TBH raises the bar on Data Centre delivery

Adding value

Cundall’s Lee French on global integration

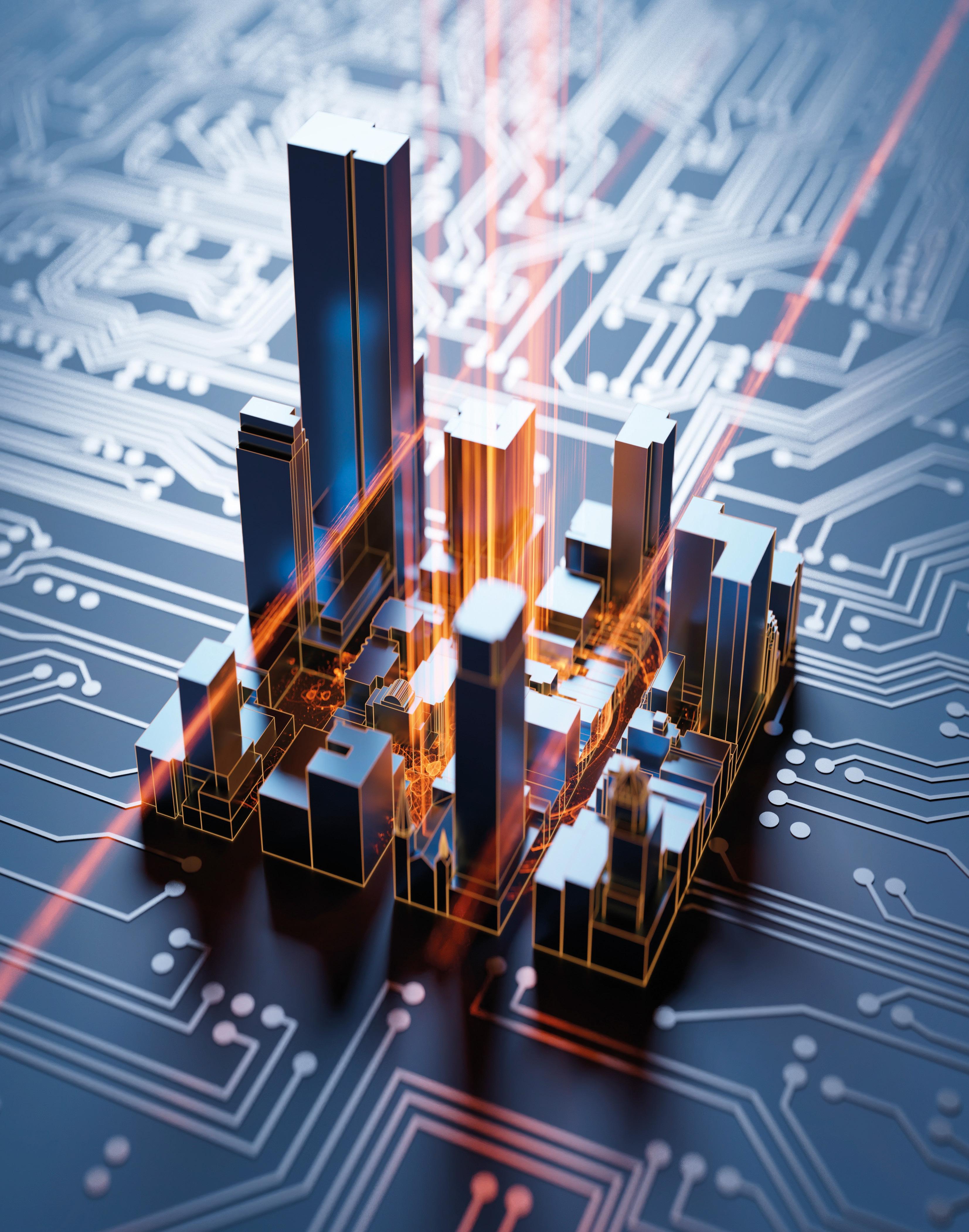

Intelligent How AI is powering Jacobs’ mega projects

Commercials

The economics of building super-tall

Journey

ECC’s Ahmed Balawi talks transformation

Taking a Deep Dive…

I firmly believe that whenever a magazine is re-designed, it carries a host of fresh meanings well beyond its mere appearance. As you can see, we’ve not only re-designed ME Consultant, but re-curated the topics and the range of analysis; I want it to embrace Content that really has resonance and purpose for our readership - that actually helps each and every one of you understand and interpret the sector’s key issues in ways that better empower you (and your organisation) to re-evaluate the agendas you’re faced with each and every day.

For example: we have a brand-new section called Competitive Advantage. In every issue, this will be very much our ‘anchor’ story and give in-depth details about how a leading organisation sets itself apart from its peers by virtue of creating sophisticated strategies, fuelled by sheer expertise and a wealth of experience when it comes to doing things differently and better.

In this debut edition, I’m proud to feature TBH in this new vertical, with three of its senior executives telling us about the company’s extraordinary work with Data Centres - and how TBH not only delivers some of the most advanced digital hubs in the world, but confronts head-on the challenges that this indispensable element of global connectivity brings centre-stage. Threaded through every sentence in this article is a deep concern for market strategy and a belief that any solution isn’t good enough if it doesn’t ‘go all the way’.

I very much hope that you enjoy this new Deep Dive approach to editorial and can use its added-value in very practical ways in your own world of work during the months ahead.

Head of Content, ME Consultant

TBH is at the forefront of Data Centre enterprise, and here, four of the firm’s senior executives explain the commitment, protocols and robust, proven experience behind that consistently innovative vision...

INTERFACE

34 Ahmed Balawi, ECC, takes a ‘deep dive’ into the transformative impact of digital tech when an organisation commits wholeheartedly to an odyssey of change and transformation ⁄ 44 What are the added-value factors that a world-class, multidisciplinary consultant brings to critical areas of masterplanning and complex project delivery? Cundall's Lee French, Partner explains...

INITIATE

10 Egis appointed to KAFD Transit System reactivation project ⁄ 12 SSH appointed lead design consultant for new Radisson RED hotel in RAK ⁄ 14 Turner & Townsend to support retirement of Abu Dhabi energy facility ⁄ 16 Mace Group announces investment in Mace Consult ⁄ 18 New trends emerge in KSA’s residential market says JLL

