+ NORTH INDIA AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com MUMBAI : (022)22661756 / 1422, 22691407

: (02836)222665/225790, E-Mail:dstimeskdl@gmail.com

+ NORTH INDIA AHMEDABAD : (079) 26569995, E-Mail:dstgujarat@gmail.com MUMBAI : (022)22661756 / 1422, 22691407

: (02836)222665/225790, E-Mail:dstimeskdl@gmail.com

M U M B A I : A U M Maritime Pvt Ltd proudly announces the appointment of Mr. Kailash Parekh as its new Commercial Director. Leveraging over three decades of unparalleled expertise, Mr Parekh assumes this pivotal role after an illustrious career and post successful retirement from Parekh Group, where he spearheaded the Gulf NVOCC & Africa sector trade.

Applauded the work of the Chamber a�er seeing the development of Gandhidham

GANDHIDHAM: The Gandhidham C h a m b e r o f C o m m e r c e & Industry organized Traders and Industrialists In the a c c o m p a n y i n g d i a l o g u e program, the dialogue program of Union Minister Mr Ashwini Vaishnav... Cont’d Pg. 19 Mr Ashwini Vaishnav

With a sterling reputation as a stalwart in the shipping industry, Mr Parekh brings a wealth of experience and a vast network of personal connections with esteemed business houses, shipping lines, and trade stakeholders. His remarkable contributions were also recognized at a prestigious shipping event in Mumbai, where he was bestowed with the Award for Excellence in Customer Service & Marketing in 2016. Cont’d Pg. 6

Cont’d from Pg. 4

Expressing gratitude for his tenure at Parekh Group and embracing the new chapter with AUM Maritime Pvt Ltd, Mr Parekh stated, "I am deeply Thankful to the management of Parekh Group for their unwavering support throughout my journey, and I am thrilled to embark on

this exciting venture with KGL Group. Together, we are poised to redefine industry standards and drive innovation in maritime commerce."

AUM Maritime Pvt Ltd, a Group Company of Kalash Global Logistics Pvt Ltd, is committed to delivering unparalleled solutions in the maritime sector For more information about KGL Group, please visit www.kglindia.in

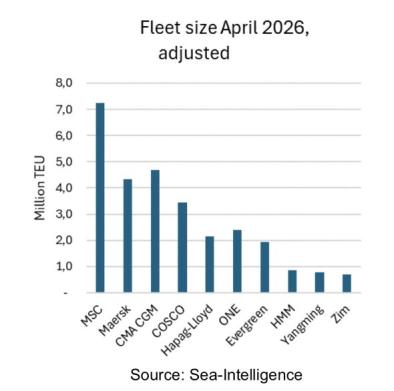

Mediterranean Shipping Co’s (MSC) lead at the top of the liner rankings is set to stretch to record levels, according to new analysis by Danish consultancy Sea-Intelligence

COPENHAGEN: It was at the start of 2022 that MSC became the world’s largest liner by o p e r a t e d c o n t a i n e r vessel capacity, surpassing 2M partner Maersk, which had been at the top of the rankings for more than a quarter of a century. Since then, MSC has been on a massive fleet expansion charge, hoovering up secondhand tonnage and taking deliveries of record numbers of newbuilds, whereby its lead over Maersk today stands at 1.55m slots.

Sea-Intelligence has projected what the top 10 liner rankings will look like two years from now (see chart), taking many aspects into account, including orderbooks, the carriers’ typical approach related to redelivery of charter vessels and the sale of secondhand tonnage.

“MSC will grow their size advantage substantially c o m p a r e d t o t h e s e c o n d l a r g e s t c a r r i e r –which incidentally will be CMA CGM, relegating Maersk to be the world’s third largest carrier,”

Sea-Intelligence stated in its latest weekly report looking at projected fleet sizes in April 2026.

MSC became the first carrier in the world to have a fleet in excess of 5m teu last May By April 2026, it is projected to have a fleet with more than 7m slots. From next year, it will be going it alone on the main eastw e s t t r a d e s , d i t c h i n g i t s partnership with Maersk in the 2M alliance.

Cash-rich MSC has invested in many industries outside of its core b u s i n e s s e s o f c r u i s e a n d containers in the last couple of years including in aviation, rail, media and logistics Last week it made a $700m bid for Gram Car Carriers

Analysts at Sea-Intelligence also pointed out that Germany’s Hapag-Lloyd will have a lot to do if it is to fend off Japan’s Ocean Network Express (ONE) in the coming couple of years Hapag-Lloyd’s recently unveiled 2030 strategy lays out a plan to retain a position among the top five carriers.

Ltd (formerly known as Transindia Realty & Logistics Parks Ltd), an Allcargo Group company has appointed Ram Walase as Chief Executive Ofcer.

As the CEO of Transindia Real Estate, Ram will manage P&L responsibility, spearhead business growth and financial strategies for the Group's real estate arm and will collaborate with Jatin Chokshi, Managing Director, Transindia Real Estate to identify land banks, execute logistics & infrastructure projects, explore PPP opportunities and participate in the government’s asset monetization plans.

