THIS IS A

THIS IS A

Tata Motors buys IVECO: biggest industry merger for over a decade

A GOOD CITIZEN? DOES GEELY’S CITYRAY HAVE URBAN SKILLS AND APPEAL?

16 / IVECO AND TATA

MERGER: WHAT’S IN IT FOR FLEETS?

T&FME deep dives into the biggest CV merger in over a decade.

NEWS

06 / NEWS FROM THE MONTH

EGME targets fleets that want to switch to EVs.

LAUNCHES

10 / THE DEEPAL 500

The new eSUV drives into market with two major EV variants.

TEST DRIVE

12 / MOVE THE CROWD

T&FME test drives the new Cityray, a car meant to impress the insta-crowd.

SPECIAL FEATURE 20 / CLEARING THE TRAFFIC

A Traffic Congestion Study by RoadSafetyUAE and Al Wathba Insurance reveals UAE Motorists’ frustrations and behaviours behind the wheel.

FEATURE

24 / A NEW OPTION FOR KSA

FAMCO on its exciting new partnership with Ashok Leyland in Saudi Arabia.

FEATURE

28 / CONNECTING A CONTINENT

A look at how African fleets are beginning their own connected fleet journeys.

As a denizen of Dubai, I have come to understand the value of booking a cab on my favourite mobility apps, but I can’t help, as a fleet writer, feel embarrassed by the level of knowledge our drivers have of their local cities. For the millions of people that flock to the city and have to rely on their professionalism we are falling far short of what they should be expecting.

There was a time, not too long ago, when you could hop into a Dubai taxi, mumble the name of a mall, landmark or obscure building, and be whisked away with barely a pause. The driver knew the route. Knew the area. Knew the city. That era, it seems, is rapidly disappearing in the rear-view mirror.

In recent years, we’ve seen a growing trend that’s difficult to ignore: taxi drivers who rely almost entirely on GPS apps like Google Maps and Waze — not as a backup, but as their only guide. While digital navigation has transformed how we move through cities, its overuse has begun to erode one of the cornerstones of professional driving: local knowledge.

Partly this is because we lost a generation of veteran drivers post-Expo 2020, and partly because the drivers that replaced them have not had to build their own internal map of the city. I do sympathise that with the age of digital mobility there is now greater scrutiny on the drivers but what cost does the customer have to pay?

It’s not uncommon now for passengers

to find themselves instructing drivers on which exit to take or pointing out that the destination is actually on the other side of Sheikh Zayed Road. Worse still, when these navigation systems make mistakes — as they sometimes do — it’s the customer who pays the price, be it in time, frustration, or even safety. I am sure I am not the only one to have been thrown sideways when my driver has almost missed his interchange.

This decline in navigational confidence also points to a larger concern. As fleets and operators across the region embrace new technologies and automation, the importance of foundational skills must not be forgotten.

A taxi driver by definition is not merely a fellow passenger (free to call whoever they like! As they often are...) — they are meant to be our trusted guides, a focused navigator through the chaos of city life. When that trust is eroded, so too is the quality of service.

It may be time for regulators and fleet operators to reconsider how we train and evaluate drivers. Familiarity with key routes, urban geography, and alternative paths should still be a core part of the profession. Smart tech is a valuable tool — but when it becomes a crutch, it threatens to compromise the very standards it was meant to elevate.

Dubai is a world-class city with a worldclass transport network. Let’s make sure the people behind the wheel are just as prepared as the tech in their dashboards.

STEPHEN WHITE HEAD OF CONTENT, MOBILITY & CAPITAL ASSETS

STEPHEN.WHITE@CPITRADEMEDIA.COM

GROUP MANAGING DIRECTOR RAZ ISLAM raz.islam@cpitrademedia.com

+971 4 375 5471

DIRECTOR OF FINANCE & BUSINESS OPERATIONS

SHIYAS KAREEM shiyas.kareem@cpitrademedia.com +971 4 375 5474

PUBLISHING DIRECTOR ANDY PITOIS andy.pitois@cpitrademedia.com +971 4 375 5473

EDITORIAL

HEAD OF CONTENT, MOBILITY & CAPITAL ASSETS

STEPHEN WHITE stephen.white@cpitrademedia.com +971 58 584 5818

ADVERTISING

SALES MANAGER BRIAN FERNANDES brian.fernandes@cpitrademedia.com +971 4 375 5479

STUDIO

ART DIRECTOR SIMON COBON simon.cobon@cpitrademedia.com

DESIGNER PERCIVAL MANALAYSAY percival.manalaysay@cpitrademedia.com

PHOTOGRAPHER MAKSYM PORIECHKIN maksym.poriechkin@cpitrademedia.com

CIRCULATION & PRODUCTION

DIRECTOR OF MARKETING & MEDIA OPERATIONS

PHINSON MATHEW GEORGE phinson.george@cpitrademedia.com

PRODUCTION & IT SPECIALIST JARRIS PEDROSO jarris.pedroso@cpitrademedia.com

MARKETING

MARKETING & EVENTS EXECUTIVE LAKSHMY MANOJ lakshmy.manoj@cpitrademedia.com

SOCIAL MEDIA EXECUTIVE FRANZIL DIAS franzil.dias@cpitrademedia.com

WEB DEVELOPMENT

SENIOR DIGITAL MANAGER ABDUL BAEIS abdul.baeis@cpitrademedia.com

WEB DEVELOPER UMAIR KHAN umair.khan@cpitrademedia.com

FINANCE

CREDIT CONTROL EXECUTIVE CAMERON CARDOZO cameron.cardozo@cpitrademedia.com +971 4 375 5499

FOUNDER DOMINIC DE SOUSA (1959-2015)

The publisher of this magazine has made every effort to ensure the content is accurate on the date of publication. The opinions and views expressed in the articles do not necessarily reflect the publisher and editor. The published material, adverts, editorials and all other content are published

CPI Trade Media. PO Box 13700, Dubai, UAE. +971 4 375 5470 cpitrademedia.com © Copyright 2025. All

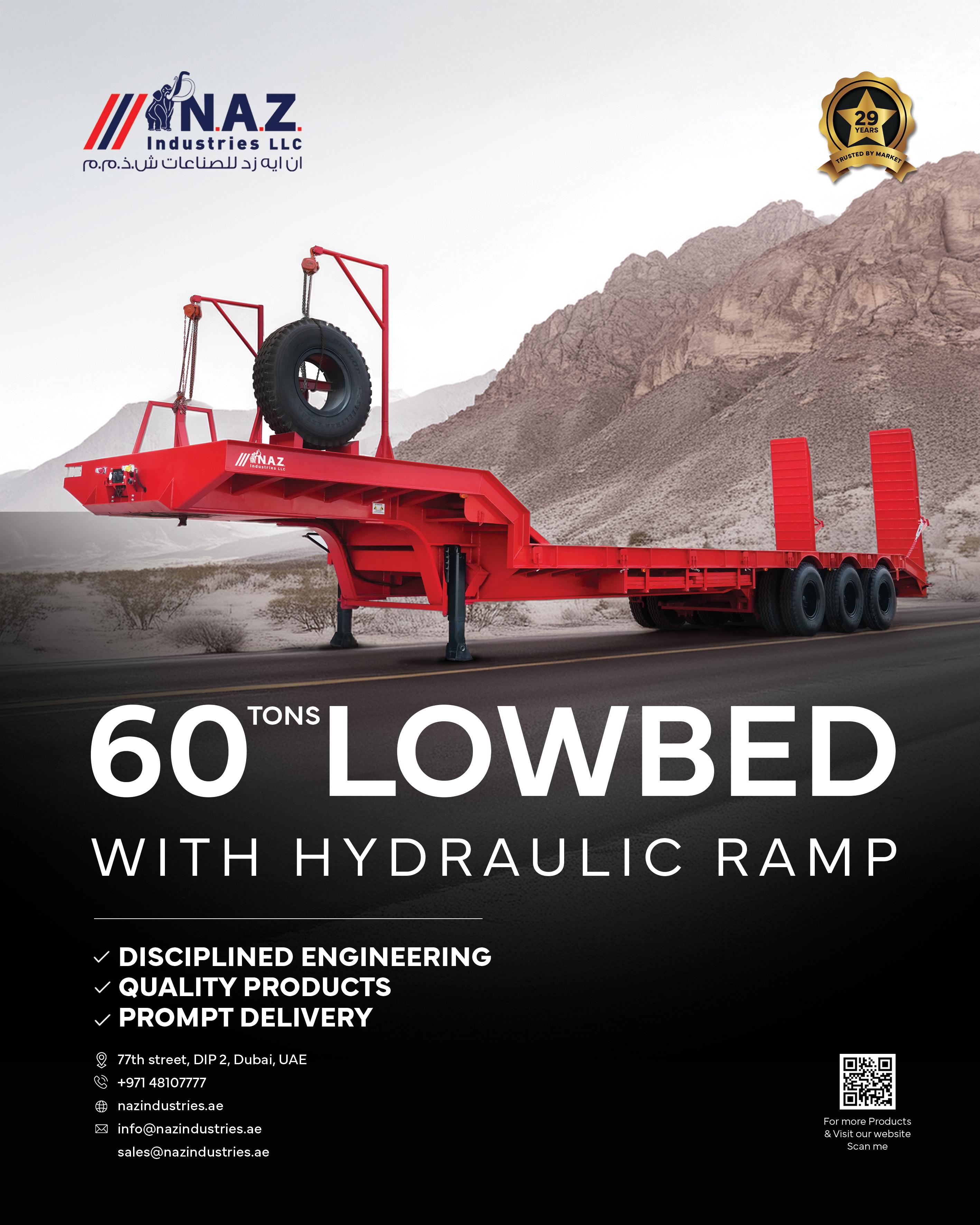

features – engineered with purpose to excel in the most

FLEET

WeRide Robotaxi secures first autonomous driving permit in Saudi Arabia

CARS

Chery UAE showcases TIGGO 9’s top-tier crash test performance

FLEET

SelfDrive Mobility launches zero-interest ‘Rent to Own’ car service in the UAE

LOGISTICS

Dubai South unveils new flexible multiuser facilities to attract logistics sector

CARS

Nissan to export Chinese-built EVs to the Middle East from 2026, claims report

FLEET

Why Tata Motors’ acquisition of Iveco is a game-changer for the global CV market – and the Middle East T&FME takes a deep-dive into the Indian giant's move to become a dominant, global player. how might the Middle East be impacted?

