JJ Foodservice has secured a £3 million-per-year contract with NEPO, running for two years and covering over 300 sites across eight councils, including schools, nurseries, cafés, theatres, leisure centres, civic buildings and care services.

The agreement is already seeing JJ deliver a wide range of frozen foods – from bakery and desserts to poultry, fish, fruit, vegetables and plant-based options – supporting the catering needs of communities in the North East and Tees Valley.

Carl Telford, professional services lead at NEPO, said: “Local authorities need suppliers that deliver healthy, nutritious and affordable food while being easy and reliable to work with. We are delighted to work with JJ Foodservice, whose strong commitment to service will help us deliver quality, value and choice to the communities we serve.”

To meet the needs of the contract, JJ has added more than 100 new product lines and recruited extra drivers and night-shift staff.

Parfetts has passed another milestone in its digital growth, with online orders consistently accounting for more than half of total sales.

The split currently stands at 40% web and 60% app, with the app driving strong engagement since its major update in April.

Time spent on the app has risen by 20%, while orders placed through it are up 10%, supported by a steady flow of new users. The Parfetts app has now been downloaded 30,000 times, with 40% of users active each week.

Retailer behaviour is also shifting. Melanie Clayton, digital marketing manager at Parfetts, said: “We’re seeing a real trend for retailers searching for energy and functional drinks, and more are now searching by brand rather than by product.

“Retailers have a lot of access to data now through the platform. They can see stock levels, spend targets,

and minimum spend quantities in real time. All of our promotions are in one place, and we’ve improved search and scanning functions to make ordering easier than ever before.

“They also get access to a three-weekly digital pack, which gives them exactly what they need to run promotions to full compliance. It’s a huge benefit and allows them to be sharp each and every promotion.”

The data shows that Sunday is now the most popular day for orders, closely followed by Monday.

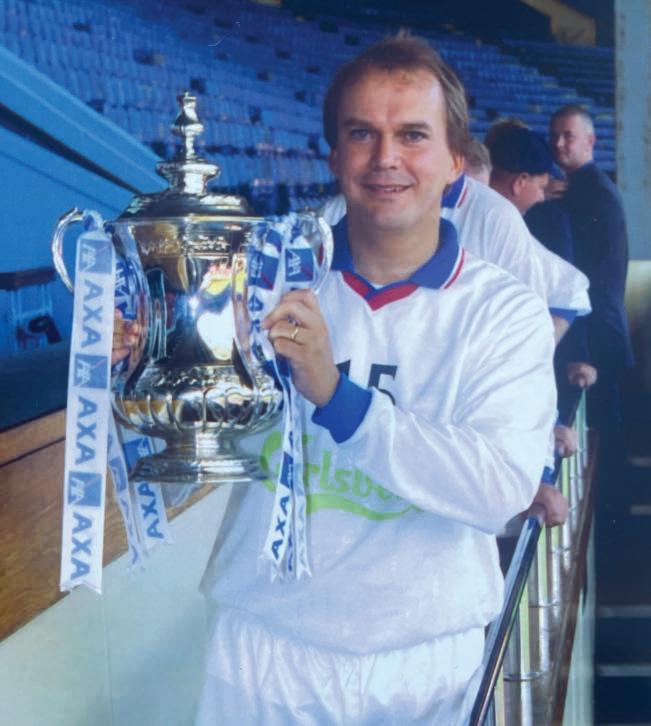

Kitwave Group has announced that Mark Earl will become its chief financial officer in April 2026. This follows the decision by the current CFO David Brind to retire from the role.

Earl (pictured) has worked for Kitwave for 10 years. In 2015, he joined as finance director of Kitwave’s frozen and chilled division, before assuming the role of group financial controller in 2019.

Brind joined Kitwave in 2011, and during his tenure he has overseen 15 acquisitions as well as the group’s IPO in 2021.

Kitwave’s trading during

the six months to 31 October has been as anticipated, and the board expects profit to be in line with market expectations for that period.

In May, Kitwave said that it had taken the decision to incur some additional operational investment at the new

South West depot to maintain service levels, as the business transitioned from three separate locations to one.

In addition, the integration of Creed into the wider operations has moved ahead of schedule, resulting in the closure of two depots in Hull and Huddersfield that previously traded under the Total Foodservice business.

Creed recently announced that Philip de Ternant, its strategy director and former managing director, will retire at the end of this year.

De Ternant joined Creed in 2006 as operations director

and then became managing director in 2013 – a role he held for 11 years. In January 2024, he handed the reins to Miles Roberts and stepped into the position of strategy director.

Before joining Creed, he worked for Bidfood for nine years, and he also previously worked for Booker Foodservice and Pullman Foods.

De Ternant also made a significant contribution to the Country Range Group, of which Creed is a founding member. He served on its board for several years and will continue in his role as CRG chairman into 2026.

Co-op Wholesale has appointed Martin Swadling, formerly customer director of Booker, as its own customer director.

The high-profile appointment signals Co-op Wholesale’s intent to deliver a market-leading proposition, operational excellence and supply chain innovation to support long-term sustainable growth across its network.

Swadling (pictured) spent 11 years at Booker, in roles that included director of Premier and Londis brand director. He also previously spent over 13 years at Musgrave, where he was regional director, and five years at Londis, where he held the post of trading manager.

In his new role, Swadling will lead the strategy and

execution of Co-op Wholesale’s logistics and warehouse operations, building a high-performing delivery proposition that meets evolving customer needs while driving operational efficiency and service excellence across the business.

Katie Secretan, managing director of Co-op Wholesale,

said: “Martin brings extensive industry knowledge and a proven track record in building strong customer propositions and leading complex operations. His leadership will be instrumental as we continue to strengthen our supply chain, enhance service for partners, and deliver on our growth ambitions.”

Swadling added: “The transformative journey Coop Wholesale has been on in recent times has been clear for all to see across the industry. I’m really excited to join the team at such a pivotal time, helping to build on its operational strengths and develop a delivery network that’s truly fit for the future.”

In other news, Co-op Wholesale has announced renewed contracts with NP Group and Highland Group.

Owned and operated by retailer Neil Patel, NP Group runs six Nisa fascia convenience stores in the North West, including sites in Manchester, Darwen, Ilkley, Colne and Castleford.

Highland Group, whose managing director is Tom Highland, is a forecourt and farm shop operator.

The Wholesale Group has launched a UK-wide tour to visit its members and showcase its CHEF Approved own-brand range.

Clocking up the miles in ‘Mabel’, the group’s branded Volkswagen ID Buzz, ownbrand manager Richard Ellison and technical manager Cezary Chmiel are visiting members to highlight the quality and versatility of the range, creating dishes tailored to each member’s customer base.

During these visits, members can find out more about the range of products, take part in blind taste tests, and discover the wider support provided by the group.

Ellison said: “By taking Mabel out on the road to meet with members and their sales teams, we’re

showcasing how the CHEF Approved range is far more than just a logo, but a really successful, versatile range that has a full package of support behind it, including sales guides, digital assets and regular updates through our own-brand newsletter.

“Not only are members delighted by the taste and performance of these products,

they can immediately see the value they bring to their customers, particularly at a time when margins are being squeezed.”

Coral Rose, joint managing director – foodservice, added: “In addition to the significant cost savings, a quality range own brand is the ultimate secret weapon for our members, creating a

powerful point of difference and driving customer loyalty.”

In other news, The Wholesale Group has revealed how its Jake by ShopAI can transform email inboxes into analytical environments without the need to install software.

Tom Gittins, joint MD of The Wholesale Group, said: “With Jake, members can now email questions about their purchasing patterns, supplier pricing comparisons or trading opportunities and receive instant analysis in the same thread.

“When we introduced this to our members, they immediately grasped how this will transform their daily workflow. Instead of accessing dashboards, they can have conversations with their data.”

IGD has launched its UK convenience market 2025-2030 report, which reveals that the channel has demonstrated ongoing resilience and adaptability in the first half of 2025 (H1), with growth of 1%. This is despite continued external challenges and a subdued broader retail environment.

IGD forecasts that the convenience channel will grow to £56.2 billion by 2030, representing a projected five-year growth rate of 2.7% (CAGR).

National mainstream retailers are expected to maintain a strong focus on convenience expansion.

However, the decline in tobacco and vape sales will remain a restraint on performance, reinforcing the importance of diversification and innovation.

