Looking to maximize opportunities in today’s volatile market?

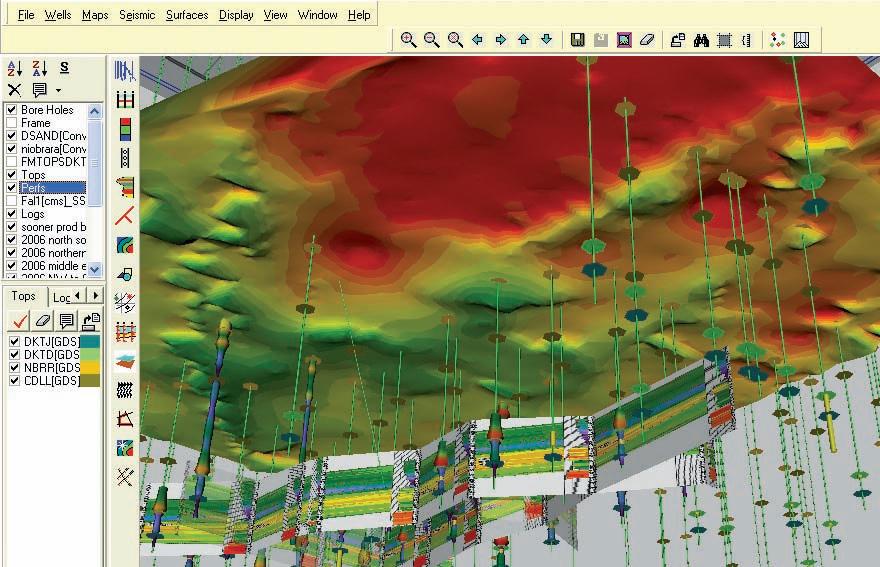

Combine the power of PETRA® and IHS Critical Information including well and log data to define reservoir parameters and determine new opportunities faster and more cost effectively.

Let IHS information solutions improve your decision-making and reduce your risk.

For more information on PETRA visit us at www.ihs.com/reservoirsolutions

CSPG OFFICE

#600, 640 - 8th Avenue SW

Calgary, Alberta, Canada T2P 1G7

Tel: 403-264-5610 Fax: 403-264-5898

Web: www.cspg.org

Office hours: Monday to Friday, 8:30am to 4:00pm

Executive Director: Lis Bjeld

Email: lis.bjeld@cspg.org

Advertising & Sponsorship Coordinator: Alyssa Middleton

Email: alyssa.middleton@cspg.org

Communications Coordinator: Heather Tyminski

Email: heather.tyminski@cspg.org

Member Services Coordinator: Kasandra Klein

Email: kasandra.klein@cspg.org

Registration Coordinator: Dayna Rhoads

Email: dayna.rhoads@cspg.org

Convention Contacts

Convention Manager: Shauna Carson

Email: scarson@geoconvention.org

Convention Coordinator: Tanya Santry

Email: tsantry@geoconvention.org

EDITORS/AUTHORS

Please submit RESERVOIR articles to the CSPG office. Submission deadline is the 23rd day of the month, two months prior to issue date. (e.g., January 23 for the March issue).

To publish an article, the CSPG requires digital copies of the document. Text should be in Microsoft Word format and illustrations should be in TIFF format at 300 dpi., at final size. For additional information on manuscript preparation, refer to the Guidelines for Authors published in the CSPG Bulletin or contact the editor.

Technical Editors

Ben McKenzie Colin Yeo (Assistant Tech. Editor) Tarheel Exploration EnCana Corporation

Tel: 403-277-4496 Tel: 403-645-7724

Email: bjmck@telusplanet.net Email: colin.yeo@encana.com

Coordinating Editor

Heather Tyminski, Comunications Coordinator, CSPG Tel: 403-513-1227, Email: heather.tyminski@cspg.org

ADVERTISING

Advertising inquiries should be directed to Alyssa Middleton, Tel: 403-513-1233, email: alyssa.middleton@cspg.org. The deadline to reserve advertising space is the 23rd day of the month, two months prior to issue date.

A FEW THINGS A GEOSCIENCE PROFESSIONAL SHOULD KNOW WHEN EXPLORING A CAREER WITH SAUDI

1. The Red Sea and Rub’ al Khali have huge potential for new discoveries.

2. We embrace bold new concepts to tackle tough technical challenges.

3. Energy is our #1 export ... Adventure stories a close second.

In other words, a career with Saudi Aramco is more than just a job. It’s exploring vast new frontiers for oil and gas resources, working with ground-breaking technologies, and teaming with top-notch professionals dedicated to a secure energy future. It’s also the opportunity for you and your family to experience international travel adventures, develop friendships that last a lifetime, and enjoy a highly competitive compensation and benefits program.

Enrich your life. Visit www.Aramco.Jobs/CSPG. Visit us at GeoCanada 2010, Booth #807

President John Varsek • Cenovus Energy john.varsek@cenovus.com Tel: (403) 645-5417

Vice President

Kirk Osadetz • Geological Survey of Canada, Calgary kosadetz@nrcan.gc.ca Tel: (403) 292-7022

Past President

Graeme Bloy • Canada Capital Energy Corporation gbloy@capitalenergy.ca Tel: (403) 975-5784

Finance director

Greg Lynch • Shell Canada Ltd. greg.lynch@shell.com Tel: (403) 691-3111

assistant Finance director

Darren Aldridge • Baker Hughes darren.aldridge@bakerhughes.com Tel: (403) 537-3505

Program director

Scott Leroux • EnCana Corporation scott.leroux@encana.com Tel: (403) 645-2000

assistant Program director

Brett Norris • TransGlobe Energy Corp. brettn@trans-globe.com Tel: (403) 264-9896

serVice director

Ayaz Gulamhussein • NuVista Energy Ltd. ayaz.gulamhussein@nuvistaenergy.com Tel: (403) 538-8510

assistant serVice director

Richard Thom • Core Laboratories Canada Ltd. richard.thom@corelab.com Tel: (403) 250-4052

outreach director

Mike DesRoches • Talisman Energy Inc. mdesroches@talisman-energy.com Tel: (403) 513-6843

assistant outreach director

Steve Dryer • Consultant whiskeyjackresources@telus.net Tel: (403) 969-2292

communications director

Stephen Hubbard • University of Calgary steve.hubbard@ucalgary.ca Tel: (403) 220-6236

assistant communications director

Jim Barclay • ConocoPhillips

Jim.E.Barclay@conocophillips.com Tel: (403) 532-3889

executiVe director

Lis Bjeld • CSPG lis.bjeld@cspg.org Tel: (403) 513-1228

A message from the CSPG Service Director, Ayaz Gulamhussein

Ko taku rourou Ko tau rou Ka or ate tangata With my resources, And your resources, Everyone will benefit.

-Traditional Maori Proverb

In the petroleum industry, the term “resource” is often used. It is used to quantify the amount of hydrocarbon we believe is in place for a given play, accredit research information showcased in journals and magazines, and to refer to individuals who posses creative ideas and a strong work ethic.

In the workplace, human resources are absolutely crucial to the success of a company. A competent and dedicated group of individuals can help an organization realize the goals and objectives that it sets for itself. In a strong organization, an individual’s personal growth tends to occur concurrently with the company’s. The development of technical, interpersonal, and leadership skills, engages employees and extracts their maximum potential.

A not-for-profit technical organization like the Canadian Society of Petroleum Geologists is no different; human resources are central to the success of the Society. Engagement of volunteers and the extraction of their t alents are two of the most important premises on which our Society is built upon. Without committed volunteers, the Society would not be able to offer the numerous programs and activities that are now seen as commonplace.

T he CSPG offers an expansive and diverse set of programs. The skill sets required from the volunteers that run these activities are equally multifarious. Having such an incredible array of programs has been crucial to the Society providing its members with opportunities that interest them, and contribute to their per sonal development. No matter where a volunteer’s interests lie, a CSPG member can find a cluster of his or her kinship somewhere within the organization.

Interested in sedimentology or structural geology? Technical Divisions is the place for you. Like being a social butterfly? Organizing the Mixed Golf tournament, the 10K Road Race, or the Squash Tournament is right up your alley. Want to provide inspiration to future geoscientists? University Outreach and K-12 Education needs you! Enjoy writing and editing? The Communications group has an opportunity with your name on it.

C reative people tend to cluster together. This makes life more fun. It also fosters technological progress. When clever people cluster, they can bounce ideas off one another. The sharing of ideas often leads to innovation, which in turn leads to efficiency. These efficiencies often act as catalysts for further innovation. As a technical society, technological advancement, innovation, and efficiency are central to our mandate.

The CSPG continues to attract top volunteer talent, whether it is for technical luncheons, technical divisions, or other committees. The clustering of highly energetic and intelligent individuals is critical to the continued evolution of the science of petroleum geology. Technology and innovation are changing the way we look at mature, under-explored, and unexplored basins. Creative and inquisitive minds will be the prerequisite to the CSPG staying at the leading edge of hydrocarbon exploration.

Currently, the CSPG has approximately 300 volunteers that serve on 60 committees. These volunteers drive all the technical aspects of the Society, while the office staff provides strong administrative and structural support.

(Continued

on page

At APEGGA we know and understand that we live and practice in a complex world. The heavy lifting in the resource extraction industries, and in the environmental industry, is done by teams, often led by Professional Geoscientists. These teams include professionals, technologists and support staff both at headquarters in the city and at camp in the field.

There’s no question in our minds that geoscience projects require teams to manage questions surrounding the many varied issues including governance, tax impact, reporting and environmental concerns including land-use and ground disturbance. Through consultation and communication, all these issues, and a multitude of others, are resolved to ensure the projects we work on benefit society. The Geoscience Professionals’ code of ethics and paramount responsibility to protect public safety and well-being must be recognized and acted upon.

P.Geol.s, P.Geoph.s and Professional Licensees (Geological and Geophysical) are team players. No doubt. Our work helps keep Alberta safe and strong and the only way we can achieve that goal is through teamwork amongst professionals.