INNOVATE

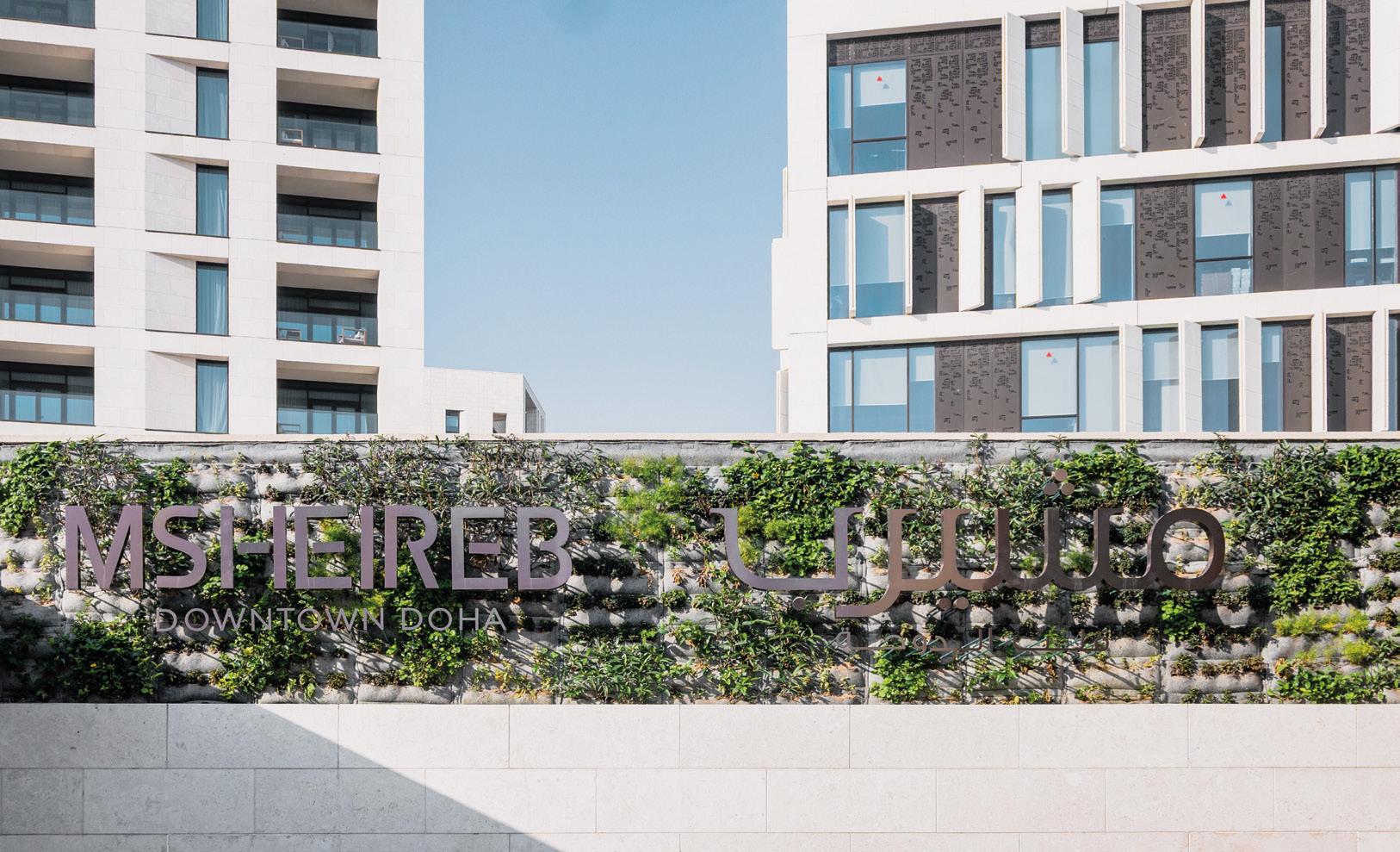

54 Built by intelligence: How AI is powering mega infrastructure delivery ⁄ 62 We look in detail at how Msheireb Properties partnered with Cundall to deliver Qatar’s first large-scale portfolio decarbonisation strategy… ⁄ 70 Building competitive advantage: Strategies for success in KSA ⁄ 78 The economics of building tall: AsiaPacific engineering titan Aurecon sets out what’s really front of mind for developers and their raft of investors

GROUP

MANAGING DIRECTOR Raz Islam

DIRECTOR OF FINANCE & BUSINESS OPERATIONS Shiyas Kareem

PUBLISHING DIRECTOR Andy Pitois

EDITORIAL

HEAD OF CONTENT Paul Godfrey

ASSOCIATE EDITOR Priyanka Raina

STUDIO

ART DIRECTOR Simon Cobon

GRAPHIC DESIGNER Percival Manalaysay PHOTOGRAPHER Maksym Poriechkin

CIRCULATION & PRODUCTION

DIRECTOR OF MARKETING & MEDIA OPERATIONS Phinson Mathew George PRODUCTION & IT SPECIALIST Jarris Pedroso

MARKETING

MARKETING & EVENTS EXECUTIVE Lakshmy Manoj

SOCIAL MEDIA EXECUTIVE Franzil Dias

WEB DEVELOPMENT

SENIOR DIGITAL MANAGER Abdul Baeis

WEB DEVELOPER Umair Khan

FOUNDER Dominic De Sousa (1959-2015)

raz.islam@cpitrademedia.com shiyas.kareem@cpitrademedia.com andy.pitois@cpitrademedia.com

paul.godfrey@cpitrademedia.com priyanka.raina@cpitrademedia.com

simon.cobon@cpitrademedia.com percival.manalaysay@cpitrademedia.com maksym.poriechkin@cpitrademedia.com

phinson.george@cpitrademedia.com jarris.pedroso@cpitrademedia.com

lakshmy.manoj@cpitrademedia.com franzil.dias@cpitrademedia.com

abdul.baeis@cpitrademedia.com umair.khan@cpitrademedia.com

When you have finished with this magazine, please recycle it

The publisher of this magazine has made every effort to ensure the content is accurate on the date of publication. The opinions and views expressed in the articles do not necessarily reflect the publisher and editor. The published material, adverts, editorials and all other content are published in good faith. No part of this publication or any part of the contents thereof may be reproduced, stored or transmitted in any form without the permission of the publisher in writing.

© Copyright 2025. All rights reserved.

FINANCE

EMSTEEL reports $1.17bn in revenue and $147mn EBITDA for H1 2025

Turner & Townsend to support retirement of Abu Dhabi energy facility

INDUSTRY

DMDC launches new division focused on property investment and renovation

CONSTRUCTION

TownX says construction of its Luma Park Views project is 95% complete

CONSTRUCTION

Arada awards US $168mn contract for Anantara Sharjah Resort and Anantara Sharjah Residences

Public transport links and the rise of sustainable tourism

Meeting Saudi Arabia’s water demand: The role of smart water management

Architectural AI − Designing better buildings while maintaining the human touch

New trends emerge in KSA’s residential market says JLL

According to a new report by JLL, Saudi Arabia’s residential market is showing signs of increasing maturity, with several urban centres demonstrating significant increases in rental rates

PROPERTY

Arada launches newest phase of its forest community, Masaar 3 Arada has launched Masaar 3, the latest and largest master plan of its forest community. With a total expected sales value of US $3.4bn, Masaar 3 will be delivered in eight phases and spread across a 21m sqft plot

INDUSTRY MERED expands UAE operations on Al Reem Island

The capital’s real estate market is experiencing growth, with transactions surpassing US $6.8bn in the first quarter of this year, a substantial increase from $5.17bn during the same period in 2023

Red Sea Global eyes new finance options

Red Sea Global’s (RSG) CEO, John Pagano, has said that the regenerative and sustainable developer is currently considering a range of alternative financing options

PROPERTY

BEEAH announces the launch of Phase One of Khalid Bin Sultan City

BEEAH has announced Phase One of Khalid Bin Sultan City, which is billed as an innovative new community in Sharjah. The city aims to redefine the future of urban living

OCTOBER

Women in Construction | ED&I Summit + Awards 1 October 2025

Habtoor Grand JBR, Dubai, United Arab Emirates

OCTOBER

Access+Handling ConfeX

30 October 2025

Lapita, Dubai, United Arab Emirates

NOVEMBER

World Cup Build Summit KSA 18 November 2025

Holiday Inn Riyadh - Al Qasr, Riyadh, Saudi Arabia

DECEMBER

ME Consultant Awards 9 December 2025

Ritz Carlton JBR, Dubai, United Arab Emirates

JANUARY

Construction Golf Day Dubai 21 January 2026

JA The Resort Golf Course, United Arab Emirates

10 Egis appointed to KAFD Transit System reactivation project ⁄ 12 Turner & Townsend to support retirement of Abu Dhabi energy facility ⁄ 14 SSH appointed lead design consultant for new Radisson RED hotel in Ras Al Khaimah ⁄ ⁄ 16 Mace Group announces investment in Mace Consult ⁄ 18 New trends emerge in KSA’s residential market, says JLL

A deep dive into the biggest construction headlines that caught our eye this month

Egis has been appointed as the Site Supervision Consultant (SSC) for the revitalisation of the King Abdullah Financial District Development and Management Company (KAFD DMC) Transit System. The move is said to mark a pivotal advancement in Riyadh’s urban mobility landscape.

The resumption of the 3.6km monorail system will complement KAFD’s innovative mobility infrastructure, which includes the world’s longest skywalk network, enabling seamless connectivity throughout the district, said a statement from Egis.

The monorail is integrated with the broader Riyadh Metro, where Egis, as part of the Riyadh Metro Transit Consultants (RMTC) consortium, was responsible for supervising the project management, design, and construction of the project, delivering the network’s Blue, Red and Orange lines (Lines 1, 2 and 3), on behalf of The Royal Commission for Riyadh City (RCRC), the statement added.

As the SSC, Egis will assume a comprehensive oversight role, ensuring meticulous execution across multiple engineering disciplines. This includes supervision of rolling stock, rail systems, civil and structural works, MEP (mechanical, electrical, and plumbing), architecture, utilities, and landscaping.

Egis is also responsible for reviewing and approving shop drawings, method statements, and material submittals, while overseeing critical compliance and quality control processes throughout the project’s construction phase.

“This project is emblematic of KAFD’s commitment to next-generation urban infrastructure, aligning with the Kingdom’s development ambitions under Vision 2030. By leveraging our deep expertise in rail and transit system supervision, we are poised to drive the successful execution of the KAFD Transit System, ensuring it embodies the highest standards of operational efficiency,

sustainability, and design excellence, while at the same time support the Kingdom’s commitments to carbon reduction,” said Mohamed Ben Messaoud the Country Managing Director for Egis in Saudi Arabia.

The KAFD Transit System is set to deliver a future-ready, efficient, and sustainable transport solution tailored to the needs of a modern business and lifestyle hub, setting new standards in urban design and mobility. The monorail will consist of six two-car trains operating on an elevated one-way loop, equipped with six strategically located stations embedded within public buildings, the statement outlined.

