Viral Bhatt Founder, Money Mantra

Viral Bhatt Founder, Money Mantra

Naveen Kumar Amar Interim CFO, Practus/Collecti veNewsroom

Rajesh Thacker

CFO, Rajiv Gandhi Cancer Institute & Research Centre

Amitesh Kumar

COO & CFO, Midland Microfin Ltd

CA Shekhar

Sood

CFO, Bajaj Capital Ltd

The FinTech Revolution

Your Digital Sherpa to discover Tech Enigma

Embark on a transformative journey with CXO Finance TechBOT, your gateway to a more inclusive and accessible financial world.

JOIN THE COMMUNITY

MAGAZINE I NEWSLETTER I WEBSITE

The CXO TechBot Team

Editor-In-Chief

Swati Gupta

Chief Strategist

Mohit Agarwal

Head of Content

Suhas Vittal

Content Editors

Suhas Vittal, Priya Sharma

Head of Technology, Delivery & Operations

Priyanka Gautam

Head of Design

Harsh Kumar

Communication Manager

Bhumika Nandhani

Director of Talent and Communication Manager

Ruchika Sharma

Digital Partner Fusionflare media

Creative Manager

Mayuree Rastogi

Web developer

Alok Bhade

Video & Production Manager

Bhawesh Mishra

Creative Co-coordinator

Umesh Tiwari

Customer Success Manager

Subha Gupta

CEO Swati Gupta

As we stand on the cusp of a digital revolution, the intersection of finance and technology is reshaping the landscape at an unprecedented pace In this special edition, we embark on a journey where innovation harmonizes with sustainability to shape the future of finance and investment

At Finance TechBot, we recognize the pivotal role of financial literacy in achieving individual and collective wellbeing. Through insightful articles, we explore how financial literacy empowers individuals to make informed decisions, ultimately leading to greater financial stability and prosperity. Moreover, we spotlight sustainable finance practices, showcasing how microfinance institutions are pioneering sustainable growth through ESG principles. Our aim is to inspire and inform readers about the transformative potential of sustainable finance in building a more resilient and equitable future

Sustainable finance and digital innovation are not just trends; they are the future. Together, let's shape a more resilient and equitable world.

In today's digital age, digital transformation is imperative for financial institutions to stay competitive and relevant. We feature a CEO's roadmap, outlining the importance of collaboration and digitalization in navigating the transformative landscape of finance

Furthermore, we delve into the intricate realms of investment management and ethical-strategic finance amidst ongoing disruption Through comprehensive expert insights and indepth analysis, we reveal the latest trends and pioneering strategies for achieving excellence in sustainable finance

As we embark on this exciting journey in Fintech , we extend our sincere gratitude to our contributors, partners, and readers for their unwavering support. We invite you to join us in celebrating innovation, collaboration, and sustainability in finance.

Thank you for being part of this transformative experience.

Happy reading!

Warm regards,

SWATI GUPTA CEO & Editor-in-Chief

A Finance Leader's Guide to Going Public 12 The IPO Roadmap Index 8 Innovations in Sustainable Finance Exploring Green Bonds, Social Bonds, and Sustainability Pioneering Sustainable Microfinance with an ESG Vision 16 Midland Microfin 22 The Importance of Financial Literacy and its Impact on Financial Wellbeing Navigating SAP Implementation: A Roadmap for Transformation 24

Leadership Strategies for Finance and Supply Chain Heads 36 Building HighPerformance Teams Index 30 Digitalisation and Collaboration A CEO’s Roadmap for a Transformative Financial Landscape Changing the Digital World in Web 3.0 42 NFTs 44 Sustainable Investment Excellence Lessons from Leaders in ESG Integration Aligning Investments with Lifelong Goals Charting Your Financial Future 48 30

The CFO's Role in Driving Innovation and Growth Amidst Disruption 60 Strategic Finance Index 54 Ethical Finance Building Trust through Corporate Governance Adapting Talent Acquisition to Thrive in the New Normal 64 Leading the Charge 70 The Future of Wealth Management How Fintech is Changing the Game

72 From Regulations to Recovery

SEBI's Proactive Measures in Resolving India's Unclaimed Securities

78 Taxation in the Digital Age

Leveraging Technology for Seamless GST Compliance

90 The Rise of Robo-Advisors

How FinTech Software is Transforming Investment Management

94 Blockchain Technology for Digital Financial Inclusion in the industry 4.0, towards Sustainable Development

Index

Innovationsin Sustainable Finance

ExploringGreenBonds,Social Bonds,andSustainability

Emerging technologies have not only opened the door to an advanced world but have also instilled an urgency across industries to advance while keeping a greener future at the forefront. The financial sector is experiencing a paradigm shift as environmental and social concerns gain momentum. Enterprises are re-designing their strategies. This environmental awareness has led to an increase in the adoption of sustainable finance, a plan to restore the balance between financial gains and ecological and social transformation Importantly, this shift proves that sustainability can be profitable and offers a bright financial future.

As financial institutions are integrated with the global economy, they are also susceptible to climate change, resource depletion, and environmental degradation From physical consequences, such as natural disasters damaging properties, leading to increased credit for banks, as loans become an urgent resort for environmentally compromised areas, to reputational and regulation risks, the banking sector is not immune to environmental concerns.

Therefore, in a world where the finance sector and global economy are deeply intertwined, green bonds and social bonds have become

the two cornerstones of Environmental, Social, and Governance (ESG) that are reshaping the financial sector into a sustainable industry Beyond mere concepts, these innovations are instrumental in offering enterprises and investors a reliable way to create a more sustainable future Together, Green, Social, and Sustainable (GSS) bonds accrued a staggering $3.8 trillion by the end of 2022

May 2024 08

GreenBonds:Pillarsofa SustainableFuture

To grapple with the rising concerns of unprecedented environmental challenges affecting financial institutions, the banking sector has introduced an innovative tool to ensure a sustainable financial future Green bonds are debt instruments issued by governments, corporations, and international organisations to finance ecological projects, such as renewable energy, clean transportation, waste and water management, and energy efficiency

Mutually beneficial to both issuers and investors, green bonds are the capital needed to accelerate the energy transition and pave the path for a sustainable economy. These bonds assist issuing bodies with diversification by attracting new investors who wouldn’t align with traditional issuing techniques. They also improve the reputation of financial bodies by allowing them to create a comprehensive framework for ensuring regulatory compliance and reducing funding costs.

On the other hand, green bonds offer high financial returns to investors along with transparency and accountability Green bonds require regular reporting, leading to higher transparency and lower risks. This commitment to transparency ensures that investors can make informed decisions, fostering a sense of security and trust in the financial system India has been leading the charge of green bond adoption in Asia since 2021, with the country’s green bond issuances reaching $21 billion in 2023

SocialBonds:CombatingSocial Challenges

As the financial world pushes the boundaries of innovation and transformation, social bonds are paramount in addressing environmental concerns and gearing towards a sustainable economy. Social bonds are

critical tools in sustainable finance, offering the banking industry an opportunity to contribute to social development while maintaining profits.

Social bonds bridge the gap between social growth and financial stability by addressing and resolving social issues, such as education, healthcare, affordable housing, and economic accessibility and inclusivity What makes social bonds impactful is their ability to ensure financial returns while guaranteeing positive social change by mobilising capital and providing it for social projects, thereby reducing poverty, providing better living conditions, and ensuring social equity.

www CXOTechBOT com 09

BeyondGreenandSocialBonds: EmbracingSustainability

Green and social bonds are the centre of the seismic shift the financial industry is witnessing They broaden the scope of economic inclusion and foster social progress. These innovative instruments intertwine seamlessly with the Environmental, Social, and Governance (ESG) concept, making waves for positive financial and social change.

Governments and financial institutions across the globe are implementing innovative approaches to meet ESG goals. Indian regulatory bodies, such as the Reserve Bank of India, issued a framework for accepting Green Deposits, encouraging investors to invest in funds from green projects. In order to accelerate energy and financial transition, this initiative carves a greener future for India, where sustainable investments and financial gains align with environmental concerns.

ESG offers investors a valuable toolkit not limited to and by traditional financial metrics.

Transparent knowledge of their environmental, social, and governance responsibilities equips investors with the power to make informed decisions ESG factors when integrated with conventional financial tools empower investors to evaluate their sustainability credentials, ensuring they invest in projects championing for a sustainable future.

GearingforaSustainable FinancialFuture

Various trends may drive sustainable finance, but it isn’t a trend itself; it is a monumental shift in bringing environmental consciousness and financial stability together The amalgamation of green and social bonds and ESG factors fosters innovation, building a more sustainable tomorrow Leaders and financial institutions have the power to spearhead this transformation, ensure that economic decisions contribute to a greener and healthier planet, and usher in a new era of sustainable finance where financial services are equitable and inclusive.

