Making Cities Fly

CONNECTING TRADE PROFESSIONALS WITH INDUSTRY INTELLIGENCE

INTERVIEW

Smarter Than Storage: The New Warehouse Playbook

TRENDS Supply Chain and Logistics Technology Trends for 2026

Making Cities Fly

CONNECTING TRADE PROFESSIONALS WITH INDUSTRY INTELLIGENCE

Smarter Than Storage: The New Warehouse Playbook

TRENDS Supply Chain and Logistics Technology Trends for 2026

Daniel Phay reveals how Saudi Global Ports is quietly engineering one of the Kingdom’s most important logistics ecosystems

New IVECO S-Way: high technology and efficiency on all missions

A wide choice of Euro III / V diesel engines, delivering class-leading power from 360 hp to 560 hp Euro III / 570 hp Euro V and superior fuel economy. 12-speed HI-TRONIX automated transmission with the most advanced technology in its category, electronic clutch and best-in-class torque-to-weight ratio. Full range of fuel-saving devices, such as anti-idling feature, EcoSwitch, Ecoroll and Smart Alternator. Top levels of comfort and safety, with a completely redesigned and reinforced cab, featuring enhanced direct visibility and enlarged cab livability.

16 20 24 30 34 38 44 48 52

OP-ED

Why Free Zones Matter More Than Ever

Mobility

The Business Case for e‑Freight in GCC Logistics

Cover Story Ports That Move a Nation

Warehousing WAREHOUSING AT A TURNING POINT

Last-mile logistics Making Cities Fly

Interview

Smarter Than Storage: The New Warehouse Playbook

Digital Transformation From Freight Forwarding To Freight Intelligence

Trends

Supply Chain and Logistics

Technology Trends for 2026

Data-driven logistics The Logistics Labyrinth: Winning Through Smarter Choices

Nestled by the coast of Lusail sits the splendor of Raf es and Fairmont Doha, where luxury is rooted in even the smallest details. Open the doors to mesmerizing hospitality and make memories in a world of sophistication.

WITH INDUSTRY INTELLIGENCE

CEO

Wissam Younane wissam@bncpublishing.net

Managing Director

CEO

Rabih Najm rabih@bncpublishing.net

Wissam Younane wissam@bncpublishing.net

Group Publishing Director

Director

Joaquim D’Costa jo@bncpublishing.net

Rabih Najm rabih@bncpublishing.net

Commercial Director

Group Publishing Director

Andrea Mocay andrea@bncpublishing.net

Joaquim D'Costa jo@bncpublishing.net

Editor-in-Chief

Editor Aya Zhang aya@bncpublishing.net

Vibha Mehta vibha@bncpublishing.net

Digital Reporter

Managing Editor

Reeba Asghar reeba@bncpublishing.net

Kasun Illankoon kasun@bncpublishing.net

Creative Lead

SUBSCRIBE

subscriptions@bncpublishing.net

subscriptions@bncpublishing.net

PO Box 502511 Dubai, United Arab Emirates P +971 4 4200 506 | F +971 4 4200 196

For all commercial enquiries, contact jo@bncpublishing.net T +971 50 440 2706

PO Box 502511 Dubai, United Arab Emirates P +971 4 4200 506 | F +971 4 4200 196

Christian Harb chriss@bncpublishing.net

Design Christian Harb

Junior Art Director

Marketing Executive

Rizaldi Febrian

Aaron Joshua Sinanbam aj@bncpublishing.net

Marketing Executive

Digital Media Producer

Aaron Joshua Sinanbam aj@bncpublishing.net

Alexander Bungas

Videographer

Eduardo Buenagua

All rights reserved © 2025. Opinions expressed are solely those of the contributors. Logistics News ME and all subsidiary publications in the MENA region are officially licensed exclusively to BNC Publishing in the MENA region by Logistics News ME. No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher.

For all commercial enquiries, contact jo@bncpublishing.net T +971 50 440 2706 All rights reserved © 2023. Opinions expressed are solely those of the contributors. Logistics News ME and all subsidiary publications in the MENA region are o cially licensed exclusively to BNC Publishing in the MENA region by Logistics News ME.

Printed by United Printing and Publishing | upp.ae

No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher.

Printed by United Printing and Publishing | upp.ae

Images used in Logistics News ME are credited when necessary. Attributed use of copyrighted images with permission. All images not credited courtesy Shutterstock.

In addition to our print edition, we’re bringing you all sorts of industry news on our web mediums. We’re looking forward to interacting with our readers on all of our social media and web platforms. See you on the web!

This is the last issue of the year, and it changes how you read the months behind you.

By December, the excitement has settled. What remains is a clearer picture of what actually moved and what quietly found its rhythm. In logistics, the year reveals itself slowly, in operations that held up, in decisions that mattered more than headlines.

2025 brought steady progress across the region. Infrastructure advanced, technology became part of daily work rather than a future concept, and supply chains adjusted in ways that will carry forward. Not everything moved at the same pace, and that, too, is part of the story.

This issue is a snapshot of where the industry stands as the year closes. A moment to pause before attention turns fully to what comes next.

Thank you for reading, and for being with us through the year.

Aya Zhang Editor aya@bncpublishing.net

(Aya) Zhang xiaoyuezhangg

The Saudi Ports Authority (Mawani) has partnered with Q Saudi to develop an integrated logistics center at Yanbu Commercial Port, valued at over SAR 29 Million.

The Saudi Ports Authority (Mawani) has signed a contract with Q Saudi to commence the development and operational works of an integrated logistics centre at Yanbu Commercial Port. Valued at over SAR 29 million, the project spans 120,490 square metres and is set to enhance the port’s cargo handling capacity in line with the National Transport and Logistics Strategy, which aims to strengthen the Kingdom’s position as a global logistics hub.

The initiative forms part of Mawani’s ongoing efforts to modernise port infrastructure across the Kingdom and increase private sector contribution to the national GDP, while reinforcing Yanbu Commercial Port’s strategic role on the Red Sea.

The agreement was formalised by H.E. Eng. Sulaiman bin Khalid Al-Mazroua, President of Mawani, and Mr. Abdullah Naeim Qarnabeesh, CEO of Q Saudi, in the presence of senior officials.

The project is expected to deliver significant economic

benefits, including attracting investments from national and international shipping and logistics companies, creating direct and indirect employment opportunities, and enhancing operational efficiency at the port. The new logistics centre will provide facilities for cargo storage and redistribution, meeting the growing needs of shipping and transport companies and supporting the objectives of Saudi Vision 2030.

Yanbu Commercial Port, one of the Kingdom’s oldest seaports, serves as a key gateway for pilgrims and commercial traffic alike. The port currently features 12 berths with a total capacity exceeding 13.5 million tonnes, a passenger terminal capable of accommodating 2,000 travellers, a general cargo terminal, and two grain silos with a combined storage capacity of 20,000 tonnes.

The integrated logistics centre is set to boost cargo handling volumes, strengthen the port’s operational capabilities, and further cement Yanbu’s status as a critical hub in Saudi Arabia’s maritime and trade ecosystem.

DHL Supply Chain signed a strategic land lease agreement with SILZ to build a major regional logistics and distribution hub in Riyadh. The €130 million investment will create an advanced multiuser warehouse space serving multiple industries.The project supports Saudi Arabia’s Vision 2030 by strengthening national supply chain infrastructure, enabling efficient flows of imports and exports and perfectly aligning with DHL Group’s strategy to accelerate growth and expansion in the Middle East.

The new facility will occupy a 78,000 sqm land plot, featuring 53,000 sqm, including leasehold commitments for a 26-year term: This multi-user warehouse will cater to diverse sectors including technology, retail and consumer, automotive, energy, and e-commerce, providing tailored solutions for each industry. Construction is scheduled to begin in the first quarter of 2026, with completion expected by the second quarter of 2027. The new warehouse is part of the €500 million investment DHL Group has recently announced for the Middle East through 2030.

“The Middle East is one of the fastest-growing logistics regions globally, and Saudi Arabia sits at the center of this transformation. Our approach is to invest ahead of demand, creating scalable infrastructure that supports high-growth

sectors such as technology, e-commerce, and new energy. Our new multiuser-facility at SILZ will not only accelerate supply chain resilience and connectivity but also enable global businesses to migrate their distribution centers to the Kingdom, positioning them to thrive in a market that is becoming a true gateway between Asia, Europe, and Africa,” said Hendrik Venter, CEO DHL Supply Chain.

