe Queen Ocean Harmony 40,100 T. Sugar In Bags 2022121014

Stream MV Pac Adhil Tristar Shpg 2,500/1,500 T.M.Chloride/Sulphate & 18 2022111285

Stream MV Pegasus 01 DBC Somalia 8,000 T. Sugar Bags 2022111256

Stream MV Propel Progress DBC 25,000 T. Sugar Bags 2022121003

Stream MT Raon Teresa Samudra Jebel Ali 2,006 T. Chem.

Stream MV Stentor Interocean Sudan 27,450 T. Sugar In Bags 2022111187

CJ-XIII MV Theotokos BS Shpg. Madgasakar 28,000 T. Rice Bags 2022111268

CJ-XVA MV African Petral Synergy Seaport Uruguay 38.068 CBM Pine Logs 09/12 MV Bao Tong 1 Rishi Shpg 20,205 CBM Pine Logs 09/12 MV Curacao Pearl Benline U.S.A. 36,529 T. Petcoke In Bulk

Stream MV Falcon Trader Chowgule Bros. Indonesia 60,500 T. Coal In Bulk CJ-VII MV Feng Li Hai V-Oeacn 60,500 T. Coal In Bulk

Stream MV Great Spring Interocean Sohar Oman 45,000 T. Urea In Bulk 2022121030

Stream MV Loyalty Hong Arnav Shpg. 24,469 T. Scrap In Bulk (HMS) 2022111397

Stream MV Mount Seymour Arnav Shpg. 13,200/22,000 T. HMS/S Scrap In Bulk

CJ-VIII MV Navigare Boreas Benline U.S.A. 59,100 T. Petcoke In Bulk CJ-VI MV Obe Grande Tauras 42,000 T. DAP 202211364 14/12 MV Olympus Tauras 49,474 T. Urea In Bulk Tuna MV Owl Interocean Egypt 50,903 T. Urea 10/12 MV Pacific Talent Benline 52,110 T. Petcoke In Bulk Tuna MV Samjohn Solidarity Dariya Shpg. 1,26,713 T. Coal 18/12 MV Serena Tauras 49,910 T. Urea In Bulk

Stream MV Tian He J M Baxi China 5,926/1,244/238HRC/Plates/Wooden 2022111341

Stream MV True Courage Tauras 1,28,470 T. Coal 2022111309 CJ-XVI MV True Confidence Seascape 27,079 T. Met Coke 2022111125

09/12 09/12-AM Maersk Detroit 248W 22381 Maersk

Maersk India Algeciras 09/12 16/12 16/12-AM Maersk Sentosa 249W 22392 (MECL) 16/12 TO LOAD

FAR

08/12 08/12-AM MOL Creation 086E 22385 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 08/12 25/12 25/12-AM Conti Contessa 112E 22407 Ningbo, Sekou, Cai Mep. (PS3) 25/12 10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 10/12 11/12 11/12-AM BSG Bimini 249E 22387 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 11/12 18/12 18/12-AM SOFIA I 250E 22394 Ningbo, Tanjung Pelepas. (FM3) 18/12 12/12 12/12-AM X-Press Bardsey 22020E 22398 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 12/12 19/12 19/12-AM Bangkok Bridge 139E 22406 ONE ONE (India) (TIP) 19/12 14/12 14/12-AM OOCL Hamburg 139E 22399 APL/OOCL DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 14/12 21/12 21/12-AM OOCL Luxembourg 099E 22401 Gold Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 21/12

09/12 09/12-AM SSL Bharat 121 22397 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 09/12 09/12 09/12-AM Maersk Detroit 248W 22381 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 09/12 16/12 16/12-AM Maersk Sentosa 249W 22392 (MECL) 16/12 13/12 13/12-AM SCI Mumbai 553 22402 SCI J. M Baxi Jebel Ali. (SMILE) 13/12

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

10/12 10/12-AM Seamax Westport 083 22391 COSCO COSCO Shpg. Karachi, Colombo (CI1) 10/12 11/12 11/12-AM Irenes Ray 249S 22388 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 11/12 11/12 11/12-AM BSG Bimini 249E 22387 SCI J. M Baxi Colombo. (FM3) 11/12 12/12 12/12-AM X-Press Bardsey 22020E 22398 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 12/12 19/12 19/12-AM Bangkok Bridge 139E 22406 ONE ONE (India) (TIP) 19/12 14/12 14/12-AM OOCL Hamburg 139E 22399 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 14/12

