SIMPLIFYING THE COMPLEX

TRIMBLE’S PAUL WALLETT DISCUSSES TECHNOLOGY’S GROWING IMPACT ON COMPLEX PROJECTS, AI, AND THE IMPORTANCE OF FULL LIFECYCLE ASSET MANAGEMENT

BACKHOE LOADER ALWAYS COPIED NEVER BETTERED

A future supported by AI

In one of my earliest roles in media some 23 years ago, I worked for a couple of reputed technology publications. Even back then we were talking about artificial intelligence (AI) and the impact it could have on all our lives. I met numerous people from Fortune 500 technology companies during those days, and while every conversation was stimulating, conversation was about as far as things went with regards to the technology itself – it never made it to market in an impactful way.

Fast forward to present day and AI is all the rage. In the construction industry specifically, AI is increasingly being used in the architecture field, the project management segment, to enhance construction site safety through realtime monitoring, and much more.

In fact, in this issue of Big Project Middle East, there’s a bit of an AI theme on as a lot of the content touches on the technology. While AI is largely seen as beneficial with regards to what it can offer, I think

one aspect of the technology that deserves a lot more conversation is how and when AI should be used. This is not simply because of the environmental ramifications of AI but rather because many decisions need to have that vital human element incorporated in the process. AI works by taking a logic-driven approach and makes decisions based on data and criteria, all of which means there’s no emotion involved. While this is not an issue in many applications, it's not ideal for things like architecture and design (for example).

In the future, AI may be able to emulate the ‘human touch’ but that’s certainly not the case now, and even then, I think it’s incredibly important for humans to be the ultimate decisionmaker.

Jason Saundalkar HEAD OF CONTENT

ANALYSIS

14 The Briefing

Khansaheb MEP's Ryan Emsley on how the company's MEP Training Centre is closing the skills gap

26 The Big Picture

A wrap-up of the biggest international construction news stories for the month

28 Market Report

Real estate demand in Dubai remained strong in Q2 2025 according to Savills' recent Dubai Residential Market report

34 In Profile

Simplifying the Complex

Paul Wallett talks to BPME about Trimble's recent business performance, future plans, technology's growing impact on complex projects, AI, and the importance of full lifecycle asset management

42 In Profile

Forging the Future of Glass

Abdulaziz Bin Yagub Al Serkal, CEO, Industrial Platform at Dubai Investments speaks about the transformative shift in architectural and industrial glass production across the UAE and MENA region

56 On Site

BPME's Jason Saundalkar talks to OCTA Properties' Gopinath Rao and DMDC's Raji Daou about the fitout of OCTA's Headquarters, and DMDC's move into commercial fitout

76 Comment

Experts from Drees & Sommer on how interdisciplinary design methodology enables smarter project and design management

88 Final Update

TownX says Luma Park Views project is 95% complete

GROUP

MANAGING DIRECTOR Raz Islam

DIRECTOR OF FINANCE & BUSINESS OPERATIONS Shiyas Kareem

PUBLISHING DIRECTOR Andy Pitois

EDITORIAL

HEAD OF CONTENT Jason Saundalkar

ASSOCIATE EDITOR Priyanka Raina

ADVERTISING

SALES DIRECTOR Arif Bari

STUDIO

ART DIRECTOR Simon Cobon

GRAPHIC DESIGNER Percival Manalaysay

PHOTOGRAPHER Maksym Poriechkin

CIRCULATION & PRODUCTION

DIRECTOR OF MARKETING & MEDIA OPERATIONS

Phinson Mathew George

PRODUCTION & IT SPECIALIST Jarris Pedroso

MARKETING

MARKETING & EVENTS EXECUTIVE Lakshmy Manoj

SOCIAL MEDIA EXECUTIVE Franzil Dias

WEB DEVELOPMENT

SENIOR DIGITAL MANAGER Abdul Baeis

WEB DEVELOPER Umair Khan

FOUNDER Dominic De Sousa (1959-2015)

raz.islam@cpitrademedia.com

shiyas.kareem@cpitrademedia.com andy.pitois@cpitrademedia.com

jason.s@cpitrademedia.com priyanka.raina@cpitrademedia.com

arif.bari@cpitrademedia.com

simon.cobon@cpitrademedia.com percival.manalaysay@cpitrademedia.com maksym.poriechkin@cpitrademedia.com

phinson.george@cpitrademedia.com jarris.pedroso@cpitrademedia.com

lakshmy.manoj@cpitrademedia.com franzil.dias@cpitrademedia.com

abdul.baeis@cpitrademedia.com umair.khan@cpitrademedia.com

When you have finished with this magazine, please recycle it

The publisher of this magazine has made every effort to ensure the content is accurate on the date of publication. The opinions and views expressed in the articles do not necessarily reflect the publisher and editor. The published material, adverts, editorials and all other content are published in good faith. No part of this publication or any part of the contents thereof may be

© Copyright 2025. All rights reserved.

MEConstructionNews.com

@meconstructionn

MEConstructionNews

me-construction-news

EMSTEEL reports $1.17bn in revenue and $147mn EBITDA for H1 2025

SUSTAINABILITY

DEWA begins trials to transfer electricity from Hatta to Dubai

PROPERTY

Diriyah Company announces the launch of the Aman Residences

CONSTRUCTION

Meraki Developers completes on-schedule handover of The Haven

PROPERTY

Shurooq announces high-end eco-retreats

EXPERTS: Why is everyone so excited about Ras Al-Khaimah’s property market?

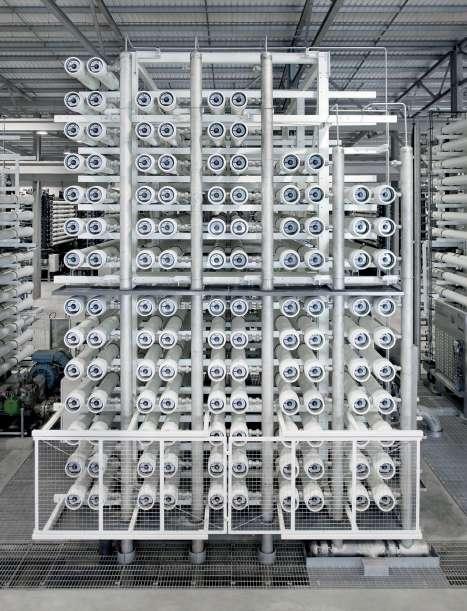

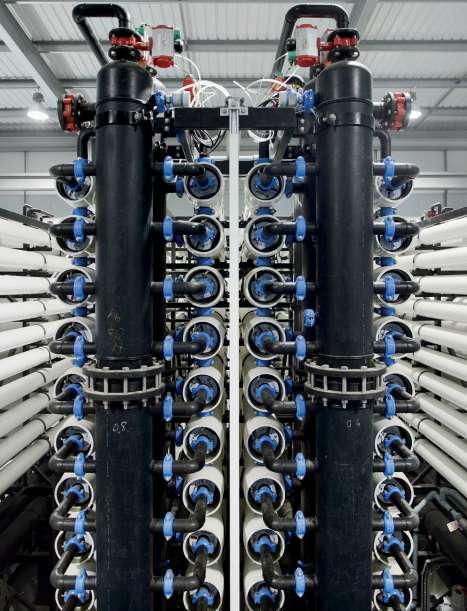

EXPERTS: Meeting Saudi’s water demand − The role of smart water management

EXPERTS: Architectural AI − Designing better buildings while maintaining the human touch

SUSTAINABILITY

Msheireb Properties partners with Cundall to decarbonise its entire portfolio

Each building has been assessed against Cundall’s Seven Steps to Net Zero Carbon, with detailed action plans developed to reduce operational energy consumption

MACHINERY

Power and productivity from a new generation of Volvo CE excavators

Each of these excavators integrates engine-pump optimisation technology, delivering up to 15% more fuel-efficiency compared to previous models

PROPERTY

Park Properties enters UAE real estate market unveiling its flagship waterfront project

INDUSTRY

Emrill announces promotion of Thomas Friswell to Support Services Director

PROPERTY

Meraas launches new phase of Nad Al Sheba Gardens development

The new phase features a diverse range of residences, including villas and townhouses, with contemporary designs and natural materials

INDUSTRY

MERED expands UAE operations on Al Reem Island

The capital’s real estate market is experiencing growth, with transactions surpassing US $6.8bn in the first quarter of this year, a substantial increase from $5.17bn during the same period in 2023

TECHNOLOGY

Sobha Realty announces the Sobha Privy Collection and launches ‘The S’ The new tower is envisioned as an equilateral triangle sculpted at the apex of the district’s canal arc

PROPERTY Mohammed bin Rashid

Aerospace Hub unveils Sky Support Complex

PROPERTY

AUM Development announces launch of Veda in JVC, Dubai

PROPERTY

DMDC launches new division focused on property investment and renovation

Powering progress: Inside

Khansaheb's

investment in talent

Khansaheb MEP’s General Manager Ryan Emsley on how the company's MEP Training Centre is closing the skills gap

Khansaheb Civil Engineering (Khansaheb) is a well-respected and trusted name within the UAE construction market, and this year celebrates its 90th anniversary. The company’s primary focus market is the UAE and over the years, it has helped engineer and build some of the country’s most prestigious projects across sectors, leveraging its broad array of in-house expertise including mechanical, electrical and plumbing (MEP), through its Khansaheb MEP division.