Teamwork Pays. Visit www.apegga.org for more information or call Tom Sneddon, P.Geol., Geoscience Affairs Manager at 403-262-7714 or 1-800-661-7020.

This ad is the sixth in a series

ApAche cAnAdA Ltd.

BAker AtLAs

cAnAdiAn nAturAL resources Limited

cAsey & AssociAtes

cenoVus enerGy inc.

conocophiLLips cAnAdA Limited

deVon cAnAdA corporAtion

FuGro AirBorne surVeys corp.

geoLoGic systems ltd.

husky enerGy inc.

ihs

imperiAL oiL resources

LArio oiL & GAs compAny

mJ systems

murphy oiL compAny

nexen inc.

petrocrAFt products Ltd

puLspetroL

proVident enerGy Ltd.

sheLL cAnAdA Limited

sprouLe AssociAtes Limited

suncor enerGy inc.

totAL e&p cAnAdA Limited

tourmALine oiL corp.

(...Continued from page 5)

the c sp G executive realizes that our so ciety needs to take a proactive role in recognizing voluntary contributions. Volunteers must also be appreciated and sincerely thanked on an ongoing basis. A concerted effort to incorporate the feedback and opinions of our volunteers is also underway.

Last year, the c sp G conducted a comprehensive survey, which solicited feedback from the membership. the information collected in regards to volunteerism within the so ciety, has been exceptionally helpful to the executive, who are building a go-forward plan for the organization.

Feedback from the c sp G s urve y conducted in 2009 indicated that over 47% of c sp G members have volunteered in the past. 48% of members indicated that they wanted clear and accurate time commitments provided to them regarding volunteer positions, while 36% wanted clear and definitive role descriptions. As to their reasons for volunteering, 43% of members wanted to improve their technical or leadership development, 36% of members wanted to expand their technical network, and 30% of volunteers wanted to expand their social network. 50% of members felt that the c sp G did a good job of informing the members of volunteer opportunities. th is last statistic is something that obviously needs to be improved upon.

In T ROduC TIO n TO ThE nE w VOl un T EER MAnAgE ME nT Sy STEM

B ecause volunteers are the so ciety, and are essential to its success, the 2010 se rvice co mmittee is designing and implementing a Volunteer ma nagement sy stem (V ms) t hat will replenish the volunteer base. the Volunteer ma nagement sy stem will be rewarding socially, technically, and professionally for all of our volunteers.

c sp G ’s V ms will act as a placement tool for individuals that want to participate within the so ciety. th is system will ensure that all members that are interested in volunteering, no matter where they may reside, will get an opportunity to participate in the growth of the c sp G. the V ms will also arrange for ap propriate volunteering training where it is deemed necessary.

cu rrently, the executive is building and populating a standardized organizational chart, assessing committee vacancies, implementing a database for tracking, and creating a process for succession planning.

While new ways of broadcasting volunteer opportunities are being evaluated, c sp G m embers can still check out the c sp G website for openings. new positions are posted regularly, along with detailed descriptions of what the roles entail. if you don’t find anything on the website that interests you, general submissions are also accepted. the c sp G office will contact you, as soon as a position that fits your fancy becomes available! if you are interested in volunteering, email c sp G at volunteer@cspg.org.

With so many options to choose from, and so many great people to meet, don’t you want to volunteer?

AS OF APRIL 12, 2010

Caitlin Roher

The highest reward for a person’s work is not what they get for it, but what they become because of it. –

Consulting & Exploration Management Over 20 years of expertise

Meaningful geophysical maps

Geology-driven seismic models

Client-tailored & confidential

For more information: Karen Brawley Rogers, P. Geoph. (403) 969-7793

karen@amuletexploration.com

www.amuletexploration.com

SPEA kER

Toni Simo

ExxonMobil, Upstream Research Company Houston, Texas, AAPG Distinguished Lecturer

11:30 am, thursday, may 27, 2010 teLus convention centre, calgary, alberta

Please note: the cut-off date for ticket sales is 1:00 pm, Friday, may 21, 2010. csPg member ticket Price: $38.00 + gst. non-member ticket Price: $45.00 + gst.

Each CSPG Technical Luncheon is 1 APEGGA PDH credit.

Did you know that you can book a table for the Technical Luncheon? To book your company’s table or to buy tickets, visit http://www.cspg.org/ events/events-luncheons.cfm.

Isolated carbonate platforms and mounds (ICPM) originate on topographic highs in shallow marine waters and are surrounded on all sides by deeper-water environments. Comparative studies of modern and ancient isolated platforms allow insights into mechanisms that control the platforms. Modern examples provide information especially relevant to Tertiary platforms because the carbonate-secreting organisms that built the platforms are very similar and occupied similar ecologic zones.

In the modern detailed information on the organisms and environments of deposition can provide insights into the dominant controls on facies type and dimensions today. However, there is a challenging lack of information regarding how the facies and size change through time. This challenge can be addressed through high-resolution seismic images, which provide sequential and spatial information and allow for comprehensive analysis on ICPM initiation, amalgamation, and demise. A unique combination of insights gathered from modern and ancient datasets on isolated carbonate platforms and mounds can be used to make predictions, create conceptual models, and guide geologic model inputs.

Webcasts sponsored by

Two- and three-dimensional seismic surveys from Southeast Asia show internal seismic geometries and positions of margins, providing clues on the evolution of the ICPM. Mounds initiate as small positive features that amalgamate to form platforms of different sizes and geometries prior to drowning. The distance between the mounds appears to be the first-order control on amalgamation and ultimate platform size. However, amalgamation may be inhibited if strong currents redistribute sediment transported off-bank and away from the mounds, leaving unfilled accommodation space.

Understanding the feedbacks between mound amalgamation and carbonate production will have implications for predicting control mechanisms and building conceptual models. High amalgamation rates imply large areas of shallow-water carbonate deposition and high carbonate production resulting in the formation of mega-platforms. Smaller areas of shallow-water deposition tend to drown faster when environmental conditions deteriorate and platforms cannot keep up with increased accommodation.

Satellite images over several modern platforms in Southeast Asia provide an opportunity to investigate the importance of oceanographic processes such as tides and currents as well as tectonic subsidence and chemistry on carbonate deposition and the impact on ICPM evolution. In the Tertiary, however, special consideration is needed for seasurface temperature and salinity residence times. These parameters are thought to be the major difference in biologic controls on the types of organisms building shallow-water platforms in the Tertiary versus today.

Modern and ancient datasets are used in parallel to evaluate what and how certain processes control initiation, growth, and demise of isolated carbonate platforms and mounds. This allows us to predict the controls for ancient ICPM, thus establishing a framework of rules for predictive conceptual models.

bIOGRAPH y

Toni Simo completed his B.Sc., M.Sc., and Ph.D. in Geology at the University of Barcelona. He is currently Research Associate for Upstream Research Company, ExxonMobil. Before that, he was a professor at University Polytechnic Barcelona and before that, a professor at the University of Wisconsin. Some of his previous publications include Controls on Carbonate Platform and Reef Development, Advances in Carbonate Sequence Stratigraphy, and Cretaceous Carbonate Platforms.

SPEAKER

Lynn N. Hughes

United State District Judge AAPG Distinguished Lecturer

11:30 am Tuesday, June 8, 2010

Calgary TELUS Convention Centre Calgary, Alberta

Please note:

The cut-off date for ticket sales is 1:00 pm, Thursday, June 3, 2010.

CSPG Member Ticket Price: $38.00 + GST.

Non-Member Ticket Price: $45.00 + GST.

Each CSPG Technical Luncheon is 1 APEGGA PDH credit. Tickets may be purchased online at https://www.cspg.org/eSeries/ source/Events/index.cfm.

Mixing principles and examples with economics and anthropology, a thoughtful and practical perspective on integrity is developed. Often in ethics – as in science – identifying the problem is harder than knowing the solution, making recognition the critical first step in ethical analysis.

Good things, like cooperation, can become negative when they are not

tethered to an external reality and the larger society. Also, because our ideology and psychology can blind us to the nature of our choices, we need balance, feed-back, and thought to resolve the ethical aspects of the ordinary and unfamiliar.

Since 1985, Lynn N. Hughes has been a judge with the United States District Court, Houston. Before that (19791985), he was a judge with the Texas C ivil District Court. Hughes was Adjunct Professor at South Texas College of Law (1973-2003) and at the University of Texas (1991, 2000). He is a member of the Judicial Advisory Board, Law and Economics Centre, George Mason University School of Law; Advisory Board, Houston Journal of International Law since 1980 (Chair, 1989-1999); American Anthropological Association; and Council on Foreign Relations. He received his B.A. from the University of Alabama, his J.D. from the University of Texas Law School, and his LL.M. from the University of Virginia School of Law.

Webcasts

Volunteers are needed in the following areas:

• Information Booth

• Registration Package Pick-Up

• Technical Sessions

• Core Conference

Students who volunteer for a minimum of 8 hours will have the registration fee refunded. If you are interested in any of these opportunities, please contact volunteers@geocanada2010.ca.