08/12 08/12-AM MOL Creation 086E 22385 ONE ONE (India) Los Angeles, Oakland. (PS3) 08/12 09/12 09/12-AM Maersk Detroit 248W 22381 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 09/12 16/12 16/12-AM Maersk Sentosa 249W 22392 Safmarine Maersk Line India (MECL) 16/12 12/12 12/12-AM X-press Bardsey 22020E 22398 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 12/12 19/12 19/12-AM Bangkok Bridge 139E 22406 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 19/12

OTHER PORTS OF GUJARAT

ETD VESSEL'S NAME AGENT FROM COMMODITY QTY(m.t.)

IMPORT

In Port TS Alpha Samsara Shpg. Korea Steel Slab 31291

m.v. “ESL KABIR” V-02245 I. G. M. NO. 2328974 Dtd. 07-12-2022 The above vessel has arrived at Mundra on 08/12/2022 as per following details. Item Nos. B/L NOS. Item Nos. B/L NOS. Item Nos. B/L NOS. 1 75730054233 2 75730054235 3 76230002793 4 EPIRCHNQGA228463 5 EPIRCHNQGA228466 6 39030056807

63 EPIRCHNCWA229556 64 EPIRCHNNBO229659 65 EPIRCHNNBO229652 66 EPIRCHNNBO229653 67 EPIRCHNCWA229531 68 EPIRCHNCWA229545 69 EPIRCHNCWA229548 70 EPIRCHNCWA229552 71 EPIRCHNCWA229554 72 EPIRCHNCWA229535 73 EPIRCHNCWA229536 74 EPIRCHNCWA229530 75 EPIRCHNCWA229568 76 EPIRCHNCWA229569 77 EPIRCHNCWA229570 78 EPIRCHNCWA229571 79 EPIRCHNCWA229557 80 EPIRCHNCWA229559 81 EPIRCHNCWA229560 82 EPIRKRFGCL231969

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable.

If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws.

Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Rajkamal-II,

No. 103, 1st Floor, Plot No. 342, Ward - 12/B, Gandhidham - 370201. India. In case of any query kindly contact the below E-mail IDS & Phone Numbers :

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : benoy.varghese@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89800 25092

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

NEW DELHI: State-owned ports handled 1.9 million tonnes (mt) of cargo in November, or 3 per cent more than last year, as international trade volatilityandfreightcostscontinuedto dampen traffic at these ports, Indian Ports’Association(IPA)datashowed.

India’s 12 Major Ports recorded a combined traffic of 61.3 mt in November, even as many hoped that the festive months would give a fillip tothelogisticssector.

Experts believe the slowdown in international trade has been the biggest factor behind this, and expect the slow momentum to continue in the near-term, with only minor increases or decreases depending on change in high-frequency economic indicators in western countries. Trade in finished goods has been especially weak, with thefirstsevenmonthsshowingonly1.5 per cent growth in container traffic as againstthelastfiscalyear.

“Current year’s container segmentvolumeshavebeensubdued.

Two factors have primarily contributedtothis—subduedexportimport trade has had an impact, and high freight cost in the first quarter of the fiscal year also led container volumes to move towards the break bulk segment,” said Sai Krishna, Vice-President and sector head at ICRA.

Indian Major Ports handled record traffic of 70 mt in March this year, marking a robust end to a year filled with uncertainties amid multiple Covid-19 waves. Ever since the first quarterofthisfinancialyear,combined cargo at 12 Major Ports has not even crossed 65 mt, and for the last three months,ithasbeenflatat61mt.

International trade concerns continue to weigh on the container segment. “We expect FY23 growth to be in the range of 3-4 per cent (versus the earlier 5-6 per cent) given the higher uncertainty in global trade,” said Mohit Kumar, a Research AnalystatDAMCapital.

Meanwhile, overall cargo growth, which was in double-digits at the beginning of this fiscal year, stands below9percent.

However,thegrowthhasbeendue to disproportionate increases in commodities such as coal (see chart), which was due to a nationwide coal crisis, forcing the Centre to import more coal, and also push more coal out through the coastal route as railwaynetworksremainedchoked.