Ram, an alumnus of IIM Mumbai, formerly NITIE, brings with him 25 years of leadership experience across various sectors including real estate, infrastructure, project finance, public-private partnerships, and consulting. Before joining Allcargo Group, Ram worked as Managing Director & CEO at VBHC Value Homes Private Limited.

Welcoming Ram Walase, Jatin Chokshi, Managing Director, Transindia Real Estate Limited said,

“Ram's arrival marks a strategic move aimed at strengthening our real estate plans and operational efficiency at Transindia. Ram, with his rich experience in the real estate industry and infrastructure, will help us drive growth for our real estate business. I welcome Ram to the Allcargo Group family and we wish him success in his new role."

Commenting on his appointment, Ram Walase, Chief Executive Officer, Transindia Real Estate Limited said, "I am excited to be a part of the Allcargo Group and Transindia Real Estate Transindia Real Estate has emerged as a key player in warehousing and commercial industry The role offers me an opportunity to drive the company's goals in developing cutting-edge logistics assets and expand its range of investments in the real estate sector."

After the recent restructuring, the Allcargo Group founded and promoted by its Chairman Shashi Kiran Shetty has been demerged into four listed strategic business undertakings - Allcargo ECU Ltd, Allcargo Logistics Ltd, Allcargo Terminals Ltd and Transindia Real Estate Ltd.

NEW DELHI: Indian Railways will look at developing an additional 200o d d G a t i S h a k t i m u l t i - m o d a l terminals in its bid to improve freight earnings and decongest existing tracks for faster passenger train movement.

The average cost per terminal is expected to be around Rs. 70 crore, as per initial estimates of Railways; which works out around Rs. 14,000 crore for all these, officials aware of discussions said.

Railways have earned over Rs 2 56 lakh crore, with freight services accounting for 70 per cent of these earnings in FY24.

First phase under implementation

U n d e r t h e f i r s t p h a s e o f implementation of the Gati Shakti Cargo Terminal Policy, some 100-odd multi-modal terminals will be developed by 2024-25. Around 77-odd are ready and commissioned at an estimated cost of Rs. 5,400 crore.

These terminals have come up in West Bengal, Jharkhand, Odisha, Telangana, Tamil Nadu and Uttar Pradesh, among others. Some of the operators include Concor, Reliance,

Adani, Western Coalfields, Wonder Cements, JSW, SECL, IOCL, BPCL, among others.

Routes/stations include important industry points like Paradip, Jasoda and Dahej, among others.

“So once the first set of 100 terminals are completed, which would be by the end of this fiscal, Railways will tender for 200 more. The average cost of each of these terminals works out at Rs. 65-70 crore at present Individually, a terminal cost could be Rs. 50 crore in some cases, or more,” an official taking part in these discussions said.

Gati Shakti Cargo Terminals can be developed by private players and o n n o n - R a i l w a y l a n d o r e v e n fully/partially on Railway land.

For terminals on non-Railway land, the operators will identify the location and will construct the terminal after obtaining necessary approval.

In case of terminals coming-up either fully or partially on Railway land, the land parcels will be identified by Railways and the operator for

construction and operation of the terminal will be selected through open tendering process.

The Railways, say the official, is looking to push for greater share in the country’s overall freight traffic.

The share has freight carried by Railways at 29 per cent at present,

35 per cent by 2030.

Of the 5,500 million tonnes (mt) of cargo carried across the country, some 1,600 mt – odd is moved by the Railways in FY24. Loading was to the tune of 787.6 mt of coal, 181 mt of iron ore, 154 mt of cement and 114.4 mt across others categories that include volume-based items like white goods, among others.

“As these multi modal terminals come up, there will be faster movement of goods, de-congestion of tracks for passenger trains too,” says one of the officials.

Also complimenting this plan, the Railways will continue to add 5,000 km of new tracks, every year, at least for another three-to-five years.

NEW DELHI: With increasing India’s dependence on Chinese industrial goods like telecom, machinery and electronics, Beijing’s share in New Delhi’s imports of such goods rose to 30 per cent from 21 per cent in the last 15 years, a report said. According to the report by the economic think tank Global Trade Research Initiative (GTRI), the growing trade deficit with China is a cause of concern, and the strategic implications of this dependency are profound, affecting not only economic but also national security dimensions

From 2019 to 2024, India’s exports

to China have stagnated at around USD 16 billion annually, while imports from China have surged from USD 70.3 billion in 2018-19 to over USD 101 billion in 2023-24, resulting in a cumulative trade deficit exceeding USD 387 billion over five years

T h e I n d i a n g o v e r n m e n t a n d industries must evaluate and potentially recalibrate their import strategies, fostering more diversified and resilient supply chains, GTRI Founder Ajay Srivastava said.