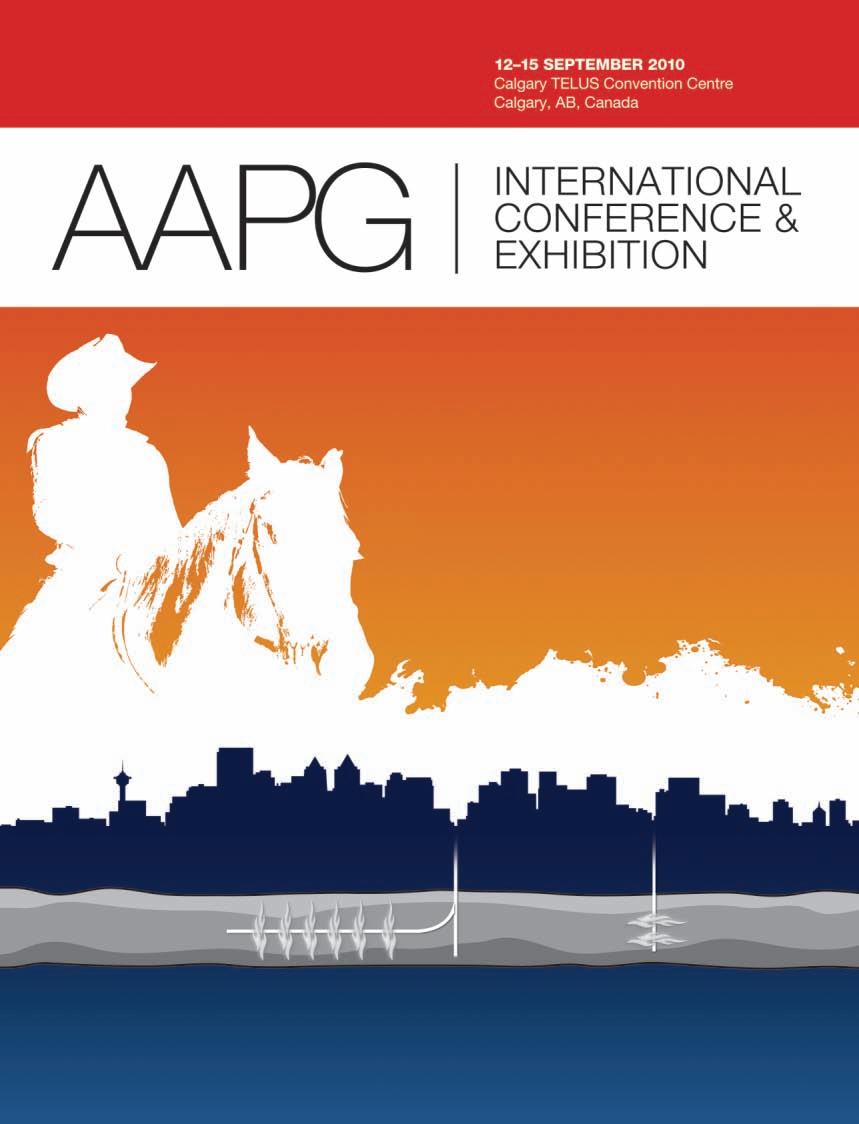

Creative Petroleum Exploration

Location: Calgary, AB, Canada, with the AAPG International Conference & Exhibition

Instructors: Edward Beaumont and Doug Strickland

Image Log Interpretation

Location: Calgary, AB, Canada, with the AAPG International Conference & Exhibition

Instructor: Laird Thompson

Writing for the Bulletin – A Primer in Scientific Writing for Refereed Geoscience Journals

Location: Calgary, AB, Canada, with the AAPG International Conference & Exhibition

Instructor: Gretchen Gillis

Field Seminars:

Choose from over 50 exciting field seminars, short courses and online programs all designed with the goal of helping you explore and better understand the science of this industry. Please see the AAPG website for complete descriptions and registration information. Below are the highlights of courses coming up very soon. Make your plans now before seats get filled! JUNE 21-25 SEPT 23-30

LAUNCH DATE JUN 1

MAY 11-13 MAY 16-21

MAY 17-18 MAY 19-21

Fractures and Tectonics of the Northern Appalachian Basin

Location: New York

Leader: Robert Jacobi

Sedimentology and Sequence Stratigraphic Response of Paralic Deposits to Changes in Accommodation: Predicting Reservoir Architecture, Book Cliffs, Utah

Location: Colorado/Utah

Leaders: Keith Shanley, Michael Boyles

Renewable & Non-Renewable Resources

- Overview & Integration: A Renewable Energy Certificate Course

Instructor: Theresa Coffman

Essentials of Subsurface Mappping – Short Course

Location: Houston, TX

Instructor: Richard Banks

Play Concepts and Controls on Porosity in Carbonate Reservoir Analogs – Field Seminar

Location: Almeria, Spain

Leaders: Evan K. Franseen, Robert H. Goldstein, Mateu Esteban

Reservoir Engineering for Petroleum Geologists – Short Course

Location: Houston, TX

Instructor: Richard Green

Fundamentals of Petroleum Geology – Short Course

Location: Houston, TX

Instructor: Stephen Bend

Folds, Faults and Hydrocarbons in the Southern Canadian Cordillera – Principles and Practices Combination Short Course/Field Trip

Instructors: Chuck Kluth and Wayne Narr SEPT 16-19 NOV 8-12 OCT 4-8

Location: Calgary, AB, Canada, with the AAPG International Conference & Exhibition

Instructor: Peter Jones

FALL EDUCATION CONFERENCE 2010 – Theme: Unconventional Resources

Location: Houston, Texas

Instructor: Multiple experts!

Application of Structural Geology in Prospecting in Thrusted and Extensional Terrain

Location: Las Vegas, NV

Modern Terrigenous Clastic Depositional Systems

Leader: John Warme OCT 2-9 OCT 10-13

Location: South Carolina

Leader: Walter Sexton

Applied Stratigraphy of Paleozoic Carbonate Platforms; Facies, Cycles, Sequences, Reefs, Reservoirs

Location: Nevada

Introduction to Geological Reservoir Characterization

Instructor: Roger Slatt SEPT 13DEC 17

MAY 30JUNE 5 JUNE 7-9 JUNE 7-11 JUNE 9-10

Complex Carbonates Reservoirs: The Role of Fracturing, Facies and Tectonics – Field Seminar

Location: Naples – Rome, Italy

Leaders: Raffaele Di Cuia, Davide Casabianca, Claudio Turrini

Exploring for Bypassed Pay in Old Wells – Short Course

Location: Wichita, KS

Leader: Hugh Reid

Folding, Thrusting and Syntectonic Sedimentation: Perspectives from Classic Localities of the Central Pyrenees – Field Seminar

Location: Barcelona, Spain

Leaders: Antonio Teixell, Antonio Barnolas

The Petroleum Industry: Upstream & Downstream – Short Course

Location: Dallas, TX

Instructor: Stephen Bend

For more information on any AAPG Education programs, call 918-560-2650 or toll-free 1-888-338-3387, or visit www.aapg.org/education.

SPEAKER

Philip S. Simony

Department of Geology and Geophysics, University of Calgary

SPEAKER

Sharon D. Carr

Department of Earth Sciences, Carleton University

12:00 noon, Thursday, May 6, 2010 Room LPW-910, Livingston Place West (250 2nd St SW), Calgary, Alberta

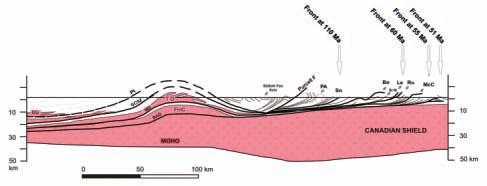

The approximately 400 km-wide thrust belt of the southeastern Canadian Cordillera largely comprises four major composite thrust sheets that evolved and were emplaced “in sequence” in the Cretaceous to Eocene during the westward underthrusting of the North Amercian craton. In the Rocky Mountain external zone, each sheet is thin skinned and was carried by a thrust system that has a common basal thrust. In the internal zone, there is a westward increase, toward the core, in thickness and importance of ductile shear within each sheet. In the core, each

Figure 1. Flow zones – thrust system linkages: Schematic southwest – northeast cross-section showing linkages between the internal and external zones of the southeastern Canadian Cordillera, and the location of successive Cretaceous to Eocene orogenic fronts. Four composite Early Cretaceous to Eocene “in-sequence” thrust sheets comprise mid-crustal flow zones in the core linked to thrust fault systems in the foreland. (FmC = Frenchman Cap dome; PA = Porcupine Creek Anticlinorium; Ru = Rundle thrust; St M. = Saint Mary fault; TO = Thor-Odin dome; Malton (Ma) – Ptarmingan (Pt) – Snaring (Sn), Gwillim Creek Shear Zone (GCSZ) – Bourgeau-Lewis (Bo-Le), Monashee décollement (MOD) – McConnell (McC), Basal décollement (BAD) – Foothills thrusts).

sheet has an infrastructure of metamorphic and migmatitic rocks that includes interfolded cover and basement under a suprastructure of rocks that had been previously deformed and thrust into place. “Transport” (Couette) flow and ductile shear were important in the infrastructure of each sheet. That infrastructure had an eastern margin or “tip line” where the flow and shear, within each sheet, were transferred eastward into an external thrust system via transport on the basal thrust. This geometric – kinematic framework of great thrust sheets is based on the facts of stratigraphy, mapped geometry and geochronology, and can form the basis for dynamic modeling. Channel flow (Poiseuille) models, with or without extrusion, can be evaluated within this framework.

BiogR APhy

Philip Simony obtained his Ph.D. at the Imperial

College London in 1963. His career as a professor at the University of Calgary, spanning forty years, was dedicated to teaching geology and mapping in the southeast Canadian Cordillera.

Research themes include thrust tectonics; structure of metamorphic complexes; and geometry, emplacement, and deformation of plutons. Although retired since 2002, Philip continues to be active, and is presently working on the kinematic linkages between the internal core zone and external thrust belt of the Cordillera.