Commenting on the step, Dr. Fadi Al-Buhairan, Chief Executive Officer of the Special Integrated Logistics Zone Company, stated: “Our vision has always been to build the next generation of smart logistics infrastructure. Our partnership with DHL is a fusion of SILZ Company’s premium infrastructure and DHL’s speed and global network. This is a milestone deal as DHL will be our anchor tenant in logistics, making this facility their regional hub. The entry of a partner the size of DHL into the Riyadh Integrated ecosystem reflects confidence in our stimulating regulatory environment”.

The agreement marks a key milestone in DHL Supply Chain’s long-term expansion in the Kingdom and reflects the strong alignment between the company’s growth ambitions and Saudi Arabia’s Vision 2030 objectives. The facility is expected to create new employment opportunities, contributing to local workforce development in line with Vision 2030.

AD Ports Group and LDC have signed a long-term agreement to develop a modern bulk handling facility at Karachi Port

AD Ports Group has announced a strategic partnership between Karachi Gateway Terminal Multipurpose Limited (KGTML), part of Noatum Ports, and Louis Dreyfus Company Pakistan (Private) Limited (LDC) to develop and operate a stateof-the-art clean bulk handling and storage facility for agricultural goods at Karachi Port.

The long-term commercial agreement will see KGTML design and construct a highly efficient, food-grade bulk facility, equipped with advanced handling and conveyor systems, as well as supporting infrastructure and utilities. The facility is intended to streamline the handling and storage of dry agricultural commodities in line with international best practices, while LDC will provide a steady inbound volume of agricultural goods.

This initiative builds on AD Ports Group’s previous $75 million investment during phase one of the KGTML project and represents a significant step in enhancing Pakistan’s agricultural supply chain and port logistics ecosystem. By leveraging the expertise and capabilities of two companies within the ADQ portfolio, the collaboration aims to strengthen regional trade connectivity and bolster access to food.

The signing took place in Abu Dhabi with Mohammed Al Tamimi, CEO of Noatum Ports, and Rubens Marques, Head of South and Southeast Asia for LDC, in the presence of Capt. Mohamed Juma Al Shamisi, Managing Director and Group CEO of AD Ports Group, and Michael Gelchie, CEO of LDC.

Mohammed Al Tamimi stated: “This

collaboration reflects a shared commitment to strengthening Pakistan’s agricultural supply chain and port logistics ecosystem. KGTML will design, construct, and operate a food-grade silo system to support the efficient handling and storage of dry agricultural bulk cargo, in line with international best practices. This development will significantly upgrade the country’s logistics infrastructure, creating new opportunities for growth, and reinforcing Karachi Port’s position as a critical hub for international commerce.”

Rubens Marques of LDC added: “We are pleased to partner with KGTML and deepen our cooperation with AD Ports Group on this transformative project to upgrade Karachi’s port infrastructure, supporting the growth of Pakistan’s agriculture sector. The facility will be a key lever as we enhance our supply chain capabilities for the benefit of our business partners in Pakistan, the region, and beyond.”

In addition to the KGTML facility, AD Ports Group is also developing, operating, and managing the Karachi Gateway Terminal Limited (KGTL) container terminal. Pakistan’s strategic location makes it a pivotal maritime gateway to Central Asia, where AD Ports Group is developing the ‘Middle Corridor’ East-West land route between China and Europe.

The new facility is expected to increase operational efficiency, reduce handling times, and improve resilience in Pakistan’s agricultural logistics network, aligning with global food safety and operational standards. The partnership represents a milestone in bilateral trade and economic development between the UAE and Pakistan, while enhancing Karachi Port’s standing as a modern hub for international commerce.

The Riyadh-Doha high-speed railway is set to create 30,000 jobs and carry up to 10 million passengers annually.

In a landmark move signalling closer ties between the two Gulf neighbours, Saudi Arabia and Qatar have signed an agreement to construct a highspeed railway linking Riyadh and Doha. The announcement comes amid ongoing efforts to strengthen diplomatic and economic relations following the restoration of ties after the 2017 Gulf crisis.

The new line will connect King Salman International Airport in Riyadh with Hamad International Airport in Doha, with intermediate stops in Al-Hofuf and Dammam in eastern Saudi Arabia. Trains will operate at speeds exceeding 300 km/h, completing the journey in approximately two hours.

The agreement was formalised on 8 December during a visit to Riyadh by Qatar’s Emir, Sheikh Tamim bin Hamad Al Thani, alongside Saudi Crown Prince Mohammed bin Salman. Both leaders hailed the project as a “historic milestone” in regional connectivity and economic cooperation.

The Riyadh-Doha high-speed line is expected to generate around 30,000 direct and indirect jobs across Saudi Arabia and Qatar and is projected to carry up to 10 million passengers annually once operational. The project is scheduled for completion within six years.

For Saudi Arabia, the Riyadh-Doha line will mark the country’s second highspeed rail venture, following the 2018 opening of the Jeddah–Mecca–Medina line. It will also be the first cross-border high-speed railway in the Gulf region, reflecting the Kingdom’s ambitions to modernise transport infrastructure and

strengthen regional connectivity.

The agreement underscores the warming diplomatic relations between the two countries, following the lifting of the Saudi-led blockade on Qatar in 2021. Officials from both nations described the railway as a symbol of enhanced collaboration, economic integration, and mutual

commitment to advancing regional development.

With ultra-fast trains connecting major cities and airports across the Gulf, the Riyadh-Doha line is set to reshape travel in the region, bringing economic growth, tourism, and new opportunities for millions of passengers.

The UAE’s economic success didn’t happen by chance. At the heart of its shift beyond oil lie the country’s free zones, dynamic hubs that have become powerful drivers of investment, innovation, and global competitiveness.

The United Arab Emirates (UAE) has long been a model of economic transformation, shifting from an oil-dependent economy to one increasingly powered by trade, manufacturing, logistics, and innovation.

Central to this journey are the country’s economic zones, which have emerged as critical enablers of diversification and global competitiveness. The UAE’s transformative economic growth has been recognised globally, with its visionary leaders helping the country achieve record-breaking numbers across various domains. The latest GDP figures released by the Ministry of Economy further highlight the fact that the UAE’s real gross domestic product (GDP) reached AED 1,776 billion in 2024, marking a 4 per cent increase compared to 2023. It’s also worth noting that non-oil sectors account for 75.5 per cent of the UAE’s GDP, contributing AED 1,342 billion, while oil-related activities

contributed AED 434 billion to the overall economy.

These figures signal robust economic growth that is diversified and spread across non-oil sectors, in line with the country’s ‘We the UAE 2031’ vision. However, these achievements have been made possible largely due to the establishment of Free Zones in the UAE, which provide expatriates and foreign investors with a conducive environment for business dealings.

Free zones are designated areas that attract businesses and investors while driving economic growth and diversification. The UAE is home to more than 40 multidisciplinary free zones, each offering world-class infrastructure, efficient systems, and specialised services that streamline operations and reduce administrative complexities.

These zones provide several advantages, making them an attractive choice for entrepreneurs and global corporations

alike. Among the key benefits are 100% foreign ownership, allowing investors full control without the need for local sponsorship, and significant tax incentives, including exemptions from corporate, import, export, and personal income taxes for specific activities. Businesses also benefit from state-of-the-art facilities, including modern office spaces and warehouses, as well as advanced logistics and ports, all designed to support international trade. Strategically positioned between East and West, the UAE’s 10 airports, 12 seaports, and extensive transport network connect companies to

Dr. Shereen Nassar, Global Director of Logistics Studies and Director of MSc Logistics and Supply Chain Management Suite at Heriot-Watt University Dubai

key global markets, with 33 per cent of the world’s population reachable within four hours and 66 per cent within eight. Moreover, free zones offer simplified business setup procedures and access to a diverse, highly skilled talent pool drawn from around the world.

These advantages have attracted thousands of international companies and catalysed the UAE’s economic growth. According to the Dubai Free Zones Economic Impact 2022 Report, free zones have contributed AED 247 billion and AED 336.5 billion to the GDPs of Dubai and the UAE, respectively. Sectors such as wholesale and retail trade, finance, manufacturing, transport, and professional services are the major beneficiaries. They are also a major driver of foreign direct investments (FDI), receiving USD 1.62 billion (29.9 per cent of total FDI) across 107 projects in H1 2025. Even though free zones account for less than onefifth of projects, they capture nearly one-third of total capital investment, underscoring their appeal for capitalintensive operations.

Some of the largest free zones in the region are Jebel Ali Free Zone, Dubai Airport Free Zone, and Khalifa Industrial Zone, all located in Dubai and Abu Dhabi, each catering to specific sectors and boasting mature business communities.