FEATURE

Uber takes aim at GigSisters in Saudi Arabia

It has been seven years since women in Saudi Arabia were granted the right to drive, and Uber says it is reaffirming its commitment to empowering women by launching its innovative ‘Women Drivers’ product and the GigSister Community

FLEET

Test Drive: 2025 Mitsubishi Outlander

The latest Outlander makes a confident impression and could be a fleet-friendly option

FEATURE

Recruitment report: Bridging the gap in construction and logistics

The surge in off-plan property sales — spurred by investor confidence and strong demand from end-users — has led to a subsequent spike in project approvals and construction contracts

LOGISTICS

Emirates SkyCargo doubles down on providing exceptional customer experience

As the industry navigates evolving trade patterns, commitment to an exceptional customer experience has never been more important

“WE’VE LAID THE FOUNDATION FOR A SCALABLE, SMART ECOSYSTEM FOR THE GROWTH AND ADOPTION OF COMMERCIALLY OPERATED ELECTRIC FLEETS,” SAYS HANY TAWFIK

E-TRUCKS

Emirates Global Motor Electric (EGME), a subsidiary of Al Fahim Group unveiled three new electric commercial vehicle models at Mobility Live Middle East 2025.

The expanded lineup—officially launching on the opening day of the show—signals the beginning of Phase 2 of EGME’s ambitious regional growth strategy and cements its role as a key driver of electric commercial vehicle adoption in the Middle East.

Since launching operations, EGME has spearheaded the

deployment of electric trucks in the UAE, starting with two models: the SANY Heavy Duty Truck (6x4, 350 kWh) and the Light Duty Truck (105 kWh). Over the past two years, more than 40 of these vehicles have been integrated into the fleets of leading logistics and transport companies such as DSV, Einride, Emirates Logistics, DB Schenker, Kuehne + Nagel, Red Lines International, Massar Solutions, and AVL General Land Transport.

The three new electric truck models introduced at the show are the SANY Electric 8x4 Dump

Truck – 25 CBM load capacity, designed for site, quarry, and crusher operations. Alternatively, the SANY Electric 4x2 Chassis (12-tonne payload) is adaptable for municipal vehicles, mid-mile logistics, and food and beverage distribution. Finally, the SANY Electric 6x4 Tractor Head (588 kWh) – engineered for long-range container and materials transport

“Over the past two years, we’ve not only proven that electric trucks can operate reliably in the UAE, but we’ve also laid the foundation for a

scalable, smart ecosystem for the growth and adoption of commercially operated electric fleets – across multiple industry sectors,” said Hany Tawfik, General Manager of EGME.

The visibility of SANY electric trucks on UAE roads is growing rapidly, with the brand becoming a go-to solution across various sectors, including container transport, last-mile delivery, and aggregate hauling. Their ability to perform under the region’s harsh climate and terrain has played a key role in their success.

BREAKING NEWS: TATA MOTORS HAS MOVED A STEP CLOSER TO BECOMING A GLOBAL POWERHOUSE WITH A $4.3BN BID TO BUY IVECO

Tata Motors has officially entered the Egyptian commercial vehicle market with a diverse lineup of trucks and buses launched in partnership with MM Group for Industry and International Trade (MTI), one of Egypt’s largest distribution and service networks.

The new vehicle portfolio includes the Tata Xenon, Ultra T.7, Ultra T.9, Prima 3328.K, Prima 4438.S, Prima 6038.S, and LP 613 bus, covering a comprehensive range from pickups to heavy-duty trucks and mass mobility solutions.

The launch marks a significant step in Tata Motors’ strategic expansion into Egypt, tapping into a market experiencing rapid infrastructure development, increased urbanisation, and a rising demand for reliable commercial transport solutions.

“Egypt is a pivotal market for Tata Motors,” said Asif Shamim, Head of International Business at Tata Motors Commercial Vehicles. “Our vehicles have been developed with a focus on performance, fuel efficiency, and uptime to support business productivity and profitability. We’re confident in creating long-term value for Egyptian fleet operators.”

MTI, known for its deep market reach and customer-centric operations, will support the rollout with seven strategically located service touchpoints offering customers quick access to spare parts, maintenance, and warranty support.

Khaled Mahmoud, CEO of MTI, added: “We’re proud to partner with Tata Motors to deliver world-class CVs.”

truckandfleetme.com

DHL Express UAE and Meydan Free Zone have entered into a strategic partnership which will allow businesses registered in the free zone to gain access to DHL’s global logistics network spanning over 220 countries and territories, with preferential shipping rates and dedicated logistics assistance.

The agreement was signed at the Meydan Free Zone headquarters by Mahmoud Haj Hussein, Managing Director of DHL Express UAE, and Mohammad Bin Humaidan Al Falasi, CPA, Director of Free Zone Licensing at Meydan Free Zone.

The collaboration seeks to reduce operational friction by offering faster customs clearance, automated tracking, and scalable solutions for international shipping. These benefits will streamline cross-border trade and enable businesses to expand into

global markets more effectively.

According to both parties, the agreement is expected to be a catalyst for growth among UAE-based SMEs, particularly in high-opportunity sectors such as e-commerce, manufacturing, healthcare, and retail. E-commerce enterprises in particular will benefit from specialised solutions that will help improve fulfilment and return logistics, they added in a statement.

Mahmoud Haj Hussein, Managing Director of DHL Express UAE, said, “We are proud to be a part of the UAE’s supportive ecosystem for the SMEs. Our partnership with Meydan Free Zone enables us to deliver reliable, scalable, and sector-specific logistics solutions that help entrepreneurs expand globally with confidence.

Al Tayer Motors, the importerdistributor of Ford Trucks in the UAE, has been honoured with the prestigious Champions Award 2024, marking the seventh time the company has received this global accolade for excellence across Sales, AfterSales Services, and Marketing. It remains the only distributor in

the Middle East to have won the award. The win comes on the back of a strong performance in 2024, with Al Tayer Motors reporting a 40% growth in the construction sector and a 24% increase in logistics segment sales. The figures underscore the brand’s growing market presence in the UAE’s heavyduty commercial vehicles space.

Ashok Khanna, CEO, Al Tayer Motors, said: “Winning the Champions Award from Ford Trucks for the seventh time is incredible. This tremendous achievement highlights the unwavering dedication and excellence of our entire team in delivering top-notch services to our customers.”

He added: “As a key player in this dynamic region, we are at the forefront of providing efficient and cost-effective transportation solutions, ensuring smooth operations for major industries. We are thrilled to be leading the charge in this ever-evolving landscape.”

In 2024, Al Tayer Motors launched the F-Line series and 34-ton 6x4 chassis models, which received strong customer feedback. The dealership continues to support its offerings with competitive aftersales support, including warranties of up to five years.

Inter Emirates Motors (IEM), the exclusive distributor of MG cars in the UAE, has officially inaugurated its flagship showroom in Abu Dhabi, representing a significant milestone in MG Motor’s strategic growth within the Emirates.

Located in Rawdhat, this state-of-the-art showroom covers

approximately 2,000 sqm and can display up to 22 vehicles from MG’s latest model range.

The facility features a dedicated Electric Vehicle (EV) zone, highlighting MG’s commitment to sustainable mobility. It also includes a service reception designed for both new and pre-owned MG vehicles, ensuring an exceptional

and tailored customer experience backed by premium aftersales care.

The Abu Dhabi showroom inauguration is part of MG and IEM’s wider expansion across the UAE. A new 3S facility is scheduled to open in Musaffah, Abu Dhabi, in Q3 2025, along with another showroom in Sharjah during the same quarter. Additionally, a mega 3S facility on Sheikh Zayed Road in Dubai is planned to open in Q1 2026, significantly strengthening the brand’s presence nationwide.

