Honda selects APM Terminals Pipavav Port for Japan Route

PIPAVAV: APM Terminals Pipavav has made Indian vehicle-export history as the first choice for Honda to export their new mid-size SUV to Japan

Cont’d Pg. 6

PIPAVAV: APM Terminals Pipavav has made Indian vehicle-export history as the first choice for Honda to export their new mid-size SUV to Japan

Cont’d Pg. 6

Cont’d from Pg. 4

Teamglobal Logistics

Pvt Limited, established in 2005 and headquartered in Mumbai, India, is a leading integrated logistics service provider with a focus on Sea Cargo Consolidation, Sea Freight Forwarding, Air Freight, Coastal Shipping, and Container Freight Stations.

With over 1000 on-roll employees and 900 off-roll employees, the company operates across 16 offices in India and 2 offices in Bangladesh, along with 4 strategically located container freight stations

Teamglobal Logistics serves 180 countries and operates in 1500 ports globally through alliances like the World Wide Alliance, Air Cargo Group, and GPLN

The company holds various certications including ISO certications, C-TPAT, AEO, GDP, and IGBC.

Notably, it has received the "Best Consolidator of the Year – All India" award numerous times from 2010 to 2024.

Moreover, Teamglobal

L o g i s t i c s i n t e g r a t e s Environmental, Social, and Governance (ESG) principles into its operations and is dedicated to Corporate Social Responsibility (CSR) through its trust, Saksham Sarthi, aiming to make a positive impact on individuals and communities.

Cont’d from Pg. 4

T h e m a d e - i n - I n d i a H o n d a E l e v a t e w a s launched in the Japanese market under the brand name WR-V in March 2024.

This is the first time that a Honda model has been exported from India to Japan, representing not only a significant leap for India’s automotive industry but also highlighting the country’s growing manufacturing prowess and global competitiveness.

APM Terminals Pipavav partnered with NYK line and Auto Logistics to load the initial shipment of cars in December 2023. A celebration was held, witnessed by Mr. Takuya Tsumura – President & CEO of Honda Cars India Ltd, Mr. Nobuaki Sumida – Chairman of NYK line & Auto Logistics Ltd., Mr. Phiroz Dubhash –

MD of DCB Sons Gujarat Pvt. Ltd., Capt. P K Mishra –COO and Mr. Amit Bhardwaj - CCO of APM Terminals Pipavav and dignitaries from Honda cars, NYL lines & logistics, DBC & colleagues from APM Terminals Pipavav.

MUMBAI: RBI’s decision to keep the r e p o r a t e unchanged in the f i r s t m o n e t a r y policy of FY 2024-25 comes as no big surprise. The policy stance of ‘withdrawal of accommodation’, ensures that inflation progressively aligns to the target, while supporting economic growth

A stable monetary policy is vital for fostering a conducive environment for the shipping and ports sector. Prioritising liquidity management and inflation control showcases the importance of a steady financial backdrop in driving sustained growth and operational efficiency within the infrastructure sector,” according to Mr. Rajiv Agarwal, MD & CEO, Essar Ports

Mr. RajivAgarwal

NAVI MUMBAI: Jawaharlal Nehru Port Authority (JNPA) has approved a partial tariff revision for Gateway Terminals India Pvt Ltd (GTI), towards the existing Scale of Rates applicable under 2019 TAMP guidelines, informs a recent GTI Advisory.

“This revision shall be applicable on the GTI’s current Scale of Rates and shall be effective from 2nd May 2024 until 30th April 2025.

“The new tariff document has been uploaded

https://www.apmterminals.com/en/mumbai/services/ta riffs-and-terms.

“All invoices generated after 0001 hrs on 02-May-2024 (irrespective of time of service provided) will be charged as per the revised tariff structure.

Kindly also be advised that Tariff Authority of Major Ports (TAMP) has announced an annual indexation of 0% (zero percent) at 60% of the WPI variation, towards the existing Scale of Rates applicable under 2019 TAMP guidelines. There will be no additional increase in tariff on account of annual indexation for year 2024,” concludes the Advisory

CJ-VIII Akij Pearl Dariya Shpg. 09/04

CJ-IX CL Lindy Dariya Shpg. 10/04

CJ-X Summer Sky Interocean 11/04

CJ-XI VACANT

CJ-XII Sounion Trader Hapag Llyod 09/04

CJ-XIII Poavosa Braave DBC 13/04

CJ-XIV African Buzzard Chowgule Bros. 14/04

CJ-XV Sealuck II Sea Link 10/04

CJ-XVA Venus Triumph Sea Trade 12/04

CJ-XVI Norse New Haven Mihir & Co. 13/04

TUNA VESSEL'S NAME AGENT'S NAME ETD VACANT

Capricorn Sigma Dariya Shpg. 09/04 VACANT VACANT

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I Rose Gas ISS Shpg. 09/04

OJ-II Oriental Cosmos Allied Shpg. 09/04

OJ-III Monax

OJ-IV Soprano Serene

OJ-V VACANT

OJ-VI VACANT

OJ-VII Asia Unity J M Baxi 09/04

CJ-VIII Akij Pearl Dariya Shpg. Indonesia 25,000 T. S. Coal In Bulk 2024031354

CJ-VI Akij Star Seascape 58,500 T. Coal In Bulk 2024041030

Sub. : Export of Onions (under HS code 0703 10 19) to UAE.