“Overall growth for the fiscal year is 8.8 per cent, primarily because of coal. We expect some normalisation in this segment in the coming time, and that may get offset by growth in other segments such as iron ore and agricultural cargo. Overall, the fiscal year is likely to end with a traffic growthof6-8percent,”saidKrishna.

While a dip in coal cargo is widely expected, experts believe that a push forcoastalshippingofthermalcoalby the Centre may ensure that the fall isn’tprominent.

NEW DELHI : Commerce Minister Shri Piyush Goyal had said thattheobjectiveofthegovernment’s “Districts as Export Hubs” initiative was “to mobilise each district of the Country to achieve its potential as an export hub” in the Rajya Sabha last year.

Moreover, in what may be seen as proof of the Government’s intent to push for a balanced pan-India growth in the exports sector, it is likely to allocateRs2,500croreforthescheme intheupcomingbudget.

However, ambitious that it is, the initiative seems to be grappling with challenges of its own, as can be inferred from the data compiled by the ministry for the period of April–September 2021–22. As per the data,Gujarat,MaharashtraandTamil Nadu have emerged as the top three

majorexporters,accountingforseven oftop10districtsinthelist.

Currently, these three states togetheraccountformorethan55per cent of the country’s merchandise exports. In the last financial year, when India’s exports touched an alltime high of $422 billion, Gujarat accounted for about 30 per cent of the total exports at $127 billion, followed by Maharashtra and Tamil Nadu at $73billionand$35billion,respectively.

Interestingly, these three states lead in the production of the goods which are among the most-exported productsofthecountryandaccountfor 81percentofthecountry’sexports.

For example, Gujarat and Maharashtra are the top-notch centres for segments like petroleum products, engineering goods, gems and jewellery, drugs and

pharmaceuticals. The fact that these were port states has given them historical advantage in terms of developing infrastructure for promotingoverseastrade.So,canthe DEH initiative help states other than theBigThreeemergeaswinners? Product diversification a viable option

In September last year, Dubai got to taste apricots from Ladakh, known for their distinctive taste, for the first time. Farmers of Chandauli district of UParegrowingblackricetoexportto markets like Australia and NewZealand.

Apricots and black rice may not be among the top five export items of states leading in the sector, but they, like many other items, hold the potential to generate revenue for theirhomestates.

NEW DELHI: India will explore with Belarus, a close ally of Russia, theoptionofreplicatingthedealithas struck with Moscow for settling international trade in rupees. Indian bankers are expected to meet a team of officials from Belarusian financial institutions this month to discuss the possibility, a person familiar with the mattersaid.

Belarus is grappling with sanctions from the US and the EU for supporting Russia’s attack on Ukraine. “Since India imports

fertiliser from Belarus, a rupee settlement could help. It could be exactly like the rupee trade with the Russianparties.ManyRussianbanks have opened Vostro accounts with us though some of the Indian oil refiners are paying hard currency to buy oil fromRussia,”saidabanker.

The industry body, the Indian Banks’ Association (IBA), reached out to banks last week on the proposed meeting. “The IBA may have been askedbytheRBIorthegovernmentto pursue this. We expect the meeting to

happen sometime this month or early January,”saidanotherbanker.

The trade settlement arrangement, finalised by the RBI in July, entails Indian importers depositing rupees in special accounts that overseas banks open with lenders inIndiaandclearingtheduesofIndian exporters from surplus balances in these rupee accounts. Though it was announced in the wake of sanctions on Russia following the invasion of Ukraine, the scheme can be used to settletradewithanyCountry.

“Districts

MUMBAI: The Reserve Bank of India hiked its key lending rate by a more modest 35 basis points to 6.25 per cent, citing slowing inflation after three consecutive 50-bps (basis points) increases to manage price pressures that have remained persistentlyabovetheupperendofits targetband.

The monetary policy committee (MPC), which is made up of three members from the RBI and three

outside members, hiked the key lending rate, also known as the repo rate, by 0.35 per cent to 6.25 per cent with a five out of six majority.

The standing deposit facility rate and the marginal standing facility rate were also increased by the same quantum to 6.00 per cent and 6.50 per cent,respectively.

The RBI cited slowing price pressures for the smaller rate hike

after consumer-price-based inflation eased to a three-month low of 6.77percentinOctoberfromayearago.