The UK convenience channel sustained limited but consistent growth in H1, with the sector on track to reach £49.2 billion for the full year.

Mevalco has introduced wild porcini mushrooms. They are harvested in Soria, in northern Spain’s Basque region. Each cep is hand-foraged by licensed locals – teachers, farmers and shopkeepers.

Picked and frozen in seconds to lock in freshness, Mevalco’s Wild Porcini are available whole, sliced and in chunks.

Multiples emerged as the fastest-growing segment, now accounting for a 25.4% share of the channel, fuelled by new store development and continued investment in store improvements. These investments have enabled multiples to counteract the downward pressure from sharply falling tobacco sales and to capitalise on rising demand for chilled, fresh, food-to-go, and evening meal solutions.

Symbols continue to hold the largest segment share, growing by just above 1% in the first half of 2025.

By contrast, Co-ops

experienced a weaker performance, impacted by a malicious cyber attack and a number of regional store closures, while unaffiliated independents and forecourts faced ongoing challenges due to the tobacco downturn and site migrations into other segments.

Chilled foods and soft drinks led category value gains in H1, each achieving uplifts of approximately £150 million. Fresh fruit and vegetables, frozen food, sandwiches and wraps, and nonfood all registered growth rates of above 10%.

The largest shift in

category share was seen in tobacco, e-cigs, and vaping, whose share dropped below 17% of channel sales in H1 2025, though it remains the single largest component.

Alcohol, the second largest category, also experienced continued share decline, now representing 15% of sales, while chilled foods and soft drinks are consolidating their positions as the third and fourth largest categories respectively.

When tobacco and vape are excluded, category channel sales were up, suggesting that wider channel growth will be notably more buoyant to 2030 as the sector adapts to changing consumer behaviours and regulatory pressures.

Patrick Mitchell Fox, senior retail analyst at IGD, said: “The sector’s strength lies in its responsiveness, whether through embracing health, indulgence or automation, and its willingness to innovate in line with evolving shopper needs.”

Brakes has introduced La Boulangerie Premium Bakery, bringing together its premium range of breads, pastries and cakes under a new banner.

The range of more than 150 products is designed to give professional kitchens a premium bakery offer throughout the day. Brakes has also added 10 new products to the range.

From rustic loaves to soft brioche, flaky pastries to indulgent cakes, the range is said to combine traditional methods and long fermentation with quality ingredients,

hand-finishing and authentic provenance.

Paul Nieduszynski, CEO of Sysco GB, said: “We understand how important bakery is to the success of the outlet: from early morning croissants to lunchtime sandwiches to afternoon tea and beyond, bakery is the

backbone of many foodservice operations.”

In other news, Sysco GB companies M&J Fresh Seafood and Brakes have been awarded the 2025 MSC UK Foodservice Supplier of the Year award and have now won the award in 11 of the past 12 years.

Sysco GB is committed to displaying leadership across all aspects of sustainability, which includes responsible sourcing.

With more than 120 MSCcertified lines available, the company continues to raise awareness of the standard.

Southampton-based Harvest Fine Foods has appointed Damon Ingamells as managing director, following Steve Whitwam’s decision to leave the business.

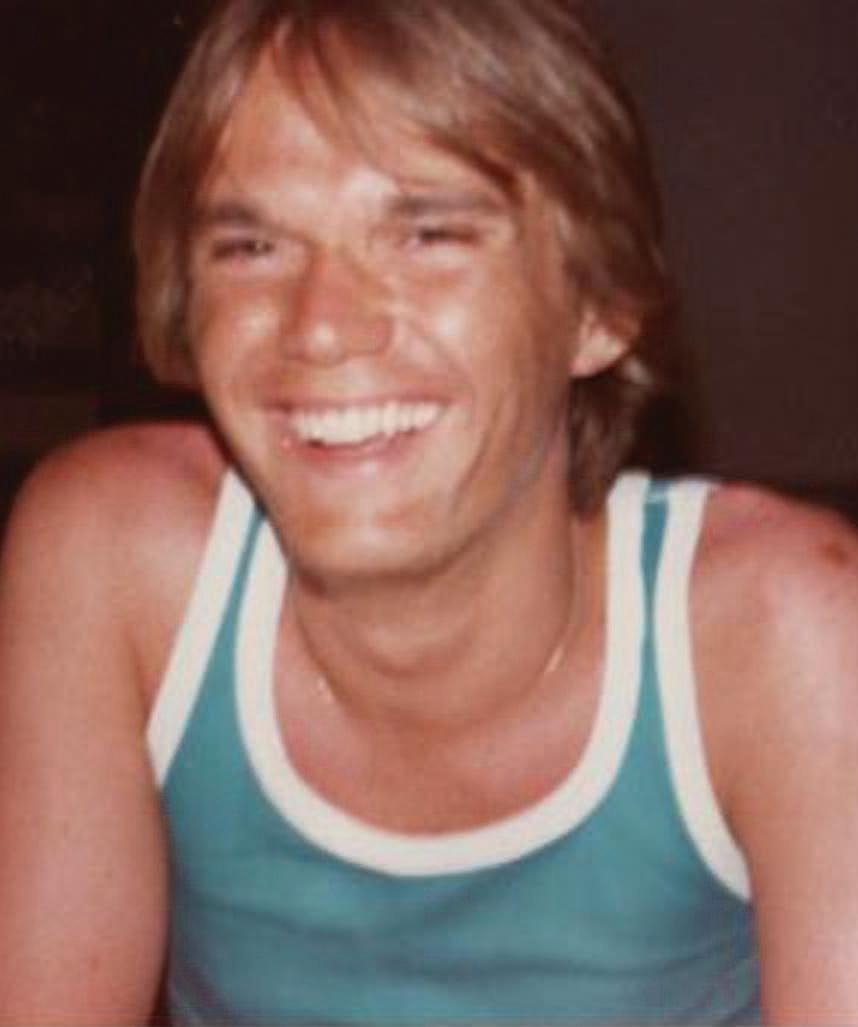

Ingamells (pictured) joins the business from South Lincs Foodservice, where he spent four-and-a-half years, firstly as transport manager and latterly as head of operations. Before that he was operations manager at The Capital Dairy Company and then Fresh Pastures.

Whitwam, who spent seven-and-a-half years at Harvest Fine Foods, said: “It’s been an exciting journey from sales director to managing director.

“We’ve been through so much together from navigating Covid to leading the

business through an acquisition. I’ve met some amazing people along the way and supported so many in their own career journeys.

“In a couple of weeks I’ll be starting a new adventure.”

Harvest Fine Foods operates 24 hours a day, seven days a week, delivering to over 1,000 customers across Dorset, Hampshire, West Sussex, Wiltshire and Surrey.

The Signature by Country Range portfolio has been bolstered with the launch of Double Crunch 7mm Skin On Fries and Frozen Mashed Potato with Butter.

A smaller version of the best-selling 10mm Double Crunch Skin-On Fries, the new 7mm fries stay crisp for 40 minutes. They are made solely from Fontane potatoes, ensuring consistency throughout the year, and come in packs of 4 x 2.27kg.

Signature by Country Range Mashed Potatoes with Butter contains only five ingredients – potatoes, butter, milk, salt and pepper –and are available in cases of 4 x 2.27 kg.

The ultra-premium range within CRG’s own-brand portfolio, Signature now features

over 30 products from across the globe.

Country Range has also launched a new range of Steam Cooked Chicken Wings.

The wings can be baked, grilled, fried or air-fried from frozen and come in packs of 5 x 1kg. According to the group, an innovative steam cooking method means that the wings retain their moisture and nutrients when cooked.

Booker is continuing the development of its ownbrand catering portfolio with the relaunch of its sauces and dressings.

This follows the introduction of new branding and three price tiers: Chef’s Essentials, Chef’s Menu and Chef’s Premium. The first category to go live was frozen chips and fries, followed by frozen desserts, and now Booker has

revamped its sauces and dressings.

Bulk products will be offered across all three tiers, while all one-litre sauces and dressings will be consolidated under the Chef’s Menu brand.

The products feature improved recipes, clearer packaging, simpler product names, and essential frontof-pack messaging such as vegan/vegetarian and chilli ratings. Sweeteners have also been removed from all Chef’s Menu products.

There are three new products, designed to tap into emerging flavour trends: Korean Style BBQ Sauce, Buttermilk Ranch Sauce, and Coronation Mayonnaise.