“We are thrilled to resume KAFD’s monorail service, which delivers seamless connectivity across the entire district and complements our multimodal mobility options, creating a unique 10-minute city for the district’s office workers, residents and visitors to effortlessly experience all that KAFD has to offer” said Faddy AlAql, Chief Asset Delivery Officer at KAFD DMC. He added, “The upgraded service reflects our commitment to adopting cutting-edge technologies to provide a comfortable, convenient and efficient transportation network that encourages the adoption of public transportation, reducing KAFD’s environmental footprint and setting new standards in livability.”

A key strategic initiative within Riyadh’s evolving transport ecosystem, the KAFD monorail is designed to enhance accessibility, furthering KAFD’s status as a pedestrian-centric 10-minute city, that reimagines urban mobility for the cities of the future. Its integration with the Riyadh Metro will further streamline transit options for professionals, residents, and visitors, reducing congestion and fostering a more connected urban core, while reinforcing Riyadh’s standing as a leader in progressive urban development, the statement concluded.

Turner & Townsend to support retirement of Abu Dhabi energy facility

TAQA Transmission has appointed Turner & Townsend to provide programme management consultancy services to support the retirement of a power generating plant in Abu Dhabi. Located in the east of Abu Dhabi, the power generating plant has a capacity of 1640MW and 1200MVAr, and will be decommissioned in 2029, according to Turner & Townsend.

Taking its place will be an upgraded energy efficient plant that will be developed with a focus on integrating solar and nuclear power into the network, further aiding decarbonisation of the UAE’s energy sector.

“In our role as programme management consultant, we are thrilled to be helping TAQA Transmission in delivering its future-fit energy infrastructure,” said Tarek Hamade, Regional Lead, Natural Resources, Middle East at Turner & Townsend.

He added, “Following the pending retirement of the plant, a large-scale project such as this demands innovative delivery models to achieve optimal performance.”

Turner & Townsend says that it will establish a Programme Management Office (PMO) and provide strategic support to expand and facilitate a comprehensive and sustainable upgrade of the power transmission and distribution infrastructure in the region. This will enable the construction of new grid and switching stations and substations, cable corridors and cable works, capacitor banks and high voltage overhead lines.

TAQA Transmission said that it aims to meet the UAE’s rapidly growing and evolving energy demands by embracing innovation and new technologies to ensure the region’s networks remain sustainable and fit for the future.

SSH appointed lead

design consultant for new Radisson RED hotel in RAK

SSH has announced its appointment as the Lead Design Consultant for the new Radisson RED branded hotel on Marjan Island in Ras Al Khaimah (RAK), United Arab Emirates.

The 269-room lifestyle hotel will mark a significant milestone for the Radisson RED brand in the region, and will introduce a new hospitality experience to one of the UAE’s growing tourist destinations. Stirling Hospitality Advisors, a boutique advisory firm, are acting as owner representatives on behalf of BB Holding. They are managing the collaboration between stakeholders and overseeing the successful delivery of the hotel, said the statement.

“The project represents an exciting evolution of the Radisson RED brand in the region, and SSH is thrilled to bring our design expertise to a destination with such potential. The hotel’s creative brief allows us to explore bold, innovative design solutions that deliver a guest

experience aligned with the future of hospitality,” said Michael Byron, Managing Director at SSH, UAE.

“We are excited to collaborate with BB Holding, Radisson, and SSH International Consultants on this exceptional lifestyle project. This venture will set a new benchmark for design and guest experiences in Ras Al Khaimah, and we are proud to be part of bringing this vision to life,” added Tatiana Veller, Managing Director of Stirling Hospitality Advisors.

Located on Marjan Island, the hotel will be situated within a district that blends retail, dining, and leisure experiences, and will boast a mall and a signature water fountain. The Radisson RED brand will undergo a refreshing transformation in this region, evolving its signature loftindustrial aesthetic into a softer, resort inspired style. Both the architecture and interiors will embrace natural materials and muted tones, fostering a warm

and contemporary ambiance with the relaxed coastal vibe of Marjan Island, the statement added.

Targeted at Millennial and Gen Z travelers seeking a unique, designcentric experience, this lifestyle hotel marks the inaugural franchised Radisson RED property in the UAE to feature the updated RED concept. Just a stone’s throw away from the shoreline, guests will enjoy exclusive private beach access. The hotel promises a fresh and vibrant hospitality experience, featuring contemporary guest rooms and suites designed with modern elements and amenities, all while staying true to the Radisson RED brand’s designdriven ethos, it continued.

As the Lead Design Consultant, SSH is responsible for delivering both precontract and post-contract services. They will manage the project’s design from the pre-concept stage through to the construction stage.

Mace Group announces investment in Mace Consult

Mace Group has announced a significant investment in Mace Consult, a program management consulting firm. This investment, facilitated by Goldman Sachs Alternatives through a carve-out from Mace Group, aims to support Mace Consult’s goal of becoming independent program management consultant. Mace Consult plays a crucial role as a delivery partner for some of the complex infrastructure and built environment projects, including the Hudson Tunnel Project in New York, Qiddiya in Saudi Arabia, and the New Hospitals Programme in the UK, said a statement.

In 2024, Mace Consult generated substantial revenues of US $926mn and employs over 5,200 people across four

global hubs, Europe, the Americas, Asia Pacific, and the Middle East and Africa. In addition to the investment, several Mace Group shareholders, including Executive Chair Mark Reynolds and Mace Group CEO Jason Millett, will retain a minority stake in Mace Consult. They will actively collaborate with Goldman Sachs Alternatives as members of the newly formed Mace Consult Board, with Mark Reynolds being appointed as the Chair.

Building on over a decade of consistent double-digit organic growth and a strategic expansion into delivering major programs across the Americas, Europe, Asia Pacific, and the Middle East and Africa, the new partnership will enable Mace Consult to further strengthen its

presence in key growth markets.

Mark Reynolds, Mace Group’s Executive Chair said, “This transaction is a key milestone in securing the longterm future of Mace Consult, enabling the next phase of growth for our global consultancy practice. The shareholders, the board and I are extremely proud of the progress we’ve made collectively to achieve this outcome. Since 1990, and accelerating since the success of the London 2012 Olympics, Mace Consult has transformed the industries it serves, delivering to exceptional standards and redefining the boundaries of ambition. We have established a foundation to enable the business to flourish for decades to come.”

New trends emerge in KSA’s residential market says JLL

According to a new report by JLL, Saudi Arabia’s residential market is showing signs of increasing maturity, with several urban centres demonstrating significant increases in rental rates.

JLL’s ‘KSA Living Market Dynamics – Q2 2025’ shows these trends as being fuelled by evolving end-user needs and a growing preference for affordable apartment living. New levels of market activity are also underpinned by the Kingdom’s ambitious urban development projects under the Vision 2030 agenda, which continue to attract substantial investments into the key residential markets of Riyadh, Jeddah and the Dammam Metropolitan Area. These investments are further propelled by population growth, economic diversification, and the government’s home ownership initiatives, the firm said.

The report also highlights the strategic impact of master-planned communities as the growing demand for integrated living environments shapes future supply, particularly in Riyadh and Jeddah.

Saud Al Sulaimani, Country Lead and Head of Capital Markets, JLL Saudi Arabia said, “The Saudi Arabian residential market is maturing, reflecting a dynamic landscape driven by the Kingdom’s broader objectives to meet end-user needs. While ongoing government initiatives have led to strong underlying demand, the sector is poised for further evolution and diversification, catalysed

by the upcoming foreign ownership law to be implemented in January 2026. This legislation is expected to invigorate the sector and boost real estate supply, attracting international developers and investors to the Saudi market, thereby opening a broader range of opportunities for all stakeholders across the Kingdom.”

JLL’s analysis reveals compelling performance indicators across the Kingdom, with Riyadh’s residential market continuing to show positive momentum, demonstrating a 15.1% surge in villa prices and a 13.3% increase in apartment prices in Q2 2025. Rental rates in the capital climbed by 13.9% annually for villas, while apartment rents rose by 6.9%.

Jeddah’s market showed a more fragmented performance. Although villa prices rose by a modest 4.4% annually, apartment prices experienced a slight 3.0% decline over the same period. In the rental market, Jeddah’s apartment rents increased by 2.4% annually, while villa rents decreased by 2.8%.

JLL’s report also provided insights into the distinct landscape of the residential market in the Dammam Metropolitan Area, encompassing Dammam, Al Khobar, and Jubail. With waterfrontage and fair weather, it is a popular destination for waterfront homes among the Saudi population. This is reflected in the growing demand for high-end residential developments offering a broad range of

community and recreational amenities, including green spaces such as parks.