Customers visiting the showroom can explore MG’s diverse lineup, including flagship SUVs and sedans such as the MG RX9 seven-seater, the premium MG 7, the sporty MG GT, and the popular MG 5 sedan.

MANUFACTURERS

BMW Group Middle East has reported a supercharged performance in the first half of 2025, achieving a 15.3% increase in BMW sales compared to the same period in 2024.

This growth underlines the UAE’s position as the German firm’s leading market in the Middle East, with strong contributions also coming from MINI, BMW M, and BMW Motorrad, said BMW Group ME.

The premium automotive brand witnessed impressive

momentum across its product portfolio particularly in highperformance models.

While BMW 7 Series remains the flagship in the BMW premium segment, the BMW X7 experienced a strong 18.6% increase in the first six months of the year. BMW M models gained significant traction, growing by 31.6% in the same period – in addition, and notably, M High-Performance models experienced exceptional growth of 46%, underscoring the region’s strong appetite

for high-performance driving experiences.

The BMW 5 Series also delivered a strong performance, recording a total 23.8% yearto-date increase as of June 2025 – solidifying its position as a key pillar in BMW’s premium sedan portfolio.

BMW Middle East achieved outstanding growth in corporate and special sales with an increase of 38.5% in the first half of the year compared to the same period from the previous year.

Rooted deeply in motorsport heritage, NISMO has consistently captivated driving enthusiasts across the Middle East. Specifically engineered for the region, the new Patrol NISMO merges the rugged, off-road capabilities synonymous with Patrol vehicles with refined, track-inspired performance. This unique blend of power, precision, and presence directly caters to the expectations of UAE motorists. CUSTOMERS GET FIRST LOOK AT

Al Masaood Automobiles, the authorised distributor for Nissan in Abu Dhabi, Al Ain, and the Al Dhafra Region, hosted an exclusive customer preview last week, becoming the first dealership globally to showcase the 2026 Nissan Patrol NISMO in its showrooms immediately after the model’s official world premiere in the UAE. Held simultaneously at the Abu Dhabi and Al Ain showrooms, the preview provided customers with early access to two highly anticipated Nissan performance icons — the 2026 Patrol NISMO and Z NISMO. The event generated significant excitement, resulting in a remarkable fivefold increase in showroom footfall and a 150% rise in Patrol NISMO bookings, underscoring the immense regional appeal of the NISMO brand.

GEELY AND AGMC LAUNCH OF THE BRAND’S FLAGSHIP SUV IN THE UAE / DEEPAL S05 ESUV DRIVES INTO MARKET WITH TWO MAJOR EV VARIANTS

900KM COMBINED RANGE

TWO MODELS ARRIVE INCLUDING COMBINED REEV THAT TAKES RANGE TO 900KM

Al Tayer Motors has launched the new DEEPAL S05, the latest intelligent electric SUV from Changan’s EV brand DEEPAL, marking the brand’s second model entry into the UAE market following the debut of the S07 earlier this year.

Positioned as a compact, connected, and affordable electric SUV, the DEEPAL S05 blends a futuristic design, advanced digital cockpit features, and dual powertrain flexibility.

“We are delighted to unveil DEEPAL’s newest model within a span of just four months,” said Ashok Khanna, Chief Executive

Officer of Al Tayer Motors. “This is a testament to the significant interest and enthusiasm the brand has garnered since its introduction in the UAE. I am confident that the S05 will further enhance the momentum established by the S07.”

Customers can now purchase the DEEPAL S05 via the Al Tayer Motors website, mobile app, or by calling 800 MOTORS to book test drives or showroom visits.

The DEEPAL S05 will be available in two versions: a fully electric (BEV) model offering a range of up to 460 km, and a range-extended

electric vehicle (REEV) with a 160 km electric range and a fuel extender delivering a combined range of over 900 km.

Mr Xiao, General Manager of Changan Automobile’s Middle East and Africa Division, added: “With its dual-power flexibility, sleek design, and connected cockpit, the S05 is built for UAE customers who want both advanced technology and practical style.”

Built on Changan’s dedicated Platform Architecture (CPA), the S05 combines rear-wheel drive agility with futuristic aesthetics and smart features. Highlights

include frameless windows, hidden door handles, and LED ‘Smart Flying Wing’ headlights with a luminous eye signature.

Inside, the SUV offers a high-tech cabin equipped with a 15.4-inch central touchscreen, AR-HUD (augmented reality head-up display), wireless phone charging, a panoramic sunroof, and seats designed for enhanced comfort with ventilation and electric adjustment.

Powered by a 160 kW (REEV) or 175 kW (BEV) rear motor, the vehicle offers strong performance paired with nextgen safety tech such as lane

DUAL-POWER VERSATILITY

Combining dual-power versatility, a modern design, and a connected cockpit, the S05 is designed to meet the needs of UAE customers seeking advanced technology with everyday practicality and style.

CHARGED UP INTERIOR DESIGN

The SUV features a high-tech interior that includes a 15.4-inch central touchscreen, an augmented reality head-up display, wireless phone charging, a panoramic sunroof, and ergonomically designed seats with electric adjustment and ventilation for added comfort.

change assist, blind spot monitoring, and adaptive cruise control. Rapid charging delivers 30–80% charge in 15–20 minutes, depending on the variant. With robust digital connectivity including app-based control, voice command interaction, and over-the-air (OTA) upgrades, the DEEPAL S05

SPECIFICATIONS

Model BEV

Range 460km

delivers a seamless and smart driving experience for UAE motorists. The launch further cements Al Tayer Motors’ commitment to nextgeneration mobility solutions and its strategic partnership with Changan’s DEEPAL brand, as the UAE continues to embrace electrified transport options.

DR ANDREAS SCHAAF, GROUP DIRECTOR AT ALBATHA AUTOMOTIVE GROUP, CLAIMS LAUNCH, “MARKS A BOLD NEW CHAPTER IN THE PREMIUM SUV SPACE”

AGMC, the official distributor of Geely Auto in the UAE, has announced the launch of the New Monjaro, the brand’s flagship SUV, at a dedicated event hosted at Geely’s new showroom on Sheikh Zayed Road. Representing the next evolution in intelligent luxury, the New Monjaro redefines what a premium SUV can be, with groundbreaking technology, refined design, and exceptional ride comfort, claims company head Dr Andreas Schaaf, Group Director, AlBatha Automotive Group.

“The launch of the New Monjaro from Geely marks a bold new chapter in the premium SUV space,” he explained.

The 2026 Monjaro builds upon the foundations laid by its 2023 predecessor, introducing a suite of high-tech enhancements that elevate every aspect of the driving experience. At the heart of its performance upgrades is a new CCD adaptive suspension system, which reads the road 200 times per second and automatically adjusts damping to absorb shocks in real time. The result is a remarkably smooth and composed ride, even on the harshest terrain.

Under the bonnet, the New Monjaro

retains its powerful 2.0L turbocharged engine, paired with an 8-speed Aisin automatic transmission, delivering 238 HP, 350 Nm of torque, and acceleration from 0 to 100 km/h in just 8.4 seconds. Built on the Compact Modular Architecture (CMA) platform, the vehicle promises strong structural integrity, advanced handling dynamics, and premium comfort. Inside the cabin, Geely has introduced a refined and immersive environment that balances intelligent design with indulgent luxury. A 12-speaker Infinity sound system with built-in headrest speakers, ventilated massage seats, and lie-flat rear seating turn every journey into a first-class experience. Improved sound insulation and a lounge-like interior design heighten the sense of serenity and space.

SPECIFICATIONS

Charging Time 15mins (30–80% SoC)

Model REEV

Range 160 km electric-only (900+ km combined)

Charging Time 20mins (30–80% SoC)

12.3IN

IMAX-LIKE SCREEN

Geely’s compact challenger makes a confident case as an urban SUV

It’s not every day you begin a test drive with an iced-latte and a curated Instagram moment —but then again, the Geely CityRay isn’t aiming for ordinary. The review kicked off at Geely’s flagship showroom, a sleek space where high-polish metal meets lifestyle branding. At the heart of it sits a café that’s less dealership pit stop and more influencer haven — a space that smacked of soft jazz, social media influencers glaring happily into their camera lenses, and the unmistakable aroma of surprisingly tasty coffee.

This space, buzzing with young creatives, brand enthusiasts, and the unmistakable aroma of specialty brews, sets the tone for everything Geely wants the CityRay to represent: urban

sophistication, digital-first sensibility, and design that’s as social as it is smart. It was an ideal backdrop to collect the keys and hit the road.

It might sound like a lifestyle launchpad, but this carefully created atmosphere by AGMC’s interior designers reflect a clear intention for the CityRay itself — a car built for urban life — not just navigating it, but embodying it. And from the moment we took the keys, it was obvious that this compact SUV is targeted at drivers who expect more from their cars than just horsepower and boot space.

Possibly a disappointment for the Insta crowd, the CityRay is a car of subtle black accents and gloss black roofs — enough to draw glances without shouting for attention.

The CityRay feels engineered for today’s digital-first driver”

The front fascia is dominated by Geely’s signature expanding cosmos grille, framed by striking LED headlamps and DRLs that give the CityRay a modern, alert stance. But then that’s modern car design for you.