S.O. (E). - In exercise of powers conferred by Section 3 read with section 5 of the Foreign Trade (Development & Regulation) Act, 1992 (No. 22 of 1992), as amended, read with Para 1.02 and 2.01 of the Foreign Trade Policy, 2023 and in accordance with the provision contained in Para 2 of Notification No. 81/2023 dt. 22.03.2024, the Central Government permits export of additional 10,000 MT of onions (under HS code 0703 10 19) to UAE through National Cooperative Exports Limited (NCEL) over and above the quota notified vide DGFT Notification No. 65/2023 dt. 01.03.2024.

2. Effect of the Notification: Export of additional 10,000 MT of onions (under HS code 0703 10 19) to UAE through National Cooperative Exports Limited (NCEL) over and above the quota notified vide DGFT Notification No. 65/2023 dt. 01.03.2024 is allowed.

Sd/-

(Santosh Kumar Sarangi) Director General of Foreign Trade Ex-Officio Additional Secretary, Government of India

F.No. 01/02/98/AM-24/EG&TF

VANIJYA BHAVAN, NEW DELHI

Dated: 02.04.2024

Sub.: Directives regarding submission of digitized ANFs, Appendices etc.

In adherence to the Directorate General of Foreign Trade's commitment to facilitating exports and imports, emphasizing efficient, transparent, and accountable delivery systems, significant efforts have been directed towards digitising a substantial number of the Aayat Niryat Forms (ANFs) and Appendices pursuant to the Foreign Trade Policy. Consequently, applications pertaining to said ANFs and Appendices must be exclusively submitted online via the DGFT Website (https://dgft.gov.in), eliminating the necessity for physical or soft copies of these documents.

2. Additionally, it should be duly noted that Importer-Exporter Code (IEC) details are available online to DGFT (HQ), Regional Authorities (RAs), Export Promotion Councils (EPCs), and other pertinent entities. Likewise, Registration-cum-Membership Certificates (RCMCs) are electronically accessible through DGFT Online Systems. Moreover, Micro, Small, and Medium Enterprises (MSMEs) status as recorded in the MSME UDYAM Registration Portal (https://udyamregistration.gov.in) is similarly accessible through electronic exchanges integrated into DGFT online systems.

3. Furthermore, certain ANFs and Appendices necessitate certification by professionals such as Chartered Accountants, Chartered Engineers, Cost Accountants, Company Secretaries, among others, and may not be entirely digitized presently Nonetheless, ongoing endeavours are directed towards digitalization of these forms, enabling said certifying authorities to digitally certify all relevant ANFs and Appendices directly on the DGFT Website. Until such digital signature processes are fully implemented, copies of these documents may be uploaded online.

4. With regard to the foregoing, it is reiterated that no hard or soft copies of digitized ANFs, Appendices, IEC, RCMC, or MSME Udyam Registration certificates need to be submitted to DGFT (HQ) or its Regional Authorities. Additionally, there is no requirement to upload such documents alongside online applications.

5. It is further emphasized that all deficiency letters and correspondences pertaining to online applications must be issued and responded to exclusively online. Physical paper responses to such communications should not be entertained.

6. Any difficulty in complying with the above or feedback concerning the same may be communicated via email to DGFT (HQ) at egtf-dgft@gov.in

This is issued with the approval of competent authority

Sd/-

(Md. Moin Afaque) Deputy Director General of Foreign Tradem.v. “MSC DANIELA” V- FY409R I.G.M. No. 2373434 Dtd. 05-04-24 Exch rate 85.83

The above vessel has arrived on 05-04-2024 at MUNDRA PORT with Import cargo from POINTE NOIRE, SAN-PEDRO, LIBREVILLE, LOME.

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

NEW DELHI: India's Major Ports under MoPSW are experiencing steady growth, indicating positive developments in the country's Trade & Logistics sectors In 2023–2024, India's 12 Major Ports have handled the highest ever Cargo of 819.4 Million Metric tonnes.

In FY 2023-24, Major Ports saw substantial investment exceeding Rs. 12,500 Cr through capital infusion & sanctioning & awarding of Public Private Partnerships. This investment is poised to enhance infrastructure, boost efficiency, drive economic growth in the Maritime Sector, informs a recent communique from Shipping Ministry

NEW DELHI: Indian Prime Minister Shri Narendra Modi, confident of winning a national election starting this month, has set an ambitious target of roughly doubling the economy and exports this decade, according to a Government document release.

Modi has highlighted economic growth as one of his biggest achievements in election rallies and has “guaranteed” making the economy the third largest in the world from fifth now if he wins a third term in a row as polls predict.

He has already asked officials to finalise plans by around May to expand the economy to $6.69 trillion in nominal terms by 2030, from around $3.51 trillion currently, according to the October document. Though short on concrete details of how to achieve that, it has been a basis for officials’ meetings.

When he took office for a second term five years ago, Modi promised to take the economy to $5 trillion by the

current fiscal year, but partly due to COVID-19 related disruptions,meetingthattargetisvirtuallyimpossiblenow.

For the next six years, Modi’s goal is to raise per capita income to $4,418 from around $2,500, the document says, without specifying the spending or reforms needed to achieve that.

Modi’s office and the finance ministry did not reply to requests seeking comment.