Al Khobar, known for its high-quality compounds and villas, saw apartment prices increase by 5.8% and villa prices by 2.2% annually. In Dammam, which has more apartment assets, prices remained relatively stable for apartments, while villa prices recorded a marginal increase of 1.8% annually.

The Kingdom’s prime urban areas showcased varied transactional dynamics,

according to JLL’s latest report. Jeddah and Al Khobar recorded increased sales transactions, underscoring strong market activity in these regions, while Riyadh and Dammam experienced slight declines.

In the capital, total sales transactions decreased by 1.5% in the year to Q2. Of the 2,758 transactions recorded, apartments were in the majority (81.3%). An Narjis emerged as the most popular area for apartments (21.9%), while Al Yasmeen led in terms of villa transactions (21.9%).

The volume of residential transactions in Jeddah increased by a significant 46.1% year-on-year to Q2 2025, totaling 1,100, with Al Marwah being the preferred area for apartment transactions (26.1%) and Ar Rawdah for villa transactions (17.0%). Al Khobar saw a marked 23.7% increase in sales transactions, while total sales transactions in Dammam decreased by 6.7% year-on-year to Q2 2025. Apartments comprised the majority of these transactions in both cities.

INTERFACE

24 TBH is at the forefront of Data Centre enterprise, and here, four of the firm’s senior executives explain the commitment, protocols and robust, proven experience behind that consistently innovative vision... ⁄ 34 Ahmed Balawi, ECC, takes a ‘deep dive’ into the transformative impact of digital tech when an organisation commits wholeheartedly to an odyssey of change and transformation ⁄ 44 What are the added-value factors that a worldclass, multidisciplinary consultant brings to critical areas of masterplanning and complex project delivery? Cundall’s Lee French, Partner explains...

INTERFACE

Going behind-the-scenes with the region’s top construction consultants and industry trailblazers

“ Our role

is to think

20 years ahead…”

Fact. Data Centres are an indispensable element of global connectivity, yet their conception, delivery and operation bring a raft of complex issues requiring profound technical and environmental solutions. As specialists in high-risk, large-scale and challenging projects, TBH is at the forefront of this new era of Data Centre enterprise, and here, four of the firm’s senior executives explain the commitment, protocols and robust, proven experience behind that consistently innovative vision...

In this in-depth Q&A, Rob Hammond, Director and Global Data Centre Lead; Meiske Sompie, Director (Asia); Stephen Topp, Director (Middle East); and Stuart Cassie, Director, Strategic Advisory, bring together the different facets of the Data Centre paradigm; their remarks show how fully understanding the regional dynamics, regulatory frameworks and evolving needs of the Energy sector have allowed TBH to deliver some of the most advanced digital hubs in the world.

ROB HAMMOND

Rob, how do you communicate the confidence of an evolved strategic vision to diverse senior executives who are all too aware of the complexities of Data Centre conception and delivery?

“At the senior executive level, the key is translating highly technical, construction-focused language into a strategic commercial narrative that speaks directly to business priorities.

“Remember, executives are not necessarily concerned with the intricacies of design or engineering, rather they want to know what it means commercially. Will it create penalties, cause reputational damage, threaten operational continuity or undermine long-term value? Our role is to make these links clear. That means distilling complexity into structured insights: here are the opportunities, here are the risks, here are the areas where risk mitigation is required. It is less about explaining why a design detail is technically substandard and more about articulating that it may result in a commercial liability under a lease or

expose the organisation to operational risk. Equally important is providing pragmatic solutions that address those concerns, so that even within complexity major stakeholders are reassured with a clear understanding of risk mitigation and return on investment.”

Some markets - Australian is a key example - set the bar very high in terms of their regulatory framework; how does this drive TBH’s vision and influence factors such as scenario planning and operational projections?

“The bar is indeed set exceptionally high in Australia, not only in terms of rigorous regulatory frameworks but also the highspec, stringent operational requirements of hyperscale tenants such as Microsoft, Google and Meta. This dual pressure means projects must not only comply with regulation but also achieve ‘five nines’ reliability, meaning approximately five minutes of downtime per year. Owners, tenants and financiers who have billions at stake require confidence that facilities will operate without interruption for many years.

“Our approach is to balance these layers of expectation; regulatory compliance, tenant operational requirements and commercial feasibility. That means asking: how do we achieve absolute reliability without ‘gold plating’ the facility to the point where it becomes commercially unviable? We run scenario planning that considers today’s hurdles as well as what facilities will need to deliver in 20 or 30 years’ time. Future requirements around technological demands, green energy, water efficiency and environmental sustainability are

already shaping design and operational projections.”

To what extent has TBH’s significant project experience in the Energy sector proved a catalyst for securing Data Centre projects of the highest level?

“Our long-standing experience in the energy sector has been critical in building credibility and capability in the data centre

market. The core building of a data centre is relatively straightforward - concrete and steel. What makes these projects complex is the integration of energy systems: bringing high-voltage power from the grid, distributing it through multiple redundant circuits and ensuring resilience through commissioning. Our energy background means we understand the technical, safety and delivery challenges of those systems in detail.

“But it’s not just energy. What has really positioned us as leaders in this space is our broader experience in largescale, high-risk, time-critical projects. In this environment, the ultimate measure of success is delivery on time and to quality, far more than cost. We bring a macro perspective: mapping long-lead items, planning around regulatory approvals and ensuring mitigation strategies are in place when delays arise. That capability,

proven across energy, infrastructure and other complex sectors, is why the biggest names in the industry, from AirTrunk to AWS, have trusted us to deliver their most critical programmes.”

Data Centres have huge contemporary significance; what is TBH’s vision for delivering projects that have resonance and exceed expectations? How do you do things differently and better - and really stand out from the pack?

“At TBH, delivering projects on time, to quality and with precision is the baseline. It is what our clients expect, and it is what we have consistently delivered for over 60 years. But what truly sets us apart is that we look beyond the immediate. Technology is evolving at extraordinary speed, demand profiles are shifting and we need ever-greater power, cooling and space… and at the same time, communities and regulators expect greater efficiency and sustainability. Our role is to think 20 years ahead, ensuring data centres are not only fit for purpose today but adaptable and resilient for the future, balancing digital growth with responsible use of scarce resources like water and energy.

“Just as important is our ability to align diverse stakeholders around that vision. We work with governments, tenants, builders, communities, and we understand what each stakeholder requires in order to make a project a success. We translate complex technical and commercial issues into terms that resonate with every group and create a shared roadmap that ensures delivery is not only possible, but successful for all involved.”

“Compliance is non-negotiable, and proactive engagement with authorities is essential to keep projects on schedule.”

MEISKE SOMPIE

MEISKE SOMPIE

What do you see as the main ‘USPs’ that have enabled TBH to make such strong inroads into the multi-billion-dollar Asian Data Centre market?

“The first thing I should say is that Asia is not a homogeneous market like Australia, where standards, costs and maturity levels are broadly consistent across cities. Each Asian country brings its own government policies, levels of market maturity, cultural context and delivery practices. Our strength has been recognising and embracing those differences, while focusing on what is universally essential to data centre delivery. We avoid imposing a single ‘Western’ playbook; instead, we adapt to local conditions and ask: what works best here? For example, what may at first appear unfamiliar, such as bamboo scaffolding in place of steel, can in fact be highly effective in certain contexts.

“Yet amid this diversity, some fundamentals are non-negotiable. Every successful project must have a clear plan, a robust construction schedule, engaged stakeholders and a defined budget. The level of detail may vary, but these disciplines cannot be compromised without risking control.

Our ability to balance respect for local practices with steadfast adherence to delivery fundamentals has been central to our success across Asia’s highly varied markets.”

What particular challenges have you had to overcome when delivering projects in acutely land-constrained territories as Jakarta, Japan and Singaporeparticularly since these are also some of the most discerning and mature urban hubs in the world?

“Building data centres in dense urban hubs such as Jakarta, Japan and Singapore presents unique challenges. These are some of the most discerning and mature markets in the world, yet they are also among the most spaceconstrained. Success begins with understanding government policy and city administration, because delivery often requires measures that impact the broader community. This could mean road closures for crane lifts, temporary utility interruptions or restrictions on transport and logistics. Compliance is non-negotiable, and proactive engagement with authorities is essential to keep projects on schedule.

“Equally critical is open

communication with local businesses and residents. Dedicated community liaison helps minimise disruption, whether that means scheduling noisy works after hours, compressing activities into shorter periods or adjusting logistics around peak use. We also plan carefully for impacts such as dust, vibration and access, which can affect daily life in high-density areas.