The cabin immediately impresses with a clean, minimalist layout. The soft-touch materials, contrast stitching, and piano black detailing feel far more upmarket than expected at this level. The large 12.3-inch infotainment screen is central to the dash — both literally and figuratively —with crisp graphics, fast response times, and seamless smartphone integration. It’s the kind of interface that feels instantly familiar to a tech-native generation. Nothing too avant guarde here. I think we call it ‘mid’ on the socials.

Nimble, responsive, and balanced

Over the three-day test, we put the CityRay through a mix of city commuting, latenight highway runs, and a few stretches of uneven suburban tarmac. Powered by a 1.5L turbocharged engine paired with a 7-speed DCT, the CityRay won’t be breaking speed records—but that’s not the point. What it offers instead is smooth power delivery, impressive torque at lower speeds, and refined gear shifts that keep the drive stress-free.

In traffic, the CityRay’s light steering and compact footprint made it incredibly easy to manoeuvre. Parking sensors and a 360-degree camera setup — standard on our test unit —turned even the tightest

city centre parking into a breeze. On the highway, it remained composed, with excellent road noise insulation and cruise control that made longer stints a pleasure.

One area that stands out on paper is fuel efficiency. Over our varied routes, the CityRay is supposed to average just under 6.5L/100km, placing it firmly in economical territory for a car with this level of equipment and comfort.

Despite its city-friendly size, the CityRay pleasingly doesn’t compromise on space. The front seats are well-contoured and supportive, with generous legroom and head clearance. The rear offers surprisingly good room for passengers — three adults can fit across the back row without complaints. And with the rear seats folded flat, the boot space expands enough to comfortably fit a weekend’s worth of luggage or even bulky trade show equipment.

We particularly appreciated the clever storage touches — wireless charging, multiple USB-C ports, and a configurable centre console that includes an under-armrest cubby spacious enough to stow a camera kit or tablet.

Designed for digital lifestyles

This is where the CityRay really shines. Geely has clearly built this car around the digitally connected lifestyle. The voice control system (with support for Arabic and English) was responsive and genuinely useful for changing music, adjusting the AC, or navigating without taking our hands off the wheel. The infotainment system also supports over-the-air (OTA) updates—a rare feature in this segment—and smart app integration for vehicle diagnostics, remote lock/unlock, and climate pre-conditioning.

A fully digital instrument cluster rounds off the tech-forward feel, with customisable views for navigation, media, and driver assistance.

A fresh take for fleets?

The CityRay’s image-driven personality may seem like a natural fit for personal buyers, but there’s genuine fleet potential here too — particularly for executive staff cars, ride-hailing fleets, or even compact delivery solutions where comfort and efficiency matter.

With competitive pricing, low fuel consumption, a stylish but non-flashy presence, and a strong warranty package from Geely’s regional distributor, the CityRay is shaping up as a smart, futureforward option in the compact SUV market.

For car rental providers in Dubai, the CityRay offers an attractive mix of features that tick both customer satisfaction and operational efficiency boxes. Its sleek design and premium-feel interior make it an attractive option for renters who want more than just basic mobility—especially tourists or business travellers looking for something modern and connected.

From a fleet management perspective, the CityRay’s strong fuel economy, low maintenance profile, and comprehensive safety suite help reduce total cost of ownership. The smart interior layout, intuitive infotainment, and generous boot space also make it ideal for short-term rentals where versatility and comfort are key selling points. And with Dubai’s emphasis on connected, tech-forward living, the CityRay’s digital ecosystem — including OTA updates and smartphone integration — feels completely in step with what rental customers now expect.

The cabin immediately impresses with a clean, minimalist layout”

Despite its size, the CityRay comes loaded with driver assistance features typically found in higher segments. Standard equipment includes Adaptive Cruise Control, Lane Keep Assist, Blind Spot Detection, Rear Cross Traffic Alert, and Front Collision Warning with Automatic Emergency Braking. Over our test, these systems performed with reassuring consistency, especially in stop-and-go traffic scenarios where fatigue can set in quickly. It’s the kind of support that not only boosts safety but also reduces driver stress in dense urban environments.

Thanks to its manageable footprint, the CityRay is easy to turn around quickly between hires, while its quality finish helps elevate the perception of any rental fleet it joins. In short, it’s a smart, stylish workhorse with broad customer appeal—exactly what rental operators need in a competitive, service-driven market like Dubai.

Verdict: A compact SUV that gets the big picture

The CityRay isn’t trying to be everything to everyone — but for urban drivers looking for a stylish, connected, and efficient compact SUV, it ticks all the right boxes. It’s confident without being overbearing, well-equipped without being overdesigned, and — most importantly — it feels built for the way people live and drive today. Shame it doesn’t come with a selfie camera.

Why Tata Motors’ acquisition of Iveco is a game-changer for the global CV marketand the Middle East

n a stunning move that resets the global commercial vehicle landscape, Tata Motors has announced its intent to acquire European heavyweight IVECO Group

The agreement will see Tata Motors acquire 100% of IVECO’s common shares — following the divestment of its defence business — via its wholly owned subsidiary, TML CV Holdings PTE LTD or a new Dutch-incorporated entity.

The transaction is backed by committed financing and already has the unanimous support of IVECO’s Board of Directors, which has recommended the offer to shareholders, the firms said in a shared announcement released as T&FME went to press.

The deal values IVECO at €14.1 per share (excluding dividends from the defence business sale) and represents a 34%-41% premium over the pre-announcement share price. Major shareholder Exor

Together, we are shaping a resilient and agile enterprise”

N.V., which holds over 27% of IVECO’s shares and 43% of its voting rights, has pledged to support the offer.

The merger, expected to close in the first half of 2026, is contingent on regulatory approvals and the completion of IVECO’s defence business divestiture, scheduled by 31 March 2026.

Upon completion, the new entity will boast combined annual revenues of around €22 billion and global unit sales of approximately 540,000 vehicles.

Leaders from both companies expressed strong alignment in strategic goals. Tata Motors Chairman Natarajan Chandrasekaran said the deal enables the new group to compete on a truly global scale, with dual strategic bases in India and Europe. IVECO Chair Suzanne Heywood added that the partnership enhances prospects for long-term industrial and employment security.

“This is a logical next step following the demerger of the Tata Motors Commercial Vehicle business and will allow the combined group to compete on a truly global basis with two strategic home markets in India and Europe,” said Natarajan Chandrasekaran, Chairman of Tata Motors.

“The combined group’s complementary businesses and greater reach will enhance our ability to invest boldly. I look forward to securing the necessary approvals and concluding the transaction in the coming months.”

The acquisition will preserve both companies’ current footprints and brands. IVECO’s Turin headquarters will be maintained, and no job cuts or factory closures are planned as a result of the transaction.

“We are proud to announce this strategically significant combination, which brings together two businesses with a shared vision for sustainable mobility,” said Suzanne Heywood, Chair of IVECO Group. “Moreover, the reinforced prospects of the new combination are strongly positive in terms of the security of employment and industrial footprint of IVECO Group as a whole.”

Olof Persson, CEO of IVECO Group added: “By joining forces with Tata Motors, we are unlocking new potential to further enhance our industrial capabilities, accelerate innovation in zero-emission transport, and expand our reach in key global markets. This combination will allow us to better serve our customers with a broader, more advanced product portfolio and deliver long-term value to all stakeholders.”

With a highly complementary product range and minimal geographical overlap, the combined company is set to become a powerful player in the global commercial vehicle sector — poised to drive innovation in zero-emission transport and sustainable mobility.

“This combination is a strategic leap

The merger of the two companies will boast combined annual revenues of around €22 billion and global unit sales of approximately 540,000 vehicles.

We are unlocking new avenues for operational excellence”

forward in our ambition to build a futureready commercial vehicle ecosystem. By integrating the strengths of both organisations we are unlocking new avenues for operational excellence, product innovation and customer-centric solutions.

“This partnership not only enhances our ability to serve diverse mobility needs across markets, but also reinforces our commitment to delivering sustainable transport solutions that are aligned with global megatrends,” said Persson.

“Together, we are shaping a resilient and agile enterprise, equipped to lead in times of transformative change.”

Tata Motors’ planned acquisition of the Italian company marks one of the most significant consolidations in the global commercial vehicle (CV) market for over a decade. Valued at €3.8 billion and due to complete in 2026, the all-cash deal is more than a financial transaction — it’s a strategic leap toward creating a globally integrated, future-ready CV powerhouse.

This acquisition comes at a time when the CV industry is under mounting pressure to decarbonise, digitise, and localise production. By joining forces, Tata Motors and IVECO — two players with strong regional identities but limited global crossover — can now achieve scale in product development, alternative powertrain deployment, and global supply chain efficiencies. Tata Motors’ earlier demerger of its commercial vehicle operations from its passenger car business set the stage for this move, giving it the autonomy and agility needed for international expansion.

IVECO, meanwhile, had recently completed its own spin-out from CNH Industrial, allowing it to operate independently — and now, be integrated more seamlessly into a larger industrial group.