Independent economist Saugata Bhattacharya said if the real GDP can grow by 6-6.5%, inflation stays around 4.5% and the rupee continues to depreciate against the dollar by 1-1.5% every year, the economy can double in seven years in nominal dollar terms..

The economy is, however, expected to have grown by around 8% in the last fiscal year ended March 31, the fastest among major countries, on the back of strong manufacturing and construction activity driven by Government spendings.

NEW DELHI: Indian exporters made further inroads in European and Latin American nations in 2023, registering h e a l t h y g r o w t h i n c o u n t r i e s s u c h a s R o m a n i a , Montenegro, Austria, and Guatemala, an official said recently India's merchandise export rose 2.1 per cent to the European Union (EU) in 2023 despite headwinds being faced by large developed markets like the EU and the UK due to high cost of living, weak external demand, and monetary tightening, the commerce ministry official said.

"India's export trade expansion has been impressive in spite of global challenges in 2023," the official said.

India's merchandise exports have recorded healthy growth in European nations like Romania, Czech Republic, Montenegro, Finland, the Netherlands, Portugal, Luxemburg, Iceland, Ireland, and Austria.

"The growth points towards India's trade resilience and growth despite prevailing uncertainties and deceleration of

the economies in Europe," the official added.

Similarly, in Latin American countries, India's exports registered high growth in 2023 in Cuba, Uruguay, Paraguay, Guyana, Peru, Mexico, and Guatemala.

"With continued social unrest, oil production cuts and tight policy settings, the growth of Middle-Eastern countries has weakened However, India's merchandise export growth to major Middle-Eastern countries remains positive," the official said.

The increased merchandise exports to Iraq, Saudi Arabia, and the UAE in 2023 underscores India's ability to navigate adverse economic conditions and capitalise on export opportunities.

Economic think-tank Global Trade Research Initiative (GTRI) have stated that India's exports and imports have dipped 2.6 per cent to USD 1,609 billion in 2023 compared to USD 1,651.9 billion in 2022.

THIRUVANANTHAPURAM: Vizhinjam International Port has successfully obtained the International Shipping and Port Security (ISPS) code, a crucial authorisation sanctioned by the International Maritime Organisation under the United Nations.

This certification is mandatory for international ships to operate within its premises, encompassing high-speed cargo vessels, bulk carriers, and other cargo ships, a port official said recently The Union Ministry of Ports, Shipping, and Water Transport has officially communicated the allocation of the ISPS code, marking a significant

achievement for Vizhinjam Port.

Developed in response to the terrorist attacks of September 11, 2001, the ISPS code aims to mitigate security risks prevalent in maritime transportation, thereby enhancing the safety of global shipping operations.

With this approval, Vizhinjam Port aligns itself with international standards of security, ensuring a secure environment for maritime activities.

Construction of the Vizhinjam Port is underway through a public-private partnership model, with the Adani Group as the private partner in the project’s development.

I.G.M. NO. 2373060 Dtd. 02-04-24 Exch rate 85.83

The above vessel has arrived on 04-04-2024 at MUNDRA PORT with Import cargo from DAR ES SALAAM. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

As Agents :

: Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com

H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059

Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com • www.msc.com

The above vessel has arrived on 05-04-2024 at MUNDRA PORT with Import cargo from TAMATAVE, POINTE DES GALETS.

Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

Charges enquiry on land line - 619100

KOLKATA: In its 154-year history, Syama Prasad Mookerjee Port, Kolkata (SMP Kolkata) including Kolkata D o c k S y s t e m (KDS) and Haldia Dock Complex (HDC), achieved a milestone in the fiscal year 2023-24 by handling 66 4 Million Metric Tonnes (MMT) of Cargo, marking a 1 11% increase from the previous record of 65.66 million tonnes moved in 2022-23.

Chairman Shri Rathendra Raman a t t r i b u t e d t h i s u n p r e c e d e n t e d throughput to a series of strategic initiatives implemented by the port to enhance productivity, safety measures, business development, and overall capacity utilization.

Highlighting HDC's significant contribution, Shri Raman noted that the complex handled 49.54 MMT in FY 2023-24, marking its highest cargo volume ever since its inception and surpassing the previous record of 48 608 MMT in FY 2022-23, representing an increase of 1 91% Meanwhile, KDS managed 16.856 MMT of cargo in 2023-24 compared to 17.052 MMT in 2022-23.

The Chairperson emphasized the port's robust financial performance in

2023-24, achieving a net surplus of Rs. 501.73 crores as well, a significant 65% growth over the previous year's net surplus of Rs. 304.07 crores, marking a remarkable accomplishment.

To augment capacity of the port, SMP Kolkata is stressing on the PPP Projects in a big way.

A Major push for PPP Projects:

✓Concession awarded by SMPK for 2 PPP projects costing Rs 480 Crore for Rejuvenation of KPD-I West (Cost Rs. 181.81 crores) and Mechanization of Berth no. 2 at HDC (Cost 298.28 Crore) which could lead to Incremental Capacity Addition of 6.78 MMT (approx.)

✓ Three more projects (Berth No 5 f o r H D C , S t r e n g t h e n i n g & Mechanization of Berth no. 7 & 8 NSD and Floating Crane at Diamond Harbour at a cost of Rs 1160 crore, incremental capacity of 4.5 MMT) are likely to reach Award stage by 2024-25. Major Projects awarded during FY 2023-24:

✓ Development of Drainage network (Phase-IIA) on eastern side of dock basin at Haldia dock complex, Haldia under master drainage plan (Cost Rs.26.79 Crore)

✓ Regarding Implementation of energy efficient/smart fittings and

outdoor purpose along-with roof top solar power plant at KDS, Lol issued for Smart Light.