Sharon Carr obtained her Ph.D. at Carleton University in Ottawa in 1990. Since then she has worked as a professor at Carleton teaching and carrying out research in the southern Canadian Cordillera, Yukon, and Grenville Province. Research themes include tectonic evolution of core zones of orogenic belts, and applications of detailed U-Pb studies to tectonic problems.

ichnology: an example of Psilonichnus

Myo Myint

exposed at

SPEA kER

Myo Myint

Geological Consultant

7:30 Pm, Friday, may 14, 2010 mount royal university, room B108 calgary, alberta

The paleoichnological research for a doctoral thesis on the Paleogene Shiramizu Group, Joban Coal Field, Japan, reveals that an ichnospecies: Psilonichnus quietis is newly proposed and is characterized by an unlined vertical-to-inclined burrow ranging in diameter from 0.4 to 2.8 cm and ranging in depth from 10 cm to 2.5 m, with four different shapes of swelling (abrupt enlargement with different

forms at varying intervals and/or at a terminus from an unbranched master shaft). It exhibits three intergradational architectural patterns, herein termed Type I, Type II, and Type III. Type I burrows have forms of straight and curve patterns of vertical and inclined shaft. Type II have vertical inclined-to-oblique shafts with four different shapes of swelling at varying intervals and at the terminus. These swellings are located at obtuse angles from a master shaft and swelling series are aligned to the same direction. Type III have vertical, inclined oblique to sinuous shafts and ranges in diameter from 0.4 to 1 cm with uniform average in diameter of 0.6 cm approximately.

The Psilonichnus quietis burrows are comparable to the burrows of modern Ocypode or constructed by adult Ocypodid crabs, but Type III by juveniles. to ephemeral Type II burrows indicate semi-permanent dwelling structures. terminus of Type II to reflect 1) pauses 2) shelter for extended period of time, 3) space utilization, 4) the position of greatest stability against gravitationally induced collapse. This structure does not demonstrate forked points for any types of branching burrow or turnarounds. Therefore, Type II burrows indicate not only semi-permanent dwelling but additional behaviors as well. The breeding burrow, expressed as expanded and distinct chambers at the terminus, and non-breeding burrows characterized by the lack of such chambers, can be found at the same side. This is consistent with present-day structures, where both breeding and

Ocypodid

SPEAKER

Dr. Quentin Goodbody

Exploration VP of Papua New Guinea/ Australia Talisman Energy

12:00 Noon

Thursday, May 20, 2010

Encana Amphitheatre, 2nd Floor East end of the Calgary Tower Complex 1st Street and 9th Avenue S.E. Calgary, Alberta

In the search for material resource in a tightening market, Talisman reassessed Papua New Guinea (PNG) potential in late 2008 with an eye to monetizing our offshore Pandora gas field. Both the offshore and onshore basins were assessed for remaining exploration potential. Although the offshore exploration

potential was s een as limited, recent discoveries in the foreland at Douglas and Puk-Puk onshore suggested an effective gas kitchen in the Cecilia Trough, capable of generating volumes significant enough to charge the entire foreland. Exploration drilling density also suggested that the potential of the foreland had barely been tested. With industry focusing on the established, producing, and expanding oil and gas resource in the PNG fold/ thrust belt, the interior foreland had been, relatively speaking, overlooked and certainly underexplored.

The petroleum system in the P NG foreland is a typical Australian Mesozoic passive margin assemblage with Early Jurassic coals sourcing Late Jurassic and Early Cretaceous paralic and shallow marine quartzitic sandstone reservoirs sealed by a thick regional transgressive shale. Effective delineation of viable structures is the primary exploration risk with remoteness, sparse 2D seismic grids, and tropical wetland conditions and climate contributing to the operational and technical challenges of finding and developing this impressive resource.

Dr. Quentin Goodbody received his Bachelor of Ge ology from Trinity College in Dublin. He then, at the University of Alberta, completed a Masters in Micropalaeontology (Silurian Radiolaria), which was followed by a Ph.D. in Stratigraphy/Sedimentology/Palaeontology

from the University of Alberta investigating the Middle Devonian of the Canadian Arctic Islands. After a three-year post-doctorate position at the ISPG, Dr. Goodbody joined Shell Canada from 1987-1998, where he worked on the Mackenzie Delta, Canadian Rockies, and the east coast of Canada. Subsequent shorter stints with Rigel, Pacalta/ City and AEC/Encana working numerous South America assets led Dr. Goodbody to his current employment with Talisman Energy. At Talisman, Dr. Goodbody has worked throughout the international organization and has recently been assigned to the Exploration Vice President Papua New Guinea and Australia. The adventure continues.

T here is no charge. Please bring your lunch. The facilities for the talk are provided complimentary of EnCana and refreshments by Geochemtech Inc. For further information or if you would like to give a talk, please contact Bob Potter at (403) 863-9738 or ropotter@telusplanet.net or Trent Rehill at (403) 606-6717 or trehill@kulczykoil.ca. Or visit our new Face Book page (“CSPG International Division”).

| by Colin Yeo, P.Geol. and Lionel Derochie, P.Eng.

In this, our final installment of the series, we discuss how the economic attributes that have been generated for plays and prospects can be used to analyze and determine the appropriate mix of investment opportunities that will meet financial and strategic corporate goals. As previously mentioned, all companies expect to be profitable, to grow the NPV of their assets, and to provide stable financial performance over the longterm. In the past, there have been some companies that did not use a disciplined approach to portfolio management, which lead to investment decisions that were not aligned with corporate strategies and hence poorer results were achieved. A rigorous, standardized, disciplined, and open process in selecting plays and prospects for exploration and development has proven to be a better approach in achieving strategic goals. Because capital discipline is important in larger companies, many of them have adopted the portfolio management process.

The PRINCIPles Beh IND PROjeCT PORT fOl IO Ma N age M e NT (PPM)

Project portfolio management is concerned with the allocation of capital and manpower resources to a large range of investment opportunities. The economic indicators that have been addressed in previous articles are used to characterize these plays and project portfolio management is the process that aligns these opportunities to corporate strategies and objectives. This ensures that a project or group of projects will help the organization meet its goals such as increasing shareholder value by profitably increasing production rates and reserves.

To be effective, opportunities must be evaluated consistently across a company. Price files, production forecasts, royalties, capital costs, operating costs, and income tax rates must be reasonable and match historical trends. In this way, each project can be properly assessed as to its contribution towards achieving corporate objectives. The decision to invest in a project can be made on its relative costs and risks and its relative benefits to the organization. PPM enables continuous monitoring of those projects that are selected for execution and, as such, some projects may be discontinued if they are under-performing or no longer aligned with corporate objectives. On the other

hand, if some projects are performing above expectations, even more capital can be allocated to them.

Risk assessment is crucial to the concept of PPM. The chance of project failure needs to be accurately determined and, if the project is successful, the variability of cash flow needs to be understood. This expected cash flow is used in PPM decisions. It is this cash flow that funds corporate financial obligations including the capital required for future exploration and development. Risk assessment must go beyond the usual exploration risk components of source, migration, reservoir, trap, and seal to include drilling and completion risk as well as production rate and reserve risk. In addition, commercial risk such as price variations, royalty changes, capital and operating cost creep, marketing, and stakeholder relations must also be considered. Organizational capability, technical skill sets and ability to execute programs is an important consideration in the PPM assessment. All of these risk factors must be calibrated with historical trends to ensure appropriate risk assessments are made. These are important issues to consider when making investment decisions.

a l IgNINg T he OPPOR TUNIT y I N ve NTORy w IT h CORPOR aT e OBjeCTI ves

All companies have cash flow requirements needed to meet debt interest payments, G&A costs, and dividend payments to shareholders even before investments are made in capital projects. Corporate objectives are often varied: small start-ups focus on adding reserves and production at low cost, income trusts seek large cash-flow streams to distribute to unit-holders, and senior producers focus on achieving high rates of return on capital employed. The risk make-up of the project portfolios for these different types of companies will certainly vary depending on the strategy they elect to adopt. Usually, senior executives strive to achieve a balance between all financial and operational measures over the long term.

In order to ensure long term, reliable and steady cash flow, companies strive to diversify their production base to avoid concentration risk and also vary their product (gas, gas liquids, oil, heavy oil) mix to stabilize their revenue streams. These concerns around diversification will sometimes override economic ranking in

the selection of projects for the portfolio because some particular projects may be better aligned with corporate and business strategies despite having poorer economic indicators.

Hard choices always have to be made. Assuming that a company does not want to take on any additional debt and does not want to issue new shares, it probably will have a fixed capital budget tied to its internal cash flow. Quite often, companies will have more investment opportunities than capital resources and are faced with difficult capital allocation decisions. This is where PPM provides useful tools and processes for making these investment decisions.

A Simple exAm ple USi ng ppm

ConCe pt S to BUi ld C ApitAl

BUdget S

There are a number of factors that influence the various economic indicators used in portfolio management and it is important to understand how the indicators are affected by these factors. Figure 1 illustrates three simple cases whereby the assumptions for initial rate (Qi), ultimate reserves (EUR), and capital invested (Capex) are identical for each case. The only variation between the cases involves a changing decline exponent (n value). Case 1 is an exponential decline that has an n value of 0 whereas Case 2 is a hyperbolic decline with an n value of 0.5 and Case 3 is a super harmonic decline that has an n value of 1.25. The associated production profiles for each of these cases are shown in Figure 1.

As seen in the table within Figure 1, although the F&D costs are the same at $4.25/BOE, the NPV10% ranges from a high of 6.6 $MM

Figure 2. Three cases showing the effects of risk on economic indicators. Risk is any event, condition, or issue that could adversely affect cash flow. This figure is a summary of economic indices and, for this discussion, we only consider rate of return, net present value, profit to investment ratio – both undiscounted and at a 10% discount rate – pay out, F&D cost, and production efficiency. There are many other, more appropriate, ratios that can be used to identify those projects that are key contributors to a corporation’s goals and strategies.

for the exponential decline case to a low of 3.6 $MM for the super harmonic decline case. Similarly, there is quite a range in values for IRR (Internal Rate of Return), PIR (Profit to Investment Ratio), PE (Production Efficiency), and PO (Payout) depending on the production prof ile assumed. Production profiles significantly affect the economic indicators of a project and it is for this reason that some higher rate/reserve

opportunities are not necessarily the best economic prospects in a given portfolio.