May 2024 10

The IPO Roadmap

AFinanceLeader'sGuidetoGoingPublic May 2024 12

or a finance leader, the career path is laden with milestones and accomplishments Among the myriad feats lies an Initial Public Offering (IPO), a pivotal moment that marks a new chapter of growth fueled by capital and heightened brand recognition

An IPO represents the amalgamation of financial expertise and strategic planning. It unlocks a new dimension for establishing and maintaining a public track record However, the road to a successful IPO is a journey of its own; it demands navigating a complex landscape of financial considerations, intricate processes, and meticulous planning the three pillars that form the foundation of a perfect IPO roadmap.

TheIPOChecklist:StrategicTipsand Considerations

The journey towards a flawlessly executed IPO commences with setting clear objectives, creating a comprehensive vision board, and conducting a thorough assessment of the company’s assets. Before embarking on the dynamic journey of an IPO, a finance leader must address three fundamental questions:

Goals and Long-Term Planning: Does the company’s long-term objectives align with the IPO?

Financial Planning: An IPO bridges the gap between an organisation’s operations and the public. Is the company’s financial position robust enough to brave the public eye?

IPO:PhasesandStages

The journey of a company from a private entity to a publicly traded company is a momentous occasion for any financial leader. It is a turning point in a company’s trajectory, for it defines the relationship between the organisation and its audience and the organisation and investors seeking an exciting financial opportunity. Thus, an IPO unfolds in stages and phases, each crucial for a stock market debut

The IPO journey is strategic. Meticulous planning, ideally starting 12-24 months before the public offering day, is crucial for a successful public debut This extended time frame allows the company to lay a solid foundation for operating as a public entity by establishing a robust accounting and governance framework and assembling a reputable team of advisors.

Market conditions: The market is unpredictable Does the current market create a supportive environment for IPOs? LeadinganIPOisathrillingyet high-stakesventure.Asuccessful launchcancatapultthecompany tonewheights.However,it necessitatesaclearvisionand meticulousplanningtonavigate thehurdlesandunlockthe exhilaratingrewards.

—CA.ShekharSood

Planning the IPO

F

www CXOTechBOT com 13

This team typically includes investment bankers, legal counsel, auditors, and an Investor Relations (IR) team to facilitate seamless communication with investors throughout the IPO process and beyond, ensuring a smooth transition into the public market

Preparing the IPO

The company transitions to the IPO preparation phase after forming a capable advisory team and establishing a comprehensive and robust governance and accounting infrastructure. This crucial stage involves securing the services of an investment bank and forging a collaborative partnership The Invest banking team will play a significant role in this process, crafting a compelling narrative that effectively communicates the company’s unique value proposition, appealing to potential investors and driving them to participate in the offering and invest in the company’s stocks

The third stage of the IPO process occurs within the final six months before the listing date This critical period is marked by designing a registration statement, which serves as a prospectus for investors. This document details the company’s goals, past achievements, and financial performance, alongside a qualitative clear vision for its prospects Simultaneously, the company also discloses its financial results in the prospectus which are not more than six months

The registration statement is filed with SEBI and stock exchanges for approvals Finally, post the regulatory approvals, the investment bank and the company will extensively market the IPO to investors and discover the price of the IPO through the book building process

Post Public Transformation

The successful execution of an IPO marks the beginning of a new chapter for the company becoming a publicly traded entity. However, the journey of the IPO process underscores the importance of delivering on the promises made to investors during the transaction phase. Therefore, the final stage of the IPO roadmap entails transparent and accurate reporting and timely trade disclosures It also extends to robust governance practices, ensuring the company operates with the highest ethical standards and fosters longterm investor confidence

An IPO is a groundbreaking day for any organisation, possessing the potential to propel the company to unimaginable heights. However, this journey is complex and arduous, requiring diligent planning, assembling a solid team, and fostering transparent communication with investors to ensure a successful IPO An IPO is not a sprint or an overnight task; it is a culmination of strategic framework and execution to solidify a company’s stature as a public entity.

IPO Transaction

IPO Transaction

ThePerfectIPOPlan:TheRoadAhead May 2024 14

CFO, Bajaj Capital Ltd

CA Shekhar Sood is a seasoned business professional, Chartered Accountant with 18 years of experience across diverse industries in India, Asia Pacific, and Europe. He boasts a successful track record leading Finance, IT, Legal and Secretarial functions for established Indian listed companies and multinational corporations He is recognised for his passion for driving sustainable and profitable growth through strategic thinking and skilful execution.

Mr Sood’s comprehensive expertise encompasses fundraising, mergers and acquisitions, business development, and relationship management He fosters collaboration across diverse teams, leveraging his strong interpersonal and communication skills Currently serving as Chief Financial Officer at Bajaj Capital Group, his distinguished career encompasses leading MNCs across France, Germany, India, the US, and the UK, spanning various industries

With a commitment to continuous learning, an Alumni from ISB, Mr Sood holds certifications in IFRS, Lean methodologies, and business strategy. He has also done Global Advanced Management Programme from ISB-NUS These achievements, coupled with his extensive business acumen, position him as an expert in compliance (SEBI-MCA-FEMA), business restructuring, investor relations, and digital transformation. He also possesses a deep understanding of ERP implementation and upgrades, financial planning, treasury and change management, risk management, margin and cost optimisation, and cash flow management

He has been recognized as FE Business Leader 2024 by Financial Express and he has also won Best Technology CFO of the year 2025 award

www CXOTechBOT com 15

Midland Microfin PioneeringSustainableMicrofinance

withanESGVision

Microfinance, as exemplified by Midland Microfin Ltd. (MML),

serves as a cornerstone in fostering socioeconomic empowerment among marginalised communities MML's journey is defined by its unwavering dedication to principles of compassion, responsibility, and innovation

Over the past decade, MML has undertaken significant strides, extending its reach across

Leveraging technologically-driven financial services, MML has not only catalysed the elevation of income levels but has also facilitated improved access to crucial sectors such as education and healthcare, thereby illuminating a path towards a more promising future for underserved communities

PioneeringESGLeadership

ESG

I h th

(E i t l S i l

May 2024 16

For MML, the ascent of ESG principles wasn't a newfound revelation; it served as a reaffirmation of deeply ingrained values Beyond mere financial success, ESG embodies MML's enduring dedication to effecting profound social and environmental change while upholding the utmost standards of ethics and governance.

SpearheadingSustainableFinancing

MML demonstrates a steadfast commitment to environmental sustainability, marked by tangible actions aimed at reducing energy consumption and mitigating ecological impact across its operations. The organisation actively implements initiatives such as solar power systems at its branches, embracing renewable energy adoption. Additionally, MML employs energy-efficient technologies and effective waste management practices to minimise its environmental footprint.

Furthermore, MML's dedication to financing environmental impact is exemplified through its Water, Sanitation, and Hygiene (WASH) loan initiatives These efforts empower communities to access essential resources for sustainable living, extending beyond traditional microfinance

Through innovative products like solar lanterns, water purifiers, and energy-efficient appliances, MML has significantly curtailed greenhouse gas emissions by an impressive 21,479 tonnes. Moreover, its initiatives in renewable energy generation contribute substantially to climate change mitigation.

Remarkably, these endeavours directly empower over 3 6 lakh households with access to clean energy, setting a precedent for sustainable development within the microfinance industry

FosteringEconomicEmpowerment ThroughTechnologicalAdvancement

In a strategic move aimed at fostering economic self-sufficiency, Midland embarked on the innovative "Digital Didi" campaign, acknowledging the indispensable role of financial literacy and digital empowerment This pioneering initiative seeks to narrow the digital gap prevalent among marginalised communities by imparting essential digital skills and knowledge.

Central to the campaign's objectives is the enhancement of digital payment proficiency among our members, facilitating their journey towards financial autonomy through comprehensive digital literacy programs Moreover, "Digital Didi" serves as a platform for knowledge dissemination within communities, fostering a culture of information sharing and collaboration.

Midland Microfin Ltd recognises that digital literacy is a cornerstone for expanding access to a diverse array of financial services, thereby aligning seamlessly with its overarching mission to uplift underserved communities and promote financial inclusion.

www CXOTechBOT com 17

PioneeringSocialResponsibility: ExemplifyingEthicalPrinciples

At Midland Microfin Ltd. (MML), their dedication to social responsibility extends far beyond conventional financial services, embodying a deeply entrenched ethos that has guided their actions since inception. With a customer base exceeding 900,000, predominantly composed of women, they embark on a mission to enhance their quality of life by empowering them to establish income-generating enterprises

In their relentless pursuit of societal betterment, MML forges robust bonds with local communities through multifaceted initiatives. These encompass promoting women ' s empowerment, fostering financial inclusion, spearheading environmentally sustainable endeavours, and nurturing skill development programs

Furthermore, through their participation in the Reserve Bank of India's Depositor Education and Awareness initiatives, MML ensures the holistic well-being of their stakeholders. Notably, their flagship project entails the distribution of sanitary napkins, a cornerstone in their commitment to female hygiene and environmental stewardship through the utilisation of recyclable biodegradable

Collaborations with esteemed partners like Micro Energy Credit have enabled MML to pioneer clean energy lending programs, empowering their clientele to embrace sustainable energy solutions in their journey towards socioeconomic upliftment

Moreover, safeguarding the privacy and data security of their stakeholders remains paramount for MML, enhancing the credibility and efficacy of their offerings. Embracing digitisation and promoting cashless transactions not only streamline their operations but also advance their vision of fostering sustainability across all facets of their operations

ExemplaryGovernanceStandards

Midland Microfin Ltd. (MML) upholds a steadfast commitment to transparent and accountable governance, recognising its fundamental importance in fostering trust and credibility With an unwavering dedication to ethical conduct, MML ensures that its operations adhere to the highest standards of integrity and accountability

A robust system is in place to address grievances raised by stakeholders promptly and effectively, underscoring MML's commitment to listening to and addressing

May 2024 18

Diversity and inclusivity are integral values embedded within MML's organisational culture The inclusion of an independent woman director on the leadership team reflects MML's dedication to fostering diverse perspectives and ensuring equitable representation at the highest levels of decision-making.