4 Major Projects costing Rs. 201.23

crore completed during FY 2023-24:

✓ Procurement of 1 no. 40 Tonne Rail Mounted Quay Crane (RMQC) at H D C , ( C o s t R s 5 2 8 2 C r a n d 0.25 MMTPA capacity addition).

✓ Augmentation of Fire Fighting s y s t e m a t H O J - I & I I i n c l u d i n g 2 nos. Barge Jetties including O&M for 10 years (Cost Rs.107.49 Cr.).

✓ Development of GCD Yard(Cost Rs.5.87 Cr.).

✓ Procurement, Supply installation, Testing & Commissioning of 1 DriveThrough X-Ray Container Scanning System with 2 year on-site Warranty and 8 year CAMC with spares/consumables for KDS (Cost Rs. 35.05 Cr)-Trial run completed and expected to commence shortly.

HDC registered growth in respect of POL (Product), Other Liquid, Vegetable Oil, Iron Ore, Other Coal Coke, Finished Fertilizer, Container TEUs, etc. while KDS registered growth in respect of Finished Fertilizer, Timber, Other Coal / Coke, Pulses & Peas, Container (both TEUs and Tonnage) etc. during 2023-24 vis-à-vis 2022-23.

Over 90% DFCs are operational, 138 km to be added by April-end

NEW DELHI: Indian Railways have disclosed that more than 90 percent of the expansive 2,843 km Dedicated Freight Cor ridor (DFC) is now operational. This significant milestone includes complete coverage of the eastern segment and 85 percent completion of the western arm. Over 300 trains are currently traversing this network daily, marking a pivotal advancement in freight transportation efficiency

The cost incurred in operationalizing this vast network currently stands at a staggering Rs 1,24,000 crore Plans are in motion to elevate operational route kilometers to over 95 percent by the end of April, further optimizing freight movementsacrossthecountry

Trains navigating through the Dedicated Freight Corridor have achieved impressive speeds, averaging between 50-60 km per hour, with the potential to escalate to 100 km per hour This speed is more than double the

velocity of goods trains operating on conventional Indian Railways tracks, where speeds typically range between 20-25 km per hour

According to an official from the D e d i c a t e d F r e i g h t C o r r i d o r Corporation of India Ltd (DFCCIL), speaking on the condition of anonymity, approximately 95 percent of the corridor’s route commissioning is completed, with only around 110 km remaining to be finalized in the western arm. Notably, a 138 km stretch between Sanand and Makarpura is on the brink of being operationalized.

The Western Dedicated Freight Corridor (WDFC), spanning 1,506 km, links the JNPT port in Mumbai to Dadri in Uttar Pradesh, traversing through Maharashtra, Gujarat, Rajasthan, Haryana, and UP. While significant progress has been made, challenges persist along a 110 km stretch between Vaitarna and JNPT port, attributable to adverse weather conditions and

c o n t r a c t u a l i s s u e s H o w e v e r, authorities anticipate completion within the next year, after which the entire WDFC will be fully operational.

Conversely, the Eastern Dedicated Freight Corridor (EDFC) spanning 1,337 km is entirely operational, f a c i l i t a t i n g s m o o t h e r l o g i s t i c s operations across Sahnewal—Khurja, Khurja Bhaupur, Bhaupur DDU (Deen Dayal Upadhyay junction), DDU Sonnagar, and Khurja Dadri sections. The corridor intersects through Punjab, Haryana, Uttar Pradesh, Jharkhand, and Bihar, with approximately 200 trains traversing the route daily

Additionally, a 538 km route between Sonnagar and West Bengal, initially proposed as part of the EDFC but subsequently excluded from the project, will now be directly developed by the Ministry of Railways, further bolstering freight transport capabilities in the region.

NEW DELHI: India has allowed l i m i t e d e x p o r t s o f e s s e n t i a l commodities, including sugar, wheat, rice, and onions, to the Maldives, the Government said recently, even as ties b e t w e e n M a l e a n d N e w D e l h i remained tense amid rising Chinese influence

India, a leading exporter of rice, sugar and onions, has imposed various curbs on exports of these food

commodities to keep a lid on local prices ahead of general election.

Shipments of these commodities in the 2024/25 financial year which started on April 1 to Maldives “will be exempted f r o m a n y e x i s t i n g o r f u t u r e restriction/prohibition on export,” the government said in a notification.

The South Asian country has allowed exports of 124,218 metric tons of rice, 109,162 tons of wheat flour, 64,494

tons of sugar, 21,513 metric tons of potatoes, 35,749 tons of onions, and 427.5 million eggs to the Maldives.

The DGFT announced that exports of 1 million tons each of stone aggregate and river sand, items like eggs, potatoes, onions, rice, wheat flour, sugar, dal, stone aggregate, and river sand can now be exported to the Maldives as per the bilateral trade agreement for 2024-25.