“Our role is to balance these competing pressures with rigorous scheduling and stakeholder co-ordination, ensuring delivery remains efficient, compliant and respectful of the surrounding communities.”

With TBH’s 60 years of expertise, and your own 20 years of experience, what are the key lessons you’ve learned about client liaison, and inspiring trust in complex, high-risk project conception and delivery? Plus, Data Centres involve extremely broad stakeholder networks - so, how do you cost-in everyone’s priorities and concerns, and risk-fit (especially with powerful telcos and utilities providers)?

“Inspiring trust begins with honesty and independence. We are open in our communications, we do not make

promises we cannot keep, and we treat all parties fairly. If another stakeholder has a strong case, we tell our client directly, because informed decisions require clear sight of both strengths and weaknesses. This perspective, in addition to our independence as a privately held firm, is a core reason why we are trusted by investors, governments, contractors and owners alike. Clients know we are on their side, but never sycophantic; our role is to give them the truth, backed by analysis and experience.

“Large data centre projects involve a broad network of stakeholders, including powerful telcos and utilities. Here our approach is to identify common goals and build delivery roadmaps that clarify roles, responsibilities and sequences of work. We gain buy-in by speaking each party’s language, whether commercial, technical or regulatory, and by demonstrating how collaboration delivers benefits for all. When people see genuine alignment and independence rather than an agenda, trust follows.”

What importance do you attach to the end-user’s experience?

How far ‘down the telescope’ do you look when providing optimum strategic delivery?

“For us, the end-user’s experience is not just a measure of satisfaction - it is a key driver of commercial success. Our role is to ensure that strategy, sequencing and delivery are aligned so that the investment translates into an asset that performs as intended and generates longterm value.

“Looking ‘down the telescope’ means keeping line of sight from the earliest strategic decisions through to the

operational outcomes. This approach helps our clients avoid misalignment between intent and delivery, reduce wasted capital, and make sure that every decision on time, cost, and risk ultimately protects both the user experience and the financial return.”

You sit on TBH’s Inclusivity and Diversity Committee; what lessons have you learned in terms of the role of cultural intelligence and how it best empowers TBH’s market presence?

“At TBH, diversity and inclusivity are values we live internally, but they also shape how we operate externally. They allow us to connect across cultures and markets, and in doing so, they strengthen our market presence and our ability to deliver consistently at a global level.

“In Asia, cultural intelligence is essential. Every country has its own ways of making decisions, conducting business and defining value. Success depends on recognising those differences, listening carefully and adapting our approach to each environment rather than applying a one-size-fits-all model. When we engage genuinely and respectfully with local partners, we build that trust quickly and represent our clients more effectively.

“This approach is also a competitive advantage. Clients and stakeholders can tell the difference between a firm imposing external methods and one that is committed to learning and working with the local context. Ultimately, the cultural know-how we have built over decades enables us to deliver consistency at a global level while remaining sensitive to the local environments where projects take shape.”

STEPHEN TOPP

With your considerable industry experience across Australia, Asia and the Middle East, what are the lessons that you’ve learned about the power of effective knowledge transfer?

“Knowledge transfer is an extremely powerful tool that can shorten the learning curve in the delivery of complex projects. By identifying

common challenges and best practices that have previously been successfully implemented for a specific type of project, in this case Data Centres, teams can deliver more efficiently and with greater confidence. TBH employs knowledge transfer across all sectors and geographies, regularly deploying subject matter experts based in our Australian and Asian offices to supplement our Middle East teams on projects in their area of expertise, and vice versa.

“An area where knowledge transfer can be particularly impactful is in identification of risks and understanding of subsequent mitigation strategies that have or have not been successful in similar scenarios. However, it is essential that these lessons learned are applied in the local context, with a strong understanding of regional differences guiding the implementation of appropriate lessons learned and global best practices.”

“We've seen significant commitment to digital transformation and an integrated 'smart city' approach across the giga-portfolios that we are supporting across the Kingdom.”

STEPHEN TOPP

How do you see the importance of a new and powerful Data Centre infrastructure in the Middle East, particularly in the context of the Saudi Gigaprojects and their commitment to a Smart City agenda?

“We've seen significant commitment to digital transformation and an integrated 'smart city' approach across the giga-portfolios that we are supporting across the Kingdom. Appropriate capacity and quality of Data Centres is obviously essential to the success of these initiatives. The intensive demand of such portfolios is also a key driver in determining optimal locations and the required timing for the roll-out of Data Centre capacity, whilst the localised infrastructure required downstream will also put a lot of stress on the homogeneous specialist resources required to deliver these assets. Another key driver in demand for Data Centre capacity is the growing requirement for Data Sovereignty, the ambition of which is significantly under-serviced currently in a number of Middle East markets.”

What do you see as the greatest challenge in deployment of significant additional Data Centre Capacity in the Middle East in the short-term?

“As is the case with the delivery of complex assets across most development sectors in the Middle East, specialised labour resources will be a challenge with the quantum of assets planned for concurrent delivery in the Data Centre sector, alongside the competing demands of giga-portfolio developments. Similar constraints also apply to specialised plant and equipment, including switchgear, chillers and generators.

“Another key challenge, also being faced in many other regions, will be the availability of supporting infrastructure and utilities, such as power and water (for water-based cooling, dependent on the system design), in the quantities required to not only support Data Centre development but simultaneously the significant growth across many sectors of the development industry in these locations. In the Middle East, for example, creating significant additional water capacity often involves

the development of desalination plant capacity which, in itself, is a complex, costly, and time-consuming process.”

How do you feel that TBH’s 60-year legacy (with 20-years in the Middle East) gives you a competitive advantage in delivering regional Data Centre projects of the largest scale and complexity?

“TBH has specialised in large complex projects for over 60 years, helping our clients to deliver many 'first of their kind' projects in a given region. In the Data Centre space, we understand the requirements and processes of global leaders in the development of Data Centres, and we combine this with significant local experience delivering projects in the Middle East. One of our main focuses in the Data Centre sector currently, is supporting key global clients to navigate Middle East markets and understand localised risks, to give them the best opportunity to deliver their Data Centres, or adjacent infrastructure, successfully.”

STUART CASSIE

With ESG commitments becoming a defining factor in the Data Centre sector’s market reputation and investment appeal, how important is it for clients that TBH embeds end-to-end sustainability and low-carbon protocols as standard practice? Do they view this as a differentiator that strengthens their own ESG positioning and brand?

“Sustainability is now a defining factor in Data Centre delivery. For investors, owners and tenants, ESG performance is now inseparable from commercial performance. Financiers want assurance that assets can operate reliably for decades without becoming stranded by rising environmental expectations or water levels. Communities expect efficient use of scarce resources like power and water as well as low carbon footprints. And hyperscalers see ESG alignment as central to their global brand.

“We need to look ahead. A Data Centre today may simply connect to existing utilities, but in the future power and water will not be guaranteed.

“That shift will require facilities to be conceived alongside renewable energy, new water sources, fibre connectivity working in harmony with communities, often in new locations. And to deliver this successfully, you need more than just data centre experience, but also deep knowledge and integrated thinking across energy, water, infrastructure and logistics.”

Here, in an extraordinary interview with Ahmed Balawi, Engineering Manager, ECC, we take a ‘deep dive’ into the transformative impact of digital tech when an organisation commits wholeheartedly to an odyssey of change and transformation…

“The digital journey? It’s a strategic imperative”

Ahmed, can you describe and summarise the ‘journey’ towards full digitisation that you have led at ECC? What key stages has this involved?

“The first thing I should say is that our digital transformation here at ECC was never envisioned as a one simple, single-step rollout. In fact, there were really five key stages, namely -

1. Project Digital Delivery & Construction Digital Twin

“We began by digitising project delivery workflows and introducing the Construction Digital Twin concept, which connects real-time site activities with back-office management systems and dashboards. This creates a continuous data feedback loop, enhancing visibility, improving planning accuracy and control, and enabling early risk mitigation through timely, data-driven decision-making across the entire project lifecycle.

While the concept is relatively straightforward, its impact is significant. It relies on structured data integration, bringing together models, BOQs, and schedule data using a unified coding and identification structure. With that solid foundation, we selected the appropriate authoring tools for model development, cost and quantity (QTO) management, and schedule control.

“We then progressed to the integration of 4D and 5D tools, enabling detailed analysis of both time and cost dimensions. These were further connected to simulation and forecasting platforms, giving project teams the ability to evaluate performance trends and make proactive adjustments before issues emerge on-site.

“The result is a true bridge between the digital and physical environments, delivering better coordination, traceability, and continuous optimisation throughout the project lifecycle.”