That lines up with broad market expectations for a moderation in rate hikes given that the central bank had front-loaded its tightening policy, with predictions for inflation to have likely peaked in September and favourable base effects guiding the price rise trajectory to below 6 per cent from earlynextyear.

NEW DELHI: Responding to the increase in the Repo Rate by 35 basis points, FIEO President, Dr A Sakthivel said that such an increase to contain inflation and the flight of capital is on expected lines with further fears of Fed rate hike in theUS.

The FIEO President said that global trade is passing through a difficult phase owing to rising inflation, reducing the purchasing power, and countries entering into recession and high volatility in currencies. In the given scenario, we have to ensure that further increase

in export credit rates should not blunt our competitive edge as we are losing out to our competitors in countries with reduced rates of interest and deepdepreciationoftheircurrencies.

FIEO Chief requested RBI to extend "Export Refinance Facility" to banks. Under such a mechanism, banks may be encouraged to provide export credit in Rupee to exporters and the same amount can be refinanced by the RBI at the Repo Rate. Such a mechanism will bring down the interest cost for export credit providing much needed competitiveness to our exports amidst headwinds in the global economy.

: FIEODr Sakthivel also requested the Government to increase interest subvention under the Interest Equalization Scheme (IES) from 3% and 2% respectively to 5% (to all MSME manufacturers) and 3% (to all other eligible categories) as interest rates have already crossed the precovid level by a high margin when the Interest Equalization Scheme was providedfor5%&3%forsubvention.

At the same time, FIEO advised exporters to opt for foreign currency denominatedcreditwhichisavailable at LIBOR+150-200 basis points and provideacomfort,duringtheextreme volatility in dollar, without any hedgingcost.

MUMBAI: Reserve Bank of India Governor Shaktikanta Das while announcing a rate hike highlighted that slowing global demand is weighing on India's merchandise importsandexports.

"The external sector has been affected by strong global headwinds. Slowingglobaldemandisweighingon ourmerchandiseexports.Thegrowth of merchandise imports is also decelerating,"Dassaid.

After a successful run for many quarters merchandise exports contracted by a massive 16.7 per cent

to USD29.8 billion in October-- the first contraction in 19 months. Merchandise imports also lost steam, clipping at just 5.7 per cent in October and all the available indicators show thatexportswillcontinuetofacemore headwinds.

Governor Das said that it is also important to take cognizance of India’s innate buffers. "The growth of services exports, mainly contributed by software, business and travel services remained robust at 29.1 per centinApril-October2022,"hesaid.

According to the latest update of

the World Bank, India’s remittances are estimated to grow by around 12 percenttoUS$100billionin2022from US$ 89.4 billion in 2021. Remittances to India rose by 22.6 per cent year-onyearinthefirstquarteroftheongoing fiscal.

"The net balance under services and remittances remains in large surplus, partly offsetting the trade deficit. Consequently, even if the current account deficit is higher than 2021-22, it is eminently manageable and within the parameters of viability,"Dasadded.

THIRUVANANTHAPURAM :

The protests in Kerala against the Vizhinjam Port Project by the fishing community which were underway for almost 140 days has been called off on Tuesday following hectic deliberations between the protesters and the state government which was also attended by Chief Minister Shri Pinarayi Vijayan.

Speaking to the media after their meeting with Vijayan, spokesperson

of Latin Church, Eugiene Perreria said even as their demands were not fully met by the government, the protest has been called off. The Kerala High Court is likely to take somecrucialdecisionsonWednesday in connection with the protest against theportproject.

“We have got certain assurances from the government and though we have not got all our demands accepted, it has been decided to call off the protest. We will be closely

monitoring the upcoming events and at the same time we will be expecting that the government will take a favourable step,” said Perreria. The major demands put forward by the protesters which includes stopping of the ongoing work at the Vizhinjam port has not been accepted. Also, another demand, to constitute a special committee – comprising their members to study the environmental damages caused to the locality – was alsonotaccepted.

AHMEDABAD: As a result of the Comprehensive Economic Partnership Agreement (CEPA) between India and the UAE from May 2022, global shipping lines are launching new container services between India’s ports on the west coastandtheUAE.

This is in anticipation of increased trade between the major trading partners, which will largely benefit Indianexporters,especiallyinlabourintensive sectors like gems and jewellery,textilesandleather.