Risk is another very important factor that has to be accounted for in portfolio management. Consider the three cases presented in Figure 2. For the purpose of this analysis, Case 4 is considered to be a low-risk, lowreward opportunity, Case 5 is a medium-risk,

(Continued on page 16...)

medium-reward opportunity, and Case 6 is a high-risk, high-reopportunity. The economic indicators presented in the top part of the table in Figure 2 assume 100% success. All three cases generate similar IRRs (~75%) and payouts (~18 months). Although the IRRs are the same, F&D as well as PIR10% are considerably different from one case to the other. The high case has an F&D of $5.00/ BOE and generates a PIR10% of 2.14 whereas the low case has an F&D of $9.00/BOE and generates a PIR10% of 1.27. On the face of it, without taking risk into account, most

companies would prefer to have a portfolio of projects made up of high-case opportunities.

The bottom portion of the table in Figure 2 provides the economic indicators after risk is applied. It was assumed that the low-risk case has a chance of success (COS) of 90%, the medium-risk case, 60% and the high-risk case, 40%. As can be seen, the IRR for the high-risk, high-reward case is considerably reduced after risk is accounted for and this would cause the portfolio manager to rethink which projects should be pursued and which ones should be delayed.

Improve your exploration odds with Divestco. At Divestco we want the odds to be in your favor so we have given you a whole deck of geological products and services to choose from. Divestco’s integrated offering for geological professionals gives you the ability to choose from a wide range of geological products and services to suit your unique needs. Pick as many individual cards as you want or let our experts deal you a winning hand. Call us at 403.237.9170 or email sales@divestco.com for more information.

There are many considerations a manager must give in building a portfolio. Let’s assume a company has 50 $MM to invest in drilling. If the company was to invest its entire budget on low-risk opportunities, it would drill 69 low-risk, low-reward wells (Case 4) and, with a risked NPV10 of 812 $M per well, the program would be expected to generate 56 $MM of NPV. If the same 50 $MM was invested in medium-risk, medium-reward opportunities (Case 5), 25 wells would be drilled with an expected NPV of 43 $MM. Similarly, if the entire budget was dedicated to high-risk, high-reward opportunities (Case 6), 14 wells would be drilled and, on a risk-adjusted basis, would be expected to generate 40 $MM of NPV. Therefore, if the company is focused on maximizing NPV and is risk averse, the portfolio manager would be inclined to invest the entire budget in lowrisk, low-reward wells.

Now let’s consider a hypothetical situation where the company’s investment criteria require it to generate a minimum PIR10% of 1 from its drilling program. This represents an NPV of 50 $MM for a 50 $MM capital budget. The manager could generate the required 50 $MM of NPV by spending 45 $MM to drill 62 low risk wells (Case 4). Now the manager has 5 $MM to spend on a higher-risk, higher-reward opportunity. Let’s suppose the manager elects to invest the 5 $MM to drill a high-risk, high-reward well (Case 6). If the high-risk well comes in as forecasted, an additional 10.7 $MM of NPV10 will be generated bringing the total return to 60.7 $MM, which is 4.7 $MM more than the 56 $MM that would have been generated had the entire budget been invested in low-risk, low-reward wells.

In this instance, the portfolio manager is not simply gambling on the higher-risk well, the manager is trying to diversify the company while still achieving the original PIR target. By drilling the higher-risk well, the manager is potentially opening up a new exploration area and providing new opportunities for growth. Follow-up wells to any discovery will generally have improved COSs, making subsequent outpost and development wells even more economic on a risk adjusted basis.

Aligning the Portfolio to the needs of the Cor PorAt ion

As we have shown, there is no one “right” portfolio for a company; it is a combination of projects that will achieve the financial, strategic, and operational goals of a company. Consideration must be given to the number of opportunities available within a certain play-type, their comprehensive risk attributes (not just technical risk), the capability of staff to execute the program on time and within

budget while getting the desired results and the ability of the company to provide the ongoing capital resources to get the job done. Small companies with limited budgets may not want to bet the farm on a one-off, deep, high-risk, technically complex prospect but rather may want to focus on building a low-risk, low-reward, diversified production base to generate stable cash flow upon which to grow, further diversify and increase corporate NPV in a slow and steady manner.

Project Portfolio Management is both the art and science of understanding what the corporation needs to be successful, however it chooses to define success. The Portfolio Manager must insist on standardization where appropriate and encourage thoroughness and thoughtfulness when dealing with unique features of an individual project. Risk is front and centre in all of these deliberations. Then, by assembling a portfolio of these projects, the Manager improves the company’s chances of meeting its goals and objectives. It should be remembered that there is a “lost opportunity cost” in not pursuing some projects. Hopefully, this is a deferral and not a complete loss. For those opportunities not pursued, the Portfolio Manager may elect to farmout or divest to monetize those plays and prospects that always rank low in the inventory.

In this series, we have attempted to present a simple but accurate explanation of petroleum economics for geoscientists. We hope we have shown that something that appears to be complicated at first glance is not really difficult to understand when it is broken down into its constituent parts.

We hope we have provided the concepts and jargon that will allow geoscientists to actively engage in discussions with reservoir engineers, reserve evaluators, financial analysts, portfolio managers, and management. A basic understanding of petroleum economics is a prerequisite for success in the oil industry. And remember, it’s all about cash flow!

Support for this series is provided by Energy Navigator who have reviewed articles, supplied technical consultation, and critiqued manuscripts. We thank them for their help.

You’ve got the power of Petrel.

A unified seismic-tosimulation solution for geothermal operations.

Geophysics. Geology. Reservoir Engineering.

Petrel* gives you an advantage no other application can offer—a powerful integrated workflow from seismic to simulation. This enables you to model complex geologic structures with pinchouts and truncated faults—and easily incorporate new data to update the model and rerun ECLIPSE* simulations at any time. That really makes the difference in understanding complex geothermal resources.

“With Petrel and its integrated workflow, we can exploit the complete reservoir potential and minimize the exploration risk in geothermal operations.”

Dr. Zoltan Timar-Geng, Geologist GEOenergie Bayern GmbH www.slb.com/petrel2009

WWW.CSPG.ORG

www.cspg.org/education/education-trips.cfm

CSPG Continuing Education Committee is proud to offer the Summer/Fall Field Trip Seminar Series. Offering local one- to three-day field trips running in and around Calgary.

Stratigraphy and Hydrocarbon Potential of the Bakken Formation in Western Montana

Instructor: Ted Doughty

Contrasting the Reservoirs of Braided vs. Meandering Depositional Systems

Instructor: Jon Noad

Upper Cretaceous Meander River Deposits Exposed in the Dinosaur Park Badlands

Instructor: Derald Smith and Peter Putnam

Structure and Hydrocarbon Occurrence, Rocky Mountain Foothills and Front Ranges

Instructor: Kirk Osadetz, Glen Stockmal, and David Kisilevsky

For additional information please see the website at: or contact: www.cspg.org/education/education-trips.cfm

Amanda Mitander at amitander@tridentexploration.ca

Tyrus Bender at tyrus.bender@EnCana.com

| by R. E. (Gene) Ballay, Ph.D.

The only certainty in most of our formation evaluations is the presence of uncertainty and how that issue is (or is not) addressed. At the simplest level one may estimate the Best and Worst Case, for each input attribute, and then bound the evaluation with the resulting extreme values, even as we recognize that the simultaneous occurrence of multiple “best” or “worst” values is an unlikely event.

It is in fact relatively simple to address the uncertainty question in a comprehensive, realistic and quantitative fashion, and to further identify where to focus time, and money, in search of an improved evaluation.

At the simplest level our S w estimates are compromised by uncertainty in the various Archie equation attributes.

S w n = a Rw / ( m Rt )

In another article (Risky Business) we took the derivative of Archie’s equation (the same approach will suffice for a shaly sand equation), and calculated the individual impact of each term’s uncertainty upon S w to identify where the biggest bang for the buck, in terms of a core analyses program or suite of potential logs, was to be found. At that time we noted the “link between parameters, in that the relative importance of a single attribute, can be dependent upon the magnitude of another attribute, so that the characterization must be done for locally specific conditions.”

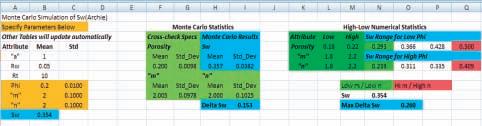

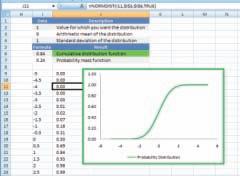

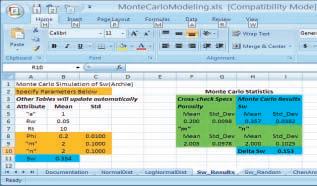

An alternative approach is Monte Carlo simulation, which can be implemented with routine Excel spreadsheet functions. The Monte Carlo method randomly assigns values, according to user specified probability distributions, to each of the input parameters and then calculates the result. When the simulation is repeated a statistically significant number of times (results herein are based upon 2,000 passes, which Excel handles without a problem), one is able to determine the likely outcome within any specific probability band, and to further identify which parameter is dominating the uncertainty (and hence where time and money is most efficiently directed for an improved result).

As an example, with the specifications tabulated in Figure 1, there is a 95%

•Monte Carlo simulation of Sw (Archie) for above user-specified distributions

• w and Rt are assumed to be ‘well known’, but may be varied by a straightforward extension of the technique ‘a’, R

•With these specifications, there is a 95% probability that Sw is bounded by 0.357 +/–2(0.0382) 0.28 < Sw < 0.43

•The Best / Worst case would have 0.24 < Sw < 0.50, the difference being the unlikely chance of all Best (or Worst) events occurring simultaneously

probability (+/- two standard deviations) that 0.28 < S w < 0.43, whereas the Best / Worst approach would bound the results with 0.24 < S w < 0.50; the difference being the unlikely event of multiple, simultaneous Best or Worst events. Not only does Monte Carlo give us a more realistic summary, but by varying the input standard deviations (uncertainties), one is able to identify where to most efficiently concentrate time / money in an effort to improve results.

The Monte Carlo method relies on repeated random sampling of user specified input probability distributions to model expected results. This approach is attractive when it is infeasible or impossible to compute an exact

2

Simulations

result with a deterministic algorithm.