MML places paramount importance on comprehensive risk management, underpinned by a well-structured policy framework and robust business continuity and disaster recovery plans. These measures serve to safeguard MML's operations and ensure resilience in the face of unforeseen challenges.

Investing in the ongoing training and development of its workforce is a cornerstone of MML's approach to governance Through continuous education on company policies and stakeholder engagement mechanisms, MML empowers its employees to navigate ethical complexities with clarity and confidence, fostering a culture of ethical excellence throughout the organisation.

ChartingthePathAhead

As Midland Microfin Ltd. (MML) looks to the future, its trajectory is guided by a steadfast commitment to ESG principles and the United Nations' Sustainable Development Goals. Envisioning a future characterised by sustainability, inclusivity, and prosperity for all, MML is poised to take decisive actions to realise this vision.

Embracing initiatives to reduce emissions from buildings and track emissions specific to the finance function, MML aims to make meaningful contributions to reducing greenhouse gas emissions.

Collaborating with national and international institutions, MML will invest in various ESG initiatives, including expanding solar power generation, improving e-waste management, adopting digital solutions, and promoting emissions reduction through E-bikes

In line with its commitment to diversity, MML will actively promote increased representation of women and differently-abled employees. Additionally, plans are underway to launch more sustainable loan products for green deposits, further enhancing stakeholder value Strengthening its risk management approach, MML will conduct thorough physical and transition risk assessments to mitigate potential risks effectively.

To solidify its commitment to ESG principles, MML will implement a robust governance framework and conduct significant impact assessments Embracing digital repayment collection to reduce paper usage, MML seeks to contribute to a greener future while fostering financial literacy among participants and offering complementary health check initiatives to all employees.

In its pursuit of advancing various ESG facets, MML will implement an advanced feedback mechanism to align its trajectory with evolving sustainability standards This data-driven approach will prioritise different sustainability goals and track ROI, and performance against them, ensuring that every action contributes to a more equitable and sustainable world

MML's journey epitomises the transformative power of vision, commitment, and values As more than just a microfinance institution, MML stands as a beacon of hope, driving positive change and demonstrating the profound impact that responsible microfinance can have on a global scale.

www CXOTechBOT com 19

COO&CFO,MidlandMicrofinLtd May 2024 20

The Importance of Financial Literacy and its Impact on Financial Wellbeing

Akey marker that indicates the dynamism of today’s world is the evolution of financial wellness Financial wellbeing is no longer limited to being a personal achievement; it has graduated to becoming a pillar of a robust and thriving society The concerns arising from financial stress are etched in every nook and corner of the industry, affecting workforce productivity, performance, and commitment Almost 75% of Indians do not have an emergency fund, forcing them to rely on EMIs in case of sudden layoffs, suggesting an upheaval in the financial industry This is where financial literacy makes a difference.

Financial literacy doesn’t only mean learning how to file taxes or a chequebook It is a broader concept, spreading beyond basic financial understanding. It encompasses the awareness and knowledge of financial tools needed to thrive amid unpredictable economic times. It includes understanding the mechanisms of debt management, budgeting, and responsible investment concepts that empower individuals to make comprehensive and informed financial decisions for an economically secure and stable future

May 2024 22

FinancialLiteracy:ACriticalLifeSkill

In an era where financial health governs better living standards and a financially sound future, financial literacy equips individuals with the ability to navigate unprecedented financial waters and gear towards accumulating wealth through saving and investment strategies while reducing debt. It is a lifelong, continuous learning that requires staying up-to-date with changing financial markets and terminology, such as interest rates, loans, and various investment models.

Handling Expenses: With financial literacy comes a holistic understanding of budgeting and expense management mastering the concept of creating attainable budgets, tracking expenses, and reducing financial burdens while simultaneously saving resources to repay debts

Financial Planning: The cornerstone of living safely and comfortably is fostering a culture of balancing spending and saving. Financial literacy is the key to creating a future without financial anxiety by setting aside emergency funds and reducing reliance on EMIs, paychecks, and high-interest credit cards.

Investing Confidently: What makes financial literacy an essential life skill is the knowledge it imparts, allowing individuals and employees to make informed decisions and build a riskaverse, cost-efficient, and easy-to-manage portfolio.

Fintech:TheBedrockofFinancial Literacy

The advent of financial technology has created ripples across the industry, revolutionising financial management. FinTech has unlocked a treasure trove of valuable information, tools, and services to boost financial performance and conduct financial tasks confidently and securely,

from online and mobile banking to investment applications. When financial literacy and FinTech join forces, they create a symbiotic relationship that allows individuals to harness the power of FinTech for their financial wellbeing.

This symbiotic relationship equips individuals with the knowledge to uncover the full potential of FinTech for their financial wellness Financial literacy empowers users to evaluate current and emerging FinTech tools and services critically. For instance, interactive budgeting applications automatically connect to bank accounts, enabling automated financial transactions while offering users valuable insights into their spending and saving habits Armed with this data, individuals can make informed budgeting decisions