Jebel Ali Free Zone (JAFZA), the UAE’s oldest free zone, stands out as a cornerstone of success, with nearly 11,000 companies and AED 620 billion facilitated in trade annually. The relatively younger ones, such as Ras Al Khaimah Free Zone and Ajman Free Zone, are also evolving to meet modern demands, offering one-click license

issuance systems and digitised processes to attract investors.

In the UAE, small and medium-sized enterprises (SMEs) represent over 94% of the UAE’s businesses and contribute more than 60% to non-oil GDP, with plans to reach one million SMEs by 2030 (AB Magazine & UAE Government Portal, July 2025). For many developing economies, including the UAE their integration into global value chains has been instrumental in achieving key development priorities and accelerating growth.

The support for SMEs within UAE economic zones plays a pivotal role in fostering entrepreneurship and innovation, ultimately contributing to a more diversified and robust industrial base. For example, the UAE government and various economic zones offer financial incentives, grants, and funding programs specifically designed to support SMEs. Many economic zones provide flexible regulatory frameworks that allow SMEs to adapt quickly to market changes. Additionally, by operating within economic zones, SMEs can easily connect with larger corporations and supply chains, enhancing their visibility and opportunities for collaboration.

Beyond economic development, these zones also support sustainability and gender balance initiatives, employing more than 308,000 women across the UAE. Abu Dhabi’s Masdar City Free Zone, for instance, is home to one of the largest clusters of LEED Platinum buildings in the world and a venture investor in clean-tech in partnership

with BP. JAFZA, on the other hand, was among the first free zones in the region to install energy-efficient LED streetlights and has invested AED 105 million in major retrofit projects to install solar water heaters.

Economic Free Zones form the backbone of the UAE’s national economy. Offering unparalleled advantages, including 100 per cent foreign ownership, tax exemptions, simplified licensing procedures, and state-of-the-art infrastructure, they have become highly attractive destinations for industries such as manufacturing, technology, and logistics, sectors central to the nation’s diversification agenda.

Aligned with the government’s vision for sustainable and futureready growth, free zones are now actively attracting investments in emerging fields such as artificial intelligence, blockchain, and clean energy. By fostering innovation and integrating digitalisation and green infrastructure into their frameworks, they are redefining competitiveness in an era of global supply chain transformation.

As the UAE advances toward Vision 2031 and its goal of becoming a knowledgeand innovation-driven economy, economic zones will continue to serve as powerful engines of growth, connecting global trade, accelerating industrial diversification, and solidifying the country’s position as a leading hub for logistics, innovation, and sustainable development.

BEGA pole-top luminaires with BugSaver® technology protect nocturnal fauna by reducing the color temperature from 3000 Kelvin to an amber color around 1800 Kelvin, which reduces the light attractive effect. The color temperature and output can be controlled dynamically. bega.com/bugsaver

Das gute Licht.

The

GCC’s freight roads are going electric,

and the race is on to make e-trucks the new backbone of logistics.

Martina Di Licosa is a business journalist reporting on consumer startups at Forbes. She is based in New York City and holds a Master of Science degree in journalism from Columbia University.

The Gulf Cooperation Council is edging toward a transformative moment in freight logistics as battery‑electric heavy trucks, or e freight, gain traction, yet the road ahead remains challenging. Volkswagen Group Logistics and MAN Truck & Bus have teamed up in a concerted push to electrify long haul road transport, arguing that zero emission trucks are central to reducing the logistics sector’s carbon footprint.

Simon Motter, Head of Volkswagen Group Logistics, recently said that battery electric vehicles are the “most suitable” technology for a more climate‑friendly commercial vehicle fleet. Friedrich Baumann, Executive Board Member at MAN for Sales and Customer Solutions, added that while over 1,000 e‑trucks have now been ordered, wider adoption will depend on “a boost through faster approvals and the expansion of the power grids.”

But even with this momentum, a September PwC Middle East report warns that the GCC’s progress is fragile. Without intervention, emissions from new heavy truck sales across the UAE, Saudi Arabia, and Qatar could exceed 54 million

tonnes of CO₂ by 2035, the report forecasts. If government incentives, infrastructure, and regulation step in, that number could fall by 4.7%, a modest but meaningful reduction.

One of the report’s key observations is that the availability of electric heavyduty trucks in the GCC is severely constrained: there are roughly 70% fewer zero-emission truck models in the region than in Europe.

This shortage limits how quickly logistics companies in the region can adopt e‑freight, because many vehicle options simply aren’t marketed here. This lack of model diversity hinders fleet diversification and slows electrification.

Meanwhile, infrastructure is catching up, but not fast enough. According to the Roland Berger EV Charging Index 2025, EV penetration in the GCC doubled in just a year (from 2% to 4%), driven by strong

consumer interest and rising confidence. Public‑private partnerships are already expanding charging networks. Cities like Dubai report more than 1,270 public charging points, and Abu Dhabi is planning to open 500 more by 2028. In Saudi Arabia, the state backed Electric Vehicle Infrastructure Company aims to deploy 5,000 chargers across 1,000 locations by 2030, targeting highways and logistics hubs.

Still, freight level charging infrastructure, particularly for heavy duty trucks, needs to scale more aggressively. MAN’s own electric truck models, such as their eTGX, eTGS, and “lowliner” ultra tractors, can already travel long distances, but their modular battery systems require high capacity charging. In a European context, MAN had designed its eTrucks to charge at up to 375 kW, with future plans for megawatt level charging capacity, but similar heavy duty charging stations remain rare in the GCC.

The business case for electric freight in the GCC hinges on whether the total cost of ownership can compete with diesel. While MAN has said that its modular battery design and digital fleet tools help optimise payload and charging efficiency, government policy will be

the real lever: incentives, financing, and regulatory support are essential if e‑truck adoption is to scale. Heiko Seitz, Global Transport & Logistics Leader at PwC Middle East, put it bluntly:

“With smarter policy, investment and the right incentives,zero‑emission trucks can soon outpace their combustion‑engine counterparts not just environmentally but commercially.”

What makes this moment especially urgent is that transportation

emissions risk undermining broader sustainability goals in the region. Heavy road freight is one of the most emissions intensive sectors in the GCC’s logistics ecosystem, and electrifying it could not only drive down CO₂ but also make the road network more resilient, efficient, and aligned with future net zero ambitions.

Yet the challenge is systemic. It’s not just about more e‑trucks; it’s about the power grid, long haul charging stations, speeding up permitting, and establishing financial support for companies making the transition. The potential is real, but only if governments and industry act together quickly.

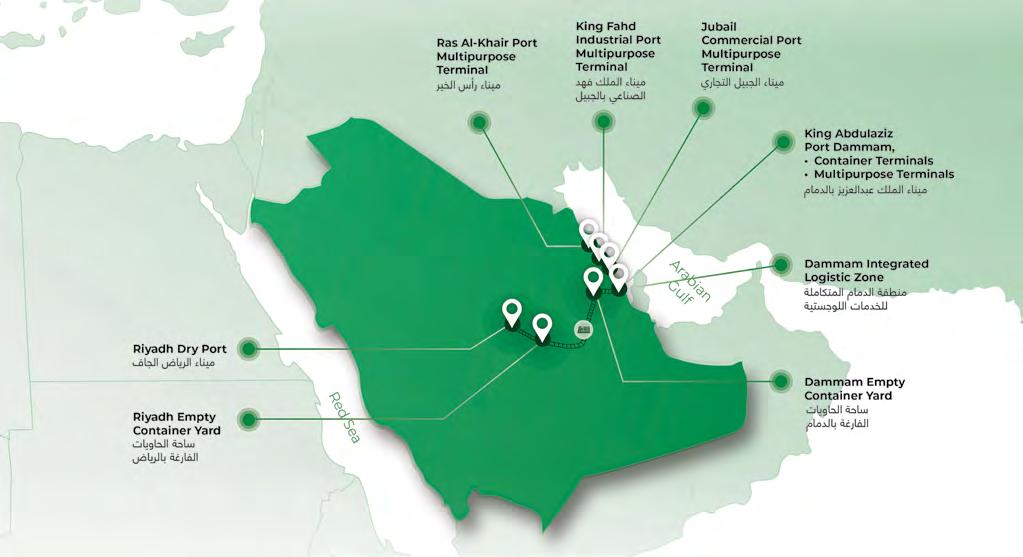

This conversation starts at the quay, but it quickly moves far beyond it. In this exclusive interview, Daniel Phay reveals how Saudi Global Ports is quietly engineering one of the Kingdom’s most important logistics ecosystems.

SGP recently surpassed 15 million TEUs at Dammam since launch. How do you see this milestone influencing your strategic priorities for capacity expansion, particularly in light of your long-term concession?