This is imperative not only to mitigate economic risks but also to bolster domestic industries and reduce dependency on single-country

imports, especially from a geopolitical competitor like China, he added. “Over the last 15 years, China’s share in India’s industrial product imports has increased significantly, from 21 per cent to 30 per cent.

“This growth in imports from China has been much faster than India’s overall import growth, with China’s exports to India growing 2 3 times faster than India’s total imports from all other

merchandise imports amounted to USD 677 2 billion, with USD 101 8 billion of that coming from China.

COCHIN: Sharp fall in shrimp prices and surplus supply by Ecuador has cost the Indian seafood export industry dearer Marine product exports from the country plummeted by $710 million in FY24 at $7.4 billion from more than $8 billion in FY23.

The decline comes after export of marine products shot up for two consecutive years post-Covid.

Data available with NIRYAT portal of the Union ministry of commerce and industry states that USA was a top market for India in the marine products segment at $2.5 billion,

followed by China with nearly $1 4 billion and Japan at $412 million

Shrimp is a significant item in the basket of India’s seafood exports However, its price dipped by 20%-25% last year, according to industry sources.

Seafood Exporters Association of India (SEAI) National Vice President K V V Mohanan said, marine products export value declined mainly due to the decrease in average export price of shrimp comparing to the previous year

“Our major markets for shrimp are the USA, China, EU, Japan, Vietnam and Middle East, where we suffered due to

oversupply from other countries, especially Ecuador, whose production was almost 1.5 million tonne,” he said. India shipped 17,35,286 MT of seafood worth more than $8 billion during 2022-23, the Marine Products Export Development Authority had announced last year. With export value to the tune of $5.5 billion, frozen shrimp retained its top position accounting for a share of 67 7% of the total earnings through seafood exports in that year (FY23). It was followed by frozen fish g e n e r a t i n g a n e x p o r t v a l u e o f $687 million.

m.v. “SC MARA” V - 2415W (IGX - XPF)

The above vessel has arrived at Mundra on 30-04-2024 as per following details.

Item Nos. B/L NOS.

1 EPIRKWSLSC201518

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable. If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws. Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Aura Commercial Building, Ward 6, Plot No. 23 Commercial, Office No. S/3 & 4, 2nd Floor, Aerodrome Road, Opp. Om Cineplex, Gandhidham, Gujarat - 370201. In case of any query kindly contact the below E-mail IDS & Phone Numbers : IMPORT related : ravi.vaghela@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 89809 97977

EXPORT related : hardik.jadeja@in.emiratesline.com

Tel. No. : +91-2836-239378 / 239379 - Mob. : +91 98980 76324

IGM Tracking : http://www.emiratesline.com : 8090/eadmins/igm_main.jsp.

m.v. “KMTC

” V - 2414E (CIVS - KMT), IGM NO.: 2375326 DTD. 26-04-2024

The above vessel has arrived at Mundra on 30-04-2024 as per following details.

EPIRVNVELG212075 10

EPIRVNVELG212310 11

EPIRVNVELG212366 12 WSZ24040257 13

EPIRCHNCWA256317 14

EPIRCHNCWA256605 15 DH202404023

Consignees are requested to obtain the DELIVERY ORDERS on presentation of ORIGINAL BILLS OF LADING duly discharged and on payment of relative charges as applicable within 5 days or else Detention Charges will be applicable. If there is any delay in CY-CFS / lCD's movement due to port congestion or any other cause beyond the control of the Shipping Line / Agents are not responsible for the same. Also note that the Shipping Line / or their Agents will not be held responsible for auction by Port / Customs / Custodian of uncleared cargo on expiry of stipulated period as laid down in the byelaws. Consignees are advised that the carriers and/or their Agents are not bound to send individual notifications regarding the arrival of the vessel or the goods.

For vessel ETA / IGM- ITEM/ Exchange Rate / Local charges & Detention Charges please contact our office.

Aura Commercial Building, Ward 6, Plot No. 23 Commercial, Office No. S/3 & 4, 2nd Floor, Aerodrome Road, Opp. Om Cineplex, Gandhidham, Gujarat - 370201. In case of any query kindly contact the below E-mail IDS & Phone Numbers :