An advantage of Monte Carlo is that any type of distribution can be used to characterize the uncertainty specification of input parameters, for example normal, log normal, etc; an issue since the phenomena governing frequency distributions in nature often favor log-normal (Limpert et al., 2001).

As illustrated in Figure 1, Monte Carlo also allows one to quantify the upside and down side better than a Best / Worst approach, and to recognize which distribution (parameter) is dominating the result uncertainty.

•Petroleum applications typically use log normal , and triangular statistical distributions.

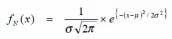

•Probably the best known statistical distribution is the bell shaped normal distribution, whose probability density function is described by:

•Two parameters characterize the distribution

•the mean value µ,

•the variance represented by σ2

•The square root of the variance is the standard deviation

A limitation of Monte Carlo is that special software is typically utilized (commercial add-ons to Excel, etc.), and is often not even an option in commercially available petrophysics software packages. Common oilfield distributions, however, such as Normal, Log Normal, and Triangle are available in Excel and it is straightforward to implement Monte Carlo within the Excel framework. In this approach, one remains in the familiar Excel environment, and actually leverages their Excel skill set via the additional hands-on experience within the platform.

(Continued on page

A discussion of the Monte Carlo method can be found in Decision Analysis for Petroleum Exploration by Paul Newendorp and John Schuyler, and a collection of articles addressing exploration risk can be found in The Business of Petroleum Exploration published by the AAPG, Tulsa, Oklahoma. Additional information may be found in the References, with useful on-line reference material to be found at the following links:

• http://www.enrg.lsu.edu/pttc/

• http://www.mrexcel.com/

• http://people.stfx.ca/bliengme/exceltips. htm

• http://office.microsoft.com/en-us/excel/ HA011118931033.aspx

• http://www.statsoft.com/textbook/ stathome.html

• http://en.wikipedia.org/wiki/Monte_ carlo_simulation

• http://www.ipp.mpg.de/de/for/bereiche/ stellarator/Comp_sci/CompScience/ csep/csep1.phy.ornl.gov/mc/mc.html

• http://www.sitmo.com/eqcat/15

• http://www.riskglossary.com/link/monte_ carlo_method.htm

• http://www.chem.unl.edu/zeng/joy/mclab/ mcintro.html

THE G AUSSIAN OR NORMAL DISTRI bU TION

For illustration purposes, we focus here on the bell-shaped Gaussian distribution. Log Normal or Triangular distributions are easily handled with a simple change of Excel functions.

Gauss was a child prodigy and perhaps the greatest mathematician since antiquity (http://en.wikipedia.org/wiki/Carl_ Friedrich_Gauss). When the dwarf planet Ceres was discovered, and observed for only a few days before vanishing, Gauss was able to mathematically predict where it would be found a year later, and missed the mark by only half a degree.

The bell-shaped, or normal, probability distribution, is the most widely used family of statistical distributions and came to be referred to as Gaussian because he analyzed astronomical data within that context.

Two parameters characterize the Gaussian distribution: the ‘mean’ and ‘variance’ (Figure 2, page 19).

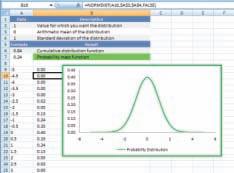

Excel’s NormDist function [NORMDIST(x, mean, standard_dev, cumulative)] calculates both the probability density, and cumulative probability, for a specified ‘x’ value with given mean and standard deviation (standard deviation being the square root of the variance) (Figure 3).

•Syntax: NORMDIST(x, mean, standard_dev, cumulative)

•There are two variations of NORMDIST, according to the value assigned cumulative

•Cumulativeis a logical parameter that determines the form of the function

•If True, it returns the cumulative distribution function.

•If FALSE, it returns the probability mass function.

Figure 4

Figure 5

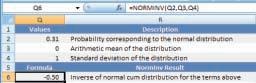

•The NORMINV [NORMINV(Probability, Mean, Standard_Dev)] performs the inverse operation by returning the ‘x’ value for a given cumulative probability of normal distribution with specified mean and standard deviation

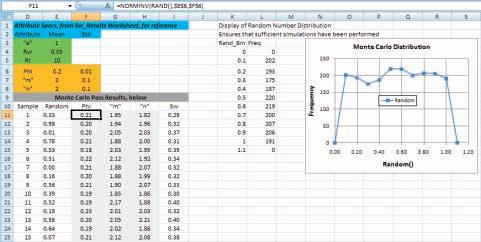

•As a quality control device, we determine and display the distribution of random numbers, between zero and one, for the number of Monte Carlo passes being used in a specific simulation (2000, in this example). In a perfect world there would then be 200 observations in each of the ten bins displayed

•Each of the uncertain attributes are modeled as a random number input to NormInv, whose mean value and standard deviation are locally appropriate For example, the first pass random estimate of porosity, with a distribution centered on 20 pu and having a standard deviation of 1 pu, results in an estimate of 21 pu.

Setting the logical variable ‘cumulative’ to ‘false’ in the preceding expression will yield the ‘probability mass function,’ while setting ‘cumulative’ to ‘true’ returns the ‘cumulative’ distribution.

Be aware that Excel 2007 is used for these illustrations and while there is a Compatibility Mode for earlier Excel versions, it is conceivable that screens could differ. For greater clarity, the graphics / text in Figure 3 are color-coded, and in each case (true and false) the Excel cursor has been placed in a calculation cell, so that the functional form of NormDist is displayed at the top of the respective screen capture.

As an illustrative interpretation of the cumulative distribution, we recognize (Figure 3, right side) that the Cumulative Probability (vertical axis) has reached 0.50 (50%) when the Probability Distribution (horizontal axis) is 0. As expected, when the mean value is specified to be 0, there is equal probability of any single value being higher or lower.

Departing from the mean, Figure 3 (graphical display and Excel cell values) reveal that a cumulative probability of

• 16% has been reached @ x= -1.0,

• 31% @ x=-0.5,

• 69% @ x=+0.5,

• 84% @ x=1.0, etc.

There is then a 31% chance that ‘x’ is at least -0.5 in magnitude, a 69% chance that ‘x’ is at least 0.5 in magnitude, etc.

•Relation between NormInv Magnitude and the distribution of NormInv values

•90 samples

•The distribution of NormInv Magnitude is ‘normal’ per specified ‘mean’ and ‘std’, and will approach the expected ‘bellshape’ as yet more simulations are performed -

•It is the distribution of NormInv values that is driving the Sw(Archie) simulation

The NORMIN v [NORMIN v (Probability, Mean, Standard_Dev)] performs the inverse operation by returning the ‘x’ value for a given cumulative probability of normal distribution with specified mean and standard deviation (Figure 4).

This calculation indicates the Cumulative probability is

• 16% when ‘x’ attains the value -0.99,

• 31% when ‘x’ attains the value -0.50,

• 69% when ‘x’ reaches 0.50.

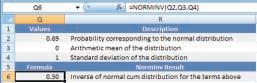

With a basic understanding of what the Excel Gaussian Distributions options are, one is able to model the Archie equation within that framework. For illustration purposes, we regard ‘a,’ Rw and Rt to be well known, and , ‘m’ and ‘n’ subject to uncertainty as specified in Figure 5. Allowance for uncertainty in ‘a,’ Rw and Rt may be addressed by a straight-forward extension of the techniques presented here.

Also, while the focus here is on the simple S w (Archie), any other model (shaly sand, for example) may be evaluated in a similar manner. Once the concepts are understood, locally specific models are readily developed.

Each of the uncertain attributes is modeled as a random number input to NormInv, whose mean value and standard deviation are locally appropriate. For example (Figure 5), the first pass random estimate of porosity, with a distribution centered on 20 pu and having a standard deviation of 1 pu, results in an estimate of 21 pu. The random values of ‘m’ and ‘n,’ appropriate to the specified distributions, are independently and randomly determined, and S w calculated per the Archie relation.

Because Excel recalculates equations each time the spreadsheet is opened, or specifications are changed, the various results will change (your line item spreadsheet values will change, each time you make a modification).

As a quality control device, we determine and display the distribution of random numbers, between zero and one, for the number of Monte Carlo passes being used in a specific simulation (2,000, in this example). In a perfect world there would be 200 observations in each of the ten blue bins displayed in Figure 5.

Figure 6 illustrates the relation between the magnitude of NormInv, and the distribution of NormInv values, for different standard (Continued on page 22...)

•Porosity is specified as a Gaussian distribution, centered on 20 pu with a standard deviation of 1 pu

•2,000 calculations are done, and the result

histograming the resulting porosity distribution and calculating the resulting statistics ‘checked’ by means of

•The MC simulation is observed to reproduce the specified inputs

•Random number mean Std converge to input values ‘’‘’and

•One issue of interest is the dependence of Sw upon individual attribute values / uncertainties

•With the specifications at right

• Sw (mean) = 0.357

• σ ) = 0.038 (S

•There is a 95% likelihood that S is contained within + / -2 σ

•(0.357 –0.076) < Sw < (0.357 + 0.076)

•0.28 < Sw < 0.433

•Be aware of how Excel ‘bins’ data

(...Continued from page 21)

deviations, at 90 simulations. Both distributions take on an approximate Gaussian appearance, with the larger standard deviation result displaying more scatter. It is the distribution of NormInv values that is driving the S w (Archie) simulation. It is important to realize that each occurrence of NormInv involves an independent Rand() input.

The approach taken here is intended to parallel that of the LSU results (Must Read supplemental material – www.enrg. lsu.edu/pttc/), which also includes Log Normal and Triangle distributions, and so can be directly referenced if either of those distributions are required.

As an additional QC device, the statistical attributes of the simulated quantities ( , ‘m’ and ‘n’ in this example) are tabulated directly from the simulation population, and displayed graphically (Figure 7).

With 2,000 simulations, the model population nicely replicates the input numerical specifications, and the porosity distribution takes on the expected appearance (Figure 7).