Surpassing 15 million TEUs marked an important milestone for SGP Container Terminals, Saudi Arabia’s Eastern gateway. It reflects consistent growth, the trust of our customers, and the strength of our collaboration with Mawani and long-term partners. At Saudi Global Ports, we stay committed to our longterm growth trajectory with a clear focus on expanding throughput capacity, strengthening operational performance and delivering a future-ready hub for the Kingdom’s logistics ambitions.

Building on this momentum, we recently celebrated the inauguration of the Terminal 2 berth expansion, adding 225 metres to the existing 700 metres of quay length, allowing two UltraLarge Container Vessels (ULCVs) to berth simultaneously and significantly improving our operational capabilities. Combined with Terminal 1, the consolidated handling capacity will rise to 3.8 million TEUs in 2025, reinforcing KAPD’s position as a key maritime gateway on the Arabian Gulf.

SGP has secured four 20-year concession agreements for multipurpose terminals along the Eastern Coast. What operational or digital transformations are you planning to deploy across these terminals to maximise efficiency? These multipurpose terminals represent a natural extension of SGP’s ecosystem. They enable us to serve a wider range of cargo, from breakbulk and project cargo to RoRo and bulk commodities. As a Group, SGP is steering its business units, including the multipurpose terminals, towards a comprehensive modernisation programme. This initiative includes more than SAR 700 million in investments to upgrade infrastructure, introduce new equipment and align operating standards across Dammam, Jubail and Ras Al Khair. The intention is to integrate these

“Surpassing 15 million TEUs marked an important milestone for SGP Container Terminals, Saudi Arabia’s Eastern gateway.”

terminals fully into SGP’s existing sea–rail–road ecosystem, allowing them to operate as connected gateways rather than standalone assets.

Digitally, we are embedding systems and training modelled on our technical partner PSA International’s best practices in safety, automation, and sustainability.

Our earlier 5G Smart Port trials in Dammam have proven the benefits of real-time monitoring, remote operations, and data-driven yard management.These insights will guide our next phase of digital transformation.

ESG is becoming more critical in global logistics. What sustainability initiatives are you prioritising at SGP, and how do you intend to measure their impact over time?

Sustainability is embedded in our operational model. SGP has already deployed hybrid and electric equipment, including 80 electric prime movers. We continue to focus on procuring sustainable equipment with upcoming plans for more electric prime movers, hybrid and electric yard equipment, and will track emissions and energy performance at asset level to drive continuous improvement.

The Terminal 2 expansion incorporates energy-efficient cranes, LED yard lighting and solarready infrastructure, supporting our long-term target to lower carbon emissions per move. Rail integration is another lever in our efforts toward Sustainable Logistics. Supported

Construction milestones and the arrival of quay cranes and RTGs lay the foundation for large-scale container operations. Building Capacity

PIF and PSA International come together to develop and operate Terminal 2 at King Abdulaziz Port Dammam.

SGP handles its first vessel at Terminal 2, formally entering Saudi Arabia’s Eastern gateway.

SGP assumes operatorship of the Riyadh Dry Port ecosystem, extending its footprint inland and enabling intermodal connectivity.

Operations of Terminals 1 and 2 are consolidated, strengthening throughput, efficiency, and service reliability.

SGP expands operatorship to multipurpose terminals along Saudi Arabia’s Eastern Coast, reinforcing a fully connected logistics ecosystem.

SGP surpasses 10 million TEUs handled since launch, accelerates expansion works, and advances digital port infrastructure.

by seven daily rail services within the Riyadh Dry Port ecosystem, we aim to reduce truck dependency and emissions across the Dammam–Riyadh corridor.

We will maintain rigorous tracking and review of key KPIs - including equipment emissions, fuel consumption, rail utilisation and safety performance – as part of our broader sustainability agenda. These efforts are complemented by initiatives such as the establishment of our SGP Academy this year to further sharpen our focus on workforce upskilling.

How do you see digital infrastructure (e.g., 5G, AI, edge computing) influencing the future of SGP terminals, especially given the push for smarter, more connected ports?

In 2023, SGP completed Saudi Arabia’s first 5G Smart Port trial and the Middle East’s first remote-controlled ARTG pilot, which gives us a strong foundation for the next phase of digital enhancement. The trials demonstrated gains in safety, visibility and equipment performance.

A partnership between the Public Investment Fund, the shareholders of Al Blagha Holding for Investments (ABHI) and PSA International, Saudi Global Ports (SGP) is the leading port operator and a trusted partner of the region’s ports and logistics ecosystem.

SGP operates deepsea Container Terminals and Multipurpose Terminals along the Eastern Coast of Saudi Arabia and three raillinked intermodal terminals across Riyadh and Dammam. Growing its portfolio, SGP is also developing the Dammam Integrated Logistics Zone, adjacent to its operations at King Abdulaziz Port Dammam. With their extensive and growing operations in the Kingdom, they aim to deliver the infrastructure that moves trade, supports national projects, and empowers Vision 2030.

“Our long-term vision is to strengthen Saudi Arabia’s position as a leading global logistics hub, through our fully integrated ecosystem that connects sea, rail, road and logistics zones.”

Building on these results, the Terminal 2 expansion incorporates nextgeneration digital systems including smart yard management, automated gate operations and data synchronisation with our inland network.

Our next steps concentrate on real-time data analytics, remote monitoring and predictive maintenance to strengthen decision-making and operating predictability across SGP Container Terminals. Digitalisation is not a project, it is the operating backbone of our capacity expansion.

As SGP evolves into a more integrated ecosystem, from container terminals to multipurpose terminals

and inland logistics, how are you aligning your operational strategy with Saudi Arabia’s Vision 2030 logistics ambitions?

Vision 2030 calls for a more connected, competitive, and diversified logistics sector. Our ecosystem approach directly supports this by linking deepsea terminals, rail-linked inland hubs and logistics zones under one integrated network.

The 15 million TEU milestone reflects how SGP contributes to Vision 2030 in real terms, through consistent performance, technology adoption and Saudi talent development. Our operations support non-oil trade growth, strengthen Saudi supply chain resilience and expand local

execution inland, ensuring synchronisation across berths, yards, rail and warehouses.

employment – key national priorities aligned with Vision 2030.

How do you balance investments between seaport capacity and inland intermodal growth, and what role will automation and digital platforms play in that balance?

Our model views ports and inland assets as integrated ecosystems rather than separate investments. The Riyadh Dry Port Ecosystem already operates seven daily rail services linking Dammam and Riyadh and forms the backbone of our intermodal offering.

Capacity investments therefore follow the flow of cargo across the entire supply chain. The milestone of 15 million TEUs reinforces our belief in building integrated capacity, both at the quay-side and inland, so that the ecosystem grows in unison. On the digital side, the same integrated data approach we use in the seaport continues to unify planning and

Looking ahead, what is your longterm vision for enabling Saudi Arabia’s logistics sector to become a global hub? Our long-term vision is to strengthen Saudi Arabia’s position as a leading global logistics hub, through our fully integrated ecosystem that connects sea, rail, road and logistics zones.

Our people, partners and systems are ready for the next phase of growth. Digital transformation will remain central, building on our Smart Port achievements to create safer, smarter and seamless operations. Sustainability will progress through electric equipment, rail integration and lower-emission infrastructure. Talent development will continue to be underpinned by training programmes designed by SGP Academy and supported by PSA University, enhancing national workforce growth across all terminals.

Together, these elements shape a resilient ecosystem that unlocks more opportunity for the Kingdom, its industries and its people.

Swisslog explores the five defining trends that will shape warehouse design, operations, and competitiveness across the Middle East in 2026.

The Middle East is entering a defining chapter in its logistics journey. As governments accelerate long-term plans to position the region as a global trade and distribution hub, investment in logistics is gathering pace. The regional market is set to double compared

with 2020, signalling a surge in infrastructure development, technology adoption and supply chain modernisation. This rapid growth is changing what is expected of warehouse operations. Performance, energy efficiency and service reliability are now central to competitiveness, not added extras. Against this backdrop, Swisslog highlights the five trends

that will shape the Middle East’s warehousing landscape as 2026 approaches.

Across the region, automation is moving from ambition to reality. The Middle East warehouse robotics market is projected to surpass $714 million by 2030, fuelled by rising labour costs, surging e-commerce volumes and national strategies that actively promote automation. AMRs, AGVs, and robotic picking systems are

increasingly supported by AI and machine learning, enabling them to handle more complex, highvariability tasks while improving throughput and reducing operational risk.