related : ravi.vaghela@in.emiratesline.com

No. : +91-2836-239378 / 239379 - Mob. : +91 89809

Cargo Steamer's Agent's ETD

Jetty Name Name

CJ-I VACANT

CJ-II Sofia II DBC 03-05

CJ-III Prince Khaled DBC 03-05

CJ-IV Alora Shantilal Shpg. 04-05

CJ-V Charmous DBC 03-05

CJ-VI MP Ultramax 1 V Ocean 04-05

CJ-VII KM Weipa Cross Trade 06-05

CJ-VIII VACANT

CJ-IX Sea Prospect Genesis 04-05

CJ-X BH Fortune Aditya Marine 03-05

CJ-XI Arzin (IIX) Armita India 03-05

CJ-XII SCI Chennai (SMILE) JMBaxi 03-05

CJ-XIII African Avocet Aditya Marine 03-05

CJ-XIV Ae Mars Trueblue 04-05

CJ-XV Jessei Rishi Shpg. 03-05

CJ-XVA Everest Arnav Shpg. 04-05

CJ-XVI Capricorn Synergy 03-05

TUNA VESSEL'S NAME AGENT'S NAME ETD Flora D Benline 06-05

OIL JETTY VESSEL'S NAME AGENT'S NAME ETD

OJ-I VACANT

OJ-II Bay Vasu

OJ-III Stolt Breland

OJ-IV Fairchem Endurance Interocean 03-05

OJ-V Stolt Calluna JMBaxi 03-05

OJ-VI Jag Pankhi

OJ-VII Champion Tern GAC Shpg. 03-05

Newsun Harmony 29-Apr

Sounion Trader 30-Apr Jebel Ali Dioni 30-Apr

Erietta 30-Apr China

CS Felicity 30-Apr Vietnam

Arya 30-Apr

Oriente Gloria 30-Apr Bangladesh

Suvari Kaptan 30-Apr Somalia Pegasus 02 30-Apr Somalia

Grand Mariner (PGI) 30-Apr Jebel Ali Shamim (IIX) 01-May Bandar Abbas Anna Elisabeth 01-May Italy

CJ-XIV Ae Mars Trueblue

CJ-XIII African Avocet Aditya Marine

CJ-IV Alora Shantilal

15-May Atriculate DBC

02-May Agia Eirin

CJ-XVI Capricorn Synergy

CJ-V Charmous DBC

03-May ES Warrior Interocean

03-May Hosei Crown Seaworld

EAST

&

PORTS 03/05 02/05-PM Wan Hai 505 174E 4041554 Heung A / WHL Samsara / WHL Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Hongkong (C16)

04/05 04/05-AM Gregos 2408 4041473 Asyad Line Seabridge Marine Haiphong, Shekou, Laem Chabang, Port Kelang (FEX1) 05/05 05/05 05/05-AM X-Press Carina 24018E 4041591 X-Press Feeder Sea Consortium Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang,

15/05 14/05-PM X-Press Cassiopeia 24019E 4041689 Maersk Line Maersk India Ningbo, Tanjung, Pelepas, Port Kelang (NWX)

08/05 08/05-AM Grace Bridge 2403 4041649 Global Feeder Sima Marine Port Kelang, Busan, Gwangyang (CSC)

18/05 18/05-AM Terataki 2407 4041471 Asyad Line Seabridge Marine Haiphong, Laem Chabang, Jakarta (FEX)

TO LOAD FOR INDIAN SUB CONTINENT 05/05 05/05-AM Kmarin Azur 418W 4041645 Maersk Line Maersk India Tema, Lome, Abidjan (MW2 MEWA)

08/05 08/05-AM Grace Bridge 2403 4041649 Global Feeder Sima Marine Karachi (CSC)

12/05 11/05-AM Wadi Duka 2409 4041472 Asyad Line Seabridge Marine Karachi (REX)

03/05 Maersk Cairo (V-418S) 4041565 Maersk India Port Qasim 03/05

/TS Line KMTC India/TS Line (I) Port Kelang, Hongkong, Sanghai, Ningbo. (CWX)

03/05 03/05-1700 Conti Crystal 0136E24150 ONE ONE (India) Port Kelang, Singapore, Haiphong, Cai Mep, Pusan, Shahghai, 04/05 14/05 14/05-0500 One Competence 090E 24160 HMM / YML HMM(I) / YML(I) Ningbo, Shekou (PS3)

05/05 05/05-0900 Wide Alpha 246E 24151 X-Press Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 06/05 10/05 10/05-0300 Clemens Schulte 032E 24155 ONE ONE (India) (TIP) 11/05 08/05 08/05-0900 Seamax Stratford 129E 24137 COSCO / OOCL COSCO Shpg./OOCL(I) Port Kelang, Singapore, Hong Kong, Shanghai, Xiamen, Shekou. 09/05 16/05 16/05-0900 Xin Da Yang Zhou 093E 24157 Gold Star / RCL Star Shpg/RCL Ag. (CIXA) 17/05 11/05 11/05-0500 X-Press Cassiopea 24019E 24158 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 12/05 15/05 15/05-0500 X-Press Phoenix 24020E X-Press Feeders Merchant Shpg. Ningbo, Tanjung Pelepas. (NWX) 16/05 Sinokor / Heung A Sinokor India Port kelang, Singapore, Qindao, Xingang, Pusan 17/05 17/05-2200 Xin Hongkong 070E 24148 COSCO COSCO Shpg. Singapor Cai Mep,Hongkong, Shanghai,Ningbo, Shekou, Nansha (CI1) 18/05

03/05 03/05-1800 Maersk Karachi 417W 24143 Maersk Line Maersk India Salallah, Port Said, Djibouti, Jebel Ali, Port Qasim. (MECL) 04/05 05/05 04/05-2300 GFS Prestige 417E 24149 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam (SHAEX) 06/05 07/05 07/05-0300 Seaspan Jakarta 418E 24152 08/05 TO LOAD FOR INDIAN SUB CONTINENT PORTS & COASTAL SERVICE