In other news, Booker Retail Partners has informed its customers that a £75 charge will be made for any unused scheduled delivery slot.

Birchall Foodservice has promoted Steve Chadwick to sales director. This follows a promotion to head of sales & marketing in April this year.

Chadwick (right) joined Birchalls in 2014 as a regional sales manager and has since played a key role in driving growth, building customer relationships, and leading the sales team.

He commented: “I’m lucky to work alongside such a talented team, and I’m so grateful for the support from my colleagues, friends, and family. Here’s to the next exciting chapter!”

Birchall Foodservice is a fifth-generation wholesaler based in Burnley, with satellite depots in Durham and Rotherham. It offers a range

SPAR Scotland is set to launch a digital activation in Spring 2026, designed to attract new shoppers, boost footfall and drive sales across its 300+ stores.

Running from 12 March to 22 April 2026, the ‘Spin into Spring’ campaign will invite shoppers to take part in a daily spin-to-win game via a dedicated web app.

Each play offers an instant opportunity to receive FMCG-branded digital vouchers for free products or money-off rewards redeemable exclusively in SPAR Scotland stores.

of over 7,000 products to a customer base that includes caterers from the care, education and hospitality sectors.

Earlier this month, Birchall Foodservice held a workshop for healthcare sector caterers on preparing dysphagia-friendly meals. The event was led by Gary Brailsford of training provider Dining with Dignity.

Over 250,000 instant reward vouchers will be available, redeemable within seconds. Shoppers can also unlock a bonus game and guaranteed reward by engaging with the app three times during the campaign, helping to drive repeat participation and store visits.

To keep excitement high, a £10,000 grand prize draw will conclude the promotion.

The campaign will be supported by PoS and digital, web and social activity.

In other news, SPAR Scotland has announced that its 2026 tradeshow will take place at the Macdonald Aviemore Resort on 24 September. It will have the theme ‘Collaborate’.

SPAR’s ‘Big Deals of Christmas’ campaign is back for 2025, marking its third consecutive year of delivering value to shoppers and driving footfall for retailers.

The initiative, which is running in SPAR stores in England, Scotland and Wales from 6 November to 1 January, offers customers weekly deals from leading household brands in categories including beers, wines & spirits, ice cream, soft drinks and confectionery.

Ian Taylor, SPAR UK retail & brand development director, said: “Shoppers have really embraced the campaign and many now look forward to the deals dropping in the weeks running up to Christmas. It’s become a

highly anticipated part of our value message, helping customers stretch their budgets while still enjoying festive treats.

“Last year we saw above average uplifts across the featured products, driven by strong feature space and solid marketing support.”

The campaign will benefit from marketing support across social media, digital screens, in-store displays and regional activations.

At the JJ Connect event, delegates heard that the wholesaler is not only extending its network, it is also expanding what it can offer its customers.

Anew depot in the Midlands next year is one of eight new branches that JJ Foodservice is planning to open within five years.

Speaking at the JJ Connect conference at Convene in Bishopsgate, London, chief operating officer Kaan Hendekli shared the group’s expansion strategy.

“We’re close to securing our new location in the Midlands for 2026 and we hope to have another branch opening next year,” he said. “Our ambition is to take JJ beyond UK borders: first it will be the Netherlands and then hopefully other places.”

To support its growth aspirations, JJ is investing in a 25,000 sq ft multi-temperature facility at its Enfield headquarters, boosting capacity by 4,000 pallets across frozen, chilled and ambient.

This investment will help JJ expand its product range to 5,000 SKUs by next year. The range has already increased by 27% to 3,800 SKUs in the past year.

“We’re not just expanding our network – we’re expanding what we can offer customers,” said Hendekli. “This new space will help us serve caterers with more choice, while maintaining the same great service customers expect.”

Established 37 years ago, JJ has grown to have 12 sites, a turnover of over £250 million and 800 employees.

“Today’s market is scary because restaurants are closing, menus are shrinking, wholesalers are eating into their margins to stay afloat, and consumers are going out less and less, but at JJ we are not just trying to survive, we are trying to be – and we will be – ahead of the competition,” he maintained.

In addition to its expansion plans, JJ is focusing on innovation. Digital innovation is a priority. “In the last 10 years,

we have increased our online orders from 56% to 79%. 79% is a great number but it is not the finish line for us: we would like to push it forward.”

Growth has already been driven by JJ’s kiosk roll-out alongside increased use of its app, website and EDI channels, and now the wholesaler is trialling a conversational AI telesales agent that can ‘talk naturally’ to customers, analyse their previous orders, and offer them new products.

In addition, said Hendekli, “our AI agent might take 100 calls a day [versus around 20 for a human] and they don’t get grouchy on Monday mornings and they don’t need lunch breaks. But this isn’t about replacing people; this is about giving people the right tools in JJ to make things smoother, easier and more efficient.”

JJ is also continuing its ‘Buy More, Save More’ campaign, which is aimed at delivering value for caterers and strong results for suppliers. “We tell customers we will give them the best price in the market on 400 products as long as they buy any 20 or more of them from us,” Hendekli explained.

Head of marketing Omar El-Haj told delegates that JJ has used AI Deep Research to find out more about what customers want and shape the company’s initiatives and areas of focus. It found that customers want:

• Reliable deliveries

• Transparent pricing

• Excellent customer service

• Loyalty, partnership and support

• Full stock availability

• Consistent product quality

• A one-stop product range

“When it comes to transparent pricing, loyalty and one-stop shop, that was why it was so important for us to create ‘Buy More, Save More’,” he said. “It’s the most important innovation to hit our industry when it comes to not messing about with prices.

“What does all of this do? It creates trust,” he added. “It’s what keeps people coming back to us.”

The JJ Connect event also saw the launch of Future Partners, a new supplier initiative featuring ‘speed connecting’ sessions with JJ buyers.

“Every investment we make is about building for long-term growth,” Hendekli said. “Together, we’re shaping a more resilient future for foodservice.” CCM

Night-shift workers form the largest cohort of employees in the Sysco GB business, and it has introduced a training programme and ongoing support for these colleagues to create a better, healthier experience.

Aprogramme to support nightshift workers across Sysco GB’s business has not only brought benefits for the employees, it has also reduced absence levels and improved retention rates.

Following research that highlighted the challenges night-shift workers face around poor nutrition and sleep disorders, as well as reports of mental health issues, Sysco created the ‘Night Club’ programme to support its employees

working through the night, helping to create a better, healthier experience.

“We started to develop the programme a couple of years ago, initially trialling it in a couple of sites to get it absolutely right before rolling it out across Sysco GB this year,” explains

Katrina Simpson-Haines, Sysco GB’s human resources director.

The immersive training programme – built in conjunction with specialist training provider The Liminal Space – is designed to address some of the specific needs of the night shift.

Units within the training programme include diet and exercise, mental health, chronotype (propensity for the individual to sleep at a particular time during a 24-hour period), light and environment.

These sessions are delivered in an interactive way through physical examples, quizzes and activities to maximise engagement, and all contain practical tips and handouts such as recipe suggestions.

To date, Sysco GB has introduced the programme across 24 sites, training more than 1,100 colleagues. It has also introduced 40 sleep champions, including four lead sleep champions to represent each of the business’s regions, who will provide ongoing support to colleagues.

‘I’m desperate to share the learnings as they’ve improved my life so much’

Casey Green (right), a warehouse trainer at Brakes’ Reading depot, has worked the night shift since he started there more than five years ago.

Despite having some limited experience at his previous role with Tesco, where the occasional night shift was required, starting the night shift fulltime was a shock to the system.

“It badly affected my sleep patterns,” he says. “I was struggling to get to sleep and would wake up after a few hours.

“In the end I was getting through the night on energy drinks and I was tired, and when you are tired there are safety implications, particularly in the highrisk environment of the warehouse.

“But the Night Club training has been a godsend, and completely changed my outlook. It’s not necessarily one big change, but lots of little things that add up. Gone are the energy drinks – I didn’t realise they stayed in my system for so long – and

I’m now drinking water.

“I’ve also changed the background of my phone to orange, bought a sleep mask and stopped scrolling through my phone. One of the strangest things was switching to a glass of warm milk before bedtime, which is bizarrely effective in

sending me off!”