Shipping majors Maersk and the Singapore-based SeaLand launched new services in November. Another Singapore-based Ocean Network Express (ONE) will commence a new service on December 8, and many morelineswillfollowsuit,sayofficials

intheshippingindustry.

ONE’s new India Gulf Service (IGS) will cover the rising trade demand between the two countries. The weekly service will have the port rotation of Jebel Ali, Mundra, Hazira, NhavaSheva,andJebelAli.

After the US, UAE is the second largestexportdestinationofIndiawith exports of $28 billion in the year 2021-22. For the UAE, India is the second largest trading partner for the year 2021 with an amount of around $45 billion (non-oil trade), according to theEmbassyofIndia,AbuDhabi,UAE. Otherroutesintroduced Maersk launched the ‘Shaheen Express’ connecting the India-UAE-Saudi Arabia corridor with ships rotating being Mundra, Pipavav, Jebel Ali, Dammam, and

JebelAliandbacktoMundra.

The main commodities moving between these two countries that will benefit from the increased capacity include FMCG such as electronics, perishables such as foodstuff, retail goods including textiles and apparel, andchemicals.Theservicewillbenefit the exporters of the petrochemical sector from the eastern province of SaudiArabia,saidMaersk.

SeaLead launched a new service connecting India and the UAE to East Africa. India-Dubai-East Africa (IDEA) began on November 22 as a weekly service with four ships, two from SeaLead and one each from OOCLandTSLines.Theportrotation will be Nhava Sheva, Mundra, Jebel Ali, Khalifa, Mombasa, Dar Es Salam andNhavaSheva.

AHMEDABAD: New data points to a rebound in box volumes moving viaMundraPort,India’sbusiestcargo hub,inNovember.

Accordingtothelatestfigures,the four Adani Group-controlled Mundra terminals together handled 438,453 TEUs last month, versus 431,334 TEUsduringOctober.

The private harbour also includes a DP World concession, named Mundra International Container Terminal (MICT), which handled 90,781 TEUs in November, versus 92,908 TEUs in the prior month. That takes Mundra’s November combinedthroughputto529,234TEUs, upfrom524,242TEUsinOctober.

The volume trend-up, albeit modest, at Adani’s flagship port is noteworthy, given the current demandpressure.

Container volumes across the Adani port network in India (APSEZ) also edged up last month. The group

saw 693,624 TEUs, out of six boxhandling locations, up 2.5% from Octoberfigures.

In addition to Mundra, APSEZ has container terminals at Kattupalli, Ennore, Krishnapatnam, Hazira and Gangavaram. The private behemoth issettoacquireKaraikalPort,amultipurpose privately-built cargo gateway in India’s southern region. The group has reportedly bid about Rs. 1,200 crore (US$150 million) for the concession rights, according to industrysources.

The planned investment is the latest in a series of port takeovers APSEZ has made in recent years across India, the last notable being the addition of the Gangavaram port toitsnetwork.

APSEZ has also signed a concession agreement for berth mechanisation at Haldia Port, near Kolkata, taking its Indian footprint to 13locations.

It is also gearing up for a new harbour at Tajpur in West Bengal, a greenfield site expected to be in five years. APSEZ has also been actively pursuing investments in global markets. The company recently signed a US$1.2 billion deal to secure concession rights for the Haifa port, Israel’ssecond-busiestgateway.

Additionally, the group has an ongoing terminal development at Sri Lanka’s Colombo Port. The West Container Terminal (WCT) is targeted for completion in 2025 under a two-phased development, able to provide an annual capacity of 3.5millionTEUswhenfullyoperational.

“APSEZ remains committed to its philosophy of ensuring sustainable growth in partnership with our key stakeholders,” APSEZ CEO Karan Adani said in a recent statement. He added,“Weareontracktoachieveour full year guidance of 350-360 MMT cargovolumes.”

NEW DELHI: The World Bank on December6lifteditsgrowthforecastfor India’s economy this year to 6.9%, after havingdowngradeditto6.5%inOctober, citing resilience in economic activity despite a deteriorating external environment.

The Bank said it revised the GDP forecast considering the strong upturn in the July to September quarter of 2022-23, when it grew 6.3% despite inflationary pressures and tighter financing conditions, “driven by strong privateconsumptionandinvestment”.