2. Integrated Engineering Delivery

“To ensure consistency and interoperability, we prioritized the standardisation of engineering practices, the foundation of all project information, and information exchange meta data. A key focus was developing a universal modeling protocol to enable seamless data exchange across the asset lifecycle.”

“We also established a coding structure and model breakdown based on BOQ and site activities, developed in close collaboration with Planning and Cost teams. This ensured that models addressed real-world operational and commercial needs while maintaining alignment with international standards.

“Given the volume and complexity of data integration, whether originating from design models or department-level inputs, manual handling would have introduced delays and risks. To overcome this, we implemented automation through API scripting and RPA (Robotic Process Automation). These technologies played a pivotal role in streamlining model updates, ensuring timely data flow, and minimising manual intervention, critical for delivering engineering models efficiently and at the speed of project demands.”

3. Business Intelligence & Analytical Reporting

“To enable effective Business Intelligence, the foundation lay in data curation, structured analysis, and seamless integration. I led the implementation of a Project

Information Management System (PIMS) rooted in ECC’s internal workflows. This required a comprehensive review of departmental data and process efficiency to ensure the system was aligned with actual operational needs.

“To unlock real value, we integrated the PIMS with Power BI dashboards through centralised data lakes, enabling leadership to make timely, data-driven decisions. We also deployed Robotic Process Automation

(RPA) to eliminate repetitive tasks, reduce turnaround time, and free up staff capacity for higher-value work.

“A key enabler of this transformation was the formation of a dedicated digital team, whose role was to bridge the gap between business expectations and technical execution. Rather than blindly adopting the latest technology, we focused on identifying the right tools for our environment, solutions that aligned

with long-term goals and delivered measurable impact.”

4. AI Initiatives

“In line with my long-term focus on automation, I’ve taken a serious step toward exploring and implementing AI-driven solutions within our digital strategy. Our approach was deliberately pragmatic: rather than building from scratch, we leveraged existing platform modules, using them both as training

datasets and as a base for developing custom-scripted algorithms to standardise key outcome requirements.

5. Generative Design & DFMA Enablement

“In parallel, we initiated the integration of DfMA (Design for Manufacture and Assembly) and generative design, with a strong focus on modular off-site construction. This included prefabricated components such as pods, aluminum systems, steel structures, and joinery. The primary objective was to streamline the flow of data from design to fabrication, enhancing precision, reducing material waste, and accelerating delivery timelines.

“To achieve this, I led the integration of several platforms, connecting design tools, production planning systems, and manufacturing workflows. This ensured a seamless data handover across disciplines, enabling co-ordinated execution and efficient off-site production. The result was a more intelligent, agile, and scaleable approach to construction delivery, aligned with both business goals and modern construction practices. It followed a carefully-phased approach designed to ensure value, adoption, and scalability at every stage. So, the key steps included -

1. Standardisation

We began by standardising engineering practices, data structures, and information exchange protocols. This created a solid foundation for consistency and interoperability across departments and project stages.

2. Resource Selection & Training

We ensured the right people were in place, those with the mindset and skillset to support transformation. At the same time, we fostered a culture of research, innovation, and continuous learning. Our philosophy was always to build from

where others left off - not to reinvent the wheel.

3.

Pilot Projects

Before scaling, we ran pilot implementations to validate our concepts under real project conditions. This allowed us to refine strategies based on practical feedback.

4. Implementation at Scale

With proven pilots, we moved to integrate systems across departments and multiple projects. We also developed engineering and BIM standards, supported by digital kits and control documentation to guide consistent delivery.

5. Control & Monitoring

We established performance tracking mechanisms and continuous feedback loops to monitor effectiveness, troubleshoot challenges, and improve workflows iteratively.

6. Automation

Finally, we introduced Robotic Process Automation (RPA) and other automation tools to reduce manual workloads, increase efficiency, and scale delivery across the organization.

“In summary, our transformation has been people-first, process-oriented, and technology-enabled. It has redefined how ECC delivers value - not just through digital tools, but through stronger collaboration, smarter use of data, and a lasting cultural shift toward innovation.”

With your career spanning major brands such as Arabtec and Dewan, what are some of the important lessons you’ve learned about project delivery and the benefits accrued from strong digital capability?

“Well, let’s start with the Arabtec

experience. My time at Arabtec was truly transformative. Working on mega-iconic projects, ranging from international airports and state-of-the-art hospitals to national museums and high-end residential towers, provided a once-in-alifetime opportunity to deeply understand the demands of complex project delivery. These projects were not only ambitious in scale but also pushed the boundaries of technology, coordination, and stakeholder management.

“One of the most valuable lessons I gained was a practical understanding of business needs from an engineering

and delivery perspective. I learned how different departments interact, how communication flows between stakeholders, and how to identify the interdependencies that define project success. This exposure enabled me to bridge the gap between technological capabilities and actual business requirements. I learned to map the right technologies to the right teams - ensuring fit-for-purpose solutions that addressed real operational challenges. This led to rapid and effective implementations that delivered measurable benefits across departments.

“Those who integrate digital deeply into their core operations will lead the future of construction - not just survive it.”

AHMED BALAWI

“Arabtec’s strong commitment to innovation and digital transformation was another key driver of growth. We had early access to emerging technologies through an in-house R&D team, which collaborated with global software providers to test beta versions of tools and contribute to product development. This early involvement allowed us to tailor technologies to our realworld needs, granting us a significant competitive advantage.

“We were among the first, if not the first, in the Middle East construction sector to implement a comprehensive internal Common Data Environment (CDE) as early as 2010. This CDE governed the automated control of model generation and data exchange, supported by a user-friendly interface. It included custom-built RFI systems integrated directly with the models, automated workflows using barcode-linked data from models, and an automated E1 log generation for drawings and placeholder identification.

“At the time, platforms such as Revit were still in their early stages. Many of the integrations we now take for granted simply didn’t exist. In response, I led a team to develop custom APIs to support automated modeling practices, data management, and collaboration workflows based on BS 1192 - all within Revit itself.

“We were also early adopters of Autodesk’s ecosystem: the first contractor in the region to implement both C4R (Collaboration for Revit) and BIM 360 Field, setting a new standard for cloud-based design and mobile site management in the region.

“In parallel, we pioneered the development of dashboard systems specifically tailored for technical progress, engineering issues, and submission status. These dashboards offered visualised, real-time updates that aligned engineering activities with project milestones - enabling proactive coordination. Additionally, we developed custom mobile-enabled systems for on-site progress tracking, later integrating them with BIM models using Power BI. Field personnel could enter data via mobile apps, which was then linked back to the models for

progress visualisation - well before such integrations were industry norms.

“One of the most innovative initiatives we led was the use of gaming engines to support 3D navigation and data interaction, aimed specifically at non-technical stakeholders. We introduced this concept well before it became a trend. The goal was to make live, interactive, and intuitive navigation of project models accessible to all, not just those trained in BIM software.

“We started with Unreal Engine and later transitioned to Unity, transferring data from authoring tools like Revit and Bentley into immersive environments. These environments included embedded project data - from specifications and drawings to element-specific metadata - and were navigable via standard gaming controllers.

“All of these implementations were underpinned by international standards, such as ISO 19650 and BS 1192. A key success factor was our ability to translate global standards into regional practices, aligning compliance with project realities. This approach contributed to successful audits, certifications, and several international innovation awards.”

“What about my insights from the Consultancy Side? My experience in the design and consultancy sector gave me a comprehensive understanding of the early phases of the asset lifecycle. Working with a tier-one firm, I gained first-hand insight into how early design decisions, shaped by clearly defined client expectations and structured workflows, significantly influence construction, handover, and operation. This stage of my career was both technically and digitally enriching, reinforcing the importance of aligning design outputs with lifecycle requirements.

“I also learned to appreciate the complexity of managing information structures across the asset lifecycle, particularly the transition from design to construction. Designing for seamless data exchange, between consultants, contractors, and FM teams, requires not only technical foresight but also practical strategies

for integrating information across stages. This includes specifications, design assumptions, and embedded asset data structured for future use.

“Bridging the gap between design and construction was a recurring theme. I brought construction feedback and realworld lessons into the design process to minimise redesigns, anticipate value engineering requirements, and support more resilient and coordinated design outputs. This effort had three important dimensions:

• Translating lessons learned from site execution into improved design assurance with fewer late-stage changes.

• Highlighting typical contractor constraints that may conflict with design integrity, enabling early discussion and resolution.

• These interventions significantly improved the design’s resilience, reduced scope creep, and improved stakeholder confidence.

What are the most critical issues you currently see facing the Construction sector here in the GCC? What role will the advances in Digital tech play in minimising these?