As a result, many organisations are turning to AS/RS and robotic storage solutions to unlock space and speed. These systems can utilise up to 85% of available floor space, delivering strong returns in sectors with dense SKU profiles such as grocery retail. By 2025, autonomous robots are

expected to process up to 50% e-commerce orders, highlighting how rapidly automation is becoming a core pillar of both large-scale distribution centres and micro-fulfilment operations.

AI Powers the Smart Warehouse

Across the Middle East, artificial intelligence is rapidly becoming the backbone of modern warehouse operations. National initiatives such as Saudi Vision 2030 and the UAE National AI Strategy 2031 are accelerating the adoption of AI, IoT sensors and digital twins, turning warehouses into data-driven environments. With AI expected to contribute up to $320 billion to the region’s GDP by 2030, logistics operators are moving quickly to harness realtime insights to forecast demand, maximise uptime and optimise storage density.

The results are already visible. The UAE now ranks among the top 11 countries on the World Bank’s Logistics Performance Index, reflecting years of sustained investment in automation-led efficiency. At the operational level, advances in warehouse control software are proving just as critical. Insights from AutoStore’s research show that optimised bin selection and intelligent order batching can improve retrieval speeds by up to 20%, delivering measurable gains in both speed and accuracy.

E-commerce Boom Drives Automation

Online shopping continues to redefine warehouse operations across the Middle East. With

the region’s e-commerce market expected to reach $50 billion this year, demand is rising for fast-turnaround fulfilment centres, micro-warehouses located closer to urban populations and more advanced reverse logistics capabilities. Warehouses are being reshaped to support higher volumes, smaller order sizes and ever-shorter delivery windows. Whereas, speed has become the defining metric. For leading operators, fulfilment times measured in hours today are expected to fall to just 30 minutes by 2028. Meeting this expectation is only possible through advanced automation, which is fast becoming central to scalability, service reliability and customer

satisfaction, while delivering a decisive competitive edge.

Sustainability is moving firmly to the centre of warehousing strategies across the Middle East, underpinned by national commitments such as the UAE’s Net Zero 2050 initiative. The region recorded its largest-ever increase in renewable energy capacity in 2022, adding 3.2 gigawatts, and this momentum is increasingly reflected within logistics operations. Many modern systems can be powered by renewable sources, while high-bay pallet stacker cranes equipped with regenerative braking significantly cut

energy use. Electric automation systems can operate at less than 0.1 kW per hour, demonstrating how efficiency and performance can go hand in hand. Swisslog’s development of the world’s first fully solarpowered warehouse automation system highlights how technology can support long-term sustainability goals without compromising on operational excellence.

Retailers and logistics providers are reconfiguring warehouses to support multiple fulfilment streams from a single facility. Operations are being redesigned to handle store replenishment, same-day delivery, B2B orders and returns, all enabled by automationready layouts and real-time data platforms. Insights

from AutoStore’s research show that 93% of supply chain leaders now prioritise throughput improvement, while 97% have already implemented some form of automation. As customer expectations continue to rise in major cities, micro-fulfilment centres and lastmile hubs are becoming essential to maintaining reliability during peak demand.

Taken together, these shifts signal a fundamental change in the role of warehousing across the Middle East. Facilities are evolving into data-driven, automated and sustainability-focused ecosystems. The next phase of growth will favour operators that invest early, adapt quickly and design warehouses with long-term regional expansion in mind.

Junwei Yang, General Manager of Keeta Drone, is helping cities think differently about the skies above them. In this conversation, he shares how drones are not just flying parcels, they’re creating smarter, safer, and more connected urban spaces, changing the way we move through the world.

The UAE is building one of the world’s most advanced air mobility ecosystems.

How is Keeta Drone influencing the architecture of regulated “sky corridors” for commercial drone delivery in dense, urban environments?

Keeta Drone leverages “Safety Bubble” technology to orchestrate large scale drone operations within highdensity urban areas, thereby establishing a last-mile drone delivery network. This approach facilitates the formation of an aerial corridor structured as a mirrored

tower, stratified from high density, low-range layers to low-density, high-range tiers.

This creates a clean, controlled structure in the sky, letting drones move safely and predictably through crowded urban areas.

You’ve completed 700,000+ autonomous deliveries, far more than most players globally. What were the biggest breakthroughs that allowed Keeta Drone to

move from experimental pilots to fully commercial, city-scale operations?

The most significant breakthrough is the maturation of BVLOS (Beyond Visual Line of Sight) operations, which fundamentally changes how drone networks can function in a city. Under BVLOS, drones no longer require a dedicated pilot monitoring each flight, enabling the simultaneous deployment of large, highly automated fleets. This shift dramatically lowers operational costs, and it opens the door to

far more flexible, efficient route planning across complex urban environments.

Your work with the Dubai Civil Aviation Authority has been described as a model for safe drone integration. What did it take to earn the UAE’s first commercial drone-operations certificate, and how does this regulatory clarity accelerate industry adoption?

From a regulatory standpoint, the DCAA’s Enable Drone Transportation Programme

JUNWEI YANG, GENERAL MANAGER, KEETA DRONE

Junwei Yang is the General Manager of Keeta Drone, Meituan’s autonomous drone delivery solution revolutionising urban logistics. With a decade of aviation experience and a dual background as both an air traffic controller and a certified pilot, Junwei brings deep operational insight and strategic expertise to this fast growing aerial systems sector.

At Keeta Drone, he leads the full spectrum of drone operations including overseeing airspace coordination, designing low-altitude operation rules, and addressing safety protocols.

Keeta Drone has been at the forefront of aerial innovation since 2017, building a low-altitude drone network capable of completing 3 km deliveries in just 15 minutes. Under Junwei’s leadership, Keeta Drone continues to enhance living and dining experiences through cutting edge drone technology.

Junwei has spent nearly six years at Meituan, China’s leading technology-driven platform for local services and on-demand delivery, where he shaped one of the world’s most advanced drone delivery ecosystems. As Head of Strategy and Policy, and later Head of Operations for the Drone Delivery Division, he played a central role in regulatory development, operational design, and strategic expansion.

Junwei’s career also includes influential positions at global aviation institutions including International Civil Aviation Organisation (ICAO) and World Economic Forum.

Today, Junwei remains committed to advancing responsible drone innovation, developing systems, policies, and technologies that make urban air mobility safer, smarter, and more accessible.

provides a clear and structured certification pathway. Both Keeta Drone and the DCAA follow internationally recognised risk assessment frameworks and adhere to a rigorous, stepby-step approval process—from documentation review to flight testing in unpopulated areas, and finally to supervised tests in populated environments. The DCAA sponsors a completed path to certify drone transportation operators, while Keeta Drone contributes practical expertise by sharing the detailed flight test subjects according to experience in China. Together, the two parties are helping shape a complete and robust regulatory methodology for drone transportation operators.

Urban drone delivery is notoriously difficult due to unpredictable environments, tall buildings, GPS issues, and human movement. What technological innovations

(navigation, sensors, AI, or redundancy systems) allowed Keeta Drone to operate safely in a real city?

We use an integrated navigation architecture that intelligently combines multiple sources of positioning data—such as GPS and visual-inertial odometry— through algorithmic crossvalidation to achieve highly accurate and reliable navigation. By continuously comparing inputs from different sensors, the system can detect inconsistencies in real time and refine the drone’s position accordingly.

A key advantage of this approach is its autonomous reconfiguration capability. If one data source fails, the navigation stack automatically adjusts, leveraging the remaining sensors to maintain uninterrupted operation. This redundancy ensures both continuity and robustness.

700,000 autonomous flights generate enormous safety and performance data. What have you learned about risk, reliability, and public acceptance?

Safety constitutes the fundamental prerequisite for any commercial operation; only through a systematic framework for risk governance and the continuous enhancement of system stability can we secure public trust and acceptance.

As cities move toward hybrid fulfilment (bikes, EVs, lockers, drones) how do you see drones fitting into the broader lastmile ecosystem? Are they for speed, cost optimisation, certain parcel types, or specific geographies?

Drone delivery serves as a strategic augmentation of the conventional distribution network in two key dimensions: first, as a viable solution for spatially isolated or obstructed environments—such

as enclosed campuses, islands, and mountainous regions; and second, as a cost-efficient, high speed one-to-one dedicateddelivery modality.

Beyond small parcel delivery, what future applications do you see emerging? And what milestones must the region reach to get there?

Beyond small parcel delivery, we see several emerging applications for drones, medical transport.

Drone medical delivery, in particular, can avoid delays caused by traffic congestion, save critical time for healthcare staff, reduce infection risks through minimal human contact, and streamline oversight of the delivery process.