NEW DELHI: The Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, organised a pivotal Workshop on 'Integration of Economic/User Ministries/Departments on PM GatiShakti National Master Plan (PMGS-NMP' on 3rd April 2024 in New Delhi. The workshop was chaired by Additional Secretary (Logistics), DPIIT, Shri Rajeev Singh Thakur, aimed to sensitise the Economic/User Ministries/ Departments about onboarding of GIS Data Layers on the PM GatiShakti NMP , benefits of using the platform for planning and to review the progress made in this respect.

Additional Secretary, DPIIT, Shri Rajeev Singh Thakur, highlighted PM GatiShakti principles to be adopted for integrated planning and holistic development of socioeconomic infrastructure. He further emphasized PMGSNMP as a comprehensive and sustainable strategy to reshape India’s infrastructure, by fostering integrated planning and harmonised project implementation involving all relevant Ministries and State Governments. This “whole-of-the-government” approach is embraced to enhance decision-making in project planning as well as ‘ease of doing’ and ‘ease of living’.

Joint Secretary, DPIIT, Dr. Surendra Kumar Ahirwar, mentioned that adoption of PM GatiShakti NMP by economic Ministries is important not only for efficient data driven planning of its own infra/schemes but also for planning of infra/schemes by infra/social Ministries as well as States/UTs. Joint Secretary, DPIIT, Shri E Srinivas,

stated integration of Economic/User Ministries on the PMGS-NMP will ensure the efficient realisation of the core principles of GatiShakti logistical efficiency, multimodality, and connectivity to economic hubs.

The workshop witnessed enthusiastic participation from over 32 officials representing 18 Ministries / Departments, including Agriculture & Farmers Welfare, Chemicals & Petrochemicals, Fertilisers, Coal, Commerce, Food & Public Distribution, Defence Production, Electronics & Information Technology, Economic Affairs, Revenue, Animal Husbandry & Dairying, Fisheries, Food Processing Industries, Micro, Small & Medium Enterprises, Mines, Steel, Earth Sciences, and Pharmaceuticals More than 20 officials from BISAG-N and Logistics Division, DPIIT were also present

NEW DELHI: India aims to attract at least $100 billion a year in gross foreign direct investment, a top official said, as the South Asian nation courts investors looking to diversify away from China.

“Our target is that we will average at least $100 billion over the next five years. The trend is very positive and upward,” Rajesh Kumar Singh, secretary in the Department for Promotion of Industry and Internal Trade, was quoted as saying in an interview in New Delhi recently.

The ambitious target compares with an annual average of more than $70 billion in FDI in the five years through March 2023 and would be a reversal in trend after last year’s decline. Singh said that the figure for the current fiscal year will be “closer to” the $100 billion target.

The world’s fastest-growing major economy is appealing to businesses that want to hedge against geopolitical tensions by spreading their operations more broadly — sometimes called a “China plus one” strategy.

Companies like Apple Inc. and Samsung Electronics Co. have boosted manufacturing in India, taking advantage of incentives offered by Prime Minister Narendra Modi’s government. Still, foreign investment hasn’t matched the pickup in local manufacturing. Singh attributed that to higher inflation and interest rates in developed nations, as well as geopolitical conflicts and risk perception about emerging markets.

India has “unmatched market growth opportunity in a variety of sectors such as electric vehicles, electronic goods or general consumer goods, where penetration levels in our population is far lower than the global average,” he said. He vowed that the Government will take more steps to ease FDI rules.

Boosting the share of manufacturing in India’s economy has been one of the key promises made by Modi, who is seeking a third term in elections that start on April 19.

NEW DELHI: With an export ban in place on rice and wheat, the Union Commerce Ministry has shifted its focus to exports of agricultural products including fresh fruit and vegetables to new destinations, including the US, European Union and African countries, two persons said.

The new playbook involves trial shipments of mangoes, pomegranates, and bananas among others to these geographies shortly. This move, being rolled out by the Agricultural and Processed Food Products Export Development Authority (Apeda) is part of the government’s efforts to double its agricultural exports to $100 billion by 2030.

“The Commerce Ministry is focusing on harnessing the export potential available in the newly discovered markets of

Nigeria, Switzerland, Lithuania, Slovenia, Mexico, Sweden, Portugal, Cameroon, Djibouti, Latvia, Egypt, and Senegal, among others,” one of the people cited above said.

The move is seen as a redefined approach to fill the export gap that widened after the ban on essential food items like wheat, non-basmati rice, and broken rice.

According to Mr. Rakesh Arrawatia, Professor of finance and accounting at Institute of Rural Management Anand (Irma), this will encourage farmers to diversify their crops from conventional crops to cash crops. “The push to export fruits and vegetables will not only increase farmers’ income and bring foreign exchange for the country, but it will also help address our export-import imbalances,” Arrawatia said.

MUMBAI: Reserve Bank of India (RBI) Governor Shaktikanta Das said on Friday, 06th Friday that the Central Bank projects GDP growth for the fiscal year 2024-25 at 7%. He shared the GDP projection during his monetary policy address.

While the forecast indicates that the Indian economy will maintain its strong run, Governor Das also mentioned that risks are evenly balanced.

The projections for real GDP growth in specific quarters of the fiscal year were also discussed. For the first quarter of 2024-25, the RBI

anticipates a growth rate of 7.1%, a slight adjustment from the previous estimate of 7.2% made in February

Earlier, the RBI had estimated a growth rate of 6.7% for the same quarter Looking ahead, the RBI projects a growth rate of 6.9% for the second quarter, followed by 7% for both the third and fourth quarters. These projections signify a consistent growth trajectory, albeit with some fluctuations across quarters.