“Having worked in the UAE construction sector for over 22 years, I’ve witnessed five major shifts that have shaped the industry's direction. Each period brought unique challenges, influenced by market dynamics, technological readiness, and evolving workforce capabilities. Today, the most critical issues can be broadly grouped into three core goals: delivering quality, on time, and within budget.

A word to the wise. Partially adapting working processes is not enough; ECC is testimony to the value of a completely tranformative journey.

To understand how digital transformation is addressing these, we can examine the two main fronts where these challenges manifest: Construction Execution and Design & Engineering.

1. Challenges at the Construction Stage

a. Fragmented Project Delivery: Many construction projects continue to suffer from siloed workflows across design, engineering, procurement, and site operations. This fragmentation often results in misalignment, delays, scope changes, and cost overruns.

b. Inefficient Information Management: Project data is often scattered, duplicated, or manually processed, leading to rework, lost time, and poor decision-making.

“Notwithstanding, the adoption of Building Information Modeling (BIM) has laid a foundation for smarter workflows. The key to unlocking value lies in structured models data built for purpose, models embedded with clean, organised data that support integration across functions and stages. Today, key digital advancements in construction execution include:

• Functional Interactive Planning: 3D model visualizations allow real-time tracking and comparison of actual progress against milestone schedules.

• Site Activity & KPI Reporting: Integrated systems enable the monitoring of site inspections, providing real-time oversight on quality performance.

• Resource-Based KPI Reporting: Tracks labour and material consumption per task, offering insight into project health and cost control.

• Early Coordination & Clash Avoidance: BIM-based sequencing highlights conflicts before they occur on site, reducing rework and improving efficiency.

• Digital Construction Twins: Structured model data lays the groundwork for FM digital twins— critical for delivering functional, manageable assets during handover.

2. Digital Transformation in Design & Engineering

Addressing upstream inefficiencies is just as crucial. I’ve led several initiatives that modernised design coordination, documentation workflows, and stakeholder engagement. Key issues and solutions include:

• Cost Control & Reactive Value

Engineering: Projects frequently face cost overruns due to late-stage design changes. By integrating generative

design, AI-driven simulation, and early lifecycle modeling, teams can embed value engineering from the startimproving constructability and cost predictability.

• Early In-House CDE (2010): Developed a custom Common Data Environment to streamline data exchange and enhance collaboration - long before CDEs became industry standard.

• Interactive As-Built Models with Gaming Engines: Enabled intuitive model navigation for non-technical users using Unreal and Unity, with embedded specifications, drawings, and VR support.

• Remote VR Collaboration: Supported mega-project teams through immersive, real-time collaboration across geographies.

• Laser Scanning & Drone Mapping: Used for layout accuracy and site

verification—especially useful when skilled resources are limited.

• 4D & 5D Visual Scheduling: Delivered accessible simulations to visualize project timelines and cost impacts, even for non-technical stakeholders.

• AI Integration in Engineering: Over the past 18 months, we have piloted AI applications for:

Model and drawing reviews

Quality control

Cross-platform data exchange

EDMS/PM system handovers

Data Analytics & Dashboards

Real-time dashboards centralize performance data, enabling proactive decision-making and continuous improvement.

“The GCC construction sector is facing increasingly complex challenges - rising costs, fragmented delivery, data gaps, and growing sustainability demands. In

this context, digital transformation is not optional - it is essential.

At ECC, our digital initiatives have focused on aligning technology with purpose and people, delivering both shortterm efficiencies and long-term resilience. The value added by these efforts can be summarized across two dimensions:

1. Strategic Investment, Not Just Immediate ROI

• Digital transformation is a long-term investment in business sustainability.

• While some initiatives (e.g., automation, RPA, clash detection) offer direct cost savings, many benefits are cumulative and futureproofing.

• Investing in technology during stable periods prepares the business to navigate future disruptions and resource challenges.

2. Tangible Business Benefits

• Reduced Rework & Delays: Through improved planning, coordination, and clash detection.

• Faster Decision-Making: Enabled by real-time dashboards, data lakes, and integrated reporting.

• Resource Optimization: Automation reduced manual tasks, freeing teams to focus on higher-value work.

• Better Project Visibility: Enhanced transparency across departments supports proactive risk management.

• Data-Driven Growth: Historical data is now leveraged to track performance, benchmark KPIs, and guide strategy.

• Increased Competitiveness: Firms that delay adoption risk being left behind, while digital-ready companies are better positioned for client trust and market expansion.

“Ultimately, adapting to digital transformation isn’t about age or title - it’s about mindset. I prioritise curiosity, openness, and collaboration at every level of recruitment.”

AHMED BALAWI

“In summary, the true return on digital investment lies not just in immediate savings, but in building a smarter, more agile, and more resilient business. Those who integrate digital deeply into their core operations will lead the future of constructionnot just survive it.”

What do you see as the ‘next steps’ for ECC in terms of how it uses technology and Smart working to evolve client relationships and project management?

“At ECC, the next steps in our digital and Smart working journey are focused on deepening adoption, not as a matter of choice, but as a strategic imperative. We recognise that to remain competitive and deliver excellence, technology must be seamlessly embedded across every layer of our operations, both internally and in how we serve our clients. There are several aspects here –

1. End-to-End Platform Integration

We are accelerating our move towards cross-platform integration, connecting design, project management, procurement, construction, and handover processes through unified digital ecosystems. This creates a single source of truth that enables faster, more informed decision-making across departments and stakeholders.

2. Connected Sites and Offices

Bridging the gap between the field and the office is a priority. Our focus is on enabling real-time communication and data flow between on-site teams and central operations. This allows for better tracking, immediate issue resolution, and enhanced collaboration - ultimately leading to more agile and responsive project management.

3. Data Visibility and Predictive Insights

We are enhancing data transparency and accessibility across all levels of the organisation. With robust data collection and analysis, we can shift from reactive to predictive

project management, leveraging historical data, trends, and benchmarking to anticipate challenges before they arise.

4. AI-Driven Optimisation

Artificial Intelligence is the next major step in our transformation journey. AI-assisted design reviews, Data Analysis, we aim to infuse AI across all our business units. This will allow us to scale decision-making, uncover new efficiencies, and offer smarter, faster service to our clients.

5. Smart Dashboards

We're enhancing our engagement through interactive dashboards that provide real-time visibility into progress, and performance metrics. This not only increases transparency and trust but also encourages collaborative problem-solving and proactive decisionmaking.

6. Empowering People

Technology only delivers value when people are equipped to use it effectively. That’s why we are continuing to invest in training, upskilling, and digital enablement of our teams - ensuring that ECC not only leads with tools, but with capable, forward-thinking people who know how to get the most from them.

7. Industry Leadership

Our commitment remains to lead the market, not just follow it. By setting benchmarks in digital adoption, Smart working, and client collaboration, ECC aims to be the partner of choice for projects that demand precision, innovation, and impact.”

Does the increasing importance of technology and Smart working change the skillsets you’re looking for when you recruit? Plus, how do you ensure that the more senior team members don’t get left behind as the Digital skills gap widens?

“Yes, the rise of technology and Smart working has definitely influenced how I approach recruitment. Today, I assess candidates across three distinct levels, junior, senior, and leadership with a tailored focus at each level.

1. For junior professionals or fresh graduates, I focus heavily on their tech orientation. I look for candidates who are comfortable with digital tools, ideally with exposure to scripting, automation, or programming, and more importantly, those who are self-learners with a growth mindset. Their ability and willingness to continuously learn and adapt is more valuable than their current skillset alone.

2. For senior level professionals, my primary focus is on technical depth and business acumen. While I don’t expect them to be hands-on users of every digital tool, I do expect them to understand technology's value, be open to its application in their domain, and be collaborative with tech-driven teams. The key trait I avoid is resistance, if a senior candidate is not open-minded, not a team player, or dismissive of digital change, that becomes a clear concern. In today's environment, even high-level users must be willing to engage, learn, and evolve.

3. For managerial or leadership roles, I look for strategic thinkers, those who can evaluate, promote, and guide the use of technology. They should have critical thinking skills, the ability to assess digital tools for specific use cases, and the foresight to drive technology adoption in a practical, results-focused way.

“To prevent senior team members from falling behind, I don’t focus on turning them into daily users of every new tool. Instead, I ensure they stay technologically aware and open-minded. This is supported through continuous orientation, exposure, and internal knowledge-sharing. We blend them into teams with younger, tech-enabled staff to encourage cross-learning, and we provide training sessions and guided exploration - not just on tools, but on trends and use-case thinking.