Taking part in the programme has had a dramatic impact on the amount of sleep that Green is getting. He says: “The little tweaks to my routine have seen me go from four-and-a-half hours to seven hours’ sleep per day. And despite cutting down on the energy drinks, my energy levels have gone up massively, allowing me to run more and get more steps – I’m averaging five thousand more steps per day since the Night Club programme. I’ve also found my mood has improved and I’ve got more of a spring in my step.”

It was perhaps a natural progression for Green to become a sleep champion. “Having gone through the programme, I’m desperate to share the learnings as they’ve improved my life so much,” he explains. “I’ve introduced it to the induction programme and am creating some support materials so that we can start everyone off in the right direction.”

‘We help our colleagues to look more closely at their own routine’

David Cahill (right) has worked at Brakes for nearly eight years as a goods-out warehouse administrator, and Cash & Carry Management spoke to him about his views on night-shift working and Sysco GB’s ‘Night Club’ programme:

For how long have night shifts been part of your working life?

Around 18 years in total, both with Brakes and in my previous employment as a hotel night manager.

How did you view night working before taking part in the Night Club programme?

I’ve always viewed the night shift as a necessary part of business operations. Coming from a hospitality background and now within the supply chain, night workers are required to provide a service to our customers.

How did you benefit from the programme personally?

Learning just how many different things affect our sleep, for example how blue light wakes us on the lighter mornings when we travel home, making it that little bit more difficult to get to sleep.

“We’ve been really pleased with the uptake and the way that colleagues have interacted in the sessions, especially the ongoing passion and commitment from our sleep champions,” says Simpson-Haines. “This demonstrates there was a real need for an initiative like this.”

She adds: “As a child, my mum was a night-shift worker as well as a single parent, so supporting our night workers is particularly important to me. I’ve seen first-hand the pressures they are under and how challenging it can sometimes be.

“Often, the night shift can be the forgotten shift, but in our business, they are the largest cohort of colleagues and it’s important that we provide them with the support they need for their unique challenges. Night working is notoriously difficult, and providing colleagues with some tried and tested approaches to

In your role as a sleep champion, how do you help other night-shift workers? Our network of sleep champions across the country are trained and ready to support colleagues struggling with their sleep when on night shift. We are, in turn, supported by our teams, departmental and senior management along with the experts at The Liminal Space [Sysco GB’s training partner for this initiative].

Sometimes our advice can be a

managing sleep patterns and nutrition should help them to have a better experience both at home and in work.”

Sysco GB has received significant positive feedback from its night-shift workers, including Casey Green (left) and David Cahill (above), who are both sleep champions.

straightforward change to the way someone winds down or a combination of things like diet, environment, light exposure, etc. We can also refer our colleagues for additional support if they require, like to our Mental Health First Aiders.

We help our colleagues to look more closely at their own routine and make small changes where possible to assist them with being better rested and energised.

From a business point of view, Sysco GB expects to have some formal metrics later this year. “We are delighted to have seen a reduction in absence levels and an improvement in retention rates,” says Simpson-Haynes, ”and we believe that Night Club is playing a key part in that.”

‘I enjoyed it all immensely’

As Martin Williams retires after 50 years, he reflects on a career that brought great fulfilment.

After joining Fine Fare from school in 1975, did you ever think you would end up spending 50 years in the food & drink sector, including 42 years in wholesale?

To be honest I didn’t do very well at my school exams, even after staying on for a year for retakes, so I just needed a job.

The head office for Fine Fare was in Welwyn Garden City where I lived so I popped along for an interview and luckily got a job in stock control. That got me heavily into food & drink and working closely with the buyers.

At 17 I didn’t have any real ambitions other than to enjoy life!

What were the significant milestones in your career?

In 1983 I joined what was then Spar Consort (which became Landmark and more recently Unitas) and got into buying Spar own-brand and branded goods. I was initially an assistant executive, as we were called then, and slowly but surely worked my way up the business.

Real milestones were the days I was made buying director for Landmark in 1997 and then managing director in 2002. They were very proud moments for me and my family.

What were the highlights and low points?

I guess it is the points I just mentioned for highlights and, as much as this may surprise people, there were no real low points. I have been very lucky in doing a job that I enjoy so much.

Who have you most enjoyed working with, and who has inspired you the most?

There have been plenty of names and characters over the years and far too

many to mention here, but four people stand out for real inspiration, two of whom have sadly passed away.

At Fine Fare I worked for a guy called Alf Cameron; we became great friends out of work and are godfathers to one of each other’s children.

At Landmark there were two amazing bosses. Steve Denny was our managing director and the whole team idolised him for his leadership and management style – he was a real one-off. My trading director after the Consort and Landmark merger in 1985 was Fred McLaughlin, who was just an outstanding boss and developed my career enormously.

And, finally, my great friend and former Landmark chairman, Steve Parfett, was a big inspiration. Being chairman of the Landmark board was never an easy job, but Steve was brilliant and became a huge influence on my career and development as a managing director.

It was an honour to know and work with Steve and his dad, Alan, who was the founder of Parfetts. Alan very sadly passed away at the age of 95 in December last year.

How did you develop professionally during your 50 years in the sector?

I would say that most of my development came from other people, like the ones I just mentioned. I was good at looking and listening and taking the good stuff I saw and heard from others on board. I also learnt how not to do things from a few people!

What were your toughest jobs, and what gave you the most fulfilment? It didn’t happen an awful lot but having to sack people due to poor performance, or behaviour, was always hard and emotional.

As a ‘people person’ I got a lot of satisfaction from the development of my teams and seeing them do well and move on to even better jobs (although I was not always happy about it at the time!).

What were your most memorable moments?

It was not a specific moment but developing Landmark Wholesale into becoming the leading buying group in the UK was very special.

From a day-to-day perspective, Landmark did an overseas conference every year, going as far away as San Francisco and Cape Town. I was very hands on with the selection and planning, working with the great Chris Rose (marketing director) and then John Searle (trading director). We had some superb events looking after around 300 members and suppliers each time. Every one is a happy memory!

During his 50-year career, Martin Williams has held numerous posts since his first job at supermarket chain Fine Fare, where he spent eight years. His senior roles included 16 years as managing director of Landmark Wholesale. More recently, he was chairman of Confex for seven years before becoming co-chair of The Wholesale Group when it was launched in January 2025. He joined the FWD in 2018 as associate director following his position as FWD chair for the previous three years.

What advice would you give to someone starting their first job in wholesale?

Work hard, make the effort and enjoy it. We have great people in wholesale; it’s a fantastic place to work. Listen, learn, and succeed.

Will you be fully retiring, or will you still be involved with the trade in some capacity?

I tried to retire at the end of 2016 but ended up setting up my own freelance business and have worked for James Bielby at the FWD for nearly nine years now. I was also chairman of Confex for eight years, working with Tom Gittins and Jess Douglas growing their business

– they are an amazing brother and sister team. Also, for best part of nine years, I worked with another great friend, Paul Marsh, who owns Inspire Field Marketing.

I have no plans for next year yet –except for spending more time with my family (including my three lovely grandchildren) and watching my team Luton Town – but I have never been able to say no, so who knows?

Looking back, would you have done anything differently?

Probably not. I have always enjoyed working. Landmark was great for me personally and I enjoyed it all immensely.

Some 97% of consumers have breakfast and it is also the meal occasion least likely to be skipped. It is important to cover all bases with both in-the-home and out-of-home options.

Fewer households are purchasing traditional breakfast categories such as bread, cereals, juices and smoothies, which have declined in penetration year on year (Nielsen), and so retailers should be looking to alternative categories that meet growing consumer demand for convenient, but healthier options for breakfast, says Ewa Moxham, UK head of marketing at Yoplait.

Value sales of yoghurts and dairy drinks are up by 6.5% and volume sales by 5.9% (Nielsen). “It’s a growing opportunity,” Moxham maintains. “Dairy drinks can be enjoyed across many mealtimes, including breakfast, and across age ranges. People are also consuming yoghurts on more occasions, with total occasions growing by 6% year on year, largely driven by growth in breakfast, but also in snacking (Kantar).”

Moxham adds that breakfast is the fastest growing occasion for kids’ yoghurts, up by 8% year on year (Kantar).

St Pierre Groupe is seeing younger shoppers and families returning to brands that offer both quality and value. “Despite ongoing economic pressures, these groups are still looking to treat themselves well for breakfast, whether that’s an indulgent croissant at home or a sweet treat in the morning routine,” says Louise Reynard, customer development director.