The construction company’s MEP arm is committed to safety, quality, build ability, value engineering and delivery and, as part of this commitment, it has placed a high priority on investing in its people’s capabilities through its MEP Training Centre. The facility was originally set up over a decade ago and in 2024 the company decided to step up its focus on up-skilling staff through the training centre.

“The MEP Training Centre was set up about 10 or 12 years ago and was originally based in Jebel Ali. There’s minimal focus on MEP staff training in the market and as we are committed to safety and quality of delivery, we took the opportunity to set the facility up, so that we could enhance the capabilities of our onsite staff,” says Ryan Emsley, General Manager – MEP, Khansaheb.

He adds, “We had plans to expand the training centre just before the pandemic hit but due to the impact of COVID-19 on the construction market and the market in general, we reluctantly hit pause. Early last year we reinvigorated our plans because there’s a huge benefit to the centre, and in September 2024, the first group

went through the training program at our new facility in Al Quoz.”

Emsley says that the MEP Training Centre is now a part of Khansaheb MEP’s main office in Al Quoz and is a dedicated, purposebuilt space for training staff.

“The new centre is a better facility than its predecessor and puts people together rather than have them in individual cabins as was the case before. We now have dedicated classrooms and we typically put

through about 15 members of our team each week. Since September last year to about July this year, we put around 330 people through the training centre in what we call Phase One training. Going forward, any new recruits that we onboard will be put through the training centre

DRIVING FORCE

Ryan Emsley, General Manager - MEP, Khansaheb.

so they’re up-skilled to our way of doing things and can provide value on jobsites,” explains Emsley.

Discussing the MEP Training Centre in greater detail, Emsley notes that the division developed its own training program and says that whereas it was previously a two-week course, it has been revised to six days. He states that the training centre is focused on general MEP build knowledge rather than focusing on designs and installations for specific builds or sectors.

“Depending on the person’s discipline within the MEP segment they go through a specific part of the course but first and foremost, as our number one priority is health and safety, everyone goes through that training together to begin with. That’s mandatory and it is designed

to bring everyone up to speed in terms of our health and safety regulations, what our sites should look like, what is safe/what is not etc. From there, they then filter off into their own disciplines, and learn about materials and planning, so they are ultimately more productive on jobsites,” comments Emsley.

Asked about whether the program extends beyond the facility and includes onsite training, Emsley responds, “Everything is handled within the facility itself but we take feedback from the supervisors who are monitoring the staff on a dayto-day basis. In addition, down the line we plan to bring all the staff who did the Phase One training back to the MEP Training Centre to see their current skill levels and make sure the training is still with them.”

TRAINING PROGRAM

The training program has been revised from being a two-week course to one that requires six-days.

Talking about whether the centre has specific KPIs that can be equated to success and return on investment for the company, Emsley says it’s quite a tricky thing to measure. He elaborates, “We’re getting a lot of positive feedback from supervisors and foremen on our jobsites but it’s quite difficult to measure that against full-fledged KPIs. That said, we are seeing people coming away from the training with a greater breadth of capabilities and are able to add real value when they go to work on a project alongside staff from our other divisions.”

Growth Plans

Discussing the market and what the future looks like for Khansaheb MEP, Emsley is positive noting that whereas the market slowed down when the pandemic first hit, there’s a healthy pipeline of development going forward in the UAE.

“There’s quite a bit to come through on the new build side of things and the data centre market in particular seems to be taking off. The segment came to light a few years ago and cooled but it looks poised to explode again, with a few big announcements that have been made recently,” he says.

Emsley says outside of that, the MEP division alongside the company’s contracting division has recently secured contract for

the Dubai Harbour Residences and expects that turnover will increase significantly next year. “This project is one of the largest projects we have taken on to date, both in scale and value, and is set to significantly grow our turnover in the coming year while enabling us to reinvest in the continued expansion of the division.”

Commenting on the pool of available talent, Emsley states that there is a void in the MEP segment that’s been caused by several factors, including the outbreak of the pandemic. He notes that in recent years there’s been a lack of fresh new talent coming into the discipline, while existing engineers have simultaneously moved into manager roles thus creating a supply and demand gap. He says that going forward, the MEP division will be focused on bringing in trainee engineers and developing a healthy pipeline of talent with the support of the MEP Training Centre. This includes offering opportunities to Emirati trainee engineers, as part of the company’s ongoing commitment to nurturing local talent and contributing to the future growth of the sector. He concludes, “Khansaheb MEP has maintained its premier standing in the market and the MEP Training Centre is going to ensure that continues as we grow and take on larger and more complex projects in the UAE.”

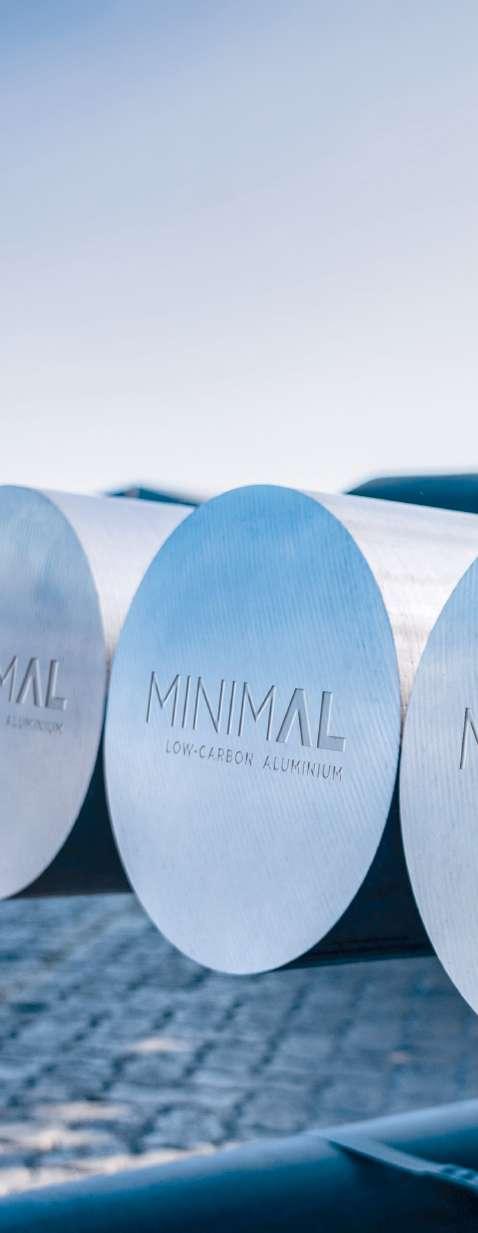

EGA and ENEC announce the UAE’s first delivery of lowcarbon aluminium

The global demand for low-carbon aluminium is projected to triple by 2040, and EGA is committed to playing a significant role in this growth

Emirates Global Aluminium (EGA) and Emirates Nuclear Energy Company (ENEC) announced the UAE’s inaugural delivery of lowcarbon aluminium. This aluminium is generated using electricity produced at the Barakah Nuclear Energy Plant in the Al Dhafra region of Abu Dhabi, UAE.

EGA is marketing this low-carbon aluminium under the brand name MinimAL. The metal will be supplied to CANEX Aluminium, Egypt’s aluminium downstream producer. EGA’s new product positions the UAE as a reliable supplier of low-carbon industrial materials to global markets, expanding EGA’s low-carbon metal portfolio for both local and international customers, the company said.

Generating the electricity necessary for aluminium smelting and production accounts for 60% of the global aluminium industry’s greenhouse gas emissions. ENEC’s

Barakah Nuclear Energy Plant provides access to abundant, clean electricity 24/7 from nuclear energy, which is crucial for decarbonising the UAE’s industrial sector.

Abdulnasser Bin Kalban, Chief Executive Officer of Emirates Global Aluminium said, "Global demand for low carbon aluminium is expected to triple by 2040, and EGA aims to play an important role in this growth. MinimAL is our latest low-carbon product, made possible through the UAE’s investment in nuclear power generation. We are glad to be working with ENEC to supply more low carbon aluminium to the world."

Mohamed Al Hammadi, Managing Director and Chief Executive Officer of ENEC added, "This milestone shows how nuclear energy is boosting national energy security and enabling the UAE’s industrial decarbonisation in parallel, reliably powering energyintensive sectors like aluminium production with clean electricity 24/7.

Through the abundant electricity generated at Barakah, we have unlocked the significant, proven and long-term benefits of nuclear energy to power the UAE’s low-carbon economy for decades to come."

Mutassem Daaboul, Managing Director of CANEX Aluminium commented, "At CANEX, we believe true sustainability is built into every layer of productionfrom the raw material to the final product. Our upcycling model already transforms waste into

EXPANSION

Earlier in the year, EGA advanced its plans to develop the first new primary aluminium production plant in the US since 1980.

value-added products. Now, with MinimAL, we are taking another step forward by reducing embedded emissions at the very beginning of our process. This partnership with EGA reflects our shared commitment to responsible innovation."