The logic behind the timing is sound: with the rapid shift towards

zero-emission transport, autonomous driving, and integrated logistics solutions, both OEMs needed scale and reach. Together, they can share R&D costs, unify platforms, and leverage supplier relationships across a broader portfolio.

The combined company will draw roughly 50% of its revenue from Europe, 35% from India, and 15% from the Americas, with growing influence in Africa and

Asia. This distribution speaks to the companies’ complementary geographies — Tata with its dominant Indian base and IVECO with deep European roots.

Unlike previous mergers plagued by overlap and internal competition, this deal avoids cannibalisation and fosters synergy, claim both parties.

It’s a similar logic to recent automotive alliances, such as Volvo’s strategic collaborations in electrification or Daimler Truck’s platform consolidation. However,

The prospects of the new combination are strongly positive”

what sets Tata-IVECO apart is the emerging market knowhow and experience, and a focus on building a resilient industrial base across regions that are often underserved in terms of advanced CV technologies.

For fleet operators, governments, and end-users, the implications are profound. Expect a broader range of vehicles — diesel, gas (where IVECO is arguably the industry leader), electric, and potentially hydrogen

Unlike other recent mergers in the industry, the deal should see Tata and Iveco bring together their emerging market knowhow and experience with a focus on building a resilient industrial base across regions that are often underserved in terms of advanced CV technologies.

— delivered through shared distribution and service networks. IVECO has been an early mover in natural gas, electric, and hydrogen technologies in Europe. Tata Motors has invested in electric buses and trucks in India. Together, they could scale their clean mobility technologies for Middle Eastern cities and fleets — especially as countries like the UAE and Saudi Arabia push toward net-zero targets. The move could potentially accelerate the development of next-gen light commercial vehicles and

This combination is a strategic leap forward in our ambition”

heavy-duty trucks, especially in pricesensitive and regulation-tightening markets.

The Middle East has seen an influx of Chinese brands like JAC, Foton, and FAW, offering affordable CVs with improving aftersales. The Tata-IVECO combination may become a credible value-oriented counterweight to these players. Government operators and large logistics providers in the Middle East often favour suppliers with global credentials and local service capabilities.

1. Greater Pressure on European OEMs

Rivals like Volvo Trucks, Daimler Truck and MAN, will be watching the merger closely. Iveco was traditionally seen as a mid-tier player in Europe, but with the backing of Tata Motors’ capital, supply chain muscle, and emerging market footprint,means a more formidable competitor.

Threat to market share:

Fleets looking for affordable, sustainable, and reliable vehicles may increasingly consider the combining portfolio, especially a it gains scale to compete on price and tech.

Acceleration of partnerships: European OEMs may look to deepen or accelerate collaborations — particularly in EV and autonomous systems—to avoid losing ground.

2. Heightened Competition in Emerging Markets

Brands with a strong presence in Asia, the Middle East, and Africa — such as Ashok Leyland, JAC Motors, Foton, and FAW — could face increased pressure.

Expanded product reach:

Tata Motors already has an established footprint in India, Africa, and parts of the Middle East. Iveco’s engineering and product breadth could strengthen its competitiveness in medium and heavyduty truck segments in these regions.

Localisation advantage: With production bases in both India and Europe, the new entity could offer customised models for local operating conditions and regulatory frameworks more quickly and efficiently than some rivals.

3. Response from Chinese Manufacturers

Chinese CV makers like BYD, Dongfeng, and Geely Commercial Vehicles are aggressively expanding into overseas markets with electric and hybrid offerings.

Technology race intensifies: Iveco has been developing zero-emission vehicles across both light and heavy-duty categories, including hydrogen projects. Tata Motors brings its EV learnings from India. Their combination could provide a counterweight to Chinese dominance in affordable electric commercial vehicles.

Strategic urgency: The deal may prompt Chinese brands to fast-track acquisitions or forge alliances to boost their presence in Europe and South Asia.

The merger also bolsters IVECO’s FPT Industrial powertrain business, potentially unlocking new cross-platform efficiencies and driving down cost per unit for electrified components.

In short, Tata Motors’ acquisition of IVECO is not merely about expansion — it’s about survival and growth in a CV sector undergoing systemic transformation. With this deal, the two companies have declared their intent to lead, not follow, in the next era of commercial transport.

4. US Players May Refocus or Consolidate

For players like Navistar (owned by Traton Group/ Volkswagen), Paccar (Kenworth, Peterbilt), and Ford Trucks, the merger adds complexity in the international arena.

Export competition:

As the new Tata-Iveco entity leverages its scale to compete in Latin America, the Middle East, and Southeast Asia, US OEMs may need to sharpen their value proposition or revisit expansion plans in those markets.

Re-evaluation of alliances: US and European brands may consider consolidating powertrain development or telematics ecosystems to keep pace with a more vertically integrated Tata-Iveco.

5. Supply Chain and Component Players Global tier-1 suppliers— especially those in powertrain, battery systems, and electronics— will likely benefit from the combined purchasing power of Tata-Iveco, but face downward pricing pressure as the new group seeks cost synergies. Smaller OEMs and local assemblers could find it harder to match procurement prices and R&D pace, possibly driving further consolidation in the industry.

In Summary:

The Tata-Iveco combination will act as a strategic trigger in the commercial vehicle sector—challenging global and regional OEMs to react either through:

• product innovation

• geographic expansion

• strategic M&A

• or deeper technology collaborations

We all know that sinking feeling — being stuck in traffic, watching the minutes tick by, stress levels rising with every angry horn and brake light. Whether it’s the morning school run or the evening commute along Sheikh Zayed Road, traffic isn’t just an inconvenience in the UAE — it’s a way of life for many which frequently affects our well-being, our relationships, and, critically, our safety.

That’s why the latest Traffic Congestion Study by RoadSafetyUAE and Al Wathba Insurance is so important. Behind the statistics are real people: families trying to get home, professionals rushing to work, and young drivers navigating some of the busiest roads in the region. The study, conducted in June 2025 with over 1,000 respondents, goes beyond the numbers to explore how congestion is shaping our emotional responses and behaviour on the roads.

According to the survey, 86% of UAE motorists regularly encounter traffic

80% say congestion has worsened over the past year”

congestion, with the issue being especially severe in Dubai (91%) and Sharjah (90%). Perhaps more concerning, 80% say congestion has worsened over the past year—particularly in Dubai, where urban expansion and population growth continue to test the limits of infrastructure. But congestion is more than just lost time — it’s a trigger for frustration, stress, and even aggression behind the wheel. Nearly half (47%) of respondents said they feel frustrated, annoyed, or anxious in traffic, with female and younger

Almost half of the respondents (47%) feel frustrated, annoyed, very stressed or anxious. These feelings are more pronounced with females and younger road users: “29% can deal with it, as they state to be indifferent and used to it, or they stay calm and relaxed. 19% s tate they feel bored or restless. Interestingly, a small minority of 5% even enjoys the downtime during traffic jams!”

drivers reporting higher stress levels. It’s a concern with clear safety implications, and one that demands attention.

The emotional toll of traffic congestion is substantial, with almost half (47%) of respondents expressing frustration, annoyance, stress, or anxiety when trapped in traffic. These emotions are notably stronger among female and younger drivers. Conversely, 29% report feeling indifferent or calm, while 19% admit feeling bored or restless. Interestingly, a small minority (5%) even enjoy the downtime during congestion.

Behaviourally, aggressive driving remains an issue, with only 18% stating they ‘hardly ever’ witness rude or aggressive

Congestion is more than just lost time—it’s a trigger for frustration, stress and aggression”

behaviour in traffic. This figure drops further to 15% in Dubai. More than onethird of respondents regularly observe aggressive behaviour, while almost half report encountering it occasionally.

The study also highlights the UAE’s heavy reliance on road transportation, with 92% of respondents using their own cars, buses, minibuses, or taxis daily. Only 8% use alternative modes such as the metro, eScooters, bicycles, or eBikes. Personal cars remain the predominant mode of transportation, with 60% using their vehicles daily.

Additionally, the study examines car occupancy levels, revealing that over half (54%) of drivers travel alone, with

Sharjah recording an even higher rate of 62%. Increasing car occupancy levels, especially in high-congestion areas like Sharjah, presents a potential solution to reduce overall traffic. Notably, Dubai shows the highest car occupancy rates, with 43% of drivers typically carrying one or two passengers, highlighting a possible model for other emirates to follow.

Muralikrishnan Raman, CFO of Al Wathba Insurance, emphasized the importance of understanding motorist needs: “We want to give the concerned traffic participants a voice. We need to understand their feelings and perceptions with regards to the omni-present traffic congestion. We need to understand how

Unfortunately, only a small number of 18% ‘hardly ever’ witness aggressive behavior, and in Dubai this number dips further to only 15%. Conversely, more than 1/3 of respondents ‘very often’ notice rude or aggressive behavior, and almost half of the respondents notice this ‘occasionally’.

Do you depend on road transportation on a daily basis?

I use a taxi or ride-hailing service

No, I use the metro/subway

No, I walk or use personal mobility options (scooter, bike etc.)

The dependency on road transportation is very high, as 92% of respondents state they depend daily on it by utilizing their own car, bus, minibus or taxi services. Only 8% use transportation by metro or alternative means like eScooter, Bicycle, eBike): “60% of respondents depend on daily transportation in their own car, which is the highest mention by far,” says the report.

much they depend on road transportation.