“Premiumisation and permissible indulgence are key trends here, and bakery items that deliver restaurant-quality experiences, like our All Butter Croissants made with 30% French-churned butter, are performing strongly across a range of age and income brackets.”

The rise in hybrid working means that more people are grabbing breakfast on the go during ‘in office’ days. “This presents a clear opportunity for wholesalers and the retailers they supply, and at St Pierre we’re delivering solutions that cater to both convenience and indulgence, in the form of our individually-wrapped morning goods,” says Reynard.

St Pierre Groupe works with wholesalers to maximise the visibility of its products, and this activity will continue in the run-up to the Christmas break.

The Baker Street brand features an extended shelf life, which has obvious benefits for wholesalers and their customers. From classic white and brown loaves to on-trend Seeded Rye and Rye & Wheat loaves, it claims to offer shoppers both convenience and value.

For caterers and foodservice operators looking to appeal to consumers eating out, premium frozen bakery company La Lorraine Bakery Group has added 13 products to its portfolio. These include Rustic Style Sourdough & Poppyseed bread, Miche Paysanne –described as a perfect everyday bread, and Apple Turnover with Sugar for those looking for a sweeter option.

Also new from the company – this time under the Panesco brand – are a readyto-bake Salted Caramel Plait and ready-to-heat American Pancakes Cocoa, both ideal as a breakfast treat.

Hovis has launched its first-ever sourdough products –White Sourdough Cob and Seeded Sourdough Cob – providing an accessible option to the one in four consumers looking for a change from traditional sliced bread.

The UK sourdough market is now valued at more than £170 million, with 26% category penetration and 56% yearon-year growth (NIQ).

There has been a 6% year-on-year increase in on-the-go missions within healthier biscuits (Kantar), with shoppers increasingly looking for healthier breakfast options while out and about, reports Mondelez International.

The belVita Soft Bakes range is non-HFSS, including bestselling Soft Bake Choc Chip and Choco Hazelnut, and Mondelez recently launched a limited-edition belVita Duo Crunch Choco Hazelnut, available until December 2026. It is described as the perfect combination of chocolate alongside high fibre and belVita’s blend of five wholegrains.

The Cadbury Brunch Light range is also non-HFSS. CCM

There is a surge in sales of cigars during Christmas time, so wholesalers and their customers would be wise to stock up, ready to meet the increased demand.

The total cigar category is worth £327 million in annual sales, up by 2.6% year on year (IRI). Sales from the cigarillo segment currently generate nearly £154 million of that total, while the three other segments combined (miniature, small and medium/large) account for just over £171 million. Handmade cigars make up the remainder.

During the festive period, cigar sales enjoy an upward trajectory, points out Prianka Jhingan, head of marketing at Scandinavian Tobacco Group UK (STG UK).

“Cash & carries certainly won’t need me to tell them, but it’s typically larger cigars that people will gravitate towards as a bit of a Christmas treat when they are in celebratory mood and typically have more time to enjoy them,” she says.

“My advice at this time of year is always make sure you have brands like our Henri Wintermans Half Corona in stock as it is easily the UK’s best-selling medium/large cigar and has a loyal following due to its quality blend and heritage.”

‘Many adult smokers do often like to take the opportunity to trade up to more premium or larger format cigars at Christmas’

Prianka Jhingan, head of marketing, Scandinavian Tobacco Group UK

As for choosing a year-round core range, she says: “It’s important to stock the right range of cigars rather a big range, so we usually advise stocking no more than the top two or three brands in each of the four main cigar segments. In fact, the top 10 biggest sellers overall account for well over 90% of total sales so there’s little point tying up your cashflow with slowmoving brands.”

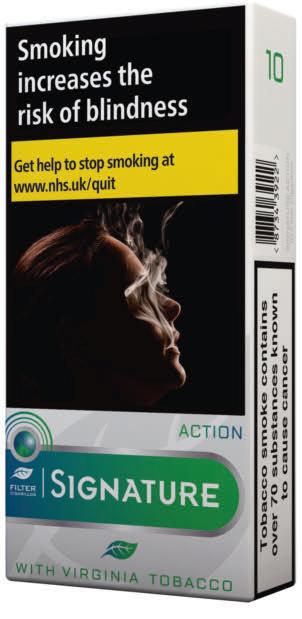

From STG’s portfolio, the ‘must stock’ brands are Signature Blue, which is the UK’s best-selling cigar outside cigarillos; Signature Action, which is the UK’s third biggest-selling cigarillo and growing fast; Moments Blue, which is the company’s value proposition; and Henri Wintermans Half Corona, which, although particularly important at Christmas, is popular throughout the year.

Wholesalers and their customers should also take note that cigarillos are undoubtedly the current success story in the cigar category. The cigarillo segment is easily the largest of the four segments in terms of volume and not far off the other three combined in terms of value.

“Over the last couple of years, distribution has improved and sales have really shot up for our Signature Action cigarillo brand,” reports Jhingan. “In fact, its sales have almost doubled since last year, with adult smokers appreciating the great flavour and cheaper price point compared to other brands in the market.”

To further capitalise on the surge in demand for flavoured cigarillos, at the start of this year STG launched Signature Action Mix cigarillos, which contain two capsules and combine the flavours of berry and mint.

More recently, the company expanded its Signature Action menthol capsule range with the introduction of a 17pack format. This addition complements the existing two 10pack offerings. With an rsp of £9.89, including a price-marked version, the 17-pack delivers value to consumers, positioning it as a competitively priced option in the market. “It also offers an attractive margin for retailers, reinforcing STG UK’s commitment to supporting its trade partners with highquality, high-demand products,” says Jhingan.

Returning to the festive season, she says: “Whilst value can, of course, be a motivating driver of purchase in the cigar category, many adult smokers do often like to take the opportunity to trade up to more premium or larger format cigars at Christmas and I wouldn’t expect this year to be any different.”

Party season means innovative drinks and trading up to embrace the holiday spirit. Wholesalers should ensure that their stock reflects trends and NPD, as well as the classics.

Last year, shoppers increased their spend by 10% on average in December (Kantar), and the busy month represents a huge opportunity for convenience retailers as consumers pop to their local shops for top-up items and impulse purchases

Red Bull highlights the increased opportunity for incremental sales, particularly with shoppers more open to trying something new or seasonal.

In the functional energy category, Red Bull Editions were key to driving the category at Christmas. The launch of Winter Edition Iced Vanilla Berry was instrumental in this success and the brand intends to replicate this with its 2025 Red Bull Winter Edition. Featuring the taste of Fuji Apple and Ginger, the drink is available in full-sugar and sugar-free options in an eye-catching ombre can. To drive trial, there is a limited £1 price-marked can.

Fun NPD for kids in the soft drinks category comes from Radnor Hills. The manufacturer is collaborating with Disney to launch three Lilo & Stitch inspired SKUs in its ambient juice drink range. The specially branded 200ml Tetra Paks feature a character from the new liveaction reimagining of the animated classic and are HFSS compliant and allergen-free, in Apple, Forest Fruits and Orange variants.

The versatility of soft drinks such as colas, mixers and adult soft drinks ensures they will be an essential basket spend for many festive shoppers. Coca-Cola Europacific Partners recommends that wholesalers and retailers make the most of the big night in trend that is balancing the current economic squeeze and will spill over into festive entertaining.

“Soft drinks will be key to making the most of these opportunities, with the category now up 3.8% in value, generating more than £5.7 billion annually in the convenience channel. During Christmas 2024 soft drink value sales were up 5.8%, with cola sales also seeing a boost of 3.1% (Nielsen),” says Kate Abbotson, senior external communications manager.

The manufacturer has effectively tapped into the shopper’s festive desire with high-visibility campaigns for its Schweppes and Coca-Cola brands that have made them synonymous with seasonal occasions, while prioritising cost-effective appeal with PMP formats.

“Making mixed drinks or cocktails at home over the festive season can be a more affordable, fun alternative to going out to a bar,” says Abbotson.

“Consumers are looking to pair their favourite spirits with quality mixers like Schweppes Classic Tonic and Slimline Tonic. This is why we expanded our PMP range by introducing price-marked Schweppes onelitre PET bottles, enabling more convenience customers to enjoy the advantages of PMPs –perfect for a big Christmas night in or New Year’s Eve party.”