Governor Das reiterated the RBI's commitment to maintaining stability and controlling inflation. To this end, the Monetary Policy Committee

(MPC) decided to keep the key repo rate unchanged at 6.5%.

The decision reflects the central b a n k ' s c a u t i o u s a p p r o a c h t o monetary policy, ensuring that it remains aligned with the broader economic goals and challenges. This also marks the seventh consecutive time that the MPC has opted to maintain key policy rates at their current levels.

The decision was made collectively by the six-member MPC committee, in line with their assessment of the prevailing economic conditions and future outlook.

MEXICO CITY: The severe drought which has forced the Panama Canal, one of the world’s busiest trade passages, to limit daily crossings could impact global supply chains during a period of high demand, S&P Global said on Wednesday

The canal has imposed several restrictions since 2023, though last month the Panama Canal Authority bumped up daily crossings to 27, from 24, as water levels rose at the manmade Gatun Lake which feeds into the canal.

“Capacity pressures at the Panama Canal are starting to have an effect on supply chains,” S&P Global s a i d i n a n a n a l y s t r e p o r t o n transportation of cargo and raw materials. “Container ships have yet to feel the impact in light of their priority status, although the situation is changing”.

Container ships have priority to pass through the Panama Canal, but transit restrictions have hurt other

c a t e g o r i e s , p a r t i c u l a r l y b u l k carriers

I f r a i n s r e t u r n i n M a y a s expected, the canal authority plans to ramp daily slots back up to about 36 per day, the average during rainy season

The need to maintain water levels at the reservoirs feeding into the canal has prevented it from absorbing demand from shippers seeking alternative routes away from the Red Sea, where Houthi attackers have blocked the passage of ships in the Suez Canal, the world’s busiest waterway

Exporters unable to leverage rupee depreciation to boost

NEW DELHI: Despite the rupee hovering around 83 40 to the dollar, exporters are not able to leverage the price competitiveness to boost exports due to a paucity of foreign exchange with India’s major export destinations, stakeholders said.

“ T h e r e i s a f o r e x c r i s i s i n Bangladesh, the biggest trading partner with India for engineering goods. There is a tremendous dollar shortage in that country Exports are not growing to Bangladesh, on the contrary its gone down. We are exporting to Latin America, African countries, they all have a problem of foreign exchange It affects our exports, we are not able to grow exports substantially,” Mr. Arun K u m a r G a r o d i a , C h a i r m a n , Engineering Exports Promotion Council of India (EEPC India), told. India’s engineering exports in the five months to February rose by only 2 percent,hesaid

“Countries like Zambia, Kenya, Tanzania, Mozambique, Nigeria, Angola and Latin America are facing dollar unavailability Exporters are facing huge cash flow challenges, the major issue being the availability of foreign c u r r e n c y i n t h e s e c o u n t r i e s , ” Mr Sandeep Modi, Joint Secretary, Federation of Pharmaceutical and Allied Products Merchant Exporters (FPME), told. The cause of the dollar shortage in these countries can be traced back to their balance of payments deteriorating.

The rupee trade—where payments are made by buyers in the domestic currency via a vostro account —allowed by the Reserve Bank of India (RBI) to override such challenges was a welcome step but it is not yet applicable to these countries.

“Rupee trade in these countries is not fully operational. The ministry of external affairs and the RBI should form a joint task force and take this ahead,” FPME’s Modi said.

Rupee trade is currently functional with Russia, the United Arab Emirates and Sri Lanka In July 2022, the RBI allowed the settlement of India’s international trade in rupees for which authorised Indian banks open vostro accounts When an Indian exporter has to be paid for goods and services in rupees, this vostro account held in the trading country will be deducted and the amount creditedtotheexporter’sregularaccount

“Although the RBI has allowed rupee trade, it’s not happening with m a n y d e s t i n a t i o n s , i n c l u d i n g Bangladesh, Africa and Latin America. There has to be repeat export and imports in rupees through the vostro a c c o u n t s s o t h a t t h e c u r r e n c y accumulated can be adjusted As an example, in the case of Kenya, if the exports are done in rupee, Kenya needs to export to India in rupees but Indian importers are not keen on rupee trades. Bangladesh is reluctant for rupee trades as they do not do major exports to

India, so how will they stock rupees?” EEPC India’s Garodia said.

Given the ongoing strength in the dollar and elevated crude oil prices, the rupee may stay under pressure in the near term. The rupee has been hovering around record lows for the past few months. Remarks from the US Federal Reserve hinted that it may lower the interest rates this year Robust demand for dollars from importers and a widening trade deficit have kept the rupee in a limited range of 83.00-83.45.

“If the rupee remains stable over a long term, it helps exporters as negotiations are made accordingly Volatility is never good, short-term rupee fall doesn’t help However, 50 paiea-plus or minus doesn’t make much of a difference. Also, when the rupee depreciates, buyers seek discounts,” said Mr Anas Mullaveetil, an exporter of perishables to the UK, Middle East, etc.

He and others like him face price competition from countries like other Asian countries dealing in the same produce.

“When the rupee depreciates, my e x p o r t s s h o u l d b e s e e n m o r e . Unfortunately, the bargaining power has increased for buyers They seek discounts So is the case with exports of processed food items where countries like Sri Lanka, Philippines and Thailand are our competitors,” Mr. Munshid Ali, secretary, Kerala Exporters’ forum, told.