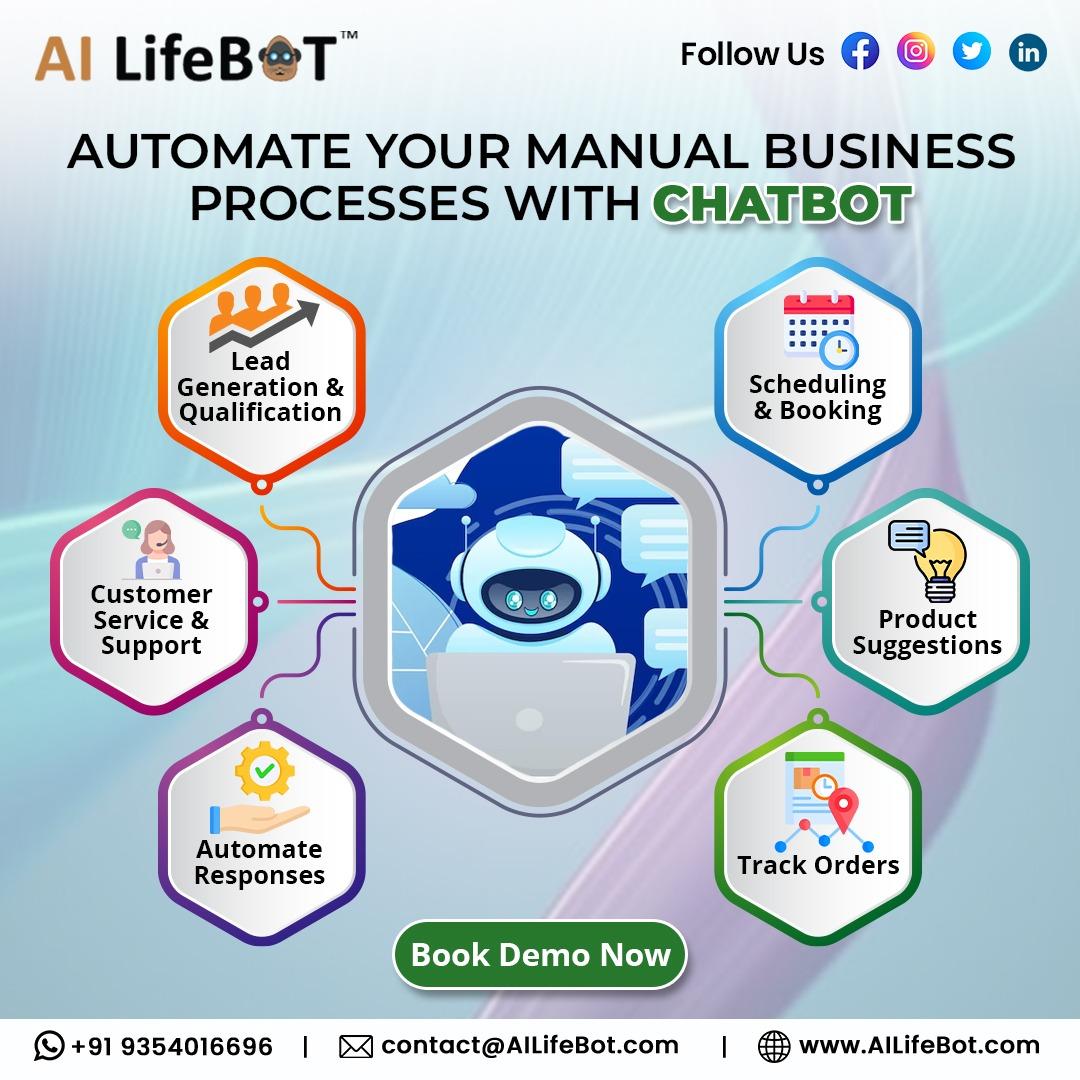

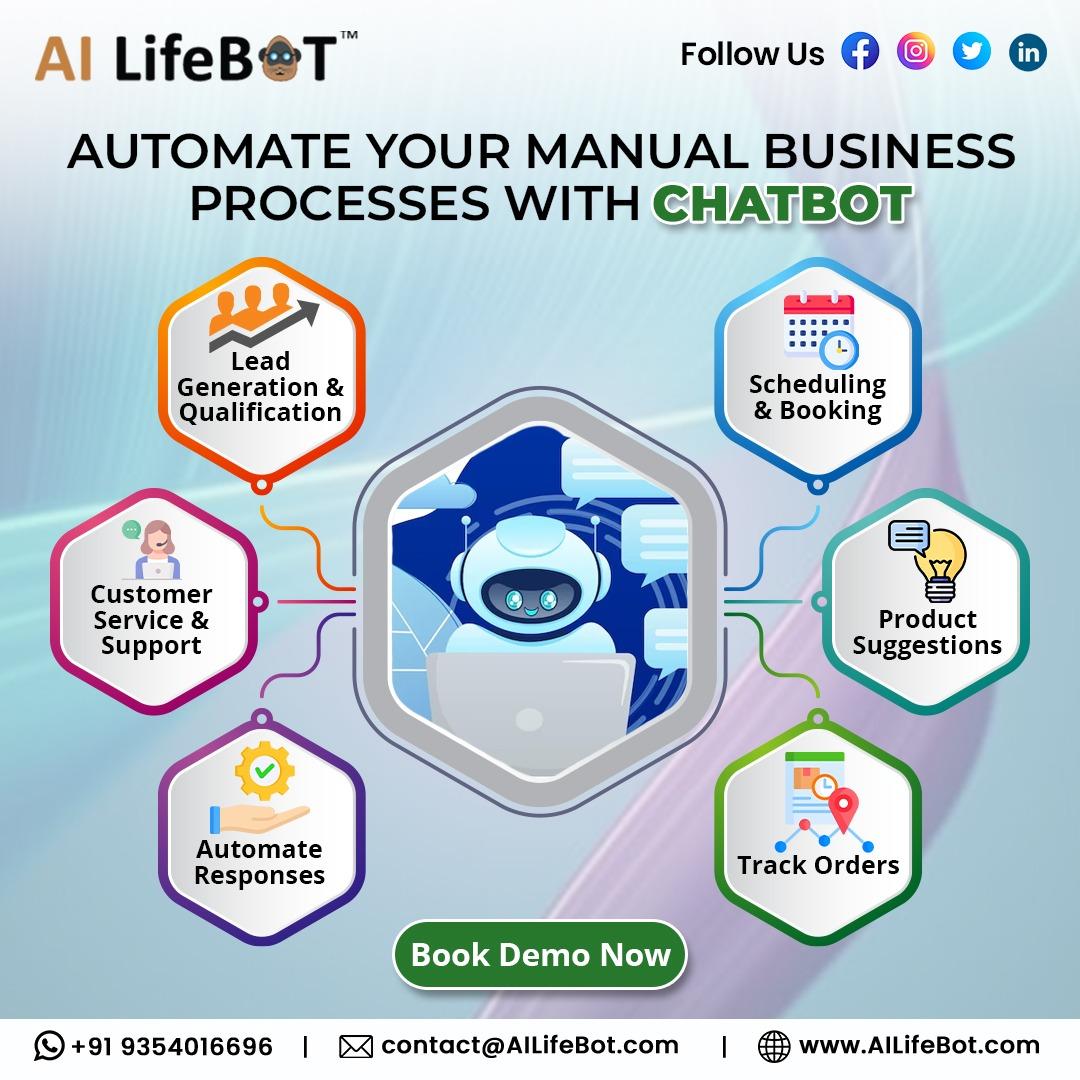

Furthermore, FinTech leverages cutting-edge technologies like generative AI to provide 24/7, on-demand support Chatbots and virtual assistants can promptly answer financial queries, offer instant guidance on managing debt and saving strategies, and personalise the user experience

FinancialLiteracyandFinancial Wellness: TwoSidesoftheSameCoin

Financial literacy is an irreplaceable skill in the current financial market. Not only does it equip individuals with the confidence and knowledge to perform primary financial tasks, but it also reduces economic anxiety, fostering a secure environment and honing the ability to navigate the ever-changing financial industry

www CXOTechBOT com 23

Navigating SAP Implementation ARoadmapforTransformation

In today’s fiercely competitive environment, where operational efficiency and data management are crucial for business success, SAP implementation emerges as a transformative solution. SAP’s robust Enterprise Resource Planning (ERP) system not only streamlines operations and boosts productivity but also empowers datadriven decision-making. Moreover, it offers a remarkable return on investment, if harnessed to its full potential

However, despite its revolutionary potential to reform companies by centralising their core functions, SAP implementation can be a complex journey for small and medium enterprises., and in the service industry. Adapting to this software hinges on meticulous planning, collaboration, and understanding unique industry needs, making it a challenge that requires careful navigation.

May 2024 24

TheChecklistforSuccessfulSAP Integration

SAP implementation stands as a disruptive force, empowering organisations to unlock new levels of operational excellence. However, harnessing its power for business growth requires a carefully crafted roadmap that not only addresses the inherent challenges related to its integration but also proactively anticipates and mitigates potential roadblocks.

Catering to the Right Industry: Manufacturing vs. Services

SAP’s versatility lies in its ability to adapt to the unique challenges of different industries. Manufacturing companies leverage modules like Material Management (MM) for inventory control and Production Planning (PP) to optimise procurement and scheduling. Conversely, service-oriented businesses use Customer Relationship Management (CRM) and Project Management (PM) to achieve their goals Therefore, the first step in successful SAP implementation is understanding the target industry’s specific needs, trends, and processes. This knowledge empowers organisations to select relevant and compatible SAP modules and configure them to integrate with existing workflows seamlessly

Transparency is the Key

The second step in SAP implementation is maintaining transparency. The consultants, CFO, and CIO must clearly define all the schedules, costs, and results related to the SAP modules; they must collaborate to create an attainable roadmap and share it with management

Previous success stories of SAP implementation play a significant role in shaping and establishing SAP parameters and act as reliable benchmarks to measure the status and progress of SAP integration for achieving high benefits and ROI

Building the Perfect Team

The success of SAP implementation hinges on the strength of the team. A perfect team should include a core group of experts who understand the current business processes and are open to change. They should be supported by IT specialists and SAP consultants who provide technical expertise However, it’s not just about finding experts from each field; it’s about ensuring that every team member has a unique skill set that complements the team’s overall skills, such as business process management, data management, and change management

Three Pillars of Collaboration: CFO, CIO, and Stakeholders

While the CFO and CIO play an undeniable role in steering the wheel towards process and technological excellence, stakeholders are also the driving force behind operational success

www CXOTechBOT com 25

Their valuable input and insights offer a deeper understanding of the necessary features to champion change and design solutions to address communication and collaboration gaps

Resources are of the Essence

ThetruepotentialofSAPis unleashedwithcarefulplanning, changemanagement,and effectiveresourceallocation.Once SAPissuccessfullyimplemented,it servesasacatalystformaximised ROIandgains.

—RajeshThacker

Implementing SAP is not merely a strategy; it is a significant investment. It entails investing time, money, and resources into understanding the core systems and developing training modules to empower teams. However, transitioning to new software can be time-consuming and affect the workload Thus, organisations must be equipped with the proper tools and exhibit patience to tackle potential productivity challenges Recognising the time and effort invested by both team members and the enterprise fosters a culture of mutual respect, boosts morale, and encourages the adoption of new technologies

Additional compensation by the organisation also provides encouragement and motivation to cultivate a culture of continuous learning and incentivises teams to achieve monumental milestones during the implementation process.

Designing Compatible SAP Modules

The design phase is arguably the most critical stage of SAP implementation During this phase, the team meticulously selects and configures the most suitable SAP modules that align seamlessly with the organisation’s strategic objectives. This involves integrating a range of modules, such as Material Management, Finance, Operations, or HR, within a clearly defined timeline that takes into account their functional dependencies. For example, the Material Management module must be configured before implementing the Production Planning module to ensure optimal functionality. Therefore, the design phase serves the crucial purpose of identifying modules that work effectively independently and collaboratively to prevent bottlenecks and provide a seamless data flow across the entire system

May 2024 26

Testing, Executing, and Improving

Once the configuration stage is implemented successfully, the IT and core support teams perform User Acceptance Testing (UAT) to test the configuration and ensure the systems deliver optimal performance They conduct a soft launch of the product for two to four weeks in a controlled environment to monitor user experience and identify underlying concerns After the soft launch period, the teams can refine the system based on user feedback and continue the process until they find the perfect solution However, teams must continue testing even after the system goes live and monitor user reviews to ensure the stability of the software

SAP Implementation: The Launch Date

A phased approach to SAP implementation mitigates risk and fosters a smoother software migration for the organisation. By implementing the system in phases, targeted

departments can test it first to enable early identification and correction of any disruptions, allowing the team to refine processes before a wider rollout The success of these initial phases paves the way for a gradual, full launch, ensuring a more stable transition for the entire enterprise.