Meanwhile, the rising popularity for sober celebrations has widened the appeal of premium soft drinks – brands such as Appletiser are ideal for inclusive entertainment.

Vinarchy (formerly Accolade Wines and Pernod Ricard Winemakers) recommends that retailers stock their shelves with festive excitement in mind, as consumers are prepared to dig a little deeper over the period in order to sprinkle a little Christmas magic.

“Limited editions are key to driving excitement in the alcohol category, with 19.7% of UK consumers saying they are willing to pay more for limited editions. In the final four weeks leading up to Christmas 2024, Britons spent 3.4% more on table wine than they did one year previously (NIQ),” says Tom Smith, marketing director –Europe.

In the red wine segment, established grapes such as merlot, shiraz and cabernet sauvignon remain a core offering. However, there is a significant growth in red blend varietals.

White wines are also seeing growth in blends, alongside the longstanding popularity of sauvignon blanc, chardonnay and pinot grigio.

Rosé continues to surge in popularity and a release from country icon Dolly Parton is likely to boost sales further. Her Dolly wines range is now available to the wholesale channel and includes prosecco in the line-up.

Australian wine brand Jam Shed features festive ‘Jam Sled’ packaging. There are five designs across the 750ml shiraz, while the 1.5-litre minibox features a single design.

Lifestyle brand Traces, from DrinkWell , offers consumers a way to indulge ‘without the sugar bomb’. Available through HT Drinks, products such as Traces sauvignon blanc, rosé, merlot and Hugo spritz have been formulated with fewer calories and additives.

“Christmas is when alcohol sales peak, but also when consumers feel the most conflicted. They want to celebrate but they’re more sugar-aware than ever,” says Tom Bell, founder of DrinkWell.

The brand is planning to launch RTD products in 2026.

Alcoholic RTDs are an ideal impulse purchase for attending social events and ‘pre-drinks’, over-indexing with younger consumers. Global Brands has seen an impressive increase in sales from its nostalgic, fruity Reef RTD, now in resealable Tetra packaging. The move makes the product more portable as well as more sustainable.

With a lower abv of 3.4% and a light, fruity flavour profile, Reef aligns with Gen Z’s more mindful approach to alcohol.

Also in the RTD category, Coca-Cola Europacific Partners has made it even easier for shoppers to enjoy branded spirits and mixers conveniently over the festive period. Its canned alcoholic RTD range, which recently concluded a retailer-focused promotion, now includes a Jack Daniel’s & Coca-Cola Cherry variant.

Jack Daniel’s and Coca-Cola RTD is now the number one RTD SKU in GB (Nielsen). The supplier’s alcoholic RTD portfolio also includes Absolut Vodka & Sprite and Bacardi & Coca-Cola, which is now available in a sleek format.

International wholesaler and distributor Pricecheck has announced a UK distribution partnership with OSHEE Hydration Drinks, one of Europe’s leading sports and vitamin drinks brands.

Pricecheck has taken on responsibility for UK distribution, sales, and channel development for OSHEE, bringing its extensive range of functional hydration and vitamin drinks to British consumers.

“Sports & functional waters are worth in excess of £500 million in the UK and continue to grow consistently, which is why OSHEE has made the UK a priority market,” said Matt Collins, general manager at OSHEE UK.

“To succeed, we need to extend our partnerships with strong trade connections and proven expertise, and Pricecheck is the ideal choice. Together, we’ll establish a strong presence and grow sustainably in the UK.”

With the wave of in-home entertaining that takes place across the Christmas holidays, liqueurs and spirits see sales spike as people recreate high-end cocktails and linger over after-dinner drinks. Gifting is also a sales driver and wholesalers should ensure that they can provide their customers with a comprehensive range to cover all festive sales opportunities, paying attention to well-known brands at a time when consumers are likely to trade up.

Disaronno recommends that wholesalers cater to a demand for high-end and on-trend options to suit a variety of seasonal missions. “Retailers should be aware of the key flavour and cocktail trends in the out-of-home sector,” says Aiste Pugh Williams, trade marketing manager.

“Alongside this, there’s a rising demand for no and low alcohol options, as shoppers look to cater to a wider range of tastes and lifestyles during the holiday season.”

For this festive season, the manufacturer has launched a limited-edition collection to mark its 500-year anniversary. The five-strong range is supported with a campaign that spans in-store, in-bar, social, PR and retail activity.

Paragon Brands represents a range of premium innovative spirit brands, ideal for festive entertaining. These include non-alcoholic rum brand Caleño.

“Retailers are expanding their offerings to meet consumer demand, with more space dedicated to non-alcoholic spirit alternatives and better visibility on the fixture,” says Chris Jones, managing director. “We’re experiencing a cultural shift as opposed to a trend. While we’re moving from a relatively small base, it’s here to stay, and there are plenty of opportunities for retailers to ride the wave while it’s cresting.”

The beer segment also sees a boost at Christmas, with low and no-alcohol options reflecting significant growth last year. BrewDog suggests retailers take into account the reenergisation of stout, continuing popularity of craft beer and soaring demand for low/no alcohol options when selecting their range.

BrewDog also offers budgetfriendly promotional 4 x 330ml PMP formats for its top-selling Punk IPA and Hazy Jane beers.

Heineken UK highlights growth in larger formats in the run-up to Christmas in both beer and cider, as well as the high demand for premium brands as consumers trade up.

Christmas and New Year is one of the biggest trading periods for the beer and cider category, worth £748 million, and impulse sales are worth £159 million of that (Nielsen). CCM

In the wholesale and cash & carry sector, recruitment is fast-paced. Warehouses, distribution centres, and customer-facing outlets need reliable staff who can handle long shifts, heavy workloads, and seasonal peaks. But in the rush to fill roles, employers can sometimes slip into practices that expose them to legal risk.

The Equality Act 2010, along with data protection law, sets clear boundaries for how interviews must be conducted. Getting this right is not just about compliance – it protects your business from claims, enhances your reputation as an employer, and helps you attract the best people.

Interview questions should relate only to whether a candidate can do the job. Asking about marital status, childcare, or family plans is not appropriate. Even informal comments – “Will school runs affect early shifts?” or “Are you planning to start a family?” – may amount to discrimination if they influence the hiring decision.

You should also avoid assumptions. For example, don’t presume that a younger candidate will be more flexible with weekend work, or that a parent will be less committed. These stereotypes, even if unintended, risk breaching the law.

Avoiding discrimination before offers are made

Legal protections apply from the moment a candidate submits their application. This means the arrangements you make, from scheduling interviews to selecting who is invited, must not disadvantage certain groups.

A common issue in wholesale is

timing. If interviews are offered only late at night, candidates with caring responsibilities may be excluded. Unless there is a genuine business reason, this could amount to indirect sex discrimination. Offering alternative slots helps avoid such claims and widens your talent pool.

If a candidate has a disability or longterm health condition, you have a duty to make reasonable adjustments to the process. In a warehouse context, this might mean providing materials in advance, offering extra time on written tasks, or ensuring interview rooms are physically accessible.

Once you are informed of a need, you must act. Failing to do so may expose your business to a disability discrimination claim. Importantly, the request itself should never affect your assessment of the candidate.

Shift systems and weekend work are part of wholesale life. It is lawful, and increasingly common, for candidates to ask about flexible working at interview.

Rejecting them solely on that basis could amount to discrimination, particularly if the refusal disadvantages certain groups.

Being prepared to discuss options

openly can prevent disputes later and supports a more inclusive culture.

Pay decisions must be transparent and fair. The law requires equal pay for equal work, regardless of gender. If two warehouse supervisors perform the same role, they should be paid the same unless you can demonstrate a genuine reason for any difference.

When discussing salaries, avoid relying solely on a candidate’s previous pay history, which may perpetuate inequalities. Instead, base offers on the skills and experience required for the role.

Some positions, particularly those involving finance, security, or highvalue stock, may require background checks. These must always be proportionate. A credit check for a finance manager may be defensible; the same for a checkout assistant would not.

Any personal information shared during recruitment is covered by data protection law. Ensure that only those involved in hiring can access it, store it securely, and delete it when no longer needed. Breaches can lead to legal claims and reputational damage.

Running fair, lawful interviews is not simply about avoiding claims. It builds trust with candidates, strengthens your employer brand, and ensures you secure the best people in a competitive market. In an industry that relies on reliability and long-term loyalty, these benefits are invaluable.