CANEX Aluminium said that it has become the inaugural customer to utilise EGA’s MinimAL technology in the production of advanced products for various applications, including infrastructure, solar energy, transportation, and architectural design.

The clean electricity generated by the Barakah plant is certified through the UAE’s Clean Energy Certification program, adhering to the International REC Standard (I-REC) protocols to ensure traceability and credibility. This

power is supplied through Emirates Water and Electricity Company (EWEC) via the national grid.

The Barakah plant has the capability to generate 40 terawatthours (TWh) of clean electricity annually, which accounts for 25% of the UAE’s electricity requirements. This amount of clean electricity is equivalent to the annual total power demand of Switzerland. By producing carbon-free electricity from Barakah, the plant avoids the emission of 22.4m tons of carbon annually, which is equivalent to removing 4.8m cars from the road.

In a groundbreaking achievement, EGA holds the distinction of being the first company globally to produce aluminium using solar power. In 2024, they produced 80 thousand tonnes of CelestiAL, the firm said.

“Can you manage a project seamlessly from estimation to certification?”

CANDY CAN!

Smart Estimating, Planning & Project Control Software at your Fingertips

All-in-One: Powerful features streamlined workflow.

Fast & Accurate Estimates: First Principles simplify and ensure accuracy.

Crystal Clear Data: Track data origin and calculations easily.

Reusable Estimates: Save time with adaptable project data.

Control Costs: Manage resources for optimal budgeting

ALEC & ALEMCO offices achieve

LEED Platinum and LEED Gold

The move is said to reflect the company’s deep-rooted commitment to quality, sustainability and employee well-being

ALEC has said that following its extension renovation works, it has been awarded LEED Platinum certification for its headquarters in Dubai. The firm said that its MEP subsidiary, ALEMCO, has also secured LEED Gold certification for its corporate office and adjoining yard in Dubai Industrial City.

These certifications, awarded by the US Green Building Council for Commercial Interiors, reflect the company’s deep-rooted commitment to quality, sustainability and employee well-being, the firm said in its statement.

“Our priority was to enhance the overall workplace experience for our people, while embedding sustainability at every stage of the renovation. With improvements ranging from low-flow water fittings to LED lighting and advanced energy metering, we’ve not only reduced our footprint but reaffirmed our commitment to creating better buildings. These upgrades echo the same principles we bring to client projects, helping them meet and exceed their green building targets,” said Barry Lewis, CEO at ALEC.

LEED for interior design and construction (LEED ID+C) is a green building rating system focused on the design and construction of interior spaces within commercial buildings. The upgrades mark a significant milestone for ALEC, as it continues to invest in creating healthier, more efficient workspaces.

By achieving the highest level of LEED certification, ALEC demonstrates both its capabilities in delivering world-class green building solutions, and its determination to hold its own operations to the highest standards, the firm stated.

Implementing Sustainable Measures

To earn the certifications, ALEC said that it implemented a wide range of sustainability measures across both facilities. Water consumption was reduced by 55% from baseline through the use of low-flow fixtures equipped with sensors,

and lighting energy was cut by 25% compared to ASHRAE 90.1-2010 standards, thanks to the installation of energy-efficient LED fixtures, occupancy sensors, and enhanced commissioning protocols. Indoor environmental quality was also enhanced through the use of lowVOC paints, adhesives, and materials, while design features maximised daylight-use and improved acoustics. Significant attention was given to responsible sourcing and material reuse. Structural materials included

CEO

Barry Lewis is CEO at ALEC Holdings.

HIGH STANDARDS

By achieving the highest level of LEED certification, ALEC said it is demonstrating its determination to hold its own operations to the highest standards.

steel with 25% post-consumer recycled content, 100% bio-based wall boards for phone booths, and high-recycled content in insulation and ceiling components. Similar practices were adopted at ALEMCO’s

facility, reinforcing the company’s circular approach to design and construction, the firm explained.

Almost 100% of workstation tables, wooden wall panels, reception desks, joinery, storage units, and various meeting room elements from ALEC HQ offices were diverted and reused at the company’s new design office in Dubai, reducing refurbishmentrelated waste. The firm said the achievement extends its track record in helping clients realise their own green building ambitions.

“As we continue to drive the sustainability agenda forward across the region, our own renovations stand as proof that you don’t need to choose between sustainability and design. With careful planning, extensive reuse and responsible material selection, organisations can elevate their interiors while delivering on environmental performance. We’re proud of what we’ve achieved and look forward to supporting more partners across the region in their own green building journeys,” Lewis concluded.

Kier Group's Andrew Davies to retire

Kier has appointed Stuart Togwell as its new Chief Executive. Togwell will assume the role on 1 November 2025, following the retirement of Andrew Davies. Currently, Togwell serves as Kier’s Executive Director and Group Managing Director of Kier Construction.

Commenting on the move, Togwell notes, "I am honoured to be appointed as the next Chief Executive and look forward to working with Kier's exceptional teams to drive success and growth and deliver for our customers, our communities and this industry that I am so passionate about".

Sizewell C receives final decision

Sizewell C, a new nuclear power station under development on the Suffolk coast in England, has received its final investment decision from the British government. The move is said to mark a significant milestone in the UK’s energy sector. The decision unlocks the investment in clean, homegrown energy in a generation, paving the way for the delivery of secure, affordable, and low-carbon electricity to the nation.

The UK has not had a new nuclear plant since 1995, and all existing nuclear plants, except for Sizewell B, are expected to be phased out by the early 2030s.

AMEA Power commissions Egypt’s first utility-scale BESS

AMEA Power has announced the successful commissioning of Egypt’s first utility-scale Battery Energy Storage System (BESS).

The 300MWh facility, fully powered by solar PV energy, was delivered ahead of its scheduled commercial operation date (COD).

The milestone follows the project’s recent financial close, marking a significant step forward in AMEA Power’s strategy to enhance energy security and grid stability in emerging markets.

RSG eyes new finance options

Red Sea Global’s (RSG) CEO, John Pagano, has said that the regenerative and sustainable developer is currently considering a range of alternative financing options. This includes the possibility of launching an initial public offering (IPO), or converting assets into real estate investment trusts (REITs).

This comes at a time when the company is fully focused on leveraging current momentum, with resorts such as Amaala set to be fully operational by year-end, and a raft of further hotel openings slated for Q3 & Q4 2025.

CRC Group unveils The PERIDONA

CRC Group has unveiled its ultra-luxury experiential residential development, The PERIDONA. Taking shape within the Jaypee Greens Golf Course in Greater Noida, the project is being developed at a cost of US $180mn (excluding land costs).

The project is being developed by an accomplished gamut of firms including Killa Design, known for its work on Dubai’s Museum of the Future, and Rockwell Group, a New York-based interior design firm, which will bring its expertise to the project to create a luxurious ambiance, said a statement.

Chedi Hospitality announces entry into Japanese market

Chedi Hospitality has entered the Japanese market with the Chedi Niseko, a boutique hotel that will take shape in the heart of Hirafu, Niseko. The alpine development is set to open in June 2029. The announcement marks Chedi Hospitality’s return to Asia and solidifies its growing influence in the world’s most exceptional alpine destinations, the firm said.

Nestled within one of Japan’s major ski and nature regions, the hotel will provide guests access to ski slopes, culinary options and outdoor adventures.

05 INDIA

04 SAUDI ARABIA

06 JAPAN

Residential Market Snapshot: Dubai Q2 2025

Real estate demand remained strong in Q2 with continued value appreciation across the sector according to Savills’ recent Dubai Residential Market report

Dubai’s residential real estate market reached record levels once again in Q2 2025, underpinned by the city’s sustained appeal. Positive momentum is supported by an influx of HNWIs and anticipated population growth, with Dubai Statistics Centre estimating Dubai’s population will reach four million by the end of this year, and a strong UAE GDP growth forecast, revised upwards in June 2025 by Oxford Economics to 5.1%, from 4.7%.

Real estate demand remains strong with continued value appreciation across the sector. The emirate’s taxfree ecosystem, the ease of securing mortgages, a comparatively lower cost of property ownership versus other global gateway cities, and rising rents — a growing pinch point for tenants — are all contributing to a clear shift toward homeownership among expatriates and continued appeal for investors.

Q2 2025 broke the 50,000 threshold for transaction volumes marking an all-time quarterly record and a robust 21% y-o-y increase, underscoring the emirate’s continued ability to hit a sweet spot between investment potential and quality of life.

Apartments dominated market activity accounting for 80% of all transactions. Off-plan sales continued as the cornerstone of transaction activity, representing 70% of all deals in Q2 2025 — increasing marginally on the 68% share throughout 2024 and significantly higher than 55% in 2023.

Key Locations

Zone 6 recorded the highest level of activity again during Q2, accounting for 53% of total transaction volumes.

The zone covers prominent micromarkets located along the Al Khail corridor, including Jumeirah Village Circle (JVC), Dubailand, Damac Hills 2, The Valley, and Damac Lagoons. This area continues to see significant development, transforming a once peripheral zone to an attractive proposition to investors and end users.

49% of all newly launched residential units were within Zone 6 along the Al Khail Corridor. Key project launches in Zone 6 during the quarter include Parkwood by Emaar in Dubai Hills Estate, Timez by Danube in Dubai Silicon Oasis, Ostra and Palace Villas by Emaar in The Oasis, and Acres 3 by Meraas in Dubailand, among others.