14/05 14/05-0600 SCI Chennai 2404 24161 SCI J M Baxi Mundra, Cochin, Tuticorine. (SMILE) 15/05

05/05 05/05-0900 Wide Alpha 246E 24151 X-Press Feeders Merchant Shpg. Muhammad Bin Qasim, Karachi, Colombo. 06/05 10/05 10/05-0300 Clemens Schulte 032E 24155 ONE ONE (India) (TIP)

08/05 08/05-0900 Seamax Stratford 129E 24137 COSCO/OOCL COSCO Shpg./OOCL(I) Colombo. (CIXA)

09/05 09/05-0600 SSL Godavari 026 24159 SLSSLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 10/05 09/05 09/05-1330 SM Manali 0041 24154 CCG Sima Marine Hazira, Mangalore, Cochin, Colombo, Katupalli, Vishakhapatanam, 10/05 Krishnapatanam, Cochin, Mundra. (CCG)

11/05 11/05-0500 X-Press Cassiopea 24019E 24158 Maersk Line Maersk India Colombo. (NWX) 12/05 17/05 17/05-2200 Xin Hongkong 070E 24148 COSCO COSCO Shpg. Karachi, Colombo (CI1) 18/05 TO LOAD FOR US & CANADA

03/05 03/05-1700 Conti Crystal 0136E24150 ONE ONE (India) Los Angeles, Oakland. (PS3)

03/05 03/05-1800 Maersk Karachi 417W 24143 Maersk Line Maersk Line India Newark, Charleston, Savannah, Houston, Norfolk. 04/05 10/05 10/05-1800 Maersk Atlanta 418W 24146 Safmarine Maersk Line India (MECL)

05/05 05/05-0900 Wide Alpha 246E 24151 X-Press Feeders

In Port SSL Mumbai 169A 2400474 Shreyas

m.v

V - 0FFBIE1MA

The above vessel is arriving at MUNDRA on 08-05-2024 with Import Cargo in containers.

GOSUNGB1181027 1—

GOSUNGB1181028 —1

GOSUNGB20167848 —1

GOSUNGB20167849 —1

GOSUNGB20167854 —1

GOSUNGB20355036 1—

GOSUNGB20355038 1—

GOSUQIN3111685 1—

GOSUQIN6311598 1—

GOSUQIN6708911 —1 ZIMUSAV9056594 —1

Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS OF LADING, duly discharged and on payment of applicable charges.

Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods.

As Agents :

First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201

Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836) 230433

Export Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@zim.com Mr. Vijay Anand - 9824504315 Email : anand.vijay@zim.com

Import Marketing Queries : Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: imp@starship-knd.zim.com

m.v. “MSC MILA 3” Voy : XA417A I.G.M. NO. 2375520 Dtd. 29-04-24 Exch rate 85.92

The above vessel has arrived on 30-04-2024 at MUNDRA PORT with Import cargo from BRISBANE, FREMANTLE, MELBOURNE, SYDNEY, PARANAGUA, SANTOS,

MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804

Gandhidham : Siddhi Vinayak Complex, Plot No. 1, Office No. 201-208, 2nd Floor, Ward - 6, Near Rotary Circle, Gandhidham - Kutch 370 201 Gujarat India. Tel : +91-2836-619100 to 616100 (Board) E-mail : jatin.hadiya@msc.com, niraj.raval@msc.com, operator.gandhidham@msc.com

H. O. & Regd. Office : MSC House, Andheri Kurla Road, Andheri (East), Mumbai - 400 059 Tel : +91-22-66378000, Fax : +91-22-66378192, E-mail : IN363-comm.mumbai@msc.com • www.msc.com

The above vessel is arriving at MUNDRA PORT on 08-05-2024 with Import Cargo in containers.

ZIMUMIA925293 —3

ZIMUMIA925364 —5

ZIMUMIA925587 1—

ZIMUNYC9070422 —1

ZIMUNYC9070690 1—

ZIMUNYC9071643 —7

ZIMUNYC9071819 10

ZIMUNYC9072352 2—

ZIMUNYC9073668 —1

ZIMUORF969089 1— ZIMUORF969329 2—

ZIMUORF970342 1—

ZIMUORF970912 1—

Consignees are requested to obtain DELIVERY ORDERS from our office address given below on presentation of ORIGINAL BILLS OF LADING, duly discharged and on payment of applicable charges.

Consignees are requested to note that the carrier and or agents are not bound to send further individual notification regarding the arrival of the cargo vessel or their goods.