SAP implementation is a decisive factor driving business growth. By streamlining operations and enabling data-driven decision-making, SAP empowers organisations to achieve new heights of performance and efficiency While the road to successful implementation requires careful planning, collaboration, and a phased approach, the potential rewards are undeniable By leveraging the expertise of consulting teams and fostering open communication across leadership, businesses can harness the full potential of SAP and gear towards long-term success

SimplifyingComplexSAPAdoption

www CXOTechBOT com 27

Mr. Rajesh Thacker

A visionary leader in the field of SAP implementation, Mr Rajesh Thacker vast experience over two decades of driving organisational success. He empowers businesses in a wide array of disciplines, encompassing optimising accounting and financial processes, strategic financial management, and treasury and revenue management expertise

Mr Thacker has transformed the SAP landscape by contributing to industry studies, including GST’s impact on healthcare, mergers and acquisitions, and facilitating internal and statutory audits with leading Big Four audit firms

His prowess in the industry is reflected in his role as the Chief Financial Officer at the Rajiv Gandhi Cancer Institute and Research Centre, where he demonstrates exemplary leadership by strengthening financial procedures, financial planning and cost management, enhancing auditing and compliance, exceptional financial reporting, and tax management expertise.

As a proactive planner who remains abreast of emerging trends, Mr Thacker leverages his expertise and experience to identify and adopt trends to achieve organisational objectives and empower the industry. ChiefFinancialOfficer,RajivGandhiCancerInstitute&ResearchCentre

May 2024 28

Digitalisation and Collaboration

A CEO’s

he waves of digitalisation have been endlessly dashing towards and rolling over the shores of every sector in today’s economy. Over the years, these waves have washed over the financial landscape, too, making it more technologically advanced and innovative The days of walking into a bank branch and spending hours in long queues only to cash a cheque are long gone this is what the modern financial sector looks like What initially began as a venture for small startups has emerged as a multi-trillion-dollar industry, gearing up to reach $1 5 trillion by 2030. As the financial space heads towards a smarter future, the amalgamation of digital innovations is holding the torch for a more financially secure tomorrow

The financial sector has risen like a phoenix in a race governed by technological endeavours Online and mobile banking solutions, digital payment services, roboadvisors, blockchain technology and cryptocurrency, InsurTech, and artificial intelligence are both the product of and the fuel behind the industry’s tremendous growth; they bear witness to the dynamic combination of innovation with technology in the financial industry.

p for a Transformative Financial Landscape

Roadma

TheDigitalFootprintofFinTech T May 2024 30

As banks adopt the API-first strategy, there has been a revolutionary change in customers’ financial journeys, creating a streamlined and user-friendly experience for them, along with broadening the scope for partner banking, embedded finance, and Neobanking. India’s Digital Public Infrastructure has also evened the playing field for new businesses while simultaneously speeding up the shift towards digitalisation and increasing competition among traditional financial institutions and emerging FinTech startups

Digital innovation isn’t a trend but a permanent shift from conventional financial practices. It is a movement driving the industry towards continuous development and customer-centric services, as evidenced by customer growth levels reaching above 50% across industry verticals.

WhenFinTechMeetsEducation

In recent years, the FinTech industry has formed a symbiotic relationship with educational institutions, embarking on a collaborative journey built on innovation, exchange of knowledge and ideas, and skill training and development This powerful alliance has adopted a cohort working approach to meet the industry’s constantly evolving needs and demands The integration of FinTech into education has addressed the trends of the rapidly changing economy by shedding light on the need for more handson experience, practical insights, and a dynamic curriculum and SP Jain School of Global Management is pioneering this shift.

SP Jain School of Global Management has recognised the ever-evolving and fluid nature of FinTech To prepare students to stay ahead of the curve in this dynamic landscape, the institution has equipped them with a curriculum that undergoes regular

Digitalinnovationsare revolutionisingfinance, notjustbyaccelerating transactions,butalso bydemocratising theaccess offinancialservices andopeningthedoors toafinancially thrivingfuture foreveryone.

www CXOTechBOT com 31

VikramPandya

Vikram Pandya

May 2024 32

FounderandDirector,AssociationforEmergingTechnologies

updates to reflect the latest industry trends, technological advancements, and regulatory guidelines. Hands-on learning is given the stage through cloud labs and tools, industry collaborations, and real-world projects, empowering graduates with practical skills like blockchain, AI, data analytics, and digital payments The institute’s commitment to ensure continuous learning doesn’t end when students spread their wings after graduation; SP Jain School of Global Management’s Perpetual Learning Program (PLP) offers alums regular sessions on recent industry changes and updates.

Where educational institutions and the FinTech industry meet, the industry moves forward, becomes more innovative, and expands the talent pool Partnering with industry leaders through internships, projects, and guest lectures opens the gateway to realworld exposure and the skills needed to climb the ladder. This collaboration forms the basis of mutual appreciation and benefits, allowing the industry access to fresh talent, new ideas, and dynamic opportunities The joint venture of FinTech and education is more than a symbiotic relationship; it is a bridge that covers the gap between academia and industry, fostering innovation and growth.

TheCumulativeEffectof CollaborativeInitiatives

The future of finance is being reshaped through joint efforts and groundbreaking partnerships across academia, industry, government, and startups by sparking innovation, promoting knowledge sharing, and fostering cross-industry collaborations The Association for Emerging Technologies (AET) unites diverse stakeholders from a plethora of industries to drive thought leadership, encourage best practices, and collectively face shared challenges, making the future of finance more sustainable and inclusive

AET has been championing collaboration and innovation in emerging technologies across business verticals by fostering a conducive ecosystem that facilitates partnerships between students, entrepreneurs, IT vendors, investors, and corporates This visionary initiative imparts awareness of emerging technologies, assists in formulating policies and regulations, and accelerates the adoption of technologies per industry needs through research and awareness programs.

AET’s efforts go beyond building connections. The Association believes in leveraging technology to reinforce positive change by identifying opportunities to enhance efficiency, combat fraud and corruption, and bridge skill gaps Furthermore, AET forges a nurturing environment for startups, generates employment opportunities, and establishes local workshops documenting successful case studies and international best practices, contributing to the demanding industry standards

www CXOTechBOT com 33

RoleofRegulatoryBodiesinFinTech ShapingtheFutureofFinancial Services

In the fast-paced world of FinTech, where innovation stops for no one and takes pathbreaking strides at breakneck speed, regulatory bodies play a critical role in not only striking an essential balance but also supporting and regulating the financial sphere to ensure consumer protection, market integrity, and financial stability.

The future of the financial sector is in the hands of regulatory bodies By collaborating closely with industry stakeholders to draft regulatory frameworks, the FinTech landscape is one step closer to ensuring compliance and promoting fair competition.

The convergence of emerging technologies like blockchain, ICOs, process mining & RPA, and AI/ML is the key to a future brimming with possibilities and opportunities for financial services. These technologies are the answer to revamping traditional financial processes, making the landscape more transparent and accountable, streamlining processes, bolstering security, and unlocking new business models bustling with promise However, navigating the complexities of scams, regulatory uncertainty, data privacy concerns, interoperability issues, and talent shortages will be crucial to uncovering the full potential of this financial revolution.