To achieve these milestones, the region will need to develop dedicated drone infrastructure, such as drone ports at hospitals before the drone medical transport can be mass applied.

Navin Narayan, CEO of Acme Intralog, discusses the technologies and strategic moves enabling warehouses to operate smarter, faster, and with unprecedented autonomy.

Acme celebrated an impressive 50-year milestone. Looking back at the company’s journey, what do you see as the defining moments that shaped Acme into one of the region’s leading automation and intralogistics innovators?

Acme’s 50-year journey is marked by a series of defining moments that have shaped who we are today, one of the region’s leading innovators in automation and intralogistics. Our story began in 1975 as a family-owned trading business supplying warehouse storage equipment to the local market. As industry needs evolved, so did we. We gradually expanded our portfolio to include automation components, such as pneumatics, ensuring local businesses had reliable access to the technologies required to improve their operations.

A major turning point came in 2012. Warehouses were becoming more integrated, and automation demands were growing increasingly sophisticated. It was clear that the market needed more than individual products, it needed complete solutions. This prompted our transition from component supply to full system integration.

Another pivotal milestone arrived in 2018 with the launch of Acme Intralog, a dedicated automation solutions arm. This was further strengthened in 2019 by the establishment of our in-house R&D and manufacturing facility in Jebel Ali. Having the ability to design, engineer, and build customised automation systems locally for the Middle East market has been transformative.

Together, these steps have evolved Acme into a full-spectrum intralogistics provider delivering turnkey projects that seamlessly integrate robotics, AS/RS technologies, intelligent software, and comprehensive life-cycle support. Throughout our growth, our commitment to engineering excellence, long-term partnerships, and sustained

Navin Narayan, CEO of Acme Intralog

“In the next three to five years, artificial intelligence, robotics, and data-led automation will shape the future of warehouse operations.”

investment in technology close to the markets we serve has remained constant.

You led Acme’s transition from a storage solutions provider into a full-fledged system integrator and later into a manufacturer of integrated automation systems. What motivated this strategic evolution, and what were the biggest challenges during this transformation?

The motivation behind Acme’s strategic evolution was, in many ways, straightforward. As our customers’ challenges grew more complex, it became clear that providing components or standalone products was no longer enough. Businesses increasingly require integrated automation systems that bring together mechanical equipment, robotics, control software, and operational intelligence into a single, dependable platform. Transitioning into a system integrator enabled us to meet those needs more effectively.

However, we also recognised that differentiation would only come from owning our technology and engineering capabilities. To deliver solutions tailored to the unique requirements of our region, we needed full control over design, development, and execution. This was the catalyst for establishing our in-house R&D, engineering, and manufacturing capabilities.

Building these capabilities was not without its challenges. It demanded significant investment in talent, processes, and robust quality systems. One of the biggest hurdles was doing this while maintaining service continuity. The results have validated the strategy. Today, we can customise solutions with agility, maintain complete

quality oversight, and innovate continuously without relying entirely on external supply chains.

Which emerging technologies do you believe will have the biggest impact on warehouse automation in the next 3–5 years, especially in the Middle East?

In the next three to five years, artificial intelligence, robotics, and data-led automation will shape the future of warehouse operations. AI will become the quiet force behind the scenes, constantly refining inventory flows, picking patterns, space utilisation, and labour planning with real-time intelligence. On the ground, autonomous mobile robots and more adaptable AS/RS systems will gain momentum as businesses look for solutions that are both scalable and quick to deploy.

In the Middle East, companies are expanding quickly, navigating seasonal peaks, and adapting to omnichannel demands, so

modular automation will be in high demand. As sustainability rises on the regional agenda, energy-efficient designs and smarter system architectures will increasingly influence how warehouses of the future are built.

How do you balance customization with standardisation to ensure scalability, reliability, and fast deployment for your clients?

Our approach centres on modular design. We standardise the core system architecture, control platforms, and component interfaces, while keeping flexibility where it truly matters: layout, throughput, storage profiles, and process flows. This allows us to tailor each installation to the

“Successful

automation is as much about people as technology; once teams see how connected systems improve predictability and reduce disruption, digital transformation becomes a confident, practical journey rather than an abstract goal.”

customer’s operational reality without rebuilding the entire solution from the ground up.

By relying on proven technology platforms and validated engineering methods, we ensure reliability and shorten delivery timelines while the engineering teams can focus their custom work on features that add value, rather than on the fundamentals that underpin system stability.

Under your leadership, Acme has expanded into Europe, India, and South America. What drives your global strategy, and how different are the automation needs and expectations across these markets?

Our global strategy is shaped by a simple principle: stay close to customer demand and focus on markets where our engineering capabilities can make a meaningful difference. Saudi Arabia has become a particular priority for us. Being physically present there is essential, proximity allows for faster response times, tighter project coordination, and deeper partnerships at a moment when the Kingdom is investing heavily in logistics and industrial infrastructure under Vision 2030.

In Europe, our role is more technology-led. Rather than acting as a full system integrator, we support established players by supplying engineered components and specialised automation modules, drawing on our strengths in design and manufacturing.

India and South America, meanwhile, are undergoing rapid supply-chain

modernisation. These markets need scalable, cost-efficient automation that can support expanding warehousing capacity, often with limited access to flexible, locally tailored solutions. Our modular, adaptable systems are wellsuited to meet those needs.

While each region has its own dynamics, one expectation is universal: solutions that scale seamlessly, perform reliably, and evolve as operational demands change.

With supply chains becoming more data-driven and efficiency-focused, how is Acme preparing its customers for the next wave of automation, especially in terms of AI adoption, predictive maintenance, and autonomous material handling?

We’re preparing our customers for the next wave of automation by combining advanced technology with practical operational readiness. Our warehouse execution platform, AcmePlus, brings together analytics, AI-driven optimisation, and predictive maintenance to maximise uptime, enhance asset performance, and deliver full visibility across warehouse operations. It gives customers immediate value from their data while creating a scalable foundation for future automation.

A major shift taking place today is the deeper integration between automated

hardware and a unified software layer. This enables digital twins and real-time “what-if” simulations, allowing businesses to model scenarios, from throughput spikes to equipment downtime, before they happen. It moves them from retrospective insight to actionable foresight, where technology actively supports day-to-day decision-making.

On the hardware side, we continue to advance autonomous transport systems, robotic integration, and flexible AS/ RS solutions designed to evolve with a customer’s operational maturity because our systems are modular; companies can adopt automation step by step, reducing investment risk while progressing steadily towards highly autonomous operations.

The human element is equally important. We embed robust change management, training, and knowledge transfer into every project. Successful automation is as much about people as technology; once teams see how connected systems improve predictability and reduce disruption, digital transformation becomes a confident, practical journey rather than an abstract goal.