As Agents :

First Floor, Plot No.86, Sector 1A, Near Quality Enterprises Hero Showroom, Gandhidham - Kutch, Gujarat - 370201

Tel: (0091-2836) 229543 235282 235283 235383, Fax: (0091-2836) 230433

Export Marketing Queries: Mr. Parmar Devendra - 9824413365, E-mail: parmar.devendra@zim.com Mr. Vijay Anand - 9824504315 Email : anand.vijay@zim.com

Import Marketing Queries : Mr. Mitesh Rajgor - 02836-235282,229543 E-mail: imp@starship-knd.zim.com

NOTICE TO CONSIGNEES

m.v. “MSC JEWEL” Voy : GA417R

I.G.M. NO. 2375552 DTD. 29-04-24 Exch rate 86.03

The above vessel has arrived on 01-05-2024 at MUNDRA PORT with Import cargo from VENICE, TUNIS. Please note the item Nos. against the B/L Nos. for MUNDRA delivery.

Consignees are requested to kindly note that the above item Nos. are for the B/L Nos.arrived for Mundra Delivery. Separate IGM will be lodged with Kandla Customs for CFS - Gandhidham. Consignees are requested to collect Delivery Order for all imports delivered at Mundra from our Import Documentation Deptt. at Siddhi Vinayak Complex, 2nd Floor, Off. No.201-208, Opp. Reliance Petrol Pump, Nr. Rotary Circle, on Presentation of duly discharged Original Bills of Lading and payment of relevant charges. The container detention charges will be applicable after 5 days from the GLD for containers meant for delivery at Mundra. The containers meant for movement by ROAD to inland destinations will be despatched upon receipt of required documents from consignees/receivers and the consignees will be liable for paymeant of port storage charges in case of delay in submission of these Documents. Our Surveyors are M/s. Master Marine Services Pvt. Ltd. and usual survey conditions will apply.Consignees are also requested to note that the carriers and their agents are not bound to send individual notification regarding the arrival of the vessel or the cargo.

- Charges enquiry on land line - 619100

- IGM No./Item No./Destuffing point enquiries can also be done at our computerized helpline No.(079) 40072804 As

NEW DELHI: The government is scrutinising the Interest Equalisation Scheme for exporters to analyse its usefulness in promoting exports so far, including from the MSME sector, to decide if it should be continued beyond June 30 2024, sources have said.

“The DGFT office is holding consultations with various export bodies and banks to have more clarity on those benefitting from the scheme and find out if it actually played a role in promoting exports,” an official said.

The interest equalisation scheme, first implemented in April 2015 for five years, allows exporters of 410 identified products and all exporters from the MSME sector, to get bank credit at a subsidised interest rate determined by the government. The banks are later reimbursed by the government for their lower interest earnings. The scheme has since got a number of extensions and the last one

is set to lapse on June 30, 2024.

“There is a need for a detailed analysis of beneficiaries of the scheme under various sectors to pinpoint where the benefits are accruing and if a correlation can be established with growth in exports. If no direct correlation can be established, then the government will take a call on whether it should be withdrawn completely or for certain sectors,” the official said.

The Commerce and Industry Ministry has already been taking steps to ensure a better distribution of the outlay set aside for the interest equalisation scheme to ensure that it is not cornered by just a few L

introduced a cap of Rs. 10 crore per Importer Exporter Code (IEC) on the annual net subvention amount. This means that an individual unit cannot claim equalisation benefits beyond Rs. 10 crore.

In December 2023, an additional outlay of Rs. 2,500 crore, over and above the current outlay of Rs. 9,538 crore under the scheme, was approved by the Union Cabinet to bridge the funding gap to continue the scheme up to June 30, 2024.

Currently the scheme provides an interest equalisation benefit at the rate of 2 per cent on pre and post shipment rupee export credit to m e r c h

exporters of 410 identified tariff lines at four digit level and 3 per cent to all MSME manufacturer exporters.

Exporter bodies have been asking the government to increase the subsidy rate to 5 per cent for MSME exporters and 3 per cent for others to help them be more competitive and cope better with global headwinds and the uncertain geopolitical scenario. In FY2023-24, India’s goods exports declined 3 11 per cent to $437.06 billion.

N E W D E L H I : Interest equalization scheme (IES) is one of the

m o s t e f f e c t i v e instruments to remove cost disability of Indian exports. The scheme provides much needed competitiveness to our exports, said Shri Ashwani Kumar, President, FIEO particularly to MSMEs as the interest costs in India is much above than in our competitors’ countries. The bank rate in India is 6.5% whereas the bank rate in many of our Asian economies is around 3 5% With a higher spread, the credit cost in India is generally over 5-6% as compared to such countries, observed FIEO Chief.

a slowdown in demand and offtake from the shelves, whereas exporters are also looking for larger credit due to huge hike in Sea and air freight.

Mr Kumar said that the relevance of the Interest Equalisation Scheme is much more today as buyers are asking for longer period of credit, with

The interest subvention rates may also be enhanced from 3% to 5% for manufacturers MSMEs and from 2% to 3% for 410 tariff lines respectively as when the subvention was reduced, the repo rate was 4.4% which has gone up and currently is 6.5%. This justifies the restoration of the interest subvention to the original level of 5% and 3% respectively so as to provide necessary competitiveness to our exports, said President, FIEO

NEW DELHI: The Government is looking at ways to improve the competitiveness of exports amid mounting geopolitical tensions and has begun examining the export credit landscape The Commerce and Industry Ministry has sought details on exporters' financial needs, challenges faced in accessing export credit and the ways to improve it India gives pre- and post-shipment export credit to enable exporters to access financial resources that are crucial for facilitatinginternationaltrade

"The exercise aims to look at effective interventions as many exporters encounter difficulties in

utilising these export credit facilities," said an official.