May 2024 34

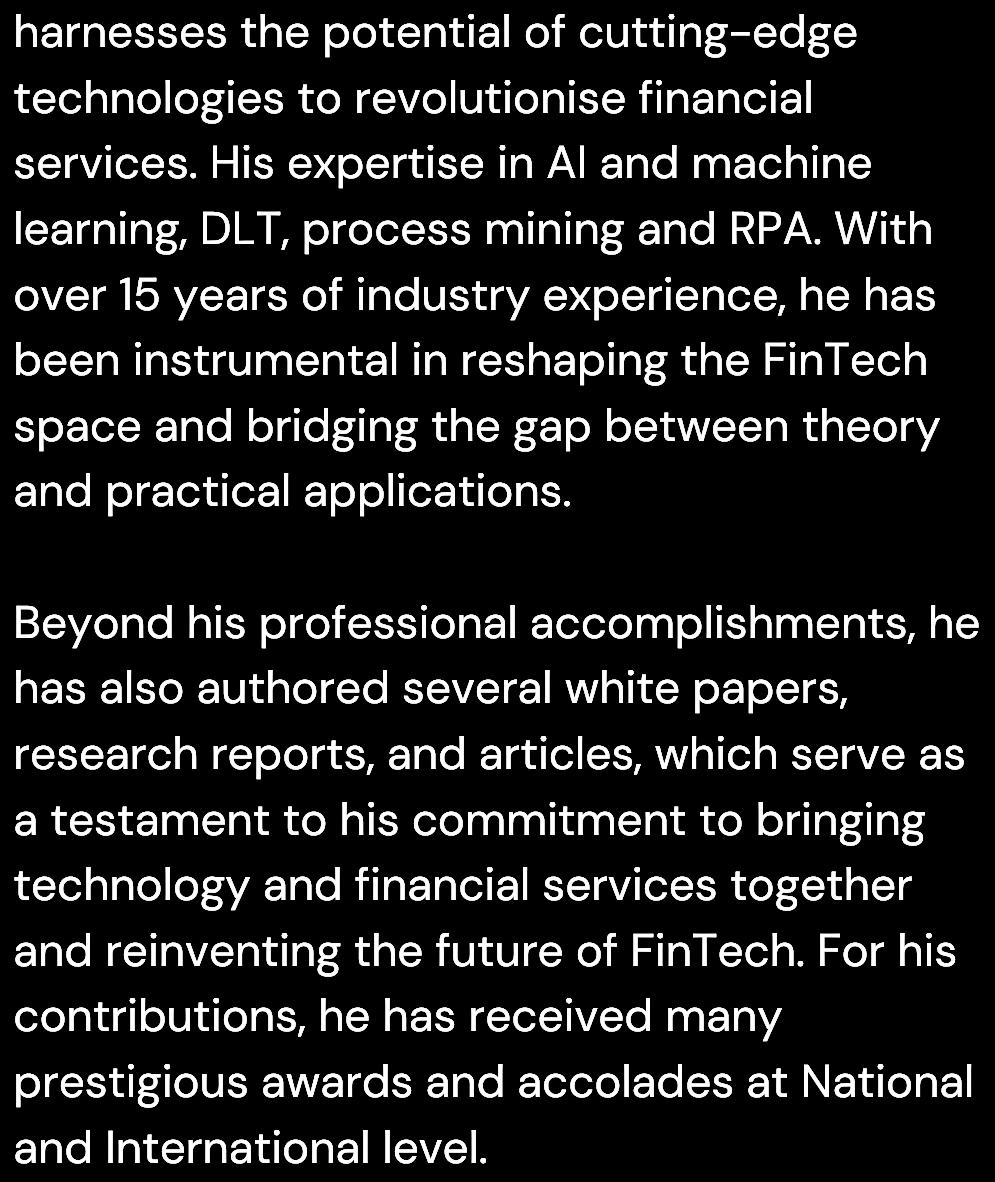

FounderandDirector,AssociationforEmergingTechnologies www CXOTechBOT com 35

BuildingHighPerformanceTeams

LeadershipStrategiesforFinance andSupplyChainHeads

In any organization, regardless of its size, industry, product, or business model, Finance and Supply Chain are critical functions In today’s rapidly evolving business environment, where speed is essential for differentiation, these functions must work with the same agility. Timely and costeffective operations are essential for organizational strength Finance and Supply Chain leaders must move beyond traditional

Effective management in these areas goes beyond productivity and efficiency; it drives business growth and sustainability Successful Finance and SCM require meticulously planned leadership strategies to form highperformance teams with the expertise, knowledge, and agility to overcome challenges, deliver best performance, and achieve long-term success

JackWelch

JackWelch

Beforeyouarealeader, successisallabout growingyourself.When youbecomealeader, successisallabout growingothers.

May 2024 36

Gaurav Kant

CFOatShyamSpectra

Gaurav Kant is a seasoned finance professional with over 19 years of dedicated expertise in the dynamic realm of finance Currently serving as a CFO at Shyam Spectra, Gaurav brings a wealth of knowledge and a strategic mindset to the table, contributing significantly to the company ' s financial success.

Throughout his illustrious career, Gaurav has honed his skills across various facets of finance, encompassing financial reporting, business planning and analysis, budgeting, risk and compliance management, and strategic decision-making. His keen analytical acumen and ability to navigate complex financial landscapes have earned him a stellar reputation within the industry

His experience also includes working in companies like EY, Vodafone, Telenor, Bharti Airtel, Sterling Holidays where he has gained an extensive operational and strategic experience in both B2C and B2B domain across industries

Beyond his professional endeavours, Gaurav is known for his leadership prowess and collaborative spirit He actively mentors aspiring finance professionals, imparting his knowledge and insights to nurture the next generation of talent in the field.

With a proven record of success and a passion for excellence, Gaurav Kant continues to be a driving force in the realm of finance, propelling Shyam Spectra towards new heights of prosperity and innovation.

www CXOTechBOT com 37

FosteringExcellencewithLeadership Strategies:AFour-StepRoadmap

In today's competitive market, having wellequipped and high-performing finance and supply chain departments is no longer just a luxury, but a necessity. As the demand for efficiency and productivity continues to rise, the heads of these departments must prioritize the cultivation and implementation of key leadership strategies By fostering a culture of innovation and continuous improvement, finance and supply chain heads can empower their teams to deliver exceptional results This includes investing in the latest technologies, developing talent, and fostering collaboration across departments.

Create a Mission Statement: To effectively contribute to the overall vision of the organisation, it is essential for the finance and supply chain management (SCM) teams to set up a clear and aligned mission statement This statement should serve as a subset of the organisational vision, guiding the operational tasks of each leader in a manner that strategically supports the achievement of the broader vision. By curating a mission statement, these teams can more effectively generate innovative ideas, develop processes, and set up attainable goals that are in line with the company ' s vision. Additionally, the mission statement provides a framework for setting metrics that can be used to gauge team performance, ensuring that progress is being made towards the organisation's vision. Ultimately, a well-defined mission statement for finance and SCM teams is integral to driving the company forward in a cohesive and purposeful manner.

Assembling the Perfect Team: Building a high-performing team requires careful consideration of each team member's skills and compatibility. It's essential to assess the task and skill requirements for every role within the organization I propose categorizing profile competencies into three segments: A. Subject matter expertise; B Business Partnership; C. Challenging Status-quo and thinking beyond. Each profile should be evaluated based on these segments and rated at a level of Low, Medium, or High. When assembling a team, this matrix can be used to match individual experience with a holistic skillset, technical expertise, and business acumen to create a well-rounded team. Additionally, problem-solving and communication skills are crucial for continuous learning. With a team of expert individuals, development, collaboration, innovation, and growth are inevitable When a team member leaves, it's an opportunity to enhance the team by seeking an even better candidate to fill the vacancy.

Iproposecategorizingprofile competenciesintothreesegments: A.Subjectmatterexpertise;B. BusinessPartnership;C.Challenging Status-quoandthinkingbeyond. Eachprofileshouldbeevaluated basedonthesesegmentsandrated atalevelofLow,Medium,orHigh. Whenassemblingateam,this matrixcanbeusedtomatch individualexperiencewithaholistic skillset,technicalexpertise,and businessacumentocreateawellroundedteam

GauravKant May 2024 38

Embracing the Digital Revolution: In today's fast-paced business environment, creating a digital revolution is crucial for effective leadership. It begins with finding repetitive tasks and analysing the time spent on these activities By treating internal stakeholders as valued customers, leaders can focus on providing efficient solutions to simplify their work processes This approach naturally leads to exploring automation and digitization opportunities. The next step involves streamlining processes to empower financial and supply chain teams. A well-designed framework is essential for enhancing efficiency and ensuring consistency in operations. By using tools and embracing digitalization, organizations can achieve simplified and accelerated functions Furthermore, the integration of artificial intelligence, machine learning, the Internet of Things (IoT), and blockchain technologies plays a pivotal role in automating tasks such as data analysis and management This enables teams to access real-time information and continuous insights, ultimately driving improvement across the board. Embracing a digital mindset is not just about keeping up with the times, but also about staying ahead in the competitive landscape.

Cultivating

a Collaborative Environment:

Effective collaboration is essential for teams to consistently deliver high-quality work that meets the expectations of customers and investors It not only strengthens team dynamics but also serves as a benchmark for achieving company goals and driving continuous improvement A successful team works as a partner, and a collaborative culture enables seamless information flow and expertise across departments, leading to the achievement of shared goals To operationalize this, implementing weekly cross-functional hurdle meetings and fostering a collaborative format can greatly enhance team communication, issue resolution, and alignment of expectations This approach helps ease of working together and ensures that teams can address challenges and expectations with greater frequency and efficiency

www CXOTechBOT com 39

Drivingteamtowardsexecution excellence:

To achieve execution excellence, it is important to clearly define goals and expectations for your team. This includes setting clear goals, setting up key performance indicators, and providing the necessary resources and support Communication is also key, ensuring that everyone understands their role and responsibilities in achieving the team's goals

When crafting the Key Performance Indicators (KPI) and Key Result Areas (KRA) of the organization, it is important to assign four key roles (KRA) for each person in the team as mentioned below

KRA-1 Operational: Executing Operational responsibilities assigned to vertical/Individual – “Faster & Better Quality”.

KRA-2 Customer First: Customer (Internal/ External) Centric Delivery priorities –“Proactive & Collaborative

KRA-3 Quality Jobs: For leaders- Reduce Individual dependency and provide cross functional exposure; For Individual contributors- Identify and reduce time on repetitive jobs.