By keeping interviews focused on ability, offering reasonable adjustments, and protecting candidate data, you safeguard not only your business but also the sector’s reputation for professionalism. www.buckles-law.co.uk

Wholesalers and retailers need to ensure that they offer the right range of tastes and formats to make the most of seasonal sales. From larger sharing bags to innovative flavours, there are plenty of ways to bring festive fun and value to the snack aisles.

Savoury snacks are a major sales driver in the impulse channel and the category is growing at 3.3% (Circana). With the festive season coming up and long nights ahead, there are plenty of opportunities for retailers and wholesalers to boost sales through promotions and NPD, along with a stable core range.

Savoury snacking remains an intrinsic part of consumer behaviour and 50% of shoppers purchase savoury snacks from convenience outlets (Kantar).

Earlier this year, PepsiCo tapped into the appreciation for cheesy flavours with the launch of Cheetos Original Cheese and Quavers Red Leicester. Another trend is world tastes, which continue to be a popular choice, and the Walkers permanent line-up now includes Sticky Teriyaki and Masala Chicken variants.

In anticipation of the final series of the Netflix smash hit, Stranger Things, PepsiCo has launched a limited-edition Doritos Black Garlic Dip along with Stranger Things-inspired 270g party-sized bags. The themed pack designs are also featured on Monster Munch, Wotsits, Quavers and Squares.

“NPD has a really important role in driving interest and excitement within the category, but the key to success is supplementing this with a strong core that will drive repeat sales,” says Ed Merrett, wholesale controller.

New festive activity from the supplier includes a limitededition Doritos Gingerbread sharing bag, along with Walkers Emmental Cheese and Walkers Beef Wellington multipacks. The return of the limited-edition Sensations Honey-Glazed Ham sharing bag is also set to boost seasonal sales.

KP Snacks covers a range of snacking options, with strong sellers in crisps, nuts, popcorn and pretzels, and again highlights the strength of the sharing segment in the convenience channel.

“The crisps, snacks & nuts category is thriving, driven by key trends in convenience, bold flavours and sharing occasions,” says Stuart Graham, head of convenience & impulse. “Food-to-go and at-home occasions are an essential part of category growth, with innovation and promotions continuing to drive category momentum and shopper appeal.

“As well as gravitating towards trusted brands, consumers are experimenting with bold new flavours, with spicy and meaty profiles in particular gaining momentum.”

The manufacturer is currently running an on-pack promotion for KP Nuts, featuring PDC World Darts Champion Luke Littler. The competition offers consumers the chance to win £180 every 180 minutes via an on-pack QR code on promotional SKUs. KP Original Salted Peanuts, Dry Roasted Peanuts and Aromatic Thai Chilli Flavour Coated Peanuts all feature the promotion, which runs until 7 December.

“As the UK’s No.1 nut brand, KP Nuts continues to drive category growth as a trusted and recognisable brand, with a range of tasty flavours and formats that cater to all occasions,” says Rachel Horrell, senior brand manager.

“This promotion represents a landmark moment for KP Nuts as we partner with one of the most exciting sports personalities in the UK today. The on-pack perfectly captures the excitement of darts while delivering extra value and excitement to shoppers and retailers.”

Envis Snacks has seen a rise in demand for larger sharing bags, and they are particularly popular with retailers in large conurbations where rents are high. The supplier offers 130g bags with higher price points for the most recent product launches, X-cut Kebab and X-cut Sour Cream, alongside 75g bags.

“This ‘trade up’ from retailers to offer larger everyday packs as well as, or instead of, smaller sharing bags seems to be a trend – as is keeping an eye on what is new and differentiated in the market. We are maintaining our focus on that area too with products, with our X-cut Chilli & Lime, WOW Jalapeno, X-cut Hot & Spicy and Curly Classic all being in our top 10 sellers,” says Andy Brown, director.

‘This ‘trade up’ from retailers to offer larger everyday packs as well as, or instead of, smaller sharing bags seems to be a trend’

Andy Brown, director, Envis Snacks

The supplier focuses heavily on ensuring that the wholesale sector can be competitive and respond to the specific demands of convenience retailers.

“We generally work on providing everyday promotional pricing to wholesalers to reduce peaks and troughs in sales and to also help with availability, as well as offering good lead times on deliveries and market-leading ‘best before’ dates on our range: between 9-12 months from production,” Brown adds.

Kellanova has recorded sales for its Cheez-It Snap’d brand of more than £24 million in one year after its launch in the UK. During its first year, the brand also achieved 12.8% penetration and a 52% repeat purchase rate across the total market (Kantar).

This success comes alongside a Great Taste Award star for its Double Cheese variant, which is baked and made with 100% real cheese.

The Snap’d line-up includes Double Cheese, Cheese & Chilli, Cheese, Sour Cream & Onion, and Cheese & Smokey Bacon variants.

“Cheez-It’s playful, bold approach appeals to snack lovers and it’s unlike anything else currently available in the UK,” says Rui Frias, senior marketing manager at Kellanova. “What’s exceeded our expectations is how quickly UK shoppers have embraced not just the flavour, but the versatility of the brand across different retail channels.

“This first year has proven there’s a real appetite for cheese-based snacking in the UK and we’re just scratching the surface of what’s possible in year two.”

The company continues to drive visibility and growth for Cheez-It, collaborating with retailers and wholesalers on a range of activations and promotions to provide them with tools and strategies to maximise sales and drive footfall.

In excess of 30% of Golden Wonder’s sales go through the cash & carry/delivered wholesale channel – a significant over-trade compared to the approximate 15% of overall savoury snacks that are sold in symbols & independents.

Tayto’s group marketing director Matt Smith attributes much of this success to the company’s focus on what customers –wholesalers, retailers and consumers – are looking for.

“The convenience market is under pressure. Traditionally, people were going into convenience stores for cigarettes and newspapers (and now their vapes) and those footfall drivers have either disappeared or are reducing,” he says.

“The challenge for independent shops is how to get that footfall back, and we see snacks as a key driver. Snacks is a category that’s got 95% penetration – nearly everybody eats snacks and two-thirds of people eat them every week.”

Value and taste are key in the snacks marketplace, says Smith, and the Golden Wonder crisps range has recently been relaunched with new packaging that clearly highlights the brand promise, ‘More Punch Per Crunch’.

“Flavour is at the heart of Golden Wonder as a brand, but value is also important,” he points out. “This is particularly the case where people are under quite significant cost pressures and budgets are stretched.”

... LISTING SOME CRUNCHIPS X-CUT AS THEY:

• Ofer Diferentiation

• Have a Long Shelf Life

• Provide Great POR‘s

• Add Incremental Sales

• Taste Fantastic

• Are Much Loved Across Europe

• Available in both 75g with £1.25 RSP and 130g larger sharing bags WhatsApp Envis Snacks on 07843 782592 or email sales@envissnacks.com for more information on the full Lorenz ranges

Volume sales of crisps & snacks are in slight decline. A focus on health is one of the reasons, but a big factor, according to Smith, is affordability. “Total market penetration is largely unchanged but frequency is declining – people are buying crisps & snacks less often. And I think we’re seeing people’s repertoire decreasing. Whether it be crinkle-cut crisps or flat crisps or tortillas, we’re seeing the penetration of each sector reducing slightly, so people are being a bit more selective as to what they want to spend their money on.”

Price-marked sharing packs account for around 57% of the crisps & snacks category, and Tayto took the decision a few years ago to keep its price-marked sharing packs at £1, when other suppliers raised the price to around £1.25.

“We believe that was absolutely the right thing for Tayto to do,” Smith maintains. It was not only the right thing for consumers, it has also benefited the Tayto business and its trade customers. “In terms of units sold, price-marked sharing snacks are down by about 3% but Golden Wonder £1 PMPs are up by 11% year on year,” he reports.

“What’s driving that significant growth is an increasing

Retailers are missing out if they don’t stock pork scratchings, maintains Tayto’s group marketing director Matt Smith: “Of the shops that are stocking crisps & snacks, a third aren’t stocking pork scratchings, yet 40% of people eat pork scratchings so it’s not a niche category in the way that some people might assume.”

Another widely-held assumption is that it is mainly men who consume pork scratchings, but in fact sales are split almost 50:50 men to women.