The ready market - comprising transactions in completed and handed-over projects - continued to demonstrate stable activity during Q2 2025 with over 15,000 transactions. This reflects a continuation of the steady pace in the last 12 months, when quarterly ready market transactions averaged around 14,500.

Within the ready market, apartment sales accounted for 83% of transactions in Q2 2025 - a level that is consistent with the 82% recorded throughout 2024, when a notable shift toward apartment dominance first emerged. This is up from 75% in both 2023 and 2022, reflecting the continued preference for apartment units in the market amid availability and affordability pressures.

Whilst apartments dominated the market with an 80% share in Q2 2025, the villa and townhouse segment has held steady with circa 10,000 transactions per quarter over the last 12 months.

New Launches

Dubai’s residential market witnessed robust supply activity, with nearly 20,000 units launched in Q2 2025. H1 2025 saw 52,000 launched, showing a 66% increase compared to the same period last year. This surge is largely attributed to developers capitalising on strong market demand. Apartments have dominated the market, accounting for 91% of new launches. Whilst villas and townhouse launches were limited, masterplan announcements including Phase 2 of Jumeirah Golf Estates and Jebel Ali Racecourse promise further future supply.

Approximately 6,000 units were added to the city’s residential stock during the quarter, bringing the H1 volume to 13,500. In addition, approximately 20,000 residential units are slated for completion in H2 2025,

underscoring the strength of Dubai’s supply pipeline. Noteworthy upcoming completions for 2025 include Ocean House by Ellington, Aura by Majid Al Futtaim, and Cavalli Casa by Damac. The forward-looking supply pipeline also remains strong, with a healthy stream of completions anticipated through to 2028, positioning the market for dynamic shifts as the balance between supply and demand evolves.

Prime Residential

Dubai’s prime residential market

reached unprecedented levels in Q2 2025, continuing to perform well, driven by the growing population of affluent expatriates and the supportive regulatory environment under the Dubai Economic Agenda (D33). These factors have strengthened Dubai’s appeal to HNWIs and global talent, sustaining demand for premium properties.

Over 2,500 units were transacted at values exceeding the US $2.7mn mark in Q2 2025 - approximately double that of Q2 2024. Contrary to the wider market, villas dominated prime transactions with

76% of market share. This sub-sector of the market does however follow the off-plan market dominance pattern with 80% of transactions over $2.7mn being off-plan sales. Zone 6 also dominated the 2.7mn plus market, with over 50% of all transactions. Top-performing villa locations by price bracket included The Oasis, Palm Jebel Ali and Acres.

Average ticket prices and average rates per sqft reached new highs in Q2 2025 for both apartments and villas, bolstered by luxury product launches.

Average capital values during the quarter for apartments remained broadly stable year-on-year, while villas posted a 4% increase overall. Villas have performed well at all ends of the market: prime villa communities - including Al Barari, Arabian Ranches, Palm Jumeirah, The Springs, and Meadows and Dubai Hillsrecorded stronger capital appreciation, with values rising between 7 and 10%.

Dubai Government’s policy and vision continues to shape the city. May 2025 marked the official commencement on the $5.6bn Dubai Metro Blue Line, which will deliver 14 new stations with its opening scheduled for 2029. The line will enhance connectivity between

VALUE TRENDS - VILLAS

key districts, including Mirdif, Dubai Silicon Oasis, Dubai Creek Harbour, and Dubai Festival City and drive real estate demand in these locations.

Additionally, the Dubai Land Department launched the First Time Buyer Scheme at the end of Q2 2025, allowing first time buyers preferential access to new launches from participating developers, preferential pricing, flexible payment plans for off-plan units, relaxed payment plans for DLD fees and improved access to financing through partner banks.

Dubai Real Estate Outlook

Dubai’s real estate market continues to benefit from global wealth migration trends with Henley & Partners anticipating 9,800 millionaires will migrate to the UAE in 2025.

Savills Dynamic Wealth Index placed Dubai as the top global city for attracting and developing individual wealth, driven by the strong quality of life proposition, low tax environment and strength of the Golden Visa programme.

Looking ahead, the outlook for Dubai’s residential sector remains optimistic

with Q2 delivering record-breaking metrics with transaction volumes, average rate per sqft and average ticket prices all reaching new highs.

While Savills anticipates that global macroeconomic headwinds - including the evolving US-China trade relationship and the eventual outcome of US tariffscould moderate economic activity in the near term, the emirate’s political stability, competitive regulatory landscape, and business friendly ecosystem are expected to support ongoing population and investment inflows.

EXCEL IN PIPELINE PROJECTS WITH TESMEC 1875XL EVO

Tesmec has been producing trenchers for 70 years, with three factories located in Italy, France and Texas. Over the last 20 years, Tesmec has focused on innovation and technology. Saudi Tesmec is our local branch, supporting the pipeline industry.

Tesmec 1875XL EVO Chainsaw only solution on the market trench widths up to 213 cm Featuring an impressive 950-hp is engineered to conquer challenges, making it ideal installations in hard and

Chainsaw Trencher stands as the market capable of achieving cm and depths up to 732 cm. 950-hp engine, this machine conquer the toughest excavation for large-diameter pipeline abrasive rock conditions.

SIMPLIFYING THE COMPLEX

BPME ’S JASON SAUNDALKAR TALKS TO TRIMBLE’S PAUL WALLETT ABOUT THE COMPANY’S RECENT BUSINESS PERFORMANCE, FUTURE PLANS, TECHNOLOGY’S GROWING IMPACT ON COMPLEX PROJECTS, ARTIFICIAL INTELLIGENCE, AND THE IMPORTANCE OF FULL LIFECYCLE ASSET MANAGEMENT

US-headquartered Trimble is a long-term player in the global construction industry and, over the years, the company has steadily invested in growing its operations in key Middle East markets. This strategy has paid dividends, as GCC markets such as the UAE, Saudi Arabia and others embarked on their respective transformation journeys to diversify their economies away from hydrocarbons, which has seen significant construction projects announced, and delivered.

These projects have been and continue to be complex and at a scale that’s rarely observed outside of Middle East markets. This presented construction companies with a multitude of challenges – primarily delivering projects ontime and under budget and at the expected level of quality. Addressing these challenges has pushed construction firms to accelerate their adoption of technology and, in some cases, embark on full digital transformation journeys.

Although there has been significant adoption of technology by a multitude of industry stakeholders over the last few years, and some GCC construction markets have slowed, there’s still a healthy appetite for technology in the region.

“There’s still a long way to go in many of these markets as far as the adoption of technology is concerned. There’s still massive growth potential for us as existing companies look at refining their offerings and look for even greater efficiencies, while new companies continue to set up shop in the region. Consequently, we've been able to expand our team both here in the UAE as well as in Saudi Arabia, and there’s renewed focus on continuing our growth across the region,” explains Paul Wallett, Regional Area Director, Trimble AECO Middle East.

“Recently, we’ve seen that certain markets and economies have in one way scaled back. If we look at the

We’re bridging the gap between design, construction and operations through the ability that we have in both the hardware and software ecosystem, so that gives better data quality and data flow across all stages of the project.

MUSEUM OF THE FUTURE

construction index for Saudi Arabia, for example, it's not at the level they anticipated three years ago - when you compare the UAE and Saudi Arabia, I believe the UAE is now on par with the Kingdom in that regard.”

Wallett notes that Trimble has seen strong year-on-year growth in the region, while globally, the firm has enjoyed significant momentum and surpassed expectations. “Trimble had a tremendous Q2 2025 where we recorded an annualised recurring revenue growth of US $2.21bn. This surpassed expectations and reflects the momentum that we have in our business with our Connect and Scale strategy that we’ve been pushing for the past few years. Following that strong Q2 performance, our CEO Robert Painter and the Financial Board raised the full year 2025 guidance,” Wallett remarks.

Wallett points out that the performance is the result of investments Trimble continues to make internally and externally. He notes that the Connect and Scale strategy is a customer driven strategy and says the firm has also heavily invested in its own digital transformation over the last couple of years, with the goal of ensuring Trimble’s customers have easier transactions and communications with the company.

Discussing the firm’s customers and projects that Trimble’s solutions have supported recently, Wallett says his customers are involved in multiple projects across the region, including in key markets such as the UAE, Saudi Arabia and Egypt.