Simulation results are reported both numerically and graphically (Figure 8). In this particular case, there is a 95% likelihood that S w is contained within + / - 2 , (0.357 – 0.076) < S w < (0.357 + 0.076) ➔ 0.28 < S w < 0.433.

In utilizing Excel frequency distribution graphics, one should take note of how the ‘bins’ are populated, as they are not ‘centered’. This can cause the graphic to take on a shifted appearance, with respect to the numerical report (consult Excel Help on the Frequency function for details).

The S w (Archie) result population is further affected by the nonlinear relation between the various attributes, as discussed by Bryant et al. in Understanding Uncertainty (Oilfield Review. Autumn 2002), who illustrates that a normal uncertainty distribution about a given porosity yields a log-normal distribution for the resulting S w distribution. Bryant’s article is another Must Read.

IN SE ARCH OF T HE bIGGEST b ANG FOR T HE bUCk

We are typically confronted with two issues, first to characterize the uncertainty in the S w estimate itself, and next to identify where time and money would be best spent to reduce that uncertainty. There are two ways to proceed: 1) take the derivative of Archie’s equation with respect to each term, and compare the magnitude of each term against one another, for specific attribute values or 2) Monte Carlo simulation, with the input attribute distributions specified per locally representative requirements.

The differential approach was illustrated in an earlier article, Risky Business, and those results have been included in the following so as to both ‘make the connection’ and to also serve as a cross-check. The illustrative attribute values / uncertainties are those in the Chen and Fang (1986) paper, so as to allow reference to that material as well.

In the case of Figure 9 attributes, the differential approach would indicate that time / money would be best spent on ‘m,’ as the relative uncertainty of the cementation exponent is far greater than any of the other attributes.

The connection between derivatives and Monte Carlo is made by recognizing that two standard deviations encompasses 95% of the statistical scatter, and then setting, attribute by attribute, 2 equal to the Chen and Fang illustrative uncertainties, thereby forming the Base Case for Monte Carlo (Figure 9).

Monte Carlo simulations are then performed, incrementally, with each attribute better defined by 10% and the improvement (reduced scatter) in the resulting S w noted (Figure 10).

Monte Carlo simulation reveals that a 10%

• + / -1 σ will encompass ~ 68% of the distribution

• +/-2 σ 95 % of the distribution,

•Approximate the ‘Phi’ relative uncertainty of 15% @ 10 pu (1.5 pu) as 2 σ 1.5 pu => σ 0.75 pu for Monte Carlo Simulation purposes

•That is, 2 σ encompasses 95 % of the spread in the distribution, and it is set equal to the 15 % uncertainty of the Chen & Fang analyses

•Approximate the ‘m’ relative uncertainty of 10% @ 2.00 (0.2) as 2 σ 0.2 => σ ~ 0.1 for Monte Carlo Simulation purposes

•Approximate the n relative uncertainty of 5% @ 2.00 (0.1) as 2 σ 0.1 => σ ~ 0.05 for Monte Carlo Simulation purposes ‘’

•The Biggest Bang For The Buck is to be found in ‘m’ as it has the greatest uncertainty relative to the other attributes

The Biggest Bang for the Buck Derivatives vs. Monte Carlo

After C. Chen & J. H. Fang. Sensitivity Analysis of the Parameters in Archie‘s Water Saturation Equation. The Log Analyst. Sept –Oct 1986

Figure 11

•One also observes that the Best / Worst numerical evaluation of S is considerably more pessimistic than is the +/-2 σ Monte Carlo simulation (Archie)

•The Best and Worst of all parameters are unlikely to occur simultaneously

improvement in definition of the cementation exponent will yield the greatest reduction in S w uncertainty, relative to the other attributes, and consistent (as expected) with Chen and Fang (Figure 9).

We also note that the Best / Worst case scenario would significantly overstate the 95% Monte Carlo uncertainty, because it’s unlikely (though not impossible) that the Best or Worst, of all attributes, would occur simultaneously (Figure 11).

Were porosity to be 25 pu, rather than the 10 pu of the above example, the focus changes. Now attention is best devoted to the ‘n’ exponent (Figure 12).

The uncertainty in an S w estimate is a dynamic issue, dependent upon the relative magnitudes of the input attributes which are themselves linked, and thus may change through the reservoir.

(to be continued...)

•Chen and Fang identify the attribute resulting in the greatest Sw uncertainty

•In the case at right, ‘m’ is the dominant issue

•This same issue can be addressed with Monte Carlo simulation (below)

•The Base Case is at lower left, with each simulation towards the right

improvement in Phi , m and n individual precision by 10

•If porosity were to be 25 pu, rather than 10, the focus changes

•‘m’ and ‘n’ uncertainties have been set equal in this simulation

•The Base Case is at lower left, with each simulation towards the right reflecting an improvement in Phi m n precision by 10 %. ‘ ’, ‘ ’ and ‘’

•With the improved porosity, focus shifts to ‘n’, the tortuosity of the conductive (brine) phase in the presence of a non-conductive (hydrocarbon) phase, as offering the Biggest Bang For The Buck.

•Improved n definition yields the greatest reduction in the standard deviation of Sw ‘’

We appreciate the unidentified LSU faculty who posted their material (located via Google) to http://www.enrg.lsu.edu/pttc/.

George Eden (BP Canada) and Larry Maple (ConocoPhillips) generously shared their thoughts, and suggested relevant reference material, as ideas and material on this question were gathered over the past few years.

Stefan Calvert (BG India, E&P) has kindly shared his thoughts and spreadsheet examples, as this overview was put together.

Omissions, typos, etc. remain, of course, my (the author’s) responsibility.

Copyright 2009 Robert E Ballay, LLC.

The second part of “Rolling the Dice,” including the references, will be printed in the June issue of the Reservoir.

Headquartered in Munich, Germany, GeoNeurale is a center for excellence in earth science research and training, as applied to both hydrocarbon and geothermal reservoir characterization and evaluation.

GeoNeurale’s Malm 2010 Research Project involves an international team of scientists, each with at least 20 years of experience, integrating geology, geophysics, petrophysics, geostatistics, neural networks, and artificial intelligence for static and dynamic simulation of the Bavarian Malm.

GeoNeural is also engaged in the development and delivery of specialized training courses. In the last two years, scientists from 17 countries and 31 companies or universities have attended their presentations.

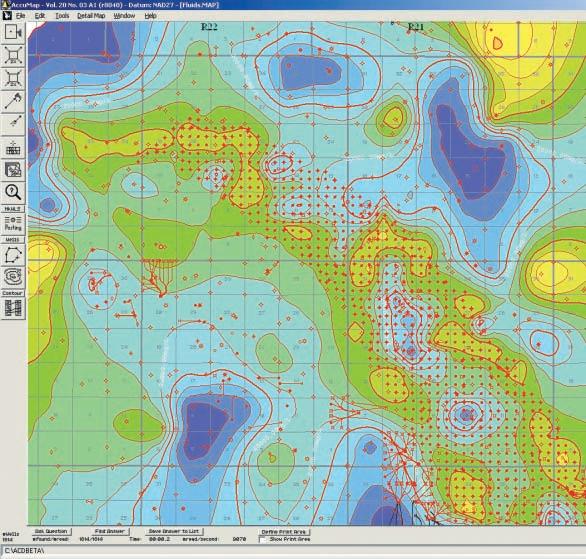

Combine the power of AccuMap® & PETRA® for your complete E&P solution

You rely on the power of your applications to make your plays count. We’ve got the solution. To find out more information visit us at GeoCanada 2010, booth 427.

www.ihs.com/power

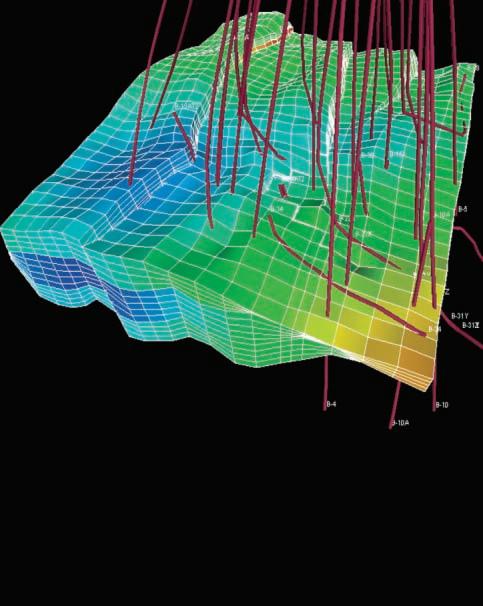

| by Zeev Berger*, Michelle Boast, and Martin Mushayandebvu (Image Interpretation Technologies Inc.) *corresponding author: zeev@iitech.ca, michelle@iitech.ca, martin@iitech.ca

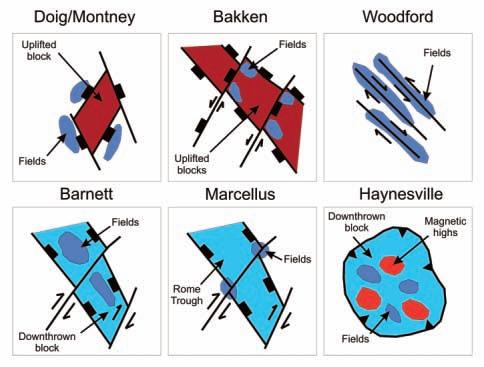

The emergence of unconventional plays in North America provided us with the opportunity to critically review the use of integrated regional studies of high resolution aeromagnetic (HRAM) data, in several mature basins in the USA and Canada. The results of these studies have been compiled onto a series of structural/ tectonic maps that are designed to illustrate the relationships between basement and sedimentary structures and the presence of ‘sweet spots’ and ‘preferred trends’ within these unconventional plays (Figure 1). Our regional studies have been used by our clients to evaluated and rank new opportunities within the different resource play areas and to assist existing operators in making some crucial drilling decisions. For example, the ‘sweet-spots’ in the Woodford shale gas plays of the Anadarko and Delaware basins are clearly localized along major reactivated wrench-fault systems and related fracture systems (Figure 1). This information can be used to evaluate acquisition opportunities as well as to position horizontal wells that are designed to intersect areas of maximum fracture densities. In contrast, in the Barnett shale play of the Dallas Forth Worth basin, the presence of wrench-fault systems has a negative impact on the play because this area is known to have problems with deep formation water (Figure 1).