“As one of the leading motor insurers in the UAE, and a customer-centric organization, we are committed to staying relevant to the evolving needs of our customers and improving their daily lives. This is the reason why we teamed up with RoadSafetyUAE on this important research project.”

Thomas Edelmann, Founder of RoadSafetyUAE, added: ““For most, traffic

More than half (54%) travel alone in their car”

congestion means high levels of stress and frustration. This can cause misbehaviour which carries the risk of accidents. Hence, from a road safety perspective, traffic congestions should be avoided. Testimony to that, UAE motorists notice a lot of rude or aggressive behaviour in traffic jams and hence, the awareness for polite and caring manners must be raised.

“The dependency on road transportation is extremely high in the

When you drive your own car, how many people (including yourself) are usually in the car?

UAE and we need to find ways to reduce this dependency and as a consequence reduce the number of vehicles on the roads. Especially, considering the high number of motorists traveling alone in their cars without passengers.”

The research underscores the need for strategic interventions to alleviate congestion, improve motorists’ experiences, and enhance overall road safety across the UAE.

According to the study, of the majority of road users utilising their own car (60% see above), more than half (54%) travel alone in their car. In Sharjah even 62% of motorists usually travel alone, which might be a contributing factor to the problem of daily traffic congest ion there. In order to reduce the number of vehicles on the roads, one opportunity is to gradually increase the number of people per car. It is interesting to note, that Dubai represents the highest number with 43% of motorists usually carry one or two passengers. It would be interesting to understand the reasons for this and how other Emirates and especially Sharjah can learn from it, the report suggests.

FAMCO KSA discuss its game-changing Ashok Leyland partnership in Saudi Arabia

From construction to cargo, FAMCO is reshaping Saudi Arabia’s fleet sector with proven engineering from Ashok Leyland.

A little over a year since the launching of its flagship 3S (Sales, Service, Spare Parts) facility in Riyadh, FAMCO KSA has made major strides in the Kingdom’s commercial vehicle landscape. Traditionally known for its role in industrial and construction equipment in the market, FAMCO is bringing its international knowhow of the segment into the Saudi market. It has now truly planted its flag in the truck and bus market thanks to its distribution of Ashok Leyland vehicles in Saudi Arabia.

According to the company, the partnership has already surpassed expectations, with the first 12 months laying the foundation for rapid growth across the logistics, construction, and passenger transport sectors. Sales volumes have doubled in recent months, driven by new customer acquisitions and repeat business from satisfied operators, Ramez Hamdan, Managing Director at Al Futtaim Industrial Equipment (UAE, KSA, Qatar & Bahrain), tells T&FME

“FAMCO KSA has quickly solidified its presence as a key player in Saudi Arabia’s commercial vehicle sector,” explains Hamdan. “Ashok Leyland is a strategic part of our portfolio, particularly in buses and trucks, where we focus on reliability and cost-effective solutions.”

With the introduction of Ashok Leyland, the company continues to expand

its portfolio to cover price sensitive segments with high quality products as well as meet the demands of the booming logistics and construction sectors.

Prior to adding Ashok Leyland to its line-up, FAMCO KSA’s focus was squarely on construction machinery, power systems, and compressors. But with the Kingdom’s construction and logistics sectors booming under Vision 2030, the company saw an opportunity to diversify and expand its

FAMCO KSA has quickly solidified its presence”

offering to its many customers in the market, recognising that there is an increasing rise for cost-effective but proven and reliable products. Features such as enhanced cooling systems as well as locally-based, dedicated product development teams which work hand in hand with principals, ensure sure FAMCO KSA is delivering products that are tailored for the Saudi market and meet demanding customer requirements.

This methodical approach to market entry has been enhanced by its existing partnerships with key players across the supply chain, including leasing companies, financiers, and contractors. FAMCO has also invested in localised body configurations and customisation through regional fabricators.

“This was always the right strategy for the Kingdom, and our first year has proven that,” adds Hamdan.

The distributor’s successful rollout of Ashok Leyland in Saudi Arabia has already been recognised at a global level. During Ashok Leyland’s annual event in Kolkata, India, FAMCO KSA took home the manufacturer’s top honours: Best Debut Performance and Fastest Ramp-Up to 1,000 Units.

The awards validate the FAMCO team’s efforts to maintain an approach that emphasises streamlining services through strong internal collaboration and close customer relationships.

Plugging into its existing network, FAMCO KSA is able to supply a growing range of Ashok Leyland trucks and buses across Saudi Arabia.

In the truck segment, the BOSS Series serves as a strong medium-duty offering, particularly for construction and logistics applications. Models such as the BOSS 913 and 1223 are equipped with Ashok Leyland’s H-series engine and come with a five-year warranty. While customers appreciate the trucks’ performance, warranty coverage, and durability, local fac-tors like resale value and the widespread availability of Japanese-brand spare parts remain key benefits when purchasing.

Meanwhile, the Partner Series addresses the light and medium-duty market with its proven flexibility ability to fulfil a number of roles. It is widely used in logistics for dry cargo and refrigerated transport, and in the construction sector for tipper and water tanker applications. Operators are drawn to its proven 600,000-plus kilometre durability in GCC conditions, as well as its best-in-class fuel-efficient performance, which delivers optimum power and torque at lower RPMs.

On the bus side, the Falcon and Falcon Super models are the mainstay of FAMCO KSA’s offering. These high-

Ashok Leyland is a strategic part of our portfolio”

capacity buses are heavily used by major contractors and leasing companies, primarily for staff transportation. They offer strong air-conditioning performance and high passenger capacity, although customers have noted that cabin space in competing models provides better headroom and premium interiors.

The Oyster has begun to establish itself as a more premium option, suited for schools and corporate operations.

While still developing its position in the tourism and hospitality segments, the Oyster stands out for its strong AC performance and low operating costs.

The Gazl bus, designed for compact, urban use, is most popular among schools, hospitals, and contractors operating in city environments. The introduction of more affordable and increasingly premium Chinese models in this segment has created a highly competitive environment for the bus. However, feedback from customers, particularly the Gazl’s strong value proposition, is inspiring FAMCO and Ashok Leyland to continue to make further improvements in ground clearance and interior finish to ensure it further distinguishes itself from its peers.

Whatever the vehicle in the range, Ashok Leyland vehicles distributed by FAMCO KSA are specified to withstand the Kingdom’s extreme conditions. The company points to enhanced cooling systems and strong AC performance as critical features for year-round operability. Dedicated product development teams work closely with the manufacturer to ensure that all specifications meet the performance

and reliability demands of the region.

In terms of operating cost, Ashok Leyland vehicles benefit from competitively priced spare parts and low maintenance demands, helping them maintain an edge in cost-effectiveness compared to many regional rivals.

The range will soon be extended even further, with FAMCO KSA confirming plans to introduce Ashok Leyland pickup trucks in the near future, targeting last-mile delivery and light urban logistics customers.

FAMCO KSA recognises that long-term growth in the commercial vehicle sector depends not only on initial sales, but on

This was always the right strategy for the Kingdom, and our first year has proven that”

robust after-sales service and support. In the past year, the company has opened 3S facilities in Riyadh and soon a new facility in Jeddah, with improvements underway at its Dammam branch and plans to expand into tier-3 cities.

The network includes off-site service teams that provide support in the field, especially during the high-demand summer months when air-conditioning systems are under maximum strain. FAMCO’s expanding service infrastructure is designed to keep downtime to a minimum and support customer retention.

Despite an award-winning first year, customer retention remains important to maintain the numbers seen so far, and the company tells T&FME that it is making

significant investments to ensure “we’re there for our customers, wherever they are”.

FAMCO KSA’s growth trajectory reflects a broader trend in the Saudi commercial vehicle sector. With rising demand for costeffective but reliable transport solutions, the distributor believes its Ashok Leyland range strikes the right balance for local operators.

FAMCO expects this momentum to continue as it builds on its early successes and aligns with Saudi Arabia’s wider economic transformation, and is guaranteeing that its reliable Ashok Leyland vehicles will be backed by unparalleled after-sales support, “ensuring your operations never stop.”