KRA-4 Strategic Projects: Business Priority & Innovation projects (Yearly)

This ensures that every team member has a clear understanding of their responsibilities and how their performance will be evaluated. By defining these roles, management can effectively drive efficiency and create a team that is adaptable to change Ultimately, by focusing on these key elements, leaders can build teams that are not only high-performing but also capable of thriving in dynamic and challenging environments.

At last, forming high-performance teams and departments is a critical task that requires dedicated effort from leaders To achieve this, it is essential to cultivate a collaborative and inclusive culture within the organization. Setting clear and achievable goals in the first phases is also crucial, as it provides a roadmap for the team to follow. Finding wellrounded individuals with diverse skill sets and experiences is another key factor in building a successful team. Additionally, using digital transformation can provide the necessary tools and resources for the team to excel in their roles

May 2024 40

A unit of Edgespark IT Ventures Pvt Ltd. WeWork India, Chromium, Cts No. 106/1-5, Jogesh Wari-Vikhroli link Road, Milind Nagar, Powai, Mumbai - 400076. Mumbai | Pune | Noida contact@cxotechbot.com +91 7304 67 0468 ADVERTISE WITH US

NFTs

Changing the Digital World in Web 3.0

The internet is one of, if not the most revolutionary inventions. What started as breaking geographical barriers and connecting people globally has evolved into crafting a more engaging and immersive virtual world Web 3 0 and NFTs (NonFungible Tokens) are proof of the dynamic nature of the internet and digitalisation, with the latter moulding Web 3 0 or web3 into a more user-friendly platform by enabling digital ownership.

How do you own something you cannot touch? How is it possible to own an asset in the virtual realm? How can you purchase a photo, social media post, or even assets that seem impossible to possess, such as a plot, in the digital world of the metaverse? The answer is straightforward NFTs

NFTs:MakingtheIntangibleTangible

May 2024 42

NFTs’ ability to produce proof and maintain their record makes them a game-changer. Each NFT is entered on a blockchain with irrefutable evidence of ownership Instead of using interchangeable tokens, NFTs are transparent, verifying digital asset ownership.

Art and Music in the Digital World

In an era that promotes, encourages, and thrives on creativity, NFTs forge the path to a creative economy Artists and creators can spread their wings in the virtual landscape, monetising their digital creations For the longest time, art, which was considered a physical work, limited to museums and galleries, now has unlimited space in the digital world Artists and art aficionados no longer have geographical boundaries that confine their love for the interest; creators and their audiences can communicate, interact, and support each other in Web 3 0

In a world where intellectual property is still considered a grey area, NFTs value artists’ intellectual property, ensuring they have complete control over their creativity and creation

Becoming Land Owners in Web3

Why limit yourself to only owning a piece of virtual art when you can expand your horizons and delve into the digital real estate market? Like becoming a real estate investor in the physical world, NFTs are the key to owning land in the metaverse. The adoption of metaverse and, consequently, the ownership of virtual real estate was met with enthusiasm; the value of virtual real estate grew by 879% from 2019 to 2022.

billion by 2030 As blockchain technology evolves, it will soon embed itself into the mainstream market, leading to more sectors realising its potential NFTs are the true definition of disruptive technology, breaking barriers, taking art, music, and entertainment to new realms, transforming digital ownership, protecting intellectual property, and safeguarding virtual investments.

However, despite embarking on new adventures and creating exciting opportunities for the virtual space, NFTs come with their own challenges, such as copyright claims and their carbon footprint on average, an NFT releases 211kg of carbon dioxide into the atmosphere

Takeaway

The digital landscape is ever-changing; every day marks the introduction of an innovation If one innovation has demonstrated a steady presence, however, it is NFTs. Encompassing blockchain technology and digital advancement, NFTs have engineered a monumental shift in the ownership of assets in web3.

NFTs’ future looks booming and dynamic. With the integration of NFTs, the global Web 3 0 market worth is expected to reach $5 5

TheRoadAheadforNFTsandWeb3.0

www CXOTechBOT com 43

Sustainable InvestmentExcellence

LessonsfromLeadersinESGIntegration

In recent years, investors have shown a growing inclination towards aligning their decisions with a positive impact on both the environment and society. The ESG framework, which encompasses Environmental, Social, and Governance factors, serves as a cornerstone for identifying companies committed to sustainable business practices, social impact, and ethical governance a reflection of investors' personal beliefs and principles. Remarkably, ESG transcends a singular approach; rather, its application varies depending on the industry's nature and the specific requirements of the investment.

The recognition of environmental, social, and governance (ESG) factors as crucial components of corporate performance is now widespread.

No longer relegated to mere "soft" reputational concerns managed by public relations or marketing, ESG issues are acknowledged as significant determinants of success. Investors increasingly understand that inadequate ESG practices pose environmental, legal, and reputational risks, impacting both company integrity and financial outcomes. Conversely, embracing positive ESG practices can enhance overall company performance, underscoring the intrinsic link between sustainable practices and profitability

May 2024 44

LessonsfromESGIntegrationLeaders

Fostering Cultural Transformation

Leaders wield significant influence in promoting ESG integration and instilling sustainability principles throughout their organisations They establish an ethos of environmental and social responsibility that permeates the workforce. When leaders prioritise sustainability, it shapes various aspects of operations, from product development and supply chain management to employee welfare and community engagement

Global corporations such as Heidelberg Materials, Unilever, Patagonia, and Microsoft exemplify the impact of sustainable leadership. Heidelberg Materials will pioneer with net-zero cement and concrete and lead with circular solutions and aim to achieve net zero emissions by 2050 Unilever's CEO, Alan Jope, remains dedicated to its Sustainable Living Plan, pursuing ambitious sustainability targets across its operations Patagonia's founder, Yvon Chouinard, champions environmental activism, demonstrating the compatibility of profitability and environmental advocacy. Microsoft's CEO drives the company ' s investments in renewable energy, aiming for carbon neutrality and fostering innovation in clean technologies.

Strategic Alignment

Comprehensive Due Diligence

Rigorous due diligence lies at the heart of effective ESG integration It’s critical to employ sophisticated analytical frameworks to assess companies' ESG performance, scrutinising factors such as carbon footprint, diversity and inclusion practices, and ethical governance standards. By conducting comprehensive assessments, investors can identify and engage with companies committed to sustainable practices.

Engagement and Advocacy

Beyond passive evaluation, there is a need to actively engage with investee companies to drive positive change Through shareholder engagement, proxy voting, and collaborative initiatives, investors wield their influence to encourage transparency, accountability, and continuous improvement in ESG performance.

Impact Measurement

Successful ESG integration necessitates a strategic alignment between sustainability objectives and investment goals By articulating clear sustainability objectives and embedding them within investment mandates, leaders in ESG integration demonstrate a commitment to generating positive social and environmental outcomes alongside financial returns

Robust impact measurement mechanisms are indispensable for evaluating the efficacy of sustainable investment strategies Leverage sophisticated metrics and frameworks to quantify the social and environmental impact of their investments, enabling stakeholders to track progress, refine strategies, and optimise outcomes over time.

www CXOTechBOT com 45

Sustainability for Long-Term Success

Leadership that transcends profits embodies a commitment to long-term value creation, prioritising the well-being of stakeholders and the planet alongside financial gains Visionary leaders understand that Environmental, Social, and Governance (ESG) factors present not only risks but also opportunities for innovation and growth By championing initiatives aligned with sustainability goals, these leaders foster organisational resilience and success in an ever-evolving landscape

Harnessing AI for Enhanced ESG Integration

The upward trajectory in ESG integration and sustainable practices elevates companies' recognition in sustainability benchmarks, driving investor interest and bolstering stock prices However, assessing ESG performance and making investment decisions in this realm poses significant challenges. Leveraging AI and advanced technologies can assist investors in navigating this complex landscape effectively. the utilisation of cutting-edge technologies like Artificial Intelligence (AI) emerges as a transformative tool, revolutionising ESG decision-making. By harnessing AI's analytical prowess, leaders gain deeper insights into ESG metrics and public sentiment, empowering them to make informed investment choices. Moreover, AI's ability to estimate indirect emissions and forecast future ESG performance elevates the efficacy of sustainability initiatives, paving the way for enhanced environmental stewardship and risk management Through strategic implementation of AI-driven solutions, ESG Integration Leaders demonstrate a commitment to driving positive change and maximising long-term value creation.

Challenges and Opportunities

While the momentum behind sustainable investing continues to swell, it is not without its challenges

From data limitations and standardisation hurdles to greenwashing risks and regulatory complexities, investors grapple with a myriad of obstacles on the path to ESG integration. However, amidst these challenges lie untold opportunities for innovation, collaboration, and impact. By harnessing technology, fostering industry collaboration, and advocating for policy reforms, investors can surmount barriers and unlock new frontiers in sustainable investment excellence.