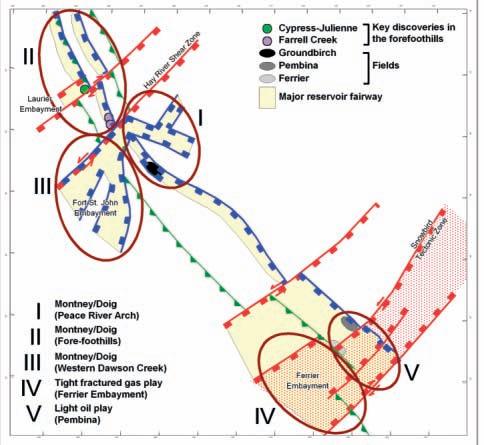

Previously, we provided an in-depth look at the structural setting of the Peace River Arch area and illustrated the control of basement and sedimentary structures on the development of the emerging Montney/ Doig resource play (Berger et al., 2008; Berger et al., 2009). The development of several new exploration opportunities have lead us to revisit our tectonic work and expand the interpretation further north and south along the foreland area of the Western Canada Sedimentary Basin. To the north, the Montney/Doig play has been successfully extended into the moderately deformed region of the fore-foothills of northeast British Columbia. To the south, in the Ferrier/Pembina area, a new and exciting unconventional resource play of Cardium

light oil is emerging. This new play is located in the vicinity of an existing tight gas plays of the Rock Creek and Ellerslie formations, which are also beginning to show some new signs of life due to improved economic outlook for gas exploration in Alberta. The objective of this article is to illustrate the tectonic framework and uniqueness of all these new active resource plays, and to demonstrate the contribution of our regional approach to the exploration and exploitation of these plays.

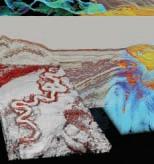

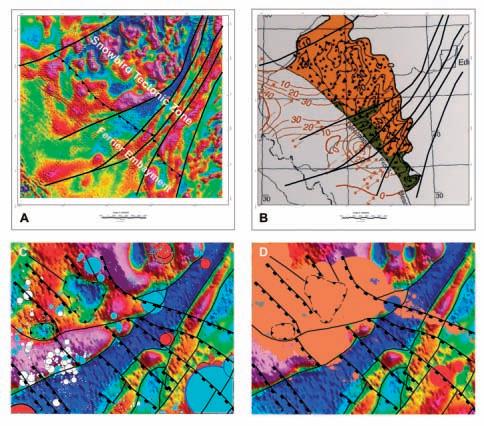

A summary tectonic map of the WCSB foreland basin covering the location of the new resource plays is presented in Figure 2. This map is based on integrated analysis of seismic data, well data, gravity and magnetic data, as well as remote sensing images. Geological structures in this area can be divided into three major categories. The first structural type is regional in scale and

includes the northeast-trending Hay River Shear Zone and Snowbird Suture Zone. These major Precambrian basement terrain structures have been active throughout the geological history of the basin. The second structural type comprises a number of linear to curvilinear normal faults systems that trend more or less parallel to the fold belt. These ‘down to the basin’ normal faults developed during the formation of the foreland basin. The third type of structure consists of exposed and buried thrust faults of the fold belt region, as well as several different types of reactivated and inverted structures that have developed in response to the evolution of the thrust belt to the west.

Unique plays that demonstrate the relationship between these three distinct structural types, and related Mesozoic sedimentation, are: 1) the mature play of the Montney/Doig of the Peace River Arch 2) the emerging Montney/Doig play of the fore-foothills 3)

the relatively unexplored Montney/Doig play of the Western Dawson Creek Complex 4) the fractured reservoir play of the Rock Creek and Ellerslie formations in Ferrier embayment area and 5) the Cardium light oil play of the Pembina field (Figure 2).

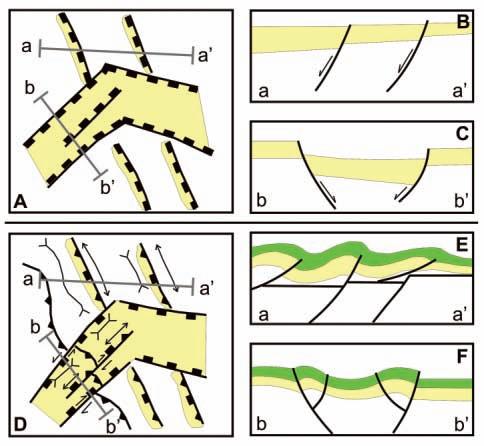

The structural and sedimentary evolution of the foreland basin comprises the foreland basin phase and the Laramide reactivation and inversion phase (Figure 3). The foreland basin phase is characterized by the presence of normal faults that trend parallel to the mountain front. These faults are cut and offset by northeast-trending reactivated basement structures which represent elements of the major shear zones (Figure 3A). The effect of the two different set of structures on Mesozoic sedimentation is illustrated in Figures 3B and 3C. Faults that trend parallel to the mountain front locally enhance the development of the typical sedimentary prism to the west (Figure 3B). Whereas, the northeast-trending faults create well defined grabens and/or structural embayments which are locally filled with foreland basin sediments (Figure 3C). In northeast British Columbia, the extensional faults that trend parallel to the mountain front are known to control the development of reservoir fairways of the Baldonnel, Doig, and Montney formations. In contrast, the structural embayment of the Dawson Creek Complex is primarily responsible for controlling the development of the reservoir fairway of the Halfway Formation. In the Ferrier/Pembina area, extensional faults trending parallel to the mountain front control the development of reservoir fairways of the Cardium Formation, while the structural embayment of the Snowbird Suture zone clearly controls the development of a reservoir fairway of the Rock Creek and Ellerslie formations.

The Laramide reactivation and inversion phase of foreland basin development is characterized by the emergence of new detached thrust faults, as well as the reactivation and inversion of the existing normal faults (Figure 3D). Normal faults that parallel the mountain front may either act as a ‘ramp’ to the thrust faults (Figure 3E), or, they may be completely or partially inverted (Figure 3F). Northeast-trending faults of the structural embayment may become reactivated as strike-slip faults, leading to a northeasterly directed penetration of the thrust belt into the structural embayment. In the case of the Dawson Creek Complex, the strike-slip reactivation of graben-related

(Continued on page 28...)

illustrations of the relationships between structures and sedimentation in the foreland basin of WCSB. Figures 3A, 3B, and 3C illustrate, in map and cross-section views, the effect of structures of Mesozoic sedimentation during the formation of the foreland. Figures 3D, 3E, and 3F, illustrate the impact of Laramide thrusting, reactivation, and inversion.

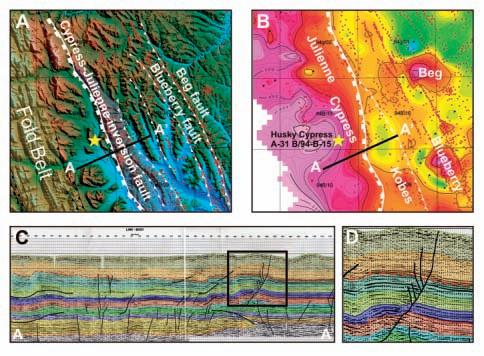

Figure 4. Structural and stratigraphic play elements of the Cypress Creek play area. The structural setting of the play is illustrated in Figure 4A with digital topographic data. The presence of thick Montney/doig play is illustrated with Doig isopach map in Figure 4B. The process of inversion is demonstrated with the seismic line in Figure 4C. Whereas, the abrupt increase in thickness of the Montney/Doig sediments across the fault is shown in Figure 4D.

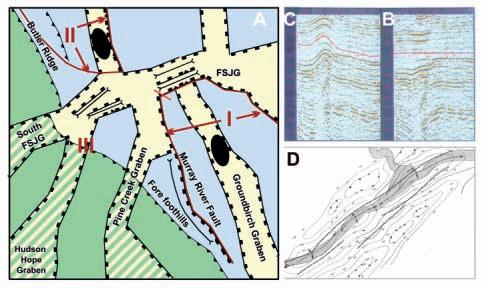

Figure 5. Structural and statigraphic play elements of the Western Dawson Creek Complex (Figure 5A). Numeral I: the location of the Peace River Arch Play, Numeral II: the fore-foothills play. The location of the seismic line shown in figures 5B and 5C is shown in red. Structural inversion of the Monias field is illustrated in Figures 5B and 5C. The presence of northeast-trending anticlines and synclines is demonstrated with surface structures maps in Figure 5D. (Berger, 2010)

(...Continued from page 27)

faults led to partial inversion of the graben’s margins, as can be seen in the Monias fields.

T HE MONTNE y/DOIG PLAy OF THE FORE-FOOTHILLS REGION

The past two years have been marked by an unprecedented expansion of the Montney/ Doig play into the fore-foothill region of northeast BC. This was mostly driven by the exploration successes of Talisman in the Farrell Creek area and Husky in the Cypress Creek

area. Although both companies remain tightlipped about their exploration strategies, it is possible to deduce, from available regional data sets, the key elements of this new and emerging resource play. Figure 4 focuses on the key Husky well and the area to the north that was recently sold for an exceptionally high price. The Husky discovery is located in a large and structurally undisturbed synclinal valley that has developed between the exposed thrust front to the west and a major thrust fault to the east which we have

named the “Cypress-Julienne Fault Zone” or “CJFZ.” These structural features have clear topographic expressions that can be recognized with digital topographic data and other remote-sensing tools.