“Ultimately, adapting to digital transformation isn’t about age or title - it’s about mindset. I prioritise curiosity, openness, and collaboration at every level of recruitment.”

How global collaboration delivers local success

Delivering complex projects calls for more than technical expertise, it calls for strategic vision, specialist skills and a deep understanding of how to bring diverse disciplines together seamlessly. To explore what truly sets a world-class multidisciplinary consultancy apart, ME Consultant sat down with Lee French, Partner and Managing Director MENA

at

Cundall

Lee, can you tell us a little about the growth and expansion of your MENA operations over the last several years?

“It has been a really exciting few years for Cundall in MENA with regards to growth and expansion. In fact, one of the most significant periods in our evolution since we opened our first office in the region in 2007.

“In the past two and a half years, our regional business has grown by more than 250%, which included the opening of our new offices in Bengaluru, India and Riyadh, Saudi Arabia, in mid-2023.

“We established in our new locations to complement our existing offices in Dubai, UAE and Doha, Qatar, with the primary objective of maintaining the highest levels of service for our clients while creating more opportunities for our people.”

Given that Cundall has been on the ground in the MENA region for 18 years, can you tell us about the skills evolution that has enabled the business to increasingly position itself as Lead Design Consultant?

“Since Cundall was established in the UK in 1976, we have always operated as a true multi-disciplinary design consultant, offering integrated engineering services to our clients across the globe. Our evolution in the MENA region has been no different.

“Of course, when we first opened our Dubai office in 2007, we grew the business organically, utilising our specialist expertise in disciplines across the business to support local projects. While we still collaborate globally and operate as One Cundall, over the years we have built a stronger regional offering, adding disciplines locally to respond to the Lead Design Consultant market.

“In recent years, we have seen an increasing trend in MENA with the Lead Design Consultant role becoming more prominent, and Cundall are perfectly positioned to deliver this. As a true multi-disciplinary consultant, with inhouse design managers, we provide the high-quality design services that clients expect and manage their interests along with other specialist consultants and key architects. Collaboration is central to our approach, and this is fundamental in developing an understanding that ensures that we never work in silos.

“We also recognise that every project and every client is different. Our flexibility allows us to respond accordingly, either offering specific design services or taking on leadership roles as Lead Design Consultant or Multi-Disciplinary Design Consultant.”

What is the ‘Factor X’ that makes Cundall unique; can you tell us about the organisation’s values, people and culture?

“Cundall has always been an independent business. 100% owned by the Partners who work within it every day, on our projects and alongside our clients. This

structure allows us to focus on what really matters: our people and our clients.

“Our people are at the heart of everything we do, and our philosophy has remained unchanged, rooted in the ethos set out by our founding Partners in 1976. At the same time, we continue to evolve to meet the needs of our clients and the aspirations of our people.

“Attracting and retaining the best talent is central to our success, and we continually invest in our people. Among the many initiatives that we have within Cundall, two stand out. Cundall Elevate, our development programme designed to support career growth, and Cundall Engage, our dynamic internal global employee engagement survey, which empowers our people to share feedback and drive change alongside our leaders.

“Our values represent who we are as a business and are inherently people focused: we are Creative, strive for Excellence, Collaboration is key and we mean what we say with integrity.

“Equally fundamental to our culture is sustainability. It runs through everything we do and always has. This matters to us and it matters to our people. We recognise our duty, and opportunity, to effect change through all that we do, with sustainability and zero carbon design underpinning our work at every level.”

Masterplanning is a major sector for Cundall. Can you share some examples from the MENA region where this holistic approach to development has been especially impactful?

“Masterplanning is a major sector for us and an extremely important one as it allows us to effect positive change at scale.”

LEE FRENCH

“Masterplanning is a major sector for us and an extremely important one as it allows us to effect positive change at scale. Urban planning also sits at the heart of the region's national visions - Saudi and Qatar 2030, UAE 2031 and Oman 2040. In Dubai, the 2040 Urban Plan provides even more specific direction. Across all of these, digital transformation and sustainability are central to shaping future communities and neighborhoods.

Just as with zero carbon design goals, effective masterplanning enables cohesive, future-ready communities and assets by addressing environmental and social impacts while embedding resilience and foresight into development.

“We are incredibly proud to have contributed at this scale across the MENA region, and none more so than at a city level with our work on the Greater Muscat Structure Plan. In collaboration with the Ministry of Housing and Urban Planning (MoHUP) and a wider team of consultants, including F&M and Broadway Malayan, we re-envisioned Greater Muscat and developed a framework to guide development through to 2040. This included efficiency and resilience in the citywide utility infrastructure network, with emphasis on renewable technology and water lifecycle, as well as creating an overarching sustainable and smart city framework. Resilient

planning around flood risk and coastal change was also integral to shaping future development - essentially providing a blueprint for the future of Oman’s capital.”

Part of Cundall’s strategy is to achieve zero carbon design across all projects by 2030; how will this be applied to complex masterplanning initiatives, with their many interconnected elements?

“Masterplans are the perfect place to start driving zero carbon design practices. It is at this stage - with so many stakeholders and considerations - that we can develop a framework that

guides all future design stages. Many of the complexities we face in considering zero carbon designs at the building level are driven by restrictions in infrastructure, the communities or the masterplans and guidelines they sit within.

“By considering these at the masterplanning level, whether city, district or community, we can not only enable zero carbon design but also remove restrictions that might otherwise limit it.

“There are, of course, still obstacles to overcome, particularly the collective approach needed from all components and stakeholders. However, we are seeing positive change. In the UAE, for example, the new Climate Law, which came into effect in May of this year, requires everyone to support the UAE’s Net Zero 2050 commitment. Today's masterplans hold the key to unlocking the potential to achieve this tomorrow.

“At Cundall, we are taking this responsibility, and obligation, very seriously. We are transforming how we approach projects to embed designing for net zero carbon as our ‘business as usual’. Our Zero Carbon Design 2030 (ZCD2030) commitment means that by the end of the decade, all our projects will be aligned with our zero carbon design criteria driven by science-based targets. As part of that journey, we are already working with clients to produce pathways for their projects, and in our experience to date, we've found that clients absolutely value this support and recognise the scale of the challenge ahead.”

How is Cundall embracing digital tools, such as AI, to enhance project delivery?

“The rapid rise of AI and generative AI goes far beyond improving efficiencies, we see it as a transformative force in how we deliver projects and in the outcomes we can achieve. It can even play a hugely transformative role in decarbonising the built environment and accelerating the transition to net zero. Used correctly, these technologies are key enablers for the next generation of smart buildings and cities.

“At Cundall, we are advancing our AI capabilities by integrating them into our operations while creating an environment where technology and human expertise work hand in hand. We recognise that while AI is a powerful tool, it is the creativity, judgement, and skills of our people that unlock its full potential. That is why we continue to invest in both innovation and talent development, ensuring our teams are equipped to thrive in a future where human ingenuity and AI technologies drive meaningful change together.”

Cundall is now a global business with 29 locations around the world; how do you leverage this global expertise and international ‘work-sharing’ to give the organisation a real competitive advantage?

“As I touched on earlier, although Cundall has local offices to serve our clients, we are truly one business that operates without borders, where work sharing is just the norm for us.

“We recognise the importance of local expertise, but we also draw on the right talent wherever it may be in the world, empowering us to respond beyond any boundary restrictions. This agility allows us to always bring global knowledge to local contexts and tailor our support to each client's needs.

“Having been with the business for 25 years across multiple offices, I've seen first-hand how global project collaboration delivers success. There is an inherent desire at Cundall, aligned to our ethos, to support each other and bring people together, and this culture translates directly into the way we deliver projects.”

Cundall has been heavily involved in project/site conception and delivery across a number of very specific sectors - and Entertainment really stands

out here. Can you give us some key examples?

“Entertainment is a hugely important sector for the MENA region and the growth over the last 10-15 years has completely elevated its offering, serving both international and local tourism markets.

“We have been privileged to work on many attractions across the region, including contributing to Saudi Arabia's ambitious transformation plans. Over the past few years, we have partnered closely with Saudi Entertainment Ventures (SEVEN) as their destinations have come to fruition across 14 cities, including their Discovery attractions. These projects are about delivering groundbreaking experiences that not only meet demand but do so in a way that is authentic, culturally relevant and aligned with Vision 2030’s ambition to build a thriving entertainment sector that brings joy, enriches lives, empowers communities, and inspires.

“A key to success in this sector is understanding the market and acknowledging the evolving needs of a very fast-moving industry and audience. This is especially true when introducing large-scale entertainment to locations experiencing it for the first time. To succeed, developments must be cutting edge, adaptable and flexible enough to be able to evolve.”

INNO