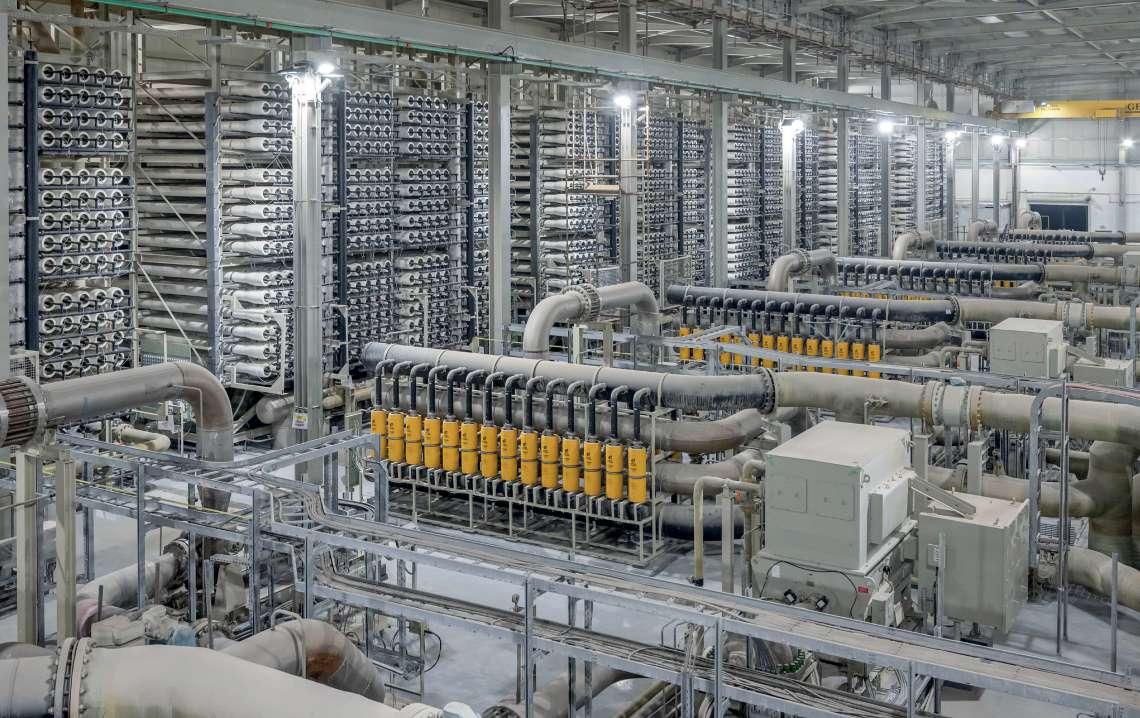

“We’re supporting a lot of projects across the region with multiple customers using our technology at the early stages to deliver their project. Across the Middle East we’re supporting the delivery of several museums including the Guggenheim Abu Dhabi, Zayed National Museum, and the National History Museum. We’re also on the Etihad Rail project and are involved with projects on Al Marjan Island in Ras Al Khaimah, and many others. There’s still a big need for technology in this market, so although we are solution providers at the end of the supply chain, we’ve not really felt the scale back that has taken place in some markets,” he comments.

Pressed for insights into potential challenges that Trimble anticipates within the region, Wallett says there

Multiple Trimble solutions supported the delivery of the Museum of the Future in Dubai. The structure is one of the most complex buildings ever built.

is a focus on keeping up with the pace of growth that the company expects. “Expectations are high, and all eyes are on the Middle East. There are global influences at play which may have some impact on projects and business but it’s not something that we focus on because, thus far, we’ve not seen any real negative impact on our business,” he responds.

“We’re fortunate that there's many companies across the region that need our technology and support to help them deliver their projects more efficiently and on time. So I wouldn't say big challenges or surprises are really on the horizon, unless the oil prices are suddenly impacted heavily and there’s a complete downturn of the construction economy itself,” he adds.

Customer Pain Points

Moving onto the topic of regional client demands and the challenges that they face on projects, Wallett says there are a raft of issues that construction companies are keen to overcome.

“There’s still a major challenge of silos in construction companies and even between the teams that are working together on a project, which leads to inefficiencies on top of the usual project challenges of delays and cost overruns. Many clients in the region are now also increasingly demanding faster outputs and want to leverage technology such as artificial intelligence (AI) to accelerate designs, detailing and project planning,

CULTURAL PROJECTS

so they can meet tighter project schedules without compromising their accuracy,” Wallett remarks.

Explaining how the company’s variety of solutions address customer demands and provide real value, he explains, “Clients are looking for true automation and integration; there’s always been a strong push for seamless interoperability between software platforms and physical components (machines, surveying equipment, GPS systems, sensors etc) and that ultradetailed digital twin. In this respect, Trimble is fortunate as we have a lot of technology that enables us and our customers to connect the physical and digital world.”

He continues, “We’re bridging the gap between design, construction and operations through the ability that we have in both the hardware and software ecosystem, so that gives better data quality and data flow across all stages of the project.”

Wallett says that the demands for AI integration are also increasing steadily in the construction industry, and here he points out that Trimble does

not see the technology as an add-on, but instead has it embedded into its end-to-end processes.

“Many customers have their own R&D departments set up and they’re specifically looking at AI, automation and productivity. Automation and enhancing productivity is a core element that Trimble has historically been known for, from digital twins right down to machine control on the job site. We enable repetitive tasks to be automated and offer high-precision, and this enables people to focus on high value decisions rather than worry about the small stuff, as that’s being taken care of by our advanced solutions,” Wallett emphasises.

Sustainable Construction Goals and Future Regional Opportunities

Across the Middle East, developers and construction companies are aligning with global efforts to reduce the impact of their developments on the environment, in a bid to reduce greenhouse gas emissions (GHGE), and prevent climate change.

Here, technology has a significant part to play in the decarbonisation of construction company operations and project delivery. “From Trimble’s perspective, we’re fully focused on how our technology can reduce the carbon output from each construction project, and even from operating machinery. With construction there

The company is supporting the delivery of several prominent museums across the Middle East, including the Zayed National Museum, Guggenheim Abu Dhabi and the National History Museum.

are many inherent issues and, overall, the amount of wastage on each project is a big problem, and for as long as you stay onsite, that keeps adding up in terms of the human element and material waste,” he cautions.

He adds, “By leveraging our technology, construction companies can become more efficient and enjoy accuracy of data and can complete their projects on time and, ultimately, reduce waste going to landfills, in support of a circular economy. Digitising construction processes also has the benefit of reducing the paper chain, and all this ultimately plays into achieving sustainability goals in the long run.”

Another topic gaining increasing attention in the industry internationally, as well as on a regional level, is full lifecycle asset management. Wallett says that this is absolutely crucial and while the market is still somewhat focused on construction processes (due to the amount of construction that’s currently underway in the region) the time is right for the idea of full lifecycle asset management to take hold.

“This has to be initiated at the very beginning of a project, starting with deciding which model the data is going to be incorporated into, and how that is going to be utilised in the long term. There are projects where they’ve built the lifecycle model retroactively and while there are specialists firms focusing on Building Management System (BMS) models, that’s a huge cost in itself. It’s crucial for a full lifecycle asset management approach to start with the right intent and build on that data with the outcome being to have a model that you can actually use and tie into the various SCADA systems, internet of things (IoT) devices and so on,” he explains.

“There are already projects leveraging that technology today to manage their facilities post-delivery, but I think what’s interesting is how this concept can be used in delivering a project. Our long-term vision is anchored in the Connect and Scale strategy and leveraging AI in the future to automate processes using AI agents. That is

going to be a huge benefit and it really is a gamechanger - I think if you are not looking at that technology as a large developer or even as a contractor, you’re probably going to be left behind in the market. It’s certainly something that’s going to have a big impact in terms of how people work in the industry,” Wallett notes.

From Field to Office

Wallett also tells Big Project Middle East that there’s a growing focus on ‘connecting the field to the office’, with regional interest in such technology coming to a boil at the start of 2025.

“We had the Connected Construction Conference at the Museum of the Future, and had the regional launch of Viewpoint Field View, which is part of the Viewpoint product suite. Field View offers a cost effective data capture solution, with reality capture capability. So, if you take an Insta 360 camera to site, we can hook that directly into the platform and it becomes a really great way for people to capture all the information they need, rather than going down the more expensive route of 3D laser scanning,” he says.

CLIENT DEMANDS

Clients are increasingly demanding faster outputs and want to leverage artificial intelligence to accelerate designs, detailing and project planning, so they can meet tighter schedules without compromising their accuracy says Wallett.

The captured information is available on the cloud and for snagging purposes you can tag areas that have been missed or need snagging directly on the platform. This gives you the rapid capability that’s needed when you’re executing the project onsite, and you want to make sure that construction is going in the right direction,” he explains. Making his closing remarks, Wallett notes, “There’s a lot going on at Trimble, and there’s a heavy focus on solutions and technologies to enhance the way that people can deliver complex projects on time and under budget. The future of construction is going to be increasingly technology driven, so I encourage everyone to put aside their worries about technology and embrace it, and become a part of the evolution of the construction industry.”

Knowledge. Resources.

The value of ACI membership has never been greater. Our top fi ve benefits for the region are:

• Webinars and on-demand courses

• ACI Practices (includes all ACI guides and reports)

• Concrete International and ACI Journals

• Connections with over 30,000 global concrete industry professionals

• Discounts on ACI’s Codes and Specifications (including SI Units)

ACI membership is your most valuable resource in the concrete industry. Join the premier world community dedicated to the best use of concrete.

“ACI is the premier organization for the concrete industry. Becoming an active member will enhance anyone’s professional career.”

—John F.

ACI Membership means high value.

ACI members know it. Join now at concrete.org.