Tayto is market leader in the category, with a 63% share. Mr Porky is the biggest brand overall, and Midland Snacks is a top performer in symbols & independents. The company also offers lighter products, such as Strips and Puffs, to appeal to a broad customer base, with formats including pub-style cards for effective merchandising.

Smith points out that the high-protein, VAT-free snack is often an impulse purchase. He adds: “Between 15-20% of people who go into a shop for pork scratchings just won’t buy anything else, and pork scratchings never go in the cupboard – sometimes they don’t even make it home – so independent retailers can tap into that.”

number of retailers stocking our £1 snacks. Retailers are saying, ‘I understand who’s coming through my door, I understand they can’t afford that particular treat. I’m going to stock more of this range or start stocking this range because it offers great value for money’. Retailers have got their finger on the pulse of what their customers are looking for.

“I think that we at Tayto stand out as taking a very different stance to other brands. We’re saying we understand consumers, we understand that the £1 is important. We are going to stick with that, and retailers and consumers are obviously seeing value in that offer.”

Earlier this year, Tayto introduced Chippies potato sticks –a solid performer in supermarkets – into the wholesale channel. Available in Gravy and Chip Shop Curry variants in a £1 PMP, the product is selling well and distribution is building.

Smith urges the trade not to forget about impulse packs, which still account for around 22% of unit sales. Again, Tayto’s focus is on taste and value. For example, its popular Transform-A-Snack has a 50p price mark, while Tangy Toms and Bikers packs are flashed at 35p or ‘2 for 60p’.

In terms of NPD, Smith believes that it has a role in driving excitement among consumers. Tayto’s festive NPD for this year features Golden Wonder Glazed Ham Baubles and Honey Glazed Christmas Tree Tortillas in sharing bags, which join the established festive favourite Turkey & Stuffing Crisps in a six-pack. These products are deliberately not in PMPs because limited editions are not as price-sensitive as core SKUs, says Smith.

In addition to ensuring it invests in the right products at the right price point, Tayto invests in its team that looks after the delivered wholesale/cash & carry channel. It has six people in the team, some of whom are dedicated to looking after accounts in Scotland, which is Golden Wonder’s heartland, generating half of the £50 million brand’s sales.

The company has been running a campaign on social media, YouTube and radio in support of Golden Wonder in Scotland, and the radio adverts will continue into the New Year. It also recently held a ‘World of Wonder’ event in Glasgow, where around 300 consumers got the chance to create their own crisp flavouring. The brand awarenessbuilding initiative was such a success (consumers were queuing for hours to take part) that Tayto is planning to repeat it next year in Glasgow and other cities in Scotland.

According to Smith, wholesalers are very supportive of Tayto’s efforts to give customers a taste- and value-led range. “We get how tough it is out there, and we’re designing products and strategies that give symbols & independents a chance to fight back,” he concludes. “If our partners in the wholesale/cash & carry trade have any ideas about how we can help those retailers, we’re all ears.”

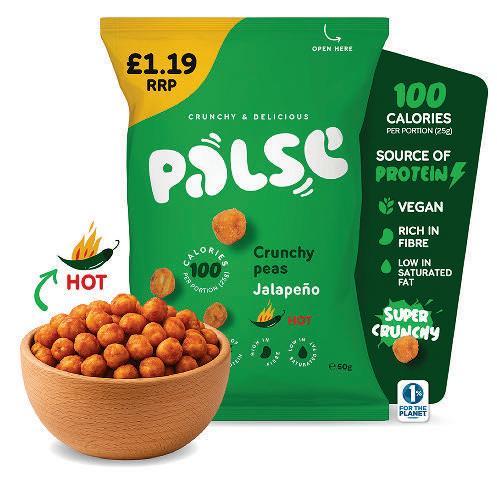

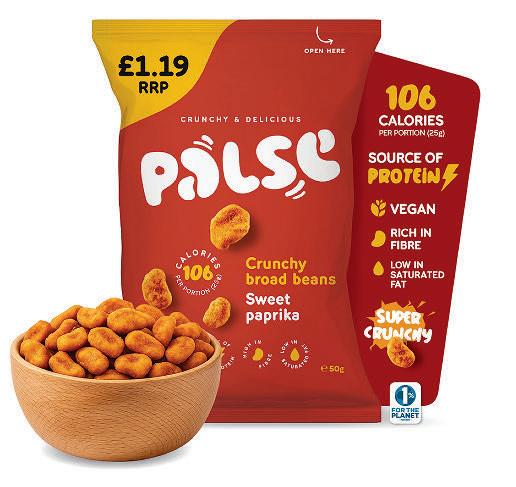

Although the festive period is an undeniably indulgent time, there is still a high demand for healthier options, and this is reflected in the success of suppliers like Palse Snacks.

“In recent months, the brand has achieved impressive growth, securing listings with some of the UK’s leading wholesalers, including Dhamecha, Lioncroft, Parfetts, Wanis, United Wholesale Grocers, United Wholesale Scotland and across foodservice outlets. These partnerships underline both the strength of the brand and the growing appetite for healthier alternatives across the convenience and wholesale sector,” says Jason Stocker, business development director.

“Palse Snacks is making healthy snacking irresistible, offering consumers a range that proves better-for-you options can still be full of flavour.”

The manufacturer is continuing its support of the wholesale channel with further activity in the pipeline. “Looking ahead, Palse is preparing to launch a series of exciting manufacturing collaborations in depots nationwide. These initiatives will not only showcase the brand’s innovative spirit but also encourage trial, raise awareness, and drive further distribution,” says Stocker.

“By combining high-quality products with strong strategic partnerships, Palse Snacks is positioning itself as a key player in shaping the future of the healthy snacking category, making the choice for consumers easier, tastier and more rewarding.”

Protein snacks have moved beyond a trend to become mainstream, with nearly one in three UK households now

This month, Pringles and Movember return to pubs with a campaign designed to encourage the promotion of safe spaces for meaningful conversation about men’s mental wellbeing.

Kellanova is offering free PoS kits, including coasters, T-shirts, bathroom mirror stickers and posters, to on-trade operators to promote the initiative. For every kit ordered, Pringles will donate £2.50 to Movember (up to a maximum of £1,250).

Alongside this, a limited-edition Movember 40g tube has been produced exclusively for the on-trade that features a QR code linking directly to The Movember Conversations tool, where people can access practical advice and conversation prompts.

purchasing meat snacks. Jack Link’s Peperami brand is now worth £140 million and has grown by more than 80% over the past five years.

Peperami five-stick packs are the best-selling product in the entire meat snack category. The range includes Original, Hot, Firestick and Chorizo variants.

The brand’s line-up now includes formats such as Original Lunchbox Minis, BBQ Lunchbox Minis, Salami & Cheese Snack Boxes, and Pizza Buns. A recent move into chicken snacks includes Chicken Tikka Skewers and Chicken Bites.

“For parents, Peperami is a convenient, tasty option they know their children will eat, helping to reduce waste thanks to its long shelf life –making Peperami great value, especially during the current cost-of-living climate,” says Shaun Whelan, convenience/wholesale and out-of-home controller.

“Young adults aged 26-35 are another key target group, often picking up Peperami in lunch meal deals or for on-the-go protein boosts. With more people working from home or adopting hybrid working patterns, we are also seeing growth in active at-home snacking, and with nine in 10 snacks consumed at home (Mintel), it’s important to stock trusted brands that meet this demand.”

‘By focusing on range, innovation and availability, retailers can unlock more value from the fast-growing meat snacking category’

Shaun Whelan, convenience/wholesale and OOH controller, Jack Link’s

The £1 PMP Peperami Chicken Bites, available in Tikka and Roasted variants, offer the reassurance of value that many convenience shoppers seek and come in at 95kcals per 45g pack. Retailers should ensure that they are visible along with the core range such as the five-pack and £1.25 PMP single sticks. Clear PoS and well-stocked displays should spotlight both best-sellers and NPD.

“By focusing on range, innovation and availability, retailers can unlock more value from this fast-growing category,” says Whelan. “One in five UK households already buys Peperami, but there’s still significant room for growth, especially in the chilled food-to-go space.

“As the category leader, Peperami has driven growth in meat snacking, supported by heavyweight TV and throughthe-line advertising campaigns featuring the iconic Animal –highlighting our investment both on the shop floor and through above-the-line activity to drive visibility and sales.”