T&FME looks at how Wialon is digitally transforming Africa’s fleet landscape

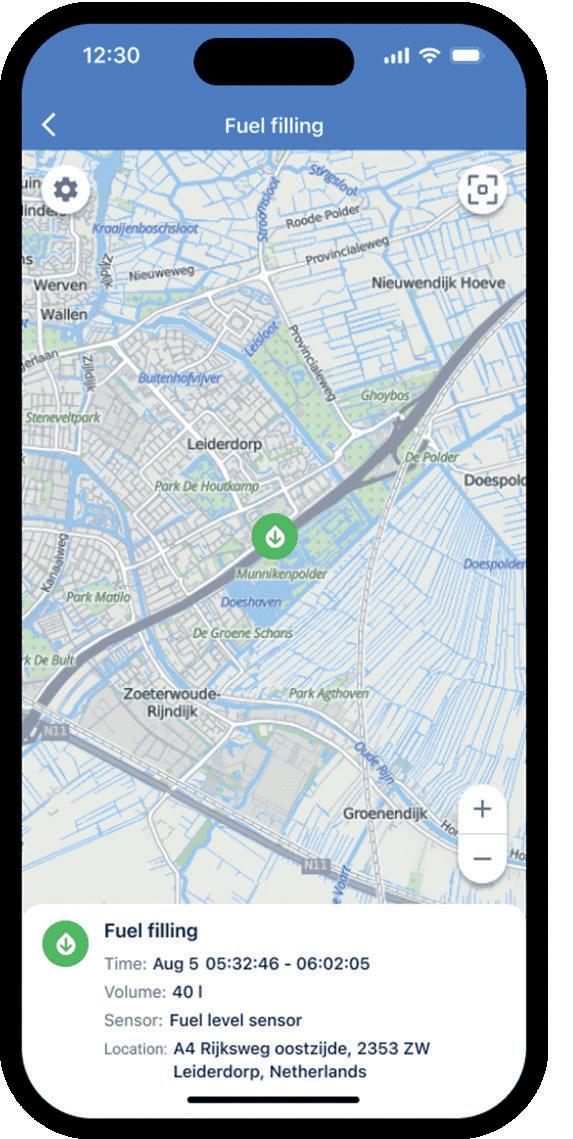

n the heart of Africa’s rapidly evolving transport and logistics landscape, a quiet revolution is gaining speed — powered not by roads or runways, but by data. At the centre of this transformation is Wialon, the global fleet digitalisation platform developed by Gurtam, which has just crossed a major milestone: 250,000 connected vehicles and assets now active across the continent.

This isn’t just a statistic — it’s a signal. A signal that fleet operators across Africa are embracing digital tools at unprecedented

scale to overcome complex terrain, regulatory fragmentation, and infrastructure limitations. Wialon’s surge in adoption reflects a growing hunger for smart, AIdriven solutions capable of turning raw vehicle data into real-time insights, safer journeys, and more efficient operations. In a region where logistics challenges are as diverse as its geography, Wialon is proving that intelligent fleet management doesn’t need to be a luxury on the huge continent — it’s becoming essential infrastructure.

Reaching 250,000 connected vehicles is far more than a numerical milestone.

There is a high appetite for fleet management tech”

It represents a dramatic increase in telematics adoption across key African markets. Wialon now processes over 300 million data points every day from these vehicles, offering a rich analytical bedrock for real-time optimisation, predictive insights, and operational efficiency. These capabilities enable companies to manage costs, improve safety, and elevate customer service in sectors ranging from long-haul logistics to construction and mining.

Such a feat wouldn’t be possible without local engagement. Wialon works with over 400 regional partners across

Africa, who are instrumental in delivering custom telematics solutions, ongoing technical support, and compliance guidance to more than 20,000 fleet owners. These partnerships are key to Wialon’s success. They empower African businesses to adopt digital tools quickly, with support that is both local and highly specialised.

“There is a high appetite for fleet management technology across many countries in Africa, and as the continent is still in the early stages of fleet digitalisation, there is tremendous potential for telematics and IoT adoption,” says Aliaksandr Kuushynau, Head of Wialon.

Building the Backbone of Smart Fleets Wialon has developed one of the most comprehensive digital platforms for fleet management in the world. It supports realtime vehicle tracking, fuel management, driver behaviour monitoring, video telematics, and customised reporting, among other features. Globally, the platform connects more than 4.2 million vehicles in over 160 countries, from heavy-duty trucks and municipal fleets to buses and construction machinery.

In Africa, this suite of tools is tailored to address the continent’s unique needs. Operating in regions with variable infrastructure, cross-border regulatory discrepancies, and often difficult terrain, African fleet managers require robust, adaptable, and accessible systems. Wialon’s flexibility, modularity, and multilingual support give it a clear edge in these environments.

“When we recently attended GITEX Africa, the continent’s largest tech and startup exhibition in Morocco, we were energised by the insights from our telematics service partners and the spirit of innovation throughout the event,” Kuushynau adds. “The technology ecosystem across the continent is ramping up and we’re very excited to be part of this momentous growth.”

Telematics Meets AI Wialon’s rapid growth in Africa coincides with another powerful shift in the fleet management world—the integration of Artificial Intelligence (AI). With AIpowered modules now embedded across the Wialon platform, fleet operators can move from passive monitoring to predictive, data-driven management.

The foundation being laid today is setting the stage for smarter logistics and enhanced safety across the continent”

AI enables predictive maintenance by using algorithms that analyse sensor data to forecast component wear and mechanical issues before they occur. This allows fleets to reduce downtime and avoid costly breakdowns. Smart route optimisation is another major advantage, with AI tapping into real-time traffic, road, and weather data to recommend optimal routing — saving both time and fuel. When it comes to driver behaviour, AI interprets data such as braking, acceleration, idling, and speeding patterns. This allows fleet managers to identify risky practices and implement tailored training programmes, ultimately enhancing safety and reducing incidents. Additionally, AI can detect fuel theft by identifying irregularities in consumption patterns, helping operators curb losses — particularly in regions where fuel pilferage is a persistent issue.

In one striking case study, Wialon was deployed in the South African construction sector to monitor fuel usage. By identifying discrepancies and reducing unauthorised consumption, the system helped cut fuel losses by approximately 4,500 litres per month, while also improving oversight and operator accountability.

The growth of Wialon and telematics in Africa is also being driven by regulation.

Predictive Maintenance: AI algorithms analyse sensor data to forecast component wear and mechanical issues before they occur, allowing fleets to reduce downtime and avoid costly breakdowns.

Smart Route Optimisation: AI uses real-time traffic, road, and weather data to recommend optimal routing, saving time and reducing fuel costs.

Driver Behaviour Analysis: By interpreting braking, acceleration, idling, and speed data, AI can identify risky behaviour and help fleet managers implement targeted training programmes.

Fuel Theft Detection: AI can flag irregularities in fuel consumption, reducing losses in environments where fuel theft is a persistent issue.

Logistics and Freight: Fleet operators use Wialon for route optimisation, cargo monitoring, and cross-border compliance. East Africa’s Electronic Cargo Tracking System (ECTS), for instance, is integrated into the platform to enhance transport security.

Public Transport: In countries like Kenya and Nigeria, where buses and minibuses are integral to daily mobility, Wialon helps ensure safety compliance through speed governors and route tracking.

Mining and Construction: South Africa’s heavy equipment operators use Wialon to ensure vehicle uptime and safety, employing AI for predictive maintenance and fatigue monitoring.

Government and Municipal Fleets: Agencies rely on the platform to control fuel usage, prevent misuse, and maintain centralised visibility of large vehicle inventories—such as Kenya’s Government Fleet Management Directorate (GFMD).

From continental frameworks like the African Union’s Transport and Transit Facilitation Programme and the AfCFTA Digital Trade Protocol, to national-level mandates in Nigeria, Kenya, and South Africa, regulatory momentum is making digital oversight not just beneficial — but necessary.

In Kenya, government policies require telematics systems in public transport vehicles such as matatus, as

AI is make driving professions more appealing”

well as in government fleet operations. South Africa’s mining industry, meanwhile, mandates the use of collision avoidance systems and telematics solutions in heavy-duty machinery.

“Fleet digitalisation is gaining pace thanks to progressive policies,” says Kuushynau. “The foundation being laid today is setting the stage for smarter logistics and enhanced safety across the continent.”

The use of Wialon varies widely by sector in Africa. In logistics and freight, the platform is employed to optimise routes, monitor fuel use, and secure cross-border cargo. Integrations with systems like East Africa’s Electronic Cargo Tracking System (ECTS) enhance transport security and streamline regulatory compliance. In public transport, Wialon plays a critical role in countries such as Kenya and Nigeria, where telematics is mandated for safety compliance. Speed governors and realtime tracking are commonly deployed in buses and matatus (local minibuses) to reduce accidents and enforce speed limits.

In the mining and construction sectors, particularly in South Africa, Wialon is used to ensure vehicle safety and operational uptime. AI-based predictive maintenance tools help reduce breakdowns and improve productivity in heavy-duty machinery.

Meanwhile, government and public sector fleets across Africa are using the platform for better fuel control, preventative maintenance scheduling, and centralised route optimisation. Kenya’s Government Fleet Management Directorate (GFMD) is a case in point, employing Wialon to reduce misuse and drive significant cost savings across public assets.

Beyond efficiency, Wialon’s AI tools are designed to enhance the driver experience. Video telematics, ADAS (Advanced Driver Assistance Systems), and driver scoring help reduce stress and fatigue, particularly on long-haul journeys. Smart alerts, real-time feedback, and route planning tools ensure that the operator isn’t overwhelmed but empowered.

Incorporating AI and ADAS into vehicles significantly reduces the cognitive load on drivers. Real-time traffic updates, voice-activated controls, and fatigue detection systems enhance both comfort and safety. This has a direct impact on job satisfaction and can make the profession more attractive to new drivers—a key consideration given the global shortage of qualified transport operators.