NEW DELHI: The Government is likely to abandon the plan to set up three more dedicated freight corridors (DFCs) – East Coast, EastWest and North-South – at an estimated combined cost of Rs 2 trillion. The Centre may instead opt for a few commodity-specific rail networks, a senior Railway official was quoted as saying recently

The move comes in the wake of the railways having to hard-sell the recently commissioned east and west freight corridors to potential bulk customers, and the issues that have cropped up of the network planning of t h e s e p r o j e c t s T h e c a p a c i t y utilisation of the two corridors remain low

T h e r e t h i n k o n t h e t h r e e additional DFCs is despite the fact that the Railway Board has recently received the detailed project reports for two or them (East Coast and North-South), and the DPR on the third one – East-West – is expected anytime soon.

According to the source, members of the railways board and the D e d i c a t e d F r e i g h t C o r r i d o r Corporation (DFCCL) have already met once to discuss DPRs.

“The reports for new DFCs have been submitted to the rail ministry for further approvals, but it is likely that the railways will not pursue the proposed corridors. Instead, the focus

will be on building commodity-based corridors as announced by the finance minister,” said the official.

In her interim Budget speech, finance minister Nirmala Sitharaman had announced major railway corridor projects. These are exclusive corridors for specific commodities –energy, mineral and cement – and for s p e c i f i c p u r p o s e s l i k e p o r t connectivity, and high-traffic density.

“The projects have been identified under the PM Gati Shakti for enabling multi-modal connectivity Together with DFCs, these three economic corridor programmes will accelerate our GDP growth and reduce logistic costs,” Sitharaman had said recently

The announcement in the last Budget was, however, seen as a deviation by the Narendra Modi government’s previous plan in this regard. In her Budget 2021-22 speech, Sitharaman had announced generic East Coast, East-West and NorthSouth corridors.

If implemented, these three proposed corridors would have a combined length of 4,315 kms. As per DPRs, the 1,078-km East Coast corridor will connect Kharagpur to Vijaywada, and 931-km North-South corridor will connect Itarasi to Vijaywada.

The third East-West corridor is divided into two sub-corridors: 2,106km Palghar to Dankuni section and

200-km Rajkharswan to Andal section. The proposed corridors aim to slash the transit time of freight trains, bring down the overall logistics costs, and further enhance the railways’ share in the total cargo movement.

“ T h e c o m m o d i t y - s p e c i f i c corridors make more sense because there will be existing customers for them. The DFCCIL has been hard selling the eastern and western dedicated freight corridors.. there are issues with the network planning of these projects,” said the official.

The capacity utilisation levels of the 1,337-km EDFC and 1,506-km WDFC remain fairly low For instance, the fully-completed EDFC has a capacity to run 120 trains each way per day but due to low demand, just about 75-80 trains are being operated at the moment EDFC connects power plants in the northern states of UP , Delhi, Haryana, Punjab and parts of Rajasthan with Eastern coal fields. Traffic on EDFC also comprises finished steel, food grains, cement, fertilisers and limestone.

WDFC, which still has a 109-km stretch under construction, is running just 40-45 trains per day (each way) against the capacity of 120 trains. This stretch is used primarily for export-import container traffic and transporting milk from Gujarat to northern India.

NEW DELHI: National Maritime Day, celebrated annually in India on April 5, honours those who spend months at sea, contributing to India’s trade It also commemorates the inaugural voyage of the first Indiano w n e d s h i p . T h i s y e a r, t h e Government of India will celebrate the National Maritime Day alongside the Merchant Navy Week from March 30 to April 5. The National Maritime D a y o f f e r s a n o p p o r t u n i t y t o emphasise the role of the maritime industry in India’s economic growth and highlights the sacrifice of seafarers who not only run the trade but also partake in national security by deterring pirate attacks.

The National Maritime Day was first celebrated in 1964 by the Ministry of Ports, Shipping, and Waterways. This year will mark the 61st National Maritime Day The day not only celebrates India’s maritime might, b u t a l s o c o m m e m o r a t e s t h e inaugural voyage of the first Indianowned ship, SS Loyalty from Mumbai to London on April 5, 1919.

The maiden voyage of SS Loyalty

symbolised India’s aspiration of becoming a key stakeholder in the maritime sector The SS Loyalty also put a dent in the monopoly of the British shipping companies.

The day serves as a platform to highlight issues affecting the maritime industry such as ocean pollution, lack of global cooperation to ensure safe voyages, and improving working conditions for ship and port workers.

The

Maritime Day celebrations are held across the country, but major ports such as Mumbai, Kolkata, Chennai, Kandla, and Visakhapatnam see special government-supported events such as seminars, medical camps, and blood donation drives.

The National Maritime Day celebrations include observing the Merchant Navy Flag Day and the Wreath Laying Ceremony to honour the sailors who lost their lives in the First and Second world wars.

On National Maritime Day, the Ministry of Ports, Shipping, and Waterways presents the Sagar

Samman Awards to those who display “exceptional and outstanding allr o u n d a n d l e a d e r s h i p ” a n d “outstanding braver y ” in the maritime sector

The awards include the Sagar Samman Varuna Award, which is the highest category of award, the Sagar Samman Award for Excellence, and the Sagar Samman Award for Gallantry.