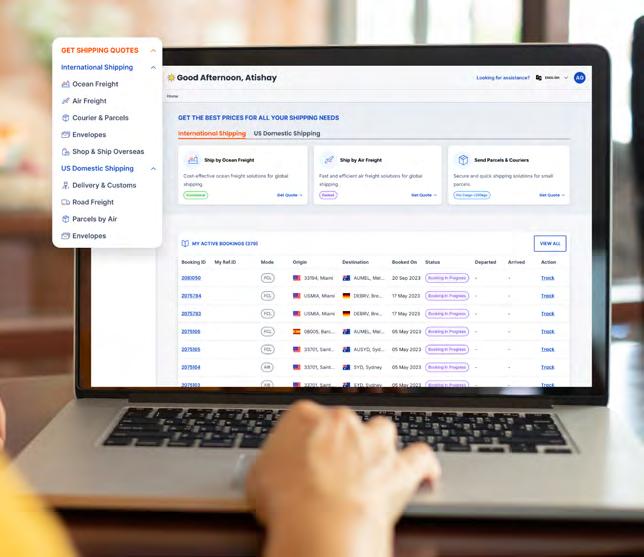

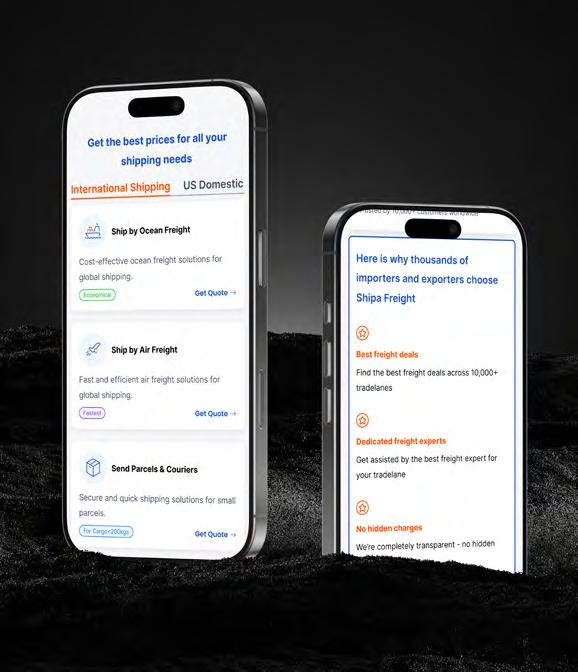

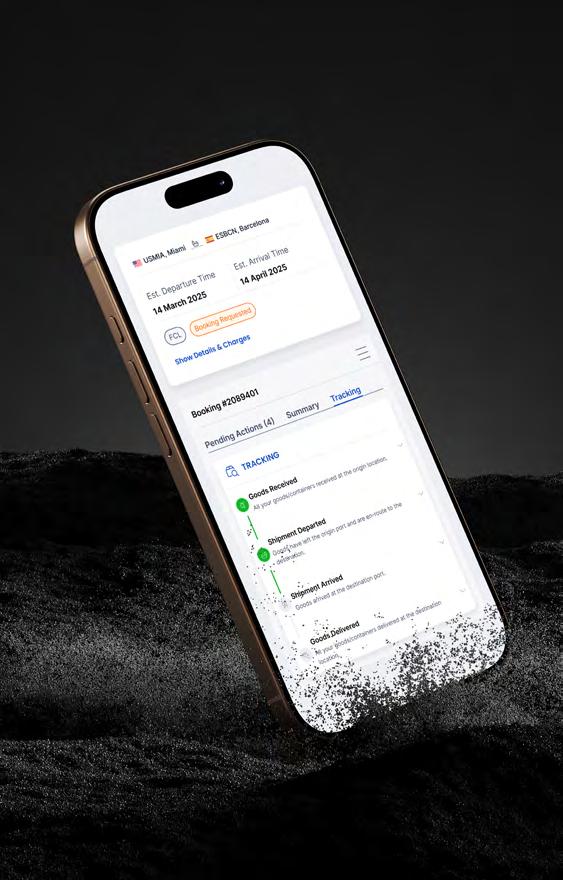

Hemang Kapur explains how Shipa Freight is harnessing AI and agentic technology to modernise forwarding end-to-end to meet the demands of modern global trade.

Reimagining Freight

Forwarding for the AI Era

The core issue is that traditional freight forwarding is still built on processes from a different era. Too many forwarders rely on manually updated rate sheets, scattered emails, and siloed systems that don’t talk to one another. The result is slow quoting, inconsistent pricing, reactive problem-solving, and a customer experience that depends entirely on individuals rather than robust systems.

At Shipa, we are transforming forwarding by replacing fragmentation with intelligence. Our approach is anchored on three interconnected

Hemang Kapur CEO of Shipa Freight & iContainers

layers of AI that together create a fast, transparent and predictive freight experience:

• AI Insights, which analyse quotes, shipments, carrier performance, congestion patterns and market sentiment in real time.

• AI Automation, which removes repetitive tasks such as quoting, document processing, shipment tracking and invoice validation.

• Agentic AI, which can carry out complete operational workflows, running RFQs, preparing quotes, interacting with customers, validating supplier invoices, and managing exceptions autonomously.

Underneath is our Model Context Protocol (MCP), a universal intelligence layer for global forwarding. MCP connects to every critical logistics touchpoint:

rate databases, carrier schedules, customs engines, internal SOPs, unstructured documents and external APIs. It equips our AI agents with the context, security and structured data they need to reason and act autonomously.

The real shift is clear: freight forwarding is evolving from slow, human-driven processes into real-time, AI-powered, agentic operations, and Shipa is leading that transformation.

The GCC has emerged as one of the world’s most forward-thinking logistics regions. The UAE and Saudi Arabia, in particular, have built an ecosystem where smart ports, digital customs systems, bonded zones and unified trade corridors operate seamlessly. This level of digital sophistication aligns perfectly with the logistics models we are developing at Shipa.

We leverage the region’s infrastructure in three key ways:

• AI trained on rich regional data

The GCC’s digitised environment provides our AI with highquality signals—port congestion data, customs milestones, trucking events, carrier reliability and transit patterns. This enhances the accuracy of our quoting, routing and predictive visibility models.

• Automated compliance aligned with Gulf systems

Our platform prevalidates documentation,

assesses risk, and runs HS code checks in line with modernised GCC customs frameworks, helping exporters and importers avoid delays at clearance.

• Agentic workflows that optimise corridor performance

AI agents manage quoting, routing, customer interactions and exception handling across busy GCC corridors, making the movement of goods faster, smoother and more predictable.

By combining the GCC’s physical infrastructure with our AI-powered digital backbone, we are creating a modern logistics ecosystem where businesses experience fewer delays, faster decision-making and a seamless crossborder journey.

Real-time logistics goes beyond tracking updates, it demands automated decision-making, predictive insights

and intelligent workflows. That is where we are focusing our investment.

We’ve developed a new operating model powered by real-time AI:

• Instant quoting and routing

Our engine combines multimodal rates, carrier schedules, historical lane performance, congestion data and demand signals to generate accurate door-to-door quotes in seconds.

• Predictive visibility and proactive exception alerts

Rather than reacting to delays, our AI agents analyse shipment events, weather conditions, port activity and carrier reliability to anticipate potential issues, whether it’s missed cut-offs, rolled cargo, documentation gaps or demurrage risks.

• AI-driven documentation and compliance

Our document parsing layer extracts, validates and reconciles information from invoices, bills of lading, packing lists, certificates of origin and customs documents,

cutting manual errors by up to 60% and smoothing the clearance process.

• Agentic operations across the supply chain

AI agents now perform tasks that traditionally required entire teams: running RFQs and consolidating partner quotes, validating supplier invoices, preparing quotes and routing plans, managing customer interactions across chat, WhatsApp or email, and triggering alternative routes when conditions change.

At Shipa, real-time logistics isn’t just about informing decisions, it’s about having AI execute them, enabling faster, smarter and more reliable freight operations.

Solving Global Freight Fragmentation at Scale

Global forwarding is notoriously fragmented. Every country has its own documentation formats, customs processes, data structures, regulatory requirements and visibility standards. These inconsistencies create delays, add costs, and frustrate customers.

The key friction points we encounter include:

• Non-standard documentation

Invoices, packing lists and bills of lading often arrive in inconsistent formats. Our document-parsing AI automatically converts them into structured, validated data, eliminating manual rework.

• Customs variability

Some markets rely on automated systems, while others require physical inspections. Our compliance engine and agentic AI perform HS code checks, clearance predictions and regulatory validations tailored to each market.

• Patchy visibility

Carrier updates vary widely in quality. We unify data from carrier APIs, partner systems, AIS vessel tracking and predictive ETA models to create a single, reliable visibility layer.

• Volatile pricing and congestion

Seasonal peaks, blank sailings and geopolitical events disrupt pricing and capacity. Our routing engine instantly recommends alternative ports, modes or schedules to keep shipments moving.

• Regional data and security differences

Our Model Context Protocol (MCP) ensures secure data isolation, encryption, audit trails and compliance with local regulations worldwide.

By standardising data through MCP and automating workflows with agentic AI, Shipa can deliver a consistent,

reliable experience at a global scale, a feat that has traditionally been impossible in the forwarding industry.

Levelling the Global Trade Playing Field for SMEs

SMEs face challenges that larger enterprises can easily absorb; limited resources, little logistics expertise, and no internal systems to manage complex shipping requirements. Shipa is designed to remove these barriers and make global shipping accessible to businesses of every size.

Our platform offers SMEs:

• Instant rate transparency

They can compare air and ocean rates immediately, without the need for RFQs or long email chains.

• Guided booking experiences

Clear prompts for Incoterms, shipment details, compliance requirements and documentation help reduce errors and uncertainty.

• AI-powered document support

Our system flags missing or incorrect fields early, helping SMEs avoid costly customs delays.

• Predictive tracking and alerts

SMEs rarely have time to chase updates, so our platform proactively notifies them of milestones, risks or delays.

• Integrated end-to-end services

Customs, insurance and payments can all be handled through a single interface.

Most importantly, through MCP and agentic AI, SMEs now gain capabilities once reserved for multinational companies: smart routing, predictive visibility, automated compliance and intelligent decision support. This levels the playing field, empowering smaller businesses to participate confidently in global trade.

The Next Frontier for Shipa Freight

We see three major shifts shaping the future of freight forwarding.