“The Government’s focus on bolstering capital expenditure also

supported domestic demand in the first half of 2022-23. High frequency indicators indicate continued robust growth of domestic demand at the start of Q3 (October to December quarter),” the Bank noted in its latest India Development Report titled ‘Navigating theStorm’.

“India’s economy has been remarkably resilient to the deteriorating external environment, and strong macroeconomic fundamentals have placeditingoodsteadcomparedtoother emerging market economies,” said Auguste Tano Kouame, World Bank’s CountryDirectorinIndia.

In response to a query on whether Indiawasexperiencing‘joblessgrowth’, Mr. Kouame said that jobs are being created, but they are all in the informal sector. “So, the policy question here is what to do to formalise that… How to make job creation visible,” heremarked,addingthattherenewable energy and green economy sectors can createalotofjobs.

The Bank expects the Indian economy to grow at a slightly slower 6.6%in2023-24asachallengingexternal environment and faltering global growth will affect its economic outlook throughdifferentchannels.

GANDHIDHAM: Deendayal Port Authority, Kandla organised various activities viz. distribution of leaflets, pamphlets, counselling etc., at different locations in order to increase awareness amongst the Port Employees and labourers, working in & around Port area,inobservanceofWorldAIDSDay.

In this process, NGOs also joined hands with DPA in the activities. Shri S.K. Mehta, IFS, Chairman and ShriNandeeshShukla,IRTS,Dy.Chairman visitedthe stall installed at AO Building, Gandhidham and encouragedtheTeamswhichwereparticipatingactively intheawarenessprogrammes.

DUBAI: GAC Group has acquired Finland-based ESL Shipping's Swedish subsidiary Norra Skeppningsgruppen (NSG), marking the second Swedish ship agency purchase by GAC this year. The transfer of NSG to GAC Sweden was completedtoday1December.

Established in 2015 and a part ofESLShippingsincetheautumn of 2019, NSG provides a range of ship agency services, as well as logistics and chartering services, to ship owners and operators in most ports in the southeast of Sweden. Its main office in Oxelösund,whereGACSwedenhashadapresencesince itsacquisitionofSwedAgencyABinAugust2019,handles about 200 port calls a year, with a further 150 at other ports in the region, including Åhus, Luleå, Norrköping, SödertäljeandYstad.Underthedeal,thestaffofNSGwill transfertoGACSweden.

“We are pleased to welcome NSG to GAC Sweden,” says Johan Ehn, Managing Director of GAC Sweden. “This latest addition, following the acquisition of

Hasting Ship Services AB in October, represents the latest step in our sustainable growth strategy, especially in the dry bulk sector. Together with our new colleagues, we will continue to strengthen our organisation, working evenmorecloselywithourcustomersintheregion.”

Dedicationandcommitment

“ESLShippinghasbeenworkingwithGACinFinland for many years, and we are pleased that we have found a goodandexperiencedownerfortheNSGbusiness,”says MikkiKoskinen,ManagingDirectorofESLShipping. “ThesaleofNSGwillenableESLShippingtofocusonits coreoperationsastheleadingcarrierofdrybulkcargoes inthe BalticSea region. I want to take thisopportunityto thank all NSG employees for their dedication and commitment”.

PSA’s Bharat Mumbai Container Terminals (BMCT) is located in Jawaharlal Nehru Port (JNP) in Maharashtra, India’s largest and premier container gateway. The terminal is equipped with the latest technology to offer customers fast turnaround of their vessels and is also wellconnected by major highways and rail networks to key markets in Maharashtra, Gujarat, and the National Capital Region of India. It serves the important industrial and manufacturing centres and cities in Northwest India, as well as India's largest hinterland with a population in excess of 400 million.

BMCT’s Phase 1 development has a quay length of 1000 metres and the deepest berths at JNP, capable of handling super post-panamax vessels. When fully completed, the terminal will have a berth length of 2,000 metres.

of senior officials of PSA India, PSAMumbaiandJNPA.

The terminal will be doubling capacity to 4.8millionTEUsandisproud to be associated with JNPort,thebest-performing port, it emphasised in a communique.

NAVI MUMBAI: Wharf & Approach Trestle construction commenced for Phase 2 of PSA Mumbai (BMCT,atJNPort)onDecember5,2022withthefirstpile drilling. It was launched by Mr Sanjay Sethi, IAS, Chairman, Jawaharlal Nehru Port Authority (JNPA), in the presence