FORGING THE FUTURE OF GLASS

ABDULAZIZ BIN YAGUB AL SERKAL, CEO, INDUSTRIAL PLATFORM AT DUBAI INVESTMENTS SPEAKS ABOUT THE TRANSFORMATIVE SHIFT IN ARCHITECTURAL AND INDUSTRIAL GLASS PRODUCTION ACROSS THE UAE, AND THE BROADER MENA REGION WITH BPME ’S PRIYANKA RAINA

In line with the ongoing construction and infrastructure boom in the GCC and the need to align with sustainability mandates, the demand for high-performance, energyefficient glass has grown significantly. At the heart of this transformation is ‘Glass LLC’, a key industrial subsidiary of Dubai Investments, that blends innovation, scale, and sustainability across the region’s evolving built environment.

With Emirates Float Glass, Emirates Glass, and Saudi American Glass under its umbrella, Glass LLC says it is redefining architectural and industrial glass production across the UAE, Saudi Arabia, and wider MENA region. From cutting-edge jumbo processing lines to advanced coatings tailored for desert climates, the company notes that it is aligned with the region’s push for greener, smarter, and more resilient buildings and infrastructure.

According to Data Bridge Market Research’s analysis, the Middle East glass market is expected to reach US $4,027mn by 2031 up from $2,406mn in 2023, growing at a CAGR of 6.8% during the forecast period of 2024 to 2031.

As the demand for sustainable, high-performance glass continues to grow, the company says it has emerged as a leading force in innovation, manufacturing excellence, and regional supply chain integration. From smart glass technologies to next-generation coatings and strategic capacity expansions, the company says it is setting new benchmarks in the glass manufacturing industry.

In this exclusive interview Abdulaziz Bin Yagub Al Serkal, CEO, Industrial Platform at Dubai Investments delves into Glass LLC's 2024 performance, investments in nextgeneration technologies, and its strategic role in shaping the future of glass manufacturing across international markets.

Share an overview of Glass LLC’s performance and achievements in 2024, and what were your main targets and goals for that year?

2024 marked a significant year of achievement for Glass LLC, with total production surpassing 14.8m sqm. Emirates Float Glass reached full production capacity, Emirates Glass recorded an 8% year-on-year growth, and Saudi American Glass achieved its highest-ever annual output. The group’s focus was on scaling production, enhancing operational efficiency, and strengthening product innovation. These results reflect Dubai Investments’ strategic investment in manufacturing excellence and its commitment to serving regional and global market needs.

What sectors are primarily driving glass demand and how do you plan to meet increasing regional and international demand?

The primary demand is driven by the construction and infrastructure sectors, particularly from large-scale developments in the UAE, Saudi Arabia, and other highgrowth markets across the region. With the rise of mega

projects, smart cities, and green buildings, the need for high-performance, sustainable glass solutions has intensified.

To meet this growing regional and international demand, Glass LLC is significantly ramping up capacity and expanding its product range. The group is investing in a new coater line to enhance the production of energy-efficient glass, including advanced solar control and low-emissivity (Low-E) products. Additionally, new processing lines have been commissioned to support increased volumes of jumbo-sized, fire-rated, bullet-resistant, and digitally printed glass tailored for specialised architectural and commercial applications.

Alongside capacity expansion, the company is also introducing new product lines aimed at high-end interior

ADVANCED MANUFACTURING

The group's manufacturing is closely aligned with local building codes, sustainability frameworks, and client requirements, giving it a competitive edge in mega projects.

and design markets, including decorative and artistic glass solutions under dedicated sub-brands. These efforts are aligned with evolving customer preferences for customised, high-precision, and sustainable materials.

Glass LLC’s export footprint now spans over 35 countries, with growing demand from Africa, Asia, and Europe, reinforcing its reputation as a trusted supplier for both standard and premium glass solutions across diverse geographies.

Can you elaborate on the latest technology investments, particularly the jumbo lamination and glazing lines?

The installation of jumbo glass processing lines at Emirates Glass - covering cutting, seaming, tempering, and lamination - has significantly enhanced the group’s architectural glass manufacturing capabilities. These advanced systems enable the high-precision production of oversized, safety-rated glass, catering to the evolving demands of modern, large- format architectural designs.

In parallel, the commissioning of Line 3 at Emirates Float Glass (EFG) has further bolstered the group’s value chain. This line supports the manufacture of high-quality jumbo float glass sheets, serving as the base substrate for advanced processing at Emirates Glass. Together, these investments ensure seamless integration between float glass production and downstream processing, increasing operational efficiency and product versatility.

Additionally, the introduction of a digital ceramic printing line at Emirates Glass has elevated the group’s ability to deliver custom, design-led solutions. This is especially relevant for projects requiring decorative façades, branding elements, or functional artistic treatments – combining form with performance for both commercial and creative applications.

Glass LLC has been recognised for its next-generation coatings - what sets these high-performance coatings apart from competitor solutions, and how are they addressing evolving real estate/construction needs?

Glass LLC’s coatings are developed to deliver energy efficiency, solar control, and aesthetic adaptability - features that are increasingly essential in real estate and construction. With advanced Low-E and reflective coatings, these products are engineered to perform in high-temperature climates, helping developers meet sustainability benchmarks while supporting thermal comfort and visual appeal.

Can you share insights into the expansion roadmap both in terms of production capacity and geographic footprint over the next three-to-five years?

Dubai Investments is actively pursuing a multi-tier expansion strategy. Plans are underway to increase production capacity across all three subsidiaries under Glass LLC. Geographic expansion is focused on strengthening penetration in high-growth markets across Africa and Asia, while aligning with strategic initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050. Evaluations are also being conducted for localised operations and partnerships in key international markets.

R&D seems central to your innovation strategywhat are some of the top priorities or breakthroughs we can expect from Glass LLC’s R&D arm? Research and development priorities include the advancement

INTEGRAL TO MODERN ARCHITECTURE

Smart glass and dynamic façades are increasingly integral to modern architecture in the region.

Glass LLC’s coatings are developed to deliver energy efficiency, solar control, and aesthetic adaptability—features that are increasingly essential in real estate and construction.

of smart coatings, lightweight laminated glass, and acoustic and UV protection solutions. Glass is also investing in AI-driven quality control, automated process optimisation, and recycled material usage. Future breakthroughs are expected in the area of dynamic glazing, which will support the evolving demands of smart cities and intelligent façades.

What strategic themes or shifts do you foresee shaping the glass manufacturing industry in 2025 and beyond, especially in the context of sustainability and smart construction?

The industry is moving rapidly towards energy-efficient materials, smart façades, and digitalised production systems. In the Middle East, these shifts are accelerated by large-scale infrastructure projects that demand low-carbon, high-performance building materials.

The integration of glass as an active component in energy regulation and intelligent design is expected to become a key differentiator in future developments.

As sustainability becomes a core priority for the built environment, how is Glass LLC innovating around energyefficient glazing solutions and environmentally responsible manufacturing?

Glass LLC is prioritising Low-E glass, solar control solutions, and high-transparency coatings to support energy-efficient construction. Emirates Float Glass is the only ICV-certified glass manufacturer in the UAE and is listed on the Golden List by the Abu Dhabi Department of Economic Development. These recognitions reflect the group’s leadership in localised, sustainable manufacturing. In addition, the adoption of resourceefficient processes and exploration of alternative fuels underline Dubai Investments' environmental commitment.

How do you see the role of smart glass and dynamic façades evolving in the Middle East, and

is Glass LLC investing in these technologies?

Smart glass and dynamic façades are increasingly integral to modern architecture in the region. With rising demand for climate-responsive and adaptive solutions, the group is actively exploring partnerships and innovations in glass technologies.

Glass LLC is positioning itself to deliver intelligent glass systems that can adjust to light, heat, and privacy requirements in real time. Additionally, the group has introduced certified fire-resistant glass to meet growing safety requirements, complementing its range of advanced glass solutions for high-performance buildings.

STRUCTURED PROGRAMS

The group has implemented structured programs to build internal capabilities across manufacturing, R&D, and automation.

What competitive advantages does Glass LLC offer compared to international glass manufacturers particularly when bidding on large-scale projects across MENA and beyond?

Glass LLC’s core advantage lies in its vertically integrated structure, regional presence, and ability to offer customised, value-added solutions with reduced lead times. The group's manufacturing is closely aligned

with local building codes, sustainability frameworks, and client requirements, giving it a competitive edge in megaprojects. The inclusion of Emirates Float Glass in the Golden List enhances eligibility for government-backed initiatives, adding further value.

Can you shed light on workforce development? How is Glass LLC investing in talent, training, and automation to keep pace with technological shifts? What is the percentage of automation you have in your production? Glass LLC maintains a strong focus on technical training, cross-skilling, and workforce digitalisation. The group has implemented structured programs to build internal capabilities across manufacturing, R&D, and automation. Approximately 60–70% of production is currently automated, particularly in float glass manufacturing, where precision and efficiency are paramount. These efforts ensure readiness for the evolving demands of industrial transformation.

What’s the strategic importance of Saudi American Glass within your platform, especially as Saudi Arabia becomes a hub for giga-projects and industrial investment?

Saudi American Glass plays a central role in addressing the escalating demand for specialised and decorative glass solutions in Saudi Arabia. The launch of Elite Vitrage, the brand’s premium artistic line, is in line with the Kingdom’s design-led development direction. With production scaling up by over 13% year-on-year and a 57% increase forecast for 2025, SAG is crucial to the Group’s growth in one of the region’s most dynamic markets.