Final Thoughts

Sustainable investment excellence represents a paradigm shift in the world of finance, reflecting a broader recognition of the intrinsic linkages between financial performance and environmental, social, and governance considerations By drawing insights from leaders in ESG integration and embracing the lessons gleaned from their experiences, investors can navigate the complexities of the modern investment landscape with confidence and purpose. As the momentum behind sustainable investing continues to gather pace, the journey towards a more sustainable future beckons one informed by innovation, collaboration, and a steadfast commitment to positive change

AmitAngra

AmitAngra

"Truesustainableinvestment excellenceliesinstrategic alignmentbetweenESG objectivesandfinancialgoals, fosteringacultureof innovationandresponsibility acrossallfacetsofthe organisation."

May 2024 46

Amit Angra

VicePresidentFinance,HeidelbergCementIndia

Mr Amit Angra is a seasoned corporate finance leader with over two decades of experience, specializing in strategy, mergers and acquisitions, treasury, risk management, and investor relations Armed with a Master of Business Administration and a Gold Medalist distinction, he has consistently demonstrated operational excellence and delivered successful projects throughout his career.

Currently serving as Vice President Finance at HeidelbergCement India, Mr Angra manages a portfolio exceeding US Dollars 800 million annually, leading a multi-disciplinary team. His notable achievements include driving power initiatives that increased green power share to over 35% and implementing cost optimization measures resulting in significant recurring and perpetual savings

With a track record of conducting due diligence for over 50 large to mid-size transactions across various sectors, Mr Angra is recognized for his strong business acumen and negotiation skills He is proficient in financial modelling, research, communication, analytics, and presentation, leveraging advanced tools like Microsoft Office 365, Tableau, and Think Cell.

Prior to his current role, Mr Angra held senior positions at Ernst & Young, where he led transaction advisory services, and at leading industrial groups such as JBM Group and Sandhar Technologies Ltd.

Mr Amit Angra’s extensive experience and expertise make him a valuable asset in driving financial success and strategic growth initiatives

www CXOTechBOT com 47

A AligningInvestments withLifelongGoals

Charting Your Financial Future

couple of years back, a survey found that although 76% of respondents recognized the importance of financial planning for future security, only 27% actively pursued comprehensive financial strategies This distinct contrast reflects a vital opportunity: aligning investments with lifelong goals to ensure every rupee invested actively supports one’s personal and professional aspirations This strategic approach transforms investments from mere financial decisions to powerful tools for realising longterm visions and dreams.

SettingLifelongGoals

The journey to financial alignment starts with an unequivocal understanding of one ' s goals. Whether it's planning for a comfortable retirement, securing your children's educational future, or acquiring a dream home – each objective necessitates a perceptible financial strategy. Research shows that individuals who have a written financial plan experience greater financial stability compared to those without one This fact highlights the foundational importance of clear, actionable planning in achieving financial well-being.

May 2024 48

UnderstandingYourFinancialPosition CreatinganInvestmentPlan

Let’s address a pivotal aspect of strategic planning: financial management The notion that money is a simplistic resource is perhaps an oxymoron That said – it’s crucial to thoroughly assess your financial circumstances to effectively align your resources with your long-term objectives.

Initially, evaluate your current financial status comprehensively. This involves more than a cursory glance at your bank account; it requires a detailed analysis of your income, expenses, assets, and liabilities. Consider this a thorough audit of your financial health

Begin with your income: quantify how much you earn and assess the stability of these earnings Are you on a path towards substantial wealth, or are you managing a more modest budget? With a clear understanding of your income, shift focus to your expenditures It’s essential to know where your money goes each month, even if the expenses are significant

Having set your lifelong goals and gained a comprehensive understanding of your financial situation, it's time to construct an investment plan that can navigate the ebbs and flows of the financial markets Prepare for a dynamic journey that might see you soaring at peaks and, at times, reevaluating decisions.

First, assess your risk tolerance. Do you thrive on adrenaline or do you prefer predictable comfort? Identifying this is crucial in selecting appropriate investment vehicles

Strategic investment is crucial for realising long-term financial goals Historically, equities have yielded an average annual return of approximately 12%, significantly outperforming other asset classes such as bonds and gold This superior performance demonstrates the importance of selecting the right investment types based on personal financial timelines and risk tolerance

Next, examine your assets and liabilities. Assets include valuable possessions like hi l ll tibl Li biliti i t f

Next, consider your investment timeline Is retirement decades away, or are you aiming to achieve financial goals in the near term? This timeline influences whether your i t t h h ld b i

www CXOTechBOT com 49

Diversification is your next step. Avoid concentrating your assets in a single area to prevent significant losses Instead, distribute your investments across diverse asset classes like stocks, bonds, real estate, and perhaps precious metals

Be mindful of fees associated with investing. These can diminish your returns significantly Conduct thorough research, compare various investment options, and stay vigilant about high expense ratios

Regularly monitor your investments. The market's volatility can be unpredictable, necessitating periodic portfolio rebalancing to align with your evolving financial goals.

Remember – creating an investment requires a solid foundation, meticulous planning, and constant vigilance. Equip yourself with the necessary tools, and start building your financial stronghold

NavigatingMarketTrends

Avoid being distracted by sensational headlines or alarming market graphs Patience and perseverance are key in this context

Diversification is a wise tactic By spreading your investments across various sectors, asset classes, and regions, you mitigate the risk of significant losses if one area underperforms

Lastly, do not hesitate to seek professional advice Even if you are confident in your financial acumen, expert guidance can provide invaluable insights and prevent common pitfalls

When continuing on your investment journey, embrace the challenges of navigating market trends Stay informed, remain committed to your goals, and most importantly, enjoy the process.

Having established your long-term goals and devised a strategic investment plan, it's time to address the dynamic nature of market trends. These trends can be elusive and unpredictable, often leaving investors perplexed and reevaluating their strategies

It is essential to remain informed about the latest financial news and developments This does not require incessant monitoring of the stock market but maintaining awareness of significant trends that could influence your investments

Market volatility is a given, akin to the unpredictable nature of a hyperactive cat It is crucial to stay focused and not be swayed by short-term market swings or the pervasive fear of missing out Your investment strategy should remain aligned with your long-term objectives.

Technological advancements have significantly transformed the investment trends Tools such as robo-advisors utilise sophisticated algorithms to offer personalised investment advice. This. in turn, makes sophisticated investing strategies accessible to all. The global robo-advisory market is anticipated to manage assets worth US$2334 00 billion by 2028 The figure reflects the increasing trust and reliance investors place on these platforms.

Technology'sRoleinModernInvesting May 2024 50

MonitoringandAdjustingYour Investments

The financial world is perpetually changing This change is influenced by economic evolutions, interest rates, and geopolitical events Active and regular monitoring of investment portfolio is essential to ensure that it remains aligned with one’s strategic goals. Financial experts recommend conducting at least an annual review to adapt to any significant life or market changes.

FiscalHealthandEmergencyPlanning

Part of aligning investments with goals involves preparing for unforeseen circumstances. An emergency fund is a critical component of any financial plan – it provides a buffer that allows you to handle unexpected expenses without disrupting your investment strategy. Ideally, this fund should cover three to six months of living expenses, ensuring that you are prepared for financial disruptions.

EthicalandSociallyResponsible Investing

In today's socially conscious market, more investors are choosing to align their financial goals with their ethical values. Socially responsible investing (SRI) has seen a substantial increase – assets under management in SRI funds have grown exponentially. These investments allow individuals to contribute to societal and environmental improvements while pursuing financial returns.

While DIY investing has become more accessible, consulting with financial professionals can provide a deeper analysis and more personalised advice, especially for complex portfolios or significant assets.

Financial advisors can offer a level of expertise and oversight that is difficult to match through individual effort alone

Aligninginvestmentswith lifelonggoalstransforms financialdecisionsinto powerfultoolsforrealising dreams.Diligentlycharting thefinancialcoursepropels eachinvestmentdecision towardsone’sdesired future.

Aligning Investments with lifelong goals is no less than a commitment to a future where one’s financial resources effectively support their deepest aspirations This approach requires diligence, foresight, and an ongoing commitment to adapting strategies as life and markets evolve One can ensure that each investment decision propels them closer to their desired future by thoughtfully charting your financial course

ThePathTowardsaFinancially SecureFuture EngagingwithFinancialProfessionals

www CXOTechBOT com 51

Viral

Bhatt Founder-Owner,MoneyMantra

Viral Bhatt, Founder and Owner of Money Mantra, boasts over 17 years of expertise in personal finance and investment He is a qualified financial advisor and esteemed guest speaker on media platforms like CNBC, Zee, Money9, and Free Press Journal Newspaper. Viral is dedicated to ushering his clients towards financial freedom His mission centres on providing tailored financial advice and solutions, covering budgeting, tax efficiency, and investment alignment with future goals With a focus on eradicating financial market anxieties, he cultivates growth-oriented, diversified investment portfolios. Viral, former Mumbai Chapter Chairman for the Advisory Committee for Qualified Financial Advisors, brings a wealth of experience from roles at VP Wealth Management, Karvy Private Wealth, and Bajaj Capital Ltd. His journey reflects a commitment to enriching clients' financial wellness and maximising their wealth.

May 2024 52

SkillzzaJob SimulationProgram