The best Indian ship-owning companies, maritime training institutes, and Indian Ports are also recognised with a number of awards.

India’s growth as an emerging maritime superpower

Today, India has become the 16th largest maritime country in the world, supported by about 200 non-major ports and 12 major ports.

As per a March 2024, press release by the Ministry of Ports, Shipping and Waterways, “over the last 9 years, the number of seafarers has increased by 140 per cent.”

Additionally, the Indian seafarers “occupy 12 percent of international seafaring jobs”. By 2023, the Ministry wants this figure to touch 20 per cent.

Allcargo

MUMBAI: Allcargo Group, an Indian-born global logistics conglomerate, has appointed logistics and supply chain i n d u s t r y v e t e r a n K e t a n Kulkarni as Chief Growth Officer. In this crucial role, Ketan will be closely working with the Chairman’s office to strengthen the overall growth and operational efficiency at Allcargo Group.

He will lead the process of stakeholder value creation across multiple businesses through periodic engagement with the respective leadership teams of Allcargo ECU Ltd (as per proposed scheme of arrangement, the international supply chain business will be demerged into Allcargo ECU limited, subject approvals), Allcargo Gati Ltd, Allcargo Supply Chain Ltd and Allcargo Terminals Ltd.

Ketan will also be responsible for managing investor relations on behalf of Allcargo Group's key management professionals such as MDs, CFOs and Group CFO with a focus on shareholder value creation In addition, he will drive Group wide global and domestic partnerships in addition to the existing engagements, nurturing existing customer relationships and cultivating new ones. He will lead the Marketing and Enterprise Account strategy of the Group. He will report to Shashi Kiran Shetty, Founder and Chairman, Allcargo Group.

Ketan comes to Allcargo Group with over three decades of diversified experiences and an impressive track record spanning multiple sectors such as logistics, consumer durables, FMCG and beverages. Before joining Allcargo Group, he worked with Blue Dart Express (DHL Group) as Chief Commercial Officer.

Welcoming Ketan Kulkarni, Shashi Kiran Shetty, Founder and Chairman, Allcargo Group said, "I am delighted to have Ketan in the leadership team. His proven track record, remarkable achievements and deeper understanding of the logistics industry will help us navigate our company towards the next phase of

g r o w t h A s w e a r e empowering our flagship businesses with strategic i n d e p e n d e n c e a n d operational synergies, his experience and expertise complement our goal to drive synergistic growth to gain higher market share organically by leveraging our existing network and resources in India and overseas. We continue to optimise physical assets, capitalise on our tremendous brand value while continuing to be an employer of choice, all so painstakingly built over the last four decades. We are dedicated to strengthening our team and supporting the government’s continued efforts to develop superior logistics infrastructure, thus playing our role in the mission to transform our country into Viksit Bharat Our leadership is fully committed to driving Allcargo Gati's mission towards becoming the largest domestic logistics player, similarly to the group's established leadership in the International supply chain through Allcargo ECU and CFS/ICD infrastructure through Allcargo Terminals in the country I welcome Ketan to the Allcargo family and we wish him success in his new role. Under his leadership, our growth strategies will deliver superior value to our customers."

Commenting on his appointment, Ketan Kulkarni, Chief Growth Ofcer, Allcargo Group said, "I am excited to be a part of Allcargo Group known for its integrated logistics capabilities and unmatched global scale. The Group has firmly established its leadership position in the international supply chain segment and is poised for accelerated growth with unparalleled digital and operational competencies. It's a privilege for me to be part of the growth journey of the Group and I look forward to collaborating with the leadership teams to further propel Allcargo Group's growth keeping the customer interest and sustainability in sharp focus.’’

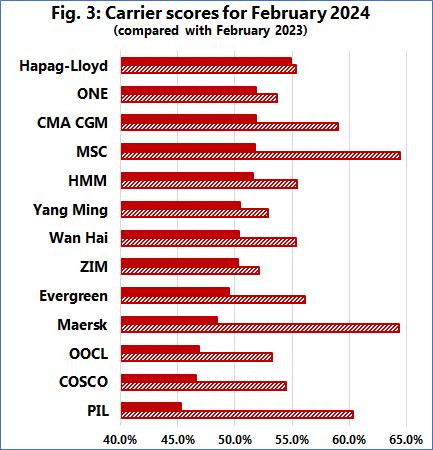

COPENHAGEN: After a tumultuous few weeks in the wake of the Red Sea crisis, some form of stability has ensued, with the round-Africa routings now normalising This was also reflected in the February 2024 global schedule reliability score, which improved by 1 7 percentage points M/M to 53 3% On a Y/Y level however, schedule reliability was -6.9 percentage points lower The average delay for LATE vessel arrivals also improved to 5.46 days, roughly the same level as pre-Crisis, which means that the increase due to the crisis has reverted.

Hapag-Lloyd was the most reliable top-13 carrier in

February 2024 with schedule reliability of 54 9%

Another 7 carriers were above the 50% mark, with the remaining carriers all in the 40%-50% range PIL was at the bottom with a score of 45.3%. On a M/M level, 7 carriers recorded an improvement in schedule reliability, with the highest improvement of 9.7 percentage points recorded by Hapag-Lloyd

On a Y/Y level, none of the 13 carriers recorded an increase in schedule reliability

Mr. Ketan Kulkarni