The Ministry has sought details on specific bottlenecks in the existing export credit mechanisms that need to be addressed and the best practices from other countries that could be adapted to improve the export credit landscape in India.

"There is almost a 5% difference between the cost of export credit in India and countries like China, Vietnam and South Korea, which impacts the competitiveness of our exports," said Ajay Sahai, Director General, Federation of Indian Export Organisations (FIEO). T

significance as India's goods exports in FY24 fell 3.11% to $437.06 billion from $451.07 billion in the previous fiscal. Exporters expect a demand slowdown due to global uncertainty and hence need funds for a longer period Officials said specific intentions could be looked at to improve the access to export credit once the exercise is over.

Export credit includes priority s e c t o r l e n d i n g a n d i n t e r e s t subvention scheme, which allows exporters of 410 products and all MSME exporters to get bank credit at a subsidised rate of 2-3%.

KABUL: Two Central Asian states Kazakhstan and Turkmenistan along with Afghanistan have agreed to enhance transit and transport infrastructure in Afghanistan at a trilateral meeting last week between Kazakh Deputy Prime Minister Serik Zhumangarin, Director General of the Transport and Communications Agency under Turkmenistan’s Cabinet of Ministers Mammetkhan Chakyev, and Afghan Minister of Commerce and Industry Nooruddin

Azizi in Kabul.

At the meeting Zhumangarin emphasized the need for calculations and reorientation of traffic flows, highlighting upcoming infrastructure development initiatives. The idea of three sides is also to connect with India. This can be possible via Chabahar Port of Iran.

“All this will help develop the Turkmen infrastructure and ours at Beineu-Aktau-Bolashak,” he said.

The three sides noted that the

eastern branch of the International North South Transport Corridor (INSTC) had gained new impetus to become a key route for transporting goods from Russia and Belarus t h r o u g h K a z a k h s t a n a n d Turkmenistan to Afghanistan, India, and West Asia.

Following the negotiations, they agreed to establish a working group to implement the agreements reached. Kazakhstan-Turkmenistan route is one of the branches of INSTC.

NEW DELHI: The escalating geopolitical tension may have implications for the country's exports in the first quarter of 2024-25 as it is likely to impact global demand, apex exporters body FIEO said. The global uncertainties caused by continuing war between Russia and Ukraine has impacted India's outbound shipments in 2023-24, which recorded a decline of 3.11 per cent to USD 437 billion. Imports too dipped by over 8 per cent to USD 677.24 billion.

"If the global situation continues to be like this, it would impact global demand. In the first quarter numbers, the demand slowdown may be

visible," FIEO Director General Ajay Sahai said. He added that despite all the challenges, freight rates are softening and it is giving an indication that demand may be impacted in the times to come.

H e c a u t i o n e d t h a t f u r t h e r escalation of the current situation could have serious implications on the world trade.

" B e s i d e s g e o p o l i t i c a l uncertainties, high inflation and high interest rates are also crucial reasons for demand slowdown," he said, adding certain advanced economies like Europe may witness more slowdown.

He also said that India's domestic currency depreciated only about 1.3 per cent during 2023-24 as against Chinese Yuan's 4.8 per cent; Thai Baht 6.3 per cent and Malaysian Ringgit's 7 per cent.

When asked about the impact of Israel-Iran war, he said certain exporters from engineering sector have stated that the demand for goods that are going to the UAE and then to Iran has come down.

Jewellery demand may also come down, he said.

The Director General suggested the government to take certain steps for exporters at the liquidity front.

VISAKHAPATNAM: Andhra Pradesh’s effort to strengthen its maritime logistics capability is on course as work gathers pace in the construction of four new ports and a notable increase in shipments from the existing six ports.

According to data from Andhra Pradesh Maritime Board (APMB), the six ports Gangavaram, K a k i n a d a D e e p w a t e r , Krishnapatnam, Ravva, Kakinada A n c h o r a g e ( m a j o r p o r t ) , a n d Visakhapatnam — together handled 189.21 million tonnes during financial year ended March 31, 2024, compared to 175.206 million tonnes a year ago.

The Andhra Pradesh government, together with APMB, is investing in port-led economic growth. The four new ports are in various stages of completion.

Work on the Rs. 2,123-crore Kakinada SEZ Port development project, entrusted to a special

purpose vehicle (SPV), includes dredging, breakwater revetment, and construction of berths, port buildings, roads, railway line, and port craft berth, among other facilities.