The first is autonomous freight operations. Leveraging our MCP foundation and agentic AI, many core workflows, quoting, routing, documentation, compliance checks, tracking and issue resolution, will transition from humanexecuted to AI-executed, with teams focusing on oversight and strategy rather than repetitive manual tasks.

The second is our ambition to become the operating system for forwarders worldwide. Smaller forwarders have traditionally lacked access to modern technology. We are building a universal, modular platform powered by MCP,

enabling any forwarder to plug in and operate with the sophistication of a digital-first global player.

The third is deepening our presence across high-growth trade corridors. While we already operate in over 100 countries, our focus is on unlocking value in Asia–GCC, GCC–Africa, GCC–Europe and South Asia–GCC lanes. These corridors are expanding rapidly and provide the ideal environment for deploying advanced, AI-native logistics infrastructure.

Shipa’s trajectory is clear: we are evolving from a digital freight platform into the intelligence layer for global forwarding, enabling faster, smarter and increasingly autonomous logistics for businesses of all sizes.

2026 will reshape supply chains with AI, automation, and smarter networks. Alan Win, CEO of Middlebank Consulting Group, reveals how technology and human insight will work together to make logistics faster, leaner, and more resilient.

Middlebank Consulting Group (MCG), shared its insights on the technology trends set to reshape supply chains in 2026. Founded over 25 years ago in New Zealand, supply chain and value chain management consultancy MCG has been operational in Australia since 2003, in Singapore and India since 2016, in the USA since 2022, and recently in the Middle East. The consultancy specialises in technology-driven operational efficiency,

process optimisation and scalable supply chain solutions, helping businesses improve performance and reduce costs.

Here are eight key technology trends for supply chains in 2026:

Smarter Operations with AI

Artificial Intelligence (AI) is moving beyond suggestions; it can act independently in many operational scenarios. Agentic AI systems adjust delivery routes, manage inventory, and flag potential bottlenecks with minimal human intervention. But here’s the catch: these tools are not flawless.

Alan Win, Founder and CEO, Middlebank Consulting Group

Organisations that combine AI insights with practical operational monitoring are expected to see faster, more informed decision-making and improved agility in complex supply chain scenarios.

Warehouse Efficiency and Automation

Warehouses are evolving rapidly. Digital twins allow teams to model changes before implementing them, and autonomous robots take over repetitive tasks. That

3

said, people remain essential. Warehouse teams uncover process gaps by questioning automated recommendations and testing tweaks on the ground. Together, this hybrid approach of human intuition and machine efficiency is expected to enhance accuracy, reduce errors, and improve overall warehouse performance in the year ahead.

Selecting the right third- or fourthparty logistics partner will be critical. Experience, technology, and flexibility matter, but the real differentiator will be how partners respond under pressure. Open communication and adaptability are expected to strengthen operational continuity and support more seamless responses to evolving demands.

4

Cost reduction is one thing; frictionless customer experience is another. Simple changes like adjusting packaging sizes or optimising pick routes can have ripple effects through operations. These changes are expected to improve both speed and reliability, helping organisations maintain profitability and enhance customer satisfaction.

5 6

Dual sourcing, nearshoring, and modular supply chains are no longer optional. Disruptions are inevitable, and the ability to pivot quickly can make the difference between maintaining client trust or losing it. Organisations that prioritise adaptive processes and continuous learning are predicted to strengthen client trust and operational continuity.

Sustainability has moved from a nice-to-have to a must-have.

Reducing emissions, cutting energy use, and limiting packaging waste are increasingly tied to performance. Practical improvements arise from simple steps: smarter routing, greener packaging, and energy-conscious facilities. While no single initiative is transformative alone, collectively they will support sustainable and cost-effective supply chain practices.

7

AI frees teams from repetitive work, allowing them to focus on decisions, coordination, and process improvement. When technology is leveraged as a supportive tool, organisations are likely to see higher engagement, faster problem-solving, and enhanced operational insights that machines alone cannot produce.

8

Dynamic routing, real-time tracking, and close collaboration with carriers are transforming delivery. But technology alone is not enough. Human oversight, adjusting plans on the fly and responding to unexpected issues, will remain crucial, especially in complex last-mile scenarios. This combination of technology and on-the-ground decision-making is expected to improve delivery speed and customer satisfaction.

Technology provides a competitive edge, but its value depends on people who know how to use it. In 2026, supply chains that blend AI, automation, adaptable teams, and strong partnerships are most likely to succeed. Those willing to experiment, learn from missteps, and adjust in real time will not only react to change but they will shape the future of the industry.

Faster delivery is no longer enough. The true differentiator in modern logistics is the ability to decide faster, allocate smarter, and respond to disruptions in real time, turning traditional supply chains into decision-driven ecosystems.

By Reeba Asghar

At the edge of the desert, where the world’s goods stream through free zones, seaports and sprawling warehouses, something subtle, yet seismic, is taking place. In logistics, a sector long defined by physical movement and mechanised throughput, the real battleground has shifted from forklifts and conveyor belts to decision making itself.

Behind every parcel that moves, every container that sails, and every delivery that arrives on time, lies a series of critical choices. Historically, these decisions were made on periodic plans and manual adjustments. Now, with volatility rising and expectations rising even faster, logistics leaders are discovering that quality and speed of decisions are the true determinants of performance, a paradigm we call decisioncentric logistics.

For years, logistics digitalisation focused on visibility, real-time tracking, dashboards,

Real-time insights keep cargo flowing smoothly, even in volatile trade environments

control towers. While these deliver insight, visibility alone does not solve problems: it only shows them. The next step, and the more powerful one, is actionable insight that informs real-time decisions and triggers the right response at the right moment.

Academic research in supply chain decision support underscores this shift. A systematic review of logistics decision frameworks shows that intelligent systems combining IoT, Big Data analytics and automation are moving beyond mere monitoring to actual decision optimisation. These systems can predict disturbances, propose corrective

actions and, in some cases, take decisions autonomously, without human intervention.

Another study introduces machine learning-based decision support tools in warehouse operations, demonstrating how predictive models can forecast cycle times and generate real-time alerts to guide operational choices that materially improve throughput.

In essence, logistics is evolving from an environment of reporting toward one

of responsive, dynamic decision making, a transformation as much intellectual as technological.

The GCC: A Unique Laboratory for Digital Decisions

The Gulf Cooperation Council (GCC) region, and the UAE, in particular, is uniquely positioned to demonstrate the potential of decision-centric logistics. Governments across the GCC have placed digital transformation at the centre of national economic strategies, aiming to turn their logistics hubs into globally competitive, highvelocity trade gateways. Dubai’s Logistics City, the Emirates Blockchain Strategy and broader Vision 2030 initiatives highlight ambitious plans to embed digital technologies in supply chains, from realtime cargo tracking to automated fulfilment.

However, research on Industry 4.0 adoption in the GCC shows that while technology adoption is accelerating, implementation remains uneven. Many logistics firms have introduced elements such as cloud computing, AI, IoT and big data analytics, but full integration, especially of real-time decision frameworks, remains in progress.

Despite these challenges, significant strides are visible:

AD Ports Group (UAE) is harnessing IoT sensors and analytics to support realtime cargo monitoring and predictive maintenance

across its logistics assets, enabling operations teams to make faster, databacked decisions.

Saudi Logistics Services (SAL) implements advanced digital warehouse management systems (WMS), enhancing visibility and decision support for inventory and storage allocation.

Maersk’s TradeLens platform, deployed across key GCC trade corridors, uses blockchain to ensure secure, timely sharing of supply chain data, enabling partners to make coordinated decisions across borders.

What differentiates decision-centric logistics from traditional practice is not simply the adoption of new technology, but a fundamental redefinition of roles and responsibilities across the organisation. In this operating model, data is no longer treated as a passive by-product of daily activity, reviewed retrospectively through end-ofday reports. Instead, it becomes a strategic decision asset, continuously synthesised by intelligent decision engines into real-time, contextually relevant insights that guide action as events unfold.

As a result, decision cycles compress and organisational agility expands. Rapid prioritisation in response to demand volatility, transport disruptions or port congestion becomes an embedded capability rather than a manual scramble triggered by crisis. Importantly, decision-centric logistics does not remove humans from the equation; it reshapes their contribution. Machines take responsibility for repetitive, high-frequency choice tasks, allowing operational teams to focus on judgement, exception management and strategic oversight where human expertise delivers the greatest value. These shifts reflect a growing academic consensus that digital technologies, including the Internet of Things, big data analytics and artificial intelligence, materially enhance strategic flexibility, operational agility and the overall

quality of decision-making across modern supply chains.