“Incorporating AI and ADAS into vehicles reduces the cognitive load on drivers,” says Kuushynau. “By improving the overall job satisfaction and reducing stress, these technologies make driving professions more appealing.”

This is especially important in Africa, where the driver shortage is as acute as in other global regions. By digitising driver support systems and improving working conditions, Wialon not only improves performance but supports workforce development.

A major trend shaping the future of fleet management is the integration of OEM and aftermarket telematics.

Traditionally, factoryinstalled (OEM) and thirdparty (aftermarket) systems operated independently. Wialon is helping bridge this gap by creating a unified platform capable of ingesting

Fleet platforms must evolve alongside vehicles”

and interpreting data from multiple systems. This allows fleet operators to enjoy a cohesive, centralised view of their vehicles, minimising inefficiencies and ensuring better data utilisation.

In parallel, Wialon is playing a critical role in the global shift toward sustainability with tools tailored to support fleet electrification. The platform provides functionality to assess which fleet segments are suitable for

electrification based on mileage, routes, and infrastructure availability. It also monitors EV-specific data such as battery health, charging cycles, and energy cost optimisation. As cities and regions in Africa begin to adopt EVs for public and commercial use, this will become an increasingly important capability.

“Fleet platforms must evolve alongside vehicles,” says Kuushynau. “That means being ready for electric, autonomous, and hybrid fleets, and helping operators transition smoothly with data-driven insights.”

In less than a decade, Africa’s fleet landscape is undergoing a profound transformation. Digital connectivity, AI, and regulatory alignment are converging to reshape how companies manage vehicles and cargo.

At the heart of this evolution is Wialon— building not just a network of connected vehicles, but an ecosystem of informed decisions, safer roads, and more efficient transport systems.

“The telematics market in Africa is on track to nearly triple in size,” says Kuushynau. “We are proud to play our part in helping African businesses make the most of this opportunity, with technology that’s practical, scalable, and ready for the future.”

DEEPAL COMPLETES TRAINING PROGRAMME IN DUBAI / GOODYEAR SHOWCASES TYRE TECH / MICHELIN EXPANDS FOOTPRINT

In preparation for the regional launch of its new all-electric compact SUV, the DEEPAL S05, DEEPAL has concluded a two-part training programme in Dubai aimed at bolstering customer experience and technical expertise across the Middle East and Africa

Sales representatives from eight countries – including the UAE, Kuwait, Bahrain, Jordan, Morocco, Angola, Benin, and Ivory Coast –attended sessions designed to enhance their understanding of the S05’s key selling points, electric mobility

features, and intelligent technologies. Real-world demonstrations and customer engagement scenarios were used to help participants effectively communicate the S05’s value proposition.

Following the sales-focused segment, DEEPAL delivered a handson Service and Aftersales Training session in collaboration with Al Tayer Motors and Changan MEA.

This part of the programme, which forms part of Phase II of the Changan Advanced NEV Technology Training initiative, was attended by over 20 technicians and

service advisors from 14 markets, including the UAE, Oman, Kuwait, Bahrain, Jordan, and Egypt.

Participants received advanced instruction in areas such as highvoltage system repairs, battery diagnostics, low-voltage integration, and intelligent fault diagnosis. Designed to simulate real workshop conditions, the training placed strong emphasis on practical learning, technical collaboration, and global certification in line with Changan’s NEV standards.

“Building deep technical knowledge and a high-quality service network is essential,” said Mr Xiao, General Manager of Changan Automobile’s Middle East and Africa Division. “These training sessions ensure that every customer interaction with DEEPAL — from test drive to long-term ownership — is backed by expertise, safety, and confidence.”

The programme follows a similar training held earlier this year for the DEEPAL S07 and forms part of a wider regional strategy to upskill frontline staff and enhance aftersales support in both existing and upcoming DEEPAL markets.

TYRES

Goodyear unveiled a suite of intelligent tyre management tools aimed at enhancing fleet efficiency, performance, and safety at Mobility Live Middle East 2025, as well the KMAX S EXTREME GEN 2, Goodyear’s latest tyre engineered specifically for fleets operating in harsh Middle Eastern climates. Among the other solutions was Goodyear CheckPoint, an automated drive-over reader that provides instant tire diagnostics to ensure vehicles are operating with optimal efficiency. Goodyear DrivePoint, a plug-and-play system, allows for quick and easy tire condition checks that enhance vehicle safety and performance. Meanwhile, Goodyear Tire Optix, a mobile-enabled inspection platform, delivers real-time tire health diagnostics, assisting fleet operators with preventive maintenance to reduce operational downtime.

Bridgestone has developed a bespoke version of its Potenza Race semislick tyre for Volkswagen’s newly launched Golf GTI EDITION 50 — the exclusive 50th anniversary edition of the legendary hot hatch.

The tyre partnership between the two automotive powershouses helped the commemorative model become the fastest Volkswagen production car to lap the Nürburgring’s Nordschleife circuit, marking a significant milestone for both brands.

The Golf GTI EDITION 50, revealed during the prestigious 24hour race at Germany’s Nürburgring, completed the iconic 20.82-kilometre circuit in a blistering time of 07:46:13.

The record-breaking vehicle was equipped exclusively with Bridgestone’s custom-developed Potenza Race tyres — delivering relentless grip, precise handling, and the endurance to match the extreme performance demands of the Nordschleife.

Engineered and manufactured in Europe, the exclusive 235/35 R19 91Y Potenza Race fitment has been tailored to complement the GTI EDITION 50’s high-performance profile. The tyres feature a high-grip compound, optimised cavity profile, and motorsport-inspired tread pattern — providing not only dry track confidence but also reliable wet performance. A high-strength, lightweight carcass also contributes to reduced rolling resistance and responsive feedback, ideal for both track and road applications.

Magna Tyres, a global leader in premium off-the-road (OTR), industrial, and truck tyre solutions, has introduced a new AI-powered chatbot on its official website. The chatbot is available 24 hours a day, 7 days a week, delivering instant assistance to customers and prospects around the world in any language.

This strategic digital enhancement marks a significant upgrade in Magna Tyres’ customer service capabilities, ensuring users across time zones and geographies receive fast, accurate, and consistent support, regardless of their preferred language.

“Customer service is at the core of our brand promise,” said Robert Gruijters, Head of Marketing at Magna Tyres. “With

a Net Promoter Score (NPS) of 67, we already outperform many in our industry, and this launch reinforces our commitment to becoming a truly best-in-class brand by being always available, accessible, and responsive.”

The chatbot offers several advantages to customers: Roundthe-clock availability means support is always accessible with no waiting

times. The multilingual feature allows users to communicate in any language, tailoring the experience to regional preferences. It delivers accurate and consistent responses to a wide range of queries, from product information to general support, and is designed with a seamless, conversational interface that underscores Magna Tyres’ dedication to service excellence.

TYRES

Michelin has opened its latest Tyreplus outlet in Dubai’s Umm Suqeim district. Operated in partnership with Central Trading Company, the new store — Al Toufiq Tyres & Car Accessories L.L.C — marks the 16th Tyreplus location in Dubai and the Northern Emirates, and the 29th overall across the UAE.

The expansion widens Michelin’s service network and extends its strategy of collaboration with

regional partners to meet the growing demand for high-quality automotive care. Strategically located on Umm Suqeim Road, the new facility provides a comprehensive range of services including tyre replacement, oil changes, brake services, suspension maintenance, battery checks, and air conditioning support.

“The UAE continues to be a key growth market for Michelin, driven by rising demand for reliable, high-quality automotive

care across diverse vehicle types,” said Harkesh Jaggi, Vice-President, Sales & Marketing for Michelin Middle East & North Africa.

“With the opening of our new Tyreplus store in Umm Suqeim, we are reinforcing our commitment to delivering comprehensive, customer-focused services that go beyond tyres to include maintenance solutions for passenger cars, SUVs, and electric vehicles alike.”

Jean-Pierre Barnier, General Manager of Central Trading Company, commented: “At Central Trading Company, we are delighted to support the opening of Tyreplus Al Toufiq as part of our ongoing collaboration with Michelin.

He added: “This new location strengthens our shared goal of bringing high-quality Michelin products and reliable services closer to customers.”

Michelin’s Tyreplus network operates under a global retail model, with certified partners providing standardised tyre and vehicle maintenance services.

The latest Let’s Talk Trends

episode deep dives into decarbonisation within

fleets

In the newest episode of the Let’s Talk Trends podcast — produced in partnership with Caltex Lubricants — host Stephen White invites three regional transport leaders back to the table to unpack the realities behind transport electrification, infrastructure gaps, and how disaster resilience planning is reshaping the logistics conversation in the UAE.

From electric truck adoption to contingency planning after extreme weather, the episode pulls no punches. Featuring

returning experts Zain Paracha (Head of New Ventures at Emirates Transport), Diana Ali (Arabia Logistics Excellence Manager, Unilever NAME), and Martin Roberts (Director of Transportation at Momentum Logistics), the discussion provides a refreshingly honest view of the growing pains involved in fleet innovation.

Unilever’s Diana Ali continues to lead the way in sustainable fleet transformation, sharing how her organisation became the

The concern is very real in this region”

first to introduce electric trucks in the UAE.