Has digital transformation played a role in scaling your production or managing quality across your facilities? Are there any new specific technologies you’ve adopted recently and what impact have they had on your business so far?

Digital transformation has enabled real-time monitoring, predictive maintenance, and improved production accuracy across Glass LLC facilities. Recent implementations include automated quality control systems and high-precision digital printing technology, which have enhanced product consistency and allowed for greater design flexibility. These digital advancements have directly contributed to increased throughput, reduced operational downtime, and an elevated standard of product innovation.

GREEN CEMENT INNOVATION

ENG. SAEED GHUMRAN AL REMEITHI, GROUP CEO OF EMSTEEL TALKS TO BPME ’S PRIYANKA RAINA ABOUT THE FIRM’S COMPREHENSIVE DECARBONISATION STRATEGY, ITS GREEN CEMENT INITIATIVE AND THE IMPACT IT CAN HAVE ON THE CONSTRUCTION SECTOR

The cement industry stands as one of the most carbonintensive sectors globally, responsible for approximately 7–8% of global greenhouse gas emissions (GHGE). This environmental footprint primarily arises from the energyintensive production of clinker, a key component in cement manufacturing. In the Gulf Cooperation Council (GCC) region, where rapid urbanisation and infrastructure development are taking place, the demand for cement continues to rise, amplifying the urgency for sustainable practices.

In response to this challenge, EMSTEEL - a prominent player in the GCC's steel and building materials sector - has unveiled its comprehensive decarbonisation strategy. Aligned with the UAE's ambitious Net Zero by 2050 initiative, EMSTEEL aims to achieve a 40% reduction in GHGE in its steel division and a 30% reduction in its cement division by 2030, using 2019 as the baseline year. The company says it is committed to reaching Net Zero emissions across its operations by 2050.

A cornerstone of EMSTEEL's strategy is the industrialscale adoption of decarbonised cement, which saw the company partner with Finnish firm MAGSORT to produce cement utilising steel slag, a by-product of steel manufacturing. This innovative approach not only reduces carbon emissions but also repurposes industrial waste, contributing to a circular economy, the company explained.

EMSTEEL's proactive stance underscores a broader regional trend in the GCC, where governments and industries are increasingly prioritising sustainability. The Global Cement and Concrete Association's (GCCA) 2050 Net Zero Roadmap outlines the collective commitment

COMMITTED TO THE ENVIRONMENT

EMSTEEL is committed to minimising its environmental footprint; its circular economy approach optimises the production cycle, extends the lifecycle of materials, and drives long-term sustainability.

Cement production is responsible for approximately 7–8% of global CO 2 emissions, and decarbonised alternatives can reduce these emissions by 30–50%.

of leading cement producers to achieve Net Zero concrete by 2050, emphasising the need for technological innovation, policy support, and industry collaboration.

As the GCC navigates its path toward sustainable development, EMSTEEL's initiatives exemplifies how the cement sector can tackle decarbonisation and align industrial growth with environmental stewardship.

Decarbonising Construction Materials

Discussing EMSTEEL’s pilot for decarbonised cement production and what key materials were used to produce decarbonised cement, Eng. Saeed Ghumran Al Remeithi, Group CEO of EMSTEEL states, “Following a commitment to the UAE’s Net Zero 2050 strategy, EMSTEEL, announced its strategic collaboration with MAGSORT to drive an innovative initiative across its Al Ain Cement Factory, setting the stage for a transformative approach to Green Cement production.”

“The partnership aimed to initiate the region’s firstof-its-kind large scale industrial pilot project in our Al Ain Cement plant, a vision which is now being executed by processing steel slag to produce low-carbon cement by reducing both limestone and fuel consumption. The current agreement follows the success the group had in implementing the industrial-scale pilot through utilising 10,000t of materials that reduced carbon.”

He adds, “Using steel slag to produce decarbonised cement provides both environmental and performance benefits. As a by-product of the steelmaking process, repurposing steel slag reduces industrial waste and landfill use, supporting a circular economy. It contains minerals like calcium that can partially replace clinker, cutting down on the energy-intensive processing of limestone and reducing raw material extraction. Since steel slag is already partially processed, it also lowers the overall energy demand in cement production. In addition, it can improve the durability, chemical resistance, and longterm strength of concrete, thereby extending the lifespan of structures and further contributing to sustainability goals.”

CHIEF EXECUTIVE OFFICER

When asked about the significance of integrating EMSTEEL’s steel and cement operations and what role industrial circularity plays in EMSTEEL’s business strategy, Al Remeithi responds, “We are committed to responsible waste management and reduction practices to minimise our environmental footprint. Our circular economy approach optimises the production cycle, extends the lifecycle of materials, and fosters long-term sustainability.”

He continues, “EMSTEEL Group’s pilot provides a unique use-case for complementary operations between its two main business lines: steel and cement. This is achieved by incorporating steel slag at scale as raw material for clinker and cement production, reinforcing the group’s commitment towards driving sustainability in the sector.”

Engineer Saeed Ghumran Al Remeithi is the Group CEO of EMSTEEL.

Pressed for details on how the decarbonisation project can positively impact emissions, Al Remeithi first said that to address the growing local market demand for low-carbon cement, an integrated line will be built at the company's Al Ain plant.

“This line will process steel residue and refine materials sourced from EMSTEEL’s steel plant in Abu Dhabi. This significant initiative is a crucial step expected to directly contribute to reducing Scope 1 carbon dioxide emissions, which are generated from the direct combustion of fuels and chemical processes during clinker production.”

Discussing how the adoption of decarbonised cement could contribute to sustainable urban development in the region, Al Remeithi says, “One of the most critical contributions is the reduction of carbon emissions from construction activities. Cement production is responsible for approximately 7–8% of global CO2 emissions, and decarbonised alternatives can reduce these emissions by 30–50%. This reduction is essential for aligning construction practices with national climate strategies, including the UAE’s Net Zero 2050 initiative, which requires a significant cut in emissions across all sectors, particularly in rapidly expanding urban infrastructure.”

“Additionally, the use of decarbonised cement supports compliance with green building standards increasingly mandated in the region. Regulatory frameworks such as the Dubai Green Building Regulations and Specifications (Al Sa’fat) and the Estidama Pearl Rating System in Abu Dhabi encourage or require the use of low carbon materials. Incorporating decarbonised cement into construction projects helps developers meet these standards, securing certifications that reflect sustainable practices and enhancing the environmental credentials of buildings,” he explained.

Outside of positively impacting emissions within the industry, the low carbon cement production line will also

Slag-based cement provides enhanced durability, showing superior resistance to sulfate, chloride, and alkali attacks - making it particularly suitable for use in aggressive environmental conditions.

positively impact the local supply chain, with regards to the availability of sustainable materials for construction projects.

“By localising the production of green cement types such as CEM II, CEM IV, and CEM V, it reduces the reliance on imported supplementary cementitious materials (SCMs) and blended cements, strengthening the regional supply chain. This localised approach ensures more consistent access to sustainable cement for infrastructure, housing, and green building projects in Al Ain, Abu Dhabi, and the Western Region, while also minimising logistical risks, transport costs, and project delays,” he exclaims.

Future Demand

Discussing the future and his expectations in terms of the demand for decarbonised cement, Al Remeithi is positive and said that there are robust demand projections for green cement in the GCC and broader Middle East region, indicating strong growth in the coming years.

“The GCC Green Cement market, which includes products such as limestone, slag, and other low-carbon blends, was valued at approximately US $1.22bn in 2024 and is projected to reach $3.3bn by 2033, growing at a compound annual growth rate (CAGR) of around 10.95% between 2025 and 2033. These figures indicate a rapidly increasing demand for decarbonised cement, driven by sustainability goals, regulatory requirements, and the growing focus on low-carbon construction across the region.”

Talking about the performance characteristics of cement made from steel slag versus traditional cement, Al Remeithi said there are several advantages, with one of the most significant benefits being a 30%–50% reduction in CO2 emissions, which substantially lowers the embodied carbon of the concrete and supports more sustainable construction practices.

“Additionally, slag-based cement provides enhanced durability, showing superior resistance to sulfate, chloride, and alkali attacks - making it particularly suitable for use

MAKING A DIFFERENCE

in aggressive environmental conditions. It also generates a lower heat of hydration, reducing the risk of thermal cracking in mass concrete applications. Over time, it tends to develop higher long-term compressive strength compared to Ordinary Portland Cement (OPC).”

EMSTEEL's decarbonised cement, CEM II/B-L (limestone cement), also offers notable advantages over traditional OPC. Its reduced clinker content - approximately 65% - results in a significantly lower carbon footprint, aligning well with the sustainability goals of green building certifications such as ESTIDAMA and LEED. Like slag cement, EMSTEEL’s product exhibits a lower heat of hydration, making it well-suited for mass pours and hot climate conditions, where thermal stress is a concern. Additionally, it provides improved workability and plasticity, which enhances ease of handling and leads to better surface finishes in concrete applications, he points out.