Ramayapatnam Port in Nellore district is being developed under the ‘landlord model’ — the government will own the infrastructure and lease it to private companies by the Ramayapatnam Port Development Corporation Ltd at a cost of Rs. 3,736 crore.

Work on phase I of the Rs. 5,155c r o r e M a c h i l i p a t n a m P o r t development project in Krishna district and Rs. 4,362-crore Mulapeta Port (previously Bhavanapadu Port) development project in Srikakulam district, are also ongoing under the ‘landlord model’.

Improvement works at Kakinada

A n c h o r a g e P o r t , u n d e r t h e Sagarmala project, is underway at a cost of Rs. 91 crore with about

Rs. 43 crore coming from Sagarmala and Rs. 48 crore from APMB.

“In addition to port development, investments are going towards building four fishing harbours under phase I at a cost of Rs. 1,523 crore and six fishing harbours under phase II at a cost of Rs. 1,595 crore,” a senior APMB official said.

Fish landing centres will also be built at a cost of Rs. 127 crore, aimed at b o o s t i n g t h e s t a t e ’ s f i s h i n g infrastructure and coastal economic activities.

“Additionally, the Andhra Pradesh government has introduced the Smart Port System in the AP Port Department, enabling port users to conveniently pay port tariffs and/or charges and submit applications and/or requisitions online This is meant to streamline port operations, enhance efficiency, and provide convenience to stakeholders in the maritime sector,” the official said.

Applauded the work of the Chamber a�er seeing the development of Gandhidham

Cont’d from Pg. 4

who arrived at Gandhidham after Rajkot and Porbandar was held under the auspices of Gandhidham Chamber of Commerce and industry, in which the Ahmedabad Division of Western Railway and Gandhidham Area presented the goods transport and income figures of Gandhidham Chamber for the development of the complex An overview was presented and an application form was submitted for the purpose of registering more facilities and development in the field of railway infrastructure for Kutch, in which mainly starting Bharat train service from Kutch to Ahmedabad, starting train service to beautiful and scenic sea city of Mandvi Kutch, allocating daily super fast train service from Kutch to Delhi, developing Gandhidham railway station and converting them on daily basis to change the frequency of train services. The main points were presented by the President of GandhidhamChamberMr.MaheshPuj.

Initially, the Minister was felicitated by a delegation of Gandhidham Chamber as well as various commercial and industrial associations with bouquets, shawls, Kutchi Bandhni, Pagh and Shawl, and Momentos, while the Railway Minister, overwhelmed by the development of Kutch, presented an overview of the various development works during the last ten years of the Central Government's tenure. He said, I am honoured to receive such a welcome honour on this sacred and historic land of Kutch. And four of the five demands of the Gandhidham Chamber were quite reasonable and invited to visit Delhi with a delegation after the completion of the Code of Conduct

Mr. Ashwini Vaishnav further said that

Mr Vinodbhai Chavda, the MP of Kutch Morbi, has from time to time presented questions related to various railways of Kutch and why he has been continuously striving towards the growth of business and industry in the district, he said that this debt of affection has fallen on me whenever the business industry of Kutch. and showed readiness to act on railway related issues

Mr. Mahesh Tirthani, the Hon'ble secretary of the Chamber, will invest lakhs of crores of green hydro in Kutch in the coming years. A humble appeal was made to focus on the needs of Kutch in view of the next decade, which is expected to double in population, development and economic progress, when the city has attained the status of a municipality due to the mega project of Gujarat Government, as well as the Tuna-Tekra Container Terminal Port, which the Minister welcomed He expressed the courage to be the leader in all the fields of industry, trade and tourism in the coming time, and also presented the development road map of the Prime Minister of the country till 2047 along with upgrading the railway stations of Kutch, Bhuj, Gandhidham, Bhachau, Samkhialli, Adipur, Gopalpuri. He assured speedy resolution of all the issues like broad gauge train, gauge expansion, electrification up to Nalia,

development of infrastructure facilities.

During this program, Kutch District MP Mr. Vinodbhai Chavda, BJP President Mr Devjibhai Varchand, Gandhidham MLA Mrs. Maltiben Maheshwari, Anjar MLA Mr Trikambhai Chhanga, District BJP General Secretary Mr Dhawal Acharya, Mr Narendra Prajapati, Yuva Morcha State President Mr Prashant Korat, Gandhidham Municipality President Mr. Tejas Seth, Chamber President Mr. Mahesh Puj, Vice President Mr. Dipak Parekh, Hon'ble Secretary Mr Mahesh Tirthani, Joint Secretary Mr Jatin Agarwal, Treasurer Mr Narendra Ramani, Past President Mr Teja Kangad, Mr Anil Jain, Mr Parasmal Nahta, as well as Timber Salt, Transport, Shipping, KASEZ and representatives of various organizations like South Indian Society, Bengali Samaj, Punjabi Samaj, Ahir Samaj, Kshatriya Samaj besides representatives of Bhuj, Anjar and Mandvi Chambers joined thousands of members, Hon Secretary Mr Mahesh Tirthani has released the press release.