Al Remeithi said that decarbonised cement is increasingly proving advantageous across a wide range of construction applications. Its lower heat of hydration makes it especially well-suited for mass concrete structures like foundations, podium slabs, and retaining walls, where it helps minimise thermal cracking.

Additionally, decarbonised cement performs well in controlled environments for non-structural and precast elements such as blocks and pavers, offering sustainability benefits along with improved finish quality. Urban infrastructure projects, such as pavements and utility works in non-aggressive environments, can also adopt these cements effectively, contributing to public sector carbon reduction goals, he explains.

When asked about the certifications or regulatory approvals that are required for decarbonised cement to be widely adopted in construction projects, Al Remeithi comments, “The cement must comply with international and national technical standards to ensure safety, structural integrity, and compatibility with existing concrete mix designs. This includes adherence to European standards such as EN 197-1 for general cement performance, EN 197-5 for blended cements like CEM II and CEM VI, and EN 197-6 for incorporating recycled construction materials. In the US, relevant standards include ASTM C150 for Portland cement and ASTM C595 or C1157 for blended and performance-based cements.”

EMSTEEL has collaborated with MAGSORT to drive forward a transformative approach to Green Cement production.

Asked about the cost of decarbonised cement versus regular cement and whether project budgets will have to allow for higher material costs, Al Remeithi states, “To maintain cost efficiency while continuing to lower carbon emissions, the cement and construction industries will need to diversify their SCM sources. Alternatives such as calcined clays, natural pozzolans, and treated EAF slag offer promising substitutes. Additionally, adopting performance-based specifications can provide greater flexibility in mix design and raw material use.”

He also says that going forward, regulatory changes may further favour decarbonised cement. “Policies like carbon pricing, stricter carbon disclosure requirements, and public procurement rules that prioritise low-emission materials could make low-carbon cement more financially attractive. In this evolving landscape, decarbonised cement has the potential to remain cost-effective, while helping the industry meet its climate goals,” he points out.

A Collaborative Effort

Ensuring that the construction sector decarbonises effectively requires that all of its stakeholders adopt sustainable practices and materials. Therefore, developers, consultants and contractors have a significant role to play in this effort, as well as accelerating the adoption of low-carbon cement and other sustainable materials.

“In the UAE, all cement products must be registered and approved under the ESMA (Emirates Authority for Standardisation and Metrology) conformity scheme, aligned with UAE.S 42:2017 and EN/ASTM standards. Manufacturers must also undergo annual audits, third-party testing, and comply with labelling requirements under the Emirati Conformity Assessment Scheme (ECAS).”

He continues, “Secondly, environmental and sustainability certifications are essential for adoption in ESG-driven developments. An Environmental Product Declaration (EPD), verified under ISO 14025 and EN 15804, is required to document the cement’s lifecycle carbon footprint. This supports eligibility for sustainability rating systems - for example, LEED recognises low-carbon materials under its Materials & Resources credits, Estidama offers credits for recycled and low-emission materials, and Al Sa’fat promotes the use of locally sourced, low-clinker cement.”

Commenting on the importance of broad stakeholder involvement in decarbonisation efforts, Al Remeithi says, “Contractors, as the frontline implementers, can accelerate adoption by actively incorporating low-carbon cement into construction practices. This involves collaborating with suppliers to approve and trial new mix designs, particularly in structural and mass concrete applications.”

“Developers can also act as key demand drivers by embedding low-carbon cement into project specifications and procurement requirements. By mandating the use of materials with Environmental Product Declarations (EPDs) or compliance with standards like EN 197-5/6, they can create upstream market pressure for sustainable supply readiness.”

Regulatory bodies can also accelerate the shift through policy-driven initiatives. “This includes updating procurement policies to mandate or incentivise low-carbon materials in public projects, integrating requirements into building codes and sustainability standards like Estidama and Al Sa’fat, and offering incentives such as carbon credits or streamlined certification processes,” he concludes.

GROWING DEMAND

There are robust demand projections for Green Cement in major markets across the GCC, as well as the broader Middle East region, EMSTEEL says.

NEW FRONTIERS

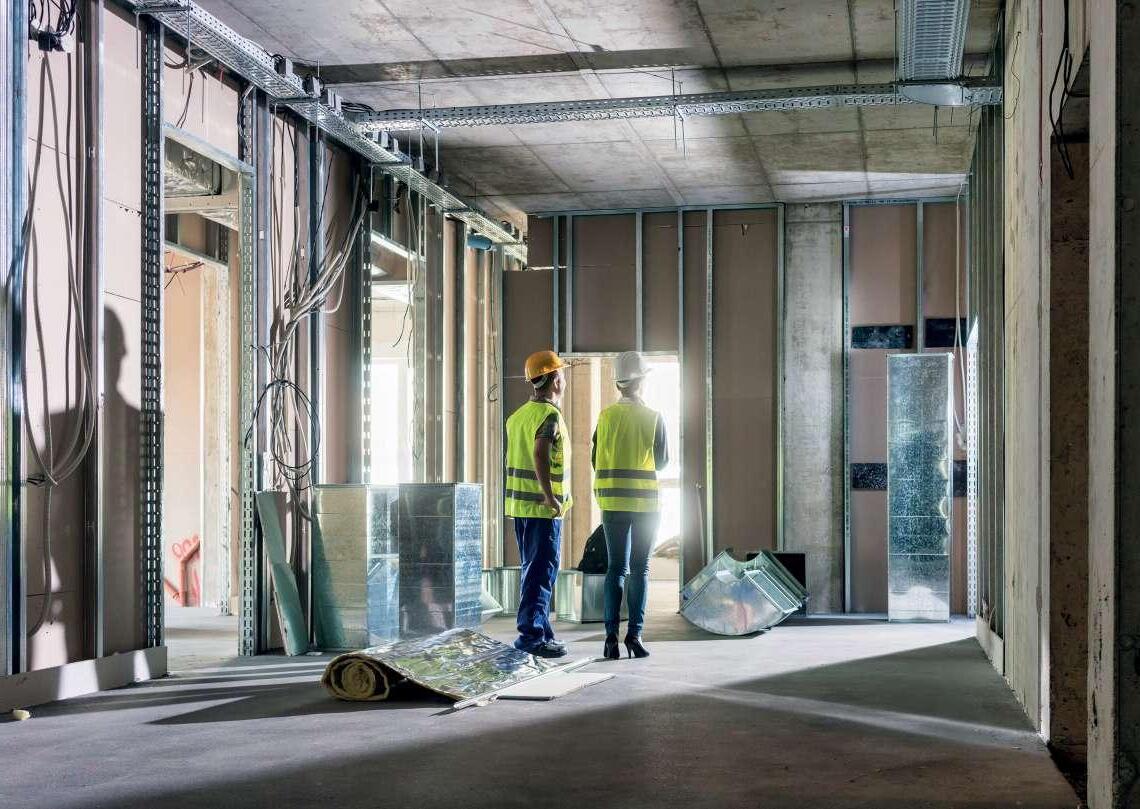

BPME ’S JASON SAUNDALKAR TALKS TO OCTA PROPERTIES’ GOPINATH RAO AND DMDC’S RAJI DAOU ABOUT THE FITOUT OF OCTA’S HEADQUARTERS, AND DMDC’S MOVE INTO THE COMMERCIAL FITOUT

OCTA Properties (OCTA) has over 20 years of experience in the real estate sector, and it recently unveiled its renovated headquarters in Dubai Hills Estate. To realise the project, OCTA partnered with DMDC, a construction firm that specialises in custom builds, luxury renovations and bespoke fitout.

Discussing the vision and some of the main goals for the project, Gopinath Rao, Head of House Design at OCTA Properties told Big Project Middle East that the office was designed to support the company’s mission of delivering end-to-end services to industry-leading names.

“The office serves as an integrated collaboration hub where ideas come to life and partnerships are formed. The space was originally conceptualised by our in-house design team and executed in partnership with DMDC,” Rao shares.

“The office features an OCTA Café, a space where meaningful business conversations and deals naturally

LONG-TERM COMMITMENT

The 14,000sqft headquarters is said to reflect OCTA Properties’ long-term commitment to innovation and excellence.

unfold. It’s intentionally designed without the conventional reception desk to create a more welcoming, informal setting. There’s also the OCTA Gallery, where all our project models and information are shown to help clients make informed decisions. We’ve also incorporated exclusive lounges dedicated to signature-branded projects and private developments. This seamless blend of formal and informal areas makes the OCTA headquarters unlike any other in the market,” he adds.

The office boasts a modern design and is themed in cool grey and natural tones, which is said to create a cosy, inviting lounge and café experience rather than a traditional corporate office.

“We currently employ over 100 team members inhouse and work closely with more than 1,600 property firms. The new office was designed to accommodate design, marketing, and real estate teams, while also serving as a destination for visiting partners and clients, fostering seamless collaboration across all our verticals.”

“Our investment in this 14,000sqft headquarters reflects our long-term commitment to innovation and excellence. Every design and functional element was

crafted to reflect our vision of being at the forefront of Dubai’s real estate landscape,” he summarises.

DMDC has significant expertise in delivering residential projects, with the delivery of the OCTA head office marking the construction firm’s expansion into the commercial segment.